Research Article: 2022 Vol: 25 Issue: 4S

The influence of service quality, customer satisfaction and bank image on customer loyalty in Palestinian Islamic banks

Hussein M. A. Abed, An-Najah National University

Muhmmad I. Nofal, Al-Ahliyya Amman University

Feras Alnasr, Al-Zaytoonah University for Science and Technology

Ghaith Abdulraheem Ali Alsheikh, Amman Arab University

Enas Ali Theeb Alnawafleh, Al-Balqa` Applied University

Citation Information: Abed, H.M.A., Nofal, M.I., Alnasr, F., Alsheikh, G.A.A., & Alnawafleh, E.A.T. (2022). The influence of service quality, customer satisfaction and bank image on customer loyalty in Palestinian Islamic banks. Journal of Management Information and Decision Sciences, 25(S4), 1-18.

Keywords

PAKSERV, Subjective Norms, Customer Satisfaction, Customer Loyalty, Bank Image

Abstract

This study was conducted to investigate the influence of Palestine Service Quality dimensions (PAKSERV), subjective norms, customer satisfaction and bank image on customer loyalty of Palestine Islamic banking customers. The respondents for this study were Islamic banks customers in Palestine. A total of 500 questionnaires were distributed in three cities: Nablus, Ramallah and Hebron using convenience sampling method. Therefore, 357 completed questionnaires were retrieved, giving a response rate of 71% of the original sample. The data was collected in six weeks beginning of September 2017. The research model was empirically tested using Structural Equation Modeling (SEM) technique. Results of SEM depicted that tangibility, reliability, assurance, sincerity, personalization, formality and subjective norms explained 80% variance in customer satisfaction. Additionally, customer satisfaction was found positively impact on customer loyalty. Customer satisfaction was found to mediate the relationship between service quality dimensions (tangibility, reliability, assurance, sincerity, personalization, formality and subjective norms) and customer loyalty. Moreover, the study also confirmed that bank image moderates the relationship between customer satisfaction and customer loyalty. The results of this study have provided several implications for practitioners and researchers. The findings of this study provided insights to top managements of banking industry with regard to the importance of delivering good service quality and establishing a good image.

Introduction

The service industry has gained greater attention in today’s business environment since it has been a major player in the growth of the economy. Consequently, the rapid growth in services industries has made it important for companies to measure and evaluate service quality determinants. The incorporate sector service quality plays a vital role in company’s success and international recognition. Researchers that discuss service quality issues in services sector using SERVQUAL model. (Ashraf, Ilyas, Imtiaz & Ahmad, 2018) defined service quality as the consumer’s overall impressions of the relative superiority of the organization and its services”. Parasuraman, Zeithaml & Malhotra (2005), postulated that service quality may differ in culture to culture. It was argued that service provider companies that operate in variety of cultural contexts have found SERVQUAL model insignificant and less applicable especially in developing countries (Parasuraman et al., 2005). Consequently, PAKSERV model was introduced by Raajpoot (2004) that explore the service quality issues in cultural context. In line with Raajpoot (2004), who postulated that service quality varies from culture to culture. Hence, the current study examines the influence of PAKSERV dimensions on (Tangibility, Reliability, Assurance, Sincerity, Personalization and Formality) on customer loyalty and customer satisfaction in Palestinian Islamic banks.

In addition to that PAKSERV model was extended with the subjective norm which is the most core factor of Theory of Reasoned Action (TRA). Subjective norm is defined as the individual perception of likelihood that the potential group or individual approve or disapprove of performing a given behavior (Fishbein & Ajzen, 1975). Subjective norm is a stage where an individual performs a behavior under significant social influence or under social pressure even though the individual is not in favor to perform a behavior. Subjective norms deals with the influence of social environment or social pressure on the individuals that further motivate them to perform a behavior (Fauziah, Taib, Ramayah & Abdul Razak, 2008). In financial sector, subjective norm has been identified as an important construct to measure the consumer behavior towards acceptance or rejection of financial products or service in Malaysian cultural context.

This study tested customer satisfaction as mediating variable between extended PAKSERV model and customer loyalty because satisfied customers will, in general, keep up their consumption pattern or consume more of the same product or service (Ghaith, Mutia, Ayassrah, Abdul Malek & Enas, 2018; Mokhlis, Aleesa & Mamat, 2011). Ali, Zainuddin, Rashid & Jusoff (2009) revealed that customer satisfaction is the antecedent of customer loyalty and has key importance for banking customers. Another study conducted by M. Amin, Isa & Fontaine (2013) stated that fast and effective service, friendliness of bank personnel, confidentiality and transaction speed are the key factors for customer satisfaction. According to Petzer, De Meyer-Heydenrych & Svensson (2017) postulated that customer satisfaction is a key factor in banking sector that motivate customers towards loyalty or intend to be loyal. The current study investigates that customer satisfaction mediate the relationship among tangibility, reliability, assurance, sincerity, personalization, formality, subjective norm and customer loyalty in Islamic banks of Palestine.

A new dimension of the relationship was added in extended PAKSERV model wherein bank image was examined as moderating variable between customer satisfaction and customer loyalty in Palestine Islamic banks. Image is an association that comes in mind when customer hears the name of an organization or its related products (Ghaith, Junoh & Abdullah, 2016; Ghaith et al., 2018; Nguyen & Leclerc, 2011). According to (Putro, 2016) good image moderate the relationship between customer satisfaction and loyalty and attract new customer and investors. Therefore, customer satisfaction leads to customer loyalty that referred as customer positive attitudinal and behavioral response. According to Kang & James (2004) image can measured by customer’s perception of quality. In banking context, Bravo, Montaner & Pina (2009) explain that bank image is the net result of the interaction of all experiences, impression, beliefs, feelings, and knowledge that people have about Islamic banks. A study conducted by (Putro, 2016) explains that Good image moderates the relationship between customer satisfaction and customer loyalty and attracts new customer and investors. Therefore, examining the role of bank image as moderator variable between customer satisfaction and customer loyalty is important to be taken into consideration in the context of Islamic banks of Palestine.

In the banking business, service quality has been identified as a significant determinant of customer satisfaction and loyalty. A pleased client, according to scholars and practitioners, behaves in such a manner that they repeat service purchases and disseminate the positive word of mouth about the service quality received and the service provider's honesty. A disgruntled client, on the other hand, is more likely to seek out alternative choices and spread the unfavorable word of mouth to his or her circle of influence. It's no surprise that customer happiness has been identified as a predictor of future purchase intentions and loyalty in research. The concept is described as a consumer's commitment to a product or service that remains consistent in the future. Customer loyalty was defined in this study as a bank customer's continued patronage.

Customer loyalty and retention in Islamic banking has been a major concern to practitioners due to increasing local and global competition from conventional and non-Islamic banks. The constant findings of customer loyalty as a predictor of client retention have been emphasized by researchers (Ghaith et al., 2016). Many Islamic banks are working on enhancing service delivery and developing connections to decrease client switching behavior in order to stay afloat and thrive. Banks are considering perceived service quality as a need in order to maintain their competitive edge tool to retain loyal customers. Similarly, loyal consumers contribute to the success of a service company, and maintaining existing and loyal customers has been identified as being more cost-effective than acquiring new ones, affecting profitability.

Thus, understanding the determinants that influence on Islamic banks growth is important. The monetary authority statement suggested that, this study intends to investigate factors influence on customer satisfaction and customer loyalty in Islamic banks of Palestine. With the help of service quality literature, the present study develops an integrated model with the extension of PAKSERV model (Tangibility, Reliability, Assurance, Sincerity, Personalization & Formality), subjective norm, customer satisfaction, and bank image in order to investigate customer loyalty towards Islamic banks of Palestine.

Hypotheses Development

The Relationship between Tangibility and Customer Satisfaction

Tangibility is observed as the appearance of office, staff, furniture, and other related materials (Raajpoot, 2004). Tangibility is the first dimension of PAKSERV model and identified as appearance of office, staff, furniture, and other related materials (Raajpoot, 2004). One recent study conducted on tangibility Aramburu & Pescador (2019), has mentioned that managers and staff members need to work to enhance service tangibility across products and services. Earlier studies have confirmed that tangibility has a significant impact on customer satisfaction (Aramburu & Pescador, 2019; Charnley, Walker & Kuzmina (2015). Therefore, based on past studies and discussion above, this study proposes the following hypothesis:

H1: Tangibility is positively related to Customer Satisfaction.

The Relationship between Reliability and Customer Satisfaction

Reliability is defined as the ability of a service provider to deliver service accurately, over a consistent period of time (Raajpoot, 2004). Reliability can satisfy the desires, and needs of customer, associated with a brand, product, and service. Previous studies conducted by (Bahia & Nantel, 2000; Graham Saunders, 2008; Kang & James, 2004; Muhammad Kashif et al., 2016), they found reliability has a positive relationship with customer satisfaction. Therefore, based on the past studies, this study proposes the following hypothesis:

H2: Reliability is positively related to Customer Satisfaction.

The Relationship between Assurance and Customer Satisfaction

Assurance defined as where employees are knowledgeable, courteous, inspiring, and trustworthy (Raajpoot, 2004). Assurance is about the courteous attitude of the person that offers a product or service to customer. Additionally, it is one of the most important dimensions of PAKSERV model. Assurance refers to the courtesy of staff members during the provision of product or service (Ali & Raza, 2017). Moreover, staff members must show manners as per the language, cultural values, and beliefs of each. Additionally, an organization can preserve just a single group of customers and can face a challenging environment to compete globally. Several studies investigating the influence of assurance on customer satisfaction such as (Bahia & Nantel, 2000; Kang & James, 2004; Muhammad Kashif et al., 2016). They found there is a strong, positive relationship between assurance and customer loyalty. Thus, based on the above discussion, this study proposes the following hypothesis:

H3: Assurance is positively related to Customer Satisfaction.

The Relationship between Sincerity and Customer Satisfaction

Sincerity defined as where the service personnel is genuine and original while providing the service (Raajpoot, 2004). Sincerity must show to customer from each culture. Additionally, the impression or image of the organization will become bias and cannot achieve loyal customers. The organization can achieve loyal customers in the long run. Standard behavior of employees is essential particularly in a highly diverse and global organization. Previous studies found that there was a significant relationship between sincerity and customer satisfaction (Hussain, Al Nasser & Hussain, 2015; Raajpoot, 2004). As such, this study proposes the following hypothesis:

H4: Sincerity is positively related to Customer Satisfaction.

The Relationship between Personalization and Customer Satisfaction

Personalization means where the service provider pays attention and the service is highly customized (Raajpoot, 2004). Indeed, some customers want to get personal only to the necessary extent to purchase a product and service. Thus, for the customer service staff, it is important to identify the right depth of personalization with each customer. Personnel must adopt a fair attitude with all customers that can suitable and necessary to sell a product (Izogo & Ogba, 2015). Izogo & Ogba (2015), stated that customer will likely to find out a place where complete guidance and customization will offer from the personnel. Previous studies conducted by Muhammad Kashif & Abdur Rehman, et al., (2016); Raajpoot (2004) in Islamic banks, they found there was a positive, strong relationship between personalization and customer satisfaction. Thus, based on the above discussion, this study proposes the following hypothesis:

H5: Personalization is positively related to Customer Satisfaction.

The Relationship between Formality and Customer Satisfaction

Formality is defined as where the social distance is maintained, and cultural rituals are performed (Raajpoot, 2004). A study conducted by Muhammad Kashif, et al., (2016); Raajpoot (2004), they found formality has a significant impact on customer satisfaction. For example, across the Arab region, customers are usually not accepted an in-depth informal behavior or unnecessary closeness of customer service personnel. Instead, a highly formal behavior is applied to purchase or sell a product or service. Thus, depends on the previous studies and the above discussion, this study proposes the following hypothesis:

H6: Formality is positively related to Customer Satisfaction.

The Relationship between Subjective Norms and Customer Satisfaction

The individual's sense of social pressure from those who are important to them (e.g., family, friends, co-workers and others) to approve (or not) in a specific manner, as well as their incentive to follow other people's opinions, is referred to as a subjective norm. In a Yemeni banking study, researchers found a significant relationship between subjective norms and customer satisfaction in banking services among university students. Moreover, in Islamic online banking studies, the subjective norms variable has been added by several researchers. Subjective norms, it was discovered, had a beneficial impact on the usage of online banking in Iran. Subjective norm was recently validated as a major independent variable towards the satisfaction-loyalty route in Palestine when it was combined with SERVQUAL dimensions (Alnaser, Ghani & Rahi, 2017). It may be inferred from this study that the subjective norms variable has an influence on customer satisfaction in Islamic banking. Thus, this study proposes the following hypothesis:

H7: Subjective Norm is positively related to Customer Satisfaction.

The Relationship between Customer Satisfaction and Customer Loyalty

Customer satisfaction is defined as a meeting of customer expectation of the products and services provided by banks (Zameer, Tara, Kausar & Mohsin, 2015). Client happiness has been proven as an independent variable influencing customer loyalty in a variety of service sectors. However, there has been little empirical research on the path of quality satisfaction loyalty in Islamic banks. Muahmmad Kashif, et al., (2015) pioneered the use of PAKSERV to evaluate risk in Asian Islamic banking the influence of customer satisfaction as an independent. The researchers discovered a high link between PAKSERV-satisfaction-loyalty in Malaysian Islamic banks, with a coefficient value of 0.867. The findings matched those of Bangladeshi research (Siddiqui, 2001) that looked at the same process that led to customer loyalty in Bangladesh retail banks. It may be inferred from this study that the customer satisfaction variable has a direct influence on customer loyalty in Islamic banks. Thus, this study proposes the following hypothesis:

H8: Customer Satisfaction is positively related to Customer Loyalty.

Mediating Role of Customer Satisfaction in the Relationship between PAKSERV Dimensions, Subjective Norm, and Customer Loyalty

Customer satisfaction has been proven as a mediating variable affecting customer loyalty in a variety of service sectors (Kitapci et al., 2014; Hussain, 2016). However, there has been little empirical research on the path of quality-satisfaction-loyalty in Islamic banks. As an independent variable, Molaee, Ansari & Teimuori (2013) Customer satisfaction has a direct impact on the loyalty of Iranian Muslim clients, according to the study. Customer satisfaction, as a mediating variable, was shown to have a strong mediation impact between the service quality dimensions of dependability, tangibility, and responsiveness toward customer loyalty, according to the researchers. The customer satisfaction variable can directly affect customer loyalty in Islamic banks, as well as mediate the individual connections between each PAKSERV component and customer loyalty in Islamic banks, according to the findings of this study. Thus, based on the above discussion and evidence, and taking into consideration previous hypotheses (H1, H2, H3, H4, H5, H6, H7, H8) the following hypotheses are proposed in the current study:

H9: Customer Satisfaction mediates the relationship between Tangibility and Customer Loyalty.

H10: Customer Satisfaction mediates the relationship between Reliability and Customer Loyalty.

H11: Customer Satisfaction mediates the relationship between Assurance and Customer Loyalty.

H12: Customer Satisfaction mediates the relationship between Sincerity and Customer Loyalty.

H13: Customer Satisfaction mediates the relationship between Personalization and Customer Loyalty.

H14: Customer Satisfaction mediates the relationship between Formality and Customer Loyalty.

H15: Customer Satisfaction mediates the relationship between subjective norm and Customer Loyalty

Moderating Role of Bank Image in the Relationship between Customer Satisfaction and Customer Loyalty

The image of a bank is described as the mental image that people have of it when they hear its name or when they conduct business with it (Alnaser, Ghani, Rahi, Mansour & Abed, 2017). The image was proven to be a major predictor of consumer loyalty by researchers. As a result, Faullant, Matzler & Füller (2008) believe that a highly-approved image is important for a service company to secure and retain its market position. As a result, image is linked to how clients perceive a service organization after hearing its name, goods, and services (Nguyen & Leclerc, 2011). Customers' perceptions of service quality were proven to be a good indicator of image.

There is inadequate research on bank image as a moderating variable in customer loyalty in banking, particularly Islamic banking, in the context of bank service quality. According to Sabir, et al., (2014), banks with superior services than their competitors have a stronger bank image. In order to better understand the importance of bank image in both conventional and Islamic banking, researchers looked into it, (Saleh, Quazi, Keating & Gaur, 2017) Customers have a higher level of loyalty to reputable banks, according to the study. There is a notion that these well-established institutions are better able to deliver services of higher quality. Most significantly, according to the study by Amin, et al., (2013), Muslim banking clients choose Islamic banks because of their reputation for Shariah-compliant practices, this is in accordance with and fulfills their religious responsibilities Customers' favourable attitudes toward Shariah-compliant financial goods were further confirmed in Indonesian Islamic banking (Wahyuni & Fitriani, 2017). According to this research, a bank's image can influence client happiness and loyalty. Thus, based on the past studies and evidence above this study proposes the following hypothesis:

H16: Bank Image moderates the relationship between Customer Satisfaction and Customer Loyalty.

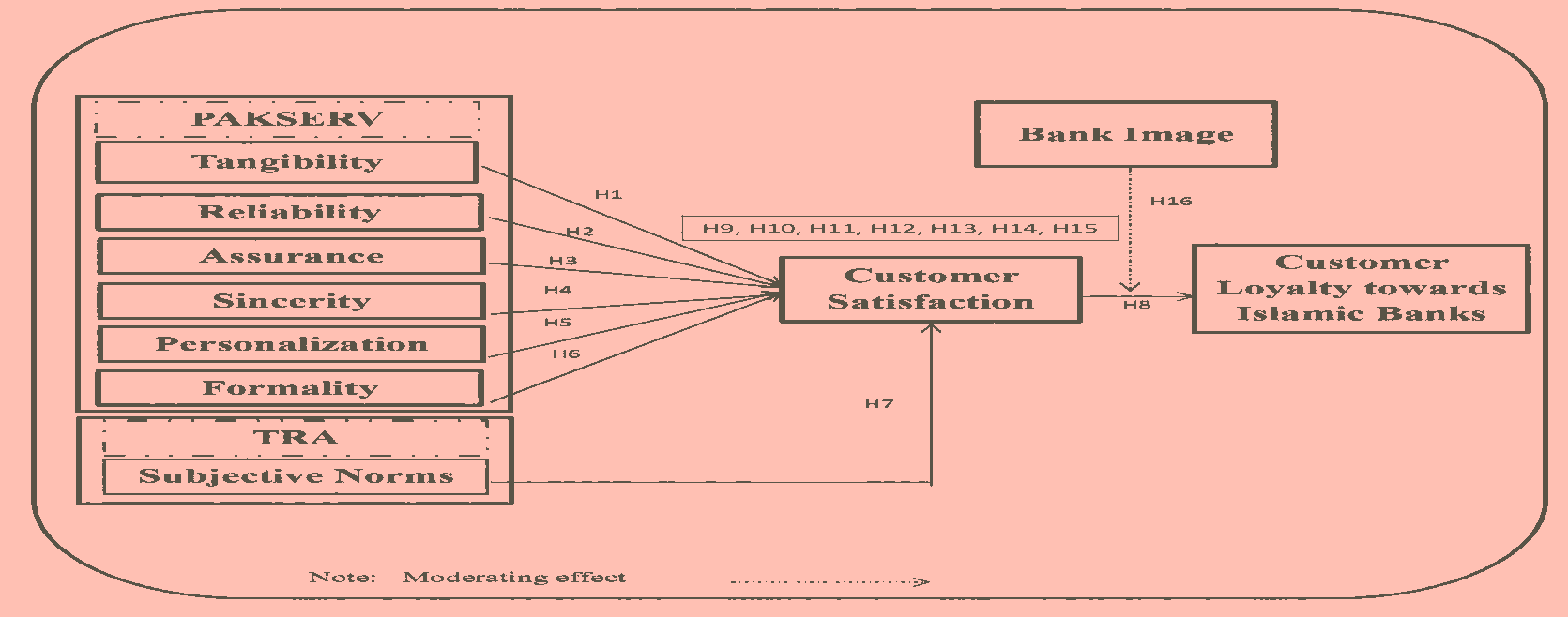

The Conceptual Framework

The TRA serves as the foundation for this study's conceptual framework. Subjective norm, attitude, behavioural intention, and behavior were the four key components of this approach. Although all of the TRA components are relevant, this study just looks at subjective norms. Subjective norm was important in assessing customers' behavior toward acceptance or rejection of financial products or services in a Malaysian cultural setting, according to a study by Fauziah, et al., (2008). As a result, this study used subjective norm above other TRA variables to measure the cultural effect on service quality and purchasing decisions.

In addition, the SERVQUAL and PAKSERV models for service quality were expanded in this work. The PAKSERV model is made up of six different dimensions: tangibility, dependability, assurance, sincerity, customization, and formality. The PAKSERV concept was created in a non-Western environment and is better suited to countries with a strong cultural influence (Raajpoot, 2004). To quantify service quality, this approach has been used in the Pakistani (Muhammad Kashif et al., 2015; Muhammad Kashif et al., 2016); and African (Yalley & Agyapong, 2017) banking sectors. As shown in Figure 1, this study offers a conceptual framework.

Methodology

As study aim to investigate the effect of service quality PAKSERV dimensions those influence customer loyalty with mediating role of customer satisfaction and moderating role of bank image in Islamic banks of Palestine. Based on this approach study is apply positivist research philosophy and explanatory in nature, whereas the research design based on quantitative research approach. Hence this helps researchers to elaborate and test existing theory. The population of this study comprised on customers of Islamic banks from West Bank Palestine since it is under Palestinian Authority Control. Furthermore, there are two major Islamic banks working in Palestine namely Palestine Islamic bank with 15 branches and Arab Islamic Bank with 14 branches respectively.

From west bank Palestine, Branches of two banks in three major city Nablus north west bank, Ramallah middle west bank and Hebron south west bank was selected for data collection from customer and convenience sampling, since the list of customers were not available in order to get customer response about service quality of Islamic banks. For appropriate sample size was 360 valid responses from customers based of G-power technique for determination of sample size. As the statistical power analysis which is also known as prior power analysis is able to estimate sufficient sample sizes to achieve adequate power for the study (Marcoulides & Saunders, 2006). Self-administrative survey questionnaire used for data collection and response rate was 71% for this study. As 500 questionnaire were distributed and 360 complete questionnaire return back by customers. Moreover, Seven-point Likert scale as “1” for strongly disagree and “7” for strongly agree was

Research Instrument

As this study comprised on five constructs, PAKSERV, customer satisfaction, bank image and customer loyalty. However, PAKSERV comprised on six sub-construct and all construct items were adopted and adapted from previous studies. The adaptation of scale for four constructs of this study discussed below in detail;

Pakserv

There are six variables in this study that associated with PAKSERV service quality namely Tangibility, Reliability, Assurance, Sincerity, Personalization, and Formality. The measurement items of these variables were adopted and adapted from previous research conducted by Raajpoot (2004). The reason for adoption was higher Cronbach’s alpha values (0.80) that demonstrate the reliability of this instrument. Moreover, these items have used in Islamic bank study conducted by Muhammad Kashif & Abdur Rehman, et al., (2016) which enrich the content validity of the items.

Subjective Norms

The term subjective norms referred to the individual’s perception of social pressure from social players those are important for them (e.g. family, friends, colleagues and other) to approve in a particular manner and motivation to conform to those people’s views. The scale was adopted since the value of Cronbach alpha is 0.97 which exhibit the strong reliability of and instrument.

Customer Satisfaction

The term customer satisfaction refers to the meeting of customer expectations related to the products and service with actual product and service provided by banks. To measure the customer satisfaction three items were adopted from study conducted by Muhammad Kashif & Abdur Rehman, et al., (2016). The pervious study measure the Cronbach alpha value greater than 0.7 for three items.

Bank Image

The Islamic bank images from the customer’s perspective are the association that they have when they hear the name or while they are conducting their transactions with these institutions (Alnaser, Ghani & Rahi, et al., 2017). Three items were adapted from study conducted in context of Islamic banking by Amin, et al., (2013).

Customer Loyalty

Customer loyalty referred to the consumer commitment towards product and service provided by bank and remained consistent with it in the future (Amin et al., 2013). To measure loyalty three items were adopted from the study conducted by Muhammad Kashif & Abdur Rehman, et al., (2016). The value of Cronbach alpha is greater than 0.70 so it is considered that scale is developed and adopted for this study.

Data Analysis

Respondents’ Profile

The demographic characteristics of the respondents were shown in Table 1 Below. In this study the respondents for the main survey was profiled related to their age, gender, education region, occupation and marital status.

| Table 1 Descriptive Statistics of the Respondent |

|||

|---|---|---|---|

| Demographic | Category | Frequency (n=357) | Percentage (%) |

| Gender | Male | 207 | 58 |

| Female | 150 | 42 | |

| Marital Status | Married | 266 | 74 |

| Single | 91 | 26 | |

| Age | < 20 | 27 | 7.6 |

| 21-30 | 51 | 14.3 | |

| 31-40 | 139 | 38.9 | |

| 41-50 | 87 | 24.4 | |

| 51-60 | 53 | 14.8 | |

| > 60 | -- | -- | |

| Education | High School or below | 55 | 15.4 |

| Diploma | 154 | 43.1 | |

| Bachelor | 61 | 17.1 | |

| Master | 87 | 24.4 | |

| Ph.D. | -- | -- | |

| Region | Urban | 279 | 78.2 |

| Countryside | 78 | 21.8 | |

| Occupation | Student | 19 | 5.3 |

| Private Sector | 174 | 48.7 | |

| Public Sector | 84 | 23.5 | |

| Self-employed | 77 | 21.6 | |

| Others | 3 | .8 | |

It was depicted that there were 207 male and 150 were females respondents which represents 58% were male and 42% females. According to this survey 74% respondents were married and remaining 26 was unmarried. Whereas, regarding age results showed that majority of the Islamic banking customer were adults and there ages are greater than 31 years. Among all 43.1% customers were diploma holder, 17.1% were bachelor degree and 24.4% had master degree holder which indicated that majority of respondents were educated and have appropriate perception and opinion related to the Islamic banks service quality concerns. Moreover, about 78.2% customers were from urban area of west bank Palestine. Lastly, among all customers majority of them are private or government sector employees were 21.6% customers were doing their own business as they are self-employed.

Final-Stage Data Analysis

Missing value or missing data considered as an important issue in quantitative data analysis. Missing value issue usually emerged because the survey research includes a large number of the sample. If the missing value in data set is systematic or not randomly, any technique used for the treatment of missing value can probably create biased results. Whereas, if the missing values prevails at random pattern which known as Missing Value Completely At Random (MCAR) and remedying is considered to a produce acceptable results. In this study, we used Expectation Maximization (EM) test used to deal with missing values. It has been argued that missing values should be less than 10% of the total responses collected. In this study none of the constructs has greater than 2% missing values and maximum of missing values is 0.6% which is negligible and process for further data analysis.

After dealing with missing values, it is important to evaluate the dataset for data normality. Because it is critical to check data normality before application of multivariate data analysis. Normality was measured with Skewness and kurtosis, however, it not necessary to test normality, particularly when have large sample size. It is argued that value between -2.58 and +2.58 is the most repeatedly used and critical test value of kurtosis and skewness. The values of each items are well prevails within the predefined limits of skewness and kurtosis. Moreover, it is argued that to ensure that common method variance may not affect the results of study. So we used Harman’s single factor test to evaluate the CMV problem. It is to ensure that covariance account for single factor must not be greater than 50%. CMV results by using Harman’s single factor test. Results showed that first component is only accounted for 29.777% variance i.e., <50%. This revealed that common method variance is not gone be effect the study results.

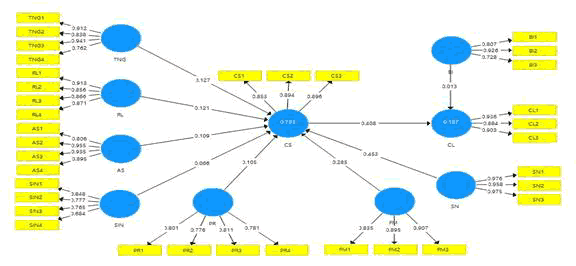

When data is examined and clean for final stage data analysis, two-step data analysis model was used. At first stage measurement model was tested using Partial Least Squares (PLS) through Smart PLS 3.0. The validation of measurement model was evaluated by measuring indicator reliability, internal consistency, convergent and discriminant validity.

| Table 2 Results of Measurement Model |

|||||

|---|---|---|---|---|---|

| Model Construct | Measurement Items | Loading | CA | CR | AVE |

| Assurance | AS1 | 0.806 | 0.920 | 0.944 | 0.809 |

| AS2 | 0.955 | ||||

| AS3 | 0.935 | ||||

| AS4 | 0.895 | ||||

| Bank Image | BI1 | 0.807 | 0.775 | 0.863 | 0.680 |

| BI2 | 0.926 | ||||

| BI3 | 0.728 | ||||

| Customer Loyalty | CL1 | 0.936 | 0.894 | 0.934 | 0.824 |

| CL2 | 0.884 | ||||

| CL3 | 0.903 | ||||

| Customer Satisfaction | CS1 | 0.853 | 0.856 | 0.912 | 0.776 |

| CS2 | 0.894 | ||||

| CS3 | 0.896 | ||||

| Formality | FM1 | 0.835 | 0.853 | 0.911 | 0.774 |

| FM2 | 0.895 | ||||

| FM3 | 0.907 | ||||

| Personalization | PR1 | 0.801 | 0.802 | 0.871 | 0.628 |

| PR2 | 0.776 | ||||

| PR3 | 0.811 | ||||

| PR4 | 0.781 | ||||

| Reliability | RL1 | 0.913 | 0.899 | 0.930 | 0.768 |

| RL2 | 0.856 | ||||

| RL3 | 0.866 | ||||

| RL4 | 0.871 | ||||

| Sincerity | SIN1 | 0.848 | 0.775 | 0.853 | 0.594 |

| SIN2 | 0.777 | ||||

| SIN3 | 0.765 | ||||

| SIN4 | 0.684 | ||||

| Subjective Norm | SN1 | 0.976 | 0.968 | 0.979 | 0.941 |

| SN2 | 0.958 | ||||

| SN3 | 0.975 | ||||

| Tangibility | TNG1 | 0.912 | 0.890 | 0.923 | 0.750 |

| TNG2 | 0.838 | ||||

| TNG3 | 0.941 | ||||

| TNG4 | 0.762 | ||||

Table 2 showed that internal consistency was measured with composite reliability, the value of each items is range from 0.853 to 0.979 which >0.70 recommended threshold value. Also, the values of Cronbach’s Alpha (CA) were also above the threshold value, ranges from 0.775 to 0.968 established the internal consistency reliability of each constructs. After achievement of composite reliability, it is to assess the indicator reliability of the measurement model. It is argued by that recommended loading greater is than 0.7, however the factor loading 0.6, 0.5 or 0.4 is adequate if complement AVE and CR achieved required threshold value. All items of each construct for this study have exhibit acceptable indicator reliability. The result of measurement model presented below in Figure 2.

The convergent validity was measurement by examined the Average Variance Extracted (AVE) value. The AVE value was higher than threshold values ranging from 0.594 to 0.941. So the measurement model achieved the required convergent validity. Discriminant validity was achieved when cross loading achievement required values. Square of each AVE was calculated, average variance shared between each construct and its measure ought to be greater than the variance shared between the constructs and other constructs. Hence this study achieved the discriminant validity. Below Table 3 showed the results of Fornell and Larcker Criterion for this study.

| Table 3 Discriminant Validity Using Fornell and Larcker’s Criterion |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| AS | BI | CL | CS | FM | PR | RL | SIN | SN | TNG | |

| AS | 0.900 | |||||||||

| BI | 0.067 | 0.825 | ||||||||

| CL | 0.217 | 0.043 | 0.908 | |||||||

| CS | 0.437 | 0.073 | 0.409 | 0.881 | ||||||

| FM | 0.351 | 0.062 | 0.406 | 0.708 | 0.880 | |||||

| PR | 0.146 | 0.086 | 0.244 | 0.436 | 0.299 | 0.792 | ||||

| RL | 0.376 | 0.058 | 0.360 | 0.658 | 0.582 | 0.305 | 0.877 | |||

| SIN | 0.108 | 0.652 | 0.040 | 0.150 | 0.087 | 0.082 | 0.096 | 0.771 | ||

| SN | 0.280 | 0.009 | 0.282 | 0.771 | 0.522 | 0.351 | 0.516 | 0.030 | 0.970 | |

| TNG | 0.258 | 0.055 | 0.321 | 0.467 | 0.325 | 0.226 | 0.453 | 0.107 | 0.296 | 0.866 |

After, the validity and reliability of the measurement model were confirmed, next have to test the structural model. The validity of the structural model was measurement via lateral collinearity assessment, path coefficient, and coefficient of determination Furthermore, the effect size and predictive relevance of the path model was evaluated. As Ramayah et al. (2016) argued the prior to examine to evaluate the structural model, it is imperative to confirm the no collinearity issue in the structural model. The literal collinearity was examined with VIF statistics. If the value of VIF 3.3 or higher, the value signpost a potential collinearity problem, hence Inner VIF values for all the exogenous constructs were examined for lateral multicollinearity was <5 demonstrating lateral multicollinearity was not a problem for this study. The values of VIF shown below in Table 4.

| Table 4 Results of Lateral Collinearity Assessment |

||

|---|---|---|

| Customer Loyalty VIF | Customer Satisfaction VIF | |

| Assurance | 1.221 | |

| Bank Image | 1.005 | |

| Customer Loyalty | ||

| Customer Satisfaction | 1.005 | |

| Formality | 1.738 | |

| Personalisation | 1.189 | |

| Reliability | 1.915 | |

| Sincerity | 1.025 | |

| Subjective Norm | 1.591 | |

| Tangibility | 1.296 | |

Coefficient of determination the amount of variance caused in endogenous constructs by all exogenous constructs. The value from 0 to 1 with higher level demonstrates the higher level of predictive accuracy. Smart-PLS algorithm function was performed to obtain the values. Findings revealed that exogenous constructs were capable to explain 79.3% of the variance on endogenous construct customer satisfaction. Whereas, the bank image and customer satisfaction explained about 16.7% of the variance in Islamic banks customer loyalty. After that, we assessed the predictive relevance of of the path model. The predictive relevance of the path model was measured with blindfolding procedure. It is only applied to the endogenous constructs those have reflective measurement. The value of were greater than 0 it certain that the path model has predicative relevance for endogenous construct of this study. The results of and for this study has been presented below in Table 5.

| Table 5 predictive relevance Q2 and (q2) analysis |

||||

|---|---|---|---|---|

| Customer Satisfaction | ||||

| Construct | R2 | Q2 | (q2) | Decision |

| Customer Satisfaction | 0.793 | 0.574 | Supportive | |

| Tangibility | 0.016 | Small | ||

| Reliability | 0.009 | Small | ||

| Assurance | 0.014 | Small | ||

| Sincerity | 0.004 | Small | ||

| Personalization | 0.016 | Small | ||

| Formality | 0.082 | Small | ||

| Subjective Norm | 0.211 | Medium | ||

| Customer Loyalty | ||||

| Construct | R2 | Q2 | Decision | |

| Customer Loyalty | 0.167 | 0.123 | 0.083 | Supportive |

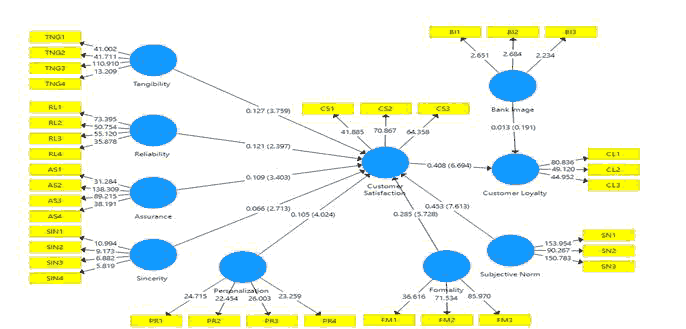

As shown in above Table 6, the values of for customer satisfaction was 0.574 and 0.123 for customer satisfaction greater than 0, that demonstrate the model has sufficient predicative relevance. Small effect sizes wherein tangibility, reliability, assurance, sincerity, personalization, and formality have less than small predictive effect sizes. Therefore, subjective norm has a medium effect size and indicates that the most important construct in order to predict customer satisfaction. Below Figure 3 present the results of structural model.

Hypotheses Testing

As Partial Least Squares (PLS) is non-parametric technique, does not need data to be normalized. But chances are there that the t-values might be inflated or deflated hence leads to type one error. Thus, it is recommended to use bootstrapping. 5000 bootstrapping sample was taken from original sample with replacement to determined bootstrap standard error, which gave approximate t-values for the significance for testing structural path. Therefore, the critical values for significance in two-tailed and one-tailed test path coefficients were followed as recommended by (Ramayah et al., 2016). Thus, direct effects of initial of 8 hypotheses were tabulated in Table 6.

| Table 6 Path Coefficient Assessment |

|||||||

|---|---|---|---|---|---|---|---|

| Hypothesis | Relationship | Direct effect (β) | SE | T-Statistics | P Values | Interval estimate | |

| LL | UL | ||||||

| H1 | TNG -> CS | 0.127 | 0.032 | 3.759** | 0.000 | 0.077 | 0.182 |

| H2 | RL -> CS | 0.121 | 0.048 | 2.397** | 0.005 | 0.044 | 0.201 |

| H3 | AS -> CS | 0.109 | 0.031 | 3.403** | 0.000 | 0.057 | 0.158 |

| H4 | SIN -> CS | 0.066 | 0.025 | 2.713** | 0.004 | 0.022 | 0.104 |

| H5 | PR -> CS | 0.105 | 0.026 | 4.024** | 0.000 | 0.067 | 0.151 |

| H6 | FM -> CS | 0.285 | 0.053 | 5.728** | 0.000 | 0.208 | 0.374 |

| H7 | SN -> CS | 0.453 | 0.060 | 7.613** | 0.000 | 0.364 | 0.555 |

| H8 | CS -> CL | 0.408 | 0.062 | 6.694** | 0.000 | 0.285 | 0.497 |

Thus, H1, H2, H3, H4, H5, H6, H7 were statistically significant and effect on customer satisfaction. Tangibility, Reliability, sincerity, assurance, personalization, formality and subjective norms has positive effect on customer satisfaction. Moreover, H8 Customer satisfaction also has positive effect on customer loyalty in Islamic banks of Palestine. Remain aligned with the research objective to assess the mediating relationship. Recommendations were followed to obtain the mediating relationship prevailing between dependents and independents constructs. The mediating relationships among constructs are discussed in Table 7.

| Table 7 Indirect Effect For Mediation |

|||||||

|---|---|---|---|---|---|---|---|

| Hypothesis | Relationship | Indirect effect (β) | SE | t-statistic | P – Value | Interval estimate | |

| LL | UL | ||||||

| H9 | TNG -> CS-> CL | 0.052 | 0.016 | 3.235** | 0.001 | 0.023 | 0.083 |

| H10 | RL -> CS-> CL | 0.049 | 0.023 | 2.196* | 0.029 | 0.010 | 0.101 |

| H11 | AS -> CS-> CL | 0.045 | 0.015 | 2.939** | 0.003 | 0.019 | 0.079 |

| H12 | SIN -> CS-> CL | 0.027 | 0.010 | 2.734** | 0.006 | 0.008 | 0.047 |

| H13 | PR -> CS-> CL | 0.043 | 0.011 | 3.821** | 0.000 | 0.023 | 0.064 |

| H14 | FM -> CS-> CL | 0.116 | 0.029 | 3.953** | 0.000 | 0.061 | 0.179 |

| H15 | SN -> CS-> CL | 0.185 | 0.031 | 5.868** | 0.000 | 0.130 | 0.254 |

Thus, H9, H10, H11, H12, H13, H14, H15 were statistically significant and customer satisfaction mediate the relationship. Tangibility, Reliability, sincerity, assurance, personalization, formality and subjective norms has positive effect on customer loyalty mediated by customer satisfaction. We used bank image as moderating variable between customer satisfaction and customer loyalty. Moderation was tested by using orthogonalization approach. Results of the moderating test were discussed in Table 8.

| Table 8 Indirect Effect for Moderator |

|||||

|---|---|---|---|---|---|

| Hypothesis | Relationship | Indirect effect (β) | SE | t-statistic | P - Value |

| H16 | CS*BI-CL | 0.150 | 0.073 | 2.412* | 0.020 |

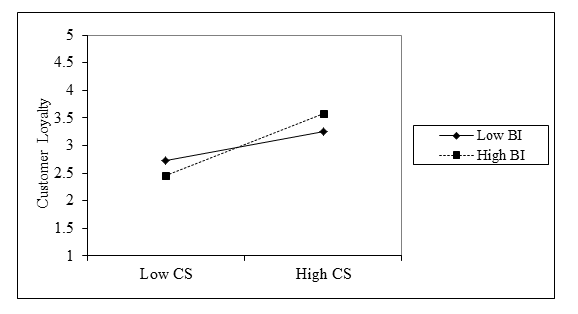

Findings revealed that, the interaction effect between customer satisfaction and bank image was significant (β=0.150, t-value=2.412 p<0.05). The value of for customer loyalty was also increased from 1.67 to 1.87. Additionally, interaction plot was drafted to see how the moderator changes the relationship between customer satisfaction and bank image. Following is the interaction plot that elaborates the strength of the moderating relationship. Figure 4 revealed that the relationship between customer satisfaction and customer loyalty was stronger when bank image was higher. These findings supported for H16 which indicates that the positive relationship between customer satisfaction and customer loyalty will be stronger when Bank image is higher. Thus, it is confirmed that bank image a significant moderator and moderate the relationship between customer satisfaction and customer loyalty in Islamic banks of Palestine.

Discussion

The first research objective was to examine the influence of PAKSERV Service Quality dimensions (Tangibility, Reliability, Assurance, Sincerity, Personalization and Formality) and subjective norms on Customer Satisfaction in Islamic Banks of Palestine. All above hypotheses confirmed that a positive and significant relationship was existed between PAKSERV dimensions and subjective norms with customer satisfaction towards Islamic Banks in Palestine. This has been proved also in previous studies that PAKSERV is culture supportive service quality model (Graham Saunders, 2008; Muhammad Kashif et al., 2016; Raajpoot, 2004). With the accession to this argument, this study has tested PAKSERV model in banking sector of Palestine and indicated that PAKSERV model is valid service quality measure even in Palestine culture.

Moreover, this section discussed the relationship between subjective norm and customer satisfaction towards Islamic banks in Palestine. This study proposed that “Subjective Norm is positively related to Customer Satisfaction”. Findings of the structural model confirmed that Islamic banks following subjective norm have more satisfied customers in Palestine. Previous studies conducted by (Fauziah et al., 2008; Han & Kim, 2010; Liao, Chen & Yen, 2007) had highlighted the importance of subjective norm in banking sector. Thus, depends on the above arguments, it was concluded that in Palestine Islamic banking sector, subjective norm is important to be taken into consideration.

Moreover, this study stated that “Customer Satisfaction is positively related to Customer Loyalty”. The significant relationship was found between customer satisfaction and customer loyalty which was in line with previous studies (Osman, Ali, Zainuddin, Rashid & Jusoff, 2009). Thus, the above findings answer the second research question and confirmed that customer satisfaction leads to customer loyalty in Palestine Islamic banks. The third research objective measure the mediating role of customer satisfaction. Among PAKSERV dimensions (Tangibility, Reliability, Assurance, Sincerity, Personalization, Formality) and Subjective Norm and Customer Loyalty towards Islamic Banks in Palestine. Findings suggested that mediating relationship of customer satisfaction between service quality PAKSERV dimensions and customer loyalty is statistically significant. Additionally, customer satisfaction mediates the relationship between subjective norm and customer loyalty.

The fourth research objective to measure the moderating relationship of Bank image between customer satisfaction and customer loyalty. In line with Bravo, et al., (2009) this study explains bank image is the net result of the interaction of all experiences, impression, beliefs, feelings, and knowledge that people have about Philistine Islamic banks. Good image moderates the relationship between customer satisfaction and loyalty and attract new customer and investors (Putro, 2016). Hence, researcher concluded that the bank image moderates the relationship between customer satisfaction and customer loyalty in Islamic banks of Palestine.

Conclusion

This study has made several contributions to service quality research by integrating PAKSERV model, the Theory of Reasoned Action, bank image and customer satisfaction in Islamic banking context. First, this research contributes to the body of knowledge by examining the impact of PAKSERV model and subjective norms on customer satisfaction and customer loyalty in the Palestine Islamic banking context. The present study is different from several traditional studies those examined SERVQUAL model for the measurement of service quality in banking sector. On contrary this research incorporated PAKSERV model to investigate service quality issues in Islamic banks of Palestine. Second, PAKSERV model is extended with subjective norm which is one of the most core factors of Theory of Reasoned Action. Extension of PAKSERV model revealed that subjective norm is the most influencing factor to investigate customer satisfaction of Islamic banks customers in Palestine. Effect size analysis indicated that subjective norm had medium level of effect size in order to determine customer satisfaction. Therefore, importance-performance matrix analysis showed that subjective norm has substantial power and considered as the most important factor to investigate customer satisfaction. Thus, the present study contributes to PAKSERV model by adding subjective norm and revealed that for service quality investigation extension of PAKSERV model with subjective norm is adequate.

Third, the current study is considered customer satisfaction as a mediating variable between extended PAKSERV model and customer loyalty. Therefore, the current study has confirmed that customer satisfaction mediates the relationship between tangibility, reliability, assurance, sincerity, personalization, formality, subjective norm and customer loyalty in Islamic banks of Palestine. Thus, investigating a new dimension of relationship contributes to service quality literature especially in Palestine Islamic banks. Fourth, the current study examined the role of bank image and outlined bank image as a moderating variable between customer satisfaction and customer loyalty. Thus, investigation of bank image as moderator variable contributes to services marketing literature and augments the understanding of customer loyalty in Islamic banking.

Finally, the study contribution to the development of an integrated service quality model. The present study is developed an integrated service quality model with the integration of PAKSERV, subjective norm and bank image to see the influence of these dimensions on customer satisfaction and customer loyalty. Thus, integration of PAKSERV model with subjective norm and bank image is appropriate and extends the body of knowledge to understand customer satisfaction and loyalty of Islamic banking customers in better ways in Palestine.

References

Ali, H., Zainuddin, A., Rashid, W.E.W., & Jusoff, K. (2009). Customers satisfaction in Malaysian Islamic banking. International Journal of Economics and Finance, 1(1), 197-202.

Alnaser, F., Ghani, M., & Rahi, S. (2017). The impact of SERVQUAL model and subjective norms on customer’s satisfaction and customer loyalty in Islamic banks: A cultural context. Int J Econ Manag Sci, 6(5), 455.

Alnaser, F., Ghani, M., Rahi, S., Mansour, M., & Abed, H. (2017). Determinants of customer loyalty: The role of service quality, customer satisfaction and bank image of Islamic banks in Palestine. Int J Econ Manag Sci, 6(461), 2.

Aramburu, I.A., & Pescador, I.G. (2019). The effects of corporate social responsibility on customer loyalty: The mediating effect of reputation in cooperative banks versus commercial banks in the Basque country. Journal of Business Ethics, 154(3), 701-719.

Ashraf, S., Ilyas, R., Imtiaz, M., & Ahmad, S. (2018). Impact of service quality, corporate image and perceived value on brand loyalty with presence and absence of customer satisfaction: A study of four service sectors of Pakistan. International Journal of Academic Research in Business and Social Sciences, 8(2), 452-474.

Bahia, K., & Nantel, J. (2000). A reliable and valid measurement scale for the perceived service quality of banks. International journal of bank marketing, 18(2), 84-91.

Bravo, R., Montaner, T., & Pina, J.M. (2009). The role of bank image for customers versus non-customers. International journal of bank marketing, 27(4), 315-334.

Charnley, F., Walker, D., & Kuzmina, K. (2015). Fast-Moving Circular Goods 2025.

Choi, G., & Chung, H. (2013). Applying the technology acceptance model to Social Networking Sites (SNS): Impact of subjective norm and social capital on the acceptance of SNS. International Journal of Human-Computer Interaction, 29(10), 619-628.

Faullant, R., Matzler, K., & Füller, J. (2008). The impact of satisfaction and image on loyalty: The case of Alpine ski resorts. Managing Service Quality: An International Journal, 18(2), 163-178.

Fauziah, T.M., Ramayah, T., & Abdul, R.D. (2008). Factors influencing intention to use diminishing partnership home financing. International Journal of Islamic and Middle Eastern Finance and Management, 1(3), 235-248.

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to theory and research reading, MA: Addison-Wesley, 6.

Ghaith, A., Junoh, Z., & Abdullah, S. (2016). The impact and trend of service quality on customer loyalty towards five stars hotels: A comparative study of Malaysia and Jordan. International Journal of Engineering Sciences & Management Research, 3(1).

Ghaith, A., Mutia, S., Ayassrah, A.Y., Abdul Malek, T., & Enas, A. (2018). Investigation of factors influencing customer loyalty in Malaysia and Jordan hotel industry. Journal of Hotel & Business Management, 8(12), 797-809.

Graham, S.S. (2008). Measuring and applying the PAKSERV service quality construct: Evidence from a South African cultural context. Managing Service Quality: An International Journal, 18(5), 442-456.

Han, H., & Kim, Y. (2010). An investigation of green hotel customers’ decision formation: Developing an extended model of the theory of planned behavior. International Journal of Hospitality Management, 29(4), 659-668.

Hussain, R. (2016). The mediating role of customer satisfaction: Evidence from the airline industry. Asia Pacific Journal of Marketing and Logistics, 28(2), 234-255.

Hussain, R., Al Nasser, A., & Hussain, Y.K. (2015). Service quality and customer satisfaction of a UAE-based airline: An empirical investigation. Journal of Air Transport Management, 42, 167-175.

Izogo, E.E., & Ogba, I.E. (2015). Service quality, customer satisfaction and loyalty in automobile repair services sector. International Journal of Quality & Reliability Management, 32(3), 250-269.

Kashif, M., Wan Shukran, S.S., Rehman, M.A., & Sarifuddin, S. (2015). Customer satisfaction and loyalty in Malaysian Islamic banks: A PAKSERV investigation. International journal of bank marketing, 33(1), 23-40.

Kitapci, O., Akdogan, C., & Dortyol, I.T. (2014). The impact of service quality dimensions on patient satisfaction, repurchase intentions and word-of-mouth communication in the public healthcare industry. Procedia-Social and Behavioral Sciences, 148, 161-169.

Liao, C., Chen, J.L., & Yen, D.C. (2007). Theory of Planning Behavior (TPB) and customer satisfaction in the continued use of e-service: An integrated model. Computers in Human Behavior, 23(6), 2804-2822.

Marcoulides, G.A., & Saunders, C. (2006). Editor's comments: PLS: A silver bullet? MIS quarterly, iii-ix.

Mokhlis, S., Aleesa, Y., & Mamat, I. (2011). Municipal service quality and citizen satisfaction in southern Thailand. Journal of Public Administration and Governance, 1(1), 122-137.

Molaee, M., Ansari, R., & Teimuori, H. (2013). Analyzing the impact of service quality dimensions on customer satisfaction and loyalty in the banking industry of Iran. International Journal of Academic Research in Accounting, Finance and Management Sciences, 3(3), 1-9.

Nguyen, N., & Leclerc, A. (2011). The effect of service employees' competence on financial institutions' image: Benevolence as a moderator variable. Journal of services marketing, 25(5), 349-360.

Osman, I., Ali, H., Zainuddin, A., Rashid, W.E.W., & Jusoff, K. (2009). Customer’s satisfaction in Malaysian Islamic banking. International Journal of Economics and Finance, 1(1), 197.

Parasuraman, A., Zeithaml, V.A., & Malhotra, A. (2005). ES-QUAL a multiple-item scale for assessing electronic service quality. Journal of Service Research, 7(3), 213-233.

Petzer, D.J., De Meyer-Heydenrych, C.F., & Svensson, G. (2017). Perceived justice, service satisfaction and behaviour intentions following service recovery efforts in a South African retail banking context. International Journal of Bank Marketing, 35(2).

Putro, A. (2016). Influence of corporate image and relationship quality on customer Trust and customer loyalty on the pt garuda Indonesia in Surabaya. Asian Journal of Business and Management Sciences, 4(11), 24-36.

Raajpoot, N. (2004). Reconceptualizing service encounter quality in a non-western context. Journal of Service Research, 7(2), 181-201.

Sabir, R.I., Akhtar, N., Ghafoor, O., Hafeez, I., Chaudhri, A., & Rehman, A.U. (2014). Difference between Islamic banks and commercial banks performance in Pakistan. International Review of Management and Business Research, 3(2), 1038.

Saleh, M.A., Quazi, A., Keating, B., & Gaur, S.S. (2017). Quality and image of banking services: A comparative study of conventional and Islamic banks. International journal of bank marketing, 35(6), 878-902.

Siddiqui, S.H. (2001). Islamic banking: True modes of financing. New Horizon, 109(2), 15-20.

Teo, T. (2010). Examining the influence of subjective norm and facilitating conditions on the intention to use technology among pre-service teachers: A structural equation modeling of an extended technology acceptance model. Asia Pacific Education Review, 11(2), 253-262.

Wahyuni, S., & Fitriani, N. (2017). Brand religiosity aura and brand loyalty in Indonesia Islamic banking. Journal of Islamic Marketing, 8(3), 361-372.

Yalley, A.A., & Agyapong, G.K. (2017). Measuring service quality in Ghana: A crossvergence cultural perspective. Journal of Financial Services Marketing, 22(2), 43-53.

Received: 30-DEC-2021, Manuscript No. JMIDS-21-6207; Editor Assigned: 02-JAN-2022, Preqc No. JMIDS-21-6207 (PQ); Reviewed: 15-JAN-2022, QC NO. JMIDS-21-6207; Revised: 23-JAN-2022, Manuscript No. JMIDS-21-6207 (R); Published: 30-JAN-2022