Research Article: 2022 Vol: 26 Issue: 2

The Innovation-Sales Growth Nexus in Europe

Alberto Costantiello, Professor of Economics and International Economics, Lum-University

Lucio Laureti, Professor of Economics, Lum-University

Marco Matarrese, Assistant Professor at Lum-University

Angelo Leogrande, Assistant Professor at Lum-University

Citation Information: Costantiello, A., Laureti, L., Matarrese, M., & Leogrande, A. (2022). The innovation-sales growth nexus in Europe. Academy of Accounting and Financial Studies Journal, 26(2), 1-14.

Abstract

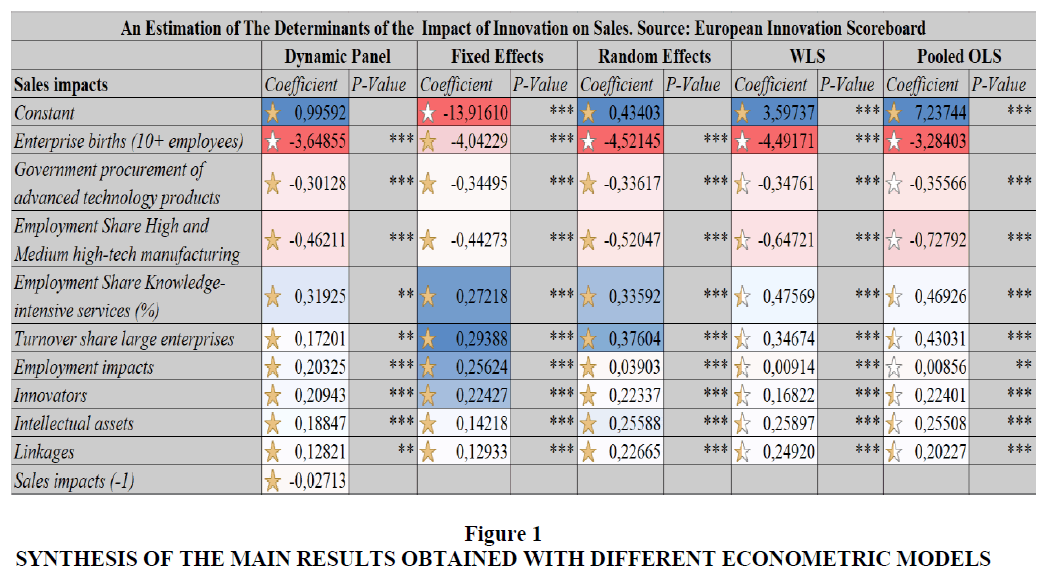

In this article we investigate the innovation-sales growth nexus in Europe. We use data from European Innovation Scoreboard of the European Commission in the period 2000-2019 for 36 countries. Data are analyzed using Panel Data with Random Effects, Fixed Effects, Dynamic Panel at 1 Stage, Pooled OLS, WLS. Results show that the impact of innovation on sales in Europe is positively associated with “Share Knowledge-Intensive Services”, “Turnover of Share Large Enterprises”, “Employment Impacts”, “Innovators”, “Intellectual Assets”, “Linkages” and is negatively associated with “Enterprise Births”, “Government Procurement of Advanced Technology Products”, “Share of Employment in High and Medium high-tech Manufacturing”.

Keywords

Innovation, Open Innovation, Research and Development, Sales Growht, Firm Performance.

Introduction

We investigate what are the determinants of the innovation sales growth nexus using data from European Innovation Scoreboard for 36 countries (The countries are: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finlandia, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Latvia, Lithuania, Luxembourg, Malta, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, UK) in the period 2000-2019. We analyze data using Panel Data with Fixed Effects, Random Effects, Dynamic Panel at 1 stage, WLS and Pooled OLS. The question of innovation is essential in the context of the economic growth especially in the context of the Schumpeterian economics (Schumpeter & Opie, 1934) in the theory of (Solow, 1956) and in the endogenous growth theory (Romer, 1994). Technological innovation and Research and Development can boost economic growth and promote productivity and firm performance. Innovation also has a positive on employment (Costantiello & Leogrande, 2020). The degree of financial development of an economic system has a positive effect on innovation (Laureti, et al., 2020). Based on economic theory and on research on innovation, we address the question of the relationship between innovation and sales growth.

The article continues as follows: the second paragraph presents a literature review centered on the relationship between innovation and firm performance, the third paragraph discusses the econometric model, the fourth paragraph concludes.

Literature Review

Love & Roper, (2015) affords the question of the relationship among SMEs innovation, exporting and growth. The authors find that it is important to develop policies that can enforce the relationship between innovation and exportation SMEs. Specifically, there is also a positive connection between access to finance for SMEs and investment in innovation and exportation. But the authors also consider the relevance of intangible and human capital in promoting the investment in innovation as a tool to boost exportations and sales. Wei et al. (2014) afford the question of the relationship between technological innovation and firm growth. The authors investigate a dataset of 176 Chinese firms, and they distinguish between exploitative innovation and exploratory innovation. They find that on one side exploitative innovation is negatively associated to the firm performance while on the other side exploratory innovation has a positive impact on firm growth. But, if firms choose to a management model based on efficiency then there are greater probabilities that the exploitative innovation prevails on the exploratory innovation. Authors find that if firm are oriented to improve new models of business management then they tend to improve exploratory innovation on exploitative innovation. Audretsch et al. (2014) afford the question of the role of innovation as a driver of firm growth. The authors show some critique on the ability of innovation to produce growth of sales in economic organizations. But to analyze the role of innovation in the sense of firm growth it is necessary to improve a multidimensional approach. Authors are essentially skeptic about the automatic relationship between innovation and firm-growth. Choi & Williams, (2014) analyze the relationship between innovation and sales growth in China. The authors consider the fact that firm invest in improving technological innovation to promote the economic performance and to boost growth. Essentially there are three methodologies through with firms can innovate:1. Improving the general orientation of the firm toward the innovation;

2. Developing a managerial model based on innovation scope either in the sense of depth either in the sense of diversity;

3. Implementing innovational spillovers;

But the authors question if these approaches also hold for newcos in emerging markets and they find that effectively innovation intensity and knowledge spillovers have a positive effect on sales growth.

Chaston & Scott, (2012) analyze the role of firm performance in Peru in connection with innovation and specifically open innovation. The authors have realized an interview to Peruvian corporate managers, and they effectively find the presence of a positive relationship between open innovation and firm performance in the sense of sales growth. Cui, et al. (2015) underline the role of technology in promoting the ability of firm to perform open innovation. But the authors sustain that the relationship between information technology and open innovation is not well-suited on a theoretical background. The main question is to investigate the connection between open innovation and the strategic alignment of information technology. The ways in which open innovation and IT strategies are connected shape the outcomes of firms in the sense of performance, growth, and sales. 225 Chinese firms are analyzed. The authors find that:1. Information Technology-IT flexibility improves either innovation radicalness either innovation volume;

2. Information Technology-IT integration is positively associated only with innovation volume;

3. Innovation volumes and innovation radicalness promote sales growth.

Kyläheiko et al., (2011) consider that firms can apply two different strategies to growth in their sales i.e. either to innovate by creating new products and services either to acquire new customer through internationalization and the conquer of new markets abroad. But firms also can choose to apply a combination of innovation and internationalization. The authors question if innovation and internationalization are in a zero sum or in a positive sum game. 300 Finnish firms are analyzed and classified in four different clusters i.e.:1. Domestic replicators;

2. Domestic innovators;

3. International replicators;

4. International innovators.

These firms are analyzed considering their ability to promote innovation, technology and to have access to knowledge economy. Results show that the probability of firms to gain from innovation is strongly associated to the ability to introduce new technologies. But if national markets are characterized by saturation then the mix of innovation and internationalization can have a positive impact on the impact of firm to improve their sales growth.

Golovko & Valentini, (2011) consider the role of innovation on SMEs exportation. The authors find that there is a strong complementarity between innovation and exportation. Specifically, the connection between innovation and exportation can be explained interpreting exportation in the context of learning by doing: since exportation is a learning process then it increases the ability of a firm to innovate. But also, innovation can improve exportation since new products and services can open new geographical markets for firms. The authors apply the hypothesis of the biunivocal positive relationship between innovation and exportation through a panel of Spanish manufacturing firms in the period 1990-1999. Results confirm the presence of a strong complementarity between innovation and exportation. Demirel & Mazzucato, (2012) afford the question of the relationship between investment in Research and Development and firm performance. The authors analyze the data of US pharmaceutical firms, either small either public quoted, in the period 1950-2008. The authors find that:1. There is a positive relationship between Research and Development and firm performance especially for big pharmaceutical corporations if they realize patents;

2. If big pharmaceutical corporations do not realize patents then there is no positive relationship between Research and Development and firm performance;

3. There is a positive relationship between Research and Development and firm performance also for SMEs but only if they realize a patent at least for 5 years.

Love et al. (2011) analyze the relationship between firms in the service sectors considering the nexus between innovation and business growth. The authors consider a survey of 1100 UK firms in the third sector. Specifically, the research investigates not only the ability of a single firm to innovate but also the positive relationship existing between firm’s external links and the innovation process. The authors realize an econometric analysis and find the sequent results:1. The presence of an openness innovation can boost team working;

2. There is a positive relationship between the capacity of a firm to absorb external knowledge and the presence of an in-house design ability;

3. There exists a positive relationship between business growth and innovation in the service sector;

4. The diversity of innovation is positively related to business process change in the service sector;

5. The presence of links to customer improve innovation at firm level;

6. The ability to develop linkages with private and public institutions has a positive effect on innovation.

Uhlaner et al. (2013) analyze the relationship between sales growth and innovation in SMEs. Specifically, the authors consider external sourcing of knowledge and innovation and the ability of employees to participate actively in the innovational process. Data are collected from Dutch SMEs. Results show that:

1. There is a direct effect of innovation and external sourcing either on process and on product innovation;2. There is an indirect effect of innovation on sales growth;

3. The activism of employees boosts innovation;

4. There is a negative relationship between activism of employees towards innovation and sales growth.

But the authors also find that the smallest firms can reduce the negative effect of employment involvement in innovation in its relationship with sales growth.

Wang & Miao, (2015) analyze the relationship between market orientation and innovation. The authors consider the presence of a positive relationship between market orientation and innovation. Specifically, market orientation is decomposed in three parts that are: customer orientation, competitor orientation and inter-functional coordination. Data are collected from the US Manufacturing sector. Results shows that sales force creativity has a positive impact on customer orientation and firm performance and that it depends strongly on the ability to innovate. Troilo, (2014) analyze the question of the relationship among collaboration, innovation, and sales growth in Chinese firms. Data are collected from 2.700 Chinese firms in 15 industries and 25 cities. The authors process data through Logistic Regression, Poisson Regression and Ordinary Least Squares-OLS. Results shows that domestic collaboration can improve the degree of innovation in SMEs. Semuel et al. (2017) afford the question of the relationship between innovation and leadership in the touristic sector in Indonesia. The authors collected data through interviews to CEOs. SPSS, Structural Equation Model and Partial Least Square are used to analyze data. Results show that leadership have a positive effect on innovation and on performance in tourists’ firms. Pantano et al., (2017) analyze the role of technological innovation in retail industry. The authors consider specifically the role of patents in creating the conditions for technological change. Results shows that patents and intellectual property rights are essential in promoting not only the ability to innovate but also the orientation towards competition. Howell, (2016) afford the question of the connection among taxation, financial constraints, and innovation in China. Specifically, the authors consider the reform of value added tax in the 2004. Findings show that the lack of financial resources has a negative impact on the ability of Chinese firms to innovate and invest in Research and Development. But the authors also find that the reduction in taxation does not improve the orientation of firms towards innovation and Research and Development i.e. the alleviation of financial resources does not automatically implies the investment in technological change. Alrubaiee et al. (2015) recognize the role of knowledge management and innovation in economic organizations. Specifically, the authors analyze the relationship among Knowledge Management, Organizational Performance and Organizational Innovation. The analysis is applied to ICT and telecommunication sector in Jordan. The results show that:1. Knowledge Management has a positive effect on Organizational Innovation;

2. Knowledge Management improves Organizational Performance;

3. Organizational Innovation positively affect Organizational Performance.

Oh et al. (2020) afford specifically the question of the eco-innovation. Specifically, the authors consider the impact of eco-innovation on sales in Korea. The results show that the investment in eco-innovation is positively associated to sales growth. Rodríguez & Nieto (2016) afford the question of the impact of R&D offshoring on sales growth in SMEs. The authors consider that R&D offshoring has a positive effect on sales, but these effects can change since firms can realize either an insourcing either an outsourcing methodology. Specifically, the role of R&D is analyzed in connection with innovation. Data are collected from SMEs manufacturing enterprises in Spain. Results show that:1. Offshore outsourcing of Research and Development positively affect sales growth either directly either indirectly;

2. Offshore insourcing of Research and Development affect positively sales growth only indirectly through innovation.

The investigation shows the ability of R&D to promote sales growth even if though innovation. The authors distinguish between the direct impact of Research and Development on sales growth in contradiction with the indirect impact of R&D on sales growth.

Gërguri‐Rashiti et al. (2017) analyze the role of technological innovation, specifically ICT, on business performance. The authors use data from the Business Environment Enterprise Performance Survey-BEEPS in the period 2002, 2005, and 2008. The authors show that the investment in innovation technology is positively associated to an increase in firm performance. Fernández-Mesa & Alegre, (2015) afford the question of the relationship between exportation and firm performance. The authors use data from Spanish and Italian SMEs and show the presence of a positive relationship between the ability of firms to innovate and the orientation toward exportation. Firms that have CEOs able to invest in innovation and organizational learning also have greater probability to have access to exportation. Lee et al. (2019) afford the question of the relationship among product, process, marketing, and organizational innovation in respect to firm performance. The authors also consider the role of exploration and exploitation innovation in respect to firm performance, and they find that:1. exploration has a positive impact on product innovation;

2. exploitation has a positive impact on process innovation;

3. process innovation is positively associated to product innovation;

4. marketing innovation can promote a deeper connection between product innovation and firm performance in the high-tech sectors;

5. in low-tech firms process innovation has a positive effect on firm’s performance

The authors show the role of innovativeness on firm’s performance. Bagheri et al. (2019) afford the question of the relationship among internationalization, technological innovation, and firm performance in SMEs. The authors are interested in investigating the role of technological innovation on firm performance. Data are collected from 116 SMEs in UK. Results show:

1. the presence of an inverted U-shaped relationship between international firm performance and technological innovation in SMEs;

2. technological innovation can improve international performance of SMEs.

Caputo et al. (2016) analyze the question of the relationship between open innovation and firm performance. The authors consider the growing role of open innovation in promoting the ability of firm in creating new products and services. Open innovation actively participates in the business model of SMEs. Firms need to promote open innovation due to main economic changes i.e. intensification of global competition, rising costs of Research and Development, and the reduction of life cycle of products. The authors show that firms that invest in open innovation tend to have greater probability to improve performance, but since, open innovation is costly, the result can be in part counterfactual. Cassiman & Valentini, (2016) afford the question of the relationship among open innovation, internal and external knowledge. The authors find that firms can sell and buy knowledge, through products and services, and that this activity has a positive impact on innovation. Specifically, open innovation offers economic advantages in reducing some costs of producing knowledge i.e. cognitive, transactional, organizational costs. Firms that buy and sell knowledge also improve sales. The authors show the presence of a positive relationship between open innovation and sales growth. Junge et al. (2016) ) afford the question of the impact of product and marketing innovation in productivity growth. Authors analyze data from Danish economy. Product innovation requires either product innovation either marketing innovation. But innovation also is based on high-skilled human capital. In effect the authors find that marketing innovation and product innovation can improve productivity growth only if firms employ high-skilled human capital. Specifically, the authors find that if a firm improve the share of high skilled workers of 1% then the productivity improves of 0.1%. The analysis shows that marketing and product innovation also require high skilled workers to promote productivity growth. The positive relationship among product innovation, marketing innovation and productivity growth also depends on human capital. Boermans & Roelfsema, (2016) afford the question of the relationship between internationalization, innovation, and firm performance. Firm performance is considered as a combination of employment growth and sales growth. The authors consider data from 150 Dutch SMEs. Results show that:1. internationalization has a positive effect on innovation;

2. internationalization has a positive effect on firm performance through innovation;

3. the impact of innovation of firm performance lacks statistical significance.

Zhang et al. (2019) afford the question of the relationship between innovation and firm performance in the context of the green economy. The authors find that there is a positive relationship between green innovation especially in the form of green patenting and firm performance. Data are collected from Chinese listed manufacturing firms in the period 2000-2010. The authors find that the positive relationship between green innovation and firm performance holds especially for Chinese State-Owned Enterprises. Xie et al. (2019) afford the question of the relationship between green technology innovation and firm performance. The authors collected data from 209 listed company operating in sectors characterized by negative environmental externalities. Results show that:1. there is a positive relationship between green product innovation and green process innovation

2. green process innovation and green product innovation have a positive impact on firm performance

3. the positive relationship between green process innovation and firm performance is mediated by product innovation;

4. if customers perceive the firm as green in its image than the positive relationship between product innovation and firm performances is weakened;

5. green subsidies lack the ability to reduce the statistical significance of the positive relationship between product innovation and firm performance.

Guo et al. (2017) analyze the relationships between opportunity recognition and SMEs performance. Specifically, not all the opportunities are able to promote SMEs performance. The authors investigate the methodologies that can strengthened the relationship between business opportunities and SMEs performance. Results show that there is a positive relationship between opportunity recognition and SMEs performance mediated through business model innovation.The Model

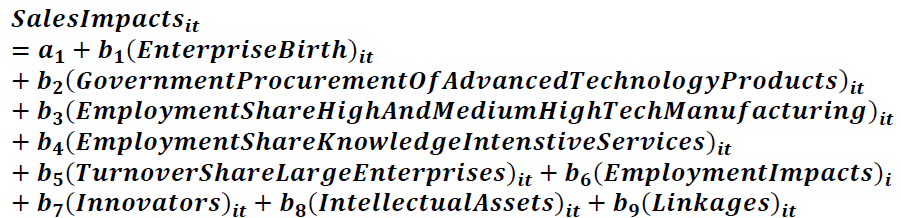

We estimate the sequent model:

Where i = 36 and t = [2000;2019]

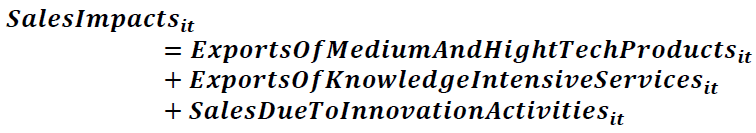

We estimate the determinants of “Sales Impacts”. The European Innovation Scoreboard (Hollanders, 2009) defines “Sales Impacts” as a variable that: «[…] measures the economic impact of innovation and includes three indicators measuring Exports of medium and high-tech products, Exports of knowledge-intensive services, and Sales due to innovation activities.»

In this sense it is possible to write extensively the three components of the variable “Sales Impacts” that are:

We found that the level of “Sales Impacts” is negatively associated to:

1. Enterprise births (10+ employees): is defined as the number of births of enterprises in a certain year. There exists a negative relationship between “Sales Impact” and the role of “Enterprise births”. This relationship suggests that if firms can growth through innovation then there is a sort of zero-sum game with new entrants. In effect if a sector is characterized by growing sales then there are low probabilities that new enterprises enter in the same sector due to barriers and market limitations that can impede the formation of newcos and startups.

2. Government procurement of advanced technology products: is an indicator that « […] measures the extent to which government procurement decisions in a country foster technology innovation by providing the average response to the following question: “Government purchase decisions for the procurement of advanced technology product are (1=based solely on price, 7=based on technical performance and innovativeness)” (Hollanders, 2009)». In effect if firms can improve their sales through innovation then they have also lowed needs to work as suppliers of the government. There is an effect of substitution between the ability of firm to improve sales and the presence of a public demand for high-tech quality.

3. Share of Employment in High and Medium high-tech manufacturing: it is a variable evaluate the percentage of employment in medium and high-tech manufacturing (Hollanders, 2009).

The presence of a negative relationship between the impact of innovation on sales growth and the percentage of employment in medium and high-tech manufacturing show that the role of human capital is marginal in creating the conditions for a successful innovation in the sense of firm performance on the market. The increase in the percentage of employment in high and medium tech manufacturing has a negative impact on the ability of a firm to improve sales trough innovation. This can be due to the fact that the manufacturing sector i.e. the traditional industry, has a marginal role in the context of the new technology based on ICT that can better sustain innovation.

We also find that the level of “Sales Impacts” is positively associated to:

1. Share Knowledge-intensive services (%): is a variable that consider the role of percentage of Employment in Knowledge-intensive services (Hollanders, 2009). If firms improve the percentage of human capital in intensive services, this can have a positive impact of the ability of a firm to improve sales growth through innovation. This relationship shows that the ability of firm to innovate is essentially based on the level of servitization. The process of innovation requires knowledge-intensive services such as for example in the case of Research and Development. This means that if policy makers are interested in creating the conditions to promote the ability of firm to innovate, they should introduce fiscal incentives for knowledge-intensive services firms and corporations.

2. Percentage of turnover share of large enterprises: is positively associated to the ability of a firm to improve sales through innovation. This means that if in a certain economy there is a polarization of turnover among large enterprises then also there is the possibility for firm to innovate with positive impact on sales growth. The positive relationship can be better understood considering that generally the markets that are associated to the presence of larger enterprises are essentially based on monopolistic competition. In a regime of monopolistic competition firms tend to invest more in product and process innovation with positive impact on sales growth.

3. Employment impacts: is a variable that evaluate «[…] the impact of innovation on employment […]»(Hollanders, 2009). There is a positive relationship between employment impacts of innovation and sales growth. This positive relationship means that innovation is essentially an activity that is based on the active participation of human capital in the productive process in a knowledge economy. If an innovation has a positive impact on employment then the same innovation also promote sales growth.

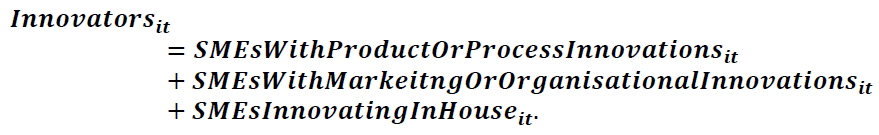

4. Innovators: is an indicators that « […] includes three indicators measuring the share of firms that have introduced innovations onto the market or within their organisations, covering both product and process innovators, marketing and organisational innovators, and SMEs that innovate in-house. » (Hollanders, 2009). We can express the three dimensions of the innovators in an explicit form that is:

There is a positive relationship between the presence of innovators and the ability of innovation to promote sales growth. This means that if firms are generally characterized by the presence of a management that recognizes the role of innovation to promote the firm’s growth then this can also boost the positive relationship between innovation and sales growth.

1. Intellectual assets: is an indicator that « […] captures different forms of Intellectual Property Rights (IPR) generated in the innovation process, including PCT patent applications, Trademark applications, and Design applications. (Hollanders, 2009) ». We can express the three determinants of the intellectual assets in an explicit form: IntellectualAssets_it=PCTPatentApplications_it+TrademarkApplications_it+DesignApplication_it .There is a positive relationship between the presence of intellectual assets and the ability of firms to improve sales through innovation. This positive relationship can be better understood since generally an innovation takes the form of a patent. The greater the number of patents, trademark application and design application the greater the probability of a positive impact of innovation on sales growth.

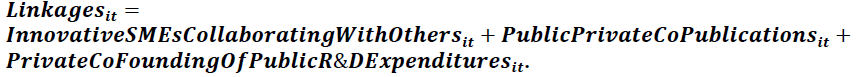

2. Linkages: is an indicator that « […] includes three indicators measuring innovation capabilities by looking at collaboration efforts between innovating firms, research collaboration between the private and public sector, and the extent to which the private sector finances public R&D activities.» (Hollanders, 2019). We can express the indicator “Linkages” in an explicit way as follows:

3.

There is a positive relationship between the presence of linkages and the ability of innovation to promote sales growth. The greater the ability of a firm to develop relationships and linkages with other firms and institutions in promoting Research and Development projects the greater the ability of a firm to promote sales growth through innovation. If a firm is interested in promoting an innovation that can also boost sales growth then the firm also should improve the level and degree of relationships with corporations and institutions.

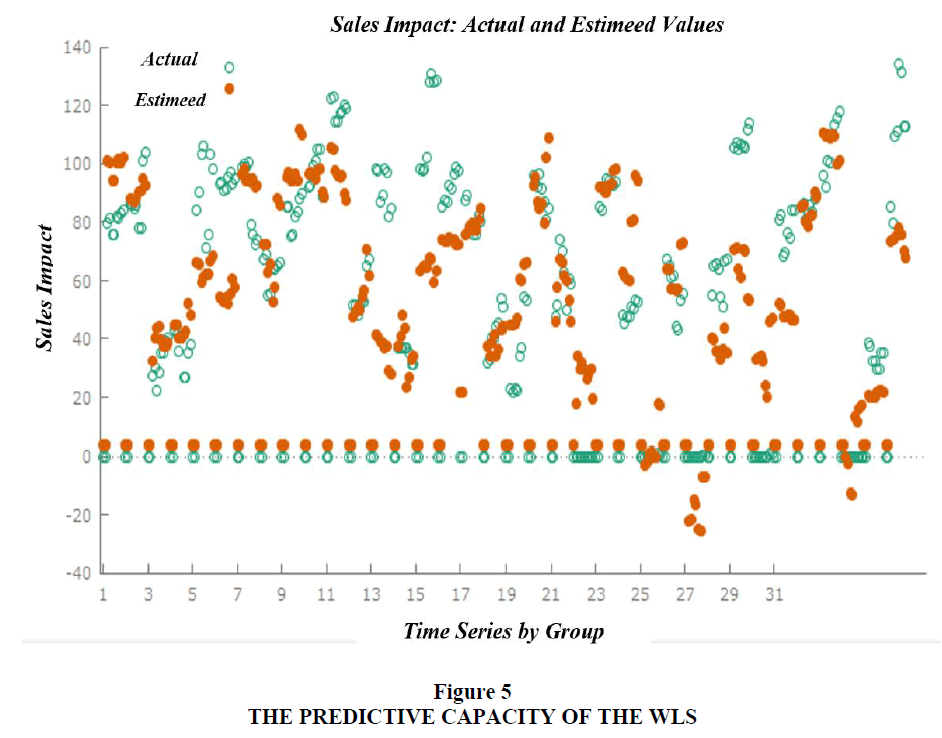

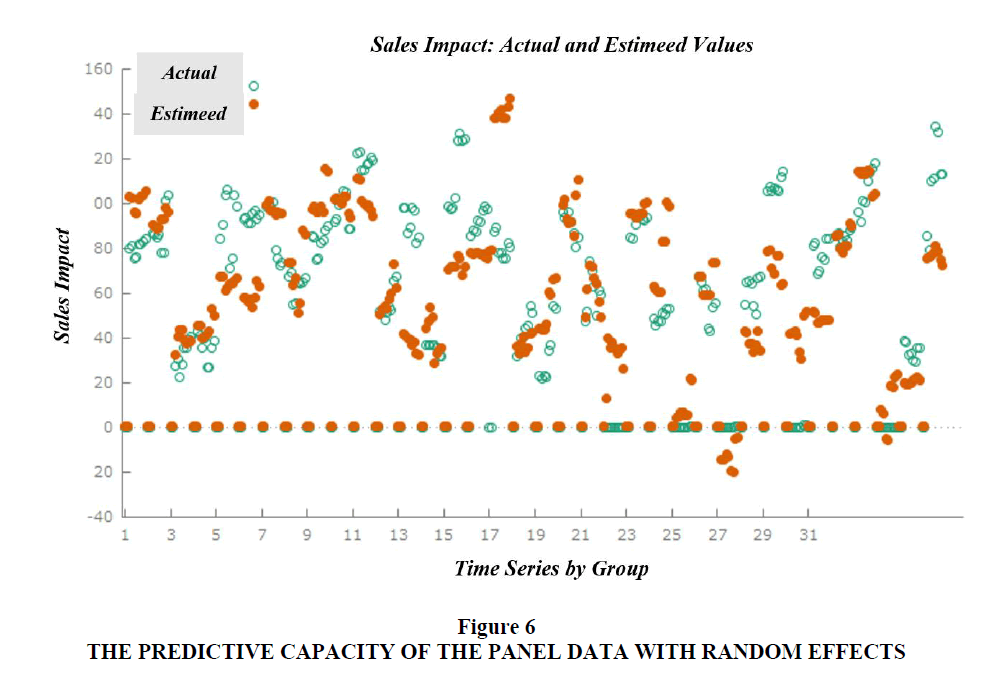

Our model shows that the ability of a firm to implement an innovation that is able to promote sales growth with a positive impact on the overall economic and financial performance depends positively by the presence of innovators, linkages among corporations and institutions, knowledge intensive services, intellectual assets, a positive relationship between innovation and employment, and the turnover share for large enterprises. If policy makers are interested in promoting economic policies able to generate innovation with a positive effect on firm performance, they should incentivize the system of innovation considering not only the individual ability of a firm to realize Research and Development, but also the presence of a cultural and entrepreneurial environment that is positively oriented to technological innovation Figures 1 to 6.

Conclusions

In this article we investigate the impact of innovation on sales growth for European firms in 36 countries in the period 2000-2019. We use data from the European Innovation Scoreboard processed with Panel data with Random Effects, Fixed Effects, Dynamic Panel at 1 Stage, Pooled OLS, WLS. The literature discussed in the second paragraph shows the presence of a positive relationship between innovation and sales growth especially in the sense of exportation. In effect, on one side, more innovative firms have greater probability to improve exportations, and on the other side the increasing exportation is positively associated to sales growth. The positive relationship between innovation and sales growth is common factor either of developed countries either of developing ones. Our econometric results show that the impact of innovation on sales in Europe is positively associated with “Share Knowledge-Intensive Services”, “Turnover Share of Large Enterprises”, “Employment Impacts”, “Innovators”, “Intellectual Assets”, “Linkages” and is negatively associated with “Enterprise Births”, “Government Procurement of Advanced Technology Products”, “Share of Employment in High and Medium high-tech Manufacturing”.

Index of FiguresFigure 1. Synthesis of the Main Results Obtained with Different Econometric Models. 9

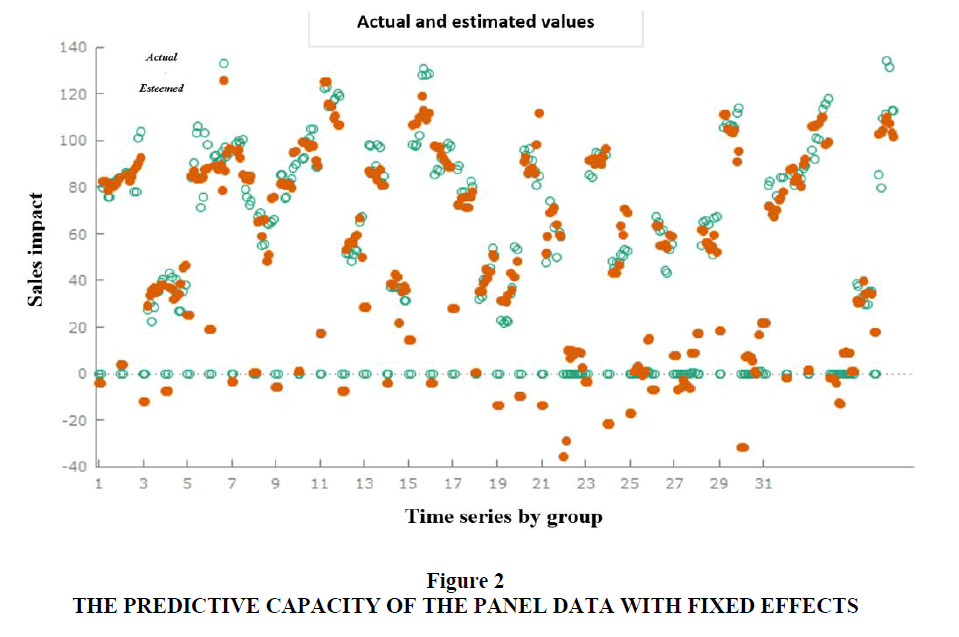

Figure 2. The Predictive Capacity of the Panel Data with Fixed Effects. 10

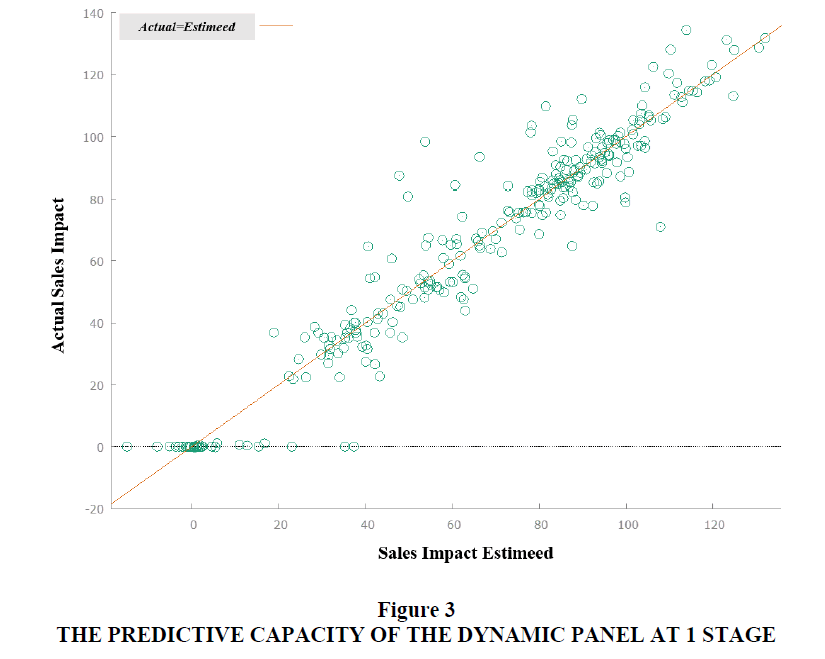

Figure 3. The Predictive Capacity of the Dynamic Panel at 1 stage. 10

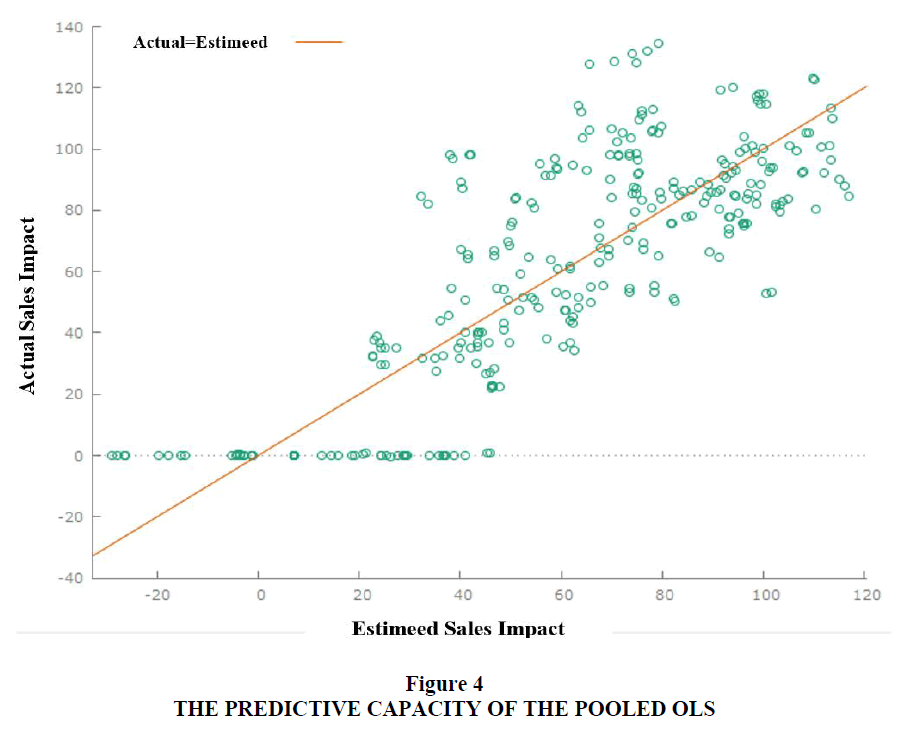

Figure 4. The Predictive Capacity of the Pooled OLS. 11

Figure 5. The Predictive Capacity of the WLS. 11

Figure 6. The Predictive Capacity of the Panel Data with Random Effects. 12

References

Alrubaiee, L., Alzubi, H.M., Hanandeh, R.E., & Al Ali, R. (2015). Investigating the relationship between knowledge management processes and organizational performance the mediating effect of organizational innovation. International Review of Management and Business Research, 989, 4.

Caputo, M., Lamberti, E., Cammarano, A., & Michelino, F. (2016). Exploring the impact of open innovation on firm performances. Management Decision.

Chaston, I., & Scott, G.J. (2012). Entrepreneurship and open innovation in an emerging economy. Management Decision, 50(7), 1161 - 1177.

Costantiello, A., & Leogrande, A. (2020). The innovation-employment nexus in Europe. American Journal of Humanities and Social Sciences Research, 4(11), 166-187.

Demirel, P., & Mazzucato, M. (2012). Innovation and firm growth: Is R&D worth it?. Industry and Innovation, 19(1), 45-62.

Gërguri‐Rashiti, S., et al. (2017). ICT, innovation and firm performance: the transition economies context. Thunderbird International Business Review, 59(1), 93-102.

Hollanders, H. (2019). European Innovation Scoreboard 2019 – Methodology Report. European Commission, 2-34.

Laureti, L., Costantiello, A., & Leogrande, A. (2020). The Finance-Innovation Nexus in Europe. IJISET - International Journal of Innovative Science, Engineering & Technology, 7(12), 11-55.

Love, J.H., & Roper, S. (2015). SME innovation, exporting and growth: A review of existing evidence. International Small Business Journal, 33(1), 28-48.

Oh, M., Shin, J., Park, P.J., & Kim, S. (2020). Does eco‐innovation drive sales and technology investment? Focusing on eco‐label in Korea. Business Strategy and the Environment, 29(8), 3174-3186.

Romer, P.M. (1994). The origins of endogenous growth. Journal of Economic Perspectives, 8(1), 3-22.

Schumpeter, J.A., & Opie, R. (1934). The theory of economic development: an inquiry into profits, capital, credit, interest, and the business cycle. New Jersey: Transaction Books a cura di New Brunswick: s.n.

Solow, R.M. (1956). A contribution to the theory of economic growth. The Quarterly Journal of Economics, 70(1), 65-94.