Research Article: 2022 Vol: 28 Issue: 2S

The investment decision-making process of Portuguese venture capital funds: Whats different and whats the same?

Mária Leonardo, ISCTE Business School, ISCTE Instituto Universitário de Lisboa

Renato Pereira, Business Research Unit, ISCTE Instituto Universitário de Lisboa

Citation Information: Leonardo, M., & Pereira, R. (2022). The investment decision-making process of Portuguese venture capital funds: What’s different and what’s the same? Academy of Entrepreneurship Journal, 28(S2), 1-18.

Keywords

Valuation, Selection, Startup, Entrepreneurship, Venture Capital, Portugal

Abstract

Startups have been proliferating in the business landscape despite the capital restrictions that these companies usually face. This competition for capital has created a very sophisticated venture capital industry across the world. Extant literature explains the investment process of venture capital firms in different countries but no work has previously studied the Portuguese industry. To fill this gap, we have conducted an exploratory study in this country using semi-structured interviews. Our findings unfold an interactive process with some simultaneous elements. Surprisingly, the startup’s financial track record is not important in the investment decision. This research results represent a contribution to the body of knowledge on the Portuguese VC industry.

Introduction

A startup is generally a company in the initial stage of its life cycle that aims to create products or services with a strong element of innovation and potential for growth (Pineda, 2016). Among the benefits that arise from the activity of startups, job creation stands out. Startups are characterised by high levels of risk and usually have no relevant tangible assets, which makes traditional sources of funding reluctant to provide them with capital. This, together with the fact that it provides early stage companies with the resources they would not otherwise have access to, is why venture capital is considered an attractive option for startups (Gompers & Lerner, 2001).

In Portugal, the venture capital market is growing rapidly. The efforts of various players have contributed to this, with the Portuguese government, in particular, having done much to foster this type of funding and promote innovation. The most notable example of this strategy is the government’s direct support for the Web Summit, a global event that Portugal hosts each year and which has greatly stimulated the entrepreneurial ecosystem of its capital, Lisbon.

Although several studies have focused on different aspects of risk capital in Portugal (e.g., Delgado et al., 2015), none have investigated the investment decision-making process of venture capitalists in this country.

Startup Companies

The word startup was first used in 1845 (Magalhães, 2019), but it was only after the 1990s that the term became widespread. This was due to the development of the Internet and consequent globalisation of the entrepreneurial phenomenon (De Oliveira & Zotes, 2018). Although it is difficult to define a startup precisely (Salamzadeh & Kawamorita-Kesim, 2015), these companies do have certain characteristics in common such as, innovation (Achleitner, 2016; Kolosok & Koniukh, 2017; Lewandowski, 2015; Rostek & Skala, 2017) and technology (Giardino et al., 2014; Pineda, 2016; Rosa et al., 2019). Two further elements that many studies associate with startups involve both their capacity for growth (Cockayne, 2019; Da Silva Piñeiro et al., 2017; Rostek & Skala, 2017) and the high level of uncertainty (Blank & Dorf, 2012; Cox et al., 2017; Ries, 2013). This latter not only being a consequence of the limited resources at their disposal, but also because of their short history of operations (De Oliveira & Zotes, 2018; Giardino et al., 2014). Startups are newly created companies, generally less than three years old that explore new ideas and market opportunities. They have an important impact on the economy of countries, contributing to higher levels of productivity and, consequently, to increased national wealth (Pineda, 2016). Funding is a major concern for this type of company given those factors such as a limited or non-existent financial history (Crow, 2005; Pacheco-Torgal, 2016) and the asymmetry of information between entrepreneurs and investors (Ahluwalia et al., 2020) make investing in startups an extremely risky business. With most startups having difficulty raising capital (Tanrisever et al., 2012) and most likely having to rely on various sources of funding, it is crucial that they choose the most appropriate means of finance for each stage of their development (Smith et al., 2011).

In an initial phase, entrepreneurs’ personal savings and informal investors, frequently referred to as 3Fs (family, friends, and fools), are important sources of capital (De Clercq et al., 2006; Malecki, 2012; Prohorovs et al., 2019; Smith et al., 2011; Ubal et al., 2019). Another traditional source of funding is commercial banking, but such participation is very limited as they are not geared to take on the high risk inherent to startups. Lastly, there are the business angels and venture capital funds that contribute not only with capital but also with know-how.

Venture Capital

Venture capital is a particularly important source of support for early stage companies, startups and PMEs, since it enables them to meet their financial needs (Casanova et al., 2018; Gompers & Lerner, 2001; Li & Zahra, 2012; Zhong et al., 2018). While in the US there is a clear distinction between the two fundamental forms of risk capital investment - venture capital and private equity–in Europe, this distinction tends to be less clear.

Private equity is a form of investment in already established businesses in mature sectors whose shares are not listed on any stock exchange (Caselli & Negri, 2018; Sullivan, 2017), and is aimed at companies that have finished growing (Caselli & Negri, 2018).

Venture capital essentially focuses on companies in their early stages, and is considered to be a subcategory of private equity geared to the financing of new enterprises – seed and startup – or enterprises undergoing expansion (Landström, 2007; Silveira & Wright, 2016; Šimi?, 2015). Venture capital is a source of funding that provides capital to companies characterized by high levels of risk, great potential for growth and the probability of high returns (Groh et al., 2010; Mishra et al., 2017; Van Deventer & Mlambo, 2009). It supports innovation and strategically contributes to these companies being able to scale their business dealings (Kumar & Kaura, 2003). Venture capital companies provide a certain amount of capital to early stage enterprises to help them grow and so that they can eventually earn a return from disinvestment.

The venture capital industry operates through three players: entrepreneurs who have the business ideas but lack the funding; investors who have the resources and want high returns but lack new business ideas; and venture capitalists (the term used henceforth to refer to the venture capital team), who act as intermediaries between the first two (Zider, 1998). Venture capitalists (general partners) raise capital from investors (limited partners) who are individuals with assets, and financial institutions to invest in startups (Teker & Teker, 2016). The limited partners, while providing almost all the capital are nevertheless passive investors as they do not intervene in the management of the investments (De Bernardi & Azucar, 2020; Freeman & Engel, 2007). Besides raising capital, venture capitalists are responsible for managing the funds, which includes selecting investments and seeking out good investment opportunities (De Clercq et al., 2006). Venture capitalists are actively involved in managing the enterprises in their portfolio by providing strategic and operational advice as well as know-how and networking possibilities (Freeman & Engel, 2007; Gifford, 1998; Zhong et al., 2018). Venture capitalists spend a considerable amount of time on their investments to reduce information asymmetry and to ensure that these investments are successful and result in high returns for all the players involved.

From the organizational point of view, there are two critical areas in the structure of venture capital enterprises: the investment team and the investment committee. The investment team is responsible for investment activity, such as business analysis, portfolio monitoring and fund-raising. The investment committee is the practical area that guides the investment team with regard to evaluating proposals (De Bernardi & Azucar, 2020). Venture capital firms typically invest in companies at two different stages of development: early stage and later stage (Jordan, 2010).

Investment Process

Since the 1970s, attempts have been made to describe the decision-making process of venture capitalists, there being a significant number of studies on the subject and different theoretical models put forward to specify that process. According to Silva (2004), the existing literature on the decision-making process of venture capitalists can be organised into two principal approaches. The first concerns processual research that focuses on the activities involved in the decision-making process (e.g., Hall, 1989; Tyebjee & Bruno, 1984). The second approach–criteria research–highlights the criteria used by venture capitalists to evaluate investment proposals (e.g., MacMillan et al., 1985; Poindexter, 1975). Comparing the two main approaches presented above, it is clear that most existing research on the subject has focused on identifying the selection and evaluation criteria (Hall & Hofer, 1993; Hudson & Evans, 2005).

The diversity among existing models would suggest that venture capitalists have different views on how to select investment propositions (Gompers et al., 2020). All agree, however, that the decision process involves multiple phases (Hall & Hofer, 1993; Hsu et al., 2014) that are essential for successful decision-making (Petty, 2009). In every model, the initial stage involves creating the business, first by identifying potential investments and then by analysing existing proposals. While a further stage involves evaluating previously selected investments, the various authors all agree that the process culminates with the venture capitalists’ withdrawal.

Before venture capitalists invest in an enterprise, there are several steps to be gone through, from analysing the investment opportunities to selecting those that meet all the criteria. In a first phase, venture capitalists will have been contacted by entrepreneurs wanting to present their projects. Tyebjee & Bruno (1984), through a study of the venture capital industry in the US, concluded that it was the entrepreneurs who presented the majority of investment proposals, thus assigning a passive role to the venture capitalists. There has, however, been a change in this behaviour, with investment proposals being presented in three ways: via the entrepreneurs themselves; via direct contact from the venture capitalists; and through intermediaries, such as other venture capital firms or other investors (Hall & Hofer, 1993; Klonowski, 2007; Siskos & Zopounidis, 1987).

Venture capitalists receive thousands of investment proposals, all of which need to be analysed in order to select those that best fit the profile of the venture capital firm. In the course of the initial analysis, most proposals are rejected (Gompers et al., 2020; Silver, 1985; Tyebjee & Bruno, 1984), since not meeting just one of the venture capitalists’ criteria is enough to get a company excluded (Grzech, 2009).

Although the criteria venture capitalists use to select projects may differ due to the culture in which they are embedded (Mishra et al., 2017; Rakhman & Evans, 2005), there are several aspects that tend to coincide (Monika & Sharma, 2015). These are: the quality and experience of the entrepreneurs and the management team (Ho et al., 2016; MacMillan et al., 1985; Nunes et al., 2014); the strategy (Hall & Hofer, 1993; Kaplan & Strömberg, 2004); financial aspects (MacMillan et al., 1985); and characteristics of the product and the market (Kaplan & Strömberg, 2004; MacMillan et al., 1985; Nunes et al., 2014). Among these, the most relevant considerations are those that concern the entrepreneurs and the management team (Bortoluzzi et al., 2014; Falik et al., 2016; Köhn, 2018; Zinecker & Rajchlová, 2010), with the personality and experience of entrepreneurs also being determinant (Knight, 1994; Silva, 2004).

After the initial analysis phase, companies that meet the parameters set by the venture capitalists advance to the evaluation phase. During evaluation, the venture capitalists gather additional information in order to conduct a more detailed analysis (Fried & Hisrich, 1994), either through interviews with the entrepreneurs (Koryak & Smolarski, 2008) or via outside sources (Klonowski, 2007). In addition to this, several meetings are held with the management team to get a better understanding of the business (Fried & Hisrich, 1994).

The evaluation phase also involves carrying out due diligence, a detailed analysis of the company that allows the venture capitalists to reduce the risks associated with decision making (Hudson & Evans, 2005). Provided the due diligence does not identify any obstacles to the investment, the venture capitalists go on to negotiate with the entrepreneurs. At this point, a term sheet is drawn up by the venture capital firm that contains the terms of agreement (Klonowski, 2007). This document outlines the terms and conditions of the investment decision, that is to say, the value the venture capitalists have attributed to the business and, consequently, to the equity stake (Hudson & Evans, 2005; Kollmann & Kuckertz, 2010). Further conditions included on the term sheet are the voting rights, frequency of reporting, and the exit strategy (Correia & Da Rocha Armada, 2007). This negotiation occurs in order to align the entrepreneurs’ interests with those of the venture capitalists and to mitigate any possible opportunistic behaviour of the entrepreneurs (Manigart & Wright, 2013).

Once the investment decision has been made and an agreement has been reached between the two parties, the venture capitalists monitor the project’s progress. Their being actively involved is to avoid any possible information asymmetry. Although venture capitalists do not typically hold executive roles in the companies they invest in, they do closely follow them and proactively seek to add value (Pratch, 2005). They do this by providing resources and expertise in management tasks, financial, strategic and organisational decisions, and by allowing them access to their network of contacts. Furthermore, they may also help them raise capital from other investors (Tykvová, 2007). Venture capitalists intervene in a formal way via their representation on the boards of directors of the companies in their portfolio, and informally through periodic contact with these companies.

This type of investment is always temporary and venture capitalists prepare in advance for their exit, which may take different forms. It is then at this point that the venture capital firm disinvests in the expectation of obtaining an economic gain from the success of their investment (Kaplan & Strömberg, 2004). However, should the investment prove to be a failure, the venture capital firm will assume the loss. The most common exit strategies involve the sale of equity: to the entrepreneurs themselves (MBO), or to third parties, such as other venture capital investors; or on the stock exchange, through entering an organised market (IPO). Although the IPO is the venture capitalists’ preferred form of exit, it is relatively rare outside the US (Schwienbacher, 2007). If the company fails, the exit is affected by a write-off.

Methodological Approach

This present study, similar to other studies that have addressed the decision-making process of venture capitalists (e.g., Bouzahir & Ed-Dafali, 2019; Petty & Gruber, 2011), adopts an exploratory and qualitative approach.

Care was taken in making up the sample, to include specialists–that is to say, venture capitalists-with distinct profiles in order to not only obtain different perceptions, but also a more precise representation of the investment process in startups. The target population comprises Portuguese companies responsible for managing venture capital funds. According to the regulatory body, CMVM, in February 2020 there were 52 venture capital firms operating in Portugal and 3 venture capital fund management companies. In addition to these, private equity firms that also manage venture capital funds and invest in startups were also considered. After several attempts to contact all the investment companies that focus not just on venture capital but that also invest in startups, the sample comprised fourteen venture capitalists. It was also possible to obtain the participation of three individuals with the relevant experience in financing startups, which provided a complementary perspective to that obtained from the reports of venture capitalists. This made a total of seventeen participants in the sample.

With regard to the investment profile, five of the venture capital firms invest in specific sectors such as, for example, health or clean tech, thus assuming a specialized position. There being no limitations to the investment policies of the remaining venture capital firms, they consider startups regardless of what sector they are in (Table 1).

| Table 1 Characterisation of the Sample |

|||

|---|---|---|---|

| Individuals | Position | Size of venture capital firm (number of employees) | Size of venture capital firm (amount under management in millions of Euros) |

| Interviewee 1 | Partner | - | - |

| Interviewee 2 | Executive Vice President | 38 | 200 |

| Interviewee 3 | Corporate Finance Partner | - | - |

| Interviewee 4 | Director | - | - |

| Interviewee 5 | Managing Partner | 6 | 200 |

| Interviewee 6 | Chief Executive Officer | 3 | n/a |

| Interviewee 7 | Director | 10 | 66 |

| Interviewee 8 | Chief Executive | 23 | 335 |

| Interviewee 9 | Managing General Partner | 7 | 66 |

| Interviewee 10 | Partner | 15 | 125 |

| Interviewee 11 | Investor | 10 | 70 |

| Interviewee 12 | Partner | 11 | 260 |

| Interviewee 13 | Board Member | 9 | 100 |

| Interviewee 14 | Associate | 3 | 15 |

| Interviewee 15 | Investment Analyst | 7 | 50 |

| Interviewee 16 | Director | 3 | 2.5 |

| Interviewee 17 | Investment Analyst | 8 | 16 |

Data Collection

A script comprising a set of questions to guide the semi-structured interviews was developed. In order to do this, an initial thorough review of the relevant literature was conducted and, subsequently, the venture capital firms’ websites were analysed to obtain additional information about their investment process. As a result of a pre-test, the script underwent several changes with the introduction of some new questions and the elimination of others. In accordance with the proposal of Johnson & Rowlands (2012), the script comprised three parts, starting with questions that the interviewee could easily answer (Doody & Noonan, 2013). The first part had questions intended to gather information about the respondents and companies in the sample and, consequently, to establish a rapport with them. The next set of questions concerned not only the stages of the decision-making process, but also the challenges arising from the analysis of the startups and the methods used to evaluate this type of company. Finally, the third set addresses the venture capitalists’ intervention after having invested in the startups.

Once the interview script had been finalized, the venture capital firms were contacted via email. Additionally, an element of IAPMEI, the main public agency responsible for the awarding of venture capital funds, was contacted. The first three interview sessions were conducted in the companies’ conference rooms. However, due to the Covid-19 pandemic, the remaining interviews had to be conducted via video-call. On average, each interview was 40 minutes long, with the shortest being 25 minutes and the longest being 60 minutes. The interviews were carried out between March and June of 2020.

In the first instance, the interviews were recorded in full, then they were transcribed and subsequently analysed in detail through a second review of the recordings (Bengtsson, 2016). Following that, data analysis was carried out through coding (Auerbach & Silverstein, 2003), using Nvivo software.

Results and Discussion

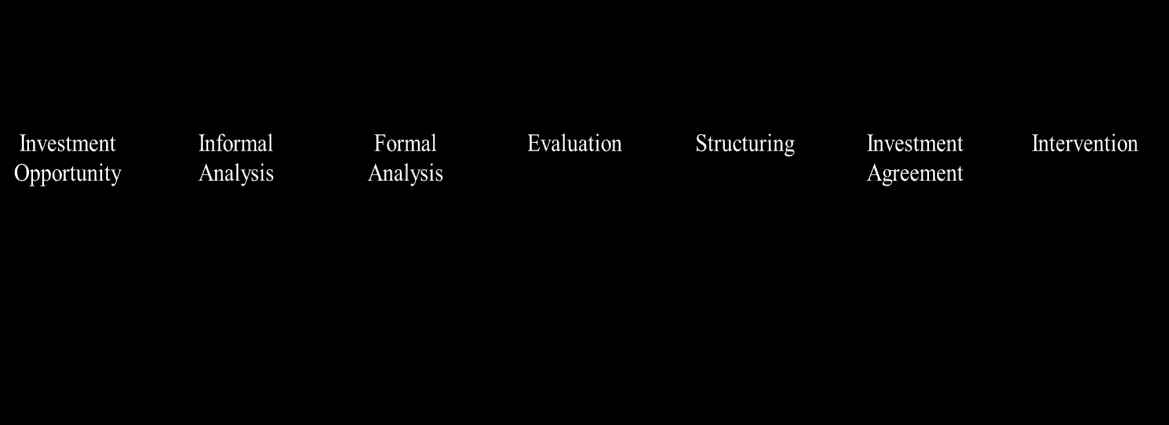

A representation of the venture capitalist firms’ investment process was drawn up by organising the data into different categories through coding the interviews. In effect, this led to ten initial units, designated activities, which combined to form the main categories of analysis (called stages). In general terms, it is possible to distinguish three main moments in the investment cycle of startups – pre-investment, investment, and post-investment – which comprise the stages identified during the course of the interviews. As can be seen in Table 2, the process begins with the investment opportunity and culminates in the exit of the venture capitalists. Certain activities, however, were not mentioned by all those interviewed. It should be noted, too, that despite certain activities being associated with a specific stage, that does not invalidate the fact that some may have occurred simultaneously and not sequentially, given that it is an interactive process.

| Table 2 Activities and Stages of the Investment Process |

||

|---|---|---|

| Stages | Activities | |

| Pre-Investment | Investment Opportunity | Signalling (N=14) |

| Informal Analysis | Information collection (N=17) | |

| Previous Selection (N=16) | ||

| Formal Analysis | Information collection (N=14) | |

| Evaluation | Evaluation procedures (N=17) | |

| Structuring | Investment committee (N=10) | |

| Term Sheet (N=13) | ||

| Due Diligence (N=11) | ||

| Investment | Investment Agreement (N=17) | |

| Post-Investment | Intervention | Monitoring (N=17) |

| Exit (N=17) | ||

Venture capitalists receive thousands of applications and, consequently, begin the decision-making process with such a vast number of potential investment opportunities that there is a need to reduce this number. Thus, and in accordance with all the elements in the sample, it becomes essential to collect information on each project in order to select only those that fit the focus of the fund. Those projects that meet the investment conditions established by the venture capitalist firms proceed to the next stages, which include a formal analysis and the evaluation of different parameters. For the investment to go ahead, the proposals have to satisfy several diverse selection criteria and be approved by the investment committee. Once agreement has been reached between the entrepreneurs and the venture capitalists, the investment proceeds as shown in Figure 1.

Pre-Investment

Investment Opportunity

The process involved in selecting a company to invest in can be a fraught one for any investor, particularly when it comes to startups that have limited information to go on (Luef et al., 2020). Consequently, as a first step, venture capitalists seek to identify investment opportunities that show high potential gains.

At the investment opportunity stage, entrepreneurs and venture capitalists make contact with one another. The investment opportunity can be created as much by the venture capital firm that is seeking projects with a high potential for growth as by entrepreneurs who essentially need resources. Although there are two possible methods–proactive and passive –signalling occurs, particularly, through the proactive attitude of the venture capitalists. The behaviour displayed is mostly due to the growing competition between the different venture capitalists, which forces them to abandon their typically passive stance (Shepherd et al., 2000). Besides participating in several events, venture capitalists also contact incubators and accelerators and maintain relations with various universities. In addition, they find startups through data bases and, given the current pandemic situation, with recourse to online events.

Startups typically present an idea, either by contacting venture capitalists directly, via email or LinkedIn, or by submitting applications on the websites of the venture capital firms themselves. Investment opportunities can also be presented by the venture capitalists' own network of contacts, such as by lawyers, consultants or even other investors.

Although some venture capitalists continue to take a passive stance, proactive approaches are progressively achieving greater relevance in Portugal. Mixed procedures are also still observed, given that there are those situations whereby promoters contact the venture capitalists, and others in which there is an active search for startups that can translate into good investment opportunities for the venture capitalists.

Once contact between the two parties has been established, venture capitalists aim to meet the the individuals involved and understand the historical background of each project. To this end, a whole set of basic information about the startups is usually required after the first contact, such as: (i) the company’s own presentation; (ii) identification of the promotors; and (iii) a description of the investment they hope to get and its purpose. This happens, essentially, so that venture capitalists can verify whether a company is a suitable fit for the venture capital firm’s investment policy and objectives. Based on this rather superficial approach to what the project is, the venture capitalists then decide whether or not to go ahead with an analysis of the proposal, which is explored in the following topics.

Informal Analysis

Venture capitalists identify investment opportunities and gather information that will allow them to make a first non-intrusive analysis, referred to as an informal analysis. Of all the applications submitted during the first stage – investment opportunity –only those that fall within the scope of the venture capital firm are considered for the informal analysis.

With regard to this choice, three principal aspects are considered: (i) the project; (ii) the market; and (iii) the team. First of all, the venture capitalists determine the project’s potential in terms of whether it is something people will find useful, it is in some way difficult to copy, and it can be scalable. Another important consideration concerns the market, insofar as it is important to know whether there is space in the market for the product or service. Lastly, venture capitalists try to evaluate the team’s suitability in order to determine whether they have the necessary know-how to develop the product or service they have put forward.

As the subsequent stages are very time-consuming and, therefore, costly, the informal analysis makes it possible to whittle down the number of projects for further consideration. In this way, most of the proposals can be eliminated, with the remaining applications going ahead to the next stage.

Formal Analysis

In the formal analysis, specific data are analysed. This is a dynamic process that involves deeper analysis and so can take months before all the necessary information becomes available.

The main conclusions are then drawn from the preliminary report resulting from the information gathered during this stage. Based on this report, venture capitalists decide whether to analyse the proposals further or, if the analysis is not favourable, to reject them. The information collected in the formal analysis is then used in the evaluation, which in certain cases may occur simultaneously with the formal analysis.

Evaluation

Evaluating early stage companies is a challenging and complex task, partly due to a lack of financial and historical information (Ge et al., 2005; Miloud et al., 2012; Rahardjo & Sugiarto, 2019). Indeed, many authors believe it is impossible to put a value on startups (Sassi, 2016).

In the evaluation phase, venture capitalists first of all assess every proposal according to a set of defined criteria, thus taking a multi-criteria approach. Once the startups have met all the criteria established by the venture capital firm, they are assigned a value in accordance with the chosen evaluation method.

Table 3 presents the evaluation criteria most frequently mentioned by the venture capitalists interviewed grouped into different categories of analysis. The exact weights of each criterion were not measured since the interviewees were only asked about the most valued parameters. As the evaluation process is marked by a high level of subjectivity (Stankevi?ien? & ?inyt?, 2012), the venture capitalists may differ with regard to the evaluation phase (Futó, 2016) and its weighting. From the results of the interviews, it was possible to observe that there are as many criteria used by the majority of interviewees as there are more specific characteristics that some venture capital firms take into account.

In general terms, all the venture capitalists considered the characteristics related to the management team and to the product or service being evaluated. Additionally, fourteen respondents assessed the characteristics of the entrepreneurs individually, while the remainder considered the entrepreneurs as an integral part of the management team. Lastly, fifteen venture capitalists mentioned market-related characteristics and exit options. Other considerations were also mentioned, specifically the startups’ need for capital, and its shareholder structure.

| Table 3 Investment Appraisal Criteria |

|

|---|---|

| Category | Criteria |

| Characteristics of the Entrepreneur (N=14) | Knowledge |

| Competences | |

| Experience | |

| Honesty | |

| Ambition | |

| Initiative | |

| Leadership Potential | |

| Characteristics of the Team (N=17) | Knowledge |

| Competences | |

| Experience | |

| Heterogeneity | |

| Resilience | |

| Passion | |

| Ambition | |

| Dedication | |

| Humility | |

| Credibility | |

| Realism | |

| Empathy | |

| Characteristics of the Product/Service (N=17) | Technology |

| Utility | |

| Protection | |

| Innovation | |

| Scalability Potential | |

| Internationalisation Potential | |

| Characteristics of the Market (N=15) | Size |

| Tendencies | |

| Competitors | |

| Clients | |

| Suppliers | |

| Growth rate | |

| Exit Potential (N=15) | |

| Other Considerations (N=4) | Need for Capital |

| Shareholder structure | |

|

Business Plan |

|

Venture capitalists consider the characteristics of the management team to be a key category in the selection of investment propositions, it being essential that team members be endowed with certain particularities. First of all, venture capitalists try to assess whether the team has solid knowledge, experience relevant to the business, and technical skills. Similar findings were also reported by Khanin, et al., (2008) in addition to the aforementioned attributes, they look for heterogeneous teams with distinct yet complementary competences, which can be advantageous for the project. It is not enough; however, for the team to possess technical qualities, it is also important that its members are resilient, dedicated and unassuming. Two further attributes valued by most venture capitalists are the team’s passion for the project they are presenting and their credibility with the market. Still with regard to the particularities of the management team, the respondents say that while it is important for entrepreneurs to be ambitious, they must also be realistic.

Over the course of the interviews, it was possible to deduce that there are venture capitalists who make a distinction between the characteristics of the management team and the characteristics of the entrepreneur, with fourteen interviewees advocating for the individual identification of each of the groups. Respondents who specifically assess the attributes of entrepreneurs pay particular attention to demonstrated skills and experience, as they consider that these aspects convey greater confidence when investing. Analogous to what was observed with regard to the management team, the promoter’s knowledge of the business, as well as their ambition and honesty are also valued.

This last particularity is an essential condition, given that venture capitalists need to trust that the entrepreneurs will make good their investment.

As with the characteristics of the management team, all venture capitalists assess the specifics related to the product (or service). Besides the requirement that the product must demonstrate utility and thus be able to meet existing market needs, it must also have a high potential for scalability. The degree of protection, whether through patents or any other similar protection mechanism that ensures the product will not be duplicated, complements the category of characteristics associated with the product. Lastly, venture capitalists only consider startups that have the potential for internationalization. Essentially, this occurs because Portugal has a relatively small internal market, which makes it indispensable that startups take advantage of every available opportunity at the international level. Indeed, the size of the Portuguese market justifies the need for Portuguese venture capitalists to seek out projects that have high internationalization potential.

Following that reasoning, the market the product is destined for must be of a relevant size and also be open to a significant rate of growth. Another dimension analysed during the selection process of startups is the degree of dependence on suppliers, which means that the possible ease of access to suppliers is valued. Similarly, the possibility of whether there is a current client/or clients with any significant weight is usually assessed. A final aspect to consider is the presence of competitors in the market. Should the threat from competition and the barriers to the entry of new products be too high for the early stage company to counter, the venture capitalists prefer not to take risks and wind up not investing in the startups.

Fifteen of the venture capitalists also mention exit potential as a key criterion to take into account. When venture capitalists raise money to set up funds intended to be used for investing, they always do so with a very clear idea of disinvesting at some point in time. The average duration of the funding period is approximately ten years and at the end of that time, what constitutes the fund must be converted into liquid assets.

Lastly, four participants mentioned two other aspects that need to be taken into consideration when evaluating a project. The first concerns the startups’ need for capital, and the second is the company’s shareholder structure. Venture capitalists assign a higher value to companies that have an undiluted shareholder structure so as to keep the promoters involved in the business. The last consideration mentioned in the interviews concerns the quality of the business plan.

As early stage companies do not usually present quantitative data, the criteria used in the decision-making process are mostly qualitative. Precisely because there is no quantitative aspect, the criteria are essentially subjective and so, therefore, is the decision-making process itself.

Should there be a favourable opinion based on the criteria mentioned above, the venture capitalists take the valuation process further to try to assign a value to the startup for the purpose of negotiation.

There are several methods for evaluating startups that mostly use quantitative economic indicators (Malyar et al., 2016). Among these, there are two that stand out in the existing literature: Discounted Cash Flows (DCF) and the multiples method. The former is described as an income approach and the latter as a market approach (Ge et al., 2005; Visconti, 2020).

The DCF approach is typically used to appraise early stage companies (Rahardjo & Sugiarto, 2019) since it does not rely on past information to forecast the value of companies. For this reason, the DCF method is used to evaluate startups given that many have no track record (Manigart et al., 1997). There are, however, obstacles to using DCF like, for example, the difficulties involved in estimating future cash flows and determining the appropriate discount rate since these depend on expectations (Ge et al., 2005; Kotova, 2014).

The multiples method is a widely used appraisal tool for startups that compares companies in the same sector and that have similar characteristics to one another. The aim of this technique is to attribute a value to the company through comparative analysis with other similar companies as a benchmark (Maya & Hernández, 2012), and using multiples of indicators from these companies to estimate the value of the company being assessed. The most commonly used indicators are the volume of sales and the EBITDA.

The results obtained show, see Table 4, that most venture capitalists use a combination of the two methods – DCF and multiples. The second most frequently used approach is the multiples method on its own, with DCF coming in last. The remaining two interviewees use their own assessment methods.

| Table 4 Methods Used to Evaluate Startups |

|---|

| DCF (N=2) |

| Multiples (N=5) |

| DCF and Multiples (N=8) |

| Other methods (N=2) |

Even though conventional valuation methods, such as DCF and multiples, are often used by venture capitalists (Dusatkova & Zinecker, 2016), they may be considered not entirely adequate for assessing early stage companies (Dhochak & Doliya, 2020) owing to: (i) a lack of relevant financial information (Miloud et al., 2012); (ii) the non-existence of comparable companies (Dusatkova & Zinecker, 2016); (iii) restrictions regarding the obtention of important information (Ubal et al., 2019); and (iv) limited applicability in the evaluation of new enterprises (Milkova et al., 2018). As previously mentioned, two of the venture capitalists interviewed said they used their own methods to assign a value to startups.

During the appraisal process, projects are analysed in accordance with certain categories of criteria and are then subject to a value assignment process. This is done so that in the following stages, the venture capitalists can negotiate the terms of the investments. Should the startups be favorably perceived with regard to the set of criteria under contemplation, they proceed to the next stage, which is called structuring.

Structuring

Following evaluation, negotiating the terms of the contract takes place. The venture capitalists make a non-binding offer, often referred to as a term sheet, in order to speed up the process (Bartlett, 1999). The term sheet is a document that summarizes the terms and conditions of the investment, namely the amount to be invested and the ownership rights that investors will receive (Mosiyevych, 2019).

Should an agreement with the promoters be reached, the venture capitalists present the projects to the investment committee; this is a body comprising people with diverse profiles and experience, which is an added value. The investment committee generally takes decisions unanimously.

Once the investment has been approved, due diligence is carried out to ensure the veracity of all the data provided by the entrepreneurs and to minimize any asymmetry of information (Pintado et al., 2007). As this more in-depth analysis is an extensive process (Manigart et al., 1997) and is more costly for venture capital firms, only those projects that have investment committee approval are subject to it. For the preparation of due diligence, venture capital firms hire specialised entities such as lawyers and auditors. There are various forms of due diligence, covering in particular financial, fiscal and legal areas.

The conclusions arising from the various due diligence measures taken then lead to the final selection of the projects and subsequent preparation and conclusion of the contracts that will govern the investment with the startups. If the outcome of the deal structuring is favourable, the investment committee intervenes again to confirm the intention to invest in the projects.

Investment

A formal and legally binding contract is then drawn up between the venture capital company and the entrepreneurs (Smith et al., 2011).

As soon as the investment agreement has been validated, the pre-established amounts are made available. One of the particularities of venture capital financing is that it normally occurs in tranches, that is, the amounts are provided in distinct phases over time (Eckbo, 2008). Investments are typically made in a controlled manner, and venture capitalists interact with promoters with the intention of helping them meet the objectives they have committed to.

Post-Investment

Follow-Up

As a rule, venture capitalists follow the path of startups at the time of investment, there being several mechanisms that allow them to do so, such as participation on the board of directors and keeping in close contact with the management team. Generally, although venture capital firms require that they have a representative on the board of directors - executive or non-executive - in their portfolio companies, and provide assistance for the various activities of the startups, some do not want to get too involved in the day-to-day running (Kaplan & Strömberg, 2001). In some cases, it may even be that venture capitalists are forced to allocate external teams to startups in order to address specific gaps that may exist.

Indeed, as with the level of intervention, the frequency of the monitoring exercise also varies, with the tendency for it to be more constant at the beginning. Thereafter, it is monthly in most cases and depends mainly on the maturity level of the startups. Formal meetings do not obviate informal moments whenever the venture capitalists should deem them necessary.

Among the activities carried out by venture capitalists, the following stand out: (i) providing support at the strategic and business management levels; (ii) finding new investors; (iii) assisting with the recruitment process; (iv) cutting through bureaucracy the startups aren’t able to; and (v) giving access to their own network of contacts.

Venture capitalists become involved with monitoring in accordance with their needs and the needs of the startups, thus it is possible to infer that they position themselves as very active investors up until the moment of disinvestment.

Exit

With venture capital firms’ investments being temporary in nature, it is important that they define an exit strategy that maximises the return for investors.

Based on the results obtained from the interviews with venture capitalists, it is possible to identify different exit mechanisms. These are presented in Table 5. Disinvestment generally occurs through: (i) the sale of the startup to another company, usually referred to as a commercial sale (ii) repurchase of the venture capital firm's shares by the entrepreneurs, or a management buyout (MBO); (iii) via an IPO, i.e., the company goes public; and (iv) sale to another financial partner such as venture capitalists or business angels.

| Table 5 Principle Exit Scenarios |

|---|

| Sale (N=17) |

| MBO (N=6) |

| IPO (N=14) |

| Sale to Another Financial Partner (N=8) |

As can be seen in Table 5, disinvestment can occur through a process designed and structured by venture capitalists, as well as at the initiative of entities interested in buying the stake held by the venture capital firm. Every venture capitalist in our sample contend that selling the startup to another company is the most common scenario. While a second possibility involves an IPO, Portuguese venture capitalists see this option as “a uniquely American utopia, since in Portugal instances of this option are extremely rare”. Eight of those interviewed mentioned selling to other financial partners as a possible way to exit. The final option involves an MBO, which is when the venture capital company formalises with the entrepreneurs the hypothesis of selling the shares they own. It is then up to these same entrepreneurs to decide the repurchase of these shares.

Notwithstanding all of the scenarios presented above, two interviewees in the sample nevertheless put forward the least desirable form of exit – write-off.

Conclusion

Through interviews with experts, it was possible to identify the set of stages that comprise the process of investing in startups, as well as the different activities that make up each of those stages. As a result, and according to the interviewees, the investment process, which lasts on average three to six months, can be broken down into three moments: (i) pre-investment; (ii) investment; and (iii) post-investment. In addition, seven stages that constitute this process were identified–(i) investment opportunity; (ii) informal analysis; (iii) formal analysis; (iv) evaluation; (v) structuring; (vi) investment agreement; e (vii) follow-up, comprising various activities.

Contrary to what previous studies have found, in Portugal this is an interactive process, and one in which some of the activities considered to be sequential may be carried out simultaneously.

In general terms, venture capitalists select startups subjectively based on a set of criteria that focuses on the management team and the product or service. However, and in contrast to the findings of previous literature, the results of this present research suggest that financial history does not play an important role in the investment decision either because it is not relevant, or because it is not accurate.

Implications

First of all, these results are useful for venture capitalists as several perspectives related to the decision-making process are discussed which they are often unaware of. Indeed, they may often be unaware of all the procedures involved in their choice precisely because they make it intuitively.

Thus, the conclusions reached allow venture capitalists a more comprehensive perspective on the topic.

The second implication concerns the entrepreneurs who, when seeking financing, have no knowledge of this process or of the selection criteria and evaluation methods which they will be subjected to. This study, therefore, may help them prepare better business proposals. Lastly, this present research also adds a contribution to the existing literature on small-sized venture capital markets.

References

Ahluwalia, S., Mahto, R.V., & Guerrero, M. (2020). Block chain technology and startup financing: A transaction cost economics perspective. Technological Forecasting and Social Change, 151, 11-54.

Auerbach, C., & Silverstein, L.B. (2003). Qualitative data: An introduction to coding and analysis. New York: New York University Press.

Bartlett, J.W. (1999). Fundamentals of venture capital. New York: Madison Books.

Bengtsson, M. (2016). How to plan and perform a qualitative study using content analysis. NursingPlus Open, 2, 8-14.

Blank, S., & Dorf, B. (2012). The startup owner’s manual: The step-by-step guide for building a great company. California: K&S Ranch. Inc.

Bortoluzzi, G., Tivan, M., Tracogna, A., & Venier, F. (2014). The growth drivers of start-up firms and business modelling: A first step toward a desirable convergence. Management, 9(2), 131-154.

Bouzahir, B., & Ed-Dafali, S. (2019). Venture capitalists’ investment decision criteria for new ventures: An exploratory study in morocco. Turkish Journal of Business Ethics, 11(2), 151–163.

Casanova, L., Cornelius, P.K., & Dutta, S. (2018). Financing entrepreneurship and innovation in emerging markets. Oxford: Academic Press.

Caselli, S., & Negri, G. (2018). Private equity and venture capital in Europe–Markets, techniques, and deals, (2nd edition). Oxford: Academic Press.

Cockayne, D. (2019). What is a startup firm? A methodological and epistemological investigation into research objects in economic geography. Geoforum, 107, 77-87.

Correia, M.C., & Da Rocha Armada, M.J. (2007). On the identification of selection factors, forms of intervention and the contribution of venture capital companies in Portugal. In Conocimiento, innovation and entrepreneurs: path to the future. Universidad de La Rioja.

Cox, K.C., Lortie, J., & Gramm, K. (2017). The investment paradox: Why attractive new ventures exhibit relatively poor investment potential. Venture Capital, 19(3), 163-181.

Crow, D. (2005). Valuing usability for startups: Cost-justifying usability–An update for an internet age, (2nd edition). London: Elsevier, 165-184.

Da Silva Piñeiro, F., De Oliveira, J.M., da Cruz, A.C., & Patias, T.Z. (2017). Business models on startups: A multicase study. Journal of Administration of the Federal University of Santa Maria, 10(5), 792-807.

De Bernardi, P., & Azucar, D. (2020). Innovation in food ecosystems: Entrepreneurship for a sustainable future. New York: Springer Nature.

De Clercq, D., Fried, V.H., Lehtonen, O., & Sapienza, H.J. (2006). An entrepreneur's guide to the venture capital galaxy. Academy of Management Perspectives, 20(3), 90-112.

De Oliveira, F.B., & Zotes, L.P. (2018). Valuation methodologies for business startups: A bibliographical study and survey. Brazilian Journal of Operations & Production Management, 15(1), 96-111.

Crossref , Google scholar , Indexed at

Delgado, M., Pereira, R., & Dias, A. (2015). Consequences of investment contract duration on the valuation of firms in maturity stage. World Review of Entrepreneurship, Management and Sustainable Development, 11(2/3), 217-231.

Crossref , Google scholar , Indexed at

Dhochak, M., & Doliya, P. (2020). Valuation of a startup: Moving towards strategic approaches. Journal of Multi-Criteria Decision Analysis, 27(1-2), 39-49.

Crossref , Google scholar , Indexed at

Doody, O., & Noonan, M. (2013). Preparing and conducting interviews to collect data. Nurse Researcher, 20(5), 28-32.

Crossref , Google scholar , Indexed at

Dusatkova, M.S., & Zinecker, M. (2016). Valuing start-ups–selected approaches and their modification based on external factors. Business: Theory and Practice, 17(4), 335-344.

Falik, Y., Lahti, T., & Keinonen, H. (2016). Does startup experience matter? Venture capital selection criteria among Israeli entrepreneurs. Venture Capital, 18(2), 149-174.

Freeman, J., & Engel, J.S. (2007). Models of innovation: Startups and mature corporations. California Management Review, 50(1), 94-119.

Crossref , Google scholar , Indexed at

Fried, V.H., & Hisrich, R.D. (1994). Toward a model of venture capital investment decision making. Financial Management, 23(3), 28-37.

Crossref , Google scholar , Indexed at

Futó, J.E. (2016). Empirical analysis of Hungarian firms according to venture capital investment criteria. Timisoara Journal of Economics and Business, 9(1), 16-32.

Ge, D., Mahoney, J.M., & Mahoney, J.T. (2005). New venture valuation by venture capitalists: An integrative approach. Urban Champaign Working Papers.

Giardino, C., Wang, X., & Abrahamsson, P. (2014). Why early-stage software startups fail: A behavioral framework. In Lecture notes in business information processing. Springer Verlag.

Crossref , Google scholar , Indexed at

Gifford, S. (1998). The allocation of limited entrepreneurial attention. Boston, MA: Springer.

Gompers, P., & Lerner, J. (2001). The venture capital revolution. Journal of Economic Perspectives, 15(2), 145-168.

Gompers, P., Gornall, W., Kaplan, S.N., & Strebulaev, I.A. (2020). How do venture capitalists make decisions? Journal of Financial Economics, 135(1), 169-190.

Groh, A.P., Von Liechtenstein, H., & Lieser, K. (2010). The European venture capital and private equity country attractiveness indices. Journal of Corporate Finance, 16(2), 205-224.

Crossref , Google scholar , Indexed at

Grzech, A. (2009). Preliminary selection in the decision-making process of venture capital funds. Operations Research and Decisions, 1(19), 27-35.

Hall, J. (1989). Venture capital decision making and the entrepreneur: An exploratory investigation. Unpublished doctoral dissertation, University of Athens, Georgia.

Hall, J., & Hofer, C.W. (1993). Venture capitalists' decision criteria in new venture evaluation. Journal of Business Venturing, 8(1), 25-42.

Crossref , Google scholar , Indexed at

Hsu, D.K., Haynie, J.M., Simmons, S.A., & McKelvie, A. (2014). What matters, matters differently: A conjoint analysis of the decision policies of angel and venture capital investors. Venture Capital, 16(1), 1-25.

Hudson, E., & Evans, M. (2005). A review of research into venture capitalists' decision making: Implications for entrepreneurs, venture capitalists and researchers. Journal of Economic & Social Policy, 10(1), 45-63.

Johnson, J.M., & Rowlands, T. (2012). The interpersonal dynamics of in-depth interviewing. In The SAGE handbook of interview research: the complexity of the craft, 99-113.

Jordan, J.F. (2010). Innovation, commercialization, and the successful startup. CMU Working Paper, 1–25.

Kaplan, S.N., & Strömberg, P. (2001). Venture capitals as principals: Contracting, screening, and monitoring. American Economic Review, 91(2), 426-430.

Crossref , Google scholar , Indexed at

Kaplan, S.N., & Strömberg, P.E. (2004). Characteristics, contracts, and actions: Evidence from venture capitalist analyses. The Journal of Finance, 59(5), 2177-2210.

Khanin, D., Baum, J.R., Mahto, R.V., & Heller, C. (2008). Venture capitalists’ investment criteria: 40 years of research. Small Business Institute Review, 35.

Klonowski, D. (2007). The venture capital investment process in emerging markets. International Journal of Emerging Markets, 2(4), 361-382.

Knight, R.M. (1994). Criteria used by venture capitalists: A cross cultural analysis. International Small Business Journal, 13(1), 26-37.

Kollmann, T., & Kuckertz, A. (2010). Evaluation uncertainty of venture capitalists' investment criteria. Journal of Business Research, 63(7), 741-747.

Crossref , Google scholar , Indexed at

Kolosok, A., & Koniukh, I. (2017). Definition of startup projects, main problems and prospects of development. Economic Journal of Lesia Ukrainka Eastern European National University, 4(12), 62-67.

Crossref , Google scholar , Indexed at

Koryak, O., & Smolarski, J. (2008). Perception of risk by venture capital and private equity firms: A European perspective. The Journal of Private Equity, 11(2), 30-42.

Kotova, M.V. (2014). The theoretical and methodological basis of startups valuation. Economy: The realities of time, 1, 107-112.

Köhn, A. (2018). The determinants of startup valuation in the venture capital context: A systematic review and avenues for future research. Management Review Quarterly, 68(1), 3-36.

Kumar, A.V., & Kaura, M.N. (2003). Venture capitalists' screening criteria. Vikalpa, 28(2), 49-59.

Landström, H. (2007). Pioneers in venture capital research. In Handbook of research on venture capital. Edward Elgar Publishing, 3–65.

Lewandowski, C.M. (2015). Why are big businesses looking to start-ups for innovation? KPMG, 1(February), 23.

Li, Y., & Zahra, S.A. (2012). Formal institutions, culture, and venture capital activity: A cross-country analysis. Journal of Business Venturing, 27(1), 95-111.

Crossref , Google scholar , Indexed at

Luef, J., Ohrfandl, C., Sacharidis, D., & Werthner, H. (2020). A recommender system for investing in early-stage enterprises. In Proceedings of the 35th annual ACM symposium on applied computing, 1453-1460.

Crossref , Google scholar , Indexed at

MacMillan, I.C., Siegel, R., & Narasimha, P.S. (1985). Criteria used by venture capitalists to evaluate new venture proposals. Journal of Business Venturing, 1(1), 119-128.

Crossref , Google scholar , Indexed at

Magalhães, R.P. (2019). What is a startup? A scoping review on how the literature defines startup. Unpublished doctoral dissertation, University of Delaware.

Malecki, E.J. (2012). Regional social capital: Why it matters. Regional Studies, 46(8), 1023-1039.

Crossref , Google scholar , Indexed at

Malyar, M., Polishchuk, V., Sharkadi, M., & Liakh, I. (2016). Model of start-ups assessment under conditions of information uncertainty. Eastern-European Journal of Enterprise Technologies, 3(4–81), 43–49.

Crossref , Google scholar , Indexed at

Manigart, S., & Wright, M. (2013). Venture capital investors and portfolio firms. Foundations and Trends in Entrepreneurship, 9(4-5), 365-370.

Crossref , Google scholar , Indexed at

Manigart, S., Wright, M., Robbie, K., Desbrieres, P., & De Waele, K. (1997). Venture capitalists’ appraisal of investment projects: An empirical European study. Entrepreneurship Theory and Practice, 21(4), 29-43.

Crossref , Google scholar , Indexed at

Maya, C.R., & Sánchez Hernández, M. (2012). Empirical evidence on investment valuation models used by Spanish venture capital companies: Special reference to the discounted cash flow method’s implementation. International Journal of Entrepreneurship and Small Business, 17(4), 495-510.

Miloud, T., Aspelund, A., & Cabrol, M. (2012). Startup valuation by venture capitalists: An empirical study. Venture Capital, 14(2-3), 151-174.

Crossref , Google scholar , Indexed at

Milkova, M., Andreichikova, O., & Andreichikov, A. (2018). Venture capitalists decision making: Applying analytic network process to the startups evaluation. International Journal of the Analytic Hierarchy Process, 10(1), 1-18.

Crossref , Google scholar , Indexed at

Mishra, S., Bag, D., & Misra, S. (2017). Venture capital investment choice: Multi criteria decision matrix. The Journal of Private Equity, 20(2), 52-68.

Monika, S., & Sharma, A.K. (2015). Venture capitalists’ investment decision criteria for new ventures: A review. Procedia-Social and Behavioral Sciences, 189, 465-470.

Mosiyevych, O.O. (2019). Deal structuring in venture capital financing. Business Inform, 5(496), 169–173.

Nunes, J.C., Félix, E.G., & Pires, C.P. (2014). Which criteria matter most in the evaluation of venture capital investments? Journal of Small Business and Enterprise Development, 21(3), 505-527.

Pacheco-Torgal, F. (2016). Introduction to start-up creation for the smart eco-efficient built environment. Start-up creation-The smart eco-efficient built environment. London: Elsevier, 1-17.

Petty, J.S. (2009). The dynamics of venture capital decision making. Academy of Management Proceedings, 1, 1-6.

Petty, J.S., & Gruber, M. (2011). In pursuit of the real deal”: A longitudinal study of VC decision making. Journal of Business Venturing, 26(2), 172-188.

Pineda, D.M.M. (2016). Startup spinoff: Definitions, differences and potentialities in the framework of behavioral economics. Context, 5, 141-152.

Pintado, T.R., De Lema, D.P., & Van Auken, H. (2007). Venture capital in Spain by stage of development. Journal of Small Business Management, 45(1), 68-88.

Poindexter, J.B. (1975). The efficiency of financial markets: The venture capital case. Unpublished doctoral dissertation, New York University, New York.

Pratch, L. (2005). Value-added investing: A framework for early stage venture capital firms. The Journal of Private Equity, 8(3), 13-29.

Prohorovs, A., Bistrova, J., & Ten, D. (2019). Startup success factors in the capital attraction stage: Founders’ perspective. Journal of East-West Business, 25(1), 26-51.

Rahardjo, D., & Sugiarto, M. (2019). Valuation model using a mixed real options method: A review on Singapore and Indonesia digital startups. Proceedings of the 16th international symposium on management (INSYMA 2019). Atlantis Press.

Rakhman, A., & Evans, M. (2005). Enhancing venture capital investment evaluation: A survey of venture capitalists', investees' and entrepreneurs' perspectives. Journal of Economic and Social Policy, 10(1), 2.

Ries, E. (2013). The lean startup. Prime Books.

Rosa, M.C.W., Sukoharsono, E.G., & Saraswati, E. (2019). The role of venture capital on start-up business development in Indonesia. Journal of Accounting and Investment, 20(1).

Rostek, K., & Skala, A. (2017). Differentiating criteria and segmentation of Polish startup companies. Management problems, 15(1), 192-208.

Salamzadeh, A., & Kawamorita-Kesim, H. (2015). Startup companies: Life cycle and challenges. 4th International Conference on Employment, Education and Entrepreneurship (EEE), Belgrade, Serbia.

Sassi, R. (2016). An improved valuation method for startups in the social-media industry. Unpublished doctoral dissertation, University of Delaware.

Schwienbacher, A. (2007). International capital flows into private equity funds. Monthly magazine for Accountancy and Business Economics, 81, 335-343.

Shepherd, D.A., Ettenson, R., & Crouch, A. (2000). New venture strategy and profitability: A venture capitalist's assessment. Journal of Business Venturing, 15(5), 449-467.

Silva, J. (2004). Venture capitalists' decision-making in small equity markets: A case study using participant observation. Venture capital, 6(2-3), 125-145.

Silveira, R., & Wright, R. (2016). Venture capital: A model of search and bargaining. Review of Economic Dynamics, 19, 232-246.

Silver, A.D. (1985). Venture capital: The complete guide for investors. New York: John Wiley and Sons.

Šimic, M. (2015). Investment criteria set by venture capitalists. Econviews-Review of Contemporary Business, Entrepreneurship and Economic Issues, 28(2), 457–479.

Siskos, J., & Zopounidis, C. (1987). The evaluation criteria of the venture capital investment activity: An interactive assessment. European Journal of Operational Research, 31(3), 304-313.

Smith, J., Smith, R.L., Smith, R., & Bliss, R. (2011). Entrepreneurial finance: Strategy, valuation, and deal structure. Stanford University Press.

Stankeviciene, J., & ?inyte, S. (2011). Valuation model of new start-up companies: Lithuanian case. Business: Theory and Practice, 12(4), 379-389.

Crossref , Google scholar , Indexed at

Sullivan, T.D. (2017). What do venture capital and private equity firms do? Some current and historical examples. Journal of Business & Finance Librarianship, 22(3-4), 182-189.

Tanrisever, F., Erzurumlu, S.S., & Joglekar, N. (2012). Production, process investment, and the survival of debt-financed startup firms. Production and Operations Management, 21(4), 637-652.

Teker, S., & Teker, D. (2016). Venture capital and business angels: Turkish case. Procedia-Social and Behavioral Sciences, 235, 630-637.

Crossref , Google scholar , Indexed at

Tyebjee, T.T., & Bruno, A.V. (1984). A model of venture capitalist investment activity. Management Science, 30(9), 1051-1066.

Crossref , Google scholar , Indexed at

Tykvová, T. (2007). What do economists tell us about venture capital contracts? Journal of Economic Surveys, 21(1), 65-89.

Crossref , Google scholar , Indexed at

Ubal, N.P., Camejo, M., Oliver, V., & Cerecedo, V.P. (2019). Investments in companies with a high share of intangibles: case study of startups in the IT sector. Accounting and Business: Journal of the Academic Department of Administrative Sciences, 14(27), 44-56.

Van Deventer, B., & Mlambo, C. (2009). Factors influencing venture capitalists' project financing decisions in South Africa. South African Journal of Business Management, 40(1), 33-41.

Visconti, R.M. (2020). The Valuation of Technological Startups. In: The Valuation of Digital Intangibles. Palgrave Macmillan.

Zhong, H., Liu, C., Zhong, J., & Xiong, H. (2018). Which startup to invest in: A personalized portfolio strategy. Annals of Operations Research, 263(1-2), 339-360.

Zider, B. (1998). How venture capital works. Harvard Business Review, 76(6), 131-139.

Zinecker, M., & Rajchlová, J. (2010). Private equity and venture capitalists' investment criteria in the Czech Republic. Acta University of Agriculture and Forestry of Mendeliana Brno, 58(6), 641-652.

Received: 30-Dec-2021, Manuscript No. AEJ-21-9093; Editor assigned: 03-Jan-2022, PreQC No. AEJ-21-9093(PQ); Reviewed: 11-Jan-2022, QC No. AEJ-21-9093; Revised: 22-Jan-2022, Manuscript No. AEJ-21-9093(R); Published: 30-Jan-2022