Research Article: 2018 Vol: 22 Issue: 6

The Mediating Effect of Investment Decisions and Financing Decisions on the Influence of Capital Structure Against Corporate Performance: Evidence From Jordanian Listed Commercial Banks

Yousef Shahwan, Zarqa University, Jordan

Abstract

The primary objective of this study is to examine the mediating effects of investment and financing decisions on the impact of capital structure towards the overall performance of the Jordanian listed commercial banks. Therefore, the listed Commercial Banks in Amman Stock Exchange that constantly published their financial statements for 16 years (2002–2017) have been considered as the unit of analysis and their annual financial report was used as a source of data. In this study, descriptive analysis and inferential tools have been employed to examine the relationship between the variables under study. Basically, Structural Equation Modelling (SEM) through AMOS version 25 and SPSS version 21 were affianced to investigate the patterns of relationships between variables under study so as to define the direct and or indirect effects of mediating variables against the endogenous and the exogenous variables. It is proved in the findings of this study that both investment and financing decisions have partially mediate the effect of capital structure on the corporate performance in the Jordanian listed commercial banks, since both direct and indirect regression path (relationships) between the endogenous and exogenous variables were significant and positive at a p-value<0.001 and 0.05 two-tailed. Originally, the contributes of this study include, bridging the gap in the existing knowledge since this study is unique in Jordanian financial sector when considering the combination of the variables used in the study. The study also makes it clear that the Jordanian banks should understand the mediating effects of the investment and financing decisions towards the impact of capital structure on the corporate performance. The findings hinted the importance of selecting appropriate capital mix since it has a key role to play in the determination of firm value.

Keywords

Investment Decision, Financial Decision, Capital Structure, Corporate Performance, Debt, Shareholders’ Equity.

Introduction

Like every business organization in the world, Jordanian banks are not exempted from making challenging decisions as to what will be the composition of their capital mix for successful investments, which would lead to positive increase in their performance. The decision regarding the capital structure always most be one of the three, either, 100% of the business investments to be financed by the shareholders equity (internal sources) or to be 100% financed by the debt (external source) or the combination of the two depending on the percentage of the combination decided. Since the decision is somehow tough to make, yet the banks have to consider the returns to be paid thereon. Accordingly, the financing decisions made by the managers is important, since choosing the best and suitable method of financing the corporate activities is directly or indirectly connected with corporate performances (Woldemariam, 2016).

Quite a lot of researches have been carried out in relation to the maximization of corporate performances through the paramount selected commendable method of capital structure. See for example the work of Masulis (1983), Barton & Gordon (1988), Majumdar and Chibber (1999), Booth et al. (2001), latest among other works are the study conducted by Kajananthan & Nimalthasan (2013), Muhammad et al. (2014), Mwangi et al. (2014) Zhang and Yu (2016), Sagara (2015), Nazri et al. (2016) and Woldemariam (2016). Despite, the investigation conducted by Modigliani and Miller (1958), which indicated the irrelevancy in capital structure decision and gave birth to the theory of irrelevance, yet based on the individual results obtained, many scholars were of the opinions contrary to that of the aforementioned scholars. For instance, included among other studies conducted by Jensen & Meckling (1976), Harris & Raviv (1991), Khan (2012), Khalaf (2013). Conversely, in their theory of agency, Jensen & Meckling (1976) revealed that financing corporate activities using debt (external source) will serve as a constrain and controlling tool against managers behaviour of personal gain and enforcing them to work for the interest of shareholders due to the payment of interest on the debt acquired, reduction of irrelevant investments and resulting to reduction of the cash flow in the organization.

Accordingly, this study is solely conducted to examine the mediating effects of investment decision and financing decision on the capital structure towards the overall performance of the Jordanian listed commercial banks. The study is formed into four sections in which section one contained the introduction, statement of the research problems, research objectives and research hypotheses. Therefore, section two deals with literature review including empirical review and underpinning theories. Section three expressed the methodology of the study while section four contained data analysis, hypotheses test and discussion of the findings and lastly section five presents conclusion, summary and recommendation.

Statement Of The Research Problem

Eyes cannot be blind-folded against the global economic crises faced by the financial sectors of many countries in the year 2008, Jordan included, which took the attentions and triggered the minds of many scholars, academicians as well as researchers worldwide toward finding the possible solutions of the abhorred disaster. From that time to date, several studies were conducted in different fields and disciplines in order to concur with the fight against economic tragedy of that day. In this vain, among many studies conducted in Jordan, especially in the banking sector were largely concentrated on either the impact of the capital structure on the corporate performances (Siam et al., 2005; Zeitun & Tian, 2007; Soumade & Hayajne, 2010; Abdalla & Fakhri, 2013; Zeyad, 2016) or investment and financing decisions on the corporate performance (Ghadome, 2008; Altarawneh, 2009; Zaher, & Altahtamoun, 2014; Daoud et al., 2015) respectively, without giving regards to the mediating role of the investment and financing decisions toward the selection of the appropriate financial mix (capital structure) for the maximization of corporate performances.

However, this study stem to bridge the existing gap in the literature as to address the question does investment and financing decisions positively and significantly mediate the effects of capital structure on the performance of Jordanian listed commercial banks?

Research Objectives

The primary objective of this study is to empirically evaluate the mediating effects of investment decision and financing decision on the influence of capital structure against corporate performance in the Jordanian listed commercial banks.

The following are the specific objectives:

1. To ascertain the direct effects of capital structure on corporate performance in the Jordanian listed commercial banks.

2. To clearly identify the extent at which investment and financing decisions mediate the effect of capital structure on corporate performance in the Jordanian listed commercial banks.

3. To examine the indirect effect of investment and financing decisions on corporate performance in the Jordanian listed commercial banks.

4. To assess the level of indirect effect of investment and financing decisions on capital structure in the Jordanian listed commercial banks.

Literature Review And Hypotheses Development

Modigliani and Miller are the two professors that have in 1958 developed theory of capital structure in the process of discussing the relevancy or otherwise of capital mix in the determination of organizational performance/value. Accordingly, they hypothesised that, in a perfect market condition, the use of equity, debt or the combination of both would not in any way affect the corporate value of a given organisation. Although, their proposition has encountered with so much oppositions from the global researchers, academicians and scholars. Recently, number of literature have contradicted with the M&M theory of capital structure, including among other examples are (Hanafi, 2005; Kajananthan & Nimalthasan, 2013; Mwangi et al., 2014; Zhang and Yu, 2016; Nazri, et al., 2016; Efni, 2017). Most of these researchers have believed that the M&M theory of irrelevance has contradicted the natural economic forces in the sense that the existence of perfect market is a myth due to the presence of market distortion such as market cost, existence and effect of taxation cost etc.

Reversely, in the earliest 1960s M&M coined a new theory which presumed that organizational capital structure is relatively affected by the cost of capital along with effects on the corporate value. They proposed that the existences of taxes indicate a tax advantage over the borrowers whereas the interest deducted on the tax becomes a tax shield which reduced the cost of borrowing and maximizing the corporate performance (Miller, 1977). Consequently, this necessitates that the firm should consider the relationship between the cost of debt and the benefits arise from the debt. Nonetheless, several theories were developed by various researchers which in many ways indicated the relationships between the organizational capital structure and the corporate value include among other theories agency theory and shareholder theory. Subsequently, Jensen & Meckling (1976), Harri & Raviv (1991), Biais & Casamatta (1999), Myer (2001) and Sukkari (2003) related in their individual studies that agency theory revealed the prospective conflicts that exist between the managers and shareholders of a firm in which the shareholders entrusted managers to be their agents toward managing the firm so as to maximize their wealth. Thus, the managers have primarily placed much concern on achieving their personal interest by concentrating on higher profit and risky investments whereas, the shareholders’ value becomes their secondary concern all of which lead to the maximization of corporate performance. Therefore, before attaining optimal mix of capital structure by the firm under the agency theory, the corporate leverage has positively affects the performance of the firm (Titman & Wessels, 1998; Myers, 2001), while, increasing such leverage through the acquisition of more debt will increase the firm value and performance as well (Noe 1988; Hadlock & James, 2002; Corriceli et al., 2011).

Accordingly, in the efforts of an organization towards evaluating and selecting the efficient and effective capital mix which will enable the firm to obtain required financial resources for its profitable investments, hence financing decisions as well as investment decisions have to be taking into consideration (ANAN, 2017). Regardless of the various financial risks connected to the capital acquisition, however, capital structure is necessary to raise the prerequisite capital for the firm to finance its investments (Mitton, 2007; Graham, 2000 and Pratheepkanth, 2011). However, Martono (2001) and Riyanto (2001) lament that investment decision is related to the management of company’s assets. They continued in their separate works to recount that the corporate cash flow and future profitability have directly related to the investment decision made by the firm. As such investment decision is one of the three vital financial management decisions since it involve the allocation of resources into various project proposals which will yield a futuristic economic benefits.

Thus, Damodaran (2006) had assumed that for a firm to appropriately manage its financing mix towards financing various investments it has to implement a sound financing principle. Based on their individual findings Kochhar (1996) and Korajczyk & Levy (2003) have separately proposed that organizations that have sufficient assets are expected to reduce the level of financing their investment using debt rather than financing it with their equity. As such, Korajczyk and Levy (2003) articulated that for a firm to adequately acquire financial resources to meet up its debt obligations that firm should obtain a huge and significant tangible assets as well as use of more debt. Subsequently, financing decision is also a prerequisite aspect of financial management. As such after making a fruitful investment decision, there is a need to make a sound financing decision for the firm to accomplish its overall performance. Primarily, firms used to make financing decision in order to acquire fund at a cheapest cost (Hanafi, 2005). A sound and efficient financial decision will improve the firm performance (Kajananthan & Nimalthasan, 2013).

Empirically, many results from various studies have indicated a positive and significant effect of capital structure on the corporate performance, these include (Sagara, 2015) whereas, some studies prove negative effects of capital mix on the corporate performance (Younus et al., 2014; Akeem et al., 2014; Mwangi et al., 2014; Ramezanalivaloujerdi et al., 2015 and Nazri, 2016). In their study Kajananthan & Nimalthasan (2013) used return on assets as proxy of corporate performance towards demonstrating the effect of capital structure on the firm performance. Their findings revealed a significant effect of capital structure on the corporate performance. They suggest that there is need for managers to be tactical when utilizing the debt and much priority should be given in using retaining earning instead of debt to finance their investments. Moreover, Arafat et al. (2014) used 32 consumer goods companies as samples from the total number 142 manufacturing companies in Indonesia. They used Price to Book Value (PBV), Debt to Equity Ratio (DER) and Market to Book (MBV) Value as a proxy of corporate performance, financing decision and investment opportunity respectively. In their findings, using multivariate regression analysis and t-test tools, they discovered positive and significant effects of capital structure and investment decision on the corporate performance.

Additionally, in their work, using a diverse econometric approach, Nilsen et al. (2009) found a significant increase in the level of production during investment from (date t−1 to t), which indicated a positive and significant effect of investment decision on the corporate performance. Various empirical studies have found the same outcomes. For example, Mathur & Mathur (2000); Fee et al. (2001) and Joshi & Hanssens (2010); among others.

For the purpose of this study, the below alternate hypotheses were developed based on the reviewed literature:

H1: Capital structure has a positive and significant effect on the corporate performances in the Jordanian listed commercial banks.

H2: Investment decision has a positive and significant effect on the corporate performances in the Jordanian listed commercial banks.

H3: Investment decision has positively and significantly mediates the effect capital structure on the corporate performances in the Jordanian listed commercial banks.

H4: Financing decision has a positive and significant effect on the corporate performances in the Jordanian listed commercial banks.

H5: Financing decision has positively and significantly mediates the effect capital structure on the corporate performances in the Jordanian listed commercial banks.

Research Methodology

This study is designed to be descriptive in nature. The data used in this study were secondary data obtained from the Amman Stock Exchange (ASE) in the form of financial statements. Accordingly, the data of financial statements used was extracted from the balance sheets and income statements as at financial year ended 31st December of the period under review. Moreover, the selection of the unit of analysis was made based on the satisfaction of the following conditions:

1. The banks must be listed under Amman Stock Exchange without for once been deleted from the list on any circumstance throughout the stated study period.

2. Having uninterruptedly published financial report for 16 years, from 2002 to 2017.

From the 15 commercial banks listed in the Amman Stock Exchange 3rd quarter reports 2017, a total of 13 commercial banks were qualified as members of the study sample. The annual financial reports of the selected banks were sourced from the portal of the selected banks, internet and the portal of Central Bank of Jordan (CBJ). Based on the primary objective of this study as to analyze the pattern of relationship among variables to determine the direct or indirect effect of a set of exogenous variables on the endogenous variables, descriptive and inferential analysis tools were employed to prove the examined relationship among the four variables under the study. The data will furthermore be analysed using SPSS version 21 and Structural Equation Model (SEM) through Analysis of Moment Structure (AMOS) version 25. The use of SEM in this study is justified based on the fact that, in SEM, the model will be regressed structurally and all important values in the model are estimated simultaneously. Among the values are the regression estimates, the covariance, correlation, coefficient of multiple determination, the factor loading, the item (R2), the variance of residuals, etc (Awang, 2014; and Abdullahi & Mansoor, 2015).

Model Specification

The regression path of the model is analyzed based on the following developed multiple equations:

Y=β0+β1X1+β2M1+β3M3+e3------------------Eq1

Y=β0+β1X1+e3.............................Eq2, (β1 represented path from CptStr. to CopPerf)

Y=β0+β2M1+e3.............................Eq3, (β2 represented path from InvDcs. to CopPerf)

Y=β0+β3M2+e3............................Eq4, (β3 represented path from FinDcs. to CopPerf)

M1=β0+β4X1+e1......................... Eq5, (β4 represented path from CptStr. to InvDcs)

M2=β0+β5X1+e2..........................Eq6, (β5 represented path from CptStr. to FinDcs)

Thus, all variables in the model are directly observed and symbols used where denoted as:

Y= Corporate Performance (Dependent variable)

Y=Σ (Tobin’s Q+PER)

X1=Capital Structure (Independent Variable)

X1=Σ (Total Equity Ratio + Total Debt Ratio)

M1=Investment Decision (First Mediating Variable)

M1=Σ (M/BAR+CPE/BVA+CATAR+M/BVE)

M2=Financing Decision (Second Mediating variable)

M2=Σ (DTA+STDTA+LTD/Eq+RE)

β1 to β5=Coefficient of the explanatory variables

β0=Interception

e1=Error Term/Residual

Definition Of Variables And Indicators

Investment Decision (Mediating Variable)

This has been measured using four variables which were considered as the best indicators toward measuring the investment decision as adopted from the previous works such as Kallapur & Trombley (1999), Adam and Goyal, (2007) and Efni (2017). An explanation on the indicators is as follow:

Market to book asset ratio (M/BAR)

There are usually two ways to determine the value of assets in an organization either by market value or book value. The value of asset is determined using book value in which Net Book Value (NBV) of the asset is considered as pictured in the balance sheet. In the other hand, ABV is determined by deducting the accumulated depreciation from the historical cost of the asset. While, Asset Market Book Value (AMBV) is the fair market value which recognized as the current market price of the asset. Market to Book Ratio Asset shows the ratio of market value of equity on book value of asset. The market value of equity depends on the stock price. If the stock price increases, then the market value of asset also increases because of the increase in equity value (Ifni, 2017). The MBAR is one of the commonly used variables in measuring the investment decision (Kallapur & Trombley, 1999; Adam & Goyal, 2007).Therefore, based on the study conducted by Adam and Goyal (2007), Market to Book Asset Ratio (M/BAR) is calculated as:

Share Price×Shares Outstanding+Preferred Stock+Debt in Current Liabilities + (Long Term Debt-Deferred Taxes and Investment Tax Credit/Book Value of Assets)

Or

MBAR=Market Value of Assets/Book Value of Assets

Market book value of equity (MBVE)

Market value and book value of equity has been playing a sensitive role to the microeconomic situation in the Jordanian financial sector. Previous studies have proven that Jordanian financial sector has been contributing to the Jordanian economic condition (Hussam- Eldin et al., 2015). Therefore, in measuring the investment decision in Jordanian listed commercial bank, MBVE has to be considered. Accordingly, the MBVE is calculated based on the suggestion offered by Black (2001), in which he explained the suitability of MBVE toward determining the level of investment decisions in respect of investors. Therefore, MBVE is calculated as follow:

MBVE=Market Value of Equity/Book Value of Equity

Current asset to total asset ratio (CATAR)

CATAR is used to calculate the total amount of money used to finance an investment as a working capital of the firm and it stressed the importance of the firm’s current assets. Additionally, it serve as a mechanisms which indicates the parts of total assets that forms the current assets since current assets forms part of working capital as it plays a significant role towards increasing corporate liquidity. This instrument was adopted from the work of Alnajjar (2014) and Efni (2017) as it was actively considered as one of the key indicator in measuring the value of investment decision in the previous researches. Thus CATAR is calculated as follows:

CATAR=(Current Assets/Total Asset)×100

Capital expenditure to book value asset (CAP/BVA)

Capital expenditure is the total amount of money used to purchase a new fixed asset or upgrading the existing fixed asset in the organization, which include the cost of acquiring Property, Plant and Equipment (PP&E) (Adams, 2003). Usually, the capital expenditure used to be added to the fixed assets so as to adjust the cost of assets for the purpose of tax. Usually, "Investment in Plant, Property, and Equipment" used to be found on the statement of cash flow statement and financial position statement of the firm. The cost of capital expenditures includes:

1. Cost of acquiring fixed assets and some times the cost of intangible assets.

2. Cost of repairing an existing asset.

3. Cost of upgrading an existing asset.

4. Cost of restoring property or leasing new assets etc.

Therefore, the ABV is the historical cost of the asset minus the cumulative depreciation, depreciation, amortization or impairment costs. CAP/BVA can be calculated using the following formula:

CAPBVA=Total Capital Expenditure/(Total Asset Market Value/Asset Current Price)

Financing Decision (Mediating Variable)

In measuring this observe variable (financial decision) four indicators were employed which were duly used in the previous works (Siam et al., 2005; Taani, 2013; Abdul, 2010) in which they emphasis on the use of the bellow indicator as the key instruments to measure Financial decision.

Short-term debts to total assets (STD/TA)

STD/TA is used to determine the extent at which short term debts was used towards funding the organizational assets. As stated by Siam et al. (2005) in their work, that sometimes working capital and other short term liabilities used to be financed by debts. Hence, the STD/TAR is calculated as follows:

STD/TA=[Short Term Debt (STD)/Total Assets (TA)]×100

Long term debts to equity (LTD/E)

LTD/E is basically calculated to determine the extent at which long-term debt was used in the total equity of the company. The ratio is indicating the degree of business risk towards repayments of its obligations which include payment of both principal amount and interest. Consequently, creditors used to be reluctant towards funding a firm with higher debt ratio. Thus, LTD/E is calculated as follows:

LTD/Eq=[Long-Term Debt (LTD)/Total Equity (TE)]×100

Debt to total assets (DTA)

TDA is another instrument used to measure the financing decision in the works of Taani (2013), Nikoo (2015), Zafar (2016). As suggested in their individual works it is used to measures the amount of assets that were financed by the creditors (liability) instead of investors. In the other hand, it is a leverage ratio that indicated the proportion of firms’ assets that are financed by the creditors in comparison with proportion of assets that were financed by the investors. In most cases, this ratio is describing how the firm has grown and acquired its assets over the period. DTA is calculated as:

TDA=[Total Liability (debt)/Total Assets]×100

Retaining earnings (Retention Ratio) (RE)

RE is also called retention ratio which indicate the percentage of retained earnings kept in the business. It is the portion of none distributable profit which is retained in the business. In the other hand it is the proportionate amount of earning kept to grow the firm rather than paying it out to the shareholders as a dividend. This indicator is adopted from the work of Efni (2017). RE is calculated as follow:

Retaining Earning Ratio=[Net Income-Dividends/Net Income]×100

Corporate Performance (Dependent Variable)

As used in the previous studies Tobin q and Price Earnings Ratio (PER) are majorly used to measure the performance of the firms (Ghosh, 2007; Agarawal & Zhao, 2007; King & Santor, 2008; Efni, 2017).

Tobin’s Q

Tobin’s Q is an instrument which measures the ratio between the market value of a physical assets and the value of its replacement. Tobin q was first described by James Tobin in 1977. The Tobin’s Q ratio is mostly used to measure the assets of a firm in connection to the market value of the firm’s assets. High value of Tobin’s Q motivates firms to inject more funds into the business since its indicated that the funds invested yield much return compared to the cost paid in relation to capital acquired. The formula for Tobin’s Q is:

Tobin’s Q=Total Market Value of Firm/Total Asset Value of Firm

Price earnings ratio (PER)

The PER is used to measure the company’s current share price in relation to the earnings per share. This PER is also known as “price multiple” or “earning multiple”. PER is calculated as follow:

PER=Market Value per Share/Earnings per Share

Capital Structure (Independent Variable)

As explained in the literature review, a capital structure is expressed as the combination of capital mix through which the company used to finance its investments. The following indicators were selected to measure the capital structure (Independent variable) in this study based on the suggestions made by various researchers (Wippern, 1966; Holz, 2002; Ghosh, 2007; Margrates & Psillaki, 2010; Efni, 2017)

Total equity ratio

TER is an investment leverage that measures the portion of assets that are funded by shareholders equity (owner’s investments). As such, TER measures the extent at which investment was used to finance the assets of a firm. TER is calculated as:

TER=Total Equity/Total Assets

Total debt ratio (TDR)

TDR is used to measure the financial solvency of a firm. It is calculated by dividing the total liability of a firm by its total assets. A higher firm leverage indicated a higher risk for bowers which singled a high level of liabilities records. The formula used is as follows:

TDR=Total Liability (both Long and Short term Debt)/Total Assets (Both Fixed and Current Assets)

Results

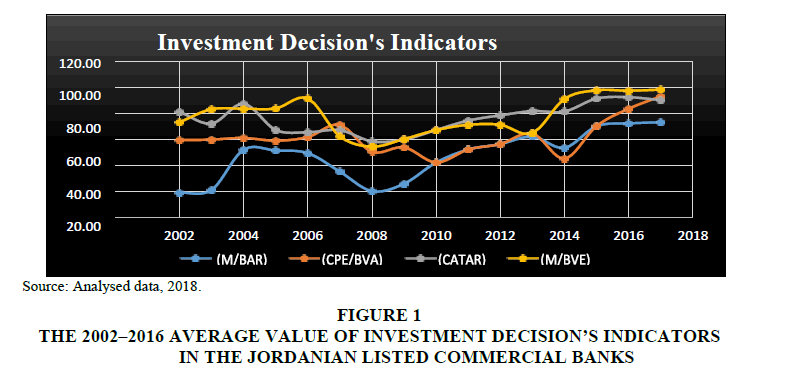

As indicated in the above Figure 1, the market book value of equity has solely depends on the stock price Market to Book Ratio Asset shows the ratio of market value of equity on book value of asset, as such a slight increase or decrease in the stock prices will consequently led to an increase or decrease of the Market Value of the Assets due to the increase or decrease in the Value of Equity. It can be seen that, from 2006 to 2013, the ratio of the market value of equity on asset value was fluctuated, whereas the average market value of equity was move on the same trend with the lowest value of 0.42 in 2010. Hence, it means that the Market Value of the Assets is lower than the Book Value of the Assets in those years. However, considering the sensitivity of market value of equity in the Jordanian commercial banks towards the microeconomic condition (Husnan, 2005; Efni, 2017), the meandering of the indicators in the 2008 and 2009 was depicting the negative impact of economic meltdown in those years, even though, the Jordanian economy had suffered less due to low engagement in the international market at that time (CBJ Report, 2010).

Figure 1: The 2002–2016 Average Value Of Investment Decision’s Indicators In The Jordanian Listed Commercial Banks

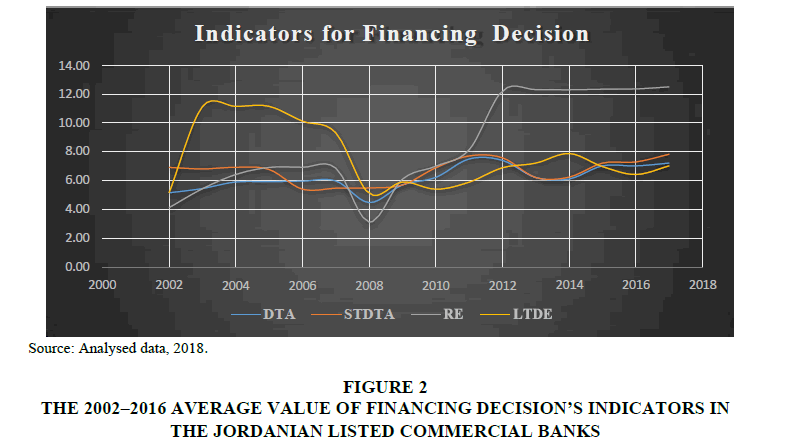

It can be seen from the Figure 2 that financing decision is been measured using four indicators such as Debt to Total Asset (DTA), Short Term Debt to Total Asset (STDTA), Retained on Earnings (RE) and Long Term Debt to Equity (LTDE). Comparatively, Jordanian listed commercial banks do patronised long term loan than short term loan even though the average value of LTDE has risen from 5.15 in 2002 to 11.13 in 2003, since then, the value continues to shrink down to 5.90 in 2008. The fall in the average value of LTDE was resulted from the increase in the rate of Jordanian economic growth which favoured the financial sector to generate more revenues thereby having green chances to pay-off their long-term debts. Therefore, it is proved that when the long-term debt of the banks is reduced the interest expenses paid on the debts would reduce as well, which in turn resulted to the ability of the banks to meetup their long term liabilities as such the performance of the banks increases due to the lower rate of risk related to none payment of long term debt. The lower the interest expenses paid on debt, the lower the risk of defaulting to pay the liabilities and the higher the performance of the firm which consequently leads to an increase in the public interest to invest in such organization (Efni, 2017).

Figure 2: The 2002–2016 Average Value Of Financing Decision’s Indicators In The Jordanian Listed Commercial Banks

Similarly, in relation to the STDTA almost the same justification as in the case of LTDE even though, in 2002 the ratio of the average value regarding STDTA is high compared to 2006 where it was represented as 60.92 and 5.40 respectively. This signifies that the level of shortterm debt related to the asset book value was decreased in 2006 despite the pact that the average value of the indicator was raised to 7.58 in 2012 which indicate that 76% of the short term debt was guaranteed by the total assets of the Jordanian banks and they have averagely patronised short term debts in 2012 regardless of its costs related to the acquisition and interest paid. Thus to some extents the banks have considered short term debt due to its less strictness in the process of acquisition (ANAN, 2017). Accordingly in the year 2008, the value of Retaining Earnings of the Jordanian listed commercial banks has drastically declined. Hence, the reduction in the average value of RE to 3.12 is directly resulted from the global financial crises in which the level of profit after tax decreased and the cost of productions increased. But as it can be seen in the Figure 2 above the Jordanian listed banks continued to enjoy an annual increase in the value of RE up to 12.50 in the year 2017, which indicated that the listed commercial banks of Jordan have enough reserves to finance their future investments.

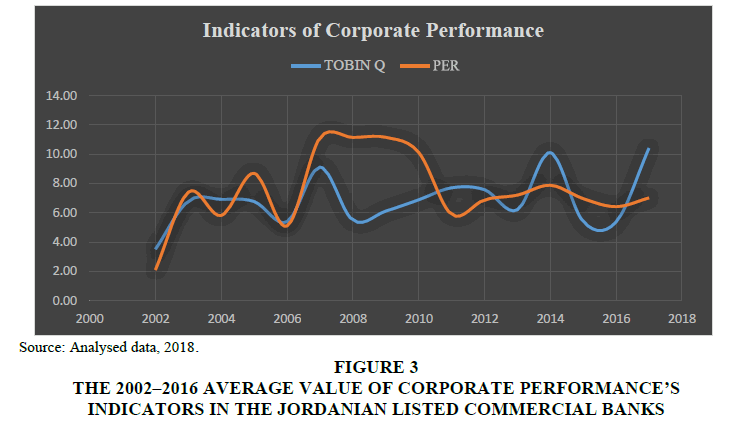

The Figure 3 above indicated that, average value of both indicators Tobin’s Q and Price Earnings Ratio were inversely fluctuating. The lowest average value of Tobin’s Q was obtained in 2002 as 3.52, where the value increases in the subsequent years until 2006, where it decreased to 5.11 from 7.41 in 2003. The highest value of Tobin’s Q had reached it maximum peak point at 10.41 in 2017. Relatively the Tobin’s Q value<4 showed that the market value of equity plus debt is reflecting the market value of share on the ratio value based on book value. The result had further means that in 2002, the market value of the equity in Jordanian listed commercial banks have decline due to the subsequent reduction in stock market price in the financial sector. The performance of the Jordanian listed banks used to decline due to the low investment and higher interest rate on long term debt which in turn affect the market price of equity in financial sector.

Figure 3: The 2002–2016 Average Value Of Corporate Performance’s Indicators In The Jordanian Listed Commercial Banks

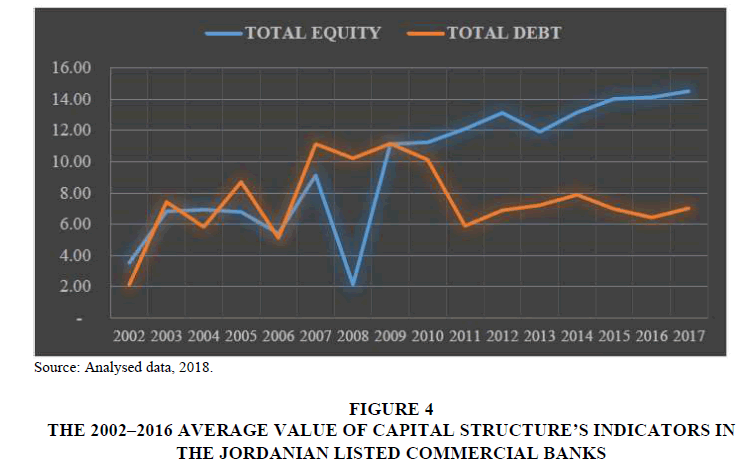

The Figure 4 describes the movements of total shareholders’ equity and total debts of Jordanian listed commercial banks which show the pattern of capital structure in the listed commercial banks of Jordan. From the indication, in 2002 the average value total equity have outweighed that of total debt, which displays that predominantly, shareholders’ equity was highly used to finance investments compare to debts in the Jordanian listed banks. Perhaps, the lowest average of total equity was recorded in 2008 as 2.12 which was came over due to world economic crunches that lead to the fall in the general prices of shares and subsequently reduction in the generated revenue from investment and low retaining earnings. Thus, this is what was actually gave room to the average value of total debts to shoot up from 5.11 in 2006 and 11.15 in 2009. Henceforth, the value of debts continues to decline while conversely the value of equity continues to rise. This means that the capital mix of the Jordanian listed banks was currently a combination of debts and equity but largely the listed banks were concentrating more on the shareholders equity than debts.

Figure 4: The 2002–2016 Average Value Of Capital Structure’s Indicators In The Jordanian Listed Commercial Banks

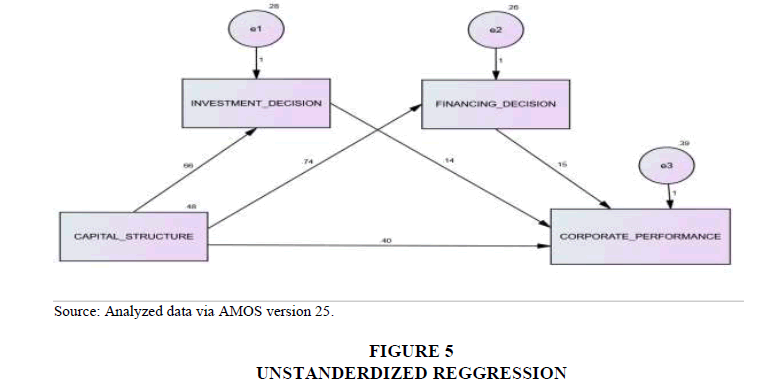

The Figure 5 above, illustrated the graphical structure of the model in which it indicates the standardized estimated coefficient (β) of each regression path.

Discussion

From the Table 1 above, it can be seen that, in a situation whereby the separate endogenous variables goes up by 1 simultaneously, the exogenous variables goes up by 0.661; 0.738; 0.143; 0.154 and 0.404 respectively. Consequently, the regression weight of the different estimated β coefficients (as mentioned above) have a standard error of about 0.045; 0.043; 0.071; 0.073 and 0.089. However, dividing the regression weight estimated by the estimate of its standard error gives a distinct critical ratio as large as 14.77; 17.12; 2.03; 2.10 and 4.53 in absolute value less than 0.001 and 0.05. In other words, the regression weight estimates are standard errors above zero. Therefore, the regression weight of capital structure and financing decisions in the predictions of investment decision, financing decision and corporate performance is positively and significantly different from zero at the p-value<0.001 level (two-tailed). Hence, the regression weight of Investment and Financing decision in the prediction of corporate performance is therefore positively and significantly different from zero at the Pvalue< 0.05 level (0.043 and 0.036 two-tailed).

| Table 1 Testing Of Research Hypotheses-Unstandardized Regression Weight |

|||||

| Variables | Estimate | S.E | C.R. | P-Value | Result |

| Investment Decision ßCapital Structure | 0.661 | 0.045 | 14.77 | 0.001 | Significant |

| Financing Decision ßCapital Structure | 0.738 | 0.043 | 17.12 | 0.001 | Significant |

| Corporate Performance ßInvestment Decision | 0.143 | 0.071 | 2.03 | 0.043 | Significant |

| Corporate Performance ßFinancing Decision | 0.154 | 0.073 | 2.10 | 0.036 | Significant |

| Corporate Performance ßCapital Structure | 0.404 | 0.089 | 4.53 | 0.001 | Significant |

| Source: Analyzed data via AMOS version 25. | |||||

| Table 2 Result Of The Indirect Effects Of The Mediating Variables |

||||

| Regression path of the mediating effects | Result of indirect regression path | Coeficient of indirect effets | Remark | |

|

Capital Structure |

FD CS (*0.74) CS (*0.74) |

CP FD (*0.15) FD (*0.15) |

0.111 | 0.404>0.111 |

Capital Structure Investment- Decision Investment- Decision Corporate Performance Corporate Performance |

ID CS CS(*0.66) |

CP ID ID (*0.14) |

0 .092 | 0.404>0 .092 |

Source: Analyzed data via AMOS version 25.

Note: * Denotes significance of the regression path.

The findings of this study have proved beyond reasonable doubt that capital structure has positive and significant effect on the corporate performance (Table 1). This finding has conformed to the hypothesis 1 of this study which stated that capital structure has positive and significant effect on the corporate performance in the Jordanian listed commercial banks. The finding has corresponded with results of various researchers (Hadlock & James, 2002; Ong & Teh, 2011; Semiu & Collins, 2011; Akinyomi, 2013; Bassey et al., 2013; Alnajjar, 2014; Arafat et al., 2014; Akeem et al., 2014). The finding had illustrated that an increase in the capital structure may lead to a positive increase in the overall performance of the Jordanian listed banks. Accordingly, this has justified the proposition of Modigliani and Miller in the trade-off theory of leverage, which relates that until the optimal capital structure is reached, there are many benefits to reap in the leverage within the capital structure. The theory considered tax benefit to be deducted from interest paid, as such a firms with higher proportion of debt are expected have greater performance due to the tax shield which in turn lead to corporate tax savings from the deducted interest tax and thus changes in the debt and equity of the firm geared towards direct effects to the corporate performances.

Relatively, this finding was contradicted with M&M theory of capital structure without corporate taxes, in which they revealed that the corporate value does not rely on the capital mix used by the firm hence it is heavily determined by the earning power and risk of its underlying investments (Zeitun & Tian, 2007; Puwanenthiren, 2011; Babalola, 2014). Moreover, based on the research findings, investment decisions had a positive and significant impact on the corporate value (Table 1). This finding is consistent with the hypothesis 2 of the study which stated that investment decisions have a significant and positive effect on the corporate performance in the Jordanian listed commercial banks. From the Table 1 above it can be seen that when the value of capital structure goes up by 1 the investment decision goes up by 0.66, thus it clarifies that when the corporate board make a sound and effective investment decision it will consequently yield an improved corporate performance, since a good investment decision brings positive Net Present Value (NPV) which signaled that the investment can generate a higher return greater than the capital cost incurred by the firm. More so, the finding had concurred with the result of (Lin et al., 2006; Fee et al., 2009; Dekimpe & Hanssens, 2010; Arafat, et al., 2014; Efni, 2017). In the other hand, the finding had opposed the M&M theory of capital structure without taxes, were they assume that in a perfect market the corporate value had no concern with its capital structure since the firms has the same risk in the market and individuals investors have the same estimation on the future, stocks and bonds traded in the perfect capital market.

Referenced to the research hypothesis 4, the findings as indicated in Table 1 above, financing decision has a positive and significant effect on the corporate performance. The table above has designated that an increase in the value of corporate performance by 1 will lead to an increase in the value of financing decision by 0.15 at p-value<0.05. Consequently, when capital structure increases by 1 subsequently financing decision increases by 0.74 with standard error of 0.43 and 17.123 critical ratio. As such, this proves that financial decision has positive and significant indirect effects on the corporate performance. Accordingly the findings have been backed by the result of the following researches among others (Husnan, 2000; Hanafi, 2005; Kajananthan & Nimalthasan, 2013; Zhang & Yu, 2016; Nazri, 2016; Efni, 2017).

Accordingly, from the Table 1 it can be seen that a positive indirect effect has been depicted between the exogenous, mediating and endogenous variables since the coefficient of their individual regression weights are positively significant at p-value less than 0.001 and 0.05 two tailed. Thus, the coefficient of the inner weight was positively significant which indicated that the relationship between the four observed variables was unidirectional. Therefore, indicating that an increase in the mediating variables will lead to an increase in the individual coefficient of each of the observed variables and vice-versa. Therefore, Table 2 has shown the overall indirect effect from the tested mediating effect of investment decision and financing decision on the relationship between the capital structure and corporate performances in the Jordanian listed commercial banks. In getting the coefficient of the mediation effects the value of two indirect standardized regression path of the individual mediating variables have to be multiply as seen in Table 2 above. Consequently, by multiplying the coefficient of the indirect (mediating) effect between the capital structure and corporate performance through the investment decision, an estimated coefficient of 0.092 was obtained which is lower than the standardized regression value of the direct effect. This indicates that mediation occurred since the direct effect between the capital structure and corporate performance is significant and the indirect effect between the capital structure and investment decision as well as investment decision and corporate performance are significant (Table 1). Accordingly, it is absolutely justified that investment decision had a partial mediation effect on the impact of capital structure against the corporate performance in the Jordanian listed commercial banks (Awang, 2014). The research hypothesis 3 has been supported by this finding which is also in line with the findings of McConnell & Servaes (1995) and Sharma (2006).

Moreover, from the test of indirect (mediating) effect on the relationship between capital structure and corporate performance through the financial decision in the Jordanian listed commercial banks, the value of 0.111 was positively attained (Table 2). Hence, the result indicated the occurrence of partial mediation of financing decision over the impact of capital structure on the corporate performances in Jordanian listed commercial banks. This bootstrapping result can be justified from the Table 1 above which portrait significant effects in both direct and indirect regression path at two tailed. In the other hand, financial decision has partly mediated the effects of capital structure on the corporate performance in the Jordanian listed commercial banks since both direct and indirect effects are positive (Tables 1 & 2). Accordingly the findings have been backed by the result of the following researches among others (Kajananthan & Nimalthasan, 2013; Zhang & Yu, 2016; Nazri et al., 2016; Efni, 2017).

In accordance with the result of the findings as discussed above, hypotheses 3 and 4 of the study were justified and accepted as investment decision and financing decision have positively and significantly mediate the effects of capital structure on the corporate performance in the Jordanian listed commercial banks. Even though, the nature of the mediation varied among the mediating variables. From the analyses, investment decision has full or complete mediation since In view of that, the primary objective of this study has been achieved.

Conclusion

The irrelevance theory of capital structure coined by M&M (1958) have triggered the minds of researchers worldwide, which resulted to the arrival of various conclusions, some of which concurred with the irrelevance theory and others proved otherwise. This provide a leeway to the development of this study which primarily stem to investigate the mediating effects of investment and financing decision over the relationship between the capital structure and corporate performances of the Jordanian listed commercial banks. Therefore, the findings of this study have substantiated that financing decision and investment decision have partially mediate the significant and positive effects on the relationship between the capital structure the corporate performance in the Jordanian listed commercial banks. As such the findings attuned with result of McConnell & Servaes (1995) and Sharma (2006). Moreover, as discussed above, the individual regression path from the Structural Equation Modelling (SEM) was graphically indicated a positive and significant effect of independent variables over the dependent variables at p-value<0.001 (two tailed) regarding hypotheses 1, 3 and 5 respectively. While, hypotheses 2 and 4 where proved to have significant and positive effects at p-value<0.05 (two tailed). These results have also corresponded with the findings of many researchers. For example, (Hadlock & James, 2002; Zeitun & Tian, 2007; Puwanenthiren, 2011; Ong & Teh, 2011; Semiu & Collins, 2011; Akinyomi, 2013; Bassey et al., 2013; Babalola, 2014; Arafat et al., 2014) and many more.

Additionally, the indicators used in measuring both indigenous and exogenous variables under this study were realistically evidenced that the Jordanian listed commercial banks are in the safest edge of growth in which the assets of the banks have overshadowed the liabilities as well as the capital structure of the banks are largely financed by the shareholders’ equity.

Recommendations

From the findings of this study, the following recommendations have been drown:

1. The combination of organizational debt and equity is what is called capital mix, which signifies a significant aspect of corporate financial risk to the businesses, whereas failure to manage it appropriately will lead to the dissuasion to the corporate performance and even bankruptcy of the firm (Ifni, 2016). Consequently, Jordanian listed banks should pay much attention on the proper combination of capital structure due to its impacts on the corporate performance. The listed commercial banks of Jordan should know that the higher the debt in the capital mix the higher the expenses and or liabilities to pay as well as the lower the corporate performance and vice versa. Financing investments using corporate reserves (shareholders’ equity) yield a positive return in most cases which increases the corporate performance.

2. Based on the findings of this study, funding decision is playing a fundamental role on the effects of capital structure on the corporate performance, since it help in evaluating and selecting a desirable source of finance at lower cost and or minimal risk. As such it is suggested that the Jordanian listed banks should take funding decisions into consideration when making investments. Failure to make appropriate financing decisions will lead to an increase in the corporate risk in investment, which will simultaneously affect the performance of the banks.

3. Furthermore, it was indicated that investment decisions is a crucial decisions among the financial management decisions which entails allocation of scarce resources into a promising investments. Subsequently, before injecting the resources into various projects there is need to evaluate the projects based on many indicators for example Net Present Value (NPV), Internal Rate of Return (IRR) and Pay Back Period (PBP) etc. Equitably, the listed commercial banks of Jordan are advised to reconsider investment decisions due to the fact that an error in making a sound and effective investment decisions may expose the banks to the investment risk which directly affect the corporate performance.

4. It is suggested that the future researchers should consider macro and micro economic variables which in some instances affects the relationships between the capital structure and corporate performances in Jordan. These variables includes among others, inflation, interest rate, cost of capital, investment risks, depletion, dividend policy etc.

Acknowledgement

This research was funded by Deanship of Research in Zarqa University. I would like to acknowledge Zarqa University who provided insight and expertise that greatly assisted the research.

References

- Abdallah, K.M.A., & Fakhri, S.O. (2013). Impact of cost of capital, financial leverage, and the growth rate of dividends on rate of return on investment an empirical study of amman stock exchange. International Journal of Academic Research in Economics and Management Sciences, 2(4).

- Abdullahi, R., & Mansor, N. (2018). Fraud prevention initiatives in the Nigerian public sector: understanding the relationship of fraud incidences and the elements of fraud triangle theory. Journal of Financial Crime, 25(2).

- Akeem, L.B., Terer, B.K., Kiyanjui, M.W., & Kayode, M.A. (2014). Effects of capital structure on firm’s performance: Empirical study of manufacturing companies in Nigeria. Journal of Finance and Investment Analysis, 3(4), 39-57.

- Akinyomi, O.J. (2013). Effect of capital structure on firms performance: Evidence from Nigerian manufacturing company. International Journal of Innovative Research and Studies, 2(9).

- Altarawneh, H. (2009). The impact of financial ratios in determining the cash dividend policy in Jordanian banks. Unpublished Ph.D. Thesis.

- Association of National Accountants of Nigeria (ANAN) (2017). Finance and Financial Management. Printed by Northern-Printing Press Jos.

- Awan, Z. (2014). Research methodology: Structural equation modelling. Published by University Sultan Zainal Abidin, Gongbadak printing press, Malaysia.

- Babalola Y.A. (2014). Triangulation analysis of capital structure and firms’ performance in Nigeria. East Ukrainian National University [Vol. Dahl] 91034 Lugansk, Ukraine.

- Barton, S.L., & Gordon, P.J. (1988). Corporate strategy and capital structure. Strategic Management Journal, 9(6), 623-632.

- Bassey, N.E., Aniekan J.A., Ikpe, I.K., & Udo, U.J. (2013). Analysis of the determinants of agricultural science. Science and Education Centre of North America, 1(4), 36-47.

- Biais, B., & Casamatta, C. (1999). Optimal leverage and aggregate investment. Journal of Finance, 54, 1291-1323.

- Booth, L., Aivazian, V., Kunt, A.D., & Maksimovic, V. (2001). Capital structure in developing countries. The Journal of Finance, 1, 87-130.

- Central Bank of Jordan, Annual Reports (2010). Retrieved from www.cbj.gov.jo/page/viewpageaspx?pageID=176

- Coricelli, F., Driffield, N., Pal, S., & Roland, I. (2011). Excess leverage and productivity growth in emerging economies: Is there a threshold effect? CEPR Discussion Papers 7617, C.E.P.R. Discussion Papers.

- Cornwell, T.B., Pruitt, S.W., & Clark, J.M. (2005). The relationship between major-league sports' official sponsorship announcements and the stock prices of sponsoring firms. Journal of the Academy of Marketing Science, 33(4), 401-412.

- Damodaran, A. (2006). Damodaran on valuation, security analysis for investment and corporate finance. Edisi kedua, John Willey & Son, Inc., New Jersey, USA.

- Daoud, H., Al-Fawwaz, M.T., & Arabyat, Y. (2015). The relationship between IT investment levels and bank performance: The case of Jordanian banking sector. Journal of the Academy of Marketing Science, 42(3), 202-21

- Dekimpe, M.G., & Hanssens, D.M. (2010). Time series models in marketing: Some recent developments. Marketing Journal of Research and Management, 1(1), 93-98.

- Fee, C.E., Hadlock, C.J., & Pierce, J.R. (2009). Investment, financing constraints, and internal capital markets: Evidence from the advertising expenditures of multinational firms. Review of Financial Studies, 22(6), 2361-2392.

- Ghadome, T. (2008). The decision to finance and its impact on the company's performance: An empirical study on a sample of companies listed on the Amman stock exchange securities. Journal Jordanian Applied Sciences, 1-24.

- Gitman, L.J. (2003). Principles of managerial finance, (International Edition). Pearson Education, Boston.

- Graham, J.R. (2000). How big are the tax benefits of debt? The Journal of Finance, 55(5), 1901-1942.

- Hadlock, C.J., & James, C.M. (2002). Do banks provide financial slack? Journal of Finance, 57(3), 1383-420.

- Hanafi, M.M., & Halim, A. (2005). Financial statement analysis, (Second Edition). Yogyakarta, AMP, YKPN.

- Harris, M., & Raviv, A. (1991). Capital structure and information role of debt. Journal of Finance, 57(2), 521-534.

- Husnan, S. (2000). The theory and application of financial management, (Third Edition). Yogyakarta: UPP AMP YKPN

- Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Joshi, A., & Hanssens, D.M. (2010). The direct and indirect effects of advertising spending on firm value. Journal of Marketing, 74(1), 20-33.

- Kajananthan, R., & Nimalthasan, P. (2013). Capital structure and its impact on firm performance. A study on Sri Lankan listed manufacturing companies. Merit Research Journals Business Management, 1(2), 37-44.

- Khalaf, A. (2013). Capital structure effects on banking performance: A case study of Jordan. International Journal of Economics. Finance and Management Sciences, 1(5), 227-233.

- Khan, A.G. (2012). The relationship of capital structure decisions with firm performance: A study of the engineering sector of Pakistan international. Journal of Accounting and Financial Reporting, 2(1), 245-262.

- Kochhar, R. (1996). Explaining firm capital structure: The role of agency theory vs. transaction cost economics. Strategic Management Journal, 17(9), 713-728.

- Korajczyk, R., & Levy, A. (2003). Capital structure choice: Macroeconomic conditions and financial constraints. Journal of Financial Economics, 68, 75-109.

- Lin, B.W., Lee, Y., & Hung, S.C. (2006). R&D intensity and commercialization orientation effects on financial performance. Journal of Business Research, 59(6), 679-685.

- Majumdar, S.K., & Chhibber, P. (1999), Capital structure and performance: Evidence from a transition economy on an aspect of corporate governance. Public Choice, 98(3-4), 287-205.

- Martono, A. (2001). Financial management (in Indonesia: Manajemen Keuangan). Faculty of Economics, University of Indonesia, Jakarta.

- Masulis, R.W. (1983). The impact of capital structure change on firm value. The Journal of Finance, 37(1), 107-126.

- Mathur, L.K., & Mathur, I. (2000). An analysis of the wealth effects of green marketing strategies. Journal of Business Research, 50(2), 193-200.

- McConnell, J.J., & Servaes, H. (1995). Equity ownership and the two faces of debt. Journal of Financial Economics, 39(1), 131-157

- Miller, M.H. (1977). Debt and taxes. Journal of Finance, 32(2), 261-275.

- Mitton, T. (2007). Why have debt ratios increases for firms in emerging markets. European Financial Management, 14(1), 127-151.

- Miyazaki, A.D., & Morgan, A.G. (2001). Assessing market value of event sponsoring: Corporate olympic sponsorship. Journal of Advertising Research, 41(1), 9-15.

- Modigliani, F., & Miller, M. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3) 261-297.

- Mohammad, M.H.A. (2014). Evaluating the financial performance of banks using financial ratios: A case study of erbil bank for investment and finance. European Journal of Accounting Auditing and Finance Research 2(2), 156-170.

- Muhammad, H., Shah, B., & Islam, Z. (2014). The impact of capital structure on firm performance. Evidence from Pakistan. Journal of Industrial Distribution and Business, 5(2), 13-20.

- Munir, M.M. (2017). Banks performance and capital structure: Comparative study between Islamic banks and conventional banks. International Research Journal of Finance and Economics, 160, 50-62.

- Mwangi, L., Makau, M.S., & Kosimbe, G. (2014), Relationship between capital structure and performance of non-financial companies listed in the Nairobi Securities Exchange, Kenya. Global Journal of Contemporary Research in Accounting, Auditing, and Business Ethics, 1(2), 72-89.

- Myers, S.C. (2001). Capital structure. Journal of Economic Perspectives, 15(2), 81-102.

- Nazri, M.D., Norwani, N., Ahmad, A.M., & Anisah, E. (2016). Does financing decision influence corporate performance in Malaysia? International Journal of Economics and Financial Issues, 6(3), 1165-1171.

- Nilsen, O.A., Raknerud, A., Rybalka, M., & Skjerpen, T. (2009). Lumpy investments, factor adjustments, and labour productivity. Oxford Economic Papers, 61(1), 104-127.

- Noe, T.H. (1988). Capital structure and signalling game equilibrium. Review of Financial Studies, 1(4), 331-355.

- Ong, T.S., & The, B.H. (2011). Capital structure and corporate performance of Malaysian construction sector. International Journal of Humanities and Social Science, 1(2).

- Pratheepkanth, P. (2011), Capital structure and financial performance: Evidence from selected business companies in Colombo Stock Exchange Sri Lanka. Journal of Arts, Science and Commerce, 2(2), 171-183.

- Ramezanalivaloujerdi, R., Rasiah, D., & Narayanasamy, K. (2015). Corporate capital structure and performance of listed construction companies in Malaysia from 2005-2009. International Business Management, 9(3), 191-199.

- Riyanto, B. (2001). Basics of company spending, (Fourth Edition). Seventh Moulds, BPFE Yogyakarta, Yogyakarta.

- Sagara, S. (2015). The analysis of capital structure on financial performance using capital, assets earnings and liquidity ratios in Islamic banks listed on the Indonesia Stock Exchange (IDX) in 2014. International Journal of Business, Economics, and Law, 8(1), 53-60.

- Semiu, B.A., & Collins, S.O. (2011). Perceived relationship between corporate capital structure and firm value in Nigeria. International Journal of Business and Social Science, 2(19).

- Siam, W.Z., Khrawish, H.A., & El-Hammoury, B.M. (2005). The capital structure of banking sector in Jordan. Dirasat, Administrative Sciences, 32(1).

- Soumadi, M.M., & Hayajneh, O.S. (2010). Capital structure and corporate performance empirical study on the public Jordanian shareholdings firms listed in the Amman stock market. European Scientific Journal, 8(22).

- Sukkari, A. (2003). The determinants of the capital structure in the Kuwaiti capital market. Master Thesis, Hashemite University, Amman, Jordan.

- Titman, S., & Wessels, R. (1988). The determinants of capital structure choice. Journal of Finance, 43, 1-19.

- Tudose, M.B. (2012), Capital structure and firm performance. Economic Trans-disciplinary Cognition, 2(15), 76-82.

- Woldemariam, B.M. (2016). The impact of capital structure on financial performance of commercial banks in Ethiopia. Global Journal of Management and Business Research, 16(8).

- Younus, S., Ishfaq, K., Usman, M., & Azeem, M. (2014). Capital structure and financial performance: Evidence from Sugar industry in Karachi Stock Exchange Pakistan. International Journal of Academic Research in Accounting, Finance and Management Sciences, 4(4), 272-279.

- Zaher, A., & Altahtamoun, F.R. (2014). The causal relationship between financial decisions and their impact on financial performance. International Journal of Academic Research in Accounting, Finance and Management Sciences, 4(2), 72–80.

- Zeitun, R., & Tian, G.G. (2007). Capital structure and corporate performance: Evidence from Jordan. Australasian Accounting Business and Finance Journal, 1, 23-31.

- Zeyad, I.R. (2016). Jordanian evidence on the capital structure. Modern Applied Science, 10(10).

- Zhang, L., & Yu, S. (2016). Research on the capital structure decisions of China logistics industry: Using the unbalanced panel data analysis. International Journal of Smart Home, 10(1), 169-180.