Research Article: 2018 Vol: 22 Issue: 4

The Mediating Role of Service Provider Expertise On the Relationship between Market Orientation and Customer Satisfaction in Iraq Banking Sector

Nibras Kadhim Abed, University of Karbala

Lamyaa Ali Ibrahim, University of Karbala

Ahmed Hussein Ahmed, University of Karbala

Abstract

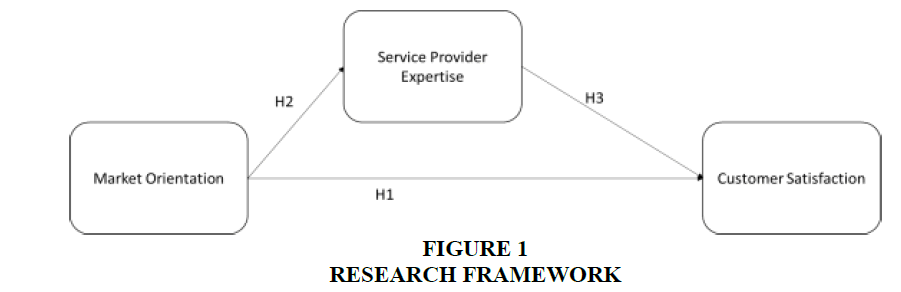

This study examines the relationship between market orientation and customer satisfaction with the mediating effect of service provider expertise. A sample of 385 respondents from the banking sector of Iraq is selected for analysis. PLS-SEM model is used to test the hypothesis. The results of path-1 reported a positive and a significant relationship between market orientation and service provider expertise. Similarly, a positive and a significant relationship is also found for path-2. The results of the bias-corrected bootstrapping method confirmed the mediating role of service provider expertise between market orientation and customer satisfaction for Iraqi banking customers.

Introduction

Like other countries, the banking sector in Iraq is also a major building block for the Iraqi economy that provides necessary financial liquidity to firms and individuals. Banking sector performs different important functions such as resources allocation, risk transferring, information efficiency, and facilitate trade and commerce (Adams, et al., 2009; Ikram and Nugroho, 2014; Amadi and Amadi, 2014; Pradhan et al., 2014; Hassan, et.al., 2015; Kaushal & Ghosh, 2016; Hang et al., 2016; Rauf, 2016; KV, 2016; Raweh et al., 2017; Tomfort, 2017; Nazal, 2017; Din, Abu-bakar & Regupathi, 2017; Din et al., 2017;). The primary function of banking in any economy is to work as an intermediator between lenders and borrowers.

US invasion, civil war, ISIS emergence, and financial crisis collectively twisted Iraq’s economy during the past decade. As a result, the Iraqi financial sector, particularly the banking sector, facing many challenges and low customer satisfaction is one of them. Couple with the crisis mentioned earlier, turbulent business environment and competition further made it difficult and possess many challenges for already suffering economy like Iraq. Iraqi financial industry, especially the banking industry, is facing customer’s satisfaction challenges. One of the reasons for low customer’s satisfaction is that either service are not designed to keep market demand or banking sector in Iraq is not stable after Saddam’s regime. Iraq ranking in terms of obtaining credit is very poor, 180 out of 189. Furthermore, Sansar (2013) claimed that the Iraqi banking sector is least developed among the Middle East North Africa countries and less than 20% Iraqi holds a bank account. In addition, poor infrastructure along with shortages of skills and technology also contributed to a lack of customer satisfaction (The World Bank, 2012). There are high changes in scientific technology, thereby reducing the product lifecycle. Consequently, firms have to satisfy customer’s needs and maintaining a profitable relationship in this competitive environment is vital (Cheng et al., 2011).

Banking industry environment is highly competitive and managers to need to quickly respond to any market need for maintaining and developing new customers. Relationship building coupled with market-driven strategies help the organization to maintain their market leadership position (Athene, 2006; Mahmoud et al., 2016; Tirado & Guillén, 2017). Therefore, companies need to adopt relationship building approach rather following the transactional approach. Following the relational approach is beneficial for many reasons, for instance, developing a new customer is five times costly than maintaining existing customers (Kotler & Armstrong, 2012; Proctor, 2002). However, financial institutions and especially the banking industry have been facing unprecedented competition creating a survival of the fittest environment. Banks are now interested more than ever before in maintaining loyal and satisfied customers. The current challenge is to improve “customer satisfaction” with exception to the banking sector in Iraq, its benefits, its utilization, its sense of attachment to customer needs. Interestingly, the expertise of service provider plays a key role in developing long-lasting business relationships with customers (Newell et al., 2016). The expertise of staff is significant to build up a loyal relationship in business dealings (Bachmann & Zaheer, 2006; Palmatier et al., 2007).

Under market orientation principle, customers are the most crucial and significant sources of creating a sustainable competitive advantage (Ansah & Chinomona, 2017; Tirado & Guillén, 2017). Besides creating a competitive advantage, market orientation would also help companies maximize their profits by satisfying their customers, internal and external (Abidemi et al., 2017; Kasim et al., 2018; Narver & Slater, 1990; Singh & Ranchhod, 2004). Market orientation concept does not require companies to merely focus on external customers only but also emphasize on satisfying the internal customer, employees. Satisfying internal customers is important because satisfied internal customers, employees, would better serve to external customers. Authors like Johnson and Grayson (2005), Spake and Megehee (2010), and Sweeney and Swait (2008) stated that relationship management and service provider expertise improvement would act as a catalyst along with market orientation approach in customer satisfaction (Tahir and Sabir, 2014; Mahmoud et al., 2016; Etale et al., 2016; Guo et al., 2017; Jaworski & Kohli, 2017).

In order to attract new and sustain existing customers, banking service providers need to understand and update their banking practices along with market-oriented approaches for the complete satisfaction of their customers. Thus, the present study fills this gap by proposing an integrative framework that connects market orientation and customer satisfaction. Against this background, there is a need to study factors that lead to customer satisfaction in a financial institution, specifically banking institution in Iraq. The literature reported several factors significant to predict customer satisfaction; however, the present study chooses service provider expertise and Market Orientation (MO) because of their relevance in this context.

Literature Review

Blau (1964), Homans (1961), and Thibaut and Kelley (1959) are prominent contributors to the development of the Theory of Social Exchange (SET). This theory holds that an individual’s action is guided by the benefits exchange in social relation. The underlying assumptions of this theory are adopted from behavioural psychology and economies. This theory implies that the satisfaction level of parties depends on the cost-benefit analysis, a low cost or a higher benefit will result in satisfaction. As banking is a financial service, where two parties, bank and customer, evaluate their costs-benefits for development of long-term and loyal customer relationship.

Satisfaction level of a person would be measured against a person’s predefined perception about something, if the actual performance is up-to or beyond predefined perception level then the person would be satisfied (Mandal, 2016; Pauline et al., 2017; Singh & Ranchhod, 2004). Customer satisfaction is of particular interest to marketers for successfully managing and improving their business activities. (Choi & Eboch, 1998: 2014) expectations of a customer on a product tell us his anticipated performance for that product. Perceived product performance is considered as an important construct due to its ability to allow making comparisons with the expectations. It is considered that customers judge products on a limited set of norms and attributes. Furthermore, Customer satisfaction can be defined as a person’s felt state; either pleasure or discontent, ensuing from comparing product’s perceived performance (or outcome) in relation to the person’s expectations (Kotler & Armstrong, 2012). Customer satisfaction has long been recognized as one of the critical success factors in today’s competitive business environment as it affects companies “market share and customer retention”. “Satisfied customers tend to be less influenced by competitors, less price sensitive, and stay loyal longer” (Dimitriades, 2006 as cited by Sitet al., 2009, pp. 958). Ultimately, this will contribute to the bottom-line or growth of the companies.

Based on the marketing perspective, a very difficult goal for the management team to achieve is CS. Ruekert (1992) indicates that the practicing effectiveness of MO is based on the enterprises’ practicing results of the following aspects:

1. The information quantity that enterprises can acquire from customers.

2. The enterprises’ responses to customers’ demands in accordance with the information collected.

3. The enterprises substantially practicing the developed strategies and relevant activities for matching the customer needs.

Based on the past research data, Day (1994) concludes that MO has three main features, which are described as follows:

1. Customer benefit is the focus of the firm.

2. The company pays attention to the integration and application of cross-sectional competences in order to create advantageous customer values.

3. The organization effectively develops, distributes, and utilizes the customers’ and competitors’information collected.

Jaworski and Kohli (1993) advise that MO is composed of three types of comprehensive organizational activities:

1. Appropriate information about existing and future potential customer demands.

2. Information regarding different markets that are distributed to different departments of the company.

3. Information that sufficiently reflects the market situation-interaction and communication are the key process elements of MO.

Besides, employees with a high level of customer orientation tend to have behaviours that positively provide good service and thus increase CS during the process of contacting customers (Bigne et al., 2005; Lai and Cheng, 2005). Based on the research results shown earlier, it is found that as employees possess MO characteristics, through employees’ customer and competitor orientation, companies will obtain more market information and with the coordination and distribution of information between departments, the organization can acquire information on the market in a timely manner, which helps create much more value for customers and thus achieve the firm’s goal in terms of a high CS level (Maydeu-Olivares and Lado, 2003). Therefore, the present study proposes a hypothesis as follows:

H1: There is a positive relationship between Market Orientation and Customer Satisfaction in Banks.

Belonax et al. (2007) and Newell et al. (2016) defined expertise as relevant skills, competencies, and industry knowledge. According to Crosby et al. (1990), service provider’s competencies and knowledge play a vital role in customer’s satisfaction, especially for the services sector. Busch and Wilson (1976) claimed buyers’ intention to be long-term, few buyers place more value to competencies of sellers while concerning long-term relationship, the more expert sellers are more likely to attract long-term buyers. However, expertise is the evaluation of sellers’ capability, knowledge, exposure and trustworthiness. The source of credibility powered through buyers’ perception of sellers’ expertise. A plethora of studies have suggested that the perceptions of salespersons’ expertise strengthen relationship quality (Palmatier et al., 2006). The nature of banking revolves around financial consultation, though, service provider expertise specific to consultative capabilities impact significantly on customer’s satisfaction. Authors like Brown and Bond (1995), Clow et al. (1996), Montoya-weiss et al. (2003), Spake and Megehee (2010), and Sweeney and Swait (2008) stated that building a trustworthy long-term relationship is beneficial for both, banks and customers. From the bank’s perspective, market orientation and better service knowledge will provide benefits like cost reduction, profit enhancement, serve as a barrier to switch, and positive word of mouth. From a customer’s perspective, these parameters will serve to satisfy their banking needs, choice reduction, confidence benefits, lower cost/effort, risk reduction, and customized service. According to Bendapudi and Berry (1997), customers prefer to maintain long-term relations with a service provider if they exhibit expertise in their respective services. Similarly, Moorman et al. (2010) and Swan et al. (1985) claimed that expertise, in case of the service sector, is considered to be one of the significant factors for customer’s satisfaction. Authors like Crosby et al. (1990b), Kim et al. (2004), and Macintosh (2007) argue that expertise is vital for customer satisfaction irrespective to service sector in which a firm is operating i.e. health-care, travelling, or financial. In addition, Palmatier et al. (2006) stated that an expert service provider will provide more benefit to their customers; hence, the satisfaction level of customers with an expert service provider will be high compared to the inexperienced or naïve service provider. Based on the literature we can hypothesis that

H2: There is a positive relationship between market orientation and service provider expertise in banks.

H3: Service provider expertise mediates the relationship between market orientation and customer satisfaction in Banks.

Methodology

In this study, an attempt is made to investigate the relationship between market orientation and customer’s satisfaction with the mediating effect of service provider expertise for banking sector of Iraq. The questions for service provider expertise variable is adopted from Athanassopoulos et al. (2001) and Johnson and Grayson (2005). The items for market orientation are adopted from Momrak (2012) whereas items for customer’s satisfaction are adopted from the study of (Agbor, 2013).

The data for this study is collecting on a self-administrative five-point Likert scale. Data is collected from a total of 385 customers from Iraq. As Baron and Kenny (1986) stated that three conditions must hold for a successful mediation such as there must be a relationship between independent (market orientation) and dependent variable (customer satisfaction), between independent and mediator (service provider expertise), and between the mediator and dependent variable. Literature revealed that although studies examined the relationship between market orientation and customer’s satisfaction (Mahmoud et al., 2016; Momrak, 2012; Tirado & Guillén, 2017) and studies that explored relationship between service provider expertise and customer satisfaction (Bendapudi & Berry, 1997; Chai et al., 2015; Crosby et al., 1990a; Johnson & Grayson, 2005; Macintosh, 2007; Moradi et al., 2017; Sweeney & Swait, 2008). However, not a single study investigated the relationship, as per the author’s knowledge, between market orientation and service provider expertise. Hence et al. (1986) principle do not hold in this case, resultantly, mediation is supported by Hayes and Preacher (2014), Preacher and Hayes (2008), Preacher et al. (2007) which holds no such conditions as reported by Baron and Kenny (1986).

Partial least square structural equational modelling is used to test the hypothesis. PLSSEM technique is superior to other statistical methods in many ways such as no sample size restriction, effective for statistical model building along with forecasting, precise and accuracy in estimation, soft modelling assumptions, doesn’t require normality of data, and suitable especially in case of mediation (Hair et al., 2014; Hair et al., 2017; Iacobucci et al., 2007; Mattanah et al., 2004; Osborne, 2011; Ramli & Nartea, 2016; Wahab, 2016). Moreover, SEM is a combination of two powerful statistical approaches: exploratory factor analysis and structural path analysis, which enables simultaneous assessment of the measurement model and the structural model (Hair et al., 2017).

Results and Discussion

The results of data analysis are present in this section. A sample size of 385 is selected for this study and a questionnaire is distributed to respondent, 348 questionnaires were complete in all aspects and used to test the hypothesis with a response rate of 90.03%. Descriptive statistics are presented below

Descriptive statistics reported demographic statistics of respondents, for instance, 60.63% respondents for this research are Iraqi males and about 68.38% are ageing between 30 years to 49 years old (Table 1). Additionally, descriptive statistics also revealed that 91% of the respondents are either job-holders or businessmen. It is important because the majority of the banking services/products are designed keeping in view the needs of either job-holders or businessmen. Following Table 2 contains the results of Cronbach’s Alpha.

| TABLE 1 DESCRIPTIVE STATISTICS |

|||||||||

| Measures | Gender | Age group | Nature of customers | ||||||

| Male | Female | 20+ | 30+ | 40+ | 50 & above | Job holders | Businessman | Other | |

| Frequency | 211 | 137 | 50 | 135 | 103 | 60 | 129 | 185 | 34 |

| Percentage | 60.63% | 39.37% | 14.36 | 38.79 | 29.59 | 17.24 | 37.06 | 53.16 | 9.77 |

| Mean | 1.79 | 2.19 | 1.89 | ||||||

| Std. Deviation | 0.531 | 0.438 | 0.471 | ||||||

| TABLE 2 CRONBACH’S ALPHA |

||||

| Variable | Number of Items | Cronbach’s Alpha | CR | AVE |

| Market Orientation | 07 | 0.82 | 0.71 | 0.76 |

| Customer’s Satisfaction | 17 | 0.78 | 0.83 | 0.79 |

| Service Provider Expertise | 06 | 0.92 | 0.79 | 0.77 |

Litzinger et al. (2005) claimed that a value higher than 0.70 represents good internal consistency and high reliability. The results of Cronbach's alpha indicated that none of the value is less than 0.70. Hence, all the variables have good internal consistency and reliability.

The test of normality is vital for any multivariate analysis. According to Tabachinich and Fidell (2007), the basic assumption of regression analysis is that “each variable and all linear groupings of the variable are normally distributed”. The basic tools for evaluating the normality of the data can be either graphical or statistical techniques. Accordingly, the skewness, as well as Kurtosis, is the statistical method, while Q-Q is a graphical component. Authors like Agostino et al. (1990) and Royston (1990) stated that the Shapiro-Wilk test has poor predictability power whereas statistical tests, Skewness and Kurtosis, have better predictability power. Hence, statistical are used to check the normality of data for this research. Following table presents the results of Skewness and Kurtosis.

Agostino et al. (1990) and Royston (1990) reported that the data would be normal if the value of Skewness and Kurtosis fall between -1 and +1. The results highlighted that no value is neither less than -1 or greater than +1, hence, data is normally distributed.

A correlation analysis is also performed to gauge the level of association between market orientation, service provider expertise, and customer’s satisfaction. The results are presented below Table 4.

| TABLE 3 RESULTS OF SKEWNESS AND KURTOSIS |

||||

| Variables | Skewness | Kurtosis | ||

| Std. Deviation | Value | Std. Deviation | Value | |

| Market Orientation | 0.471 | -0.68 | 0.059 | -0.17 |

| Customer’s Satisfaction | -0.13 | 0.53 | ||

| Service Provider Expertise | 0.27 | 0.27 | ||

| TABLE 4 CORRELATION MATRIX |

||||

| Customer Satisfaction | Market Orientation | Service Provider Expertise | ||

| Customer Satisfaction | Pearson Correlation Sig N |

1 348 | ||

| Market Orientation | Pearson Correlation Sig N |

0.76 0.00 348 |

1 | |

| Service Provider Expertise | Pearson Correlation Sig N |

0.62 0.01 348 |

0.29 0.05 348 |

1 |

A value less than 0.3 indicates a weak correlation among variables while a value between 0.4 to 0.7 shows a medium level of correlation whereas a value higher than 0.7 represents variables are highly correlated (Bednarczyk, 2013; Gujarati, 2003). The results of the correlation matrix reported a high correlation between market orientation and customer satisfaction whereas a medium to high level of correlation also exists for service provider expertise and customer satisfaction.

In order to serve the purpose of this study, PLS-SEM is applied to examine the mediation effect of service provider expertise between market orientation and customer satisfaction. Following table contains the results of PLS-SEM Table 5.

| TABLE 5 PARTIAL LEAST SQUARES STRUCTURAL EQUATION MODELLING |

|||||||||

| Direct Effect | Total Effect | ||||||||

| Service provider expertise | Customer satisfaction | Customer satisfaction | |||||||

| SE | Β | P-value | SE | β | P-value | SE | β | P-value | |

| Market orientation | 0.621 | 0.351 | 0.00 | 0.171 | 0.079 | 0.01 | 1.671 | 0.401 | 0.00 |

| Service Provider Expertise | 0.439 | 0.163 | 0.00 | ||||||

| R2 | 0.38** | 0.56** | 0.67* | ||||||

PLS-SEM analysis also known as Path analysis (Table 6). The value of R2 is 38% for path-1where service provider is taken as a dependent, meaning that market orientation is explaining about 38% variation in service provider expertise. Further analysis of path-1 also revealed a significant and positive (β=0.621 & P=0.00) relationship between market orientation and service provider expertise, hence, H2 is accepted. One unit increase in market orientation, holding other things constant, would generate a change of 62% in service provider’s expertise. Previous researchers such as Abidemi et al. (2017), Guo et al. (2017), Jaworski and Kohli (2017), Singh and Ranchhod (2004) also supported the notion, as market orientation is the application of marketing concept, understanding customer’s needs and responding accordingly.

| TABLE 6 PLS-SEM ANALYSIS |

|||||||

| Variables | Total Effect | Direct Effect | Indirect Effect | ||||

| β | ρ | β | ρ | β | Ρ-LL | Ρ-UL | |

| Market orientation | 0.401 | 0.00 | 0.351 | 0.01 | 0.050 | 0.01 | 0.107 |

Hence, a company following market orientation practice represents the expertise of a company to successfully transforming customer’s needs into product or service.

The result for path-2 of PLS-SEM reported a value of 56% for R2, meaning that market orientation and service provider expertise collectively explains about 56% variation in service provider expertise. Analysis for path-2 reported a significant and positive (β=0.171 & P=0.00) relationship between market orientation and customer satisfaction, hence, H1 is accepted. One unit increase in market orientation, holding other things constant, would increase customer satisfaction by 17%. Studies like Ansah and Chinomona (2017), Guo et al. (2017), Jaworski and Kohli (2017), Kasim et al. (2018), Mahmoud et al. (2016), Narver and Slater (1990), Singh and Ranchhod (2004), and Tse et al. (2003) also found a positive and significant relationship between market orientation and customer satisfaction. The underlying reason for this positive and significant relationship is that if the company is serving as per the requirements of the customer then the loyalty and satisfaction level of the customers will rise. The analysis further revealed a positive and significant relationship between service provider expertise and customer satisfaction. Authors like Chai et al. (2015), Johnson and Grayson (2005), Macintosh (2007), Moradi et al. (2017), Spake and Megehee (2010), and Sweeney and Swait (2008) also found a positive and a significant relationship between service provider expertise and customer satisfaction. This positive and significant relation is justifiable because a higher level of expertise, especially in the service sector, would reduce customer’s risk and a pace of mind that the company has necessary capabilities to satisfy my intended needs, thereby, promoting customer satisfaction.

Path-3 of PLS-SEM for total effect reported a higher R2 with a value of 67% when the mediating role of service provider expertise is considered between market orientation and customer satisfaction. Again, results revealed a positive and a significant relationship between market orientation and customer satisfaction with the mediation of service provider expertise. To further confirm the mediating role of service provider expertise, a bias-corrected bootstrapping method is used. Results of indirect effect indicate that service provider expertise mediates the relationship between market orientation (β=0.050 & P-value between=0.01 to 0.107) and customer satisfaction, hence, H3 is accepted. A positive relationship indicates sound industry knowledge and expertise of the banking sector along with market-oriented services would promote higher customer satisfaction and vice versa. It is important to mention here that expertise along does not make any significant impact unless the company is providing marketoriented products/services.

Conclusion

An attempt is made in this article to explore the mediation effect of service provider expertise between market orientation and customer satisfaction for Iraqi banking sector customers. Customer satisfaction is one of the significant challenges facing every service industry because no quantitative measures are available to rate services. Previous researchers although examining the determinants of customer satisfaction, however, studies ignored the service provider expertise while conducting any such studies.

A total of 385 questionnaires were distributed to collect data and data of 348 questionnaires are used to test the hypothesis. PLS-SEM model is used for estimation purpose. Estimation results for path-1 provide evidence for a significant and a positive relationship between market orientation and service provider expertise. Literature supported this positive and significant relationship because the market-oriented approach would help companies to further improve their expertise. A positive and a significant relationship was also observed for path-2, where market orientation and service provider expertise are found be significantly affecting customer satisfaction of Iraqi banking customers. Finally, the bias-corrected bootstrapping method confirmed the mediation effect of service provider expertise for market orientation and customer satisfaction.

This study has significant implications for the financial sector, particularly bank managers, and policymakers. From a managerial perspective, the market orientation concept would help them in choosing appropriate marketing mix for increasing customer satisfaction. At the same time, managers and staff need to improve their expertise, knowledge, and information sharing mechanism for increased customer satisfaction. From policymaker’s perspective, banking sector provides resources to accelerate economic growth, hence, customer satisfaction with banking system would improve banking sector efficiency and effectiveness. Policymakers also need to implement policies and regulations to improve the banking sector competencies and knowledge base. One of the limitations of current study is model is tested for banking sector perspective and only market orientation was taken as independent variable. Future researchers may extend this model and possibly test this model for some other service sector other than banking.

References

- Abidemi, B.T., Halim, F., Bin, & Alshuabi, A.I. (2017). Market orientation and organizational performance?: A proposed model on the moderating effect of technological turbulence. Asian Journal of Multidisciplinary Studies, 5(6), 111-117.

- Adams, M., Andersson, J., Andersson, L.F., & Lindmark, M. (2009). Commercial banking, insurance and economic growth in Sweden between 1830 and 1998. Accounting, Business & Financial History, 19(1), 21-38.

- Agbor, J.M. (2013). The relationship between customer satisfaction and service quality: A study of three service sectors in umeå. Middle Eastern Finance and Economics. Umea University. Retrieved from https://doi.org/10.1017/CBO9781107415324.004

- Agostino, R.B.D., Belanger, A., & Agostino, R.B.D. (1990). A suggestion for using powerful and informative tests of normality. The American Statistician, 44(4), 316-321.

- Amadi, F.Y., & Amadi, C.W. (2014). Earnings management and stock market returns. International Journal of Business, Economics and Management, 1(10), 272-290.

- Ansah, M.O., & Chinomona, R. (2017). Analysis of market orientation on business performance in the multinational service industries. Journal of Social Sciences, 13(1), 1-14.

- Athanassopoulos, A., Gounaris, S., & Stathakopoulos, V. (2001). Behavioural responses to customer satisfaction: an empirical study. European Journal of Marketing, 35(5/6), 687-707.

- Athene, S. (2006). How corporate strategy contributes to firm performance: A Cross-Sectional Study of Resource Governance Decision Making in Us Firms. Massay University.

- Baron, R.M., & Kenny, D.A. (1986). The moderator-mediator variable distinction in social the moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182.

- Bednarczyk, T.H. (2013). Insurance development as a factor in long-term economic growth. Insurance Review, 35(2), 29-47.

- Belonax, J.J., Newell, S.J., & Plank, R.E. (2007). The role of purchase importance on buyer perceptions of the trust and expertise components of supplier and salesperson credibility in business-to-business relationships. Journal of Personal Selling and Sales Management, 27(3), 247-258.

- Bendapudi, N., & Berry, L.L. (1997). Customers’ motivations for maintaining relationship with service providers. Journal of Retailing, 73(1), 15-37.

- Blau, P.M. (1964). Exchange and power in social life. New Brunswick: Transaction Publishers.

- Brown, S.W., & Bond, E.U. (1995). The internal market/external market framework and service quality: Toward theory in services marketing. Journal of Marketing Management, 11(1-3), 25-39.

- Busch, P., & Wilson, D.T. (1976). An experimental analysis of a salesman’s expert and referent bases of social power in the buyer-seller dyad. Journal of Marketing Research, 13(1), 3-11.

- Chai, J.C.Y., Malhotra, N.K., & Alpert, F. (2015). A two-dimensional model of trust-value-loyalty in service relationships. Journal of Retailing and Consumer Services, 26, 23-31.

- Clow, K.E., Tripp, C., & Kenny, J.T. (1996). The importance of service quality determinants in advertising a professional service: an exploratory study. Journal of Services Marketing, 10(2), 57-72.

- Crosby, L.A., Evans, K.R., & Cowles, D. (1990a). Relationship Quality in Services Selling: An Interpersonal Influence Perspective. Journal of Marketing, 54(3), 68-81.

- Crosby, L.A., Evans, K.R., & Cowles, D. (1990b). Relationship Quality in Services Selling: An Interpersonal Influence Perspective. Journal of Marketing, 54(3), 68-81.

- Din, S.M.U., Abu-bakar, A., & Regupathi, A. (2017). Does Insurance Promotes Economic Growth: A Comparative Study of Developed and Emerging/Developing Economies. Cogent Economics & Finance, 5(1), 1-12.

- Din, S.M.U., Regupathi, A., & Abu-Bakar, A. (2017). Insurance effect on economic growth-among economies in various phases of development. Review of International Business and Strategy, 27(4), 501-519.

- Etale, L.M., Bingilar, P.F., & Ifurueze, M.S. (2016). Market share and profitability relationship: A study of the banking sector in nigeria. International Journal of Business, Economics and Management, 3(8), 103-112.

- Gujarati, D.N. (2003). Basic Econometrics (Fourth Edition). New York: McGraw-HiII/Irwin.

- Guo, C., Kulviwat, S., Zhu, J., & Wang, Y.J. (2017). Competing in an emerging market: antecedents and consequences of market orientation and the role of environmental factors. Journal of Strategic Marketing, 1–20.

- Hair, J.F., Matthews, L.M., Matthews, R.L., & Sarstedt, M. (2017). PLS-SEM or CB-SEM?: Updated guidelines on which method to use. International Journal Multivariate Data Analysis, 1(2), 107-123.

- Hair, J.F.J., Hult, G.T.M., Ringle, C., & Sarstedt, M. (2014). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Long Range Planning (First Edition). Los Angeles: SAGE Publications Ltd.

- Hang, H.T.T., Vy, P.D., & Bandaralage, J. (2016). Mergers, Acquisitions and Market Concentration in the Banking Sector: The Case of Vietnam. Asian Journal of Economics and Empirical Research, 3(1), 49-58.

- Hassan, D., Abdullah, N., Zainodin, H.J., & Salleh, S. (2015). Motivation and Medium of Information Affecting Behavioural Patterns of Film Viewers in Malaysia. Humanities and Social Sciences Letters, 3(3), 121-133.

- Hayes, A.F., & Preacher, K.J. (2014). Statistical mediation analysis with a multicategorical independent variable. British Journal of Mathematical and Statistical Psychology, 67(3), 451-470.

- Homans, G.C. (1961). Social behaviour: its elementary forms. New York: Harcourt Brace & World Inc.

- Ikram, F., & Nugroho, A.B. (2014). Cumulative average abnormal return and semistrong form efficiency testing in indonesian equity market over restructuring issue. International Journal of Management and Sustainability, 3(9), 552-566.

- Jaworski, B.J., & Kohli, A.K. (2017). Conducting field-based, discovery-oriented research: lessons from our market orientation research experience. AMS Review, 7(1-2), 4–12.

- Johnson, D., & Grayson, K. (2005). Cognitive and affective trust in service relationships. Journal of Business Research, 58, 500–507.

- Kasim, A., Ekinci, Y., Altinay, L., & Hussein, K. (2018). Impact of market orientation, organizational learning and market conditions on small and medium-sized hospitality enterprises. Journal of Hospitality Marketing and Management, 27(7), 1-21.

- Kaushal, S., & Ghosh, A. (2016). Banking Sector Development and Capital Formation in the Indian Economy?: an Empirical Analysis of 47 Years Post Economic, 14(6), 4543-4555.

- Kim, S.S., Kaplowitz, S., & Johnston, M.V. (2004). The effects of physician empathy on patient satisfaction and compliance. Evaluation and the Health Professions, 27(3), 237-251.

- Kotler, P., & Armstrong, G. (2012). Principes of Marketing. New Jersey: Pearson Education, Inc.

- KV, V.L. (2016). Managerial perspectives on the applicability of deming’s system of profound knowledge and his 14 point philosophy: An opinion survey. Global Journal of Social Sciences, 2(1), 14-25.

- Litzinger, T.A., Lee, S.H., Wise, J.C., & Felder, R.M. (2005). Applications, reliability and validity of the index of learning styles. International Journal of Continuing Engineering Education and Life Long Learning, 21(1), 103-112.

- Macintosh, G. (2007). Customer orientation, relationship quality, and relational benefits to the firm. Journal of Services Marketing, 21(3), 150-159.

- Mahmoud, M.A., Blankson, C., Owusu-Frimpong, N., Nwankwo, S., & Trang, T.P. (2016). Market orientation, learning orientation and business performance. International Journal of Bank Marketing, 34(5), 623-648.

- Mandal, P.C. (2016). Customer retention in organizations?: A review. International Journal of Applied Research, 2(3), 770–772.

- Momrak, A.M. (2012). Effects of market orientation on business performance Environmental moderators, effectiveness and efficiency mediators and the role of firm capabilities. Buskerud University College.

- Montoya-weiss, M.M., Voss, G.B., & Grewal, D. (2003). Determinants of online channel use and overall satisfaction with a relational, Multichannel Service Provider. Journal of the Academy of Marketing Science, 31(4), 448-458.

- Moorman, C., Deshpande, R., & Zaltman, G. (2010). Factors Affecting Trust in Market Research Relationships. Journal of Marketing, 57(1), 81-101.

- Moradi, B., Maroofi, F., & Ahmadizad, A. (2017). The investigating of cognitive and affective two-dimensional pattern between consumer trust, Perceived value and behavioral loyalty in Iran governmental and non-governmental insurance areas. Bankac?l?k ve Sigortac?l?k Ara?t?rmalar? Dergisi, 2(11), 21-35.

- Narver, J.C., & Slater, S.F. (1990). The effect of a market orientation on business profitability. Journal of Marketing, 54(4), 20-35.

- Nazal, A.I. (2017). Added value of ijarah tamwilia service in Jordanian Islamic bank (Case Study of Contract No: 2012/500). Humanities and Social Sciences Letters, 5(1), 11-17.

- Newell, S.J., Wu, B., Leingpibul, D., & Jiang, Y. (2016). The importance of corporate and salesperson expertise and trust in building loyal business-to-business relationships in China. Journal of Personal Selling and Sales Management, 36(2), 160-173.

- Palmatier, R.W., Dant, R.P., Grewal, D., & Evans, K.R. (2006). Factors influencing the effectiveness of relationship marketing: A meta-analysis. Journal of Marketing, 70(4), 136-153.

- Pauline, W.J., Esterik-Plasmeijer, V., & Raaij, W.F. van. (2017). Banking system trust, bank trust, and bank loyalty. International Journal of Banking Marketing, 35(1), 97-111.

- Pradhan, R.P., Bahmani, S., & Kiran, M.U. (2014). The dynamics of insurance sector development, banking sector development and economic growth: Evidence from G-20 countries. Global Economics and Management Review, 19(1–2), 16-25.

- Preacher, K.J., & Hayes, A.F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behaviour Research Methods, 40(3), 879-891.

- Preacher, K.J., Rucker, D.D., & Hayes, A.F. (2007). Addressing moderated mediation hypotheses?: Theory, methods, and prescriptions. Multivariate Behavioral Research, 42(1), 185-227.

- Proctor, T. (2002). Strategic Marketing an Introduction. New York, Taylor & Francis.

- Rauf, A.L.A. (2016). Risk and return: Comparative study of active sukuk markets of Nasdaq HSBC amanah sukuk and nasdaq Dubai listed sukuk. Global Journal of Social Sciences Studies, 2(2), 104-111.

- Raweh, B.A., Erbao, C., & Shihadeh, F. (2017). Review the literature and theories on anti-money laundering. Asian Development Policy Review, 5(3), 140-147.

- Royston, P. (1990). Remark AS R94: A remark on algorithm AS 181: The W-test for normality. Journal of the Royal Statistical Society, 14(2), 102-139.

- Singh, S., & Ranchhod, A. (2004). Market orientation and customer satisfaction: Evidence from British machine tool industry. Industrial Marketing Management, 33(2), 135-144.

- Spake, D.F., & Megehee, C.M. (2010). Consumer sociability and service provider expertise influence on service relationship success. Journal of Services Marketing, 24(4), 314-324.

- Swan, J.E., Trawick, I.F., & Silva, D.W. (1985). How industrial salespeople gain customer trust. Industrial Marketing Management, 14(3), 203-211.

- Sweeney, J., & Swait, J. (2008). The effects of brand credibility on customer loyalty. Journal of Retailing and Consumer Services, 15(3), 179-193.

- Tahir, S.H., & Sabir, H.M. (2014). Impact of family ownership on market value of a firm: A comparative analysis of family and non-family companies listed at karachi stock exchange (Pakistan). International Journal of Management and Sustainability, 3(12), 673-683.

- Thibaut, J.W., & Kelley, H.H. (1959). The social psychology of groups. New York: Wiley.

- Tirado, D.M., & Guillén, M.E. (2017). Network market orientation, knowledge management and born globals’ competitiveness. Knowledge Management Strategies and Applications, 47-67.

- Tomfort, A. (2017). The Japanese asset price bubble: Evolvement and consequences. Asian Journal of Economics and Empirical Research, 4(2), 132-141.

- Tse, A.C.B., Sin, L.Y.M., Yau, O.H.M., Lee, J.S.Y., & Chow, R. (2003). Market orientation and business performance in a Chinese business environment. Journal of Business Research, 56(3), 227-239.

- Wahab, A. (2016). Factors Determining Perceived Job Performance of University Leaders in Doctor of Philosophy. Universiti Utara Malaysia.