Research Article: 2022 Vol: 26 Issue: 2S

The mediating role of the cash dividends distribution policy in the relationship between the determinants of the cash dividends distribution policy and the market value

Bahaa Awwad, Palestine Technical University

Bahaa Razia, Palestine Technical University

Keywords

Determinants of the Cash Dividend Policy, Market Value, Palestine Stock Exchange

Citation Information: Awwad, B., & Razia, B. (2022). The mediating role of the cash dividends distribution policy in the relationship between the determinants of the cash dividends distribution policy and the market value. Accounting and Financial Studies Journal, 26(S2), 1-13.

Abstract

This study seeks to identify the mediating role of the cash dividends distribution policy in the relationship between the determinants of the cash dividends distribution policy and the market value of the companies listed on the Palestine Stock Exchange for the services, banking and insurance sectors during the period 2010-2018. The descriptive analytical approach was adopted and the study sample consisted of 16 companies that meet the conditions of the sample inducing distribution of profits. The study used a set of determinants of the dividend policy as independent variables. These include company size, company age, earnings per share, financial leverage. The study concluded that there is a positive relationship to the size of the company, earnings per share, the age of the company on the market value. There is a negative relationship to the financial leverage on the market value. This has an impact on the market value in light of the dividends distribution policy. In light of this, the study recommended that the companies listed on the Palestine Stock Exchange, especially the insurance sector, should pay extra attention to distributing dividends to shareholders, and not to exaggerate withholding profits if appropriate investment opportunities are not available. It is also important to expand the scope of the sample to include all sectors of the stock exchange in future studies.

Introduction

Stock markets in any country are considered an excellent investment opportunity and an important attraction factor for local and foreign capital. Recent years have witnessed unremitting efforts in most developing countries to improve the investment climate in them by creating the appropriate conditions and conditions to attract investments, and in our contemporary world and in light of the emergence of stock exchanges and the emergence of companies Public shareholding, which depends in part of its financing on the sale of shares to shareholders, the distribution decision has become sensitive and essential to the institution, and may affect the market price of the share in many financial markets (Qeshta, 2021; Awwad & Razia, 2017).

The decision to distribute dividends to shareholders is one of the important decisions, given its interaction and mutual impact with both the investment and financing decisions in the company. The policy followed must satisfy the shareholders on the one hand and support the internal sources of financing on the other. The amount of profits that are distributed, their stability, and the method of distribution followed have important implications that investors use during their assessment of the company’s conditions and its foreseeable future, which is reflected in their actions in the stock market and appears through the quantity of supply and demand for the company’s shares, and this of course affects the market value of the company (Haider, 2015). The shares of companies are evaluated by investors based on several financial factors, including: earnings per share and dividend distribution, in addition to many other factors. The financial market indicators are also important measures that indicate the size and type of the economy, the availability of liquidity in the market, transparency and efficiency (Nasr, 2015).

In addition to the fact that the policy of distributing dividend is one of the financial decisions that would affect the market value of the institution, but the market value is usually linked to the financing decision considering retained profits as one of the elements that enter into self-financing on the one hand, and an investment decision on the other hand if it depends on cash Available resulting from operational operations, and the effects of these decisions may include the investment opportunities available to the institution, despite that, it is still the policy of distributing dividend and its impact on the market value a matter of controversy among researchers and financial analysts. This is confirmed by studies conducted on this subject, the most famous of which is the hypothesis M&M (Miller & Modigliani, 1961).

Miller & Modigliani (1961) confirmed that the dividend policy does not have any impact on the market value of the institution, and then followed by studies to prove the impact of the dividend policy on the market value of the institution or not. Myron & Gordon (1962) concluded that the policy of dividend distribution has a direct impact on the market value of the institution (Hafsi, 2016). The decision to announce the distribution of dividend is also considered one of the difficult and important decisions taken by the management in companies, because of this decision has a direct impact on the investor and the company. The main objective of any investor is to achieve profits, and many investors seek to achieve current profits that result from the distribution process. The management has also to balance between distributed dividend and retained dividend, especially in new and developing companies that need financing. As a result, it is necessary to test the mediating role of the policy of distributing cash dividends in the relationship between the determinants of cash dividend policy and the market value.

Theoretical Framework and Previous Studies

According to the Distribution Inadequate Theory: that is introduced by Miller and Modigliani M&M in 1961, the value of a company is determined by the profits that the company makes. The value of the company will not be determined until after investment and financing decisions are taken within the framework of the optimal structure and not through the decision to distribute profits. In other words, the value of the company does not affect the style or decision of dividends, which are in the form of cash dividends or retained earnings to be, reinvested again (ALShawawreh, 2014). The bird in hand is a theory which is proposed by John and Gordon suggest, says that there is a relationship between company performance and dividends where investors believe that current profits are less risky than potential future profits and therefore investors prefer to obtain current profits (Latifa & Azeez, 2015). In addition, the tax preference theory, which states that the difference in the tax rates of dividends distributed and capital gains plays a major role in the preference of shareholders to the process of retaining profits, because the dividends that are distributed are subject to a tax higher than the tax rates on capital gains resulting from the sale of shares. Therefore, investors prefer to retain profits, because of the consequent increase in the market price of the stock and thus achieving capital gains (Nasr, 2015).

The dividend policy affects the increase in the market value of the share, but this will lead to a decrease in the retained earnings available for the company to reinvest as it becomes insufficient, which may negatively reflect on the growth rate of the company and thus lead to a decrease in the prices of its shares in the financial market (Westen, 1987).

Numerous researchers support the theory of the inappropriateness of distributions any theory (M&M) in 1961, which indicates that there is no relationship between the policy of dividend distribution and the market value of the stock. However, others are skeptical about it. The researchers who are supporting the theory of M&M believe that companies should follow the policy of distributing surpluses. While the opposing researchers are divided into two parts, the first part believes that there is a positive relationship between the policies of dividend distribution and the market value of the company, and the other part believes that there is a negative relationship. The relationship between the profit distribution policies and the company’s market value is also affected by other dimensions that formed a number of theories, as we find that the state of uncertainty came through the theory of a bird in the hand, and that the presence of taxes helped in the formation of the tax impact theory (Hussein, 2016).

As for the determinants of the dividend policy, it is easy for a large, stable company that has recorded high profitability and stability in its profits to obtain funds from the financial markets, and therefore it can distribute a profit at a greater rate than the new small companies that carry with them a greater degree of risks for to investors. Therefore, these small and new companies or companies with great risks find themselves facing the necessity of relying on their profits to finance expansion and to finance current operations (Al-Khool, 2014). According to Al-Alcohol (2014), the age of the company is affected by the profit distribution policy approved by the company, as the newly established company usually needs a lot of money to finance its expansion, and it faces great difficulties to obtain this money from the market, so it turns out that The company follows a distribution policy that is summarized in keeping a large amount of profits for reinvestment, but the old and experienced company, which has reached the point of saturation, whether in its investments or in expansion, may follow a policy of distributing a high rate of profits, because the money that the company collected during its operations The former is sufficient to finance the financial needs, in addition to the ease of resorting to the financial market, and these factors will increase the funds distributed to shareholders. With regard to the earnings per share, this is considered one of the most important indicators of profitability since it is easy to compare this profitability per share during previous years, as well as comparing it with the earnings per share of other companies (Daoud, 2006). Therefore, investors find in this indicator a good and appropriate way to rationalize their investment decisions. And the impact on the demand for shares, and given its importance to investors in the capital markets, companies are obliged to disclose earnings per share, and the Accounting Standards Committee has obligated the need to present it in accordance with the IAS standard (Talaba, 2009; Razia & Awwad, 2021).

As for the financial leverage, it reflects the use of the funds of others at fixed costs, which are represented by loans, preferred shares and bonds, all of which have a fixed cost and the company must commit to paying them, meaning that the financial leverage is linked to the company’s financing structure. Effectively, if the company is able to invest the borrowed money at a rate of return that exceeds the cost of the borrowed money, and if the company does not succeed in investing the borrowed money, it will be exposed to a greater risk and achieve greater losses, so what if it did not use financial leverage. It is clear from this that companies that wish to raise the percentage of external debt or make debt a permanent part of the financing structure, tend to retain a large part of their profits in order to meet the payment of debts. When the company finances the expansion with loans, it faces two alternatives, either repaying the loan at maturity by obtaining a new loan, or making arrangements to pay the loan amount from the company’s own funds, and the board of directors should take this into account when distributing profits according to the company’s financing structure (Alkohol, 2014; Kamal Abu Amsha, 2017).

Several studies discussed the determinants of dividend distribution policies in companies and their relationship to market value. The most prominent of which is the study of Khazaleh (2015), which found a positive impact on the size of the bank and the bank’s profitability and a negative impact of financial leverage on the dividend policy and market value in banks Jordanian business. Koshji (2018) confirmed that the decision to distribute dividends is one of the most important and difficult decisions taken by the management in any company (e.g., growth rate, market considerations, profit size, type of dividend distribution, the company’s degree of liquidity). These determined as determinants of the dividend policy for companies listed on the Damascus Stock Exchange. The study concluded that these factors had a significant effect on the market value of the company's stock prices, and that the factor of market considerations had no effect on the market value of the company's stock prices. Haddadin (2006) found that EPS (Earning Per Share) has a positive relationship with the dividend policy, and this supports many companies to pay more profits and improve their reputation, performance and market value. Awwad (2016) examined the determinants of the dividend policy for companies in the Kuwait Stock Exchange during the years 2011-2014; three determinants were employed including company size, profitability, and financial leverage. The results concluded that the dividend policy in the Kuwait Stock Exchange is positively affected by financial leverage, profitability, and company size.

Sharif & Pillai (2015) sought to identify the main factors that affect the stock prices of companies listed on the Bahrain Stock Exchange during the period from 2006 to 2010. The results indicated a positive relationship between return on shareholders' equity, book value and earnings per share. One and the size of the company with the share price, and a negative relationship between dividends and the market share price. With regard to the ownership structure, Al-Najjar (2015) revealed the companies listed on the Turkey Stock Exchange about the effects of family participation (through ownership and board representation), non-family equity custodians (foreign investors, local and state financial institutions) and minority shareholders in dividend decisions in the post-2003 period of major economic and structural reforms. Abdella (2016) sought to identify the determinants of the dividend policy in Saudi commercial banks during the period between 2011 and 2015. A stable dividend policy, given that this reassures the shareholders about the financial position of the bank and reduces their uncertainty on the one hand, and on the other hand, changing the dividend policy on the part of the banks has a direct impact on the bank as it can reflect the passage of a bad financial situation and thus is reflected negatively affect the market value.

Ibrahim (2015) aimed to expand the causal relationship between liquidity and profitability with the growth of the share price in order to bridge the research gap by dividends paid (as an intermediate variable) in banks listed on the Indonesia Stock Exchange from 2011 to 2014. The results showed a high degree from the relevance between liquidity and profitability, it was found that the ratio of liquidity and profitability ratio have a positive and significantly impact on the dividends paid, and the dividends paid had a positive impact on the growth of the share price. In another context, Gali (2017) conducted a research on Iraqi commercial banks, confirmed the existence of a strong direct statistically significant relationship between the distributed profits and the market value of the shares. Qeshta (2017) aimed to measure the impact of the announcement of the distribution of profits on the market price of the share. The trading values of the companies listed on the Palestine Stock Exchange, including the disclosure of the variables that may affect those prices, which are net profit, distributed cash profits, retained earnings, and the date of announcing the distribution of profits. Announcing the share of the retained earnings and that the shares prices of the companies listed on the Palestine Exchange are significantly affected when the dividend is announced or after. This is in agreement with the study of Hafsa (2016), which examined the impact of the dividend policy on the market value of the shares of the companies listed on the Dubai. It was found through the study that there is a statistically significant relationship between the dividend policy represented in (share of cash dividends, earnings per share) and the value of the shares of institutions listed on the Dubai Financial Market, while there is no statistically significant relationship between retained earnings and the value of the stock.

In light of the previous studies and to provide a more comprehensive explanation of the mediating role of the cash dividend policy in the relationship between the determinants of the cash dividend policy and the market value. It was necessary to focus on a larger group of the determinants of the dividend policy in the Palestinian environment, namely the company’s age, company size, share of dividends and leverage the financial sector for the three most important sectors in the Palestine Stock Exchange, which are the banking, insurance and services sectors.

Research Methodology

Study Population

As shown in Table 1, the study population consists of 22 companies distributed in the services, insurance and banking sectors. Nine companies from the service sector, six banks and seven insurance companies.

| Table 1 Study Population |

|||

|---|---|---|---|

| Number | Company name | Date of incorporation | Date of listing |

| 1 | National Towers | 1995 | 2010 |

| 2 | The Arab Hotels Company | 1996 | 1998 |

| 3 | Nablus Surgical Center | 1995 | 2008 |

| 4 | Wataniya Mobile, Ooredoo Palestine | 2010 | 2011 |

| 5 | Pal Aqar Company for Real Estate Development and Management | 1998 | 2012 |

| 6 | Palestinian Communications | 1995 | 1997 |

| 7 | Palestine Electric Company | 1999 | 2004 |

| 8 | Ramallah Summer Resorts | 1945 | 2010 |

| 9 | Palestinian Distribution and Electricity Services | 2005 | 2007 |

| 10 | Arab Islamic Bank | 1995 | 1997 |

| 11 | Bank of Palestine | 1960 | 2005 |

| 12 | Palestinian Islamic Bank | 1995 | 2009 |

| 13 | Palestine Investment Bank | 1994 | 1997 |

| 14 | Al Quds Bank | 1995 | 1997 |

| 15 | The National Bank | 2005 | 2007 |

| 16 | Ahlia Insurance Group | 1994 | 1997 |

| 17 | Global United Insurance | 2010 | 2011 |

| 18 | Al Mashreq Insurance | 1992 | 2006 |

| 19 | National Insurance company | 1992 | 1997 |

| 20 | Palestine Insurance | 1994 | 2010 |

| 21 | Al-Takaful Palestinian Insurance Company | 2006 | 2011 |

| 22 | Trust International Insurance Company | 1994 | 2008 |

Source: Palestine Monetary Authority, Palestine Exchange, 2020

The Study Sample

The study sample was limited to companies that distributed profits during the studied period of the year between 2010 and 2018. The number of companies distributing profits was 16 companies, including 5 service companies, 5 banks, and 6 insurance companies (see table 2).

| Table 2 Study Sample |

|||

|---|---|---|---|

| Number | Company name | Date of incorporation | Date of listing |

| 1 | National Towers | 1995 | 2010 |

| 2 | Nablus Surgical Center | 1995 | 2008 |

| 3 | Palestinian Communications | 1995 | 1997 |

| 4 | Palestine Electric Company | 1999 | 2004 |

| 5 | Palestinian Distribution and Electricity Services | 2005 | 2007 |

| 6 | Arab Islamic Bank | 1995 | 1997 |

| 7 | Bank of Palestine | 1960 | 2005 |

| 8 | Palestinian Islamic Bank | 1995 | 2009 |

| 9 | Al Quds Bank | 1995 | 1997 |

| 10 | The National Bank | 2005 | 2007 |

| 11 | Ahlia Insurance Group | 1994 | 1997 |

| 12 | Global United Insurance | 2010 | 2011 |

| 13 | National Insurance company | 1992 | 1997 |

| 14 | Palestine Insurance | 1994 | 2010 |

| 15 | Al-Takaful Palestinian Insurance Company | 2006 | 2011 |

| 16 | Trust International Insurance Company | 1994 | 2008 |

Source: Palestine Monetary Authority, Palestine Exchange, 2020

Study Variables

The study relied on testing the data collected from the financial statements of the study sample companies listed on the Palestine Stock Exchange during the period 2010-2018. In order to clarify the effect between the independent variables represented in the determinants of the dividend policy (company size, company age, financial leverage, earnings per share), mediating variable (dividend policy), and dependent variable (market value). Table 3 shows how to measure the study variables.

| Table 3 Study Variables |

||

|---|---|---|

| Variable | Label | Definition and Measurement |

| Dependent variable | ||

| Market value | MV | It is the trading value of the stock in the stock market and it moves up and down according to the factors of demand and supply on this stock. The economic conditions and the results of the company's business, in addition to speculation, play a major role in influencing the stock price (Khasawneh, 2011, 159 |

| Independent variables | ||

| Company size | CSize | Natural log of total assets. (Al-Khatib, 2010, p. 71) |

| Financial leverage | FinLev | The ratio of total debt to total assets. (Brighm & ehrhardt.2013.p101) |

| Earnings per Share | EPS | Net income divided by number of outstanding common shares (Imam, 2018, pp. 62-63) |

| Company age | CAge | Company age since establishment until year of the study. |

| Moderator Variable | ||

| Dividend payout ratio | DPS | It is the ratio of the total profits paid to shareholders in relation to the company's net income, and it is also considered the percentage of profits paid to shareholders in dividends, and the amount that is not paid to shareholders is kept by the company to pay off its debts or reinvest it back in core operations. (Al-Hayali, 2007, 151).It is measured by the following formula=cash dividends/number of outstanding common shares. |

Hypotheses and Study Model

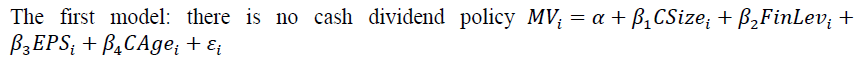

The main problem of this study lies in answering the following question: What is the mediating role of the cash dividend policy in the relationship between the determinants of the cash dividend policy and the market value? Where 4 main determinants were chosen to test whether they have a relationship in the market value with the presence or absence of a cash dividend policy and what is the type of relationship actually? Hypotheses can be written based on the main question of the study as follows:

Ha1: There is a positive impact of the determinants of the policy of distributing cash dividends on the market value of the services, banking and insurance companies listed on the Palestine Stock Exchange.

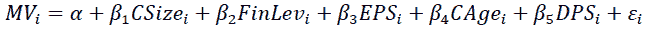

Ha2: There is a positive effect of the mediating role of the cash dividends distribution policy in the relationship between the determinants of the cash dividends distribution policy and the market value of the service sector companies, banks and insurance listed on the Palestine Stock Exchange. To clarify the effect between the independent variables (company size, financial leverage, earnings per share, company age), the mediating variable (profit distribution policy) and the dependent variable (market value), two models were built for the study as follows:

The second model: the existence of a cash dividend policy

Where:

MV= stock market price for the firm (i).

α: The constant.

β1-5: the slope for independence and Moderator variables.

Csizei: Natural log to total assets of the company (i).

FinLevi: total debt divided by total assets of the firm (i).

EPSi: Net income divided by number of outstanding common shares of the firm (i).

CAgei: the total number of company (i) age.

DPSi ; total cash dividends divided by number of outstanding common shares of firm (i).

εi: Random errors.

Statistical Analysis and Hypothesis Testing

Descriptive Analysis

Table 4 demonstrates the average market value of the sample companies in the service sector which is amounted to 212 million dollars. This amount is greater than the banking and insurance sector which are 152 million dollars and 20 million dollars, respectively. However, the logarithm average of the size of the assets of the sample companies in the banking sector is 8.71. This is greater than the services and insurance sector which is 7.44, 7.72. In addition, the rate of financial leverage of the sample companies in the banking sector is 81%, which was high compared to the services and insurance sector which are 32%, 68%, respectively. It is important to note that the rate of return per share for the sample companies in the insurance sector which is 0.23, is the highest among sectors. On the other hand, it obvious that the sample companies in the banking sector are the oldest in terms of establishment, as it can be said that the local banks sector listed on the Palestine Exchange is the first sector that was established to support the elements of economic development, and the average share per share of the profits distributed to the sample companies in the services sector is the highest, reaching 0.108 compared to the banking and insurance sector.

| Table 4 Descriptive Analysis of the Study Variables |

||||||||

|---|---|---|---|---|---|---|---|---|

| Descriptive Statistics | ||||||||

| Services sector | ||||||||

| N | Range | Minimum | Maximum | Mean | Std. Deviation | |||

| MV | 45 | 1072056657 | 4706210 | 1076762867 | 212859707.9 | 381880069 | ||

| CSize | 45 | 3.26777 | 5.741357 | 9.009127 | 7.44628326 | 0.8029227 | ||

| FinLev | 45 | 0.690657 | 0.024832 | 0.715489 | 0.32425631 | 0.1988243 | ||

| Eps | 45 | 1.082234 | -0.384593 | 0.697641 | 0.18342752 | 0.2569841 | ||

| Cage | 45 | 18 | 5 | 23 | 16.2 | 4.746 | ||

| DPS | 45 | 0.5 | 0 | 0.5 | 0.1081402 | 0.1630843 | ||

| Banking sector | ||||||||

| N | Range | Minimum | Maximum | Mean | Std. Deviation | |||

| MV | 45 | 508700000 | 21300000 | 530000000 | 152900734.4 | 157781870 | ||

| CSize | 45 | 1.489808 | 8.199041 | 9.688849 | 8.91254529 | 0.3433556 | ||

| FinLev | 45 | 0.605653 | 0.308854 | 0.914507 | 0.81869572 | 0.186641 | ||

| Eps | 45 | 2.058464 | -0.051688 | 2.006776 | 0.16983974 | 0.297151 | ||

| Cage | 45 | 53 | 5 | 58 | 24 | 15.883 | ||

| DPS | 45 | 1.55556 | 0 | 1.55556 | 0.0680727 | 0.2323569 | ||

| Insurance sector | ||||||||

| N | Range | Minimum | Maximum | Mean | Std. Deviation | |||

| MV | 53 | 52150000 | 5600000 | 57750000 | 20779632.77 | 14784212.49 | ||

| CSize | 54 | 1.834934 | 7.038581 | 8.873514 | 7.72327727 | 0.302834587 | ||

| FinLev | 54 | 0.432234 | 0.450111 | 0.882345 | 0.68635202 | 0.089026051 | ||

| Eps | 54 | 2.258609 | -0.339557 | 1.919052 | 0.2331173 | 0.332367818 | ||

| Cage | 54 | 26 | 0 | 26 | 15.52 | 7.389 | ||

| DPS | 54 | 0.33333 | 0 | 0.33333 | 0.0742044 | 0.08746142 | ||

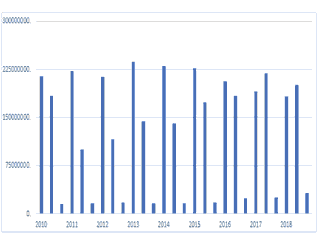

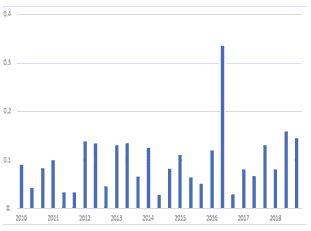

With regard to the dependent variable and the mediating variable, it is possible to compare the sectors (see figure 1). The market value of the insurance sector was the lowest during the years between 2010 and 2018. However, the services sector issued the highest values during the period between 2010 and 2016. In terms of banking sector, the market value was the highest between 2017 and 2018.

As shown in figure 2, the share of dividends per share was the highest in the banking sector during the years 2013, 2016 and 2018. Nevertheless, the insurance sector topped the value in 2017. The share of dividends distributed to the services sector was the highest in the other years.

Hypothesis Testing

The first hypothesis tests the existence of a positive impact of the determinants of the monetary dividend policy (company size, financial leverage, earnings per share, company age) on the market value of the services, banking and insurance companies listed on the Palestine Stock Exchange. To prove or disprove this hypothesis, the ordinary least squares test was used. Table 5 presents the results of the OLS regression.

| Table 5 Results of the First Hypothesis Test |

||||

|---|---|---|---|---|

| Variables | Label | Beta (β) | T-test | Sig. |

| Constant | α | -2.092 | 0.038 | |

| Company Size | Csizei (β1) | .218 | 2.307* | 0.023 |

| Financial Leverage | FinLevi (β2) | -.273 | -3.255** | 0.001 |

| Earnings per share | EPS (β3) | .307 | 4.239** | 0.000 |

| Company age | CAge | .271 | 3.257** | 0.001 |

| R | 0.544 | |||

| R Square | 0.296 | |||

| F-Test | 14.631 ** | |||

| Sig. (F-Test) | 0.000 | |||

* And ** denote significance at the 0.05 and 0.01 levels.

Table 5 presents the explanatory power of the model R and R Square has increased in the presence of the median variable, which is the share per share of the distributed cash profits from (0.544, 0.296 to 0.696, 0.484). This indicates a positive and strong relationship between the policy of distributing cash dividends and the market value. To test the mediating variable, the calculated T was observed and it was greater than the critical T (7.081>1.671, 2.390) and Sig. Less than 0.05 and 0.01. This confirms that the policy of distributing cash dividends plays a clear and important role in influencing the market value of the companies listed on the Palestine Stock Exchange in addition to the other determinants addressed by the study. It is also evident that in the presence of the dividend policy, all the following determinants: company size, financial leverage and earnings per share still affect the same direction of the relationship on the market value, except for the age of the company, which did not appear to have a statistically significant effect. To test the effect of the four variables together and in the presence of the cash dividend policy on the market value, the calculated F was more than critical as it rose from 14,631 to 25,872. Furthermore, Sig. (F-Test) is less than 0.01, which means that the four variables increased their importance in their impact on the market value of the company and the existence of a cash dividend policy, as the difference in R2 between the presence and absence of the median variable of 0.188 (0.484 - 0.296) indicates the size of the effect) The size of the company, profitability, financial leverage, and the age of the company (with the presence of a policy of distributing cash dividends) on the market value. This means that 18% of the explanatory power of market value increased with the presence of the mediating variable.

Discussion and Recommendations

The results of the study support the theory of a bird in the hand: which John Litner and Gordon Myron came up with. This theory indicates that there is a relationship between dividends and the market value of the company, where investors believe that current profits are less risky than potential future profits. Investors prefer to obtain current profits and that companies should follow the policy of distributing surpluses, and with regard to the determinants of the dividend policy, the study confirmed that the size of the company, earnings per share and the age of the company have a prominent role in the market value, as larger companies that have faster and easier access to the capital markets tend to pay more profits from small companies. Small companies also suffer from the problem of information asymmetry in addition to the agency problem, and that investing in them is more risky than large-sized companies, so investors demand higher returns. Paying off their debts and this is reflected in one way or another in their market value, while the older companies entered into advanced stages of growth and maximizing profits against the newer companies, but the presence of a monetary dividend policy factor was important in influencing the market value regardless of the company’s age.

With regard to the inverse relationship between financial leverage and market value, investing in companies with high financial leverage is characterized by a relatively high risk, in addition to the political and economic risks that accompany investing in the Palestine Stock Exchange, as most investors avoid investing in such type of companies. Companies may also use debts to pay dividends to deliver a message to investors that the company is fine and working well. This is the opposite, and this is consistent with several studies including (Sharif & Pillai, 2015; Gali, 2017; Hafsi, 2016; Customer, 2015; Haddadin, 2006). Based on the previous results, the study recommends that the companies listed on the Palestine Stock Exchange, especially the insurance sector companies, should pay attention to distributing profits to shareholders, and not to exaggerate withholding profits if appropriate investment opportunities are not available or excessive use of external funding sources. Informing shareholders and dealers in the financial market in advance of the reasons that drive management to take decisions related to making changes in the dividend policy, in order to avoid the negative reaction of shareholders to these changes. It is possible to conduct future studies for later periods to include all companies that distribute cash dividends in the Palestine Exchange.

Conclusion

This study aimed to identify the mediating role of the cash dividend policy in the relationship between the determinants of the cash dividend policy and the market value. To achieve this, four variables representing the determinants of the dividend policy were selected. Then the cash dividend policy variable was introduced as an intermediary variable to study how they affect the market value of the service, banking and insurance sector companies listed on the Palestine Stock Exchange and their relationship to the market value of the companies. 5 companies from the services sector, 5 companies from the banking sector, and 6 companies from the insurance sector were regular in distributing cash dividends on the Palestine Stock Exchange from 2010 to 2018.

To study these variables, the study developed two main hypotheses. After testing each of them, a positive relationship was found between (company size, earnings per share) and the market value with the presence and absence of the mediating variable. There is also an inverse relationship of financial leverage on the market value with the presence and absence of the mediating variable, and there was no statistically significant effect for the age of the company with the presence of the mediating variable. As shown in the results, there is an important role of the existence of the cash dividend policy variable in the relationship between the determinants of the cash dividend policy and the market value. This means that large size companies with high earnings per share, which tend to pay more cash dividends, these approaches improve the market value of the company.

Acknowledgment

Special thanks to Palestine Technical University for their continued and valuable support.

References

Abdul, L.H. (2016). Islamic investment banks theory and practice. Dar Al-Manhal for Publishing and Distribution, Amman, Jordan.

Abdelhak, Q. (2013). The impact of profit distribution policy on the stock exchange summit of economic institutions, an unpublished master’s thesis. Kasdi Merbah University - Ouargla – Algeria.

Arshad, A.A. (2009) Advanced financial management. Amman: Dar Al-Yawzri Scientific for Publishing and Distribution.

Al-Shawawreh. (2014). The impact of dividend policy on share price volatility: Empirical evidence from Jordanian Stock market. Finance and Banking Department, Unpublished Master Thesis, Mutah University.

AlNaijar, B. (2016). The effect of ownership structure on dividend policy: Evidence from Turkey. Corporate Governance International Journal of Business in Society, 2(6), 20-40.

Google scholar, Crossref, Indexed at

Ahmed, B.A. (2016). A study on the determinants of dividend policies of commercial banks in Saudi Arabia. Imperial Journal of Interdisciplinary Research, 2(9), 1064-1071, Asia Pacific University of Technology and Innovation, Malaysia.

Awwad, B. (2015). Determinants-of-dividend-policy-in-Kuwait-Stock-Exchange. International Journal of Business and Management Review, 3(7), 72-78. Palestine Technical University – Kadoorie, Palestine.

Awwad, B., & Razia, B. (2021). Adapting Altman’s model to predict the performance of the Palestinian industrial sector. Journal of Business and Socio-economic Development.

Awwad, B., & Razia, B. (2021).) Impact of efficiency indicators and its related aspects on the market return: An applied study on Palestine stock exchange. Investment Management and Financial Innovations, 18(3), 94-103.

Batoul, G. (2017). The role of financial analysis in strengthening the relationship between dividends and the market value of shares in commercial banks an applied study. Al-Muthanna Journal for Administrative and Economic Sciences, 7(3), 171-183. Al-Qadisiyah University.

Brigham, E., & Ehrhardt, M. (2013). Financial Management, (13th edition), USA.

Elsiddig, I. (2015). Liquidity, profitability and the dividends payout policy. World Review of Business Research, 5(2), 73-85. Al-Ghurair University, Dubai.

Haddad, H. (2010). Financial Management, (3rd Edition). Amman: Dar Hamed for Publishing and Distribution.

Haddadin, L. (2006). The determinants of the dividends policy evidence from the Jordanian insurance industry. Unpublished thesis, University of Jordan.

Hamid, A.A. (2010). Financial management, scientific and applied foundations, (1st Edition). Jordan: Dar Wael for Publishing and Distribution.

Harmony, H. (2015). Factors affecting the policy of distributing cash dividends for companies listed on the Damascus Securities Exchange. Tishreen University Journal of Scientific Research and Studies, 37(3), 145-162.

Hussein, S.S. (2016). The impact of the quality of financial reporting on the policies of dividend distribution and its implications on the market value of companies listed on the Iraqi Stock Exchange. An unpublished doctoral thesis, University of Baghdad – Iraq. ge, operating cash flows, and company size on the distribution of profits. Al-Manara Journal for Research and Studies, 21(1), 120-140.

Hussein, Q. (2017). The effect of the announcement of dividends on the trading prices and values of the shares of companies listed on the Palestine Stock Exchange. An applied study, published Master’s thesis. The Islamic University, Palestine-Gaza.

Ibn Al-Dhab, A. (2009). Study of the impact of the financial structure and the policy of dividend distribution on the value of the economic institution listed on the stock exchange. A case study: A memorandum submitted to obtain a master’s degree unpublished, Kasdi Merbah University, Ouargla – Algeria.

Ibrahim, Q. (2018). The impact of the determinants of the dividend policy of companies listed on the Damascus Stock Exchange and their impact on the market value of the stock. Al-Baath University Journal, 40 (3), 11-53.

Ibrahim, H. (2010). Financial management - A Contemporary Analytical Introduction, (6th Edition). Egypt. Alexandria: The Modern Arab Office for Publishing and Distribution.

Issam, A. (2018). The impact of the use of information technology on the performance of insurance companies in the city of Ramallah. unpublished master’s thesis, Al-Quds University, Ramallah.

Kamal A.A.M. (2017). Evaluation and predictability of performance Sector portfolio’s and Al-Quds Index/Evidence from Palestine Exchange. Palestine Technical University. Research Journal, 5(1), 16–34.

Khaled, N. (2015). The effect of the announcement of dividends and earnings per share on the market value of the shares of Jordanian companies listed on the Amman Stock Exchange. Unpublished Master's Thesis, Applied Science Private University, Amman - Jordan.

Latifat, A. (2015). Relationship between dividend payout and firms performance: Evaluation of dividend policy of OANDO PLC. International Journal of Contemporary Applied Sciences, 27(3), 120-150.

Muhammad, A. (2010). Financial performance and its impact on corporate stock returns. Dar Al-Ameen for Publishing and Distribution, Ramallah – Palestine.

Muhammad, K. (2011). The fundamentals of financial management. 1st floor, Dar Al-Fikr, Amman - Jordan.

PEX. (2021). Palestine Stock Exchange. Palestine Investment Conference, the banking system in Palestine, date of visit 2-4-2019.

PMA. (2021). Palestine Monetary Authority.

Princess, S. (2009). The impact of financial and accounting disclosure on the market value of the share. Unpublished Master’s thesis, Mentouri University, Algeria.

Ramadani, H. (2012). The impact of the dividend policy on the value of the institution quoted in the financial market, a study of a sample of the institutions quoted in the Amman financial market during the period from 2008-2012. Memorandum submitted to obtain a master’s degree unpublished, Kasdi Merbah University, Ouargla – Algeria.

Rashid, H. (2016). Study and analysis of the impact of the dividend policy on the performance of the shares of listed institutions in the financial market - the case of the Dubai Financial Market in the period between 2011-2014. Al-Jazaeryia Journal for Accounting and Financial Studies, Kasdi Merbah University and Wurqal, 20(22), 39-52.

Razia, B. (2021). Practices of risk evaluation in the construction industry within conflict zones. International Journal of scientific & technology research, 10(02).

Razia, B., & Awwad, B. (2021). Risk indicators and related aspects in insurance companies in Palestine. Insurance Markets and Companies, 12(1), 43-50.

Razia, B., Thurairajah, N., & Larkham, P. (2017). Understanding delays in construction in conflict zones. In: International Research Conference, Salford, Manchester, UK.

Razia, B., Thurairajah, N., & Larkham, P. (2019). Risk assessment and risk engagement in the construction industry within conflict zones. In: Proceedings of the 35th Annual ARCOM Conference, 2-4 September 2019, Leeds, UK. Association of Researchers in Construction Management (ARCOM), 863-872. (In Press).

Salah, A.A. (2018). Profitability indicators and their impact on the market prices of shares, an analytical study of a sample of companies listed in the Iraqi Stock Exchange. Journal of Administration and Economics, Al-Mustansiriya University, 4(117), 58-70.

Salem, D. (2006). Factors affecting the liquidity of the Palestine stock exchange. Unpublished Master’s Thesis, the Islamic University, Gaza.

Samer, K. (2014). Factors affecting the policy of profit distribution “applied study”. This study was presented to complete the requirements for obtaining a master’s degree in Accounting and Finance, the Islamic University – Gaza.

Sharif, T., Harsh. P., & Rekha. P. (2015). Analysis of factors affecting share prices: The case of Bahrain Stock exchange. International Journal of Economics and Finance, 7(5), 207-216.

Stan, D. (2015). Schedules of values, standards, and rules for market value, Henderson county board of commissioner. Journal of Financial and Quantitative Analysis, 27(2), 247-263.

Tuomas, L. (2016). The correlation between dividend policy measures and share price. Unpublished Master Thesis, University of Victoria,Victoria.

Walid, A.N. (2007). Financial analysis publications of the Arab open academy in Denmark.

Westen, J., & Fred, B. (1996). Essentials of management Finance, (11th edition). Scott and Brigham, F., Eugene, Dryden press.

Zawaweed, Z. (2011). Studying the impact of the dividend policy on the financing behaviour of the economic institution listed on the stock exchange, a study of a sample of institutions, a memorandum submitted to obtain a master’s degree in management sciences. Unpublished, Kasdi Merbah University, Ouargla – Algeria.

Received: 24-Nov-2021, Manuscript No. aafsj-21-9509; Editor assigned: 27-Nov-2021; PreQC No. aafsj-21-9509(PQ); Reviewed: 14-Dec-2021, QC No. aafsj-21-9509; Revised: 20-Dec-2021, Manuscript No. aafsj-21-9509(R); Published: 24-Dec-2021