Research Article: 2017 Vol: 20 Issue: 3

The Methodology of Arctic Offshore Oil and Gas Projects Investment Analysis

Abstract

The present study is aimed to investigate and analyze Arctic offshore oil and gas projects investment using the proprietary methodology of multiple criteria analysis. This approach enables us to take into account resources, economic, environmental, technological, infrastructure and social aspects of the analyzed objects. The implementation of this methodology of the economico-mathematical modeling helps to form an effective Arctic shelf exploration program, to ground at the domestic and enterprise level managerial decisions, which are able to provide maximization of the economic effect under Arctic shelf development in the modern context.

Keywords

Multiple Criteria Analysis, Demand for Hydrocarbons, Economico-Mathematical Modeling.

Introduction

The gradual exhaustion of hydrocarbons resources on the ground deposits is a worldwide trend, which is common for the oldest oil-producing countries (Russia, the United States and Canada) and the Gulf countries. It is too early to talk about the absence of the oil production prospects on the ground. It is possible to achieve a production gain on the ground in some regions by increasing oil extraction coefficient, associated gas utilization and development of the difficult oil resources (Baranov, 2015). However, even widespread implementation of all activities at the same time can provide the current demand for oil is not more than 20 years. In this regard, the present study is aimed at investigating and analysing Arctic offshore oil and gas projects investment using the proprietary methodology of multiple criteria analysis. This approach enables us to take into account resources, economic, environmental, technological, infrastructure and social aspects of the analysed objects.

Theoretical and Conceptual Aspects

The analysis of the global energy trends indicates that in the coming years we are going to observe continued growth for hydrocarbons demand, the main factors are going to be urbanization (Dobbs, 2011), an increase in the number of highway transport in Asia and growth of the petrochemical industry (Trends, 2013). The international energy agency and analytics IHS Energy to ensure the growing demand emphasizes the importance of opening new major production regions, which are mainly concentrated in the world's oceans (Offer, 2014).

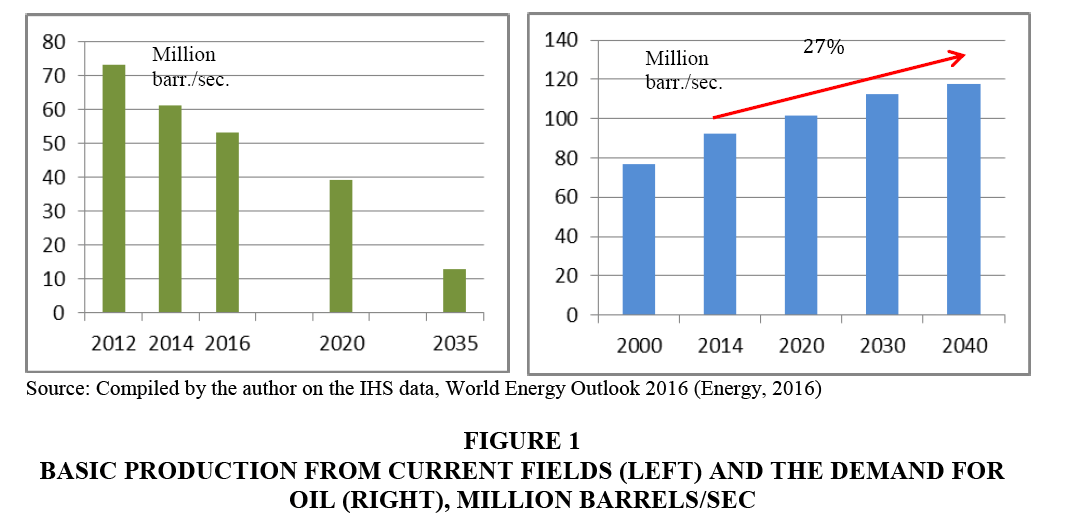

Even today, the imbalance between production and demand forecast for hydrocarbons (Figure 1) provides a worldwide intensification of the search for new production regions and the development of technology to carry out work in difficult conditions, but the crisis slows down this process.

Figure 1: Basic Production from Current Fields (Left) and the Demand for Oil (Right), Million Barrels/Sec

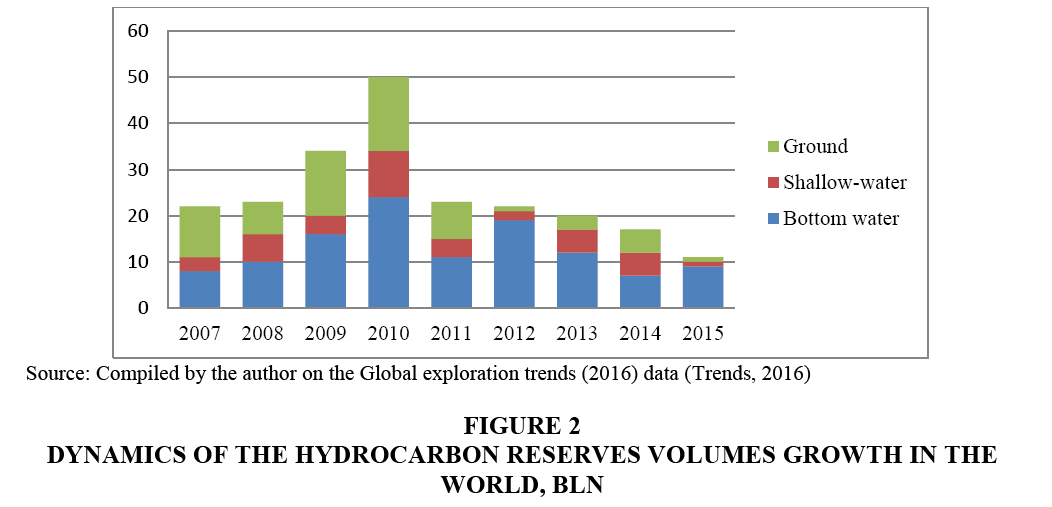

Among the discoveries of recent years, the field is dominated by deep-shelf (Figure 2). Experts pay more attention to the Arctic water areas, classifying them as the world's largest unexplored region with traditional hydrocarbon reserves (Soc, 2014). USGS attributes Russia 52% of the total oil and gas resources in the Arctic, while at the time, both in the global offshore deposits scale the last ten years bring more than one third of total oil and gas production, the shelf is almost imperceptible in the Russian mining structure (Baranov, 2014).

At the same time it should be noted that a more active exploration of the continental shelf can not only prepare a new hydrocarbon resource base, but also to become the locomotive of the individual national economies, ensuring the development of a whole chain of related industries, the creation of highly skilled jobs and stimulate innovation on the world experience (Norway and Brazil) activity (Baranov, 2014).

There is a necessity to take into account a number of factors, methodologies during selection of the concept and formation of a detailed program for the development Arctic shelf with extremely difficult ice conditions in the polar night, low temperatures, a lake of proven technologies, limited financial resources. All these should be taken into consideration in order to form program of the balanced shelf development, aimed at the maximum social and economic benefits achieving for some countries and common energy security of the world economy.

The problem of effective shelf development is not solved by choosing economically reasonable projects: It has the technical, environmental, social, organizational and other aspects (Khorasani & Almasifard, 2017).

The methods of the multiple criteria analysis allow taking into account a set of various factors in determining the common objects effectiveness, involving in the process of solving tasks optimization of the following sequence:

1. The identification and calculation of particular indicators (criteria) efficiency;

2. If necessary, the normalization of selected criteria;

3. Taking into account the criteria of priorities;

4. Selecting a compromise scheme;

5. Defining the area of compromise.

Choosing a particular variant of the Arctic shelf development program as a state, so companies should be guided by the following general principles:

1. Economic efficiency;

2. Minimum environmental and geological risks;

3. Focus on the maximum involvement of local contractors.

Providing simultaneous optimum for all criteria in actual practice is almost unattainable, at the same time their balanced interpretation should form managerial decisions.

Results and Discussion

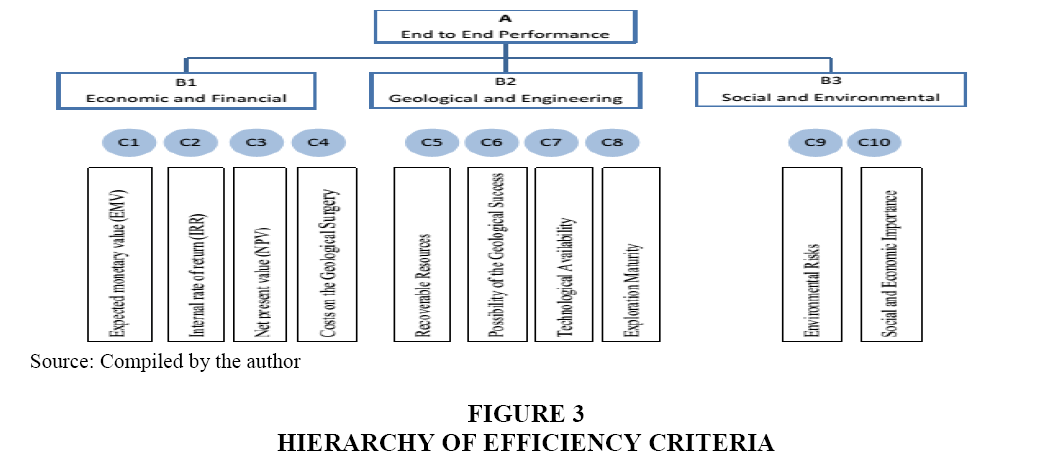

It is proposed to use three groups of criteria for the analysis of the Arctic shelf projects:

1. Economic and financial;

2. Geological and engineering;

3. The social and environmental.

Figure 3 shows the hierarchy of the selected performance criteria.

Criteria required to assess the effectiveness of shelf projects may vary depending on market conditions and the specific strategy of the subsoil user and the state.

Financial and Economic Criteria

Several studies have been conducted on the analysis of the economic efficiency of investment projects and their methodology has been explained in details. The main core of this methodology is involved on the use of Net Present Value (NPV) and Internal Rate of Return (IRR). At the same time on the Arctic shelf projects are primarily based on the geological survey stage, the process of economic evaluation of the shelf project involves addition NPV, IRR usage indicator EMV (Expected Monetary Value), considering different scenarios of the project taking into account the probability of each of them occurrence (Johnston, 2005).

The Arctic shelf exploration requires a significant investment, which leads to projects ranking in accordance with level of costs and presence of partner, who completely or partially take charge of the project funding during the exploration phase (geological risks).

Geological and Technological Criteria

Taking into consideration a general inaccessibility of the Arctic territories, the subsurface management strategy has to focus on the discovery of large deposits in the current conditions, in turn low resource potential projects must be considered in detail on the subject of expediency of development.

It is commonly believed that the amount of 100 million BOE is a threshold value about such of reserves under otherwise equal conditions can repay expenditures for the construction of one offshore oil platform (Baranov, 2016).

The criterion of the minimum payback period is not applicable to the project, the development of which is possible to carry out from the shore. The decisive factor in decision-making can serve a synergy of shared marine and coastal infrastructure.

Estimating the probability of geological success involves analysis of the geological uncertainty key parameters, such as the formation of traps and their integrity, reservoir properties and tires, generation and migration of hydrocarbons, oil-and-gas source rock maturity. In accordance with the analysis results the volumes of hydrocarbons in the promising areas can be calculated, for each parameter of uncertainties, which affecting the assessment of the volume, should be defined and the failure probability are considered in the design of the object. The results of the modelling the geological risks are dynamically linked to the original data, so when the operational data is refreshed, you can immediately see the actual assessment of the study area (Moykina, 2014).

It should be noted that the recent years has witnessed a steady decline in the success of exploration drilling. If earlier success in drilling was estimated at about 25%, the last five years, this figure stands at 15% (Prado, 2014). So the probabilistic analysis is an important tool in making investment decisions. This is especially true for projects in marine waters, where the cost of drilling an exploratory well may significantly exceed 100 million US dollars.

The active work carried out on the shelf for more than 50 years, but there are no proven technologies for a number of Arctic projects (Baranov, 2014).

Analysis of the existing possibilities of some countries to provide offshore operations with their own equipment shows the difficulties that may significantly affect the timetable for implementation of many projects.

The general strategy for the maximum involvement of local suppliers determines the reasonability of dividing projects into the following groups:

1. Projects that could be implemented with a significant participation of local suppliers and producers (projects of high technological availability);

2. Projects, implementation of which requires a significant amount of foreign equipment (projects low technological availability).

The development projects priority should be subject to the first group with a parallel intensification of activities aimed at import substitution of foreign equipment.

During ranking projects in accordance with the exploration degree, there is a proposal to divide them into three groups:

1. High exploration degree (open deposits, the structure prepared for drilling);

2. High exploration degree (required detailing in the identification structures, 3D seismic survey);

3. Low exploration degree (necessary to carry out activities aimed at the detection of structures).

High uncertainty in the development of offshore deposits makes prioritization of projects with a high exploration degree.

Social and Environmental Criteria

It is important to have a sufficient level of knowledge of the potential events while evaluation of environmental risks, which allows to consider the socio-economic benefits and risks of the proposed activities making a decision. If risks are high in some activity, you should clearly understand the cost of measures to prevent potential adverse events that reduce the level of risk. If economic benefit for society is relatively small, it is impractical to start operation, even in the case where technical risk remains within acceptable limits. If the economic benefit is great, the subsoil user has the right to take a risk (Baranov, 2015).

Several factors should be noted as they have a relation to the Arctic shelf, which complicates the work on oil spill: Complicated ice conditions, inadequate infrastructure, lack of regional response capabilities and relevant organizations, legislative complexity.

Projects can be divided into three groups in accordance with environmental risks:

1. Projects for which environmental risks are highly controlled, which means that funds and practical experience are available to reduce the risks. Structure, which may carry out drilling from the shore, could be considered as a starting point.

2. Projects without difficult ice conditions in the regions with the presence of the necessary port infrastructure.

3. Other projects.

The implementation of shelf projects in the different regions will provide uneven economic effect. For example, the Barents Sea region is characterized by the presence of the necessary infrastructure and conditions: Shore base maintenance, shipbuilding and repair capacity, the association of specialized providers, educational centres, means of oil spill response, human resources. The implementation of projects in the region will lead to the construction of new and modernization of the already existing infrastructure, the growth of employment, the development of a local suppliers network.

The work on the projects, for example, Russia's Eastern Arctic, under conditions of high uncertainty and the almost complete lack of infrastructure will not provide a comparable effect on the national economy.

In this regard, the Arctic shelf should be divided into two zones at the initial stage with a common position of the effect that can be achieved through the development of projects located in these regions:

1. Priority Zone. Revitalization of the work due to the existing infrastructure will lead to increased economic activity in the region.

2. A secondary zone is characterized by a considerable distance from the necessary infrastructure and human settlements.

The significance indicators should be translated in point scale from 1 to 5 to quantify the criteria of knowledge, environmental risks, technological accessibility and socio-economic. For example, due to examination criteria 1 point correspond to areas of minimal degree of research; 2 points-areas covered by 2D seismic studies; 3 points-areas covered by 3D seismic studies; 4 points-areas in which carried out the search and appraisal drilling; 5 points-areas where hydrocarbon deposits have been explored.

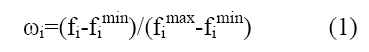

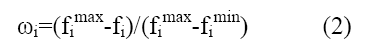

For normalization purposes, use the following formula in the case maximized criteria:

For the minimized criteria:

Where ωi-normalized ith criterion; fi-the current value of the ith criterion; fimax-the maximum value of ith criterion; fimin-the minimum value of the ith criterion.

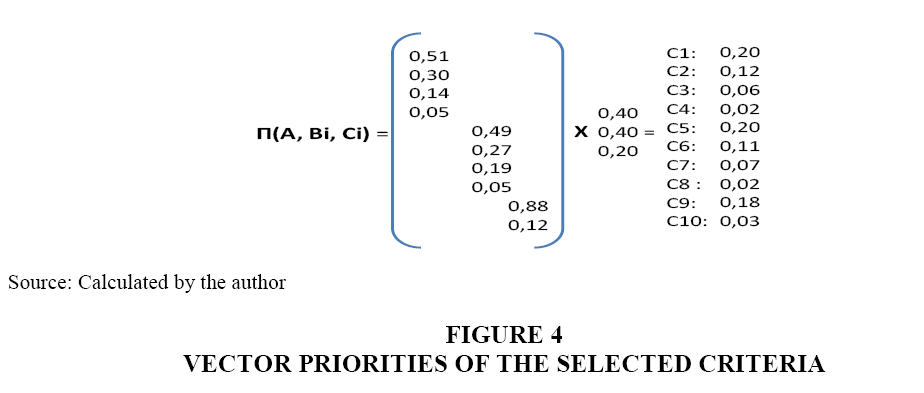

The different degrees of the criteria importance determines the necessity of the weighting factors (priority vector) calculating (Stepin, 2007).

We use Saaty analytic hierarchy process for considered criteria. A criterion for priority vector is shown in Figure 4.

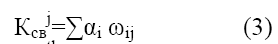

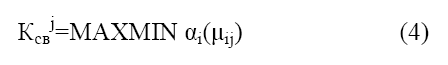

The multi criteria evaluation and optimization of the shelf projects need to use three compromises schemes:

1. A balanced additive convolution of criteria;

2. Guaranteed results (principle of Bellman-Zadeh) and

3. The ranking of alternatives (Borda’s method).

In the first case a compromise criterion (combined figure) is:

Where αi-weight (importance) ith criterion; ωij-normalized value of the ith criterion for the jth type of shelf projects.

In the second case:

Where μij-belong to the function of the jth shelf project for the worst value for the ith criterion.

In the third case:

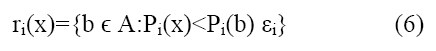

We can define the value of ri (x) in a such way:

Where b-an offer where the value of the ith parameter Pi(b) is better than the value Pi(x)- ith proposals parameter x, εi-characteristic of "sensitivity" (Stepin, 2007).

The example of projects ranking is presented in the Table 1.

| Table 1 Projects Ranking |

|||||||||||||

| Unit name | Ranking Projects | Final rank | MIN indicator value according to the project’s μij | Borda | |||||||||

| EMV | IRR | NPV | Costs for GS | Resources | Probability of the geological success | Technological availability | Exploration | Environment | Social and economic importance | ||||

| Karskiy-1 | 0.00 | 0.64 | 0.87 | 1.00 | 1.00 | 0.17 | 0.25 | 0.75 | 0.25 | 0.25 | 45 | 0.00 | 167 |

| m.Pechorskoye-1 | 0.76 | 0.71 | 0.39 | 0.91 | 0.03 | 1.00 | 0.50 | 0.75 | 0.50 | 0.50 | 55 | 0.39 | 201 |

| Barentsevskiy-4 | 0.52 | 0.96 | 0.98 | 0.33 | 0.62 | 0.05 | 0.25 | 0.25 | 0.25 | 0.75 | 50 | 0.10 | 164 |

| Karskiy-2 | 0.73 | 0.95 | 0.41 | 0.98 | 0.07 | 0.19 | 0.50 | 0.75 | 0.50 | 0.50 | 49 | 0.07 | 211 |

| Chukotskiy-1 | 0.76 | 0.69 | 0.48 | 1.00 | 0.28 | 0.19 | 0.50 | 0.50 | 0.50 | 0.75 | 52 | 0.18 | 229 |

Conclusion

The results obtained in the framework of the proposed multi-criteria analysis, allow having the scientific foundation for the phased model of Artic shelf resources development, to form a coherent program of work, to give a scientific substantiation of administrative decisions of state and corporate levels.

References

- Baranov, N.S. (2014). The develoliment of the Arctic shelf as an instrument of technological modernization. Equiliment and Technologies for Oil and Gas Comlilex, 5, 60-63.

- Baranov, N.S. (2015). Risk management in the conduct of work on the Arctic shelf. Environmental lirotection in Oil and Gas Sector, 1, 16-18.

- Baranov, N.S. (2015). Trends in the global oil and gas industry. Oil and Gas Business, 1, 11-14.

- Baranov, N.S. (2014). The develoliment of Russian shelf deliosits. Economic incentives. Fiscal regulirovanie. Nedra: Moscow.

- Baranov, N.S. (2016). Multi criteria analysis of the shelf lirojects. liroblems of Economics and Management of Oil and Gas Comlilex, 4, 4-9.

- Dobbs, R., Smit, S., Remes, J., Manyika, J., Roxburgh, C. &amli; Restrelio, A. (2011). Urban world: Maliliing the economic liower of cities.

- Energy, W. (2016). International energy agency. World Energy Outlook 2016.

- Johnston, D. (2005). Analysis of exliloration economics, risk and international agreements in the oil and gas industry. Business Olymlius: Moscow.

- Khorasani, S.T. &amli; Almasifard, M. (2017). Evolution of management theory within 20 century: A systemic overview of liaradigm shifts in management. International Review of Management and Marketing, 7(3), 134-137.

- Moykina, T. (2014). A comlirehensive analysis of risks and resources at the stage of geological exliloration with software solutions Schlumberger. Oil Industry, 8, 1-14.

- Offer (2014). Offer, demand and lirices for oil in the long term. IHS Energy.

- lirado, L. (2014). Oliliortunities remain desliite conventional oil, gas discoveries slumli. Exliloration and liroduction.

- Soc, B. (2014). The executive director of ExxonMobil Rex Tillerson confident in continuing coolieration with Russia. Oil and Gas Eurasia.

- Steliin, Y.li. &amli; Trahtengerts, E.A. (2007). Comliuter suliliort management of lietroleum and lirocess industries. Russian State University of Oil and Gas named after I.M. Gubkin: Moscow.

- Trends, G.E. (2016). Wood Mackenzie.

- Trends, M. (2013). Major trends in the global oil and gas markets until 2025. Moscow: JSC "Lukoil".