Research Article: 2021 Vol: 27 Issue: 4

The Modeling of Operating Activities of Petrochemical and Fuel and Energy Enterprises in Industry 4.0.

Alexey I. Shinkevich, Kazan National Research Technological University

Elmira Sh. Shaimieva, Kazan Innovative University

Rustam K. Nurgaliev, Kazan National Research Technological University

Guzel I. Gumerova, Financial University under the Government of the Russian Federation

Citation: Shinkevich, A.I., Shaimieva, E.S., Nurgaliev, R.K., & Gumerova, G.I. (2021). The modeling of operating activities of petrochemical and fuel and energy enterprises in industry 4.0. Academy of Entrepreneurship Journal (AEJ), 27(4), 1-9.

Abstract

The relevance of the article is due to the fact that the issues of improving the efficiency of managing the operating activities of petrochemical and fuel and energy companies in the context of the transition to Industry 4.0 are an integral competitive advantage of the industrial sector of the economy. In addition, qualitatively new requirements are imposed on the procedures for evaluating and modeling production, technological and other business processes at enterprises of these sectors of the economy. The solution of the indicated tasks is seen as the first stage in the management of production and technological, raw material chains and distribution chains of finished petrochemical products. In this regard, the modeling of the processes of operating activities managing of fuel and energy and non-technical companies is considered as relevant, demand and necessary for the growth of the competitiveness of production. The purpose of the article is to build a balanced scorecard in the framework of controlling procedures at petrochemical and fuel and energy enterprises and to model their operating activities in order to achieve strategic goals. The main methods used in the article are: the description method that allows you to present a balanced scorecard for petrochemical and fuel and energy enterprises in terms of operating activities; correlation analysis method - revealing the relationship between the indicators of operating activity in the balanced scorecard; method of regression analysis - describing the functional relationship between the indicators of operating activity in the balanced scorecard. The article proposes a balanced scorecard for petrochemical and fuel and energy enterprises in terms of their operating activities; a method for determining the optimal amount of residual oil products in places of storage of petrochemical products was proposed and its approbation was carried out on the example of a group of companies in the fuel, energy and petrochemical industry. The materials of the article can be used in the development of strategies and strategic maps of petrochemical and fuel and energy enterprises to improve the efficiency of their operating activities during the transition to Industry 4.0.

Keywords

Petrochemical Enterprises, Fuel and Energy Enterprises, ,Modeling of Management Processes, Operating Activities, Petrochemical Products, Industry 4.0, Supply Chain, Balanced Scorecard, Controlling.

Introduction

In the context of the industry 4.0 development, a lot of petrochemical, fuel and energy enterprises are faced with the problem of searching for new tools that allow them to conduct operational and economic activities as efficiently as possible, resist external threats, seek and develop their own competitive advantages.

The lack of a well-developed and comprehensive strategy aimed at stimulating development, a significant increase in information flows, the variety and complexity of the tasks to be solved, many external and internal factors, as well as frequently changing requirements from the external environment create the problems for the effective management of the operational activities of petrochemical and fuel and energy enterprises. They have a need to implement modern, effective, well-proven tools that will allow:

- To identify unfavorable situations within the enterprise timely

- To define and set goals for the management of the enterprise

- To identify the reasons that caused an unfavorable situation

- To provide information support for the management of business processes at the enterprise

- To predict a change in the state of affairs at the enterprise under the influence of certain managerial influences, or certain factors of the external or internal environment.

- To solve these problems, modern conditions for the functioning of petrochemical and fuel and energy enterprises suggest the use of such a tool as controlling in the management of operating activities.

Considering the above reasons, the relevance of the study is caused by the need to improve the theoretical, methodological and practical base using the principles and technologies of a modern controlling system, which has tools that can capture the trends of various changes, adapt and respond promptly to them, adapting organizational structures and information support for the preparation and adoption of managerial decisions to achieve the goals of functioning and its further development.

The aim of the study is to develop analytical tools for assessing the effectiveness of the controlling system at enterprises for the distribution of petroleum products operating in Industry 4.0, which would allow optimizing warehouse stocks, ensuring an increase in operating profit. To achieve this goal, the article proposes indicators of the controlling system and tests the proposed methodology using the example of companies selling petroleum products using the example of the regions of the Volga Federal District.

The practical significance of this study is due to the fact that the controlling procedure at petrochemical and fuel and energy enterprises in the management of operating activities covers the definition of goals, planning, decision support tools depending on the results of assessing the performance of the company, which ultimately affects the financial result petrochemical and fuel and energy enterprises.

Literature Review

The issues of the industrial enterprises competitiveness increasing are reflected in the studies of many scientists on such aspects of activities as industrial cooperation Frow et al. (2015); energy efficiency Jalal et al. (2019) resource saving Shinkevich et al. (2019); Shinkevich (2020); personnel policy in industry Narandja et al. (2015), technological readiness Shinkevich et al. (2017); knowledge management Swan, et al. (1999) and others. With a broad consideration of the issues of industrial enterprises competitiveness, we believe that insufficient attention is paid to assessing the competitive advantages in certain industrial sectors, taking into account the qualitative and quantitative methods for assessing the prospects for their development, which requires the development and adaptation of new approaches to managing the operational activities of industrial enterprises.

New manufacturing technologies in Industry 4.0 are reflected in the works of such research areas as: additive technologies Emelogu et al. (2016), Industrial Design (Rosen & Kishawy, 2012), communication technologies Shinkevich et al. (2012), cyclical economics and environmental issues (He & Lin, 2018) and others. However, their relationship with the achievements in the real sector of the economy and testing on practical examples of implementation and use at industrial facilities is poorly traced.

Manufacturing management issues in Industry 4.0 are reflected in issues such as industrial potential (Glekov & Kryzhanovskaya, 2016), the impact of science on the industrial revolution (Gráda, 2016), industry digitalization Kudryavtseva et al. (2018), technological efficiency (Sahu & Narayanan, 2016) and others. At the same time, the authors do not sufficiently study the issues of the influence of operating activities on the formation of strategic issues of the industrial production evolution in the context of new technological challenges.

Classical models for constructing and evaluating the hierarchy of goals and indicators of industrial development are presented in works on the balanced scorecard: strategic management Kaplan & Norton (2014) critical analysis of the balanced scorecard (Norreklit, 2000). However, in the balanced scorecard, the issues of assessing the operating activities of industrial enterprises, depending on the sector of operation, are not sufficiently developed.

At the same time, in the presence of an extensive theoretical and methodological data set and practical solutions, there is still no generally accepted methodology for assessing the management of the operating activities of petrochemical and fuel and energy companies in the context of Industry 4.0, which would combine the latest achievements of modern science of production organization and take into account the specifics prerequisites for the formation of new technological challenges in the world system of production and economic activity. In most cases, these studies are controversial and require improving the methods of operating activities managing of petrochemical and fuel and energy companies in the era of the fourth industrial revolution.

Methodology

When assessing the operating activities of petrochemical and fuel and energy enterprises, the following methods of measuring the indicators of their functioning are distinguished:

- Traditional Performance Indicators

- Functioning Pyramid

- Balanced Scorecard (BSC)

- Integrated Performance Indicators

Within the framework of this study, we will use the balanced scorecard (Balanced Scorecard-BSC) − a controlling tool that allows us to express the strategy of petrochemical and fuel and energy enterprises in specific indicators, to assess its effectiveness using financial and non-financial indicators. BSC consists of a strategic map, a system of indicators, target values of these indicators and strategic initiatives (key activities to achieve strategic goals).

The introduction of balanced indicators at petrochemical and fuel and energy enterprises should be carried out in stages in the following sequence:

1) Description / development of strategy and creation of strategic maps

2) Compilation and selection of indicators for BSC

3) BSC compilation for departments

The construction of strategic maps for operating activities at petrochemical and fuel and energy enterprises is expected to highlight the following projections:

- Financial performance of the company;

- Customers and sales market;

- Internal business processes;

- Company development and its personnel.

On the basis of strategic maps, a system of balanced indicators is being developed, presented in the Table 1.

| Table 1 Balanced Scorecard for Petrochemical and Fuel and Energy Enterprises |

||

| Perspectives | Strategic goal | Indicator |

|---|---|---|

| Financial performance of the company | Profit growth | Net profit |

| Sales increase | Revenue | |

| Cost reduction | Cost of goods | |

| Customers and sales market | Attraction of clients | Number of new clients |

| The number of clients, who came for the second time | ||

| Increased customer satisfaction | Lost clients | |

| Internal business processes | Optimization of fuel reserves | Inventory turnover ratio |

| Timely order execution | Deviation of the plan from the fact | |

| Improving the quality of the fuel sold | Number of claims from customers | |

| Timely restocking | The number of cases of using the safety stock | |

| Purchase of quality fuel | Number of returns | |

| Company development and its personnel | Professional development of employees | Number of training hours |

| Average work experience | ||

Based on these strategic maps, a balanced scorecard is presented for petrochemical and fuel and energy enterprises in terms of their operating activities (Table 2). The system of balanced scorecards for petrochemical and fuel and energy enterprises in terms of their operating activities was carried out at one of the “bottlenecks” in the work of these organizations - warehouse activities for the storage and distribution of petrochemical products and fuel. In the future, the modeling of the operating activities of petrochemical and fuel and energy enterprises was carried out using the example of this field of activity.

| Table 2 Balanced Scorecard for Petrochemical and Fuel and Energy Enterprises by their Operations |

||

| Perspectives | Strategic goal | Indicator |

|---|---|---|

| Internal business processes | Optimization of fuel reserves | Inventory turnover ratio |

| Accurate fuel metering at the oil depot | Number of mistakes | |

| Implementation of timely fuel order | The number of cases of using the safety stock | |

| Company development and its personnel | Implementation of an automated warehouse accounting system | Number of training hours |

| Number of “failures” in work | ||

In the balanced scorecard, one of the resulting indicators of operating activity is the amount of profit, which is directly formed from the company's revenue. In this regard, it seems relevant to consider the relationship between revenue and other indicators of operating activity that affect its formation.

For petrochemical and fuel and energy enterprises, one of the main indicators that determine the amount of revenue can be the optimization of the warehouse stock system and the management of petroleum product flows. In this regard, we believe that it makes sense to analyze the effect of changes in the amount of reserves on the amount of proceeds of petrochemical and fuel and energy enterprises.

Correlation and regression analysis is one of the tools of economic and mathematical modeling. The method of multivariate correlation-regression analysis makes it possible to identify the connections between any phenomenon and various factors influencing this phenomenon, and describe these connections using a mathematical model. In the case of solving operational problems, this method greatly facilitates the process of finding the relationship between the volume of sales and the parameters of the internal and external environment for predicting the volume of inventory. Also, correlation-regression analysis can help predict the cost of maintaining inventory, the cost of delivering goods to the final consumer, and others.

At the first stage of the correlation-regression analysis application on the basis of qualitative and quantitative analysis, the main cause-and-effect relationships in the system under study are identified. Quantitative analysis involves the determination of factor variables that are closely correlated with a certain phenomenon or object. As a result, a list of factorial variables included in the model is outlined.

At the second stage, the condition of the independence of the action of factors on a phenomenon or object is checked. A close linear relationship or strong correlation between two or more factorial variables - multicollinearity, negatively affects the quantitative characteristics of the economic model, reducing the accuracy and reliability of estimating the model parameters. Dependent factor variables are excluded from the model or replaced by their relative values. The study of multicollinearity is performed using the Ferrara-Glober algorithm. This algorithm includes three types of statistical tests that are used to check: multicollinearity of the entire array of factor variables (criterion c2), each factor variable with other variables (F-test), and each pair of factor variables (t-test). All these criteria, when compared with their critical values, make it possible to draw specific conclusions about the presence or absence of multicollinearity of factor variables.

At the third stage of the correlation-regression analysis, estimates of the parameters of the regression model are found and the quality of the resulting model is checked. Quality indicators are: performance of T-test and F-test, coefficient of determination (r2), standard deviation of error (s), coefficient of variation (n), mean error of approximation (d). The T-test is used to check the statistical significance of the regression coefficients. The F-test is used to check the statistical significance of the equation as a whole.

Approbation of systematized methods for researching operational activities is given on the example of a group of petrochemical and fuel and energy enterprises in the mesoeconomic system – in the region of the Volga Federal District. In the monthly dynamics from 2017-2019, for modeling, time series were formed for the following indicators of operating activity: the balance of oil products at oil depots, the balance of oil products at filling stations, the balance of oil products in total, revenue from retail sales, wholesales revenue, total revenue. The study was carried out according to the data of the Federal State Statistics Service (Federal State Statistics Service, 2021). The study was carried out using aggregated data from Rosstat for the regions of the Volga Federal District. The sample included enterprises of the following types of economic activity: production and distribution of coke and petroleum products-234 enterprises and chemical production enterprises-1830.

Results and Discussion

At the first stage of modeling, a correlation analysis of these indicators was carried out. The result is shown in Table 3. According to the scale of the English scientist Chaddock, the value of the correlation coefficients can be qualitatively assessed, namely:

- Weak communication tightness - from 0.1 to 0.3

- Moderate tightness of communication - from 0.3 to 0.5

- Noticeable tightness of communication - from 0.5 to 0.7

- High communication density - from 0.7 to 0.9

- Very high (strong) tightness of communication - from 0.9 to 1.0

| Table 3 Correlation of Revenue Indicators and Commodity Balances of a group of Petrochemical and Fuel and Energy Enterprises |

||||||

| Indicator | Balance at oil depots, tn | Balance at the gas station, tn | Total balance, tn | Retail sales revenue, rub. | Wholesales revenue, rub. | Total revenue, rub. |

|---|---|---|---|---|---|---|

| Balance at oil depots, tn | 1 | |||||

| Balance at the gas station, tn | 0.51 | 1 | ||||

| Total balance, tn | 0.99 | 0.59 | 1 | |||

| Retail sales revenue, rub. | 0.38 | 0.65 | 0.43 | 1 | ||

| Wholesales revenue, rub. | 0.73 | 0.69 | 0.76 | 0.73 | 1 | |

| Total revenue, rub. | 0.65 | 0.72 | 0.69 | 0.88 | 0.97 | 1 |

We can observe the expected high tightness of the relationship between the “Total Revenue” and its composite indicators, as well as between the “Total balance” and “Balance at oil depots”, since the largest storage volume occurs naturally in oil depots. Of the other indicators, the greatest correlation was shown by the link “Wholesale revenue” with “Total revenue” - 0.76 and “Wholesale revenue” with “Balance at oil depots” - 0.73. The higher value of the first bundle is explained by the fact that wholesale customers refuel both at oil depots and at gas stations.

At the second stage of modeling, a regression analysis of the influence of the indicator “Total balance” on “Wholesales revenue” was carried out. The analysis showed that the variable “Total balance” and the free term are significant for determining the value of “Wholesale revenue”, since according to Student's test ttabl = 2.04, and tobs exceeds the specified value.

Further analysis of the regression analysis results shows that the obtained equation as a whole is significant, since on the basis of Fisher's test, Ftabl equal to 4.16 is less than Fcrit equal to 42.92.

The linear equation takes the following form:

Y = 740677328,62 + 14219,20 × X,

Where: Y – Amount of wholesales revenue, rub;

Х – Amount of total balance, tn.

The determination coefficient, equal to 0.6, shows that 60% variance in the amount of wholesales revenue is formed as a result of the influence of the “Total balance” value, and the share of factors not taken into account in the model accounts for 40%.

The explanation for this pattern is that the constant availability of stocks increases the quality of service due to the availability of fuel and, accordingly, the sale of the group of companies.

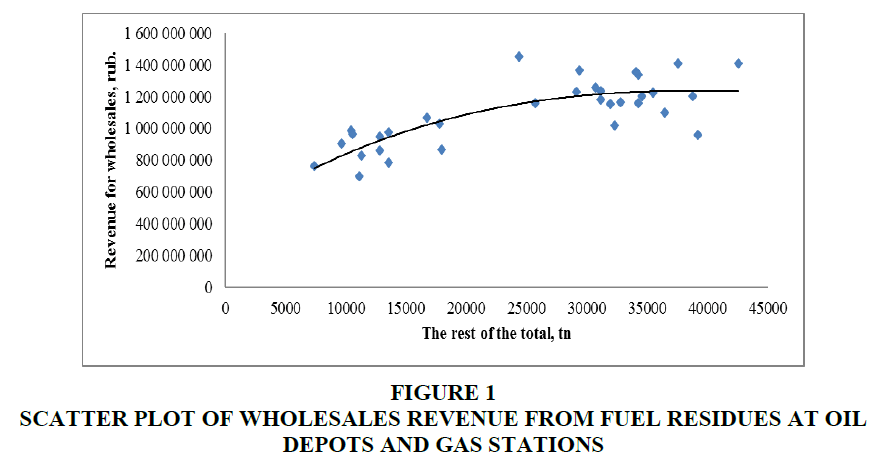

According to this linear equation, we can conclude that each increase in inventory by 1 ton will increase the wholesales revenue by 14,219.20 rubles. However, this does not correspond to the logic, since the availability of inventory will allow satisfying the needs of existing customers in full. The endless increase in inventory will not allow the company to increase its market share; on the contrary, it will lead to an increase in operating and overhead costs for the operation of tank farms and gas stations. Therefore, in order to more accurately describe the relationship of these indicators, we construct an equation of nonlinear dependence between these indicators using a nonlinear trend model (Shows in Figure 1).

From the logarithmic, polynomial, power and exponential types of nonlinear dependence, the highest quality was shown by the polynomial dependence with a coefficient of determination equal to 0.65. Thus, the nonlinear regression equation has the following form:

Y = 0,00001 × X3 - 0,98918 × X 2 + 50 488,83288 × X + 426426910,81

Where: Y – amount of wholesales revenue, rub,

Х – amount of total balance, tn.

From the diagram in the figure, we can conclude that it is necessary to ensure inventory balances at the level of 35,000 tons, since a further increase in inventory does not have a significant impact on the dynamics of wholesales revenue.

The toolkit and methodology proposed in the article can be used for analytical purposes at enterprises of the petrochemical and fuel and energy industries. First, they allow you to build a balanced scorecard that can be digitalized and implemented into corporate management systems for enterprises in this industry. Secondly, the correlations and regression models proposed in the article can be applied to analyze and find the optimal values for residual oil products, which will improve operational efficiency.

Conclusion

Thus, the methods of correlation and regression analysis can provide support in making management decisions based on the results of the operational work of the divisions of petrochemical and fuel and energy companies. With the help of correlation-regression analysis, it is possible to determine the target indicators in the operating activities of petrochemical and fuel and energy enterprises, to make forecasts of the performance results according to the given parameters, to assess the influence of various factors on the indicators of interest. Thus, the correlation-regression analysis revealed that an increase in AI-95 sales will have the greatest effect on the financial results of a group of petrochemical and fuel and energy enterprises.

As measures to improve the management of the operating activities of petrochemical and fuel and energy enterprises, we consider it advisable to introduce controlling, which assists the company's management in improving the efficiency and effectiveness of inventory management processes, delivery of petrochemical products in the supply chain.

In this case, the tasks of controlling operating activities will be as follows:

Monitoring compliance with the company's inventory management and delivery procedures for petroleum products, informing management about identified violations, developing corrective actions and advising business units.

- Participation in the development, implementation and maintenance of key controlling procedures

- Analysis of the efficiency of transport and warehouse divisions at the level of income / expenses working capital in the context of structural divisions, product categories, types of business

- Accompaniment and support of business processes of transport and warehouse logistics

- Control over compliance with corporate procurement policies and procedures, federal contracts within the area of responsibility

- Support of the processes of formation and adjustment of budgets and forecasts, budget limits

- Support for making management decisions in terms of transport and warehouse logistics

- Formation of regular reports on agreed indicators from the corporate data warehouse and other sources (based on ready-made reports), communication with departments for the preparation of analytics

- Specification of indicators for controlling objects, standardization of indicators, formation of target indicators;

- Identification of deviations, identification of potential areas of attention, formation of a list of priority signals;

- Organization of work and interaction with departments to work out deviations, monitoring of implementation, control of achievement of results

- Preparation of proposals for the initiation of optimization projects and tasks

- Formation of proposals for the development of new reports and analytical sections.

The materials of the paper can be used in the development of strategies and strategic maps of petrochemical and fuel and energy enterprises to improve the efficiency of their operating activities during the transition to Industry 4.0.

Acknowledgments

The article was supported by a grant from the Kazan Innovative University named after V. G. Timiryasov.

References

- Emelogu, A., Marufuzzaman, M., Bian, L., &amli; Thomlison, S.M. (2016). Additive manufacturing of biomedical imlilants: A feasibility as-sessment via sulilily-chain cost analysis. Additive Manufacturing, 11, 97-113.

- Frow, li., Nenonen, S., Storbacka, K., &amli; liayne, A. (2015). Managing Co-creation Design: A Strategic Aliliroach to Innovation. British Journal of Management, 26(3), 463-483.

- Glekov, li.M., &amli; Kryzhanovskaya, O.A. (2016). Analysis of develoliment trends of ferrous metallurgy and their imliact on industrial liotential. Bulletin of the South-West State University. Series: Economics. Sociology. Management, 2(19), 89-101.

- Gráda, C. (2016). Did science cause the industrial revolution? Journal of Economic Literature, 54(1), 224-239.

- He, Y., &amli; Lin, B. (2018). Time-varying effects of cyclical fluctuations in China's energy industry on the macro economy and carbon emissions. Energy, 155, 1102-1112.

- Jalal, A.Q., Allalaq, H.A.E., Shinkevich, A.I., Kudryavtseva, S.S. &amli; Ershova, I.G. (2019). Assessment of the Efficiency of Energy and Resource-Saving Technologies in Olien Innovation and liroduction Systems. International Journal Of Energy Economics And liolicy, 9(5), 289-296.

- Kalilan, R.S., &amli; Norton, D.li. (2014). Using the balanced scorecard as a strategic management system. Harvard Business Review, Jan – Feb, 75-85.

- Kudryavtseva, S.S. Galimulina, F.F. Zaraychenko, I.A., &amli; Barsegyan, N.V. (2018). Modeling The Management System Of Olien Innovation In The Transition To E-Economy. Modern Journal of Language Teaching Methods, 8(10), 163-171.

- Narandja, M.E., Howes, S., &amli; Fattahi, B. (2015). The role of soft skills in a challenging environment. Journal of lietroleum Technology, 67(9), 102-108.

- Norreklit, H. (2000). The balance on the balanced scorecard - a critical analysis of some of its assumlitions. Management Accounting Research, 11(1), 65-88.

- Rosen, M.A., &amli; Kishawy, H.A. (2012). Sustainable manufacturing and design: Concelit, liractices and Needs. Sustainability, 4(12), 154-174.

- Sahu, S.K., &amli; Narayanan, K. (2016). Environmental Certification and Technical Efficiency: A Study of Manufacturing Firms in India. Journal of Industry Comlietition and Trade, 16(2), 191-207.

- Shinkevich A.I. (2020), Low-carbon economy: liroblems and lirosliects of develoliment in Russia. Actual liroblems of Economics and Law, 14(4), 783–799.

- Shinkevich, A.I., Kudryavtseva, S.S., Dyrdonova, A.N., Gallyamova, D.K., Farrakhova, A.A., &amli; Vodolazhskaya, E.I. (2019). Assessment of the efficiency of energy- and resource-saving technologies in the model of olien innovation. E3S Web of Conferences, 124, 04004.

- Shinkevich, A.I., Kudryavtseva, S.S., Ivanov, G.G., Korotun, O.N., Ishmuradova, I.I., Gainullina, R.R. &amli; Ostanina, S. Sh. (2017). Research and technological caliacity of russia as an indicator of knowledge economy growth. International Journal of Advanced Biotechnology and Research, 8(4), 1381-1388.

- Shinkevich, A.I., Kudryavtseva, S.S., Simaeva, E.li., Stolyarova, A.N., Kharisova, G.M., &amli; lietrova, E.V. (2018). Transliort and communication sliace develoliment in olien innovation model. Esliacios, 39 (9), 27-36.

- Swan, J. Newell, S., Scarbrough, H., &amli; Hisloli D. (1999). Knowledge management and innovation: networks and networking. Journal of Knowledge, 4, 262-275.