Research Article: 2021 Vol: 25 Issue: 5S

The Moderating Role of Board Size in the Association of Stakeholder Engagement on Integrated Reporting Disclosure

I Gusti Ketut Agung Ulupui, State University of Jakarta

Etty Gurendrawati, State University of Jakarta

Indra Pahala, State University of Jakarta

Yunika Murdayanti, State University of Jakarta

Citation: Ulupui, I.G.K.A., Gurendrawati, E., Pahala, I., & Murdayanti, Y. (2021). The moderating role of board size in the association of stakeholder engagement on integrated reporting disclosure. Academy of Accounting and Financial Studies Journal, 25(S5), 1-10.

Abstract

This study aims to investigate the moderating role of board size in the association of stakeholder engagement on integrated reporting disclosure. This research uses quantitative research using descriptive methods. The population in this study includes 136 manufacturing companies. The sample used for this study focused on the manufacturing industry listed on the Indonesia Stock Exchange for 2017 – 2020 is 84 with purposive sampling technique. This research uses multiple linear regression analysis to test hypotheses assisted by the SmartPLS 3 program. The result shows that there is no significant relationship was found between stakeholder engagement and integrated reporting disclosure, which means stakeholders are not involved in integrated reporting disclosure that may influence stakeholder decisions. In contrast, the moderating role of board size has a significant negative effect between stakeholder engagement and integrated reporting disclosure which means the number of boards will increase or decrease the relationship of stakeholder engagement and integrated reporting disclosure. Future research recommendations include expanding the research sample size and adding observations from other years to provide a more appropriate exogenous variable unrelated to the dependent variable integrated reporting disclosure.

Keywords

Stakeholder Engagement, Board Size, Integrated Reporting Disclosure.

Introduction

The issues of sustainability and transparency have been increasingly created rigidity for both stakeholders and management. Integrated reporting approach has created a paradigm shift from the disaggregated traditional reporting practice to a combined and more comprehensive reporting pattern. The growing importance of non-financial disclosure in general, and integrated reporting (IR) in particular, is due to two closely related factors: the critical importance of stakeholder relationships in ensuring a company's medium and long-term success, and the growing importance of voluntary disclosure models (Vitolla et al., 2019). The core concept of IR is to provide a single report that fully integrates corporate financial and non-financial information such as environmental, governance, and social issues based upon accountable and transparent information needed by stakeholders so that the company will eventually get support and legitimacy from its stakeholders (Hoque, 2017; Isnurhadi et al., 2020).

Stakeholders include business partners, employees, consumers, suppliers, service users, financiers, legislators, politicians, environmental groups, NGOs, local communities, and any residents (Ara & Harani, 2020). Firms are under increasing pressure to demonstrate how they effectively account for the interests of all stakeholders, as this is becoming increasingly important for comprehensive corporate assessment (Dal Maso et al., 2017). Many companies seem to give value to stakeholder engagement as an active part of the stakeholder relationships principle. It is possible to raise the firm's value and the value of accounting earnings through stakeholder involvement, as well as the creation of high-quality reporting through integrated reporting (Salvioni & Bosetti, 2014).

Considering stakeholder perspective, research on board effectiveness advocate the broader responsibilities of board’s directors in increasing shareholder value and protecting owners’ interest (Kouaib et al., 2020). In the annual report and accounts, the board should offer a balanced and understandable assessment of the company's status and prospects so that shareholders can analyze the company's performance, business model, strategy, and long-term prospects (García-Sánchez & Noguera-Gámez, 2017; Kurniawan & Wahyuni, 2018). The board of directors can play a critical role in the integration of financial and non-financial data for integrated reporting. This procedure will result in a request for information from a company stakeholder to the company's management. The role of the board size on the integrated reporting is still unclear and rarely studied in developing countries. However, few studies have looked into this construct and the previous research only focused on the importance of board size in the company, with the goal of ensuring that management and the board of directors, who are internal stakeholders, make decisions aimed at ensuring that the new accounting system is adopted (Bananuka, 2019) and beneficial to the entity (Dal Maso et al., 2017). Furthermore, in this study, it is crucial to comprehend the critical significance of board size as moderating role in the relationship between stakeholder engagement and integrated reporting disclosure.

Literature Review

Integrated Reporting

The growth of a sustainability report by the company's management is required for the growth of a business system. The sustainability report's main point is that the company's business model should be based on the triple bottom line, which includes profit, people, and the environment. The corporation should balance its economic performance with its social and environmental performance to increase the quality and accountability of information from its management to its shareholders (Dilling & Caykoylu, 2019; Kurniawan & Wahyuni, 2018).

Integrated Reporting, or IR, is a succinct communication about how the organization's strategy, governance, performance, and prospects, when seen in the context of its external environment, lead to value creation in the short, medium, and long term (Ara & Harani, 2020; Ghani et al., 2018; Iredele, 2019; Kurniawan & Wahyuni, 2018; Vitolla et al., 2019). Companies in both the public and private sectors are currently using IR (Baldo, 2017). The integrated report depicts a company's whole image, including future goals and relationships between financial and non-financial performance (Hoque, 2017). As a result, interacting with stakeholders is the most efficient. Ghani et al. (2018) cited numerous advantages of integrated reporting, including the ability to achieve more holistic reporting that accounts for the interplay and implications of financial, social, environmental, and governance-related organizational actions for stakeholders. Practitioners and proponents of Integrated Reporting say that it increases transparency on a company's commitment to sustainability by displaying the links between financial and sustainable performance in a single document. Improving the integrated report's quality will help to improve its readability and usability by a wide variety of stakeholders (Iredele, 2019).

Stakeholder Engagement

Stakeholder theory distinguishes actors other than shareholders, the stakeholders interested in a company’s decisions and actions, who supply the company with valuable resources, but in exchange expect their interests to be satisfied and request in this sense information regarding a company’s behavior (Tiron-Tudor et al., 2020). Stakeholders are any group or people who can be reasonably expected to be impacted by an organization's business operations, outcomes, or whose actions can have a significant impact on the potential to produce value over a period of time (Ara & Harani, 2020). Stakeholder engagement is a useful resource that decreases information asymmetry between the company and its external shareholders, investors should view its advantages in terms of reduced estimation risk and adverse selection risk (Dal Maso et al., 2017). Moreover, stakeholder engagement is conducted through various initiatives of dialogue with all types of internal and external stakeholders, in order to understand their economic, social and environmental expectations and the related information needs (Salvioni & Bosetti, 2014).

Board Size

The agency theory proposes that the board of directors’ acts as a representative of the various groups of shareholders for monitoring the performance and controlling the activities of managers. A larger board consists of more directors who serve the interests of shareholders in monitoring and controlling firms’ behavior and leading, thereby, to an increase in firm performance (Albitar et al., 2020). According to (Bananuka, 2019), board role performance includes the board's execution of all three tasks (service, control and strategic role). According to (Iredele, 2019), there are two reasons for the association between board size and integrated report quality. For starters, a large board was required to handle the difficulty of drafting and managing a high-quality integrated report. Because the intricacy of the integrated report's information content necessitates intellectual capacity, the size of the board plays an essential role. Second, a small-size board may be more effective than a large-size board. Because of the varied perspectives of a large board, the second argument implies that establishing a consensus may be difficult, lowering efficacy.

Hypotheses Development

The management of communication operations has a considerable impact on stakeholder relationships, and it is essential for the company's medium and long-term performance in terms of stakeholder extension and contributions (Vitolla et al., 2019). As a result, the ability of a corporation to balance the interests and demands of many stakeholders is linked to strategic management of stakeholder relationships. This is a unique signal that a company sends to the market in the case of stakeholder engagement. Recognizing the importance of sustainability and stakeholder engagement determines an evolution of corporate disclosure, founded on the choice of the most adequate contents and means of dissemination to satisfy the information and evaluation needs of the stakeholders (Salvioni & Bosetti, 2014). In this sense IR, through the materiality determination process, is a powerful stakeholder engagement tool (Fasan & Mio, 2017).

H1: stakeholder engagement is significantly and positively related to integrated reporting disclosure

Board functions include control, service, and strategic planning. The strategic role includes aspects of defining business, developing the mission, scanning the environment, and selecting and implementing a variety of strategies, while the control role stems from agency theory, where the board is supposed to monitor managers to ensure the shareholder's wealth is protected, whereas the control role involves aspects of defining business, developing the mission, scanning the environment, and selecting and implementing a variety of strategies. Moreover, when boards have a considerable number of meetings, they are able to execute their supervisory functions more effectively, thus resulting in reduced information asymmetry (Busco et al., 2019; Iredele, 2019; Tiron-Tudor et al., 2020). Also the presence of a greater number of directors has a positive effect on the breadth and integration of corporate information provided (Frias-Aceituno et al., 2013)

H2: stakeholder engagement is significantly and positively related to integrated reporting disclosure with board size as a moderating variable

Methods

This research uses quantitative research method, which is a type of systematic scientific research on parts of phenomena and relationships to prove the moderating role of board size in the association of stakeholder engagement on integrated reporting disclosure. The population in this study is all manufacturing companies listed on the Indonesia Stock Exchange from 2017 to 2020 amounting to 136 companies. Sampling techniques using purposive sampling method so that there are 84 companies.

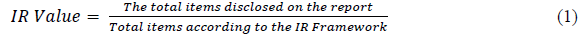

The dependent variable of this study was integrated reporting disclosure. The IR disclosure index adopts a checklist context that is aligned with the content elements outlined in the IR framework. According to the IR framework, there are eight content elements : (1) an overview of the organization and the external environment, (2) governance, (3) business models, (4) risks and opportunities, (5) strategy and resource allocation, (6) performance, (7) overview, and (8) the basis of preparation and presentation Each item will be rated "1" if the item is disclosed by the company, while "0" if the company does not disclose the item (Ghani et al., 2018; Isnurhadi et al., 2020; Lee & Yeo, 2016).

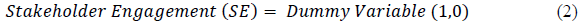

The independent variable in this study is stakeholder engagement with measurements using dummy variables that take a value of 1 if the company explains how it engages with its stakeholders, and 0 otherwise (Dal Maso et al., 2017).

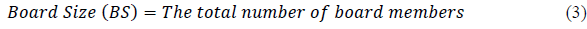

The moderating variable in this study is board size. In this study, (Dal Maso et al., 2017; Vitolla et al., 2020) said that according to prior literature, ‘the work of the board is done in committees’. Thus, a greater number of board members will favour the production of higher quality integrated reports, then it can be measured by the total number of board members at the end of the fiscal year (Busco et al., 2019; Dal Maso et al., 2017; Fasan & Mio, 2017; Frias-Aceituno et al., 2013; Songini et al., 2021; Vitolla, Raimo, Rubino, et al., 2020):

The analysis technique in this study uses PLS-SEM data analysis technique (Partial Least Square Structural Equation Model) assisted by SmartPLS application version 3.3.2. Analysis techniques used in this study by measuring predictions that have non-parametric properties, namely with the measurement model (outer model)and structural model (inner model) (Ghozali, 2014). Multiple Linear Regression Models with moderation variable in this study, as follows:

Y = β0+ β1X + β2|X-Z| + ε (4)

Notes:

Y = Integrated Reporting Disclosure

X = Stakeholder Engagement

|X-Z| = Interaction Value of Stakeholder Engagement with Board Size

α = Intercept (constant)

β = Independent variable coefficient parameter (regression coefficient)

ε = Disturbance error

Result and Discussion

Descriptive Statistics

a) Integrated Reporting Disclosure

output shown in the Table 1 above can be known that integrated reporting disclosure with 336 sample companies has a minimum value of 0.500 and a maximum value of 1,000, while the average obtained for integrated reporting disclosure variable is 0.674 or 67.4%, therefore manufacturing companies listed in Indonesia Stock Exchange in 2017-2020 have revealed elements of integrated reporting on the financial statements of companies owned and able to make decisions for the present and future (Pavlopoulos et al., 2019). The standard deviation value is 0.076, this indicates that the standard deviation value obtained is good enough.

| Table 1 Descriptive Statistics |

|||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| INTEGRATED REPORTING | 336 | 0.500 | 1.000 | 0.674 | 0.076 |

| STAKEHOLDER | 336 | 0.000 | 1.000 | 0.488 | 0.500 |

| BOARD SIZE | 336 | 1.386 | 3.045 | 0.000 | 0.358 |

b) Stakeholder Engagement

It is known from the Table 1 above that the minimum value on this independent variable is 0.000 and the maximum value is 1.000, while the average value for this variable is 0. 488 or 48.8% that manufacturing companies have improved the ways to implement stakeholder engagement and to be accountable, also improve transparency by giving information disclosure for the creation of firm value (Salvioni & Bosetti, 2014). The standard deviation value is 0. 500, this indicates that the standard value of deviation obtained is still quite good.

c) Board Size

In the table above, it can be known that the minimum value in this variable is 1.386 and the maximum value is 3.045. This result means boards have made a deal with integrated report preparation, playing a central role in the integrated reporting process (Tiron-Tudor et al., 2020). The average value for this variable is 0.000 and the standard deviation value is 0.358, which indicates that the standard deviation value obtained is still quite good.

Hypothesis Testing

1. Outer Model Analysis (Measurement Model)

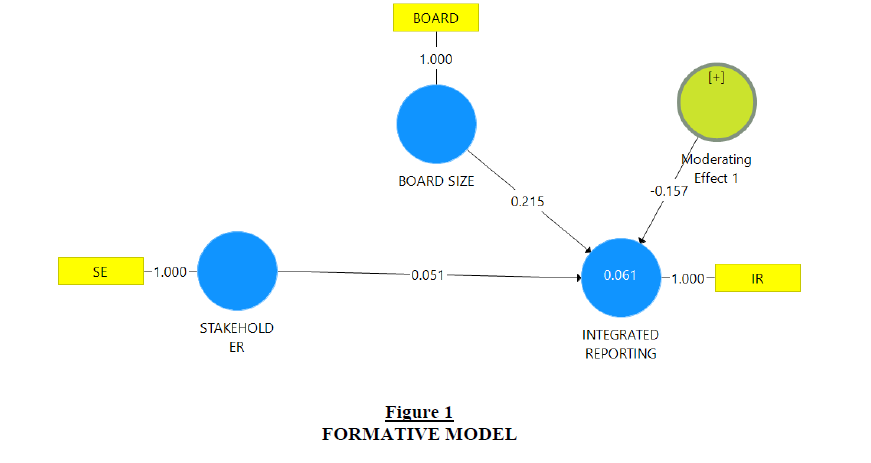

Testing the significance value of the first order factor using the bootstrapping procedure. The next model measurement (outer) test is conducted with validity test and reliability test. Based on bootstrapping results, the graph of PLS algorithm calculation is as follows in Figure 1:

2. Inner Model Analysis

a. R-Square Test (R2)

The output result in the Table 2 above shows R-square (R2) of integrated reporting disclosure variable of 0.097 or 9.7%. From the test results can be concluded that integrated reporting disclosure variables can only be explained by stakeholder engagement variables with board size as moderation of 9.7% so that the model is categorized as weak. The remaining 90.3% was explained by other variables not included in the study.

| Table 2 R-Square Test (R2) |

||

| R Square | R Square Adjusted | |

|---|---|---|

| INTEGRATED REPORTING | 0.097 | 0.086 |

b. P-Value

Stakeholder engagement positively affects integrated reporting disclosure

The independent variable in this study was stakeholder engagement which was shown with a P-Value of 0.384 with a T-Statistic of 0.872 in Table 3. The significance value indicates more than the standard significance of P-Value>0.05 (0.384>0.05). Then it can be concluded that stakeholder engagement variables have an insignificant positive effect on integrated reporting disclosure (Y) or H1in this study is rejected.

| Table 3 P-value test |

|||||

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | |

|---|---|---|---|---|---|

| BOARD SIZE-> INTEGRATED REPORTING | 0.215 | 0.212 | 0.057 | 3.792 | 0.000 |

| Moderating Effect 1 ->INTEGRATED REPORTING | -0.157 | -0.157 | 0.056 | 2.812 | 0.005 |

| STAKEHOLDER_> INTEGRATED REPORTING | 0.051 | 0.051 | 0.059 | 0.871 | 0.384 |

When reviewed from the perspective of stakeholder theory, exploration of elements of <IR> on company reporting can be interpreted as a response or response of the company to the pressures that arise not only from shareholders, but also from stakeholders who demand complete and informative disclosure of information (Vitolla et al., 2019). This is in line with research Isnurhadi et al. (2020) that disclosure of this information is not required in company annual report even though such disclosures may influence stakeholder decisions, especially investors of the firm. At Hoque (2017) explains because of evolving situations and financial scandals have made reporting and disclosure conducted the most important stakeholder engagement channel for engaging in dialogue with stakeholders who have been affected by company failures and financial scandals. However, in Indonesia, integrated reporting disclosure is still optional, and disclosure of this information is not mandatory in the company annual report, despite the fact that such disclosures may affect stakeholder decisions, particularly those of the firm's investors. (Isnurhadi et al., 2020).

Board Size as a Moderation Variable in Stakeholder Engagement Positively Affects Integrated Reporting Disclosure

The board size as a moderating variable with the relationship between stakeholder engagement and integrated reporting disclosure in this study were shown with a P-Value of 0.005 and a T-Statistic of 2.812. The significance value indicates less than the standard significance of P-Value<0.005 (0.005<0.05). Then it can be concluded that the variables of board size as moderating with the relationship between stakeholder engagement and integrated reporting disclosure have a significant negative influence on integrated reporting (Y).

This is contrary to the perspective of stakeholders theory that the exploration of elements of <IR>on the reporting of companies that can be interpreted as the response or response of the company that arises not only from shareholders, but also from stakeholderswho demand complete and informative disclosure of information (Vitolla et al., 2020). The results of this study indicated that the higher role of board size in monitoring or supervising and managing the course of a company implemented properly, the lower for companies to be able to produce high disclosure of integrated reporting.

This is also supported by the fact that integrated reporting disclosure is still voluntary, implying that the company is not yet under a complete obligation to disclose information, in which case integrated reporting disclosure has not been supported by the role of the board of commissioners in the company. This research also showed that small boards are better at monitoring than large boards because larger boards have more difficulty reaching an agreement (Songini et al., 2021). In conclusion, small number of boards will increase the relationship of stakeholder engagement and integrated reporting disclosure, vice versa.

Conclusion

The findings show that the independent variable stakeholder engagement has no significant positive relationship with integrated reporting disclosure of manufacturing companies listed on the Indonesia Stock Exchange for the period between 2017 and 2020, based on statistical analysis and examination of the moderating role of board size in the association of stakeholder engagement on integrated reporting disclosure. The findings of this study show that stakeholders have no influence over the company's disclosure, and that other parties within the company, such as the directors, board of directors, and or other committees (which are all part of the corporate governance mechanism), have not contributed to the company's disclosure in the form of IR.

Another finding shows that the moderating variable board size has a significant but in negative effect in the association of stakeholder engagement against integrated reporting disclosure which means larger number of boards can decrease the relationship of stakeholder engagement and integrated reporting disclosure, vice versa.

The findings of this study clearly show that IR is a relatively new issue in Indonesia. As a result, the corporation has not yet paid attention to this new reporting method. Not only that, but in Indonesia, IR and even sustainability reporting are still optional, thus the company sees no reason to publish its report in accordance with a conventional integrated report or sustainability report. However, in several of the organizations in the sample, the components of an integrated report were disclosed in the annual report. This indicates that the corporation will not rule out the use of an integrated report in the future.

Future research should overcome these limitations by expanding the research sample and including observations from different years. Future research should look for better exogenous variables that are unrelated to the dependent variable integrated reporting disclosure. Finally, financial analysts, investors, and other stakeholders who interested in determining voluntary disclosure in general and integrated reporting should be interested in our findings. They're also important to standard-setters and local and international regulators, who could use them to raise information openness and comparability standards.

References

- Albitar, K., Hussainey, K., Kolade, N., & Gerged, A.M. (2020). ESG disclosure and firm performance before and after IR: The moderating role of governance mechanisms. International Journal of Accounting and Information Management, 28(3), 429–444. https://doi.org/10.1108/IJAIM-09-2019-0108

- Ara, M., & Harani, B. (2020). Integrated reporting insight: Why organisation voluntarily reports? International Journal of Scientific and Technology Research, 9(1), 3055–3069.

- Baldo, M.D. (2017). The implementation of integrating reporting <IR> in SMEs: Insights from a pioneering experience in Italy. In Meditari Accountancy Research, 25(4), 505–532.

- Bananuka, J. (2019). The adoption of integrated reporting: a developing country perspective. Journal of Financial Reporting and Accounting, 17(1), 2–23. https://doi.org/10.1108/JFRA-09-2017-0089

- Busco, C., Malafronte, I., Pereira, J., & Starita, M. G. (2019). The determinants of companies’ levels of integration: Does one size fit all? British Accounting Review, 51(3), 277–298. https://doi.org/10.1016/j.bar.2019.01.002

- Dal Maso, L., Liberatore, G., & Mazzi, F. (2017). Value Relevance of Stakeholder Engagement: The Influence of National Culture. Corporate Social Responsibility and Environmental Management, 24(1), 44–56. https://doi.org/10.1002/csr.1390

- Dilling, P.F.A., & Caykoylu, S. (2019). Determinants of companies that disclose high-quality integrated reports. Sustainability (Switzerland), 11(13). https://doi.org/10.3390/su11133744

- Fasan, M., & Mio, C. (2017). Fostering Stakeholder Engagement: The Role of Materiality Disclosure in Integrated Reporting. Business Strategy and the Environment, 26(3), 288–305. https://doi.org/10.1002/bse.1917

- Frias-Aceituno, J.V., Rodriguez-Ariza, L., & Garcia-Sanchez, I.M. (2013). The role of the board in the dissemination of integrated corporate social reporting. Corporate Social Responsibility and Environmental Management, 20(4), 219–233. https://doi.org/10.1002/csr.1294

- García-Sánchez, I.M., & Noguera-Gámez, L. (2017). Integrated Reporting and Stakeholder Engagement: The Effect on Information Asymmetry. Corporate Social Responsibility and Environmental Management, 24(5), 395–413. https://doi.org/10.1002/csr.1415

- Ghani, E.K., Jamal, J., Puspitasari, E., & Gunardi, A. (2018). Factors influencing integrated reporting practices among Malaysian public listed real property companies: A sustainable development effort. International Journal of Managerial and Financial Accounting, 10(2), 144–162. https://doi.org/10.1504/IJMFA.2018.091662

- Ghozali, I. (2014). Structural Equation Modeling, Metode Alternatif dengan Partial Least Square (PLS) (4th ed.). Badan Penerbit Universitas Diponergoro.

- Hoque, M.E. (2017). Why Company Should Adopt Integrated Reporting? International Journal of Economics and Financial Issues, 7(1), 241–248.

- Iredele, O. (2019). Examining the association between quality of integrated reports and corporate characteristics. Heliyon, 5(7). https://doi.org/10.1016/j.heliyon.2019.e01932

- Isnurhadi, I., Oktarini, K.W., Meutia, I., & Mukhtaruddin, M. (2020). Effects of Stakeholder Engagement and Corporate Governance on Integrated Reporting Disclosure. Indonesian Journal of Sustainability Accounting and Management, 4(2), 164. https://doi.org/10.28992/ijsam.v4i2.129

- Kouaib, A., Mhiri, S., & Jarboui, A. (2020). Board of directors’ effectiveness and sustainable performance: The triple bottom line. Journal of High Technology Management Research, 31(2). https://doi.org/10.1016/j.hitech.2020.100390

- Kurniawan, P.S., & Wahyuni, M.A. (2018). Integrated Reporting?: An empirical evidence from Indonesian. Jurnal Akuntansi Dan Pendidikan, 7(2), 141–155.

- Lee, K.W., & Yeo, G.H.H. (2016). The association between integrated reporting and firm valuation. Review of Quantitative Finance and Accounting, 47(4), 1221–1250. https://doi.org/10.1007/s11156-015-0536-y

- Pavlopoulos, A., Magnis, C., & Iatridis, G.E. (2019). Integrated reporting: An accounting disclosure tool for high quality financial reporting. Research in International Business and Finance, 49(May 2018), 13–40. https://doi.org/10.1016/j.ribaf.2019.02.007

- Salvioni, D.M., & Bosetti, L. (2014). Stakeholder engagement and integrated reporting: Evidence from the adoption of the IIRC Framework. Journal of Strategic and International Studies, IX(3), 78–89. https://doi.org/10.13140/RG.2.1.1099.3762

- Songini, L., Pistoni, A., Tettamanzi, P., Fratini, F., & Minutiello, V. (2021). Integrated reporting quality and BoD characteristics: an empirical analysis. In Journal of Management and Governance (Issue 0123456789). Springer US. https://doi.org/10.1007/s10997-021-09568-8

- Tiron-Tudor, A., Hurghis, R., Lacurezeanu, R., & Podoaba, L. (2020). The level of european companies’ integrated reports alignment to the <IR> framework: The role of boards’ characteristics. Sustainability (Switzerland), 12(21), 1–16. https://doi.org/10.3390/su12218777

- Vitolla, F., Raimo, N., & Rubino, M. (2020). Board characteristics and integrated reporting quality: an agency theory perspective. Corporate Social Responsibility and Environmental Management, 27(2), 1152–1163. https://doi.org/10.1002/csr.1879

- Vitolla, F., Raimo, N., Rubino, M., & Garzoni, A. (2019). How pressure from stakeholders affects integrated reporting quality. Corporate Social Responsibility and Environmental Management, 26(6), 1591–1606. https://doi.org/10.1002/csr.1850

- Vitolla, F., Raimo, N., Rubino, M., & Garzoni, A. (2020). The determinants of integrated reporting quality in financial institutions. Corporate Governance (Bingley), 20(3), 429–444. https://doi.org/10.1108/CG-07-2019-0202