Research Article: 2021 Vol: 25 Issue: 5

The Nexus between Remittances and Mobile Technology: Evidence from Southern Africa

Courage Mlambo, Mangosuthu University of Technology

Abstract

The main purpose of our study is to establish the causal linkages between remittances and mobile technology. The study drew from the fact that remittances are critical to the livelihoods of hundreds of millions of people in the developing world, and mobile technology is an emerging force shaping how people send and receive money. Evidence from the literature demonstrates that empirical findings on the nature of the relationship between remittances and mobile technology are scant or non-existent. This study, motivated by the scarcity of literature on the direction of causality between remittances and mobile technology investigated the nature of the relationship between remittances and mobile technology in selected SADC states. The study employed some panel cointegration techniques and the Dumitrescu & Hurlin (2012) to test the relationship between remittances and mobile technology in selected SADC states. Results showed that causality runs from remittances to mobile subscriptions. This shows that remittances have an impact on mobile subscriptions but not vice versa. This result shows the development impact of remittances. The analysis also showed that there is no causal relationships between unemployment and remittances. The relationship between economic development and remittances seen to be running from economic development to remittances. The study recommended that the expansion of mobile telecom infrastructure should precede any effort to expand mobile money adoption in these countries.

Introduction

Remittances are vital to the livelihoods of millions of people in low-income countries, and mobile technology is an emerging force moulding how people send and receive money (GSMA, 2019). Remittances are potentially a good source for economic development, especially for low income countries. Millions of people around the world rely on remittances, which is often used for essential household goods, food, housing, education and healthcare costs (Le, 2011; Kunze, 2017). For those living in extreme poverty or in fragile states, remittances are an important means of survival. Although remittances have become a means of survival for millions of people in Sub-Saharan Africa, the cost of sending remmitances remains excessively high (Gogo, 2019). According to the Overseas Development Institute, Africa loses close to 1.8 billion dollars each year to excessive charges on remittances to Africans by other Africans in the diaspora. When compared to all other regions in the world, sending remittances to Africa is more expensive (Hairsine, 2018; Giriyan, 2019; Pombo-van Zyl, 2020) and reducing the cost of the payments would greatly benefit the region’s residents (Ischebeck, 2020). This indicates that efforts are needed to address high transaction costs in the remittance-transmission industry.

Technology is one of the key drivers of price decline in remittance tranfers (World Bank, 2015; Ribiva, 2015). Mobile technology allows people to access remittance money from local agents, such as post offices and small shops (African Business Magazine, 2017; Rafay, 2019). People are now putting their hopes in mobile technology as a way of reducing fees and making it better for people to send and receive remittance money across Africa's borders (Hairsine, 2018). This is based on the view that if appropriately utilised, the proliferation of mobile money can help strengthen and sustain remittances flows (Vota, 2018). Mobile technology is well placed to serve the needs of low-income migrants, as it is specifically suitable for low-value remittances. Mobile money has progressed into a complex value scheme that is influencing how people send and receive remittances and offering a fundamental source of income for millions of migrants and their families (Lopez, 2019). The growth of this mobile technology sector will benefit the remittance market, making payments faster, more convenient, more secure and more accessible to underserved people.

Unfortunately, remittances are far from an effective tool for development and inclusiveness (United Nations Economic and Social Commission for Asia and the Pacific, 2019). This is because of their transaction charges, which are untenably high. Because of its reach, cost efficiency and increasing use among underserved people, mobile money is distinctively placed to change official remittance markets and to promote financial inclusion. Mobile money has, consequently, made itself a vital instrument for expediting remittance transfers, while decreasing remittance costs and exploiting the effect of remittances on growth (GSMA, 2019; Bhana, 2020). It is claimed that using mobile money is, on average, more than 50 percent cheaper than using global money transfer operators (GSMA, 2016; Vota, 2018). Reduced remittance transfer costs can immediately transform into extra income for remittance receivers (Vota, 2018). Now, a digital channel for remittances might possibly remove the need for expensive agent linkages and physical agent locations by arriving straight to a customer’s computer, laptop or mobile device of choice (Palomas, 2018). Mobile money is reforming the international remittance industry by leveraging broad mobile penetration and the asset-light business models of mobile operators (GSMA, 2016).

Mobile technology has the capability to transform the remittances market in Southern Africa, reducing costs and enabling the move away from uncontrolled and cash-based remittance systems towards organised, digital systems (Kachingwe & Nicoli, 2019). Sending money within Southern Africa, for instance, costs an average of 14.6% of the value of the money sent – the highest rate in the world (Africa Business Magazine, 2017; Kachingwe & Nicoli, 2019; BBC, 2020). Relative to the low incomes of migrant workers, such high costs can be prohibitive (World Bank Group, 2018). Mobile remittances have a high growth potential as they provide an easy, faster and cheap way of remitting money. This study attempts to examine the causal relationship between remittances and mobile technology in selected Southern African states. The idea of causal relationship emanates from the fact that financial innovation such as mobile money can stimulate remittance inflows and remittances can also influence mobile technology (Bair & Tritah, 2019; Olayungbo & Quadri, 2019). Remittance can also be used by households to acquire goods such as food, shelter and mobile phones (Chamatirn, 2014; Randazzo & Piracha, 2014). This may then attract remittances because many people will be making use of mobile technology. This may suggest that there could be a causal relationship between remittances and mobile technology.

This study, motivated by the scarcity of literature on the direction of causality between remittances and mobile technology investigated the nature of the relationship between remittances and mobile technology in selected SADC states. To the best of this study’s knowledge there is no known study which has investigated the causal relationship between remittances and mobile technology in SADC countries. This study is therefore intended to make contributions to the limited literature on remittances and mobile technology.

Literature Review

The novelty of mobile money and its recent introduction in many countries means few studies have examined the economics of mobile money (Aron, 2018). Let alone the causal relationship between remittances and mobile technology. This study, motivated by the scarcity of literature on the direction of causality between remittances and mobile technology investigated the nature of the relationship between remittances and mobile technology in selected SADC states.

Kumar (2012) explored the interactive effects of remittances, financial development and ICT in Sub-Saharan Africa. Results from the study showed that ICT contribute positively to financial development and remittance transfers. The study concluded that there was a need for link the remittance market with ICT services in order to promote financial development and remittance transfers. Seifallah & Goaied (2013) showed that the interface between ICT diffusion and financial development is positive and it also contributed significantly to economic growth. Kumar (2014) examined the relationship between remittance inflows, remittances interaction with financial development and ICT, trade openness and overseas development assistance (ODA) vis-à-vis income. The study concluded that exploiting benefits from mobile network systems, and assessing remittance transfer fees via banking systems would be ideal for scaling up ICT, and safeguarding better financial inclusion and sustainability of remittance transfers. Jayaraman et al. (2019) investigated the role of ICT as a contingency factor in remittances transfer in Cambodia, Laos and Vietnam. The results showed that ICT had a positive influence on remittance transfers.

Simplice, Asongu & Odhiambo (2020) examined the role of ICT on remittances for industrialisation in a panel of 49 African countries for the period 1980-2014. Their study showed that mobile phone penetration contributed positively to remittance transfers and internet penetration also had a positive relationship with remittance transfers. Makun & Jayaraman (2020) examined the role of ICT as a factor in Indonesia’s financial sector development, remittances, and economic growth nexus using annual data from 1984-2017. The results from the study showed that ICT made a significant contribution to the remittance-growth interconnection by playing a supporting role in financial sector development.

Several studies have attempted to explained the channels with which ICT can improve remittance transfers. Mobile phones and Internet technology can help reduce the cost and effort associated with sending money back home (Kunze, 2017; Aron & Muellbauer, 2019; Ru?hmann et al., 2020; Gundaniya, 2020). The average cost of remittances sent through mobile money tends to be much lower than those sent through other channels, and the remittance transfers also tend to be more frequent (Scharwatt, 2019). This shows that in order to make the best use of formal remittance effect, the remittance transfer charges needs to drop to encourage higher formal remittance transfers. This does not only include a reduction in the remittances transfer costs but also increased access for underserved people (Cooper et al., 2018). The lower the remittance transfer costs, the higher the volume of remittance transfers (Hahm et al., 2019) which in turn will help to drive take-up of digital remittances (TechnoServe, 2016). A study by Munyegera & Matsumoto (2016) showed that mobile user households are more likely to receive remittances more frequently, and the total value received is significantly higher than that of non-user households.

The extensive use of mobile phone in developing countries has opened new prospects to send and receive money cheaply and make low-value payments, including for people without bank accounts (UNCTAD, 2014). Hahm et al. (2019) concur and argue that the main advantage of mobile technology money transfers is that no formal bank account is required to send or receive money, making it available to a larger share of the population. Established mobile money structures and the records they produce help foster the formalisation of the economy, incorporating informal sector users into business systems (Aron & Muellbauer, 2019). Other studies have found that financial inclusion through access to mobile money increases the willingness of individuals to remit cash (Blumenstock et al., 2011; Batista & Vicente, 2012; TechnoServe, 2016; Mothobi & Grzybowski, 2019). Another advantage that comes along with using mobile technology is speed. Where alternative channels such as banks can take up to a few days to transfer money, the mobile technology platforms take significantly shorter time. Moreover, it also permits the users to select the option of express delivery method that further speeds up the transfer process (Gundiya, 2020).

The above discussion showed that mobile technology is believed to play a pivotal role in the remittance sending process. Remittances are assumed to play an important role in the development process which then leads to a building of the mobile technology system. In this way, a causal relationship is established between remittances and mobile technology. Remittances have a welfare enhancing effect, particularly when they support consumption, capital investment, education and human development, entrepreneurship and poverty reduction efforts (Ratha, 2007; Buch & Kuckulenz, 2010; Kumar & Vu, 2014). Remittance can be used by households to acquire goods such as food, shelter and mobile phones. This may then attract remittances because many people will be making use of financial innovation. From this, a causal relationship can be stablished; remittances through their development potential allow people to buy essential items such as cell phones (Chamatirn, 2014; Randazzo & Piracha, 2014; Fanta, 2016) and the increase use of mobile technology making it easier to send and receive remittances and leading to an increase in remittance flows.

However, it must be noted that the relationship between remittances and mobile technology is complex in developing countries. Part of the reason for this is that there are factors hindering mobile payments players from offering superior-value propositions. These factors include telecommunications infrastructure, regulatory challenges, financial illiteracy and several other factors. McAuliffe (2020) argue that mobile money platforms have made the transfer of remittances cheaper and faster than other services and have become especially vital during the COVID 19 pandemic, but ICT accessibility remains a challenge. Munyegera and Matsumoto (2014) argues that the efficiency of this remittance system heavily relies on the quality of physical infrastructure. Safahi (2018) note that even with the demand from their customers, most money transfer operators (MTOs) are unable to develop the requisite technological infrastructure to facilitate meaningful business scaling, with most of their resources going towards overhead compliance instead.

Without a digital financial infrastructure and formal identification in the last mile, as is the case across much of Africa, many of the new business models and potential benefits offered by new technologies cannot be realised (Isaacs et al., 2017). It can thus be said that improving digital infrastructure is a pre-cursor to increasing financial inclusion levels, which in turn will help to drive take-up of digital remittances (TechnoServe, 2016). Apart from infrastructure, there are also other issues that need to be addressed. These are consumer protection, registration and transaction limits, regulatory challenges and interoperability, meaning interconnection between telecommunication networks. (UNCTAD, 2012; Pramanik, 2017 Isaac et al., 2017). The Payments Association of South Africa has identified interoperability and integration as some of the biggest factors obstructing remittance payments (Naik, 2018). Lacking any of these dimensions would explain why migrants would still consider using traditional remittance providers over fintech companies (United Nations Economic and Social Commission for Asia and the (Pacific, 2019).

Methodology

Data Sources and Model Specification

This study used secondary quantitative data to achieve its objective. The study employed a balanced panel of 5 SADC countries for the period 2005–2018. The sample countries are: DRC, Eswatini, Lesotho, Mozambique and Zimbabwe. The choice of sample countries is purely governed by data availability and also by the ratio of remittances to GDP. DRC, Eswatini, Lesotho, Mozambique and Zimbabwe have high volumes of remittances. Data was sourced from the World Bank.

The study adopted Olayungbo & Quadri (2019) model. Olayungbo & Quadri (2019) tested the causal relationship between remittances, economic growth and technology. The variables to be included in the study are displayed in Table 1 below.

| Table 1 Summary of Variable Description |

||

| Variable | Description and Unit of Measurement | Source |

|---|---|---|

| UN | Unemployment. | World Bank |

| MS | Mobile subscriptions. | World Bank |

| REM | Remittance flows | World Bank |

| GDPG | GDP per capita | World Bank |

Estimation Procedures

This study follows the three-step methodology which was suggested by (Bayar & Gavriletea, 2018; Samadi, 2019). The first step tests for cross sectional dependence, the second step tests for unit root based on the results from the cross-dependence tests. The third step tests for causality among the variables. The empirical strategy used in this paper can be divided into four main stages. First, unit root tests in panel series are undertaken. Second, if they are integrated of the same order, the Co-integration tests are used. Third, if the series are co-integrated, the vector of Co-integration in the long-term is estimated using the methods (FMOLS) and (DOLS).

Stationarity and Cross Dependence

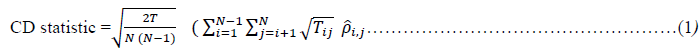

Before proceeding with the causality analysis, a number of pre-tests are required to determine appropriate test methods. These tests are cross- section dependence and the stationary of the series. Y?ld?r?m & Balan (2018) argued that before conducting the causality test between the variables of interest, it is necessary to perform cross- section dependency and unit root tests. Ignoring the problem of cross dependence can create considerable difficulty for the unit root test, and may lead to inaccurate estimates and biased standard errors (Rana et al., 2018). In order to test whether the variable series have the cross-sectional dependence or not the CD test developed by Pesaran (2004) was used. The Pesaran CD test statistics for balanced panel data is in the form of eq. (i)

where Tij = # (Ti ∩ Tj) (i.e., the number of common time-series observations between units i and j) (Hoyos and Sarafidis, 2006). If a CD test statistic at a certain significant level is higher than the critical value of the normal standard distribution, it means that the null hypothesis is rejected and the Cross-Sectional dependence is concluded. Otherwise, there will be cross-sectional independence (Pesaran cited in Samada, 2019).

The second step was to test for unit root. In order to determine the causality relationship between variables using the test of Dumitrescu & Hurlin (2012), the panel variables should be stationary (Zeren & Ari, 2013). Because panel causality analysis using time-series data which are non-stationary, produces biased results. Moreover, determining integration levels of the series are as crucial as stationary of the series. For this reason, the study had to perform stationarity tests using the panel unit root test. The type of unit root test to be adopted in panel data analyses, depends on the cross-sectional dependence test results. For example, if cross dependence is not detected, the first generation unit root tests are used and if cross dependence is detected the second generation unit root tests are used (Hipotezi & Analizi, 2018; Bo?Lu?Kbas? et al., 2018).

DOLS and FMOLS

This study applied both the Fully Modified Ordinary Least Squares (FMOLS) and the Dynamic Ordinary Least Squares (DOLS) techniques to estimate the long-run parameters.

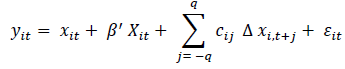

DOLS

Kao & Chiang (2000) propose a panel dynamic OLS estimator (DOLS) which is a generalisation of the method originally proposed by Saikkonen (1991) and Stock & Watson (1993) for time series regressions. The regression equation is:

where Xit is a vector of explanatory variables, β the estimated long-run impact, q the number of leads and lags of the first-differenced data, and cij the associated parameters. The estimator assumes cross-sectional independence and is asymptotically normally distributed. The authors provide Monte Carlo results suggesting that the finite-sample properties of the DOLS estimator are superior to both fully-modified OLS (FMOLS) and OLS estimators (Martins, 2011)

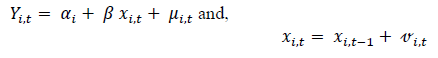

FMOLS

The FMOLS allows consistent and efficient estimation of cointegratioin vector and at same time it addresses the problem of nonstationary regressors, as well as the problem of simultaneity biases in the heterogenous cointegrated panels. The OLS estimation is not as powerful as FMOLS and it yields biased results in regressors that are endogenously determined in the I(1) cases.

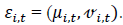

Where, αi allows for the country specific fixed effects, β is a cointegrating vector if Yi,t is integrated of order 1. At the same time, the vector error process

Panel Cointegration Analysis

This study employed two of panel Cointegration tests: (Pedroni’s, 2004; Kao’s, 1999). The most popular test in panel cointegrating test is Pedroni test (Bidirici & Ruhir, 2015). The Pedroni test is an Engle-Granger (1987) cointegration test that is based on an examination of the residuals of a spurious regression performed using I (1) variables. If the variables are cointegrated then the residuals should be I (0). On the other hand, if the variables are not cointegrated then the residuals will be I (1). Kao (1999) uses both DF and ADF to test for cointegation in panel as well as this test similar to the standard approach adopted in the EG-step procedures (Chaiboonsri et al., 2010).

Dumitrescu and Hurlin Causality Test

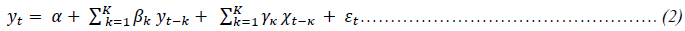

This study sought to establish the causal relationship between remittances and mobile technology. The idea of causal relationship stems from the fact technology can motivate remittance inflows. Remittance can also be used by households to acquire goods such as food, shelter and mobile phones (Chamatirn, 2014; Randazzo & Piracha, 2014). This may then attract remittances because many people will be making use of mobile technology. This may suggest that there could be a causal relationship between remittances and mobile technology. A causality analysis was, therefore, conducted in order to examine whether there was a relationsip between remittances and mobile technology. in order to do this, the study used the Dumitrescu & Hurlin (2012) test. Dumitrescu & Hurlin (2012) proposed a similar bivariate testing procedure to Granger (1969) causality test in a panel setting. In a seminal paper, Granger (1969) developed a methodology for analyzing the causal relationships between time series. Suppose xt and yt are two stationary series. Then the following model:

Can be used to test whether x causes y. The basic idea is that if past values of x are significant predictors of the current value of y even when past values of y have been included in the model, then x exerts a causal influence on y (Lopez & Weber, 2017). Dumitrescu & Hurlin (2012) proposed a similar bivariate testing procedure to Granger (1969) causality test in a panel setting. The underlying regression writes as follows:

where xi,t and yi,t are the observations of two stationary variables for individual i in period t. Coefficients are allowed to differ across individuals but are assumed time- invariant (Lopez & Weber, 2017). This test takes into account (i) the heterogeneity of the regression model used to test the Granger causality test and (ii) heterogeneity of the causality relationships over the cross-section dimension under the null hypothesis that there is no causal relationship for any of the units of the panel (i.e., homogeneous non-causality) (Babayemi et al., 2019). the Monte Carlo simulations show that even under the conditions of cross-sectional dependency, this test can produce strong results (Liddle & Messinis, 2013; Akbas et al., 2013; Desterk, 2016; Sener & Delican, 2019). Furthermore, the test can be used it can also be used when T>N and when N>T (Akbas et al., 2013; Bo?Lu?Kbas? et al., 2018; Sener & Delican, 2019). However, this approach does not account for “Nickell” bias, and therefore, it is theoretically justified only for sequences with N/T2→0N/T2→0, as it is the case with standard Mean-Group type approaches (Juodis et al., 2021).

Presentation of Results

Cross dependence test

The Cross-Dependence test was performed and the results are shown in Table 2 below.

| Table 2 Cross Dependence Test |

|||

| Test | Statistic | df | Prob |

|---|---|---|---|

| Breusch-Pagan LM | 140.4228 | 78 | 0.0835 |

| Pesaran CD | 4.4561 | 0.2934 | |

Results show that the null hypothesis which states that there is no dependency between cross sections is not rejected at 5% significance level. Both p-values of the Breusch-Pagan LM (0.0835) and Pesaran CD (0.2934) are higher than 0.05 and this suggests that the null hypothesis cannot be rejected. This shows that a shock in one of the countries involved in the study does not affect the other countries.

Panel Unit Root Test

The study performed 2 first generation unit root tests; the Levin, Lin & Chu and the Lm, Pesaran and Shin. Results from these two tests are displayed in Table 3 below.

| Table 3 Unit Root Tests |

||||

| Variable | Levin, Lin & Chu | Lm, Pesaran and Shin W-stat | ||

|---|---|---|---|---|

| Stat. | Prob | Stat | Prob | |

| REM | -1.13455 | 0.1283 | -0.55644 | 0.7110 |

| 1st diff | -2.18151 | 0.0146 | -1.41923 | 0.0379 |

| UN | -1.70132 | 0.0444 | 0.30461 | 0.6197 |

| 1st diff | - | - | 1.4822 | 0.0261 |

| MS | -4.23034 | 0.0000 | -3.11557 | 0.0000 |

| - | - | - | - | - |

| GDPG | 6.632760 | 0.0000 | -1.67796 | 0.0367 |

| - | - | - | - | - |

Results from the unit root tests show that all test reveal that MS and GDPG were stationary at levels. Both tests also show that REM had unit root at levels and became stationary after being differenced once. However, for UN the Levin test showed that UN was stationary at levels but this was not the case for the Lm, Pesaran and Shin test; it showed that UN had unit at levels. The UN variable became stationary at first difference.The first difference of the variables were used for the causality analysis as suggested by (Zeren & Ari, 2013; Gui-Diby & Mosle, 2017).

Panel Cointegration

Having found that all variables in question are integrated of order one (I(1)), we then proceed to test whether a long-run relationship exists between them.

| Table 4 Pedroni Cointergration Test |

|

| Cointergration test | Intercept |

| Prob. | |

| Panel v-statistic | |

| 0.0003 | |

| Panel rho?statistic | 0.0000 |

| Panel PP?statistic | 0.0000 |

| Panel ADF?statistic | 0.0007 |

| Group Panel rho?statistic | 0.0000 |

| Group PP?statistic | 0.7809 |

| Group ADF?statistic | 0.0003 |

Results show that four of the four panel test statistics and two of the three group test statistics suggest that there is a panel cointegration. It can thus be said that the Pedroni test finds that there is a long run association amongst the variables under investigation. The Kao Test was performed to affirm the Pedroni Test. Results are shown in Table

| Table 5 KAO Residual Cointegration Test |

||

| ADF | t-statistic | Prob |

| -5.6482 | 0.0000 | |

The results show that the Kao’s (1999) residual panel cointegration test fails to accept the null of no cointegration at 5% significance level. Thus, given that the two tests (Pedroni and Kao) suggest panel cointegration in most cases, it is safe to say that that there is cointegration amongst the variables.

Panel Causality Results

Granger causality tests in panel data give no information on the sign of this causal relationship (Raffinot & Venet, 2017). In order to have a cursory of the strength of association between the variables under investigation, a correlation test was performed. Results are showed in Table 6 below.

| Table 6 Correlation Results |

||||

| REM | MS | UN | GDPG | |

|---|---|---|---|---|

| REM | 1.00000 | 0.44968 | -0.15189 | 0.39671 |

| MS | 0.44968 | 1.00000 | 0.29110 | 0.16930 |

| UN | -0.15189 | 0.29110 | 1.00000 | -0.13178 |

| GDPG | 0.39671 | 0.16930 | -0.13178 | 1.0000 |

Table 6 shows that the correlation coefficients do not show a strong relationship among the variables. The results also show that MS and GDPG have positive relationship with REM. the correlation coefficient turned out to be 0.449 and 0.396 respectively. The relationship between UN and Rem was negative. The correlation coefficient turned out to be -0.1518. However, seeing two variables moving together does not necessarily mean we know whether one variable causes the other to occur. The study had to perform a DOLS and FMOLS for estimation purposes. Results are shown in Table 7 and Table 8 below.

| Table 7 DOLS Results (Dependent Variable: MS) |

||||

| Variable | Coefficient | Std Error | t-statistic | Prob |

|---|---|---|---|---|

| GDPG | 0.016921 | 0.001297 | 13.04820 | 0.0000 |

| REM | 0.209213 | 0.056690 | 3.690452 | 0.0007 |

| UN | 0.208532 | 0.260424 | 0.800741 | 0.4285 |

| Table 8 FMOLS Results (Dependent Variable: MS) |

||||

| Variable | Coefficient | Std Error | t-statistic | Prob |

|---|---|---|---|---|

| GDPG | 0.012762 | 0.006434 | 1.983574 | 0.0514 |

| REM | 0.427034 | 0.0233385 | 18.26106 | 0.0000 |

| UN | -0.036351 | 0.007654 | -4.749049 | 0.0000 |

Results from Table 7 and Table 8 show that REM have a significant and positive relationship with MS. This is in line with literature. If remittances are considered as resources that could potentially be used for investment purposes, ICT can help in the reduction of informational rents that constraint the doing of business (Asongu & Biekpe, 2020). The findings of the study reveal that ICT has indeed emerged as a significant factor in the remittance-growth nexus by playing a complementary role in financial sector development (Makun & Jayaraman, 2020).Results also show that there is a positive relationship between GDPG and MS. This may suggest that when there is an increase in income, the number of mobile subscriptions increase. The results are in line with Diacon & Maha’s (2015) findings. Diacon and Maha (2015) showed that there is a positive relationship between income, consumption and GDP in low-income countries. Results from the DOLS model show that there is an insignificant relationship between UN and MS. However, the FMOLS results displayed in Table 8 show that there is a negative relationship between unemployment and REM. Results from the Dumitrescu & Hurlin (2012) causality test are displayed in Table 8 below.

| Table 9 Causality Results |

|||

| Null Hypothesis | Obs | F-statistic | Prob |

|---|---|---|---|

| MS does not Granger Cause REM REM does not Granger Cause MS |

42 | 1.02336 3.12278 |

0.3693 0.0358 |

| UN does not Granger Cause REM REM does not Granger Cause UN |

42 | 1.68931 0.58564 |

0.1986 0.5618 |

| GDPG does not Granger Cause REM REM does not Granger Cause GDPG |

42 | 2.54120 2.43274 |

0.0224 0.1017 |

*, ** & *** denote a rejection of null hypothesis at 10%, 5% & 1% significance level, respectively.

The hypothesis that MS (Mobile subscriptions) does not Granger cause REM (Remittances) cannot be rejected. This is because the p-value of 0.3693 is greater than the 5% p-value of significance. Results also show that the study can reject the hypothesis that REM does not Granger cause MS. This is shown by the p-value which is less than 0.05 (0.0358). The analysis also show that there are no causal relationships between UN (unemployment) and REM (remittances) as the null hypothesis cannot be rejected. The p-value for both hypotheses turned out to be 0.1986 and 0.5618 respectively. They are all above the 5% p-value of significance and this results in the null hypotheses being not rejected. The analysis in Table 1 show that the hypothesis that GDPG (GDP per capita) does not Granger cause REM (Remittances) can be rejected. This is because the p-value of 0.0224 is smaller than the 5% p-value of significance. Results also show that the study cannot reject the hypothesis that REM does not Granger cause GDPG. This is shown by the p-value which is more than 0.05 (0.1017).

Discussion of Results

The results showed that the relationship between REM and MS runs one way; from REM to MS. This finding is also in line with Fanta (2016) who showed that in SADCthere is a strong link between remittances and mobile money adoption. Most countries that have a higher level of remittances exhibit higher levels of mobile money adoption. A study by Batista & Vicente (2019) also showed that an increase in the migrant remittances households was met with increased access to mobile money services. There reason why mobile money is not causing remittances may be because of the fact that the Southern African mobile money market is much less mature (Du, 2019), and there is a regulatory vacuum in the mobile money market (Fikre, 2018). Lack of telecommunications Infrastructure also limits mobile money service providers’ growth (Isaacs et al., 2017; Asongu, 2018, Du, 2019). A 2016 GSMA report cited high costs of mobile connectivity, lack of relevant local content, and high digital illiteracy levels as barriers for mobile penetration in the rural areas of Africa (GSMA, 2016). Furthermore, the combined global market share of digital disruptors remains small; and in Southern Africa (Kachingwe & Nicoli, 2019). It is important to stress that, as is the case with mobile money accounts, a sizeable proportion of mobile money agents are inactive and therefore may not be effective in supporting the capturing and disbursement of remittances (World Bank Group, 2018).

The analysis also showed that there are no causal relationships between UN (unemployment) and REM (remittances) as the null hypothesis cannot be rejected. The results are inconsistent with the Gagnon & Khoudour-Casteras (2011) who argued that there was an inverse relationship between remittances and unemployment. In other words, the greater the drop in remittances, the higher was the increase in the unemployment rate. However, this study’s outcome supports the findings of Azizzi (2018) confirmed that remittances but do not affect the male labor force participation rate. Jackman (2014) also found that there is no statistically significant relationship between remittances and unemployment. This may be true in SADC because the amount of remittances sent might not be enough to affect the recipient’s employment situation. the average annual remittance for those that do remit is between R6 500 and R4 500 per year (Finmark Trust, 2017). This is way too small to influence one to make an employment decision.

The results showed that the relationship between REM and GDPG runs one way. This show the relationship runs one way: from GDPG to remittances. In other words, the level of economic development influences the flow of remittances. Remittance flows were not seen to be influencing GDP per capita. This is consistent with David (2013) who found that while remittances did seem to have a positive effect on both economic growth and GDP the coefficients where primarily insignificant. Fajnzylber & Lo?pez (2008) had earlier stated that the effect of remittances on economic development is conditional: remittances have more positive effects on growth in better policy contexts—encompassing more stable macroeconomic regimes, better institutional quality, and higher levels of human capital.

Conclusion

The main purpose of our study is to establish the causal linkages between remittances and ICT. A causality analysis was carried out in order to assess whether there is any potential predictability power of one indicator for the other. Evidence from the literature demonstrates that empirical findings on the nature of the relationship between remittances and mobile technology are scant or non-existent. This study, motivated by the scarcity of literature on the direction of causality between remittances and mobile technology investigated the nature of the relationship between remittances and mobile technology in selected SADC states.

The analysis also showed that there is no causal relationships between unemployment and remittances. The relationship between economic development and remittances seen to be running from economic development to remittances. Results also showed that causality runs from remittances to mobile subscriptions. This shows that remittances have an impact on mobile subscriptions but not vice versa. This result shows the development impact of remittances. The result also show how the Southern African market is failing to benefit from benefits presented by mobile technology. This inability of the Southern African market to reap the benefits of mobile technology is being caused by the poor telecommunications infrastructure, poor financial awareness and absence of business-friendly legislation. These problems may have limited the uptake of domestic digital payments. There is therefore a need for the establishment of mechanism and environments that make it easy for mobile companies to develop mobile infrastructure. Furthermore, establishing an enabling regulatory atmosphere around mobile money-enabled remittances will be vital to affect significant change.

References

- Acharya, C., & León-González, R. (2018). Remittances, Human Capital, and Economic Growth: Panel Data Evidence from Asia and Sub-Saharan Africa. file:///C:/Users/Admin/Downloads/DP18-01.pdf

- African Business Magazine. (2017). Fintech can cut remittance costs to a fraction. African Business. https://africanbusinessmagazine.com/african-banker/fintech-can-cut-remittance-costs-fraction/

- Akbas, Y., Senturk, M., & Sancar, C. (2013). Testing for Causality between the Foreign Direct Investment, Current Account Deficit, GDP and Total Credit: Evidence from G7. https://panoeconomicus.org/index.php/jorunal/article/view/82

- Aron, J. (2018). Mobile Money and the Economy: A Review of the Evidence. https://academic.oup.com/wbro/article/33/2/135/5127166

- Aron, J., & Muellbauer, J. (2019). The Economics of Mobile Money: harnessing the transformative power of technology to benefit the global poor. https://www.oxfordmartin.ox.ac.uk/downloads/May 19-OMS-Policy-Paper-Mobile-Money-Aron-Muellbauer.pdf

- Arouri, M.E., & Rault, C. (2014). An Econometric Analysis of the Impact of Oil Prices on Stock Markets in Gulf Cooperation Countries. https://www.sciencedirect.com/science/article/pii/B9780124115491000089?via%3Dihub

- Asongu, S.A. (2018). Conditional determinants of mobile phones penetration and mobile banking in Sub Saharan Africa. Journal of the Knowledge Economy, 9(1), 81–135. https://doi.org/10.1007/s13132-015-0322-z

- Asongu, S., Biekpe, N., & Tchamyou, N. (2018). Remittances, ICT and Doing Business in Sub-Saharan Africa. https://mpra.ub.uni-muenchen.de/88513/1/MPRA_paper_88513.pdf

- Azizzi, S. (2018). The impacts of workers' remittances on human capital and labor supply in developing countries. https://www.sciencedirect.com/science/article/pii/S0264999318302542

- Babayemi, A.W., Asare, B.K., Gulumbe S.U., & Onwuka, G.I. (2019). Panel Causality between Financial Development and Economic Growth in Africa. https://www.semanticscholar.org/paper/Panel-Causality-between-Financial-Development-and-BabayemiA.W./e6396c53b1097e5aeaab68b85816b579d3db1114

- Bai, J., & Ng, S. (2010). Panel Unit Root Tests with Cross-Section Dependence: A Further Investigation. Econometric Theory, 26, 2010, 1088–1114.

- Bair, S., & Tritah, A. (2019). Mobile Money and Inter-Household Financial Flows: Evidence from Madagascar. https://www.cairn.info/revue-economique-2019-5-page-847.htm

- Batista, C., & Vicente, P.C. (2019). Is Mobile Money Changing Rural Africa? Evidence from a Field Experiment. https://econpapers.repec.org/paper/unlnovafr/wp1805.htm

- Batista, C., & Vicente, P.C. (2012). Introducing Mobile Money in Rural Mozambique: Evidence from a Field Experiment. Nova Africa. 2012. Available online: https://doi.org/10.2139/ssrn.2384561

- Bayar, Y., & Gavriletea, M.D. (2018). Foreign Direct Investment Inflows and Financial Development in Central and Eastern European Union Countries: A Panel Cointegration and Causality. https://www.mdpi.com/2227-7072/6/2/55/htm

- BBC. (2020). Africa 'could lose $37bn in remittances'. https://www.bbc.com/news/live/world africa-47639452

- Bhana, D. (2020). Dematerialized transactions: An ecosystem to be regulated and secured. https://www.globalvoicegroup.com/dematerialized-transactions-an-ecosystem-to-be-regulated-and-secured/

- Bidirici, M., & Ruhir, E. (2015). Design and Economic Growth: Panel Cointegration and Causality. Procedia - Social and Behavioral Sciences, 210, 193-202.

- Blumenstock, J., Eagle, N., & Fafchamps, M. (2011). Risk Sharing over the Mobile Phone Network: Evidence from Rwanda. Available online: bhttps://aae.wisc.edu/mwiedc/papers/2011/blumenstock_joshua.pdf

- Bo?Lu?Kbas?, M., Topal, M.H., & Hotunluog? Lu, H. (2018). Testing Twin Deficits Hypothesis for Eu 27 And Turkey: A Panel Granger Causality Approach Under Cross-Sectional Dependence. http://www.ipe.ro/rjef/rjef4_18/rjef4_2018p101-119.pdf

- Chaiboonsri, C., Jittaporr, S., Thanes, S., & Songsak, S. (2010). A panel cointegration analysis: An application to international tourism demand of Thailand. https://ideas.repec.org/a/pet/annals/v10y2010i3p69-86.html

- Chamarttin, G.M. (2014). The Effective Use of Remittances in Promoting Economic Development. https://www.un.org/en/development/desa/policy/publications/general_assembly/eitconference/2aprpm_moreno.pdf

- Cooper, B, Denoon-Stevens, C., Peter, R.T., & Esser, A. (2018). Where are the flows? Exploring barriers to remittances in sub-Saharan Africa. https://cenfri.org/publications/where-are-the-flows/

- David, T. (2013). Remittances and Economic Development. https://opensiuc.lib.siu.edu/cgi/viewcontent.cgi?article=1492&context=gs_rp

- Desterk, M. (2016). The Nexus between Military Spending and Economic Growth in Newly Industrialized Countries: Panel Evidence from Cross Sectional Dependency Economic development of women. https://www.semanticscholar.org/paper/The-Nexus-between-Military-Spending-and-Economic-in-Destek/ed9a4479ffeecbad8864e31c7ac5f5d545f8d948

- Diacon, P., & Maha, L. (2015). The Relationship between Income, Consumption and GDP: A Time Series, Cross-Country Analysis. https://www.sciencedirect.com/science/article/pii/S2212567115003743

- Du, L. (2019). Can Mobile Money Boost Financial Inclusion in Southern Africa? https://insights.som.yale.edu/insights/can-mobile-money-boost-financial-inclusion-in-southern-africa

- Fajnzylber, P., & Lo?pez, J.H. (2008). Remittances and Development: The Development Impact of Remittances in Latin America. https://www.oecd.org/dev/americas/42716118.pdf

- Fanta, B.A. (2016). The role of mobile money in financial inclusion in the SADC region: Evidence using FinScope Surveys. https://www.finmark.org.za/wpcontent/uploads/2016/12/mobile-money-and-financial-inclusion-in-sadc.pdf

- Fikre, M. (2018). Digital Finance in Africa’s Future: Mobile financial services: unnoticed vulnerability issues. https://www.up.ac.za/media/shared/17/PdF%20Documents/digital finance-in-africa-desktop.zp180976.pdf

- Finmark Trust. (2016). Fact Sheet Remittances from South Africa to SADC. https://www.finmark.org.za/wp-content/uploads/2016/07/remittances-from-south-africa-to sadc.pdf

- Fuinhas, J.A., Marques, A.C., & Couto, A.P. (2019). Oil-Growth Nexus in Oil Producing Countries: Macro Panel Evidence. https://www.econjournals.com/index.php/ijeep/article/view/990

- Gagnon, J., & Khoudour-Casteras, D. (2011). Global Economic Crisis and the Remittance-Unemployment Riddle. https://blogs.worldbank.org/peoplemove/global-economic-crisis-and-the-remittance-unemployment-riddle

- Giriyan, S. (2019). Remittance and migration trends within Africa. https://www.finextra.com/blogposting/17946/remittance-and-migration-trends-within-africa

- Gogo, J. (2019). Crypto-Based Transfers Can Cut Remittance Costs in Africa by 90%. https://news.bitcoin.com/crypto-based-transfers-can-cut-remittance-costs-in-africa-by-90/

- GSM Association (GSMA). (2016). The mobile economy: Africa 2016.London: GSMA. https://www.africanbusinesscentral.com/wp-content/uploads/2016/08/Mobile-Economy-Africa-2016-GSMA.pdf

- GSMA. (2016). Driving a price revolution: Mobile money in international remittances. https://www.gsma.com/mobilefordevelopment/resources/driving-a-price-revolution-mobile-money-in-international-remittances/

- GSMA. (2019). Mobile Money and International Remittances. https://www.gsma.com/mobilefordevelopment/mobile-money-international-remittances/

- Gui-Dib, S.L., & Mosle., S. (2017). Governance and Development Outcomes: Re-Assessing the two-way causality. https://www.unescap.org/sites/default/files/publications/WP-17 09_Governance%20and%20Development%20Outcomes.pdf

- Gundaniya, N. (2020.) How did FinTech transformed international remittance? https://www.digipay.guru/blog/fintech-impact-on-international-remittance/

- Hahm, H., Subhanij, T., & Almeid, R. (2019). Finteching remittances in Paradise: a path to sustainable development. https://www.unescap.org/sites/default/files/publications/WP-19-08%20Fintech%20and%20Remittance%20Paper.pdf

- Hairsine, K. (2018). Africa loses billions due to high cost of remittances. https://www.dw.com/en/africa-loses-billions-due-to-high-cost-of-remittances/a-43506362

- Hipotezi, P.Y., & Analizi, V. (2018). The Hypothesis of Neutrality of Money: Panel Data Analysis. https://pdfs.semanticscholar.org/5431/39727a6f242bdbbcc738ef51dc9ad5311caa.pdf?_ga=2.130810959.1903802308.1589217055-1192119508.1569487969

- Hoyos, R., & Sarafidis, V. (2006). Testing for Cross-Sectional Dependence in Panel-Data Models. https://journals.sagepub.com/doi/10.1177/1536867X0600600403

- Isaacs, L., Hugo, S., Boakye-Adjei, N., & Robson, G. (2017). Reducing Costs and Scaling Up UK to Africa Remittances Through Technology. https://www.fsdafrica.org/wp content/uploads/2019/08/Scaling-up-Remittances-15.06.2017_Final.pdf

- Ischebeck, J. (2020). How Will the African Remittance Market Look Like in 2025? https://africa.com/how-will-the-african-remittance-market-look-like-in-2025/

- Jackman. (2014). A Note on The Labor Market Effects of Remittances in Latin American and Caribbean Countries: Do Thresholds Exist? https://Onlinelibrary.Wiley.Com/Doi/Pdf/10.1111/Deve.12034

- Jayaraman, T.K., Thurai, M.N., & Cheong, F.N.G. (2019). ICT, As A Contingent Factor In Remittances And Growth Nexus In Cambodia, Laos And Vietnam A Panel Study: 2000-17. http://tkjayaraman.com/docs/2019/conf/2019%20_%20ICT%20as%20a%20conntingent%20factor%20in%20remittances%20and%20growth%20nexus%20in%20Cambodia,%20Laos%20and%20Vietnam%20_%202000-

- Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economics Dynamic and Control, 12, 231–254.

- Juodis, A., Karavias, Y., & Sarafidis, V. (2021). A homogeneous approach to testing for Granger non-causality in heterogeneous panels. Empirical Economics. 60, 93–112.

- Kachingwe, N., & Nicoli, M. (2019). What’s holding back digital disruption in remittances in Southern Africa? https://blogs.worldbank.org/psd/what-s-holding-back-digital-disruption-remittances-southern-africa

- Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data, Journal of Econometrics, 90, 1-44.

- Kumar, R.R. (2012). Exploring the interactive effects of remittances, financial development and ICT in Sub-Saharan Africa: an ARDL bounds approach. https://www.inderscienceonline.com/doi/abs/10.1504/AJESD.2012.049288

- Kumar, R.R. (2014). Linking remittances with financial development and ICT: a study of the Philippines. https://www.inderscience.com/info/inarticle.php?artid=54254

- Kumar, R.R., & Vu, H.T.T. (2014). Exploring the Nexus Between ICT, Remittances and Economic Growth: A Study of Vietnam. Journal of Southeast Asian Economies, 31(1), Policy Focus: Building Social Protection Systems in Southeast Asia (April 2014), 104 120.

- Kunze, J. (2017). How technology is reimagining remittances. https://www.retaildive.com/ex/mobilecommercedaily/how-technology-is-reimagining-remittances

- Ladu, M.G., & Melledu, M. (2016). Productivity, Wage and Inflation Relationship for a Sample of Developed Countries: New Evidence from Panel Cointegration Tests with Multiple Structural Breaks. https://crenos.unica.it/crenos/publications/productivity-wage-and-inflation-relationship-sample-developed-countries-new-evidence

- Le, T., & Bodman, P. (2007). Remittances or technological diffusion: Which is more important for generating economic growth in developing countries? https://econpapers.repec.org/paper/qlduqmrg6/18.htm

- Le, T. (2011). Remittances for Economic Development: the Investment Perspective. http://www.uq.edu.au/economics/mrg/4411.pdf

- Liddle, B., & Messinis, G. (2013). Which comes first—urbanization or economic growth? Evidence from heterogeneous panel causality tests. https://www.tandfonline.com/doi/abs/10.1080/13504851.2014.943877

- Lopez, L., & Weber, S. (2017). Testing for Granger causality in panel data. University of Neuchatel (Institute of Economic Research). https://www.unine.ch/files/live/sites/irene/files/shared/documents/Publications/Working%20papers/2017/WP17-03_V2.pdf

- Maddala, G.S., & Wu, S. (1999). A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics, 631–652, Special Issue.

- Makun, K., & Jayaraman, T.K. (2020). Role of ICT as a contingent factor in financial sector development, remittances, and economic growth nexus: an empirical study of Indonesia. Bulletin of Monetary Economics and Banking, 23(3). pp. 365-38

- McAuliffe, M. (2020). Digital Currency and Remittances in the Time of Covid-19. https://www.iom.int/sites/default/files/our_work/ICP/MPR/csis_remittances_africa_webinar_final_mcauliffe.pdf

- Mothobi, O., & Grzybowski, J. (2019). Infrastructure deficiencies and adoption of mobile money in Sub-Saharan Africa. https://www.sciencedirect.com/science/article/pii/S0167624516301342

- Munyegera, K.G., & Matsumoto, T. (2016). Mobile Money, Remittances, and Household Welfare: Panel Evidence from Rural Uganda. https://www.sciencedirect.com/science/article/abs/pii/S0305750X15002880

- Naik, L. (2018). Who will be the WhatsApp of remittances? https://www.itweb.co.za/content/lLn14MmyLbaMJ6Aa

- Olayungbo, D.O., & Quadri, A. (2019). Remittances, financial development and economic growth in sub-Saharan African countries: evidence from a PMG-ARDL approach. https://link.springer.com/article/10.1186/s40854-019-0122-8#auth-1

- Pedroni, P. (2004). Panel Cointegration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis, Econometric Theory, 20, 579?625

- Pombo-van Zyl, N. (2020). Intra-African remittance market set to soar in 2020. https://www.esi africa.com/industry-sectors/business-and-markets/intra-african-remittance-market-set-to soar-in-2020/

- Pramanik, A.K. (2017). The Technology That’s Making a Difference in the Developing World. https://www.usglc.org/blog/the-technology-thats-making-a-difference-in-the-developing-world/

- Rafay, A. (2019). FinTech as a Disruptive Technology for Financial Institutions. https://books.google.co.za/books?id=i_iEDwAAQBAJ&pg=PA76&lpg=PA76&dq=Fintech can+cut+remittance+costs+to+a+fraction&source=bl&ots=anPgp4_VoM&sig=ACfU3U3zd2

- Raffinot, M., & Venet, B. (2017). Low Income Countries, Credit Rationing and Debt Relief: Bye Bye International Financial Market? https://ideas.repec.org/p/hal/wpaper/hal-01489954.html

- Rana, R.H., Alam, K., & Gow, J. (2018). Health expenditure, child and maternal mortality nexus: a comparative global analysis. https://europepmc.org/article/PMC/6048901

- Randazzo, T., & Piracha, M. (2014). Remittances and Household Expenditure Behaviour in Senegal. http://ftp.iza.org/dp8106.pdf

- Rehman, F.U., Noman, A.A., & Ding, Y. (2020). Does infrastructure increase exports and reduce trade defcit? Evidence from selected South Asian countries using a new Global Infrastructure Index. https://link.springer.com/article/10.1186/s40008-020-0183-x

- Ribicca, S. (2015). Cutting the Cost of Remittances. https://www.cgap.org/blog/cutting-cost-remittances

- Ru?hmann, F., Konda, S.A., Horrocks, P., & Taka, N. (2020). Can Blockchain Technology Reduce The Cost Of Remittances? https://www.oecd-ilibrary.org/docserver/d4d6ac8f en.pdf?expires=1588869730&id=id&accname=guest&checksum=B3F2DF9085D221D1DA13B53DE7063CF8

- Sahraoui M.A., Belmokaddem, M., Guellil, M.G., & Ghouali, Y.Z. (2014). Causal Interactions between FDI, and Economic Growth: Evidence from Dynamic Panel Co-Integration. https://daneshyari.com/article/preview/981404.pdf

- Samadi, A.H. (2019). Institutions and entrepreneurship: unidirectional or bidirectional causality? https://link.springer.com/article/10.1186/s40497-018-0129-z

- Santana-Gallego, M., Ledesma-Rodri?guez, F., & Pe?rez-Rodri?guez, J.V. (2011). Tourism and trade in OECD countries. A dynamic heterogeneous panel data analysis. https://ideas.repec.org/a/spr/empeco/v41y2011i2p533-554.html

- Scharwatt, C. (2019). Mobile money: A product of choice for women to send and receive remittances. https://www.ifad.org/en/web/latest/blog/asset/41410919

- Seifallah, S., & Goaied, M. (2013). Financial development, ICT diffusion and economic growth: Lessons from MENA region. https://www.sciencedirect.com/science/article/abs/pii/S0308596112002054

- Sener, S., & Delican, D. (2019). The causal relationship between innovation, competitiveness and foreign trade in developed and developing countries foreign trade in developed and developing countries. https://www.sciencedirect.com/science/article/pii/S1877050919312463

- TechnoServe. (2016). The Digital Remittance Revolution in South Africa: Challenges and next steps for Africa’s largest cross-border payments market. https://www.technoserve.org/wp-content/uploads/2016/11/South-Africa-international-remittances-report.pdf

- UNCTAD. (2012). UNCTAD Report addresses the 'mobile money' trend. https://unctad.org/en/pages/newsdetails.aspx?OriginalVersionID=134

- UNCTAD. (2014). Cutting the Costs of Remittances: The Role of Mobile Money (Interactive debate). https://unctad.org/en/pages/MeetingDetails.aspx?meetingid=558

- Vota, W. (2018). The Mobile Noney Revolution in International Remmitances. https://voxeu.org/article/stubbornly-high-cost-remittances

- World Bank Group. (2018). The Market for Remittance Services in Southern Africa. http://documents.worldbank.org/curated/en/986021536640899843/The-Market-for-Remittance-Services-in-Southern-Africa

- World Bank. (2015). Migration and Remittances: Recent Developments and Outlook* Special Topic: Financing for Development. http://siteresources.worldbank.org/INTPROSPECTS/Resources/334934 1288990760745/MigrationandDevelopmentBrief24.pdf

- Y?ld?r?m, Y., & Balan, F. (2018). Key Role Of R&D Intensity On Political And Financial Stability: Evidence From The G-8 Countries. International Journal Of Economics And Finance Studies . Vol 10, No 2, 2018 ISSN: 1309-8055

- Zeren, F., & Ari, A. (2013). Trade Openness and Economic Growth: A Panel Causality Test. http://ijbssnet.com/journals/ _4(9), August_2013/32.pdf