Research Article: 2022 Vol: 25 Issue: 2S

The performance and ownership structure of Islamic banks, empirical evidence from multiregional, throughout the last global financial crisis

Khaldoun Al-Qaisi, Zarqa University

Mahmoud Odeh, Zarqa University

Emad Nawayiseh, Zarqa University

Tarek Al–Mubaidain, Zarqa University

Citation Information: Al-Qaisi, K., Odeh, M., Nawayiseh, E., & Al–Mubaidain, T. (2022). The performance and ownership structure of Islamic banks, empirical evidence from multiregional, throughout the last global financial crisis. Journal of Management Information and Decision Sciences, 25(S2), 1-24.

Keywords

Corporate Governance, Ownership Concentration, Islamic Banks Performance, Multiregional.

Abstract

The paper seeks to investigate the impacts of ownership structures on the Islamic Banks or IBs performance in numerous regions especially in the Middle East and North Africa or MENA, in Europe, and in other different Asian countries through the application of the agency theory as being an “Analytical Framework”. The study timeframe is ten consecutive years thus from the year 2006 to 2015. In order to measure performance, the study will use the Return on Average Asset (ROA), the Return on the Average Equity or ROAE, and the Net Income Margin or NIM. This ownership structure was indeed operationalized through the terms of “ownership concentration” or the percentage of the share that was held by top shareholders as well as the ownership identities of the identity of topmost shareholders. The results that emanated from the study suggested that there was nearly no relationship that existed the concentration of ownership and the performance of IB before, during, and even after the 2008/2009 Financial Crisis. The identity of ownership may this be associated to the performance of IB, and thus depicting that there was not only a positive but also a “statistically significant relationship” that prevailed between the IBs that were family owned and performance as well as the managerial IBs and controlled IBs.

Introduction

Majority of the problems in management have been linked with dysfunctional governance system that ranges from quite simple internal conflicts to even extremely big financial scandals (WorldCom, Enron). Management literature sometimes presents us with viable tools that are used in the management or evacuation of management risks. This implies that there might actually be a link between governance systems in finance institutions as well as the management problems which are encountered (Faff & Pathan, 2013). Besides the above, apart from the conventional or traditional finance in which corporate governance is known to experience improvements constantly, Islamic Finance was known to have been initiated for more than even forty years (Ahmed & Chapra, 2002). Indeed, there has been immense relevance of its statistics especially in the representation of assets. According to the Sole Study that was carried out in the year 2007 by Juan of the IMF, it was ascertained that about 1 percent of the overall global financial assets during the first half in 2014 as well as more than three hundred (300) Islamic Finance Institutions in almost 51 nations had an increase in statistics. According to the latest report that was released by Ernst & Young, (2016), it was noted that there was 17 percent change in the Islamic Banking Assets during the period of 2009-2013. This is thus a clear pointer of the necessity and the will of comprehending the concept of the finance issue, this is especially so because the general argument which underlies the performance is actually the respect that is associated with the Sharia Compliant principle as well as Sharia governance. According to some other researchers such as Warde (2000); Mirakhor & Iqbal, (2004); Ahmed & Chapra, (2002); Grassa & Matoussi, (2012), it was found that there were indeed some links between the two major aspects associated with the Islamic Banks or IBs and activity or performance and governance.

In the aspect of performance and governance, it was ascertained that the conclusions that were associated with the empirical studies were quite divided since according to Charreaux (1991), it was noted that there was a “nuanced influence” which may prevail between the structure of ownership and the performance of the French Firms. This included a total of 96 listed companies or firms in a sample comprising of 106 firms or companies. The author’s works were reliant in on two major theories namely the Lawrisky (1984) that was behind the fact that the ownership structure and the managerial decision will have a great impact on the performance.

The second theory known as the organizational theory by Fama (1980); Jensen (1983 a and b) makes it possible and even easier in elaborating the numerous forms organization especially in respect to both ownership as well as decision making. According to Schatt & Godard, (2000), it was ascertained that mechanisms in corporate governance may greatly have an impact on performance as well as a demonstration that the general composition highly determined the effectiveness in the fulfilment of the roles. The association that existed between the mechanism of governance as well as performance can be quite negative as depicted by Hutcshinson (2002) who found out that there was a negative influence or impact in the corporate governance on the firm’s value.

The major objective here will be to better comprehend the findings that were made by Charreaux (1991) and make efforts to ascertain if transposition can actually be made especially in the case of the IBs. Indeed, this work’s contribution in the banking sector that Charreaux (1991) was aimed at better understanding the link that may prevail regarding the structure of ownership as well as the performances that is associated with the banks in question and specifically the Islamic Banks. It is important to note that the structure of ownership has a significant impact on the non-bank entities’’ management (Charreaux, 1991), because banking institutions have not only been but also remain at the centre of great debate in relation to the 2007/2008 financial crisis. Therefore, it was ascertained that it was quite judicious in studying the link that prevailed between the governance mechanisms as well as the performances of banking on a timeframe that takes into consideration the “before” and the “after” of the 2007/2008 financial crisis. The observation of this study can thus be observed through the terms below:

The period of study which is ten years from 2006 to 2015 that has made it possible for evaluation of the robustness that is associated between performance and the structure of ownership and that is before, during, and even before the financial crisis of 2008/2009. The impact of some specific mechanisms of corporate governance on the performance of IBs on a given study period. For example, this research study will compute the total number of the “Sharia Supervisory Board” or SSB members, Board of Directors or BOD members as well as the number of meetings that has been carried out by BOD in appreciating whether they might be associated with the performance of IBs. The relationship that prevails between the structure of ownership and the performance of the IBs based on regions or geographical locations. Finally, the sample will integrate the African listed “Controversial Banks” or CB and this is quite interesting especially in a context of making comparisons between the Islamic Banks versus the CB since the geographical position can have a great impact on the performance. The Generalized Least Squares or the GLS estimation technique will be applied since it will serve in correcting the prevalence of heteroscedacity and correlation as well as take care of the problem that is associated with endogeneity (Taktak & Zouari, 2012).

In order to ensure that all the points are covered, the entire research paper will be compiled in the following format: Section two will present an outline major literature regarding the ownership structure as well as performance in both conventional and Islamic finance. This section will further take into consideration the development of the hypothesis. Data description and the methodology that will be used will be discussed in section three. A discussion of the empirical studies will be discussed in section four while the robustness checks will be handled in section five. The last part and section of the paper which is section six will be the conclusion.

Literature Review

The literature regarding this issue especially the one that deals with Islamic Finance cannot be deemed to be abundantly sufficient. Research regarding the structure of ownership as well as the impact that it has on corporate management has been recently on the increase in the contemporary times as a result of the “necessity of having” a better comprehension regarding the association that prevails between the board of managers and the director. Means & Berle, (1932) were among the first individuals known to have issued some ideas regarding issues to do with governance which might emanate as a result of the firm configurations. According to the agency theory by Meckling & Jensen, (1976) that was instrumental in bringing on board specific changes in this field, this was achieved through presentation of some ways that can be used in solving any emerging conflicts of interests as well as the reduction of costs of the agency. The major difficult that was associated with the issue is ascertaining how to reduce or minimize the manager’s conflict of interest towards shareholders, thus how the structure of ownership might have an influence on not only the management behaviour but also in the management.

According to Demsetz (1983), it was suggested that ownership separation and decision resulted in an increase in the directors’ levies and thus there was no apparent reason of believing that an organization whose major capital was entirely owned by a manager was more effective as opposed to a firm where its capital was scattered. In the contemporary world, there are numerous government systems in a firm which were aimed at suggesting how to resolve problems linked with divergence of interests as well as the minimization of the agency costs that were linked with conflicts. The ownership structure comprised of vital mechanisms that may have an impact on the firm’s financial performance. In this particular framework, researchers tasked with the responsibility of questioning the optimal structure of ownership that maximized performance.

The structure was highly depended on the manner in which shareholders were organized in controlling as well as mobi9lizing for any of “optimal decision undertaking”. It was therefore important to pose questions regarding the extent of the ownership structure which can have an effect on the firm’s value. This question is quite important because it aids numerous research studies which have made attempts aimed at highlighting a clear association as well as interactive processes that prevail between the firms’ performance as well as the capital concentration on one hand while on the other hand dealing with the “nature of ownership”.

According to researchers such as Srairi (2013), it was ascertained that there was a negative association between risk taking and ownership concentration whereas Khlif & Madani, (2010) argued in a different perspective in their works regarding the conventional or traditional Tunisian companies since they asserted that the ownership concentration had no impact on performances of firms. In addition to the public enterprises, it was ascertained by Ongore (2011) that government ownership and ownership concentration had a great negative association with the performance of firms in Kenya due to the divergent conclusions.

To become more specific, this research study will check the association between that may prevail between the ownership nature of property and the firm’s performance. According to the contents of the sample, this was based on the ownership nature, public-owned companies, family-owned companies, controlled firms, and managerial firms. One of the major study objectives was first of all checking the link as well as the significance between both the ownership as well as the IBs performance. Most of the conclusions were made in this field and thus some of them found that there was a great “non-significant” link or association between ROE and the ownership structure, but a great association with the ROA as being a measure of performance with the “family owned” as being the best and the most viable “ownership structure” for the performances (Charreaux, 1991).

According to Charreaux (1991), it was reported that in circumstances of the shareholder value maximization among the 3 thesis that had been developed such as the convergence thesis of convergence and the thesis of entrenchment for managers, and the neutrality thesis, the neutrality thesis was deemed to be the best according to the study (Demsetz, 1983). It was further reported that there was no relationship that prevailed between performance and the concentration of capital which was measured by the ROE and the ROA and a positive relationship was reported between the family-owned entities and the accounting performance. This research study will thus check if the conclusion really mattered regarding the IBs field. On the other hand, it was important for us to become aware that positive relationships between the ownership structure and corporate performance prevailed. This implied that the issue of corporate governance was highly influenced through the ownership structure as it was reported positively by Pahlevan & Asadi, (2016). This paper will thus seek at discussing different points so as to have an enhanced point of view regarding IBs.

SSB Structure and Performance

In issues dealing Islamic Finance and more so those dealing with banks, it was noted that the link between governance and performance was a major divergence cause. While other authors such as Nabib & Bourkhis, (2013) did not find the actual effect that was associated to differences in business model in association with the IBs performance, other authors on the other hand such as Zaman & Mollah, (2015); Ayumardani & Kusuma, (2016), Beck and others ascertained some actual differences based on the business model and even justified the fact that Islamic Banks were less cost effective as opposed to other banks (Beck et al., 2013). They also asserted that such banks were better performing as opposed to the CB (Zoubi & Olson, 2016) through their mechanisms of performance. It was prudently noted that the main financial differences were undoubtedly the availability of SSB in IB (Zaman & Mollah, 2015). It was a board which did not prevail in the CBs organizational structure whereas in the Islamic Bank, it allowed for both the development as well as the control of strict compliance with the “Sharia-compliant” rules.

Based on the “Accounting and Auditing Organization for Islamic Financial Institutions Standards” (AAOIFI), the SBB ought to become an “independent office” that has recognized specialists and doctors in Islamic Law, Fiqh al-Mua’malat, and “Islamic Commercial Jurisprudence” who have good and enhanced knowledge regarding how the Islamic Finance firms work. According to the SSB members’ profile, there was a wide range of skills. It is important to note that apart from the AAOIFI definition, there were more with common points that reside in the role that the body can play in the Islamic Finance institutions.

It was ascertained that within such institutions, the SSB was charged with the responsibility of ensuring that they strictly conformed to the Sharia transactions as well as in the development of the Islamic products, and even in the jurisprudence of issuance as well the rules that governed those operational practices. It must also ensure that there was the monitoring of procedures and compliance with rules which had been put up in place. As to the question regarding the SSB, it can truly be ascertained that it is indeed the body in charge of control, implementation, and the management of elements in Sharia governance in the Islamic finance institutions. The AAOFI thus provided in the texts that the SSBs comprised of at least a total of 03 members, note that in actual practice, the number was known to vary from four to seven and this was highly dependent on the activity of the entire entity being specified.

Before a general role of the SSB was given, it was important to note that Iran holds more than 40.21 percent of the first position of the “Islamic Financial Assets”, had a configuration or SSB that was different from the ones that can be observed in other nations where there is evolvement Islamic Finance. In a country like Iran, there was no SSB in Islamic Banks and therefore all were centralized in a “council of guardian” of the country’s Central Bank where the council not only used the development but also the monitoring and the controlling of the corporate governance mechanisms of the bank since all the banks practiced Islamic finance. The major role of SSB can thus be divided into 5 major areas (Pellegrini & Grais, 2006) namely: The certification of the financial instruments that have been authorized through the fatwas or the “ex-ante Sharia audit”. Verifications of the transactions’ compliance with regard to the “fatwas issued” or the “ex-post” Sharia Audit. Calculation and payments of Zakat. How to deal with or handle operational consequences that are deemed not to be compliant with the Sharia. Presentation of advice regarding income distribution or even expenditure between owners and shareholders of the investment accounts.

Development of the Hypotheses

Ownership Performance and concentration

According to Means & Berle, (1932), it was noted that the concentration of ownership highly contributed towards the alleviation of agency conflicts between the managers and shareholders and highly enhanced control on the operations and management of a firm. According to the theory called alignment hypothesis, it was explained that the position of large shareholders gave them a better ability of collecting the information that was required in the evaluation of decisions that were taken by directors. The controlling power resulted in the maximization of value to the firm as well as the wealth of shareholders (Vishny & Shfleifer, 1986). As a result of this controlling power that emanates from the ownership concentration, it was regarded as being a “viable control mechanism” over the discretionary “management behaviors” which was heavily relied on by small investors and which could ultimately aid them in becoming aware of the actual situation of the firm.

The association between the concentration of ownership and performance was highly discussed in topics of corporate governance like for example Stancic, et al., (2014); Demsetz, (1983); Khlif & Madani, (2010), Pahlevan & Asadi, (2016), Kuznetsov, et al., (2010); Iannotta, et al., (2007); Khamis, et al., (2015); Charreaux, (1991) towards the conventional or traditional finance view. Most of the studies indicated that there was no relationship between the concentration of ownership and performance as a thesis of neutrality through Demsetz (1993).

In the field of Islamic Finance, it was ascertained that ownership concentration had actually been discussed in few papers such as Srairi (2013); Nabib & Bourkhis (2013); Khamis, et al., (2015); Pahlevan & Asadi, (2016) and their findings were almost different in some incidences from the “conventional finance conclusions” that had been made regarding similar topics like for example when Nabib & Bourkhis, (2013) reported that there was indeed a positive relationship between the concentration of ownership and performance in nations that had low “official bank supervision”. It was reported by Khamis, et al., (2015) that the ownership structure” had a negative impact on a company’s statistical significance.

According to Taktakm Zouari & Bahrain, (2012), it was ascertained that there was indeed no obvious or significant correlation that prevailed between the ownership structure and the performance of IB. It can thus truly be ascertained based on methodology and observation that conclusions may in some instances be highly influences and thus future researchers need to ensure that this issue is settled and try all possible means of explaining the conflicting findings. In this specific research paper, it is intended that the Charreaux conclusion (1991) will be checked out, since the first hypothesis is associated to the first conclusion regarding ownership concentration as well as performance especially in regard to the thesis of neutrality of the ownership structure on performances. This is the major reason as to why the first hypothesis of this study has been developed in this manner.

H1: There prevails no relationship or association between the ownership concentration and the Islamic Bank’s performance.

The Nature of the Ownership Structure and Performances

When talking about the nature of ownership, this implies to the main profile regarding the firm’s ownership. The classification of this type of profile is in some instances associated to the aim of the research paper and the topics or environments. The three types of firms were distinguished by Charreaux (1991) based on the ownership nature (managerial firms, controlled firms, and the family-owned firms). The distinction was made in regard to the degree or rate of separation of the “couple ownership” as well as the decision or even that of control and ownership and thus none of the managers held a great share of the organization as well.

On the other hand, it was ascertained that in the family-owned entities, a family actually held larger firm ownership and ultimately appointed one of the family members to manage it. In such circumstances, the degree or rate of ownership separation ownership and decision/control, despite of the prevalence of other investors or minority shareholders. It was ascertained that in controlled companies, the concentration of ownership was actually more accentuated, while rate of control or ownership or decisions was quite strict while the larger ownerships such as the pension funds and institutional funds among others may highly control the strategy of the firm and even some of the governance tools. The last form of ownership that was chosen to add in the classification is actually the government or the state-owned firms because of their roles in the supervision of Islamic Banking in most countries or nations in the Middle East as well as in Africa.

The relationship or link between the nature of the ownership structure and the performance of the firm has been an interesting topic in literature. This is attributed to the fact that in the conventional finance, the results were not only mixed up but also the performance of the firm was found through numerous research studies that includes (Charreaux, 1991); (Morck, et al., 2011); (Khlif & Madani, 2010); (Iannota, et al., 2007); (McConnel & Servaes, 1990); (Stancic, et al., 2004). It was found out that some of the research papers had positive and significant relationship between the performance of the firm and managerial ownership and these included Servaes & McConnel, (1990); Khamis, et al., (2015); Khlif & Madani, (2010). According to Charreaux (1991), it was found that there was a great association between the performance of a firm and the managerial ownership but however, there was a great association between the firms that were family owned and the performance especially on the Return on the Average Asset or the ROAA. This implied that according to the author’s sample, there was indeed a strong link between the type of the ownership structure and the performance of the firm.

In regard to how the controlled firms were concerned, it was ascertained by numerous researchers such as ureaucratic thus leading to ineffective performances. It was further found that there was a significant and negative relationship between performance and government ownership (Ongore, 2011). This research paper intends at checking out the conclusions and this is the major reason why the assumption of the firm performance and ownership structure was based on the hypothesis developed below:

H2: The Nature of “ownership structure” has an impact on the Islamic Bank performance.

SSB structure and Islamic Performance

Since authors are actually working on the field of Islamic Finance, the SSB monitors as well as certifies the issue of compliance and it is quite unique in the governance structures of Islamic Banks as compared to the CB which are its counterparts. We shall thus aim at checking if the compositional features associated with the SSB have an impact on the performance of IB. The main idea here is the appreciation of the impact that is associated with the prevalence of the Sharia scholars on the performance of IBS. Zaman & Mollah, (2015) made efforts of linking the “Sharia supervisor’ to the performance of IB because of the prevalence of the board, Islamic Banks will actually be likely to present lesser risky products and as a result, this may have a great impact on the general performance. We thus think that because size, remuneration, and the composition of the BOD members can have an influence on the performance of a firm, the Size of any SSB may ultimately have an impact on the performance of IB, and this is the major reason why this hypothesis has been formulated:

H3: The size of the SSB greatly influences the performances of the IBs.

| Table 1 Sample Distribution |

||||

|---|---|---|---|---|

| Country | Conventional banks | Islamic banks | Full sample | Percentage |

| Algeria | 2 | 0 | 2 | 1.2 |

| Bahrein | 6 | 14 | 20 | 11.99 |

| Egypt | 3 | 2 | 5 | 2.99 |

| Indonesia | 3 | 2 | 5 | 2.99 |

| Iraq | 0 | 3 | 3 | 1.8 |

| Israel | 5 | 0 | 5 | 2.99 |

| Iran | 0 | 9 | 9 | 5.39 |

| Jordan | 2 | 2 | 4 | 2.40 |

| Kuwait | 5 | 7 | 12 | 7.19 |

| Lebanon | 4 | 0 | 4 | 2.39 |

| Libya | 1 | 0 | 1 | 0.6 |

| Malaysia | 2 | 11 | 13 | 7.78 |

| Morocco | 3 | 0 | 3 | 1.79 |

| Oman | 6 | 0 | 6 | 3.60 |

| Philippines | 2 | 0 | 2 | 1.20 |

| Pakistan | 0 | 6 | 6 | 3.59 |

| Qatar | 6 | 3 | 9 | 5.39 |

| Saudi Arabia | 8 | 4 | 12 | 7.19 |

| Singapore | 3 | 0 | 3 | 1.79 |

| Sri lanka | 0 | 1 | 1 | 0.6 |

| Sudan | 0 | 9 | 9 | 5.39 |

| South Africa | 0 | 1 | 1 | 0.6 |

| Thailand | 1 | 0 | 1 | 0.6 |

| Turkey | 0 | 4 | 4 | 2.4 |

| United Arab Emirates | 15 | 6 | 21 | 12.58 |

| United Kingdom | 0 | 3 | 3 | 1.79 |

| Vietnam | 1 | 0 | 1 | 0.6 |

| Yemen | 0 | 2 | 2 | 1.2 |

| Total | 78 | 89 | 167 | 100 |

Data and Methodology

It is prudent to note that data under which the analysis will be executed are actually based on the databases below: DataStream, Bank scope, World Bank Country of the levels of the macroeconomic data as well as the annual reports of both the CBs and the IBs, and the Fact set. The study timeframe ranges from the year 2006 to the year 2015 which is a ten-year sample that takes into consideration the year 2007, during which there is need to understand as well as assess the robustness that is associated with the robustness of some of the specific of banks as well as the mechanisms of corporate governance that in both the IBs and CBs on the issue of performance. The study period is known to follow a similar subdivision that was used by Zaman & Mollah, (2015) and this is known to comprise of the 2006 to 2007 pre-crisis as well as the 2008 to 2009 crisis, and even the 2010 to 2015 post-crisis periods covering 28 nations.

We have selected banks through the application of some of the selection criteria in order to develop a panel that is well balanced as well as avoid numerous bias conditions. We thus kept banks for only a minimum of five years just like it was executed by Srairi (2013). Through having a homogenous sample, only commercial banks were retained and therefore no other forms of banks were given consideration. Table 1 below makes a description of the sample study, but however, it is prudent to note that the sample further takes into consideration the concentration of ownership, the ownership structure, as well as some different mechanisms of governance such as the total number of meetings that were conducted by the BOD, the total membership of SSB, among others.

In order to effectively complete the sample, it is prudent to make use of information that emanates from different websites such as the Islamicfinance.com, salamgareway.com, and the Islamicbanker.com. It is also prudent to ensure that we use other well renowned websites that are normally quoted and used in the Islamic researches dealing in finance Pierce & Garas, (2010); Mirakhor & Iqbal, (2004); Alman, (2012). Information regarding the structure of ownership and the concentration and the number of BOD/SSB members as well as the total number of meetings held emanated from the annual reports for each bank on an annual basis while any of the information that was missing was duly completed through the relevant Islamic website. The composition of shareholders was found in both the website of Thomson Reuters known as salamgateway.com and from the annual reports.

Measures of the Performance of Banks

According to Charreaux (1991), it was indicated that there were numerous factors that were responsible for the performance of a firm and these included the growth rate, Return on Asset, Return on Equity, Marris, Ratio, Tobin Q, Sharpe ratio, the Rate of Profitability among others. The Return on the Average Equity or the ROAE was retained as being the first since it was not only the “Proxy of bank performance” but it was also a measurement of return on the funds that had been contributed by stakeholders. The higher the figure was the better, except in circumstances where banks were highly leveraged (Zaman & Mollah, 2015). The second “performance measure” was the ROAA which implies to the measurement of return which has been generated by assets and which also gives an idea regarding the firm’s investment policy. The table below gives a description of the sample study and as can be seen, it is a total of 167 comprising of 89 IBs and 78 conventional banks while the proportion of each nation in terms of banks was actually presented in the last column.

The ROAA as an indicator was used as a proxy in the determination of profitability in numerous studies of governance (Busta, 2007; Stancic, et al., 2014; Classens, et al., 2000; Kaymak & Bektas). In this given study, it is important since it will help us in better capturing the performance of the IB as well as comparisons to the conventional ones as well. The last measurement of performance is the “net Interest Margin” or the NIM which is also used in conventional finance or the Islamic Finance. It is obtained through the principle of the “Profit and Loss Sharing” or the PLS since the IBs don’t charge or collect interests (Hassoune, 2002). It is usually found under the NIM in income. Some of the studies were known to proxy the NPM as the performance of IB in view of coming up with comparisons between the IB and the CB (Rachdi, 2013; Zoubi & Olson, 2016). It is also important to note that the Q by Tobin was used as an indicator for bank performance (Zaman & Mollah, 2015; Charreaux, 1991; Soufeljil, et al., 2016; Zoubi & Olson, 2016) since it reflected the firm’s market performance.

However, it is important to note that “Tobin’s Q” might not reflect accurately the performance of the bank especially if the liquidity and market efficiency deviated from the set stands of the stock markets that have been developed (Stancic, et al., 2014) which was actually the case with some of the of the financial markets from the Middle East and North Africa or MENA and from the “Association of Southeast Asian Nations” or ASEAN. In addition to that, it is also prudent to note that the issue of missing data did not aid in using “Tobin’s Q” as a proxy of ascertaining the performance of the Islamic Banks. That is the main reason why most emphasis was placed on NPM, ROAE and ROAA as being a proxy of the performance of banks for both conventional and Islamic. This is because authors were using data that emanated from the Bank scope and there were some conventional variables that had been brought to similar significance levels for easy comparison of the statements.

Variables in Bank Ownership

In this research paper, the ownership structure will take two major dimensions namely the identification of the major shareholders based on the definition given by Charreaux. The next dimension is deals with how dispersed or concentrated the shareholding of the configuration of the firm is. As was done in Charreaux, we shall follow Lehn and Demsetz (1985) in the measurement of concentration through taking into consideration the percentage of share or equities that have been held by shareholders that are well known (Charreaux, 1991). The concentration ownership was described by two major variables by Charreaux so as to take into consideration decision and ownership: at first, the PCAAD was named as a variable that captured the total percentage of capital that was actually given by directors while the PCADI was named as being a variable that captured the total percentage of capital that had been put forth by managers. In the research paper, just like was done by La Porta, et al., (2002), there will be need to retain the fact that a bank actually has a dominant shareholder if such a shareholder had more than 10 percent of indirect or direct voting rights. However, it is important to note that the procedure was a “little bit different” in the listed banks.

As far as the issue of the structure of ownership identity was concerned, we ensured that it was considered as being a “categorical variable” so as to appreciate its impacts on the banking performances (Charreaux, 1991). As a result, we made use of 4 dummy variables that represented the identity of the “largest owners” that had been used. The first dummy that was publicly owned took a value of one in circumstances where the largest shareholder was the government or state or even its decentralized organism and 0 for otherwise. On the other hand, the dummies that were owned managerially took a value of one if shareholders were dispersed and in circumstances where the managers were in charge of main policies without having immense pressure from shareholders and thus the dummy took a value of zero otherwise.

Lastly, the dummy that was family owned took a value of one of the largest shareholders was a private investor that was capable of managing the entity with family members. In some instances, the shareholders’ surname may be an indicator for the detection of such forms of links. The dummy thus took a value of one if the largest shareholder was a “financial institution investor” or another entity and 0 for otherwise.

The Bank Specific Variables

Majority of studies that exist reported numerous covariates that were commonly used in comprehending what may actually influence the association between the structures of ownership and performances, we thus selected the bank’s “logarithm of total assets” as a measure for its own size (for example Beck, et al. 2013; Zaman & Mollah, 2015; Grassa & Matoussi, 2012). It was also used as a positive link or association between both size and performance which can truly be interpreted based on the economies of scales as well as a negative association which may be a matter of encountering difficulties in the adaptation towards changes. In our case, we will tend to ascertain if the size will have an impact on both the ownership structure as well as performance. Other specific variables for other banks such as the LOAN/TA, EQ/TA; the non-performing “loan provision” towards total assets “inter alia” will also be executed. The major idea for this case will be the selection of the specific bank variables that will have an influence in similar time in both ownership structure and performance.

Finally, in order to have control of some country impacts or the region impacts on the analysis, it will be important for us to make use of the numerous “macroeconomics environment variables. The first one will be the use of the “Boone Indicator Variable” emanating from World Bank Data that will depict the degree of competition of banks in a given country, the growth rate of GDP in a year, the rate of inflation, the annual growth rate of the GDP, the rate of inflations, and the population can have a great influence on the performance of banks (Zaman & Mollah, 2015).

| Table 2 Summary of The Variables |

|||

|---|---|---|---|

| Variables | Description | Sources | |

| Dependent variables: Bank performance | |||

| ROAA | Net total income divided the average total assets in percentage | Scope of the bank | |

| ROAEV | Net income over the divided total equity in percentage | Scope of the bank | |

| NIM | Investment returns – interest expenses over earning assets | Scope of the bank | |

| Independent variables | |||

| Ownership variables | |||

| Concentration of ownership | Total equity percentage participation by the largest shareholder of the bank | Annual reports and salamgateway.com | |

| Controlled-owned banks | Largest proportion of capital held by a financial institution or nonfinancial group | Annual reports and salamgateway.com | |

| Family-owned banks | Largest proportion of capital held by an individual or family member investor | Annual reports and salamgateway.com | |

| Public-owned banks | Largest proportion of capital held by government or its decentralized organism | Annual reports and salamgateway.com | |

| Managerial-owned bank | Dispersed ownership | Annual reports and salamgateway.com | |

| Bank specific variables | |||

| Capital ratio | Total equity to total assets value | Scope of the bank | |

| Loan to deposit ratio | Total loan value divided as percentage of total deposit | Scope of the bank | |

| Overheads to total assets | Operating expenses divided total assets | Scope of the bank | |

| Nonperforming loan provision | Loss provision divided total assets | Scope of the bank | |

| Bank size | Log of total assets | Scope of the bank | |

| Cost to income ratio | Ratio of total expenses to total revenue | Scope of the bank | |

| bank age | Number of years the bank was established until 2015 | Scope of the bank | |

| Bank category | As for Islamic bank or conventional bank | ||

| Macroeconomic variables | |||

| GDP growth | Yearly GDP growth rate in percentage | World development indicators | |

| Inflation rate | Yearly consumer price index variable in percentage | World development indicators | |

| Boone indicator | Competition measure derived from Boone-type model | Global financial development | |

| Table 3Descriptive Statistic of Main Variables | ||||

|---|---|---|---|---|

| Variables | Obs. | Mean ± standard deviation | Min. | Max. |

| ROAA | 666 | 0.134±5.052 | −46.310 | 31.952 |

| ROAE | 724 | 3.338±12.051 | −130.146 | 54.574 |

| NIM | 300 | 6.409±9.275 | −26.268 | 48.198 |

| OFBS | 579 | 5191.446±30730.10 | 0 | 426324.6 |

| CIR | 534 | 20.505±102.010 | −961.337 | 951 |

| Board size o~B | 822 | 3.241±1.801 | 0 | 7 |

| BODSIZE | 802 | 8.079±2.428 | 2 | 16 |

| Number of se~r | 759 | 6.260±4.801 | 0 | 40 |

| CONC | 887 | 54.362±34.506 | 5.55 | 100 |

| log size | 725 | 7.526±1.924 | 2.493 | 11.340 |

| EQTA | 725 | 0.250±0.249 | 0.018 | 0.995 |

| OFBSTA | 574 | 0.167±0.153 | 0 | 0.9995290 |

| Equity | 725 | 884.9906±1468.337 | 1.390132 | 12437.09 |

| Log age | 887 | 3.081±0.5978882 | 2.302 | 4.635 |

| Loans | 679 | 4561.24±7759.591 | 0.001435 | 58681.79 |

Methodology

In order to effectively investigate the research question, stipulations made by Charreaux (1991) were dully followed through the addition of specifications that emanated from among others Taktak & Zouari, 2012; Omri & Bourkhis, 2016; Stancil, et al., 2014; Iannotta, et al., 2007. The region variable was then encoded with an aim of capturing the association between the aspects of the structure of ownership and performance based on specific regions such as GCC, ASEAN, MENA, among others as a contribution to literature. The model below has therefore been established:

Perfi, j, t = a +βOSi, j, t+dBSi, j, t+μBGi,j,t, j, t+ lMAj,t+θYt+τRj+Σi,j,t

In which Perfi, j, t implied for the I bank’s performance in region j and at year t that was going to be expressed through the Net Profit Margin, ROAE, or the ROAAs. On the other hand, the regression coefficients are represented through α, β, δ, ∝, λ, θ, τ while the ownership structure’s vector is represented through OSi, j, t Rj and Yt are the region dummy and year variables respectively. On the other hand, BS implied to the vector for the specific variables for the bank while MA was the vector that was used for the macroeconomic environment vector. The last and least section of the model was actually the “disturbance term” termed as εi, j, t.

In order to run this model, it was important for us to apply the panel regression that had the objective of testing the impact or effect of the variables of ownership structure on the performance of IB that was based on a panel totaling 89 Islamic banks from the 2006 to the 2015 period. As a result, the Hausman test was performed so as to ascertain the kind of the random effects or the fixed effects that should be applied. However, the test suggested the use of random effect. The prevalence of the “categorical variables” that used dummies that may adopt similar values for similar banks over a given period of study can actually be prevented to use the “fixed effect models” (Taktak & Zouari, 2012) we executed the random-effect or impact with quite robust results. Through the consideration of Drukker (2003) in testing the problems associated with autocorrelation as well as for the heteroscedacity and multicollinearity, we ascertained that that both heteroscedacity and multicollinearity can be used in solving such problems as well as in the estimation of our model as was done by Taktak & Zouari, (2012). In addition to that, we also used the GLS estimation technique that served in correcting the total presence or prevalence of “serial hereroscedacity and correlation” which also took care of the problem associated with endogeneity (Taktak & Zouari, 2012).

Study Results

Table 4 below depicts the “correlation matrix” that show different prevailing correlations between the variables that have been included or integrated in analysis together with the respective levels of corresponding significance. It can thus be ascertained that the forms of ownership structures were significantly and individually correlated to at least 1 dependent variable. In addition to that, it was further noted that the CONC variable that captures the concentration depicted no immense association with the dependent variables. The matrix also depicted that there was a great correlation between the log sizes as well as both NIM and ROAE as far as the “cost to income” ratio or CIR was concerned since it was significantly and negatively correlated with both NIM and ROAA. We also noted that there was a high inter-correlation that prevailed between the CONC and some of the specific variables associated to the bank such as CIR and EQTA. This was quite interesting since all the variables accounted together as being the predictor variables especially in analysis and thus be helpful in helping avoid multicollinearity.

Based on the table above, it can be observed that the average of the prevailing scholar in SSB was approximately 3. This is also similar to figure I that gave the standard recommendations that were given by AAOIFI. On the other hand, it was further noted that the BOD average number was approximately eight, which is quite essential and thanks to the point of view presented by literature especially in the issue of governance as was suggested through the “agency theory”.

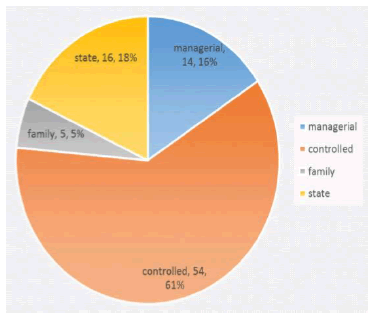

On the other hand, it was noted that the average total number of meetings which were conducted by the Board of Directors was about 6 and this implied that during the study period, they used to meet at lease for once in a quarter. Regarding the average concentration, it was ascertained to be about 54 percent as we said during the start, different degree or rates of concentration mattered greatly in the study. As a result, we did according to La Porta el al. (2002) who had suggested that a firm had dominant shareholders if such a shareholder had more than 10 percent of either indirect or direct voting rights. In such a case, the minimum value of concentration was actually supposed to be more than 10 percent, and this is the major reason as to why this condition was added in the regression model. As far as the nature associated with the ownership structure was concerned, it was ascertained from the pie chart given below that presented a description on how they were distributed:

It was noted that banks that had pensions’ funds or institutional funds as being dominant shareholders were highly represented in the sample at 61% and it was actually this percentage that was equivalent to 54IBs. According to Khamis, et al., (2015a); Taktak & Zouari, (2012); Khamis, et al., (2015b), it was ascertained that the most common type of ownership structure that prevailed in North Africa, Southeast Asia, and the Middle East was the controlled ownership. It was ascertained that it was common “interalia” since Islamic Finance was private initiative and majority of the financial groups across the world wanted to greatly benefit from such profitability. The remaining sample comprised of 5 families owned Islamic Banks at 5.6 % while the public IBs were a6 or 18% and the IBs that were managerially owned were 14 or 16%.

It was noted that where the ROAE, ROAA, and NIM respectively implied that the ROAA, the ROAE as well as the Interest Margin/Net Profit were all proxy as dependent variables for performances and the specificities of the bank were capture in this through the Cost to Income Ratio or the CIR as well as governance variables such as the SSB board size, the Directors’ Board size, as well as the total number of meetings that were held by the board annually. As it can be seen, there are numerous correlations that prevailed among the major variable. For example, the net interest margin was quite significantly correlated to the specificity of the bank or CIR and the type of ownership structures were also correlated individually to at least one variable that was dependent.

Table five depicts the different types of regression that were run from estimating the performance equation coupled with concentration as being the major variable for the ownership structure where numerous bank characteristics such as Loans, cost to the income ratio, and the Log size were used in capturing of the bank activities regarded the macroeconomic variables that were added to inflation. The governance indicators were as well represented where the results that emanated from regressions suggested that there was no relationship that was statistically significant between performance and concentration. According to estimated values linked to the Wald Chi2, it was indicated that estimated values were indeed an effective fit to data. It was farther noted that regardless of the proxy performance that was chosen (NIM, ROAA, or ROAE), the absence of this link was indeed noticed. This implies that we can interpret the results through saying that through taking into consideration the features of our respective sample, ownership concentration seemed to have no great influence on the performance of IBs. The findings were indeed quite consistent with the thesis of neutrality that was presented by Lehn & Demsetz, (1985); Demsetz (1983) who asserted that the ownership structure indeed had no link or association with performances. It was noted that our results highly corroborated with the conclusions presented by Charreaux (1991) and other authors such as Fazlzadeh, et al., (2011); Khlif & Madani, (2010).

In the Islamic Banking Field, it was further noted that Taktak & Zouari, (2012) found no greater relationship between performance and concentration among the 53 Islamic Banks. In general, the major explanation that was given for the lack of a statistically “significant link” between the structure of ownership and performance was indeed the fact that “ownership structure” may indeed be quite endogenous due to the simultaneity that prevails between both value and ownership (Torre & Pindadom, 2004). Another main explanation may emanate from how far developed the different economies in the analysis were based on. The significant influence associated to the ownership structure was justified by Bonin, et al., (2004) due to the environmental nature in which such banks operated.

The bank’s size that negatively affected as well as significant performance with both the ROAE and ROAA and the result was indeed quite consistent with findings made by Jabeen & Rashid, (2016); Charreaux, (1991); Zoubi & Olson, (2016); Beck, et al., (2013) who also found a similar link as well as significance level. The lack of economies of scale, operating costs, bureaucracy, and the Agency costs may ascertain a negative relationship that prevails between performance and bank size. Smaller Islamic Banks were known to be more profitable as opposed to the larger ones (Zoubi & Olson, 2016).

The size of the SSB was known to be significantly and positively correlated with the ROAE especially in circumstances where concentration was chosen as being the major ownership variable of “ownership structure identity”. The results suggested that at first, there was a great association between the size of SSB and performance and the total number of “Sharia scholars” that sat on the SSB matters when making analysis of the performance of the IBs. Positive links or associations also suggested that the higher the number of the Sharia scholars in the SSB for the analysis of activities, certification of the reports, issuance of fatwa regarding rules and products that should be strictly be followed by the Islamic Banks, the better performance that can be achieved.

According to the third hypothesis (H3), it was thus confirmed through the result that there was indeed a great influence of the size of SSB to the performance or ROAE and this was highly depended on whether there was concentration in the model or not. This is because when substituting concentration through the different types or forms of ownership structure such as Government, Controlled, Managerial, and Family, the results were indeed different as depicted in the figure below (Table 6). It is vital to note that, the results above were further confirmed in a full sample as stipulated in Appendix 1.

Based on table six above, a link that prevails between the form of the ownership structure as well as performance both during and after the 2008/2009 financial crisis has been depicted. It was ascertained that the relationship between the form of the ownership structure and the performance was quite consistent with numerous findings that prevailed in the fields of governance (Pahlevan & Asadi 2016); Omri & Bourkhis, (2016), Khamis, et al., (2015a), Charreaux (1991); Ongore (2011); Khlif & Madani, (2010); Taktak & Zouari, (2012); Stancic, et al., (2014); Soufeljil, et al., (2016) all were known to have found out that the type of the ownership structure has a great impact on the performance of banks. The regression model displayed both a significant and positive relation between performance and the family-owned Islamic Banks and performance or ROAE. The relationship was known to be persistent not only before but also during and after the 2008/2009 financial crisis. Taktak & Zouari, (2012) also found a similar link prevailing between the family owned ROAE and the IBs, and indeed, their explanations were based more on the environment of commitment and love that may be quite essential in order to achieve enhanced performances that resulted in lower agency costs.

It was also deemed prudent to take into consideration that the will of ensuring generational transmission that safeguarded the patrimony of the family may ultimately push managers in the family-owned businesses in settling down to good governance practices since such actions may be quite helpful in influencing the performance of the firms. It was further found that there was a positive relationship that existed between the controlled Islamic banks and the performances during NIM and ROAA and after ROAA and ROAE in the financial crisis of 2008/2009.

The findings were thus quite consistent with those carried out by Fazlzadeh, et al., (2011); Khamis, et al., (2015a); pound (1998); Khamis, et al., (2015b); Abbas, et al., (2009); Uwalomwa, (2012) who gave out conclusions regarding a significant and positive relationship that prevailed between performance and institutional ownership. This link or association might be due to monitoring of the role played by the institutional investors who have “superior monitoring abilities” with enhanced resources and power which when effectively exercised may have a great impact on performance. It was further noted that managerial Islamic Banks also had a positive relationship or link with the performance measure after the ROAE and ROAA 2008/2009 financial crisis. This was quite consistent with other studies such as Lichtenberg and Palia (1999); Donghui, et al., (2007); Spitz & Mueller, (2002) who found out that there was a significant and positive link or relationship between the aspect of Managerial ownership and performance (Productivity measurement, ROA, e.t.c). This form of ownership, the managerial ownership was known to align both the interests of management and shareholders through placing the power of voting in the corporate decision makers; hands. Indeed, the latter were aware of the financial health or status of the firm since owing to the fact that they are stakeholders, they can indeed have a “direct influence or impact” on the performance of such a firm through their decisions and choice.

As far as factors regarding bank specify were concerned, it was noted that there was a significant and negative relationship that prevailed between the Net loans to the total assets or the NLTA and the performances of the firms before, during, and even after the financial crisis of 2008/2009. This implied that there was a negative relationship in both liquidity as well as the performance of the bank, and that the more Islamic Banks are liquid, the lesser their performances, NLTA also measured the total percentage of the assets that were tied up in different loans. Regarding the Net Loans that had to be deposited as well as the funding of the short terms or NLDSTF, it was ascertained that there was no significant relationship that was displayed through regressions. It was further noted that the cost to the income ratio was significantly and negatively associated to performance during ROAA, NIM, ROAE, and that after the financial crisis of 2008/2009, the finding was quite consistent with the view of literature that cost had a negative impact on the income and that indeed, it was such an influence that ultimately had a negative impact on performances. Appendix two is known to depict a similar relationship as was depicted in Table six.

| Table 4The Ownership Structure And The Mechanisms of Governance In Case of A Crisis | |||

|---|---|---|---|

| Variables | ROAE | ROAA | NIM |

| Managerial company | −0.05287(3.82277) | 0.60539(1.28370) | −9.51227**(4.13765) |

| Controlled company | 2.76366(3.83185) | 3.22484***(0.95131) | 21.27756***(4.08620) |

| Family-owned company | 23.16530*** | 8.31285*** | 4.70172 |

| (5.81346) | (2.01406) | (6.80391) | |

| Public owned company | - | - | - |

| Log SIZE | 2.09739 | −0.32649 | −1.21064*** |

| (1.32486) | (0.31273) | (0.39812) | |

| EQTA | 8.46970 | 4.50101 | −10.82961** |

| (6.14065) | (2.85697) | (4.71713) | |

| Net Loans Tot Assets | −0.03092*** | −0.01170*** | −0.06003*** |

| (0.00972) | (0.00401) | (0.01621) | |

| Net Loans Dep STFundi | 0.00945 | −0.00201 | −0.01494 |

| (0.00928) | (0.00266) | (0.01067) | |

| Cost To Income Ratio | −0.03854** | −0.00310 | −0.02287 |

| (0.01697) | (0.00373) | (0.02760) | |

| AGE | −0.04686 | 0.02737 | −0.00243 |

| (0.09820) | (0.02704) | (0.14409) | |

| Boone indicator | 56. 99527** | 20.30770*** | −14.94295 |

| (22.98311) | (5.11792) | (10.81877) | |

| Board size of SSB | 1.17312 | 1.03446*** | 9.19692*** |

| (1.76061) | (0.40017) | (1.57293) | |

| N of session per year | −0.60061 | 0.16738 | 1.77607*** |

| (0.39526) | (0.11514) | (0.65130) | |

| BDSIZE | 0.53668 | 0.39086* | 0.42266 |

| (0.62035) | (0.20797) | (1.69903) | |

| Inflation | −0.18802 | −0.09260 | −0.27833*** |

| (0.33849) | (0.07530) | (0.10745) | |

| GCC | 0.55289 | 4.02420 | 0.82816 |

| (5.02885) | (12. 88543) | (10. 02619) | |

| MENA | 32. 88234*** | 15.10918 | 50.12335*** |

| (13. 10092) | (12.71502) | (12.76387) | |

| Others | 18.54390 | 9.94316* | 0.00000 |

| (12.55563) | (5.20317) | (0.00000) | |

| West Europe | 10.05576 | 4.34926 | 0.00000 |

| (9.51840) | (12.97530) | (0.00000) | |

| Constant | −17.96714 | −11.87526 | −32.93176** |

| (13.51189) | (11.04805) | (15.86271) | |

| Observations | 33 | 33 | 23 |

| Years dummies | Yes | Yes | Yes |

| Wald chi2 | 211.94*** | 339.26*** | 1472.39*** |

| Regions dummies | Yes | Yes | Yes |

| Number of pan id | 19 | 19 | 13 |

As it can be depicted in the table 7 above, it is apparent that during the financial crisis of 2008/2009, the size of SSB was positively and significantly associated to performance (NIM, ROAA). The explanation can be associated to the presence of Sharia scholars which has been on annually increase and the role they play in not only advising but delivering the fatwas especially during this time frame. In literature, the large board that had an increase in the total number of directors which may sometimes have a negative impact on the performances because of not only lack of monitoring but also due to efficient control and agency costs. The total number of sessions that were held by the Board of Directors was significantly and negatively associated to the performance (NIM, ROAE), and it suggested that the costs that were allocated to such periods during such a period might be too much and thus need to be minimized. As far as the size of the BOD was concerned, it was ascertained that the regression depicted a significant and positive relationship between the size of the BOD and performance (ROA, NIM, and ROAE) during the financial crisis of 2008/2009. The result was thus quite consistent with Locke and Fauzi (2012) conclusion which ascertained that large boards improved the performance of companies in New Zealand through provision of enhanced monitoring, increased the board’s independence, and counteracting of the management entrancement.

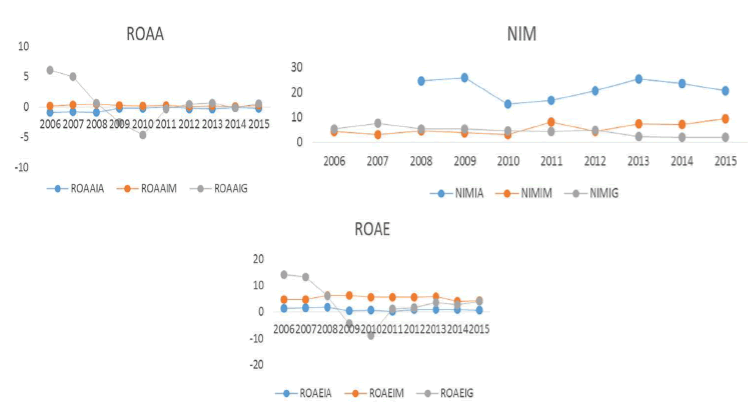

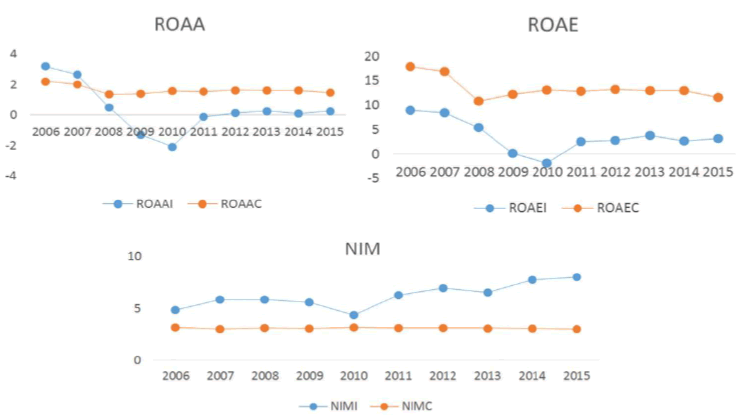

The findings followed the view of literature in cases where more board directors implied that there will be greater monitoring despite of the agency costs. It was also revealed that some of the regions such as MENA and GCC were significantly and negatively associated to the performance of IB (NIM, ROAA) during the financial crisis and the link thus suggested that these regions greatly mattered in the performances of IBs and that this relationship was highly influenced by the financial crisis. It is important to note that before the financial crisis, the prevailing relationship between performance (ROAA) and regions (MENA, GCC) was quite significant and positive may be as a result of specific rules that could have been settled down by the major Islam schools that intervened in such regions and that their fatwas may greatly influence the activity of the Islamic Banks. The positive link or association may have suggested that the “Return on Investment” might actually have been higher in such regions as opposed to others in which such relationships might be significantly and statistically negative. Figure two above depicts how different indicators of performance such as NIM, ROAE, and ROAA are among regions namely MENA, GCC, and ASEAN. As far as ROAE was concerned, it was ascertained that MENA had a better trend both during and after the financial crisis in which some of the GCC’s Islamic Banks were known to have recorded negative ROAA and ROAEE during the financial crisis in which it was observed on graph (ROAA and ROAE). The Net Profit Margin or the Net Interest Margin was higher in the ASEAN as opposed to MENA and GCC and the trend was known to persist before, during, and after the financial crisis of 2008/2009. We can also make a comparison between the performance indicators of Islamic Banks with the Counterparts where figure 3 depicts the comparison.

Before the 2006-2007 financial crisis, the Islamic Banks’ ROAA was higher than the ROAA of the CBs as a result of the robust growth of the Islamic Finance industry that began during early 200 that included among others a strong demand in majority of the Islamic countries for the Sharia compliant items, an increasing demand from the conventional investors for purposes of diversification, the creation of financial instruments that were capable of meeting the needs of both corporate and individual investors, and the actual progress in enhancing both the regulatory and legal frameworks also led to robust growth of the Islamic Banks.

During the 2008/2009 financial crisis, the average ROA was known to have fallen to 0.48 for the Islamic Banks and to 1.34 for the CBs. The crisis then spread to the actual economy, the economic effect of the crisis resulted in a reduction in the ROAA to -1.31 for the Islamic Banks and slightly improved towards 1.37 for the CBs in the year 2009. Taking into consideration the full sample of the study time, it was ascertained that the ROAA for the IBs was 0.35 whereas the one for CBs was 1.63. The results pointed out that the manner in which both CBs and IBs faced was quite different. At first, about the reaction time to financial crisis, ROAE and ROAA graph in figure three depicted that initially, the CBs “weather the shock in a better way” while the performance of the IBs began decreasing directly at the start of this financial crisis. This implied that that the time pattern in response was relatively shorter in the performance of CBs (ROAE and ROAA) as opposed to the performance of the IBs (ROAA and ROAEE). The observation can be explained through the nature of the financial crisis, the banks’ business model, the regions’ specificities, and even the age of the banks. The average age of banks was approximately 26 years for the Islamic banks and 52 years for their counterparts (CBs). Such age difference may greatly matter in the manner of the facing financial crisis.

Majority of the IBs have avoided the “subprime exposure”, since Islamic finance was based on a close association between financial and the productive flows (Ziemba & El said, 2009), however, the crisis duration greatly affected the Islamic Banks as well since and this was not because they did not have a direct exposure towards derivative instruments but just because the contracts of the Islamic Banks were based on the “asset backed transactions” (Jemma & Maher, 2010). The spreading of the financial crisis in the actual economy like for instance market property in many nations where there is a significant presence of the IBs have highly contributed to a negative impact and performance of the IBs. It can be noted that the GCC curve and shape depicted in figure two (ROAE and ROAA) was fairly similar as figure three because the largest IBs were based in the GCC and the region was effectively represented in the sample at 34/89. As a result, the persistence of the actual difficulty in coming back to the “pre-crisis performance” or ROAA may be as a result of erosions in the collateral value especial in the GCC nations that were leveraged highly (Jemma & Maher, 2010).

Robustness Balances and Checks

In order to ascertain the robustness of the results that had been depicted by different models of regression that had been used and in order to address the issue to do with omitted values and endogeneity bias that might have an impact on the results, it will be important that we strictly follow the assertions made by Poi Hun, et al., (2016); Iannotta, et al., (2007) through the application of Bond & Blundell, (1998); Bover & Arellano, (1995) two step system GMM which used lagged values in dependent variables in both difference and levels and even lagged values that were linked with levels of explanatory variables. The results which were depicted in Table eight suggested that the model effectively fitted in the estimators of system GMM.

Despite the fact that Hasen test appeared to have no significant statistics, Waldi and Sargan test were statistically significant at 1 percent. The “first-order auto-correlation” appeared to be “statistically significant” while the second one was not and this was quite true through construction. After matters “controlling for endogeneity and omitted values”, inflation, EQTA, ownership structure, and overhead variables appeared to become statistically significant. The persistence of the bank’s performance was confirmed through estimation models NIM, ROAA, and ROA) during the study period and the results were quite consistent with findings from Poi Hun, et al., (2016); Iannotta, et al., (2007).

| Table 5 System Gmm Estimation of Ownership Structure And Performance |

|||

|---|---|---|---|

| Variables | ROAA | ROAE | NIM |

| ROAA=L, ROAE=L, NIM=L | 0.49451*** | 0.36316*** | 0.39642*** |

| (0.00119) | (0.00297) | (0.01970) | |

| EQTA | 12.96857*** | 12.02095*** | 0.82719 |

| (0.36001) | (0.86070) | (2.41589) | |

| Inflation | -0.16112*** | -0.37104*** | -0.11890 |

| (0.00759) | (0.00989) | (0.10158) | |

| Overheads | -0.00642*** | -0.00609*** | 0.00242** |

| (0.00059) | (0.00043) | (0.00115) | |

| No. of sessions per year | 1.98975*** | -0.93018*** | 0.04016 |

| (0.02289) | (0.07858) | (0.21416) | |

| B. Size of SSB | -2.97736*** | -1.91117*** | -5.27136** |

| (0.22115) | (0.34252) | (2.43947) | |

| Managerial company 1 | 6.69406*** | 0.00000 | -10.42519 |

| (1.78452) | (0.00000) | (7.39052) | |

| Controlled company 2 | 4.30464** | -4.00503** | -14.99785 |

| (1.53459) | (1.38975) | (9.18026) | |

| Family-owned company 3 | 5.68217** | 6.24429* | 0.00000 |

| (2.88572) | (3.77393) | (0.00000) | |

| Public owned company 4 | 0.00000 | 3.93281 | -20.76821** |

| (0.00000) | (2.67847) | (11.31143) | |

| GCC | 3.97419 | -4.83998 | -11.73158** |

| (6.42990) | (12.85028) | (4.79168) | |

| MENA | 23.0052*** | 10.98440 | -20.29685*** |

| (7.84640) | (16.97491) | (4.60418) | |

| Others | -11.00510 | -39.0719*** | -79.8116 |

| (9.03662) | (14.89057) | (106.0024) | |

| West Europe | -2.42630 | 28.58992 | 0.00000 |

| (7.11087) | (24.98371) | (0.00000) | |

| Constant | -16.03711** | 0.00000 | 47.93782*** |

| (6.39439) | (0.00000) | (13.83684) | |

| Observations | 479 | 528 | 220 |

| No. of pan-id | 83 | 83 | 39 |

| No. of instruments | 81 | 81 | 81 |

| Years dummies | Yes | Yes | Yes |

| AR1 P value | 0.037 | 0.032 | 0.0864 |

| AR2 P value | 0.224 | 0.236 | 0.637 |

| Sargan P value | 0.000 | 0.000 | 0.000 |

| Hansen P value | 0.224 | 0.269 | 1.000 |

| Standard errors in parentheses. ***P<0.01, **P<0.05, *P<0.1 | |||

| Table 6 The Full Sample From This Study |

|||||

|---|---|---|---|---|---|

| Variables | ROAE | ROAA | N.I.M | ||

| Managerialfirm1 | 0.83576 | 0.49473 | -1.26309 | ||

| (1.53813) | (0.68409) | (1.78199) | |||

| Controlledfirm2 | 1.34894 | 0.03864 | 0.88938 | ||

| (1.28931) | (0.57562) | (1.62481) | |||

| Familyownedfirm3 | 8.06598*** | 1.63181 | 3.28646 | ||

| (2.47758) | (1.12802) | (2.86958) | |||

| Publicownedfirm4=o, | - | - | - | ||

| log_SIZE | 0.55279** | 0.12322 | 0.39474 | ||

| (0.25407) | (0.11508) | (0.30039) | |||

| Board size of SSB | 0.90933*** | 0.00724 | 0.19757 | ||

| (0.30421) | (0.13585) | (0.31596) | |||

| BODSIZE | -0.56515*** | -0.00106 | 0.75801*** | ||

| (0.19658) | (0.08869) | (0.23164) | |||

| Region=2, GCC | 2.76789* | 0.28790 | -18.56365*** | ||

| (1.53090) | (0.67356) | (1.75414) | |||

| Region=3, MENA | 6.90035*** | 0.55052 | -15.88597*** | ||

| (1.68450) | (0.74233) | (1.90946) | |||

| Region=4, Others | 3.80796* | 0.31497 | -13.15566*** | ||

| (2.10817) | (0.93489) | (3.13044) | |||

| Region=5, West Europe | -1.86822 | -0.67377 | 0.00000 | ||

| (2.77635) | (1.46524) | (0.00000) | |||

| Constant | -1.05726 | 0.32979 | 10.30523*** | ||

| (3.62437) | (1.68221) | (3.97724) | |||

| Observations | 667 | 614 | 276 | ||

| Number of pan id | 89 | 89 | 45 | ||

| Wald chi2 | 90.97*** | 33.56** | 155.78*** | ||

| Standard errors in parentheses. ***P<0.01, **P<0.05, *P<0.1 | |||||

Conclusions

In this research paper, we presented empirical evidence regarding mechanisms related between the ownership structure and the performance of the IBs. Indeed, the research paper analyzed the relationship that prevailed between the concentration of ownership and the performance on one side, as well as the ownership structure ownership and the performance of the IB on another side through taking into consideration the “bank specify” factors as well as a number of corporate governance tools or mechanisms that were suggested by Charreaux (1991). The research paper is aimed checking out whether the conclusions that were made by Charreux regarding both the ownership structure as well as performances greatly mattered in the Islamic Banks.

As far as the issue of ownership concentration of companies was concerned, the results suggested that there was indeed no relationship between the performance of IBs and the concentration that was measured by the total percentage of shares which had been held by dominant shareholders. The results were noted to have been persistent not only before but also during and after the financial crisis of 2008/2009 and this was for all the performance measures (ROAA, NIM, and ROAE). The results corroborated with the conclusions that were made by Charreaux (1991) and also followed the neutrality thesis that was presented by Lehn and Demsetz (1985) and Demsetz (1985) who indicated that the ownership structure had no link or association with performance since the performance of such companies or organizations were constrained essentially by conditions and environments which businesses were developed.

The ownership identity namely Controlled, Public, Managerial, and family may be associated to the performance of IBs. Our results from the study suggested that there was a significant and positive relationship between the family Islamic businesses and their performance (ROAE) before, during or after the 2008/2009 financial crisis. The result was indeed consistence with the conclusions made by Charreaux regarding the family-owned entities as well as performances (ROAE). We can further truly argue that the relationship between the Family-Owned Islamic Banks and performances was not only positive it was also statistically significant since Family Shareholders may actually have even better information as compared to other forms of shareholders since they have a closer relationship with administrators and leaders.

This research study suggested that there was a positive as well as significant relationship or link between the managerial ownership and the performance of IBs during and after the financial crisis. We also observed that there was indeed an “insignificant relationship” in the course of the study. It was noted that both the significant and positive relationship between the managerial property and the performance of IBs (ROE) was quite consistent with Donghui et al. (2007), Spitz and Mueller (2002), Soufeljil et al. (2016), Litchenberg and Palia (1999), and Charreaux (1991) findings. The link may be better explained by better or enhanced decisions taken by managers due to the positions they hold and the effects of such decisions on the performance of IBs.

The conclusion con company's truly the convergence thesis of interests, that stipulates that value of a given company increases in line with the “proportion of control” that was held by such managers. Controlled property was also significantly and positively associated to the performance of IB sometimes because of not only monitoring the role played by institutional funds but also due to their ability of maximizing the profitability of IB. The GMM regression displayed a significant and negative relationship between the Public Owned Islamic Banks and performances or the ROAA and this result was also consistent with the findings presented by Ongore (2011). Indeed, according to the author, the companies that were publicly owned were governed by politicians and bureaucrats with no immense cash flows since all profits known to be generated by the entities were channeled to government or state exchequer in order to help in financing the national or state budget.

We also noted that a number of factors in corporate governance highly influenced the relationship between the ownership structure and the performance of banks and these included among others the size of the “Supervisory Board of Sharia) or SSB, the size of the Board of Directors (BOD), the number of sessions that had been conducted by BOD and some “bank specify” factors such as the CIR, NLDSTF, NLTA which may have a great influence on the relationship. As it can be seen, the major hypotheses of the study have been duly confirmed through such results.

In addition to the above, the findings from this study displayed the association between the SSBs and the performance of the IBs as well as the role that it played in the Islamic Corporate Governance’s conceptual framework that suggested that some of the Islamic financial companies enjoyed an “extra layer” of governance regarding ethical behaviors and Sharia rules that may minimize opportunistic actions that resulted in lesser agency conflicts.

Finally, as a result of the study limitations, this research paper could be duly extended in numerous ways. Before the 2006-2007 financial crisis that can be extended through beginning from 2000 so as to actually appreciate the evolution of the structure of ownership and the impact that it has on the performance of IBs in numerous regions (Tobin Q). The findings’ validity that was interpreted in the study was limited to the “scope of the data” and the economics’ condition for a specified data period.

Acknowledgment

This research is funded by the Deanship of Research in Zarqa University, Jordan.

References

Abbas, S.Z., Rahman, R.A., & Mahenthiran, S. (2009). Ultimate ownership structure and performance of Islamic institutions in Malaysia. Paper presented at Asian Finance Association Conference, July 2009, in Brisbane, Australia.

Alman, M. (2012). Shari’ah supervisory board composition effects on islamic banks’ risk-taking behavior. Journal of Banking Regulation, 14, 134 – 163.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 29-51. .

Asadi, A., & Pahlevan, M. (2016). The relationship between ownership structure and firms’ performance in tehran stock exchange. Journal of Insurance and Financial Management, 1(2), 62-76.

Beck, T., Demirgüç-Kunt, A., & Merrouche, O. (2013), Islamic vs. conventional banking: Business model, efficiency and stability. Journal of Banking and Finance, 37, 433-447. .

Bektas, E., & Kaymak, T. (2009). Governance mechanisms and ownership in an emerging market: The case of Turkish banks. Emerging Markets Finance and Trade, 45, 20-32. .

Berle, A., & Means, G. (1932). The modern corporation and private property. New Brunswick: Harcourt Brace and world, Inc.

Blundell, R., & Bond, S. (1998), Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 115-143. .

Bonin, J.P., Iftekhar, H., & Wachtel, P. (2004), Bank performance, efficiency and ownership in transition countries. Journal of Banking and Finance, 29, 31-53. .

Bourkhis, K., & Nabib, M.S. (2013), Islamic and conventional banks’ soundness during the 2007–2008 financial crisis. Review of Financial Economics, 22(2), 68-77. .

Bourkhis, K., & Omri, A. (2016), Ownership concentration, risk and performance: Comparison between MENA islamic and conventional banks. Journal of Islamic Legal Studies, 2(2), 28-57.

Busta, I. (2007), Board effectiveness and the impact of the legal family in the European banking industry. Barcelona, Spain: Paper Presented at the Meeting of FMA EUROPEAN Conference.

Chapra, U. (2009). Global financial crisis: Can Islamic finance help? A book chapter in the issues of international financial crisis from Islamic perpective. Saudi Arabia: Islamic Economy Research Centre.

Chapra, U., & Ahmed, H. (2002). Corporate governance in Islamic financial institution. Djeddah Saudi Arabia: Islamic Development Bank – Islamic Research Training Institute.

Charreaux, G. (1991). Structure de propriété, relation d’agence et performance financière. Revue Économique, 42(3), 521-552.

Classens, S., Djankov, S., & Lang, L. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Econmics, 58, 81-112. .

Demsetz, H. (1983). The structure of ownership and the theory of the firm. Journal of Law and Economics, 375-390.

Demsetz, H., & Lehn, K. (1985). The structure of corporate Ownership: Causes and Consequences. Journal of political economy, 93(6), 1155-1177.

Donghui, L., Fariborz, M., Pascal, N., & Tan, L.W. (2007). Managerial ownership and firm performance: Evidence from China’s privatizations. Research in International Business and Finance, 21(3), 396-413. .