Research Article: 2021 Vol: 25 Issue: 6

The Performance of Collection, Management and Empowerment of Public Endowment Institutions in Indonesia on the Financial Performances

Muhammad Iskandar, Universitas Pendidikan Indonesia

Disman, Universitas Pendidikan Indonesia

Nugraha, Universitas Pendidikan Indonesia

Mayasari, Universitas Pendidikan Indonesia

Ari Riswanto, Universitas Pendidikan Indonesia

Citation Information: Iskandar, M., Disman, Nugraha, Mayasari, & Riswanto, A. (2021). The performance of collection, management and empowerment of public endowment institutions in indonesia on the financial performances. Academy of Accounting and Financial Studies Journal, 25(6), 1-11.

Abstract

This article analyzes the effectiveness and efficiency of financial performance of endownment institutions in Indonesia related to the elements of collection, management and utilization. This collection involves strategic innovation and technological innovation, includes good governance and intellectual capital, and empowerment includes financing and utilization. The research was conducted at endownment institutions, with a population of 192 administrators and a sample of 128 administrators. Data were analyzed with descriptive analysis and partial least square (SEM-PLS) structural equation modeling. In general, the results of the study indicate that the effectiveness and efficiency of financial performance of endownment institutions in Indonesia are influenced by strategic innovation, technological innovation, good governance, intellectual capital, financing, and the use of endownmen.

Keywords

Endownment Institutions, Financial Performance, Good Governance, Intellectual Capital, Innovation, Financing, Utilization.

Introduction

Religious endownment is one of the instruments of Islamic Social Finance (ISF), in addition to alms, and grants, which has been dominant as one of the pillars of the economy since the past. The nature of endownment law is voluntary, intending to be closer to God and provide broad benefits to others (Masyhadi, 2019). Recently, discussion about endownment has started to become a major concern by many parties. Endownmen, including productive endownmen, is a major component of ISF that cannot be separated from Islamic Commercial Finance (ICF) in the integrated Islamic Financial System (IFS). Endownment has an important role in the social and economic life of the community. The inherent nature of endowments will result in capital accumulation over a very long period of time, which will increase the financial capacity of individuals or management organizations, thereby contributing positively to improving people's welfare (Fadilah, 2015; Çizakça, 2000). The results of the use of endownment are not only limited to poverty reduction, creating economic growth, increasing socio-economic welfare and increasing holistic financial inclusion. In addition, productive endowments need and involve more parties, who, if managed by professional management, will be able to maintain financial system stability.

Endownment in an economic system is important because endowments in Islamic finance always include and bind commercial finance and social finance, unlike conventional financial systems. In conventional secular economic systems, efforts to maximize profits are a logical goal. At present, the conventional secular economic system is dominated by commercial finance without involving aspects of social finance (also environmental impact). Some proponent of sharia economy also noted that conventional commercial finance only focuses on commercial goals so that it is not aligned with the triple-bottom-line (economic, social and environmental) objectives of conventional social finance (Griffin & McKinley, 1994). In addition, conventional commercial finance inherently shows instability (Rothbard, 2008) because it uses a fractional reserve banking system. Furthermore, the concept of triplebottom- line in the conventional social financial system is possible to be achieved through a shift in social missions to reach the poor and improve the welfare of the community into more profitable commercially sustainable missions (Armendáriz et al., 2013) and commercialization (Hamada, 2010). Meanwhile, Islamic commercial finance inherently shows stability (Azis & Osada, 2010), partly because of the prohibition of usury and maysir, as well as risk sharing to launch productive investment, and endownment to drive the economy and encourage commercial and social investment. Furthermore, Islamic commercial finance invites the public to be more productive in participating in the real business sector, business activities based on ethical partnerships and well managed, so that Islamic social finance can simultaneously reach the triple-bottom-line as expected (Acarya & Guruh, 2009).

Endowment funds in Indonesia have increased from year to year which is channeled to the poor and the program strengthens its production capacity (Acarya & Guruh, 2009). Meanwhile, the endownment sector has huge assets to be managed and has very promising prospects for further development. In this case, endownment assets in the form of land, schools, mosques, hospitals are estimated to be around Rp. 600 trillion (potential for wakaf money in excess of Rp. 60 trillion). However, until now, endownment has not been able to play an effective role in empowering the socio-economic sector of society (Budiman, 2011). The cause of the not yet maximal endownment in Indonesia as an instrument of community empowerment, according to Acarya & Guruh (2009), can be caused by several factors. The factors include the level of public literacy about endownment is very low, public trust in endownment management institutions is low, endownment has not become a community habit and has not become a lifestyle, lack of national endownment database, including data on endownment assets, no incentive for waqif, dualism of authority of the Indonesian endownment board as regulator and operator, position of the Indonesian endownment agency as operator and private endownment management agency, and manager has not become a career choice and weak professionalism of the endownment management institute (Acarya & Guruh, 2009). An optimal endownment management system cannot be carried out without sincere cooperation between the manager and endownment supervisor with all relevant authorities. In this case, an adequate system is needed to develop, implement, monitor, and enforce monitoring tools and policies regarding the management of endownment and optimal monitoring systems. Based on the endownment management system framework, this study focuses on the financial performance model of endownment institutions. The financial performance of endownment institutions can be said to be good or high if the activities of collecting, managing, and empowering endownment funds carried out by endownment institutions also run well and smoothly. First, the endowment of fundraising activities (fundraising) requires support and innovation breakthroughs. Meanwhile, management activities certainly require good governance and intellectual capital for endownment managers. Finally, empowerment activities cover aspects of financing and utilization (consumptive and productive).

Literature Review

Agency Theory and Stewardship Theory

Agency Theory, according to Jensen & Meckling (1976), begins with the separation between ownership and control of modern companies that issue shares. This separation, when combined with the inability to actually determine contracts, will give agents/managers the opportunity to pursue activities that will benefit themselves at the expense of their principals/owners. Jensen & Meckling (1976) state that differences in key interests cause managers to fail to maximize the welfare of principals. This failure is the most important cost resulting from the conflict of principals and managers and is known as an agency problem. Agency theorists view company management as an agent for shareholders who will act with awareness for their own interests, not as a wise and prudent and fair party for shareholders as assumed in the previous theory.

This agency theory assumes that management cannot be trusted to act as well as possible in the interests of the public in general and shareholders in particular. Agency theory emerged based on the phenomenon of separation between company owners/shareholders and managers who manage companies (Kurniawan, 2017). In overcoming conflicts that occur within the company or rather to overcome this agency problem there are various systems that can be done, one of which is by implementing good corporate governance. The concept of corporate governance can be explained by the Theory of Stewardship, which assumes that human nature is inherently trustworthy, able to act responsibly and has integrity and honesty with others. If the assumptions in this theory are applied in company management, management theory sees management as a party that can be trusted to act as best it can in the public interest in general and shareholders in particular.

Innovation of in Collection of Endowments

Innovation plays an important role not only for business companies but also for nonbusiness institutions (Jong & Vermeulen, 2006). Innovation is a new element that is introduced in a network that can change, even if only for a moment, both the price, the culprit, the element or the node in the network (Cabral, 2003). Innovation is an important factor in business activities (Rosli & Sidek, 2013; Ali, 2019). According to Kuratko & Hodgetts (2004), innovation is the creation of wealth or new changes and an increase in existing resources to create new wealth.

Schlegelmilch et al. (2003) argued that strategic innovation is a fundamental conceptualization of the business model and reshaping existing markets to achieve dramatic increases in value for customers and high growth for companies. This definition contains three main elements, namely the first element is the fundamental conceptualization of the business model, the second key element is reshaping the existing market and the third key element is a dramatic increase in value for customers.

In addition, Thornhill (2006) states that innovation includes the creation of ideas, the development of inventions and finally the introduction of new products, processes or services to the market. By adopting the concept from Zimmerer and Scarborough (2005), Kreiser and Davis (2010), Okpara (2007), Avlonitisa (2007), this study used the innovation with 4 dimensions, namely strategy innovation, product innovation, marketing innovation, and technology innovation.

Good Governance, Intellectual Capital and Endownment Management

The term good corporate governance is widely known in the business world. There are several expert opinions about good corporate governance. The Cadbury Committee definition of corporate governance in 1992 was that corporate governance is a system where the company is directed and controlled. Furthermore, Shleifer & Vishny (1997) suggested that corporate governance is a way to give trust to suppliers of company funds that they will get a return on their investment.

Corporate governance, in general, is defined as the rights, roles and responsibilities of the principals and agents of a company in line with the provisions that underlie the relationship between "company management, boards, shareholders and other stakeholders" (OECD, 2004: 11). In this case, a good corporate governance framework can help improve the overall credibility of a particular institution/company and increase the confidence of its stakeholders. An appropriate governance framework for endowments will not only contribute to bringing greater accountability and transparency into operations but will also play an important role in improving the long-term health of the institution itself (Dasuki & Lestari, 2019). In order for endownment institutions to develop consistently and sustainably, integration is needed in one system related to aspects of efficiency, accountability, transparency, monitoring and control mechanisms. For this reason, the need for an appropriate governance framework for endowments cannot be ignored.

Marwah & Bolz (2009) stress the importance of changing the endownment into a modern institutional/corporate structure. This change is in line with endownment characteristics related to longer endurance aspects. The specific characteristics of the endownment itself can be strengthened by a mechanism of good corporate governance (GCG). Foster & Garduño (2013) in this case emphasizes the similarity between the principles of Western world governance and sharia governance, especially those related to aspects of justice, transparency, and accountability.

According to Bontis et al. (2000) states that in general, researchers identify three main constructs of IC, namely: human capital (HC), structural capital (SC), and customer capital (CC). Human Capital is a source of knowledge, skills and competencies that are very useful in the development of corporate value. Structural Capital is a means used to support optimal work for employees which includes the organization's ability to reach markets, software, hardware, databases, organizational structures, patents, trade marks, and all organizational capabilities in supporting employee productivity. Customer Capital is a series of knowledge from markets, customers, suppliers, governments and industry associations. By referring to the description from Tiswarni 92013), the endownment manager in this study refers to the party authorized by the endowment to administer, maintain, improve, develop, manage, and share endowments and benefits to the recipients, where the manager has several rights and obligations which is in accordance with Islamic sharia.

Religious endowment management in Indonesia

The Islamic commercial and social financial system or Islamic financial system in Indonesia is built on a number of regulatory frameworks that currently apply, including Islamic banking regulations, endownment regulations, and microfinance regulations. The practice of combining commercial and social Islamic finance supported by the role of endowment institutions and Islamic banks has been carried out in various countries. Some countries have developed endowments and are able to solve their socio-economic problems with endowments, such as Egypt, Singapore, Malaysia, Turkey, and Indonesia. In Indonesia, since the launch of the movement of endownment money by the President in 2010. the collection of endownment money based on data from the Indonesian Endownment Board (BWI) until the end of 2015 reached Rp185 billion. As for endownment land assets, Indonesia has a endownment land of 4.3 billion square meters. Indonesia, with various endownment management organizations, began to develop productive endownment schemes.

Collecting money for endowments is still far compared to the potential endowments of existing money, which is estimated to reach Rp. 7.2 trillion per year (Ministry of Religion, 2014). With the notes of endownment land, assets that can be produced are still less than 10 percent. In addition, the Government of the Republic of Indonesia has provided strong support for the development of endownment in this country. With the presence of Law No. 41 of 2004 concerning endowments, in fact endowments are expected to make a meaningful contribution to the empowerment of endownment assets in Indonesia productively for the welfare of society in general. Basically, endowments are expected to contribute more to the socio-economic life of the community, not only to play a role in the aspect of ritual worship (Aisyah, 2014).

Endownment managers and supervisors need to implement strong external controls and risk management to respond to a number of elements or prerequisites that have a direct impact on endownment management and optimal supervision in practice. At least, there are three prerequisites for an optimal endownment management system. First, A predetermined framework for the formulation of endownment management policies. All parties involved and responsible for the overall implementation of the endownment management system must be identified in a clear framework for the formulation of endownment policies. The framework of this endowment is set on endowments, laws, regulations, or other arrangements. The framework reflects the need to manage mechanisms for an optimal endownment management system.

Second, well-developed public infrastructure. There are four elements of public infrastructure to support optimal management and supervision of endownmen, namely: (i) management and accounting standards and national accounting standards that are comprehensive and appropriate; (ii) an external audit system and independent accountants; (iii) availability of competent and professional Nazirs with transparent technical and Islamic ethical standards; and (iv) Availability of regional, economic and social statistics.

Third, a clear framework model for the collection, investment, management and distribution of endownment activities. A clear framework model for all of these activities can help optimize the function of endownment as an instrument that can be utilized for the prosperity and welfare of the community.

Hypothesis Development

Financial performance refers to the act of carrying out financial activities. In a broader sense, financial performance refers to the extent to which financial objectives will, are or have been achieved (Hakim, 2017). This is the process of measuring the results of company policies and operations relating to monetary or financial aspects (Patra, 2009). Businessoriented financial performance and financial performance in non-profit institutions have different characteristics. As one of the non-profit financial institutions, financial performance in endownment institutions in Indonesia also has different characteristics from the financial performance of business institutions because they have different goals, although there are some similarities.

Financial ratios are very important for evaluating an organization's financial condition, but they may not be the most important measure of success in a non-profit organization. These institutions must be assessed in a more complex manner, which generally relates to aspects of efficiency and effectiveness (Shafii et al., 2009). Thus, endownment institutions cannot be evaluated based on financial figures alone. For example, high current assets are dominated by cash and cash equivalents indicate that the institution may not mobilize its assets.

Dewi et al. (2013) proposed a endownment measurement model using six ratios, namely: program efficiency ratios, operating cost efficiency ratios, rental activity margins, investment returns, fundraising efficiency ratios, and distribution efficiency ratios. As a nonprofit organization and institution that may get full support from the government, endownment institutions need to focus on aspects of efficiency. In addition, Epstein et al., (2009) proposed four categories of ratios that could represent the efficiency and sustainability of nonprofits through various program implementations, namely: administrative efficiency, program efficiency, fundraising efficiency, and other financial performance measures. Regarding aspects of financial performance, Atan et al. (2013) briefly states that financial indicators are used to measure efficiency and effectiveness, namely the ratio of performance efficiency and ratio of operating efficiency. Accordinly, the hypotheses proposes in this research are:

H1: Collection activities have a positive influence on financial performance

H2: Management activities have a positive influence on financial performance

H3: Empowerment activities have a positive influence on financial performance

Research Methods

This is a quantitative approach using the questionnaire as the main instrument of data collection. Data were analyzed by deception analysis to describe the various characteristics of the variables studied. Verification analysis for testing the hypothesis of this research is Structural Equation Modeling Partial Least Square (SEM-PLS). The population of this study is 192 endownment managers in 192 endownment institutions in Indonesia. Samples were randomly selected and 128 selected. Questionnaires were distributed to 128 as respondents with Google forms. The questionnaire consisted of 81 items.

The focus of research that is the object of research is based on some considerations. First, financial Performance Model, seen from the aspect of effectiveness and efficiency. The financial performance of endownment institutions can be said to be good or high if the activities of collecting, managing, and utilizing endowment funds carried out by endowment funds also run well and smoothly. Second, collection activities (fundraising) now require support and innovation breakthroughs. Third, management activities certainly require good governance and intellectual capital from the human resources manager of endownment. Fourth, empowerment activities include aspects of financing and utilization (consumptive and productive).

In the model, financial performance (Y) is a latent endogenous variable that has two manifest variables: effectiveness and efficiency (21 items). Collection activity (X1) is a latent exogenous variable that has two manifest variables: strategy innovation and technology innovation (24 items). Management activity (X2) is a latent exogenous variable that has two manifest variables: good governance and intellectual capital (18 items). Finally, empowerment activities (X3) are latent exogenous variables that have two real variables: financing and utilization (18 items).

Results and Discussion

Descriptive analysis illustrates the average score of each manifest variable, which indicates that most manifest variables are adequate, while some manifest variables are in the high category and the low category.

Table 1 shows that all latent variables are in the adequate category. Based on the calculation of manifest variables, aspects of financing in empowerment and aspects of effectiveness in financial performance are relatively high, while aspects of good governance in management and aspects of utilization in empowerment are relatively low. This condition indicates that the application of good governance still confuses respondents. The respondents were also not very sure about the suitability of the use of endownmen. However, the financing aspect is relatively high, which reflects the application of the appropriate financing aspects. Most respondents believe that the effectiveness aspects of the financial performance of endownment institutions have achieved general endownment objectives.

| Table 1 Scores and Category Averages |

||

| Latent/Manifest variable | Mean | Category |

|---|---|---|

| Collection: | 3.105 | Adequate |

| Strategy Innovation | 3.003 | Adequate |

| Technology Innovation | 3.27 | Adequate |

| Management: | 2.906 | Adequate |

| Good Governance | 2.513 | Low |

| Intellectual Capital | 3.3 | Adequate |

| Empowerment: | 3.108 | Adequate |

| Financing | 3.818 | High |

| Utilization | 2.398 | Low |

| Financial Performance | 3.375 | Adequate |

| Effectiveness | 3.505 | High |

| Efficiency | 3.243 | Adequate |

Hypothesis testing using SEM-PLS consists of two steps. The first step is the evaluation of the external model or measurement model, which includes the value of external loading (valid when an external loading is> 0.5 and ideally an external loading> 0.7). The measurement model is a model that connects latent variables with manifest variables. In this study, there are 4 latent variables with 8 manifest variables. The structure matrix of loading factors of all manifest variables can be illustrated in Table 2.

| Table 2 Factor Structure Matrix of Loadings |

||||

| Scale Items | X1 | X2 | X3 | Y |

|---|---|---|---|---|

| Strategy Innovation | 0.870 | |||

| Technology Innovation | 0.879 | |||

| Good Governance | 0.887 | |||

| Intellectual Capital | 0.886 | |||

| Financing | 0.888 | |||

| Utilization | 0.907 | |||

| Effectiveness | 0.932 | |||

| Efficiency | 0.940 | |||

The second step is the evaluation of the inner model (structural model), which includes the correlation value of latent variables, path coefficients, and R-square (R2), in terms of variants of endogenous constructs explained by exogenous constructs. This external load represents the absolute contribution of each manifest variable (dimension or indicator) in reflecting its latent variable. The results showed that all manifest variables have a loading path/coefficient> 0.50 which indicates that each manifest variable is significantly able to reflect the latent variables of collection, management, empowerment, and financial performance in endownment institutions in Indonesia.

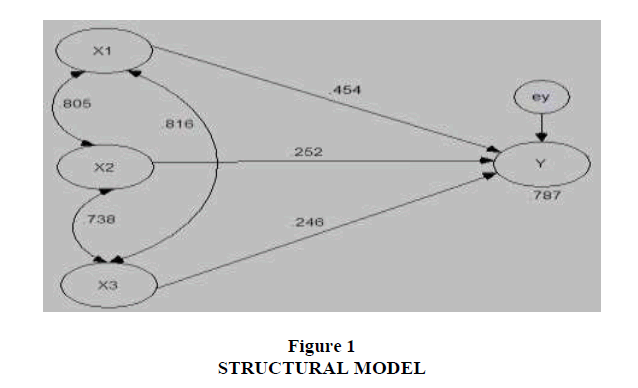

The result of R-square of 0.787 shows a significant effect of collection, management, and empowerment on financial performance, which means that 78.7% of the variance of financial performance can be explained by collection, management, and empowerment, and 21.3% is influenced by other factors which is not researched in this model. This value also shows the importance of collection, management and empowerment to improve the financial performance of endownment institutions in Indonesia. The structural model can be illustrated in Figure 1.

Figure 1 explains the correlation coefficient, path coefficient, and R-Square. Basically, the structural model is to test hypotheses. The results revealed that all hypotheses were accepted. Hypothesis tests can be presented in Table 3.

| Table 3 Results of Hypotheses Testing |

|||

| Model | Coefficient | t-statistic (p-value) |

Notes |

|---|---|---|---|

| Collection à Financial Performance | 0.454 | 3,063 (0.002) |

Significant |

| Management à Financial Performance | 0.252 | 2,199 (0.028) |

Significant |

| Empowerment à Financial Performance | 0.246 | 2,089 (0.037) |

Significant |

Based on the results of the study, it was found that collection activities have a positive and significant effect on financial performance. This shows that the higher the implementation of endownment collection (strategic innovation and technological innovation), the higher the effectiveness and efficiency of financial performance being carried out by endownment institutions in Indonesia. It was also found that management activities (good governance and intellectual capital) had a positive and significant influence on financial performance. This means that the higher the application of good governance and intellectual capital, the higher the effectiveness and efficiency of financial performance.

Empowerment activities have a positive and significant impact on financial performance, which means the higher the implementation of financing and the use of productive endowments, the higher the effectiveness and efficiency of financial performance. The findings of this study reveal that some aspects are still low (good governance in management and utilization in empowerment). Endownment institutions must pay attention to these aspects to improve financial performance in general. Endownment institutions can maintain financing aspects in empowerment and effectiveness aspects in financial performance because their achievements are relatively high.

Conclusion

Endownment is one of the instruments of Islamic economics that has the potential to improve socio-economic well-being. Endownment can have a good role to help solve social and economic problems in the community if it can be managed productively and professionally. Endownment institutions in Indonesia seek to improve their financial performance through various models of productive endownment financing, ranging from planning, implementation, and evaluation. It is also related to financing, utilization, and empowerment of endownmen. At least, there are two main models of productive endownment financing, namely simple model and innovative model.

The findings showed that the effect of elements of collection, management and empowerment on the financial performance of endownment institutions in Indonesia is relatively high. This model reveals that financial performance can be influenced, indirectly, by strategic innovation, technological innovation, good governance, intellectual capital, endownment financing, and the use of endownmen. Endownment managers must pay more attention to the implementation of good governance so that the effectiveness and efficiency of financial performance of endownment institutions in Indonesia can be better. Different perspectives on the use of endowments of each endownment institution can enrich scientific insights about the use of endowments, including productive endowments, in Indonesia.

The purpose of productive endownment s is to improve economic welfare, social welfare, environmental welfare, spiritual well-being, and financial stability. Various criteria for so-called productive endowments involve various aspects. First, the endownment management body can consist of individuals, organizations, social legal entities, cooperative legal entities, and commercial legal entities. Second, endownment assets can be in the form of small business facilities, residential buildings, office buildings, large commercial centers, as well as mixed social & community centers. Third, financing can be done through cash endownmen, cash endownment and joint finance, Islamic banks, international institutions, and sukuk. Fourth, management can be done alone, a subsidiary, internal-external partnership, temporary external partnership, and permanent external partnership. Fifth, the expected benefits are related to profitability, increase in endownment assets, endownment reach, reach of endownment Alaih, and improvement of manager's reputation. Finally, sixth, compliance is related to sharia provisions, legal regulations for endownment management institutions, endownment regulations, land regulations, and differences in regulations.

References

- Acarya, D.Y., & Guruh, S.R. (2009). Analisis Efisiensi Perbankan Konvensional dan Perbankan Syariah di Indonesia dengan Data Envelopment Analysis: Current Issues Lembaga Keuangan Syariah. Jakarta: Prenada Media Group.

- Aisyah, M. (2014). The role of zakah and binary economics in poverty reduction. Esensi: Jurnal Bisnis dan Manajemen, 4(2).

- Ali, A. (2019). Entrepreneurial Marketing and Consumer Need Adaptability for Batik Industry Marketing Performance in Lasem, Rembang. Arthatama, 3(1), 55-66.

- Armendáriz, B., D'Espallier, B., Hudon, M., & Szafarz, A. (2013). Subsidy uncertainty and microfinance mission drift. Available at SSRN 1731265.

- Atan, R., Zainon, S., Aliman, S., & Nam, R.Y. (2013). Financial Management in Religious Non-Profit Organizations: A Mission Based Approach to Ratio Analysis. International Conference on Advanced Computer Science and Electronics Information (ICACSEI).

- Avlonitis, G.J., & Salavou, H.E. (2007). Entrepreneurial orientation of SMEs, product innovativeness, and performance. Journal of Business Research, 60(5), 566-575.

- Azis, Y., & Osada, H. (2010). An empirical study of new value creation in financial service companies using design for Six Sigma approach. International Journal of Productivity and Quality Management, 7(1), 104-124.

- Bontis, N., Keow, W.C.C., & Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital 1(1), 85-100.

- Budiman, A.A. (2011). Akuntabilitas lembaga pengelola wakaf. Walisongo: Jurnal Penelitian Sosial Keagamaan, 19(1), 75-102.

- Cabral, R. (2003). Science and Development. The Oxford Companion to the History of Modern Science, 205-207.

- Çizakça, M. (2000). A history of philanthropic foundations: The Islamic world from the seventh century to the present (pp. 2-10). Istanbul: Bo?aziçi University Press.

- Dasuki, R.E., & Lestari, A. (2019). Implementation of Good Corporate Governance to the Value of Cooperative Company. Journal of Economic Empowerment Strategy (JEES), 2(1), 24-41.

- De Jong, J.P., & Vermeulen, P.A. (2006). Determinants of product innovation in small firms: A comparison across industries. International Small Business Journal, 24(6), 587-609.

- Dewi, M.K., Ibrahim, S.H., & Ferdian, I.H (2011). Measuring Performance of Awqaf Institutions: A Proposal. Retrieved from http://conference.qfis.edu.qa/app/media/7041.

- Epstein, M.J., Buhovac, A.R., & Yuthas, K. (2015). Managing social, environmental and financial performance simultaneously. Long Range Planning, 48(1), 35-45.

- Fadilah, S. (2015). Going Concern: An Implementation inWaqf Institutions (Religious Charitable Endowment). Procedia-Social and Behavioral Sciences, 211, 356-363.

- Foster, S., & Garduño, H. (2013). Groundwater-resource governance: Are governments and stakeholders responding to the challenge?. Hydrogeology Journal, 21(2), 317-320.

- Griffin, K., & McKinley, T. (1994). A new framework for development cooperation. UNDP Human Development Report Office.

- Hakim, F. (2017). The Influence of non-performing loan and loan to deposit ratio on the level of conventional bank health in Indonesia. Arthatama, 1(1), 35-49.

- Hamada, M. (2010). Commercialization of microfinance in Indonesia: The shortage of funds and the linkage program. The Developing Economies, 48(1), 156-176.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kreiser, P.M., & Davis, J. (2010). Entrepreneurial orientation and firm performance: The unique impact of innovativeness, proactiveness, and risk-taking. Journal of Small Business & Entrepreneurship, 23(1), 39-51.

- Kuratko, D.F., & Hodgetts, R.M. (2004). Innovation and the entrepreneur. 2004): Entrepreneurship, 6th edn. Mason, OH: Thomson, 138-50.

- Kurniawan, R. (2017). Effect of environmental performance on environmental disclosures of manufacturing, mining and plantation companies listed in Indonesia stock exchange. Arthatama, 1(1), 6-17.

- Martono, S., Nurkhin, A., Lutfhiyah, F., Fachrurrozie, F., Rofiq, A., Sumiadji. (2019). The relationship between knowledge, trust, intention to pay zakah, and zakah-paying behavior. International Journal of Financial Research 10(2)

- Marwah, H., & Bolz, A.K. (2009). Waqfs and trusts: a comparative study. Trusts & Trustees, 15(10), 811-816.

- Masyhadi, A. (2019). Nilai-Nilai Tasawuf Ajaran Sunan Drajat. Doctoral dissertation, UIN Sunan Ampel Surabaya.

- Ministry of Religion. (2014). Laporan Akuntabilitas Kinerja Instansi Pemerintah: Kementerian Agama Tahun 2013. Jakarta, Indonesia: Kementerian Agama.

- OECD (Organisation for Economic Co-operation and Development) (2004). Principles of Corporate Governance, France: OECD Publications.

- Okpara, F.O. (2007). The value of creativity and innovation in entrepreneurship. Journal of Asia Entrepreneurship and Sustainability, 3(2), 1.

- Patra, S. (2009). Financial Performance of Iron and Steel Industry in India: An Analytical and Comparative Study of Some Selected Companies During 1995-1996 To 2004-2005 (Doctoral thesis). Retrieved: http://shodhganga.inflibnet.ac.in/bitstream/10603/705/11/12_chapter3.pdf

- Rosli, M.M., & Sidek, S. (2013). The Impact of Innovation on the Performance of Small and Medium Manufacturing Enterprises: Evidence from Malaysia. Journal of Innovation Management in Small & Medium Enterprises, 1.

- Rothbard, N.M. (2008). The Mystery of Banking (2 ed.). Auburn. Alabama: Ludwig von Mises Institute.

- Schlegelmilch, B.B., Diamantopoulos, A., & Kreuz, P. (2003). Strategic innovation: the construct, its drivers and its strategic outcomes. Journal of Strategic Marketing, 11(2), 117-132.

- Shafii, Z., Yunanda, R.A., & Rahman, F.K. (2014). Financial and operational measures of waqf performance: the case of state islamic religion council of Singapore and Malaysia. Seminar Waqf Iqlimi. https://oarep.usim.edu.my/jspui/handle/123456789/11587.

- Shleifer, A., & Vishny, R.W. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737-783.

- Thornhill, S. (2006). Knowledge, innovation and firm performance in high-and low-technology regimes. Journal of Business Venturing, 21(5), 687-703.

- Tiswarni, T. (2013). Strategi Nazhir dalam Pengelolaan Wakaf (Studi Kasus Badan Wakaf Al-Qur’an [BWA] dan Wakaf Center [Water]) (Doctoral dissertation, IAIN Walisongo).

- Zimmerer, T.W., & Scarborough, N.M. (2005). Essentials of entrepreneurship and small business management: the foundations of entrepreneurship. Pearson Education.