Research Article: 2021 Vol: 25 Issue: 1

The Possibility of Applying the Tax Accounting System and Its Effectiveness on Electronic Commerce in Jordan

Rafat Salameh Salameh, Al-Balqa Applied University

Omar Khader AL Fatafta, Al-Balqa Applied University

Taha Barakat Al Shawawreh, Al-Balqa Applied University

Abstract

The study aimed to demonstrate the possibility of applying the tax accounting system and its effectiveness on e-commerce in Jordan. To achieve the objectives of the study, a questionnaire was developed and distributed to the authorized income and sales tax assessors within the capital Amman, whose number is (293) estimates. The study was based on the simple random sample, where (250) questionnaires were distributed and (205) were retrieved from them, i.e. 82% of the distributed questionnaires, and (3) questionnaires were excluded for their lack of suitability, and thus the number of valid questionnaires for the purposes of statistical analysis was (202) That is, a rate of (80.8 %.( A set of statistical methods suitable for the study were used through the Statistical Package of Social Sciences (SPSS) software. The results of the study are the possibility of applying the tax accounting system in its dimensions to e-commerce in Jordan, and the existence of a positive relationship between the study variables. The study recommendations are to develop current tax laws in line with the technological developments of global e-commerce laws, to raise the efficiency of income and sales tax assessors through scientific and practical courses, to increase international cooperation in the field of e-commerce and to benefit from the experiences of developed countries in this field.

Keywords

Tax Accounting System, E-Commerce, Electronic Tax, Electronic Invoicing.

Introduction

The tremendous and rapid development of information and communication technology, and entry into the world of the Internet, has led to the emergence of what is called electronic commerce, which has created a set of challenges and difficulties that may face electronic transactions, especially tracking sales taxes outside and within the limits of its authority. The existence of a gap between the infrastructure of tax accounting systems and their legislation and the great development in information technology and electronic commerce which, in turn, will negatively affect the economy and economic reform. (Bird, 2003) Consequently, it is necessary to think clearly about how to keep up with this rapid development in the various types of economic and commercial sectors. And reviewing each of the economic, legal and social policies and legislations. Since the relationship between taxation and technological development is an interactive, dynamic and complex relationship (Basu, 2008). Therefore, this research is based on studying the possibility of taxation and effectiveness on electronic commerce in Jordan and challenges and obstacles surrounding both electronic commerce and the current tax regulations and laws. The fact that these revenues constitute 67.2% of the total local revenues in Jordan, according to the annual report issued by the Central Bank of Jordan for the year 2019.

Study Problem and Importance

The importance of the study appears in the increase in the number of electronic commercial transactions in Jordan, their negative effects on the Jordanian economy, the relevance of the current tax laws and legislations, their applicability, and digital transformation. Many studies have shown the existence of many financial, political, economic, legal and social problems arising from the application of electronic commerce, and the most fair and efficient methods of enacting appropriate tax laws and legislation, with a gap between the current tax accounting systems and electronic commerce. The research problem in studying the possibility of applying the tax accounting system and its effectiveness on electronic commerce in Jordan, and ways to maintain tax revenue and regulating electronic transactions. This leads us to the following main research question:

What is the effect of applying the tax accounting system in its dimensions (tax regulations and laws, the computerized tax system, electronic invoicing) on electronic commerce in Jordan?

The main research question is divided into the following sub-questions:

1. what is the impact of (tax regulations and laws, computerized tax system and electronic invoicing) on the technical dimension of electronic commerce?

2. What is the impact of (tax regulations and laws, computerized tax system and electronic invoicing) on the provisions of electronic commerce?

3. How effective is the application of the tax accounting system in Jordan from the viewpoint of the income and sales tax department assessors?

Study Objectives

This study aims to achieve a set of objectives:

1. Identify the possibility of applying the tax accounting system and its effectiveness on electronic commerce in Jordan.

2. Identify the impact of tax regulations and laws and their effectiveness on electronic commerce in Jordan.

3. Identify the possibility of applying the computerized tax system and its effectiveness on electronic commerce in Jordan.

4. Identify the impact and effectiveness of electronic invoicing on electronic commerce in Jordan.

Study Hypotheses

The study hypotheses are represented by the following nihilistic main hypothesis:

HO: There is no statistically significant impact at the level of significance (α≤0.05) for the application of the tax accounting system in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on electronic commerce.

It stems from the following sub-hypotheses:

HO.1: There is no statistically significant impact at the level of significance (α≤0.05) for the application of the tax accounting system in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the technical dimension.

HO.2: There is no statistically significant impact at the level of significance (α≤0.05) for the application of the tax accounting system in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the electronic provisions of the tax.

Literature Review

Simon, (2020), the study aimed to demonstrate how states can obtain tax revenues from sales originating outside the state's borders in the United States of America. And the criteria that should be required to impose such taxes on vendors outside the boundaries of the state. The study population is Wayfair. The results of the study indicate the proposed solutions for working in the world of e-commerce with more than 10,000 different governmental and local tax authorities. The researcher recommended that electronic companies should use the internal or external systems in their electronic transactions to comply with the sales tax legislation.

Damanik, (2020), the aim of the research is to study tax compliance policies and their impact on electronic commerce in Indonesia. The results of the study indicate the difficulty of imposing taxes on electronic commerce transactions with current laws and conditions. The researcher recommended the Indonesian Ministry of Finance to formulate policies and regulations that regulate electronic commerce transactions.

Polezharova & Krasnobaeva (2020), the study aimed at how to tax the profits of e-commerce transactions of multinational companies in Russia. And its impact on the tax burden and economic growth. The results of the study indicate the existence of a relationship between the taxation process and the transparency of the total revenues of multinational companies. The researcher recommended that the Russian authorities go ahead with imposing taxes on the basis of total revenues and not the net profits of multinational companies.

Agbo & Nwadialor (2020) the study aimed to demonstrate how to protect tax revenues, regulate Internet transactions, and their impact on the national economy with the development of electronic taxes in Nigeria. The researcher relied on electronic companies and consumers. The researcher recommended the Nigerian government to develop a comprehensive legal framework to protect tax revenues, reduce tax evasion, and develop the infrastructure for e-commerce.

Mwencha (2019) the aim of the research is to study the nature of tax systems to be applied in Kenya. And its effect on electronic commerce to reduce revenue losses. Where the study population was various research and articles of information, theories, behaviors and books. And the results of the study indicated that there is a negative impact between the growth of electronic commerce and tax revenues. The researcher recommended formulating key policies that help establish a sound regulatory framework for electronic commerce taxes and their challenges.

Ismail et al. (2019) the goal of the research is to clarify and analyze the obstacles facing companies operating in the field of electronic commerce in the city of Erbil. The results of the study indicated that there is a direct linear relationship between the political, financial, human, technological, and legal obstacles and their negative impact on the application of electronic commerce. The study recommended the issuance of a law defining the nature and scope of electronic commerce in the Kurdistan Region - Iraq, and the application of the e-government project.

Theoretical Framework

The Concept of Tax Accounting System

The tax system is directly related to the economic, social and political system (Salameh et al., 2016). Where the definition of the tax system depends on the laws and legislations in force and their uses in each country (Nour et al. 2003). The tax system is a set of legislations and laws that work on tax withholding in Sequential stages, starting with legislation and ending with collection, which are in a tax structure consisting of specific features and methods (Al-Khatib & Tafish, 2008). Abu Nassar defined the tax, which is an amount that the state or one of the local bodies in it imposes forcibly, and is collected from the taxpayer permanently and without any consideration, In accordance with pre-defined laws and legislation (Abunassar, 2020).

The Importance and Objectives of Tax Accounting System

The tax system is considered one of the most important financial policy tools, and the strategy that the country depends on in implementing the plans (Abu Hashish, 2004: 9). And collect permanent revenues from internal sources to increase the proceeds of the counter's sovereign resources and to provide the appropriate climate to attract investments, with the aim of contributing to increasing sustainable economic development and achieving social justice, as in developed countries (Al-Rifai, 2017: 25-27). Tax revenues in Jordan, according to the general budget department report for the year 2019, constitute approximately 67.2% of total public revenues.

Dimensions of Tax Accounting System

Tax Regulations and Laws

Since Jordan is a country with limited resources, successive governments, since independence to this day, have enacted and developed tax laws and legislation that help governments cover public expenditures and implement the planned plans, including assistance to repay domestic and foreign loans. And contribute to reducing the public budget deficit, maintaining sustainable development and achieving social justice (Jordan Strategy Forum, 2013). From this standpoint, the amended Income Tax Law No. (38) of 2018 came in the final form after the amendments that were made to it, which included (82) articles to regulate the process of imposing taxes on all incomes from inside or outside the Kingdom and the process of collecting and protecting them. And the General Tax on Sales Law No. (29) for the year 2009, which included (75) articles defining taxable goods and services, determining tax percentages, and working to determine the competent authorities to consider tax disputes arising from the application of the law, and to impose, collect and protect taxes.

Computerized Tax Accounting System

With the technical development and information technology, computerized tax accounting information systems have replaced the traditional manual methods. It has dealt with many issues related to supporting data inputs and outputs and automating financial reports with high accuracy and in a timely manner, for decision-making at various administrative levels (Hall, 2012). The computerized tax system is considered one of the sub-systems of accounting information systems and is classified as an often complex, relatively closed, prospective and realistic industrial system (Gelinas et.al, 2017). On the other hand, the Sarbanes-Oxley Act (SOX) focused on computer-based accounting information systems, creating reports for internal control, and determining who is responsible for the internal control structure (Qader, 2018).

Electronic Invoicing

The development of the electronic invoicing process began at the end of the twentieth century along with the development of internet banking services and the introduction of accounting software, as electronic invoicing is the backbone of electronic transactions. Electronic invoicing has been defined as the process of creating and submitting an invoice electronically and approving electronic payments for its payment (Yusup et al., 2015). In Jordan, and to complement the approach taken by successive governments to preserve tax revenues, the financial reform project, and in cooperation with the Ministry of Digital Economy and Entrepreneurship, and the Income and Sales Tax Department, the billing affairs regulation system has been approved, which defined the legal form of invoicing, and approved it in all its forms, whether paper, computerized or electronic. . The Income and Sales Tax Department is in charge of following up on the implementation of invoicing and controlling it, as well as the competent authorities in the implementation of the system materials (Regulation for Regulating and Supervising Billing Affairs No. 34, 2019).

The Concept of e-Commerce

There is no doubt that electronic commerce has created a new style in the way of conducting business and commercial transactions, and removing borders between all countries of the world. And the language of numbers has become one of the most important distinguishing features of electronic commerce from others, as it deals with electronic digital products that are manufactured, transported, delivered and consumed completely differently from any other product and without any intermediary between the seller and the buyer (Galuszka, 2013). There are many definitions of electronic commerce, including (Qin et al., 2014). Definition of Organization for Economic Cooperation and Development (OECD): Electronic commerce is an electronic transaction through which goods are sold or purchased or services provided between companies, individuals, governments, and other public or private organizations that take place over networks by computer. The definition of the United Nation Commission on International Trade Law (UNCITRAL): is a function that relies on Electronic Data Interchange (EDI) and other modes of communication to improve international trade, as defined by The International Chamber of Commerce (ICC) as the digitization of all stages of trading activities in The entire business process by which people can advertise, buy and settle products and services of economic value.

Dimensions of Electronic Commerce

The technical dimension

Electronic commerce depends mainly on an advanced system of communication and information networks, which is represented in establishing and building an advanced technical (technological) infrastructure related to the communication network, owning computers, and connecting them to these networks. And providing a qualified human cadre to deal with this technological development (Qin, 2009).

The Provisions of Electronic Commerce

The Internet has had a direct impact on the lives of individuals and societies, and made profound changes in them. This led to the development of legislation laws and regulations to organize, secure, and protect the legal interests of electronic commerce in light of the development of electronic commerce transactions. And determine the jurisdiction that will be competent to hear cases of electronic disputes. And protection of electronic trademarks, protection of intellectual property and copyrights. And keeping pace with the provisions of electronic commerce with the rapid development of communication and information technology, and the speed of adaptation to the digital age and its requirements. In light of an electronic commerce without spatial and temporal boundaries (Laundon & Traver, 2016).

E-commerce in Jordan

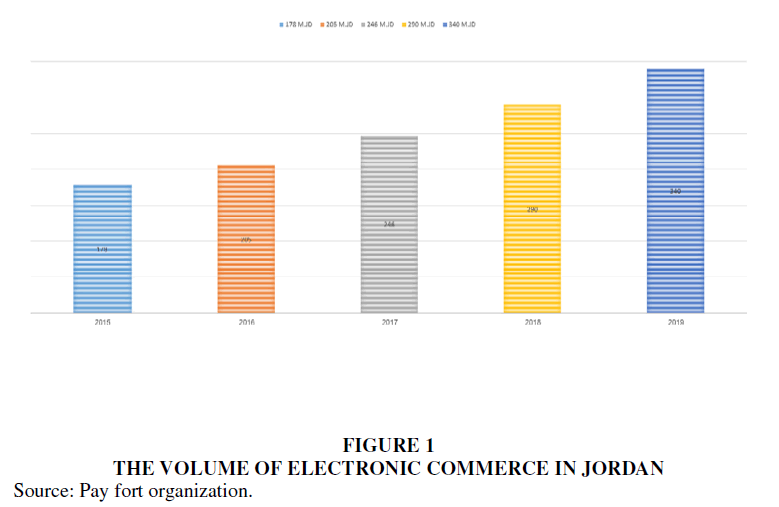

The lately developments in Jordan in various fields, electronic commerce has become an urgent necessity and an important developmental requirement, in order to develop its production and marketing sectors, and to take advantage of all the opportunities provided by electronic commerce to contribute to increasing the growth rate of the Jordanian economy, and to achieve this the successive governments have worked on Overcoming the challenges and obstacles to electronic commerce represented in providing advanced infrastructure related to communication and information technology, as well as finding the elements for the success of electronic commerce represented by the enactment of legislations and laws that regulate the work of electronic commerce within and outside the kingdom's borders (The Fourth Arbitrated Scientific Conference, Ajloun National University, 2019). From this standpoint, Jordan has worked since the beginning of the matter to develop the communications and information technology sector, and to introduce the advanced infrastructure represented by the Ministry of Digital Economy and Entrepreneurship. From the legal point of view, Jordan has enacted legislation and laws regulating the work of electronic commerce, including the Electronic Transactions Law No. (85) Of 2001. The Electronic Transactions Law No. (15) Of 2015. And since electronic commerce in Jordan is considered one of the most important branches of electronic transactions because of its impact directly on the Jordanian national economy, sustainable development and achieving the desired balance. The Prime Minister, in cooperation with the Jordanian Customs Department, issued a decision (Regulating Electronic Trade) on 8/22/2019 that included the regulation of electronic commercial business and imposing a customs service fee on these businesses (the Jordanian Customs Department), 2019). Figure 1 shows the development of the volume of electronic commerce in Jordan between the years (2015-2019).

Methodology

The study relied on the descriptive approach and the inferential approach using statistical package of social sciences (SPSS) software in order to identify the extent of the possibility of applying the tax accounting system and its effectiveness on e-commerce in Jordan.

Study Population

The study population consisted of all tax assessors of income and sales commissioned by Jordanians within the capital, Amman, whose number (293) was estimated in various directorates (Income and Sales Tax Department, 2020).

Study Sample

The study relied on drawing a simple random sample. (250) questionnaires were distributed and (205) retrievals, meaning (82%) of the original distributed questionnaires. (3) Questionnaires were enslaved due to their insufficiency, thus the number of questionnaires that were subjected to statistical analysis became (202), i.e. a rate of (80.8%). It is representative of the study community according to the sample schedule drawn up by (Sekaran, & Bougie, 2016), which states that the appropriate number should not be less than (167) samples.

Constructive Validity

To achieve the desired goals of the study tool, and its ability to measure its content, the value of the correlation coefficient (Pearson) was extracted. Which shows the ability of each paragraph of the study and the extent of its relevance to the dimension to which it belongs (Linn, & Gronlund, 2012). After testing the value of the correlation coefficients, it was found that the lowest correlation value for the items of the independent variable (the tax accounting system) was (0.671). And the value of the lowest correlation for the paragraphs of the dependent variable (electronic commerce) was (0.786). Based on this, these values are more than (25%) and all bear a direct direction (+). Therefore, no paragraphs were deleted. Accordingly, it is considered constructively valid and approved for statistical analysis.

Study Stability

It means the degree of reliance on the results of the questionnaire in terms of consistency and consistency if it is applied more than once and in similar circumstances (Al-Najjar et al., 2020). The reliability of the study tool is calculated by calculating the value of the Cronbach's Alpha. That the result of the stability test if it is more than (0.70) is considered acceptable, and the higher the value than that and the closer to (1) indicates a higher stability (Sekaran & Bougie, 2016).

Table 1 indicates that the value of the Cronbach Alpha coefficient ranged between (89.2% -93.8%), which is greater than (70%). This is an indication of its stability and, therefore, it depends on it in the statistical analysis stage.

| Table 1 Cronbach's Alpha | |||

| Variables and Dimensions | Variables Types | Cronbach's Alpha | No. of Paragraphs |

| Tax Regulations and Laws | Independent | 0.892 | 8 |

| Computerized Tax System | 0.903 | 8 | |

| Electronic Invoicing | 0.914 | 7 | |

| Tax Accounting System | 0.932 | 23 | |

| Technical Dimension | Dependent | 0.916 | 6 |

| Provisions of Electronic Commerce | 0.905 | 6 | |

| Electronic Commerce | 0.931 | 12 | |

| Total of All Paragraphs | 0.938 | 35 | |

Multicollinearity Test

Hair et al. (2018) showed when testing the multiple linear correlation between the independent variables, which is extracted by means of (VIF) and (Tolerance) some conditions, namely that the value of the data inflation factor (VIF) if it is less From (5) and the permissible variance value is less than (1) and greater than (0.2), the independent variables do not have a high correlation between them and are suitable for conducting multiple linear regression analysis. It is clear from Table 2 that the data are suitable for subjecting them to the multiple analysis process.

| Table 2 Multicollinearity Test (Independent Variables) | ||

| Independent Variables | VIF | Tolerance |

| Tax Regulations and Laws. | 1.989 | 0.503 |

| Computerized Tax System | 1.876 | 0.533 |

| Electronic Invoicing | 2.020 | 0.495 |

To confirm that there is no high multi-linear correlation, the Pearson correlation coefficient value was extracted between the independent variables. Where (Gujarati et al., 2017: 365) indicated that the high correlation coefficient does not fit the statistical analysis related to the multiple regression model if its value exceeds (80%). It is clear from Table (3) that the correlation coefficient between the independent variables ranged between (0.617-0.652) and that it is suitable and good for conducting statistical analysis, and it is free from the problem of multiple correlation between the independent variables.

| Table 3 Pearson Correlation (Independent Variables) | |||

| Variables | Tax Regulations and Laws. | Computerized Tax System | Electronic Invoicing |

| Tax Laws and Regulations | 1.00 | ||

| Computerized Tax System | 0.617 ** | 1.00 | |

| Electronic Invoicing | 0.652 ** | 0.625 ** | 1.00 |

| ** Significant at (0.01) level | |||

Table 4 shows. The results of (Durbin-Watson), and that the value of (DW) calculated for the study hypotheses is greater than its higher tabular values (du) and is close to the value (2) at the level of significance (5%), which leads to the absence of the autocorrelation problem and its validity to be used in the regression model.

| Table 4 Auto-Correlation (Durbin–Watson) of the Study Hypotheses | ||||

| Hypotheses | D-W | D-W(du) | D-W(di) | Result |

| H0.1 | 1.921 | 1.799 | 1.738 | absence autocorrelation |

| H0.1.1 | 1.954 | 1.799 | 1.738 | |

| H0.1.2 | 1.923 | 1.799 | 1.738 | |

Results and Discussion

Description of the Results of the Variables and Dimensions of the Study

This paragraph explains the study variables and the study tool paragraphs, where the arithmetic average and the standard deviation of the paragraphs were calculated to judge the degree of application, and to determine the relative importance of these paragraphs and the results were as follows:

Table 5 shows that the arithmetic average of the independent variable (the tax accounting system) ranged between (3.63-3.72), as the dimension of (Tax Regulations and Laws) got the highest and with a high degree of application, and the (computerized tax system) dimension was at the lowest and medium degree Application and the general scale of the tax accounting system reached (3.66) with a percentage (73.2%). Thus, it becomes clear that the level of the relative importance of the sample's trends towards the tax accounting system in the researched sector came within the middle level of application.

| Table 5 Tax Accounting System Dimensions | |||||

| Tax accounting system Dimensions | Arithmetic Average | Standard Deviation | percentage | Application Degree | Ranking |

| Tax Regulations and Laws. | 3.72 | 0.731 | 74.4% | high | 1 |

| Computerized Tax System | 3.63 | 0.909 | 72.6% | medium | 3 |

| Electronic Invoicing | 3.65 | 0.828 | 73% | medium | 2 |

| General scale | 3.66 | 0.714 | 73.2% | medium | |

Table 6 shows that the arithmetic mean of the dependent variable (e-commerce) has medium degrees of application, ranging between (3.28-3.51), as the technical (technological) dimension gets the highest and with a medium degree of application, and the (e-commerce provisions) dimension has a higher degree of application. With a medium degree of application, the general index of e-commerce reached (3.40) and a percentage (68%). Thus, it becomes clear that the level of relative importance of the sample's trends towards electronic commerce in the researched sector came within the medium level of the application.

| Table 6 Electronic Commerce Dimensions | |||||

| Tax accounting system Dimensions | Arithmetic Average | Standard Deviation | percentage | Application Degree | Ranking |

| Technical Dimension | 3.51 | 0.899 | 70.2% | medium | 1 |

| Provisions of Electronic Commerce | 3.28 | 0.968 | 65.6% | medium | 2 |

| General scale | 3.40 | 0.881 | 68% | medium | |

Hypotheses Testing

Hypothesis Test Result (main)

HO: There is no statistically significant impact at the level of significance (α≤0.05) for the application of the tax accounting system in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on electronic commerce. To test this hypothesis, multiple linear regression was used, and Table 7 shows the results.

| Table 7 The Result of (Main) Hypothesis Test | ||||||||||

| Dependent Variable | Model Summery | ANOVA | Coefficient | |||||||

| R | R2 | F | F Sig | DF | Independent Variable | Standard Error | Beta | T | T Sig | |

| Electronic commerce | 0.799 | 0.639 | 116.799 | 0.00* | 3/198 | Tax Regulations and Laws | 0.073 | 0.162 | 2.687 | 0.008* |

| Computerized Tax System | 0.057 | 0.148 | 2.524 | 0.012* | ||||||

| Electronic Invoicing | 0.065 | 0.577 | 9.511 | 0.00* | ||||||

Tabular F value = (2.60)

Tabular T value = (1.96)

Table 7 shows the results of the statistical test represented by the existence of a set of dimensions of the independent variable: “tax regulations and laws, computerized tax system, electronic invoicing” and only one dependent variable that represents electronic commerce. It is noticed from the above table that the correlation coefficient R = (79.9%), which indicates the existence of a strong relationship between the application of the “tax accounting system” with its dimensions, and “electronic commerce” in Jordan. It is also noted that there is a statistically significant effect of applying a “tax accounting system” on the dependent variable “electronic commerce”, through the value of (F. Sig) of (0.00) which is less than (0.05) and also through the value of (F) calculated and its value (116.799) It is greater than its tabular value (2.60), which also represents the significance of this model at a degree of freedom (3/198). The value of the coefficient of determination (R2 = 0.639) indicates that the application of the tax accounting system with its dimensions has explained its ratio (63.9%) of the variance in electronic commerce. So we cannot accept the null hypothesis (HO). We accept the alternative hypothesis (Ha) which says: There is a statistically significant effect at the level of significance (α≤0.05) for applying the “tax accounting system” in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the “electronic commerce”.

| Table 8 The Result of Sub-Hypothesis Test | ||||||||||

| Dependent Variable | Model Summery | ANOVA | Coefficient | |||||||

| R | R2 | F | F Sig | DF | Independent Variable | Standard Error | Beta | T | T Sig | |

| Technical Dimension | 0.793 | 0.628 | 111.533 | 0.00* | 3/198 | Tax Regulations and Laws | 0.075 | 0.167 | 2.736 | 0.007* |

| Computerized Tax System | 0.059 | 0.139 | 2.335 | 0.021* | ||||||

| Electronic Invoicing | 0.067 | 0.573 | 9.305 | 0.00* | ||||||

Tabular F value = (2.60)

Tabular T value = (1.96)

Sub-Hypothesis Test Result (1)

HO.1: There is no statistically significant impact at the level of significance (α≤0.05) for the application of the tax accounting system in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the technical dimension. To test this hypothesis, multiple linear regression was used, and Table 8 shows the results.

Table 8 shows the results of the statistical test represented by the existence of a set of dimensions of the independent variable: “tax regulations and laws, computerized tax system, electronic invoicing” and only one dependent variable that represents technical dimension. It is noticed from the above table that the correlation coefficient R = (79.3%), which indicates the existence of a strong relationship between the application of the “tax accounting system” with its dimensions, and “technical dimension” in Jordan. It is also noted that there is a statistically significant effect of applying a “tax accounting system” on the dependent variable “technical dimension” through the value of (F. Sig) of (0.00) which is less than (0.05) and also through the value of (F) calculated and its value (111.533) It is greater than its tabular value (2.60), which also represents the significance of this model at a degree of freedom (3/198). The value of the coefficient of determination (R2 = 0.608) indicates that the application of the tax accounting system with its dimensions has explained its ratio (60.8%) of the variance in technical dimension. So we cannot accept the null hypothesis (HO). We accept the alternative hypothesis (Ha) which says: There is a statistically significant effect at the level of significance (α≤0.05) for applying the “tax accounting system” in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the “technical dimension”.

Sub-Hypothesis Test Result (2)

HO.2: There is no statistically significant impact at the level of significance (α≤0.05) for the application of the tax accounting system in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the Provisions of Electronic Commerce. To test this hypothesis, multiple linear regression was used, and Table 9 shows the results.

| Table 9 The Result of Sub-Hypothesis Test (2) | ||||||||||

| Dependent Variable | Model Summery | ANOVA | Coefficient | |||||||

| R | R2 | F | F Sig | DF | Independent Variable | Standard Error | Beta | T | T Sig | |

| Provisions of Electronic Commerce |

0.718 | 0.516 | 70.302 | 0.00* | 3/198 | Tax Regulations and Laws | 0.092 | 0.139 | 1.995 | 0.047* |

| Computerized Tax System | 0.072 | 0.140 | 2.065 | 0.040* | ||||||

| Electronic Invoicing | 0.082 | 0.518 | 7.370 | 0.00* | ||||||

Tabular F value = (2.60)

Tabular T value = (1.96)

Table 9 shows the results of the statistical test represented by the existence of a set of dimensions of the independent variable: “tax regulations and laws, computerized tax system, electronic invoicing” and only one dependent variable that represents provisions of electronic commerce. It is noticed from the above table that the correlation coefficient R = (71.8%), which indicates the existence of a strong relationship between the application of the “tax accounting system” with its dimensions, and “provisions of electronic commerce” in Jordan. It is also noted that there is a statistically significant effect of applying a “tax accounting system” on the dependent variable “provisions of electronic commerce” through the value of (F. Sig) of (0.00) which is less than (0.05) and also through the value of (F) calculated and its value (70.302) It is greater than its tabular value (2.60), which also represents the significance of this model at a degree of freedom (3/198). The value of the coefficient of determination (R2 = 0.516) indicates that the application of the tax accounting system with its dimensions has explained its ratio (51.6%) of the variance in provisions of electronic commerce. So we cannot accept the null hypothesis (HO). We accept the alternative hypothesis (Ha) which says: There is a statistically significant effect at the level of significance (α≤0.05) for applying the “tax accounting system” in all its dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the “provisions of electronic commerce”.

Conclusion

The Study Variables' Test Conclusions

a. The results of describing the study variables showed that the tax accounting system achieved a medium degree of application in the income and sales tax department by (73.2%) from the viewpoint of the study sample. Where the dimension of tax regulations and laws achieved the highest with a high degree of application (74.4%), and the computerized tax system dimension at the lowest with a medium degree of application at a rate of (72.6%). This result is consistent with the study (Simon, 2020), the study (Damank, 2020) and the study (Agbo & Nwadialor, 2020) who recommended the need to formulate policies and regulations governing the work of electronic commerce and comply with sales tax legislation and develop a comprehensive legal framework to protect tax revenues.

b. The results of describing the study variables showed that the electronic commerce achieved a medium degree of application in the income and sales tax department by (68%) from the viewpoint of the study sample. Where the dimension of technical dimension achieved the highest with a medium degree of application (70.2%), and the provisions of electronic commerce dimension at the lowest with a medium degree of application at a rate of (65.6%). This result is consistent with a study (Agbo & Nwadialor, 2020), which recommended the development of infrastructure for electronic commerce.

The Study Hypothesis Test Conclusions

a. A statistically significant impact was demonstrated at the level of significance (α≤0.05) for the application of the tax accounting system with dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on electronic commerce.

b. A statistically significant impact was demonstrated at the level of significance (α≤0.05) for the application of the tax accounting system with dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the technical dimension.

c. A statistically significant impact was demonstrated at the level of significance (α≤0.05) for the application of the tax accounting system with dimensions (tax regulations and laws, computerized tax system, electronic invoicing) on the provisions of electronic commerce.

Recommendations

a. The necessity to emphasize the application of the regulation and control of billing affairs no. (34) / 2019, especially Article 8a.b, Article 9, Article 14a.b, and Article 15, and work to increase to convert of invoicing electronically.

b. Increasing the application of the Jordanian Electronic Transactions Law No. (15) Of 2015 and the commitment to apply the legal articles and clauses contained therein in a way that regulates electronic commerce.

c. Develop the current tax laws to comply with technological developments and global e-commerce laws.

d. Increasing international cooperation in the field of e-commerce, and making use of the expertise and experiences of developed countries in this field.

e. Developing a computerized tax system and qualified staff that supports Electronic invoicing and is in line with the provisions of modern electronic commerce and tax legislation.

References

- Abu Hashish, K., (2004). Advanced Studies in Tax Accounting, (1sted). Dar Al-Hamed for Publishing & Distribution, Amman, Jordan, 9.

- Abunssar, M., (2020). Tax Accounting: Income Tax and Sales, (3rded). National Library Department, Amman, Jordan, 3-4.

- Agbo, E.I., & Nwadialor, E.O. (2020). E-Commerce and Tax Revenue. Noble International Journal of Economics and Financial Research, 5(8), 80-91.

- Al-Khatib, K., & Tafesh, N. (2008). The Scientific and Practical Principles of Tax Accounting, (1sted). Dar Al-Hamed for Publishing & Distribution, Amman, Jordan, 17-18.

- Al-Najjar, F.J., al-Najjar, N.J. & al-Zaabi, M.R. (2020). Methods of Scientific Research and an Applied Perspective, (5thed). Dar Al-Hamed for Publishing & Distribution, Amman, Jordan, 149-150.

- Al-Rifai, K., (2017), Tax Accounting between Theory and Practice Income Tax and Sales, (2nded), Dar Tasnim Publishing and Distribution, Amman, Jordan, 25-27.

- Al-Shomali, Y. (2013). The Tax System in Jordan. (The Jordan Strategies Forum), Amman, Jordan, 2-8.

- Basu, S. (2008). International taxation of e-commerce: Persistent problems and possible developments. The Journal of Information, Law and Technology, 1, 1-25.

- Bird, R. (2003). Taxing electronic commerce: A revolution in the making. Commentary-CD Howe Institute, (186/187), 1.

- Damanik, D. N. (2020). Taxation Policy on E-Commerce Transactions. In Proceedings of the International Seminar, 1(1), 20-24.

- Derbaz, A.I., Badawey, S.O., & Majeed, A.A. (2019). Analysis of the obstacles to implementing electronic commerce: An applied study of a sample of companies operating in the city of Erbil for the year 2017. Anbar University Journal of Economic and Administrative Sciences, 11 (25), 168-192.

- Electronic Transactions Law No. (15) Of 2015.

- Electronic Transactions Law No. (85) Of 2001.

- Ga?uszka, J. (2013). How to tax e-commerce-global or national problem? Studia Ekonomiczne, (150), 193-202.

- Gelinas, U.J., Dull, R.B., Wheeler, P., & Hill, M.C. (2017). Accounting Information Systems. (11thed). Cengage Learning, USA, 12-13.

- General Sales Tax Law No. (29) Of 2009.

- Gujarati D, Porter, D., & Gunasekar, S. (2017). Basic Econometrics (5thed). USA, New York, The Mc Graw- Hill Gunasekar, 365-366.

- Hair, J.F., Black, W.C, Babin, B.J, Anderson, R.E., & Tatham, R.L. (2018). Multivariate Data Analysis (8thed). Cengage Learning EMEA, 200-201.

- Hall, J.A. (2012). Accounting information systems (E-book), 3-4.

- Income Tax Law No. (38) Of 2018.

- Laudon, K.C., & Traver, C.G. (2016). E-commerce: business, technology, society.

- Linn, R.L., & Gronlund, N.E. (2012). Measurement and Assessment in Teaching, (11th Ed). Prentice Hall, 136-137.

- Mwencha, P.M. (2019). Taxation of electronic commerce–a commentary. Financing for Development, 1(1).

- Nour, A.N., Adas, N., & Al-Sharif, A. (2003). Taxes and Accounting, (1sted). Dar Al Masirah for Publishing & Distribution, Amman, Jordan, 10-11.

- Polezharova, L.V., & Krasnobaeva, A.M. (2020). E-Commerce Taxation in Russia: Problems and Approaches. Journal of Tax Reform, 6(2), 104-123.

- Qader, M.A.R.Z.A. (2018). The implications of the Sarbanes-Oxley Act on the role and responsibility of Auditor in the detection and prevention of fraud. Journal of Administration and Economics, 4(117), 272-284.

- Qin, Z., & Qin, Z. (2009). Introduction to E-commerce (Vol. 2009). New York, NY: Springer, 80-166.

- Qin, Z., Chang, Y., Li, S., & Li, F. (2014). E-commerce strategy. Springer, 2-3.

- Salameh, R.S., Kalbouneh, A.Y., Al Farah, A.R.M.S., & Zalloum, N.A.M. (2016). Factors affecting the estimates' decision of the income and sales tax department. An Exploratory Study of the Estimates of the Income and Sales Tax Department in Jordan. Islamic University Journal for Humanitarian Research, 19 (1).

- Sekaran, U., & Bougie, R., (2016). Research Methods for Business: A Skill Building Approach, (7thed). NY: John Wiley & Sons Inc, New York, 295-296.

- Simon, O. (2020). Proposal for: Tackling Internet Sales Taxes in a Post-Wayfair World (Doctoral dissertation).

- Yusup, M., Hardiyana, A., & Sidharta, I. (2015). User acceptance model on e-billing adoption: A study of tax payment by government agencies. Asia Pacific Journal of Multidisciplinary Research, 3(4), 150-157.