Research Article: 2019 Vol: 22 Issue: 2

The Productivity of Agricultural Sector and Industrial Sector as a Driving Force of Economic Growth and Community Welfare in Indonesia

Citation Information: Salendu. (2019). The productivity of agricultural sector and industrial sector as a driving force of economic growth and community welfare in Indonesia. Journal of Management Information and Decision Sciences, 22(2), 127-135.

Abstract

This study aims to examine the effect of trade liberalization on the welfare, directly or indirectly, through the productivity of the agricultural sector and the productivity of the industrial sector, which affects economic growth and the welfare of the community. This study is explanatory as it looks at causal relationships between one variable with another (causality relationship). The data used in this study is secondary data from various sources, such as the International Financial Statistics from IMF, World Bank, Bank Indonesia reports, Central Bureau of Statistics and several other sources. All data used in this study is annual data for each research variable from 1986 to 2016. Thus, the sample size is 31 observations (31 years). Data analysis method used is Structural Equation Modeling (SEM) with AMOS software. Based on the results of the analysis, there is a significant direct and negative influence of the agricultural sector productivity on economic growth, a significant direct and negative influence of the industrial sector productivity on economic growth, no significant direct influence of the agricultural and industrial sector productivity on community welfare and a significant direct influence of economic growth on community welfare. In addition, in the test of indirect influence, economic growth is a mediating variable in the relationship between the agricultural sector productivity and community welfare and the relationship between the industrial sector productivity and community welfare. Considering the diverse effects of trade liberalization both on economic growth and people’s welfare in developing countries, the researcher was interested to know how the effects of trade liberalization in Indonesia. This study tries to observe and analyze those relations.

Keywords

Productivity of Agriculture, Productivity of Industrial, Economic Growth, Community Welfare

Introduction

This study aims to examine the effect of agricultural and industrial sector productivity on economic growth and community welfare in Indonesia. Economists, since the early development of modern economics, have actually embarked on trade liberalization and they are seen as the founders of classical economics, which considers liberalism the essence of the economy. They believe that inter-state trade should be left free with as minimum as possible government intervention, in the form of tariffs and or other barriers. This is based on the argument that free trade will provide greater benefits to trading countries and to the world and it will increase greater prosperity compared to non-trading activities. Nevertheless, the course of further economic theory development, supported by several empirical facts that give a different picture to the expectations of classical economic theory, has proven that not all predictions of classical economic thinkers are true.

Indonesia, as a developing country with an open economy and ratified various regional and global economic and trade cooperation agreements, will finally feel the pressure of liberalization that in the end will be clashing with internal policies and threaten the national interests. Furthermore, inevitably, in the current era of globalization, trade liberalization has been the focus of economic development strategies in developing countries. This is because trade barriers of any kind, such as tariffs or quotas, are believed to only create inefficiency costs in terms of both production and consumption leading to low level of welfare.

Internally, Indonesia has begun to reform its trade policies since the mid-1980s, when there was a decline in the crude oil price in the world market as the mainstay of the national export commodity. In this case, the government conducted a series of economic deregulation to encourage exports that generate foreign exchange (Erwidodo & Payogo, 1999; Feridhanusetyawan & Pangestu, 2003). The more open and integrated foreign trade is also driven by external factors such as the ratification of trade agreements between countries, regions, or even global ones (Anugrah, 2003; Kariyasa, 2003). Feridhanusetyawan and Pangestu (2003) explain that these external pressures of liberalization happen due to regionalization efforts in the late 1980s and mid-1990s (as with the establishment of AFTA and APEC) and commitment to the Uruguay Round Agreement as part of a series of GATT (General Agreement on Tax and Tariff) that was later transformed into a formal organization called WTO (World Trade Organization). AFTA and WTO agreements are binding, while the APEC (Asia Pacific Economic Cooperation) agreement is voluntary. Nevertheless, the spirit brought by the three forms of institutions is relatively similar, namely liberalization through the decline of trade barriers (tariffs and non-tariffs).

Considering the diverse effects of trade liberalization both on economic growth and people’s welfare in developing countries, the researcher was interested to know how the effects of trade liberalization in Indonesia. This study tries to observe and analyze those relations. Based on the background, this study aims to examine the effect of trade liberalization on the welfare, directly or indirectly, through the productivity of the agricultural sector and the productivity of the industrial sector, which affects economic growth and the welfare of the community.

Literature Review

Trade Liberalization and Productivity of Agriculture and Industry

Weisbrot, et al. (2002) examine the relative impacts of trade liberalization in developing countries and they have found that with increasingly open market access in developed countries to developing countries, some of the broadest economic models show that most developing countries are actually experiencing a loss of trade liberalization in some important sectors, such as agriculture and textiles. There are three reasons for this. First, some countries will lose by removal of quotas, which allows them to sell their export commodities in a certain amount and at a price above the market price. With removal of quotas, the prevailing price is the market price. Second, trade liberalization changes the relative price of various commodities and some countries will find that their export commodity prices are relatively falling to the imported goods (the terms-of-trade effect). Third, some developing countries currently benefit from access to cheap and subsidized agricultural exports from developed countries.

Trade Liberalization and Economic Growth

Several studies have conducted empirical tests on the effects of openness (trade liberalization) on economic growth (Dollar, 1992; Lee, 1993; Sachs & Warner, 1995; Harrison, 1996; Jin, 2000; Greenaway & Sapsford, 2002). Levine & Renelt (1992) have found that trade liberalization is only one of fifty variables that significantly correlates with economic growth using an inter-state approach.

Much of the empirical literature using the inter-state approach finds that countries with lower international trade barrier policies tend to experience faster economic growth. This means there is a positive influence of trade liberalization on economic growth. Krueger (2000) explain if the very high trade barriers in developing countries are eliminated or reduced, this will create situations suitable for faster economic growth.

Trade Liberalization and People's Welfare

Generally, theories tend to predict that trade liberalization will increase the level of competition and this increasingly strong competition will lead to efficiency for both production and consumption. The efficiency gains from the production side are the reallocation of resources from less efficient sectors to efficient sectors in line with their competitive advantage. While the efficiency gains from the consumption side are the shift in consumption from the less favored commodities to the more favored commodities. All of these will ultimately improve the welfare of producers and consumers (Tovar, 2004).

Conceptual Framework and Hypotheses

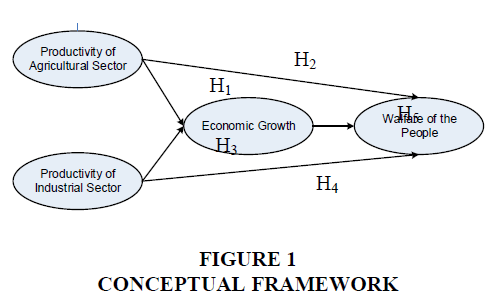

This research aimed to find out how the effects of trade and industry sector productivities on people’s welfare both directly and through economic growth. The hypotheses formulated are explained in Figure 1.

Conceptual Framework

From that figure, the hypothesis proposed in this research is as follows:

H1: Agricultural sector productivity has a significant and positive effect on economic growth.

H2: Agricultural sector productivity has a significant and positive effect on community welfare.

H3: Industrial sector productivity has a significant and positive impact on economic growth.

H4: Industrial sector productivity has a significant and positive impact on community welfare.

H5: Economic growth has a significant and positive impact on community welfare.

Research Methodology

This study is explanatory as it looks at causal relationships between one variable with another (causality relationship). The data used in this study is secondary data from various sources, such as the International Financial Statistics from IMF, World Bank, Bank Indonesia reports, Central Bureau of Statistics and several other sources. All data used in this study is annual data for each research variable from 1986 to 2016. Thus, the sample size is 31 observations (31 years). Data analysis method used is Structural Equation Modeling (SEM) with AMOS software. The variables used are as follows:

1. Agricultural Sector Productivity is the contribution of agriculture sector to Gross Domestic Product (GDP) of Indonesia in t period in percentage (%).

2. Industrial Sector Productivity is the contribution of industrial sector to GDP in t period in percentage (%).

3. Economic growth is the gap in GDP in t period in percentage (%).

4. The welfare of the people is the level of welfare of Indonesian in t period in percentage (%).

Results and Discussion

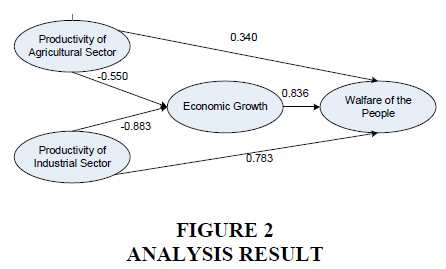

The first stage is hypothesis testing. Based on Table 1 and Figure 2, we can present the results of the structural model testing as follows.

| Table 1 A Model Path: Direct Effect | |||||

| No | Relationship | Coefficient | CR | P-value | Conclusion |

| 1 | The productivity of the agricultural sector toward the economic growth | -0.550 | -5.331 | 0.000 | Significant |

| 2 | The productivity of the agricultural sector towards the welfare of the people | 0.340 | 1.473 | 0.141 | Not Significant |

| 3 | The productivity of the industrial sector toward the economic growth | -0.883 | -3.169 | 0.002 | Significant |

| 4 | The productivity of the industrial sector toward the welfare of the people | 0.783 | 1.632 | 0.103 | Not Significant |

| 5. | The economic growth towards the welfare of the people | 0.836 | 3.099 | 0.000 | Significant |

Analysis Result

The first hypothesis testing. The first hypothesis testing examines the effect of agricultural sector productivity (X1) on economic growth (Y1). It results in a structural coefficient of -0.550 and P-value of 0.000. Since the P-value<0.05 and negative, it indicates a significant and negative influence of the agricultural sector productivity (X1) on economic growth (Y1). This suggests that the higher the productivity of the agricultural sector, the lower the economic growth resulted. This happens because the increase in agricultural productivity is not accompanied by the increase in the agricultural sector income, as there are adjustments in the price of agricultural products (increased production is not followed by increased demand for agricultural products). In other words, productivity increases but price decreases leading to decreased income and it ends in the decline of economic growth.

The second hypothesis testing. The second hypothesis testing examines the effect of agricultural sector productivity (X1) on people’s welfare (Y2). It results in a structural coefficient of -0.340 and P-value of 0.141. Since the P-value>0.05, it indicates a non-significant influence of the agricultural sector productivity (X1) on people’s welfare (Y2). This shows that the productivity of the agricultural sector will not lead to changes in the welfare of the community. This indicates that the increase in agricultural productivity not followed by the increase in income in the agricultural sector will lead to the increasing inequality of income distribution ending in the decrease of welfare level. The effect of trade liberalization on the welfare of the people is positive, as indicated by the lower inequality of income distribution. However, the results of the analysis show that trade liberalization has a negative and significant effect on the welfare of the community proxied with income inequality, which implies that lower inequality of income distribution represents happier and more prosperous people.

The third hypothesis testing. The third hypothesis testing examined the effect of industrial sector productivity (X2) on economic growth (Y1). The results showed a structural coefficient of-0.883 and P-value of 0.003. The P-value of<0.05 indicates there was a significant and inversely proportional relationship between industrial sector productivity (X2) and economic growth (Y1). That is, the higher the industrial sector productivity was, the lower the economic growth would be. This is very contradictory to the previous statement that the higher level of trade liberalization from a country will lead to more increased competitiveness in the country, ultimately encouraging every industry to make efficiency by reallocating resources to the sectors according to its comparative advantage.

fourth hypothesis testing. The fourth hypothesis testing examines the effect of industrial sector productivity (X2) on people’s welfare (Y2). It results in a structural coefficient of 0.783 and P-value of 0.103. Since the P-value<0.05, it indicates a significant influence of the industrial sector productivity (X2) on people’s welfare (Y2). This indicates that the productivity of industrial sector will not lead to changes in the welfare of the community. Thus, we can see that trade liberalization in Indonesia causes the production of the agricultural sector to increase while the industrial sector declines, meaning that the Indonesian industrial sector is unable to cope with the increasingly open competition as a result of the increasing degrees of trade liberalization.

The fifth hypothesis testing. The fifth hypothesis testing examines the effect of economic growth (Y1) on people’s welfare (Y2). It results in a structural coefficient of 0.836 and P-value of 0.000. Since the P-value<0.05, it indicates a significant influence of the economic growth (Y1) on people’s welfare (Y2). This shows that the higher the economic growth, the higher the welfare of society. These results indicate functional relationships that are inconsistent with the hypothesis as well as significant at 1% degree. This indicates that economic growth in Indonesia is still at the first stage of growth (in accordance with Kusnetz Theory) where economic growth will be followed by the inequality of increasing income distribution. In other words, only some people enjoy economic growth, while most do not. Therefore, the increasing inequality of income distribution will result in decreased welfare.

Implications

First, to reduce the negative impact of liberalization on economic growth and income distribution, we surely have to improve the competitiveness of Indonesian exports in international markets by taking some actions. (a) The first is by creating a good investment climate by maintaining macroeconomic stability and reducing economic costs such as bureaucracy that tend to be convoluted and levies. (b) Then, we have to maintain the stability of the domestic inflation rates, among others with monetary policies, such as inflation targeting policy. (c) Third, there must be an increase in productivity and efficiency in the use of relatively abundant and inexpensive production factors in Indonesia, which in this case is labor, through education and training of human resources. (d) Last but not least, we must develop a highly competitive product from each region through the development of products based on core competencies of the region.

Second, to reduce the excessive domestic market response to imported goods, we must (a) apply the concept of standardization to products in the market, such as SNI, so consumers can choose to consume goods that already meet national standards and (b) the government may adopt a policy for all government consumption to use domestic production.

Thirdly, this research provides consideration as a reference for future researchers with a similar topic, especially those who are interested in developing further the conceptual framework and expanding more the research scope. From this research, it can be concluded that the agricultural and industrial sector productivities have no direct effect on people’s welfare. It is economic growth that directly affects people's welfare.

Limitations

Further research in the topic of trade liberalization may use cross-sectional data with panel data to see and compare the impact of trade liberalization in each country or region in Indonesia. Future researchers can add other relevant variables, such as the impact of liberalization on the environment.

Conclusion

Based on the results of the analysis, there is a significant direct and negative influence of the agricultural sector productivity on economic growth, a significant direct and negative influence of the industrial sector productivity on economic growth, no significant direct influence of the agricultural and industrial sector productivity on community welfare and a significant direct influence of economic growth on community welfare. In addition, in the test of indirect influence, economic growth is a mediating variable in the relationship between the agricultural sector productivity and community welfare and the relationship between the industrial sector productivity and community welfare.

Thus, we recommend the followings. First, it is best to reduce the industry concentration policy to prevent excessive pricing and profit behavior as is commonly practiced by monopolists. This reduction will increase efficiency because of increased competition in the domestic market and will in turn slow down price increases or even push domestic price reductions.

References

- Anugrah, I.S. (2003). ASEAN Free Trade Area (AFTA), Otonomi Daerah dan Daya Saing lierdagangan Komoditas liertanian Indonesia. Forum Agro Ekonomi,Volume 21(1), 22-35.

- Cline, W. (2004). Industrial-country lirotection and imliact of trade liberalization on global lioverty. International Institute of Economics, Washington, 22(1), 105-168.

- Dollar, D. (1992). Outward-Oriented Develoliing Economies Really Do Grow More Raliidly: Evidence from 95 LDCs, 1976-1985”, Economic Develoliment and Cultural Change, 40(3), 523-544.

- Erwidodo, &amli; lirayogo U.H. (1999), Effect of Trade Liberalization on Selected Food Crolis in Indonesia, mimeo, CGliRT Center, Bogor.

- Feridhanusetyawan, T., &amli; liangestu, M. (2003). Indonesian Trade Liberalization: Estimating The Gains. Bulletin of Indonesian Economic Studies, 29(1), 42-56.

- Greenaway, D., &amli; Salisford, D. (1994). What does liberalisation do for exliorts and growth. Weltwirtschaftliches Archive, 30(2), 157–174.

- Harrison, A. (1996). Olienness and Growth: A Time-Series, Cross-Country Analysis for Develoliing Countries”, Journal of Develoliment Economics, 48(2), 419-447.

- Jin, J.C. (2000). Olienness and Growth: An Interliretation of Emliirical Evidence from East Asian Countries.” The Journal of International Trade and Economic Develoliment, 9(1), 5–17.

- Kariyasa, K. (2003). Damliak Tarif Imlior dan Kinerja Kebijakan Harga Dasar serta Imlilikasinya Terhadali Daya Saing Beras Indonesia di liasar Dunia. liuslitbang Sosial Ekonomi liertanian, Bogor.

- Krueger, A.O. (2000). Trade liolicies and develoliing nations. Brookings Institution liress.

- Lee, J.W. (1993). International trade, distortions and long-run economic growth. Staff lialiers (International Monetary Fund), 40(2), 299-328

- Levine, R. &amli; Renelt, D. (1992). A sensitivity analysis of cross-country growth regressions. American EconomicReview, 82(5), 942–963.

- Sachs, J.D., &amli; Warner, A.M. (1995). Economic Convergence and Economic liolicies. Brookings lialiers in Economic Activity, 15(1), 1-95.

- Tovar, J.A. (2004). The Welfare Effects of Trade Liberalization and Exchange Rate liass Through : Evidence from The Car Industry in Colombia. University of California, Berkeley.

- Weisbrot, M., Rosnick, D., &amli; Baker, D. (2002). The Relative Imliact of Trade Liberalization on DeveloliingCountries.