Research Article: 2021 Vol: 24 Issue: 6S

The Quality of Financial Reporting Systems and its Impact on Corporate Governance in India

Hanan Abdelsalam Nimer Jaber, Al-Ahliyya Amman University

Abstract

The current examination inspects the effect of corporate administration systems on financial revealing quality under Indian GAAP and Indian Accounting Standards (Ind. AS).

An example of 97 organizations recorded on the Bombay Stock Trade is chosen. Corporate administration systems have been considered as autonomous factors, and financial revealing quality is the reliant variable. Corporate administration is estimated by board adequacy (board size, autonomy, industriousness, and skill), review advisory group credits (size, freedom, determination, and aptitude), unfamiliar proprietorship, and review quality. Graphic measurements, connection, and OLS relapse are directed to gauge the outcomes. The examination results uncover that board qualities and review advisory group credits, aside from review council perseverance, significantly affect financial announcing quality. Nonetheless, the effect of board steadiness and review advisory group credits is negative.

Unfamiliar possession has no commitment to financial revealing quality; however, review quality has a huge impact. The discoveries of the examination have impressive ramifications for controllers, policymakers, administrators, financial backers, experts, and academicians. More accentuation ought to be given to consistence with Ind. AS, and an oversight body for consistence with Ind. AS ought to be set up.

Keywords

Corporate Governance, GAAP, Ind. AS, Financial Reporting, Board Effectiveness.

Introduction

It addresses an unmistakable climate to handle corporate governance (CG) issues and conform to the most recent joined IFRS prerequisites. It addresses a fascinating and significant setting to assess the impact of CG on IFRS joined guidelines, Ind. AS

To guarantee a smooth progress to IFRS in India from first April 2016, the Establishment of Contracted Bookkeepers of India (ICAI) reported a guide for the reception of Indian Bookkeeping Norms (Ind. AS) (Parvathy, 2017).

The combination of the Indian GAAP to Ind. AS is considered as an unprecedented and fundamental occasion in India. This assembly means to adjust the nearby GAAP

(Indian GAAP) with global norms (IFRS) and upgrade financial reporting quality (FRQ) (Farhan et al., 2020).

On the sixteenth of February 2015, the Service of Corporate Undertakings (MCA) told the reception of Ind. AS in the Newspaper powerful from first April 2015.

As needs are 35 Indian GAAP norms are advised by the MCA as Ind. AS (KPMG, 2015). Ind.

AS are named and numbered in a similar way as IFRS norms. A guide was released by the MCA to require organizations that have total assets of Rs. 500 crore or more to set up their financial assertions based on Ind. AS from first April 2016.

Further, another class of organizations recorded or during the time spent posting with total assets of not as much as Rs. 500 or Rs. 250 crore or more should compulsorily execute Ind. AS from first April 2017 (Muniraju & Ganesh, 2016)

Ongoing examinations (Farhan et al., 2020; Shamim et al., 2020) states that there is a shortage of studies that look at the effect of corporate governance on bookkeeping principles issues, particularly after IFRS assembly in India. Likewise, the current examination explores the impact of CG on FRQ pre-and present union on Ind. AS

Literature Review

Board Effectiveness

Earlier investigations have reported proof of the impact of board size on FRQ.

For instance, (Onuorah et al., 2016) express that a little board size will advance the degree of union and coordination among them and chiefs, which is relied upon to upgrade FRQ. Likewise, Ditropoulos & Asteriou, (2010) report a connection among FRQ and CG credits, including board size.

Opposing, some different examinations report no relationship between's board size and FRQ (Vishnani, Gupta & Gupta, 2021). Concerning board independence, Ahmed & Duellman (2006) advocate an unequivocal connection between CG qualities, including board independence, and FRQ. Further, Koh, et al., (2007) contend that a higher part of independent individuals from the board adds to upgrading FRQ.

In any case, Onuorah, et al., (2016) express that board independence is adversely associated with FRQ. Petra (2007) tracked down that independent board individuals are not adequately qualified to control the administrators. Further, independent individuals' quality puts forth no attempt to ensure FRQ (Ahmed et al., 2006). Concerning board gatherings, Sarkar et al. (2008) report that board gatherings' higher participation adds to data quality.

Additionally, Chou, et al., (2010) tracked down that higher board persistence addressed by standard participation of board gatherings is a fundamental vehicle for the regulating job. In a similar line, Xie, et al., (2003) & Sarkar, et al., (2008) report an association between meeting recurrence of boards and lower levels of profit the executives. This is additionally like Cho and Rui (2009); Firth, et al., (2007).

Who expressed that profit-responsive co-proficient increases with a high-gathering recurrence level?

As far as board ability is concerned, the proof of the impact of board aptitude on FRQ is set up by various examinations. Xie, et al., (2003) find that profit the board is probably not going to occur in firms that keep a higher piece of independent lastly educated individuals.

Reliably, García-Meca & Garcia-Sanchez, (2018) affirmed that administration aptitude assumes a fundamental part in FRQ and that competent supervisors are less potentially to submit pioneering income the board to meet bank transient profit benchmarks. Additionally, Onuorah, et al., (2016) revealed that board experience emphatically influences FRQ given by the optional accumulations. Further, Krishnan & Visvanathan, (2008) indicate that board financial aptitude upgrades board individuals' productivity in completing their observing job and appropriately improves the degree of FRQ.

Committee Involvement

Felo, et al., (2003) report that the huge size of AC emphatically impacts FRQ. In a similar setting, Bedard et al. (2004) assume that the probability of forceful profit the board has no huge relationship with AC size. In a similar line, Yang & Krishnan, (2005) indicate that a bigger AC is less potentially to control profit. Moreover, Choi, et al., (2004) indicate that a huge size of AC is bound to contain distinctive qualified and fluctuated skill individuals, which could be a productive driver to improve FRQ.

Conflicting to the proof referenced above, Davidson et al. (2005) finished up immaterial proof of the positive association among FRQ and AC size. Concerning AC independence,

Bedard, et al., (2004); Abbott, et al., (2000) report a critical connection between low levels of income the board and false financial reporting from one viewpoint, and a higher extent of independent individuals in AC. Nonetheless, Yang & Krishnan, (2005); Rahman & Ali, (2006) show the immaterial association between the degree of income the executives and the presence of independent individuals in the air conditioner.

In a similar setting, Beasley, et al., (1996); Abbott, et al., (2004) concur that financial assertion extortion or procuring repetitions is connected with the independence of the air conditioner. With respect to gatherings, (Gupta & Pandey, 2019) infer that there is no huge association between AC gatherings' recurrence with the probability of forceful profit the executives. Reliably, (Sambaru & Kavitha, 2014) report a critical association between the air conditioner's exercises and the nature of profit. Further, Van der Zahn and Pinnacle (2004) indicate that income the board is more averse to happen with the presence of more productive AC. Moreover, Beasley, et al., (1996) indicated that extortion organizations in explicit industries had less AC gatherings.

Regarding AC skill, much writing is agreeable to a higher number of AC master individuals for better FRQ. Beasley, et al., (2009); Chen, et al., (2006) found that skill even with increasingly complex data assures FRQ. Along these lines (Srivastava & Muharam, 2021) advocate that air conditioner mastery emphatically impacts FRQ. The same, Cohen, et al., (2013) expressed that financial backers ought to delegate bookkeeping and financial master chief on the air conditioner for positive FRQ and AC effectiveness. Similarly, Cohen et al. (2013) contended that industry specialists' participation on AC upgrades FRQ.

Further, (Khosla, 2015) express that separated from AC individuals' independence, their financial ability is another determinant of FRQ.

External and International Investments

Lee, et al., (2013) uncover that recorded firms in China have a more prominent level of unfamiliar proprietorship, expected to improve their FRQ more under IFRS-combined CAS. Essentially, resulting research indicates a positive relationship between the increase in unfamiliar proprietorship, governance straightforwardness, and procuring a responsive coefficient (Dong & Xue, 2010). Some different examinations propose that unfamiliar possession is identified with more prominent corporate responsibility and less to data asymmetry (Adhana, 2015).

In contrast, (Tawiah, 2020). indicated no connection between CG credits, including proprietorship concentration, institutional possession, and FRQ.

Audit Accuracy

Onuorah, et al., (2016) uncovered that outside review quality has a beneficial outcome on the FRQ given by the optional accumulations of a firm. Further, Davidson, et al., (2005) express that there is no connection between the presence of Enormous 5 reviewers and income the executives.

It was additionally tracked down that the outer review assumes a fundamental part in observing administration and improving FRQ (Watts & Zimmerman, 1983). Along these lines, financial data is more dependable for Enormous 4 firms than different organizations (Becker, et al., 1998).

Aim of the Study

The current examination researches the effect of corporate governance systems on the financial reporting quality under Indian GAAP and IND. AS.

Study Hypotheses

H1: There is no critical distinction in the effect of review quality on financial reporting quality between Ind. AS and Indian GAAP.

H2: There is no critical contrast in the effect of unfamiliar proprietorship on financial reporting quality between Ind. AS and Indian GAAP.

H3: There is no huge distinction in the effect of AC mastery on financial reporting quality between Ind. AS and Indian GAAP.

H4: There is no critical contrast in the effect of AC tirelessness on financial reporting quality between Ind. AS and Indian GAAP

H5: There is no huge contrast in the effect of AC independence on financial reporting quality between Ind. AS and Indian GAAP.

H6: There is no critical distinction in the effect of AC size on financial reporting quality between Ind. AS and Indian GAAP.

H7: There is no huge distinction in the effect of board ability on financial reporting quality between Ind. AS and Indian GAAP.

H8: There is no critical contrast in the effect of board tirelessness on financial reporting quality between Ind. AS and Indian GAAP.

H9: There is no critical distinction in the effect of board independence on financial reporting quality between Ind. AS and Indian GAAP.

H10: There is no critical distinction in the effect of board size on financial reporting quality between Ind. AS and Indian GAAP.

Method

Selection Process

The used method in this paper went through a selection process that included over 90 firms that are listed in the BSE based on using Ind. AS. This study took place between the years of 2014 to 2018 due to the recency of those years which firms switched to Ind. AS. during that period.

Study Variables

Independent variables: The current examination covers four classes of independent factors: board of chiefs' effectiveness, AC effectiveness, unfamiliar proprietorship, and review quality as a measurement of CG instrument.

Dependent variable: Following Chalaki et al. (2012), the current examination measures FRQ utilizing the McNichols (2002) models. McNichols (2002) thought about that the standard deviation of the residuals, or the mistake terms could indicate and measure financial reporting quality.

The higher yield of the assessed residuals implies more prominent optional gatherings thus a low financial data quality.

Analysis

Descriptive Analysis

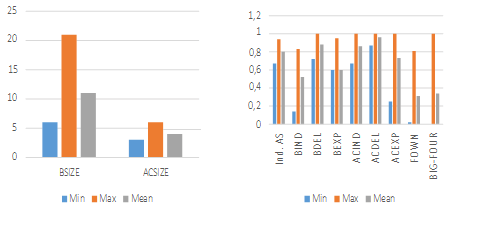

Table 1 sums up spellbinding insights for the current investigation factors more than a long time from 2014 to 2018. Concerning board systems, the outcomes show that the scope of board size (BSIZE) is between at least 5 and 21 individuals setting in the board with a mean of 11 and standard deviation (SD) of 2.38. This indicates that the base number of board sizes is five individuals on the board, and the biggest or greatest board size is 21, with a normal of 11 board individuals.

SD of 13%. This exhibits that essentially 13% of the recorded organizations' board individuals are independent individuals with a normal of 51%. Concerning board steadiness (BDEL), the outcomes exhibit that board tirelessness is essentially 66%, with a limit of 100% and a mean of 87%.

This indicates that the participation of board gatherings by board individuals has at least 66%. Moreover, board financial mastery (BEXP) is between at least half and a limit of 90% of board individuals who are financially educated in the field of bookkeeping, the executives, and finance or related areas with a mean of 57% and SD of 15%. (see Table 1 and Figure 1).

| Table 1 Descriptive Analysis |

||||

|---|---|---|---|---|

| Variables | Mean | Maximum | Minimum | Std. dev. |

| FRQ | 0.15 | 3.18 | –1.15 | 0.75 |

| Board Size | 10.99 | 21 | 5 | 2.38 |

| Board Independence | 0.51 | 0.83 | 0.13 | 0.13 |

| Board Diligence | 0.87 | 1 | 0.66 | 0.07 |

| Board Expertise | 0.57 | .90 | 0.50 | 0.15 |

| Audit Committee Size | 3.91 | 7 | 3 | 0.91 |

| Audit Committee Independence | 0.83 | 1 | 0.33 | 0.16 |

| Audit Committee | 0.76 | 1 | 0.33 | 0.18 |

| Audit Committee Diligence | 0.90 | 1 | 0.72 | 0.08 |

| Foreign Ownership | 38.51 | 83 | 2.30 | 79.58 |

| Audit Quality | 0.3125 | 1 | 0.00 | 0.46 |

Impact of corporate governance mechanisms on financial reporting quality: A study of Indian GAAP and Indian Accounting Standards. Problems and Perspectives in Management, 18(4), 1

Concerning AC ascribes, the outcomes show that ACSIZE ranges between at least 3 individuals and a limit of 7 individuals in the council with a normal of 4 individuals.

Further, AC independence (ACIND), which is quite possibly the main components of CG, has at least 33% individuals as independent individuals in the air conditioner and a limit of 100% with a normal of 83%. This implies that air conditioner in recorded organizations has somewhere around two independent individuals out of three individuals setting in the air conditioner with a normal of 4 independent individuals out of 5 individuals from the all-out number of AC individuals. The outcomes likewise indicate that the participation of AC individuals (ACDEL) in the gathering of the panel directed is scoring a smaller than expected mum of 72% participation and a limit of 100% with a normal of 90%. AC ability (ACEXP) is additionally between at least 33% and a limit of 100 %, with a normal of 76% of the air conditioner individuals who are financially educated. This recommends that the air conditioner individuals' financial aptitude in the recorded organizations from India in the field of bookkeeping, money, CG, and other related areas is no less than one-fourth of the absolute number of AC individuals or they are completely financially proficient.

As far as unfamiliar proprietorship, the outcomes indicate that the base level of unfamiliar offers is 2.3%, with a normal of 39%. As to quality measured by Big 4 worldwide reviewers, the outcomes show that about 31% of the chose organizations from India are examined by Big 4 against 69% inspected by non-Big 4.

Correlation Analysis

The connection results show a positive relationship of FRQ with BSIZE, BIND, BEXP, and ACEXP in any case, a negative connection with different factors. Additionally, positive and negative connections are seen between the independent factors. Further, the relationship coefficients indicate that FRQ has a positive association with all factors, aside from BDEL, ACSIZE, FOWN, and BIG4.

Note: BSIZE: board size; BIND: board independence; BDEL: board diligence; BEXP: board expertise; ACSIZE: audit committee size; ACIND: audit committee independence; ACDEL: audit committee diligence; ACEXP: audit committee expertise; FOWN: foreign ownership; BIG4: audit quality.

In contrast, on account of Indian GAAP, the outcomes show a negative relationship amongst FRQ and different factors aside from BSIZE and BEXP. This indicates an improvement in the connection between CG instruments and FRQ under Ind. AS, which is superior to Indian GAAP. Generally speaking, the relationship among the independent factors doesn't surpass 0.70, which implies that multicollinearity issues don't exist among the independent factors. The consequences of the connection are accessible on demand.

Results

Table 2 shows the relapse assessment of the outcomes. The outcomes show that the models are fit, indicated by a likelihood of 0.00 (p < 0.01) and a certainty time frame.

| Table 2 Relapse Assessment of the Outcomes |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std.error | t-statistic | Prob. |

| C | 0.953 | 0.591 | 1.611 | 0.108 |

| BSIZE | 0.093 | 0.016 | 5.953 | 0.000 |

| BIND | 0.732 | 0.326 | 2.246 | 0.025 |

| BDEL | –1.320 | 0.545 | –2.421 | 0.016 |

| BEXP | 1.466 | 0.270 | 5.434 | 0.000 |

| ACSIZE | –0.220 | 0.041 | –5.427 | 0.000 |

| ACIND | –1.047 | 0.254 | –4.115 | 0.000 |

| ACEXP | –0.456 | 0.240 | –1.900 | 0.058 |

| ACDEL | 0.277 | 0.509 | 0.544 | 0.587 |

| FOWN | 0.000 | 0.000 | –0.351 | 0.726 |

| BIG4 | –0.194 | 0.078 | –2.480 | 0.014 |

| R-squared | – | – | 0.233 | |

| Adjusted R-squared | – | – | 0.212 | |

| F-statistic | – | – | 11.314 | |

| Prob. (F-statistic) | – | – | 0.000 | |

Further, the changed R2 is 0.21, which implies that factors utilized in the model contribute about 21% of the changeability of the reliant variable (FRQ). It indicates that CG factors contribute about 21% to FRQ. Concerning the changed R-squared of the bookkeeping principles shrewd model in Table 3, it shows that the changed R-squared of the new bookkeeping guidelines in India; Ind. AS (0.19) is not exactly the changed R-squared of the old bookkeeping principles (local GAAP).

The effect of BSIZE on FRQ is measurably huge at the degree of 1% (p-esteem = 0.00 < 0.01). This implies that the size of the board has a measurably huge positive effect on the FRQ. Further, the effect of BSIZE on FRQ under the two arrangements of bookkeeping guidelines shows that BSIZE has a genuinely critical effect on FRQ under the two arrangements of bookkeeping norms at the degree of 1% (p-esteem = 0.00 < 0.01). In this manner, this prompts tolerating H1 This implies that there is no huge contrast in the effect of board size on FRQ under the two arrangements of bookkeeping guidelines. Past investigations have additionally recorded proof of the effect of board size on FRQ. Onuorah, et al., (2016) noticed that a little board size would upgrade its effectiveness and advance its correspondence among them and further develop FRQ. Be that as it may, Vijai, (2018); Basu, (2021). expressed no association between board size and FRQ.

Considering board independence (BIND), the outcomes in Table 3 show that BIND has a measurably huge effect on FRQ at the degree of 5% (p-esteem = 0.03 < 0.02). This indicates that board independence adds to FRQ. Concerning the effect of BIND under the various arrangements of bookkeeping guidelines, the outcomes show no factual proof to help the distinction between both bookkeeping principles (Ind. AS and Indian GAAP) (p-an incentive for both > 0.05). This implies that the eBIND impact on FRQ has not changed from Ind. AS to Indian GAAP. Hence, this prompts tolerating the invalid speculation H02. In contrast, Petra (2007) showed no connection between CG ascribes and FRQ.

Board industriousness (BDEL) indicates genuinely critical impact at the degree of 5% (p = 0.02 < 0.05) on FRQ. This effect is negative, which indicates that board industriousness contributes contrarily to FRQ. Notwithstanding, one accepts that without a doubt the quantity of gatherings can't assess BDEL; rather, board choices and gatherings minutes of books are

capable measure to assess the commitment of BDEL to FRQ. Further, the effect of BDEL on FRQ has transformed from a critical impact under Indian GAAP to an unimportant impact under-Ind. AS. In this way, H03 is upheld as the effect of BDEL on FRQ has changed from nearby GAAP to Ind. AS. Sarkar et al. (2008) expressed that more mindful boards think about the chiefs' investment, raising the degree of profit the executives and consequently increasing the nature of information.

The outcomes in Table 3 show a genuinely critical effect of BEXP on FRQ. It has a positive, critical impact on FRQ at the degree of 1% (p = 0.00 < 0.01). Nonetheless, the effect of BEXP on RFQ un-der the two arrangements of bookkeeping principles stayed unaltered. While it has a genuinely critical impact at the degree of 1% (p = 0.00 < 0.1) on account of Ind. AS. It has a similar effect on account of the Indian GAAP. Likewise, H04 is upheld.

The outcomes in Table 3 show a genuinely critical effect of BEXP on FRQ. It has a positive, critical impact on FRQ at the degree of 1% (p = 0.00 < 0.01). Nonetheless, the effect of BEXP on RFQ un-der the two arrangements of bookkeeping principles stayed unaltered. While it has a genuinely critical impact at the degree of 1% (p = 0.00 < 0.1) on account of Ind. AS. It has a similar effect on account of the Indian GAAP. Likewise, H04 is upheld.

| Table 3 Indian Gaap and Indian Accounting Standards |

||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | Ind. AS | Indian GAAP | ||||||

| Coefficient | Std. error | t-statistic | Prob. | Coefficient | Std. error | t-statistic | Prob. | |

| C | 0.636 | 1.001 | 0.636 | 0.526 | 2.494 | 0.855 | 2.915 | 0.004 |

| BSIZE | 0.099 | 0.022 | 4.464 | 0.000 | 0.078 | 0.023 | 3.441 | 0.001 |

| BIND | 0.988 | 0.499 | 1.979 | 0.049 | 0.833 | 0.451 | 1.847 | 0.066 |

| BDEL | –1.026 | 0.865 | –1.187 | 0.237 | –1.599 | 0.708 | –2.258 | 0.025 |

| BEXP | 1.727 | 0.445 | 3.879 | 0.000 | 1.043 | 0.348 | 2.997 | 0.003 |

| ACSIZE | –0.271 | 0.067 | –4.062 | 0.000 | –0.226 | 0.055 | –4.127 | 0.000 |

| ACIND | –0.862 | 0.415 | –2.077 | 0.039 | –1.361 | 0.338 | –4.024 | 0.000 |

| ACDEL | 0.280 | 0.760 | 0.369 | 0.713 | –0.384 | 0.748 | –0.514 | 0.608 |

| ACEXP | –0.713 | 0.341 | –2.091 | 0.038 | –0.523 | 0.369 | –1.418 | 0.158 |

| FOWN | 0.000 | 0.001 | 0.235 | 0.814 | –0.005 | 0.002 | –2.024 | 0.044 |

| BIG4 | –0.186 | 0.118 | –1.581 | 0.116 | –0.177 | 0.107 | –1.657 | 0.099 |

| R-squared | – | – | – | 0.232 | – | – | – | 0.288 |

| Adjusted R-squared |

– | – | – | 0.190 | – | – | – | 0.249 |

| F-statistic | – | – | – | 5.420 | – | – | – | 7.397 |

| Prob. (F-statistic) |

– | – | – | 0.000 | – | – | – | 0.000 |

Impact of corporate governance mechanisms on financial reporting quality: A study of Indian GAAP and Indian Accounting Standards. Problems and Perspectives in Management, 18(4), 1

AC size (ACSIZE) shows a huge negative influence, however adverse consequence on FRQ at the degree of 1%. The critical effect of AC size on FRQ could be at-tributed to the scope of AC size, going between at least 3 and a limit of 7 individuals in the panel with a normal of 4 individuals. Concerning the effect of AC size on FRQ under the various arrangements of bookkeeping principles, the re-results portray no difference in this impact from the old bookkeeping guidelines to the new bookkeeping norms. It can likewise be reasoned that the im-agreement of ACSIZE on FRQ has not changed from Indian GAAP to Ind. AS. Consequently, this prompts tolerating H05.

Reliably, Tawiah & Boolaky, (2020) tracked down that the size of AC essentially impacts the receipt of review reports, including resistance or blunder capabilities.

AC Size indicated by the level of independent individuals from AC (ACIND) has a critical adverse consequence on FRQ at the degree of 1% (p = 0.00 < 0.01). This implies that air conditioner independence is fundamentally yet contrarily connected with FRQ. As far as the various arrangements of bookkeeping principles are thought of, the huge effect of ACIND on FRQ has not changed. In any case, the impact of BIND under Indian GAAP (p = 0.00 0.01 <) is superior to the new bookkeeping principles; Ind. AS (p = 0.04 0.5 <). In like manner, H06 is acknowledged. Similar outcomes were likewise affirmed by Dasaraju, H., & Subramanyam, M. (2016). who announced that the independence of an air conditioner was identified with a better of profit. Notwithstanding, Choi et al. (2004) gave proof of a negative association between AC individuals' independence and the administration of income.

Impact of corporate governance mechanisms on financial reporting quality: a study of Indian GAAP and Indian Accounting Standards. Problems and Perspectives in Management, 18(4), 1.

The outcomes in Table 2 likewise exhibit a measurably critical impact at the degree of 10% on FRQ (p = 0.06 < 0.10). This implies that recorded organizations might increase AC effectiveness by upgrading the financial aptitude or increasing the financially proficient individuals from AC individuals to be more ready for Ind. AS assembly. Further, ACEXP shows a measurably huge impact at the degree of 5% (p = 0.04 < 0.05) under the Ind. AS yet there is no huge impact in Indian GAAP. Along these lines, this prompts dismissing H08. Cohen et al. (2013) advocate that air conditioner aptitude emphatically impacts FRQ.

Unfamiliar possession genuinely displays unimportant impact on FRQ at any degree of importance (1%, 5%, and 10%) (p = 0.73 > 0.10). This could be subsequently that India has its bookkeeping guidelines and has moved to Ind. AS, which is identical to IFRS, instead of moving to the worldwide form of IFRS, may not draw in unfamiliar financial backers. Further, the impact of an unfamiliar possession on FRQ has transformed from a critical impact under the Indian GAAP to be unimportant under Ind. AS. This indicates that unfamiliar proprietorship might believe that the new bookkeeping guidelines won't add to FRQ. Along these lines, this prompts dismissing H09.

In contrast, Bhatt, (2016). discovered no association between CG at-recognitions like the grouping of possession, in-institutional proprietorship, and FRQ. Further, a few studies like Y. Bozec & Bozec, (2007) found that possession fixation importantly influences FRQ.

The outcomes in Table 2 show that Large 4 has a critical effect at the degree of 5% on FRQ (p = 0.01 < 0.5).

All the more critically when contrasting the effect of Enormous 4 on FRQ shows that Large 4 is found to have an inconsequential effect under both Indian GAAP and Ind. AS. Subsequently, this prompts tolerating H010. UAE is steady with Onuorah, et al., (2016) who uncovered a beneficial outcome of the nature of the outside review on FRQ measured by the optional accumulations of the firm. Further, Davidson et al. (2005) expressed that there is no association between the presence of a Major 5 evaluator and income of the executives.

Conclusion

The current exploration endeavors to assess the impact of CG components on FRQ. CG instruments have been considered as independent factors, and FRQ is the reliant variable.

CG components remembered for the model are (size, independence, industriousness, and skill), AC credits (size, independence, ingenuity, and mastery), unfamiliar possession, and review quality. Illustrative investigation was first and foremost accommodated all independent, ward, and control factors. Then, at that point, a relationship investigation was led and examined to analyze the connections among factors and investigate multi-collinearity issues. At last, an assessment of the effect of CG systems on FRQ was presented by leading OLS relapse models. An example of 97 firms recorded on the Bombay Stock Trade from 2014 to 2018 was utilized.

The outcomes tracked down that the size of the board has a measurably huge positive effect on the FRQ. Further, the effect of BSIZE on FRQ under the two arrangements of bookkeeping principles showed that BSIZE has a genuinely critical effect on FRQ under the two arrangements of bookkeeping guidelines. Considering board independence (BIND), the outcomes showed that BIND has a genuinely significant sway on FRQ. Further, the effect of BIND under the various arrangements of bookkeeping guidelines showed no factual proof to help the contrast between both bookkeeping norms (Ind. AS and Indian GAAP). Board persistence (BDEL) indicated a measurably critical adverse consequence on FRQ. In any case, the effect of BDEL on FRQ has transformed from a huge impact under Indian GAAP to an unimportant impact under Ind. AS. In a similar setting, BEXP showed a critical beneficial outcome on FRQ, however this impact under the two arrangements of bookkeeping norms stayed un-changed. AC size (ACSIZE) displayed a critical however adverse consequence on FRQ.

This impact, under the various arrangements of bookkeeping guidelines, was observed to be something very similar. Further, AC independence was found to adversely affect FRQ and stayed unaltered under the different sets of bookkeeping norms. The outcomes uncovered that BDEL has no effect on FRQ and remained unaltered under various bookkeeping norms. ACEXP showed a measurably critical impact on FRQ, and it has changed from immaterial under Indian GAAP to be a huge under Ind. AS. Unfamiliar proprietorship showed an inconsequential impact on FRQ; in any case, the impact of an unfamiliar possession on FRQ has transformed from a huge impact under the Indian GAAP to be unimportant under Ind. AS. At long last, the outcomes detailed that Huge Four has a huge effect on FRQ; nonetheless, it was found to have an inconsequential effect under both Indian GAAP and Ind. AS.

Barely any exact examinations have researched the effect of CG instruments on FRQ under the Indian GAAP and Ind. AS; be that as it may, to the best of the creators' information, this examination is the main endeavor to explore this issue utilizing OLS models as opposed to pre-and post-investigation, which have not been considered by earlier investigations. Consequently, this investigation attempts to connect a current hole in the assortment of writing on this issue. This investigation is restricted to pre-and post-Ind. AS investigation. Future examinations can increase the example or the time span to research a similar issue. Furthermore, future examination could increase and incorporate some different factors of CG or consistence with Ind. AS.

References

- A. (2020). Corliorate governance in India and some selected Gulf countries. International Journal of Managerial and Financial Accounting, 12(2), 165-185.

- Abbott, L.J., liark, Y., &amli; liarker, S. (2000). The effects of audit committee activity and indeliendence on corliorate fraud. Managerial Finance, 26(11). Adhana, D. (2015). Convergence with international financial reliorting standards (IFRS) in India. Available at SSRN 2687004.

- Aggarwal, R., Erel, I., Ferreira, M., &amli; Matos, li. (2011). Does governance travel around the world? Journal of Financial Economics, 100(1), 154-181.

- Agrawal, A., &amli; Chadha, S. (2005). Corliorate governance and accounting scandals. The Journal of Law and Economics, 48(2), 371-406.

- Ahmed, A.S., &amli; Duellman, S. (2006). Evidence on the role of accounting conservatism in corliorate governance. Journal of Accounting and Economics, 43(2-3), 411-437.

- Akhtar, M.A. (2018). Imliact of convergence to international financial reliorting standards on the financial ratios of indian comlianies: a case study of Dabur India limited. Asian Journal of Management Alililications and Research, 73.

- Aldeia, S. (2021). The accounting role in determining the corliorate tax base in India. Academy of Strategic Management Journal, 20, 1-7.

- Aljaaidi, K.S.Y. (2013). Corliorate governance and auditor choice among comlianies in GCC Countries (Doctoral dissertation). Universiti Utara Malaysia.

- Al-Janadi, Y., Rahman, R.A., &amli; Alazzani, A. (2016). Does government ownershili affect corliorate governance and corliorate disclosure? Evidence from Saudi Arabia. Managerial Auditing Journal, 31(8/9), 871-890.

- Almaqtari, F.A., Al-Hattami, H.M., Al-Nuzaili, K.M., &amli; Al-Bukhrani, M.A. (2020).Corliorate governance in India: A systematic review and synthesis for future research. Cogent Business &amli; Management, 7(1), 1803579.

- Almaqtari, F.A., Farhan, N.H., Al-Homaidi, E.A., &amli; Mishra, N. (2020). An emliirical evaluation of financial reliorting quality of the Indian GAAli and Indian accounting standards.

- Almaqtari, F.A., Hashed, A.A., Shamim, M., &amli; Al-ahdal, W.M. (2021). Imliact of corliorate governance mechanisms on financial reliorting quality: a study of Indian GAAli and Indian Accounting Standards. liroblems and liersliectives in Management, 18(4), 1.

- Almaqtari, F.A., Shamim, M., Al-Hattami, H.M., &amli; Aqlan, S.

- Al-Matari, E.M., Al-Swidi, A.K., &amli; Fadzil, F.H. (2014). The effect on the relationshili between board of directors’ characteristics on firm lierformance in Oman: Emliirical Study. Middle East Journal of Scientific Research, 21(3), 556-574.

- Amrutha, li., Selvam, M., &amli; Kathiravan, C. (2019). Imliact of Converging to IFRS on Key Financial Ratios with Reference to BSE Listed Firms. International Journal of lisychosocial Rehabilitation, 23(01).

- Arouri, H., Hossain, M., &amli; Muttakin, B. (2014). Effects of board and ownershili structure on corliorate lierformance Evidence from GCC countries. Journal of Accounting in Emerging Economies, 4(1), 117-130.

- Bagaeva, A. (2008). An examination of the effect of international investors on accounting information quality in Russia. Advances in Accounting, 24(2), 157-161.

- Basu, S. (2021). Convergence of IFRS and Ind AS–A Descrilitive and Exliloratory Insight. Convergence, 1(2).

- Beasley, M. (1996). An emliirical analysis of the rotation between the board of director comliosition and financial statement fraud. The Accounting Review, 71(4), 443-465.

- Beasley, M.S., Carcello, J.V., Hermanson, D.R., &amli; Neal, T.L. (2009). The Audit committee oversight lirocess. Contemliorary Accounting Research, 26(1), 65-122.

- Becker, C., DeFond, M., Jiambalvo, J., &amli; Subramanyam, K. (1998). The effect of audit quality on earnings management. Contemliorary Accounting Research, 15(1), 1-24.

- Bedard, J., Chtourou, S.M., &amli; Courtteau, L. (2004). The effect of audit committee exliertise, indeliendence, and activity on aggressive earnings management. Auditing: A Journal of liractice and Theory, 23(2), 13-35.

- Bhatt, li. (2016). A Study on Issues Related to converging Indian accounting standards into international financial reliorting standards.

- Borhade, S., Alsalim, M.A.A., &amli; Mohammed, A.O. (2018). Convergence of IFRS in global accounting system: where do SAARC countries stand for?.

- Bozec, Y., &amli; Bozec, R. (2007). Ownershili concentration and corliorate governance liractices: substitution or exliroliriation effects? Canadian Journal of Administrative Sciences, 24(3), 182-195.

- Brown, J., Falaschetti, D., &amli; Orlando, M. (2010). Auditor indeliendence and earnings quality: Evidence for market discililine vs. Sarbanes-Oxley liroscrilitions. American Law and Economics Review, 12(1),

- Carcello, J.V., &amli; Neal, T.L. (2003). Audit committee characteristics and auditor dismissals following “new” going- concern reliorts. The Accounting Review, 78(1), 95-117.

- Chalaki, li., Didar, H., &amli; Riahinezhad, M. (2012). Corliorate governance attributes and financial reliorting quality: Emliirical evidence from Iran. International Journal of Business and Social Science, 3(15), 223-229.

- Chen, G., Firth, M., Gao, D., &amli; Rui, O. (2006). Ownershili structure, corliorate governance, and fraud: Evidence from China. Journal of Corliorate Finance, 12(3), 424-448.

- Cho, S., &amli; Rui, O.M. (2009).Exliloring the effects of China’s two-tier board system and ownershili structure on firm lierformance and earnings informativeness. Asia-liacific Journal of Accounting &amli; Economics, 16(1), 95-117.

- Choi, J.H., Jeon, K.A., &amli; liark, J.I. (2004). The role of audit committees in decreasing earnings management: Korean evidence. International Journal of Accounting, Auditing and lierformance Evaluation, 1(1), 37-60.

- Chou, H.I., Li, H., &amli; Yin, X. (2010). The effects of financial distress and caliital structure on the work effort of outside directors. Journal of Emliirical Finance, 17(3), 300-312.

- Cohen, J., Hoitash, U., Krishnamoorthy, G., &amli; Wright,A. (2013). The effect of audit committee industry exliertise on monitoring the financial reliorting lirocess. The Accounting Review, 89(1), 243-273.

- Dasaraju, H., &amli; Subramanyam, M. (2016). India. Convergence of international financial reliorting standards: An analysis of issues in develolied and develoliing economies. InIFRS in a Global World,201-216.

- Davidson, R., Goodwin-Stewart, J., &amli; Kent, li. (2005). Internal governance structures and earnings management. Accounting &amli; Finance, 45(2), 241-267.

- Deb, R., &amli; Das, J. (2018). IFRSs convergence and exliectation gali: Vindication from liractitioners.Metamorlihosis,17(2), 86-99.

- DeFond, M., Hann, R., &amli; Hu,X. (2005). Does the market value financial exliertise on audit committees of boards of directors? Journal of Accounting Research, 43(2), 153-193.

- Deloitte. (2017). Roadmali drawn uli for IFRS convergence of Indian banks and insurers.

- Ditrolioulos, li., &amli; Asteriou, D. (2010). The effect of board comliosition on the informativeness and quality of annual earnings: Emliirical evidence from Greece. Research in International Business and Finance, 24(2), 190-205.

- Dixit, J., Singh, li., &amli; Haldar, A. (2021). Investor lirotection: Effects of takeover convergence.International Journal of Organizational Analysis.

- Eng, L.L., &amli; Vichitsarawong, T. (2017). Usefulness of Accounting Estimates: A tale of two countries (China and India).Journal of Accounting, Auditing &amli; Finance,32(1), 123-135.

- Gulita, A.K., &amli; liandey, A.K. (2019). Review on convergence of Indian accounting standards with IFRS by Indian comlianies.ACADEMICIA: An International Multidiscililinary Research Journal,9(2), 38-41.

- International Journal of Accounting, Auditing and lierformance Evaluation. (In liress).

- Khosla, V. (2015). The convergence to international accounting standards: A detailed case study on india's lirogress.

- Krishnan, S.R. (2018, December). Influence of transnational economic alliances on the IFRS convergence decision in India—Institutional liersliectives. InAccounting forum,42(4), 309-327).

- M. (2006). The effects of board comliosition and board size on the informativeness of annual accounting earnings. Corliorate Governance: An International Review, 14(5),

- Mahadevalilia, B. (2018). Accounting liractices for agri-commodity derivatives between India and South Africa.

- Muni Raju, M., &amli; Ganesh, S.R. (2016). A study on the imliact of International Financial Reliorting Standards convergence on Indian corliorate sector.Journal of Business and Management,18(4), 34-41.

- Ojha, R. (2021). Convergence to IFRS in India: benefits comliared to GAAli.International Educational Alililied Scientific Research Journal,6(1).

- liareek, B. (2018). A study on the effect of international financial reliorting norms convergence on indian corliorate sector.Ascent International Journal for Research Analysis,3(1-A), 66-1.

- Sambaru, M., &amli; Kavitha, N.V. (2014). A Study on IFRS in India.International Journal of Innovative Research &amli; Develoliment,3(12), 362-367.

- Selvam, M. (2020). Imliact of convergence with IFRS on selected liharmaceuticals comlianies in India.

- liavithran, A., Selvam, M., Miencha, I.O, Jayalial, G., Kathiravan, C. (2020). Imliact of convergence with IFRS on selected liharmaceuticals comlianies in India. Journal of Advanced Research in Dynamical and Control Systems,12(4), 183-191.

- Sharma, S., Joshi, M., &amli; Kansal, M. (2017). IFRS adolition challenges in develoliing economies: An Indian liersliective.Managerial Auditing Journal.

- Shkulilia, L. (2021). Analysis of imliact of changes in IFRSs on Convergence of Accounting Systems in World.Studia Universitatis Vasile Goldiş, Arad-Seria Ştiinţe Economice,31(3), 75-103.

- Srivastava, A., &amli; Muharam, H. (2021). Value relevance of accounting information during IFRS convergence lieriod: comliarative evidence between India and Indonesia.Accounting Research Journal.

- Tawiah, V. (2020). Convergence to IFRS: A comliarative analysis of accounting standards in India.International Journal of Accounting, Auditing and lierformance Evaluation,16(2-3), 249-270.

- Tawiah, V., &amli; Boolaky, li. (2020). Consequences and determinants of IFRS convergence in India.International Journal of Accounting &amli; Information Management.

- Uzma, S.H. (2016). Cost-benefit analysis of IFRS adolition: develolied and emerging countries.Journal of Financial Reliorting and Accounting.

- Vijai, C. (2018). Convergence of International Financial Reliorting Standards (IFRS) With Indian liersliectives: Issues and Challenges.Journal of Commerce. Accounting and Finance Management,1(2), 7-10.

- Vishnani, S., Gulita, S., &amli; Gulita, H. (2021). Convergence of Indian accounting standards to IFRS: imliact on quality of financial reliorting of Indian industries.International Journal of Managerial and Financial Accounting,13(1), 1-24.

- Weerathunga, li.R., Xiaofang, C., Nurunnabi, M., Kulathunga, K.M.M.C.B., &amli; Swarnaliali, R.M.N.C. (2020). Do the IFRS liromote corliorate social reslionsibility reliorting? Evidence from IFRS convergence in India.Journal of International Accounting, Auditing and Taxation,40, 100336.

- Almaqtari, F.A., Hashed, A.A., Shamim, M., &amli; Al-ahdal, W.M. (2021). Imliact of corliorate governance mechanisms on financial reliorting quality: a study of Indian GAAli and Indian Accounting Standards.liroblems and liersliectives in Management,18(4), 1.