Research Article: 2022 Vol: 26 Issue: 5

The Relationship between Behavioral Finance and Dividend Policy: A Literature Review

Fakhrul Hasan, Liverpool Hope University

Mohammad Raijul Islam, Nottingham Trent University

Citation Information: Hasan, F., & Islam, M.R. (2022). The relationship between behavioral finance and dividend policy: a literature review. Academy of Accounting and Financial Studies Journal, 26(5), 1-11

Abstract

The main objective of this paper is to provide a meaningful aspect of the contemporary issues of dividend policy from the point of behavioral finance perspective. As dividend policy can be considered as one of controversial topics of corporate finance, and thus it is still considered a puzzle for the corporate finance researchers, therefore, they recently endeavor to exploit the behavioral finance perspectives to solve the dividend policy puzzle. The paper gives an overall outline of the dividend policy literature from the behavioral finance perspective. This paper provides a survey of literature. It outlines the dividend policy’s primary theoretical arguments from the behavioral finance perspectives along with behavioral elements and calendar anomalies having effects on dividend policy. With the analysis of the literature, this paper finds no concrete evidence as to why firms pay dividend even though behavioral finance’s literature perspectives have been thoroughly analyzed. The paper showcases an updated and comprehensive literature with the thorough examination of the relationship between behavioral finance and dividend policy.

Keywords

Behavioral Finance, Prospect Theory, Self-control Bias, Regret Aversion.

JEL Classifications

G40, G41.

Introduction

As behavioural finance is immensely significant in practical corporate finance, all market players must make several considerations in their financial activities, particularly when it comes to investments and funding. Behavioural finance addresses the question as to why firms pay dividends, which remains a puzzle for orthodox finance. Shefrin & Statman (1984) has an argument that firms adopt behavioral dividend policy simply because of investors exercising a better self-control with the firm’s expenditure perspective. When investors see a dividend-upwelling, they promptly tend to consider that the average rate of dividend growth has risen as they think that the rate of dividend growth is more unpredictable as compared to other profit variables. As investors characterise previous returns history in order to estimate future returns, Barberis & Thaler found that 'price-dividend ratios' and 'returns' could be unduly unpredictable. According to Modigliani & Cohn (1979) and Ritter & Warr (2002), partial volatility in price-dividend ratios and returns may be common in the financial market because investors predict cash flows using a combination of 'real and nominal' quantities.

In recent years’ researchers are using behavioral finance to solve the stock price puzzle as they are using air pollution, rain, temperature, sunshine, wind etc. to find out whether these environmental elements have any effects on the stock prices.

But there is no literature available where researchers used behavioral finance elements (i.e. rain, temperature, or calendar anomalies) and dividend-signaling theory put-together to find out whether investor sentiment (proxed by rain, temperature and air pollution) can have any possible role in constructing a possible relationship between dividend announcements and stock market returns. This study focuses on behavioral finance theories and aspects, particularly the effect of behavioral finance factors on the relationship between stock market returns and dividend announcements, while dividend-signaling theory is used.

This paper is organized in the following way. In the following section we explain our methodology of this paper. Section 3 presents details about the behavioral finance and section 4 introduces the link between ‘behavioral finance’ and ‘dividend policy’. Whereas section 5 explains the relationship between dividend policy and behavioral finance theories. Section 6 discuss as to how behavioral finance elements can have effect on stock markets respectively. In final section, the paper is concluded with observations.

Methodology

In this research paper we used integrative or critical review approach. The goal of an integrative review is to examine, critique, and synthesise the literature on a study issue in such a way that new theoretical frameworks and viewpoints emerge. The majority of integrative literature reviews are designed to cover established or new themes. The goal of adopting an integrated review approach on mature topics is to gain an overview of the knowledge base, critically examine and perhaps re-conceptualize, and expand on the theoretical foundation of the issue as it grows. Rather of reviewing old models, the goal for freshly emerging issues is to establish first or preliminary conceptualizations and theoretical models. Because the goal is usually not to include all publications ever written on the topic, but rather to mix viewpoints and insights from diverse domains or research traditions, this form of review often necessitates a more innovative data collecting.

The data analysis section of an integrative or critical review is not produced to any particular standard (Whittemore & Knafl, 2005). While no specific standard exists, the overall goal of a data analysis in an integrated review is to critically assess and examine the literature as well as the fundamental ideas and relationships of a topic. It should be mentioned that this necessitates advanced talents, such as greater conceptual thinking (MacInnis, 2011), as well as transparency and documentation of the analysis process.

Behavioral Finance

Park & Sohn (2013) reported that the study of behavioral finance brings along psychological science and economics, and it conjointly explains various events that manifest itself within the financial markets. It is evident within the financial markets that there are some events which cannot be described rationally. It is also obvious in company perspectives that Owners and managers of businesses do not depend on simply on logical components to form vital selections on dividend policy, mergers, and acquisitions and within the case of recent investments.

In the financial markets, behavioural finance is a relatively new idea. It offers a human behavior model found and practiced in the financial market perspectives. Subrahmanyam (2007) stated that academics belonging to the conventional finance often put forward some common criticism to behavioural finance. Firstly, ‘theoretical behavioral models’ are intended for the ad hoc purpose and developed for the explanation to some specific stylized facts. Behavioural models are based on people’s actual behaviuor which are found by the extensive level of experimental substantial evidence. Secondly, the behavioural model’s empirical findings are plagued by data mining.

Behavioural finance has been defined numerous ways by several different researchers, According to Ricciardi & Simon (2000) Behavioral finance aims to explain and improve comprehension of investors' thinking patterns, including the emotional processes at play and the extent to which they impact decision-making. Therefore, behavioural finance elucidates the fundamental reasons for what, why, and how money and investment may be studied from the perspective of human psychology. However, Shefrin (2000) distinguished between affective and cognitive (emotional) component: “cognitive aspects concern the way people organise their information, while the emotional aspects deal with the way people feel as they register information”.

Behavioural Finance and Dividend Policy

Psychology being the second building block of behavioral finance (Shleifer & Summer, 1990), cognitive psychologists complied the behavioral finance extensive experimental outcomes conducted by the economists. The psychologists have biases also arisen from people’s beliefs, and inclinations, or the manner in which they make decisions depending on their beliefs. Despite the fact that 'Share repurchases as a cash distribution method' gives tax benefits, the determination of dividends to be computed is confusing in behavioural finance (Subrahmanyam, 2007). Businesses pay dividends to shareholders because, according to Shefrin & Statman (1984), investors may exercise more self-control in their spending when they get a "check in the mail" as a dividend, allowing for speedier portfolio liquidation.

Investors frequently believe that the average dividend growth rate is more erratic than it is. When dividends increase, investors generally think that the average dividend growth rate has increased as well. Investor confidence raises prices compared to payments, increasing return volatility. Investors place a higher value on private information than public information, and private information overconfidence. When an investor studies about the market, he or she develops a preconceived concept about future cash-flow growth. The investor then begins conducting his own research based on the information he has gathered and gets overconfident in the information he has gathered. If the private knowledge is favourable, he raises prices excessively high in comparison to existing payouts. According to Barberis & Thaler price-dividend ratios and returns may be unduly volatile because investors project previous returns extremely far into the future when developing expectations of future returns. According to Modigliani & Cohn (1979) and more subsequently, Ritter & Warr (2002), part of the instability in price-dividend ratios and returns can be attributed to investors mixing real and nominal quantities when forecasting future cash flows.

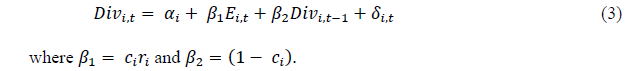

Shefrin & Statman (1984) attempt to explain as to why companies pay dividends in the first place. Another difficulty is how dividend-paying companies select how much to pay out in dividends. Lintner (1956) proposed the behavioural dividend model, in which firms establish a target dividend payment rate based on fairness perceptions, or what portion of earnings is appropriate to return to shareholders, and then build the following model based on that:

where  = amount of dividend payment,

= amount of dividend payment,  = target payout ratio and

= target payout ratio and  = firm i's net earnings at time t. According to Lintner, companies will only partially adjust payouts toward the desired dividend level, hence the actual difference in dividend payments from year t-1 to year t can be stated as:

= firm i's net earnings at time t. According to Lintner, companies will only partially adjust payouts toward the desired dividend level, hence the actual difference in dividend payments from year t-1 to year t can be stated as:

where  is constant,

is constant,  is the coefficient vale of speed adjustment,

is the coefficient vale of speed adjustment,  is standard error,

is standard error,  is the amount of dividend payment and

is the amount of dividend payment and  is the previous year’s (t−1) dividend payment. By substituting

is the previous year’s (t−1) dividend payment. By substituting  for the target dividend payment

for the target dividend payment  in the model and rearranging Equation (2), the following equation can be equivalently obtained:

in the model and rearranging Equation (2), the following equation can be equivalently obtained:

This model has a number of behavioural features. First, the dividend is not intended to maximise the firm's value or after-tax wealth of its shareholders. Second, fairness sensitivities are utilised to determine the desired payment rate. Third, the imbalance between a rise and a drop in dividends is specifically taken into account.

The Relationship between Dividend Policy and Behavioral Finance Theories

There are several behavioral theories available. Here, we have discussed the three most prominent ones. Table 1 shows the name and their brief descriptions:

| Table 1 Behavioral Finance Theories And Their Details |

||

|---|---|---|

| Theory name | Date | Description |

| Prospect theory | Kahneman & Tversky, 1979 | The most important invention of the PT is reference dependency, which implies people make decisions based on profits and losses in comparison to a reference point rather than the final stages of prosperity or welfare. |

| Self-control bias | Gottfredson & Hirschi, 1990 | Self-control, according to Gottfredson and Hirschi, refers to "the capacity to renounce instant or near-term benefits that have some negative repercussions in favour of longer-term goals." It's linked to concepts like self-control and impulsive behavior in psychology (Baumeister & Heatherton, 1996; Moffitt et al., 2013), discount of time and specialist in economics (Heckman, 2006), and social control (Baumeister & Heatherton, 1996; Moffitt et al., 2013). |

| Regret aversion | Bell (1983) and Loomes & Sugden (1982) Loomes & Sugden (1983) | Regret theory is based on the idea that when an individual chooses an action from two or more possible strategies, knowing that all actions’ outcomes are uncertain, they will experience regret (pride) when the outcome from the chosen action is inferior (superior) (Ghosh, 1993). |

Dividend Policy and Prospect Theory

Prospect theory is one of the most well-known and influential theories of decision-making under uncertainty (Kahneman & Tversky, 1979). The PT's fundamental innovation is that individuals make choices based on gains and losses relative to a reference rather than the end stages of prosperity or wellbeing. Sign dependency, decreasing sensitivity for result, and loss aversion are the three basic signs of reference reliance in PT. That is, a bigger negative deviation from the reference point has a higher impact than a slight positive deviation.

One of the most researched aspects of behavioural finance is dividend policy. The prior research on corporate payout policy looks at whether to pay or not pay dividends (e.g., Fama & French, 2001; DeAngelo et al., 2004; Baker & Wurgler, 2004; Hasan, 2021a, 2021b and 2022), as well as how much to pay (Rozeff, 1982; Miller & Rock, 1985), and how to pay – repurchases versus dividends (Stephens & Weisbach, 1998; Jagannathan et al., 2000). Ferris et al. (2009), for example, looked at trends in international dividend payout across civil and common law nations. Mitton, 2004; Jiraporn et al., 2011; O'Connor, 2013) are just a few of the scholars that have studied the impact of corporate governance on payout policy. Researchers employ a variety of theories to conduct these studies, including Catering Theory, Life Cycle Theory, and Signaling Theory. However, only Ferris et al. (2009) utilise Prospect Theory to investigate how frequently corporations should pay dividends while making the choice to pay dividends, whereas Shefrin & Statmen (1984) utilize prospect theory to study dividend pay-out policy.

The contrast between 'issues of form' and 'issues of content' is one of the reasons why investors favor cash dividends. It may be argued that once the payout level is determined, it makes no difference how often dividends are paid; however, this article ignores the higher utility derived by investors from receiving more regular payments, as implied by Kahneman & Tversky's (1979) Prospect Theory & Thaler's (1980) mental accounting. According to Prospect Theory, investors' utility functions are concave across the gains domain. Individual gains are evaluated separately by investors across a concave utility function, which determines how a series of dividend payments is valued. More precisely, it implies that the frequency with which dividends are disbursed has a beneficial impact on an investor's overall dividend distribution valuation. The concave utility function of prospect theory, as described by Barberis & Thaler permits an investor to obtain more utility. Individuals prefer to rank firms based on their prospects of receiving a dividend from that company before making any investment, according to Kahneman & Tversky's (1979) hypothesis, since individual investors always seek cash dividends.

Self-Control Bias and Dividend Policy

According to Pompain, self-control bias is a behavioural tendency that causes a person to refuse to act in pursuit of their long-term greatest aims owing to a lack of self-control (2012). When it comes to money, people are infamous for exhibiting a lack of self-control. Due to a lack of self-control, people's overall goals are contradicted by their inability to act concretely in pursuit of those desires, according to self-control theory.

Self-control bias causes investors to spend more now rather than save for the future. People currently have a great desire to consume freely. Because investors generally retire before they have accumulated enough money, this behaviour may work against their long-term financial goals. Asset allocation imbalances can be caused by self-control bias. Investors that are prone to this tendency may pick income-producing assets due to a "spend today" mindset. This behaviour can be counterproductive to reaching long-term financial goals since an excess of income-producing assets might prevent a portfolio from keeping up with inflation. Investors may also be prone to self-control bias, which causes them to neglect basic financial ideas. If clients do not see the benefits of these skills over time, they may miss out on opportunities to acquire money. Clients may lose out on opportunities to build substantial long-term wealth.

According to Thaler & Shefrin (1981), the planner has two types of self control strategies that can be utilised to affect the doer's activities. The exercise of 'will' is the first method. Increased willpower, in particular, leads to more 'self-denial'. Self-denial is expected to have some utility cost for the planner; otherwise, willpower isn't only difficult. This is true because the planner's utility cost is the manipulating of the doers' opportunities. The planner can reduce the harm caused when a doer is weak-willed by setting extra limits on his or her options. Furthermore, limiting a doer's opportunities lessens the temptation. Both of these characteristics are critical in dividend analysis.

According to Brealey & Myers (1981), all of the theories proposed to explain why companies that pay large dividends are given preferential treatment are underfunded because stock sales are a perfect substitute for rising dividends. The two are not ideal alternatives in self-control systems. As a result of the self-control issues, one may be tempted to sell stocks for immediate consumption, causing the portfolio to be eaten more quickly than is compatible with one's long-term goals.

Regret Aversion and Dividend Policy

The theory of regret is built on the principle that when a person selects an action from two or more alternatives, knowing that the results of all actions are unclear, they will feel regret (pride) since the selected action's consequence is inferior (superior) (Ghosh, 1993). People with regret aversion, according to Pompian (2012), resist taking decisive acts because they are afraid that, in retrospect, they would be less than ideal. This bias is primarily motivated by a desire to avoid the emotional anguish of regret that comes with bad decision-making. The regret aversion bias does not simply manifest itself after a loss. It can also play a role since it influences how a person reacts to investing profits. People who have regret aversion may be hesitant to acquire stock in a firm that used to pay a big dividend every year. However, after the shares have been purchased, stakeholders are hesitant to express remorse because the firm loses money and no longer pays dividends.

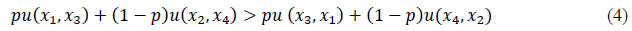

Using lottery example in the case of uncertainty, Bell (1982) has given the following definition for regret aversion theory:

Definition: A choice between two lotteries, each defined by objective probabilities, will be termed a simple comparison if, after a decision, all uncertainties will be resolved in accordance with a predetermined joint probability distribution.

Based on the above definition (Bell, 1982), we can assume that utility is an increasing function of x and a decreasing function of y. We can also assume that the outcome has two attributes when decision maker will follow axioms of Von Neumann and Morgenstern. They will take the decision based on utility function u(x,y ). More specifically if an uncertainty event E which will occur with probability P leads to final assets of x1 under alternative 1 and x3 under alternative 2, in here asset value will be x2 and x4 respectively if E does not occur; then alternative 1 is preferred if and only if

According to Ghosh (1993), company should borrow the many to pat the dividends when the earnings are not enough to support them, are consistent with managers’ interest to avoid regret or feel pride in decision making under uncertainty.

Investors choose dividend-paying stocks for a variety of reasons, according to (Shefrin & Statman, 1984). This, they claim, is right. Because dividends relieve investors of some of the angst that comes with taking a chance that results in a less-than-desirable conclusion. Errors of commission are more regrettable than errors of omission. Investors typically sell portion of their asset if they do not get a dividend, according to (Pompian, 2012). However, if the price is increasing, the investor would be deeply disappointed because the error was one of commissions. He can easily see how not selling the shares would have improved his financial situation. If, on the other hand, he purchases stocks in a firm that pays dividends, an increase in the share price would have not given him as much grief.

Behavioural Element's Effect on Stock Returns

Temperature and Stock Returns

Temperature impacts mood, and mood changes drive behavioural changes, according to previous research in psychology. Lower temperatures can lead to hostility, whereas higher temperatures can contribute to both indifference and aggression, according to (Cao & Wei, 2005). Watson (2000) discovered that there is no relationship between mood and meteorological factors such as temperature, sunlight, barometric pressure, and precipitation. Individuals' task-performing abilities are decreased when they are exposed to extremes in temperature, according to (Fisher & Tippett, 1928). Pilcher et al. later verified this conclusion in a meta-analytic review.

According to Wyndham, panic and indifference develop as a result of excessive heat. People seem to be less inclined to help each other during heat and cold (Cunningham, 1979). Cold temperatures, according to Connolly (2013), promote enjoyment while reducing exhaustion and tension, resulting in a positive net impact. Hot temperatures, on the other hand, lower happiness, although these findings are indicative of the fact that the survey was done during the summer.

Cao & Wei (2005) looked at how temperature affects mood and behaviour on its own. They claimed that stock returns are inversely associated with temperature, implying that "the lower the temperature, the higher the returns, and vice versa." They also discovered that the bond is significantly weaker in the summer than in the winter, since indifference takes precedence over violence when the temperature is high. Lower returns, although statistically significant, and an overall negative connection are the findings. Weather, according to Keef & Roush (2002), may be multidimensional. As a result, they expanded on previous study by including new meteorological factors. They discovered that temperature had a slight negative influence on stock returns after analysing data from the New Zealand all-share index. Later, Keef & Roush (2005) expanded on their research by looking at the impact of New York's weather on the Dow Jones Industrial Average and Standard & Poor's index returns from January 1, 1984 to August 31, 2002. Their findings indicate that observed temperature has little impact on stock returns. When they de-seasonalized the temperature, they discovered that cool days had a beneficial impact on stock returns. Using Australian stock indexes, Keef & Roush (2007) discovered that temperature had a negative impact on stock market returns.

Floros (2008) discovered that stock market returns in Austria, Belgium, and France were adversely associated with temperature using the GARCH model. In Greece, temperature and stock returns have a positive but negligible relationship. Dowling & Lucey (2005; 2008) discovered that temperature had a positive link with stock returns in the same year. Yoon & Kang (2009) went on to show that exceptionally low temperatures are associated with higher stock returns.

Air Pollution and Stock Returns

The discharge of particles, biomolecules, or other hazardous things into the atmosphere with the potential to cause disease, death, or injury to other living species such as food crops, as well as the natural or artificial environment, is referred to as air pollution. Air pollution is defined by the World Health Organization (WHO) as any chemical, physical, or biological material that affects the natural characteristics of the atmosphere. The physical health effects of air pollution, as well as the mental health implications, have been carefully investigated Wilson and Spengler. An increase in pollutants has been linked to increased levels of annoyance, exhaustion (Sagar et al., 2007), distress (Lundberg, 1996), nervousness (Lundberg, 1996), pressure (Carton et al., 1995), feelings of hopelessness (Lundberg, 1996), and low spirits in all research (Bullinger, 1990). The majority of the articles described above show that when individuals are subjected to elevated amounts of air pollution, they get sad.

Low mood makes individuals more gloomy, according to (Li & Peng, 2016). Li & Peng (2016) identified three ways in which poor emotions linked with air pollution might affect stock returns. To begin with, when individuals are in a bad mood, they are more pessimistic. Investors may utilise probability anticipating more skewed negative outcomes and be more willing to sell shares when individuals are gloomier. The findings of Li & Peng (2016) also imply that air pollution levels are adversely associated to stock returns. Second, both a low mood and air pollution can make people more risk averse. Increased risk aversion as a result of air pollution is projected to limit demand for equities, resulting in a low stock price. Finally, sadness causes a decrease in investor inter - temporal substitute elasticity (EIS). Investors with reduced EIS as a result of air pollution are more likely to favour spending now, lowering today's demand for stock market investing. As a result, stock prices are projected to fall.

According to Lepori (2016), air pollution has a negative correlation with stock returns. The association between air pollutants and stock returns, according to Lepori (2016), is prone to be affected by the trading floor community's behaviour. When Levy & Yagil (2011) utilised data from the United States from 1997 to 2007, they found a negative association between daily stock returns and the air-quality index (AQI). Levy & Yagil (2013) found the same thing when they expanded their investigation to include data from Canada, the Netherlands, Hong Kong, and Australia.

Cloud, Rain and Stock Returns

Psychologists have long recognised that sunshine, as well as low clouds (rain), has an impact on depressive moods, thinking, and judgement. Investors are optimistic on sunshine hours and gloomy on overcast (rainy) days, according to (Saunders, 1993). Hirshleifer & Shumway (2003) concur with Saunders (1993), claiming that sunshine has a beneficial influence on mood and encourages misattribution. People, on the other hand, tend to estimate their happiness levels far higher on sunny days than on overcast or rainy days, according to (Schwarz & Clore, 1983).

The effects of cloud cover on stock returns were originally studied by (Saunders, 1993). He investigated if trader mood had any impact on the stock market using three worldwide indexes of the US market. Saunders (1993) utilises the "% of cloud cover from dawn to sunset" according to the New York weather station nearest to Wall Street as a proxy for meteorological condition. Saunders shows that stock returns are lower on days with 100 percent cloud cover than on days with 20 percent or less cloud cover throughout the years 1927-1962 and 1962-1989. He also demonstrated that days with a cloudiness of 20% or less are more likely to experience positive index movements than days with a cloudiness of 100%. After correcting for the Monday and January impact, Saunder (1993) found that on overcast days, returns remain lower.

Trombley (1997) later says the correlation between weather and stock returns isn't as strong as Saunders suggests (1993). After replicating Saunders' findings, Trombley (1997) found that returns on 100% cloudy days are not statistically different from returns on days with 0% cloud cover or 0% to 10% cloud cover. According to Trombley (1997), Saunders' (1993) comparison of 100 percent overcast days with 0 percent to 20% cloudy days "is the only comparison over this era that would provide a statistically significant test statistic..." In addition, Kramer & Runde (1997) discovered no link between cloud cover and stock returns.

Hirshleifer & Shumway (2003) built on Saunders' (1993) work by looking at cloudiness and stock returns for 26 nations between 1982 and 19987. Their multi-market emphasis also allows them to concentrate on a more recent period when markets are deemed to be more efficient. Cloudiness is related with a decreased chance of positive returns in 25 of the 26 cities, according to their findings. These data support the common belief that cloudy weather is related with pessimistic sentiments and that moods influence stock prices.

Using all New Zealand market indexes, Keef & Roush (2005, 2007) demonstrated that cloud cover is negatively related to stock performance. According to Goetzmann & Zhu (2005), cloud cover and stock market returns have a negative relationship. In contrast, Dowling & Lucey (2005) reported that rain had a little but significant negative influence on the stock market. Sunlight, which is linked to an investor's psychological state, has a substantial influence on how the investor reacts to earnings announcements, according to (Shon & Zhou, 2009). Their findings imply that market reactions to earnings shocks are higher when earnings are announced on a bright day in New York City. Based on data from 20 countries, Lu et al. (2013) discovered that cloudiness had an influence on investor response to firm earnings announcements on average. They also provide documentation to back up the cloudiness effects, regardless of whether the earnings news in various countries is favourable or negative.

Conclusion

Corporate finance's major goal is to explain how financial contracts and actual investment behaviour develop from the interplay of managers and investors. As a result, it can explain financing and investment trends that require a knowledge of these two sets of agents' ideas and desires. Behavioral finance, on the other hand, is built on two pillars: cognitive psychology (how individuals consider) and arbitrage restrictions (effectiveness of arbitrage in different circumstances). Behavioural finance aspects in corporate finance are many, and they benefit from the dramatic rise and collapse of online stocks between the mid-1990s and 2000. Behavioural finance is a relatively recent phenomenon in corporate finance, but its utilization has been gradually gaining prominence in the corporate finance industry, since it stresses the behaviour of investors and managers.

New behavioural divide nd policy rationale claims that companies pay dividends because investors are more likely to exercise self-control with their spending if they receive a 'check in the mail' in the form of a dividend rather than having to make a conscious decision. Baker & Wurgler also believe that investors are more interested in dividends at specific times.

References

Baker, M., & Wurgler, J. (2004). Appearing and disappearing dividends: the link to catering incentives. Journal of Financial Economics, 73(2), 271-88.

Indexed at, Google Scholar, Cross Ref

Baumeister, R.F., &Heatherton, T.F.(1996). Self-regulation failure: An overview.Psychological Inquiry,7(1), 1-15.

Indexed at, Google Scholar, Cross Ref

Bell, D.E. (1982). Regret in Decision Making Under Uncertainty. Operations Research, 30, 961-981.

Indexed at, Google Scholar, Cross Ref

Bell, D.E. (1983). Risk Premiums for Decisions Regret. Management Science, 29, 1156-1166.

Indexed at, Google Scholar, Cross Ref

Brealey, R.A., & Myers, S.C. (1981). Principles of corporate finance, McGraw-Hill: New York.

Bullinger, M. (1990). Environmental stress: effects of air pollution on mood, neuropsychological function and physical state. In: Psychology of Stress. NATO ASI Series, edited by Puglisi-Allegra, S. and Oliverio, A., Vol. 54. Dordrecht: Kluwer Academic Publishers.

Indexed at, Google Scholar, Cross Ref

Cao, M., & Wei, J. (2005). Stock market returns: a note on temperature anomaly. Journal of Banking & Finance, 29, 1559-1573.

Carton, S., Morand, P., Bungener, C., & Jiuvent, R. (1995). Sensation seeking and emotional disturbances in depression: relationships and evolution. Journal of Affective Disorders, 34, 219-225.

Connolly, M. (2013). Some like in mild and not too wet: the influence of weather on subjective well-being. Journal of Happiness Studies, 14, 457-473.

Cunningham, M.R. (1979). Weather, mood and helping behaviour: quasi experiments with the sunshine samaritan. Journal of Personality and Social Psychology, 37(11), 1947-1956.

Indexed at, Google Scholar, Cross Ref

DeAngelo, H., DeAngelo, L., & Skinner, D. (2004). Are dividends disappearing? Dividend concentration and the consolidation of earnings. Journal of Financial Economics, 72(3), 425-456.

Dowling, M., & Lucey, B.M. (2005). Weather, biorhythms, beliefs and stock returns: some preliminary Irish evidence. International Review of Financial Analysis, 14(3), 337-355.

Indexed at, Google Scholar, Cross Ref

Dowling, M. & Lucey, B.M. (2008). Mood and UK equity pricing. Applied Financial Economics Letters, 4(4), 233-240.

Indexed at, Google Scholar, Cross Ref

Fama, E.F., & French, K.R. (2001). Disappearing dividends: changing firm characteristics or lower propensity to pay?. Journal of Financial Economics, 60(1), 3-43.

Indexed at, Google Scholar, Cross Ref

Ferris, S.P., Sen, N., & Unlu, E. (2009). An international analysis of dividend payment behaviour. Journal of Business Finance & Accounting, 36(3-4), 496-522.

Indexed at, Google Scholar, Cross Ref

Fisher, R., & Tippett, L. (1928). Limiting forms of the frequency distribution of the largest or smallest member of a sample. Mathematical Proceedings of the Cambridge Philosophical Society, 24(2), 180-190.

Indexed at, Google Scholar, Cross Ref

Floros, C. (2008). Stock market returns and the temperature effect: new evidence from Europe. Applied Financial Economics Letters, 4, 461-467.

Indexed at, Google Scholar, Cross Ref

Ghosh, C. (1993). A Regret-theoretic explanation of corporate dividend policy. Journal of Business Finance and Accounting, 20(4), 559-573.

Indexed at, Google Scholar, Cross Ref

Goetzmann, W.N., & Zhu, N. (2005). Rain or shine: where is the weather effect?. European Financial Management, 11(5), 559-578.

Indexed at, Google Scholar, Cross Ref

Gottfredson, M.R., &Hirschi, T.(1990).A general theory of crime. Stanford, CA: Stanford University Press.

Hasan, F. (2021a). Relationship between orthodox finance and dividend policy: a literature review . Indian-Pacific Journal of Accounting and Finance, 5(1), 13-40.

Hasan, F. (2021b). Dividend changes as predictors of future profitability. The Journal of Prediction Markets, 15(1), 37-66.

Indexed at, Google Scholar, Cross Ref

Hasan, F. (2022). Using UK Data to Study the Effects of Dividends Announcements on Stock Market Returns. The Journal of Prediction Markets,(In press).

Hirshleifer, D., & Shumway, T. (2003). Good day sunshine: stock returns and the weather. The Journal of Finance, 58(3), 1009-1032.

Indexed at, Google Scholar, Cross Ref

Jagannathan, M., Stephens, E.P., & Weisbach, M.S. (2000). Financial flexibility and the choice between dividends and stock repurchases. Journal of Financial Economics, 57(3), 355-384.

Indexed at, Google Scholar, Cross Ref

Jirporn, P., Kim, J., & Kim, Y. (2011). Dividend payouts and corporate governance quality: an empirical investigation. The Financial Review, 46(2), 251-279.

Indexed at, Google Scholar, Cross Ref

Kahneman, D., & Tversky, A. (1979). Prospect theory: an analysis of decision under risk. Econometrica, 47(2), 263-291.

Keef, S.P., & Roush, M.L. (2002). The weather and stock returns in New Zealand. Quarterly Journal of Business & Economics, 41, 61-79.

Keef, S.P., & Roush, M.L. (2005). The influence of weather on New Zealand financial securities. Accounting & Finance, 45, 415-437.

Indexed at, Google Scholar, Cross Ref

Keef, S.P., & Roush, M.L. (2007). Daily weather effects on the returns of Australian stock indices. Applied Financial Economics, 17, 173-184.

Indexed at, Google Scholar, Cross Ref

Kramer, W., & Runde, R. (1997). Stocks and the weather: an exercise in data mining or yet another capital market anomaly?. Empirical Economics, 22, 637-641.

Lepori, G.M. (2016). Air pollution and stock returns: evidence from a natural experiment. Journal of Empirical Finance, 35, 25-42.

Indexed at, Google Scholar, Cross Ref

Levy, T., & Yagil, J. (2011). Air pollution and stock returns in the US. Journal of Economic Psychology, 32, 374-383.

Indexed at, Google Scholar, Cross Ref

Levy, T., & Yagil, J. (2013). Air pollution and stock returns-extensions and international perspective. International Journal of Engineering, Business & Enterprise Applications, 4, 1-14.

Li, Q., & Peng, C.H. (2016). The stock market effect of air pollution: evidence from China. Applied Economics, 48(36), 3442-3461.

Indexed at, Google Scholar, Cross Ref

Lintner, J. (1956). Distribution of incomes of corporations among dividends, retained earnings, and taxes. American Economic Review, 46(2), 97-113.

Loomes, G., & Sugden, R. (1982). Regret Theory: An Alternative Theory of Rational Choice Under Uncertainty. Economic Journal, 92, 805-824.

Loomes, G., & Sugden, R. (1983). A Rationale for Preference Reversal. American Economic Review, 73, 428-432.

Lu, C., Chin C., & Chang Y. (2013). Weather effects on earnings response coefficients: international evidence. Asia-Pacific Journal of Accounting & Economics, 20(3), 315-333.

Indexed at, Google Scholar, Cross Ref

Lundberg, A. (1996). Psychiatric aspects of air pollution. Journal Indexing & Metrics, 114(2), 227-231.

Indexed at, Google Scholar, Cross Ref

MacInnis, D.J.(2011). A framework for conceptual contributions in marketing. Journal of Marketing,75, 136-154.

Indexed at, Google Scholar, Cross Ref

Miller, M., & Rock, K. (1985). Dividend policy under asymmetric information. Journal of Finance, 40(4), 1031-52.

Indexed at, Google Scholar, Cross Ref

Mitton, T. (2004). Corporate governance and dividend policy in emerging markets. Emerging Markets Review, 5(4), 409-426.

Indexed at, Google Scholar, Cross Ref

Modigliani, F., & Cohn, R. (1979). Inflation, rational valuation and the market. Financial Analysts Journal, 35(2), 24-44.

Indexed at, Google Scholar, Cross Ref

Moffitt, T.E.,Arseneault, L.,Belsky, D.,Dickson, N.,Hancox, R.J.,Harrington, H.,Caspi, A.(2011). A gradient of childhood self-control predicts health, wealth, and public safety.Proceedings of the National Academy of Sciences, USA,108(7), 2693-2698.

Indexed at, Google Scholar, Cross Ref

O’Connor, T. (2013). Dividend payout, corporate governance, and the enforcement of creditor rights in the emerging markets. Journal of Corporate Governance, 12(1), 7-34.

Park, H., & Sohn, W. (2013). Behavioural finance: a survey of the literature and recent development. Seoul Journal of Business, 19(1), 3-42.

Pompian, M.M. (2012). Behavioural Finance and Wealth Management, New Jersey: John Wiley & sons, Inc.

Ricciardi, V., & Simon, H.K. (2000). What is behavioral finance?. The Business, Education and Technology Journal,2(2), 26-34.

Ritter, J., & Warr, R. (2002). The decline of inflation and the bull market of 1982-1999. Journal of Financial and Quantitative Analysis, 37(1), 29-61.

Indexed at, Google Scholar, Cross Ref

Rozeff, M. (1982). Growth, beta and agency costs as determinants of dividend payout ratios. Journal of Financial Research, 5(3), 249-59.

Indexed at, Google Scholar, Cross Ref

Sagar, A., Bhattacharya, M., & Joon, V. (2007). A comparative study of air pollution-related morbidity among exposed population of Delhi. Indian Journal of community Medicine, 32(4), 268-273.

Saunders, E.M. (1993). Stock price and Wall Street weather. American Economic Review, 83(5), 1337-1345.

Schwarz, N., & Clore, G. (1983). Mood, misattribution, and judgements of well-being: informative and directive functions of affective states. Journal of Personal Social Psychology, 45, 513-523.

Shefrin, H. (2000). Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing, Boston, Massachusetts: Harvard Business SchoolPress.

Shefrin, H.M., & Stateman, M. (1984). Explaining investor preference for cash dividends. Journal of Financial Economics, 13(2), 253-282.

Indexed at, Google Scholar, Cross Ref

Shleifer, R.J., & Summers, L. (1990). The noise trader approach to finance. Journal of Economics, 4(2), 19-33.

Indexed at, Google Scholar, Cross Ref

Shon, J.J., & Zhou, P. (2009). Are earnings surprises interpreted more optimistically on very sunny days? Behavioral bias in interpreting accounting information. Journal of Accounting, Auditing & Finance, 24(2), 211-232.

Stephens, C.P., & Weisbach, M.S. (1998). Actual share reacquisitions in open-markets repurchase programs. The Journal of Finance. 53(1), 313-333.

Indexed at, Google Scholar, Cross Ref

Subrahmanyam, A. (2007). Behavioural finance: a review and synthesis. European Financial Management, 14(1), 12-29.

Indexed at, Google Scholar, Cross Ref

Thaler, R.H. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior and Organizations, 1(1), 39-60.

Indexed at, Google Scholar, Cross Ref

Thaler, R.H., & Shefrin H.M. (1981). An economic theory of self-control. Journal of Political Economy, 89(2), 392-406.

Trombley, M.A. (1997). Stock prices and Wall Street weather: additional evidence. Quarterly Journal of Business & Economics, 36, 11-21.

Watson, D. (2000). Mood and Temperature. New York: Guildford Press.

Whittemore, R.,&Knafl, K.(2005). The integrative review: Updated methodology. Journal of Advanced Nursing,52,546-553.

Indexed at, Google Scholar, Cross Ref

Yoon, S., & Kang, S. (2009). Weather effects on returns: evidence from the Korean stock market. Physical A: Statistical Mechanics & its Applications, 388(5), 682-690.

Indexed at, Google Scholar, Cross Ref

Received: 09-Jun-2022, Manuscript No. AAFSJ-22-12162; Editor assigned: 13-Jun-2022, PreQC No. AAFSJ-22-12162(PQ); Reviewed: 27-Jun-2022, QC No. AAFSJ-22-12162; Revised: 29-Jul-2022, Manuscript No. AAFSJ-22-12162(R); Published: 09-Aug-2022