Research Article: 2019 Vol: 23 Issue: 4

The Relationship between Executive Remuneration and Financial Performance in South African State-Owned Entities

Ferina Marimuthu, Durban University of Technology

Farai Kwenda, University of KwaZulu-Natal

Abstract

This study aimed to determine whether executive remuneration levels at poorly performing state-owned entities (SOE)s in South Africa are justified. The study was motivated by the weak economic growth, fiscal consolidation, increased debt levels and poor financial performance of these entities. Dynamic panel data models were employed and estimated using the Generalised Method of Moments (GMM) estimator. The data set comprised an unbalanced panel data of 33 commercial SOEs in South Africa that are listed under the Public Financial Management Act. The study found an inverse relationship between executive remuneration and financial performance. This is of concern as executive remuneration is high despite the SOEs’ declining performance. The misalignment between pay and performance undermines the core principles of the agency theory, resulting in poor performance. These findings provide empirical support for public and media perceptions that executive remuneration is excessive and unmerited when measured against SOEs’ performance. The findings will be of interest to observers of the economy, as they measure SOEs’ capacity to play a leading role in investment and in improving the efficiency of the economy. They could also inform decision making and policy development on SOEs.

Keywords

Executive Remuneration, Financial Performance, Generalized Method of Moments.

Introduction

State-owned entities (SOEs) are important drivers of development, especially in developing economies (Mbo, 2017). South African SOEs have a constitutional duty to deliver services to citizens and play a developmental role in the country's economy. Since the birth of democracy in 1994, their role in driving socio-economic development and transformation has become more significant. However, in order to address the challenges of inadequate infrastructure, inequitable land and capital distribution, poverty, unemployment and the disparities between rich and poor, the highly publicized inefficiencies confronting several of these entities need to be addressed.

The excessive remuneration levels of SOE executives in South Africa have been scrutinized as a result of their perceived underperformance and the large wage gap between executives and lower-level employees (Bussin & Ncube, 2017). Executive remuneration is often perceived to be excessive and unmerited when measured against the firm’s performance and remuneration of other employees, and the opacity of remuneration disclosure amongst some firms in South Africa adds to this perception (PWC, 2018). Furthermore, there are inconsistencies in remuneration of senior executives between SOEs, with no justification for why chief executive officers (CEOs) in some SOEs are remunerated at considerably higher levels than in others. Finally, there are significant differences in the salary increases awarded to CEOs across SOEs (Bezuidenhout, 2016).

Remuneration practices shape income distribution and extreme earnings disparities cause offence when they are associated with profiteering and financial malfeasance, and when the reward for honest work seems disproportionate or weakly aligned with incentives (National Treasury, 2010). Executives should be held accountable for the financial performance of the SOE and ensure that financial performance is maximized. Their remuneration should be based on the extent to which they make decisions that improve performance, resulting in increased firm value. When executive remuneration is not aligned to firm performance, this can pose a threat to the SOE’s continued existence and the broader society.

Morton & Blair (2016) found that the average total guaranteed executive remuneration package at SOEs was similar to the private sector. This is cause for concern as several SOEs are experiencing financial constraints and are underperforming. Furthermore, remuneration that is not linked to performance is inflationary and places a substantial burden on taxpayers.

The theoretical framework to examine the relationship between executive remuneration and firm performance was anchored on the agency theory. The applicability of this theory to SOEs can be tested based on their alignment of executive remuneration and firm performance. Despite the plethora of research on the agency theory in both private and public companies, there is limited literature on SOEs, especially within the South African context. Hence, this study aimed to determine if the premise of the agency theory applies to South African SOEs, and more specifically whether executive remuneration is aligned to SOEs’ financial performance.

The study contributes to the existing empirical literature on the relationship between executive remuneration and firms’ financial performance, focusing on commercial South African SOEs. These entities are deemed important given their significant role in the country’s economy.

The rest of this article is structured as follows: the following section presents a review of the existing literature on the relationship between executive remuneration and financial performance amongst various entities. This is followed by the research design and a description of the methods used in which we detail our econometric model. The subsequent section presents and discusses the data analysis and results, and the article ends with a conclusion and recommendations (Appendix 1).

| Appendix 1 Sampled South African State-Owned Entities | |

| 1 | AIR TRAFFIC & NAVIGATION SERVICES COMPANY LTD |

| 2 | AIRPORTS COMPANY SOUTH AFRICA SOC LTD |

| 3 | ALEXKOR SOC LTD |

| 4 | AMATOLA WATER BOARD |

| 5 | ARMAMENTS CORPORATION OF SOUTH AFRICA SOC LTD |

| 6 | BLOEM WATER BOARD |

| 7 | BROADBAND INFRACO SOC (PTY) LIMITED |

| 8 | CEF SOC LTD |

| 9 | COUNCIL FOR MINERAL TECHNOLOGY (MINTEK) |

| 10 | COUNCIL FOR SCIENTIFIC & INDUSTRIAL RESEARCH |

| 11 | DBSA DEVELOPMENT FUND |

| 12 | DENEL SOC LTD |

| 13 | ESKOM HOLDINGS SOC LTD |

| 14 | INDEPENDENT DEVELOPMENT TRUST |

| 15 | INDUSTRIAL DEVELOPMENT CORPORATION OF SOUTH AFRICA SOC LTD |

| 16 | LAND & AGRICULTURAL DEVELOPMENT BANK OF SA |

| 17 | ONDERSTEPOORT BIOLOGICAL PRODUCTS SOC LTD |

| 18 | PASSENGER RAIL AGENCY OF SOUTH AFRICA |

| 19 | PUBLIC INVESTMENT CORPORATION SOC LTD |

| 20 | RAND WATER |

| 21 | SEDIBENG WATER |

| 22 | SENTECH SOC LTD |

| 23 | SOUTH AFRICAN AIRWAYS (SOC) LTD |

| 24 | SOUTH AFRICAN BROADCASTING CORPORATION LTD |

| 25 | SOUTH AFRICAN BUREAU OF STANDARDS |

| 26 | SOUTH AFRICAN EXPRESS SOC LTD |

| 27 | SOUTH AFRICAN FORESTRY COMPANY SOC LTD |

| 28 | SOUTH AFRICAN NUCLEAR ENERGY CORPORATION SOC LTD (THE) |

| 29 | SOUTH AFRICAN POST OFFICE (SOC) LTD |

| 30 | TELKOM SA SOC LTD |

| 31 | TRANS-CALEDON TUNNEL AUTHORITY |

| 32 | TRANSNET SOC LTD |

| 33 | UMGENI WATER |

Literature Review

This section reviews the literature relevant to the research constructs on executive remuneration and firm performance. Empirical studies conducted in South Africa relating to the specific constructs presented in this study are also reviewed.

Executive Remuneration

Executive remuneration (compensation) can be defined as financial and non-financial payments to executives of a firm comprising basic fixed pay, bonuses and other long-term incentives (Bezuidenhout, 2016). Remuneration can be a useful tool in minimising the agency problem that arises from the agency relationship between executives and government. Adequate incentives can help to maximise motivation and performance, especially when they are linked to performance. Hence, from an agency theory perspective, the executive’s effort and objectives may be more accurately aligned with those of government, provided there are adequate remuneration packages comprising incentives, including share options, ownership stakes and bonuses, and dividends, among others (Otieno, 2012).

Determining an appropriate remuneration package for executives is often a difficult task. When these packages are inadequately designed, employees tend to use the firm’s property for their personal gain. However, when they are appropriately designed, they can motivate employees to improve the firm’s performance. Remuneration packages need to be sufficiently competitive to attract and retain executives from both the public and private sectors. These packages are an important aspect of corporate governance and are usually designed by the board of directors. The size of the firm, the industry and the nature of the job are usually taken into consideration (Maloa & Bussin, 2016).

Executive Remuneration among South African SOEs

The poor performance of South African SOEs is widely publicised. Many do not follow the remuneration guidelines issued in 2011 by the Department of Public Enterprises (DPE) that require remuneration to be benchmarked with the private sector (Maloa & Bussin, 2016). These remuneration guidelines have been subsequently revised in 2018. The issue of remuneration of top executives, especially in light of the poor performance of SOEs in South Africa, has attracted widespread attention from various stakeholders especially the exorbitant remuneration packages of CEOs which have been widely publicised by the media (Bezuidenhout et al., 2018).

Executive remuneration frameworks and practices are inconsistent amongst South African SOEs and this has a direct impact on their performance which is under constant public scrutiny, especially when such packages are disconnected from the firm’s performance (Davies, 2018). Remuneration policies and principles should ensure competitiveness and optimum retention by promoting alignment and harmonisation across SOEs as well as improving governance and oversight of such remuneration by the executive authority (Presidential Review Committee, 2012). Challenges with regard to executive remuneration among SOEs that were identified by the Presidential Review Committee (2012) include:

1. Inconsistencies across SOEs as, in most cases, their boards determine executive remuneration. Furthermore, the PRC observed that there was no valid reason why some SOEs paid their executives much more than others.

2. The income disparity between executive management and workers on the lower levels of the pay scale, which causes a widening wage gap.

3. The lack of a centralised authority to manage SOE remuneration, which may result in executives defining their own packages.

The remuneration of SOE executives in the form of fixed salaries and bonuses has recently triggered an outcry (Bezuidenhout, 2016). The pay-performance link has been scrutinised by the media because excessive executive remuneration is misaligned with the performance of SOEs in South Africa. Striking cases include: Talib Sadik, Denel’s CEO was paid ZAR5.6 million, and executives received bonuses of ZAR4.3 million during the 2009/2010 financial year despite Denel declaring a loss of ZAR544 million during 2009 (Bezuidenhout, 2016); Brian Molefe, Eskom’s former acting CEO received total remuneration of R9.467 million during the 2015/2016 financial year. In addition, he was awarded performance shares in April 2015 to the value of ZAR4.73 million, payable in June 2018 at a share price of ZAR1.26. Eskom executives received ZAR75.33 million in total remuneration packages during the 2015/2016 financial year, in comparison to ZAR50.61 million in the 2014/2015 financial year (Peyper, 2016); and Monwabisi Kalawe, the former suspended CEO of South African Airways (SAA), received a termination payment of almost ZAR2.7 million upon resignation (Majangaza, 2015).

SOEs should be following the remuneration model developed by the DPE when determining their executive remuneration packages. The purpose of the guidelines is to assist boards and remuneration committees in negotiating and setting remuneration of executives and non-executives (Department of Public Enterprises, 2007). Strict implementation and adherence to this model should eliminate excessive and unjustified executive remuneration. However, many SOEs have not adopted these guidelines (Bezuidenhout et al., 2018; Maloa & Bussin, 2016).

The Agency Theory Link with Executive Remuneration and Firm Performance

The agency theory assumes that the separation between owners, managers and debt holders can create conflict amongst the principal and agent (Jensen & Meckling, 1976). The conflicting relationship between the agent (management) and principal (shareholders) can generate agency problems as they have different interests, especially if the former’s objectives are not aligned with the latter’s. In the case of SOEs, government, referred to as the principal, entrusts the running of the entity to executive management, the agent, fostering a principal-agent relationship. The separation of ownership and management can create agency problems that result in agency costs, which are the costs incurred by the owners to prevent managers from deviating from the goal of the firm (Firer et al., 2012). These include using exclusive facilities, making sub-optimal investments, mismanaging the firm’s funds, and focusing more on social status (Hastori et al., 2015).

The costs associated with the agency problem can reduce the value of SOEs and hence decrease shareholders’ wealth. Therefore, the agency theory is commonly applied in research relating to executive remuneration and firm performance (Otieno, 2012). The problems include reduced effort on the part of executives; on-the-job perks; empire-building; entrenchment of investments through the selection of projects designed to reward existing managers; and avoiding risk by investing in low net present value (NPV) projects (Brealey et al., 2012). They generally arise when executives are not appropriately incentivised in the form of adequate remuneration packages, resulting in the misalignment of executive remuneration and the entity’s value. Li & Xia (2008) highlighted the agency issue in SOEs, especially government’s inability to monitor executives, which ultimately leads to executives’ participation in wasteful projects that are to their own advantage.

Guilding et al., (2005) suggested possible reasons for this conflict of interests, namely: the agent could put little effort into completing a task; the agent’s use of the work situation as an opportunity to divert resources for personal gain; there could be a difference of opinion between the agent and principal in terms of the time horizon, where the former focuses on the short-term and the latter on the long-term; and the agent and the principal may have different attitudes towards risk.

Remuneration is an area of significance in the application of the agency theory as it is a means of reducing the agency conflict because of the incentives that can be created. It is thus identified as an agency variable by Eisenhardt (1989). An adequate remuneration package, especially incentives, can help to motivate executives to improve performance especially when the incentive is linked to performance. The pay-performance system based on executive remuneration and firm performance is a means of aligning the interests of shareholders (government) with those of agents (top executives) since shareholders have to incentivise the agents to act in their best interests due to information asymmetry. According to Van Den Eijnden (2010), one means of accomplishing this is to link executive remuneration to the firm’s performance; reduced monitoring of executives results in reduced agency costs. When executives are not remunerated according to firm performance, they may not be motivated to maximise the value of the firm. In the case of SOEs whose mandate is to fulfil state objectives, this agency problem may hinder the entity from achieving government’s objectives such as the provision of basic goods or services and infrastructure (Otieno, 2012).

An effective board is another common tool to reduce agency costs and maximise shareholder wealth. The board is a key role player in corporate governance and overseeing the performance of SOEs as it acts as an intermediary between government and executive management. Increased commercialisation of SOEs around the globe as well as heightened expectations of improved performance, have motivated governments to professionalise boards and improve their performance by ensuring their independence and shielding them from ad hoc political intervention (OECD, 2018). Appointment of the chairperson and executive directors of a board by a political executive can compromise the governance of an SOE especially when a commercial SOE is fully owned by government. This was the case at SAA, where the appointment of board members was the outcome of political power (Chilenga, 2016). The chairperson is responsible for governance of the SOE; however, he/she may become susceptible to political influence where executive members promote political agendas. Chilenga (2016) suggested that government shareholders on different SOE boards are not appointed for their skills but based on political affiliation. Political influence on SOE boards can seriously jeopardise their functions of audit, risk management and remuneration (OECD, 2018) where executives are rewarded despite the entity’s poor performance.

Empirical Evidence on Executive Remuneration and Firm Performance

Numerous empirical studies have been conducted on executive remuneration, and firm performance in both developed and developing economies, with mixed findings. Mengistae & Xu (2004) examined the extent to which the agency theory explains CEOs’ remuneration in 769 Chinese SOEs from 1980-1989. The study found that there was a decrease in CEO pay-performance sensitivity, which supports the agency theory. It also noted that the level of incentives, a determinant of managerial remuneration policies, was far greater than in other transitional economies. Gunasekhar & Dinesh (2017) investigated the effect of corporate governance and performance on CEO remuneration in 62 Indian SOEs for the year 2015 using Partial Least Square (PLS) based on Structural Equation Modelling. Their results revealed that corporate governance measures using board monitoring and performance had no impact on CEO remuneration because CEOs’ pay is determined by government through the Central Pay Commission. Khanna (2016) studied the influence of performance (ROA), size (log of sales), management (dummy variable of 1 if professionally managed), and CEO duality (binary variable if the CEO is also chair then value is 1) on CEO remuneration (basic salary plus director’s sitting fees plus bonus and commission plus perquisites plus retirement benefits plus provident fund contribution) using company age and industry as control variables. The sample was 300 Indian companies over the period 2007 to 2009. The findings revealed that size and performance positively affected remuneration. Data analysis was done using random effects. Raithatha & Komera (2016) analysed the effect of firm performance measured by both accounting measures (ROE and ROA) and market based measures (Tobin’s Q and annual stock return) together with the firm size (natural log of total assets), leverage (total debt/total assets), and risk (firm’s beta) to determine the influence of the pay-performance relationship. The sample was 3 100 Indian firms over the period 2002 to 2012. The system generalised methods of moments (GMM) estimator was employed, and the study found significant persistence in executive remuneration. Conyon & He (2012) conducted an empirical investigation of the relationship between CEO remuneration (salary, bonus, and stipend) and firm performance (ROA) during the period 2000 to 2010 for 2 104 Chinese publically traded firms. Control variables included ownership and board monitoring, firm age, CEO tenure, age and gender and remuneration committee. Based on Fixed Effects and OLS estimation, the findings revealed a significant positive correlation between executive remuneration and firm performance using a dynamic panel model. Ghosh & Paterson (2011) examined the influence of capital structure (total debt ratio), firm size, growth opportunities, and net income on executive remuneration (salary and bonus) among 336 US firms from 1989 to 1999 with dummy variables (industry characteristics). They found a statistically significant positive relationship between capital structure, firm growth and remuneration based on an OLS model. The findings on net income and firm size showed insignificant results. Hence, the authors posited that higher leverage and growth opportunities result in higher remuneration for the higher risk borne and increased growth. Kazan (2016) examined the impact of CEO remuneration (base salary plus cash bonuses, share-based payments and stock option payments) on firm performance (ROE and ROA) during 2016 among Scandinavian firms. A non-significant negative relationship was established using a linear regression model. Control variables included age, size, previous year’s performance and leverage.

Uwuigbe et al. (2016) investigated the relationship between CEO remuneration and financial performance for the period 2005-2013 among ten banks listed on the Nigerian Stock Exchange. They found a significantly positive relationship between executive remuneration and firm performance, whereas the relationship between board size and remuneration was significantly negative. Kyalo & Lishenga (2017) examined the effect of executive remuneration on the financial performance of SOEs in Kenya for the period 2010-2014 by controlling for the effect of size and leverage on financial performance. A weak negative association was found between remuneration, and financial performance and a strong negative relationship was established between size and financial performance, whereby a unit increase in either remuneration or size led to a commensurate decline in ROA. The correlation analysis results revealed no increased value in performance for higher CEO remuneration. The authors thus suggested that systems should be designed to include pay-for-performance perks.

Otieno (2012) studied 21 Schedule 2 SOEs in South Africa during 2007-2009 and found a positive relationship between executive remuneration and firm performance, supporting the tenets of the agency theory. Furthermore, the author suggested that remuneration schemes are effective tools in reducing the agency conflict that results from the negative impact of the principal-agent relationship. In considering the relationship between executive remuneration and firm performance, the board needs to take into account the size of the firm, growth opportunities, leverage and government regulations as these factors may distort the results. Ngwenya & Khumalo (2012) investigated the relationship between CEO remuneration and financial performance for the period 2009-2011 among five South African SOEs that fall under the DPE and five that do not. The authors found an insignificant relationship between remuneration and performance, which contradicted the findings of the majority of studies and statements that executive remuneration should be linked to firm performance for economic reasons. They offered possible reasons that included the fact that SOEs’ main purpose is to provide services to the public without making a profit and that they receive government subsidies as most of the sampled SOEs had negative total revenue. A positive relationship between size and remuneration was only found amongst the SOEs that fell under the DPE, indicating that larger SOEs remunerate their executives at a higher level. The entities that fall under the DPE are very large; therefore, the finding of a positive relationship. Bussin & Ncube (2017) investigated the relationship between CEO and CFO remuneration and performance among 21 Schedule 2 South African SOEs for the period 2010-2014 using the Cochrane-Orcutt estimation method. They found a positive relationship between remuneration and performance using absolute profitability measures. Bezuidenhout et al. (2018) examined the relationship between CEO remuneration and firm performance based on turnover, operating profit, net profit, ROCE, ROE, liquidity ratio, solvency ratio, audit opinion and irregular, fruitless and wasteful expenditure (IFWE). Their sample included 18 Schedule 2 South African SOEs for the period 2006-2014 and the OLS estimation method was employed. Statistically significant results were found with a positive relationship between remuneration and turnover and a negative relationship between remuneration, net profit and IFWE.

Peng et al. (2016) applied the property rights, transaction cost, agency cost and resource-based theories to SOEs in a conceptual paper with 12 testable propositions. The study demonstrated that theories of the firm could be applied to SOEs to develop research focusing on these entities. It also noted that research on SOEs could extend existing theories.

It is clear from the above-mentioned empirical analyses of executive remuneration and firm performance that there are mixed results. Other South African studies on executive remuneration and financial performance focused on a limited number of Schedule 2 SOEs. This study expanded the sample to include all commercial Schedule 2, 3B and 3D SOEs using a using dynamic panel data model estimated using the two-step GMM. The excessive remuneration levels of SOE executives in South Africa has been scrutinised by the media and the public as a result of their perceived underperformance. The study contributes to knowledge by providing empirical support to the perceptions of the public and the media that executive remuneration is excessive and unmerited when measured against the firm’s performance. This suggests that serious intervention is required from government and other decision-makers to ensure strict adherence to the pay-for-performance system as well as punitive measures when directives are not followed.

Methodology

The study was quantitative in nature and used secondary data obtained from external sources, including the McGregor BFA Library and Bloomberg online databases. The target population was SOEs as listed under the Public Finance Management Act (PFMA), classified as Schedule 1, 2, 3a, 3b, 3c and 3d entities. All non-commercial SOEs were excluded from the sample, namely, Schedule 1; 3a and 3c. A non-probability sampling design was selected as the data required for the study could only be obtained from commercial entities. A stratified sampling technique was used as the SOEs have been classified into different schedules as per the PFMA. A census was then used within the selected stratum as the size of the sample was small. The final sample consisted of 33 SOEs. The data was for the period 1995 to 2017 as some SOEs were only formed after the new democratic government came to power in 1994. The data set contained cross-sectional dimensions (several SOEs) and longitudinal dimensions (several periods from 1995-2017). Unbalanced panel data was used to achieve the study’s aim.

Table 1 presents the variables that were selected based on previous empirical studies and the predictions of the agency theory. Executive remuneration consists of the following: a guaranteed amount, short-term incentives, long-term incentives.

| Table 1 Summary of Variables and Measures | ||

| Variable | Measurement | Formulae / proxy |

| Control variables | ||

| Firm age | AGE | Number of years in existence |

| Firm size | SIZE | Natural logarithm of total assets |

| Board monitoring | BOARD | Natural logarithm of board members |

| Independent variables | ||

| Financial performance: | ||

| Return on equity | ROE | Profit after tax / Equity |

| Return on assets | ROA | Operating profit / Total assets |

| Dependent variable | ||

| Executive remuneration | COMP | Logarithm of executive remuneration |

Model Specification

The econometric model to test the agency theory builds on the framework used in studies by Gunasekhar & Dinesh (2017); Kazan (2016) and Mengistae & Xu (2004) to test whether CEO remuneration is linked to firm performance in financial terms. These studies showed that board size and financial performance have an effect on remuneration as boards that include independent directors would ensure effective monitoring and a well-paid CEO would be motivated to improve the entity’s performance. Hence, the model tests whether board monitoring and financial performance have a positive influence on executive remuneration.

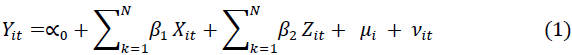

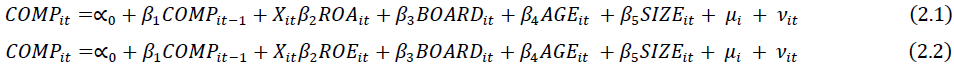

Where Yit is the measure of executive remuneration for firm i in year t, Xit is the measure of firm performance (ROA and ROE) and board monitoring (BOARD), Zit are the control variables which include size (SIZE) and age (AGE) and μit represents the time-invariant firm(country)-specific effect, while νit represents the remainder of the disturbance in the estimated regressions. εitis the error term. Consideration of lagged remuneration as one of the explanatory variables, makes the estimated equation a dynamic one. The specified equations are:

Estimation Methods

Dynamic panel data models include a lagged dependent variable as a regressor; therefore, strict exogeneity is violated because the lagged variable may be correlated with the idiosyncratic error, resulting in endogeneity. A commonly applied technique by Arellano & Bond (1991) referred to as the GMM estimator was used to estimate the specified models. GMM using the Arellano-Bond conditions is the most robust method that uses only the moment conditions implied by the AR(1) model, and it properly removes the heterogeneity. The application of GMM as an estimating technique in econometrics is predominantly due to its ability to account for endogeneity in models’ regressions arising from cases of reverse causality, simultaneity and variable omission, amongst others. GMM utilises the appropriate lag instruments, which is usually that of the first difference, required to resolve the issues that would have made the regressions somewhat invalid. The two-step System-GMM estimator, which is asymptotically more efficient (Lew, 2013), was employed.

Empirical Results and Discussion

Descriptive Statistics

A summary of the descriptive statistics for all the variables used in the executive remuneration model is presented in Table 2. The average ROA for the sample firms is 1.90%, which is extremely low in comparison to the findings of other studies in developing economies, including Raithatha & Komera (2016) who reported 10.74% among Indian firms and Kyalo & Lishenga (2017) who reported 7.64% among Kenyan SOEs. However, the ROE indicates a much higher average of 10%.

| Table 2 Descriptive Statistics | |||||

| Variable | Observations | Mean | Standard Deviation | Minimum | Maximum |

| COMP | 495 | 8.7124 | 1.0970 | 4.8752 | 11.259 |

| ROA | 541 | 0.0190 | 0.0968 | -0.397 | 0.2350 |

| ROE | 541 | 0.0999 | 0.7262 | -2.248 | 8.9660 |

| BOARD | 265 | 2.4185 | 0.2936 | 1.7918 | 3.4012 |

| AGE | 546 | 10.529 | 6.1459 | 1.0000 | 23.0000 |

| SIZE | 541 | 15.164 | 1.7378 | 11.697 | 19.7619 |

Correlation Analysis

The correlation matrix that shows the direction and strength of the linear relationship between pairs of variables is presented in Table 3. The degree of association between the pairs of variables reveals the linear relationship and also whether any multi-collinearity exists between the variables. The Pearson correlation test was utilised to assess the degree of multi-collinearity. The pairwise correlation coefficient was estimated between the independent variables to identify if any of the correlation coefficients were above 0.80, which would indicate serious multi-collinearity issues (Islam, 2012). Attention needs to be paid to the correlation between variables that will be included in the same model.

| Table 3 Correlation Analysis | ||||||

| COMP | ROA | ROE | BOARD | AGE | SIZE | |

| COMP | 1.0000 | |||||

| ROA | 0.1347* | 1.0000 | ||||

| 0.0027 | ||||||

| ROE | 0.0277 | 0.1506* | 1.0000 | |||

| 0.5391 | 0.0004 | |||||

| BOARD | 0.5520* | 0.1065 | 0.0007 | 1.0000 | ||

| 0.0000 | 0.0837 | 0.9908 | ||||

| AGE | 0.5303* | 0.0555 | 0.0303 | 0.1983* | 1.0000 | |

| 0.0000 | 0.1975 | 0.4823 | 0.0012 | |||

| SIZE | 0.5693* | 0.0768 | -0.0155 | 0.4921* | 0.3065* | 1.0000 |

| 0.0000 | 0.0743 | 0.7192 | 0.0000 | 0.0000 | ||

***p<0.01 significant at 1% level **p<0.05 significant at 5% level, *p<0.1 significant at 1% level Source: Own construction

Table 3 indicates that no two explanatory variables are strongly correlated with each other beyond the rule of thumb of 0.80. The results of the correlation analysis indicate that the relationship between executive remuneration and ROA, board size, firm age and firm size is statistically significant. Positive correlation between ROA and remuneration is significant which supports the theoretical predictions of the agency theory discussed earlier. The correlation between ROE and remuneration is insignificant. Correlation coefficients only show the pair-wise relationship between the variables and how variables move together; this does not mean causation. On the other hand, regression analysis checks causation.

Econometric Analysis

This section presents and discusses the regression results of the GMM estimation of the models: ROA and ROE in Table 4. The relationship between executive remuneration and firm performance was measured by Equation 2.1 and 2.2. There are two different specifications, with each using a different performance measure as a predictor variable. The results indicated strong significant results across the performance measures (ROA and ROE) based on the System-GMM estimations. Furthermore, there was consistency in the signs across both the model specifications.

| Table 4 Regression Analysis | ||

| Model 1 | Model 2 | |

| ROA | ROE | |

| ROA | -1.329*** | |

| -0.0651 | ||

| ROE | -0.0499*** | |

| -0.0142 | ||

| AGE | 0.0105*** | 0.00805*** |

| -0.00061 | -0.00044 | |

| BOARD | 0.549*** | 0.277*** |

| -0.0673 | -0.0185 | |

| SIZE | 0.0269*** | 0.033*** |

| -0.00722 | -0.00939 | |

| COMPt-1 | 0.703*** | 0.723*** |

| -0.00468 | -0.0107 | |

| Constant | 0.901*** | 1.327*** |

| -0.0935 | -0.181 | |

| Observations | 246 | 246 |

| Number of id | 31 | 31 |

| Instruments | 30 | 30 |

| AR(2) | 0.455 | 0.9 |

| Hansen test | 0.582 | 0.99 |

Source: Own construction

The contemporaneous performance of the SOE as measured by ROA and ROE, displays a negative influence on executive remuneration. This implies that executive pay increases despite a decrease in the performance of South African SOEs. These findings are statistically highly significant at the 1% level and are a contradiction of the agency theory that posits that executive remuneration is positively linked to firm performance. This also suggests that there is no increased value in the SOEs that can justify higher executive remuneration. When there is an improvement in firm performance and executives’ remuneration packages increase, this is an indication that their remuneration is linked to performance (El-Sayed & Elbardan, 2016). Misalignment between executive remuneration and firm performance is also an indication that executives have significant power to influence their remuneration packages, including their incentives as they are rewarded despite the SOEs’ poor performance. These findings are consistent with those of Bezuidenhout et al. (2018) whose main finding was an inverse relationship between pay and performance. Supporting this negative prediction, Kyalo & Lishenga (2017) found a weak negative correlation between firm performance and executive remuneration. The authors suggested that for performance to be enhanced, harmonisation and review of the remuneration system, including pay-for-performance perks is necessary. Ngwenya & Khumalo (2012) found an insignificant relationship between executive remuneration and firm performance, therefore offering no support for the tenets of the agency theory whereby alignment implies that executives are held accountable and that performance is maximised. These findings were based on the period 2007-2009 and Schedule 2 SOEs in South Africa. The findings of this study contradict those of Ngwenya & Khumalo (2012) and the tenets of the agency theory with the results indicating that higher executive remuneration does not translate to higher performance. This lends credibility to public perceptions that executive remuneration is excessive and unjustified.

These findings of a significant negative influence between firm performance and executive remuneration are similar to those of Kyalo & Lishenga (2017) who examined Kenyan SOEs. They imply that excessive executive remuneration that is not aligned with performance is common in other African developing economies.

Tuhaika Jr (2007) argued that due to the divergent interests of SOE executives and government, there would be a negative relationship between executive remuneration and performance. Furthermore, the value of the SOE can be destroyed if executive remuneration and performance are misaligned. Misalignment between these two variables is an indication of the agency problem whereby the one party (executive) benefits at the expense of the other (government). Individuals are motivated by economic benefit and can be incentivised through appropriate remuneration packages and incentives when they add value to the entity, which would minimise the agency costs. In order for SOEs to achieve their developmental objectives, they have to remain financially viable and sustainable, and alignment of executive remuneration and financial performance is a critical factor in doing so.

Abiding by the DPE’s 2007 remuneration guidelines as revised in 2011 is another means of ensuring that performance is aligned with remuneration. However, many SOEs have not adopted and implemented these guidelines (Maloa & Bussin, 2016). This is further explanation for the misalignment between executive remuneration and firm performance.

Governance of SOEs is the responsibility of Parliament, and the executive authority responsible for the SOE (for example the Minister of Transport is responsible for the South African National Roads Agency (SANRAL)) as well as the board of directors (Mtshali, 2016). However, an SOE can put all the right governance structures in place such as setting up a board, forming various committees such as audit and remuneration and designing and implementing policies, but corrupt or ill-intentioned shareholders or executives place these policies and practices at risk.

The evidence suggests there is political interference in the operations of many South African SOEs and reports of mismanagement of resources, wasteful expenditure and leadership issues point to the need for stringent government oversight, as the sole or major shareholder, to ensure that their agents (the board, ministerial executive authority, and executive management) run the SOE efficiently. Reports of excessive executive remuneration also create negative public perceptions of SOEs (Thomas, 2012).

A sound corporate governance structure can ensure that the pay-for-performance system works properly. Board monitoring, proxied by board size is one of the key components of a strong corporate governance structure. The results indicated that there is a statistically highly significant and positive relationship between board size and executive remuneration. This finding is consistent with Conyon & He (2012) who reported that board size was significantly associated with higher executive remuneration among Chinese public firms. However, board size was negatively associated with the quality of board monitoring. Given that executive remuneration increases despite a decrease in performance, as reflected by the significant negative coefficients in both performance measures, the effectiveness of board monitoring has to be questioned. Hence, this study supports the argument that an increased board size reduces the quality of board monitoring. Larger boards would be inefficient in their monitoring and as such executives may have opportunities to compensate themselves at higher levels. Pressure is not exerted by these larger boards on executives to ensure that wealth is not expropriated in the form of excess remuneration (Ozkan, 2007).

In light of South African SOEs’ poor performance, the statistically highly significant positive relationship between board size and executive remuneration corroborates the earlier discussion on the misalignment between executive remuneration and firm performance. This positive influence that suggests that larger boards result in higher executive remuneration could be an indication of issues relating to coordination, communication, and decision-making such that board effectiveness is compromised. These findings are consistent with those of Ozkan (2011) and support Chilenga’s (2016) suggestion that appointments to SOE boards are based on political affiliation.

The South African government has reviewed the manner in which board members are appointed in order to ensure that they have the necessary expertise, experience and integrity. Furthermore, in order to restore sound corporate governance, new boards with credible, appropriately experienced and ethical directors, have been appointed at Eskom, Denel, Transnet, the South African Forestry Company (Ltd) (SAFCOL), Passenger Rail Agency of South Africa (PRASA) and SA Express (Zyl, 2019).

The results indicate that the size of the SOE is statistically highly significant (at the 1% significance level) and positively influences executive remuneration with consistent results in both the models. They are consistent with the findings of Raithatha & Komera (2016); Ngwenya & Khumalo (2012) & Vaneylen (2017) who reported that executives are paid more when the firm is large as it is more complex to manage a larger enterprise and they are exposed to greater risk (Core et al. 1999). Attractive remuneration packages thus need to be designed in order to retain high-quality executives. Jeppson et al. (2009) also found that larger firms, measured by sales value, remunerate their executives on a higher scale. This is due to the fact that they are required to perform more complex tasks and take on additional responsibilities, as well as oversee several layers of management and possibly more subsidiaries.

Remuneration packages are largely determined by the size of the organisation (Maloa & Bussin, 2016) as the larger the firm, the more complex it becomes and a better qualified CEO is required who would then demand a higher remuneration package as the position becomes more demanding (McKnight & Tomkins, 2004). Bezuidenhout (2016) inferred that size does affect executive remuneration in very large Schedule 2 SOEs in South Africa; however, the results were not statistically significant. SOEs are classified into four size bands, namely very large, large, medium and small, based on their asset structure and revenue. Their executive remuneration should be based on the category they fall under. These results indicate that size positively influences executive remuneration in SOEs; therefore, the remuneration guidelines set by the DPE are followed to a certain extent.

The age of SOEs proxied by the number of years in existence is also positive and statistically highly significant at the 1% level. This implies that SOEs that have been in existence for a longer period remunerate their executives at a higher rate. These findings are consistent with those of Bouvier (2010); Heyman (2007) who found that age is positively correlated with executive remuneration as more established firms have more highly paid executives. Heyman (2007) also argued that the relationship between firm age and remuneration is robust when variables that may have an effect on the findings are included. Given that a firm’s size and age are linked, with larger firms often being older firms, the findings reveal that by including firm age as a variable, the positive influence of firm size on remuneration and its level of significance is not altered. Generally, the explanation provided for the relationship between firm age and remuneration is identical to that of firm size and remuneration to the extent that it is sometimes difficult to distinguish the difference between the firm size and the firm age effect. The general expectation is that on an average, larger firms have been in existence for a longer period of time; hence, if there is a positive relationship between firm size and remuneration, there is also a positive relationship between firm age and remuneration as revealed by the results of this study. Most of the large SOEs sampled had existed from the beginning of the sampled period.

The results also provide strong evidence in support of the view that executive remuneration displays adjustment dynamics since the estimated coefficient on the lagged-remuneration variable displays a sign that is consistent with the literature and is statistically highly significant at the 1% level of significance (p-values<0.01), regardless of the performance measure. The coefficient estimate of the lagged executive remuneration is significant and positive, which implies that there is consistency with past remuneration and the coefficients are less than one, which is consistent with dynamic stability. These findings are in line with those of Canarella & Nourayi (2008) and Conyon & He (2012) whose results indicated that executive remuneration dynamics are important due to the current year’s remuneration being significantly and positively influenced by the previous year’s remuneration. This study incorporated a lagged executive remuneration variable in the model based on the study of Conyon & He (2012) who argued that remuneration is serially correlated as the board gradually learns about the capabilities of executives and can therefore not immediately adjust the pay to the target levels.

Conyon & He (2012) further argued that if pay is serially correlated, this suggests that studies on executive remuneration and firm performance that did not incorporate pay dynamics in their models may suffer from omitted variable bias, with the result that their estimates were inaccurately calibrated. This implies that the results of previous South African studies on the relationship between executive remuneration and the performance of SOEs that did not incorporate pay dynamics, are not completely accurate as the findings of this study clearly show that pay dynamics are relevant.

The results in Table 4 provide evidence that the performance of South African SOEs and executive remuneration are linked; however, the inverse relationship is cause for real concern. Executive remuneration is excessive and unjustified in SOEs that are underperforming as indicated by their financial performance measures.

In order to ensure that SOEs deliver on their developmental roles to support infrastructure development and transformation of the economy, their performance must improve. Existing key policies should be strictly implemented while new policies are required, with severe repercussions for non-compliance. Should this not occur, the trajectory of the economy will continue to weaken. The results on the key variables highlighted in this study, may assist in aligning executive remuneration and performance which would, in turn, improve SOEs’ performance. Such improvement is crucial to the delivery of basic services, fostering economic growth, generating employment, and increasing the fiscal space to address inequality.

Summary and Conclusion

This study analysed the relationship between executive remuneration and firm performance from an agency theory perspective. The main aim was to determine whether there is alignment between the remuneration of SOE executives and the financial performance of the entities they manage.

It could be expected that the PFMA, the Companies Act (2008), King III and King IV, among others, would ensure increased regulation and monitoring of SOEs and hence executive remuneration would be positively and significantly linked to performance. The poor performance that is continuously reported in the media in relation to the magnitude of executive remuneration and the results of this study negate this expectation.

From the regression results, it can be concluded that there exists a statistically highly significant and negative relationship between executive remuneration in South African SOEs and their financial performance proxied by two different accounting-based performance measures. Of great concern is the inverse relationship, implying that executive remuneration is high despite the declining performance of these SOEs. This misalignment between executive pay and performance could contribute to SOEs’ poor performance. These findings undermine the core principles of the agency theory, resulting in poor performance. They provide empirical support for public and media perceptions that executive remuneration is excessive and unmerited when measured against the firm’s performance. Serious intervention by government and sound remuneration practices are urgently required to ensure that the relationship between executive remuneration and financial performance changes to a positive one. This would promote strict adherence to the pay-for-performance system and government should act punitively when directives are not followed.

On the other hand, there is a statistically highly significant and positive relationship between executive remuneration and the size, age and board size of the SOE. This is an indication that remuneration packages take into consideration the size of the SOE and that some SOEs follow the DPE’s remuneration guidelines.

These findings highlight key performance indicators that affect executive remuneration in South African SOEs which can be used by remuneration committees to determine the relationship between executive remuneration and financial performance based on strong, statistically significant empirical evidence.

Recommendations

In view of the finding of a statistically highly significant negative relationship between executive remuneration and financial performance amongst South African SOEs, the executive remuneration system in South Africa’s public sector should be reviewed in order to ensure that it is in line with SOEs’ performance. Executive perks should be based on the pay-for-performance system. In light of South African SOEs’ poor performance, the significant positive relationship between board size and executive remuneration suggests that larger boards result in higher executive remuneration, an indication of issues relating to coordination, communication, and decision-making such that board effectiveness is compromised. Hence, the Department of Public Service and Administration (DPSA) guidelines on the appointment of boards and executive management should be implemented, especially considering that the majority of the boards will reach the end of their term of office in 2018/19 (Department of Public Enterprises, 2018) and new boards will be appointed. Executives appointed to serve on these new boards should have the requisite expertise, experience and integrity.

Given that executive remuneration frameworks and practices are inconsistent amongst SOEs, the “SOC Remuneration and Incentives Standards for Non-Executive Directors, Executive Directors and Prescribed Officers” framework that was approved by Cabinet in November 2018 (Department of Public Enterprises, 2018) should be strictly implemented across government. Furthermore, a central remuneration authority should be established to ensure that consistent and accountable remuneration frameworks and practices are adopted across SOE boards and executives. These recommendations are also in line with those of the Presidential Review Committee.

References

- Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The review of economic studies, 58(2), 277-297.

- Bezuidenhout, M.L. (2016). The relationship between CEO remuneration and company performance in South African state-owned entities. University of South Africa, Pretoria.

- Bezuidenhout, M.L., Bussin, M.H., & Coetzee, M. (2018). The chief executive officer pay–performance relationship within South African state-owned entities. SA Journal of Human Resource Management, 16(1), 1-13.

- Bouvier, A. (2010). The Effect of Age upon CEO Compensation: A Cross-Industry Study. (CMC Senior Theses ), Claremont McKenna College, California.

- Brealey, R.A., Myers, S.C., Allen, F., & Mohanty, P. (2012). Principles of corporate finance: Tata McGraw-Hill Education.

- Bussin, M.H.R., & Ncube, M. (2017). Chief executive officer and chief financial officer compensation relationship to company performance in state-owned entities. South African Journal of Economic and Management Sciences, 20(1), e1-e10.

- Canarella, G., & Nourayi, M.M. (2008). Executive compensation and firm performance: adjustment dynamics, non-linearity and asymmetry. Managerial and Decision Economics, 29(4), 293-315.

- Chilenga, A. (2016). State owned enterprises: a policy analysis of South African Airways (SAA). (Masters in Social Sciences (Policy and Development Studies) ), University of KwaZulu-Natal, KwaZulu Natal.

- Conyon, M.J., & He, L. (2012). CEO compensation and corporate governance in China. Corporate Governance: An International Review, 20(6), 575-592.

- Core, J.E., Holthausen, R.W., & Larcker, D.F. (1999). Corporate governance, chief executive officer compensation, and firm performance. Journal of Financial Economics, 51(3), 371-406.

- Davies, T. (2018). Chief executives’ pay is no small issue. Retrieved from https://mg.co.za/article/2018-12-14-00-chief-executives-pay-is-no-small-issue

- Department of Public Enterprises. (2007). State owned enterprises remuneration guidelines. Pretoria Retrieved from http://pmg-assets.s3-website-eu-west-1.amazonaws.com/docs/100319guidlines1.pdf

- Department of Public Enterprises. (2018). Annual performance plan 2018/19. Pretoria Retrieved from http://www.dpe.gov.za/resourcecentre/publications/Annual%20Performance%20Plans/Department%20of%20Public%20Enterprises%20Annual%20Performance%20Plan%202018-19.pdf

- Eisenhardt, K.M. (1989). Agency theory: An assessment and review. Academy of management Review, 14(1), 57-74.

- El-Sayed, N., & Elbardan, H. (2016). Executive compensation, corporate governance and corporate performance: evidence from the UK. Journal of Organisational Studies an d Innovation, 3(2), 31-49.

- Firer, C., Ross, S.A., Westerfield, R.W., & Jordan, B.D. (2012). Fundamentals of corporate finance (Fifth Edition). Maidenhead: Mc Graw Hill.

- Ghosh, A., & Paterson, W. (2011). Capital structure and executive compensation. The International Business and Economics Research Journal, 1, 43-48.

- Guilding, C., Warnken, J., Ardill, A., & Fredline, L. (2005). An agency theory perspective on the owner/manager relationship in tourism-based condominiums. Tourism Management, 26(3), 409-420.

- Gunasekhar, S., & Dinesh, K.G.S. (2017). The impact of corporate governance and firm performance on chief executive officer's compensation: Evidence from central state owned enterprises in India. Paper presented at the International Conference on Data Management, Analytics and Innovation, India.

- Hastori, H., Siregar, H., Sembel, R., & Maulana, T.N.A. (2015). Agency costs, corporate governance and ownership concentration: The case of agro-industrial companies in Indonesia. Asian Social Science, 11(18), 311.

- Heyman, F. (2007). Firm size or firm age? The effect on wages using matched employer-employee data. Labour, 21(2), 237-263.

- Islam, S. (2012). Manufacturing firms’ cash holding determinants: Evidence from Bangladesh. International Journal of Business and Management, 7(6), 172.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Jeppson, C.T., Smith, W.W., & Stone, R.S. (2009). CEO compensation and firm performance: Is there any relationship. Journal of Business and Economics Research, 7(11), 81-93.

- Kazan, E. (2016). The impact of CEO compensation on firm performance in Scandinavia. University of Twente,

- Khanna, V. (2016). Determinants of CEO compensation. International Journal of Management Excellence, 6(2), 679-683.

- Kyalo, B.M., & Lishenga, J.L. (2017). Relationship between executive compensation and financial performance of commercial state owned enterprises in the energy sector in Kenya. African Development Finance Journal (ADFJ), 1(2).

- Lew, S.H. (2013). An investigation of the most appropriate capital structure theory and leverage level determinants.

- Li, S., & Xia, J. (2008). The roles and performance of state firms and non-state firms in China’s economic transition. World Development, 36(1), 39-54.

- Majangaza, S. (2015). SAA CEO settles for R2.7m pay-out. Retrieved from http://www.dispatchlive.co.za/business/2015/04/29/saa-ceosettles-for-r2-7m-payout/

- Maloa, F., & Bussin, M. (2016). Determinants of executive compensation in South African state-owned enterprises. South African Journal of Labour Relations, 40(1), 8-24.

- Mbo, M. (2017). Drivers of organisational performance: a state owned enterprise perspective. Stellenbosch: Stellenbosch University,

- McKnight, P., & Tomkins, C. (2004). The implications of firm and individual characteristics on CEO pay. European Management Journal, 22(1), 27-40.

- Mengistae, T., & Xu, L.C. (2004). Agency Theory and Executive Compensation: The Case of Chinese State-Owned Enterprises. Journal of Labor Economics, 22(3), 615-637.

- Morton, B., & Blair, C. (2016). Private versus public pay practices. Retrieved from https://www.21century.co.za/private-vs-public-pay-practices/

- Mtshali, M.S. (2016). A policy analysis of state-owned enterprises: the case study of South African national road agency limited (SANRAL).

- National Treasury. (2010). Budget Vote Speech for National Treasury by Pravin Gordhan, Minister of Finance. Pretoria Retrieved from https://www.gov.za/budget-vote-speech-national-treasury-pravin-gordhan-minister-finance

- Ngwenya, S., & Khumalo, M. (2012). CEO compensation and performance of state owned enterprises in South Africa. Corporate Ownership and Control, 10(1).

- OECD. (2018). Professionalising Boards of Directors of State-Owned Enterprises: Stocktaking ofNational Practices. Retrieved from https://www.oecd.org/corporate/Professionalising-boards-of-directors-of-SOEs.pdf

- Otieno, D.O.A. (2012). The relationship between financial performance and executive remuneration in South African State Owned Enterprises: An agency theory perspective. University of Johannesburg,

- Ozkan, N. (2007). Do corporate governance mechanisms influence CEO compensation? An empirical investigation of UK companies. Journal of multinational financial management, 17(5), 349-364.

- Ozkan, N. (2011). CEO compensation and firm performance: An empirical investigation of UK panel data. European Financial Management, 17(2), 260-285.

- Peng, M.W., Bruton, G.D., Stan, C.V., & Huang, Y. (2016). Theories of the (state-owned) firm. Asia Pacific Journal of Management, 33(2), 293-317.

- Peyper, L. (2016). No raise on top of Eskom boss Brian Molefe’s R9.4m salary. Retrieved from https://www.fin24.com/Economy/Eskom/no-raise-on-top-of-eskom-boss-brian-molefes-r94m-salary-20161021

- Presidential Review Committee. (2012). Presidential review committee on state-owned entities. Retrieved from South Africa: http://www.thepresidency.gov.za/electronicreport/downloads/volume_1/volume_1.pdf

- PWC. (2018). Executive directors practices and remuneration trends report. Retrieved from https://www.bbrief.co.za/content/uploads/2018/07/Executive-directors-Practices-and-remuneration-trends-report-2018.pdf

- Raithatha, M., & Komera, S. (2016). Executive compensation and firm performance: Evidence from Indian firms. IIMB Management Review, 28(3), 160-169.

- Thomas, A. (2012). Governance at South African state-owned enterprises: What do annual reports and the print media tell us? Social Responsibility Journal, 8(4), 448-470.

- Tuhaika Jr, J.A. (2007). State-owned enterprises and the principal-agent problem: A case study of the Solomon Islands water authority. Pacific Economic Bulletin, 22(2), 131-139.

- Uwuigbe, U., Uwuigbe, O.R., Igbinoba, E., Olugbenga, J., & Adegbola, O. (2016). The effect of financial performance and board size on corporate executive compensation: A study of selected listed banks in Nigeria. The Journal of Internet Banking and Commerce, 21(3).

- Van Den Eijnden, P.P.J.P. (2010). The effect of board of directors characteristics on pay for performance compensation. Tilburg University, Retrieved from http://arno.uvt.nl/show.cgi?fid=107759

- Vaneylen, M. (2017). The relationship between ceo compensation and company performance and risk. (Master of Science in Business Economics), University of Ghent, Retrieved from https://lib.ugent.be/fulltxt/RUG01/002/351/059/RUG01-002351059_2017_0001_AC.pdf

- Zyl, G.V. (2019). SOE’s state of play-grim reading from Public Enterprises. BizNews. Retrieved from https://www.biznews.com/sa-investing/2019/02/14/eskom-numbers-r42bn-shortfall-r420bn-debt