Review Article: 2022 Vol: 26 Issue: 1

The Rise of Crypto-currency: A view from the Libra Project by Facebook

Salih M. Sahi, Wasit University

Citation Information: Sahi, S.M. (2022). The rise of crypto-currency: a view from the libra project by facebook. Academy of Accounting and Financial Studies Journal, 26(1), 1-13.

Abstract

Facebook announced an aspiring project called “Libra” on June 18, 2019 to convert the current economic system with an international digital currency (Libra Coin) following an unconventional economic infrastructure (Libra Blockchain).As such, this study aimed to comprehend the consequences of Libra and the Libra concept from financial perspectives. Two primary study methods (deductive and inductive) and the relevant data derived from the European Parliament, European Blockchain Center,Coinmetrics.com and the representative survey among 3059 German adult Internet users by Blockchain Research Lab offered useful insights into understanding the Libra effect on emerging crypto market behaviours. Notably, Libra was designed to manage over 1,000 transactions per second upon being launched. Less than a week later, the Libra testnet averaged 25,000 transactions daily and was approximately on par with Dash and NEO (crypto-currencies) with over $1 billion in market capitalisation. Conclusively, the Libra project would promote blockchain-oriented currencies as a mass adoption catalyst. Notably, the subsequent behaviours following the COVID-19 pandemic potentially instigated the decline in cash flow.

Keywords

Libra, Crypto-currency, Facebook, Accounting, Finance, DLT, Blockchain.

Introduction

On June 18, 2019, Facebook presented the Libra Association in collaboration with 28 other members to launch a novel crypto-currency (Libra). Specifically, the association issued a white paper that highlighted Libra attributes and described the crypto-currency as a means to overcome some of the issues confronted by other crypto-currencies and deliver potential big-scale technological advantages. In the study context, Libra could significantly shift economic equilibrium, financial stability, and the global financial system (Abraham & Guégan, 2020). Although the launching of the Libra testnet (a simplified version of what mainnet would probably look like) by Facebook was planned for early 2020, the actual event would more likely start in early 2021 or later. Nonetheless, smart contract capacities were yet to be obtainable (Coinmetrics.com, 2020) due to the Cashless Cold War.

From the perspective of the US Federal Government, Jerome Powell (the US Federal Reserve Chairman) maintained that Libra could not be permitted to operate. Similarly, Christine Lagarde (the ECB president) argued that crypto-currencies were “shaking the system.” As such, the perpetual conflict between fintech innovation and regulatory attempts were deemed to be a continuous issue (Laboure & Reid, 2020). Facebook and other founding members aimed to empower billions of people in emerging economies who seldom had access to banking or other economic sectors. In this vein, Libra would establish a novel ecosystem that facilitated international financial transactions in a stable digital currency at nearly zero marginal costs (Brühl, 2019). Mark Zuckerberg (Facebook founder) stated at the Libra launch that “building a financial system is not the kind of thing that a company can do by itself. So, we played a role in helping to stand this up” (The Asean Post Team, 2019).

The total crypto-currency market capitalization has drastically increased by 1000 times in under six years since 2014. Towards the end of 2019, the market capital was just under one trillion euros with a similar immensity to the total currency in circulation by the end of 2019 (1.2 trillion euros) (Gerba & Rubio, 2019). Although crypto-currencies have existed for approximately 10 years, the increased Bitcoin price to almost $20,000 in 2017garnered remarkable worldwide attention (Laboure & Reid, 2020). As of 25 May 2020, the crypto assets price-tracking service (CoinMarketCap.com, 2020) listed 5500 crypto- currencies with a substantial overall market capitalisation of $258 billion for the novel market segment. Although Bitcoin dominated the market share by66.5%, the rise of novel currencies induced complexities in market supervision (Alt, 2020).

This study proffered an alternate perspective of Libra by acknowledging that various Libra-based developmental scenarios were workable. Hence, this study presented testable preliminary hypotheses to be assessed with extensive examination. As studies on economics regarding the financial relevance of crypto assets and the effects of Libra by facebook and other crypto-currencies was scarce, this study recommended a framework to assess Facebook´s Libra activities with a comprehensive conceptual overview of Libra and the probable advantages of evaluating market potential. This research also strived to comprehend the Libra notion and subsequent implications from a financial perspective. The remaining sections are arranged as follows: Section 2presentsthe theoretical background of the Libra ecosystem; Section 3 presents the study data and methodology; Section 4 reveals the outcomes; Section 5 outlines the study conclusion

Theoretical Background

The Libra Ecosystem

Crypto-currency (or crypto asset) denoted digital currencies that employed cryptography to secure payment networks and transactions in a decentralised manner (Abraham & Guégan, 2020). Specifically, crypto-currency indicated a virtual or digital currency with encryption methods (encoding information that required authorised access) to assess monetary units and authenticate fund transfers (Drishti.com, 2019).For example, Facebook´s Libra indicated a crypto-currency for immediate transfer with almost no cost worldwide. Although Libra principles resembled Bitcoin counterparts, Libra required a stable value aided by global currencies (the US dollar, Euro, and Yen) (Libra White paper, 2019).Libra coin types denoted single-currency stablecoins, multi-currency coins (USD, EUR, and GBP), and a digital composite of several single-currency stablecoins on the Libra network (Catalini, 2020).

Facebook introduced a subdivision (Calibra) to offer economic services for smartphone users to access and engage in networks through a digital wallet in 2020. For example, account owners could transfer funds (US dollars) to Libra and utilise the currency through digital wallets (Shirai, 2020). As Calibra was incorporated into Facebook´s ecosystem with complete user access, Facebook could compel consumers to use specific digital wallets (Gerba & Rubio, 2019).

Facebook´s crypto-currency Libra would also permit smartphone users to digitally purchase services from phones. In this vein, Libra was a stablecoin that was stabilised against a basket of renownfiat currencies resembling the Singapore currency basket or Special Drawing Right by the International Monetary Fund. Reserve assets would also be retained in bank deposits and short-term treasury securities denominated in the currencies (see Table 1).

| Table 1 Bitcoin, Tether, and Libra Features | |||

| Libra | Tether | Bitcoin | Features |

| Libra | USDT | BTC | Unit |

| Stable against basket currencies | Stable against US dollar | Extreme volatility | Value |

| Potentially large | Approximately$6.4 | Approximately$133 | Market capitalisation |

| Yes (consortium type) (Libra Association) | Yes (private type) (Tether Limited) | None | Central manager |

| Potentially no limit | Potentially no limit | Yes (21 million) | Cap on issuance |

| Own blockchain | Currentopen blockchain (Bitcoin and Ethereum) | Bitcoin blockchain | Technological issuance |

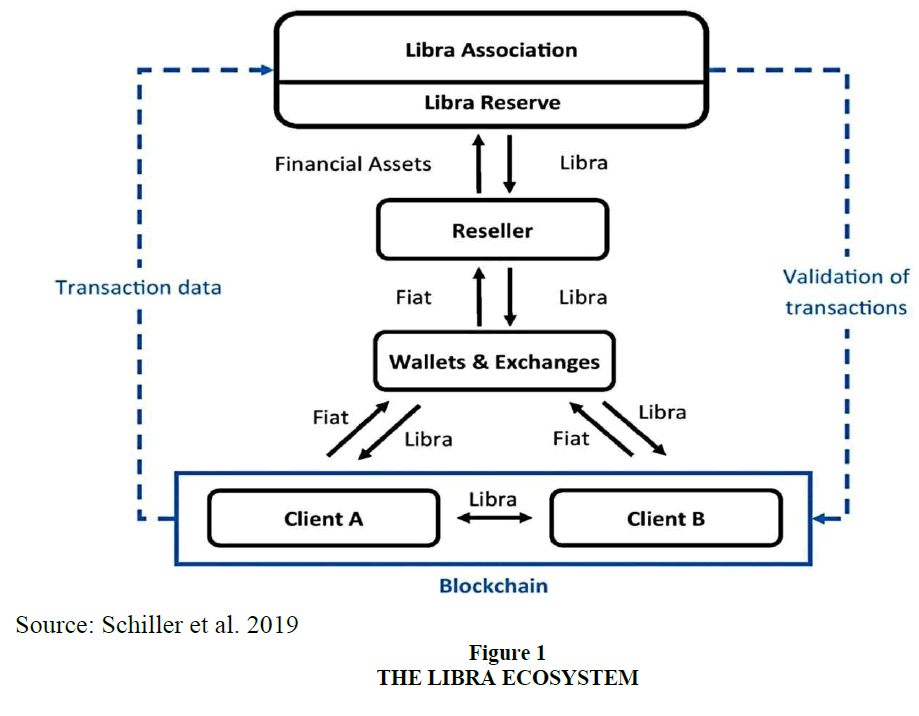

Following the Libra White Paper (2019), Libra denoted a “global currency and financial infrastructure” involving three components:(1) Libra indicated a blockchain- oriented digital currency, (2) Libra was supported by reserve assets for consistent value, and (3) Libra was regulated by an independent firm (the Libra Association) towards the currency ecosystem development (Schmeling, 2019). Following Figure 1, the aforementioned elements became evident when consumers selected Libra against fiat currency on exchanges or digital wallets for exchanges with other consumers through the Libra Blockchain. For example, resellers exchanged Libra with the Libra Association for the short-term government bonds and bank deposits (Libra Reserve) gained with previously-obtained fiat currencies (Libra White paper, 2019).

Libra followed a distributed ledger technology (DLT) and Libra Blockchain, a decentralised and dispersed database system (Schiller et al., 2019). Essentially, DLT implied how custodian banks made public guarantees. Instead of posting a signed letter on the website, digital signatures were utilised to cryptographically sign guarantees in the public Libra Blockchain (Sandner, 2019). Therefore, each Libra payment was permanently written in Libra blockchain (a cryptographically-verified database) as a public online ledger to manage 1,000 transactions per second (Drishti.com, 2019). Although all nodes could verify transactions in permissionless blockchains, only the nodes predefined by a central authority could subsequently authenticate the transactions. In this regard, a permissioned blockchain was both public and private (see Table 2).

| Table 2 Blockchain Classification | ||

| Transaction verification access | Transaction access | |

| Permissionless | Permissioned | |

| All nodes can comprehend blockchain data, submit transactions, and authenticate transactions. | All nodes can comprehend blockchain data and submit transactions. Only preconceived nodes can authenticate transactions. | Public |

| Not applicable | Only preconceived nodes can comprehend blockchain data, submit transactions, and authenticate transactions. | Private |

The Libra blockchain system would become permissionless within five years following the launching of Libra for public blockchain access. Additionally, transaction authentication was no longer solely executed by Libra Association members (Libra White paper, 2019).In supporting Libra, the Libra Association established a substantial worldwide reserve fund (Libra Reserve) to catalyse significant reactions and systemic risks in crises. Consequently, commentators recommended a substantial and globalised regulation (partly to deter the Libra project). The reserve was crucial for value conservation as each Libra coin received the complete assistance of a diversified basket involving low volatility and liquid assets (short-term government bonds and deposits in stable fiat currencies),such as the US dollar, Euro, British Pound, and Japanese Yen) (Brühl, 2019).

The Libra Association was accountable for the issuance or termination of Libra, reserve asset management, Libra network development, and financial inclusion. For example, Libra was issued when authorised resellers received the currency from the Libra Association in exchange for particular global counterparts (Shirai, 2020). In this vein, the Libra Association could generate revenue from interest incomes (through foreign reserve assets) and transaction fees. Regarding interest incomes, Libra reserve securities were anticipated to offer an average interest rate of approximately 0.9% (Schiller et al., 2019). Under low-risk and short-term government bonds and bank deposits from stable economies. Thus, the Libra Association could produce approximately $900 million in interest income for every $100 billion invested for operating costs (Schiller et al., 2019).

As the currency encompassed three functions (account unit for financial calculation or accounting, value reserve, and exchange intermediaries or debt-eliminating capacities and obligations) Libra was structured to “bring together the attributes of the world’s best currencies: stability, low inflation, wide global acceptance, and fungibility” (Libra White paper, 2019). As an established money type, Libra could reflect value storage and account units instead of merely being a payment source. The Libra Association published an updated version of the 2019 white paper on April 16, 2020, to address significant concerns raised by global regulatory communities. Although the current Libra 2.0 white paper made specific alterations, economic regulators remained concerned about the aforementioned revision (Allen, 2021).

Econometrics Considerations

Is Libra a cryptocurrency part? You may agree, on the one hand, but the cryptocurrency concepts in general are not followed by Libra. Libra is not censorship resistant to free, public, unbiased and unrestricted. This indicates that Libra is not as regionalized as enthusiasts anticipate crypto. It may be preferable to compare this when you think about Libra with standard payment networks (payment called peer-to-peer) like Square, Venmo, PayPal and even Western Union. Next, since the core idea of Libra is completely distinct from cryptocurrency, should the introduction of Libra not influence the price of Bitcoin? This assumption may be accurate, however there is a notion of what are termed asymmetry of information and this is often utilized to see stock price movements.

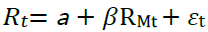

There may be a possibility that the market may not grasp the Libra project correctly if there is a major prices change based on statistical data. The Market Model was selected for the calculation of anticipated returns before estimating the main parameters required for the calculation of the expected returns throughout the event period. The fact that several researches proved that this model was the best and most often utilized justifies this decision (Azouzi & Echchabi, 2019). The market model is expressed in particular as (1):

(1)

(1)

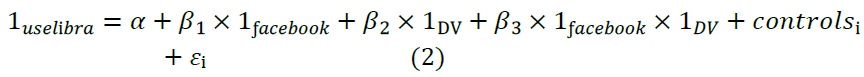

When Rt represents the Bitcoin return for the Day t and RMt represents the market index return for the Day t, β is a measure of risk that indicates a Bitcoin sensitivity to the cryptocurrency market, α defines the average rates throughout the time not defined by the market, and εt is a statistical error term. Different users respond to Facebook-issued vs general technology-enabled money There is a difference (Goldfarb, & Park, 2019). We estimated this:

Where 1use libra is a dummy who is 1 if the respondent is eager to utilize libra; 1Facebook is a dummy who is 1 if a user was questioned about the money supplied by Facebook; 1DV is a dummy which symbolizes the variables above (e.g., whether someone is male). The interaction factor β3 that stops the marginal impact of for example a man being asked for Facebook-issued money in relation to a female being asked for the comparable issue, is our interest variable.

Unlike in the ex-news the study presupposes that it will have a negative impact on the volatility of Bitcoin on new cryptocurrency launches because ICO offers investors an opportunity to expand investments in the cryptocurrencies industry, and moderate risk-taking traders are swapping their Bitcoin investments to new cryptocurrencies because of high security.This can result in Bitcoin market stability. For instance, Libra's initial offering value will also be a key driver of the type of the influence Libra has on Bitcoin volatility. These initial beliefs are experienced by the GARCH model used to predict Bitcoin's volatility (Senarathne, 2019).

(3)

(3)

(4)

(4)

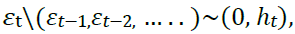

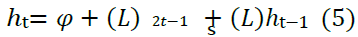

Where:represents the conditional variance’s constantof the equation (5). When, α and λ defines the ARCH and GARCH coefficients correspondingly. Also, ht-1represents the Bitcoin returnof the conditional variance in the prior period (t-1). It is predictable that θ>0, α>0 and λ>0. The distribution of εt tracks a normal distribution, given that the data set Ω is obtainable to investors at time t-1. That is means, E(εt| Ω_(t-1)) ∼N(0,ht) and if δi is dispersed with mean zero and unit variance (σ2), εt|n_t ∼ N(0,σ2nt).

Bitcoin return and Blockchain shave a variety of distinctive features which may solve various accessibility challenges and trust works' difficulties. But if Libra has any influence on the volatility of Bitcoin, the underlying information on the value of Libra (i.e. the libra project) should be taken as the truth about information-rich projects (i.e. Ethereum cryptocurrency) have been released in new cryptocurrency projects thus far. Many articles demonstrate that ICO promoters' insider knowledge flaws (e.g., hidden projects) would enable arbitrators prepare for purchases in advance and profit from trading shortly after introduction of the offer (see e.g., Sandner, 2019; Abraham, & Guégan, 2020; Brühl, 2019). Obviously, the introduction of Libra will have a same influence on Bitcoin, as it will probably be Bitcoin's largest concurrent.

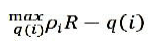

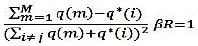

There are also M mining companies competing to update a blockchainwithin subperiods  with all subperiod 0 transactions (Chiu & Koeppl, 2018). Miners do exactly one expensive computational operation with a random rate of success by using investing computer power in each sub-period, q, measured in real cryptocurrency balances. We believe miners value genuine equilibriums linearly. If the computing power of miner in a sub-period is q(i), as motivated by the Bitcoin protocol, the chance of a certain miner i winning is:

with all subperiod 0 transactions (Chiu & Koeppl, 2018). Miners do exactly one expensive computational operation with a random rate of success by using investing computer power in each sub-period, q, measured in real cryptocurrency balances. We believe miners value genuine equilibriums linearly. If the computing power of miner in a sub-period is q(i), as motivated by the Bitcoin protocol, the chance of a certain miner i winning is:

A miner can update the blockchain (i.e., append the nth block to the blockchain) and get a reward R in real balances by winning the competition in any subperiod. We presume that miners acquire and consume this reward after the period, which has been discounted by their time preference β. It should be noted that mining games are not affected by subperiods. As a result, miner solves the following problems in any subperiod:

(7)

(7)

so that

(8)

(8)

Where he accepts the decision of all miners m ≠ i as given and imposes symmetry, q(m) = Q for every m, we achieve as the Nash equilibrium of the mining game (Chiu & Koeppl, 2018). As a result, the overall computational cost of mining in any subperiod is as follows:

(10)

(10)

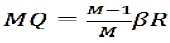

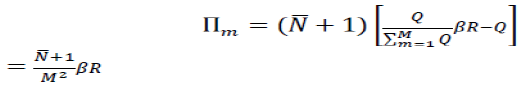

Thus, the probableprofit of a miner in equilibrium over a single transaction period is given by:

(11)

(11)

To represent the reality that mining is very competitive and leading to new entrants, we can let M→∞ arrive to the next lemma. By way of Lemma 1, as M→∞, the anticipated value of miners is equal to zero, and the combined processing the power of miners dissipates all mining rewards:

(12)

(12)

Methodology

The study analysis involved extensive works of literature. An essential opportunity area concerned the collection and aggregation of and access to required data to monitor Facebook´s Libra, trend interpretations, and adequate studies to efficiently respond to crypto assets. The qualitative analysis is based on quantitative extrapolation. The study methods encompassed scientific publication reviews and research articles on the synthesis of Facebook’s Libra and crypto assets and data analysis. Notably, most articles were relatively recent and updated (published between 2018 and 2020). Two primary techniques were employed in the study (deductive and inductive). The deductive method involved general to specific movements, whereas the deductive counterpart denoted conceptual and theoretical structures that were tested against scientific perceptions. Additionally, the inductive approach concerned specific to general movements and was often utilised within interpretivism, whereas the inductive counterpart was presented as logic that utilised known theories for novel conclusions. As the technology of Facebook´s Libra remains relatively novel and unknown, the survey technique (typically utilised for large samples) was disregarded. Alternatively, research articles and data from the European Parliament, European Blockchain Center, Coinmetrics.com and the representative survey among 3059 German adult Internet users by Blockchain Research Lab were employed.

Results and Discussion

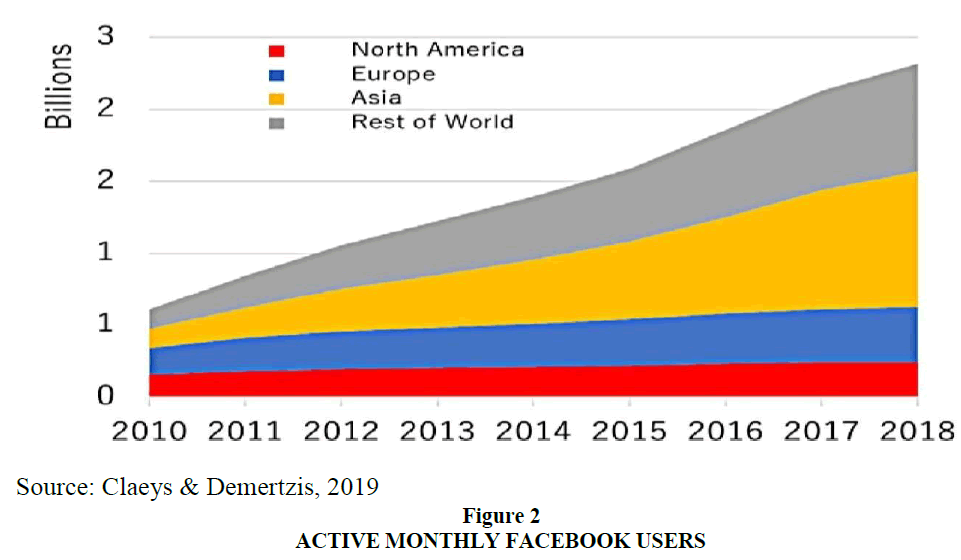

Digital currencies could become more worthy competitors than conventional money types in terms of scalability. Specifically, the advent of Facebook´s Libra urged central banks and governments that feared the loss of monetary sovereignty to consider regulatory needs and the Central Bank Digital Currency (CBDC) as potential alternatives (Gerba & Rubio, 2019). Almost a decade post Bitcoin, the currency was predicted to have 7.1 million owners globally (Bitcoinmarketjournal.com, 2017) in 2017. Comparatively, the number of active Facebook users (Libra’s immediate network size) reached approximately 2.5 billion (substantially bigger than users of global currencies, such as Euros or US Dollars) (see Figure 2).

The Bank for International Settlements BIS (2019) discussed the intricate exchanges that potentially emerged “between financial stability, competition, and data protection.” One such complexity involved Calibra (the digital wallet stored under Libra). Approximately 200 crypto-currency wallets 24 with which over 1600 crypto-currencies were exchanged and stored (Gerba & Rubio, 2019).

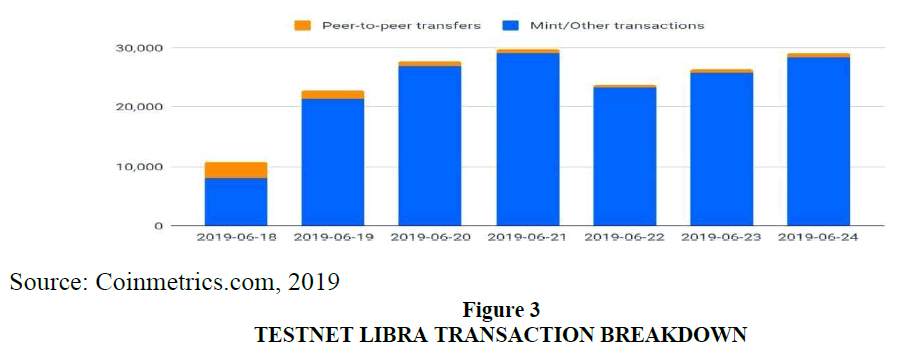

Facebook is currently designing Libra to be measurable (high throughput) as an international currency. Specifically, Libra was designed to manage over 1,000 transactions per second at the launch. Less than aweek later, the Libra testnet averaged 25,000 transactions a day and was roughly at par with Dash and NEO (crypto-currencies) exceeding $1 billion in market capitalisation. Regardless, most transactions were token mints (public members could request up to trillions of Libra Testnet tokens for free) compared to peer-to- peer token transfers (see Figure 3).

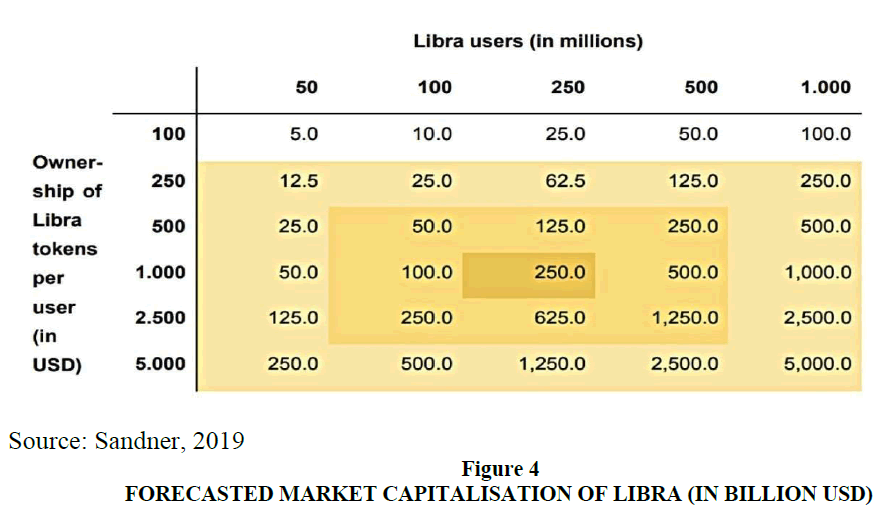

Libra was in a novel position with billions of potential users (mass demand) following extensive Facebook and WhatsApp user bases. Given the relative novelty regarding the collaboration of established organizations in blockchain regulation, Libra required user trust through governance for potential mass users. Although a precise estimate of the number of Libra users was currently unobtainable, potential consumers between 100 and 500 million individuals (each possessing between $500.00 and $ 2,500.00 in Libra) were foreseen, hence leading to a predictable market capitalisation between $50 and $1,250 billion (see Table 3). Presently, Facebook consisted of 2.7 billion users on Whatsapp, Instagram, and Facebook Messenger applications (Sandner, 2019). As such, the estimation of 250 million potential Libra consumers (about 10%) was deemed realistic.

| Table 3 Utilization of Libra as Indicated by Income Groups | ||||

| Would you use Libra? | Level of trust | Income group | ||

| possibly | no | yes | ||

| 35.8% | 53.1% | 11.1% | 2.98 | Below €500 |

| 36.6% | 57.7% | 5.7% | 3.11 | €500 to €999 |

| 32.5% | 56.2% | 11.4% | 3.51 | €1.000 to €1.499 |

| 28.7% | 57.7% | 13.6% | 3.52 | €1.500 to €1.999 |

| 33.3% | 54.6% | 12.0% | 3.55 | €2.000 to €2.999 |

| 28.7% | 53.8% | 17.4% | 3.80 | €3.000 to €4.999 |

| 23.2% | 60.7% | 16.1% | 3.61 | €5.000 or more |

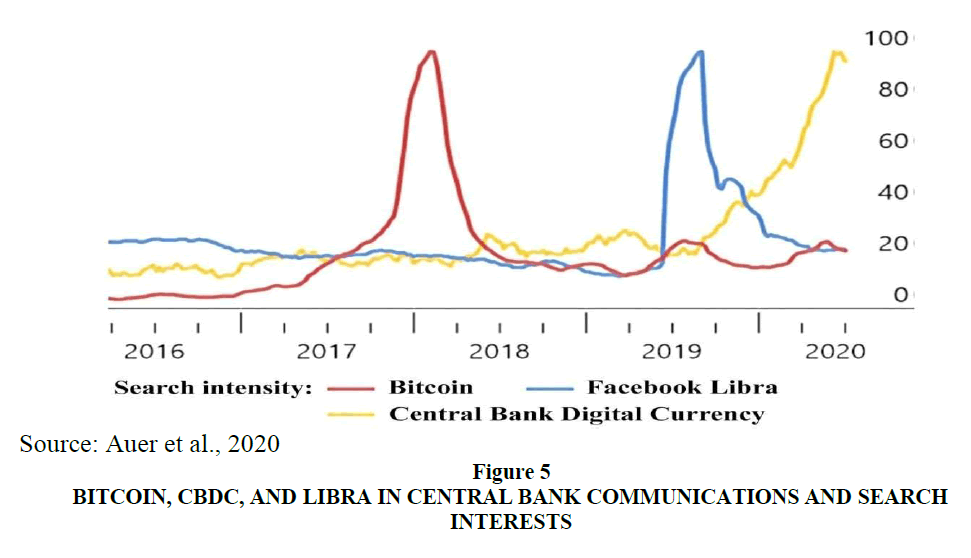

Brühl, (2019) claimed that 25% of the present 2.41 billion active Facebook users (monthly as of June 30, 2019) could be transformed into Libra consumers within five years following the Libra launch. An average Libra demand (at approximately 1,000 Libra annually) led to an annual Libra demand of about 600 billion Libra. Following the Covid-19 pandemic, physical distancing measures, public concerns on Covid-19 virus transmissions through cash, and new government-to-person payment schemes catalysed the shift to digital payments with further impetus to CBDC. Resultantly, CBDCs have garnered worldwide attention and featured extensively in central bank communications and public search interests (see Figure 4). In Auer, Cornelli, & Frost, (2020), no major jurisdiction issued a retail CBDC despite numerous questions. In the growing works of CBDC-oriented literature, the discussions focused on specific essential elements (money creation by central banks and the desirability of CBDCs) in the study context.

Given that Libra was wholly aided by value-stable financial assets, Libra Reserve denoted an extensive global money market fund with an investment-based emphasison worldwide bank deposits and short-term government securities (Schiller et al., 2019). Libra could also be perceived as an investment certificate to be employed as a global payment method through direct share transfers between clients A and B under the Libra Blockchain.

Also, the data is part of a series of information reports based on a biennial representative survey of internet users in Germany, assessing society's adoption of cryptocurrencies (Blockchain Research Lab, 2020).This report is based on a representative survey of 3059 adult Internet users in Germany and captures users' perceptions and expectations of Libra. Libra is a blockchain-based payment token backed by a basket of financial assets, such as U.S. dollars and Euros. It was developed by the Libra Association headquartered in Switzerland, initiated by Facebook. The public and government had a controversial discussion about the project. Among the respondents, Libra 82% is almost as famous as Bitcoin 85%. In the range of 0 to 10, the respondents' assessment of Libra's credibility is quite low, at 3.48. Nearly one-fifth 19.4% believe that Libra is not trustworthy at all. The majority of respondents 57% will not use Libra for payment, while 12% will definitely and 31% will likely do so (Blockchain Research Lab, 2020).

In terms of interviewees' previous touch points with crypto currencies, there are significant differences in the assessment of Libra's views. Socio-demographic also have an impact: young people with the highest and lowest levels of education, men and respondents tend to report higher levels of trust and willingness to use Libra. In accordance with income class, we did not find a significant impact on Libra trust, except for the most skeptical of the lowest income group. However, the certainty of answers about future use- whether yes or no- increases as income levels increase. Therefore, the ''possible'' share of answer category decreases as income increases (see Table 3).

Conclusions

The Libra project launch evoked varied responses. For example, the proponents anticipated Libra to remarkably enhance the efficiency of international payment systems as a source of currency competition in line with Hayek's denationalisation of money in overcoming the politico-economic complexities of public and credit money systems. Libra could attain considerable advantages within an international and decentralised financial ecosystem, such as minimising financial transaction costs (remittances) and encouraging financial inclusion for the masses in developing nations. Although Libra could predictably obtain a market capitalisation of $250 billion that reflected Libra as a substantial government bond buyer, the adoption of crypto-currencies lagged due to inherent volatility. For example, most crypto-currencies had an annualised volatility exceeding 100%, whereas most S&P500 firms had an annualised volatility of 10%. In this regard, crypto-currencies considerably failed in value storage, hence resulting in a second wave of digital coins (stablecoins), including Facebook´s Libra. Unlike conventional crypto-currencies (Bitcoin), Facebook´s Libra was not universally accessible. Although ‘wholesale crypto-currency’ involved Libra, Libra ‘currency’ relied on the underpinning currency definition. It was suggested that Libra be categorised as money based on the three money objectives: 1) exchange medium, 2) account unit, and 3) value storage. On another note, Libra might instigate illegal activities and terrorism compared to other crypto assets following potentially-large user numbers. Consequently, regulatory authorities were required to enforce stringent global standards as preventive measures. The demand for Libra could also increase following low transaction fees and the network impacts on high Libra utilisation among Facebook users. Although the project undeniably provided the capacity to integrate inclusive global finances on a large scale, many questions remained unaddressed. Nevertheless, it was assumed that the Libra project would popularise blockchain-based currencies as a catalyst for mass adoption. As the behaviours in response to COVID-19 possibly accelerated cash decline, the Libra system was established with a reserve to promotestability. For every purchased Libra unit, the same amount would be deposited into a bank account. In other words, each Libra unit would be supported by an equivalent dollar in the bank without the mining process in Bitcoin, thus minimising high electricity consumption by the digital coin mining industry. Although decentralisation and data security reflected project priorities under the published white paper, further expansion in technical architecture and data-protection implementation needed close monitoring to assess whether decentralisation and data security were truly ensured. In other words, the factors potentially impacted the success of Libra. Moreover, macroeconomic consequences also needed to be assessed if the project required a holistic evaluation. Thus, the relevant authorities were genuinely perturbed that Libra demonstrated the required scale for an international currency rival without clearly comprehending the probable implications for citizens. Among the respondents, Libra (82%) is nearly pretty much as popular as Bitcoin (85%). In the scope of 0 to 10, the respondents' appraisal of Libra's validity is very low, at 3.48. Almost one-fifth (19.4%) accept that Libra isn’t dependable in any way. Most of respondents (57%) won't utilize Libra for installment.

References

Abraham, L., & Guégan, D. (2020). The other side of the Coin: Risks of the Libra Blockchain.

Alt, R. (2020). Electronic markets on blockchain markets, Springer.

Asean Post Team (2019). Facebook’s Libra is coming. Retrieved from https://theaseanpost.com/article/facebooks-libra-coming

BIS (2019). ‘Big Tech in Finance: Opportunities and Risks, BIS Annual Economic Report, 23 June, Bank for International Settlements, BIS Available from: https://www.bis.org/publ/arpdf/ar2019e3.pdf

Blockchain Research Lab. (2020). Perceptions towards the Digital Currency Project Libra, Report No. 4, Germany. Retrieved from https://www.blockchainresearchlab.org/wp-content/uploads/2020/03/BRL- Report-4-Libra-.pdf

Catalini, C. (2020). Economics of Libra. MIT & NBER. Retrieved from https://cepr.org/sites/default/files/Catalini%20CEPR%20-%20Final.pdf

Chiu, J. & Koeppl, T.V. (2018). The Economics of Cryptocurrencies-Bitcoin and Beyond. Retrieved from https://econpapers.repec.org/paper/qedwpaper/1389.htm

CoinMarketCap.com (2020). Today's Cryptocurrency Prices by Market Cap. Retrieved from

Drishti.com (2019). Retrieved from https://www.drishtiias.com/to-the-points/paper3/libra-3

Schmeling, M. (2019).What is Libra? Understanding Facebook´s Currency, House of finance, Goethe University Frankfurt, Retrieved from https://safefrankfurt.de/fileadmin/user_upload/editor_common/Policy_Center/SAFE_Policy_Letter_No_76.pdf

Libra White paper. (2019). Libra-Concept and Policy Implications (No. 02-19). Wirtschaftswissenschaftliche Diskussionspapiere.