Research Article: 2018 Vol: 22 Issue: 4

The Role of Accounting Auditing In Activating the Control on Earnings Management and Identifying Its Reverse Effects: An Applied Study to a Sample of Iraqi Companies

Nadhim Shaalan Jabbar, University of Al Qadisiyah

Abstract

Due to the importance that net earning represents to the institution related parties, the management uses a kind of deliberate influence and manipulation of declared earnings through the use of real or accounting methods, whether within the framework of accounting standards or principles, in pursuit of achieving certain objectives and desires. Therefore the reliance of the interest-bearing parties on the accounting earning number without taking into account other factors which lead to a reduction in the level of earning quality would lead to irrational decisions due to a bias in the measurement of income by the management. Despite the role that accounting standards can play in reducing earning management behavior, these efforts are limited, requiring revision of certain accounting rules, practices and standards. This is primarily the responsibility of the bodies involved in the regulation and development of these standards. The study aimed to investigate the extent of earnings management practices in Iraqi companies and the risks they entail by identifying the nature of these processes and their indicators, the methods used in their practice and their implications, and highlighting the effective role played by the auditing profession in reducing earning management practices, which helps to improve performance and contribute to the reduction of earning management practices. The Miller Model was used to measure and demonstrate the extent to which Iraqi corporates practice creative accounting methods when preparing their financial statements. Moreover, a number of descriptive statistics methods that are consistent with the model used to measure profit management in the sample companies were used.

Keywords

Ethical Codes, Generally Accepted Accounting Principles, Iraqi Companies.

Introduction

Among the controversial behavioral models are the decisions taken by management to control the accounting information on which the parties interested in economic unity are based. Such decisions may have a positive or negative effect on the net earnings, which may be considered by some as a manipulation of accounting information as long as this behavior is deliberate, while others consider it to be misleading, even if it is immoral, as long as it serves the interests of economic unity. The management's behavior may either reduce income to reduce taxes or increase it to increase the remuneration of board members, or reduce it by lowering it if it is high or increasing if it is low. Although there is a difference in the motives of the management, the behavior of the income effect takes one of the previous trends. This is known as ‘earnings management’. So, earnings management is carried out with the aim of influencing accounting earnings by exploiting some flexibility allowed by accounting policies and personal estimates practices. Therefore, the disclosure of such practices and attempts to highlight their impact on the results of financial and accounting make management take responsibilities for the risks involved in such practices to shareholders, investors and other groups.

Research Methodology

Problem of the Study

Due to the prevailing conditions in the business world and the use of many departments of the Iraqi shareholding companies to polish the financial statements in an effort to improve the financial situation in terms of profitability or financial position to achieve self-objectives, these departments resort to the use of profit management behavior, although they provide short-term benefits to the enterprise. However, they may lead to serious long-term problems, which are reflected in poor operational and economic efficiency of the enterprise. Long-term. Hence, this study seeks to determine the nature of these methods and to indicate the extent to which the external auditors in Iraq have initiated the necessary audit procedures to limit these methods so as to achieve the credibility of the published financial statements (Wild, 2003). Based on the above, the problem of the study is to find answers to the following questions:

1. What are the extent of the Iraqi companies’ practices to earnings management and the realization of the consequences?

2. Do creative accounting methods and procedures affect the reliability of financial statements issued by these companies?

3. Do the external auditors of the Iraqi corporates, during the audit of the data issued by those companies, apply the procedures and tests necessary to detect and limit the effects of creative accounting methods on such data?

The Significance of the Study

The importance of the study stems from the importance of the issue of creative accounting as it represents an important problem, especially in light of the management of companies using their methods to show the result of activity and financial position that achieves its short and long term goals, even at the expense of other categories. This study serves several categories such as investors, analysts, auditors and other categories of society. The study focused on the adoption of the method of analysis of financial reports issued by the sample companies, and the auditors' reports on these companies for three economic sectors (industrial, agricultural and commercial) following Miller Modal to measure and reveal the extent of the practice of Iraqi companies. Creative accounting methods when preparing their financial statements. Some statistical methods that best fit the modal of the analysis, such as central tendency, dispersion measures, standard deviation, and variant coefficient were used to compare two sets of data in sense that the measures of central tendency are not sufficient; the two arithmetic mean groups may have the same but differ in the degree of dispersion. Consequently, the results of this work will provide important information to the users of the accounting information and keep them away from the effects of such practices (Hassen, 2014).

The Hypotheses of the Study

In light of the study problem and its objectives, the following hypotheses can be formulated:

H1: Iraqi companies practice earnings management when preparing and presenting financial statements.

H2: There is an effective role of accounting auditing in detecting and disclosing the violations that fall under the concept of earning management practices and determining the negative consequences thereof.

The Objective of the Study

The research objectives can be summarized as follows:

1. To clarify the motives of the managements’ use of creative accounting methods and their impact on the reliability of accounting measurement, and also to demonstrate the extent to which Iraqi companies practice the conduct of profit management in the preparation of published financial statements issued by those companies

2. Highlighting the effective role played by accounting auditing profession in reducing earnings management practices, and presenting various mechanisms and policies that help to improve performance and thus contribute to the reduction of earnings management practices.

The Limits of the Study

The sample includes four Iraqi mix public corporations whose accounts are subject to the control and audit of the Financial Control Bureau and from different economic sectors (industrial, agricultural and commercial). The years (2012-2014) were selected for the availability of the required data. The years (2012-2014) were exclusively chosen because the most recent data of the companies are completely applicable in these years. Otherwise, the researcher would have chosen the last recent three years.

Theoretical Framework

Earnings Management Concept

Determining the scope and dimensions of different earnings management activities requires defining the concept of earnings management. Therefore, the accounting literature has listed many definitions of the earnings management conduct:

1.“Earnings management is the conversion of financial accounting figures from what they actually are to what the company's owners desire by taking advantage of existing rules and/or ignoring some or all of them (Yadav et al., 2014).

2. Demerens and others view earnings management as “using the flexibility available in accounting within the regulatory framework to manage, measure and present accounts so that they give priority to the benefit of the individual and not the users (Demerens et al., 2013)”.

According to (Shah, Butt and Tariq, 2011), earnings management indicates the knowledge to influence the figures disclosed, so that instead of showing the actual performance or position of the firm, it reflects what management wants to show to stakeholders.

From what has been stated above, we can say that earnings management "is a term that reflects the process of management intervention in the field of accounting measurement and disclosure in order to increase or decrease the declared earning number to reflect the desires and interests of the management rather than a reflection of the real economic performance of the company. This means that earnings management indicates practices that reflect management's desire to achieve its predefined objectives of showing the desired earnings number within the flexibility available to it for selection in accordance to the Generally Accepted Accounting Principles (Barth, 2014).

Earnings Management Techniques

There are many techniques used by the department to effect accounting numbers, and earnings management techniques can be categorized into three basic groups as follows:

First Group

Including the techniques that exploit the flexibility of GAAP such as: the choice among stock valuation methods, the choice between inventory depreciation methods, the freedom to exercise certain estimates and judgments, etc., thus called ‘earnings management within the limit and scope of GAAP’. According to researchers “the flexibility afforded by GAAP to choose between methods, accounting alternatives and personal appraisals of certain elements of the financial statements is intended to give companies the opportunity to prepare financial statements in a way that reflects their true economic performance to the maximum extent possible. But, that flexibility is seized by the administration to manipulate the declared earning number”( Bauwhede & Willekens, 2003).

Second Group

Including techniques that violate GAAP and include fraudulent operations and thus called ‘earnings management outside the scope of GAAP’. These techniques are often used by companies that have previously managed their earnings by exploiting the flexibility found in GAAP. Examples of such techniques are recognition early revenue is recognized as revenue when goods are shipped (Bortoluzzo, Sheng & Gomes, 2016).

Third Group

This group includes real operations aimed at influencing the declared earning number, which is called ‘real earning management (REM)’. Examples of real earning management are: managing optional expenses as research and development (R & D) costs, and choosing the timing of selling some of the company's assets.

Motivation of Earnings Management

There are many motives that urge management to practice earnings management to influence the declared earning number to achieve the target earning. Some of these motives make the management increase the earnings achieved, including reducing them. In order to give a clear picture of these motives, the most important ones be addressed below:

Financial Market Motivations

Companies managements attempt to manage the earnings of their companies because the decisions of investors and creditors affected the earning disclosed. Earning management occurs because of a variety of different motives, the most important of which is the influence on the stock market, the earning margin announced has an impact on the market value of the company (Jackson and Pitman, 2010). Market prices and returns are factors affecting the management's preference for the accounting methods and policies used to influence the declared earning figure. The management can influence stock prices by increasing current earnings, avoiding loss and maintaining earnings in subsequent years and not reducing them. Therefore, the companies’ earnings retreat negatively affects the prices of its shares, whereas the contrary necessarily leads to lower prices, which is why the managements resort to the practices of managing the earnings of companies listed in the financial markets (Darskuviene, 2010).

Contractual Motivations

The agency theory describes the company as a set of contractual relationships, and its existence is achieved through one or more of the contract agreements, and arises a conflict of interest between the management, shareholders and creditors, resulting in multiple contractual costs such as costs of control by the owner on management behaviour, which are borne by the administration to reduce conflicts of interest. Accordingly, contracts are used to reduce the adverse effects of conflicts of interest between management and shareholders, shareholders and creditors.

Major Shareholders Motivation

The concentration of ownership in the hands of a few major shareholders may affect the management of the company to adopt the methods and policies that lead to increased earnings to cover the leakage of the resources of these companies and their assets to the hands of these most controlling shareholders (Lybaert, 2012).

Miscellaneous Motivations

Taxation Motivation: The taxes imposed on corporate earnings rely directly on accounting figures, prompting management to choose alternative methods and policies that reduce earning. The company that uses earning reduction is motivated by paying less taxes, as well as storing earnings in booming years, In order to increase these earnings in bad years.

Political and Legislative Motivations: The taxes imposed on corporate earnings rely directly on accounting figures, prompting management to choose alternative methods and policies that reduce earning. The company that uses earning reduction is motivated by paying less taxes, as well as storing earnings in booming years so as to increase these earnings in the bad years (Falkenbach, 2010).

Granting Bank Loans Motivations

The management may utilize earnings management practices as a mask for its poor performance problems or to present unreal and financial statements more effective than reality to obtain loans from banks. Many commercial banks set a set of criteria to assess corporate performance as a step prior to making loans to these companies, as resorting to earnings management practices will positively affect the decision-making process by granting such loans (Yuliansyah, 2015).

It is clear from the above that there are many motives that stimulate managements to follow earnings management practices by adopting alternative accounting methods and policies that achieve their objectives and in accordance with the circumstances surrounding them, and that some of these motives motivate the management to increase the earnings achieved whereas some others to reduce these earnings to certain level. Also, some other motives instigate the management to prevent in annual earnings fluctuations. In other words, there is a conflict between these motives, which drives the managers of companies to balance and match these motives and goals in order to achieve their greatest benefit to consistent with their interests and goals. Fraudulent practices used by the department can be summarized as following Table 1:

| Table 1 TYPES AND TECHNIQUES OF EARNINGS MANAGEMENT | ||

| No. | Earnings Management Practice | Earning Management Technique |

| 1. | Earnings management practices for revenue recognition | 1. Timing of revenue recognition: The following aspects of manipulation can be limited to: • Recording registration of revenues for the goods of the Secretariat. • Modifying the terms of sale of original agreements confidential. • Amplifying sales with post-sales revenue and financing benefits. 2- Recording fake revenues from counterfeit sales. 3. Recording revenues in excess of their value. |

| 2. | Earnings management practices for expenses | 1. Capitalization and deferral of expenses. These practices include : • Recording certain operating expenses for the current period as fixed assets. • Reducing the amortization of certain fixed assets that are depreciated by way of revaluation, in order to overestimate the value of these assets at the end of the period. • Charging for fixed assets on another asset with a lower depreciation rate and longer amortization period. • Charging some of the expenses of contracts closed during the current period on other contracts are still under implementation. 2. Overvaluation of ending inventory. This includes: •Non-reducing the value of the loss and damage of the goods from the value of the ending inventory. •Re-packaging damaged and stagnant goods and valuing them as valid ones. •Conducting fake transfers from the original stores to external stores to cover the deficit in the amount of inventory. •Receiving goods from suppliers at the end of the period, inventorying them and evaluating them in stock, even though they are not recorded in the books as purchases, and not recording the amount of credits due to suppliers in the party of liabilities. 3. Manipulation of the composition and use of allocations of expected liabilities. This includes the following: • Overvaulting the provisions in accounting periods in which the corporation earns high earnings or decreasing the value of provisions in periods of small earnings or losses. • Utilization of provisions, such as the use of provisions from prior periods to cover operating expenses for the current period. •Non- recording the permanent decline in the value of fixed and intangible assets, overstatement of intangible assets and recognition of intangible assets in contravention of international accounting standards such as recognition of non-purchased goodwill or making unjustified changes in the amortization methods used to reduce these assets in addition to the manipulating the common depreciation ratios (Mertens, 2010). |

| 3. | Earnings management practices for non-cash transactions and the transactions under special conditions. | 1. Non-cash transactions: In some cases, the company carries out non-cash exchanges in which goods and services are offered in exchange for other goods and services without payment or cash collection of the total value of the goods and services exchanged. International accounting standards require that such transactions be recorded at fair value. Services are traded in a well-known and stable market where it is difficult to determine their fair value, which creates room for manipulation by management. 2. Transactions under special conditions: Some companies sell their products to customers in return for their commitment to purchase goods from these customers. When the sale is made, the revenue is recognized immediately even though the sale was suspended on the condition that the company bought from the customer and therefore the revenue was not realized at the time of sale. |

| 4. | Earnings management practices for merger | Earnings managements practices related to mergers can be summarized as follows: 1 - Manipulation of the evaluation of the assets of the merged institution: The management of the acquirer manipulates the assessment of the assets of the merged company either by overestimating their fair value or by recording them at their carrying amounts without verifying that they are at fair value. 2. Manipulation of Merger provisions: The merger process is usually accompanied by the incurring of expenses incurred by the merging company to achieve technical integration. These expenses are estimated and the value of the asset is recognized at the time of consolidation. In subsequent accounting periods, the required technical works are carried out and their cost is recorded against the value of the component provisions. Estimating the value of the provisions when they are formed and then reduced in subsequent accounting periods and recording this decrease as earning or using these provisions to cover the normal operating expenses in order to improve the level of earnings after the merger. |

| 5. | Earnings management for disclosure | The administration uses fraud in the preparation of the financial statements, especially the income statement. The fraud in the income statement includes the steps taken by the administration to deliver the earning power to different income levels differently from the original form. Management can place in the report non-recurring gains as other income, it is a non-operating expense. These practices have apparent levels of operating income higher than the real operating income, although this does not affect net final income. |

| 6. | Earnings management for contingent liabilities. | Contingent liabilities are those potential obligations which are not conditionally repayable on a given date. However, upon the fulfillment of the conditions specified in its contract, the liabilities become actual obligations and payable in due time, such as: leases, financing, interest rate and exchange rate hedging contracts. The company may invest alone or with third parties in companies with a special purpose. These transactions result in actual liabilities and contingent liabilities to a company with a special purpose. However, the ultimate responsibility for these obligations lies with the company (the main company). |

From the literature review we can see that the management utilizes real and non-realistic methods to achieve its objectives, but it prefers to manage earnings using accounting methods, since managing earnings by manipulating real activities may lead to reduced cash flow and value of the company. The management is not willing to sacrifice the present value of cash flows and this can be avoided using accounting methods.Earnings management practices are not only reference to the flexibility afforded by GAAP but may also arise from accounting disinformation activities in selecting accounting policies and methods from outside GAAP.

Methods Used to Detect and Eliminate Earnings Management Practices

Earnings management practices overlap significantly in accounting work and application, and evidence of their existence is not easy and requires convincible standards. Many researchers have put warning signs or a number of steps that can be followed by the auditor. Mohanram (2003) has identified two main methods, with a number of steps, of disclosing earnings management practices. The first method is descriptive based on accounting analysis, and the second method is based on optional accruals. The following is an explanation of the two methods:

Disclosure of Earnings Management Descriptively (Accounting Analysis)

This method encompasses five necessary steps that must be taken by a financial analyst or auditor to detect the existence of earnings management practices in companies:

1. Determining the basic accounting policies of the company and the industry to which it belongs, as the determination of these accounting policies allows the auditor or financial analyst to focus on areas where the probability of manipulation is significant.

2. Assessing the accounting flexibility available to the company, i.e., how flexible is the management of the company to choose its accounting policy. For some companies, the flexibility available to them is very limited because of the limitations by GAAP, whereas some others may have considerable flexibility, therefore, knowing the flexibility used by companies managers, whether the companies are conservative or not, allows us to know the extent to which earnings management practices are used. . Consequently, the rate of the earnings management methods and steps used in conservative accounting is greater than that of illegal accounting.

3. Assessing the accounting strategy of the company by showing how different it differs from the accounting strategy of its competitors, and showing whether the accounting policies and estimates are realistic in the past and to determine the extent of change in accounting policies and the impact of that change (Brüggemann, 2013).

4. Identifying the red flags in the financial statements, although the presence of one or several points does not necessarily mean anything negative, but the presence of these points raises the need for further scrutiny and confirmation, and the most important of these points are:

a. Changes in accounting unexplained policies.

b. Unjustified earnings increase such as increased earnings through sale of assets.

c. Increasing the gap between the declared net earnings and the net earnings for income tax purposes.

d. Unexpected write-offs of significant assets, or an unexpected decrease in value.

e. Changing the external auditor frequently

f. The opinion of the conservative auditor.

Disclosure of Earnings Management on Test Basis (Optional Accruals)

In this part, detecting earnings management is based on following some statistical means and methods. The researcher will test some statistical models to see which one is suitable for this purpose.

1. Coefficient of variation Method: This method is statistically based on comparing income variance with sales variance to determine whether the company is smoothing its income or not, and the most famous models that used this method:

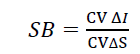

Eckler’s (1997) Model

It can be reached through the following equation:

(1)

(1)

Where:

SB = Earnings management index by income smoothing.

CVΔI= Coefficient of variation for the income change.

CVΔS= Coefficient of variation for the sales change.

If the value of SB is greater than one, the company is classified as a company that does not manage its earnings, but if SB is equal to or less than one, it is classified as a practice to manage its earnings. Through this model, it can be observed that there is no link between the income smoothing and its causes. It is noted in this model that it does not link smoothing of income and its causes. Therefore, this model is not useful for this purpose.

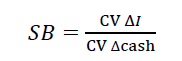

Lewis and Chaney’s (2001) Model

In this model, the researchers replaced the operational cash flows instead of the sales in the previous model. Income became a linear function of operational cash flows and any change in these cash flows resulted in a similar change in income. The model was therefore used to measure the coefficient of variation change Income and a coefficient of variation change in operating cash flows through the following equation:

(2)

(2)

Where:

Δcash = Coefficient of variation change in operating cash flows.

If the value of the index is less than one, it is evident that the management uses earnings management to manipulate its earnings. Whereas, if the index value is greater than one, it is evidence that the management does not conduct earnings management practices.

2. Accruals Methods: The statistical models and indicators are divided according to the method into nonoptional and optional accruals:

Models focused on the calculation of gross accrual and its division into optional and non-optional accruals. Gross accruals are defined as the non-cash portion of income and are measured by the difference between income on a cash basis and income on accrual basis. Gross accruals are composed of:

a. Non- optional accruals: They represent the portion of the accrual that which the management cannot control them.

b. Optional accruals are those which the management can control them by the increase of decrease, and is calculated by subtracting the non-optional accruals from the gross accruals. The following are the most popular statistical models developed by researcher to calculate the accruals:

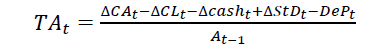

Healy’s (1985) Model

Healy attempted to estimate the optional accrual (representing the management’s intervention) as the difference between the gross and the non-optional accrual (which is the result of the company's activity) by the following equation:

1. Calculation of the total accruals according to the balance method:

(3)

(3)

Where:

TAt = total accruals for the last year t

ΔCLt = the change in current liabilities in year t

Δcash t= the change in the cash and the cash awards in the year t.

ΔStDt = Change in accounts payable in current liabilities for year t.

DePt = depreciation and depletion of intangible assets for year t.

At-1= total assets for the year preceding the year t.

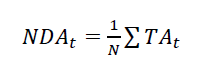

2. Calculation of non-optional accruals which represent the accounting mean of the total accruals during the period in which they are measured and according to the following equation:

(4)

(4)

Where:

NDAt= non-optional accruals for year t.

N = years number for the measurement period (time)

At= total accruals for year t

3. Calculating the optional accruals by subtracting their amount from the total amount of the accruals as follows:

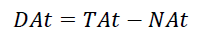

(5)

(5)

Where:

DAt= Optional accruals for year t.

TAt= Total accruals for year t.

NAt= Non-optional accruals for year t.

Models Focused on Long -Term and Short-Term Accruals

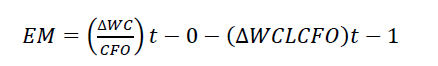

Recently, other models have emerged to predict earnings management focused on shortterm accruals (working capital accrual). Researchers shows that the total accrual consists of a long-term accrual (such as depreciations and deferred taxes) and short-term accrual which is revealed by the changes in receivables, changes in inventories, changes in creditors, accrued liabilities, changes in accrued taxes and changes in components of other current assets and liabilities. Accordingly, the accrual affects certain balances in the balance sheet and is reflected in current assets or liabilities. Therefore, the extent to which the management is able to recognize short-term earnings manipulation can be determined by changing the elements of current assets and liabilities. The components of current assets and liabilities are the components of the working capital (current assets and current liabilities). Miller (2007) has developed a ratio of the change in working capital as an exposed component of manipulation and cash flow from operational activities as a non-manipulative element. If the company is not involved in earnings management practices (Desai, 2015). This relationship is marked with consistency, and its ration is called ‘Miller’s ratio’. Miller’s ratio can be used to detect the manipulation of earnings. The value is zero if there is no earning manipulation. Otherwise, the value shows a number other than zero and it is calculated according to the following equation:

(6)

(6)

Where:

ΔWC= Change in net working capital.

CFO= Net cash flow from operating activities.

t-0= Current year.

t-1=Previous year.

The above means that whenever the ratio of Miller is less than zero (negative or positive), this indicates that there is a manipulation of the earning figure based on the accrual basis.

Field Study

The Sample of the Study

For the purpose of testing the hypotheses of the research, the sample included is composed of four Iraqi mix public corporates whose accounts are subject to Federal Audit Bureau supervision .The sample also includes economic sectors with different activities (industrial, agricultural, commercial). In order to achieve the objectives of the research and collect the necessary data objectively and impartially, the researcher observed the analysis of the financial statements of the companies and the sample of the research and the reports of the auditors that belong to the companies for the years (2012-2014). These periods have been selected because they are the only recent years in which the corporates full financial data are available and applicable to access. Otherwise, the research would last recent three years of for analyzing the corporates data. Additionally, the researcher resorts to mathematical and statistical methods of data analysis to detect the practices of earnings managements among the corporates, categorizing these corporates into earning managements practitioners and non-practitioners. In order to avoid mentioning the names of these companies based on the desire of their departments, numbers were assigned dividing them into three economic sectors as shown in the following Table 2:

| Table 2 DISTRIBUTION OF THE SAMPLE OF THE STUDY BY THEIR ECONOMIC SECTORS |

|||

| Sample No. | Economic Sector | Sample Category | Sample Activity |

| 1 | Commercial | Public | Provide the need for mills of production requirements. |

| 2 | Agricultural | Public | Provide seeds of agricultural crops of all kinds. |

| 3 | Industrial | Mix Public | Production of various types of men's, women's and boys' wear. |

| 4 | Industrial | Mix Public | Manufacture of auto parts, supplies and tools for cars, machinery and equipment. |

Mathematical and Statistical Methods

1. The researcher has adopted the Miller Model to measure quantitative earnings management practices since this modal is one of the most recent and efficient models used for detecting earnings management practices. Moreover, the Miller Model is used so as to avoid any possible potential defects or conflicts which might be caused in case of using other models.

2. A number of descriptive statistics methods have been used that are consistent with the model used for measuring earnings management in the research sample companies classifying them into earnings management companies and others that do not practice earnings management. Among the statistical methods used are:

? Within the measures of central tendency, the arithmetic mean was used to analyze the data and to determine the extent to which the companies conducted the research sample to manage profits.

? Within Dispersion measurements, standard deviation and variant coefficient were used for the purpose of comparing two sets of data. The measures of central tendency are not enough for the comparison because two groups may have the same arithmetic mean but they differ in the degree of dispersion.

Testing the Hypotheses of Research

H1: Iraqi companies exercise earnings management when preparing and presenting financial statements. To prove this hypothesis, the Miller model was used to measure the extent to which Iraqi companies practice to manage earnings, which can be calculated according to the following equation:

(7)

(7)

Where:

EM= Earnings management.

ΔWC = Change in net working capital.

CFO = Net cash flow from operating activities.

t-0 = Current year.

t-1= Previous year.

In light of the results of the earnings management index (EM), the company can be classified as either managing its earnings or not. If the value of EM is zero, the company is classified practicing earnings management, but if EM differs from zero (positive or negative), the company is classified as earnings management practicing company. The following Tables 3-9 illustrate the calculation of the earnings management index (EM) for the sample research and as follows:

| Table 3 THE WORKING CAPITAL CHANGE IN COMPANY NO.1 |

||||

| Year | Current asset in IQD (1) |

Current Liabilities in IQD (2) |

Working capital in IQD (3) |

Change in Working Capital |

| 2012 | 104909763344 | 102064519692 | 2845243652 | - |

| 2013 | 119796584467 | 112184769313 | 7611815154 | 4766571502 |

| 2014 | 132461606955 | 122184728586 | 10276878369 | 2665063215 |

| Table 4 THE APPLICATION RESULTS OF MILLER MODEL FOR COMPANY NO.1 |

||||||

| Earnings Management Indicators EM (6-3) (7) |

2013 | 2014 | ||||

| Change in Net Working Capital/ Net Cash Flow from Operating Activities/IQD (?WC / CFO ) t-1 (5/4) (6) |

Net Cash Flow from Operating Activities CFO (5) |

Change in Working Capital ?WC (4) |

Change in Net Working Capital (?WC/ CFO) t-0 (2/1) (3) |

Net Cash Flow from Operating Activities CFO (2) |

Change in Working Capital ?WC (1) |

|

| 0?0681 | 0,25710 | 18537263250 | 4766571502 | 1890 , 0 | 14096191247 | 2665063215 |

* Change in working capital for 2013 = working capital for 2013 - working capital for the year.

* Change in working capital for 2014 = working capital for 2014 - working capital for the year 2013

| Table 5 THE WORKING CAPITAL CHANGE IN COMPANY NO.2 |

||||

| Year | Current asset in IQD (1) |

Current Liabilities in IQD (2) |

Working capital in IQD (3) |

Change in Working Capital |

| 2012 | 135153435354 | 101147524960 | 34005910394 | - |

| 2013 | 138717765623 | 92419757537 | 46298008086 | 12292097692 |

| 2014 | 148051292549 | 92928643229 | 55122649320 | 8824641234 |

| Table 6 THE APPLICATION RESULTS OF MILLER MODEL FOR COMPANY NO. 2 |

|||||||

| Earnings Management Indicators EM (6-3) (7) |

2009 | 2010 | |||||

| Change in Net Working Capital/ Net Cash Flow from Operating Activities/IQD (?WC / CFO ) t-1 ( 4/5 ) ( 6 ) |

Net Cash Flow from Operating Activities CFO (5) |

Change in Working Capital ?WC (4) |

Change in Net Working Capital (?WC/ CFO) t-0 (2/1) (3) |

Net Cash Flow from Operating Activities CFO (2) |

Change in Working Capital ?WC (1) |

||

| 1 , 3483 | 1 , 8956 | 6484233778 | 12292097692 | 0?5473 | 16122243427 | 8824641234 | |

| Table 7 THE WORKING CAPITAL CHANGE IN COMPANY NO.3 |

||||

| Year | Current asset in IQD (1) |

Current Liabilities in IQD (2) |

Working capital in IQD (3) |

Change in Working Capital |

| 2012 | 2234967242 | 1605350140 | 629617102 | - |

| 2013 | 774748898 | 475621126 | 299127772 | - 330489330 |

| 2014 | 7820653834 | 6744574441 | 1076079393 | 776951621 |

| Table 8 THE APPLICATION RESULTS OF MILLER MODEL FOR COMPANY NO. 3 |

||||||

| Earnings Management Indicators EM (6-3) (7) |

2013 | 2014 | ||||

| Change in Net Working Capital/ Net Cash Flow from Operating Activities/IQD (?WC / CFO ) t-1 ( 4/5 ) ( 6 ) |

Net Cash Flow from Operating Activities CFO (5) |

Change in Working Capital ?WC (4) |

Change in Net Working Capital (?WC/ CFO) t-0 (2/1) (3) |

Net Cash Flow from Operating Activities CFO (2) |

Change in Working Capital ?WC (1) |

|

| 0 , 1505 | 0 , 2834 | 1166123608 | 330489330 | 0 , 4339 | 1790377636 | 776951621 |

| Table 9 THE WORKING CAPITAL CHANGE IN COMPANY NO.4 |

||||

| Year | Current asset in IQD (1) |

Current Liabilities in IQD (2) |

Working capital in IQD (3) |

Change in Working Capital |

| 2012 | 921519361 | 149547160 | 762972201 | - |

| 2013 | 608482278 | 147592029 | 460890249 | - 302081952 |

| 2014 | 1236030635 | 336743014 | 899287621 | 438397372 |

Following Miller’s model of statistical analysis, the researcher processed and analyzed the data of each company from the period 2012-2014, and the results were as shown below in Table 10:

| Table 10 THE APPLICATION RESULTS OF MILLER MODEL FOR COMPANY No. 4 |

|||||||

| Earnings Management Indicators EM (6-3) (7) |

2003 | 2014 | |||||

| Change in Net Working Capital/ Net Cash Flow from Operating Activities/IQD (?WC / CFO ) t-1 ( 4/5 ) ( 6 ) |

Net Cash Flow from Operating Activities CFO (5) |

Change in Working Capital ?WC (4) |

Change in Net Working Capital (?WC/ CFO) t-0 (2/1) (3) |

Net Cash Flow from Operating Activities CFO (2) |

Change in Working Capital ?WC (1) |

||

| 0,3087 | 156131569 | 156131569 | 302081952 | 1 , 6260 | 269602671 | 438397372 | |

From the above Table 11-13 we can note the following:

| Table 11 SUMMARY OF THE MILLER’S MODAL APPLICATION RESULTS FOR EACH COMPANY |

|||

| Company | (?WC / CFO ) t-0 | (?WC / CFO ) t-1 | Earnings Management Indicators EM |

| 1 | 0.1890 | 0.2571 | 0681 , 0 |

| 2 | 0.5473 | 1.8956 | 1,3483 |

| 3 | 0.4339 | 0.2834 | 1505 , 0 |

| 4 | 1.6260 | 1.9347 | 3087 0, |

| Table 12 SORTING THE COMPANIES ACCORDING TO THEIR PRACTICES OF EARNINGS COMPANIES |

||

| Company | Earnings Management Indicators | Sorting |

| 2 | 1 , 3483 | 1 |

| 4 | 0, 3087 | 2 |

| 3 | 0 , 1505 | 3 |

| 1 | 0 , 6810 | 4 |

| Table 13 THE RESULTS OF THE DESCRIPTIVE ANALYSIS TO THE COMPANIES (SAMPLE OF THE STUDY) |

||||

| Number of Company | Type of Company | Arithmetic Mean EM |

Standard Deviation EM |

Variance Coefficient EM |

| 2 | Public | 0 , 7082 | 9052 , 0 | 1 , 2781 |

| 2 | Mix | 0 , 2296 | 0 , 1118 | 0 , 4869 |

| 4 | Overall | 0 , 3512 | 0 , 4957 | 1 , 4114 |

1. The above results show that the companies in the research sample practiced earnings management in preparing and presenting the financial statements through the intended intervention in the accounting and external reporting to affect the accrued earnings. The arithmetic mean of the EM index under the Miller’s model is reached to (0.3512), the standard deviation is reached to (0.4957), and the coefficient of variation is (1.4114).

2. The above results show that public companies are the highest in earnings management practices. The arithmetic mean of the EM index is (0.7082), the standard deviation is (0.9052) and the coefficient of variation is reached to (1.2781), while the joint stock companies ranked as the second in earnings management practices with arithmetic mean of (0.2296), the standard deviation is (0.1118), and the coefficient of variation is reached to (0.4869).

3. There is a difference in the extent to which the management of these companies to manage earnings, as the value of the index of the earnings management under the Miller model is ranged between (0.0681 - 1.3483).

Based on previous results, it is possible to say that the phenomenon of earnings management exists in Iraqi companies, as it can be explained by the desire of the management to reach a target level of earnings through deliberate intervention in accounting and external reporting to affect the realized gain.There are differences in the extent of the practice of these companies to manage earnings from one company to another and from one type to another ,and thus this verifies and approves the validity of the first hypothesis which indicates that Iraqi companies practice earnings management when preparing and presenting financial statements for several reasons such as for financial and administrative incentives which represent a motive for the managements to practice earnings management or to achieve personal advantages by increasing the management incentives.

H2: There is an effective role of accounting auditing in the identification and diagnosis of the observations and violations that fall under the concept of earnings management practices and disclosure of such practices and identify the negative consequences.

In this part, the research analyzes and studies the statements of the annual auditors of the companies (the sample of the study) and examines their remarks analyzed by them under the concept of earnings management. Additionally, the effect of these remarks on the financial statements and the users of the financial statements are shown in the following Table 14:

| Table 14 THE REMARKS REVEALED AND THEIR EFFECT ON THE FINANCIAL STATEMENTS | |||

| No. | Auditor’s Remark | The Effect on Financial Statement | Company |

| 1 | The classification of extraordinary revenues as income related to the current activity. | • Affects the net result of the activity in the production and trading account, profit and loss or current operations account and shows the excess of the first stage (current income minus current expenses) more than it is. • Demonstrates the reserve account more effectively, in a way that would better reflect the company's overall balance sheet and does not reflect the actual performance of the current activity for which the company was established. • Increase cash flows from operating activities because they have included unusual items as relevant ones to the current activity of the company. |

4,2 |

| 2 | Reversing some deposits / revenues on the account of the accidental or miscellaneous revenues without fulfilling the conditions and contrary to the instructions in force. | • Affects the net result of the activity in the calculation of production and trading, profits and losses or the detection of ongoing operations and show the surplus of the second stage more than it is. • Show the reserves account more than it really is, which would lead to the incorrect presentation of the company's balance sheet. • Increase cash flows from investment activities. |

1, 3, 4 |

| 3 | Amplifying the company's sales. | • Affects the net result of the activity in the production and trading account, profit and loss or current operations account and shows the first stage surplus (current income less current expenses) more than it • Show the reserves account more than it really is in a way that will show the balance sheet. |

4,3,2 |

| 4 | Current Expenses Recognition Delay. | • Affects the net result of the activity in the production and trading account, the profit and loss or the statement of current operations and shows the excess of the first stage more than it is due to the decrease in current expenses. • Showing the reserves account more than it really is, in a way that will show the company's balance sheet better and it does not reflect the actual performance of the current activity of the company. • Increase cash flows from operating activities. |

3,2 |

| 5 | Revenue Recognition Delay. | • Affects the net result of the activity in the production, trading, profit and loss account or the current operations statement and shows the unrealized surplus as a result of the decrease in current income. • Show reserves account less than it actually is. • Decrease in cash flows from operating activities. |

1 |

| 6 | Choosing from stock assessment methods that would show it more than it really is. | • Decreasing in the cost of the goods sold in the account of production, trading, profits, losses and distribution, and then increase the net result of the activity (surplus realized) and show it more than it really. • Increasing the cost of inventory more than the fact that the effect of the inventory on the following accounting periods. •Showing the reserves account more effectively and in a way that would better show the company's balance sheet. •Increase in the amount of cash flows from operating activities, as the difference arises from net income earned over the period. |

2,3,4 |

| 7 | Uncalculating depreciation on fixed assets. | • Affects the net result of the activity in the account of production and trading, profits and losses or the disclosure of current operations and showing the surplus realized in the largest of its reality as a result of not accounting for the expiry of the accounting period. • Increase the calculation of reserves. • Affect The net value of fixed assets by less custom formation. |

1,2 |

| 8 | Increasing the cost of the fixed assets has led to increasing the depreciation. | • Affects the net result of the activity in the production and trading account, the profit and loss or the statement of current operations and shows the realized surplus less than the fact due to the increase of depreciation expense relating to the accounting period. •Decreasing the reserves account. • Unrevealing the value of fixed assets in fact because of the increased cost of fixed assets and the formation of a greater allocation of reality. •Low cash flows from investment activities. |

2 |

| 9 | • Calculating Provision for doubtful debts in such a way that it leads to its reduction, Otherwise, no calculation is made. |

• Affects the net income and show it more than the fact during the period as a result of not calculated or reduced. • Show reserves account more than it really is. • Increase the net balance of debtors and this effect is reflected on the balance in the first period of the following accounting period. |

3,2,4 |

| 10 | •Stopping some production lines and calculating their deprecation calculate. |

•As a result of this stop, the company incurred fixed costs related to the loss of lines and wages of workers in these lines in addition to indirect industrial costs in all details and the inability of the company to separate the cost of these lines separately and then determined to get rid of those burdens due to the interruption of work of these lines, Its activity and showing the surplus achieved less than the truth. • Decreasing reserves account. • The net value of fixed assets decreased as a result of a larger provision. |

1 |

| 11 | •Unreflecting the calculation of projects under implementation on the fixed assets account. |

Affects the net result of the activity in the production and trading account, the profit and loss or the statement of current operations and shows the realized surplus less than the fact due to the increase of depreciation expense relating to the accounting period. •Increase of the reserves account. •Low cash flows from investment activities. |

1 |

| 12 | •Uncalculating the annual amortization amount on the account of the differed income expenses. |

• Affects the net result of the activity in the production and trading account, the profit or loss or the statement of current operations and shows the excess realized more than the fact that no expense is incurred for the accounting period. • The inclusion of a project account under construction with the value of suspended and managed buildings from previous years has not been transferred to fixed assets. This means that the balance of the assets is reduced as it was during that period. • An increase in the calculation of reserves. • Low cash flow from investment activities. |

1 |

| 13 | •Calculating the annual amortization amount on account of deferred revenue expenditure. |

•Affects the net result of the activity in the production and trading account, profits and losses or the statement of current operations and shows the surplus realized by the most of the fact as a result of not calculating the expense of the deferred income expenses relating to the accounting period. • Increase the calculation of reserves. • The net value of fixed assets (balance of deferred revenue expenditure) is not reduced. |

1 |

| 14 | •Debt Write-Off |

•Impairment of doubtful debts. • Affects the net result of the activity in the account of production and trading, profits and losses or the detection of ongoing operations and showing the surplus realized less than the fact as a result of the increase in expenses. • Reduced balance of debtors. • Cash flows from operating activities are reduced by the decrease in the balance of debtors. |

3 |

| 15 | •An amount is calculated on account of capital losses without a formal document supporting this action. |

• Affects the net result of the activity in the production and trading account, the profit and loss or the statement of current operations and shows the unrealized surplus less than the fact that this amount is fixed at the expense of capital losses. • Show reserves account less than real. • Low cash flows from investment activities. |

3 |

| 16 | •The company’s treatment to the difference in the assessment of its foreign currency cash position (the difference between the effective exchange rate and the exchange rate under the CBI bulletin of the same date) by subtracting it from the reserve account. |

• Affects the net result of the activity in the production and trading account, the profit and loss or the statement of current operations and shows the result of the activity greater than the fact that the difference in the valuation of its foreign currency cash is not accounted for on the expense account. • Show the reserves account less than the reality in addition to showing balance sheet of the company is not true. |

|

| 17 | •Lack of an accurate costing system to allocate costs to the cost center. |

• The absence of a system for calculating the costs of finished or incomplete products will affect the cost of the goods sold, whether in excess or decrease and thereby affect the net result of the activity, as this will allow the management to increase or decrease the result of the activity. • The absence of a costing system, whether a real cost system or a standard cost system, results in poor control over cost elements, which leads to the determination of product costs as agreed, and hence the lack of a means of control and identification of deviations. |

2 |

| 18 | •Financial investments are not valued at the end of the financial year. |

• The net result of the Company's activity is greater or less significant than that for not offering valuation losses or adding investment valuation gains. • Showing reserves account more or less than their reality. |

2,3,4 |

| 19 | •The Company does not pay the amounts due to it to related parties such as the Ministry of Defense, the General Authority for Taxes, etc. |

• The company does not pay its taxes to the related parties. This means that the profits shown in the financial statements do not reflect the actual reality of the company's activities. The company does not have sufficient funds to pay the amount. These profits were shown in order to maximize the amounts paid to managers, Including realized profits or revenues during the period. |

1,2 |

| 20 | •Unsupporting some of the debit balances and credits shown in the Company's records by third parties. |

• The lack of support for some of the debit balances and credits shown in the Company's records by the other parties, whether by increasing or decreasing, will affect the net result of the activity. This will allow the management to increase or decrease the result of the activity in the production, trading, The current operations, as the management department deems fit. • Failure to show the company's balance sheet as it is by manipulating its city and creditor balances as the management wishes (Matar, 2006). |

2 |

Based on what has been mentioned above, it has become clear that:

1. Some of earnings management practices, as shown above, lead to an increase in realized profits, which is the most comprehensive in the research sample companies, and some of them lead to a reduction of these profits to a certain level, in the sense that there is a conflict between these practices, which makes the management in companies to balance and adapt between these practices and their objectives and in order to achieve the greatest benefit to them, and consistent with their interests and personal goals.

2. There is a difference in the means and methods used to manage profits, due to the different flexibility available to management in the use of accounting and operating methods and techniques.

3. The most commonly used and influential method in the earnings management of the research sample companies is the management's use of operational methods and means and the classification and manipulation of unusual paragraphs to influence the amount of earnings. This is because these methods are not disclosed in the financial statements and thus cannot be observed easily compared to accounting methods, means and other procedures.

4. The report of the auditor (Federal Audit Bureau) has been disclosed with the creation of the importance and relative importance of the impact on the financial statements, as the Office of Financial Control has a positive role and vital in determining the management practices in the earnings management ,as this was disclosed through the clarifications, observations and reservations contained in the reports of the Office of Financial Supervision for the years subject of the analysis, as its reports on the financial statements of the companies subject to control and audit for the mentioned years are conservative, pointing out many irregularities that would affect the financial position and the activity result of the company by violating companies' laws and related regulations.

It is possible to say that there is a difference in the methods and methods used to manage profits in the sample companies, due to the different flexibility available to management in the use of accounting and operating methods and methods. The most prevalent method is the use of management methods and methods.

The auditor plays an important role in giving credibility and credibility to the data contained in the financial statements by expressing a neutral technical opinion on the fairness and credibility of such lists. The role of the auditor in disclosing management practices in managing profits depends on the quality of the auditor's professional performance. Undoubtedly, the Federal Financial Control Bureau has played a positive and vital role in identifying and diagnosing the observations and violations that fall under the concept of earnings management practices, which may affect the financial statements, which mislead the users of these lists and reduce them, which reflects the quality of the professional performance of the auditor in the Control Bureau Financial statements. These practices were disclosed through clarifications, observations and reservations included in the reports of the Board for the years of the analysis, as the reports of the Office of Financial Supervision on the financial statements of the companies. Thus, the second hypothesis of the study which states ‘There is an effective role of accounting auditing in detecting and disclosing the violations that fall under the concept of earning management practices and determining the negative consequences thereof’ has been validated and proven.

Conclusions and Recommendations

Conclusions

In the light of previous analyzes of the financial statements and testing of the hypotheses of the study, the following results were reached:

1. Earnings management is a policy adopted by the management through which deliberate intervention within GAAP in the accounting measurement and disclosure process to influence the reported profit amount to achieve management objectives and in a manner that creates a different impression of the actual performance of the company to users of financial statements.

2. Earnings management processes significantly affect the credibility of financial statements and make them misleading and lose quality characteristics, objectivity and credibility, which affects the decisions of users of those financial statements.

3. There is a number of motives that encourage the management to follow the methods of earnings management, some of the motives are related to self-management interest in particular, such as increased incentives and administrative rewards and maintain administrative positions, and others such as the impact on stock prices and political costs.

4. There are many methods that can be used in earnings management practices that can take three basic dimensions: there are practices that are carried out through accounting decisions; the second type of practice is through operational decisions; the third dimension is the classification of certain expenditure items and income as ordinary or extraordinary items depending on their impact on income.

5. Earnings management practices are unacceptable conducts because they lead to: the erosion of ethical standards, the achievement of personal benefits to the administration and the misuse of the performance of the company.

6. Iraqi companies practice earnings management in the preparation and presentation of the financial statements through deliberate intervention in accounting measurement and disclosure processes within the limits of generally accepted accounting principles or outside of them to influence declared earnings.

7. There is a variation in the means and methods used to manage earnings, and the most widely used and influential method in the research sample companies is the use of operational methods and classification of unusual paragraphs in order to influence the profit. This is because these methods are not disclosed in the financial statements and are therefore not easily observable as compared to accounting methods, practices and other procedures.

8. The existence of an inverse relationship between earnings management practices adopted by the Iraqi companies and the level of performance of the accounting audit process. The auditors' keenness to perform the audit process at a high level of performance significantly contributes to the reduction of the earnings management practices adopted by the administration aimed at manipulating the financial statements and misleading its users.

Recommendations

In the light of previous findings, the study recommends the following:

1. Despite the role of international accounting standards and local accounting rules in reducing the behavior of earnings management, this role remains limited, which necessitates reconsidering some accounting rules and practices and focusing on the need to oblige companies to apply accounting policies away from opportunism.

2. The need to improve the transparency of financial statements and raise the quality of financial reports, through adequate and fair disclosure and reducing the level of information asymmetry between management and users of financial statements and then provide confidence in those statements.

3. The need for the accounting units to rehabilitate their revenues and accounting systems in line with international and local accounting standards, because they have the ability to characterize accounting policies and determine their significance in terms of the outcome and financial position of the accounting unit.

4. The need to abide by the moral and behavioral aspect and follow up the commitment of the departments of the companies concerned to the relevant professional standards of conduct

5. Professional organizations should inform the users of the financial statements about the effects and impact of the earnings management practices on their decisions and work on developing mechanisms to limit these practices within the companies, which can only be achieved by all the concerned parties.

6. The process of combating earnings management practices is difficult and complex. Therefore, those who are interested in this field should constantly seek to disclose and attempt to limit these practices. The vigilance and efficiency of auditors in discovering profit management practices is the most important and powerful means to combat and limit such practices.

7. The necessity to increase the effectiveness of the professional organization of the profession of accounting and auditing and take the necessary actions to develop and promote the competencies of its members, especially those who conduct audits of corporate accounts to detect profit management operations and then reduce them.

8. The Board of accounting and control standards in the Republic should consider the behavioral and ethical aspects of measurement process and financial reporting due to their significant impact on the accuracy of accounting information stated in the financial statements.

9. It is necessary to emphasize reasonable professional care by the auditors when auditing the financial statements and expressing independent professional opinion at a level satisfactory to all parties related to the published financial statements.

References

- 1">Barth, M.E., Landsman, W.R., Young, D. & Zhuang, Z. (2014). Relevance of differences between net income based on IFRS and domestic standards for European firms. Journal of Business Finance & Accounting, 41(3-4), 297-327.

- 2">Bauwhede, H.V., Willekens, M., & Gaeremynck, A. (2003). Audit firm size, public ownership, and firms' discretionary accruals management. International Journal of Accounting, 38(1), 1-22.

- 3">Bortoluzzo, A.B., Sheng, H.H., & Gomes, A.L.P. (2016). Earning management in Brazilian financial institutions. Revista de Administração, 51(2), 182-197.

- 4">Brüggemann, U., Hitz, J.M., & Sellhorn, T. (2013). Intended and unintended consequences of mandatory IFRS adoption: A review of extant evidence and suggestions for future research. European Accounting Review, 22(1), 1-37.

- 5">Darskuviene, V. (2010). Financial Markets. Leonardo Da Vinci Program Project, 1-140. https://doi.org/10.16475/j.cnki.1006-1029.2015.01.007

- 6">Demerens, F., Pare, J.L., & Redis, J. (2013). Investor skepticism and creative accounting: The case of a french sme listed on Alternext. International Journal of Business, 18(1), 59-80.

- 7">Desai, H., Hogan, C.E., & Wilkins, M.S. (2015). The reputational penalty for aggressive accounting: Earnings restatements and management turnover. The Accounting Review, 81(1), 83-112.

- 8">Falkenbach, H. (2010). Motivation and market selection of international investors in finnish property market. Nordic Journal of Surveying and Real Estate Research, 7(71), 15-29.

- 9">Hassen, R.B. (2014). Executive compensation and earning management. International Journal of Accounting and Financial Reporting, 4(1), 84-105.

- 10">Jackson, S.B., & Pitman, M.K. (2010). Auditors and Earnings management. The CPA Journal, December.

- 11">Lybaert, N., Jans, M., & Orens, R. (2005). Provisions a tool for earnings management, (28th Edition). Annual EAA Congress, Goteborg.

- 12">Matar, M. (2006). Modern trends in financial and credit analysis: Methods, Tools and Practical Uses. Dar Wael Publishing, Amman.

- 13">Mertens, D.M. (2010). Research methods in education and psychology. Sage Publications.

- 14">Michael, A., Giacomino, Don., & Bellovary, J.L. (2007). Earnings Management and Its Implications. The CPA Journal, Publication of The New York State Society of CPAS, August.

- 15">Mohanram, P.S. (2003). How to manage earnings management. Accounting World (ICFAI), the Institute of Chartered Financial Analysts of India.

- 16">Shah, S.Z.A., Butt, S., & Tariq, Y.B. (2011). Use or abuse of creative accounting techniques. International Journal of Trade, Economics and Finance, 2(6), 531-536.

- 17">Wild, J.J., Subramanian, K.R., & Halsey, R.F. (2003). Financial Statement Analysis (8th Edition). New York: McGraw - Hill Companies.

- 18">Yadav, B., Kumar, A., & Bhatia, B.S. (2014). Concept of Creative Accounting and Its Different Tools. Al International Journal of Management and Social Sciences Research, 3(2).

- 19"> Yuliansyah, Y., & Razimi, M.S.A. (2015). Non-financial performance measures and managerial performance: The mediation role of innovation in an Indonesian stock exchange-listed organization. Problems and Perspectives in Management, 13(4), 135-145.