Research Article: 2020 Vol: 24 Issue: 6

The Role of Computerized Accounting Information Systems (CAIS) In Providing A Credit Risk Management Environment: Moderating Role of IT

Adel M. Qatawneh, Al-Zaytoonah University of Jordan

Abstract

Study aimed at examining the influence of CAIS on building a healthy environment for credit risk management through the mediating role of IT infrastructure. Quantitative approach was used. A questionnaire distributed on (76) financial managers within banks, credit companies, and financial services in Jordan. Questionnaire consisted of statements that related to variables of CAIS (speed, compatibility with IFRS, low Error Margins, efficiency, classification, and precision) and variables of credit risk management principles (CRMP) (Establishing an appropriate credit risk environment, operating under a sound credit granting process, Credit administration, measurement and monitoring process and Ensuring adequate controls). Results of study indicated that IT infrastructure mediates the relationship between CAIS and CRM, and the fact that CAIS can help in creating a healthy environment for CRM through paving the way for (appropriate credit risk environment) and (Credit administration, measurement and monitoring process) based on its characteristics of CAIS, the relationship was highlighted through the variance relationship which was scored through by variables through analysis. Study recommended that financial institution should be more aware of CAIS due to its ability to understand and examine circumstances around the client and their eligibility to be granted credit. Also, increasing awareness of banks and financial institutions to the importance of IT infrastructure and its role in the overall organizational approach in managing and dealing with credit related risks and failures.

Keywords

CAIS, Credit Risk Management Principle, IT.

Introduction

Credit activities resemble the core of financial institutions' work as it depends on relending deposits with the aim of making a profit (Annor & Obeng, 2017; Prot, 2014). The focus on credit risks began after the great depressions during the 40s, which witnessed a lot of fraud cases due to publishing financial information about the shareholding organizations. Consequently, the concept of credit risk management appeared focusing on adopting approaches to avoid fraud, failure and different financial setbacks (Karim, 2019). Credit risk is one of the most important issues that the Basel Committee on Banking Supervision focused on, as it is related to the risks of the loan and advances portfolio and the financing portfolio of banks. Credit risk management aims to contribute to achieving the highest return on credit at the lowest acceptable level (Taiwo, 2016).

Technology managed to shift manual to automated as a way to decrease effort, time cost and improve accuracy.

Literature Review

Computerized Accounting Information System (CAIS)

Technology has also invaded such systems and turned them into CAIS, which are a form of accounting information system that work in accordance with generally accepted accounting principles (GAAP) in order to present accounting information based on users' requirements (Taiwo, 2016). Computerized accounting information system works in general within an operating environment that consists of two constituent’s software and hardware. The software is the systems and applications that are used, while the hardware is the device, computers, machines and users who use such applications and systems (Al-Wattar et al., 2019).

Such systems are now used in many organizations as an approach to tackle the financial data of an organization and present high-quality financial reports. Advance technology led organizations to pay extra attention to financial reports and the fact that such reports have to be intact with what constitutes a high-quality financial report (Trabulsi, 2018).

According to Ahmad and Al-Shbiel (2019), AIS and computer systems are complementary to each other that each one completes the other in the way information and data are processed and presented. Alewine et al (2016) noted that CAIS is based on the actual processes of AIS but it mainly depends on utilizing the computer as a user for such data not the human as the traditional approach. CAIS contains 3 main actions: input, processes and outcomes, which are the basic constituents of computers. As for Habiba et al (2019); Bataineh (2018) and Isa (2017), CAIS is considered to be a part of the conventional AIS processes but it is done through computers and other technological applications that are meant to manage finances of an organization in less time and more accuracy.

Bansah (2018) and Ili? & An?eli? (2017) argued that adopting CAIS is as beneficial as AIS in its traditional form, however, it presents more accurate information at the end but still the human factor is considered to be a major aspect in its processes.

Credit Risk Management

The world now is a small village, all windows are open for different adventures, jeopardies and opportunities, and this had led to the state where risks are more apparent than ever before as well as chances of development. The financial sector in each country isn't limited to the boarders of the country, nowadays, banks and financial institutions are dealing with each other through different affiliations, partnerships and deals which ends up for the benefit of the two side. This managed to increase the jeopardy on banks to fail in managing their financial issues, especially when it comes to credit and loans. From that point, there appeared the concept of credit risk management as an approach to present risk management strategies for banks in case of financial failure (Asfaw & Veni, 2015).

Generally, credit risk refers to the possibilities of financial failure due to creditors' inability to commit to debit payments (Crombie, 2013). According to Lapteva (2009), credit risk refers to "the risk of a credit institution suffering losses due to default, late or incomplete execution of the debtor financial obligations before the credit organization in accordance with the terms of the contract".

Credit risk management raised as financial practices have the ability to manage process and tackle the financial failure through managing capital assets of the bank or financial institution (Bülbül et al., 2019). Basically, risk management is defined as "the identification, assessment, and prioritization of risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability or impact of unfortunate events or to maximize the realization of opportunities" (Togtokh, 2012). So, credit risk management is the strategies adopted when a debtor, counterparty or a borrower within a financial organization fails to meet the financial obligation in accordance with the agreed-on terms (Pambekti et al., 2020).

Principles of Credit Risk Management

According to Giudici et al (2019), the financial crises which was followed by credit crises have grabbed the attention to credit risk management as an approach adopted to fight and control negative impacts of such crises in a way that help the bank get back on its feet and tackle the ramifications of risks associated to credits. Credit risk management is based on aspects that needs to be followed in order to make the concept of credit risk as a reality, such aspects include:

1. Create a suitable environment for credit risk which appears in three different levels among them is a) responsibilities of management to adopt a strategy or a policy to manage credit risks and evaluate this strategy on regular bases for any flaws or faults, b) the management should adopt and apply reforming policies and important regulations that control granting credits, and to follow clients and evaluate their status in dealing with the bank, and c) the management is required to promote for the adopted strategies and all interested employees should have full awareness of such strategy (Disemadi et al, 2019). Samorodov et al (2019) argued that creating a suitable environment means that executive board should make sure that the adopted strategy is being applied and all policies are being embraced by the financial institution, such activities include procedures of limiting, measuring, and controlling credit risks and adopt the needed policies and executive measures in order to cover all activities of the bank. On the other hand, Al-Rahahleh et al (2019) stated that the financial institution; through the management, should work on identifying possible sources of credit risks through focusing on types of financing that may end up in failure, also the bank has to make sure that making decisions on new and novel activities increase the chances for risks, so examining such activities and understanding its approach is the best way to identify its risks.

2. Work according to sound procedures and controls for granting credit, banks have to work through sound procedures in order to grant credits including identifying the markets and sectors that are targeted and scan the status of clients in a clear and precise way to make sure that they have all the needed back up in case of any failure of inability to commit to terms (Pambekti, 2020). Also, Elhassouni (2020) argued that banks should embrace controls over the process of granting credits that identifies the main aim of credit, its size, and the type of credit in addition to the sources of covering the terms associated with the credit. Witzany (2017) stated that the client is the main source of a sound credit environment, it means that the bank should have neutral and strong information about clients that help in making sound decisions for granting a credit, such information include the reason for credit, sources of payments and their regularity, financial status of client and its sensitivity to economic fluctuation, in addition to clients' experience in dealing with projects which they are asking credit for.

3. Finding good credit management, measurement and follow-up procedures, the banks has to establish a well-built managerial system to manage credits and follow up credit related decisions and their execution according to conditions and controls set by the strategy (Disemadi, 2019). Konovalova et al (2016) argued that the managerial system has to be efficient in order to be able to deal with and avoid credit related risks, this means:

a. Efficiency and effectiveness of the bank internal operations in fields of following the fulfillment of documents, contracts, and guarantees including all credit terms in order to avoid shortage or deviation in execution.

b. Depend on precise and timeliness of a well-built computerized programs

c. Make sure that the IT infrastructure is able to assist programs adopted

d. Commit to procedures and policies adopted

e. Have an experiences department of financing and accounting

f. Depend on a safe system to preserve documents and files

4. Verify the adequacy of credit risk control, in this sense, the bank should depend on systems that are able to predict/evaluate risks and present reports in an independent and neutral way (Samorodov et al, 2019), also, banks should follow the soundness of credit granting procedures and its compatibility with terms and conditions present in banks' strategies (Voloshyn, 2020). Anghelache and Bodo (2018) added that making sure that all controls are adequate means to adopt a system that is able to take all corrective procedures in case of risks in a sooner time, this means that the bank should built its credit decisions based on systems that are able to notify interested department in case of any mistakes, gaps or faults within the protocol of granting a credit, this way, there would be a chance to predict risks and work towards avoiding them or even prepare the interested party of their existence in order to prepare themselves to tackle it.

Model and Hypotheses

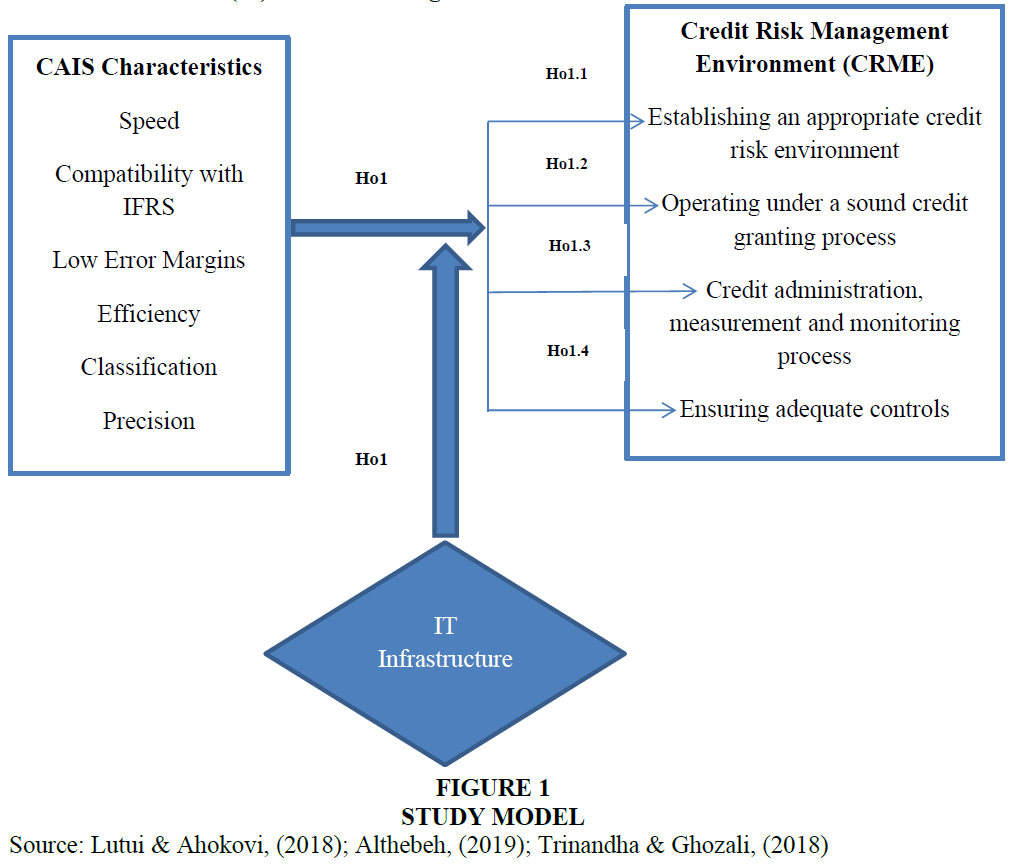

The interaction of independent variable (CRME) and dependent variable CAIS in relation with mediation factor (IT) are shown in Figure 1.

Aim and Objectives

Current study aimed at examining the influence of CAIS characteristics in providing a wellbuilt credit risk environment through the mediating effect of IT infrastructure through the following objectives:

1. Highlight the basic characteristics of CAIS and examine their influence on credit risk management.

2. Examine the role of CAIS in creating a friendly environment for credit risk management.

3. Read the extent of Jordanian banks and financial institutions awareness of CAIS and their role in creating a well-built credit risk management strategy.

4. Examine the meditating role of a string IT infrastructure and realizing a well-built credit risk management environment.

Hypotheses Development

Based on above model, hypotheses of study were developed as according to following:

Main Hypothesis

H: CAIS characteristics provide a well-built credit risk management environment through the mediating role of IT infrastructure

Sub-Hypotheses

H1: CAIS characteristics provide a well-built credit risk management environment.

H2: IT infrastructure mediates the relationship between CAIS characteristic and principles of credit risk management.

CAIS plays a role in operating, processing, storing, transferring, and extracting data and information for the benefit of the organization as according to (Taha, 2017). So, CAIS works up the data, process it and present it to users based on their needs and nature of accounting data that they have asked for at the right time with the right content in order to take the needed decisions (Taha, 2017). The relationship between CAIS and credit risk management lies in the ability to CAIS to present a database that registers the same statement only once in order to serve different uses and different applications (Metwali, 2016). According to Metwali (2016), this may lead to decrease the need for multiple document forms that contains the same statement and especially the data that are connected to operations. This idea is needed in both financial and managerial accounting at the same time.

From another perspective, computerized AIS applications and uses may help in avoiding errors and mixing in credit statements due to its ability to process those data automatically and not manually; this guarantees harmony, speed, comprehension and error free results (Lapteva, 2009). In addition to that, Togtokh (2012) argued that having all accounting processes done through a computer and based on precise and well-built input helps in avoiding errors and stays away from human mistakes which also works on preventing fraud, and human intervention due to the total dependence on automated processing.

Lutui & Ahokovi (2018) also added that depending on automated processes in accounting work may help in extracting the most suitable information based on the precision of the input, this makes it more dependent on the users' experience in entering precise data in terms of input, processing, and extracting results. This can be seen as an efficient approach in which the bank is followed and guaranteed that it is operating under a sound credit granting process. Althebeh (2019) stated that the ability of computers to process huge amounts of data utilizing highly complicated formulas and logical steps makes it more reliable to present precise and efficient information which can't be reached manually. Trinandha & Ghozali (2018) seemed to agree with the same idea arguing that CAIS has the ability to apply reciprocal distribution in distributing the costs of a large number of productive service centers that serve each other and this can't be done manually unless the number of service centers is small.

Polo & Oima (2013), on the other hand, saw that the increase interest of individuals to deal with credits have also increased the need for a well-built automated system that enables the presentation of precise information that are usable by decision makers, and on which the credit related decisions will be done giving the precise information that are available, this is a way in which adequate controls are being monitored and applied on the credit granting process in a way that guarantees a healthy environment for the bank for credit risks management.

Isa (2017) stated that banks' use of CAIS won't be of great importance unless it was supported with the well-built IT infrastructure that includes devices, programs, software, network and users. The well-built infrastructure guarantees the flow of data and information and it helps in focusing on presenting data that are precise and reliable to make critical decisions which is important in terms of managing credit risks due to its ability to ensure credit administration, measurement and monitoring process. Metwali (2016) even argued that this infrastructure help to guarantee a healthy environment for credit risk management, which includes the best control over regulations and laws, in addition to presenting detailed statements of creditors' situation with the bank.

Althebeh (2019) stated that many banks are now depending on CAIS in order to make use of its applications in measuring credit risks; those systems are now important and irreplaceable especially after technological enhancements have reach many high-end milestones in the field of technological AIS around the world. Authors added that measuring credit risks through CAIS mainly comes in following the degree of committing to regulations and procedures in granting credits, in addition to following to what degree the credits' circumstances are applicable to international accounting standards like IFRS.

Crombie (2013) added that banks are exposed to failures if their management fails to employ CAIS and use them to serve and support their own operations in making investment decisions in general and decisions to grant credit in banks in particular, and most of the failures in the field of credit are due to problems in measuring credit risk, which represents a situation facing banks at the present time making them strict in granting credit. While Taha (2017) argued that employing CAIS is influential on the bank's credit risk as it increases the reliability of accounting information.

Methods

Quantitative approach was used to collect data and accomplish the objectives of this research. A questionnaire was utilized to collect the primary data. The questionnaire contained two main sections including demographic characteristics (age, gender, experience and qualifications) and the other section contained statements that are related to variables of study including the independent variable (CAIS) and the dependent variables (Credit Risk Management) and the mediating variable (IT infrastructure).

Population of study consisted of all managers and/or those who represent them of financial management and accounting departments in addition to internal auditors within banks, credit companies, and financial services in Jordan. A random sample of (86) financial managers was chosen to represent study sample (Creative Research Systems", 2020). Participants were exposed to the self-administered questionnaire; after application process researcher was able to retrieve (76) properly filled questionnaires which indicated a response rate of (88.3 %) as statistically accepted.

Descriptive statistics, multiple and simple regression and other statistical tests of AMOS were used. Cronbach alpha is used to test the reliability of the questionnaire, as shown in the following Table 1; Alpha value for each variable is acceptable since it is greater than the cutoff value 0.60:

| Table 1 Reliability Test | |

| Alpha value | |

| Establishing an appropriate credit risk environment | 0.9 |

| Operating under a sound credit granting process | 0.874 |

| Credit administration, measurement and monitoring process | 0.922 |

| Ensuring adequate controls | 0.911 |

| Speed | 0.894 |

| Compatibility with IFRS | 0.722 |

| Low Error Margins | 0.84 |

| Efficiency | 0.85 |

| Classification | 0.867 |

| Precision | 0.914 |

| IT Infrastructure | 0.922 |

Analysis and Discussion Demographics

Table 2 above presented sample demographics characteristics, results showed that the majority of sample were males (76.3%) aged between 37-42 years old (34.2%) of the sample, and who held a BA degree (53.9%) with an experience that exceeded 10 years (42.1%) of total sample.

| Table 2 Sample Characteristics According to Variables | |||||

| Gender | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Male | 58 | 76.3 | 76.3 | 76.3 |

| Female | 18 | 23.7 | 23.7 | 100.0 | |

| Total | 76 | 100.0 | 100.0 | ||

| Age | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | 25-30 | 6 | 7.9 | 7.9 | 7.9 |

| 31-36 | 19 | 25.0 | 25.0 | 32.9 | |

| 37-42 | 26 | 34.2 | 34.2 | 67.1 | |

| +43 | 25 | 32.9 | 32.9 | 100.0 | |

| Total | 76 | 100.0 | 100.0 | ||

| Educational Level | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | BA | 41 | 53.9 | 53.9 | 53.9 |

| MA | 26 | 34.2 | 34.2 | 88.2 | |

| PhD | 9 | 11.8 | 11.8 | 100.0 | |

| Total | 76 | 100.0 | 100.0 | ||

| Experience | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | 1-3 | 5 | 6.6 | 6.6 | 6.6 |

| 4-6 | 11 | 14.5 | 14.5 | 21.1 | |

| 7-9 | 28 | 36.8 | 36.8 | 57.9 | |

| +10 | 32 | 42.1 | 42.1 | 100.0 | |

| Total | 76 | 100.0 | 100.0 | ||

Questionnaire Analysis

Statements of questionnaire were analyzed using SPSS (Table 3). The results showed positive attitude for the presented statements given that all statements' mean scored higher than mean of scale 3.00. Means in Table 4 showed a positive overall attitude from respondents regarding the presented variables and sub-variables below as all variables' means scored higher than mean of scale 3.00 reflecting a positive attitude from respondents in answering the questionnaire. This can be seen as a good indicator that reflects major results, basically, the positive attitude from respondents in answering statements of questionnaire indicated their full awareness and understanding of each statement and its suitability to the main aim of study, and for the positive attitude of variables; it indicated that respondents understood and had full awareness of what each variable meant and its role in the accounting department and managed to tackle each variables in a way that reflected the level of their understanding.

| Table 3 Respondents’ Trend for Crme, Cais and IT | |||||

| N | Min. | Max. | Mean | Std. Dev. | |

| Principles of CRM | |||||

| Establishing an appropriate credit risk environment | |||||

| Computer managed credit gives indications on banks' ability to take risks an hold responsibility | 76 | 1 | 5 | 3.8 | 1.083 |

| Depending on CAIS in managing credits gives highlights on the status of banks credit portfolio | 76 | 1 | 5 | 3.92 | 1.105 |

| There would be a chance through CAIS to indicate types of credit for each client according to sectors and geographical locations | 76 | 1 | 5 | 3.71 | 1.105 |

| Utilizing computerized AIS can help to establish maximum limits for granting credit and credit pricing principles. | 76 | 1 | 5 | 3.97 | 1.083 |

| Computer-based AIS can help to give loan-to-assets ratio or the ratio of each type of credit to assets | 76 | 1 | 5 | 3.8 | 1.096 |

| CAIS help in highlighting the relationship between the volume of credit and the value of collateral | 76 | 2 | 5 | 4.25 | 0.785 |

| CAIS present data that are compatible with IFRS principles which preserve a good environment for managing credit risks | 76 | 1 | 5 | 3.95 | 1.005 |

| Operating under a sound credit granting process | |||||

| CAIS can present precise information to evaluate risk connected to creditor and the ability to classify them according to bank internal system | 76 | 3 | 5 | 4.17 | 0.737 |

| With adequate input, CAIS can match between creditors' legal eligibility to take responsibility of credit | 76 | 1 | 5 | 4.13 | 0.929 |

| The history presented by CAIS can offer appropriate information that are related to creditors' previous connection to financial sector | 76 | 3 | 5 | 4.04 | 0.756 |

| CAIS can predict risks and jeopardies for creditor in accordance with reputation, experience and economic/governmental developments | 76 | 3 | 5 | 4.33 | 0.681 |

| There is a way to measure the extent of creditors' commitment and the suitability of guarantees accepted | 76 | 3 | 5 | 4.34 | 0.703 |

| CAIS has the ability to generate degree of the clients' credit rating which lowers the level of risks | 76 | 3 | 5 | 4.2 | 0.654 |

| CAIS can help to setting limits on the credit that can be granted to equity at the level of customer | 76 | 2 | 5 | 4.34 | 0.758 |

| Credit administration, measurement and monitoring process | |||||

| Internal censorship helps in avoiding different credit risks | 76 | 2 | 5 | 3.89 | 0.988 |

| CAIS can give information that indicate the extent of soundness of credit handling procedures | 76 | 2 | 5 | 4.24 | 0.862 |

| Automated AIS can predict the quality of credit portfolio | 76 | 2 | 5 | 3.97 | 0.993 |

| With proper input; CAIS can indicate the extent of integrity of the credit rating system | 76 | 2 | 5 | 3.92 | 1.03 |

| With a well-built IT infrastructure; the system can uncover credit policies - fiduciary procedures – and credit limits | 76 | 2 | 5 | 3.88 | 0.848 |

| Ensuring adequate controls | |||||

| Different controls are run by CAIS which facilitates | 76 | 2 | 5 | 4.3 | 0.674 |

| Preciseness in CAIS output provide early detection of troubled credit facilities | 76 | 2 | 5 | 3.91 | 0.734 |

| CAIS can appear as a system for dealing with credit files and updating their data and documents | 76 | 2 | 5 | 4.12 | 0.832 |

| CAIS can help to highlight the current status of clients and their credit situation | 76 | 1 | 5 | 4.2 | 0.88 |

| With proper use, CAIS can determine distressed loans and the adequacy of allocations | 76 | 3 | 5 | 4.22 | 0.723 |

| CAIS Characteristics | |||||

| Speed | |||||

| It can provide decision makers information on the spot | 76 | 1 | 5 | 3.84 | 1.096 |

| Delays aren't an option within CAIS | 76 | 1 | 5 | 3.93 | 1.112 |

| Speed gives a chance to decision makers to avoid risks and jeopardies | 76 | 1 | 5 | 3.74 | 1.124 |

| Speed doesn't influence the quality of generated information | 76 | 1 | 5 | 4 | 1.095 |

| Compatibility with IFRS | |||||

| Its compatibility to IFRS lowers the margin of errors and increase accounting processing information | 76 | 1 | 5 | 3.84 | 1.108 |

| Users can run tests to guarantee it meets conditions like testing the maximum credit limit | 76 | 2 | 5 | 4.29 | 0.797 |

| It is built on independent credit review system | 76 | 1 | 5 | 3.99 | 1.026 |

| Low Error Margins | |||||

| There is a high possibility to limit incidents of fraud, manipulation and unintended errors | 76 | 3 | 5 | 4.21 | 0.754 |

| There is no space for editing and changing in the generated data which lowers the margins of errors | 76 | 1 | 5 | 4.17 | 0.929 |

| CAIS are dynamic in its processes and approaches | 76 | 3 | 5 | 4.12 | 0.748 |

| Through monitoring input, the output can reach the highest levels of precision and error free | 76 | 3 | 5 | 4.36 | 0.687 |

| Efficiency | |||||

| CAIS guarantees efficient storage for info and data in accordance with accounting principles | 76 | 3 | 5 | 4.37 | 0.709 |

| It can generate directed information towards certain procedures | 76 | 3 | 5 | 4.22 | 0.665 |

| All used systems are user friendly and can be used by accounting and financial departments | 76 | 2 | 5 | 4.38 | 0.748 |

| CAIS systems are not limited to programmers and developers | 76 | 2 | 5 | 3.92 | 1.004 |

| CAIS is based on multiple systems which gives a chance to mix and match between them to reach the best system to use | 76 | 2 | 5 | 4.26 | 0.87 |

| Precision | |||||

| All generate data are precise and reflects reality | 76 | 2 | 5 | 4.03 | 0.993 |

| The periodical information generated gives an indication of the current status of the bank | 76 | 2 | 5 | 3.96 | 1.038 |

| Realistic and precision of CAIS data help in decision making process | 76 | 2 | 5 | 3.95 | 0.862 |

| CAIS are flexible and able to be developed | 76 | 2 | 5 | 4.36 | 0.667 |

| Total reliance on the accounting equation (total assets = total liabilities + equity). | 76 | 1 | 5 | 3.87 | 0.885 |

| IT Infrastructure | |||||

| All accounting department is connected to reliable servers | 76 | 1 | 5 | 4.08 | 0.977 |

| The bank depends on automated AIS due to its accuracy and clearness | 76 | 1 | 5 | 4.26 | 0.92906 |

| Auditors depend on computerized AIS in order to manage credit data and information screening | 76 | 1 | 5 | 3.82 | 1.104 |

| All CAIS are supported by separated servers to make sure that they are connected all the time | 76 | 1 | 5 | 4.16 | 1.02 |

| Internal auditors are followed and monitored for precise input in order to guarantee precise output | 76 | 1 | 5 | 3.91 | 1.085 |

| IT infrastructure of the organization is always maintained to the best shape | 76 | 1 | 5 | 3.69 | 1.2 |

| There is an ongoing following of developments and enhancements in IT tools and applications by the management | 76 | 1 | 5 | 3.71 | 1.069 |

| Valid N (listwise) | 76 | ||||

| Table 4 Descriptive Statistics of Variables | |||||

| N | Min. | Max. | Mean | Std. Dev. | |

| Establishing an appropriate credit risk environment | 76 | 1.57 | 5.00 | 3.9154 | .82451 |

| Operating under a sound credit granting process | 76 | 3.00 | 5.00 | 4.2218 | .56636 |

| Credit administration, measurement and monitoring process | 76 | 2.00 | 5.00 | 3.9816 | .82635 |

| Ensuring adequate controls | 76 | 2.80 | 5.00 | 4.1500 | .66302 |

| Speed | 76 | 1.00 | 5.00 | 3.8783 | .96393 |

| Compatibility with IFRS | 76 | 2.33 | 5.00 | 4.0395 | .79062 |

| Low Error Margins | 76 | 3.00 | 5.00 | 4.2138 | .64511 |

| Efficiency | 76 | 2.80 | 5.00 | 4.2316 | .63921 |

| Classification | 76 | 2.50 | 5.00 | 4.0724 | .76247 |

| Precision | 76 | 1.00 | 5.00 | 4.0368 | .85023 |

| IT Infrastructure | 76 | 1.00 | 5.00 | 3.8327 | .96225 |

| Valid N (listwise) | 76 | ||||

Hypotheses Testing

H1: CAIS characteristics provide a well-built credit risk management environment (Table 5).

| Table 5 H1 Testing | ||||||||||||||||

| Model Summary | ||||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||||||||||

| 1 | .933a | .870 | .859 | .23761 | ||||||||||||

| ANOVA | ||||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||||||

| 1 | Regression | 26.183 | 6 | 4.364 | 77.295 | .000b | ||||||||||

| Residual | 3.896 | 69 | 0.056 | |||||||||||||

| Total | 30.079 | 75 | ||||||||||||||

| Coefficients | ||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||||||

| B | Std. Error | Beta | ||||||||||||||

| 1 | (Constant) | .383 | .201 | 1.902 | .061 | |||||||||||

| Speed | .096 | .056 | .146 | 1.697 | .094 | |||||||||||

| Compatibility with IFRS | .157 | .089 | .196 | 1.769 | .081 | |||||||||||

| Low Error Margins | .093 | .100 | .095 | .935 | .353 | |||||||||||

| Efficiency | .241 | .100 | .243 | 2.414 | .018 | |||||||||||

| Classification | .301 | .087 | .362 | 3.469 | .001 | |||||||||||

| Precision | .010 | .055 | .014 | .185 | .854 | |||||||||||

Multiple linear regression was used to test above hypothesis, regression coefficient (0.87) reflects high and positive effect between the independent variables and the dependent variable. Also, it was found that the independent variables (CRME) explain 87% of the dependent variable (CAIS). However, F value was significant at 0.05 level, that meant CAIS characteristics provide a well-built credit risk management environment.

H1a: CAIS characteristics provide establishing an appropriate credit risk environment (Table 6).

| Table 6 H1a Testing | ||||||||||||||||

| Model Summary | ||||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||||||||||

| 1 | 0.979a | 0.958 | 0.954 | 0.17639 | ||||||||||||

| ANOVA | ||||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||||||

| 1 | Regression | 48.840 | 6 | 8.140 | 261.634 | 0.000b | ||||||||||

| Residual | 2.147 | 69 | 0.031 | |||||||||||||

| Total | 50.987 | 75 | ||||||||||||||

| Coefficients | ||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||||||

| B | Std. Error | Beta | ||||||||||||||

| 1 | (Constant) | 0.270 | 0.150 | 1.807 | 0.075 | |||||||||||

| Speed | 0.543 | 0.042 | 0.635 | 12.968 | 0.000 | |||||||||||

| Compatibility with IFRS | 0.428 | 0.066 | 0.411 | 6.504 | 0.000 | |||||||||||

| Low Error Margins | -0.024 | 0.074 | -0.019 | -0.329 | 0.743 | |||||||||||

| Efficiency | -0.024 | 0.074 | -0.019 | -0.328 | 0.744 | |||||||||||

| Classification | 0.018 | 0.064 | 0.017 | 0.277 | 0.782 | |||||||||||

| Precision | -0.015 | 0.041 | -0.015 | -0.358 | 0.722 | |||||||||||

Multiple linear regression was used to test above hypothesis, regression coefficient (0.958) reflected high and positive relationship between the independent variables and the dependent variable. Also, it was found that the independent variables explain 95.8% of the variance of the dependent variable. F value was significant at 0.05 level, which meant CAIS characteristics provide Establishing an appropriate credit risk environment.

H1b: CAIS characteristics provide Operating under a sound credit granting process Table 7.

| Table 7 H1B Testing | ||||||||||||||||

| Model Summary | ||||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||||||||||

| 1 | 0.925a | 0.857 | 0.844 | 0.22364 | ||||||||||||

| ANOVA | ||||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||||||

| 1 | Regression | 20.606 | 6 | 3.434 | 68.665 | 0.000b | ||||||||||

| Residual | 3.451 | 69 | 0.050 | |||||||||||||

| Total | 24.057 | 75 | ||||||||||||||

| Coefficients | ||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||||||

| B | Std. Error | Beta | ||||||||||||||

| 1 | (Constant) | 0.669 | 0.190 | 3.531 | 0.001 | |||||||||||

| Speed | -0.100 | 0.053 | -0.170 | -1.882 | 0.064 | |||||||||||

| Compatibility with IFRS | -0.021 | 0.084 | -0.030 | -0.255 | 0.800 | |||||||||||

| Low Error Margins | 0.538 | 0.094 | 0.613 | 5.748 | 0.000 | |||||||||||

| Efficiency | 0.490 | 0.094 | 0.553 | 5.219 | 0.000 | |||||||||||

| Classification | -0.056 | 0.082 | -0.076 | -0.687 | 0.494 | |||||||||||

| Precision | -0.022 | 0.052 | -0.033 | -0.425 | 0.672 | |||||||||||

Multiple linear regression was used to test above hypothesis, regression coefficient (0.857) reflects high and positive relationship between the independent variables and the dependent variable. Also, it was found that the independent variables explain 85.7% in the variance of the dependent variable. F value was significant at 0.05 level, this meant that CAIS characteristics provide Operating under a sound credit granting process.

H1c: CAIS characteristics provide Credit administration, measurement and monitoring process Table 8.

| Table 8 H1C Testing | ||||||||||||

| Model Summary | ||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||||||

| 1 | 0.931a | 0.866 | 0.854 | 0.31539 | ||||||||

| ANOVA | ||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||

| 1 | Regression | 44.351 | 6 | 7.392 | 74.309 | 0.000b | ||||||

| Residual | 6.864 | 69 | 0.099 | |||||||||

| Total | 51.214 | 75 | ||||||||||

| Coefficients | ||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||

| B | Std. Error | Beta | ||||||||||

| 1 | (Constant) | -0.361 | 0.267 | -1.351 | 0.181 | |||||||

| Speed | 0.111 | 0.075 | 0.130 | 1.484 | 0.142 | |||||||

| Compatibility with IFRS | -0.034 | 0.118 | -0.032 | -0.288 | 0.774 | |||||||

| Low Error Margins | -0.003 | 0.132 | -0.002 | -0.022 | 0.983 | |||||||

| Efficiency | 0.193 | 0.132 | 0.149 | 1.459 | 0.149 | |||||||

| Classification | 0.822 | 0.115 | 0.758 | 7.137 | 0.000 | |||||||

| Precision | -0.026 | 0.073 | -0.027 | -0.355 | 0.724 | |||||||

Multiple linear regression was used to test above hypothesis, regression coefficient (0.866) reflected high and positive relationship between the independent variables and the dependent variable. Also, it was found that the independent variables explain 86.6% in the variance of the dependent variable. F value was significant at 0.05 level, that meant CAIS characteristics provide Credit administration, measurement and monitoring process.

H1d: CAIS characteristics provide Ensuring adequate controls Table 8.

| Table 8 H1D Testing | ||||||||||||||||

| Model Summary | ||||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||||||||||

| 1 | 0.814a | 0.663 | 0.634 | 0.40125 | ||||||||||||

| ANOVA | ||||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||||||

| 1 | Regression | 21.861 | 6 | 3.643 | 22.630 | 0.000b | ||||||||||

| Residual | 11.109 | 69 | 0.161 | |||||||||||||

| Total | 32.970 | 75 | ||||||||||||||

| Coefficients | ||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||||||

| B | Std. Error | Beta | ||||||||||||||

| 1 | (Constant) | 0.954 | 0.340 | 2.805 | 0.007 | |||||||||||

| Speed | -0.171 | 0.095 | -0.249 | -1.798 | 0.076 | |||||||||||

| Compatibility with IFRS | 0.255 | 0.150 | 0.304 | 1.700 | 0.094 | |||||||||||

| Low Error Margins | -0.139 | 0.168 | -0.135 | -0.826 | 0.412 | |||||||||||

| Efficiency | 0.305 | 0.169 | 0.294 | 1.808 | 0.075 | |||||||||||

| Classification | 0.420 | 0.147 | 0.483 | 2.868 | 0.005 | |||||||||||

| Precision | 0.103 | 0.093 | 0.132 | 1.111 | 0.270 | |||||||||||

Multiple linear regression was used to test above hypothesis, regression coefficient (0.663) reflected high and positive relationship between the independent variables and the dependent variable. Also, it was found that the independent variables explain 66.3% of the variance of the dependent variable. F value is significant at 0.05 level, that meant CAIS characteristics provide ensuring adequate controls

H2: CAIS characteristics provide a well-built credit risk management environment through the moderating role of IT infrastructure Table 9.

| Table 9 H2 Testing | |||||||||||||||

| Model Summary | |||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||||||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | |||||||||||

| 1 | 0.931a | 0.868 | 0.866 | 0.23199 | 0.868 | 484.901 | 1 | 74 | 0.000 | ||||||

| 2 | 0.962b | 0.925 | 0.923 | 0.17609 | 0.057 | 55.437 | 1 | 73 | 0.000 | ||||||

| 3 | 0.964c | 0.929 | 0.926 | 0.17225 | 0.004 | 4.288 | 1 | 72 | 0.042 | ||||||

| ANOVA | |||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | ||||||||||

| 1 | Regression | 26.097 | 1 | 26.097 | 484.901 | 0.000b | |||||||||

| Residual | 3.983 | 74 | 0.054 | ||||||||||||

| Total | 30.079 | 75 | |||||||||||||

| 2 | Regression | 27.816 | 2 | 13.908 | 448.524 | 0.000c | |||||||||

| Residual | 2.264 | 73 | 0.031 | ||||||||||||

| Total | 30.079 | 75 | |||||||||||||

| 3 | Regression | 27.943 | 3 | 9.314 | 313.914 | 0.000d | |||||||||

| Residual | 2.136 | 72 | 0.030 | ||||||||||||

| Total | 30.079 | 75 | |||||||||||||

The Hierarchal regression test was used to test the second hypothesis and the following was concluded:

We notice from Table 9 the existence of a statistically significant effect of the CAIS characteristics on providing a well-built credit risk management environment, as the value of (R2 = 0.868, p≤0.5). The IT infrastructure variable was added in the second step, and it was found that it added Δ R2 = 5.7% of the total interpretation factor and it is significant value. The interaction between CAIS characteristics and IT infrastructure variable was added in the third step, and it was found that it added Δ R2 = 0.4% of the total interpretation factor and it is significant value. That means CAIS characteristics provide a well-built credit risk management environment through the moderating role of IT infrastructure

After analyzing gathered data, researcher was able to reach the following results:

1. Respondents have the needed awareness regarding credit risk management and the need to follow strict systems that allows management to control credits and avoid failure

2. Employing CAIS has the ability to influence liquidity risks which can predict and notify in case of possible risks among creditors.

3. The existence of CAIS with a financial institution can help in predicting clients who are possible to fall behind in commitments so the bank would take control.

4. Analyzing variables of credit risk management (Establishing an appropriate credit risk environment, operating under a sound credit granting process, credit administration, measurement and monitoring process and ensuring adequate controls) it was found that all variables are influenced by the use of CAIS. The most influencing variable was establishing an appropriate credit risk environment which scored a variance percentage of 95.8%, having this principle to be the most influenced variable of all explains that CAIS with a well structure IT tools and devices can help in providing the financial institution with the appropriate environment that enables it to avoid risks of credit and apply the needed credit risk strategies.

5. In the second rank of influence; there appeared the CRM principle (provide Credit administration, measurement and monitoring process) which scored a variance value of 86.6% as influenced by characteristics of CAIS, this explains the relationship based on the fact that all the presented variable can help the financial institution in providing the needed administration and measurements for the organization to manage risks associated with credit.

It can be seen through analysis that relying on CAIS helped in decreasing liquidity risks through depending on technology, previous studies highlighted how tiring and overwhelming manual accounting work can be but with CAIS and a well-built IT infrastructure following accounting work can be processed easily and on time.

Moreover, CAIS; through speed and efficiency, contributed to following up the urgent changes in management needs, study also showed that by relying on a strong technological infrastructure, accounting information systems have contributed to enhancing their response to changes in the economic environment, which helped decision-makers to alert in the event of any economic change to follow up on clients and focus on the possibility of fulfilling their obligations agreeing with Giudici et al. (2019).

The adoption of credit risk management on technology based on strong foundations has greatly contributed to achieving realism between the organization and the accounting information output and thus increasing the management's ability to assess the situation and take the appropriate decision, in addition to that CAIS’s characterization of precision and the low margin of error have played a major role in reducing the burdens on the organizational structure within the organization by demonstrating the ability of the organization to cover the failure on time as noted to by Samorodov et al (2019( and Al-Rahahleh et al (2019).

The idea of CAIS conforming to IFRS standards enabled the organization to match customer information with the circumstances that could guide the client after granting credit and thus maximizing its ability to study all client activities and his ability to pay obligations which agreed with Althebeh (2019); Elhassouni (2020); Potekhina & Riumkin (2017) when they state that conformity with IFRS standards can help in avoiding risks through comparing and contrasting the adaptability of credit risks to the IFRS standards to what degree they match it.

According to results of study and based on previous literature, accounting information systems, in general, have the ability to influence the process of managing credit risks through monitoring and controlling, which gives decision makers more chance to make right decisions on the spot and avoiding jeopardy as according to results by Apanga et al (2016); Witzany (2017); Feschiyan et al (2017); Isra (2017). As for CAIS, it was found out that it influences credit risk management through measuring liquidity risks and following special standards that are related to guarantees and assurance (Nusa, 2018). In addition to that, CAIS, through precise input, can work on giving information that related to clients' circumstances and their ability to stick to the terms of credit granting. Based on that, it can be said that CAIS, through well-built IT infrastructure, can provide a healthy environment for credit risk management through providing the following:

1. CAIS can monitor and control the conditions and functions of granting, renewing and following credit

2. CAIS have the ability to assess and manage credit risks so that they differ according to the type of credit, type of customer, economic sectors, geographical regions, local or foreign markets, and credit concentrations, and in a manner commensurate with the nature and degree of risk for each type.

3. Given that all the practices of CAIS are automated in nature, they can ensure the target quality level of credit, return and growth, and determine the levels of acceptable risks and their impact on the level of target return and the burden on capital.

4. The adoption of the foundations of CAIS ensures that insurance risk management policy does not conflict with incentive and reward policies.

5. If the inputs are accurate, CAIS is able to simulate policies and implementation procedures related to the identification, measurement, monitoring, and control of credit risk.

6. CAIS ensures that operational procedures are able to cover all aspects of activities and risks, including sectors and target markets, diversification in the credit portfolio, pricing, concentrations, complex and modern products, and early detection and treatment of default cases in accordance with the strategy of the organization and its board.

Conclusion

The objective of this research is to study the effect of CRME on CAIS under IT mediating variable. The questionnaire was used to collect data. The results showed that adopting CAIS that is based on well-built IT infrastructure can guarantee a healthy environment for credit risk management approaches stemming from its characteristics of (speed, compatibility with IFRS, low Error Margins, efficiency, classification, and precision). This influence was shown through analysis and results based on the fact that CAIS can give real-time financial information for decision makers, which enable them to take the right decision at the right time. In addition to that, having a good input paved the way for more precise output from CAIS programs, which also appeared as an approach to examine the surrounding environment of the client and understand their ability to commit to terms launching from their data and their relationship to the bank. The fact that CAIS can give prior data and information works as a prediction tool that notifies the bank in case of high possibility of failure which frames the limits of credit granting to individuals. In general, CAIS as a strategy have become a strategic resource that banks rely on to deal with market conditions when making credit-granting decisions, as banks must determine the degree of credit risk for credit operations that have been granted to clients, before deciding to grant new loans in order to determine the fact of their credit standing.

Recommendations and Practical Implications

Through the results, it can be concluded that CAIS contribute in increasing awareness of banks and financial institutions to the importance of IT infrastructure and how it has the ability to influence the overall organizational approach in managing and dealing with credit related risks and failures.

From that, following recommendations presented:

1. The financial institution should be more aware of CAIS due to its ability to understand and examine circumstances around the client and their eligibility to be granted credit.

2. CAIS proved its accuracy and efficiency to control credit risks, so, financial institution should reply on CAIS generated reports as letters of credit.

3. Management should pay more attention to the technological environment of the bank and especially when updating accounting information systems.

References

- Al Rahahleh, N., Ishaq Bhatti, M., & Najuna Misman, F. (2019). Developments in risk management in Islamic finance: A review. Journal of Risk and Financial Management, 12(1), 37.

- Alhosban, A., & Maqableh, A. (2014). The role of computerized accounting information in product pricing and cost measurement in Jordanian industrial corporations. International Journal of Sciences: Basic and Applied Research, 2(4)

- Althebeh, Z.A. (2019). Impact of accounting information system on reducing liquidity risk in Saudi banks comparative study between Islamic banks and commercial banks. Academy of Accounting and Financial Studies Journal, 23(1), 1-11.

- Anghelache, C., & Bodo, G. (2018). General methods of management the credit risk. International Journal of Academic Research in Accounting, Finance and Management Sciences, 8(1), 143-152.

- Annor, E., & Obeng, F. (2017). Impact of credit risk management on the profitability of selected commercial banks listed on the Ghana stock exchange. Journal of Economics, Management and Trade, 1-10.

- Apanga, M., Appiah, K., & Arthur, J. (2016). Credit risk management of Ghanaian listed banks. International Journal of Law and Management. 58(2).

- Asfaw, A.H., & Veni, P. (2015). Empirical study on credit risk management practice of Ethiopian commercial banks. Research Journal of Finance and Accounting, 6(3)

- Bülbül, D., Hakenes, H., & Lambert, C. (2019). What influences banks’ choice of credit risk management practices? Theory and evidence. Journal of Financial Stability, 40, 1-14.

- Crombie, B. (2013). Principles for the Management of Credit Risk: What has changed since the Great Financial Recession. ???? ????????? ?anadian Institutional Investment Nerwork ?? ???????.

- Dalci, ?., & Tani?, V.N. (2004). Benefits of computerized accounting information systems on the JIT production systems. Çukurova Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 13(1).

- Disemadi, H. S. (2019). Risk management in the provision of people’s business credit as implementation of prudential principles. Diponegoro Law Review, 4(2), 194-208.

- Elhassouni, J. (2020). The implementation of credit risk scorecard using ontology design patterns and BCBs 239. Cybernetics and Information Technologies, 20(2), 93-104.

- Feschiyan, D., & Andasarova, R. (2017). Study of the synergy effect of using accounting information in the process of lending and risk management in banks. Godishnik na UNSS, (1), 5-24.

- Giudici, P., Hadji-Misheva, B., & Spelta, A. (2019). Network based scoring models to improve credit risk management in peer to peer lending platforms. Frontiers in Artificial Intelligence, 2(3).

- Isa, A. (2017). The impact of computerized accounting information system on management performance in public sector in Nigeria: Problems and prospects. International Journal of Multidisciplinary Research and Development, 4(12), 80-83.

- Karim, S. (2019). The Influence of Credit Risk Management Strategies on the Performance of Commercial Banks: A Comparative Case Study of UAE and UK Commercial Banks (Doctoral dissertation, University of Liverpool).

- Konovalova, N., Kristovska, I., & Kudinska, M. (2016). Credit risk management in commercial banks. Polish Journal of Management Studies, 13.

- Lapteva, M. N. (2009). Credit risk management in the bank, letter from the bank of Russia ‘on typical banking risks’. Journal of Economic, 1(2)

- Lutui, R., & Ahokovi, T.A. (2018). The relevance of a good internal control system in a computerized accounting information system. In proceedings ofthe16th Australian Information Security Management Conference (pp. 29-40). Perth, Australia: Edith Cowan University.

- Metwali, S. (2016). Computerized accounting information systems and their role in reducing banking risks: a field study on the Bank of Khartoum, Unpublished MA thesis, University of Nailain, Sudan

- Noor, M.A., Das, P.C., & Banik, B.P. (2018). Impact of credit risk management on financial performance of banks: a study on major state-owned commercial banks in Bangladesh. The Cost and Management, 46(1).

- Nusa, I. B. S. (2018). Effectiveness risk assessment for quality of accounting information system. In International Conference on Business, Economic, Social Science and Humanities (ICOBEST 2018). Atlantis Press.

- Pambekti, G. T. (2020). Credit risk management in financial institution: comparative study in Islamic and conventional banking. EkBis: Jurnal Ekonomi Dan Bisnis, 3(1), 261-273.

- Pirayesh, R., Forouzandeh, M., & Louie, S. I. (2018). Examining the effect of computerized accounting information system on managers' decision-making process. Revista Publicando, 14(1), 68-82.

- Polo, J.O., & Oima, D. (2013). Effect of computerized accounting systems on audit risk management in public enterprises: a case of Kisumu county, Kenya. International Journal of Education and Research, 1(5), 1-10.

- Potekhina, A., & Riumkin, I. (2017). Blockchain–a new accounting paradigm: Implications for credit risk management. Retrieved from: https://www.diva-portal.org/smash/get/diva2:1114333/FULLTEXT01.pdf

- Prot, N.P. (2014). Evolution of accounting equation: Evidence of companies quoted on Dar es Salaam stock exchange-Tanzania. Journal of Finance and Accounting, 1(4), 55.

- Samorodov, B.V., Azarenkova, G.M., Golovko, O.G., Miroshnik, O.Y., & Babenko, M.V. (2019). Credit risk management in the bank’s financial stability system. Financial and credit activity: problems of theory and practice, 4(31), 301-310.

- Samorodov, B.V., Azarenkova, G.M., Golovko, O.G., Miroshnik, O.Y., & Babenko, M.V. (2019). Credit risk management in the bank’s financial stability system. Financial and credit activity: problems of theory and practice, 4(31), 301-310.

- Taha, M. (2017). The relationship between electronic accounting information systems and the degree of bank credit risk (field study on specialized Sudanese banks). Arab Journal of Sciences and Researches Publishing, 2(1).

- Togtokh, E. (2012). Credit Risk Measurement: The Case Study of Mongolian Small and Medium Sized Firms. MA thesis, Charles University of Prague

- Torban, T.K. (2020). Assessment of credit risk management in micro finance institutions: A Case of Adama Town MFIs, Ethiopia. Srusti Management Review, 13(1), 42-53.

- Trinandha, A., & Ghozali, I. (2018). Understanding the Potential Impact of Accounting Information System to Computer Accounting Fraud. International Journal of Engineering Research and Technology, 11(2)

- Voloshyn, I. (2020). What’s Wrong With Modern Credit Risk Management? Available at SSRN 3594596.

- Ware, E. O. (2015). Computerized accounting system an effective means of keeping accounting records in Ghanaian banks: A case study of the Ga Rural Bank. International Journal of Research, 111.

- Witzany, J. (2017). Credit Risk Management. In Credit Risk Management (5-18). Springer, Cham.