Research Article: 2021 Vol: 25 Issue: 2

The Role of Courts and Universities in Activating the Forensic Accounting to Discover Financial Fraud

Haitham Mamdouh Al Abbadi Al- Balqa' Applied University

Badi Alrawashdeh, Arab Open University-Saudi Arabia Kingdom

Mohammed Nadem Dabaghia, Al- Ahliyya Amman University

Riyad Neman Darwazeh, Al- Ahliyya Amman University

Abstract

The objective of this research is to investigate the role of courts and universities to activate the forensic accounting system to discover fraud. The questionnaire was used to collect data. The questionnaire composed of three parts: the first part designed to collect information about the demographic characteristics, the second part designed to collect information about the role of courts to enrich experience in forensic accounting, and the third part about the role of universities to activate forensic accounting. The results showed that the role of courts is very crucial to enrich the experience of fraud crime recorded and the method of fraud used, also the results showed that the universities should introduce specialized courses in forensic accounting and should utilize all experience from other sources to reflect in these courses. The study recommended the establishment of division in courts to record the fraud cases and styles of fraud used consider the privacy of individual and companies, also, the universities should found forensic accounting divisions to introduce specialized course.

Keywords

Forensic Accounting, Integration, Courts, Universities.

Introduction

Forensic accounting knowledge is dependent on accumulative experiences (National Institute of Justice, 2007). This is representing the method that forensic accounting developed to reach advanced stages (Dreyer, 2014). Dreyer (2014) has shown that the reporting of successive stores to discover fraud forms the base to develop the forensic accounting. The authors in forensic accounting have shown that different stakeholders are consider partners to develop forensic accounting (Dreyer, 2014; Krsti?, 2009; Oseni, 2017). In developing countries, the educational system concerned with forensic accounting is considered very important to establish the required experience (Al-sharairi, 2018; Khersiat, 2018; Tawfeeq & Alabdullah, 2013). The issue that should be raised about the bodies responsible for providing of the required experience to activate the role of forensic accounting in discovering fraud. The literature have shown that the auditing offices are part of this experience, the governmental activities, the courts experiences, and the universities (Awolowo, 2019; Imoniana, 2013). In another paper, the role of audit offices and governmental responsibility have been discussed. The current paper will discuss the role of courts and universities in enriching and activating the forensic accounting.

Literature Review

General Literature

The care for forensic accounting experience was raised deeply in developed countries (Dreyer, 2014). The countries with complicated economies started to care to enrich their experience in forensic accounting through the establishment of specialized foundations that care for the collection and arrangement of experience in this field. In USA, FBI started to employ assigned more than 700 specialized accountants in mid of nineteenth century in the Financial Crime Section to care for fraud crimes (Dreyer, 2014). In Nigeria, different commissions were established to concern with fraud crimes (Abdulrahman, 2019). The establishment of such commissions and specialized bodies will facilitate the care for collecting and organizing forensic accounting experiences. These bodies are established as independent ones to have full access for the investigation of fraud crimes. Such bodies can cooperate with courts to figure out the styles of fraud crimes and their classifications and effect on country economy. The other direction employed to care for the investment of forensic accounting experience represented in the universities. In different countries worldwide, the universities realize the importance of this accounting specialty for the local markets (National Institute of Justice, 2007).

These universities offering specialized courses in forensic accounting. The courses concentrate about the methods that can be used to figure out fraud crimes (Ocansey, 2017). Most of universities cares for the application of proper procedures that meet each type of fraud crimes. The students experience in these fields will enrich the capacities to deal with fraud crimes. In Jordan, the Accounting Bureau (2019) is a governmental dependent body used to deal with employees and governmental bodies fraud cases. The methods of Bureau work still requires improvement to cover the governmental work. The techniques and methods used are traditional and depend on individual investigations. On the other hand, the Integrity and Anti-Corruption Commission is another dependent body cares for the discovery of fraud crimes. The efforts of these two bodies is offered through results but the educational efforts are absent in these bodies. Universities care to establish forensic accounting divisions is marginal (Tawfeeq et al., 2014; Tawfeeq & Alabdullah, 2013). In Jordan, the universities are not care for the establishment of specialized divisions for forensic accounting. These results reflect the scattered efforts to fight the fraud crime. The lack of national body to lead these efforts makes it lost through time.

Related literature

Lo et al. (2016) reported that the increase of financial fraud and crimes in the last years increased the demand to have experiences forensic accountants to take their role in detecting fraud and practice their work professionally. They indicated that the forensic accountants should have high skills to test fraud. Most business schools introducing accounting programs seeks to graduate the very skillful students and other basic target for these schools is to integrate the forensic accounting education with these programs. The indicators worldwide show that the demand of forensic accounting is increasing with time. This increase is accompanied with the increase and sophistication the business world witnesses under the technological development used available these days. The response to educate forensic accounting in universities and business schools came to satisfy the increase demand on this education worldwide. The business schools try to introduce specialized courses for undergraduate and graduate programs equally. The study showed that the introduced topics are considered very important for the environment inside China and similarly for the international students who are interested in these programs. The study showed that forensic accounting education has been a growing market with high demand due to the high development in businesses. The suggested courses for forensic accounting by the authors can be very fruitful courses for universities in China and other Asia countries. The responses of students for the suggested program were varied according their interests in the forensic accounting, but in general all of the students show interest of the program of forensic accounting. The authors reported that the courses that are included still requires some addition to make integration for the course list. At the end of the study the authors recommended the importance of planning a forensic program in universities to success the forensic accounting in countries. Kramer et al. (2015) have studied the view of academician and practitioners for the education of forensic accounting considering the increase of schools that offer such education. This study used the survey for data collection. The study was distributed on random sample academicians and practitioners. The total number of academicians was 740, while the number of practitioners was 40 respondents. The questionnaire used five Likert scale variables and univariate analysis to reach the results of this research. The study was conducted in USA and other countries. The sample composed of academicians of different scientific levels, while the practitioners included fraud investigators, internal auditors, law enforcement people, and controllers. The results showed that the different categories of respondents indicated that the demand increase for litigation support, expert witnesses and fraud examination. Concerning the nature of introduction of forensic accounting, the results showed that most of the studied sample agreed to introduce the forensic accounting in a separate courses and the separation of its certificate from other certificates, as well as running doctorate programs for forensic accounting. The introduced courses were suggested to be introduced in the undergraduate level and the graduate level. The study has shown that both academicians and practitioners agreed for most of the subjects introduced by the researchers including: teaching fraud detection methods, asset misappropriation, fraud prevention, fraud investigation methods, corruption and remediation and conflict resolution. The study recommended the well prepared plans for forensic accounting programs to ensure its success in all university levels. Efiong & Leicester (2012) reported that the development of forensic accounting curriculum take place faster in the developed countries compared to the developing ones. Moreover, the testing of these curriculum take place in developed countries to match their needs. The objective of this study was to measure the awareness of forensic accounting students in the undergraduate level for the forensic accounting programs in the developing economies.

The study used Nigeria as a study case. The results of this research have shown that the adoption of forensic accounting courses will improve the students’ capabilities to practice this profession after graduation. The distribution of forensic accounting education would play a crucial role in minimizing the fraud in countries. DiGabriele (2009) has shown that the need of forensic accounting by business, regulatory authorities, government, and courts called the need to add courses of forensic accounting in universities. The offered courses are added to the accounting curriculum in different universities. The author recommended that these courses should be tested to ensure the outcome of these courses and the quality of graduates to ensure effective role in practical fields. Kranacher et al. (2008) have designed a curriculum that can be used to educate the forensic accounting at universities. The planning for guideline of the curriculum should pass in three stages. The first stage is select the members of experts that will teach the courses. Second, the building of the curriculum itself, while the third stage will be testing the guidelines and the courses for development and modifications. The suggested courses included accounting concepts, auditing concepts, business law and many other topics that considered very important for the forensic accountant to develop is skills and practicing of such accounting. Seda & Kramer (2008) studied the inclusion of forensic accounting in higher education. The authors used the questionnaire for data collection. The authors targeted academicians at universities.

The studied sample included 150 academicians. The survey concerned with the obstacles the facing the inclusion of forensic accounting in higher education. The results showed that room limitations was in the first position to introduce new courses for such programs at the studied universities. The second reason was the lack of qualifications to teach such program at the studies universities. The third reason was the lack of interest of administration and its support for such programs. The fourth reason was for its lack of significant importance to be introduced in the curriculum. The last obstacle was the lack of students interest. These results have shown the directions of universities to introduce forensic accounting at universities. It is very important to clarify that the results of this paper could be applied for different universities in the developing economic countries even at the governmental universities. The core of education business became the increase of profits and tackling the students wells. Rezaee et al. (2004) have emphasized the same idea mentioned by the other literature that the demand for forensic accounting education is increasing. The objective of this study is to investigate the extent of tendency to introduce forensic accounting in USA. Two methods are used to collect data. The first method was concentrating on executing a content analysis of course outlines of forensic accounting.

The second method included survey running national wise. The targeted people are the academicians and practitioners. Simple random sample was selected including 1000 respondents. The results of both practitioners and academicians have shown that the demand on forensic accounting is increasing, but the expectations of practitioners were higher than academicians. The results show that more than 50% of the respondents indicated that litigation is required to success the education of forensic accounting. The results showed that different universities are planning to add the forensic accounting to its educational plans in accounting divisions. The related literature discussed the increase demand for forensic accounting as a national needs specially with the increase of fraud and financial crimes in late years. The literature raised the importance role of universities to meet the national demand increase for forensic accounting and to introduce courses that meet the national requirements to combat the fraud and financial crimes. The literature concentrated on the quality of undergraduate and graduate students that will deal with forensic accounting. The other side raised in literature is concerned with the importance of legal aspects knowledge for the students when dealing with forensic accounting. The legal aspects will integrate the students knowledge to act as accountants and law men in different situations. This attitude has been raised as the forensic accountant will be responsible to deal with financial cases and crimes that require legal knowledge.

Methodology

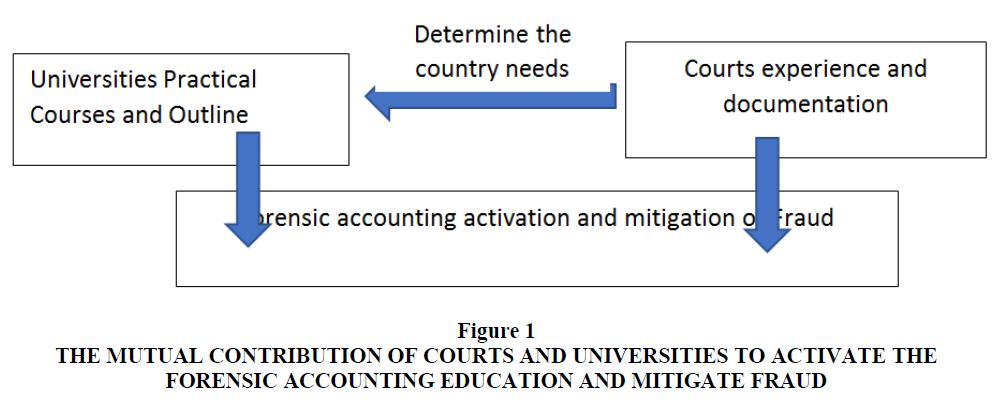

The objective of this research is to measure the integration of stakeholders for the awareness of the importance of forensic accounting in discover in Jordan. To accomplish the objective of this research the questionnaire was used as a tool to collect the data. The targeted population was the accountants working in auditing sector. The questionnaire composed of three parts. The first designed to collect the demographic data, the rest two parts introduced questions about the importance of integration of courts and universities to establish the strong base for forensic accounting in Jordan. Five Likert scale was used for answers of each item. The draft questionnaire was offered for a group of specialists to revise the ideas and the language of the questionnaire. Pilot survey was performed to measure the questionnaire reliability and detect mistakes and language ambiguity. The total number of questionnaires distributed was 300 one distributed on 150 auditing offices. The recovered questionnaires was 293 forming 97.7% response rate. The collected questionnaire were entered to SPSS software for analysis. The descriptive statistics included frequency, percentage, means and standard deviation were used to measure the demographic characteristics and sample trends for the different paragraphs of the questionnaire in Figure 1.

Figure 1 The Mutual Contribution of Courts and Universities to Activate the Forensic Accounting Education and Mitigate Fraud

Results and Discussion

The reliability of the questionnaire was measured using Cronbach’s Alpha. The results showed that alpha value exceeded 0.6 for all variables reflecting that the questionnaire is reliable for this study Table 1.

| Table 1 Reliability Analysis Using Alpha Cronbach | |

| Field | Alpha value |

| Courts’ contribution | 86.8 |

| Public and private universities contribution | 91.1 |

| Total | 94.1 |

Demographic Characteristics

The results showed that the sample almost equally distributed among the management (48.3%) and the employees (51.7%). This distribution was designed to figure out the feedback from the management and the employees for the variables of this research. The highest educational level was for bachelor (91.0%) which is the minimum qualification allowed to get license to open auditing offices, while the graduate studies formed only 9.0% of the sample. The highest experience was recorded for less than 5 years (48.4%) followed by the experience 5 to 10 years (39.4%). The minimum distribution was for the experiences 10 to 15 years (9.0%) and more than 15 years (3.2%). The experiences that exceeded 10 years were for the managers as the experience formed a condition to get license to manage auditing office Un Table 2.

| Table 2 Demographic Characteristics of the Sample (N=293) | |

| Character | Percentage |

| Position | |

| Management | 48.3 |

| Employee | 51.7 |

| Educational level | |

| Bachelor | 91.0 |

| Graduate studies | 9.0 |

| Experience | |

| Less than 5 Years | 48.4 |

| From 5 to less than 10 Years | 39.4 |

| From 10 to less than 15 Years | 9.0 |

| Over 15 Years | 3.2 |

The role of courts to enrich the experience required to activate the forensic accounting in Jordan is negative. The only moderate response of auditors was for the fraud crime records that can be used to benefit in other situations (m=3.10), but still the high standard deviation indicates that part of them are not sure if this available. The results showed that courts lack specialized divisions in financial crimes (m=2.96), lack the publishing of any information or knowledge to enrich the experience in forensic accounting (m=2.71). On the other hand, the courts lack the application of clear and good procedures to detect fraud (m=2.56) and they do not have any technology that supports the work in fraud crimes (m=1.61). This reflects that the role of enriching and activating fraud crimes is neglected. This provide a good environment to increase the fraud as the tools to protect are not matured enough. Tawfeeq & Alabdulla (2013) reported that the experience of forensic accounting is considered crucial to help fighting fraud crimes. In Jordan, Al-sharairi (2018) reported that the lack of accumulative experience in forensic accounting is considered one of the tools that facilitate the distribution of fraud crime in Jordan. The Accounting Bureau Report (2019) reflects the deal with individual cases to detect the fraud crimes. In other words, the report did not reflect the application of systematic procedures to detect fraud in governmental bodies.

Also, the courts in Jordan concentrates on cases without any scientific research to investigate the procedures used and styles in fraud crime. The legal direction should be improved in Jordan to meet the needs required to graduate successful students in forensic accounting to take the responsibility to fight financial crimes in all its forms in Jordan. Rezaee et al. (2004) explained the importance of legation support to success the specialty of forensic accounting at universities. The source of such experience always existed at couUniversities are considered the source of knowledge for all fields. Concerning the forensic accounting, the university should play a very important role to graduate qualified students to deal in this field. The care of universities in Jordan for forensic accounting should be increased to match the high formal and informal called to fight the fraud crimes in Jordan. MENAFATF report (2019) should be the initiative to design very specialized courses in forensic accounting. Table 4 shows the negative attitude of universities in building the experience in forensic accounting.

| Table 3 The Attitudes of Employees for Courts Participation in Forensic Accounting Effectiveness | ||

| Variable | Mean | Standard deviation |

| Courts have organized fraud crime records that can be used by other bodies |

3.1 | 1.2 |

| Courts have specialized divisions for fraud crimes | 2.96 | 0.65 |

| Courts publish and information to improve knowledge about fraud crimes in Jordan |

2.71 | 0.69 |

| Courts have perfect procedures to deal with fraud crimes |

2.56 | 0.93 |

| The courts have enough technology support the work in fraud crimes |

1.61 | 0.54 |

| Court role | 2.59 | 0.63 |

| Table 4 The Attitudes of Employees for Universities Participation in Forensic Accounting Effectiveness | ||

| Variable | Mean | Standard Deviation |

| Most universities offer specialized courses in forensic accounting |

3.2 | 0.49 |

| Universities utilize the experience in the outside environment to enrich the teaching courses |

3.1 | 061 |

| Universities teach the use of technology to discover fraud crimes |

2.8 | 0.51 |

| Universities consider the connection between the introduced courses to integrate knowledge |

2.6 | 0.41 |

| The space given through specialty of accounting enrich the students experience in forensic accounting |

2.3 | 0.73 |

| Universities Role | 2.8 | 0.32 |

The university only moderately offer specialize courses in forensic accounting (m=3.2). The built courses are rarely using the experiences of other bodies in fighting crimes (m=3.1). The rest of responses were negative. The universities lack the training on technology needed to figure out fraud (m=2.8), the connection between courses that raise the forensics accounting issue (m=2.6) and the number of courses designed for forensic accounting is not enough (m=2.3). These results can be justified according to Seda and Kramer (2008) results. The low interest of universities administrations and the lack of students well to join such programs cause the universities move to other directions of interest. Also, the lack of specialists in this field may form other obstacle to decrease the universities interest to introduce forensic accounting courses at the undergraduate level.

They also do not think of it totally for the graduate levels for financial reasons. The lack of concern of universities to establish such programs may resulted of the lack of interest among the students to join such programs. Such programs should be kicked off under governmental support to improve the universities capabilities to tolerate the expenses of such courses. This is compatible with Seda and Kramer (2008) results. rts or any local bodies that are interested to fight the financial crimes. This requires high cooperation of the legal bodies with other educational bodies to integrate courses that help graduating skillful students who are capable of fighting the financial crimes in Jordan in Table 3.

Conclusions and Recommendations

The objective of this paper is to investigate the role of courts and universities to enrich the experience and activating forensic accounting in Jordan. Auditors were used as respondents for this study. The results showed that the role of courts to improve the knowledge and experience in fraud crime was negative. The courts lack any facilities that can be shared to exchange experience with any other bodies. The courts care for the application of law in specific attitudes but they did not care to develop laws to protect from fraud crimes. On the other hand, the role of universities in improving and enriching the experience of forensic accounting was negative too. Universities in Jordan is separated from the participation to minimize the financial crimes in Jordan.

These universities did not take the responsibility to fight the fraud crimes through its work plans. The study recommended the rehabilitation of courts concerning the fraud crimes to have specialized staff for these crimes and divisions that organize records, styles and the other information to share with other bodies in Jordan. The universities should be part of fraud crime fighting through the design of high quality courses to fight this crime in Jordanian society, also to contact the concerned bodies in Jordan to collect information to improve the contents of the offered courses.

Future Research

The future research should concentrate on the role of technology in fighting fraud crime in Jordan.

References

- Abdulrahman, S. (2019). Forensic Accounting and Fraud Prevention in Nigerian Public Sector: A Conceptual Paper. International Journal of Accounting & Finance Review, 4(2), 13-21.

- Accounting Bureau. (2019). Accounting Annual Report. Al-sharairi, M.E. (2018). The Role of Forensic Accounting in Limiting Tax Evasion in the Jordanian Public Industrial Shareholding Companies through the Perspective of Jordanian Auditors. 10(1), 233-243.

- Awolowo, I.F. (2019). Financial Statement Fraud?: The Need for a Paradigm Shift to Forensic Accounting Financial Statement Fraud?: The Need for a Paradigm Shift to Forensic Accounting Ifedapo Francis Awolowo A thesis submitted in partial fulfilment of the requirements of Sheff.

- DiGabriele, J. (2009). The Forensic Accountant: A Closer Look at the Skills Forensic Accounting Education Should Emphasize. Forensic Examiner, 18(2), 77-79.

- Dreyer, K. (2014). A History of Forensic Accounting. Honors Projects, 296. http://scholarworks.gvsu.edu/honorsprojects/296/?utm_source=scholarworks.gvsu.edu%2Fhonorsprojects%2F296&utm_medium=PDF&utm_campaign=PDFCoverPages

- Efiong, E.J., & Leicester, U. (2012). Forensic Accounting Education?: An Exploration of Level of Awareness in Developing Economies - Nigeria as a Case Study. 7(4), 26-34. https://doi.org/10.5539/ijbm.v7n4p26

- Imoniana, J.O. (2013). The forensic accounting and corporate fraud. Journal of Information Systems and Technology Management, 10(1), 119-144. https://doi.org/10.4301/s1807-17752013000100007

- Khersiat, O.M. (2018). The Role of Forensic Accounting in Maintaining Public Money and Combating Corruption in the Jordanian Public Sector. 11(3), 66-75. https://doi.org/10.5539/ibr.v11n3p66

- Kramer, B., Seda, M., & Bobashev, G. (2015). Current opinions on forensic accounting education. Accounting Research Journal. https://doi.org/10.1108/ARJ-06-2015-0082

- Kranacher, M., Morris, B.W., Pearson, T.A., & Riley, R.A. (2008). A Model Curriculum for Education in Fraud and Forensic Accounting. Issues in Accounting Education, 23(4), 505-519.

- Krsti?, J. (2009). The role of Forensic Accountants in detecting frauds in financial statements. Economics and Organization, 6(3), 295-302. https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0CB0QFjAA&url=http://facta.junis.ni.ac.rs/eao/eao200903/eao200903-09.pdf&ei=T15nVb-JJJCKuAThkoP4BA&usg=AFQjCNEe-4A8cCvaRkkhiJZzw4KlBaNK3Q&bvm=bv.93990622,d.c2E Lo, D.,

- Ha, M., & Suen, A. (2016). Forensic Accounting Education and Practice: Insights From China. Journal of Forensic & Investigative Accounting, 8(1), 106-119.

- MENAFATF. (2019). Anti-money laundering and counter- terrorist financing measures The Hashemite Kingdome of Jordan Mutual Evaluation Report The Hashemite Kingdom of Jordan. November.

- National Institute of Justice. (2007). Education and Training in Fraud and Forensic Accounting: A Guide for Educational Institutions, Stakeholder Organizations, Faculty, and Students. NCJRS Publication No.NIJ 21-71589, 1-70. http://scholar.google.com/scholar?hl=en&btnG=Search&q=intitle:Education+and+Training+in+Fraud+and+Forensic+Accounting:+A+Guide+for+Educational+Institutions,+Stakeholder+Organizations,+Faculty,+and+Students#0

- Ocansey, E.O.N.D. (2017). Forensic Accounting and the Combating of Economic and Financial Crimes in Ghana. European Scientific Journal, ESJ, 13(31), 379. https://doi.org/10.19044/esj.2017.v13n31p379

- Oseni, A.I. (2017). Forensic accounting and financial fraud in Nigeria: Problems and prospect. Journal of Accounting and Financial Management, 3(1), 23-33.

- Rezaee, Z., Crumbley, L., & Elmore, R. (2004). Forensic accounting education: A survey of academicians and practitioners. Advances in Accounting Education, Forthcoming. https://ssrn.com/abstract=518263

- Seda, M., & Kramer, B. (2008). The emergence of forensic accounting programs in higher education. Management Spring, 9(3), 15-23.

- Tawfeeq, T., & Alabdullah, Y. (2013). The Role of Forensic Accounting in Reducing Financial Corruption?: A Study in The Role of Forensic Accounting in Reducing Financial Corruption?: A Study in Iraq. February 2017. https://doi.org/10.5539/ijbm.v9n1p26

- Tawfeeq, T., Alabdullah, Y., Mohammad, M., Alfadhl, A., Yahya, S., & Rabi, A.M.A. (2014). The Role of Forensic Accounting in Reducing Financial Corruption?: A Study in Iraq. 9(1), 26-34. https://doi.org/10.5539/ijbm.v9n1p26