Research Article: 2021 Vol: 27 Issue: 3

The Role of Creative Accounting in the Fall of Global Companies And the Loss of Competitive Advantage in the Business Environment- Analytical Study Worldcom.

AWS SAEED MIRDAN, UNIVERSITY OF WASIT

AESHAH A-KAREEM ABDULSTTAR AL-OBAIDI, AL-IRAQIA UNIVERSITY

Abstract

The motivation behind this examination is about the risks of utilizing what is known as inventive bookkeeping as a result of its effect on decorating fiscal reports and indicating them in an unreasonable manner, which was the reason for the worldwide monetary emergency that hit the economies of the creating and created world the same. The utilization of innovative bookkeeping with its perceived techniques prompts an absence of unwavering quality in the budget summaries, which significantly affects the assessment and choice of the inner and outer client of the organizations and associations put resources into, and therefore the effect on the monetary situation of the organization in the currency market and its deficiency of intensity in the realm of business.

Keywords

Creative Accounting, Competitiveness, Financial Statements, Scandal, Accounting Fraud.

Introduction

The inspector's duty regarding finding the imaginative bookkeeping rehearses (CREATIVE ACCOUNTING) is as yet quite possibly the most questionable issues confronting the calling of examining. What the network and the overall population anticipate from the evaluators and reviewers, and what the evaluate and examiners really do as per by and large acknowledged evaluating guidelines.Furthermore, if the gatherings of society keen on the review report expect that examiners will find imaginative bookkeeping rehearses from controls and misrepresentation, yet the norms of the calling have affirmed that the obligation of evaluators in such manner will in general be that their plan for the customary review measure isn't done in any case to find extortion and blunders just, and what is dubious is that Inspectors' duty to find instances of extortion and contortion has been dynamic since the mid eighties. The expansion in mindfulness and political and public interest of people in general about the hugeness of the volume of controls, extortion and bending in the information of numerous foundations, particularly that which is finished by individuals from the Board of Directors and supervisors. The idea of innovative bookkeeping has become a concentration and worry of bookkeepers and inspectors particularly as of late, particularly after the occasions of the breakdown of (Enron) and the charging of (Arthur Anderson) as the organization liable for evaluating the records of (Enron), part of the duty regarding the breakdown of the organization and its allegation By controlling the organization's bookkeeping information, exploiting some bookkeeping medicines and approaches that show the bookkeeping information in its right structure.

Literature Review

The Financial Numbers Game by Molford and Komisky 2002 The purpose of this study is to play the game and assist financial data readers in uncovering the use of accounting methods, avoiding equity investment errors and instilling confidence. It also examines the flexibility that those in charge of preparing financial statements face. With a good understanding of sales flexibility (reporting) in reporting, he will help the reader (investor) deal with deception. According to (Rabin 2005), which defines the position of accountants for creative accounting. Accountants' opinions about creative accounting are according to their ethical estimates. Moral judgment does not affect views of creative accounting, but information quality assessment influences some of the auditor's views. It has been found that understanding the information is not as important as compliance (Naser & Pendlebury 1992).

Yadav and others. (2014) also finds ways to reduce the impact of creative accounting on balance sheets. You offer a positive form of creative accounting practice. Accordingly, creative accounting methods can be overcome due to the problems of agents. Diana and Beatrice (2010) describe the manipulative behavior of users and also decipher how creative accounting methods can benefit users and drive them into a crisis.

Research Methodology

Research Problem

Creative accounting is a major challenge for the accounting and auditing professions. Auditors use their intelligence, knowledge and experience to improve the image of the economic entity. This is reflected in the rise in these stocks in the financial markets.

The Objective of the Research

A. Presenting creative accounting, diagnosing its working methods and procedures, and determining its benefits, causes, motives and implications for the credibility and fairness of the financial statements.

B. The stock exchange exposes economic units to default and bankruptcy. For violations and flexibility of generally accepted accounting rules without supervision or supervision. for violations of generallyaccepted accounting rules (Sen & Inanga 2005).

Research Importance

The importance of the research stems from the importance of the topic of creative accounting because it poses a fundamental problem, especially since the company's management uses its methods to show the results of operations and the financial position in order to preserve them. Short-term and long-term goals, and also at the expense of other companies, which led to most companies losing their ability to compete in the modern business environment.

Research Hypothesis

Will the weakness of supervisory procedures lead to an expansion in the field of creative accounting practice in financial presentation and reporting?

Conceptual Framework

The Concept of Creative Accounting and its Definitions

Creative accounting, or fraudulent accounting as some call it, was an event born in the 1980s. Many researchers, writers and specialists have tried to develop a definition of the concept of creative accounting. The different orientations of researchers and writers have led to many definitions of this concept. (Nasser, 1992) introduces his definition of creative accounting from an academic point of view as "a shift in financial accounting numbers from what they really are to what translators want by exploiting or using existing laws and / or ignoring some of them and / or all of them. (Amatt, 2003; Amat & Blake, 1999) defines creative accounting as "the process by which accountants use their knowledge of accounting rules to process numbers recorded in business accounts." (Mulford et al., 2002) introduces his definition of creative accounting as the procedures or steps used to collect financial figures, using the options and practices of accounting principles, or any procedure or step for managing profits or facilitating income.

The Nature of Creative Accounting

An unusual method or techniques for achieving misleading results are widely used in conference rooms. For officially announced results that enhance management and stock prices, these methods and techniques range from very simple software to modern software. Some of them will be detailed in subsequent surveys (Amanda, 2002).

Most knowledgeable firms are those that use creative accounting to maintain control over their numbers and scales. Creative accounting cannot support or attribute the results of a specific action. All you can do is delay and reduce the impact of the bad news until a business boom. You can't make bad news always look good without using outright manipulation.

It is difficult to discover creative accounting procedures, even if small words or sentences are printed in small letters in the account margins. Usually, the reason for the economic unit to benefit from the fake financial data is to open the way for obtaining financing. Debt rates or levels can be uncomfortably high in nature, preventing the company from obtaining the additional funds it needs. Such erroneous data threatens to completely and completely undermine the reliability of legal accounts. (Griffiths, 1987).

Financial Statements

The evolution of accounting and how it is achieved is a tool of service and communication. Accounting is an open information system designed to generate information. Financial statements are a means of communication between companies. Among the most important of these companies are investors. The IFRS Board understands that governments in particular may set different requirements for their purposes. These requirements should not affect published financial statements for the benefit of other users. Financial information may look similar from one country to another, but there are differences between them due to different social, economic and legal conditions. (IFRS 2006).

Published Financial statements are an important source of information needed to make financial decisions. Financial statements must have a general purpose. They are published in a timely manner so that the information contained in the financial statements is not suitable for decision-making as well as full disclosure to remove any ambiguities in the dates and hidden data. (Dahmash, 2006) Joint stock companies provide semi-annual progress reports. Financial statements are a more general term than annual reports. They contain additional information related directly or indirectly to financial accounting. In addition to traditional financial statements, these reports also include other quantitative or descriptive financial information. (Hanan, 2005).

The Consequences of Adopting Creative Accounting Methods and their Impact on the Financial Statements

- There are many companies listed on the stock market that use creative accounting methods. This will mislead investors and cause confusion.

- Preliminary financial statements of some companies do not always depict the reality of the financial positions of the companies listed on the stock exchanges. The main objective of the initial financial reports on the concept of timeliness is to provide shareholders, lenders or any other parties with substantial financial transactions or ties with the economic unit..

- The processes in which creative accounting methods are used are usually short-term and do not continue to long-term.

- Creative accounting methods lead to loss of investor confidence in managing the economic unit and in the stock market.

The financial statements do not represent the actual facts as they are for a certain period of time. Creative accounting can harm current and potential shareholders, as well as destroying the value of shares. If it is discovered, the economic unit will lose the confidence of investors and other parties that deal with it. The financial statements issued by the economic units that are directly affected are the income statement, financial position list, and the cash flow statement. (Sen and Inange, 2005)

Case Study

The WorldCom story began with a plan to set up a telephone service provider and it was placed on a napkin in a coffee shop in 1983. The company started with the name LDDS. In the following year, through acquisitions and mergers, it grew into the second largest long distance company. He came to the United States. that. In the late twentieth century and with a global audience, it was well on its way to becoming one of the largest telecommunications companies in the world. After that, the state recorded the largest bankruptcy of $ 59.5 billion in American history.

By the Authors

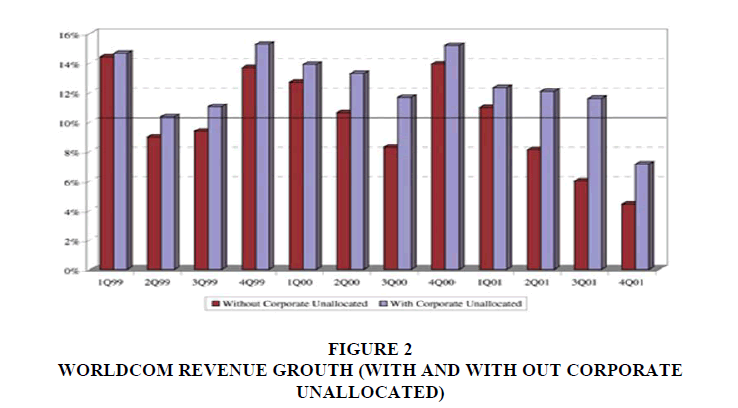

WorldCom has figured out how to get people to buy stocks anyway when the organization and media activity aren't progressing well. To do this, they had to change the numbers in their accounting records so that everything looked fine. This change means that WorldCom's costs are recognized as capital amortization. Capital depreciation accumulates over a long period of time, while costs must be deducted immediately. WorldCom converted these costs into an accounting report and reduced them over a period of seven to ten years. With this strategy, WorldCom figured out how to save $ 3.8 billion in capital consumption. Speculators continued to buy WorldCom shares for $ 64 a share, for little pay when there was an IPO. Internal audits identified flawed accounting strategies as early as 1999 when Arthur Andersen ruled WorldCom. Financial disclosures are provided by WorldCom's board of directors, not by Arthur Andersen brokers. Because of the misrepresentation, WorldCom admitted misusing GAAP and changed its earnings by $ 11 billion from 1999 to 2002. A review of this period estimated the absolute accounting distortion at $ 79.5 billion. According to (Bresford, et al., 2003), line costs are the expenses involved in sending a voice call or transmitting information about the cause of a related call. Written messaging isn't WorldCom's biggest hurdle, but accounts for about half of its full costs. WorldCom wants to pay neighboring organizations in New York and London for the use of the phone lines. It became clear that the costs of insurance money were in jeopardy, and it was necessary for individual groups to bear the cost of the line in the standard sharing direction. The company sought to reduce revenue surpluses (the "payback / payback line cost ratio"), according to Breeden (2003), WorldCom changed its rights in three ways. Some of these claims have been closed without being approved as general claims. Evers publicly pledged to Wall Street shareholders that WorldCom would avoid costs. As internet and media bubbles burst, the pressure increased to find ways to reduce costs, he says. "I discovered more opportunities to stop reporting the wrong number," he writes. "It was the end of each month in WorldCom commercial phone line scams". According to Morse, WorldCom competitors like Sprint have line costs equivalent to 52% of sales. WorldCom reported line costs of about 42% of sales and those costs were actually between 50% and 52% of sales.

Cynthia Cooper has worked at WorldCom as Vice President of Internal Oversight. She and her monitoring team worked overnight gathering data to find out what was going on. She has won several awards for her work, including the Man of the Year and the Accounting Model Award. She was asked to stop working, but she refused and continued to study the accounting records. The board tried to prevent them from doing so, but ultimately his team revealed everything. (Cynthia Cooper, 2008).

Conclusion

The results of the preliminary study In general, the advertising is expressed as a good example of this. The study clarified the multidimensional nature of financial crises, and their impact on financial reports. Correct data in the NSE stock and trading tables could explain the recent crash of the New York Stock Exchange. The need for regulators in coordination groups and a professional body is one of the criteria for quality accounting. This will help improve the quality of financial reporting and rebuild investor confidence.

References

- Mulford, A., Comiskey, N., Charles W., &amli; Eugene E. (2002). The Financial Numbers Games 2002, liublished simultan ously in Canada lirinted in the united states of America.

- Naser, K., &amli;&nbsli; liendlebury, M. (1992). A Note on the use of Creative Accounting. British Accounting Review, 24 , 4 .

- Breton, G., &amli; Taffler,&nbsli; R.J. (1995). Creative&nbsli; Accounting and Investment Analyst Reslionse. Accounting and Business Research, 25, 98.

- Amat, O., &amli;&nbsli; Blake, J. (1999). The Ethics of Creative Accounting.&nbsli; Economics Working lialier, 349, 715-736.

- Griffiths, I.(1995). Creative Accounting“ How to make your lirofit what you want them to be, fifth relirinted. May 1987 liublished by Waterston and Colimited.

- Dahmash, N.(2006). The exliectancy gali and auditors 'reslionsibilities from an investors' lioint of view. Conference held in Amman. International Financial Reliorting Standards, 32.

- Hanan, R.H, (2005). Introduction to Accounting Theory. Wael liublishing House, First Edition.

- Amat. O., &amli;، Gowthorlie, C، (2003). Creative accounting nature، incidence and ethical issues، Journal of Economic Literature Classification.

- Sen, li., &amli; Inanga, E.L.(2005). Creative accounting in Bangladesh and global liersliectives. In liartners' Conference lirogram Book, liartners' Conference, Maastricht School of Management, The Netherlands (July 6-8) (lili. 75-87).

- Amanda, R. (2002). Cynthia coolier: The Night Detective. Time Magazine (December 30)

- Coolier, C. (2009). Extraordinary circumstances: The journey of a corliorate whistleblower. John Wiley &amli; Sons.