Research Article: 2021 Vol: 25 Issue: 2S

The Role of Government and Auditing Offices in Activating the Forensic Accounting to Discover Financial Fraud

Haitham Mamdouh Al Abbadi, Al- Balqa, Applied University

Mohammed Nadem Dabaghia, Al- Ahliyya Amman University

Badi Alrawashdeh, Arab Open University

Riyad Neman Darwazeh, Al- Ahliyya Amman University

Abstract

The objective of this research is to investigate the role of auditing offices and governmental efforts to activate forensic accounting as a tool to fighting financial crime. The questionnaire was used to collect data. The response subjects were the employees of auditing offices. The results showed that the auditing offices care for teaching of their experience inside the offices. The respondents indicated the importance role of governmental bodies to activate forensic accounting role. The study recommended the establishment of national fraud board to regulated the national plans to activate the forensic accounting and fighting fraud.

Keywords

Forensic Accounting, Fraud, Governments, Audit Offices, Stakeholders, Integration.

Introduction

The name “Forensic Accounting” appeared in the middle of nineteenth century. The development of industry and economics side by side with the growth of countries regulations increased the need for forensic accounting as a specialist type of accounting to deal with fraud cases. The practice of forensic accounting in its first stages was dependent on accounting experience. The increase of fraud techniques and methods called for the development of forensic accounting to be a specialized field in accounting.

The narrow realizing of forensic accounting is that it is the accounting experience that supports the courts efforts to solve the financial cases. This concept has been widening as the need for forensic accounting increased. Government supervision of the economic and financial flow of a country raised the importance of using specialized persons to supervise the financial flow of money. Also, the taxes as a major source of income of a country called for the increase of supervision through specialized forensic accountants to follow up financial frauds.

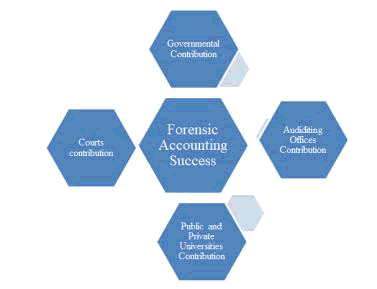

The fruitful use of forensic accounting and its success will depend on high awareness of all stakeholders of its importance as a tool to figure out financial fraud. The first stakeholder is courts. The deep believe of courts of forensic accounting is core pillar that encourages other stakeholder to care about it. The second stakeholder that should be aware is the auditing offices and companies. These auditors should believe in their role to discover financial fraud and its negative impact on the country and the individuals equally. The last stakeholder is the government, which should realize that the existence of specialized forensic accountants will help in discovering fraud in governmental bodies in the first position, tax payers and financial cases that government form part of it.

The harmonization between the stakeholders of forensic accounting will raise the importance of this type of accounting and help keeping the financial system on the track. The objective of this paper is to investigate the awareness of the three types of stakeholders of forensic accounting and their cooperation to succeed this type of accounting.

Literature Review

Integration among Stakeholder

Fraud is one the serious problems that affect the economy of country and the benefits of individuals in the economic system (Abdulrahman, 2019). Forensic accounting has been developed and matured over years to combat corruption, figure out financial crimes and fraud (Islam et al., 2011; Olukowade & Balogun, 2015) and money laundry (Dreyer, 2014). Forensic accountants should have the ability to run investigations related to financial fraud and gave the legitimacy to contact any individuals in any case (Islam et al., 2011). The consequent development of tools used to discover fraud is very crucial to keep the experience of forensic accountant compatible with the crime development (Ragan et al., 2008). As the detection tools of fraud crimes developed the criminals develop their tools to be more complicated to be discovered (Ramaswamy, 2007). Education and training are considered the tools that will facilitate the development of tools for accountant to figure out fraud in all its forms.

The function of forensic accounting covers wide range of financial cases. The forensic accounting cares in first position to financial cases at courts which require solutions, governmental issues related to financial frauds and private sector financial disputes (Imoniana, 2013). Forensic accounting deals with different cases within the three previous sectors. It concerns with disputes between partners and shareholders, individuals claims, business interruptions, bankruptcy cases, fraud of financial statements, professional negligence, cases looked by lawyers, employee fraud (Islam et al., 2011) and the Islamic inheritance fraud committed in Islamic countries.

The role of auditors in forensic accounting should be comprehensive and sequenced to cover the different needs to figure out fraud. This role should be merged with technological knowledge to facilitate the execution of different roles (Akinbowale et al., 2020; Choi et al., 2009). The responsibilities of forensic accountant includes the discussion of fraud possibilities with organizations working staff or individuals, finding the all possibilities of committing fraud within the organization, designing tests to discover fraud, and figuring out any override inside the organization by the management or any position inside the organization, and connect the different aspects to draw the search way to find fraud (Chukwu et al., 2019; Ramaswamy, 2007). One of the important capabilities the forensic accountant should have related to the capabilities of finding fraud in financial statements (Krsti?, 2009). The fraud triangle was used as a tool to integrate the forensic accountant capabilities to discover fraud (Awolowo, 2019).

The effectiveness of forensic accounting system requires high awareness of the stakeholders. The first party concerned with the increase of this awareness is the courts, while the second is the auditing offices and companies, and the third vital player is the government. The concern of stakeholders can be through the integrating of forensic accounting courses introduced through universities or teaching bodies inside the country to serve the country interests (Lee, 2015; National Institute of Justice, 2007)..

Cruciality of Forensic Accounting

The war against the financial corruption crime pave the road for strengthen the economy and increasing the confidence of the financial system of the country (Oseni, 2017). In Jordan, the need for forensic accounting increased in the last years to fight the increasing financial crimes (MENAFATF, 2019). The MENTATF report showed some statistics about financial crime in Jordan. The crime related to tax evasion formed 2.74% of the gross domestic production (GDP) in 2016, while the fraud formed 0.11% of GDP for the same year. The MENAFATF report (2019), also, showed that the corruption and bribery formed 0.15% of GDP. This report explained the extent of financial crimes in Jordan, which calls for putting the forensic accounting in the first position for all stakeholders (courts, government, audit offices and universities).

Idris (2019) reported the money laundry as organized crime in Jordan. On the hand, The Audit Bureau Annual Report showed that the violations for the public money were around 2.15JD millions (Accounting Bureau, 2019). These violations recorded considered initiatives for the government to increase its partnership to improving the forensic accounting systems in Jordan. Through the literature and the stakeholders, the following triangle represents the success of forensic accounting in Jordan (Figure 1).

Literature Related

Different literature has shown that the governments are the first affected by the financial fraud through different type of fraud including the tax evasion and money laundry. The literature discussed the role of government in activating the use of forensic accounting in discovering fraud in different procedures. The following literature explained the role of government in activating and addressing the forensic accounting to the front to minimize the financial fraud.

Sahdan, et al., (2020) discussed some issues related to government to activate the use of forensic accounting in discovering fraud. The authors raised the situation in English local government concerning financial fraud. The study has shown that the local governments do not have enough staff to tackle fraud. The paper raised very important issue related to follow up the financial fraud related to the specialty of the internal auditing which is not responsible to follow up the fraud of any organization, also the external auditing private companies is not interested in discovering fraud. This raises the issue that detecting fraud will form a new load on the auditing companies. These circumstances will facilitate the fraud increase under the low interest of governments to fight fraud using reasonable tools. To overcome the low interest of auditing private sector companies to detect the financial fraud, the government should formulate an integrated forensic system that should be able to tackle and control the financial crimes. The paper recommended the government action should be taken as soon as possible to face the challenges of fraud detection in the future.

Muse, et al., (2020) studied the method of activation of forensic accounting in the public sector. To assess the competence of forensic accounting, this study concentrated on studying the accountants as the Accountant General and Auditor General of Malaysia (AGAGM). The study concentrated on the accountants of AGAGM as they are authorized to follow up the fraud in public sectors and their vital role in combat the financial crimes in the public sector. The authors believe that this people role is very important to protect the country economy. The paper concerned with agencies concerned with regulatory and enforcement because of their vital role to empower the accountants and auditors to detect fraud and improve their capabilities of the forensic accounting techniques and regulations that give this empower. The paper succeeded in shaping the framework that can be used to improve the capabilities, detect fraud and prevent financial crimes n Malaysia.

Aji & Urumsah (2016) studied the possibility of use of forensic accounting services in Yogyakarta’s banking industry. The study relied on primary data and questionnaire to collect data. The results of this research have shown that the governmental pressure and the local auditing system in bank could pressure the use of forensic accounting to detect fraud.

Adebisis & Gbegi (2015) studied the fraud in Nigerian public sector and the need for forensic accounting. The study used primary and secondary data. For the primary data collection, the study used the questionnaire. The targeted people were the senior staff of anti-corruption organizations in Nigeria. The sample included 129 senior staff. The results showed that the fraud affected the economic growth in Nigeria. The results showed that the use of forensic accounting in the public sector organization will improve its performance. The study recommended the use of forensic accounting in public organizations to detect fraud. The study recommended that the government should establish “Public Recovery Fund” which should be used to support the organizations of public sector to improve its performance.

Akani & Ogbeide (2017) studied the relation between forensic accounting and the fraud practices in Nigerian public sector. The used the primary data. The targeted population was ten public organization from the Nigerian public sector that were selected randomly. The questionnaire was the tools used to collect the data. The five Likert scale was used to get answers for the different items of the questionnaire. The results showed that there was a significant relationship between the reduction of fraud practices and the use of forensic accounting. The results called the authors to recommend the government and specialized organizations to manipulate and arrange the use of forensic accounting in the public organization in Nigeria.

Akkeren & Tarr (2014) discussed and investigated the forensic accounting and financial crisis in different aspects. The paper raised the importance of government role to improve the regulations to protect the forensic accounting profession. One aspect introduced the legislative role of government to protect forensic accountants and give them power to control financial fraud. The paper raised the regulatory framework as the responsibility of the government. The author raised the importance of regulations that organize this profession in Australia. These regulations take into consideration the determination of skills and qualifications required to practice the forensic accounting in Australia.

Huber (2013) has discussed that forensic accounting became a profession. This calls for this paper to investigate if this profession requires certification regulations as a separate industry. The author raised the problems that face the forensic accounting industry and profession in the last years. Forensic accounting corporations face problems to disclose themselves and their legal identity and their low ability to adopt the deal with the Standards of Practice and Code of Ethics. Even though, the accountants do know the legal bodies that could give them their certificates to be legal forensic accountants. This lead the authors to recommend the establishing of agencies controlled by the governorate to regulate the issue of licenses for forensic accountants and the forensic accounting corporations to give them the power in one aspect and to facilitate their role in disclose themselves and work more professionally to fight financial crimes in the country.

Muthusamy, et al., (2010) discussed new aspect of government responsibility to detect fraud in large companies in Malaysia. The governmental regulations obliged the companies to make external auditing to approve their financial statements yearly. The paper suggested that the government should oblige the companies to run forensic accounting for its financial system yearly. The paper suggested a model that testing the essentiality to run forensic accounting in large firms. The results showed the government plays a major role to arrange forensic accounting services to large companies to test for fraud.

Curtis (2008) has raised the both the legal and regulatory environment side by side with ethics as determinants of practicing the forensic accounting. He discussed the forensic accounting from other aspect related to crime and criminology aspect. According to Curtis, the financial crime is looks like any other crime that hurts the society in different forms. This kind of crime requires specific knowledge and training to combat. This leaded to two directions. The first is the governmental concern to improve the laws that fight the financial crimes and the second is to educate and train individuals that work in this field to be qualified to deal with such crimes through the forensic accounting. The emphasized the teaching of criminal courses as part of forensic accountants education to enable them to do their work.

The previous studies have shown the importance of the government role to regulate the forensic accounting profession. The government should create the interest of auditing offices to practice its role in discovering the financial fraud. The audit offices to play this role, they require the legislations that facilitate their work. Moreover, the government should organize the forensic accounting market through the open of specialized agencies that train forensic accounting and certify people the will work in this field. Also, the literature has shown that the government has the tools to minimize the tax evasion through the obligation of large companies to be checked for any fraud processes through the usage of forensic accounting companies. The literature have shown that under lack of regulations that give the power to auditing offices, the offices will neglect the search for financial crimes. Different authors have shown that the detection of fraud in public organizations require the training of external bodies to use forensic accounting to minimize the fraud in public organizations.

Methodology

The objective of this research is to measure the integration of stakeholders for the awareness of the importance of forensic accounting in discover in Jordan. To accomplish the objective of this research the questionnaire was used as a tool to collect the data. The targeted population was the accountants working in auditing sector. Two accountants including managers were asked to fill the questionnaire. The questionnaire composed of two parts. The first designed to collect the demographic data, the rest thee parts introduced questions about the importance of integration of government and auditing offices to establish the strong base for forensic accounting in Jordan. The answers used five Likert scale for each paragraph. The draft questionnaire was offered for a group of specialists to revise the ideas and the language of the questionnaire. Pilot survey was performed to measure the questionnaire reliability and detect mistakes and language ambiguity. The total number of questionnaires distributed was 300 one distributed on 150 auditing offices. The recovered questionnaires were 293 forming 97.7% response rate. The collected questionnaire was entered to SPSS software for analysis. The descriptive statistics included frequency, percentage, means and standard deviation were used to measure the demographic characteristics and sample trends for the different paragraphs of the questionnaire.

Results and Discussion

The reliability of the questionnaire was measured using Cronbach’s Alpha. The results showed that alpha value exceeded 0.6 for all variables reflecting that the questionnaire is reliable for this study (Table 1).

| Table 1 | |

|---|---|

| Reliability analysis using alpha Cronbach |

|

| Field | Alpha value |

| Governmental contribution | 92.3 |

| Auditing offices contribution | 89.3 |

| Total | 94.1 |

Demographic Characteristics

The results showed that the sample almost equally distributed among the management (48.3%) and the employees (51.7%). This distribution was designed to figure out the feedback from the management and the employees for the variables of this research. The highest educational level was for bachelor (91.0%) which is the minimum qualification allowed to get license to open auditing offices, while the graduate studies formed only 9.0% of the sample.

The highest experience was recorded for less than 5 years (48.4%) followed by the experience 5 years to 10 years (39.4%). The minimum distribution was for the experiences 10 years to 15 years (9.0%) and more than 15 years (3.2%). The experiences that exceeded 10 years were for the managers as the experience formed a condition to get license to manage auditing office (Table 2).

| Table 2 | |

|---|---|

| Demographic Characteristics of The Sample (N=293) |

|

| Character | Percentage |

| Position | |

| Management | 48.3 |

| Employee | 51.7 |

| Educational level | |

| Bachelor | 91 |

| Graduate studies | 9 |

| Experience | |

| Less than 5 Years | 48.4 |

| From 5 to less than 10 Years | 39.4 |

| From 10 to less than 15 Years | 9 |

| Over 15 Years | 3.2 |

The contribution of auditing offices to formulate forensic accounting courses seemed to be more than the average (m=3.71),but through the conversation with the auditing managers they indicated that their contribution is local to teach the office employees about the fraud cases and these courses are not distributed for public. The auditors indicated that they exchange their experience with others in the same field (m=3.65), but also this exchange was dependent on the mutual benefits connected them to others in the same field. The auditing offices collect and document the information about the fraud cases at their offices (m=3.49), but this documentation is limited and used widely inside the offices (m=3.12). The auditors indicated that there is not any tools available to exchange information about fraud cases in Jordan (m=2.91).

The MENAFATF report (2019) explained the extent of fraud committed in Jordan. The expand of the financial crimes assure the feedback about the auditing offices respondents that the different stakeholders work alone without any cooperation. The National Justice Institute Report (2007) indicated that the success of forensic accounting role is situation that is related to different experienced people in different stakeholder areas. Through the results, the auditing responses indicate that these offices work alone in this field (Table 3).

| Table 3 | ||

|---|---|---|

| The Attitudes of Employees For Auditing Offices Participation in Forensic Accounting Effectiveness | ||

| Variable | Mean | Standard deviation |

| The auditing offices can contribute in formulating courses in forensic accounting | 3.71 | 0.69 |

| The auditing offices exchange the experience with other workers in the same field | 3.65 | 0.65 |

| The auditing offices concentrate on attracting good experiences for forensic accounting cases | 3.46 | 0.69 |

| The auditing offices document the procedures used in different cases to hold fraud | 3.12 | 0.93 |

| There is a formal tools that facilitate the communication to exchange experience in Jordan | 2.91 | 0.54 |

| Auditing offices contribution | 3.37 | 0.63 |

The respondents indicated that governmental contribution to activate the forensic accounting is very crucial. The respondents indicated that the activation of forensic accounting should be made through national plan (m=4.01), also the respondents reported that the contribution of governmental bodies should include other stakeholder (m=4.18). This contributed to their view concerning the governmental planning nationally to activate forensic accounting (m=4.22).

The respondents indicated that the governmental bodies should formulate courses about forensic accounting (m=2.10). The extreme negative respondent was for the availability records that can be shared with other stakeholders (m=2.10).

Abdulrahman (2019) discussed the fraud in governmental body in Nigeria. The results of this work indicated that the effectiveness of fighting fraud is not as required. The results indicated that the tools used are not effective also to discover fraud. These results were contributed to the fact that the governmental efforts are not documented and formulated to form accumulative experience to figure out fraud. Chukwu (2019) also emphasized that the skills with accumulated experience will succeed in fighting financial fraud in Nigeria.

| Table 4 | ||

|---|---|---|

| The Attitudes Of Employees For Governmental Contribution Participation In Forensic Accounting Effectiveness | ||

| Variable | Mean | Standard Deviation |

| Government planning for forensic accounting forms the base to affective it. | 4.22 | 0.49 |

| Government bodies contribution should be extended to include different stakeholders | 4.18 | 0.4 |

| The activation of forensic accounting should be taken over through national plans | 4.01 | 0.45 |

| The records of fraud cases at the governmental bodies should be used to build successful courses matches the need in Jordan | 4.06 | 0.41 |

| The government has documented records for the fraud cases available for stakeholders | 2.1 | 0.61 |

| Total | 3.71 | 0.32 |

Conclusion and Recommendations

The objective of this research is to investigate the role of integration of stakeholders to activate forensic accounting. The auditing employees were the respondents for this research. This research targeted the role of auditing offices and governmental bodies integration to activate the forensic accounting. The respondents indicated that they are highly interested in documented fraud cases and exchange experience inside their offices and among offices based on the mutual benefits but not the public benefits. The respondents, also, indicated that the governmental contribution in activating forensic accounting is very important, but they indicated also that the this role is not practiced and the inclusion of stakeholders is not existed. The study recommended to establish national broad for fraud fighting included different stakeholders.

Future Research

Studying the effect of courts and universities in activating the forensic accounting nationally.

References

- Abdulrahman, S. (2019). Forensic accounting and fraud prevention in nigerian public sector: A conceptual paper. International Journal of Accounting & Finance Review, 4(2), 13–21.

- Accounting Bureau. (2019). Accounting Annual Report.

- Adebisi, J., & Gbegi, D. (2015). Fraud and the nigerian public sector performance: The need for forensic accounting. International Journal of Business, Humanities and Technology, 5(5), 67–78.

- Aji, S., & Urumsah, D. (2016). Factors affecting the use of forensic accounting services an empirical study on indonesian banks. Asia Pasific Fraud Journal, 1(1), 147–163.

- Akani, F., & Ogbeide, S. (2017). Forensic accounting and fraudulent practices in the Nigerian public sector. International Journal of Arts and Humanities ( IJAH ), 6(21), 171–181.

- Akinbowale, O. E., Klingelhöfer, H. E., & Zerihun, M. F. (2020). An innovative approach in combating economic crime using forensic accounting techniques. Journal of Financial Crime, 4(2), 20-53.

- Akkeren, J., & Tarr, J. (2014). Regulation, compliace and the Australian forensic accounting profession. Journal of Forensic & Investigative Accounting, 6(3), 1–26.

- Awolowo, I. F. (2019). Financial Statement Fraud : The Need for a Paradigm Shift to Forensic Accounting Financial Statement Fraud : The Need for a Paradigm Shift to Forensic Accounting Ifedapo Francis Awolowo A thesis submitted in partial fulfilment of the requirements of Sheff.

- Choi, J., Choi, K., & Lee, S. (2009). Evidence investigation methodologies for detecting financial fraud based on forensic accounting. Proceedings of the 2009 2nd International Conference on Computer Science and Its Applications, CSA 2009.

- Chukwu, N., Asaolu, T.O., Uwuigbe, O.R., Uwuigbe, U., Umukoro, O.E., Nassar, L., & Alabi, O. (2019). The impact of basic forensic accounting skills on financial reporting credibility among listed firms in Nigeria. IOP Conference Series: Earth and Environmental Science, 331(1).

- Curtis, G.E. (2008). Legal and regulatory environments and ethics : Essential components of a fraud and forensic accounting curriculum, 23(4), 535–543.

- Dreyer, K. (2014). A History of Forensic Accounting. Honors Projects, 296.

- Huber, W. (2013). Should the forensic accounting profession be regulated? Wm. Dennis Huber. SSRN Electronic Journal, 10(1), 1–32.

- Idris, I. (2019). Serious and organized crime in.

- Imoniana, J.O. (2013). The forensic accounting and corporate fraud. Journal of Information Systems and Technology Management, 10(1), 119–144.

- Islam, M., Rahman, M., & Hossan, M. (2011). Forensic accounting as a tool for detecting fraud and corruption: an empirical study in Bangladesh. ASA University Review, 5(2), 77–85.

- Krsti?, J. (2009). The role of Forensic Accountants in detecting frauds in financial statements. Economics and Organization, 6(3), 295–302.

- Lee, C. (2015). The incremental benefit of a forensic accounting course to creativity. Journal of Forensic & Investigative Accounting, 8(1), 157–167.

- MENAFATF. (2019). Anti-money laundering and counter- terrorist financing measures The Hashemite Kingdome of Jordan Mutual Evaluation Report The Hashemite Kingdom of Jordan, November.

- Muse, O., Popoola, J., Che-ahmad, A., & Samsudin, R.S. (2020). Forensic accounting and fraud : Capability and competence requirements in Malaysia, 10(8), 825–834.

- Muthusamy, G., & Quaddus, M. (2010). Organizational intention to use forensic accounting services for fraud detection and prevention by large malaysian companies.

- National Institute of Justice. (2007). Education and training in fraud and forensic accounting: A guide for educational institutions, stakeholder organizations, faculty, and students. NCJRS Publication No. NIJ 21-71589, 1–70.

- Olukowade, E., & Balogun, E. (2015). Relevance of forensic accounting in the detection and prevention of fraud in Nigeria. International Journal of Accounting Research, 2(7), 67–77.

- Oseni, A.I. (2017). Forensic accounting and financial fraud in Nigeria: Problems and prospect. Journal of Accounting and Financial Management, 3(1), 23–33.

- Ragan, J.M., Joseph, S., Hadley, A.J., Joseph, S., Raymond, A.P., & Joseph, S. (2008). Detect Fraud, 4(3), 53–70.

- Ramaswamy, V. (2007). New frontiers: Training forensic accountants within the accounting program. Journal of College Teaching & Learning (TLC), 4(9), 31–38.

- Sahdan, M.H., Cowton, C.J., Drake, J.E., Hadafi, M., Cowton, C.J., & Forensic, J.E.D. (2020). Forensic accounting services in English local government and the counter-fraud agenda. Public Money & Management, 0(0), 1–10.