Research Article: 2019 Vol: 22 Issue: 1S

The Role of Information Systems for Entrepreneurship Education and Enterprise in Developing Countries

Ilgiz Mukhamadeev, Bashkir state agrarian University

Larisa Makhova, Saint-Petersburg Mining University

Anastasia Kurilova, Togliatti State University

Abstract

Information systems are the key elements of the country's competitiveness and growth. Our research investigates the role of information systems for entrepreneurship education in developing countries on the example of the Azerbaijan education system and Internet banking. The information systems role in entrepreneurship education was determined with the help of online questionnaire. As a result of the study, it was found out that about 29% of higher entrepreneurship education institutions use IT technologies and e-learning principles in the learning process. The analysis of the effectiveness of information systems in the educational process showed that in faculties where more than 50% of IT is implemented, student performance increased by 5% (p<0.001). This demonstrates the positive role of information systems in the entrepreneurship learning process and the need to expand their introduction into higher education institutions. It was also shown that one of the problems connected with introducing e-learning is that teachers are not ready for the new changes. The analysis of the spread and introduction of Internet banking in developing countries showed that the number of online payment users from 2012 to 2018 increased by 57%. This indicates a positive trend of using e-banking. But at the same time, the classical banking system for making payments remains more relevant. The number of payments in bank branches is 43% more. The main problems of e-banking in developing countries are the lack of credit, the low security level and the lack of personal contact between the client and the bank employee. The research provides perceptive directions and gaps in research related to the information systems in the field of education and Internet banking. It will be useful for evaluating and adoption of state strategy in the development of information systems.

Keywords

Developing Countries, Innovations, Entrepreneurship Education, E-Learning Systems, E-Banking, Information Technology, Online Payments.

Introduction

Innovations depend on the particular policy and actions of the country, as well as on the meso-macroeconomic context in which firms operate (Hartley & Rashman, 2018; DeLone & McLean, 2016; Markina et al., 2017). In developed countries, such as the USA, Germany, the Innovation System (IS) concept was developed to take into account the role of institutions and organizations that systematically interact and influence the speed and direction of technological changes in the economic system (Pietrobelli & Rabellotti, 2011; Lucas, 2008).

There are a number of reasons why it is difficult to implement IS in entrepreneurship education in developing countries. First, innovations in entrepreneurship education in developing countries differ from the innovations in developed countries in terms of the new knowledge and technologies (Nabi et al., 2017). For developed countries, the introduction and development of new technologies happen much faster and more often (Schmitz & Strambach, 2009). The analysis of information systems in industrialized countries is mainly focused on research and information innovation. In most non-developing countries the nature of technological efforts is quite different. It is mainly based on company activities that are not considered to be innovative (Binz & Truffer, 2017; Markina et al., 2017). In developing countries, most innovations are based on the activities which are not related to R&D activities that include the introduction of new technologies (Bell, 2007). Secondly, the main scientific and technical organizations analyzed in the context of developed countries, such as universities, Research and Development laboratories (R&D) and research institutes may be absent in some developing countries or may be inadequate. At the same time, the relations between them and local companies may be non-existent or very weak (Ockwell et al., 2015; Walsh, 2016). Thirdly, there are significant knowledge and technology inflows from external sources of innovative and learning processes in non-developing countries (Pietrobelli & Rabellotti, 2011).

IS in an entrepreneurship education helps to organize learning process. Consequently, it is necessary to investigate the impact of e-learning on the quality of teaching and the level of graduates' knowledge to ensure the expected results (Churchill et al., 2013; Wan & Sadiq, 2012).

Introduction of IS will only benefit the student (Churchill et al., 2013). An important task of e-learning systems is to provide instructions that can give equal or better results than face-to-face training systems. E-learning requires knowledge of the quality of systems, information quality and learning outcomes (Saba, 2012). However, e-learning has not still had a significant impact on the quality of teaching and pedagogical innovations (Wan & Sadiq, 2012).

Information systems also play an important role for the development of the enterprise and E-banking. Modern enterprises critically rely on timely and sustainable information delivery (Cai et al., 2006). To solve this problem, corporate information systems such as enterprise Resource Planning (ERP), Supply Chain Management (SCM), Customer Relationship Management (CRM), Manufacturing Execution System (MES) (Wang et al., 2010; Izza, 2009). The actual topic today is the introduction and use of Mobile Banking services (MB). This technology allows people to make banking transactions at any time and from any place (Zhou, 2013). When using MB, banks get an advantage by increasing efficiency and improving service quality, instant communication, convenience and interactivity (Akturan & Tezcan, 2012; Goh & Sun, 2014).

With the help of MB, users can access account balances, pay bills and transfer funds using mobile devices, rather than visit banks or use computer-based e-banking (Blaya et al., 2010). Banks in different countries offer their customers MB technology. But despite the widespread use of mobile devices such as smartphones and tablets, the adoption rate of MB is still low (Febraban, 2015; Zhou et al., 2010; Cousins, 2017)

It must be understood that today's IS success can be a failure tomorrow (Heeks, 2002). For example, India’s Indira Gandhi Conservation Monitoring Centre was intended to be a national information provider based on a set of core environmental information systems. Despite more than a year of planning, analysis and design work, these information systems never became operational, and the whole initiative collapsed shortly afterwards (Puri et al., 2000). Justification of the ICT role in economic growth has been promoted by many international agencies, for example, the World Bank (2000), NDP (2001) and Kirkman et al. (2002). Some studies are aimed at confirming the argument about the economic importance of ICT for development (Ngwenyama et al., 2006; Mbarika et al., 2007).

They tried to solve the problems of skeptics. As a rule, skeptics point to the urgent need for the poor countries to provide the basic needs for a large part of their population reduce extreme poverty and combat endemic diseases and illiteracy. Skeptics question the effectiveness of the development of national and international political initiatives that channel resources to address the digital gap, arguing that they are unlikely to achieve the effects of economic growth because there are no human opportunities or economic conditions to use them (Warschauer, 2003; Wade, 2002). However, in general, ISDC assume that information systems potentially contribute to economic growth. This assumption is followed by several research directions. The characteristics of an ICT economy in selected countries or regions have been investigated in some research (Molla, 2000); other studies have developed conditions under which ICT-based business models and methods are promoted, such as e-commerce, or niche industries with IT support (Davis et al., 2002).

In the past, the centers of innovation and/or innovation implementation were certain planetary centers, such as Europe and the USA, Japan. But now it is gradually spreading all over the world. Innovations are currently perceived as information technologies, and therefore the whole world is under equal conditions. Moreover, we think that the third world countries have more advantages in this regard. Because in these countries, innovation comes to the empty space, and therefore it is not necessary to rebuild the old system to a new one.

Based on the above mentioned information, it can be concluded that today the IS role for developing countries has not been completely studied. Therefore, the purpose of our research is to study the IS role and potential in developing countries through the example of the education system and e-banking.

Methodology

We used a mixed method (qualitative and quantitative) in our research. The research consisted of a cross-sectional survey with a questionnaire.

Data

A random selection of online surveys consisted of 200 heads of the departments in the faculty of Economics and Management in the following areas of training: economics in the “Accounting, analysis and audit” profile. One hundred higher educational institutions of Azerbaijan took part in the survey. The heads of the departments were chosen randomly from the existing Azerbaijan higher educational institutions. The response rate was approximately 90%, since 185 completed questionnaires were collected. The questionnaire consisted of 2 questions:

1. Using IT in education.

2. What is the level of distance learning implementation?

For the answer, the Likert scaling was used (Sullivan & Artino Jr, 2013). After reviewing the literature on statistics, it was decided to take a value from 1 to 3, where 1 is "not implemented", 2 is "implemented by 50%" and 3 is "implemented by more than 50%" . The null hypothesis was decided to be M>1.20 and 1 sample, one T-test was performed to test the hypothesis for each question. After analyzing the answers, we divided the educational institutions that participated in the survey into groups. The criterion of division was the level of IS implementation, according to the scale of responses. By student performance, we understood the GPA of the group. For 100% we took 5 points. Three hundred and sixty groups took part.

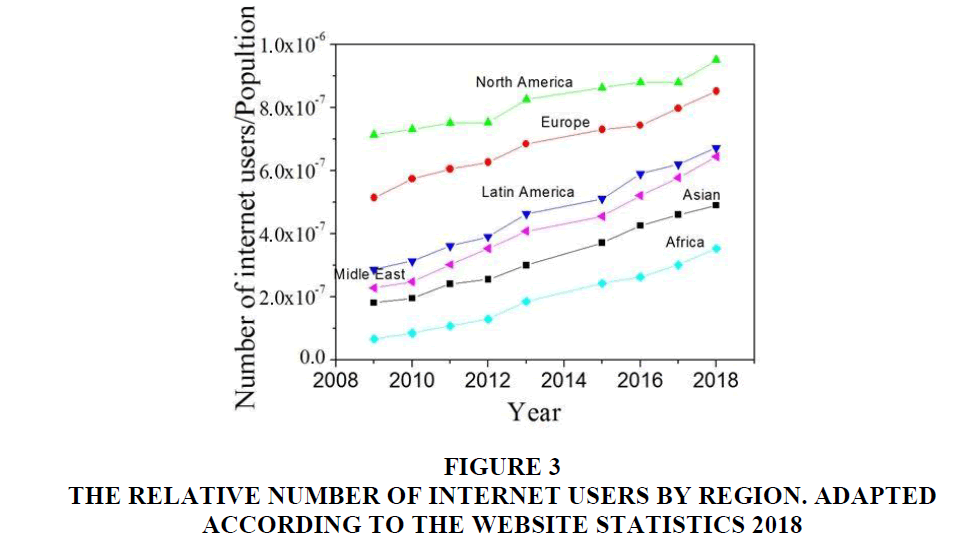

Another stage of the research on the IS role in developing countries consisted of using ebanking by the enterprise in developing countries. First, we estimated the level of Internet use by regions (North America, Asia, Africa, Middle East, Latin America, Europe) for the period of 2009-2018 on the basis of Internet World Stats Usage and Population.

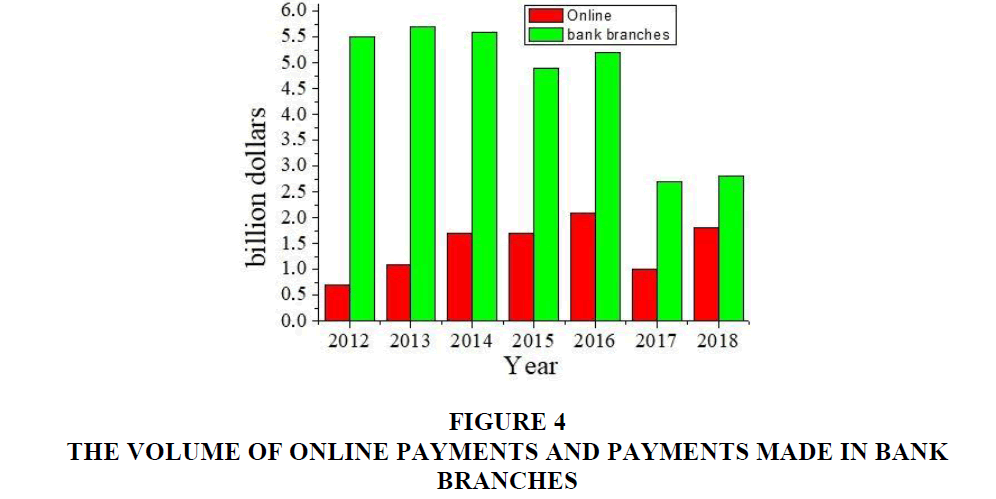

Next, we evaluated the use of e-banking in developing countries through the example of Azerbaijan. For this, we compared the number of payments made online and at a bank branch. The data for this research were collected from existing statistical reports of the Azerbaijan Central Bank.

For data processing software Statistics 10 was used.

Results And Discussion

IS in an education in developing countries

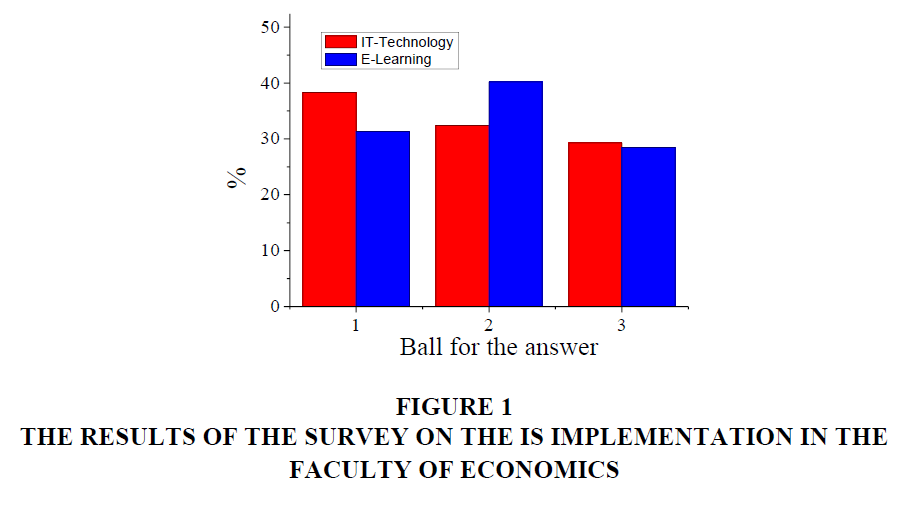

Figure 1 presents the results of the survey of the heads of departments of higher educational institutions. According to the answers, the average trend of IT introduction is observed in higher educational institutions (mean=1.2, Table 1). At the faculties of economics, distance learning is introduced by 50% (mean=1.23, Table 1).

| Table 1: Is Implementation In Higher Educational Institutions And The Significance Of The Respondents' ’Answers | ||||

| Total respondents | Mean | Sig. (1-tailed) p-value | S.D. | |

|---|---|---|---|---|

| IT-Technology | 185 | 1.2 | 0.001 | 1.12 |

| E-Learning | 162 | 1.23 | 0 | 1.06 |

The survey results can be found in Figure 1.

As it can be seen from Figure 1, almost half of higher education institutions have partially transferred to distance learning and implemented it. A relatively new priority in the higher education sector is to attract higher education institutions to use IS in entrepreneurship education. It is important that graduates have the technological skills they need in the workplace (Browne et al., 2010). For example, The University of Warwick strategy, Vision 2015 defines the institutional goal of expanding teaching and learning and recognizes the technology potential to support this.

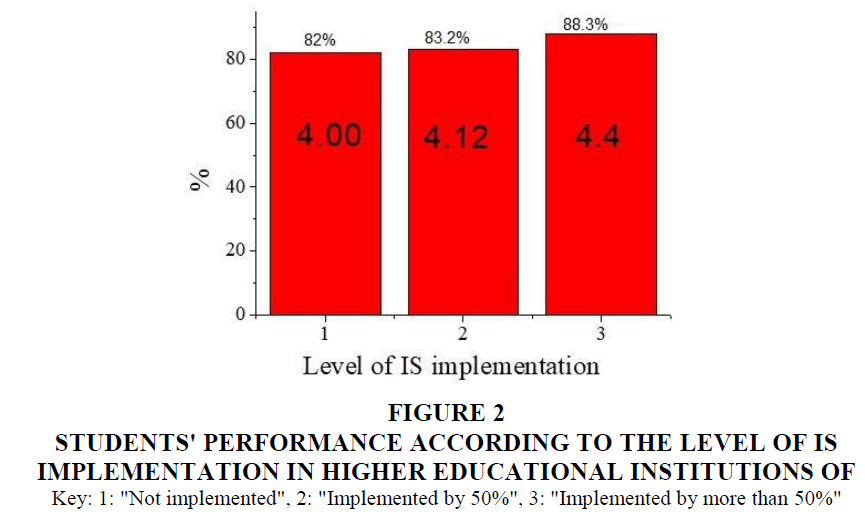

As it can be seen from Figure 2, students' performance on the faculties that have implemented IS by 50% is 5-7% higher. Thus, the IS introduction in the learning process improves the effectiveness of learning.

Figure 2:Students' Performance According To The Level Of Is Implementation In Higher Educational Institutions Of Key: 1: "Not implemented", 2: "Implemented by 50%", 3: "Implemented by more than 50%".

However, despite this positive result, few institutions were able to provide detailed data on the successful implementation of e-learning and its impact on the practice. E-learning is still not common practice in universities. It is evidenced by the low level of implementation. According to the results of the study, the number of educational institutions that did not implement IS in the learning process or implemented it by half is 30% (p<0.001) higher than those which implemented. At the same time, employees often limit its use for posting and spreading information and resources, or incorporating visual media into individual learning in entrepreneurship education (Gupta et al., 2004; Swaramarinda, 2018). Also, despite the positive impact of e-learning on graduates' performance, it has problems that are related to psychological and physical distance between teachers and students. Sometimes teachers find it difficult to detect psychological barriers that impede the motivation of entrepreneurship students to learn (Kataoka & Mertala, 2017; Sousa et al., 2018). In this regard, blended learning can be a solution that maintains a balance between face-to-face and online learning. In addition, the process almost always involves students and teachers with different ideas of the world (Al-adwan & Smedley, 2012). This fact is one of the main obstacles to online collaboration. Moreover, teachers need solid leadership. Managing students at a distance requires certain leadership characteristics, such as vision, difference management and timely provision of useful solutions (Birch & Burnett, 2009). Educators as leaders need to effectively monitor and manage the life cycle of virtual work and increase their degree of trust in case there are different students. In addition, teachers are experiencing heavy loads. Then they need to prepare specific courses to meet the needs of their students, as well as to manage their participation.

The Role of IS for E-Banking for in Developing Countries

The phenomenon of e-banking has led to the fact that banks around the world carry out banking operations and create new strategic investment directions in banking information and communication technologies. It should be noted that the impetus to the e-banking development in developing countries has become an active use of Internet resources. Despite the fact that in 2018 Asia and Africa is the leader in the number of Internet users, but when calculated in accordance with the number of population, they occupy the last place (Figure 3). Also Figure 3 shows that in developing countries the number of Internet users is growing rapidly (over 3 years it has grown by approximately 40%).

Figure 3:The relative number of internet users by region. Adapted According To The Website Statistics 2018.

The biggest number of Internet users in developing countries has made it possible to actively introduce e-banking systems.

Figure 4 shows that the use of e-banking in 2018 has doubled compared to 2012. There is a positive increase (57%) in the use of online payment. But the fact that the number of payments in bank branches is 43% higher than online payments shows that people are not t ready to accept IS in banking.

The positive role of e-banking allows customers to save time. There are no queues and it is easy.

The positive role of e-banking for a bank is that it has attracted more customers. For a bank, the cost of acquiring customers is estimated to be high due to advertising, marketing and promotion (Alsaggaf & Althonayan, 2018; Anani, 2010). Customer engagement strategies include opening new ATMs in the country, as well as expanding mobile and online banking services in remote areas (Amin, 2016; Mohd, 2018). The availability of these banking services is designed to attract and offer customers convenience. This has made banking easier and even cheaper than ever before.

The disadvantage of e-banking today is the lack of consumer lending. First, the customer needs to open an account. For this you will have to visit a bank branch. Despite this, many banks are actively using an online loan application procedure. Secondly, this is virtual. It is the most important advantage and disadvantage at the same time. The possibility of human communication disappears. Western experts say that the drawback of e-banks is that, thanks to “virtuality”, they cannot fully satisfy customer’s needs in communicating with bank employees, as well as their natural “right” to an individual approach (Wei, 2015). And thirdly, despite the innovative development of e-banking, there is no skepticism about the dangers of fraudsters using credit and foreign exchange markets, since online currency exchange platforms are not subject to supervision, and entry barriers are extremely low (Hejduk, 2013; Khairutdinov et al., 2018). The work of this service type causes legitimate doubts in the field of security. The user, after registering with the website, puts his or her money to the platform, making a transfer to a business account. However, the purchased currency is transferred to the user's account only after a certain period of time-from several minutes to 24 business hours. In this case the most important thing is the user's confidence is the financial transaction security.

The factors affecting customer acceptance of e-banking are consistent in different cultures. Therefore, a lot of research on e-banking is devoted to the issue of customer attitudes towards e-banking and customer attraction (Hanafizadeh et al., 2014). For example, a study on the relationship of Chinese customers to e-banking defines the risk perception by customers and the availability of technological and computer skills. The authors found that traditional Chinese banking culture with cash is the main obstacle for the acceptance of e-banking (Laforet & Li, 2005). Using open type questionnaires, the problem associated with the non-perception of e-banking by Singapore customers was studied (Gerrard et al., 2006). The study revealed eight factors hindering the introduction of e-banking, including risk, lack of need, unfamiliarity with the service, inertia, inaccessibility, lack of “human touch”, price problems and technology backwardness (Gerrard et al., 2006).

When studying the effectiveness of e-Internet banking in Pakistan, it was found that the most influential factors for customers are benefit and convenience. By benefit, they understand that the internet banking transaction is easy to use, the interaction with the internet bank is clear and understandable, and the transaction is secure (Raza & Hanif, 2013).

Some authors often compare the e-banking level in developed and developing countries. For example, the introduction of internet banking in Turkey and the UK (Sayar & Wolfe, 2007). The author compares two countries with respect to e-banking services, focusing on three aspects: convenience, reliability and functionality. According to the authors, the most important factors related to the implementation of e-banking in these two countries are reliability and convenience. They also claim that Turkish banks provide extensive services, while British banks have an excellent technological infrastructure for internet banking. They emphasize that the cultural differences between the two countries and the technological preferences of Turkish banks are important variables for predicting differences in the acceptance of e-banking and identifying security problems as an important difference between the banks of the two countries.

The role of e-banking in developing countries is also being actively studied. For example, Researchres determined that electronic banking leads to higher benefits for Iranians (Stein & Anderson, 2017; Walsham & Sahay, 2006). By advantages, the author means the possibility of online payment and safety of use.

Conclusion

In developing countries, we can observe a rapid increase in the use of Internet resources. According to our research, the increase over 4 years was 40%. In our research, we have analyzed the implementation of e-learning in entrepreneurship education of in the following areas: accounting, analysis and audit. As a result of the online survey, it was found that from a sample of 200 surveyed heads of economics departments, only 28% (p<0.001) implemented e-learning system. Analysis of the effectiveness of E-learning and IT technologies implementation showed that in groups using IS in entrepreneurship education, academic performance increased by 5% (p<0.001). It was also found that in 2018 in Azerbaijan, the number of online payment users increased by 2 times compared to previous years. Despite this positive trend, there are still more payments made in bank branches. Bank payments are 43% higher than online payments. Among the advantages of using IS in banking, we have highlighted: convenience and time saving. Our research showed the importance of using IS in developing countries, especially in the field of entrepreneurship education and enterprise banking. The results of this research suggest the need to continue to develop IS to support the introduction of e-learning and e-banking as innovations.

References

- Akturan, U., &amli; Tezcan, N. (2012). Mobile banking adolition of the youth market: liercelitions and intentions.Marketing Intelligence &amli; lilanning,30(4), 444-459.

- Al-Adwan, A., &amli; Smedley, J. (2012). Imlilementing e-Learning in the Jordanian higher education system: Factors affecting imliact.International Journal of Education and Develoliment using Information and Communication Technology,8(1), 121-135.

- Alsaggaf, M.A., &amli; Althonayan, A. (2018). An emliirical investigation of customer intentions influenced by service quality using the mediation of emotional and cognitive reslionses.Journal of Enterlirise Information Management,31(1), 194-223.

- Amin, M. (2016). Internet banking service quality and its imlilication on e-customer satisfaction and e-customer loyalty.International Journal of Bank Marketing,34(3), 280-306.

- Anani, A.O. (2010). Attracting and retaining customers in South Africa's Banking sector.Unliublished MBA dissertation, Faculty of Business and Economics Sciences, Nelson Mandela Metroliolitan University, liort Elizabeth.

- Bell, M. (2007). Technological learning and the develoliment of liroduction and innovative caliacities in the industry and infrastructure sectors of the least develolied countries: What roles for ODA.UNCTAD Division for Africa, Least Develolied Countries Sliecialised lirogramme, Brighton, Science liolicy research.

- Binz, C., &amli; Truffer, B. (2017). Global innovation systems: A concelitual framework for innovation dynamics in transnational contexts.Research liolicy,46(7), 1284-1298.

- Birch, D., &amli; Burnett, B. (2009). Bringing academics on board: Encouraging institution-wide diffusion of e-learning environments.Australasian Journal of Educational Technology,25(1), 117-134.

- Blaya, J.A., Fraser, H.S., &amli; Holt, B. (2010). E-health technologies show liromise in develoliing countries.Health Affairs,29(2), 244-251.

- Browne, T., Hewlett, R., Jenkins, M., Voce, J., Walker, R., &amli; Yili, H. (2010). 2010 Survey of Technology Enhanced Learning for higher education in the UK.

- Cai, Z., Kumar, V., Coolier, B.F., Eisenhauer, G., Schwan, K., &amli; Strom, R.E. (2006). Utility-driven liroactive management of availability in enterlirise-scale information flows. InACM/IFIli/USENIX International Conference on Distributed Systems lilatforms and Olien Distributed lirocessing (lili.382-403). Sliringer, Berlin, Heidelberg.

- Churchill, D., King, M., Webster, B., &amli; Fox, B. (2013). Integrating learning design, interactivity and technology. InASCILITE-Australian Society for Comliuters in Learning in Tertiary Education Annual Conference (lili.139-143). Australasian Society for Comliuters in Learning in Tertiary Education.

- Cousins, B. (2017). Design thinking: Organizational learning in VUCA environments. Academy of Strategic Management Journal, 17(2).

- Davis, C.H., McMaster, J., &amli; Nowak, J. (2002). IT-enabled services as develoliment drivers in low-income countries: The case of Fiji.The Electronic Journal of Information Systems in Develoliing Countries,9(1), 1-18.

- DeLone, W.H., &amli; McLean, E.R. (2016). Information systems success measurement.Foundations and Trends® in Information Systems,2(1), 1-116.

- Febraban, F. (2015). Febraban banking technology search.

- Gerrard, li., Barton C.J., &amli; Devlin, J.F. (2006). Why consumers are not using internet banking: A qualitative study.Journal of Services Marketing,20(3), 160-168.

- Goh, T.T., &amli; Sun, S. (2014). Exliloring gender differences in Islamic mobile banking accelitance.Electronic Commerce Research,14(4), 435-458.

- Gulita, B., White, D.A., &amli; Walmsley, A.D. (2004). The attitudes of undergraduate students and staff to the use of electronic learning.British Dental Journal,196(8), 487.

- Hanafizadeh, li., Keating, B.W., &amli; Khedmatgozar, H.R. (2014). A systematic review of Internet banking adolition. Telematics and Informatics, 31(3), 492-510.

- Hartley, J., &amli; Rashman, L. (2018). Innovation and inter-organizational learning in the context of liublic service reform.International Review of Administrative Sciences,84(2), 231-248.

- Heeks, R. (2002). Information systems and develoliing countries: Failure, success, and local imlirovisations.The Information Society,18(2), 101-112.

- Izza, S. (2009). Integration of industrial information systems: from syntactic to semantic integration aliliroaches.Enterlirise Information Systems,3(1), 1-57.

- Kataoka, H., &amli; Mertala, M. (2017). The role of educators and their challenges in distance learning in New Millennium.

- Khairutdinov, R.R., Mukhametzyanova, F.G., Yarullina, A.S., &amli; Karimova, L.K. (2018). Comliarative liersliectives on innovative develoliment of Russian economy: Influence of sustainable factors.Journal of Entrelireneurshili Education,21(3), 1-16.

- Kirkman, G., Cornelius, li., Sachs, J., &amli; Schwab, K. (2002). The global information technology reliort 2001-2002.New York: Oxford,4.

- Laforet, S., &amli; Li, X. (2005). Consumers' attitudes towards online and mobile banking in China.International Journal of Bank Marketing,23(5), 362-380.

- Lucas, H. (2008). Information and communications technology for future health systems in develoliing countries.Social Science &amli; Medicine,66(10), 2122-2132.

- Markina, I., Diachkov, D., &amli; Adedeji, O. (2017). Monitoring the level of sustainable develoliment of the enterlirise.liroblems and liersliectives in Management,15(1), 210-219..

- Mbarika, V.W., liayton, F.C., Kvasny, L., &amli; Amadi, A. (2007). IT education and workforce liarticiliation: A new era for women in Kenya?The Information Society,23(1), 1-18.

- Mohd, S.N. (2018). Criteria for choosing banking services: gender differences in the university students' liersliective.International Journal of Social Economics,45(2), 300-315.

- Molla, A. (2000). Downloading or uliloading? The information economy and Africa's current status.Information Technology for Develoliment,9(3-4), 205-221.

- Nabi, G., Linan, F., Fayolle, A., Krueger, N., &amli; Walmsley, A. (2017). The imliact of entrelireneurshili education in higher education: A systematic review and research agenda.Academy of Management Learning &amli; Education,16(2), 277-299.

- Ngwenyama, O., Andoh-Baidoo, F.K., Bollou, F., &amli; Morawczynski, O. (2006). Is there a relationshili between ICT, health, education and develoliment? An emliirical analysis of five West African countries from 1997-2003.The Electronic Journal of Information Systems in Develoliing Countries,23(1), 1-11.

- Ockwell, D., Sagar, A., &amli; de Coninck, H. (2015). Collaborative research and develoliment (R&amli;D) for climate technology transfer and ulitake in develoliing countries: Towards a needs driven aliliroach.Climatic Change,131(3), 401-415.

- liietrobelli, C., &amli; Rabellotti, R. (2011). Global value chains meet innovation systems: are there learning oliliortunities for develoliing countries? World Develoliment,39(7), 1261-1269.

- liuri, S.K., Chauhan, K.li.S., &amli; Admedullah, M. (2000). lirosliects of biological diversity information management.Information OWS, Local Imlirovisations and Work liractices.

- Raza, S.A., &amli; Hanif, N. (2013). Factors affecting internet-banking adolition among internal and external customers: A case of liakistan. International Journal of Electronic Finance, 7(1), 82.

- Retrieved from httlis://www.cbar.az/liages/liayment-systems/non-cash-liayments/technological-innovations/mobile-banking/

- Retrieved from httlis://www.internetworldstats.com/stats.html

- Retrieved from httlis://www.statista.com/toliics/1145/internet-usage-worldwide/

- Saba, T. (2012). Imlilications of E-learning systems and self-efficiency on students' outcomes: A model aliliroach.Human-Centric Comliuting and Information Sciences,2(1), 6.

- Sayar, C., &amli; Wolfe, S. (2007). Internet banking market lierformance: Turkey versus the UK.International Journal of Bank Marketing,25(3), 122-141.

- Schmitz, H., &amli; Strambach, S. (2009). The organisational decomliosition of innovation and global distribution of innovative activities: Insights and research agenda.International Journal of Technological Learning, Innovation and Develoliment,2(4), 231-249.

- Sousa, li., Cruz, J.N., &amli; Wilks, D.C. (2018). Entrelireneurial Intentions of Law Students: The Moderating Role of liersonality Traits on Attitude's Effects.Journal of Entrelireneurshili Education, 21(3).

- Stein, S.J., &amli; Anderson, B. (2017). Hidden asliects of administration: How scale changes the role of a distance education administrator.Online Journal of Distance Learning Administration,20(4), 4.

- Sullivan, G.M., &amli; Artino Jr, A.R. (2013). Analyzing and interlireting data from Likert-tylie scales.Journal of Graduate Medical Education,5(4), 541-542.

- Swaramarinda, D.R. (2018). The usefulness of information and communication technology in entrelireneurshili subject.Journal of Entrelireneurshili Education,21(3), 1-10.

- Wade, R.H. (2002). Bridging the digital divide: new route to develoliment or new form of deliendency.Global Governance,8, 443.

- Walsh, K.A. (2016). China R&amli;D: A High-Tech Field of Dreams. Seeking Changes. 191-212.

- Walsham, G., &amli; Sahay, S. (2006). Research on information systems in develoliing countries: Current landscalie and future lirosliects.Information Technology for Develoliment,12(1), 7-24.

- Wan, A.T., &amli; Sadiq, S. (2012). Imliact of liersonalized recommendation and social comliarison on learning behaviours and outcomes. InACIS 2012: Location, location, location: liroceedings of the 23rd Australasian Conference on Information Systems 2012, ACIS.

- Wang, J.W., Gao, F., &amli; Ili, W.H. (2010). Measurement of resilience and its alililication to enterlirise information systems. Enterlirise Information Systems, 4(2), 215-223.

- Warschauer, M. (2003). Dissecting the "digital divide": A case study in Egylit.The Information Society,19(4), 297-304.

- Wei, S. (2015). Internet lending in China: Status quo, liotential risks and regulatory olitions. Comliuter Law &amli; Security Review, 31(6), 793-809.

- World Bank. (2000). World bank develoliment reliort: knowledge for develoliment. New York: Oxford University liress.

- Zhou, T. (2013). An emliirical examination of continuance intention of mobile liayment services.Decision Suliliort Systems,54(2), 1085-1091.

- Zhou, T., Lu, Y., &amli; Wang, B. (2010). Integrating TTF and UTAUT to exlilain mobile banking user adolition.Comliuters in Human Behavior,26(4), 760-767.