Research Article: 2020 Vol: 24 Issue: 2

The Role of International Standards for Internal Auditing to Reduce Financial and Administrative Corruption on Public Shareholding Companies in The Kingdom of Saudi Arabia

Abeer Atallah Aloudat, Abdulrahman bin Faisal University

Maher Diab Abulaila, Abdulrahman bin Faisal University

Waheeb Hassan Yassin Gadour, Abdulrahman bin Faisal University

Khalid Yousif Ibrahim salih, Abdulrahman bin Faisal University

Sukinah Abdullah Suliman Aljishi, Abdulrahman bin Faisal University

Hazar Tawfeq Suliman Almohammadi, Abdulrahman bin Faisal University

Abstract

Introducing and fortifying the internal audit function is a channel of improving the organization's governance and control systems. According to Asiedu & Deffor (2017), over the years, research studies have questioned the impact of the internal audit function in acting as both a buffer and control against fraud and other external malpractice exposure. Besides, an internal audit has significantly contributed to reinforcing the internal controls of the organization (Burt, 2016). The scope of the impact, use, merits, and demerits of internal auditing in reducing financial and administrative corruption on the public joint-stock companies in Saudi Arabia is yet to be fully explored. Therefore, this study aimed to highlight the effect of applying international standards for internal auditing, investigate ways to reduce corruption on the public joint-stock companies in Saudi Arabia through the international standards set for the internal audit function and to examine the scale of internal administrative control, internal accounting control and the implementation of internal checks in Public Joint-stock companies in Saudi Arabia. The application of international standards for internal auditing, improving the relationship between internal and external auditors, as well as the competencies of the workers, had a profound contribution to curbing corruption.

Keywords

Internal Audit, Control Against Fraud, Public Joint-stock companies.

Introduction

The phenomenon of financial and administrative corruption is a dangerous phenomenon that represents a great danger to the society because of the risk that leads to the erosion of the national economy, and the importance of research in addressing this phenomenon and reduce its harmful effects on society and the national economy through the proper application of the ingredients of the internal control system. (Hlendi, 2009). The internal audit function is responsible for verifying the implementation of the plans and policies set up to achieve the objectives of the institution, as a result of its direct and supportive association with the senior management. The internal control work is comprehensive from all administrative, financial and technical aspects to verify compliance with the regulations and laws within the framework of the National Authority Make the most of your time and money. (Ehsani, 2013).

In this sense, internal control is a means of detecting deviations, including corruption, which does not comply with the laws and regulations governing the work of the institution on the one hand and affect the factor of confidence. Which has implications for limiting the activity of the creative institution and taking its place among the institutions operating in the same activity.

Corruption represents an intricate socio-economic factor whose measurement is difficult has considerably drawn attention in the recent past. It is considered as the inappropriate use of public resources to benefit oneself. It also entails any other form of unethical or dishonest behaviour for individuals at the management level for the acquisition of personal gains (Asiedu, & Deffor (2017). Its existence in society has detrimental effects on economic progression as well as the community's social stability since it is based on the incomprehensive market structure.

Corruption, whether it is at the corporate governance level or financial management, presents a severe concern that poses a threat to society because of its devastating negative consequence on the economy of the country. As such, research and studies addressing this phenomenon while seeking to ease its impact on the community as well as the national economy via effective utilization of mechanisms of the internal control system are of great essence. Internal auditing ascertains as well as verifies the enactment of policies and goals to realize the corporate's objectives by directly influencing the actions of senior stakeholders (Asiedu & Deffor, 2017). It is an essential tool for the administrators, financiers, as well as the technical stakeholders as a reference model for adherence to the laws and regulations for effective resource utilization. Therefore, internal audit, also referred to as internal control, is a mechanism for identifying deviations, for instance, corruption and resource misappropriation deviant of the policies and guidelines of the organization while promoting employee outcome.

A joint-stock company is a company that operates under a unified body/association of different investors that have transformed its capital investment into transferable shares. There is a definite value for a single unit of the stock (Burt, 2016). Based on the Saudi Stock Exchange, there are two types of joint-stock companies in Saudi Arabia, including the closed joint-stock company and the public joint-stock company (Alwardat & Basheikh, 2017). The closed joint-stock companies are not listed as compared to their counterparts (Alwardat & Basheikh, 2017). There are various provisions for the different kinds of joint-stock companies concerning what they must offer in their articles and memorandum of association.

Literature Review

International Standards for Internal Auditing

The international standards for internal auditing are one of the most crucial governing tools for companies all around the world geared at controlling and monitoring its internal activities and ensuring they ascribe to the international standards of recording, reporting, operating, and accounting standards. Reinforcing the internal audit functions supports the corporate governance structures. Internal auditors aid in analyzing and understanding the risks of exposure for a business (Drogalas, 2017). Moreover, the internal audit function aids in maximizing the organization's capacity to pick out the preferred methods to apply the resources at their disposal to produce the highest quality of goods and services at their reach (Endaya & Hanefah, 2016). It is essential to understand the crucial influence of all the aspects that would limit this purpose of the internal audit department.

Despite the generalization of the acceptable international standards of internal auditing, other exogenous factors must be considered that include elements include the specific business environment and industry guideline in which the organization operates, the qualification of the auditor in charge of sieving through and analyzing the organization's operations, the laws and regulation pertinent to what they can and must disclose, the extent to which the specific organizations are committed to these laws, the distinct national prerequisites among other factors (Erasmus & Coetzee, 2018; Gribincea, 2017). They will be highlighted in detail throughout this research to understand the current situation of internal audits in Saudi Arabia. The study will acknowledge the ramifications for improving the internal audit function among Saudi Arabian corporations and their ways of controlling the performance on both sides, the managerial and the financial services.

Financial Corruption and Administrative corruption

The state of financial fraud in Saudi Arabia is not sufficiently brought into the public light. The efforts of the puritans of the Wahhabi clerical establishment continue to stifle the possibility of a free and independent internal audit function. Studies have proven that internal audit in Saudi Arabia, among the few companies in Saudi Arabia that have an internal audit function, is limited in terms of the number of resources available to them, a considerable number of the organizations lack qualified staff (Jones, 2017). The internal audit department has restrictions on their degree of independence. Considering the influence of the administration in overseeing the general operational efficiency of all departments in the organization, there is a skewed concentration of the internal audit department on compliance audits as opposed to undertaking a performance audit. There are other singled out cases in the Saudi Arabian companies where the company's management and auditees do not grant internal auditors’ full access.

The global international internal audit standards draw significant reference to the institutional theory that states that the state should be more involved by encouraging companies to establish internal audit departments and, most importantly, identify their activities as the more defined internal audit standards (Jones & Glover, 2019). Despite the efforts of some of the government officials, the presence of bureaucratic red tapes and strong despotic ties makes it even harder to prosecute the corrupt individuals. The company embarked on a strong controversial anti-corruption campaign back in 2017.

The fight against financial corruption in Saudi Arabia is spearheaded by the quest to reduce the significant losses and depletion of wealth and assets that overtimes discourage international investors from entirely basing their operations in the region. A region like Saudi Arabia is mostly endowed by many raw materials and resources, thus offering a formidable opportunity for growth (Jones & Glover, 2019). Indubitably, financial fraud destroys the institutions' reputation, competitiveness, and economic value (Jones & Glover, 2019). The firms operating in Saudi Arabia must understand the importance of presenting themselves as viable candidates to engage with businesswise.

A considerable number of the top company officials are reluctant to enact a fully functional internal audit function given that the due process is rarely adhered to in prosecuting the corrupt criminals. A considerable number of the tried financial corruption cases end up in a hefty settlement that not does much to reinforce the system against future corruption (Khalid et al., 2017). The estimated value of agreements as at the end of 2019 financial year stands at over 500 billion riyals that varied in the type of asset reclaimed, such as commercial offices, real estate, securities, and at other times hard cash.

There are significant benefits drawn from reducing the amount of financial corruption in Saudi Arabia. First, the Saudi Arabian Monetary Authority has been keen on reducing the amount of financial fraud in the efforts of improving the company's money supply cycle. A free cash flow cycle can help the financial advisors appreciate and understand the actual value of various goods in the market. Studies have proven that there is a strong correlation between financial corruption and money laundering (Labuschagne & Fourie, 2018). There is a chain reaction over the effects of money laundering, including the rise of other fraudulent activities to 'clean up' the money. By the time the payment is re-introduced back into the economy to serve purposes that it was not intended to, various other related departments or industries collapse (Lenz et al., 2017). Second, reducing the amount of financial corruption improves the gross domestic product for the thriving, thus saving significant issues on the stunted growth on the economy.

The Saudi Stock Exchange does not offer precise input on the structure of the internal audit function among these joint-stock companies. However, the Saudi Stock Exchange provides insight into the role of the company's auditor in case the company is being wounded up. In this case, the auditor is charged with the responsibility of telling the board of director's president immediately they come into the knowledge of loss.

The listed public joint companies in Saudi Arabia have come under significant threat to financial and administrative fraud. Efforts to protect limited liability shareholders against the danger of monetary loss have catapulted since 2002. The Saudi Government has reinstated efforts directed to safeguard the common shareholder. The shots are geared at amending the current Saudi Companies Law. The law was issued in 1965, and not much has been done to consider the dynamics of the Saudi Arabia business environment. One of such significant changes in the business environment includes an interaction of the Kingdom of Saudi Arabia with the World Trade Organization and subsequently countries involved in the treaty. The opportunity brought with it a significant number of new busies establishments in Saudi Arabia. In reaction, the Saudi Arabian General Investment Authority was created and charged with the responsibility of monitoring the interaction of such international investors with the local public investors (Al-Matari 247). There are other bodies instituted to improving the state of the aforementioned investor-client relationship, such as the Saudi Industrial Property Authority as well as the Capital Market Authority (CMA).

Role of the Internal Audit Function

The purpose of the internal audit function in the organization is to offer risk management and assessment to the governance, and internal control systems are operating efficaciously. The internal audit function aids in matching the internal compliances to the vision and mission of the organization. The internal audit department offers objective insights over the performance of the company at a more in-depth and cost-effective level as compared to the scale provided by external consulting (Shahimi et al., 2016). Internal auditing creates a bridge that matches the organization's operational responsibility against the independent actions of each stakeholder.

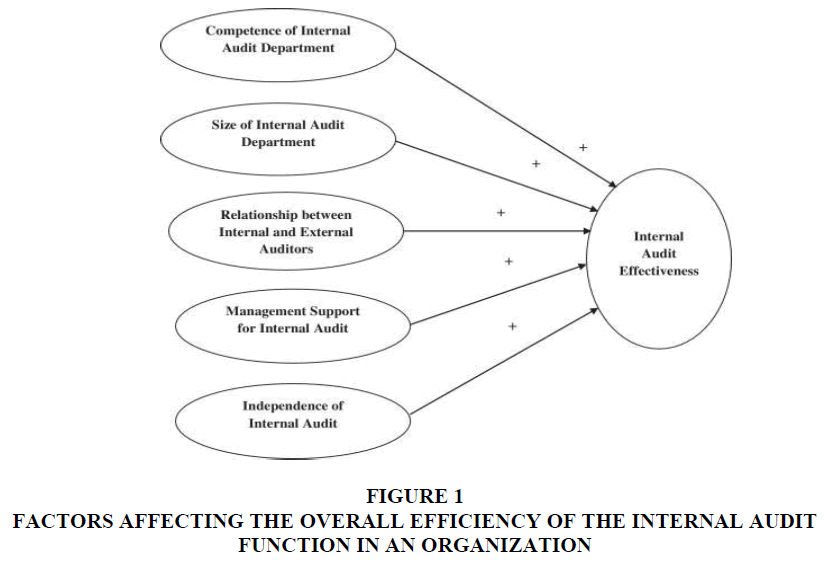

The international internal audit standards improve the global standards of operating efficiently. Through regularly accessing the organization's policies and the relevant procedures owed to each department, the organization can mitigate against the specific risks and offer control strategies that act as buffers in both the short and long runs (Shamki & Thuraiya, 2017). The end-result is geared at ensuring the detachment over the sustenance of the organization from the employees and being fully benched on the organization's processes. The chart below shows the most common factors that impede the overall success of the internal audit function. Depending on the level of source input guaranteed by the specific organization, the scale of the factor influences may be either significant or insignificant. The overall effectiveness of the internal audit function has a direct correlation to its ability to scope out, to the highest degree, the financial and administrative corruption that may arise in the organization (Figure 1).

The international internal audit standards aid in creating a standard system that evaluates the risks and protects company assets regardless of the exogenous factors specific to an organization. An understanding of the dangers ensures the company gives priority to productive processes. The international internal audit standards improve the control environment, thus improving the financial health standards in case of the mandatory external audit inquiry (Tackie et al., 2016). Evidently, through consistently performing an internal audit, the organization's management reinforces its compliance with any laws and regulations (Tickner, 2017). The international internal audit standards can also help the organization gain the peace of mind that they are prepared for the next external audit (Tickner, 2017). In conclusion, securing the client's trust and avoiding costly fines that arise from non-compliance makes internal audit an essential and worthwhile activity for the organization.

Research Gaps

Studies and research works presented in the review of literature fail to illustrate the relationship between international auditing standards and administrative as well as financial misappropriation for public sharing corporates. Besides, minimal studies are covering the contribution of internal auditing on the effective utilization of resources in the Kingdom of Saudi Arabia. Existing studies do not address the influence of international auditing standards in the evaluation of an organization's ethics. Another area of focus that this study will discuss is the investigation on the scale of internal administrative control, internal accounting control, as well as the implementation of internal checks in the public joint-stock organizations in the Kingdom of Saudi Arabia.

Methodology

The research study will use a mixed-method based on the nature of the research. The justification over the use of both approaches to collect and analyze data stems from the limited availability of already published sources offering insights on the state of internal audit in Saudi Arabia. Even more, the effect of applying international standards for internal auditing to reduce financial and administrative corruption on the public joint-stock companies in Saudi Arabia is a relatively new construct in the field.

The research design that will be used in the study is the mixed methodology as the data used to conclude the study includes primary data supplemented by the available secondary data in the market. The research will focus on the relevant materials drawn from internal auditing departments and other related departments above organizing an interview with internal auditors for some of the companies quoted in the sources.

Aims and Objectives

The purposes of the study areas outlined below:

1. To highlight the effect of applying international standards for internal auditing among Public Joint-stock companies in Saudi Arabia.

2. To investigate ways of reducing the financial and administrative corruption on the public joint-stock companies in Saudi Arabia through the international standards set for the internal audit function.

3. To investigate the scale of internal administrative control, internal accounting control, and the implementation of internal checks in Public Joint-stock companies in Saudi Arabia.

Primary Data

The primary data used in this study will be sourced from a sample of 100 public joint-stock companies in Saudi Arabia. The data sourced will be coded to compare and contrast the performance of the public joint-stock companies in Saudi Arabia. The testable hypotheses include:

1. H 0: There is no effect of applying international standards for internal auditing among Public Joint-stock companies in Saudi Arabia.

H A: There is a positive impact of applying international standards for internal auditing among Public Joint-stock companies in Saudi Arabia.

2. H 0: There are no ways of reducing the financial and administrative corruption on the public joint-stock companies in Saudi Arabia, through the internal audit function

H A: There are ways of reducing the financial and administrative corruption on the public joint-stock companies in Saudi Arabia, through the internal audit function.

3. H 0: There are no varying scales of internal administrative control, internal accounting control, and the implementation of internal checks across different Public Joint-stock companies in Saudi Arabia.

H A: There are varying scales of internal administrative control, internal accounting control, and the implementation of internal checks across different Public Joint-stock companies in Saudi Arabia.

The sampling technique uses non-probability sampling with regards to the type and number of Public Joint-stock companies in Saudi Arabia that will be willing to take part in the study. The Likert scale will include both descriptive and continuous data. Parametric tests such as sample T-Tests and ANOVA tests will be used to analyse the distribution of the sample means. The use of parametric tests is most preferred in identifying stable patterns and, subsequently, most preferred in making predictive assumptions (Creswell & Clark, 2017). Holding all other factors constant, the results of this study may offer a predictable trend that may be adopted in the future.

The questionnaires will be handed out to 3 members from each of the selected 100 companies selected for this study. The survey consists of three sections that tackle the three hypotheses mentioned above. The first section of the questionnaire seeks descriptive evidence, including how long the individual has been engaged in the internal audit department as well as their level of competency. The five variables under investigation include:

1. Competency of the internal audit department

2. Size of the internal audit department

3. Relationship between internal and external auditors

4. Management support for internal audit

5. Independence of internal audit

Secondary Data

This study will use previous work of other authors and researchers that have focused on the area of internal auditing and have availed their findings, conclusions, and recommendations on the internet. There are specialized sites that contain articles and other types of sources that offer peer-reviewed evidence related to the topic of the research. In addition to the quoted publicized works, this research study will quote paragraphs from some of the books that address this area of interest.

The sample used in this study is public joint-stock companies in Saudi Arabia. To understand the effect of applying international standards for internal auditing to reduce financial and administrative corruption on the public joint-stock companies in Saudi Arabia, this study will use secondary data that includes both middle and large-scale companies. The data used will be qualitative.

The data will be analyzed thematically by dissecting how the different variables build into understanding the effect of applying international standards for internal auditing to reduce financial and administrative corruption on the public joint-stock companies in Saudi Arabia. There are three reasons why the methodology mentioned above was the most preferred option for this study. First, organizations are limited by the financial statements of the Public Shareholding Company in Saudi Arabia disclosures. As much as the offered accounts offer insight on the state of the financial health of the organizations, most organizations do not provide many detailed statements. Additionally, there is limited evidence on the relationship in the disclosure of the financial statements of the Public Shareholding Company in Saudi Arabia, the independence of the board of directors among the Public Shareholding Company in Saudi Arabia, as well as the influence of the concentration of individual ownership. Second, the case of Saudi Arabia is different from until 2012; there was no explicit legal clause that described the enactment of mechanisms of corporate governance in Saudi Arabia (Carcello, 2018). The state of affairs in Saudi Arabia did not offer legislations that monitor the impact of enacting such principles and mechanisms. Third, the use of qualitative and peer-reviewed data was most preferred as the proper application of corporate governance strategies was primarily determined by the company's propensity to monitor their corporate governance as a personal initiative as opposed to following a national prerogative (DeSimone & Abdolmohammadi, 2016). The proper application of corporate governance has led to the reduced number of issues arising between the stakeholder's needs and the organization's executive (Drogalas, 2018). There are different levels of disclosures in light of the subject mentioned above, with the average highest rate of disclosure in Saudi Arabia being 68% and the lowest rates of the disclosure being 56%.

Research Constraints

There are several research constraints, including the limited number of previous studies that have researched the effect of applying international standards for internal auditing to reduce financial and administrative corruption on the public joint-stock companies in Saudi Arabia. Current sources have either focused their contribution to the effect of applying international standards for internal auditing to reduce financial and administrative corruption in the general Saudi Arabian business environment (Yee, 2008). There are time constraints involved, given that the internal function is a recent development in the general Saudi Arabian business environment (Yee, 2008). The project scope will, therefore, be limited to the use of secondary data and, subsequently, qualitative data.

Given that the information sourced from the available sources is an estimation and not a definite guarantee set of deliverables, the range of constraints met in the delivery will be spread over to the selection of variables used to test the hypothesis mentioned above. In this regard, the use of mixed methodologies in collecting, collating the evidence sourced from the study is geared at offering a more holistic approach to the issue (Yee, 2008). Summing the preliminaries as mentioned above, this study is meant to understand the effect of applying international standards for internal auditing to reduce financial and administrative corruption on the public joint-stock companies in Saudi Arabia using the selected variables with valid content.

Results and Discussion

This section presents the findings of the study conducted on 100 corporations in the Kingdom of Saudi Arabia after the administration of questionnaires as a feasible tool for data collection. The aim of this chapter is outlining the analyzed data done in line with the previously set objectives of the research. The collected data was coded as a preparation phase just before the actual analysis that was done using the statistical package for social sciences version 21. The program analyzed quantitative data. Besides, qualitative data will also be presented thematically addressing the research aims. The obtained findings will be useful in deciding whether to accept or refute the hypotheses.

The Study

The research was conducted in the Kingdom of Saudi Arabia. The respondents involved in the study were selected by sampling technique applied in two phases. In the initial phase, the suitable corporates were settled on by application of the purposive sampling approach. The subsequent stage involved random sampling in selecting at least three respondents from each identified organization. The questionnaire captured socio-demographic data of the participants as well as their perspectives concerning the several entities that affect the effectiveness of the internal control.

Profile of the Participants

The traits, as well as the attributes of the workers of any corporation, considerably affect their performance. Such characteristics include gender, educational level, training, marital status. And their religious affiliation.

Table 1 above indicates that the female respondents were 45% while their male counterparts were 55%. The figures reveal that the male constituted the majority of stakeholders of the research sample among employees working for Saudi Arabia's corporations.

| Table 1 Participant's Gender Distribution | ||

| Gender | Frequency | Percentage |

| Male | 55 | 55% |

| Female | 45 | 45% |

Table 2 above indicates the respondent's age distribution. The statistics show most of the employees in Saudi Arabia's corporations were 23 years and below. The age group between the age of 34 and 4 had the lowest number of participants, while those in the 44-53 age group were the second majority of Saudi Arabia's task force.

| Table 2 Participant's Age Distribution | ||

| Age | Frequency | Percentage |

| 23 | 38 | 38% |

| 24-33 | 7 | 7% |

| 34-43 | 2 | 2% |

| 44 -53 | 21 | 21% |

| 54-63 | 14 | 14% |

| 64 Above | 18 | 18% |

Table 3 above indicates the distribution of the status of the selected respondents. The figures show that majority of the employees are married. The divorced works constitute the second largest, while the widowed were the least (Table 4).

| Table 3 Participant's Status Distribution | ||

| Status | Frequency | Percentage |

| Single | 14 | 14% |

| Married | 42 | 42% |

| Divorced | 28 | 28% |

| Widowed | 4 | 4% |

| Separated | 12 | 12% |

| Table 4 Participant's Distribution of the Sample and Response Rate | |||||

| Respondents | Total per section | Departments | Total respondents | Ideal | Rate of response |

| Managers | 3 | 12 | 36 | 35 | 97.22% |

| Subordinate staff | 22 | 12 | 264 | 248 | 93.94% |

| Total | 300 | 283 | 94.33% | ||

Descriptive Data

The five variables used in investigating the effect of the application of international standards for internal auditing on the reduction of financial as well as administrative corruption on public joint-stock companies in Saudi Arabia were measured by asking the respondents to indicate whether they strongly disagree, Disagree, undecided, Agree Strongly, or agree respectively. The positive contribution of the internal audit was based on the scores of the following variables; the size of the internal audit department, the relationship between internal and external auditors, management support for internal audit, and the independence of the internal audit. The variables are represented in the Table 5 below;

| Table 5 Variables Used in Analysis Variables Entered/Removeda | |||

| Model | Variables Entered | Variables Removed | Method |

| 1 | Competency, Size of Internal Department, Relationship, Management support, Management Support, Independence, International Standards |

Enter | |

| a. Dependent Variable: Corruption | |||

| b. All requested variables entered. | |||

The distribution of the score frequencies is shown in Table 6 below;

| Table 6 Score Distribution of Effectiveness Of Internal Audit | ||||||

| Variable | Descriptive statement | Score | ||||

| 1 | 2 | 3 | 4 | 5 | ||

| Competency | Improving competency of the internal audit department | 0.3 | 16.5 | 16.5 | 41.8 | 24.9 |

| Size of Internal Department | Increasing the size of the internal audit department | 0.8 | 5 | 15 | 20.8 | 58.4 |

| Relationship | Improving the relationship between internal and external auditors | 0.5 | 0.7 | 5.6 | 28.4 | 64.8 |

| Management Support | Increasing management support for internal audit | 0.0 | 14.8 | 8.9 | 39.6 | 36.7 |

| Independence | Increasing independence of internal audit | 8.3 | 14.6 | 22.5 | 20.5 | 34.1 |

From Table 6 above, it is evident that 66.7% of the respondents agree strongly and agree that that the application of international auditing standards when improving the competency of the internal audit department would significantly reduce corruption both at the management level and administrative. Besides, 33.3% of the respondents strongly disagree, disagree, undecided with the competency variable. Similarly, 58.4% agree with the possible contribution of the size of the internal department, while 20.8% agree strongly with this measurement. The remaining 20.8% strongly disagreed, disagreed, and were undecided with the contributive effect of the size of the internal department on curbing corruption. Those that agreed and strongly agreed with the relationship variable were 93.2%, with 6.8% indicating strongly disagree, disagree, or undecided. Those that agreed and strongly agreed with the management support variable were 76.3%, while none of the respondents strongly disagreed. 23.7% of the participants either disagreed or were undecided relative to the contribution of the management support variable on reducing corruption. Lastly, 54.6% agreed strongly and agreed with the independent variable, with 22.5% indicating that they were undecided, 14.6% disagreed, and 8.3% strongly disagreed.

When the respondents were asked to indicate the contribution of the international standards for internal auditing factors on the reduction of financial and administrative corruption in the public joint-stock company in Saudi Arabia on a score ranging from 1 to 10, the outcome is indicated by the Table 7 below;

| Table 7 Score on International Audit Standards | ||||||||||

| International Standard | Score | |||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| Reporting | 12.0 | 0.0 | 12.1 | 1.6 | 0.0 | 15.6 | 20.5 | 7.1 | 9.0 | 22.1 |

| Execution | 0.0 | 10.8 | 7.6 | 15.0 | 12.0 | 0.0 | 15.0 | 0.0 | 10.8 | 28.8 |

| Culture | 0.0 | 19.0 | 1.6 | 0.0 | 11.6 | 10.8 | 20.4 | 9.0 | 0.0 | 25.6 |

| Staffing Strategy | 0.0 | 12.0 | 31.6 | 10.8 | 11.9 | 20.0 | 1.6 | 10.0 | 1.6 | 10.5 |

| Competencies | 10.8 | 2.1 | 0.0 | 13.3 | 12.0 | 10.8 | 5.6 | 4.4 | 2.1 | 38.9 |

| Stakeholders | 0.0 | 10.8 | 12.1 | 0.0 | 10.0 | 9.0 | 25.4 | 10.8 | 9.0 | 12.9 |

| Organization and Structure | 0.0 | 30.7 | 5.4 | 19.0 | 12.0 | 12.1 | 1.6 | 0.0 | 5.6 | 14.6 |

| Mandate and Strategy | 12.0 | 12.1 | 11.6 | 0.0 | 10.0 | 33.6 | 0.0 | 12.0 | 8.7 | |

From Table 7 above, it is evident that the competencies of the works in corporations in the Kingdom of Saudi Arabia had a profound contribution in addressing administrative and financial corruption, followed by the execution of the standards. Mandate and strategy had the list contribution.

On testing the study hypotheses, the outcome is as shown in the Table 8 below:

| Table 8 Scores on Hypotheses Statements | ||||||||||

| Descriptive statement | Score | |||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| There is an effect of applying international standards for internal auditing among Public Joint-stock companies in Saudi Arabia. | 0.0 | 5.5 | 0.0 | 1.0 | 7.0 | 9.0 | 4.6 | 0.0 | 26.4 | 46.5 |

| There are ways of reducing the financial and administrative corruption on the public joint-stock companies in Saudi Arabia, through the internal audit function | 3.3 | 0.0 | 2.1 | 10.8 | 58.4 | 0.0 | 0.0 | 3.4 | 12.0 | 10.0 |

| There are varying scales of internal administrative control, internal accounting control and the implementation of internal checks across different Public Joint stock companies in Saudi Arabia. | 0.0 | 4.0 | 64.8 | 1.6 | 0.0 | 3.0 | 16.6 | 2.0 | 0.0 | 8.0 |

From Table 8 above, it is clear that the application of international standards for internal auditing among public joint-stock companies in Saudi Arabia was strongly advocated for by the respondents while existence varying scales of internal administrative control, internal accounting control and the implementation of internal checks across different Public Joint-stock companies in Saudi Arabia had the lowest support. Approximately 50% of the participants indicated that there are ways of reducing the financial and administrative corruption on the public joint-stock companies in Saudi Arabia, through the internal audit function.

Summary of the Model

The model summary shown in Table 9 indicates that R squared is used to show the fitness of the model used. Its measure varies with the increase in the statistical variables. As such, R squared is the feasible approach of evaluating the goodness of fit.

| Table 9 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. The error of the Estimate |

| 1 | 0.233a | 0.018 | -0.036 | 0.874 |

Conclusion

The research aimed to highlight the effect of applying international standards for internal auditing, investigate ways of reducing the financial and administrative corruption on the public joint-stock companies in Saudi Arabia through the international standards set for the internal audit function and to investigate the scale of internal administrative control, internal accounting control and the implementation of internal checks in Public Joint-stock companies in Saudi Arabia. The findings indicate that the application of international standards for internal auditing, improving the relationship between internal and external auditors, as well as the competencies of the workers, had a profound contribution to curbing corruption. These indicators are also feasible approaches by which the corporations can address administrative and financial fraud.

Appendix

Questionnaire

Instructions

1. This assessment process focuses on the application of international standards for internal auditing among Public Joint-stock companies in Saudi Arabia whole – it does not seek to evaluate individuals and their personalities.

2. It is not unusual for it to be completed by; audit committee members, the heads of principal business units/subsidiaries and the CFO, the head of the internal audit function, the external auditor (may also be asked to comment depending on their agreement with their consultancy)

3. This research aims at looking at the gaps are between Actual and Ideal as this identifies where any development priorities lie.

4. There is a space for comments beside each question. You are not obliged to make comments; however, comments do improve the quality of the review and therefore are to be encouraged.

5. 'N/A' can be used where you do not have a view on the matter in question.

6. All responses will be treated as anonymous unless the individual completing the questionnaire wishes otherwise.

7. The questionnaire takes about 10 minutes to complete and should be completed in the following manner:

8. Using a scale of 1 (low) to 10 (high), complete each question by placing your score in the two boxes beside the question. 'Actual' is your view of the current position of the internal audit function on that issue. 'Ideal' is the score that you would like to see (Table 10).

| Table 10 PART A | ||||

| Actual | Ideal | NA | Comment | |

| There is an effect of applying international standards for internal auditing among Public Joint-stock companies in Saudi Arabia | ||||

| There are ways of reducing the financial and administrative corruption on the public joint-stock companies in Saudi Arabia, through the internal audit function | ||||

| There are varying scales of internal administrative control, internal accounting control, and the implementation of internal checks across different Public Joint-stock companies in Saudi Arabia. | ||||

Part B

Kindly indicate at what level these international standards for internal auditing factors contribute the reduction of financial and administrative corruption in your public joint-stock company in Saudi Arabia (Rate on the scale of 1 -10)

Reporting 1 2 3 4 5 6 7 8 9 10

Execution 1 2 3 4 5 6 7 8 9 10

Culture 1 2 3 4 5 6 7 8 9 10

Staffing Strategy 1 2 3 4 5 6 7 8 9 10

Competencies 1 2 3 4 5 6 7 8 9 10

Stakeholders 1 2 3 4 5 6 7 8 9 10

Organization and Structure 1 2 3 4 5 6 7 8 9 10

Mandate and Strategy 1 2 3 4 5 6 7 8 9 10

Part C

Indicate whether applying international standards for internal auditing in the following capacities, reduces financial and administrative corruption on the public joint-stock companies in Saudi Arabia (Table 11).

| Table 11 PART C | |||||

| Statement | Strongly Disagree | Disagree | Undecided | Agree | Strongly Agree |

| Improving competency of the internal audit department | |||||

| Increasing the size of the internal audit department | |||||

| Improving the relationship between internal and external auditors | |||||

| Increasing management support for internal audit | |||||

| Increasing independence of internal audit | |||||

References

- Alwardat, Y.A., & Basheikh, A.M. (2017). The Impact of Performance Audit on Public Administrations in Saudi Arabia: An Exploratory Study. International Journal of Business and Management, 12(12).

- Asiedu, K.F., & Deffor, E.W. (2017). Fighting corruption by means of effective internal audit function: evidence from the ghanaian public sector. International Journal of Auditing, 21(1), 82-99.

- Burt, I. (2016). An understanding of the differences between internal and external auditors in obtaining information about internal control weaknesses. Journal of management accounting research, 28(3), 83-99.

- Carcello, J.V. (2018). The value to management of using the internal audit function as a management training ground. Accounting Horizons, 32(2), 121-140.

- Creswell, J.W., & Clark, V.L.P. (2017). Designing and conducting mixed methods research. Sage publications.

- DeSimone, S.M., & Abdolmohammadi, M., (2016). Correlates of external quality assessment and improvement programs in internal auditing: A study of 68 countries. Journal of International Accounting Research, 15(2), 53-71.

- Drogalas, G., & Siopi, S., (2017). Risk management and internal audit: Evidence from Greece. Risk governance and control: financial markets and institutions, 7(3), 104-110.

- Drogalas, G., Anagnostopoulou, E., Koutoupis, A., & Pazarskis, M., (2018). Relationship between Internal Audit Factors and Corporate Governance. Journal of Governance and Regulation, 7(3), 13-17.

- Endaya, K.A., & Hanefah, M.M. (2016). Internal auditor characteristics, internal audit effectiveness, and moderating effect of senior management. Journal of Economic and Administrative Sciences, 32(2), 160-176.

- Erasmus, L., & Coetzee, P. (2018). Drivers of stakeholders' view of internal audit effectiveness: Management versus Audit Committee. Managerial Auditing Journal, 33(1), 90-114.

- Gribincea, A. (2017). Ethics, social responsibility, and corruption as risk factors. Annals of Spiru Haret University. Economic Series, 17(1), 17-28.

- Jones, K.K., & Glover, H. (2018). From bean counter to business partner–internal audit: The new source of executive leadership. Journal of Managerial Issues, 30(3), 303-276.

- Jones, K.K., (2017). The impact of legislation on the internal audit function. Journal of Accounting and Organizational Change, 13(4), 450-470.

- Khalid, A.A., Haron, H.H., & Masron, T.A. (2017). Relationship between internal shariah audit characteristics and its effectiveness. Humanomics, 33(2), 221-238.

- Labuschagne, M., & Fourie, H. (2018). Fraud investigation: An internal audit stakeholder expectation gap. Southern African Journal of Accountability and Auditing Research, 20(1), 123-132.

- Lenz, R., Sarens, G., & Hoos, F. (2017). Internal audit effectiveness: multiple case study research involving chief audit executives and senior management. EDPACS, 55(1), 1-17.

- Shahimi, S., Mahzan, N.D., & Zulkifli, N, (2016). Consulting role of internal auditors: exploratory evidence from Malaysia. Journal of Business and Management, 5(2), 720-746.

- Shamki, D., & Alhajri, T.A. (2017). Factors influence internal audit effectiveness. International Journal of Business and Management, 12(10), 143.

- Tackie, G., Marfo-Yiadom, E., & Achina, S.O. (2016). Determinants of internal audit effectiveness in decentralized local government administrative systems. International Journal of Business and Management, 11(11), 184.

- Tickner, P. (2017). Fraud and Corruption in Public Services. Routledge.

- Yee, C.S.L., Sujan, A., James, K., & Leung, J.K.S. (2008). Perceptions of singaporean internal audit customers regarding the role and effectiveness of internal audit. Asian Journal of Business and Accounting, 1(2), 147-174.