Research Article: 2022 Vol: 26 Issue: 1S

The Role of Investor Pressure on the Effect of Integrated Reporting Disclosure on the Intellectual Capital Disclosure

Sri Imaningati, Diponegoro University

Imam Ghozali, Diponegoro University

Etna Nur Afri Yuyetta, Diponegoro University

Citation Information: Imaningati, S., Ghozali, I., & Yuyetta, E.N.A. (2021). The role of investor pressure on the effect of integrated reporting disclosure on the intellectual capital disclosure. Academy of Accounting and

Financial Studies Journal, 25(7), 1-07.

Abstract

The aim of the research was to investigate the impact of Integrated Reporting Disclosure (IRD) on Intellectual Capital Disclosure (ICD) if there was Investor Pressure (IP) on the relation of both. Samples were taken with criteria constraints, and obtained 75 companies that did IPO on the IDX from 2016-2018. Measurement of content quantity analysis was used as the chosen methods to explore many information disclosures. A multiple linear regression was used as data processing method. For better model, Size variable and Industry Type variable were used as control variable. From the results of statistical tests, it was concluded that when management decided to increase the quantity of IRD, it turned out that the ICD had decreased in disclosure. However, the decline in the ICD was not due to pressure from investors. The results provided an understanding that under certain circumstances IRD would have greater negative influence on the ICD, because a lot of information in the ICD were company's strategic policies that were prone to being copied by other companies and competitors. This study discussed the effect of IRD on the ICD. Took into consideration, the possibility of IP influenced the relationship between the both main variables.

Keywords

Intellectual Capital Disclosure (ICD), Integrated Reporting Disclosure (IRD), Investor Pressure (IP).

Introduction

Currently, financial reporting is one of the things that is quite important for potential investors and stakeholders with regard to their investment decisions. Although financial reporting was not the only means of making investment decisions, until now it is still the main source of investment considerations (Ferenhof et al., 2015). Initially, the financial statements were sufficient. Increasing business development caused things that must be reported as a form of accountability to increase as well. The demands of stakeholders for complete information that must be presented in financial reporting were increasing as well (Febriyanti & Gunawan, 2016).

The increase in demand for financial reporting content is not only due to business developments, but also due to the increasing number of frauds committed by companies and other financial practitioners. One example was the case of (Enron, 2001; Wordcom, 2002). Enron is an energy company, reported profit (recorded larger) and debt (recorded smaller) whose magnitude did not match reality. Meanwhile, Wordcom is a telecommunications company, capitalizing operating expenses which were subsequently recognized as capital expenses. This expense did not reduce income. It was recognized as an investment expense which will be allocated in several accounting periods. The effect in that year looked high (Sunyoto et al., 2017).

The above triggered a request for completeness in the financial statements in the notes section of financial statements (Agus & Aziza, 2020). The demand for the emergence of company standards regarding basic policies for application and basis for presenting accounts was also increasing (Febriyanti & Gunawan, 2016). The stakeholders demanded of information disclosure, so that the cases above did not happen again. Management was expected to be able to disclose internal control over financial reporting as completely as possible (Hall, 2016). The demand for disclosure of good corporate governance reports was increasing. One of the requests was about risk management not only in the financial sector but also in non-financial sector.

Many companies realize that if what the company reports only focuses on internal activities, it will not be attractive to investors. In fact, both to attract investors and consumers, it is necessary to make efforts to pay attention to the environment. This concept emerged in relation to the expectations and demands of the community regarding the role of the company in the community as its responsibility. And this demand is increasing due to environmental cases such as Minamata (Japan), Chernobyl (Soviet Union) and also Lapindo Mudflow (Indonesia). Then the company discloses the responsibility for its social and environmental activities (CSR) in its Sustainability Reporting (SR) (Aleknavi?i?t? & Ma?erinskien?, 2015; Keong, 2020).

The disclosure of corporate social responsibility which was summarized in Sustainability Reporting (SR) initially stood apart from the Annual Report (AR) (Nazier & Umiyati, 2015). Investors must examined them one by one. Such analysis was very troublesome for investors. Apart from that, for company management, making reports also required more effort and financial sacrifice. There was a need for comprehensive information in comprehensive reporting. Reporting that included what was reported in AR and in SR. The idea of combining the two led to Integrated Reporting (IIRC, 2013; Eccles, 2014).

IR delivered information in an integrated manner regarding the company profile and environment, governance, business line, strategy, remuneration, performance, and prospects and risks of a company that can lead to value creation in the short, medium and long term. The main advantage of IR was a more holistic reporting on information relevant to the company as well as value creation and strategy (Phillips, 2011). IR provided information more transparently including information on past and future performance (Adams, 2015; Sibghatullah, 2018) and also provided information that is both financial and non-financial (Morros, 2016).

Regarding disclosure, there is one more interesting disclosure to discuss in this study. It is the Intellectual Capital Disclosure (ICD). ICD is a disclosure of information about IC in the company's Annual Reporting. IC is a combination of intangible assets from market position, intellectual property, infrastructure, human resource management and other intangible resources management (Bontis et al., 2000). This is company property that is intangible but present and valuable. Because it is valuable, it must be measured, reported and disclosed.

Many companies that had ICD elements were reported in other AR’s section, and very few disclosed in separate IC reports, such as SR at the start of its appearance. Therefore, many researchers had difficulties measuring ICD content. In Indonesia, the ICD measurement that was widely used by researchers was a measure developed by Guthrie et al. (1999) that modified with several items stipulated in the Decree of the Chairman of Bapepam and FS Number: Kep 431 / BL / 2012, regarding the Submission of Issuers' Annual Reports or Public Company (Ulum, 2016). The measurement categories included Human Capital (8 items), Structural Capital (15 items) and Relational Capital (13 items), a total of 36 items.

Along with the emergence of IRD, so IC reported in the form of special disclosures such as the SR which was originally introduced. The only difference is that up to the SR is still appearance, just integrated in the IRD. Meanwhile, the ICD is special, slowly many companies was starting not to do it (Dumay, 2016; Dumay & Guthrie, 2017). It has begun to be suspected since the ICD declining in Skandia and in Denmark. Even though disclosure standards had been made and the government had intervened in its implementation (Nielsen et al, 2009; Dumay & Rooney, 2018).

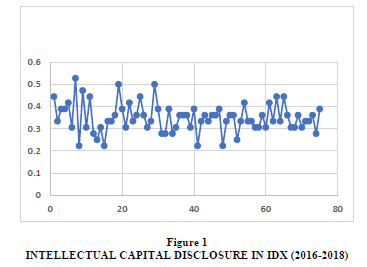

Figure 1 shows that the vertical position is the ICD ratio based on the ICD score measurement, while the horizontal position shows the IPO companies that carry out the ICD. Starting from the left of the companies that had IPOs on BEI in 2016, to the right to 2018. The blue line shows how much ICD disclosure was done by the company. The blue line appears to be getting tighter to the right, meaning that companies are doing less ICD. Company shareholders can be managerial owners, institutional owners and public owners. Managerial owners are company managers within the company. The other two are external owners of the company. Literature tends to give investors names. The company's management will pay attention to the interests of these shareholders. All policies will pay attention to the welfare of investors as shareholders (theory agency). Especially during the IPO, where the function is to attract investors to invest. Disclosure of company information during the IPO, whether in the form of ICD or IRD, will be careful. This is why it is suspected that Investor Pressure will affect the IRD relationship on the ICD.

Research Methods

The population of this study was companies that had IPOs on the IDX in 2016-2018. The reason for using companies that did IPO was because at the time of the IPO, the content reported on the IRD and ICD will be very sensitive to the behavior of investors. Therefore, the management would be very careful, and tried their best to reveal the beneficial IRs of the company in order to attract investors to invest, because that was the purpose of the IPO. Samples were obtained as many as 75 companies from various industrial fields. The data collected was secondary data. The information on sample acquisition was shown in Table 1.

| Table 1 Sampling |

|

| Firm IPO on 2016 - 2018 | 109 |

| Firm with AR complete | 84 |

| Data error | 9 |

| Total sample | 75 |

The measurement of ICD in this study used the scheme of Guthrie et al. 1999 which was modified by Bapepam Decree no. 431, 2012. When the information in the item was disclosed, it was given notation 1, and if it was not disclosed, it was given notation 0. Furthermore, it was added up for each company, then each was divided by 36. The items were shown in Table 2.

| Table 2 Icd Measurement (Modification) |

||

| No. | Category | Disclosure items |

|---|---|---|

| 1 | Human Capital | Number of employees (M); Employee education and training (M); Type of work-related training (M) Employee turnover (M); Education level; Employee qualifications; Employee knowledge; Employee competence |

| 2 | Structural Capital | Vision and mission (M); Code of conduct (M) Patent; Copyright; Trademark; Management philosophy; Organizational culture; Management process; Information Systems; Network System; Corporate Governance; Breach reporting system / Whistle blowing system (M); Comprehensive performance analysis (M); Debt repayment ability (M); Capital structure (M) |

| 3 | Relational Capital | Brand; Customer; Customer loyalty; Company name; Distribution Network; Business Collaboration; License agreement; Profitable contracts; Franchise Agreement; Award (M); Certification (M); Marketing strategy (M); Market Share (M) |

M: modification result with Bapepam, 2012.

Measuring IRD in this study used the quantitative content analysis method (Raar, 2002). The method collected data about the elements in the IRD by taking into account how much the content of the elements was informed by management. The element of IRD are (IIRC, 2013) overview of the company and the external environment; corporate governance; business model; risks and opportunities; strategy and resource allocation; performance reports; business prospects; basis for financial reporting and disclosure. The measurement methods were in Table 3 and Table 4.

| Table 3 Ird Quantities “How Many” |

|

| 1 | 0 = not disclose |

| 2 | 1 = sentence |

| 3 | 2 = paragraph |

| 4 | 3 = half A4 page |

| 5 | 4 = 1 A4 page |

| 6 | 5 => 1 A4 page |

| Table 4 Range Of Average Number Disclosures |

|

| 1 | 0 = average number of disclosures <1.67 Low |

| 2 | 1.67 = average number of disclosures <3.34 Medium |

| 3 | 3,34 = average number of disclosures = 5,00 High |

The measurement of Investor Pressure used the amount of public ownership plus institutional ownership. With the assumption that there would be more public ownership and institutional ownership as outside investors, it would reflect more investor pressure. Managerial ownership was not included because it contained an element of subjectivity in determining the extent of disclosure for both IRD and ICD that related to the Investor Pressure variable.

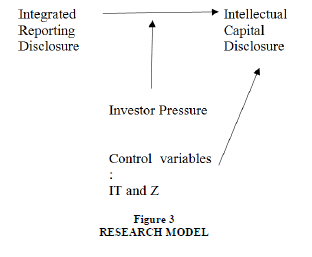

In building the models, this study used some theoretical prepositions. Stakeholder theory according to Freeman & McVea (2001) is a theory that discusses how a company that is represented by management will always pay attention to the interests of its stakeholders. Every decisions made by management always look at its impact on stakeholders. Stakeholders as groups or individuals who can influence or be influenced by the achievement of company goals. Stakeholder theory is a theory that describes which parties the company is responsible for.

Based on the stakeholder theory above, the relationship between IRD, ICD and IP can be explained. When the IPO conditions, management strived to provide information that could attract investors to invest. Therefore, the management would try to increase the IRD. However, management was also increasingly aware that IC activities carried out by companies were almost unique strategy. Such as human resources management strategies, marketing strategies, line business strategies and many more. This is prone to being copied by competitors. Therefore, when the opportunity to create an IRD opens, management tends to reproduce other information than the elements in the ICD category. The pressure from existing investors made management even more trying to maintain their trust by making disclosures that would benefit investors.

Hypothesis 1

IRD had negative effect on ICD

Model 1 ………………. ICD = α-β1ICD+β2IT+β3Z+ε

Hypothesis 2

IRD had negative effect on ICD while IP as a moderating variable.

Model 2 ……………….ICD = α-β1ICD+β2IP+β3ICD*IP+β4IT+β5Z+ε

Hypothesis testing used multiple linear regression. By using Industry Type (IT) and Firm Size (Z) as variable control to keep the model good.

Result and Discussion

Overall, the ANOVA test results showed, the significance result was 0.085. With a significance level of 0.10, the model was declared significant and fit Table 5.

| Table 5 Anova |

|||||

| Model | Sum of Squares | df | Mean Square | F | Sig. |

|---|---|---|---|---|---|

| Regression | .040 | 5 | .008 | 2.032 | .085b |

| Residual | .269 | 69 | .004 | ||

| Total | .309 | 74 | |||

| a. Dependent Variable: Intellectual Capital Disclosure b. Predictors: (Constant), Size, Investor Pressure, Integrated Reporting, Industry Type, Moderating | |||||

Based on the significance level of 0.10, Table 6 showed the significance level of the IRD variable of 0.062 and beta of -0.310. Hypothesis 1 was accepted that IRD had a negative effect on ICD. This means that if the IRD increased, it would cause the ICD to decreased. This was in line with the thoughts of (Nielsen et al., 2009). The items in the ICD were items that reported the company's strategic activities. The more management realized that there were items that constitute the company's core strategy, which were usually intangible assets (IC), the less management would disclose them. The thought was in line with (Dumay & Rooney, 2008).

| Table 6 Hypothesis Testing Result |

|||||

| Model | B (Unstd.) | Std. Error | Beta | t | Sig. |

| (Constant) | .354 | .177 | 2.004 | .049 | |

| Integrated Reporting | -.310 | .164 | -.660 | -1.895 | .062 |

| Investor Pressure | -.220 | .134 | -.719 | -1.639 | .106 |

| Moderating | .266 | .181 | .832 | 1.472 | .146 |

| Industry Type | .001 | .015 | .010 | .088 | .930 |

| Size | .021 | .011 | .224 | 1.984 | .051 |

Based on the results of the moderating variable test, the significance was 0.146 which means it was not significant so that hypothesis 2 could not be accepted. This showed that IP was not a moderating variable. As stated by Dumay (2016), investors had no effect in determining the extent of the ICD’s scope. It was possible that management influenced the broad scope of the ICD. The fear of being plagiarized by a competing company was the main reason management did not disclose IC information which as company's strategy. It was also shown that there was no direct effect of IP on ICD (significance 0.106 which means insignificant).

Conclusion

The conclusions that can be generated from this study were IRD had negative direct effect on ICD. It means that if the IRD had increased, the ICD had decreased and if the IRD had decreased, the ICD has increased. Moreover, IP was not moderating variable for the influence of IRD on ICD. It means that the increasing and decreasing in ICD caused of the increasing or decreasing in IRD was not affected by IP.

The limitation of this study is that IRD measurement used the content quantitative method. Which results was not seeing the quality side of the existing content. For example, in the elements of strategy and Human resources allocation. The score was always 5 because the company had revealed from Human Resources information itself. So that sometimes there were companies that didn't disclose any strategy, they still got 5 score because their human resources information disclosure was sufficient to get a score of 5.

Since the results showed that IP had no significant effect on the relationship between IRD and ICD, it was likely that Management was the most influential. Management effect can be measured using managerial ownership. The findings therefore suggest for further research examine the effect of management policy on the relationship between IRD in ICD. For further research, it is better to measure IRD and ICD, using quantitative and qualitative methods. It can also be mixed. So that the data can describe the real conditions.

References

Bontis, N., Keow, W.C.C., & Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital, 1(1), 85-100

Febriyanti, A.F., & Gunawan, J. (2016). Analisis luasnya pengungkapan kuantitatif pada integrated reporting di indonesia, malaysia, dan singapura. Jurnal Magister Akuntansi Trisakti, 3(2), 147-168.

Ferenhof, H.A., Durst, S., Bialecki, M.Z., & Selig, P.M. (2015). Intellectual capital dimensions: state of the art in 2014. Journal of Intellectual Capital, 16(1).

Hall, J.A. (2016). Accounting Information Systems. 9th edition. Pennsylvania: Cengage Learning.

Phillips, D., Watson, L., & Willis, M. (2011). Benefits of comprehensive integrated reporting: by standardizing disparate information sources, financial executive can eliminate the narrow perspectives of the elephant and the blind man parable and see beyond merely information silos or reports. Financial Executive, 27(2), 26-31.