Research Article: 2025 Vol: 28 Issue: 4

The Role of Islamic Finance Structures in Unlocking Financial Resources and Providing Mechanisms to Enhance Investment in the Middle East Region.

Amar Taleb, Batna 1 University

Samir Salhaoui, Batna 1 University

Adil Argabi, Batna 1 University

Tarek Khater, Batna 1 University

Citation Information: Taleb, A., Salhaoui, S., Argabi, A., & Khater, T. (2024). The role of islamic finance structures in unlocking financial resources and providing mechanisms to enhance investment in the middle east region. Journal of Management Information and Decision Sciences, 27(2), 1-19.

Abstract

Through this research paper, we aimed to discuss the role of Islamic finance structures that are intrinsically asset-backed in unlocking the financial resources needed to enhance investment, highlighting, in a general way, the development seen by the Islamic finance industry on a global scale. In addition to analyzing the strengths and weaknesses to determine the contribution of Islamic financial institutions to environmental, social and economic issues, and diagnosing the reality and prospects of the Islamic financial industry in the economies of countries in the Middle East region, in particular. Although the nature of the relationship between Islamic finance and sustainable development goals has been clarified, with evidence of the evolving size of the contribution, estimates indicate that the Islamic finance industry will move towards more sustainable development. We have also concluded that the contribution of Islamic finance to the economies of these countries is effective and significant.

Keywords

Islamic Finance, Infrastructure Development, Sustainable Economic Growth, Asset-Backed Islamic Finance Structures, Sustainable Development Goals.

Introduction

Background of Islamic Finance Structures in the Middle East Region

The roots of Islamic finance can be traced back to the early days of Islam, but its integration into modern financial systems gained momentum in the 1980s. The industry has experienced substantial growth and is now a significant player in many countries, particularly in the Middle East and Southeast Asia. Key principles of Islamic finance include the prohibition of interest, excessive uncertainty, and gambling, as well as the promotion of risk-sharing and ethical standards. This approach promotes genuine economic activities and risk-sharing, fostering social solidarity and inclusion.

Islamic finance primarily encompasses Islamic banking and Sukuk (Islamic bond) markets, with banking accounting for approximately 80 percent of total Islamic financial assets. Other services offered include equities, investment funds, insurance (Takaful), and microfinance. The industry is rapidly expanding in terms of assets and geographical reach, with substantial assets concentrated in Southeast Asia and the Middle East.

Islamic finance has the potential to contribute to increased and more inclusive economic growth by catering to underserved population segments. Its emphasis on risk-sharing makes it well-suited for financing small and medium-sized enterprises (SMEs) and startups. Additionally, Sukuk has proven valuable in infrastructure finance and can support investment and economic growth.

The ethical principles of Islamic finance form the basis for high levels of ethical conduct, governance, and consumer protection. Furthermore, its asset-based financing can promote improved risk management by both financial institutions and their clients.

The global Islamic finance industry is projected to continue on its growth trajectory. It plays a crucial role in driving expansion in regions such as the Middle East, Africa, South Asia (MEASA), contributing to financial stability while serving approximately a quarter of the world's population (Alfred Kammer, M.N. 2015; Iqbal & Mirakhor, 2013; Lukonga, 2015; S&P Global Ratings, 2021).

Purpose of the Research Paper

This study explores how Islamic finance structures can increase financial resources and investment in the Middle East.

Since the 1980s, Islamic finance has gained recognition globally, based on trade and exchange in commodities and assets, promoting risk sharing and social solidarity.

The paper provides an overview of Islamic finance structures, including principles, financial instruments, and institutions involved. It discusses how these structures emphasize reciprocity, sustainability, and interest in all stakeholders' businesses, unlocking financial resources.

It also examines how Islamic finance facilitates investment opportunities in the Middle East, particularly within the energy industry, to promote sustainable growth. The global development of the Islamic finance industry is analyzed, highlighting key players and regions within the industry.

The strengths and weaknesses of Islamic financial institutions are explored, focusing on their role in promoting sustainable development, including environmental sustainability and economic benefits generated by Sharia-compliant financing.

Furthermore, the research aims to diagnose the current state of adoption of Islamic finance practices in Middle Eastern countries and explore future prospects for growth and development in this sector (Karim, 2023; Iqbal & Mirakhor, 2013; Lukonga, 2015; The IMF and Islamic Finance, 2017).

Overview of Islamic Finance Structures

Definition and Principles of Islamic Finance

Islamic finance, guided by Shari'ah law, is a financial system that operates on ethical principles and promotes sustainable and socially responsible finance. It adheres to the prohibition of interest, gambling, and speculation while prioritizing fair treatment and the sanctity of contracts. Transactions are based on real economic activities with a focus on risk-sharing, emphasizing ethical standards and real economic activities over uncertainty and speculation.

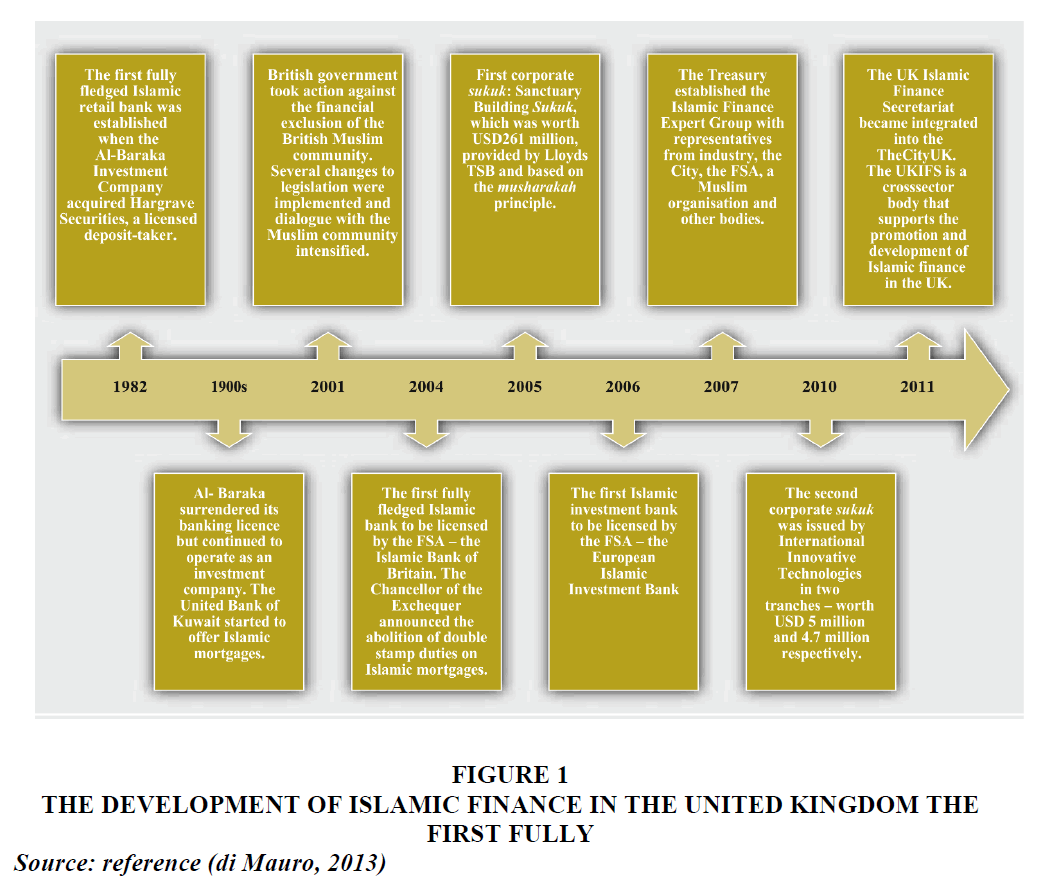

Islamic Finance encompasses a range of financial products and institutions that connect the finance sector with the real economy, promoting financial inclusion and social welfare. It strictly prohibits interest, gambling, and speculation, requiring dealings only with Shariah-approved assets. The industry has evolved from traditional finance contracts to meet modern financial needs Figure 1.

Figure 1 The Development of Islamic Finance in the United Kingdom the First Fully

Source: reference (di Mauro, 2013)

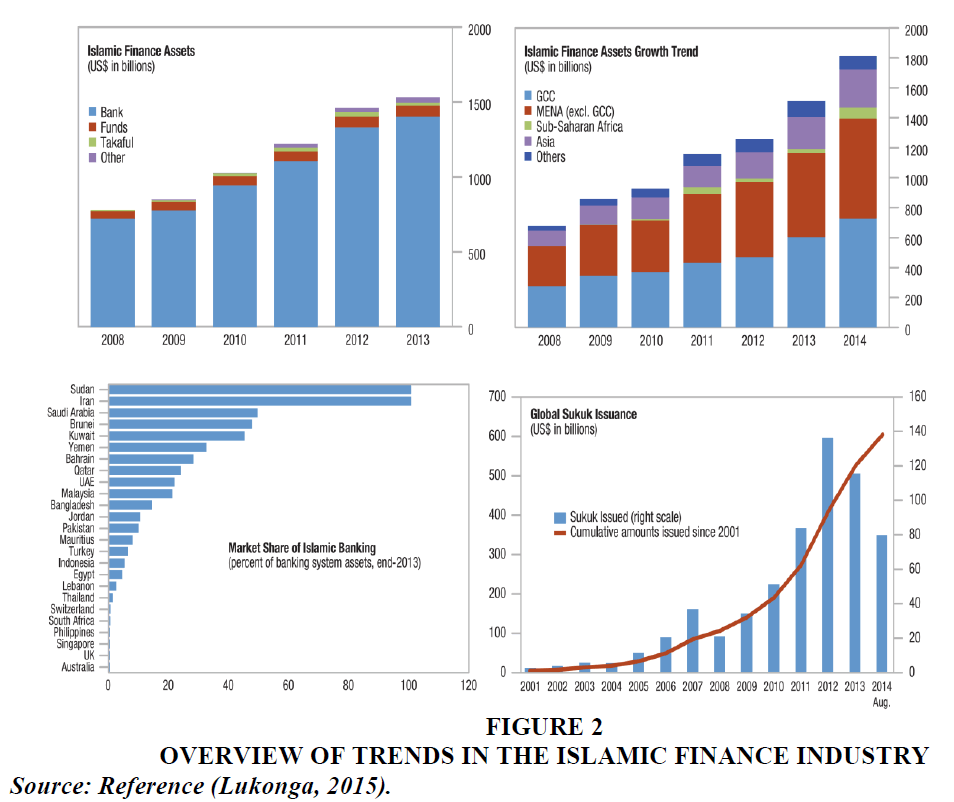

The industry has experienced significant growth over the past decade, with global assets reaching $1.9 trillion in 2015 Figure 2.

The growth of Islamic finance can be attributed to the increasing wealth in oil-producing countries in the Middle East and Asia, where Islam is predominant. Moreover, the industry is gaining traction in regions like the Middle East, Asia, and Africa as ethical-based finance gains global significance (Alshubiri & Al Ani, 2023).

Islamic finance offers various structures and principles that enhance investment opportunities in the Middle East, such as profit and loss sharing (PLS), which reduces risk for investors. The industry also promotes financial stability through the adoption of microfinance technology and digital solutions.

To further enhance investment, collaboration between Shari'ah scholars and decision-makers in the Islamic banking industry is crucial to establish a comprehensive governance framework that fosters transparency, trust, and ethical behavior. Encouraging the private sector to establish flexible Islamic banks aligned with compliance standards is also crucial.

Aligning practices and investment strategies with Shari'ah-compliant principles and implementing effective governance frameworks can contribute to sustainable development globally.

Diversifying Islamic finance instruments is essential to attract foreign fund flows and offer more investment options to different investors.

Overall, Islamic finance plays a significant role in enhancing investment in the Middle East by adhering to ethical and sustainable principles, emphasizing financial stability and social responsibility. By aligning with Sustainable Development Goals (SDGs) and implementing effective governance frameworks, Islamic finance can contribute to sustainable development globally (Alfred Kammer, M.N. 2015; Iqbal 1997; Asian Development Bank, 2022).

Types of Islamic Financial Instruments and Institutions

The role of various types of Islamic financial instruments and institutions is pivotal in the operation of Islamic finance systems in the Middle East. These instruments are tailored to meet the requirements of both fund providers and users in diverse ways. The fundamental instruments encompass cost-plus financing (murabaha), profit-sharing (mudaraba), leasing (ijara), partnership (musharaka), and forward sale (bay' salam). Cost-plus financing, which represents approximately 75% of Islamic financial transactions, entails the provision of specific goods or commodities at a predetermined markup for resale to the client. Conversely, leasing is structured to finance vehicles, machinery, equipment, and aircraft. Profit-sharing agreements resemble investment funds wherein managers oversee a pool of funds with customized terms for profit and risk sharing for each investment. Equity participation entails a collaborative venture between an entrepreneur and an investor who contribute capital assets to share in returns and risks. Additionally, sales contracts like deferred-payment sale and deferred-delivery sale contracts are utilized for credit sales with delayed payments.

These instruments form the basis for developing a wide range of more complex financial products, demonstrating significant potential for innovation and expansion in Islamic financial markets. In addition to these fundamental instruments, there is ongoing consideration about the introduction of derivative products and syndication to enhance project finance while adhering to Islamic principles. (Iqbal, 1997).

Role of Islamic Finance Structures in Unlocking Financial Resources

Islamic finance offers unique features that attract both Muslim and non-Muslim investors. It focuses on real underlying assets, making it suitable for infrastructure and project finance. The profit and loss sharing method reduces risk and increases transparency and ethical behavior. Islamic finance also contributes to financial stability in emerging market economies, attracting foreign investment.

Asset-Backed Nature of Islamic Finance Structures

The pivotal role played by Islamic finance structures in unlocking financial resources for investment in the Middle East region cannot be overstated. One of the distinguishing features of Islamic finance instruments is their asset-based nature, which means they are used for interest-free loans to acquire tangible assets. This offers an investment avenue with a fair and acceptable payment in the form of a permanent ownership share. As a result, all investments are backed by physical assets, making them more secure and less speculative than traditional financial instruments.

Islamic finance structures enable investment opportunities in the Middle East region by providing a funding mechanism that aligns with Sharia principles. The success of Islamic finance in supporting energy sector projects in the Middle East and Southeast Asia is promising, thanks to its asset-backed nature. This has led to the establishment of new Islamic banks and innovative finance models utilizing project assets.

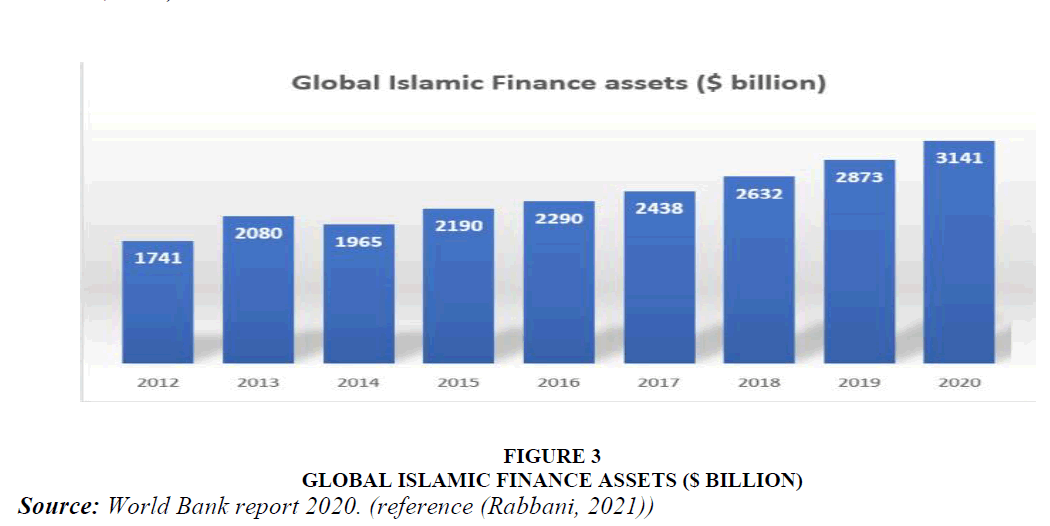

By focusing on tangible assets, Islamic finance structures ensure that investments are directed towards real economic activities, such as infrastructure development and sustainable energy projects. The demand for sociopolitical and economic systems based on Islamic principles has further contributed to the growth of Islamic finance in the region Figure 3.

Figure 3 Global Islamic Finance Assets ($ Billion)

Source: World Bank report 2020. (reference (Rabbani, 2021))

In summary, the asset-backed nature of Islamic finance structures serves as a sturdy foundation for unlocking financial resources and improving investment opportunities in the Middle East region. This approach not only fosters economic growth but also supports sustainable development initiatives through its emphasis on tangible assets (Karim, 2023; Lukonga, 2015; Diallo & Mejai, 2018).

Definition and Characteristics of Asset-Backed Islamic Finance Structures

Asset-backed Islamic finance structures prioritize equity-based financing, which connects the financial sector with the real economy and promotes risk-sharing. Islamic finance has gained popularity in Asia and the Middle East due to its compatibility with investment opportunities in these regions. It is well-suited for infrastructure and project finance and aligns with the transparency and governance requirements of both regions. The clear roles and responsibilities within Islamic financial structures ensure transparency and transfer risks to those who can contribute to value creation. Islamic finance also supports emerging market economies by fostering stability in financial markets. Asset-backed Islamic finance structures have proven effective in addressing social welfare concerns, providing alternative financing during economic disruptions like the COVID-19 pandemic. Through fintech innovations, these structures reach out to affected individuals, SMEs, and other sections of society. Overall, asset-backed Islamic finance structures offer a sustainable and ethical approach to investment, promoting risk-sharing, financial inclusion, and social welfare in the Middle East (Abayomi, 2015; Harahap et al., 2023; Rabbani, 2021).

Examples and Success Stories of Asset-Backed Islamic Finance Structures in the Middle East Region

Asset-backed Islamic finance structures, rooted in Islamic principles, have played a crucial role in promoting economic development, reducing poverty, and fostering shared prosperity in the Middle East. Sukuk, or certificates of ownership, are one example of these structures, providing financial support to productive enterprises that contribute to economic growth and generate employment opportunities. Unlike conventional finance, asset-backed Islamic finance requires financing to be linked to real assets with a clear purpose, discouraging speculative transactions and promoting investments that have a meaningful impact on the real economy. Partnership-style financing, a key feature of Islamic finance, benefits small businesses and those excluded from conventional financial services by providing access to finance based on shared risks and rewards. Additionally, asset-backed Islamic finance has demonstrated resilience during times of financial crises, as it adheres to risk-sharing principles and avoids speculative products. However, despite its rapid growth, Islamic finance is still in its early stages of development and faces challenges such as strengthening legal and regulatory frameworks. Efforts are being made by organizations like the World Bank Group to support client countries in developing foundations for Islamic finance. Overall, asset-backed Islamic finance structures have proven successful in unlocking financial resources and promoting economic development in the Middle East, offering significant potential for investment and growth in the region (Abayomi, 2015; Harahap et al., 2023; The Securities Commission Malaysia (SC) and the World Bank Group, 2020; Rabbani, 2021).

Factors Contributing to the Unlocking of Financial Resources

Islamic finance structures play an indispensable role in unleashing financial resources in the Middle East region. The asset-based nature of Islamic finance structures is a pivotal factor in unlocking financial resources. In contrast to traditional financing, Islamic finance products are grounded on tangible assets, making them more attractive to both local and international stakeholders. This asset-based approach offers a level of stability and security that entices investment in the region.

Moreover, the establishment of specialized Islamic banks and other financial institutions is made feasible through Islamic finance structures. This fosters a favorable environment for unlocking financial resources within the region. Nevertheless, it is crucial to address regulatory considerations to harmonize tax obligations across different countries. It is essential to tackle legal enforceability issues and mitigate the increased funding costs due to taxes.

Additionally, promotional endeavors by African governments are vital in overcoming challenges related to regulatory systems. By facilitating changes in regulatory systems, these efforts enhance the appeal of Islamic finance products to both local and international stakeholders. Such initiatives can help achieve the critical mass necessary for Islamic finance to thrive, thereby unlocking significant financial resources in the Middle East region (Alfred Kammer, 2015; Dey & Jin, 2018).

Enhancing Investment through Islamic Finance Structures

Importance of Investment in Economic Growth and Development

Investing in economic growth and development is paramount, particularly in the Middle East region. Islamic finance structures are vital in amplifying investment opportunities in this area. The rapid expansion of Islamic finance has made it systemically crucial in numerous countries, driven by the substantial savings amassed by oil-exporting nations seeking to invest in Sharia-compliant financial products. This presents an opening for Islamic finance to aid in fostering higher and more comprehensive economic growth, given its inherent resilience to crisis due to its risk-sharing feature and strong ethical principles. Furthermore, Islamic finance can also help promote macroeconomic and financial stability by encouraging improved risk management and discouraging excessive borrowing.

Moreover, Islamic finance is well-suited for funding small and medium-sized enterprises (SMEs) and startups, which is fundamental for inclusive growth. The asset-based nature of Islamic finance encourages better risk management by both financial institutions and their customers, making it more stable than conventional finance. This stability is essential for attracting private capital investment, which is necessary for achieving climate and development objectives.

Additionally, Islamic finance can play a part in post-COVID-19 recovery by mobilizing climate finance aligned with the Paris agenda. The strong connection of credit to collateral means that Islamic finance is well-suited for infrastructure financing, which is critical for economic growth and development. With its emphasis on responsible governance, inclusive growth, equitable society, and sustainable world resources and environment, Islamic finance has the potential to make a significant impact on economic development.

In summary, the role of Islamic finance structures in unlocking financial resources and enhancing investment in the Middle East region cannot be underestimated. It has the potential to contribute significantly to economic growth and development through its stable and ethical principles (Alfred Kammer, 2015; Asian Development Bank, 2022; Fitchs’ Islamic Finance Rating Team, 2021; Songwe et al., 2022).

How Islamic Finance Structures Facilitate Investment Opportunities in the Middle East Region

Islamic finance structures are indispensable in creating investment prospects in the Middle East region. The swift expansion of the Islamic finance industry has made it crucial in many countries, capturing a significant market share and advancing economic development. The nature of Islamic finance structures, supported by assets and their risk-sharing feature, makes them more stable than traditional finance and less susceptible to crises. Furthermore, Islamic financial institutions have been acknowledged as a valuable platform for promoting financial inclusion and supporting growth and economic development.

The standardization of documents related to Islamic finance can further benefit the industry, providing practitioners with a foundation and framework for understanding common credit and legal aspects involved in Islamic finance for public-private partnerships (PPPs) and other investment opportunities. Additionally, forming strong partnerships between multilateral development banks (MDBs), international institutions, Islamic infrastructure institutions, an Islamic Financial Institutions can give a Boost to the Sector.

The expanding reach of Islamic finance offers numerous advantages for unlocking financial resources, encouraging private sector investment in sustainable infrastructures, and supporting economic growth in the Middle East region. The potential contribution of the industry to sustainable development financing goals and its emphasis on risk-sharing can deepen financial markets and inclusion while providing new modes of finance to unbanked populations.

Despite the challenges facing the industry, such as regulatory frameworks tailored for conventional finance that do not fully consider the unique nature of Islamic finance, efforts are being made to overcome these obstacles. With projected continued growth in response to economic expansion in countries with large Muslim populations, Islamic finance structures are expected to continue playing a significant role in unlocking financial resources and enhancing investment opportunities in the Middle East region (Alfred Kammer, 2015; Iqbal, 1997; Asian Development Bank, 2022; Diallo & Mejai, 2018).

Development of the Global Islamic Finance Industry

Evolution and Growth of the Global Islamic Finance Industry

The Islamic finance industry has experienced significant growth in the Middle East, Asia, and Africa, driven by the abundance of financial resources in oil-producing countries. There is also a growing acceptance of Islamic banking globally due to its ethical and socially responsible nature. This has led to the development of increasingly sophisticated financial products and services that comply with Sharia law. Islamic financial products have gained traction in non-Muslim countries as well, indicating their recognition as part of the international finance system.

Sukuk, or Islamic bonds, have become prominent funding instruments, with the global issuance market standing at approximately $115 billion annually, concentrated mainly in the Gulf countries and Malaysia. New Sukuk products aligned with environmental, social, and governance (ESG) objectives have been successfully issued, showing the industry's interest in sustainability-driven investment certificates.

The Islamic finance industry is projected to grow by 10%-12% in 2021-2022, with stronger Sukuk issuances expected to bolster Islamic finance assets over this period. It is worth noting that Islamic banking has outperformed conventional banking in many countries in the Middle East and Asia over the past decade. Overall, the evolution and growth of the global Islamic finance industry have been driven by factors such as increasing financial resources in oil-producing countries and the industry's ethical and socially responsible nature, leading to its acceptance worldwide (Asian Development Bank, 2022; Fitchs’ Islamic Finance Rating Team, 2021).

Key Players and Regions in the Global Islamic Finance Industry

The expansion and evolution of the global Islamic finance industry have been substantial in recent years, with significant contributors and regions driving its growth. An important factor in the internationalization of Islamic finance has been the establishment of global regulatory bodies and standard-setting institutions. These organizations have played a pivotal role in creating regulations and standards for Islamic finance in new markets, including non-OIC countries like the United Kingdom and Singapore.

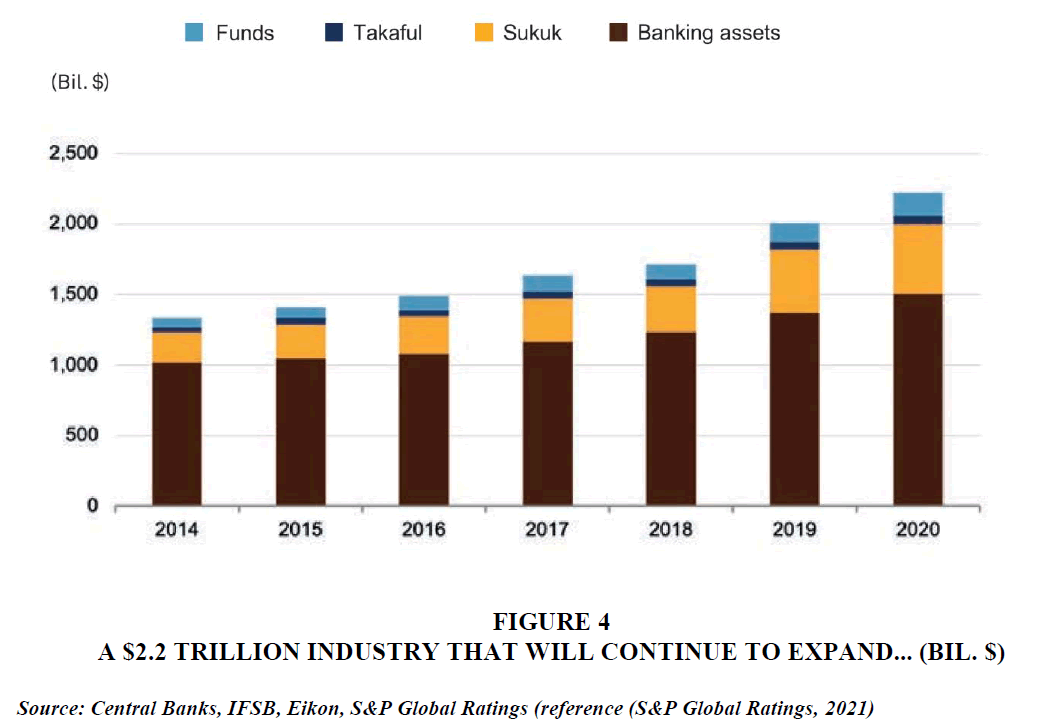

Another driver of the industry's growth has been the globalization of major players in Islamic finance, particularly banks from GCC countries. These institutions have established connections or entered into partnerships with entities in new countries, leading to the development of Islamic finance in regions such as Asia and Africa. Moreover, Islamic financial institutions have operated in various ADB DMCs like Sri Lanka, Thailand, or the Philippines, albeit with relatively small customer bases at this stage Figure 4.

Figure 4 A $2.2 Trillion Industry that will Continue to Expand... (Billion. $)

Source: Central Banks, IFSB, Eikon, S&P Global Ratings (reference (S&P Global Ratings, 2021)

The Islamic Development Bank (IsDB) has also played a crucial role in the global expansion of Islamic finance. With its AAA rating and extensive operating assets, IsDB has made significant contributions to the establishment and development of Islamic financial institutions across the globe. This has resulted in a well-established industry in some ADB DMCs and other regions such as Brunei Darussalam, Indonesia, Sri Lanka, and Thailand.

In conclusion, it is clear that there are several key contributors and regions driving the growth of the global Islamic finance industry. The internationalization of major players in Islamic finance and the support from organizations like IsDB have been essential in expanding the availability of Sharia-compliant financial services across different geographical areas (Asian Development Bank, 2022; di Mauro, 2013s).

Strengths and Weaknesses of Islamic Financial Institutions

Strengths and Advantages of Islamic Financial Institutions in Promoting Sustainable Development Islamic finance institutions have numerous strengths and advantages that aid in sustainable development. One of the noteworthy benefits is the asset-backed nature of Islamic finance structures, ensuring that transactions are supported by tangible assets, promoting stability and reducing the risk of speculative bubbles. Additionally, Islamic financial institutions have demonstrated resilience and stability compared to conventional banks, as evidenced by their lower default rates and stronger bank strength measures.

Moreover, Islamic finance highlights risk-sharing and equity-based financing, aligning with principles of sustainability and responsible investment. This focus on ethical financing encourages funds to be allocated to economically viable and socially beneficial projects. Furthermore, the emphasis on entrepreneurship promotes closer scrutiny of projects and management teams, contributing to improved business practices and economic development.

Islamic financial institutions also play a significant role in promoting financial inclusion by offering new modes of finance and attracting unbanked populations, leading to deeper financial markets and enhanced economic participation among underserved communities.

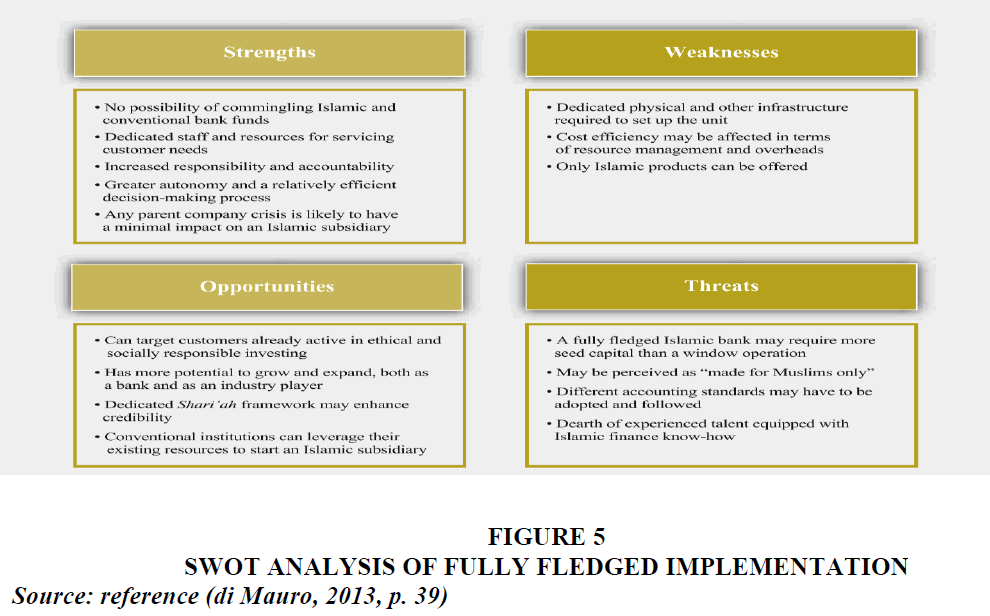

Another notable feature is the strong connection between Islamic finance and real economic activities. By prioritizing risk-sharing arrangements over debt financing, Islamic financial institutions promote investments directly tied to productive ventures, fostering sustainable economic growth Figure 5.

Figure 5 Swot Analysis of Fully Fledged Implementation

Source: reference (di Mauro, 2013, p. 39)

Overall, Islamic financial institutions possess inherent strengths aligned with principles of sustainability, responsible finance, and ethical investment, positioning them as key contributors to sustainable development in the Middle East region (International Monetary Fund. Monetary and Capital Markets Department, 2018; Iqbal, 1997; di Mauro, 2013).

Weaknesses and Challenges Faced by Islamic Financial Institutions

Islamic finance institutions are confronted with a variety of hurdles and shortcomings that hinder their progress and expansion. One significant issue is the potential for funds to be mixed together and regulatory arbitrage, which arises from the operation of Islamic windows within conventional financial institutions. This necessitates the implementation of appropriate firewalls, disclosures, and internal systems to ensure compliance with Shariah rules and principles, as well as the separation of Islamic and non-Islamic business. Another concern is the lack of consistency in the religious principles applied in Islamic countries, leading to variations in interpretation by different schools of thought. This can lead to the rejection or acceptance of identical financial instruments, resulting in inconsistency across countries.

Moreover, there is a shortage of trained personnel with expertise in analyzing and managing portfolios according to Islamic financial principles. The scarcity of Shariah scholars with financial sector expertise and a slow pace of innovation also impacts the industry. Additionally, there are specific consumer protection issues related to Islamic banking contracts, such as lease-to-purchase agreements that place consumers at a disadvantage. The complexity of some Islamic bank contracts makes it difficult for consumers to fully understand the risks involved.

Furthermore, the prohibition of interest in Islamic finance presents a significant challenge to institutions used to financing operations through interest-bearing bonds or borrowing. This has resulted in limited integration with international markets and challenges in true securitization of underlying assets.

To address these weaknesses and challenges, there is a need for greater regulatory clarity and consistency through adoption of Islamic standards developed by standard setting bodies. Countries with Islamic banks should adopt a cross-sectional approach to supervision, strengthen Shari'ah governance structures, enhance consumer protection frameworks, and develop supporting financial infrastructures including Shariah-compliant financial safety nets and appropriate resolution frameworks (Alfred Kammer, 2015; International Monetary Fund. Monetary and Capital Markets Department, 2018; Iqbal, 1997; Lukonga, 2015; di Mauro, 2013).

Contribution to Environmental, Social, and Economic Issues

Impact on environmental sustainability

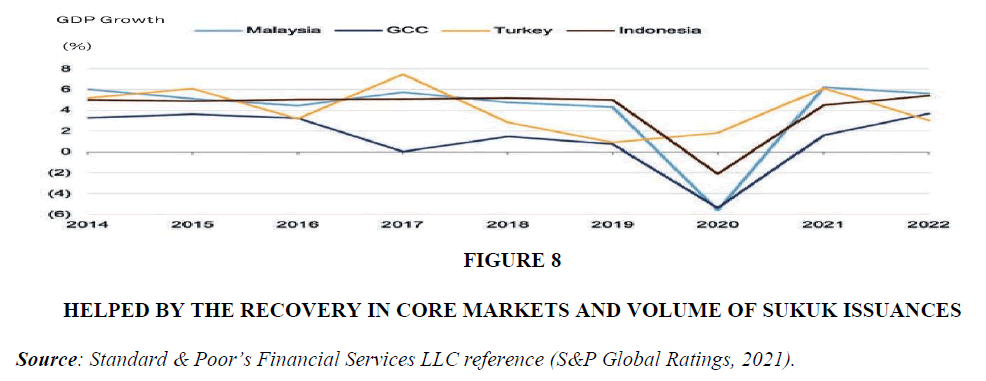

Islamic finance has the potential to contribute significantly to climate action and sustainable finance principles, particularly in the Middle East region. The industry's alignment with green finance and its focus on risk sharing and sustainability make it well-suited for financing investments to address climate change. Islamic banking assets in certain GCC countries, Malaysia, and Turkey, as well as sukuk issuances exceeding maturities, highlight the industry's potential for sustainable growth.

Additionally, Islamic finance institutions can promote environmental sustainability through social Islamic finance instruments and green sukuk, capitalizing on opportunities created by the pandemic aftermath and energy transition. This transformation can expand the impact of green development across asset classes beyond bonds and Islamic finance.

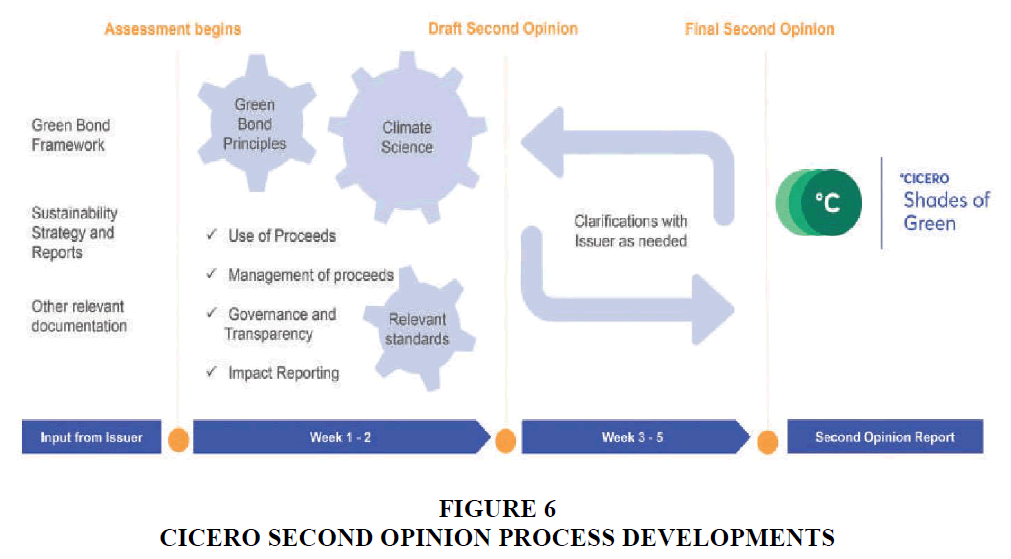

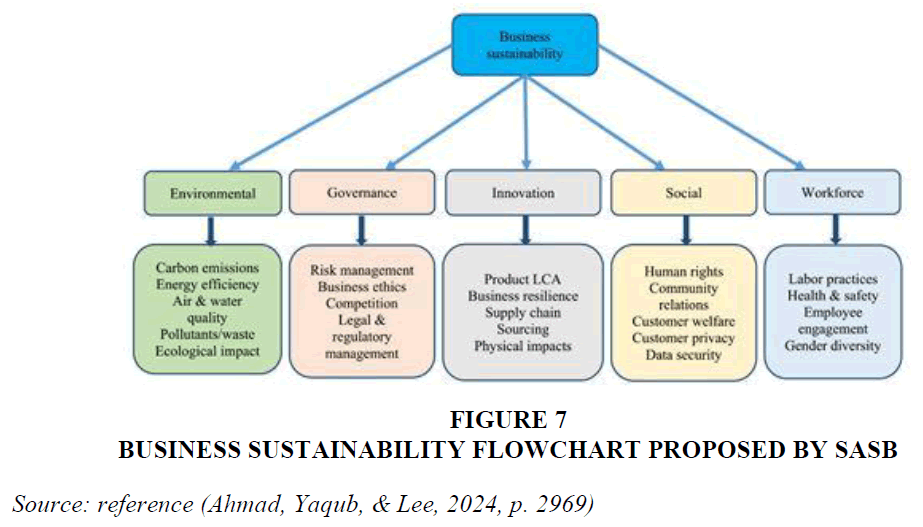

With global efforts to combat climate change, there is a growing consensus on the need for urgent action, positioning Islamic finance as a natural vehicle for promoting sustainable development. By adopting standardized approaches and aligning standards and reporting with stakeholders globally, Islamic finance can attract a broader investor base. As non-sustainable investments continue to exacerbate climate change effects, there is an emerging trend offering greater opportunities for Islamic finance to support sustainable objectives Figure 6 & Figure 7.

Figure 7 Business Sustainability Flowchart Proposed by SASB

Source: reference (Ahmad, Yaqub, & Lee, 2024, p. 2969)

In conclusion, Islamic finance, rooted in ethical and responsible finance principles, has the potential to unlock financial resources for environmental sustainability efforts while contributing significantly to economic growth in the Middle East region (Securities Commission Malaysia and the World Bank Group, 2019; S&P Global Ratings, 2021).

Social Initiatives Supported by Islamic Financial Institutions

Islamic finance institutions have a pivotal role in championing social initiatives aimed at fostering sustainable development and tackling environmental challenges. One notable way in which Islamic finance systems support social initiatives is through providing banking services to unbanked populations. In nations like Bangladesh, Kyrgyz Republic, Pakistan, and Tajikistan, Islamic banking services have substantially increased financial inclusion, with inclusion levels rising by over 50% in just three years Table 1. This has created excellent opportunities for offering Islamic banking services in line with the agenda for a green, inclusive, and resilient recovery. Moreover, Islamic finance institutions have also been instrumental in delivering targeted climate-smart investments at the community or household level through zakat or charity programs. These initiatives have helped decrease the vulnerability of disadvantaged social groups to the impacts of climate change and have provided emergency support and humanitarian aid in response to climate disasters.

| Table 1 Major ESG Indices and Relevant Factors Used by Different Providers | |||

| Major indices | Environmental | Social | Governance |

| Bloomberg | Carbon emission Climate change Pollution/Waste Resource depletion Renewable energy |

Supply chain Gender diversity Political influence Human rights Community relations |

Executive compensation Shareholder rights Staggered boards Independent directors Cumulative voting |

| Thomson Reuters | Resource usage Carbon releases Invention |

Employee Basic rights Public Product accountability |

Corporate governance Corporate behavior |

| MSCI | Climate change Sustainability initiative Pollution/Waste Natural resources |

Human capital Product liability Stakeholder opposition Social opportunities |

Management Shareholders CSR strategy |

Additionally, Islamic microfinance and awqaf have played a critical role in enhancing resilience to climate change effects and supporting the adaptation of local economies. Through providing access to financial services and targeted investments, these efforts have contributed to bolstering the resilience of communities to climate change impacts and supporting adaptation endeavors.

In summary, Islamic finance structures have showcased a strong dedication to social initiatives that advance sustainable development and tackle environmental challenges. Through their emphasis on financial inclusion, focused investments, and community assistance programs, Islamic financial institutions are making a significant impact on social and environmental issues in the Middle East region (Asian Development Bank, 2022).

Economic Benefits Generated by Sharia-Compliant Financing

Islamic finance has become a significant driver of financial resources and investment in the Middle East, aligning with sustainable finance principles. With an estimated annual turnover of $70 billion, Islamic finance has rapidly expanded since 1985, offering asset-backed structures for sustainable financing options. Innovative products like green bonds and funds provide investment opportunities for ethical and environmentally conscious investors (Refinitiv, 2021).

Institutional investors are increasingly embracing sustainable investment, while sovereign wealth funds are integrating climate change exposure into their portfolios. Islamic financial institutions are advocating for environmental sustainability through green sukuk programs and social initiatives like zakat programs to promote environmental responsibility. They have also shown potential to raise funds for climate-resilient infrastructure after climate disasters.

The development of Islamic climate finance is crucial for achieving long-term economic growth while safeguarding the environment. Efforts are needed at both domestic and international levels to expand Islamic climate finance through targeted support programs and policies tailored to each member country's level of maturity in this field. Overall, Islamic finance structures play a vital role in mobilizing financial resources, enhancing investment opportunities, and making positive contributions to environmental sustainability and social initiatives in the Middle East region (Iqbal, 1997; Asian Development Bank, 2022; Securities Commission Malaysia and the World Bank Group, 2019).

Diagnosing the Reality and Prospects of the Islamic Financial Industry

Current State of the Islamic Financial Industry in Middle Eastern Countries

The Islamic finance industry has seen significant growth, with global assets reaching around US$2 trillion in 2016, exceeded US$3 trillion in 2020 and projected to exceed US$5 trillion and approach US$6 trillion by 2026. While historically focused on the Middle East and Malaysia, non-Islamic majority jurisdictions have entered the market in the past five years, and Africa is seen as a region where Islamic finance could flourish due to its significant Muslim population and infrastructure development deficit.

Several African countries, including South Africa, Nigeria, Kenya, Senegal, Djibouti, Uganda, and Morocco, have implemented legal and regulatory frameworks to support Sharia-compliant financing. New sukuk products aligned with environmental, social, and governance objectives have been issued successfully by supranational agencies and sovereign entities.

Globally, Islamic finance covers banking, leasing, sukuk, equity markets, investment funds, insurance ('Takaful'), and microfinance. Despite its growing presence, Islamic finance assets are still concentrated in the GCC countries, Iran, and Malaysia, representing less than one percent of global financial assets but with significant growth potential.

The Middle East has been crucial in driving expansion in the global Islamic finance industry due to being home to Islam's holiest sites and having a sizable Muslim population. The global value of Sukuk issuances, including re-opened sukuk, increased in 2021 to a record US$202.1 billion, marking another good year for the segment. The growth of 9% in 2021 was at par with 2020’s. Total assets of the sector, as measured by total sukuk outstanding, stood at US$713 billion in 2021, up 14% from US$626 billion in 2020.

Challenges such as lack of uniformity in religious principles and the need for sound accounting procedures and standards exist, but there is immense potential for future growth and development within the Middle Eastern countries' Islamic financial industry (Asian Development Bank, 2022; Dey & Jin, 2018; Refnitiv, 2022; S&P Global Ratings, 2021).

Future Prospects for Growth and Development

The Islamic finance industry's future looks bright. According to the ICD-Refinitiv Islamic Finance Development Indicator report, the global Islamic finance industry is poised to rise to $6.0 trillion by 2026. This expansion is attributed to the rapid increase in Islamic banking assets in some Gulf Cooperation Council (GCC) countries, Malaysia, and Turkey, with Islamic banking activities accounted for around 70% of global Islamic finance assets in 2021, according to the IFDI Report. The second-biggest segment is Shariah-compliant debt capital market instruments, accounting for 18%, and Islamic funds in third, accounting for around 4.0%.

Other Islamic financial institutions, including financial technology (FinTech), investment, financing, and leasing and microfinance companies as well as brokers and traders accounted for 4.0% of global Islamic finance assets in 2021, while takaful (Islamic insurance) had the smallest representation with about 2.0%.

One key driver for future growth is the advancement in standardization and integration within the industry. Efforts are underway to develop a unified global legal and regulatory framework for Islamic finance, which will contribute to more sustainable growth. Additionally, there may be more frequent issuance of dedicated social Islamic finance instruments and green sukuk as the industry aligns with environmental, social, and governance (ESG) values.

Fintech collaboration also holds promise for enhancing resilience and opening new avenues for growth in Islamic finance. Higher digitalization and collaboration with fintech companies could strengthen resilience in volatile environments, while also providing opportunities for growth. However, this will require adequate physical infrastructure and regulatory frameworks to support fintech's enrichment of the industry Figure 8.

Figure 8 Helped by the Recovery in Core Markets and Volume of Sukuk Issuances

Source: Standard & Poor’s Financial Services LLC reference (S&P Global Ratings, 2021).

Looking ahead, the global Islamic finance industry is expected to continue evolving and growing. The two countries with the most developed Islamic finance sectors - Malaysia and Indonesia - are demonstrating strong performance in knowledge production, product awareness, regulations, and governance. This reinforces their global leadership position in the industry.

In conclusion, while there are challenges such as slow internationalization of Islamic Financial Services Industry (IFSI) players and demand-side obstacles hindering full potential development in Asia, efforts are being made to tackle these obstacles. With a focus on standardization, ESG-aligned products, fintech collaboration, and continued evolution of established markets like Malaysia and Indonesia, the future prospects for growth and development in the Islamic finance industry are encouraging. (S&P Global Ratings, 2021; Refnitiv, 2022; Sharma, 2024).

Conclusion

Recapitulation on the Role Played by Islamic Finance Structures in Unlocking Financial Resources and Enhancing Investment in the Middle East Region

Islamic finance has played a crucial role in unlocking financial resources and enhancing investment in the Middle East. It is seen as a stable and ethically preferable alternative to conventional finance, recognized by organizations like the Asian Development Bank for its potential in achieving inclusive growth and financial stability. Islamic finance provides financial services for all segments of the population, increasing financial inclusion. It also serves as an alternative source of funding infrastructure projects, diversifying funding and risk exposures. Islamic social finance instruments like zakat and waqf widen access to finance and support socially vital projects. The growth of the Islamic banking sector in the MENA region highlights its importance in catering to individuals' financial needs while aligning with their values. Islamic banks promote real economic activity by participating as trading partners with their clients. The global financial community is converging towards ethical investments, which aligns with Islamic investment guidelines prioritizing fair trade and environmental protection. Overall, Islamic finance contributes to sustainable development goals by providing an inclusive and productive capitalist economy while adhering to ethical principles.

Summary of Strengths and Weaknesses of Islamic Financial Institutions in Addressing Environmental, Social, and Economic Issues

Islamic financial institutions have both strengths and weaknesses in addressing environmental, social, and economic issues. Their emphasis on real asset financing helps to avoid excessive speculation and contributes to financial stability. Islamic finance promotes peace and social harmony by using redistributive and risk-sharing tools to bring poor people into the financial network and reduce poverty and inequality. It can serve both Muslim and non-Muslim individuals, providing stable financial services that promote social well-being.

However, there are weaknesses that need to be addressed. Islamic finance's impact is limited during crises like the COVID-19 pandemic due to its current structure. There is a need for adaptation of financing tools to better address the economic consequences of such crises. Additionally, challenges exist in promoting financial inclusion, supporting small and medium-sized enterprises (SMEs), and fully realizing the potential of Islamic finance.

Despite these weaknesses, Islamic finance has gained recognition internationally and aligns with the goals of sustainable development. Efforts are needed to unlock its full potential in addressing environmental, social, and economic issues effectively. By addressing weaknesses and building on strengths, Islamic finance can play a significant role in enhancing investment in the Middle East and contributing towards achieving the Sustainable Development Goals.

Importance of Ongoing Development and Prospects for the Islamic Finance Industry in Middle Eastern Economies

The ongoing development and prospects for the Islamic finance industry play a crucial role in enhancing investment in Middle Eastern economies. Islamic finance offers a unique approach to financial inclusion by promoting risk-sharing contracts and instruments of wealth redistribution. This makes it particularly suitable for Micro, Small, and Medium Enterprises (MSMEs) that are often deemed as risky by conventional lenders. Additionally, the social solidarity instruments of wealth distribution in Islamic finance, such as zakat, sadaqah, and waqf, contribute to poverty alleviation and social protection. The integration of these instruments with the formal financial system enhances transparency, governance, and trust among stakeholders. Furthermore, the availability of Islamic social finance products, crowdfunding, and other alternative financing means provide greater access to financing for MSMEs. The continuous development of these products by regulators and governments, coupled with advancements in technology like blockchain applications, broadens funding models for MSMEs and ensures better financial inclusion. Moreover, the emergence of digital technology in Islamic finance fosters innovation, scalability, and efficiency while serving as a tool for financial inclusion. It is important to address concerns about over-indebtedness by implementing better governance in credit-lending policies. Overall, ongoing development in Islamic finance holds tremendous importance for Middle Eastern economies as it supports economic growth, reduces inequality through wealth distribution mechanisms, and provides alternative financing options for businesses.

Potential for a More Sustainable Development approach within the Islamic Finance Industry

In conclusion, Islamic finance has the potential to offer a more sustainable development approach. It can play a crucial role in enhancing investment in the Middle East and addressing the challenges faced by the Islamic financial system. By utilizing its assets back, risk-sharing, and distributive financing tools, Islamic finance can complement financing needs for achieving sustainable development goals (SDGs). Emphasizing on linking financing with real assets helps avoid excessive speculation and ensures financial stability. Moreover, Islamic finance promotes peace in society through its redistributive and risk-sharing tools, reducing poverty and inequality. It serves both Muslim and non-Muslim individuals, providing stable financial services that promote social harmony and peace. The rise of fintech has provided an opportunity for Islamic finance to regroup and combat economic disruptions such as the COVID-19 pandemic. The combination of Islamic social finance tools and fintech can be extremely helpful in mitigating the economic consequences of such crises. The risk-sharing and asset-backed features of Islamic finance make it a strong support system for small and medium-sized enterprises (SMEs), promoting financial inclusion and stability. Overall, by addressing challenges and leveraging its unique features, Islamic finance can contribute significantly to sustainable economic development in the Middle East and beyond.

References

Abayomi, A.A. (2015). https://www.worldbank.org/en/topic/financialsector/brief/islamic-finance

Ahmad, H., Yaqub, M., & Lee, S. H. (2024). Environmental-, social-, and governance-related factors for business investment and sustainability: A scientometric review of global trends. Environment, Development and Sustainability, 1-23.

Indexed at, Google Scholar, Cross Ref

Alfred Kammer, M. N. (2015). Islamic finance: Opportunities, challenges, and policy options.

Indexed at, Google Scholar, Cross Ref

Alshubiri, F., & Al Ani, M. K. (2023). Financing and returns of Shari’ah-compliant contracts and sustainable investing in the Islamic banking of Oman. Economic Change and Restructuring, 1-37.

Indexed at, Google Scholar, Cross Ref

Asian Development Bank. (2022). Unlocking Islamic Climate Finance. Metro Manila, Philippines: Asian Development Bank (ADB).

Dey, D., & Jin, X. (2018). https://www.whitecase.com/insight-our-thinking/islamic-finance-africa-opportunities-and-challenges.

di Mauro, F., Caristi, P., Couderc, S., Di Maria, A., Ho, L., Kaur Grewal, B., ... & Zaheer, S. (2013). Islamic finance in Europe. ECB Occasional Paper, (146).

Diallo, A., & Mejai, M. (2018).https://blogs.worldbank.org/ppps/can-islamic-finance-unlock-funds-development-it-already.

Fitchs’ Islamic Finance Rating Team .(2021). Guide To Islamic Finance: Fitch Ratings’ Perspective.

Harahap, B., Risfandy, T., & Futri, I. N. (2023). Islamic law, islamic finance, and sustainable development goals: a systematic literature review. Sustainability, 15(8), 6626.

Indexed at, Google Scholar, Cross Ref

International Monetary Fund. Monetary and Capital Markets Department. (2018). The Core Principles for Islamic Finance Regulations and Assessment Methodology. Washington, D.C: IMF Publication.

Iqbal, Z. (1997). Islamic financial systems. Finance and development, 34, 42-45.

Indexed at, Google Scholar, Cross Ref

Iqbal, Z., & Mirakhor, A. (2013). Economic Development and Islamic Finance. Washington DC : International Bank for Reconstruction and Development / The World Bank.

Karim, R. (2023). Prospects and challenges of Islamic finance instruments for low-carbon energy transitions: a legal analysis from an energy justice perspective. Journal of Energy & Natural Resources Law, 41(2), 195-209.

Lukonga, I. (2015). Seven Questions on Islamic Finance. IMF Research Bulletin, 16(2), 6-9.

Rabbani, M.R., Bashar, A., Nawaz, N., Karim, S., Ali, M. A. M., Rahiman, H. U., & Alam, M. S. (2021). Exploring the role of islamic fintech in combating the aftershocks of covid-19: The open social innovation of the islamic financial system. Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 136.

Indexed at, Google Scholar, Cross Ref

Refinitiv. (2021). https://www.refinitiv.com/content/dam/marketing/en_us/documents/gated/reports/report-2021-all-color2.pdf

S&P Global Ratings. (2021). Islamic Finance Outlook - 2022 Edition. S&P Global Inc.

Securities Commission Malaysia and the World Bank Group. (2019). Islamic Green Finance: Development, Ecosystem And Prospects. Kuala Lumpur: Securities Commission Malaysia.

Sharma, P. (2024). https://ibsintelligence.com/ibsi-news/by-2026-the-global-islamic-finance-industry-is-expected-to-reach-6-trillion/

Songwe, V., Stern, N., & Bhattacharya, A. (2022). Finance for climate action: Scaling up investment for climate and development. Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science: London, https://www. lse. ac. uk/granthaminstitute/publication/financefor-climate-action-scaling-up-investment-for-climate-and-development.

The IMF and Islamic Finance. (2017). https://www.imf.org/external/themes/islamicfinance/index.html

The Securities Commission Malaysia (SC) and the World Bank Group. (2020). Islamic Finance: A Catalyst For Financial Inclusion. Kuala Lumpur, Malaysia: Securities Commission Malaysia.

Received: 25-Dec-2023, Manuscript No. jmids-24-14561; Editor assigned: 27-Dec-2023, Pre QC No. jmids-24-14561(PQ); Reviewed: 05- Feb-2024, QC No. jmids-24-14561; Published: 24-Feb-2024