Research Article: 2018 Vol: 22 Issue: 4

The Role of Risk Management on Budget Quality and Slack

Robinson, University of Diponegoro, Indonesia

Anis Chariri, University of Diponegoro, Indonesia

Tri Jatmiko Wahyu Prabowo, Diponegoro University, Indonesia

Abstract

There are two purposes of this study, first, to examine some effects of budget qualities of goal clarity, evaluation and accuracy on budget slack. Second, this research was tested effect of risk management as moderating variable on relation between budget qualities and slack of budget. In practice, the results of this study contribute for local parliamentarian and local government when they prepare the budget. By purposive sampling method, this study used 89 data that being collected from members of budget committee. The statistical analysis based on linier regression to test first hypothesis and interaction analysis or Moderated Regression Analysis (MRA) was used for second hypothesis analysis. The results show that goal clarity, evaluation, and accuracy tend to have negative effects on budget slack. The interaction analysis result show effect of risk management on relation between budget quality and slack of budget were found to be weak or insignificant. Risk management, furthermore, were found to have negative influence on budget slack.

Keywords

Budget Quality, Budget Slack, Risk Management.

Introduction

The business plan (i.e. budgeting) can help an organization arrive at a nice balance between reach and realism by developing a written summary of what the organization hopes to accomplish and how it intends to organize its resources (Benjamin et al., 2006).Slack existence in the budget due to distorted information in the planning and budgeting process (Belkaoui, 2002). Distortion of such information comes from the existence of understatement and overstatement in the budgeting process. Distortion of information and slack in the budget is also a strategy for the organization or negative behavior of individuals involved in the budgeting process.

Previous research has concluded about budget slack from different angles. Some researchers conclude that budget slack is common in organizations (Merchant, 1985, Merchant and Manzoni, 1989), while Merchant (1989) concludes that budget slack is useful in anticipating future uncertainty. In addition, budget slack is also seen to have negative implications such as low managerial effort, resource allocation and bias in performance evaluation of managers (Dunk and Nouri, 1998; Kren and Liao, 1988). In addition to testing the phenomenon of budget slack with the old paradigm as described above, some researchers also explore personal and contextual factors, such as reputation and ethics (Stevens, 2002), while Chen (2009) uses manager behavior as an individual factor. In exploring the abovementioned factors, Davila and Wouters (2005) argue that there are different ways to understand the phenomenon of budgetary slack to understand that the budget slack described as a negative behavior phenomenon needs to be revisited as a risk management strategy (Elmassri and Harris, 2011). Thus budget slack is one of the issues that are still a debate in budgeting.

This study differs from previous research by Stevens (2002) and Chen (2009) who explored personal and individual factors to examine the phenomenon of budgetary slack, so in this study used the characteristics of budget quality in relation to budgetary slack. According to Kenis (1979), the quality of the budget based on its characteristics (participation, clarity of objectives, and feedback, evaluation, and difficulty level of budget targets) as a whole plays an important role in the development or behavior of the budget, including the behavior of making budgetary slack. Increased participation in strategic planning leads to poor budgeting creation, in addition, budgetary participation that is one of the characteristics of budget quality also decreases the trend of budgetary slack (Baerdemaeker and Bruggeman, 2015). The phenomenon of budgetary slack can be reduced through improving the quality of the budget, so that efforts are needed to improve the quality of budget preparation. The allocation of resources in the budget is expected to be more effective and efficient when the budget slack tendency is reduced.

To improve the quality of the budget should take into account the criteria of good planning, among which are continuous, flexible and accurate, to meet these criteria in planning should ensure that between long-term strategic planning and short-term planning that is more operational have a link or synergy Blumentritt, 2006). In addition to the integration of long-term/strategic planning with short-term/operational planning, in the planning process should also consider the factors of uncertainty that contain elements of risk. This is in accordance with the definition of risk from The International Federation of Accountants (1999), the risk is uncertainty of future events that will affect the achievement of objectives. Therefore, a systematic approach is needed to determine the best course of action under conditions of uncertainty through the identification, understanding, action, and communication of a risk, in other words risk management is required.

Based on the above explanation and suggestions from Collier & Berry (2002) and (Baerdemaeker and Bruggeman, 2015) that it is important to research the risks in budgeting as well as understand how budgetary slack occurs, the purpose of this study is to empirically test how risk management roles in the relationship between budget quality and budgetary slack. Conceptually it is expected that the results of this study provide a new perspective in assessing the existence of slack in budgeting, which is reviewed based on the characteristics of budget quality. Practically, the findings of this study are also expected to provide consideration in the implementation of risk management in the budgeting process, with the aim of reducing the slack trend in the budget.

To answer the purpose of the research above, will be used primary data obtained through questionnaire instrument with the respondents of budget agency members in local government. Data were tested by regression analysis for hypothesis 1 and Moderated Regression Analysis (MRA) for hypothesis 2. In the next chapter will describe literature review and hypothesis development, research methods, results and discussion, conclusions, limitations and suggestions.

Literature Review and Hypotheses Development

The goal-setting theory was pioneered by Edwin Lock (1978), which states that the important determinant for the individual about how he exerts his efforts is the individual's own goal and the extent of his responsibility to that goal. Edwin Locke points out that the intentions to work toward a goal are a major source of work motivation. That is, the purpose of telling someone what needs to be done and how much effort will be spent, so it can be said that specific goals will improve performance (Robbins, 1998).

The implications of this theory on the budgeting system are that the targets within the budget can ideally be achieved. So basically the concept of goal setting theory is that someone who understands the purpose (what the organization expects for him) will affect his work behavior. The same is true for the party making the budget, that a good understanding of the goals listed in the budget will affect the effectiveness of budgeting done. According to the theory mentioned in this theory that the determining factor for a person in how he exerts effort in the individual's own ends and to what extent his or her responsibilities are to them, the preparation of the budget is responsibility as the party authorized for it.

Budgeting and Risk Management

The budgeting process is a formal method when a plan is created for a future period of time. This process implies there are considerations about risk and uncertainty. However, risk assessment is a conceptual problem with reference to the existence of internal or external events; information about events (i.e. their visibility);managerial perceptions of events and information (i.e. how they are perceived) and how organizations form systems, informal (or explicit and formal) as a way to deal with risk (Collier and Berry, 2002). Thus, the existence of risk in any budgeting is a necessity.

Political bargaining and top-down approaches to budgeting are frequent activities in the budgeting process, which can result in political and lagging risks in the budget (Covaleski and Dirsmith, 1986; Elmassri and Harris, 2011). Political risk in budgeting can be in the form of a fight between the legislature and the executive in fighting for their respective political interests, this leads to a mutually agreed budget negotiation. The impact of the struggle of various interests in the preparation of the budget will make these parties attempt to harmonize these interests. In the practice of budgeting in the Indonesian regional government, the relevant parties actively try to harmonize the various interests that exist (Utomo, 2015).

Magner and Johnson (1995) state that those involved in the budget preparation process have a tendency to maximize their respective interests through the allocation of resources within the budget set. The executive or agency that is the budget proposer and also the implementer or user of the budget seeks to maximize the amount of the budget (Smith and Bertozzi, 1998). In this case each actor plays his own role, according to the strategy or his own way in an effort to determine the outcome of the policy.

The direct impact of conflict of interest in budgeting is that the effectiveness of resources allocation in the budget is low. Garamfalvi (1997) argues that politicians use the influence and power to determine the allocation of resources which will thenbenefit them personally or in groups, further politicians can take advantage of their position to gain economic advantage, political manipulation of public policy causes allocation of resources in the budget uneffective and inefficient.

In addition to political risks, Collier and Berry (2002) also categorize budgetary risks based on budget processes and contents. Based on the budgeting process, the risks are possible if the budgeting process is done with a top-down approach or established with a negotiated approach. Budgeting that using a topdown approach can lead to budgetary slack. The existence of slack in the budget is due to the planning and budgeting process of distorting information (Belkaoui,2002). Distortion of such information comes from the existence of understatement and overstatement in the budgeting process.

Based on the above argument, it can be concluded that in the budgeting process there is at least political and operational risk. Political risks are battles of interest and political bargaining, so there is negotiation or harmonization of interests in budgeting that can impact on ineffective allocation of resources (Fernandez, 2004; Collins et al., 1987; Utomo, 2015; Abdullah, 2012; Magner and Johnson, 1995; Garamfalvi, 1997). Operational risk is the risk that arises when the budget is prepared by participation or top-down approach, resulting in budget slack either caused by distortion of information or due to negative behavior of the parties involved in the preparation of the budget (Belkaoui, 2012; Schein, 1977). To minimize the impact of these risks, systematic steps are taken to manage those risks.Therefore a structured approach is needed to determine the best action under conditions of uncertainty or in other words a management approach is required in managing of risk. One of the objectives to be achieved through a good budgeting process is the allocation of resources in the budget to be effective and efficient. So the effort that can be done to realize the goal is through risk management. The success of achieving goals and objectives depends on how the risks and uncertainties are managed optimally (Tummala and Leung, 1996).

Budget Quality and Budgetary Slack

The budget becomes one of the important things in ensuring the implementation of an organization's strategy and program effectively and efficiently. This is the main requirement to achieve the goals and objectives of an organization, it can be concluded that how well the achievement of goals and goals of an organization will depend on how good the quality of the budget. The next important effort in achieving the goals and objectives of an organization to match what has been planned is the existence of control mechanisms in budgeting, in anticipation of slack. In accordance with the mentioned in goal setting theory, that the determinant factor for a person to how he exert effort is located on the individual's own goals and the extent of his responsibility to the goal, then for him the preparation of the budget is a form of responsibility as the party who is authorized therefore.

Research that examines the quality of the budget based on its characteristics is undertaken by Kenis (1979) where the results show that overall the characteristics of the budget objectives (participation, clarity of objectives, feedback, evaluation, and difficulty level of budget targets) play an important role in developing or behavior toward the budget. Collins (1978) examined the interaction between budget characteristics (accuracy, estimate certainty, controllability and participation) and variable personality to budgetary response attitudes concluded that overall budget characteristics were positively and significantly correlated with response attitude. Increased participation in strategic planning leads to lower budgertary slack creation, in addition, budget participation decreases the creation of budgetary slack (Baerdemaeker and Bruggeman, 2015).

In contrast to previous studies as described above, which examined the effect of budget quality (based on its characteristics) on the various variables in terms of the party making up and executing the budget, this study attempted to examine the effect of the quality of the budget on the parties to the discussion and oversight of the budget is a member of the budget committee, with this consideration the quality of the budget is measured through the characteristics of clarity, evaluation and accuracy of the budget. Therefore, the research hypothesis are stated as follows:

H1: Budget quality (budget clarity, budget evaluation, and budget accuracy) negatively affects on budget slack.

The Role of risk management in the relationship between Budget Quality and Budgetary Slack: Contingency Approach

The concept of risk management was originally developed and practiced in the private sector, especially the concept developed by COSO that is Enterprise Risk Management (ERM). Based on these concepts, risk management is defined as a process that is influenced by all elements of the organization (directors, management and other elements) in implementing a defined strategy to ensure the achievement of organizational goals (Moeller & Robert, 2007).

The inevitability of any risk in a planning becomes the basis of the relevance of risk management implementation in budgeting to be important. Such application shall be absolute and shall be carried out, for the accuracy of the assessment of the risks of the relevant government agency, so that such risks or barriers may be overcome and the objectives of the government agency can be realized.

When there is political manipulation of budget policy, as stated by Magner and Johnson (1995), the parties involved in the budgeting process have a tendency to maximize their interests through allocation of resources within a defined budget. So it is one of the potential risks in budgeting, because it causes one of the budgeting objectives of the allocation of effective and efficient resources to be not achieved. In addition, perceptions of organizational politics will also influence the tendency to make budgetary slack (Yilmaz et al., 2014).

The use of a contingency framework allows for other variables as a moderating or intervening factor affecting the relationship between budget quality and budgetary slack. Murray (1990) explains that moderating variables are variables that affect the relationship between two variables. While the intervening variable is a variable that is influenced by a variable and affect other variables. The intervening variable is an intermediary variable between two variables.

In this study a contingency approach will be adopted to evaluate the relationship of budget quality on budgetary slack. The contingency factor chosen in this study is risk management, in which the factor will serve as a moderating variable in the relationship between budget quality and budgetary slack. In other words, risk management will affect the relationship between budget quality against budget slack.

H2: Risk management affects the relationship between budget quality and budgetary slack.

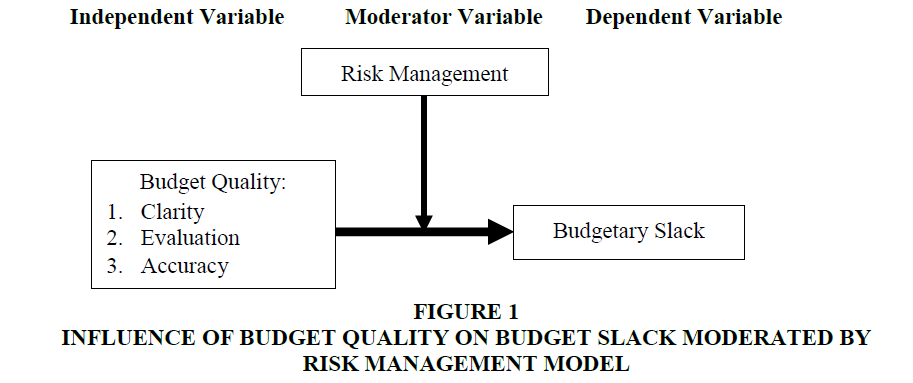

From the description of the theoretical study and the development of the hypothesis described above, the relationship between variables can be described in terms of theoretical framework as follows:

Research Methodology

Types and Data Collection Methods

The data was used in this study is the primary data, were obtained directly through the submission of questionnaires to the respondents at the Regional House of Representatives in Bengkulu Province, Indonesia. The data of this research collected by sending the questionnaire directly to the respondent, as well as the return was taken to the respondent according to promised. The population of this study is all members of parliament in 9 (nine) districts and cities throughout the province of Bengkulu. By using purposive sampling method, the sample selected in this research is all members of budget committee in Regency of Bengkulu Province which amounted to 128 people.

Operational Definition of Variables

The variables in this research consist of independent variable, moderating and dependent variable. Independent variable are budget quality (budget clarity, budget evaluation and budget accuracy), risk management as moderating variable, while the dependent variable is budget slack.

Quality of Budget

To measure the quality of the budget refers to the characteristics of the research budget by Kenis (1979) and Collins (1978), but in this study to measure the quality of the budget, both the characteristics and the instruments used will be an adjustment and modification, given the differences in the objects to be studied. In consideration of the respondents in this study were members of parliament (legislative) parties outside the government (executive) that make up the budget, as well as considering various regulations related to the budget, then the characteristics of the budget that will be used to measure the quality of the budget are: (1) the clarity of the budget (2 ) evaluation of the budget, and (3) the accuracy of the budget. From the results of modification and development of instruments, to measure the clarity of the budget target using 8 item questions, the evaluation of the budget items used 7 questions, and for the accuracy of any budget item used 5 questions.

Risk Management

Measurement instruments is done by asking the risk management and understanding of the knowledge of legislators about the proposed budget/budget in the context of performance-based budgeting. This variable by using 10 item questions refers to COSO concept by Moeller and Robert (2007) based on the results of investigation, observation of legislators and legislative documents, government regulations and ministerial decrees related to the budget. The whole question items were scored from 1 to 5 Likert scale.

Budgetary Slack

Slack of Budget was measured by using a questionnaire developed by Baerdemaeker and Bruggeman (2015) with reference to the Regulation on supervision, and considering the functions of supervision at preparation and discussion stage of budgeting. This instrument used 10 items that asked the question of surveillance activities conducted by each member of budget committee at every stage of budgeting, using measurements with a 5-point Likert scale score of 1 for the choice never to point 5 for state control activities are always done.

Statistical Test

There are two statistical models was used to test each hypothesis in this study: Multiple regression analysis was used to test the hypothesis 1 (H1), the regression equation can be formulated as follows:

Y=a+b1X1+b2X2+b3X3+e (1)

Description:

a : constant (intercept)

Y : budget slack

X1 : budget clarity

X2 : budget accuracy

X3 : budget evaluation

b1, b2, b3: regression coefficient

Interaction test, which is used to test the hypothesis 2 (H2)

Interactions Test, or often called the Moderated Regression Analysis (MRA) is a special application of linear regression where the regression equation contains elements of the interaction (multiplication of two or more independent variables) (Priest, 2005). To test the influence of risk management variables in the relationship between the quality of budget and budgetary slack, then the regression equation can be formulated as follows:

Y=a+ b1X+b2X2+b3X3+b4X4+b5X1X4+b6X2X4+b7X3X4+e (2)

Description:

Y : budgetary slack

X1 : clarity of budget

X2 : the accuracy of the budget

X3 : evaluation of the budget

X4 : risk management

X1X4 : X1 and X4 Interaction

X2X4 : X2 and X4 Interaction

X3X4 : X3 and X4 Interaction

a : constant (intercept)

b1, b2, b3, b4, b5, b6, b7 : the regression coefficient

Multiplication variables between X1 and X4, X2 and X4, X3 and X4 is a moderating variable that describes the influence of moderating variables on the relationship X4 X1, X2, X3 and Y. While the variables X1, X2, X3 and X4 is the direct influence on Y variable. Criteria for determining the risk management variable as a moderating variable in relation to the quality of budgeting and budget slack, if the coefficient b5, b6 and b7 significant at 0.05 or 0.10 level.

Findings and Discussion

Descriptive Statistics

To provide an overview of the research variables (budget quality, risk mangement and budgetary slack) used descriptive statistics table to shows the number range of theoretical and actual range, on average, and standard deviations in Table 1.

| Table 1 DESCRIPTIVE STATISTICS |

|||||

| Variabel | n | Theoritical Range | Actual Range | Average | Deviation Standart |

| Budget Clarity (X1) | 89 | 8-40 | 11- 40 | 30,69 | 5,52 |

| Budget Accuracy (X2) | 89 | 5-25 | 12-25 | 18,66 | 2,87 |

| Budget Evaluation (X3) | 89 | 8-40 | 8-40 | 34,35 | 4,65 |

| Risk Management (X4) | 89 | 10-50 | 25-50 | 38,87 | 4,66 |

| Budget Slack (Y) | 89 | 8-40 | 19-40 | 31,06 | 3,94 |

Based on the above descriptive statistics, the clarity of the budget according to the respondents is clear, that can be seen from the average value of 30.69 which shows that the average respondent to answer with the answer "agree" statement about the clarity of each budget. With an average of 18.66 for the variable accuracy of the budget, according to the respondents indicate that the budget is quite accurate. In addition to the above two variables, the benchmark set by the variable quality of the evaluation budget, for this variable is the average value of 34.35 this suggests that the evaluation activities undertaken by respondents proposed budget is good enough.

Furthermore, for the risk management variable about the budget figures show an average of 38.87 that means risk management in budgeting process is a good. Slack of budget variable have an average of 31.06 indicated that the effectiveness of surveillance conducted by the respondents to the budget has been quite effective.

Data Normality

Testing the normality of the data is done using Kolmogorof-Smirnof Test at alpha 5% degree. If the significance of the test-Smirnof Kolmogorof Test is greater than 0.05 means that the normal data. Summary of test results can be seen in Table 2 below:

| Table 2 NORMALITY TEST RESULTS |

||

| Unstandardized Residual | ||

| N | 89 | |

| Normal Parameters | Mean Std. Deviation |

0.0000000 3.09387064 |

| Kolmogorov-Smirnov Z | 1.079 | |

| Asymp. Sig. (2-tailed) | 0.195 | |

From the results of normality test of the data above, it is known that the Kolmogorov- Smirov is significant in 1.079 and significance value is 0.195, that means the p-value was greater than the confidence interval (0.05) and this indicates the data are normally distributed residuals.

Hypothesis Testing and Discussion

Hypothesis 1 examine the direct effect the quality of budget on slack of the budget which is expressed as follows: The quality of the budget (the clarity of the budget target, the evaluation of the budget, and the accuracy of the budget) have a negative effect on the budget control. Statistical model used to test this hypothesis is a multiple regression. The results of data processing by regression analysis can be seen in Table 3 below:

The results of regression analysis in Table 3 above shows the value of the coefficient for each independent variable that are of clarity the budget, budget evaluation and the accuracy of the budget in a row for (0.054), (0.474) and (0.198) with a significance level of each are 0.546, 0.005, 0.022. Thus when viewed from the level of significance for the clarity of the budget variables had no significant effect on the budget control (Sig.>0.05). As for the variable accuracy of the budget and budget evaluations have a significant effect on the budget slack (Sig.<0.05).

| Table 3 REGRESSION ANALYSIS RESULTS |

|||||

| Variabel | Beta Coefficient | Coefficient value | Standard error | t-value | Probability |

| Constanta | (a) | 13.717 | 3.512 | 3.906 | 0.000 |

| Clarity | (b1) | (0.054) | 0.091 | 0.606 | 0.546 |

| Accuracy | (b2) | (0.474) | 0.166 | 2.862 | 0.005 |

| Evaluation | (b3) | (0.198) | 0.085 | 2.333 | 0.022 |

R²=0.241 ; n=89; F=8.999; Sig.=0.000

In Table 3 also can be seen that from the ANOVA test or F test, F value obtained by calculating the probability of 8.999 with P value 0.000. Because the probability is smaller than 0.05 then the regression model can be used to predict the budget slack variables, or in other words that the variable budget clarity, accuracy of the budget and budget evaluation jointly affect budgetary slack. Thus the results of this study received a hypothesis which states that the quality of the budget (the clarity of the budget, budget evaluation, and the accuracy of the budget) has a negative effect on the budget control. It also said the problem while meeting the first objective in this study.

The study also examined the effect of risk management on the relationship between budget quality with budget slack were expressed as follows: risk management effect on the relationship between the quality of budgeting and budget slack. As mentioned earlier, to examine the effect of risk mangement in the relationship between quality of budget and budget slack was done by testing the interaction, while the interaction between the variables of test results as a whole can be seen in Table 4 below:

| Table 4 INTERATION TEST RESULTS |

|||||

| Variabel | Beta Coefficient | Coefficient Value | Standar Error | t-Value | Probability |

| Constanta | (a) | 45.738 | 20.067 | 2.279 | 0.025 |

| Clarity (X1) | (b1) | - 0.513 | 0.473 | -1.083 | 0.282 |

| Accuracy (X2) | (b2) | - 0.131 | 1.019 | 0.129 | 0.898 |

| Evaluation (X3) | (b3) | - 0.518 | 0.439 | -1.178 | 0.242 |

| Risk Mgt (X4) | (b4) | - 0.657 | 0.546 | -1.203 | 0.233 |

| X1*X4 | (b5) | 0.013 | 0.013 | 0.989 | 0.326 |

| X2*X4 | (b6) | 0.003 | 0.026 | 0.133 | 0.895 |

| X3*X4 | (b7) | 0.017 | 0.013 | 1.362 | 0.177 |

The Interaction test results above, has obtained value of coefficient of determination of 0.422 which means that 42.2% variation in budget slack can be explained by variations in the independent variables (clarity, accuracy, evaluation and knowledge of the budget) and the interaction between the knowledge of the budget with clarity, accuracy and evaluation of the budget. While the rest, amounting to 57.8% discribe by other factors outside this model.

Furthermore, from Table 4 above also note that the results of Anova test or F test has calculated F value 8.444 with a significance level 0.000. Because the probability of significance is smaller than 0.05 then the regression model can be used to predict the effectiveness of budget control, or it can be said that taken together all the independent variables significantly influence on the budget control.

Based on individual parameter significance test (t test), seven variables included in the regression, all of them have no significant effect (p>0.05), including the variable X1*X4, X2*X4, X3*X4 is an interaction between clarity , accuracy and budget evaluation of the knowledge of the budget. Therefore we can conclude that the variable risk management is not a moderating variable. Variables of risk management can be considered as moderating variable if the probability level of significance of each X1*X4, X2*X4, X3*X4 is smaller than 0.05.

The conclusion is at once rejected the notion that risk mangement as a moderating variable in the relationship between the quality and budgetary slack, so the results of this study do not accept hypothesis 2. Hair (1998) states if the interaction effect was not statistically significant, the influence of these variables are independent. Because the interaction of the test results do not prove to be moderating variables, the variables of knowledge about appropriate or possible budget consistent with a previous study by Rini (2002) that is as independent variables.

Although the results of this study indicate that risk mangement proved to act as a moderating variable in the relationship between the quality of budgeting and budget slack, but in practice the increase in risk management is still important because the results of the regression in testing of hypothesis 2 suggests that the risk management have a significant direct effect on both the quality of the budget and budget slack.

Conclusion

The results of testing the hypothesis 1 shows that the quality of the budget (clarity, and accuracy of evaluation) had a negative significant effect on the budget slack. This study thus accept the hypothesis 1, which means the quality of the budget affect (enhance) the effectiveness of the supervision carried out by members of parliament on the budget.

Based on the analysis of the interaction test in testing hypothesis 2, the theoretical results of this study support the hypothesis that high-quality budget will have a negative impact on the budget slack if it is supported by a good risk management. This is evidenced from the results of direct regression between the variables of risk management to the budget slack variables, where the results indicate a negative and significant influence. Although there is a relationship and influence gained risk mangement in the relationship between budget quality and budget slack, but the relationship was not significant. So that the results of this study concluded that the variables risk mangement are not as a moderating variable in the relationship between the quality of the budget to budgetary slack.

Implications

This study provides several contributions to both management accounting research and practice. First, our study extends the budgetary slack literature by recognising an important influencing factor: budget quality. In particular, this research shows that Budget Quality decreases budgetary slack creation through affective risk management. Second, we believe that this study contributes to the growing amount of research recognising that the budgeting process cannot be studied in isolation, as budgeting and risk management are both part of the organisational planning process (Covaleski et al., 2003). Based on our study, it appears that risk management directly related with creation of budgetary slack, but that it is not indirectly decreases budgetary slack through the moderating effect of budget quality. It is therefore important to study the effect of both parts of the planning process simultaneously to understand what exactly drives budgetary slack. Third, this study also has some implications for the practice of management accounting. In particular, our results demonstrate the importance of organisational variables such as risk management to understand budgeting behaviour. It is not the formal management control systems in itself but also the effects on these organisational variables that are important to understand budgetary slack creation. Moreover, our study gives practitioners an understanding of how budgeting and risk management can be related. Hence, it illustrates the importance and the benefits of managing the strategy and budgeting processes in an integrated way.

Limitations

There are still some limitations in this study, firts, the number of samples is relatively small, and due only conducted in 9 (nine) districts only, so to generalize the results of this study should consider many other factors or assumptions. Second, the existence of other variables suspected to have an effect on budget slack but not yet covered in this study, such as transparency and accountability policies, and the role of other supervisory and auditing institutions.

Further Research

Based on the limitations of the research, it is necessary to do further development and improvement for the better subsequent studies. Some recommendations for further research are: This research needs to be reexamined with a wider population and sample so that the results can generalize to a wider condition. For further research it is necessary to add other variables such as legislation, transparency and accountability policies, and the role of other supervisory and auditing institutions.

References

- Anthony, R.N., & Govindarajan, V. (2004). Management Control Systems (Eleventh Edition). McGraw-Hill Companies, Inc, U.S.A

- Baerdemaeker, J., & Bruggeman, W., (2015). The impact of participation in strategic planning on managers’ creation of budgetary slack: The mediating role of autonomous motivation and affective organizational commitment. Management Accounting Research, 29, 1-12.

- Belkaoui, A.R. (2000). Teori Akuntansi Jilid 1. terjemahan. Jakarta. Salemba Empat. Jakarta.

- Belkaoui, A.R.. (2002). Behavioral management accounting. QUORUM BOOKS Westport, Connecticut, London.

- Benowitz, E.A. (2001). Principles of Management. Published by Hungry Minds, Inc. 909 Third Avenue New York, NY 10022

- Berger, P.L., & Luckmann, T. (1966). The Social Construction of Reality. Doubleday, New York.

- Blumentritt, T. (2006). Integrating strategic management and budgeting. Journal of Business Strategy, 27(6),73-79.

- Chow C.W, Jean C.C., & Wlliams, S.W. (1988). Participative budgeting: Effects of a truth-inducing pay scheme and information asymmetry on slack and performance. The Accounting Review,63(1), 111-122.

- Collier, P.M., & Berry, A.J. (2002). Risk in the process of budgeting. Management Accounting Research,13(3), 273-297.

- Collins, F. (1978). The Interaction of budget characteristics and personality variabels with budgetary response attitudes. The Accounting Review, 53(2), 324-335.

- Collier, P.M., & Woods, M. (2011). A comparison of the local authority adoption of risk management in england and australia, Australian Accounting Review, 21(57), 111-123.

- Collier P.M., Berry, A.J., & Burke, G.T. (2007). Risk and Management Accounting: Best Practice Guidelines for Enterprise-wide Internal Control Procedures. CIMA Publishing, Burlington, MA 01803, USA

- Covaleski, M.A., Dirsmith, M., & Samuel, S. (1996). Managerial accounting research: The contributions of organizational and sociological theories, Journal of Management Accounting Research, 8, 1-35.

- Elmassri, M., & Harris, E. (2011). Rethinking budgetary slack as risk management, Journal of Applied Accounting Research, 12(3), 278-293.

- Hair, J.F., Tatham, R.L., Anderson, R.E., & Black, W. (1998). Multivariate Data Analysis (Fifth Edition). Prentice-Hall, Inc.

- Hanson, E.I. (1996). The budgetary control function. The Accounting Review. April, hal. 239-243

- Kenis, Izzetin. (1979). Effects of budgetary goal characteristics on managerial attitudes and performance. The Accounting Review, 54(4), 707-721.

- Magner, N.R., & Johnson, G.G. (1995). Municipal officials reactions to justice in budgetary resource allocation. Public Administrative Quarterly, 18(4), 439-456.

- Murray, D. (1990). The performance effects of participative budgeting: An integration of intervening and moderating variables. Behavioral Research In Accounting, 23(1), 104-123.

- Robbins, S.P. (1998). Organizational Behavior: Concepts, Controversies, Application, 8th Edition. Prentice Hall Inc.

- Schiff, M., & Lewin, A.Y. (1970). The impact of people on budgets. The Accounting Review, 259-268.

- Schoute, M., & Wiersma, E. (2011). The relationship between purposes of budget use and budgetary slack. Advances in Management Accounting, 19, 75-107.

- Woods, M. (2009). A Contingency Theory Perspective on the Risk Management Control System within Birmingham City Council. Management Accounting Research, 20(1), 69-81.

- Y?lmaza Emine, Özerb, G., & Günlükc, M. (2014). Do organizational politics and organizational commitment affect budgetary slack creation in public organizations? Procedia-Social and Behavioral Sciences 150, 241-250