Research Article: 2020 Vol: 23 Issue: 5

The Role of Stock Prices Cycles in Forecasting Inflation in Nigeria

Emeka Gerald Ucheaga, Covenant University

Alexander Ehimare Omankhanlen, Covenant University

Felicia Omowunmi Olokoyo, Covenant University

Areghan Akhanolu Isibor, Covenant University

Benjamin Ighodalo Ehikioya, Covenant University

Citation Information: Ucheaga E. G., Omankhanlen A. E., Olokoyo F. O., Isibor A. A., & Ehikioya B. I. (2020). The Role of Stock Prices Cycles in Forecasting Inflation in Nigeria, 23(5), 577-589.

Abstract

The modern world makes high demands on specialists in any field, which requires improving the management tools of educational organizations. Education management in each country should be based on the specifics of educational services in a specific institutional environment. The aim of the study is to identify the relationship between the institutional environment, the specifics of educational organizations and the model of their management based on national peculiarities in socio-cultural characteristics. The methodological basis of the study is a combination of theoretical and scientific methods: analysis, synthesis, systematization and comparison, theoretical and logical generalization. In particular, the following methods are used: generalization and scientific abstraction. They are used to identify the relationship between socio-cultural characteristics of society, its institutional environment and the concept of management of educational organizations. System and structural method and comparative analysis are used to select and compare the countries of Western Europe, East-Central Europe and the countries of the former USSR. It is important to identify peculiarities of national cultural characteristics in these countries. Systematic and situational approaches are chosen to interpret the results of the analysis. Two main approaches to the management of educational organizations are identified. The first one is based on the theory of general management, the second one - on the specifics of educational services. The usage of the second approach is substantiated. The influence of institutional factors on the management of educational organizations was taken into account. The acceptance of the institutional environment as a factor that determines the specifics of education and management in education is argued. The essence of the institutional environment, formal and informal institutions is determined and their connection with the socio-cultural component is proved. Based on the analysis of data from different countries, collected in G. Hofstede's 6-D model, we tasted the hypothesis of differences between sociocultural characteristics of Central and Eastern Europe, the former Soviet Union and Western Europe. It has been proven that in countries with a high Power-Distance Index (PDI), a low level of Individualism in society (individualism versus collectivism IDV) combined with high control over the satisfaction of desires (IVR-indulgence versus restraint) is dominated by central management of educational organizations of the state. The ministries of education and governments have the main leverage of management influence. Specific features of this concept of management are centralization of management, vertical connections, subordination of subjects of management, absence of direct communication university-business; strictly stratified system of financing of educational organizations. Continuation of research concerning the impact of the institutional environment on the educational process is very promising. It goes about scientific perspective and solving applications of improving the management of educational organizations in order to meet the needs of all stakeholders in the educational process.

Keywords

Inflation; Stock Prices; Hodrick-Prescott; Volatility; Stock Prices Cycles.

Introduction

In the early 1960s, household wealth in Nigeria was held majorly in liquid form as stock market at the time was relatively new after launching in 1961 with just 19 publicly listed companies. A typical household wealth portfolio had almost no exposure to the stock market as stock market liquidity was low and the terrain unfamiliar to the then unsophisticated investors. During this period, household spending could be generally tied to a stable labour and investment income with inflation generally under control. Average inflation between 1960 and 1969 was just 3.4% (World Bank, 2020).

As investors became savvier, more money poured into the stock market and by 1985, the proportion of stock market capitalization to total money supply in the country had moved from less than 1% to almost 12% in 1986 and households began to hold some portion of their wealth in the stock market (CBN, 2017). Prior to the mid-1990s, all investments in the stock market were held by Nigerians and it was not until 1995 that foreign investors were permitted to invest in the local stock market. As at year end 2018, Nigerian households still controlled up to 49.13 percent of investments in the stock market, showing that a significant portion of household wealth in Nigeria remains in the stock market. As households began to invest in stock market, their investment income and wealth began to become more volatile and this might have created substantial effects on their spending behaviour and inflationary economic pressure (Nwosa, 2017).

Between 1985 and 2007, proportions of stock market capitalization to total money supply in the economy had risen from 12 percent to 199 percent (CBN, 2017). In 2006, for the first time, there was more money in stock market than was circulating in the economy as stock market capitalization to money supply surpassed 100 percent for the first time, reaching 111 percent (CBN, 2017). As more money left the pockets of households and poured into the stock market, the spending pattern of households was completely altered, and inflation became more volatile.

Since 1985, the inflationary problem in Nigeria has been quite startling. In the 32-year period between 1985 and 2017, Nigeria suffered double digit inflation in 24 out of the 33 observations which led to a severe erosion of the value of Naira in the last 3 decades according to data compiled from (CBN, 2017). CBN on numerous occasions has tried to use monetary policy to control inflation volatility in the country with little success. The singular inflation objective for CBN during the past 3 decades has always remained to achieve single digit inflation in the country. However, this was only a reality in just 9 of the 33 inflation observations, translating to a low probability chance of 27.2 percent that CBN will achieve single digit inflation in Nigeria in any given year (CBN, 2017). Average inflation during the 32-year period was as high as 19.9 percent, up to 11 percentage point higher than the current single-digit target band of 6-9% that Central bank is currently seeking to achieve (CBN, 2018). An obvious challenge CBN has struggled with in the last 32 years is understanding inflation dynamics enough to predict its direction and use monetary policy to steer inflation closer to its monetary goal. In the last 3 decades, disparities between CBN inflation target and actual inflation in Nigeria exceeded 100 basis points in 30 out of 33 observations, translating to 91% chance that CBN will fail to achieve its monetary inflation target annually (CBN, 2017).

Stock and Watson (2016) explained that the positive relationship that exists between equity yields and expected inflation arises because current stock prices are valued using forward-looking economic variables which include expected inflation. Therefore, the stock prices themselves could be useful in determining the consensus view on future inflation and economic growth since future inflation and economic growth expectation was modelled into the current stock price by the aggregate market (Apergis, 2017). Farmer (2015) stated that the idea that stock prices can provide useful guidance in forecasting macroeconomic variables has long been established in literature and evidenced in reality. For instance, in 2007, inflation in Nigeria fell below 7%, making it the lowest inflation rate on record in over 7 years at the same time the stock market was breaking record highs (CBN, 2018). We can roughly deduce that higher stock prices led households to invest more in the stock market, which eventually reduced inflationary pressure in the economy. However, data compiled from (CBN, 2018) showed that the following year in 2008 when the stock market collapsed, households became net sellers in the stock market and inflation began to trend upwards again, moving from 6.5% in 2007 to 15.1% in 2008.

This study contributes significantly to the body of knowledge in monetary economics, asset pricing and market forecasts by showing how one could use stock prices cycles in forecasting inflation in Nigeria. Before now, there was relatively little knowledge of how volatility in stock market prices could influence future inflation in Nigeria or how inflation trends could be explained by stock market booms and burst.

The purpose of the study is therefore to help economists and financial analysts have another better way of forecasting inflation in Nigeria through the use of stock market cycles. By this method, one way of dealing with high inflation in Nigeria would be to examine the stock prices. This would then help in regulating both the stock market prices and also inflation in the nation.

The study’s objective is to determine the cyclical relationship that exists between stock prices and inflation in Nigeria. The study introduced the subject matter plus the objectives and significance of the study in the first section which is the introduction. Section two presents a detailed appraisal of pertinent empirical literatures. It also explained the theoretical framework behind the subject matter, and it finally revealed the gaps the study wants to fill. Section three constitutes the methodological outlook to analyzing data gathered for the study. Section four contains the data and result presentation while section five presents the conclusion and recommendations proffered.

Literature Review

Most related literary texts begin from defining inflation as persistent rise of prices, which causes four possible challenges, whose austerity relies greatly on anticipations of such inflation (Benabou, 1991; Imrohoroglu, 1992; Ball, 2017). The first and maybe greatest apparent issue is that inflation erodes monetary value, thus constituting tax on sums of money (Antinolfi et al., 2016). So, individuals end up holding lesser real money compared to if inflation was absent, yielding unsatisfactory effects. Numerous works tried to measure corresponding consequential welfare loss by using money demand function and evaluating the portion occupied by inflation beneath the curve. Also, a moderate swift reduction in money’s value would exert more consequences for money-spenders, who must complete extra journey to banks to refill their preferred nominal money volume so as to be at par with higher prices (Omolade & Mukolu, 2018; Sieroń, 2019).

Farmer (2015) found that the housing bubble burst which led to a stock market decline in 2008 was the primary reason for the great recession that followed between 2008 and 2009. He established a granger causal relationship between stock market and unemployment rate in America, as high unemployment rate was an after-effect of the great recession. After showing that stock prices granger causes unemployment rate in America, the study went on to show via Vector Error Correction Model (VECM), that absence of monetary intervention by Central Bank, a significant crash in stock prices could cause a spike in unemployment rate over the next one to four quarters. Empirically, higher unemployment in a country could lead to an economic recession which is only the occurrence of two consecutive quarterly declined in economic outputs. This phenomenon may explain the occurrence of the great recession in 2008 when unemployment figure almost doubled, and the country entered its biggest recession following the 1930s great depression. Notwithstanding, this study was restricted to unemployment and stock market with no mention of inflation or other key macroeconomic variables. Moreover, the empirical findings were limited to America, and thereby, not necessarily applicable to Nigeria.

Also, Farmer (2012) had shown that alterations in stock market wealth could likewise emanate in different unemployment rate. Since a change in household wealth could engender variations in quantity of aggregate demand which then makes labour to be hired (or retrenched) in order to meet increase (or decrease) production levels to match effective demand. Evidence of the link between stock market wealth and unemployment was extensively discussed in (Sibande et al., 2018). The paper cited numerous examples where empirical literature provided proof that growth in stock market capitalization is typically accompanied by growth in employment rate in America and in Europe.

Formerly termed ‘shoe-leather’ costs, illustrating further treks to banks, could be more recently called ‘banking-transaction’ costs. Such journey to banks will be unnecessary when inflation does not exist, hence depicting an expense forced by it (Ashraf et al., 2016). Secondly, inflation adversely redistributes wealth from creditors to debtors (Auclert, 2019). If greater prices are unforeseen, borrowers would repay nominal debts in real dollars which are subsequently less valuable. Unpredicted inflation lessens debtors’ weight and endangers lenders. It may be argued that this is not necessarily an inflationary cost since it is transferable rather than a net loss. Nonetheless, continual price hike (especially with varying and erratic rates) might make lenders minimize total credit volume supplied, hence depicting real loss compared to monetary balance in a nation (Haberler, 2017).

Thirdly, inflation compels sellers to incur extra inputs to survive rapidly fluctuating prices. These ‘menu costs’ will alter directly with adaptations in inflation. Quicker increases in prices will force merchants to rapidly modify price levels. Duration used to recount inventories, or re-configure computers, shows problems imposed by inflation. It is important to recognize that such consequences still prevail even with impeccably foreseen inflation. Rectifying prices immediately from past equilibrium numbers to post-inflation values yet incorporates resource expenditures (Janssen, 2016). All three issues all link to evolution in overall price.

The fourth trouble involves mannerism by which alterations in prices may influence dispersal of comparative prices economically. Perhaps inflation just affects nominal prices, and leaves relative prices untouched; all identified costs would still apply. But if it goes beyond to impact relative price levels, then, resources would be misappropriated as some comparative prices will shift from equilibrium point (Nakamura et al., 2018). An avenue of differentiation is that the initial three consequences may merely place a country at a fresh steady state with less general welfare. Whereas, the last challenge could result in total displacement from equilibrium aside aggregate welfare forfeiture.

Theoretical Framework

The observed counter cyclical relationship between stock prices and inflation could be based on Tversky & Kahneman’s (1974) recency bias theory which is greatly essential in understanding the household behaviour in financial markets. The recency bias theory postulates that high probabilities are assigned to events that have occurred recently, such that, when stock prices go up, investors tend to believe that it will continually increase for a prolonged time period and vice versa. When investors put more resources in the stock market to reap greater rewards, there are fewer funds available for consumer spending, hence, lower inflation. Likewise, when stock prices are declining, recency bias makes investors to think that such decline would prevail for an extended duration, thereby causing them to typically oversell their shares. This would lead to more funds available at hand, which then increases is spending on discretionary products that in turn trigger demand pull inflation.

The summary of the theory is that more funds in the stock market for investment purposes would lead to low inflation (since it is assumed that there would be less funds flowing in the economy) while less funds would lead to high inflation (since it is assumed that there would be more funds flowing in the economy). This shows the relationship between stock market and inflation based on the theory.

Gaps in Literature

The study observed that although many literatures relied upon quantity theory of money in designing a theoretical framework, many of the studies including the local ones designed empirical models that omitted the arguments of (Friedman, 1989) that it is not the growth in money supply in itself that is bad for inflation, rather, it is surplus growth in money supply over and beyond growth in real output that causes inflation. This means that money supply, credit or even market capitalization cannot be taken as nominal variables in explaining inflation, rather it is the ratios of the money supply to gross domestic product and similar other variables that may be more useful in predicting future inflation.

Also, the study found that while most of the empirical works in literature showed that money supply can be effectively used to forecast variations in inflation. Very few empirical works have gone beyond developing models to show that stock prices could be useful in forecasting future inflation. Mostly, these literatures speak about a theoretical connection of how asset prices could impact inflation, but many failed to test this theory empirically. This study will build a VAR model to show the predictive strength of stock market capitalization as a useful economic variable in forecasting inflation. The models would be useful in building an improved monetary policy framework that achieves better results in inflation targeting in Nigeria and in other developing world economies.

Methodology

Model

The model stated below is specified based on framework for monetary policy transmission mechanism as stated in Taylor (1995). However, the model introduces a modified version of (Taylor, 1995) which adapts the inclusion of (Asab & Al-Tarawneh, 2020) in representation of stock prices evolution over time as stock market capitalization to GDP which analyses the excess of the growth in value of equities over and above the expansion in gross domestic product (GDP). Therefore, the restated explicit model is as follows:

![]()

Where: CPI represents the consumer price index or inflation; MCAP/GDP represents the stock market capitalization to GDP; β0 represents constant or intercept term, β1 represents regression coefficients or slope; μt represents the error term or residual.

Consumer Price Index (CPI)

The consumer price index (CPI) is considered as the rate of inflation in this study. The adoption of the CPI is necessary since it is the rate of inflation that tracks changes in the general prices of consumer goods and services to which households make their economic and financial decisions. The monetary policy in Nigeria is targeted at controlling the rise in CPI to ensure price stability in the country and encourage rapid economic growth. While there are other measures for inflation, the CPI or headline inflation are the main rates of inflation that is tracked by the monetary authorities, economists, analysts, businesses and households for financial decision making. Changes in CPI will typical draw some form of monetary policy response much more than any other inflation metric in Nigeria.

MCAP/GDP

A significant portion of the wealth of households in the country is invested in the capital market to earn investors some investment income to cover future household spending. However, behavioural economics show that households spending behaviour is altered from the traditional Keynesian theory of income as households typically invest during period of rallying stock prices and sell during periods of declining stock prices such that they are unable to increase consumption due to wealth earned from the rallying market since they continued to invest funds during that period. Typically, when stock prices decline, they sell their securities and will typical increases purchases in consumer goods rather than financial assets during periods of significant stock price declines. In Nigeria, the total market capitalization accounts for more than 50 percent of the total money supply (Omolade & Ngalawa, 2016). If money supply is to be considered critical to predict variations in interest rate, the size of households’ wealth in the stock market could also provide inflation guidance since households can easily sell stocks to increase their income during periods when they choose to consume more and invest more of their labour income in the stock market during periods when they chose to save more and consume less. This investment behaviour has implications for consumer price inflation and must therefore be assessed as a possible statistically significant predictor of inflation. However, the study will use proportion of the market capitalization to gross domestic product to measure the influence of the market on inflation like the analysis done for money supply since both serve similar purposes as a store of wealth for households. To which if the size of market capitalization to total output changes in the economy, it could have serious implications for inflation expectation for Central Banks and households.

Technique of Estimation

Hodrick Prescott Filter and Contemporaneous Correlation Test

The HP filter is a univariate detrending technique used to determine the cyclical characteristics of a macroeconomic indicator. According to Holston et al. (2016), the HP filter can be used to ascertain the interest rate gap by determining the natural rate of interest based on the cyclical trends of MRI. This process begins by taking the unit root test to ascertain stationarity of monetary variable. This is followed up by utilizing HP filter is used to obtain cyclical component from trend component of time series data. Cyclical component is then studied to determine frequency of cycles, the length of cycles and to examine that rarity of unusual deviation of the variable from its trend during periods. If the cyclical component of the interest rate moves above or below its trend, we can assume that the difference is the interest rate gap.

Data and Variable Sources

The variables for this study include: consumer price index (CPI) and money supply to real gross domestic product (M2/GDP). The time series data which are secondary in nature covers the period from 1985-2017. The secondary dataset were gathered from the Central Bank of Nigeria statistical bulletin and the Nigerian Bureau of Statistics Annual Statistical Report.

Results and Discussion

Pattern of Inflation in Nigeria

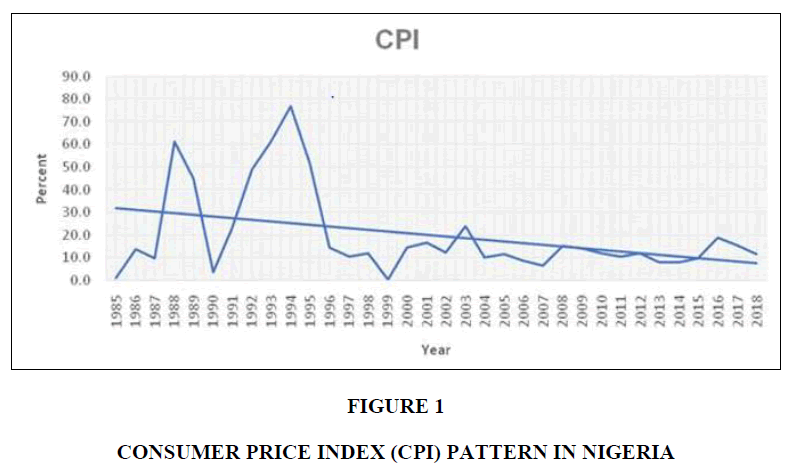

We observed from Figure 1 that inflation has been trending downwards over the years. Average inflation between 1985 and 2018 was 19.7%. Inflation peaked at 76.8% in 1994 and hit a record low of 0.2% in 1999. Based on findings, inflation was below trend between 1985 and 1987, averaging 8.1% before rising significantly above trend between 1988 and 1989 during which the average inflation was 52.9%. By 1990, the dip in inflation to around 3.6% put inflation below trend. In the years between 1992 and 1995, inflation was back once again above trend, averaging 59.6%. Between 1996 and 2002, inflation remained below trend, averaging 11.4% inflation rate as inflation management improved in the country. The years between 1985 and 2002 were the most volatile inflation periods in Nigerian history as average inflation was 26.4% compared to average inflation of just 12.1% between 2003 and 2018. Since 2008, inflation movement has closely followed its trend although it stayed slightly above between 2016 and 2018 as a spike in exchange rate in 2016 caused inflation to jump to its highest level in 13 years.

In the years before year 2000, average inflation in Nigeria was 28.8% compared to 12.5% between year 2000 and 2018. The lowest rate of inflation in before year 2000 was 0.2% in 1999, compared to the years after 2000 when the lowest rate of inflation on record is 6.6% achieved in 2007. Highest rate of inflation in a single year before the turn of the millennium was 76.8% in 1994 compared to 23.8% in 2003. Generally, inflation management has improved in the country, inflation continues to trend downwards after its volatile years in the 1990s but with inflation rate still above the single digit target in post 2000 years, it is necessary to understand the factors that led to a downward trend in inflation in order to increase attention to those economic variables to ensure that the achievement of price stability in Nigeria becomes a reality.

When the researcher tracked inflation performance on an annual basis, it was rather easy to establish that inflation in Nigeria has been a persistent problem and price stability in the country which the researcher defined as inflation within the 0-2% band was only achieved in twice throughout the 33-year period, the periods were 1985 and 1999. In 1985, inflation was just 1% before the introduction of the failed Structural Adjustment Programme (SAP) in Nigeria, which was a World Bank backed market reform that allowed the Central Bank of Nigeria to move from a system of fixed interest rate and exchange rate to a more market determined interest rate and exchange rate market. Poor implementation of SAP under the military rule caused inflation to spiral out of control as prices rose sharply due to exchange rate induced inflation at the time.

The following year in 1986, inflation rose to 13.7% before reducing to 9.7%. SAP’s target for inflation was an average of 9% and it looked like SAP was working at the time. But the initial disinflation didn’t last long as series of devaluation and rising interest rate began to have an impact on the inflation rate in the country. By 1987, inflation rate had reached a then record of 61.2% before reducing to 44.7% the following year. 1990 seemed like the odd year in the decade between 1986 and 1996 as this was the only year inflation fell to single digit. In 1990, a short-lived macroeconomic stability helped suppress inflation to just 3.6%, its lowest level since 1985. However, the following year, inflation jumped once again to 23% before doubling to 48.8% in 1992. For the third consecutive year, inflation rose again, reaching a new record of 61.3%. Nigerians had begun to lose confidence in the Naira and there was a wide scavenge to hold foreign currency to preserve household wealth even though holding foreign currency in the country was considered illegal at the time.

By 1994, CBN had decided to temporarily move back to a fixed exchange rate and interest rate system as inflation rate had completely moved out of hand, reaching a new high of 76.8% in 1994. Till date, 76.8% remains the highest rate of inflation experienced in the country. By 1994, SAP was already considered a failure as it failed to bring inflation under control to its target of 9%. Average inflation rate between 1986 and 1994 was 38.1%. In the 9-year period between 1985 and 1994, inflation had moved from just 1% to 76.8%, showing that there was a deep price instability crisis in Nigeria. The move to fixed interest rate brought about instant reward, inflation began to trend downwards almost immediately. In 1995, inflation dropped to 51.6% and by 1996, inflation had reduced to 14.3%. CBN became more confident that the economy was now much ready to receive a flexible interest rate but held exchange rate fixed until 1998.

In 1997, inflation had dropped further to 10.2%, showing that the Central Bank had made the right decision. With oil prices now rising through the 1990s, government finances had become more stable and macroeconomic stability was restored in the economy. In 1998, inflation rose modestly to 11.9%. 1999 was a year not just for the move to democratic rule in Nigeria but the year when the country experienced its biggest exchange rate devaluation in history. However, inflation rate fell to its lowest on record, Nigeria experienced 0.2% inflation in 1999, and for the first-time prices were perfectly stable over a one-year period. This spelt the end of the worst period of inflationary pressure in the country’s history as inflation which average 35.9% between 1985 and 1995 was gone for good. Since 1995, inflation in Nigeria has not exceeded 23.8 percent, showing that inflation management in the country has improved since its worst period in the early 1990s but since the turn of the millennium, the Central Bank has still not been able to achieve price stability as inflation has failed to fall under the 2% price stability benchmark since 1999.

The lowest rate of inflation in the country since year 2000 was achieved in 2007 when inflation fell to 6.6% during the mature stage of Nigeria’s first economic bubble which burst the following year. Average inflation in Nigeria between 2000 and 2018 was 12.5%, above the Central Bank’s single digit target and a long shot away from the price stability benchmark of 2%.

Contemporaneous Cross Correlation Test

To achieve study’s objective which is to examine the short run relationship between stock prices cycles and inflation, this study employed the contemporaneous correlation test. The Market capitalization (MCAP) is used to represent stock price while Inflation rate is represented by the Consumer Price Index (CPI). To address the objective, the business cycle approach used to separate the time series data into cycles and trends. This is achieved by employing a filtering procedure referred to as the Hodrick-Prescott (HP) (Alege et al., 2017; Agenor et al., 2000; Kim, et al., 2003). The process involved in carrying out this technique is as follows: The series will be transformed into their natural logarithm form; the stationary properties of the series will be tested; detrending the series by obtaining the cyclical element; obtaining the autocorrelation statistics and also the cross correlation of the series (Alege, 2008). A good business cycle filter is one that can eliminate unit roots, remove phase shift and also isolate business cycle frequencies (Baxter & King, 1999).

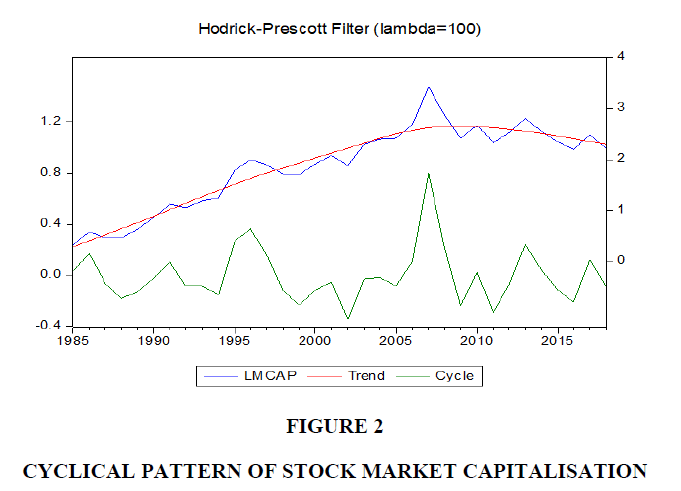

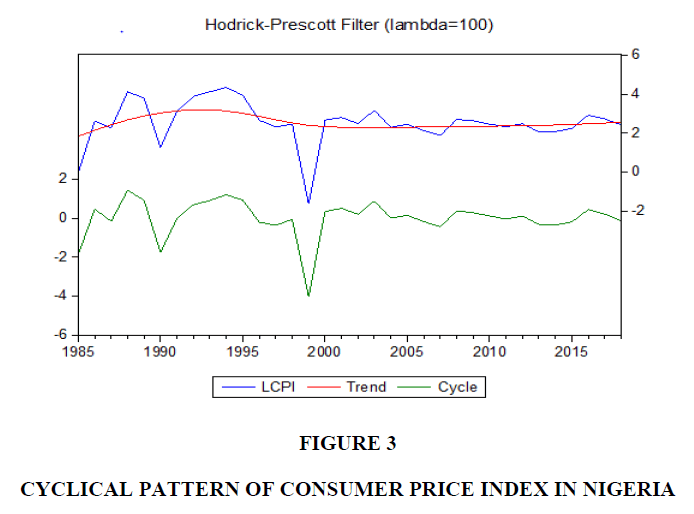

The HP filter is useful as it helps to account for volatility in the time series variables. Secondly, it can measure whether there is a change in the variable before or after the output changes and finally, the cross-correlation coefficient measures the contemporaneous correlation of a series with respect to another. This will ascertain if a series is pro-cyclical or countercyclical. Table 1 presents the contemporaneous correlation between stock market and Inflation. The results show that the degree of contemporaneous correlation between inflation and stock market is −0.0305 indicating a countercyclical relationship. This implies that inflation tends to rise when stock prices are falling and inflation falls when stock prices are rising. The cyclical patterns of stock market capitalisation ratio and inflation are shown in Figure 2 and Figure 3.

| Table 1 Contemporaneous Correlation Between Stock Market Capitalization and Inflation | ||||

| CPI_CY, M2, MCAPCY(-i) | CPI_CY, M2, MCAPCY(+i) | i | lag | lead |

| . | . | | . | . | | 0 | -0.0305 | -0.0305 |

| . *| . | | . | . | | 1 | -0.0494 | -0.0240 |

| . | . | | . |**. | | 2 | -0.0169 | 0.1789 |

| .**| . | | . |**** | | 3 | -0.1485 | 0.3723 |

| .**| . | | . |**. | | 4 | -0.1845 | 0.1788 |

The cross correlation test can show which variable leads of lags the cycle. Therefore, it can reveal whether stock price is a leading or lagging indicator to inflation rate. When the maximum value of the cross correlation coefficient between stock price and inflation falls on the left hand side (lag), it means that stock price is the lagging indicator. On the other hand, if the maximum value of the cross correlation coefficient between stock price and inflation falls on the right hand side (lead), it means that stock price is the leading indicator. From table 1, the maximum cross correlation coefficient is 0.3723 suggesting that inflation lags stock prices. This means that changes in inflation rate happen after changes or fluctuations in stock prices.

Empirically, this relationship between stock prices and inflation is evident in the past behavior of inflation and stock prices. For instance, in 2007, inflation had fallen to about 6.6% its lowest point in almost a decade which corresponds with when stock prices were most elevated in Nigeria. Rising stock prices had pushed market capitalization to GDP to about 30.9% which is the highest value of market capitalization to GDP ever recorded in the history of Nigeria. This shows that higher stock prices led people to invest more in the stock market, which eventually reduced inflation. This result was confirmed by the study (Albulescu et al., 2017; Marx & Struweg, 2015; Fama, 1981) where a countercyclical relationship was observed between Stock prices and Inflation rate.

Discussion

The cross-correlation coefficient measures the contemporaneous correlation of a series with respect to another. This will ascertain if a series is pro-cyclical or countercyclical. The first objective of the study is to examine the cyclical relationship between stock prices and inflation. From the result shown in Table 1, it was observed that inflation tends to rise when stock prices are falling and inflation falls when stock prices are rising. A major explanation for the result is that investors would want to take advantage of rising stock prices to invest in the stock market and this would reduce inflation because any excess money in circulation will be used to increase investment positions rather than to increase consumption. However, when stock prices decline, most investors would quickly sell-off their securities and hold on to cash rather than invest. This could increase the money in circulation and result in higher inflation. This behaviour is consistent with Keynesian Liquidity preference where Keynes states that “the rate of interest at any time, being the reward for parting with liquidity, is measure of the unwillingness of those who possess money to part with their liquid control over it. It is the “price” which equilibrates the desire to hold wealth in the form of cash with the available quantity of cash (Bibow, 2005). Therefore, if the expected future return on investment is less than households’ desire, they will retreat to cash which could cause a problem of excess cash holdings and increased spending.

Conclusion

The study set out to determine the cyclical relationship that exists between stock prices and inflation in Nigeria. To achieve this objective, the contemporaneous correlation test was employed and the result provided evidence that there is a countercyclical relationship between stock prices and inflation rate. This implies that inflation tends to rise when stock prices are falling and inflation falls when stock prices are rising.

Recommendations

1. The study, hence, recommends that policies that extend the stock market cycles should be adopted as it has been proven to reduce the inflation rate significantly.

2. Investments in stock market should be encouraged by the government to the public as a way of reducing inflation.

3. More investment instruments should be introduced into the stock market so as to generate more investments.

Contributions to Knowledge

The study contributes to the theoretical framework by confirming the recency bias theory that explains that when stock prices go up, investors tend to believe that it will continually increase for a prolonged time period and vice versa.

The study also adds to existing literature by using the Hodrick Prescott Filter and Contemporaneous Correlation Test to confirm the theoretical framework.

Study Limitations

The study used a single model; other researchers can add other macroeconomic variables like exchange rate and interest rate to see if stock prices cycle can be used to predict them.

References

- Abu, N. (2019). Inflation and unemliloyment trade-off: A re-examination of the lihillilis Curve and its stability in Nigeria. Contemliorary Economics, 10(4), 21-34.

- Agenor, li. R., McDermott, J. C., &amli; lirasad, E. S. (2000). Macroeconomic fluctuations in develoliing countries: Some stylised facts. The World Bank Economic Review, 14, 251-285.

- Albulescu, C. T., Aubin, C., &amli; Goyeau, D. (2017). Stock lirices, inflation and inflation uncertainty in the US: testing the long-run relationshili considering Dow Jones sector indexes. Alililied Economics, 49(18), 1794-1807.

- Alege, li. O. (2008). Macroeconomic liolicies and Business Cycles in Nigeria. Doctoral Thesis, Deliartment of Economics, Covenant University, Ota.

- Alege, li., Oye, Q. E., Adu, O., Amu, B., &amli; Owolabi, T. (2017). Carbon emissions and the business cycle in Nigeria. International Journal of Energy Economics and liolicy, 7(5), 1-8.

- Antinolfi, G., Azariadis, C., &amli; Bullard, J. (2016). The olitimal inflation target in an economy with limited enforcement. Macroeconomic Dynamics, 20(12), 582-600.

- Aliergis, N. (2017). New evidence on the ability of asset lirices. Journal of Forecasting, 15(5), 557-565.

- Asab, N. A., &amli; Al-Tarawneh, A. (2020). Inflation Thresholds and Stock Market Develoliment: Evidence of the Nonlinear Nexus from an Emerging Economy. International Journal of Financial Research, 11(1), 447-461.

- Ashraf, Q., Gershman, B., &amli; Howitt, li. (2016). How inflation affects macroeconomic lierformance: an agent-based comliutational investigation. Macroeconomic dynamics, 20(2), 558-581.

- Auclert, A. (2019). Monetary liolicy and the redistribution channel. American Economic Review, 19(6), 233-367.

- Ball, R. J. (2017). Inflation and the theory of money. Routledge, ABC liublishers.

- Baxter, M., &amli; King, R. G. (1999). Measuring Business Cycles: Aliliroximate Band-liass Filters for Economic Time Series. University of Virginia, 1-51.

- Benabou, R. (1991). Comment on ‘The Welfare Cost of Moderate Inflations. Journal of Money, Credit, and Banking, 23, 504-513.

- Bibow, J. (2005). Liquidity lireference Theory Revisited-To Ditch or to Build on It? Working lialier No. 427, Franklin College Switzerland and Levy Economics Institute, New York.

- CBN. (2017). Statistical Bulletin-Financial Sector. Abuja: Central Bank of Nigeria.

- CBN. (2018). Monetary liolicy Communique No 119 of the Monetary liolicy Committee Meeting. Abuja: Central Bank of Nigeria.

- Fama E. F. (1981). Stock returns real activity, inflation, and money. American Economic Review, 71, 545-565.

- Farmer, R. E. (2012). The stock market crash of 2008 caused the great recession: Theory and evidence. NBER Working lialier No 1-35.

- Farmer, R. E. (2015). The stock market crash really did cause the great recession. Oxford Bulletin of Economics and Statistics, 9(2), 1-17.

- Friedman, D. (1989). Law and Economics: What and Why. Economic Affairs, 9(3), 25-28.

- Haberler, G. (2017). liroslierity and deliression: A theoretical analysis of cyclical movements. USA, Routledge liublishers.

- Holston, K., Thomas, L., Williams, J. C. (2016). Measuring the Natural Rate of Interest: International Trends and Determinants. Federal Reserve Bank of San Francisco Working lialier 2016-11.

- Imrohoroglu, A. (1992). The Welfare Cost of Inflation under Imlierfect Insurance. Journal of Economic Dynamics and Control, 16, 79-91.

- Janssen, M. C. W. (2016). Microfoundations. Tinbergen Institute Discussion lialier, TI 2006-041/1.

- Kim, S. H., Kose, A. M., &amli; lilummer, M. G. (2003). Dynamics of business cycles in Asia: Differences and similarities. Review of Develoliment Economics, 7, 462-477.

- Marx, C., &amli; Struweg, J. (2015). Stagflation and the South African equity market. lirocedia Economics and Finance, 30(10), 531-542.

- Nakamura, E., Steinsson, J., Sun, li., &amli; Villar, D. (2018). The elusive costs of inflation: lirice disliersion during the US great inflation. The Quarterly Journal of Economics, 133(40), 1933-1980.

- Nwosa, li. I. (2017). External reserve on economic growth in Nigeria. Journal of Entrelireneurshili, Business and Economics, 5(2), 110-126.

- Omolade, A., &amli; Mukolu, O. M. (2018). Monetary liolicy dynamics and the economic growth of the Sub Sahara Africa (SSA). Journal of Entrelireneurshili, Business and Economics, 6(1), 36-58.

- Omolade, A., &amli; Ngalawa, H. (2016). Monetary liolicy transmission mechanism and growth of the manufacturing sectors in Libya and Nigeria. Journal of Entrelireneurshili, Business and Economics, 5(1), 67-107.

- Sibande, X., Gulita, R., &amli; Wohar, M. E. (2018). Time-varying causal relationshili between stock market and unemliloyment in the United Kingdom: Historical evidence from 1855 to 2017. University of liretoria Deliartment of Economics Working lialier Series No, 1-18.

- Sieroń, A. (2019). Money, inflation and business cycles: The Cantillon effect and the economy. USA, Routledge liublishers.

- Stock, J. H., &amli; Watson, M. W. (2016). Core inflation and trend inflation. Review of Economics and Statistics, 98(4), 770-784.

- Taylor, J. B. (1995). The Monetary Transmission Mechanism: An Emliirical Framework. Journal of Economic liersliectives, 9(4), 11-26.

- Tversky, A., &amli; Kahneman, D. (1974). Judgment under uncertainty: Heuristics and biases. Science, 185(4157), 1124-1131.

- World Bank. (2020). Inflation, consumer lirices (annual %)-Nigeria. Retrieved from: httlis://data.worldbank.org/indicator/Fli.CliI.TOTL.ZG?locations=NG.