Research Article: 2019 Vol: 23 Issue: 5

The Role of Strategies for Promoting Relations between Banks and Customers, and Their Impact on Customer Retention and the Market Share of Jordanian Commercial Banks

Ahmad Y. Areiqat, Al Ahliyya Amman University

Nihayah J. Mahrakani, Al Ahliyya Amman University

Ahmad M. Zamil, Prince Sattam Bin Abdulaziz

Ayman Abu-Rumman, Al-Ahliyya Amman University

Abstract

This research paper aims to discuss the role of the strategies for promoting the relations between banks and their clients and the appropriate means of customer retention besides highlighting the banks’ market share from the perspective of the Jordanian commercial banks’ customers. Its main purpose is to identify the degree of the commercial Jordanian banks’ utilization and maintaining benefits from these ties through marketing activities and customers’ retention strategies in order to enhance their market share. The population of the study consisted of a sample including selected clients from the Jordanian commercial banks (Five clients from every bank). The results revealed that the most active banks that achieved noticeable progress in promoting their ties with their clients were the Arab Bank and the Housing Bank. The study recommended that the Jordanian banks have to give a serious attention to the means and activities which are required to develop such relations because of their significant role in achieving customer retention and improving the banks’ market share.

Keywords

Promoting Relationship, Customer Retention, Banks’ Market Share and Jordanian Commercial Banks.

Introduction

The promotion and marketing of banking services is no longer limited to the size of offering these services, as it is considered a major factor according to which these banks are distinguished from one bank to another while operating in a competitive environment. Modern marketing activity has to be consistent with the recent and rapid trends that have been used to maximize the benefit of the involved parties, the bank and the customer. The concept of marketing that describes the client as the core of the marketing process still comes at the top priority of any banking institution. However, the process of achieving this consistency and dealing with such goal depends to a large scale on the developments of the banking sector industry. Moreover, we have to take into the increasing awareness of customers who are the bases of the strategy that shapes the relation between the clients and the banks.

The relationship between the bank and the client being a continuous planning methodology towards effective banking activity that creates more profits to both parties is addressed through two perspectives; the first is related to the administrative action and the second which refers to the marketing domain or promotion. This process includes identifying the future customer needs, and the development the bank's services and products to meet such needs, besides efforts to communicate in various ways with existing customers to convince them that the banks are keen to do their utmost to meet their needs. As for the potential customers, the marketing activity must be based on classifying customers into categories such as traders, employees, students, doctors, etc and channeling banking services that fit the needs of each category through direct contact, media, brochures and other means. Bank strategies should focus on the customers’ needs and fulfill their high expectations, and this depends on their ability to provide high quality services (Zamil & Areiqat, 2017). These activities will enhance the relationship between the customer and the bank, and will also attract new customers, and thus leads to expanding the bank's market share.

As the banking business depends primarily on achieving customer satisfaction by strengthening the relationship between the two parties in order to retain the customer, the bank must also support and promote this relationship, which is related to the banking services that meet the needs and high expectations of the customer, in addition to addressing customers’ complaints such as problem-solving etc. Banks have to arrange their customers into key groups before working to meet their needs and realizing their aspirations and expectations, (Zamil & Shammot, 2011) Therefore, this interactive relationship increases the loyalty of the customer to the bank, and such loyalty makes the customer a marketer for the bank to attract new customers and dealers, so leading to increase its market share. Hoping to build-up a close and sustainable relationship with the customer, the bank must pay attention to three issues: the value from the customer perspective, responding to the customer needs and desires to achieve customer satisfaction, and the customer loyalty which is the expected result based on customer satisfaction (Zamil & Shammot, 2011). Accordingly, the correlation between promoting the ties between the bank and the customer, the customer retention and the market share becomes clear. This research seeks to clarify the role of the strategy of marketing such relationship and retaining the customer in explaining the market share from the point of view of the clients of the Jordanian commercial banks.

The importance of the study stems from the fact that it will provide a scientific material for researchers and the decision makers in the Jordanian commercial banks as such studies are but few in the Hashemite Kingdom of Jordan. These banks are considered one of the main and sound resources for Jordan economy and thus need to cope with recent developments, raise the level of trust with their clients in order to meet their needs and increase their market share. Such goal will be achieved by dependence on skill and competency in attracting new clients and retaining old ones. Or else, these banks will lose their strength and become unable to play their role in providing trustworthy and safe service for clients and accordingly fail to adapt with the rapidly going challenges in the labor markets in all sectors.

Problem Statement and Questions

The argument included in this study is based on the fact that majority of Jordanian commercial banks do not give enough focus on the need to enhance their ties with clients and retain them in order to boost their market share in the banking sector. Numerous studies pointed out that promoting such relationship and related activities have a number of benefits that business organizations seek to gain, including customer loyalty, achieving customer satisfaction, establishing long-term relationships with customers, and eventually achieving customer retention and there is no doubt that the realization of these ambitions reflected positively on the market share of these banks.

Accordingly the problem of this research is focused on: "Studying Strategies for Promoting Relations between Banks and Customers, and their Impact on Customer Retention and the Market Share of Jordanian Commercial Banks”. The goal of the study can be achieved by providing answers to the following questions:

1. What is the role of promoting relations between banks and customers (interactive ties) in discussing the share market of Jordanian commercial banks (number of branches. their size and locations, the volume of deposits related to the best competitors, size of credit related to the market)?

2. What is the characteristics and benefit of the long-term customer relationship for the bank and the customer?

3. What are the effects of outcomes of practicing and promoting relationship activities on the customer retention?

4. How can the bank's share be affected by practicing and promoting relationship activities, and customer retention?

Significance of the Research

The significance of this research is based on the importance of the banking sector which plays a major role in the economy of all countries; in addition, the banking dealings are common practices in most economic sectors and various social classes in the country. This means that banks are the core interest of majority of people with their different needs and expectations. In order to maintain this interaction in the context of a sharp competitive environment among banks, it is imperative to establish mutual interactive ties between the bank and its customers. This research will also provide recommendations and suggestions that may bring benefit to Jordanian banks.

Objectives of the Research

Its main purpose is to identify the degree of the commercial Jordanian banks’ utilization and maintaining benefits from these ties through marketing activities and customers’ retention strategies in order to enhance their market share. This general objective is based on the following sub-objectives:

1. To provide good understanding for the activities of promoting the relationship between clients and banks.

2. To highlight the links between the promoting the relationship between clients and banks and customer retention.

3. To clarify the role of promoting the relationship between clients and banks and customer retention in enhancing the market share of the bank.

Methodology & Type of the Research

The nature of this research requires a lot of qualitative data rather than quantitative data; therefore, the qualitative approach is most likely to provide reasonable outcomes. According to Denzin & Lincolin (2011), a qualitative research is a surveying venture, and it is also a moral, allegorical and figurative project because it includes sets of terms, concepts and assumptions. Defranzo (2011) defined the qualitative research as predominantly exploratory because it involves on providing a good understanding of implicit purpose, opinions and motivations that relate to the research problem from the perspectives of the research population in order to provide suggestions and recommendations that may help in problem solving.

Methodology

The most appropriate methodology for this type of researches is the post-positivist approach, because it can ensure meaning and accessing of new knowledge, and it able to support the social movements, which were already committed by the society towards achieving social justice. Rayan (2013) has summarized the characteristics of post-positive approach as follows:

1. This research is more comprehensive than a research which consists of many specialized and different phenomena that are known as a research.

2. Theory and practice must not be separated, so, we cannot ignore theory for assessing the facts.

3. The motivations of the researcher are the serious commitments to his research and the way to carry out projects and control related measures.

4. The common idea that the research is interested only in using useful technique for collecting and categorizing data became now inadequate.

Therefore, we can say that positive social researcher plays an instructional role, rather than a testing role for an available hypothesis, and this means that the researcher can conduct the research without hypotheses prepared previously.

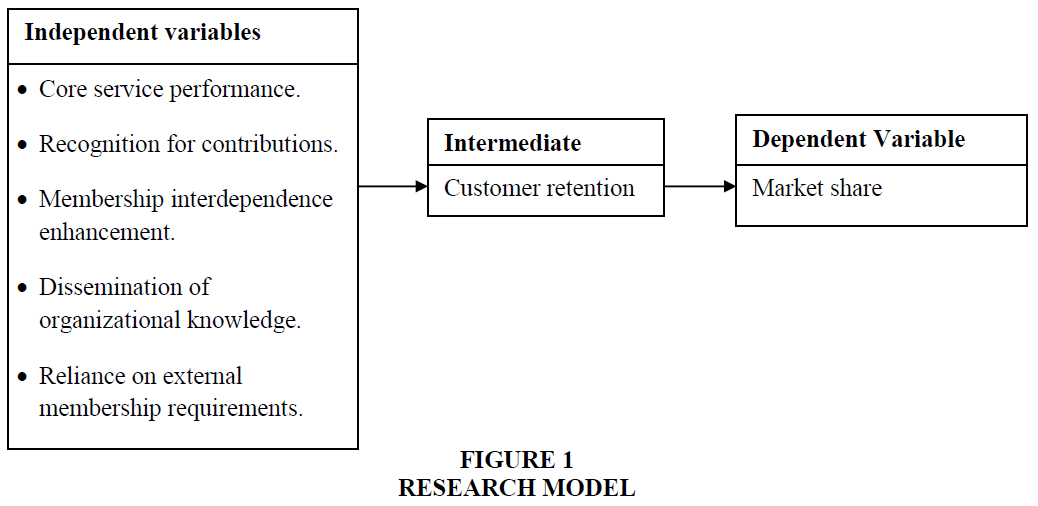

Model of the Research

The model of this research should include the activities of promoting the relationship in the banking market as independent variables. These activities play the most important role in retaining the bank's customers and maintain their dealings with the bank; the intermediate variable must be the retention of customer which is the key driver for the dependent variable that is the market share. Accordingly, the model of this research is explained by the following Figure 1:

The population of this research consisted of a sample of the clients of Jordanian commercial banks (Five clients from each bank).

Data Collection

The secondary data was collected from the books and related literature, while the primary data was collected through telephone survey with five clients from each bank.

Literature Review

Miles (2016) entitled “Importance of Relationship Marketing in Service Sector.” The study aimed to clarify the benefits of relationship marketing for banks. The study was conducted through analyzing the reports of Market Line Associate. The results showed that 20% of ideal bank customers produce as much as 150% of the total profit. While the customers at the bottom (20%) of the trading pyramid are going up to 50%, and the remaining revenue from their transactions barely covers their expenses. Therefore, promoting relationship strategy should identify the important customers, and should measure the effectiveness of each customer.

Al-Alak (2014) under the title: “Impact of promoting Activities on Relationship Quality in the Malaysian Banking Sector”. The study aimed at examining the impact of promoting activities on relationship quality in the Malaysian banking sector. The study was conducted on three lays of respondents who were form the study sample; fifty academicians who are working in finance and marketing departments in different Malaysian universities, twenty of financial advisors and experts who are working in the financial sector, 1733 respondents from the clients of the ten top and largest commercial banks according to their 2009 net profit. The results showed that the increased attention for the trends of relations of customers and employees leads to increase the relationship quality and its continuity. The results also revealed that promoting the relationships to the committed customers leads to customer satisfaction, loyalty, positive impact and promotion.

Al-Alak & Al-Nawas (2010) under the title: “Evaluating the Effect of Marketing Activities on Relationship Quality in the Banking Sector the Case of Private Commercial Banks in Jordan”. This study aimed to investigate and assess/evaluate the activities of the performance of relationship quality in Jordanian commercial banks. The study was conducted on a sample of 817 clients dealing with five Jordanian commercial banks. The results showed that the high level of relationship quality depends on serious employees' relational and client orientation and providing good financial services contributes positively in the relationship quality and sustainability, and thus establishing committed client relationships that leads to customer satisfaction, loyalty, positive attitude and promotion.

Monica, (2014) entitled: “Determining the Contribution of Relationship Marketing at Jomo Kenyatta Foundation in Kenya”. The study aimed to determine the contributions of relationship marketing at Jomo Kenyatta Foundation in Kenya. The study was conducted on a sample of 36 employees from the staff of the foundation who are 120 employees. The contributions of relationship marketing was measured through exploring the role of the independent variables which were; customer satisfaction, customer retention, loyalty, customer service, trust and commitment, while the dependent variable was relationship marketing. The results showed that JKF does not depend on promoting relationship in its day to day activities.

Alshurideh & Masa'deh (2012) under the title: "The Effect of Customer Satisfaction on Customer Retention in the Jordanian Mobile Market: An Empirical Investigation." The study aimed to investigate the relationship between customer satisfaction and customer retention. Where, these features are considered from the outcomes of good promotion relationship which results in building a sustainable relationship. The study was conducted on a sample of 364 Jordanian Mobile Phone users through a questionnaire distribution to 500 users, where the response rate was 72.8%. The results indicated that customer satisfaction has a direct impact on customer retention and leads customers to increasing utilization of the services provided. Also, the results pointed out that mutual relationship (Customer ? Supplier) sustainability directly effects the customer satisfaction, so, increasing customer satisfaction will lead to achieving customer retention.

Abu-Rumman (2019) explored the extent to which Jordanian universities had become Entrepreneurial and examined the market share of Jordanian universities. The study used an online anonymous survey to gather the views and perceptions of university academic staff about the entrepreneurial maturity of their own Institutions and market share. The findings indicate that theses universities are progressing toward becoming an entrepreneurial but facing a number of barriers to adapt to the environment changes and having the proper managerial and governance arrangements orient its activities towards an entrepreneurial culture and market share.

Theoretical Framework

Promoting Relationship

The history of practicing the promotion relationship in firms goes back to the later quarter of the past century. Where Morgan & Hunt (1994) cited in Shelby & Arnott (2006) have defined this relationship as all marketing activities that exercise to establish, develop and maintain successful relational exchanges. Palmatier et al. (2009) developed a contemporary definition linking the theory of promoting relationship to the objectives of promoting. They pointed out that this relationship process includes activities aimed at establishing a constant profitable and long-term relationship with customers in order to increase customer retention, develop and maintain trust and commitment between service providers, goods sellers in the one side and customers in the other side, which result to achieve actual customer satisfaction, high level of enduring loyalty and cost reduction. Boone & Kurtz (2007) have argued that relationship marketing does not limited to customers alone, but to develop and enhance the relationship with other stakeholders, where it involves on development, growth and maintenance of long term cost effective exchange relationship with individual customers, suppliers, employees and other stakeholders for mutual benefit. One of the most important benefits for the organization is the reduction of the competition strength, through providing the ability to deal with global competition (Ryan, 2011; Hsu, 2011).

Relationship Promoting Activities

Most of the literature agreed that the activities of promoting the relationship that were used as independent variables for this research are the following (Alrubaiee, 2010).

Core Services Performance

The basis for any long-term relationship between the buyer and the seller depends on the supplier's ability to deliver the fundamental value to the customer. For the banking sector, it is very necessary to provide the integrated package of financial services to the customer to meet his needs with a perceived value by him. Therefore, it is illogical to accept maintaining deposits from the customer by the bank, without the existence of the money transferring service in the bank.

Recognition for Contributions

In the mutual marketing among firms, the benefits received by the client from co-production activities could be found through the development of products and services to become appropriate to the customer needs better. In such membership situations, the benefits of co-production or co-marketing may have no direct effects on the customer behavior, but much of the motivation become a fundamental factor.

However, the identification of these shared services to the customer will play a desirable role for both the customer and the firm in terms of continuity in dealing and self-esteem.

Most of the Jordanian banks now receive payments from the customers on behalf of many institutions such as Electricity Company, telecom companies, internet providers, taxes and many others.

Member Interdependence Enhancement

This activity refers to the degree that the organization can provide its members the motivation, opportunity and ability to exchange value with one another. Accordingly, marketers who care in building relationships with their customers must adopt the ways that help customers in establishing productive relationships among themselves, and this action can enhance the interdependence among customers.

Actually, there are many examples for this practice, such as the importance of customer interaction in the formation of services via internet, and the customer’s positive interactions during queuing in line to receive services. In banks for example, if there is an elderly client in the waiting queue, and then find a positive interaction that gives him the priority, whether from the public or from the bank employee who provides this service, in this case this client will not think at all to change the bank to another bank.

Dissemination of Organizational Knowledge

Successful organizations always seek to increase their knowledge about the customers, or they may rely on available information about them, that leads to be close to the customer, and this considered a critical element in the organization's attempts to provide value to their customers. Therefore, the value provided to the client that based on the knowledge available to the organization leads to customer appreciation of values, norms, and behavior patterns of the organization. For example, if the bank profitable customer was from those who care to written documentation, the bank should respond to him rather than using SMS in communication with him.

Reliance on External Membership Requirements

This activity can be defined as the extent to which the organization relays on an intermediary to practice its authority to encourage the individuals under its authority to join and maintain their membership. Perhaps one of the strongest factors in strengthening the relationship between the organization and the client is to have enough information about the client in in different situations. For example, when the client is assigned to attract staff members of his friends or relatives with skills to work in the organization, or convince a distinguished employee in the performance of his job (talent) to stay in the same organization. This creates a sense of client's importance, which leads to his keenness to remain as a client of this organization and strengthen the relationship between the parties.

Practical Procedures

A phone survey was conducted for 60 customers who are dealing with nine of Jordanian commercial banks, namely they are: Arab bank, Housing bank for trade and finance, Jordan commercial bank, Al Ahli bank, Jordan Kuwait bank, Arab Jordan investment bank, Bank of Jordan, Cairo Amman Bank, and Union Bank. However, none of the respondents deal with any of the rest of the banks (4 banks. The respondents consisted of 45 individual customers and 15 organizations including commercial and industrial companies, hotels, restaurants and services.

For the first activity "Core services performance" all the respondents agreed that the banks provide an integrated package of banking services that meet the customer needs, except two customers who are dealing with the Jordan Investment Bank, and the Housing Bank for Trade and Finance.

The second activity which is related to recognition for contributions, relies on co-production and co-marketing, in terms of that banks have agreements with other organizations that are allow the customer to deal with them through the bank. All respondents have appreciated this activity which encourages them to continue dealing with the bank.

The third activity which is member interdependence enhancement requires building-up an interactive relationship with the customer by exploring customer’s opinions on introducing a new service, or improving existing services. The respondents agreed that it is very rare to practice this activity by banks, except for three clients only for the commercial Bank of Jordan, the Housing Bank and the Arab Bank, where they said that it is possible to take the opinion of some senior customers.

The fourth activity is the dissemination of organizational knowledge, where majority of the respondents agreed on this activity, as they have sufficient knowledge about the bank, and the bank has a customer data base.

The fifth activity refers to the external membership requirements. The respondents pointed out that none of the banks practice this activity, since the banks may rely on employment agencies only as mediator party for recruitment some employees.

Results and Recommendations

The results of this research can be summarized as follows:

1. Jordanian Commercial Banks are engaged in promoting activities of the relationship between them and their clients in a very inadequate manner, which negatively affects the retention of the customers and thus their market share.

2. The results revealed that the most active banks for promoting this relationship are the Arab Bank and the Housing Bank, although it is not enough. The evidence is shown in the Table 1 below which categorizes the Jordanian Commercial Banks according to their market share.

| Table 1 Ranking of Jordanian Commercial Banks by Market Share | |

| Banks | Ranks |

| Arab Bank | 1 |

| Arab Banking Corporation | 10 |

| Bank of Jordan | 5 |

| Cairo Amman Bank | 6 |

| Capital Bank | 8 |

| Jordan Commercial Bank | 9 |

| Jordan Kuwait Bank | 3 |

| Al Ahli Bank | 4 |

| Housing Bank for Trade and Finance | 2 |

| Arab Jordan Investment Bank | 11 |

| Investment Bank | 12 |

| Société General Bank | 13 |

| Union Bank | 7 |

Recommendations

According to the research results, the researchers recommends that the Jordanian banks should pay a serious attention to adopt certain measures and activities to promote the relationship between the banks and their clients because these ties play a significant role in achieving customer retention and improving the market share.

Moreover, the Jordanian commercial banks have to cope with recent developments, raise the level of trust with their clients in order to meet their needs and increase their market share. Such goal will be achieved by dependence on skill and competency in attracting new clients and retaining old ones. Or else, these banks will lose their strength and become unable to play their role in providing trustworthy and safe service for clients and accordingly fail to adapt with the rapidly going challenges in the labor markets in all sectors.

References

- Abu-Rumman, A. (2019). Challenging tradition: Exploring the transition towards university entrepreneurialism. Academy of Entrepreneurship Journal, 25(2), 1-12.

- Defranzo, S. (2011). What's the difference between qualitative and quantitative research? Retrieved from www.snapsurvey.com

- Denzin, N., & Lincolin, Y. (2011). Handbook of Qualitative Research. Thousand Oaks, CA: Sage.

- Ryan, A. (2011). Post-Positivist Approaches to Research. Researching and Writing Your Thesis: A guide for postgraduate Students, 12-26.

- Miles, M. (2016). Importance of Relationship Marketing in Service Sector. Small Business Marketing Team.

- Al-Alak, B. (2014). Impact of marketing activities on relationship quality in the Malaysian banking sector. Journal of Retailing and Customer Services, 21, 347-356.

- Al-Alak, B., & Al-Nawas, I. (2010). Evaluating the effect of marketing activities on relationship quality in the banking sector the case of private commercial banks in Jordan. International Journal of marketing Studies, 2(1), 78-91.

- Monica, W. (2014). Determining the Contribution of Relationship Marketing at Jomo Kenyatta Foundation in Kenya. Master thesis, Kenyatta University.

- Alshurideh, M., & Masa'deh, R. (2012). The effect of customer satisfaction upon customer retention in the jordanian mobile market: An empirical investigation. European Journal of Economics, Finance and Administrative Science, 47.

- Morgan, R.M., & Hunts. D. (1994). Relationship marketing in the era of network competition. Marketing Management, 3(1), 19-28, Cited in Shelby, D. and Arnett, Dennis, B. (2006). The Explanatory Foundations of Relationship Marketing Theory. Journal of Business and Industrial Marketing 21/2, 72-87.

- Palmatier, R.W., Jarvis, C.B., Bechkoff, J.R., & Kardes, F.R. (2009). The role of customer gratitude in relationship marketing. Journal of Marketing, 73(5), 1-18.

- Boone, L., & Kurtz, D. (2013). Contemporary marketing (16the Edition). Cengage Learning.

- Hsu, Y. (2011). Design innovation and marketing strategy in successful product competition. Journal of Business and Industrial Marketing, 26(4), 223-236.

- Alrubaiee, L. (2010). Investigate the impact of relationship marketing orientation on customer loyalty: The customer's perspective. International Journal of Marketing Studies, 2(1), 155-174.

- Shahabuddeen, I. (2016). The Market Share of Jordanian Commercial Banks and Its Impact on the Profitability. Master thesis, Middle East University.