Review Article: 2022 Vol: 26 Issue: 5S

The Significant Impact of Blockchain Technology in Financial Markets & Effects on Corporate Governance

Liza Macasukit, Westford University College, UAE

Alden Bajgoric, Westford University College, UAE – UCAM Spain

Raman Subramanian, Westford University College, UAE

Citation Information: Macasukit, L., Bajgoric, A., & Subramanian, R. (2022). The significant impact of blockchain technology in financial markets & effects on corporate governance. Academy of Accounting and Financial Studies Journal, 26(S5), 1-18.

Abstract

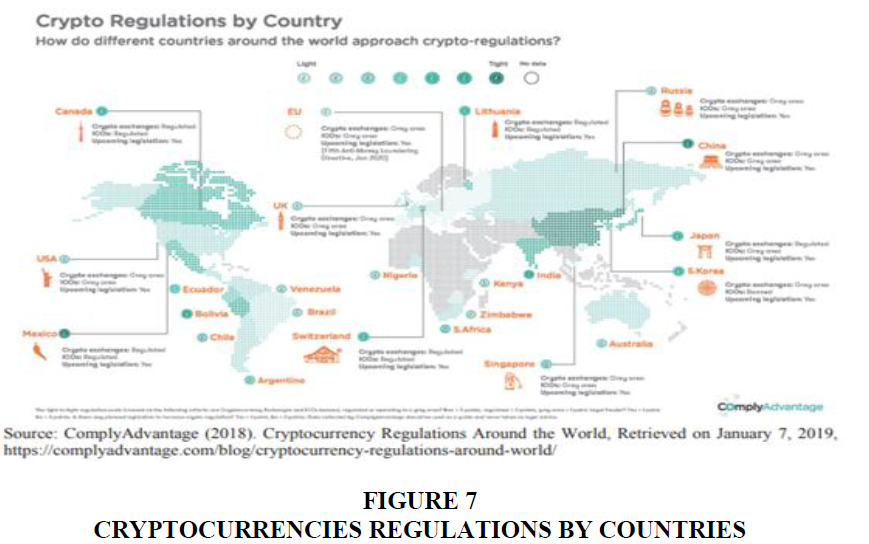

Blockchain comes into a major disruptive technology at the height of the pandemic resulting in major setbacks in the financial market. This study assessed the different countries' cryptocurrencies and practices while analyzing the government support in legalizing the cryptocurrency as part of their monetary system. Countries have been preparing for the major shift of the financial system to grab the opportunity in changing their own financial market. This study evaluates the impact of blockchain in financial markets and its effects on corporate governance in countries. It uses meta-analysis and in depth interviews from financial markets operators and its countries operations.

Keywords

Blockchain Technology, Cryptocurrency, Fintech (Financial Technology), Corporate Governance.

Introduction

Approximately 1.7 billion adults worldwide do not have a bank account. There were 2 billion of them in 2014. Because account ownership is nearly universal in high-income countries, the majority of unbanked adults live in developing countries. The vast majority of the world's unbanked are found in China and India, which have large populations. With 225 million adults without an account, China has the world's largest unbanked population (95 million). There are 190 million unbanked people in India, 100 million in Pakistan, and 95 million in Indonesia. These four countries, as well as three others—Nigeria, Mexico, and Bangladesh—are home to nearly half of the world's unbanked population Globalf index 2017.

Cryptocurrency is one of the most well-known Fintech technologies. There are already over 6,000 cryptocurrencies in circulation, but just a few incidents of digital currencies becoming legal tender have occurred, such as when El Salvador legalized Bitcoin. Other governments, like as China, have banned cryptocurrency and made any cryptocurrency transactions illegal, while others are examining the possibility of Central Bank Digital Currencies (CBDCs). While there are many different forms of digital assets in use today, mineable cryptocurrencies such as Bitcoin and Ethereum are among the most popular (OECD, 2020).

Throughout history, finance and technical advancement have been intricately connected.(Potentially, in a literal sense.) Early civilization's writing system may have evolved to record payments and debts (Schmandt–Besserat, 1996). With the emergence of blockchain technologies as a major sustainable innovation in the financial sector of the economy, improving and enabling complex high value transactional processes are more easily processible in many areas. In addition, the financial market, including regulators, has great importance in this technology. However, a certain degree may be involved in the uncertainty of the effects on themselves, and the national economy generated (Gafurov et al., 2020). In the future, blockchain technology is expected to be a major source of financial sector innovation. It allows for the creation of immutable transaction records that are visible to all network participants. A blockchain database is composed of a series of blocks linked together by a reference to the previous block in each block. Each block contains one or more transactions, which are essentially changes in the ownership of assets recorded on the ledger. To add new blocks to the existing chain, a consensus process is used, in which users of the blockchain network certify that transactions are genuine. The technology enables the creation of a "completely peer-to-peer, with no trusted third party," (Economist, 2015; Lewis, et al., 2017).

The use of new technology has significant implications for market participants' welfare, since it may result in lower financial intermediation costs in lending, payment systems, financial advising, and insurance, as well as better products for consumers (Vives, 2017). FinTech organizations provide greater ease to their borrowers by using online origination technology. FinTech boosts efficiency in a variety of ways:

The trust between the participants is the fundamental foundation for the development of the financial market. Financial transactions are generally conducted through third-party mediation (clearing houses, brokers, international payment systems). The parameters of the transaction will be verified, beginning with an assessment of the reliability of asset information and ending with the certificate and registration and the legal and regulatory transaction.

Fintech

Indeed, the rise of fintech has inexorably changed the role of technology, consumer behavior, ecosystems, and the industry and regulation as a whole (Gozman et al., 2018; Wonglimpiyarat, 2017; Iman, 2020). Fintech is a financial intermediary that eliminates the cost of intermediation in traditional banking methods. It is more convenient and less time consuming. Fintech allows traders to increase their investment amount exponentially without using the traditional method of transferring funds. The application of big data analytics and data science has also transformed how data is acquired, handled, and analyzed, resulting in significant cost savings in search (Scellato et al., 2018).

Blockchain architectures and native assets are on their way to become the next big meta-application to take advantage of the Internet's infrastructure. They currently offer a variety of services, including worldwide money, global computers, and decentralized social networks, to name a few. Historically, native assets have been referred to as cryptocurrencies or altcoins. However, the names cryptocurrencies and altcoins only express a small portion of the crypto asset economy's creativity. Not every one of the 800 existing crypto assets is a monetary instrument. As blockchains combine technology and markets to create currencies, commodities, and polished digital goods and services (OECD, 2020).

While banks have historically been at the forefront of IT adoption (Barras, 1990; Iman, 2020), the current situation has compelled banks and traditional financial institutions to broaden their capabilities and knowledge (Iman, 2019; Iman, 2020). In these scenarios, fintech firms may choose to be disruptors or partners (Hung & Luo, 2016; Iman, 2020). A co-opetition strategy, in which competition and cooperation coexist (Brandenburger & Nalebuff, 1996; Iman, 2020), would be of interest to companies in this small but profitable sector.

Some developed countries' regulatory environments may favor fintech start-ups (Arner et al., 2016; Arner et al., 2016; Arner et al., 2017; Stern et al., 2017; Zetzsche & Preiner, 2018; Iman, 2020). Other countries, on the other hand, are prone to protectionism. Taiwan's government, for example, encourages traditional banks to invest in fintech companies for the purpose of collaboration rather than providing incentives to fintech start-up entrepreneurs to develop new innovative products and services (Hung & Luo, 2016). In a similar vein, Iman discusses the complexities of government regulation pertaining to fintech in Indonesia, as well as the overlaps between the central bank and the private sector.

FinTech companies arose to meet the growing demand for mobile and online commerce apps, improved security, and small and micro-business funding and services. During this time, firms like Square formed 2009 for micro-mobile payments, Kickstarter established 2009 for crowdfunding, and SoFi founded 2009 for online personal loans arose founded 2011. Both Bitcoin and Blockchain were created in the same year founded 2008. Because established institutions were unable to keep up with these fresh upstarts due to legacy technology and large regulatory requirements, an entire generation of newly conceived financial, banking, and insurance solutions sprang all over the world (Kursh & Gold, 2016).

According to the study fintech is based on how improved functionality or new products, services, and functionality affect the customer's experience (first dimension), and the second is based on how new products, services, and functionality affect the customer's experience (second dimension) (Gomber et al., 2018).

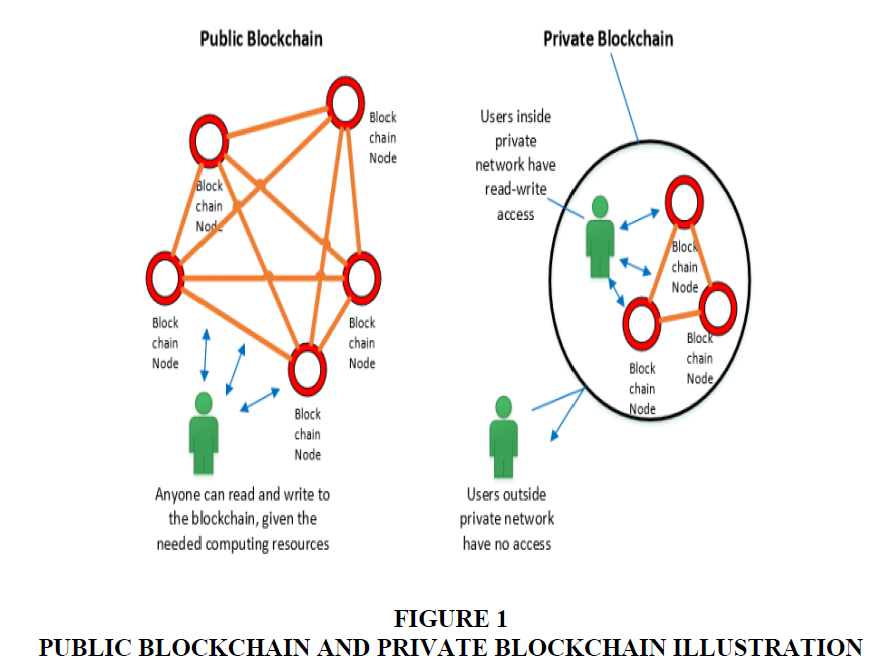

The above Figure 1 illustration shows, how fintech is secured in blockchain. Blockchain technology's genius lies in its structure as a single record of all transactions; consequently, there are no duplications or contradictions among the records. Before any transaction can be recorded in the Blockchain, it must first be approved. The network must agree, and each recorded transaction is visible to everybody while being immutable. Furthermore, the blockchain is dispersed across many nodes and is encrypted in a nearly unbreakable manner (Kursh & Gold, 2016).

Digital cash, like other data on the Internet, was easily replicated without the help of a third-party verification authority (a double-spending problem). As a result, one unit of currency might be reproduced or counterfeited and spent several times, with no method of distinguishing between the original or genuine unit of currency and a slew of counterfeits. To avoid the problem of double-spending, blockchain mixes a distributed network with public-key encryption. The ownership of a transaction is recorded in the Blockchain ledger, and all subsequent operations form part of its history, which is visible to everyone on the network (Kursh & Gold, 2016).

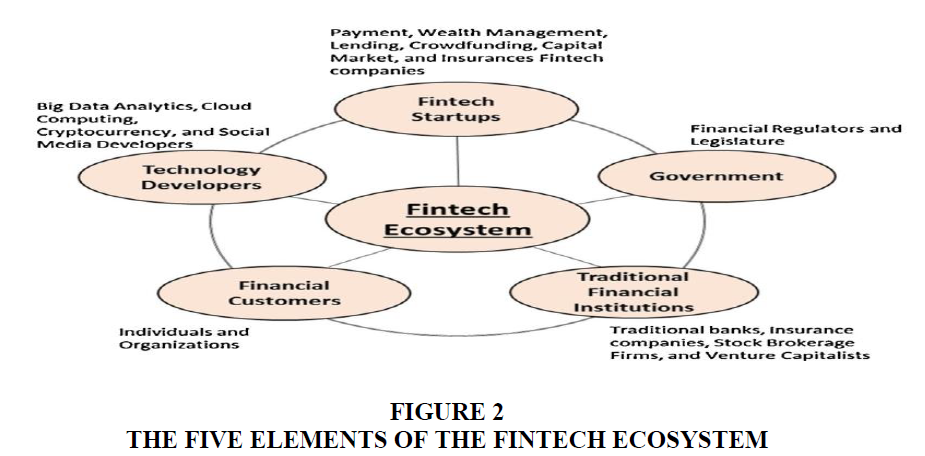

Fintech start-ups are central to the ecosystem. These organizations have spurred significant breakthroughs in payment, wealth management, lending, crowd-funding, capital markets, and insurances by incurring lower operational costs, targeting more niche markets, and providing more personalized services than traditional financial businesses. They are driving the trend of unbundling financial services, which has disrupted bank operations (Walchek, 2015; Lee & Shin, 2018) Figure 2.

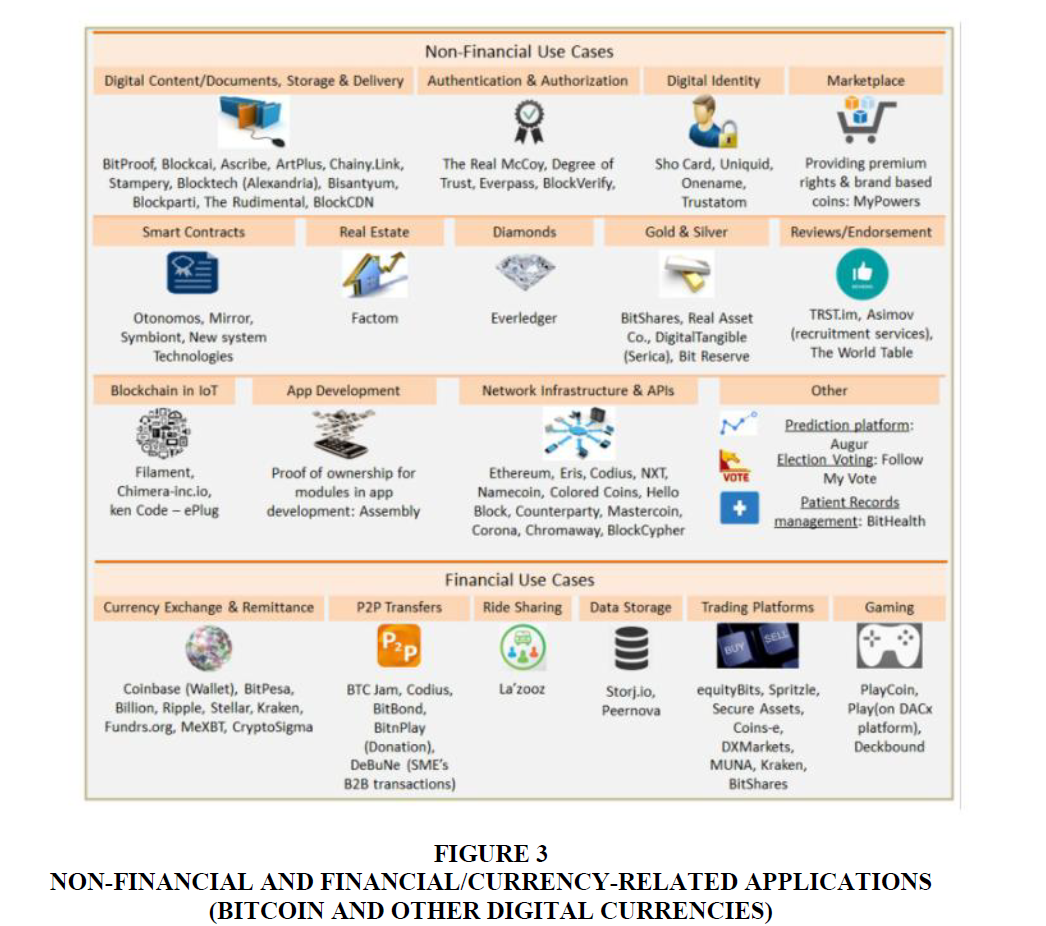

It is now widely accepted that the number of blockchain use cases is increasing day by day. Real-world assets can now be linked to the blockchain and digitally traded in an increasing number of ways. A proof-of-concept is being tested for trading commodities (such as gold, silver, and diamond physical bars) after they have been validated via blockchain, as well as establishing ownership of real-estate properties and providing electoral voting, among other things. As shown in the timeline, banks, as well as startups, have been actively investing in this decentralized system. Several banks have expressed interest in blockchain technology and have begun experimenting with it (Medici, 2018; Henten et al., 2020).

As evidenced by Santander Bank's identification of 25 use cases, with a focus on international payments and smart contracts, there are numerous existing and developing use cases for blockchain in banking Figure 3. Medici has written an article in which he describes 26 banks and financial institutions that are currently experimenting with blockchain technology (Medici, 2018). The primary application areas are money transfer, digital currency exchange, risk management, cross-border payment, investments, and so on. Among the smart contract use cases are investment banking and capital markets, commercial and retail banking, and insurance (Henten et al., 2020) Table 1.

Figure 3 Non-Financial and Financial/Currency-Related Applications (Bitcoin and Other Digital Currencies)

| Table 1 Countries Description of Fintech | ||

| Country | Fintech | Description |

| China | Digital E-Yuan | Internet finance is the most popular fintech business model in China right now. Traditional financial institutions (e.g., banks, securities firms, insurance companies, etc.) and innovative internet companies (e.g., third-party payment service companies, internet lending service providers, etc.) provide financial products by utilizing new hi-tech tools such as big data, cloud computing, and even robotic process automation to approach and serve their customers more efficiently and reduce costs. |

| United Arab Emirates | EDirham | The e-Dirham was first established in 2001 to eliminate the work, faults, and risks involved with manual collections. It now comprises a wide range of handy financial functions, is growing rapidly (YOY 52.33 percent in 2018), and is assisting the UAE in fostering green finance. For its fintech initiatives, the MoF works with recognized global experts, one of which is the goal of transforming the e-Dirham into the national ePayment ecosystem, providing a credible alternative to services like VISA and Mastercard MOF Ministry of Finance UAE, 2020. |

| Vietnam | Banana Coin | Banana coin, which vegetates banana in Laos, is a decentralized cryptocurrency that can use for selling, exchange, and crowd sales (Ebrahimiyan, et.al, 2021). |

| Japan | J-Coin ICO | Japanese banks are preparing to launch a national digital currency, J-Coin ICO, in advance of the 2020 Tokyo Olympics. Bank of Japan and financial regulators are supporting the project for the time being. |

| Bahrain | FICE | First Islamic Crypto Exchange (FICE) is being developed by ADAB Solutions in accordance with the Shariah guidelines. In accordance with Islamic principles and Shariah law, a cryptocurrency platform, exchange, and services are created. In its first and a half years of operation, the First Islamic Crypto Exchange is expected to have a daily trading volume of $ 146 million and a monthly turnover of $ 4.4 billion. Following the implementation of this initiative, an Islamic cryptoeconomics infrastructure and community will be created, which will operate in accordance with the Islamic finance principles (Adab Solutions, 2021). |

| UAE and KSA Central Bank | Aber Project | The Saudi Central Bank (SAMA) and the Central Bank of the UAE in 2020 initiated a digital currency trial – the Aber project – that intended to test the viability of issuing a wholesale CBDC to establish cross-border payment systems that would decrease time and cost Arabian Business, 2021 |

| Polkadot.com | Polkadot | Using a common set of validators for multiple blockchains, Polkadot offers unprecedented economic scalability. Due to the fact that transactions are spread across multiple parallel blockchains, Polkadot provides transactional scaleability. |

| Binance.com | Binance | On the Ethereum Blockchain, Binance Coin (BNB) runs natively on the ERC-20 protocol. Binance, the exchange behind BNB, is one of the major cryptocurrency exchanges in the world, lending credibility to the token. The coin can be used as a fuel for transactions in the Binance Ecosystem, including paying trading commissions on the Binance cryptoexchange, among other things. Using up to 20 percent of its profits every quarter, Binance plans to buy back BNB and destroy them until the total supply is reduced by half. |

| Ripple.com | Ripple | For the most part, Ripple is an enterprise-oriented electronic currency exchange network based on the concept of a shared public ledger. Ripple is a secure, fast and low-cost payment service for fiat currency, cryptocurrencies and commodities that was released in 2012. It is the third largest cryptocurrency, with a market share of 10.82 percent. Since nostro accounts are efficient at generating new revenue and provide real-time payment around the world, they have attracted many payment providers, especially banks. |

| Dogecoin.com | Dogecoin | The logo of Dogecoin, a cryptocurrency, is a Shiba Inu dog from the "Doge" Internet meme. Dogecoin was designed as an open-source digital currency as a lighter alternative to Bitcoin for payments. Elon Musk, the CEO of Tesla, has long been a supporter of dogecoin. |

Lending procedures are another use case for smart contracts based on the Ethereum blockchain. Retail and commercial lending, trade finance, and syndicated loans can all benefit from blockchain technology. Ordinary loan conditions can be turned into programmable rules on the blockchain, making this practicable. The new technology allows for considerably faster processing times, more transparent records, and risk-free loan operations (Media, 2018; Henten et al., 2020). Many big financial institutions have integrated the new technology into their systems. For example, the first successful securities lending transactions using blockchain technology were executed by ING and Credit Suisse (Suisse, 2017; Lee & Shin, 2018).

Government Regulations & Corporate Governance

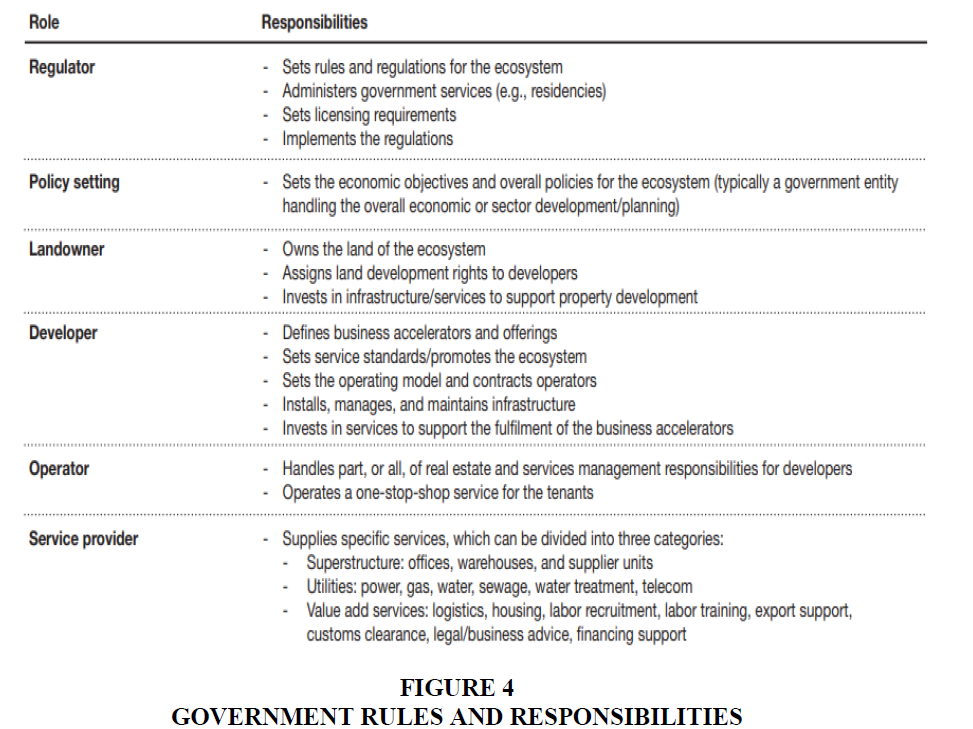

In dynamic world of business, such as outbreak of COVID-19, companies need to adopt to the development of the new strategies i.e. need to adjust to new environment and initiate the process of strategic thinking of the future. According to Moutinho and Phillips (2018) are clear that companies have to prepare in their strategic planning “to shift away from company-centric values, focussed on delivering value for shareholders towards the new customer-centric importance of adding value for customers”. Companies need to prepare for non-preparable. Lingren & Bandhold () as in case of with the outbreak of COVID-19 or in case of fast pace coming of Artificial Intelligence (AI) for which many companies even are not thinking about AI strategy to be incorporated in their overall strategy Figure 4. Ransbotham et al. (2017) are suggesting that is the time to start to be develop even if nobody know what exactly might be expected from AI. This is also suggested by Cramer. “It’s hard to predict the “future of work” – which jobs will “go” and which will take their place” (Bootle, 2019).

Blockchain system that supports cryptocurrencies: Bitcoin, ethereum, lithereum, dogecoin, and others is changing the structure of financial services by allowing for multiple applications such as value transfer, financing, asset reaffirmation, reduced settlement times and real-time tracking of transactions. It also allows for multiple applications such as ledger databases, information protection and smart contracts. There is no doubt that there are many entrepreneurial opportunities in this wide range of application types. During the period 2013–2015, more than $1.4 billion was invested in distributed ledger technology, and more than 2,500 patents were filed with respect to the technology (Leaders, 2016). Due to the instability of traditional financial markets that the world has been facing, in order that equality and prosperity of common people will be realized, the realization of cryptocurrency as part of the financial market system and a medium of exchange will help each and every one of is capable to to have exponential earnings regardless of colour, races, and have an opportunity to invest (Gomber, 2018).

Because government policies and regulations in some markets are inconsistent, a wide range of outcomes have been produced, and the efficiency with which policy objectives have been achieved has varied. Alternatively, payment policy can be driven by a policy adopted by other markets if the benefits are obvious. Once a policy has been adopted, its effects are rarely uniform and can have additional impacts beyond stated objectives that shape a variety of industries, irrespective of how it was created or adopted. An issuer, a merchant or a consumer can be affected by policy only to the extent that the government can enforce it. When it comes to the transition away from cash, the payment policy that has been most effective is one that is based on a long-term framework with the interests of consumers clearly communicated to them. This can lead to strategies that have unintended consequences, since not all stakeholders are equally represented in the payment process Euromonitor International.

As discussed above, if the board is cornerstone of the corporate governance and in accordance with corporate governance definition board should give direction and control the company. Does this apply to strategic direction as well? Agency Theory and Stewardship Theory of the corporate governance does not address strategy or development of the strategy as one of the tasks for the company. Glinkowska & Kaczmarek in their work gave the most important aspects of the corporate governance emphasized by the Agency Theory and Stewardship Theory and there is no reference to strategy as aspect of corporate governance. However, in the work of Bowman (1979) it is discussed the relationship between corporate strategy and corporate governance and from the same author where was discussed “revisionist view that corporate strategy does not matter” where was through empirical analysis proved that factors directly linked to corporate strategy lead to corporate effects. Cossin (2014) discuss that board should not disregard strategy and strategy must be one of the priority tasks in board responsibilities. However, boards find themselves in awkward situation vis-à-vis accountability and responsibility of the development of the corporate strategy since it is commonly understood that accountability and responsibility of development of the strategy is within the job description of the management i.e. CEO which runs company on daily basis (in one tier system). As a result, some boards often find themselves acting as nothing less than a rubber stamp of the CEO (Cossin, 2014).

But before Boards shall be able to be accountable in the development of the strategy discussion shall be directed to the strategy definition: “In essence, strategy, in an organisational context, is concerned with the dynamics of an organisation’s relationship to its environment, with the necessary actions being taken to achieve the organisation’s goals through the rational deployment of resources” Ronda-Pupo & Guerras-Martin. “The definition illustrates the combination of deliberate decision-making and decisions which emerge from the firm’s interaction with its environment”.

In the book Exploring Corporate Strategy strategy is defined as “direction and scope of an organisation over the long term, which achieves advantage in a changing environment through its configuration of resources and competences with the aim of fulfilling stakeholder expectations”. Like in the definition of the corporate governance there is no clear and generally accepted definition of strategy but all the definitions have the common nominator and that is interaction with the companies environment and decision making in long run (Johnson et al., 2011).

Corporate governance framework should encourage efficient utilization of the company resources and at the same time demands responsibility for the safeguarding of the resources. Goal is to harmonise at the most possible extend higher interests of the individuals, companies and the society. Some countries in their legislation that governs corporate governance imposed obligatory Codex of corporate governance (particularly in Continental Europe) which define among other things recognition of company’s social responsibility i.e. actions of the employees that are based on values integrity and fairness, in both internal and external dealings and particularly of the governance bodies to the economic success of the company and corporate transparency (Maher et al., 2000).

Blockchain has the ability to boost competitiveness and enhance connectivity across increase market inclusion for underserved markets segments, enhancing the long-term viability and transparency of global supply chains, and bolstering resilience in the face of adversity external attacks—each of which is required to the formation of markets. The international regulatory framework. The environment has been slow to adapt to technological advancements preventing it from expanding.

Regulatory & Accounting Challenges

Accounting professions are rapidly evolving and given the dominating position of cryptocurrencies in its digital form is functionally reliant on a technique called cryptography, which combines math & cryptology, that essentially converts and codes legitimate data and transactions that cannot be tampered with Milutonovic 2019. There are pertinent questions on how accounting environments shall remain better prepared to examine the market capitalization of digital assets having exceeded $228Bn CoinMarketCap 2019. Cryptocurrencies has led to the need of a Peer-to-Peer (P2P) approach enabling each terminal to maintain a continuous flow of activities and shall proceed only if within a chain of P2P devices agree with each other, so as to verify and record transactions.

This approach has revolutionized the practices, beliefs and norms adopted in accounting and finance as, although blockchain was originally ideated to facilitate Bitcoin, has now openly challenged transactional reliance on trusted third parties, that comprised of banks, government clearing houses, currency chests, and other intermediaries. A decentralized blockchain technology has further eliminated the presence of middlemen to position how technology that carried Bitcoin stores data across locations and shared across a massive P2P network to demonstrate how mining forms the eternal back bone for this digital currency.

It must be noted that Jan 13, 2018 was noted a significant date as there were 16.8 Million Bitcoins or in other words 80% of Bitcoins being mined & supplied. As noted by (Zuckerman, 2018) about 4.2 million Bitcoins or 20% are yet to be mined before reaching the threshold milestone of 21 million Bitcoins. Increased use of bitcoins as a form of payment for compensating services, positions that cryptocurrencies, as extended form of digital assets are both revolutionary and pervasive in the accounting world (Vetter, 2018).

There are qualified opinions on how Bitcoins as a digital currency when compared to fiat currency, shall overcome the mammoth challenges of inflation and currency deterioration experienced in functional, native & convertible currencies. Noted observations from (Andersen-Deloitte, 2016) informed that blockchain technology shall end up succeeding double entry system of book-keeping as Drew 2018 also shared that accounting profession is at the cross-roads of witnessing changes at unprecedented pace.

There are some compelling, complex and extremely worrisome issues calling the attention and reaction of accounting standard setting bodies along with regulatory authorities, as US GAAP interestingly does not provide any direct guidance on cryptocurrency transactional accounting Uhl, but is effectively working on accounting and auditing issues to address cryptocurrencies present with transactional holding and trading. The Financial Accounting Standards Board (FASB) Chairman as part of its meeting minutes has admitted the need to learn about accounting issues related to cryptocurrencies, given the different versions of treatment that adds more complexities.

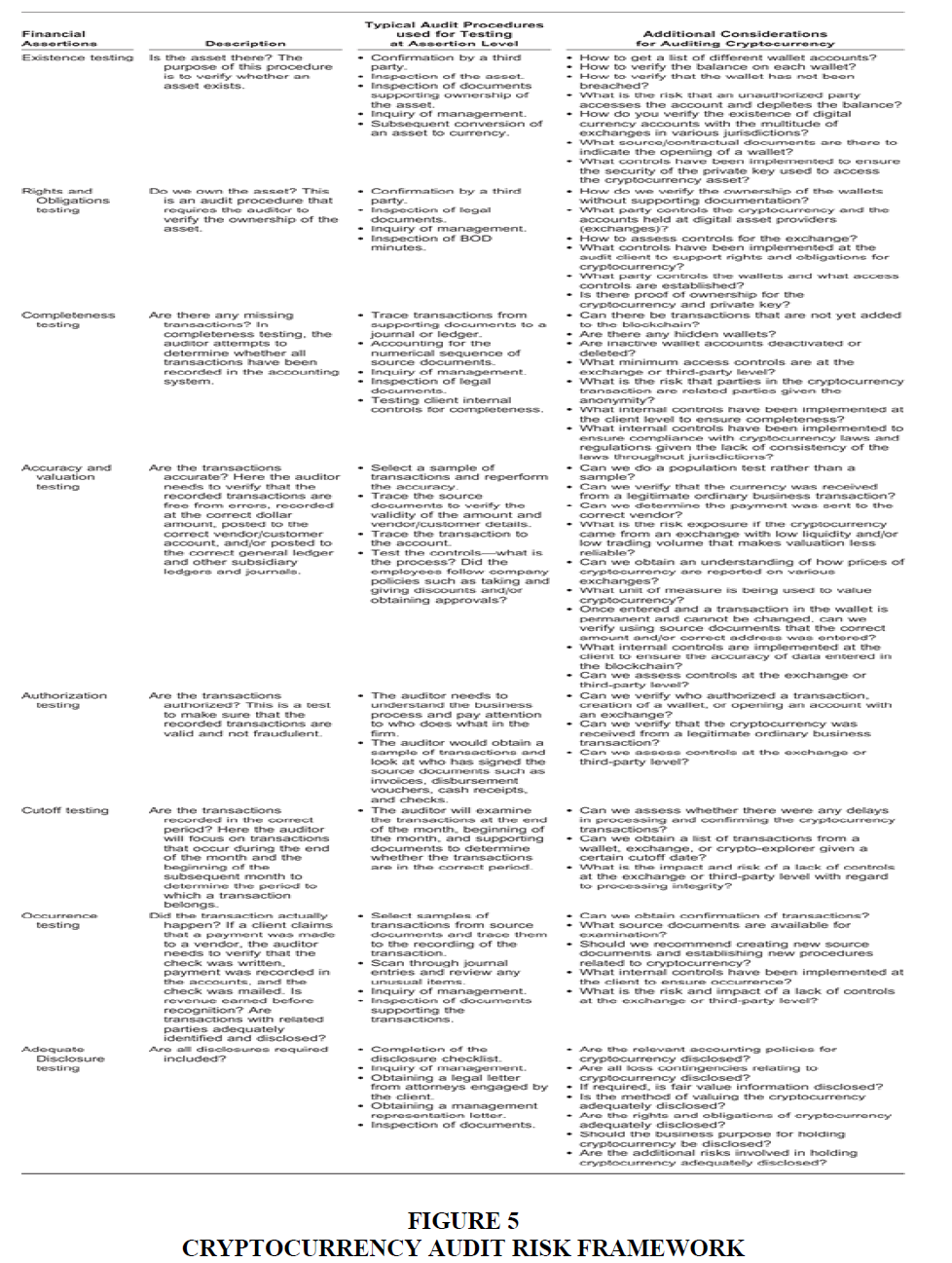

For a moment, lets presume crypto currencies are treated as “investments’, then it would require applying fair value measurements, which adds to the complexities as without a contract it is hard to justify. While, if it’s treated as intangible assets, then the lower or cost or market measurement standards apply; particularly when such digital transactions are sold or exchanged for goods and services. Now if there are substantial one-off gains, it is not captured as part of transaction economics, given that there just a judgment driven diversity in accounting practice and no on-point reference and guidance. It does not stop here, as cryptocurrencies are even offered the status of cash, currencies or cash equivalents, if its pegged to a US Dollar or any other reserve currency. The gamut of accounting issues have become increasingly complex, given that the derivative instruments are emerging and riding the wave of cryptocurrencies. FASB 2018, Board members are wanting to establish an outreach framework to examine the actual level of material interest exhibited by companies wanting to transact on cryptocurrencies apart from reaching a dialogue with those that hold and trade cryptocurrencies Figure 5.

Given the increasing gap in accounting guidance faced by accounting professionals particularly related to the measurement standards and presentation aspect of holding and trading cryptocurrencies, a growing concern has emerged based on variables like - lack of uniformity, lack of physical substance, adds to the complexities as the lack of relevant guidance further makes it hard to justify challenging auditors and standard setters. The Public Company Accounting Oversight Board PCAOB 2018 has listed cryptocurrencies and digital assets as a key focus area and is working to increase its understanding related to accounting firm’s client acceptance norms, designing audit procedures, reviewing continuance policies and examining resource deployment.

FASB and the combined opinions of global leading accounting / consulting firms (Leopold & Vollmann, 2018), opinion against cryptocurrencies not adhering to core definitions of cash or cash equivalents, foreign currencies, inventories, financial instruments, or a even a commodity, arises from the reporting policies adopted across companies – for instance reporting digital currencies as “Intangible Assets on the Balance Sheet” in one part of the world is not consistent as Overstock.com , reported Bitcoins under the head “Prepaid and Other Current Assets” in their balance sheets. Now the argument being that most cryptocurrencies are intangible and not lacks formal government support, has led to further debates particularly when there are gains and losses from cryptocurrency trades recognized under Other Income (Expenses) segment of Consolidated Statement of Income or Operations.

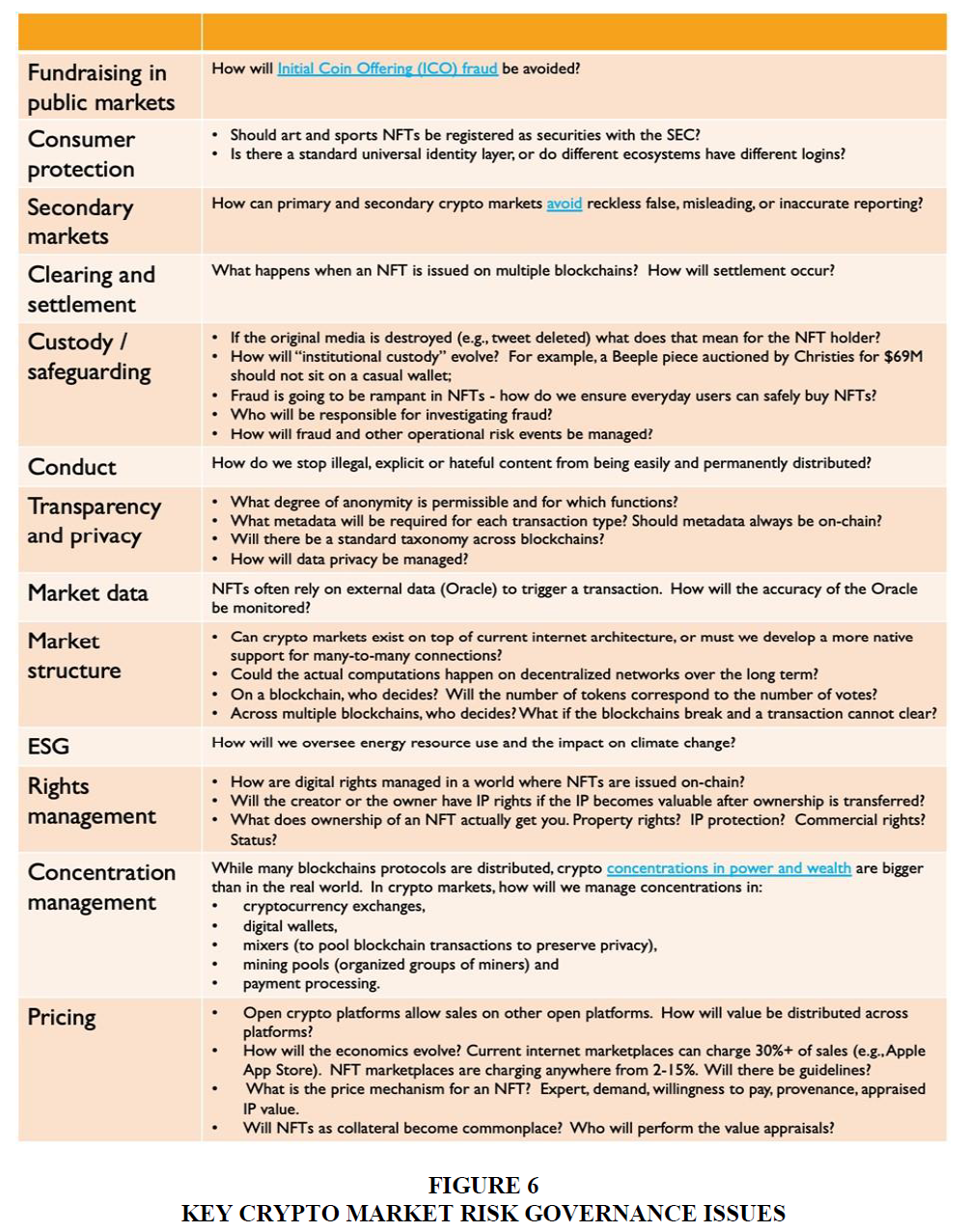

Furthermore, with the inclusion of ‘initial coin offerings’ and ‘initial token offerings’, gaining rapid visibility, trajectory, and monetary impact, given that over $22Billion has been already raised in global financial markets, issues remain, as Securities Regulators are increasingly worried considering the volatility, transparency, valuation, liquidity and custody (refer Figure 6 – Key Crypto Market Risk Governance Isuses). On the other hand, a rising number of unregulated cryptocurrencies being used, has bought forth a fundamental technical concern if any of the current digital offerings results in offering securities SEC 2018. Some of the issues and risks identified by auditors is the review of cryptocurrency risk framework (refer Figure 5 below) so as to develop a framework on audit planning for gathering necessary evidence to support management considerations related to preparation of financial statements.

Needless to mention, that accounting treatment within International Financial Reporting Standards (IFRS) is not very guidance oriented and is unclear, as most cryptocurrencies lack legal protection and carries no useful life. That said, a broad set of accounting methods classifying cryptocurrencies as intangible assets, has still not been purposive and focused, given that the definition does not fit the current standard related to ‘intangible assets’ as shared by IFSB. Also the anticipated actual guidance was found lacking to fight the current rounds of speculatory debate if cryptocurrencies can be considered as financial assets, as it does qualify and represent to receive cash or other financial instruments nor serve as a contract to exchange assets.

There also exists to a large extent continued debates, despite the International Financial Reporting Interpretations Committee (IFRIC) issuing a guidance in March 2019, recognizing the accounting treatment of holding cryptocurrencies to adhere and follow International Accounting Standard (IAS38) related to Intangible Assets (IASB, 2004), there has been a complete non-concurrent approval from the Financial Accounting Standards Board (FASB), the Auditing Standards Board (ASB), and the PCAOB as there are no formal guidance for accounting and auditing of cryptocurrency transactions.

However the Internal Revenue Service *IRS has been more proactive in issuing a relative guidance on treatment of cryptocurrency transactions IRS Notice 2014-21, 2014, to treat cryptocurrency as property and not as a currency eligible for the purpose of federal taxes (Vetter, 2018), considering if a Bitcoin is sold for USD, any noticeable gain or losses need to be reported on Form 8949. Likewise, miners have to recognize revenue, based on the value of coin received for their work Green 2017. Since Coinbase is considered the foremost US based coin exchange, courts have ordered to collect mandatory KYC data that includes and not limited to the IRS taxpayer’s ID, name, address, date of birth, historical transactions conducted, as list of penalties have been laid down civil penalties for taxpayers on unreported incomes gained from cryptocurrency transactions.

Although cryptocurrencies have been around for a decade, its global acceptance as a mainstream currency has been as late as 2020, while some nations have been working extensively to adopt digital assets exchanged against goods and service in one form or the other, as there is an urgent need to develop an overarching cryptocurrency regulation and establish common understanding on tax implications, central bank oversight and government’s obligations Figure 7. Currently Mexico is the only nation that has formalized a cryptocurrency regulation and the government published the Fintech Law under the Mexican Official Federal Gazette that oversees and monitors Financial Technology Institutions, to regulate cryptocurrency transactions in Mexico. While in South Korea, cryptocurrencies are not legal as the Ministry of Strategy and Finance plans to impose taxes on crypto transactions and published a revised tax framework 202, interestingly crypto exchanges are offered a legal status.

Among the top cryptocurrencies from a market value perspective, Bitcoin remains the first opensource popular token, when compared to other blockchain tokens as a single Bitcoin can consume 72000 GW of electricity to mine Figure 8.

There are still some fundamental questions given that crypto markets have led to elevated concerns on risk governance, single chain of protocols and greater regulations considering its emergence as an alternate global financial system. It is extremely important to find urgent solutions related risks shall be managed, governed, monitored, when crypto markets shall be decentralized by design. Who would regulate global platforms? …would there be a competent authority to drive important decisions?. Also as and when blockchain nodes connect all developing and developed nations on a common network, that practice varied accounting standards and tax regulations, how would governments respond to global corporations, miners and bitcoin speculators on answers related to accounting for and reporting of gains/ losses and tax related implication considering the status of bitcoin ranging from an intangible asset to cash to foreign exchange or a financial asset….which indeed calls for some shared crypto market objectives, risk governance and regulation (Lewis, 2017).

Conclusion

In a globalised payments environment, the biggest draw is the potential for greater transparency, trustworthiness, efficiency, and accountability. Both the banked and unbanked populations stand to benefit greatly from this. In industries that require costly intermediation, such as financial services, blockchain technology has the potential to provide large efficiency gains. But any implementation will also have to contend with a number of obstacles. In addition to examining the potential applications of blockchain technology, policymakers are also examining the potential challenges that may arise.

Beyond financial, blockchain may be used to manage global supply chains in a more sustainable and equitable way. Two key characteristics of the blockchain, in particular, the elimination of agency costs and auditable traceability, may aid trade while also ensuring compliance with specific sustainability and inclusion goals. Food and agribusiness, as well as pharmaceutical safety, are two supply chains where particular blockchain experimentation is going place. Of course, taking use of blockchain's benefits for emerging market economies would necessitate a robust legal environment that encourages competition and investment while also allowing for innovation.

References

Adab Solutions, (2021). World’s First Shariah-Compliant Crypto Exchange to Be Launched in UAE.

Andersen-Deloitte, N. (2016). Blockchain Technology: A game changer in accounting. Deloitte, March.

Arner, D.W., Barberis, J.N., & Buckley, R.P. (2016). The emergence of RegTech 2.0: From know your customer to know your data.

Indexed at, Google Scholar, Cross Ref

Arner, D.W., Barberis, J., & Buckey, R.P. (2016). FinTech, RegTech, and the reconceptualization of financial regulation. Nw. J. Int'l L. & Bus., 37, 371.

Arner, D. W., Zetzsche, D. A., Buckley, R. P., & Barberis, J. N. (2017). FinTech and RegTech: Enabling innovation while preserving financial stability. Georgetown Journal of International Affairs, 47-58.

Indexed at, Google Scholar, Cross Ref

Barras, R. (1990). Interactive innovation in financial and business services: the vanguard of the service revolution. Research policy, 19(3), 215-237.

Indexed at, Google Scholar, Cross Ref

Bootle, R. (2019). Book: The AI Economy – Work, Wealth and Welfare in Robot Age, Nicholas Brealey Publishing.

Brandenburger, A. M., & Nalebuff, B. J. (1995). The right game: Use game theory to shape strategy (Vol. 76, pp. 57-71). Chicago: Harvard Business Review.

Indexed at, Google Scholar, Cross Ref

Cossin, D. D., & Caballero, J. (2014). The four pillars of board effectiveness.

Indexed at, Google Scholar, Cross Ref

Diemers, D., Lamaa, A., Salamat, J., & Steffens, T. (2020). Developing a FinTech ecosystem in the GCC: let's get ready for take off.

Ebrahimiyan, N., Ghahroud, M.L., Abadi, S.B.A., & Jafari, F. (2021). Tokenization and its application in different countries. Journal of FinTech and Artificial Intelligence, 1(1), 6-6.

Economist, (2015). “Blockchain: The Next Big Thing or Is It?”, Special Report, May 9.

Gafurov, I. R., Safiullin, M. R., Akhmetshin, E. M., Gapsalamov, A. R., & Vasilev, V. L. (2020). Change of the Higher Education Paradigm in the Context of Digital Transformation: From Resource Management to Access Control. International Journal of Higher Education, 9(3), 71-85.

Indexed at, Google Scholar, Cross Ref

Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220-265.

Indexed at, Google Scholar, Cross Ref

Gozman, D., Liebenau, J., & Mangan, J. (2018). The innovation mechanisms of fintech start-ups: insights from SWIFT’s innotribe competition. Journal of Management Information Systems, 35(1), 145-179.

Indexed at, Google Scholar, Cross Ref

Henten, A., & Windekilde, I. (2020). Blockchains and Transaction Costs. Nordic and Baltic Journal of Information and Communications Technologies.

Indexed at, Google Scholar, Cross Ref

Hung, J. L., & Luo, B. (2016). FinTech in Taiwan: a case study of a Bank’s strategic planning for an investment in a FinTech company. Financial Innovation, 2(1), 1-16.

Indexed at, Google Scholar, Cross Ref

Iman, N. (2019). Traditional banks against fintech startups: A field investigation of a regional bank in Indonesia. Banks and Bank Systems, 14(3), 20-33.

Indexed at, Google Scholar, Cross Ref

Iman, N. (2020). The rise and rise of financial technology: The good, the bad, and the verdict. Cogent Business & Management, 7(1), 1725309.

Indexed at, Google Scholar, Cross Ref

Johnson, G., Whittington, R., Scholes, K., Angwin, D., & Regnér, P. (2011). Exploring strategy. Financial Times Prentice Hall.

Kursh, S.R., & Gold, N.A. (2016). Adding fintech and blockchain to your curriculum. Business Education Innovation Journal, 8(2), 6-12.

Leaders, Y.G. (2016). World Economic Forum Annual Meeting 2016 Mastering the Fourth Industrial Revolution.

Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business horizons, 61(1), 35-46.

Indexed at, Google Scholar, Cross Ref

Leopold, R., & Vollmann, P. (2018). Cryptographic Assets and Related Transactions: Accounting Considerations under IFRS. Depth. A Look At Current Financial Reporting Issues PwC: PricewaterhouseCoopers, London, https://www. pwc. com/gx/en/audit-services/ifrs/publications/ifrs-16/cryptographic-assets-related-transactions-accounting-considerations-ifrs-pwc-in-depth. pdf.(Erisim Tarihi: 30.07. 2019).

Lewis, R., McPartland, J., & Ranjan, R. (2017). Blockchain and financial market innovation. Economic Perspectives, 41(7), 1-17.

Maher, M., & Andersson, T. (2000). Corporate governance: effects on firm performance and economic growth. Available at SSRN 218490.

Indexed at, Google Scholar, Cross Ref

Media, C. (2018). Blockchain-Based Lending. Retrieved from https://media. consensys.net/blockchain-based-lending-1eee5edabe8a

MEDICI. (2018). Know More About Blockchain: Overview, Technology, Application Areas and Use Cases. Retrieved from https://gomedici.com/an-overview-of-blockchain-technology/

Indexed at, Google Scholar, Cross Ref

MOF Ministry of Finance UAE. (2020). https://www.mof.gov.ae/en/About/GovernmentInitiatives/Pages/uae-innovation-artificial-intelligence-blockchain-green-investment-in-financial-services.aspx

OECD (2020). Digital Disruption in Banking and its Impact on Competition http://www.oecd.org/daf/competition/digital-disruption-in-financial-markets.htm

Phillips, P., & Moutinho, L. (2018). Contemporary issues in strategic management. Routledge. Polkadot.com Public Company Accounting Oversight Board (PCAOB). (2018). Inspections outlook for 2019.

Ransbotham, S., Kiron, D., Gerbert, P., & Reeves, M. (2017). Reshaping business with artificial intelligence: Closing the gap between ambition and action. MIT Sloan Management Review, 59(1).

Scellato, G., & Giordana, M. (2018). Fintech Sector: Business Model Analysis in the Mobile Payments Area.

Schmandt–Besserat, D. (1996). How Writing Came About. Austin, TX: U.

Stern, C., Makinen, M., & Qian, Z. (2017). FinTechs in China–with a special focus on peer to peer lending. Journal of Chinese Economic and Foreign Trade Studies.

Indexed at, Google Scholar, Cross Ref

Suisse, C. (2018). Credit Suisse and ING Execute First Live Transaction Using HQLAx Securities Lending App On R3’s Corda Blockchain Platform.

Vetter, A. (2018). Blockchain, machine learning, and a future accounting. Retrieved May, 28, 2019.

Vincent, N.E., & Wilkins, A.M. (2020). Challenges when auditing cryptocurrencies. Current Issues in Auditing, 14(1), A46-A58.

Indexed at, Google Scholar, Cross Ref

Vives, X. (2017). The impact of FinTech on banking. European Economy, 2, 97-105.

Walchek, S. (2015). The unbundling of finance. TechCrunch.

Indexed at, Google Scholar, Cross Ref

Wonglimpiyarat, J. (2017). FinTech banking industry: a systemic approach. Foresight.

Indexed at, Google Scholar, Cross Ref

World Economic Forum. (2016). The future of financial infrastructure: An ambitious.

Zetzsche, D., & Preiner, C. (2018). Cross-border crowdfunding: Towards a single crowdlending and crowdinvesting market for Europe. European Business Organization Law Review, 19(2), 217-251.

Indexed at, Google Scholar, Cross Ref

Zuckerman, M.J. (2018). 80% Of All Bitcoins Already Mined, Only 4.2 Million Coins Left Until Supply Cap. Retrieved May, 28, 2019.

Received: 10-Dec-2021, Manuscript No. AAFSJ-21-10386; Editor assigned: 13-Dec-2021, PreQC No. AAFSJ-21-10386(PQ); Reviewed: 27-Dec-2021, QC No. AAFSJ-21-10386; Revised: 10-Mar-2022, Manuscript No. AAFSJ-21-10386(R); Published: 17-Mar-2022