Research Article: 2022 Vol: 26 Issue: 1S

The Study of Factors Affecting on the Accounting Effectiveness of Listed Companies in the Stock Exchange of Thailand

Nattawut Tontiset, Mahasarakham University

Citation Information: Tontiset, N. (2021). The study of factors affecting on the accounting effectiveness of listed companies in the stock exchange of thailand. Academy of Accounting and Financial Studies Journal, 25(7), 1-14.

Abstract

The aim of this research was to examine both antecedent and consequences of the accounting effectiveness of Thai-listed companies. Top management support, effective accounting system design, accountant professional and corporate governance (CG) orientation are assumed to become the antecedents of accounting effectiveness. Furthermore, the consequences of accounting effectiveness is firm success. The listed companies in the Stock Exchange of Thailand (SET) are samples of the research. A mail survey procedure via the questionnaire was used for data collection from chief accountant officer. The overall results indicate that top management support, accountant professional and CG orientation have a positive significant effect on total accounting effectiveness. Moreover, total accounting effectiveness has a positive significant effect on firm success. The results reveal that firm should develop top management support, accountant professional, and CG orientation in order to build accounting effectiveness. Overall, the results of this research contribute to chief accounting officer to emphasize on develop and support generating accounting effectiveness in order to generate firm success.

Keywords

Accounting Effectiveness, Top Management Support, Effective Accounting System Design, Accountant Professional, Corporate Governance Orientation, Firm Success.

Introduction

The primary objective of both financial and managerial accounting is to provide high quality accounting information for economic decision making of both external and internal party (Berger, 2011; Beest et al., 2009). Consistent with the process of producing accounting information in financial reporting consists of personal, procedures, technology, and records used by company in order to develop accounting information and to communicate the data to decision makers (Berger, 2011). Corresponding with successful management accounting information is supporting planning control, and decision-making including specific targets for sale, productivityion, and financing activities (Garrison et al., 2008). Therefore, management accounting system must provide information for planning, controlling, and promoting coordination and communication of business operation (

Consistent with prior financial and managerial accounting research also found that accounting information provides useful information for decision maker such as investor, creditor, bonder, owner, manager, employee and others (Socea, 2012; Beyer et al., 2010;

The prior accounting research found that there has been little empirical evidence of the antecedents and consequence of accounting effectiveness, moreover, the key characteristics of accounting effectiveness are neither clear nor covered to explain the phenomenon of accounting effectiveness (Nirwana & Haliah, 2018; Abdullah et al., 2015; Berger, 2011; Beyer, 2010). Thus, this research aims to investigate both antecedents and consequence of accounting effectiveness of the listed companies in the Stock Exchange of Thailand.

The key research question of this research is: “Do top management support, effective accounting system design, accountant professional and corporate governance orientation have an influence on total accounting effectiveness?”. Therefore, the main objective of this research is to investigate the effects of top management support, effective accounting system design, accountant professional and corporate governance orientation on total accounting effectiveness. Another research question is “Do total accounting effectiveness have an influence on firm success?”. Thus, this research is to examine the total accounting effectiveness on firm success.

This research generates both theoretical and managerial contributions. For the theoretical contribution, this research provides important extension on previous knowledge and relevant literature of accounting effectiveness. This research applies the resource based view (RBV) of the firm to explain internal resources and capabilities including top management support, effective accounting system design, accountant professional and corporate governance orientation which can affect to accounting effectiveness. For managerial contribution, the findings of this research provide information for chief accountant officer and accounting practitioner to identify and justify the key component of accounting effectiveness in order to gain firm success.

The remainder of the paper is organized as follows. The next part provides theoretical foundation. The third section provides a brief literature review and links to hypothesis development. The fourth section provides research methods including sample and data collection procedure, the variable measurements of each construct, the instrument verification, the statistics, and equations to test the hypotheses are provided. The fifth section provides the results and discussion. The sixth section provides both theoretical and managerial implications. The seventh provides limitations and suggestions for future research. The last section provides the conclusion.

Theoretical Foundation And Research Model

Resource-Based View: Internal Resource and Capability

The resource-based view (RBV) of the firm proposes that firms are bundles of resources heterogeneously distributed across firms, and that resource differences persist over time (Barney, 1991). The RBV focuses managerial attention on the firm's internal resources in an effort to identify those assets, capabilities and competencies with the potential to deliver superior competitive advantages and bring better performance (Russo & Fouts, 1997; Henri, 2006). Barney (1991) defines firm resources as "all assets, capabilities, firm attributes, processes, information, knowledge, etc. controlled by a firm that enable the firm to conceive of and implement strategies that improve its efficiency and effectiveness". Moreover, capabilities are "a special type of resource, specifically an organizationally embedded non-transferable firm-specific resource whose purpose is to improve the productivity of the other resources possessed by the firm” (Barney, 1991).

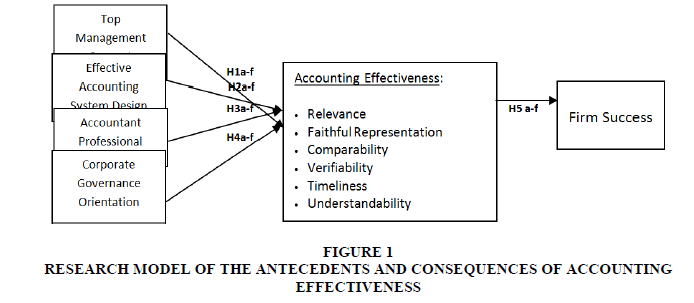

The key of resource-based approach strategy formulation is to understand the relationships among internal resources, capabilities, competitive advantage, and performance (Preutthipan, 2000). This research employ the RBV to explain internal resources and capability including top management support, effective accounting system design, accountant professional and CG orientation which are set as the antecedents of accounting effectiveness in research model. Overall, this research has developed the research model and hypotheses as shown in Figure 1 which builds on resource-based view of the firm as follows.

Literature Review And Hypothesis Development

Accounting Effectiveness

Accounting effectiveness refers to the attribute of accounting information of financial reporting from strongly accounting process that is useful to all users in making economic decision (

Top Management Support and Accounting Effectiveness

Top management support is defined as chief financial officer, chief executive officers and board of director emphasized on the amount of support given to developing and implementing new accounting technique or innovation and procedure in order to sustainable development (

H1: The higher top management support is, the more likely that the firms will gain greater accounting effectiveness: a) relevance, b) faithful representation, c) comparability, d) verifiability, e) timeliness, and f) understandability.

Effective Accounting System Design and Accounting Effectiveness

Effective accounting system design is defined as the latency of accounting information system that provides building successful accounting information. The effective accounting system design are produce accurate and reliable data, timeliness and effective network link to other systems (Altamuro & Beattey, 2010; Peppard & Ward, 2004;

H2: The higher effective accounting system design is, the more likely that the firms will gain greater accounting effectiveness: a) relevance, b) faithful representation, c) comparability, d) verifiability, e) timeliness, and f) understandability.

Accountant Professional and Accounting Effectiveness

Accountant professional is defined as an accountant’s existing professionalism and capacities that help predict competent performance in a certain job that it encompasses skills, knowledge, innovative abilities, and ethical awareness (Abdullah et al., 2015; Adediran et al., 2013; Flood & Wilson, 2008). Prior researches indicated that accountant professional has a significant impact on accounting effectiveness (Abdullah et al., 2015 ; Adediran et al., 2013; Flood & Wilson, 2008). Thus, the hypothesis is proposed as follows:

H3: The higher accountant professional is, the more likely that the firms will gain greater accounting effectiveness: a) relevance, b) faithful representation, c) comparability, d) verifiability, e) timeliness, and f) understandability.

Corporate Governance orientation and Accounting Effectiveness

Corporate governance orientation is defined as firm are concentration on process designed of management to provide reasonable ensure that the corporation produced reliable reporting, complies with applicable laws and regulation, and conducts effective performance (

H4: The higher corporate governance orientation is, the more likely that the firms will gain greater accounting effectiveness: a) relevance, b) faithful representation, c) comparability, d) verifiability, e) timeliness, and f) understandability.

Accounting Effectiveness and Firm Success

Firm success is defined as the assessment of the firm performance which is successful long term in several aspects both financial and non-financial perspective including customer satisfaction, productivity and service quality, return on investment and profitability (Tontiset & Kaiwinit, 2013; Cadez & Guilding, 2008). Previous research has shown that accounting effectiveness has a significant impact on firm success (Li & Shroff, 2014; Berger, 2011; Beyer et al., 2010). Thus, the hypothesis is proposed as follows:

H5: The higher accounting effectiveness: a) relevance, b) faithful representation, c) comparability, d) verifiability, e) timeliness, and f) understandability is, the more likely that the firms will gain firm success.

Research Methods

Sample and Data Collection Procedure

Sample of this research is the companies in the Stock Exchange of Thailand (SET). Accounting controllers or chief accountant officers are chosen as key participants because they have a direct effect on effective accounting practices in each corporation. Moreover, they are well suited to provide the details of both accounting information and other information needed for the tests (

Questionnaire Development and Variable Measurement

Questionnaire Development

In this research, a questionnaire consists of five parts. Part one asks for personal information. Part two is for general information of listed companies in the Stock Exchange of Thailand. Parts there and four are related to evaluating each of constructs in the research model designed by a five-point Likert scale, ranging from 1 (strongly disagree) to 5 (strongly agree). Part three is the measurement of accounting effectiveness by using the qualitative information of financial statement including relevance, faithful representation, comparability, verifiability, timeliness, and understandability. Part four is the measurement of the antecedents of accounting effectiveness including top management support, effective accounting system design, accountant professional and CG orientation. Moreover, this part is the measurement of firm success. Finally, an open-ended question for suggestions and opinions of chief accountant officer is included in part five.

Variable Measurement

The measure development procedures involve the multiple items development for measuring each construct in the research model. All constructs are the abstractions that cannot be directly measured or observed and should be measured by multiple items (Churchill, 1979). To measure each construct in the research model, all of variables are gained from the survey and are measured by a five-point Likert scale. The measurement of each variable are shown as follows.

Accounting Effectiveness

Accounting effectiveness is defined as the attribute of accounting information of financial reporting from strongly accounting process that is useful to all users in making economic decision (IASB, 2020; Socea, 2012; Shahwan, 2008). This variable is measured using six characteristics of the qualitative characteristic of financial reporting including relevance, faithful representation, comparability, verifiability, timeliness, and understandability (IASB, 2020; Ogundana et al., 2017; Yurisandi & Puspitasari, 2015; Beest et al., 2009). The measure of each attribute depends on literature review that is also detailed.

Relevance is defined as accounting information must be capable of making difference to a decision by helping user group to form perdition about the outcome of past, present and future events or to confirm or correct expectations. Moreover, relevance information must have predictive value, feedback value, and materiality (IASB, 2020; Socea, 2012; Shahwan, 2008). Relevance is measured using three-item scale modified from (Socea, 2012; Shahwan, 2008).

Faithfully representations is defined as information of financial reporting represent what really existed or happened. Furthermore, the accounting numbers and description agree with the resources or events that these numbers and descriptions purport to represent. The characteristic of faithfully information is completeness, neutrality, and free from error (Shahwan, 2008; McCartney, 2004). Faithfully representation is measured using three-item scale modified from (Shahwan, 2008; McCartney, 2004).

Comparability is defined as financial statement can be subject to comparability with similar firm in same industry and even over periods of times for same firm (Socea, 2012;

Verifiability is defined as accounting information can be measured, using the appropriate method which is based on GAAP, international financial reporting standard. Furthermore, knowledgeable and independent observers could reach consensus, but not necessarily complete agreement, that a depiction is a faithful representation (Socea, 2012; Berger, 2011 ). Verifiability is measured using three-item scale modified from (Ogundana et al., 2017; Socea, 2012; Berger, 2011).

Verifiability is defined as accounting information can be measured, using the appropriate method which is based on GAAP, international financial reporting standard. Furthermore, knowledgeable and independent observers could reach consensus, but not necessarily complete agreement, that a depiction is a faithful representation (Socea, 2012; Berger, 2011). Verifiability is measured using three-item scale modified from (Ogundana et al., 2017; Socea, 2012; Berger, 2011).

Understandability is defined as accounting information must be clearly and concisely data. Furthermore, understandability is the quality of information that permits reasonably informed users to perceive its significance (Socea, 2012; Berger, 2011). Understandability is measured using three-item scale modified from (Socea, 2012; Berger, 2011).

Consequence Variable

Firm success is defined as the assessment of the firm performance which is successful long term in several aspects both financial and non-financial perspective including customer satisfaction, productivity and service quality, return on investment and profitability (Tontiset & Kaiwinit, 2013; Cadez & Guilding, 2008). Firm success is measured using four-item scale modified from (Tontiset & Kaiwinit, 2013; Cadez & Guilding, 2008).

Antecedents Variable

For this research, antecedent of accounting effectiveness is including top management support, effective accounting system design, accountant professional and corporate governance orientation. The measure of each antecedent variable conforms to relevance literature to be discussed as follows.

Top management support is defined as chief financial officer, chief executive officers and board of director emphasized on the amount of support given to developing and implementing new accounting technique or innovation and procedure in order to sustainable development (

Top management support is defined as chief financial officer, chief executive officers and board of director emphasized on the amount of support given to developing and implementing new accounting technique or innovation and procedure in order to sustainable development (

Accountant professional is defined as an accountant’s existing professionalism and capacities that help predict competent performance in a certain job that it encompasses skills, knowledge, innovative abilities, and ethical awareness (Abdullah et al., 2015; Adediran et al., 2013; Flood & Wilson, 2008). Accountant professional is measured using four-item scale modified from (Abdullah et al., 2015; Adediran et al., 2013;

Accountant professional is defined as an accountant’s existing professionalism and capacities that help predict competent performance in a certain job that it encompasses skills, knowledge, innovative abilities, and ethical awareness (Abdullah et al., 2015; Adediran et al., 2013; Flood & Wilson, 2008). Accountant professional is measured using four-item scale modified from (Abdullah et al., 2015; Adediran et al., 2013;

Control Variable

Two control variables are included the firm characteristics for the fact that they may influence the hypothesized relationships of both firm age and size. Firm age (FA) is measured by number of years that a firm has been in operation, and firm size (FS) is measured by total assets of the firm. Firm success may be influenced by firm age and firm size because it may be able to achieve superior performance (Hoglund & Sundvik, 2016; Gotti & Mastrolia, 2012).

Reliability and Validity

Factor analysis was firstly utilized to investigate the underlying relationships of a large number of items and to determine whether they can be reduced to a smaller set of factors. The factor analyses conducted were done separately on each set of the items representing a particular scale due to limited observations. With respect to the confirmatory factor analysis (CFA), this analysis has a high potential to inflate the component loadings based on a higher rule-of-thumb at a cut-off value of 0.40 (Hair et al., 2010). All factor loadings are greater than the 0.40 cut-off (0.74-0.96) and are statistically significant. The reliability of the measurements was evaluated by Cronbach alpha coefficients (0.78-0.93) which are greater than 0.70 (

| Table 1 Results Of Factor Loadings And Cronbach Alpha Coefficients |

||

| Variables | Factor Loadings | Cronbach Alpha |

|---|---|---|

| Firm Success (FS) | 0.841-0.913 | 0.849 |

| Relevance (RE) | 0.782-0.878 | 0.918 |

| Faithful Representation (FR) | 0.903-0.967 | 0.786 |

| Comparability (CO) | 0.741-0.906 | 0.886 |

| Verifiability (VE) | 0.858-0.955 | 0.886 |

| Timeliness (TI) | 0.792-0.878 | 0.792 |

| Understandability (UN) | 0.925-0.952 | 0.932 |

| Top Management Support (TMS) | 0.868-0.946 | 0.888 |

| Effective Accounting System Design (EASD) | 0.889-0.945 | 0.907 |

| Accountant Professional (ACP) | 0.785-0.954 | 0.856 |

| Corporate Governance Orientation (CGO) | 0.918-0.937 | 0.919 |

Statistic Test

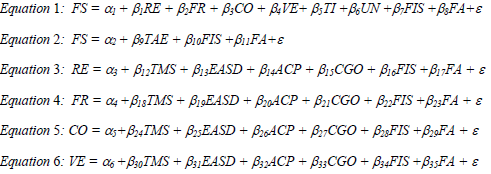

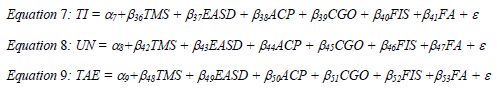

The Ordinary Least Squares (OLS) regression analysis is used to test all hypotheses of research model. For this research, both dependent and independent variables are categorical and interval data. Thus, OLS is an appropriate method for examining the hypothesized relationships of this research model. The relationship among independent, dependent and control variables of this research model was initially assessed using regression analysis (Frazier et al., 2004). The models of the aforementioned relationships are shown as follows.

Note: FIS is firm size, FA is firm age

Result and Discussion

The descriptive statistics and correlation matrix for all variables are as shown in Table 2. Checking for significance of the relationships between each independent variable is tested by variance inflation factor (VIF) technique. The results show that VIFs range from 1.45 to 6.50, well below the cut-off value of 10 recommended by Neter et al. (1985) indicating that the independent variables are not correlated with each other. Thus, there are no substantial multicollinearity problems encountered for this research.

| Table 2 Descriptive Statistics And Correlation Matrix |

|||||||||||||

| Variable | FS | RE | FR | CO | VE | TI | UN | TMS | EASD | ACP | CGO | FIS | FA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 4.06 | 4.37 | 4.50 | 4.32 | 4.63 | 4.47 | 4.39 | 4.39 | 4.34 | 4.54 | 4.54 | 2.28 | 2.38 |

| SD | 0.82 | 0.56 | 0.56 | 0.60 | 0.51 | 0.56 | 0.59 | 0.62 | 0.57 | 0.50 | 0.49 | 1.26 | 1.03 |

| VIF | - | 5.42 | 4.68 | 1.43 | 2.36 | 2.56 | 2.82 | 1.48 | 1.96 | 2.06 | 1.84 | 1.34 | 1.43 |

| FS | |||||||||||||

| RE | .224** | ||||||||||||

| FR | .232** | .765** | |||||||||||

| CO | .258* | .324** | .307** | ||||||||||

| VE | .289** | .393** | .596** | .456** | |||||||||

| TI | .440** | .638** | .696** | .386** | .594** | ||||||||

| UN | .281** | .770** | .695** | .280** | .331** | .567** | |||||||

| TMS | .269** | .406** | .266** | .196* | .149 | .498** | .503** | ||||||

| EASD | .368** | .437** | .150** | .370** | .351** | .437** | .249* | .398** | |||||

| ACP | .335** | .523** | .453** | .394** | .360** | .504** | .333** | .445** | .650** | ||||

| CGO | .413** | .307** | .399** | .391** | .496** | .619** | .352** | .510** | .506** | .557** | |||

| FIS | .040 | .231* | .019 | -.025 | .163 | .059 | .106 | .157 | .331** | .299** | .095 | ||

| FA | .060 | -.123 | .164 | .152 | .157 | .229* | .107 | -.139 | -.146 | -.077 | .090 | -.158 | |

**Correlation is significant at the 0.01 level (2-tailed), * Correlation is significant at the 0.05 level (2-tailed)

Table 3 shows the results of OLS regression analysis of the antecedents of accounting effectiveness (top management support, effective accounting system design, accountant professional and CG orientation) on accounting effectiveness that based on the qualitative characteristic of financial reporting (relevance, faithful representation, comparability, verifiability, timeliness, and understandability) in Hypotheses 1a-f to Hypotheses 4a-f. The results show that a top management support has significant positive effects on dimensions of accounting effectiveness including relevance (H1a, b12 = 0.218, p < 0.05), timeliness (H1e, b14 = 0.259, p < 0.05), and understandability (H1f, b42 = 0.454, p < 0.01). However, the results show that top management support has an insignificant effect on accounting effectiveness in dimensions of faithful representation (H1b, b18 = 0.070, p > 0.05), comparability (H1c, b24 = 0.036, p > 0.05), and verifiability (H1d, b30 = 0.162, p > 0.05). Furthermore, the results also shows that top management support has a positive significant effect on total accounting effectiveness (b48 = 0.188, p < 0.01). Overall, the results imply that top management support has an influence on producing accounting effectiveness (Krumwiede, 2008; Maelah & lbrahim, 2007;

Moreover, Table 3 shows that the effective accounting system design has significant positive effects on dimensions of accounting effectiveness including faithful representation (H2b, b19 = 0.271, p < 0.05), and comparability (H2c, b25 = 0.222, p < 0.10). However, the results show that effective accounting system design has an insignificant effect on accounting effectiveness in dimensions of relevance (H2a, b13 = 0.131, p > 0.05), verifiability (H2d, b31 = 0.118, p > 0.05), timeliness (H2e, b37 = 0.119, p > 0.05) and understandability (H2f, b43 = 0.017, p > 0.05). Furthermore, the results also shows that effective accounting system design has an insignificant effect on total accounting effectiveness (b49 = 0.056, p > 0.05). Overall, the results found that effective accounting system design has partially significant influence on accounting effectiveness (Altamuro & Beattey, 2010; Peppard & Ward, 2004; O’Donnell & David, 2000). Thus, Hypotheses 2b and 2c are supported while Hypotheses 2a, 2d, 2e, and 2f are not supported.

Additionally, Table 3 shows that accountant professional has significant positive effects on dimensions of accounting effectiveness including relevance (H3a, b14 = 0.367, p < 0.01), faithful representation (H3b, b20 = 0.521, p < 0.01), and comparability (H3c, b26 = 0.226, p < 0.10). However, the results show that accountant professional has an insignificant effect on accounting effectiveness in dimensions of verifiability (H3d, b32 = 0.083, p > 0.05), timeliness (H3e, b38 = 0.173, p > 0.05) and understandability (H3f, b44 = 0.123, p > 0.05). Moreover, the results also shows that accountant professional has significant positive effects on total accounting effectiveness (b50 = 0.321, p < 0.01). Overall, the results found that accountant professional has an influence on accounting effectiveness (Abdullah et al., 2015; Adediran et al., 2013; Flood & Wilson, 2008). Thus, Hypotheses 3a, 3b, and 3c are supported while Hypotheses 3d, 3e and 3f are not supported.

| Table 3 Results Of Ols Regression Analysis* |

|||||||

| Independent Variables | Dependent Variable | ||||||

|---|---|---|---|---|---|---|---|

| RE | FR | CO | VE | TI | UN | TAE | |

| 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| Top Management Support (TMS) | .218** | .070 | .036 | .162 | .259** | .454*** | .188** |

| (.104) | (.105) | (.109) | (.105) | (.088) | (.106) | (.033) | |

| Effective Accounting System Design (EASD) | .131 | .271** | .222* | .118 | .119 | .017 | .056 |

| (.120) | (.120) | (.126) | (.121) | (.101) | (.122) | (.038) | |

| Accountant Professional (ACP) | .367*** | .521*** | .226* | .083 | .173 | .123 | .321*** |

| (.123) | (.123) | (.129) | (.124) | (.104) | (.125) | (.039) | |

| Corporate Governance Orientation (CGO) | .076 | .207* | .171 | .451*** | .312*** | .356 | .228** |

| (.116) | (.117) | (.122) | (.118) | (.098) | (.042) | (.037) | |

| Firm Size (FIS) | .045 | .090 | .148 | .108 | -.054 | .340 | .018 |

| (.188) | (.189) | (.198) | (.191) | (.160) | (.032) | (.060) | |

| Firm Age (FA) | .030 | .139 | .154 | .138 | .257*** | .179 | .182* |

| (.189) | (.190) | (.199) | (.191) | (.160) | (.193) | (.061) | |

| Adjusted R2 | .284 | .276 | .210 | .265 | .486 | .257 | .395 |

*P < 0.10, **P < 0.05, ***P < 0.01, aBeta coefficients with standard errors in parenthesis

Finally, Table 3 also shows that corporate governance orientation has significant positive effects on dimensions of accounting effectiveness including faithful representation (H4b, b21 = 0.207, p < 0.10), verifiability (H4d, b33 = 0.451, p < 0.01), and timeliness (H4c, b39 = 0.312, p < 0.01). However, the results show that corporate governance orientation has an insignificant effect on accounting effectiveness in dimensions of relevance (H4a, b15 = 0.076, p > 0.05), comparability (H4c, b27 = 0.171, p > 0.05) and understandability (H4f, b45 = 0.356, p > 0.05). Moreover, the results also shows that corporate governance orientation has significant positive effects on total accounting effectiveness (b51 = 0.328, p < 0.05). Overall, the results found that corporate governance orientation has an influence on accounting effectiveness (Suttipun, 2018; Asiriuwa et al., 2018;

Furthermore, Table 4 also shows the results of OLS regression analysis of accounting effectiveness; that based on the qualitative characteristic of the conceptual framework for financial reporting in 6 dimension including relevance, faithful representation, comparability, verifiability, timeliness, and understandability; on firm success. The results shows that dimension of accounting effectiveness including both timeliness (H5e, b5 = 0.516, p < 0.01), and understandability (H5f, b6 = 0.257, p < 0.10) have significant positive effects on firm success. However, relevance (H5a, b1 = 0.254, p > 0.05), faithfully representation (H5b, b2 = 0.162, p > 0.05), comparability (H5c, b3 = 0.108, p > 0.05), and verifiability (H5d, b4 = 0.061, p > 0.05) have insignificant effect on accounting effectiveness. Finally, the results shows that total accounting effectiveness has significant positive effects on firm success (b9 = 0.365, p < 0.01). Overall, the results indicate that total accounting effectiveness and dimension of both timeliness and understandability of accounting effectiveness can enhance firm success (Li & Shroff, 2014; Berger, 2011; Beyer et al., 2010). Thus, Hypothesis 5e, and 5f are supported but Hypothesis 5a, 5b, 5c and 5d are not supported.

| Table 4 Results Of Ols Regression Analysis* |

||

| Variables | Dependent Variable | |

|---|---|---|

| FS | FS | |

| 1 | 2 | |

| Relevance (RE) | .254 | |

| (.213) | ||

| Faithful Representation (FR) | .162 | |

| (.198) | ||

| Comparability (CO) | .108 | |

| (.110) | ||

| Verifiability (VE) | .061 | |

| (.141) | ||

| Timeliness (TI) | .516*** | |

| (.147) | ||

| Understandability (UN) | .257* | |

| (.154) | ||

| Total Accounting Effectiveness (TAE) | .365*** | |

| (.279) | ||

| Firm Size (FIS) | .090 | 0.001 |

| (.010) | (.199) | |

| Firm Age (FA) | .115 | .006 |

| (.230) | (.207) | |

| Adjusted R2 | .176 | .107 |

*P < 0.10, **P < 0.05, ***P < 0.01, aBeta coefficients with standard errors in parenthesis.

Implication of Research

Theoretical Implications

This research provides important extension on previous knowledge and relevant literature of accounting effectiveness. Furthermore, this research focuses on the key dimensions of accounting effectiveness that based on the qualitative characteristic of the conceptual framework for financial reporting in 6 dimension including relevance, faithful representation, comparability, verifiability, timeliness, and understandability. Moreover, this research focuses on internal resources and capabilities including including top management support, effective accounting system design, accountant professional and corporate governance orientation. The results indicate that top management support, accountant professional and corporate governance orientation have a significant effect on total accounting effectiveness. This result implies that internal resources and capabilities of the firm can enhance accounting effectiveness and links to firm success.

Managerial Implications

This research helps chief accounting officer, accounting practitioner, and accounting information user identify and justify the key components of accounting effectiveness. Chief accounting officer and manager should effectively manage and produce accounting information and financial reporting. Chief accounting officer should implement and support accountant professional, effective accounting system design, and corporate governance orientation in order to build accounting effectiveness for develop accounting information to financial reporting users.

Limitation And Suggestion For Future Research

According to the results, constructs of this research are developed and measured by using only previous research. Thus, the future research will be explored the scale by different approaches such as in-depth interview or focus group, in order to fully understand constructs measurement of accounting effectiveness. Furthermore, this research uses only questionnaire for collecting data. Since then, future research will be developed mixed methods designed to observe data from sample size. Finally, the results of this research are derived from the listed companies in SET of Thailand. Moreover, future research will be collected data from another population in order to widen the perspective and generalization.

Conclusion

In this decade, the topic of effective preparation of financial reporting is very important for accounting practitioner because, it is successful accounting. Based on financial accounting research, the researcher found that both insufficient of measurement of accounting effectiveness and found that ambiguously about both antecedents and consequences of accounting effectiveness. Thus, this research attempts to identify accounting effectiveness and investigate of its antecedents and consequence. This research proposes a research model and hypothesis that build on RBV of the firm and relevance literature of accounting effectiveness. The listed companies in SET of Thailand were selected as a sample and data are collected from chief accountant officer by using a questionnaire as an instrument. Finally, 99 mail questionnaires were usable.

Overall, the result shows that a top management support, accountant professional and corporate governance orientation have a positive significant effect on accounting effectiveness in partially dimension of relevance, faithful representation, comparability, verifiability, timeliness, and understandability. Moreover, dimension of accounting effectiveness including both timeliness and understandability and total of accounting effectiveness has a positive significant effect on firm success. This research also provides both theoretical and managerial contributions to expanding on previous literature of accounting effectiveness and suggests critical point for accounting researcher for future research.

References

Abdullah, Z.I., Almsafir, M.K., & Al-Smadi, A.A. (2015). Transparency and Reliability in Financial Statement: Do They Exist? Evidence form Malaysia. Open Journal of Accounting, 4(4), 29-43.

Adediran, S.A., Alade, S.O., & Oshode, A.A. (2013). Reliability of Financial Reporting and Companies Attribute: The Nigerian Experience. Research Journal of Finance and Accounting, 4(16), 108-114.

Asiriuwa, O., Aronmwan, E.J., Uwuigbe, U., & Uwuigbe, O.R. (2018). Audit Committee Attributes and Audit Quality. Business: Theory and Practice, 19, 37-48.

Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17, 99-120.

Beaver, W.H. (1998). The Information Content of Annual Earnings Announcements. Journal of Accounting Research, 6, 67-92.

Beest, F.V., Braam, G., & Boelens, S. (2009). Quality of Financial Reporting: Measuring Qualitative Characteristics. NiCE Working Paper, Institute for Management Research, Radboud University Nijmegen. April.

Biddle, G.C., Hilary, G., & Verdi, R.S. (2009). How Does Financial Reporting Quality Related to Investment Efficiency. Journal of Accounting and Economics, 48, 112-131.

Cadez, S., & Guilding, C. (2008). An Exploratory Investigation of an Integrated Contingency Model of Strategic Management Accounting. Accounting, Organizations, and Society, 33, 1-19.

Emmanuel, C.R., & Garrod, N. (2002). On the Relevance and Comparability of Segmental Data. ABACUS, 38(2), 215-234.

Flood, B., & Wilson, R.M.S. (2008). An Exploration of the Learning Approaches of Prospective Professional Accountants in Ireland. Accounting Forum, 32, 225-239.

Foster, G., & Swenson, D.W. (1997). Measuring the Success of Activity-Based Cost Management and Its Determinants, Journal of Management Accounting Research, 9, 109-141.

Garrison, R.H., Noreen, E.W., & Brewer, P.C. (2008). Management accounting. McGraw-Hill.

Geary, K.M., & Ricketts, J.B. (1992). New Internal Control Framework and Evaluation Proposed by COSO. CPA Journal, 51(3), 1-10.

Hair, J.F., William, B.C., Black, B., Babin, B.J., & Anderson, R.E. (2010). Multivariate Data Analysis: Global Edition, 7th Edition. New York: Pearson Education International.

Horngren, C.T., & Harrison, W.T. (2008). Financial and managerial accounting. Person Prentice Hall.

IASB. (2020). Conceptual Framework for Financial Reporting. Retrieved: may, 2020 from http://www.ifrs.org

Kamolsakulchai, M. (2015). The Impact of the Audit Committee Effectiveness and Audit Quality on Financial Reporting Quality of Listed Company in the Stock Exchanges of Thailand. Review of Integrative Business & Economic, 4(2), 328-341.

Krumwiede, K.R. (2008). A Closer Look at German Cost Accounting Methods. Management Accounting Quarterly, 10(1), 1-14.

Krumwiede, K.R., Suessmair, A., & MacDonald, J. (2007). An Exploratory Study of the Factors Affecting the Implementation Success of German Cost Accounting Methods. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1003833.

Maelah, R., & Ibrahim, D.N. (2007). Factors Influencing Activity Based Costing (ABC) Adoption in Manufacturing Industry. Investment Management and Financial Innovation, 4(2), 113-124.

Neter, J., Wasserman, W., & Kutner, M.H. (1985). Applied Linear Statistical Models: Regression, Analysis of Variance, and Experimental Design, 2nd Edition. Homewood: Richard D. Irwin, Inc.

Ogundana, O., Ojeka, S., Ojua, M., & Nwaze, C. (2017). Quality of Accounting Information and Internal Audit Characteristic in Nigeria. Journal of Modern Accounting and Auditing, 13(8), 333-344.

Preutthipan, S. (2000). The Model of the Resource-Based View of the Firms. Chulalongkorn Review, 81-97.