Research Article: 2017 Vol: 21 Issue: 3

The tax-true and Fiscally-fair Principle in Italian Financial Reporting

Maria Silvia Avi, University Ca' Foscari Venice

Keywords

Empirical Research, Financial Statement, Italian Financial Reporting, Tax, Tax in Italian Financial Reporting, True and Fair View.

Introduction

A financial statement can be defined as “true and fair” when it has been prepared in the light of correct accounting standards, i.e., the International Financial Reporting Standards and the National Financial Reporting Standards (in Italy, issued by “OIC”, Organismo italiano di contabilità, the Italian Accounting Organisation Standards Setter) (Provasoli A., Mazzola P., Pozza L., 2007) or pursuant to the legislation of any other Country.

The true and fair principle (Godfrey & Chalmers, 2007) is included in the European Union’s regulations which, although applied in the various countries of the Union, do not present a univocal interpretation (Alexander, 1993; Alexander and Jermakowicz, 2006). In fact, in the numerous states of the EU, this principle has been interpreted in different ways and with different substantial, linguistic and philosophical meanings (Nobes & Alexander, 2016).In Italy, about 95% of companies do not adopt IFRS, but prepare their financial statements based on the statutory provisions of the Civil Code and the applicable national financial reporting standards. However, since the relationship between Civil Code provisions and tax/revenue law has constantly evolved over the last 20 years, to best understand the present situation, we should first shortly summarise the main literature about initiatives of lawmakers concerning financial reporting and taxation in different Countries.

The goal of this work is to investigate whether most Italian financial statements can be defined as “true and fair” or, on the contrary, these documents are affected by tax regulations that should not have an impact on corporate financial reporting (Di Pietra, McLeay, Riccaboni, 2001; Spengel, 2003; Schoen, 2004; Schoen, 2005; Shaviro, 2008; Hanlon & Heiztman, 2010; Graham, Raedy, Shackelford, 2012).

Civil Code and Tax Law In Financial Reporting: Dependent or Independent Relationship?

We will describe and explain the situation by discussing the results of an empirical research conducted in 2003-2005 and 2009-2014 and part of some on-going research. By analysing these findings and comparing data, we may be able to understand whether most Italian financial statements are actually true and fair or if the values booked in these reports have been determined only for tax purposes (Markle, 2016) , without reflecting the economic substance of transactions, in which case the financial statement could not be defined as “true and fair” but rather as “tax-true and fiscally-fair” (Zambon, 2002; Gavana, Guggiola, Marenzi, 2013).

As regards financial reporting, the relationship between Civil Code statutory provisions and tax laws (Rocchi, 1996) underwent four main changes:

In 1991, Italy adopted the IV EEC Directive and introduced two specific items in the profit and loss account before calculating the operating result:

24 Value adjustments, made exclusively to comply with tax laws; and

25 Provisions, created exclusively to comply with tax laws.

At that time, companies could overtly and lawfully recognise tax-related items, not based on economic facts, in their profits and loss statements.

As a consequence, profits were also the result of tax accounting, but their impact was highlighted by the amounts recognised in the two above-mentioned items. So, in theory, all the items before 24 and 25 of the Profit and Loss Statement would have been true and fair. The reason for the use of this conditional verb form will be explained in the following pages.

In 1994, items 24 and 25 of the profit and loss account were eliminated. The new legislation permitted the posting of value adjustments and provisions determined exclusively in compliance with tax laws (although without an obligation to highlight them as special items), provided that the reasons for these value adjustments and tax items be explained in the Explanatory Notes, where their nature of items determined and booked exclusively for tax purposes and therefore devoid of any economic meaning, should eventually be highlighted. During those years, each item of the profit and loss account could contain portions exclusively related to taxes.

Under said laws, the notion of “true and fair view” for a financial statement took on a very peculiar meaning: in the presence of tax-related items lawfully posted without a correspondence with economic facts, the balance sheet and the profit and loss account did not give a true and fair view of the financial situation of a company.

However, the true and fair view was ensured by compliance with the provision set forth in point no. 14 of art. 2427 of the Civil Code, since the Explanatory Notes were and still are today, an integral part of the financial statements. Even though the balance sheet and the profit and loss account contained items that were not “true and fair”, the information provided in the Notes would contribute to give a really true and fair view of the financial situation of the company since the whole of the forms that make up the financial statements included the balance sheet, the profit and loss account (or income statement) and the explanatory notes.

The determination of economically correct values was in any case compulsory for the financial statement to be lawfully prepared according to the legislation, even before the reform. In fact, this tax interference in statutory reporting did not translate into the opportunity to automatically account for taxes in the balance sheet or profit and loss account, but rather into the possibility to account for taxes whenever this brought a real tax benefit that could be translated into paying lower taxes. This obviously required the determination of two values: the “true and fair value” and the “tax-deductible value”.

This meant that the possibility to enter a tax item other than the economic cost was permitted by article 2426 of the Civil Code only in the event that the tax value to be deducted exceeded the amount of the production factor actually consumed by the company.

In the opposite case, however, if the economic value exceeded the tax-deductible value, the writer of the financial statement must book the economically correct cost. In fact, when the actual economic cost exceeded the tax cost, posting the tax-deductible value would have unlawfully overestimated the economic result, which would have resulted in an amount “inflated” by the recognition in the financial statement of lower values than those corresponding to the actual consumption of the factors consumed. If costs had been determined uncritically based on the fixed percentages established by the Ministry of Finance, without any simultaneous economic analysis, we would have obtained an unlawful financial statement that did not offer the “true and fair view” required by article 2423 of the Civil Code.

In 2003, based on the reform passed on January 1st 2004, the statutory regulations mentioned above were eliminated and the tax law was amended (Nobes and Aisbitt, 2001). The new tax law allowed companies to deduct values determined only for tax purposes from their tax return (without recognising anything in the financial statement) because they were considered to be devoid of economic content. For this deduction, companies had to fill a specific page called “Quadro EC” (EC Form) in the tax return with fiscally deductible items that could not be recorded in the accounts because they were not true and fair and, if they were not shown in the “EC Form” they would have no longer been eligible for tax deduction purposes. So, if, for example, the maximum limit of depreciation was 10%, but according to the “true and fair view principle”, the amount to be recognised in the financial statement was only 4%, a 6% amount could be shown in the EC Form and therefore be regularly deducted for tax purposes. This reform, effective since January 1st, 2004, was in principle meant to ensure that financial statements provide a “true and fair view” of the situation of a company because each tax item was admitted for deduction by being separately recognised in the tax return with the simultaneous recognition of a true and fair value in the balance sheet. Even in this case, the reason for the use of the conditional verb form will be clarified below. With the new reform of corporate law (Legislative Decree no. 6/2003), the term “true” passed, at least from a legal perspective, from referring to the truthfulness of financial reporting to meaning “contextual truthfulness of the balance sheet and profit and loss statement”.

Legislative Decree no. 6/2003 eliminated the last paragraph art. 2426 and point no. 14 of art. 2427 of the Civil Code. Consequently, effective from 2004, tax items without a correspondence with economic values could no longer be posted to the balance sheet and in the profit and loss account. The reform “eliminated” any interference of taxes in financial reporting. The use of inverted commas refers to the fact that, as we will see in the following pages, there was a wide gap between the regulations and corporate practice. According to the 2003 legislation, all the companies were legally provided with the appropriate technical tools to be able to prepare a true and fair financial statement without losing any tax benefit.

Obviously, compliance with the legislation required a significant amount of work from the people who had to prepare the financial statements, as they had to determine economically correct values stemming from the implementation of correct accounting criteria and then calculate the tax deductible amount, after which and not before that, they could prepare a true and fair financial statement and determine taxes correctly.

In 2008, the option to deduct, only in the tax return, tax-relevant amounts without an economic content was repealed. So, these are the requirements of the current legislation:

a) If a cost is recognised in the profit and loss account, it is theoretically tax-deductible; otherwise, if it is not recognised in the profit and loss account, it cannot be deducted from taxes;

b) Since the tax law has established some maximum limits for the deductibility of costs, if the item shown in the balance sheet is below that limit, tax deductibility will be total; otherwise, if the cost shown in the balance sheet exceeds this statutory limit, the excess of the cost may not be deducted.

After the 2008 reform, the requirement of entering only true and fair items in the balance sheet should have forced, at least theoretically, accountants to use correct reporting principles with the objective, inter alia, to facilitate international harmonization. Only later and particularly when filing tax returns and consequently determining the applicable taxes, would said accounting people monitor the presence of any discrepancy between balance sheet items and tax-deductible amounts.

At present, the financial statement is required to contain only true and fair values, regardless of the fact that any tax benefit might be lost. The presence of tax-deductible costs exceeding economic costs should not affect the financial statement, which should still be prepared based on true and fair values, outside any tax-related consideration (Nobes & Parker, 2016).

Empirical Research on the Tax Influence into Financial Reports

Therefore, at present, the financial statements of Italian companies that do not adopt IFRS must be prepared by using the fundamental (economically correct) principles set forth in the Civil Code and in the National financial report standards, which fully implement the Civil Code, while tax laws are only used to determine taxes.

If each company behaved this way, Italian financial statements would be true and fair. But unfortunately, this is not the actual situation.

The accountants often apply tax laws to valuate items of the balance sheet and profit and loss account. In Italy, this behaviour is defined as “tax interference”. The consequence of an improper use of tax laws is that the financial statement is not economically correct, so its values are not true and fair.

These considerations were deduced from the results of an empirical research I conducted with the aim of evaluating whether the Italian financial statements follow the true and fair principle or they are tainted by the application of principles which divert from the substantial representation of economic fact. The years considered for the research were 2003-2005 and 2009-2014 because, in these periods of time, the statutory and tax regulations have been subjected to modifications. Thus, the aim of the research was to verify if the change in the legislation had had an impact on the application of the principle that the items of financial report should be recorded according to the “true and fair view” principle.

The latter is still on-going, but the first results obtained from the analysis of financial statements show that balance sheet items are still “tax contaminated” today.

The first part of the research consisted in analysing the financial statements filed by a sample of 550 small and medium enterprises based in the entire Italian territory from 2003 to 2005

The second part of the research has been designed in successive stages and the first stage has been completed with the analysis of 500 financial statements of small and medium enterprises based in the entire Italian territory from 2009 to 2014. While the research is still on-going, these preliminary findings have already provided some interesting insight.

While we know that a sample of 500 companies is not statistically significant, we believe that the analysis of the results of the two investigations is still very interesting.

The objective of the research was not to identify the actual behaviour of all the Italian companies based on statistically significant samples, but rather to identify the most characterizing trends of financial reporting among Italian SMEs by analysing samples that could highlight some common trends in the valuation of the items of the balance sheets of SMEs (Small Medium Enterprise) that we may define as “no required IFRS adopters”.

The comparison of the results of the two studies after 10 years show how, in spite of the changes made to the legislation over this time span, the “tax contamination” of data in most financial statements has remained a constant feature of Italian financial statements. This means that, even if the regulatory framework is changed and in spite of time passing by, the people who prepare financial statement in Italy in most cases tend to enter values determined for tax purposes. Therefore, these items, affected by the tax legislation, do not provide a “true and fair view” of the financial standing of the company, but provide a financial statement that we would like to call only “tax-true and fiscally-fair”. As underlined by Nobes (2006), although we are in the presence of an international standardisation, in each country there is however the tendency to persist with the national traditions.

Before we pass to the analysis of the results of these two research studies, I would like to highlight how every reform passed by lawmakers specified the obligation to determine:

a) True and fair values; and

b) Tax details.

From 1991 to the present time, all the reforms have always required the dual calculation of the true and fair value and the tax amount. This is compulsory because the former value is the entry of the financial statement, while the latter is used to assess taxes.

The empirical research è stata condotta to investigate the correctness of reporting practices. This paper will only highlight the most interesting results of both studies.

The researchers interviewed or administered questionnaires to the accounting personnel who prepared financial statements in the companies surveyed. The main objective of both studies was to highlight the differences between true and fair values and tax-purpose values. The coincidence between the two amounts would show that the people who prepare financial statements determine balance sheet and profit and loss account values according to the tax law, because it is statistically impossible that the true and fair values and tax- purpose values are always the same. In case two values are coincident, the circumstance may be considered as a mere coincidence. However, the persistent equivalence of the values, in time, implies that the items of financial statement are nothing more than the tax deductible amount. This fact would prove that the financial reports are in according to the tax rules and not to the “true and fair view”; tax rules which should not taint the financial statement. It should be first pointed out that the goal of the tax law is to limit the discretionary power of taxpayers. These are very strict rules that establish threshold limits and prevent subjective action. These laws are not meant to determine true and fair profits, but rather to prevent the reduction of the taxable income.

On the other side, the purpose of statutory regulations and accounting standards is to help companies prepare true and fair financial statements. These are strict rules, but do not establish threshold limits and are highly subjective. Clearly, the coincidence between balance sheet items and tax-purpose values would indirectly demonstrate the application of tax regulations in annual reporting, with the consequent “contamination” of the financial statement by the tax law.

Questionnaire Used To Carry Out the Empirical Research

The questionnaire used for the empirical research included some questions on the items of financial reports. The goal of the answers was to understand whether the financial statement was drawn up following the principle of “true and fair” or according to tax norms which have no sort of connection with the profit and loss and balance sheet.

The question inserted in the questionnaire was chosen so as to point out the behaviour of accountants regarding the main financial report items which require a subjective evaluation.

In short, the common part of the two questionnaires can be summarised as follows:

We will try to highlight the reasons why financial statements can be prepared by entering tax values in balance sheet and profit and loss account items by analysing and discussing the outcome of these two surveys. There are three main reasons:

1. Determining the tax values to be used for the calculation of taxes and true and fair amounts requires a double calculation rather than directly entering tax values in financial statements. This implies a double administrative work and double efforts dedicated to the preparation of the balance sheet and profit and loss account.

2. Booking non-deductible values requires double calculations that extend over time, since the operating result is determined on the basis of true and fair items, while the tax income derives from the use of the values required by the tax law. This requires double determinations for the entire period covered by the differentiation between tax value and true and fair details (e.g. for the depreciation of tangible assets): the double calculation period spans throughout the life of the multi-year asset, as the differences between tax values and true and fair items will cover the entire life of the multi-year asset and, in some cases, even several years thereafter).

3. Often posting true and fair items causes the loss of tax benefits that would instead have been enjoyed if tax values had been reported. Obviously, this issue is perceived as very important by Italian companies, with the consequent tendency to waive the true and fair view principle in favour of lower taxes payable.

So, to introduce the discussion, we may start by saying that the research studies described above prove unequivocally that the “tax contamination” of Italian financial statements is very frequent, as demonstrated by the results of the 2003-2005 and 2009-2013 surveys. We specifically selected these studies, which have been conducted at a 10-year distance from one another, with the intention of highlighting the evolution of the behaviour of Italian SMEs in this domain.

Results Obtained From the Analysis of the Questionnaire

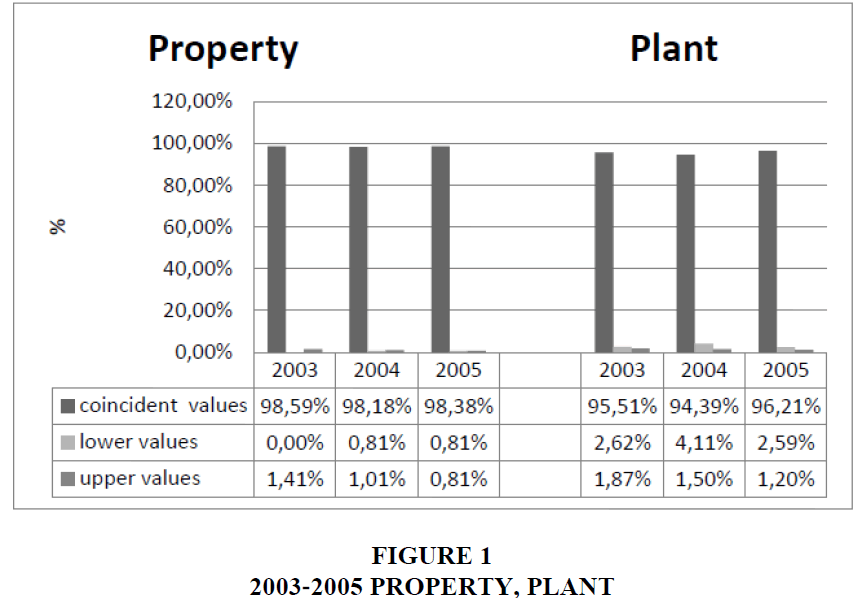

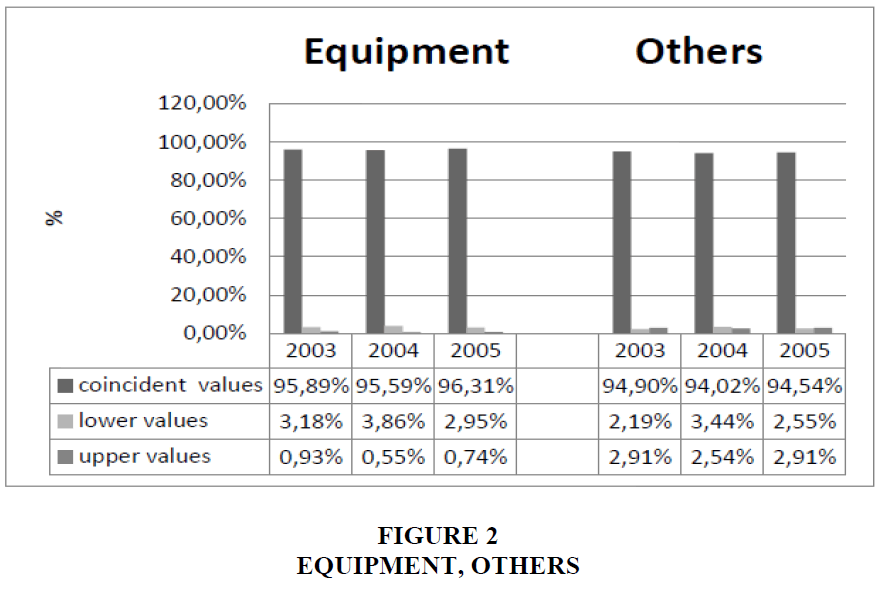

From the analysis of answers obtained in the questionnaires, it was observed how, very frequently, the accountants apply the tax rules instead of the “true and fair view” principle (Figures 1 and 2). In particular, with reference to the single answers, the results of the questionnaire were as follows:

1) How did the depreciation of tangible assets - property, plant and equipment - presented in the profit and loss account compare to tax-deductible values? Were they coincident, lower or upper values?

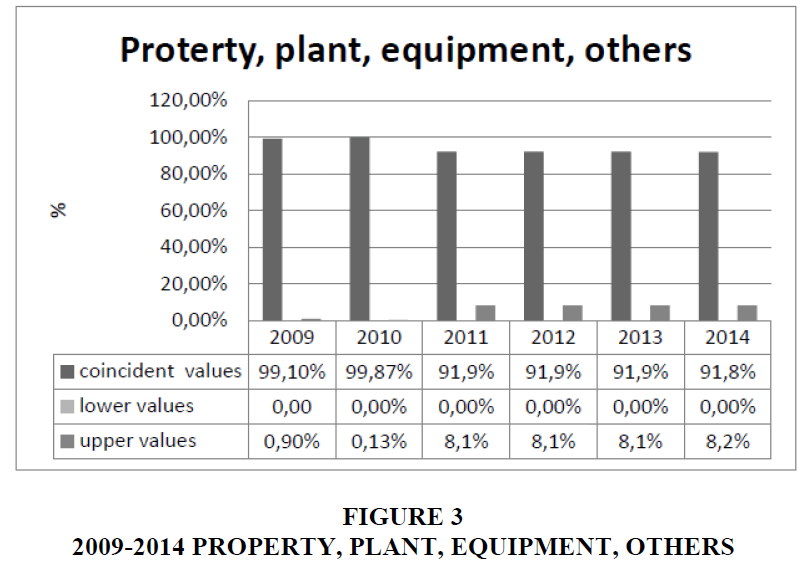

For tangible multi-year assets, a clear prevalence has become clear over time of the coincidence between values determined according to economic-technical criteria and values required by the tax law as a maximum deductibility limit, compared to the cases where a divergence between the two amounts (true and fair value and tax value) is observed. As we see, the percentages of coincidence were even higher in 2003-2005. From 2009 to 2014, the coincidence percentages between balance sheet items and tax values has reduced by a few points, but still remains very high, so much so that it exceeds 91% every year. Clearly, there has been in the past and there still is a “tax contamination” of balance sheet items because it is impossible for the maximum deductible limit to exactly coincide with the true and fair depreciation. As regards this item, we may therefore state that there has been an improper (wrong) application of the tax law in the financial statement (Figure 3).

Furthermore, we should point out that there should have been a significant differentiation between 2003 data and 2004 data. As changes in the legislation prove, in fact, while tax values could be recognised in the financial statement and highlighted in the Notes, in 2003, in 2004 this was no longer allowed, as companies had to fill the EC Form to indicate the deductibility even of portions of items not recognised in the financial statement, but deductible.

The divide that should have logically characterised the two periods was not detected, as 2003 data are very similar to 2004 data (with a relative absence of particular explanations in the explanatory notes concerning items recognised only for tax purposes and not “true and fair”). This means that items were posted in 2003, 2004 and 2005 financial statements according to the same principles: those of tax accounting. Simply, the financial statement contained items for a maximum tax deductibility amount without explaining that at least a portion of that amount was not economically true/reliable/faithful. Therefore, the 2004 reform did not materially affect accounting practices in Italy, because the valuation criteria did not change.

We should point out that the percentage of lower values is zero. In order not to miss the option to deduct amortization and depreciation that would be fiscally irrelevant if they were not reported, no company seems to have recognised values lower than the maximum tax deductibility limit. This is a further proof of the “tax contamination” of financial statements.

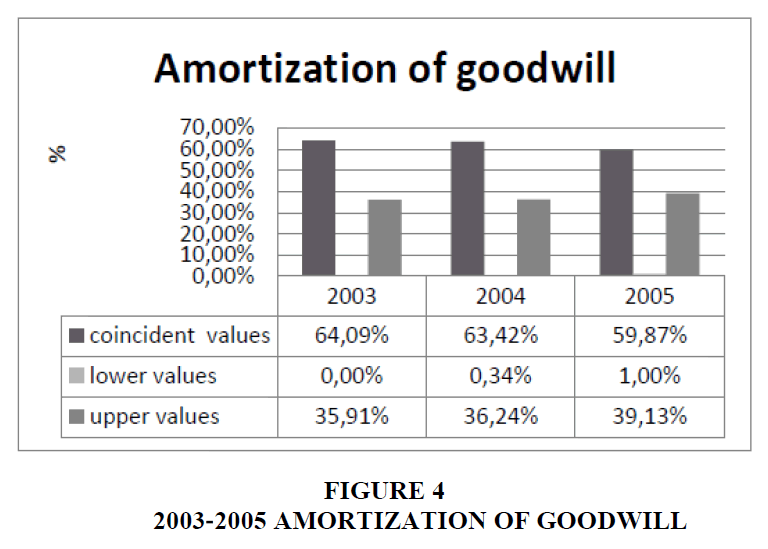

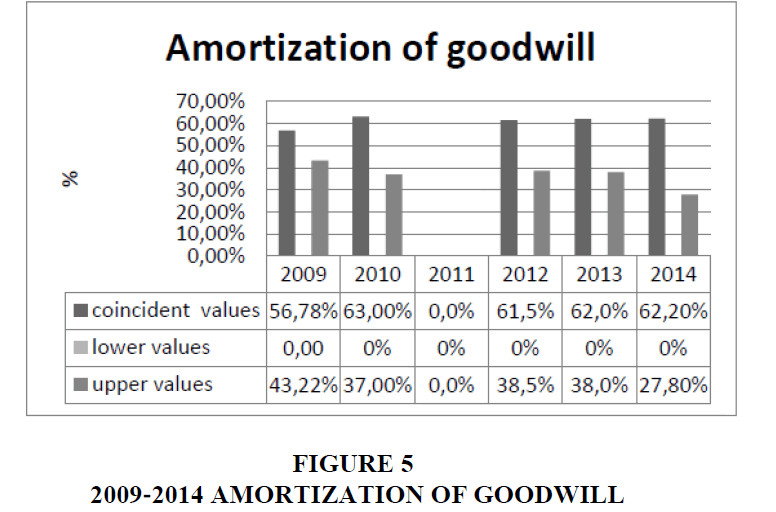

2) How did the amortization of goodwill on the profit and loss account compare to taxdeductible values?

The amortization of goodwill shows a high coincidence rate, although lower than that of the depreciation of tangible assets, between tax value and true and fair items. To better understand the situation, we should point out how in 2005 the tax law concerning this item was amended: while, before 2005, 1/10 (one tenth) of the amortization could be deducted, in 2005 the proportion was changed into 1/18 (one eighteenth). In spite of this, over 60% of the surveyed companies considered the 1/10 amortization of goodwill economically correct for 2003 and 2004 and 1/18 for 2005, which undoubtedly shows that the balance sheet item was determined on the basis of the tax law. Any other interpretation would overturn the rules of statistics. From 2003 to 2005 we can notice a slight increase in the upper value, but this amount is too limited to account for the facts observed above (Figures 4 and 5).

The situations did not change much after a decade. In the 2009-2014 period, over 62% of the companies considered tax amortization as “true and fair”, as there is a perfect coincidence between the two amounts.

This shows that financial statements are often still prepared by applying taxation criteria rather than economic criteria. As a consequence, more and more items are true and fair only from a tax perspective, rather than as they should be (Figures 6 and 7).

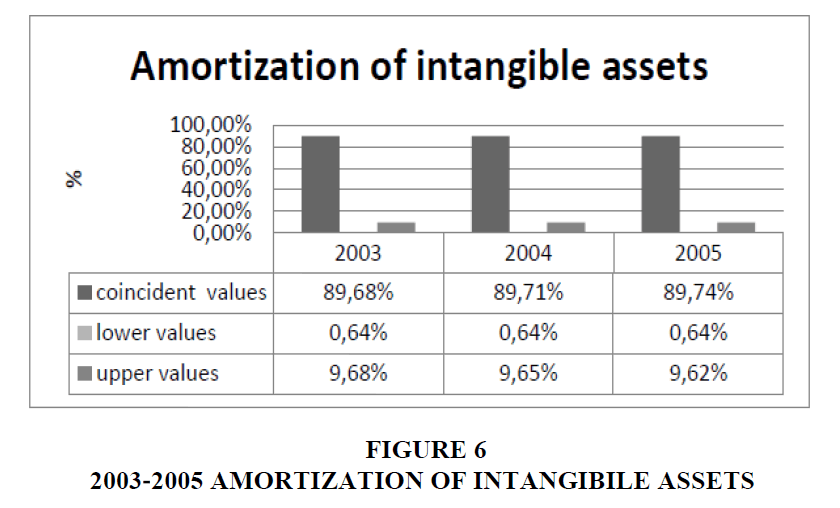

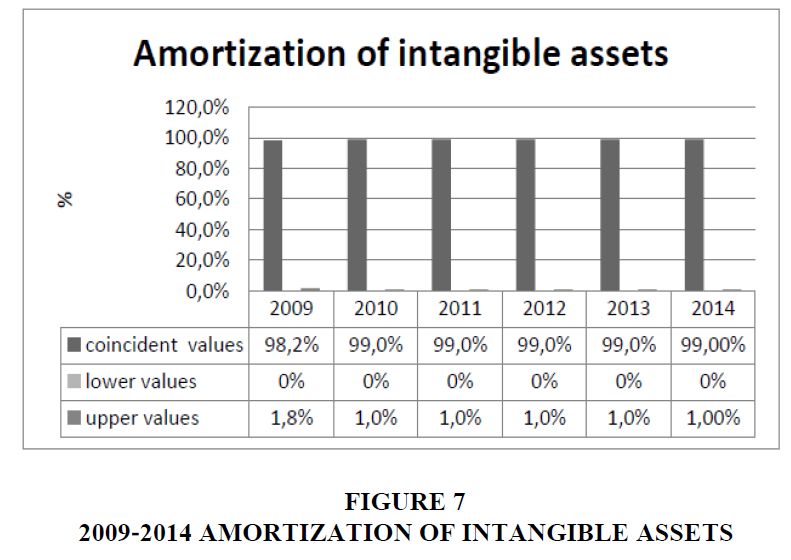

3) How did the amortization of intangible assets presented in the profit and loss account compare to tax-deductible values?

The analysis of the amortization of intangible assets shows how the interference of tax values has increased in financial reporting.

In 2003-2005, almost 90% of companies believed that tax amortization was a true and fair value. In 2009-2014, this percentage reached 99%. There is no need to further investigate the issue. As a matter of fact, it clearly appears that the amortization booked in the financial statement is the tax-deductible value. Over time, the “tax contamination” of this item increased and the financial statement has increasingly become only “tax-true and fiscally-fair”.

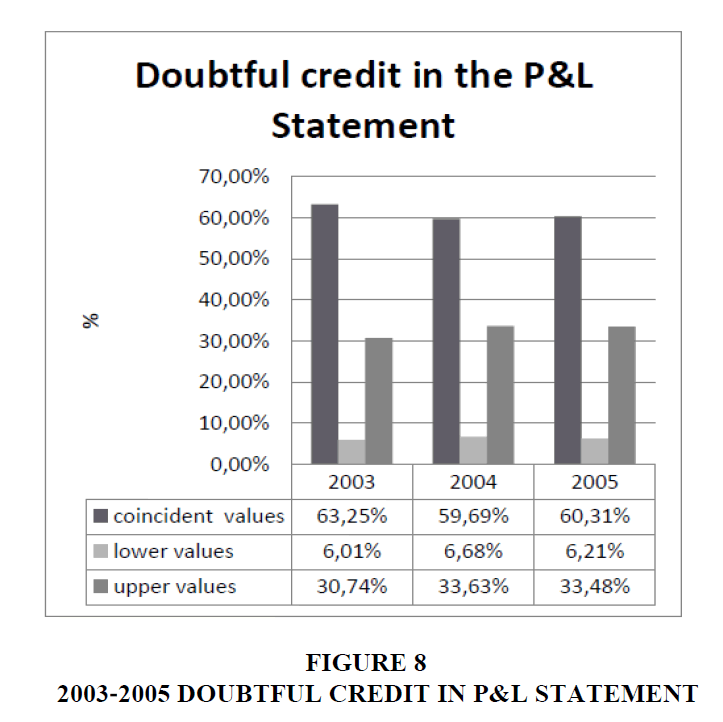

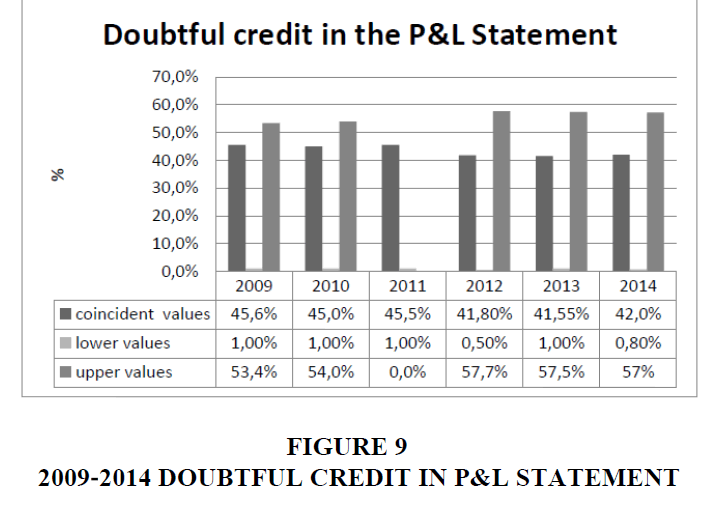

4) How did Doubtful Credit in the Profit and Loss Account Compare to Tax-Deductible Values?

The results of the survey concerning doubtful debts have been summarised as follows (Figures 8 and 9):

Doubtful credit (or bad credit) is the only item in the financial statement where the true and fair value reflects a change over time. While, in the 2003-2005 periods, the coincident values accounted for about 60%, in the 2009-2014 periods they were reduced to about 42%. Simultaneously, values recognised in the financial statement were higher, even if greater than those deductible for tax purposes.

The situation reveals two important aspects:

1. Bad or doubtful credit is the only item in the financial statement that presents considerably higher values than tax items. For this item we may say that the use of the “true and fair” notion is more widespread. This specific situation is certainly due to the deteriorated national economic situation, which caused the number of bankrupt or insolvent companies to increase.

2. In spite of the above, we should still point out that a 42% of companies considering a bad credit percentage of 0.50% to be “true and fair” is a definitely very high percentage. It is almost impossible to believe that 42% of Italian companies consider it sufficient to write down bad credit for 0.50% and, even more surprisingly, that said bad credit is exactly equivalent to the tax percentage. Even though for bad or doubtful credit the situation looks less evident than for the items analysed in the following pages, we may still say that many Italian companies use the bad credit percentage established by the tax law without having a clear idea of what is the amount of the true and fair value of the balance sheet item. Although to a lesser extent, the notion of “true and fair only for tax purposes” is also found in connection with the writing off of trade receivables, which, almost by magic, for over 42% of Italian companies seem to perfectly coincide with the items posted under the tax law (Figure 10).

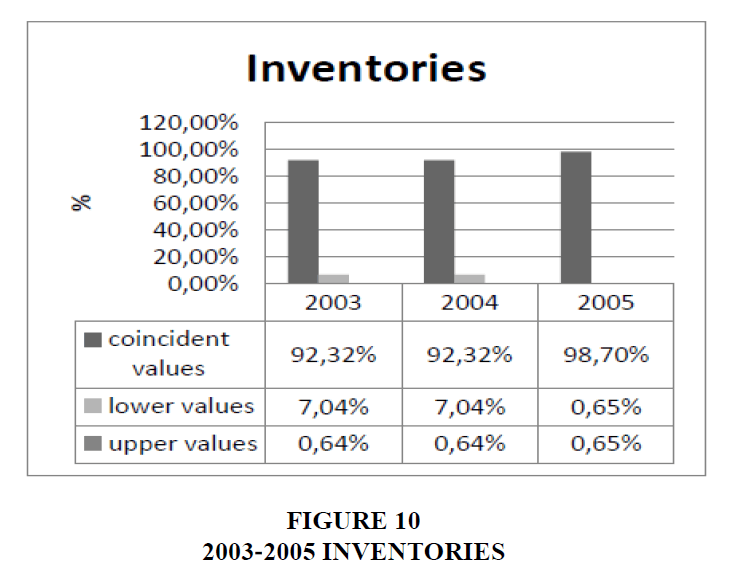

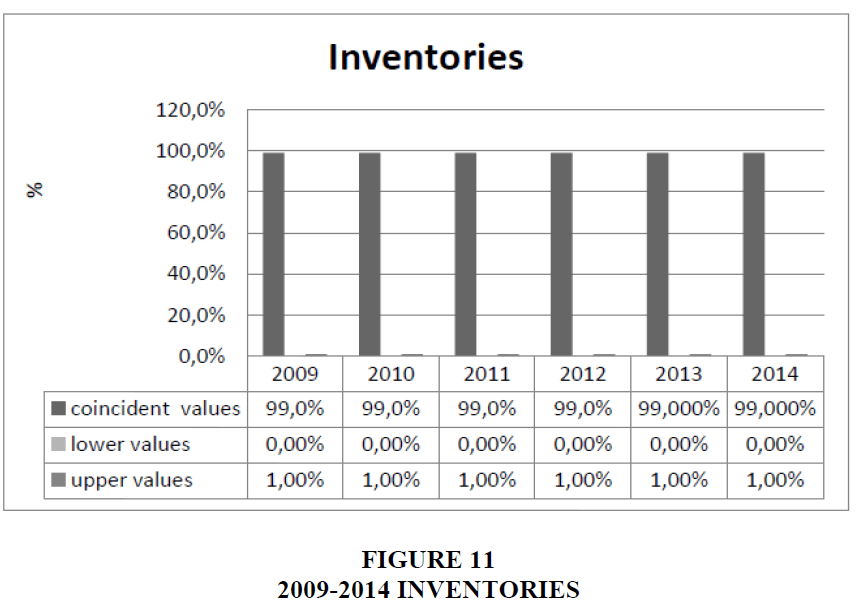

5) How did Closing Inventories in the Profit and Loss Account Compare to Tax- Deductible Values?

Even for inventories, we observed the same situation described for the other items: clearly enough, valuation according to statutory requirements and valuation according to accounting standards coincide with the tax value. All this confirms our previous considerations: unless we consider the results of the survey to be mere random occurrences, most financial reports seem to adjust balance sheet values to tax values with the purpose of avoiding troublesome calculations and double data processing (for tax purposes or to give a true and fair view). And obviously, one primary purpose is to avoid not being able to use the tax deduction option for profit and loss account items, which, if of a lower amount than the tax value, would not be considered as a “tax cost”. In summary, the tax law seems to deeply affect the behaviour of the directors of most Italian companies during the valuation of their inventories (Figures 11 and 12).

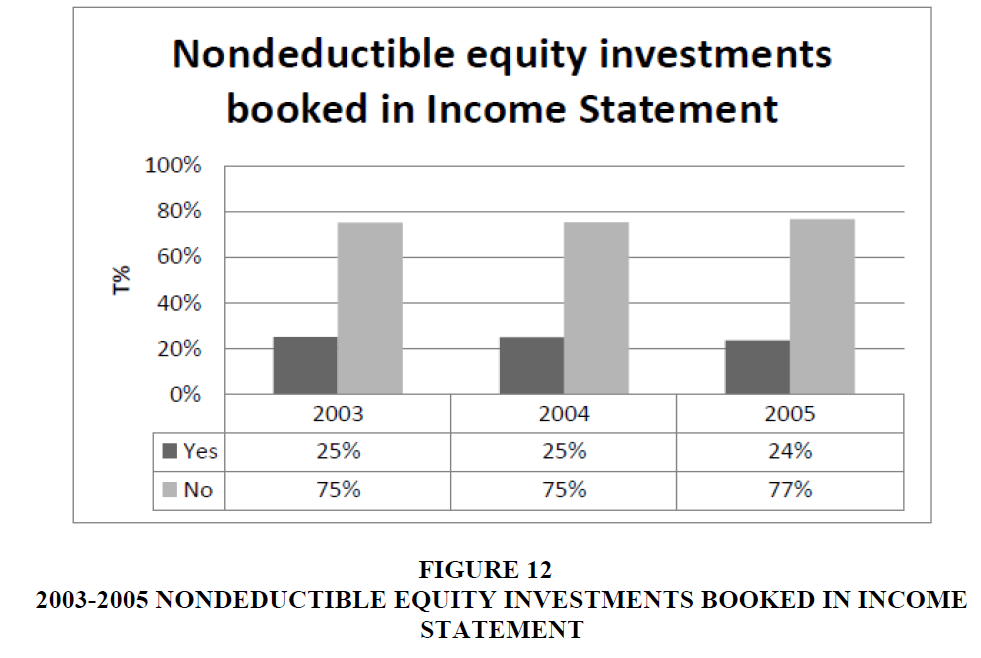

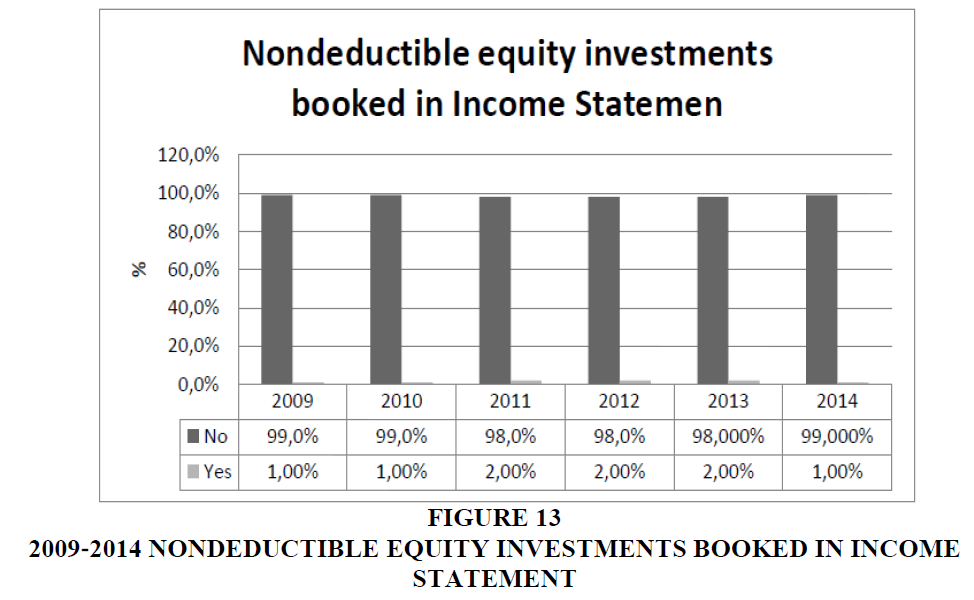

6) Did you write down Non-Deductible Equity Investments?

Even for this item there is a substantial overlapping between the value recognised in the balance sheet and the tax deductible amount, even though the tax law is much more complex and structured than the indications of accounting standards and the Civil Code. We may therefore state that equity investments are written down in the financial statement only if they are simultaneously tax deductible; otherwise no write-down is made, even though it would be required for a “true and fair view” (Figure 13).

This item is added to those that transform the financial statement from a “true and fair” report to a “tax-true and fiscally-fair” report. We know that for a report to be a true and fair view of the financial standing of a company, it must faithfully reflect its global financial situation. The outcome of the studies reported above shows that so many balance sheet items do not reflect real facts, but are only items considered to be deductible by the Inland Revenue, with very strict limits. The financial statements of many Italian small and medium enterprises increasingly depart from a fair presentation of corporate facts. This is the reason why we say that financial statements are becoming only “tax-true and fiscally-fair” documents.

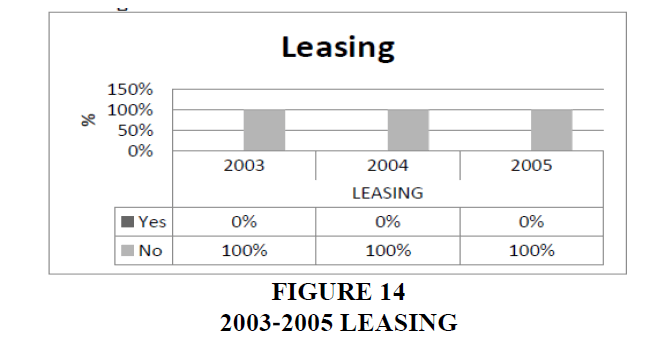

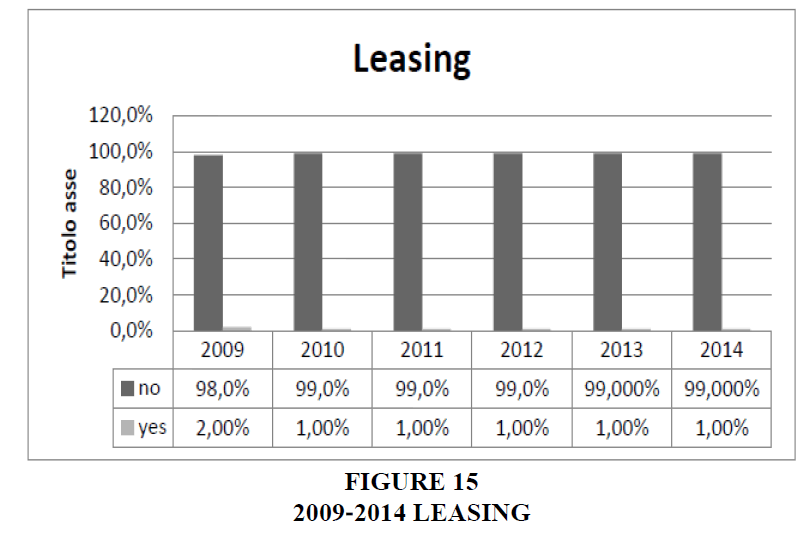

7) Did you enter into Leasing Agreements for a Term that Does Not Permit the Deduction of Lease Payments?

The questionnaire contained a question concerning the duration of lease agreements. In particular, companies were asked to say if they had signed lease agreements that did not allow for the tax deductibility of lease payments. These were the answers obtained (Figures 14 and 15):

There is no need here to further comment the data shown in the Table 1 above. Virtually all the Italian companies sign lease agreements based on the tax legislation with the objective to entirely deduct their annual payments. For this item there is a perfect overlapping between the tax value and the balance sheet item. So we see the financial statement becoming increasingly “true and fair” only for tax purposes.

| Table 1: Questionnaire | ||

| Question | Questions | Answers |

|---|---|---|

| 1 | How did the depreciation of tangible assets - property, plant and equipment - presented in the profit and loss account compare to tax- deductible values? | Coincident values |

| Lower values | ||

| Upper values | ||

| 2 | How did the amortization of goodwill on the profit and loss account compare to tax-deductible values? | Coincident values |

| Lower values | ||

| Upper values | ||

| 3 | How did the amortization of intangible assets presented in the profit and loss account compare to tax-deductible values? | Coincident values |

| Lower values | ||

| Upper values | ||

| 4 | How did doubtful credit in the profit and loss account compare to tax-deductible values? | Coincident values |

| Lower values | ||

| Upper values | ||

| 5 | How did closing inventories in the profit and loss account compare to tax-deductible values? | Coincident values |

| Lower values | ||

| Upper values | ||

| 6 | Did you write down non-deductible equity investments? | No |

| Yes | ||

| 7 | Did you enter into leasing agreements for a term that does not permit the deduction of lease payments? | No |

| Yes | ||

| 8 This question was asked only in the 2003-2005 study | Did cleaning up financial statements from tax items create a considerable increase in your expenditure over time in the reporting process? | No |

| Yes | ||

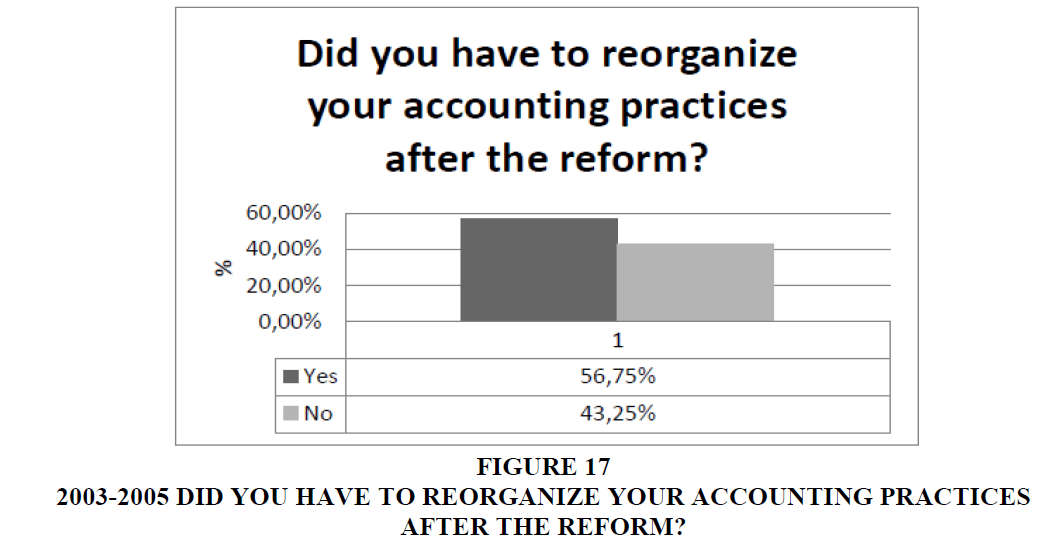

| 9 This question was asked only in the 2003-2005 study | Did you have to substantially reorganize your reporting process after the 2004 reform? | No |

| Yes | ||

| 10 This question was asked only in the 2009-2014 study | Which provisions did you adopt for your reporting process? (Multiple answers are permitted) a) Civil code (article 2423 and the following) b) National accounting principles and/or International Financial Reporting Standards c) Tax law |

Civil Code |

| Reporting Standards | ||

| Tax law | ||

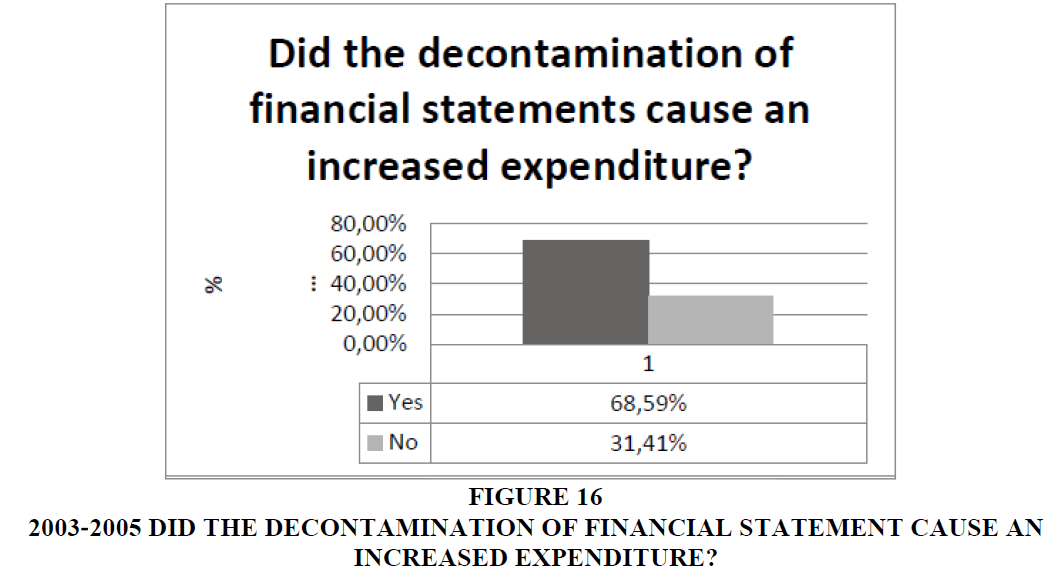

8) Did Cleaning Up Financial Statements from Tax Items Create a Considerable Increase in your Expenditure over Time in the Reporting Process?

9) Did you have to Substantially Reorganize your Reporting Process after the 2004 Reform?

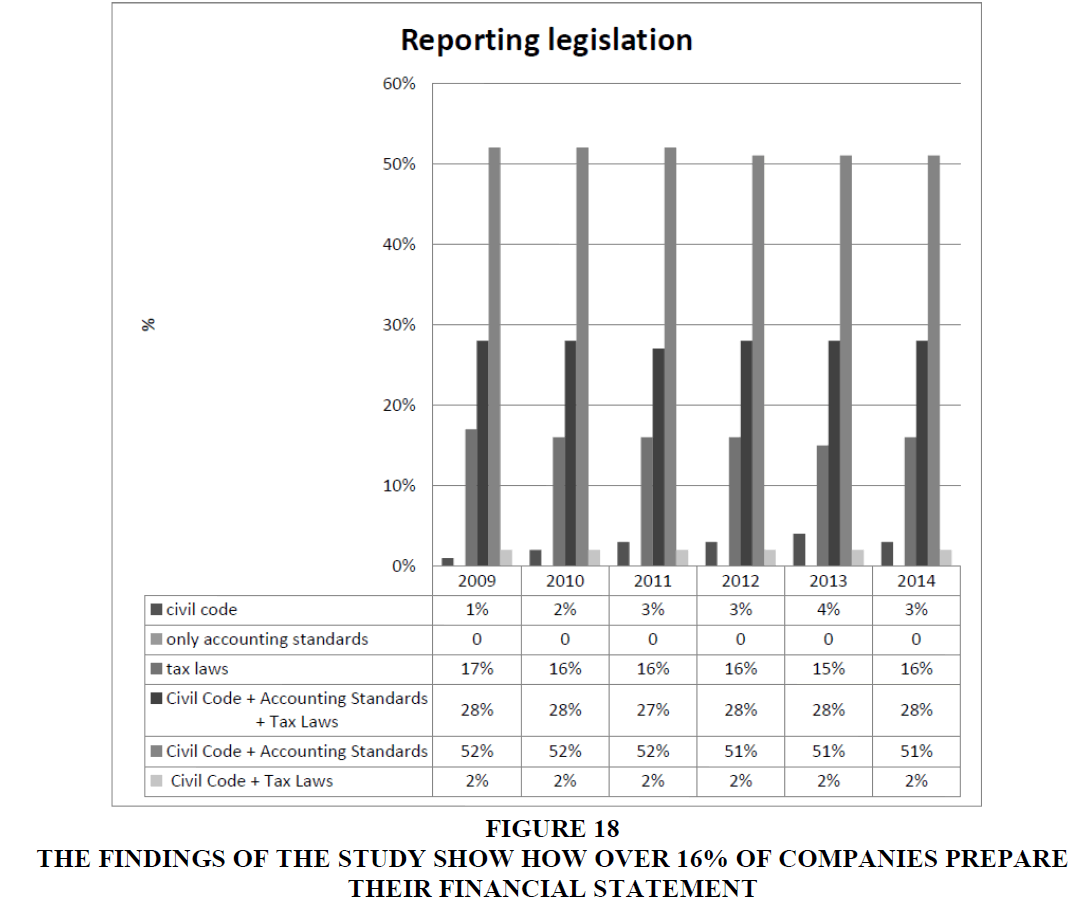

10) Which Provisions did you adopt for your Reporting Process? (Multiple Answers are Permitted)

a) Statutory provisions (article 2423 and the following)

b) National accounting principles and/or International Financial Reporting Standards

c) Tax law

Questions 8 and 9 were asked only in the questionnaire of the 2003-2005 study. They could be defined as “psychological questions” since their goal was not to explore the reporting practices of the company, but rather to assess the psychological impact of the reforms and the thought of the personnel entrusted with accounting tasks.

In theory, all the companies that had made significant changes to their accounting practices to implement the new provisions of the reform effective from January 1 st , 2004 should have answered “Yes” to questions 8 and 9. The answers received by the researchers are shown below (Figures 16 and 17).

These results are not peculiar per se. However, the bizarre element is that no differentiation is seen between 2003 and 2004-2005 items for all the financial statements analysed in the study. The reality is that companies generally tend to recognise tax values before and after the reform in the certainty that they were “true and fair”. As a consequence, the reform cannot be said to have significantly impacted the situation, as the analysis of the data provided above would seem to prove. Obviously, this is part of the typical attitude of resistance to change of each organization, where each change is perceived as a burden even if it has virtually no consequence (Figure 18).

Figure 18: The Findings Of The Study Show How Over 16% Of Companies Prepare Their Financial Statement

Question no. 10 was asked in the 2009-2014 questionnaire to challenge the competency of the people who prepared financial statements, in order to assess whether they were aware that recognising tax items in the balance sheet was wrong from an accounting perspective, unless the items were also “true and fair”. The answers to question no. 10 were.

The findings of the study show how over 16% of companies prepare their financial statements in compliance with tax laws. This means that over 16% of the people who prepare financial statements do not know that the document must meet the “true and fair view” requirement and not only comply with the tax law.

Only 51-52% of companies prepare their reports correctly in compliance with the Civil Code and accounting standards. This, while showing, on the one hand, that there is still much to do to spread the correct reporting methodology, raises another issue, on the other: since we have shown how in many cases balance sheet items derive from the enforcement of tax laws and therefore are not true and fair, answer no. 10 shows, at least partially, some bad faith or, to put it better, the awareness that the correct methodology would require compliance with the Code and accounting standard and not with tax laws. Since many items coincide with tax values, it is statistically unlikely that the tax value coincides with the true and fair item. So question no. 10 reveals that many companies know what they should do, but recognise incorrect values in financial statements for convenience and to avoid a double administrative work.

Conclusion

The findings provided above suggest that many Italian financial statements of small and medium enterprises that are “no IFRS adopters” are “true and fair” not on the whole, but only from a tax accounting perspective.

This has three significant sets of implications:

1) Disclosure implications – A financial statement prepared only according to tax accounting rules does not reflect the actual financial standing of the company. Communication with the external world is biased, with the consequence that the stakeholders of the organization (e.g. corporate creditors, shareholders, employees, backers and investors…), for whom the financial statement is the source of information concerning the entity, are presented with data that do not actually describe the real situation, either in strictly financial terms or as regards the larger environmental impact of the organization, including its economic performance (Hopwood, 2009). The ultimate consequence of this is that external stakeholders are left in the condition of making decisions based on values that do not reflect the real situation of the enterprise in which they have an interest (Burchell et al., 1980; De Franco et al., 2011; Mouritsen & Kreiners, 2016).

2) Internal management implications In most cases, general accounting books are also the source of useful information to be used for the control of the organization; the determination of the costs and returns of a product, calculated on the basis of tax values without any economic content, potentially leads to a wrong decision-making process, because they are grounded on false and unfair information and assumptions (Hoopwood, 1990; Ballwieser et al., 2012; Hopwood, 2000).

I apologize with the reader for using this comparison, but this behaviour reminds me of someone who reviews the financial statement in depth in the awareness that it is false. To implement a decision-making process on data without a concrete meaning may lead to management policies not aimed at maximizing efficiency and effectiveness, which inevitably adversely impacts the cost-performance of the company (Ewert and Wagenhofer, 2005; Hopwood, 1972; Hopwood, 1973, Hopwood, 1976; Hopwood, 1990; Hopwood, 1974).

3) Legal implications – Entering non-true and non-fair values in a financial statement implies that the “true and fair view” requirement set forth in art. 2423 of the Civil Code is not fulfilled. This invalidates and eventually nullifies the financial statement. As a consequence, anyone having a legal interest may challenge that financial statement in a trial. Failure to meet the requirements of providing a “true and fair view” of the financial situation of a company makes that company vulnerable because anyone having any kind of interest, including non-commercial interests or other interests not related to equity, may bring an action against that financial statement before a judge in a court.

Recognising false values is obviously illegal, regardless of the fact that said values contain an over-or under-valuation of income.

In fact, the instrument is invalidated both in the event that costs contain a negative income component that does not exist from an economic point of view (e.g. booking a greater tax cost than the commercially true value) and in the event that a cost is not booked in the financial statement even though it should have been (e.g. recognition of a lower cost than the true value of the production factor). The first type of behaviour is generally implemented to reduce the taxable income, while the second option is used when the need is felt to do some “window dressing” with the purpose of presenting a corporate situation more favourable than the real situation, in the awareness that this would cause an increase of taxable income.

The analysis of the reasons underlying the adoption of such an illegal accounting practice has no statutory significance. In fact, it does not seem possible to “index” the reasons why an existing cost is not booked or a non-existent value is booked in the accounts. The “justifications” that underlie the wrong accounting may, at most, be taken into consideration when tackling the issue of the criminal significance of the invalidity. In Italy, in criminal charges of false accounting, the reason takes on a legal significance, which does not happen with civil offences.

A false financial statement is an illegal financial statement and the resolution made to approve such a document is null and void, since it violates the right of information that is today unanimously recognised to all the external stakeholders of a company.

If the aforesaid statements are shared, it is not possible to deny the nullity of a financial statement that we may defined as “contaminated” by tax interferences.

If, on the one hand, recognising a high non-existent cost or not booking a substantial “real” cost would undoubtedly invalidate the financial statement, on the other hand, we find it natural not to consider valid and “true” a document presenting exactly the situations described above after “importing” in the profit and loss account and balance sheet tax values that have nothing to share with “economically correct” accounting values.

In this regard, we cannot but also mention the technical problems companies certainly encounter when faced with the calculation of a true and correct income, economic result and capital. Managing tax data is complex per se and the coexistence of said values with general ledgers of different amount, i.e., “statutorily true”, inevitably introduces more accounting complexity. However, the problem cannot be resolved, because any action undertaken to simplify accounting practices by “contaminating” the financial statement with tax accounting is an illegal behaviour under the legislation. For a “true and fair view” to be such, in fact, there must be a previous valuation of costs and revenues, without which no information can be posted to a financial statement to be defined as “legal”.

At this point, we should wonder whether the introduction in the financial statement of subjective tax-deductible values (estimates and guesswork) automatically and unequivocally causes the nullity of the meeting’s resolution. The answer to this question is not univocal.

If the tax assessment coincides with the economic substance of the item, the financial statement is true and consequently perfectly legal. However, in this case, the lawfulness of the financial statement does not derive from the fact that posting tax items in the balance sheet and profit and loss account is legally acceptable pursuant to art. 2423 of the Civil Code, but rather from the fact that those values correspond, by mere coincidence, with the economically correct determination of the event to be reflected in the financial statement.

If, on the contrary, the tax item does not identify the value determined according to statutory criteria, then its recognition in the financial statement creates the conditions for which the approval resolution can be nullified.

Uncritically importing tax values in the financial statement implies the nullity of the approval resolution due to the unlawfulness of the scope, provided, of course, that said amounts do not economically correspond to the reality to be described by the balance sheet, profit and loss account and explanatory notes. In this case, the mere consideration of the equivalence of the tax cost and the economically correct cost is not significant for the purpose of a possible unlawfulness of the financial statement.

The findings of the surveys conducted in the years 2003-2005 and 2009-2014 suggest that there is still a long way to go before really true and fair financial statements be prepared (Zareh Asatryan et al., 2016).

Changing deeply-rooted behaviour (introducing tax values rather than true and fair amounts in financial statements) is a steep road to walk and a very long one indeed, certainly difficult to complete. The only factor that may lead to achieve this objective is a general cultural change (Hopwood, 1999; Hopwood et al., 2007; Hopwood, 1983), which means companies should slowly start to understand the significance of the internal, external and legal reasons that underlie the suggestion or better the obligation, to prepare true and fair financial statements. The road will be long and difficult, but the cultural changes that have taken place in Italy over the last few years in terms of corporate disclosure allow some optimistic predictions on the fact that the objective to have true and fair financial statements without considering the related tax values may be achieved – slowly, but relentlessly.

EndNotes

1 For a summary of the accounting legislation of different Countries, Alexander, D. and Schwencke, H.R., 1997; Alexander, D. and Schwencke, H.R., 2003; Haller, A., 1992; Aisbitt, S., 2002 Haller, A., 2002; Haller, A., et al., 2004; Anda, E.O., Puiga, X., 2005; Benston et al., 2006; Wagenhofer, A., 2006; Burchell, S. and Clubb, C., and Hopwood A.G. 1985; Anda, E.O., Piuga, X. 2005; Nobes, C. and Schwencke, H. R. 2006; Nobes, S.W. 2013; Olderllheide, D., 2001; Delvaille, P., Ebbers, G. and Saccon, C., 2005; Cristea, S.M. and Saccon, C., 2008; Lewis, A., Carrera, S., Philip Jones, J.C., 2009 Alexander, D., Nobes, C., 2013; Nobes, C., Parker, R., 2016; .

2 Nobes, C.W., 1979, Nobes, C.W.,1980; Nobes, C.W., Haller, A. and Gee, M., 2010; Wagenhofer, A., Goxa, R.T., 2009; Nobes, C.W. and Schwencke, H.R., 2006; Hoogendoorn, M., 1996; Lamb, M., 2005; Lamb, M., and Nobes, C., et al., 1998; Kleven, H.J., Kreiner, C.T., Saez, E., 2016.

3 The Italian legislation did not require an “impairment test”, but amortization of the item.

References

- Aisbitt, S. (2002). Tax and accounting rules: Some recent developments. European Business Review, 14(2), 92-97.

- Alexander, D. (1993). A European true and fair view? European Accounting Review, 2(1).

- Alexander, D. & Schwencke, H.R. (1997). Accounting changes in Norway: A description and analysis of the transition from a continental towards an Anglo-Saxon perspective on accounting. 20th Annual Congress of the European Accounting Association, Graz, Austria.

- Alexander, D. & Schwencke, H.R. (2003). Accounting change in Norway. European Accounting Review, 12(3), 549-566.

- Alexander, D. & Jermakowicz, E. (2006). A true and fair view of the principles/rules debate. Abacus, 42(2).

- Alexander, D. & Nobes, C. (2013). Financial accounting: An international introduction, Pearson.

- Anda, E.O. & Puiga, X. (2005). The changing relationship between tax and financial reporting in Spain. Accounting in Europe, 2(1), 195-207.

- Ballwieser, W., Bamberg, G., Beckmann, M.J., Bester, H., Blickle, M., Ewert, R., Wagenhofer, A. & Gaynor, M. (2012). Agency theory, information and incentives. Springer Science & Business Media.

- Benston, G.J., Bromwich, M., Litan, R.E. & Wagenhofer, A. (2006). Worldwide financial reporting: The development and future of accounting standards. Oxford University Press.

- Burchell, S., Clubb, C., Hopwood, A., Hughes, J. & Nahapiet, J. (1980). The roles of accounting in organizations and society. Accounting, Organizations and Society, 5(1), 5-27.

- Burchell, S., Clubb, C., Hopwood, A.G. (1985). Accounting in its social context: Towards a history of value added in the United Kingdom. Accounting, Organizations and Society, 10(4), 381-413.

- Cristea, S.M. & Saccon, C. (2008). Italy between applying national accounting standards and IAS/18 IFRS, in Romanian Accounting Profession?s Congress (Bucharest: CECCAR).

- Delvaille, P., Ebbers, G. & Saccon, C. (2005). International financial reporting convergence: evidence from three continental European countries. Accounting in Europe, 2(1), 137-164.

- De Franco, G., Kothari, S.P. & Verdi, R.S. (2011). The benefits of financial statement comparability. Journal of Accounting Research, 49, 895-931.

- Di Pietra, R., McLeay, S. & Riccaboni, A. (2001). Regulating accounting within the political and legal system. Contemporary Issues in Accounting Regulation, Chapter 3, 59-78, Springer.

- Ewert, R. & Wagenhofer, A. (2005). Economic effects of tightening accounting standards to restrict earnings management. The Accounting Review, 80(4), 1101-1124.

- Gavana, G., Guggiola, G. & Marenzi, A. (2013). Evolving connection between tax and financial reporting in Italy. Accounting in Europe, (10).

- Godfrey, J.M. & Chalmers, K. (2007). Globalisation of accounting standards, Edgar Elgar.

- Graham, J.R., Raedy, J.S. & Shackelford, D.A. (2012). Research in accounting for income taxes. Journal of Accounting and Economics, 53(1-2), 412-434.

- Haller, A. (1992). The relationship of financial and tax accounting in Germany: A major reason for disharmony in Europe. The International Journal of Accounting, 27(4), 310-323.

- Haller, A. (2002). Financial accounting developments in the European Union: Past events and future prospects, European Accounting Review, 11(1), 153-190.

- Haller, A., Walton, P. & Raffournier, B. (2003). International accounting. Cengage Learning EMEA.

- Haller, A. & Eierle, B. (2004). The adaptation of German accounting rules to IFRS: A legislative balancing act, Accounting in Europe, 1(1), 27-50.

- Hanlon, M. & Heiztman S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2-3), 127-178.

- Hopwood, A.G. (1972). An empirical study of the role of accounting data in performance evaluation. Journal of Accounting Research, 10, 156-182.

- Hopwood, A.G. (1973). An accounting system and managerial behaviour. Lexington Books.

- Hopwood, A.G. (1974). Leadership climate and the use of accounting data in performance evaluation. The Accounting Review, 49(3), 485-495.

- Hopwood, A.G. (1976). Accounting and human behaviour. Prentice Hall.

- Hopwood, A. (1987). The archaeology of accounting systems. Accounting, Organizations and Society, 12(3), 207-234.

- Hopwood, A.G. & Peter, M. (1994). Accounting as social and institutional practice. Cambridge University Press, 24.

- Hopwood, A.G. (1999). Situating the practice of management accounting in its cultural context: An introduction. Accounting Organizations and Society, 24(5-6), 377-378.

- Hopwood, A.G. (1983). On trying to study accounting in the context in which operates. Accounting Organizations and Society. 8(213), 287-305.

- Hopwood, A.G. (1990). Ambiguity, knowledge and territorial claims: Some observations on the doctrine of substance over form. British Accounting Review, 1, 79-87.

- Hopwood, A.G. (1990). Accounting and the pursuit of efficiency. Accounting, Auditing & Accountability Journal, 1, 238-249.

- Hopwood, A.G. (2000). Understanding financial accounting practice. Accounting, Organizations and Society, 25(8), 763-766.

- Hopwood, A.G. (2007). Whither accounting research? The Accounting Review, 82(5), 1365-1374.

- Hopwood, A.G., Chapman, C.S. & Shields, M.D. (2007). Handbook of management accounting research. Volume 1, Elsevier.

- Hopwood, A.G., Chapman, C.S. & Shields, M.D. (2007). Handbook of management accounting research. Volume 2, Elsevier.

- Hopwood, A.G. (2008). Changing pressures on the research process: On trying to research in an age when curiosity is not enough. European Accounting Review, 17(1), 87-96.

- Hopwood, A.G. (2009). Accounting and the environment. Accounting, Organizations and Society. 34(3-4), 433-439.

- Hopwood, A.G. (2009). The economic crisis and accounting: Implications for the research community. Accounting, Organizations and Society, 34(6-7), 797-802.

- Hoogendoorn, M. (1996). Accounting and taxation in Europe - A comparative overview. European Accounting Review, 5.

- Lamb, M., Lymer, A., Freedman, J. & James, S. (2005). Taxation, an Interdisciplinary Approach to Research. Oxford University Press.

- Lamb, M., Nobes, C. & Roberts, A. (1998). International variations in the connections between tax and financial reporting. Accounting and Business Research, 28(3), 173-188.

- Lewis, A., Carrera, S. & Philip Jones, J.C. (2009). Individual, cognitive and cultural differences in tax compliance: UK and Italy compared. Journal of Economic Psychology, 30(3), 431-445.

- Kleven, H.J., Kreiner, C.T. & Saez, E. (2016). Why can modern governments tax so much? An Agency Model of Firms as Fiscal Intermediaries. Economica, 83(330), 219-246.

- Markle, K. (2016).Comparison of the tax-motivated income shifting of multinationals in territorial and worldwide countries. Contemporary Accounting Research, 33(1), 7-43.

- Mouritsen, J. & Kreiner, K. (2016). Accounting, decisions and promises. Accounting, Organizations and Society, 49, 21-31.

- Nobes, C.W. (1979). Fiscal harmonization and European integration: Comments. European Law Review, August.

- Nobes, C.W. (1980). Imputation systems of corporation tax in the EEC. Accounting and Business Research, Spring, 221-231.

- Nobes, C.W. & Aisbitt, S. (2001). The true and fair requirement in recent national implementations. 31(2), 83-90.

- Nobes, C. & Schwencke, H.R. (2006). Modelling the links between tax and financial reporting: A longitudinal examination of Norway over 30 years up to IFRS adoption. European Accounting Review, 15(1), 63-87.

- Nobes, C.W. & Schwencke, H.R. (2006). Tax and financial reporting links: a longitudinal examination over 30 years up to IFRS adoption, using Norway as a case study. European Accounting Review, 15(1), 63-87.

- Nobes, C.W., Gee, M. & Haller, A. (2010). The influence of tax on IFRS consolidated statements. Australian Accounting Review, 7 (1), 97-122.

- Nobes, C.W. (2013). The continued survival of international differences under IFRS. Accounting and Business Research, 43(2), 83-111.

- Nobes, C. (2016). Towards an assessment of country effects on IFRS recognition decisions and measurement estimations, Paper, Venezia.

- Nobes, C. & Parker, R. (2016). Comparative International Accounting, Pearson.

- Oderlheide, D. (2001). Transnational Accounting, Macmillan, London.

- Provasoli, A., Mazzola, P. & Pozza, L. (2007). The role of National Standard Setters in the Standards Developing process: the Italian experience. Globalisation of Accounting Standards, Edgar Elgar.

- Rocchi, F. (1996). Accounting and taxation in Italy. European Accounting Review, 5(1), 981-989.

- Shaviro, D. (2008). The optimal relationship between taxable income and financial accounting income: Analysis and a proposal. New York University, Law and Economics working papers, Paper n. 106.

- Spengel, C. (2003). International accounting standards, tax accounting and effective levels of companies tax burdens in the European Union, European Taxation, July/August, 253-266.

- Schoen, W. (2004). International accounting standards ? a ?starting point? for a common European tax base? European Taxation, 44(10), 426-440.

- Schoen, W. (2005). The odd couple: A common future for financial and tax accounting? Tax Law Review, 58(2), 111-148.

- Wagenhofer, A. (2003). Accrual-based compensation, depreciation and investment decisions. European Accounting Review, 12 (2), 287-309.

- Wagenhofer, A. (2006). Management accounting research in German-speaking countries. Journal of Management Accounting Research, 18(1), 1-19.

- Wagenhoferb, A. & Göxa, R.F. (2009). Optimal impairment rules. Journal of Accounting and Economics, 48(1), 2-16.

- Zambon, S. (2002). Locating accounting in its national context: The case of Italy, Franco Angeli.

- Zareh Asatryan, Z., Castellon, C. & Stratmann, T. (2016). Balanced budget rules and fiscal outcomes: Evidence from historical constitutions. Centre for European Economic Research. Discussion Paper N. 16-034.