Research Article: 2021 Vol: 24 Issue: 5

Traditional Vs Contemporary Management Accounting Techniques in the Nepalese Manufacturing Companies

Rewan Kumar Dahal, Tribhuvan University

Citation Information: Dahal, R. K. (2021). Traditional Vs contemporary management accounting techniques in the Nepalese manufacturing companies. Journal of Management Information and Decision Sciences, 24(5), 1-14.

Abstract

This study examined the MAPs (Management Accounting Practices) in the NMCs (Nepalese Manufacturing Companies), observing the impacts on OEP (Organizational Efficiency and Performance) within a contingency theory framework. The study's objective was to report the adoption level and the benefits derived from TMATs (Traditional/Conventional Management Accounting Techniques) and CMATs (Contemporary/Modern Management Accounting Techniques) in the NMCs. An empirical survey of 385 respondents from eighteen listed NMCs in the NEPSE (Nepal Stock Exchange) was conducted using a structured questionnaire. The level of adoption and benefits associated with OEP and future emphasis provided the discussion's premise. The findings uncovered a negative and significant association between the TMATs and CMATs with OEP in the NMCs. The package of TMATs had some minor negative impacts compared to the CMATs. Though the study was limited to the MCs (Manufacturing Companies), it offered unique insights into MATs (Management Accounting Techniques) to indicate potential trends. It provided practical information to the concerned authorities in the NMCs as well as the prospective researchers.

Keywords

Management accounting; Managers; Organizational efficiency; Performance.

JEL Classifications

M41

Introduction

There is a great deal of rivalry in the market and business world in developed and developing countries. In the competitive business environment, the corporations' owners need to go up the imprint and achieve a higher position in the market of their ventures in each part of the business (Sleihat et al., 2012). The duties and responsibilities of the directors/managers going to increment in the corporations, especially MA (Management Accounting) tasks, are crucial to controlling cost, productivity, and pricing decisions (Johnson & Kaplan, 1987). MA techniques/practices are essential to the corporation's success and can be used in the customary manners (Horngren et al., 2009). The practices/techniques incorporate cost practices, budgeting, decision-making, strategic analysis, and performance analysis (Ashfaq et al., 2014). In general, MA techniques/practices are more prevalent in the manufacturing industry and make arrangements/plans to control costs in various manners by using these accounting techniques. Owners, directors, and managers use financial and non-financial information about their firms to make different competitive advantageous decisions.

MA has developed new techniques and strategies to provide relevant information to the stakeholders (Shank & Govindarajan, 1993). MATs have been actualizing to oversee organizational cycles/processes, designs, and structures (Conti, 1993; Ledford, 1993) and can consolidate strategic priorities to upgrade OEP (Selto et al., 1995). By the traditions and awareness, MATs have originated from their centrally premeditated economic foundation, on another perspective, by the need to take care of dire issues of day-to-day management. Because of the contingencies approach, the MAPs ought to provide satisfactory data to assist managers in making decisions at various management levels. The contingency manner of dealing with MA depends on the premise that there is no universally suitable MA framework applying equally to all associations (Emmanuel et al., 1990).

MATs are categorized into TMATs and CMATs based on their development and/or features. Because of managers' requirement for backwards-looking information to comprehend general performance and responsibility in their association, TMATs have focused on cost control and accustomed competitive operating environments (Taipaleenmaki & Ikaheimo, 2013). According to Johnson and Kaplan (1987), the TMATs were developed before the 1980s. In the competitive business environment with rapid technological changes in the corporate world, MAPs have moved from backwards-based planning and control to forward-oriented decisions, strategic arrangements, and control (Dahal et al., 2020). CMATs are seen as those MATs that can relate undertakings, tasks, processes, and measures with strategic outcomes and are considered to have strategic implications for the business cycle and services (Hyvonen, 2005). In these consequences, the study encompassed uniquely Nepalese features that set the MA issues of the NMCs.

The growing degree of global competition has increased corporate challenges in recent years. Many experts/analysts have cautioned that MA needs to be adapted to meet managers' evolving requirements if it needs to hold its relevance (Pavlatos & Paggios, 2008). The managers of the NMCs are likewise facing intensified competition because of the advancement of technology and innovation and rapid changes in customers' preferences/demands. The NMCs must be equipped with appropriate MATs for them to contribute better OEP. Consequently, the study had a concern to address: Do the TMATs and CMATs contribute significantly to the OEP in the NMCs? The analysis intended to add MA literature by offering a practical comprehension of the predominance and effectiveness of MATs. Concentrating on the familiar presence of the MATs in the NMCs, the analysis's purpose was to report the adoption level and the benefits derived from the TMATs and CMATs in association with OEP.

MAPs must be concerned about whether the practices are fulfilling the current and future business environment's needs. It usually concurs that there is a requirement for significant inward accounting systems and practices to adapt and adjust to the new business situation. The need for adopting MATs that could provide adequate information about the organizational activities and performance has grown rapidly in NMCs. It is believed that MATs are simple, practical, and economically applicable. There is a gap between what types of accounting techniques/practices are being utilized and what the professionals are doing. Since the mid-1980s, when new movements in the field of MA began, the gap has arisen between researchers' and practitioners' perspectives on the utility of TMATs and CMATs. Many researchers believe that the TMATs are outdated and not compelling for managerial decisions and cultivated and advocated the CMATs. A large portion of the TMATs data is usually too late, excessively accumulated, and contorted to be pertinent for dynamic purposes (Kharbanda, 1992). Despite the extensive criticisms of the TMATs and expanding interest in developing CMATs in recent years, many associations still widely apply the TMATs (Chenhall & Langfield-Smith, 1998b). On the other hand, the reception of CMATs in the organizational system empowers organizations to integrate the proficient utilization of accessible resources to accomplish the targeted objectives and explore the most amazing aspect of those utilizations. Hence, the study examined the relationship between TMATs and CMATs with OEP and bridged the gap. The paper is outlined as follows: it starts with an introduction followed by a literature review. The subsequent sections presented methods, outcomes, discussion, limitations and suggestions, and references.

Literature Review

Studies of the successful organization have highlighted the capability of MA knowledge as a strategic weapon. The fact that the supporting role of MA in business organizations is being addressed in the literature indicates MATs and strategies represent a significant role and should not be slighted (Rahman, 2003). MATs are used more naturally in environmental uncertainty, and accounting is observed more as a 'bean counting' activity than support in management decisions (Kattan et al., 2007). MATs can be classified into two broad spectrums: TMATs and CMATs. The TMATs do not deliver the necessary information that managers need to progress and uphold strategic primacies (Johnson & Kaplan, 1987; Shank & Govindarajan, 1993). They are often viewed as incongruent with the modern business environment, especially with production systems (Umble & Srikanth, 1990). Consequently, CMATs have emerged with more attention on developing specific product costs and provides a more extensive concentration to assessing the effectiveness of manufacturing processes, relating activities, and functions to strategic outcomes (Chenhall & Langfield-Smith, 1998b).

MAPs have been perceived as a significant contributor to managerial decisions. Many professionals and researchers have called for upgrading in the MAPs of future corporate managers (Bitner, 1991). It is recommended that the specific highlights of an appropriate MA framework will rely on the particular circumstances in which an association finds itself (Haldma & Laats, 2002). A map, as guided by the contingencies approach, assumes that MATs are adopted to assist administrators in accomplishing desired association's results. If a MAT is established to be proper, it will probably provide upgraded data to the individuals who can make better decisions. The most widely emphasized contingency approaches are environmental uncertainty and hostility. The barely foreseeable environmental elements affect organizational framework, performance assessment, planning, and budgetary control related to externally focused accounting systems. Environmental hostility from rigorous competition focuses on the significance of formal control and a sophisticated accounting system (Otley, 1978). MA is an ever-evolving phenomenon that incorporates new models, behaviours, and practices over time. As a result, MAPs are interconnected to prevailing circumstances as guided by the contingency approach, and the study has articulated an overview of MATs with OEP.

TMATs

The cash flow analysis upholds the management of cash and its flows (Weygandt et al., 2008). The ratio analysis assists in diagnosing and dissecting the company's financial well-being. The information obtained from the standard costing/variance analysis provides beneficial insights into different managerial decisions. Variable and absorption costing are the well-known approaches for determining the products' costs and their uses and have undergone over the long haul as methods for providing data for managerial decisions and control (Jones et al., 2012). Break-even analysis supports managers/supervisors comprehend the relations among cost, sales, and profit of an association that wires management decisions. Budgetary control shoulders an essential role in forming goal congruence within the organization and consistently interfaces the organizational performance evaluation functions (Malmi & Brown 2008; Palermo 2018). Capital budgeting gives substance to the strategic dimensions of investment decisions (Pirttila & Sandstrom, 1995). Cost-benefit analysis is the strategy that relies upon relative correlations with costs and benefits (Dompere, 1995). Product costing is one of the cost management accounting tools that track and regulate the overall product cost during the product's life cycle (Sakurai, 2008).

CMATs

Corporations have encountered many waves of progressive agendas in the field of accounting since the mid-1980s, beginning with just-in-time systems and going on to total quality management, supply chain management, and numerous other CMATs. When the progress agendas are appropriately executed, these can improve efficiency, decrease costs, upgrade quality, enhance performance, disregard delays in retorting to customers, and eventually improve OEP (Garrison et al., 2015). Activity-based costing offers a more precise means of allocating the indirect costs and supporting means to activities, processes, services, products, and customers (Atkinson et al., 2014). Supply chain management arranges all the operational manoeuvres into an amalgamated process and coordinates them (Sotiris, 2000). Enterprise resources’ planning assimilates operational cycles and data flows to make the best use of accessible resources (Sheikh, 2003). Life-cycle costing is a technique and strategy of pursuing and amassing costs attributable to a product from its commencement to its disposal (Bhimani et al., 2012). Environmental costing espouses human activities to preclude the unfriendly effects on resources and ensures environmental adjustments that do not have destructive consequences. Benchmarking is a persistent and deliberate interaction of looking at processes, services, products, and results with various associations to progress results by recognizing, adjusting, and executing the best practice strategies (Kelessidis, 2000). Customer profitability examines the revenue generated and associated service costs with specific consumers or consumer groups and empowering the apportionment of income and expenses to an individual or group (Sridhar & Corbey, 2015). The balanced scorecard complements achieving the targets, ascertaining and placing a strategy into work, and coordinating the individual and organizational performance (Kaplan & Norton, 2004).

OEP

Many companies have implemented MATs to analyze the company's performance better. Companies exercise the techniques to assess the efficacy and quality of products or services and highlight the strengths and areas for improvement in the business cycle. OEP represents whether an organization has effectively operated a business (Triatmanto et al., 2019). There are various dimensions of OEP. As similar to earlier studies (like Rompho, 2018; Waal, 2010, and so forth), this study concentrated on operational efficiency and financial performance. Operational efficiency can be assessed through smooth operational activities relating to the customers, processes, and employees (Hussain & Gunasekaran, 2002). Financial performance can primarily assess sales growth, profit growth, and cost reduction (Rompho, 2018). Table 1 summarized the list of TMATs, CMATs, and OEP measures used in the examination based on the literature review.

| Table 1 TMATs, CMATs, and OEP Measures | |||||

| TMATs | Notation | CMATs | Notation | OPE | Notation |

| Cash Flow Analysis | CFA | Activity-based Costing | ABC | Sales Growth | SG |

| Ratio Analysis | RA | Just-in-time System | JITS | Profit Growth | PG |

| Standard Costing/ | Total Quality Management | TQM | Cost Reduction | CR | |

| Variance Analysis | SC/VA | Supply Chain Management | SCM | Operational | |

| Absorption/Variable Costing | AC/VC | Enterprise Resources Planning | ERP | Processes | OPs |

| Break-even Analysis | BA | Life Cycle Costing | LCC | Operational | |

| Budgetary Control | BC | Benchmarking | BM | Efficiency | OE |

| Capital Budgeting | CB | Environmental Coting | EC | ||

| Cost Benefit Analysis | CBA | Customer Profitability | CP | ||

| Product Costing | PC | Balanced Scorecard | BSC | ||

| Total number of TMATs | 9 | Total number of CMATs | 10 | Total measures | 5 |

TMATs and OEP

TMATs like CFA, RA, SC/VA, BC, etc., were widely applied and most relevant in MCs (Angelakis et al., 2010). Despite the criticisms levelled TMATs, they are still useful for planning and control purposes (Joshi, 2001). Literature pointed that CMATs take a long time to adopt in the organizational system (Joshi, 2001). Hence, CMATs are beneficial and have a significant impact on OEP.

H1: TMATs positively and significantly affect OEP of the MCs.

CMATs and OEP

Effective utilization of CMATs in organizations improves OEP (Rahman, 2003). CMATs help managers meet the customers' needs, make management decisions easier and coordinate the corporate value chain (Dahal, 2019). CMAT integration in business strategy supports the management of organizational tasks (Wahyuni & Triatmanto, 2020). CMATs in business have become a catalyst for employees (Laitinen, 2014).

H2: CMATs positively and significantly affect OEP of the MCs.

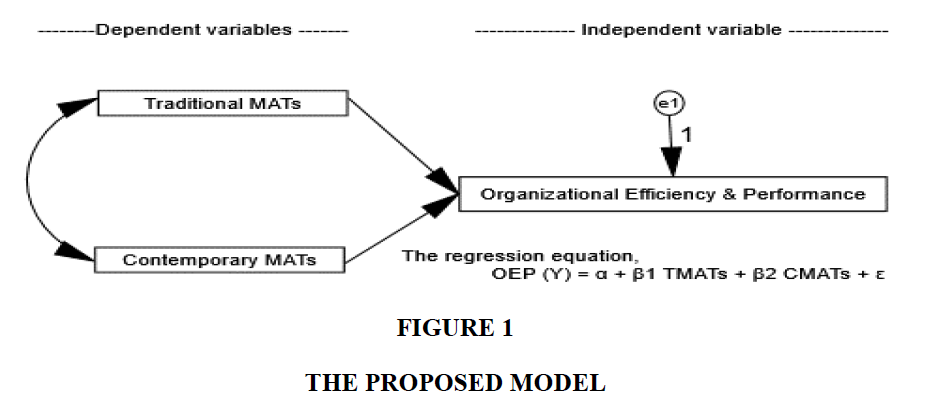

Therefore, the examination proposed to notice the relationships among TMATs and CMATs as an autonomous variable and OEP as a reliant variable followed by a regression equation offered in Figure 1.

Methodology

The population of the examination incorporated all the MCs that were working in Nepal and their working representatives. Nineteen MCs were listed in the NEPSE under the sub-group of manufacturing and processing; eighteen companies were operative. Therefore, eighteen listed MCs and their working representatives were examples of the examination. Thirty-two targeted respondents of each example company were drawn closer from November-December 2020. Altogether 576 representatives were gratified to carry out a field study and employed a random sampling method to accumulate the data. The sampling strategy ensured a fair representation of the respondents. As suggested by Krejcie and Margan's (1970) generalized methodical guideline, the good plan was promised and gathered 385 correctly topped off respondents' replies, addressing 66.84 % of the reply rate. The available responses for each surveyed company varied from 43.75 % (i.e., 14 responses) to 68.75 % (i.e., 22 responses). 46.2 % of females and 53.8 % of males contributed to the study. The respondents' status in their respective companies was: 4.4 % of board members, 15.3 % of executives/managers, 29.4 % of officers, 40.8 % of assistants/supervisors, and 10.1 % of others.

The quantitative examination was utilized to quantify the issue by generating numerical information transfigured into usable insights. Necessary data was procured through an organized poll overview and used SPSS (Statistical Package for Social Sciences) and AMOS (Analysis of Moment Structure) for analyzing and interpreting the data. The planned poll for the review contained 26 overview questions and was organized into three sections. In the initial segment, two inquiries were identifying with the general data of the representatives. In the second and the third sections, there were 24 examination variable inquiries as introduced in Table 1. Out of them, 19 MATs observed variables and five OEP observed variables were synchronized. The last two sections' inquiries were made out of a progression of close-ended inquiries assessed in a 5-point Likert-type scale differing from 1=not advantageous to 5=exceptionally advantageous, and from 1= impressively lower to 5=extensively higher, respectively.

The noticed observed variables standardized regression weight was calculated using CFA (Confirmatory Factor Analysis) within the specific dormant construct. As Hair et al. (2006) recommended, the observed variables loading 0.50 and more were taken into the assessment. Two observed variables (i.e., AC/VC, and CBA) from the TMATs and four variables (i.e., LCC, BM, CP, and BSC) from the CMATs were disregarded since they had a lower factor loading value than 0.50. Details of the retained observed variables and dormant variables with the reliability, validity, model fit, and common method bias statistics were demonstrated in Table 2.

| Table 2 Observed and Dormant Variables, Reliability, Validity, Model Fit and Common Method Bias Statistics | |||||

| Dormant Measures | Cut-off Value |

Recommend by: | |||

| TMATs | CMATs | OEP | |||

| Observed variables | CFA RA SC/VA BA BC CB PC |

ABC JITS TQM SCM ERP EC |

SG PG CR OPs OE |

||

| No of Observed Variables Retained | 7 | 6 | 5 | ||

| Reliabilty Statistics: Cronbach's Alpha |

0.872 | 0.807 | 0.950 | ≥ 0.70 | Nunnally, 1993 |

| Validity Statistcis: | |||||

| Composite Reliability | 0.882 | 0.808 | 0.942 | ≥ 0.70 | Fornell & Larcker, 1981 |

| Average Variace Extracted | 0.523 | 0.413 | 0.766 | ≥ 0.40 | Bagozzi & Baumgartner, 1994 |

| Model Fit Statistics: | |||||

| χ2 /df (Normed chi-square) | 2.870 | 2.119 | 1.398 | ≤ 3.00 | Kline, 1998 |

| RMSEA (Root Mean Square Error of Approximation) |

0.070 | 0.054 | 0.032 | ≤ 0.08 | Hu & Bentler, 1999 |

| PCLOSE (RMSEA associated p-value) |

0.090 | 0.376 | 0.584 | ≥ 0.05 | Garson, 2009 |

| AGFI (Adjusted Goodness of Fit Index) |

0.942 | 0.963 | 0.978 | ≥ 0.80 | Bagozzi & Yi, 1998 |

| CFI (Comparative Fit Index) | 0.979 | 0.983 | 0.999 | ≥ 0.90 | Hu & Bentler, 1999 |

| NFI (Normed Fit Index) | 0.969 | 0.969 | 0.998 | ≥ 0.80 | Bentler & Bonnet, 1980 |

| TLI (Tucker Lewis Index) | 0.969 | 0.972 | 0.998 | ≥ 0.90 | Hu & Bentler, 1999 |

| CMB (Common Method Bias): Harman Single-factor variance | 26.832 % | ≤ 0.50 | Cho & Lee, 2012 | ||

The suggested cut-off values were satisfied by all of the statistics as presented in Table 2. Consequently, the test variables and the latent variables were trustworthy and suitable for further examination.

Research Outcomes

The study surveyed the representatives' understanding regarding the level of adoption and the benefits derived from the TMATs and CMATs in the NMCs. The descriptive statistics of each dormant variable with mean, standard deviation, and the correlation matrix were presented in Tables 3-5.

| Table 3 Descriptive Statistics - TMATs (N = 385) | ||||||||||

| Variables | Mean | St. Dev. | CFA | RA | SC/VA | BA | BC | CB | PC | |

| 1 | CFA | 4.27 | 0.699 | 1.000 | ||||||

| 2 | RA | 4.02 | 0.748 | 0.534** | 1.000 | |||||

| 3 | SC/VA | 4.17 | 0.740 | 0.517** | 0.536** | 1.000 | ||||

| 4 | BA | 3.93 | 0.874 | 0.607** | 0.667** | 0.607** | 1.000 | |||

| 5 | BC | 3.72 | 0.723 | 0.373** | 0.390** | 0.477** | 0.456** | 1.000 | ||

| 6 | CB | 3.37 | 1.043 | 0.344** | 0.499** | 0.430** | 0.446** | 0.334** | 1.000 | |

| 7 | PC | 3.64 | 0.799 | 0.604** | 0.639** | 0.668** | 0.691** | 0.475** | 0.392** | 1.000 |

| Table 4 Descriptive Statistics - CMATs (N = 385) | |||||||||

| Variables | Mean | St. Dev. | ABC | JITS | TQM | SCM | ERP | EC | |

| 1 | ABC | 3.17 | 1.253 | 1.000 | |||||

| 2 | JITS | 3.21 | 1.130 | 0.391** | 1.000 | ||||

| 3 | TQM | 3.24 | 1.282 | 0.394** | 0.447** | 1.000 | |||

| 4 | SCM | 3.03 | 1.197 | 0.381** | 0.385** | 0.391** | 1.000 | ||

| 5 | ERP | 2.98 | 1.228 | 0.435** | 0.524** | 0.381** | 0.451** | 1.000 | |

| 6 | EC | 2.99 | 1.275 | 0.345** | 0.383** | 0.457** | 0.398** | 0.411** | 1.000 |

| Table 5 Descriptive Statistics - OEP (N = 385) | ||||||||

| Variables | Mean | St. Dev. | SG | PG | CR | OPS | OE | |

| 1 | SG | 4.00 | 0.748 | 1.000 | ||||

| 2 | PG | 4.02 | 0.725 | 0.840** | 1.000 | |||

| 3 | CR | 3.97 | 0.744 | 0.818** | 0.778** | 1.000 | ||

| 4 | OPs | 3.99 | 0.764 | 0.793** | 0.927** | 0.755** | 1.000 | |

| 5 | OE | 3.92 | 0.732 | 0.775** | 0.733** | 0.818** | 0.697** | 1.000 |

In a 5-point Likert-type scale, all the item means were approximately 3 or greater than 3, and the ratios of maximum standard deviation to the minimum standard deviation were within the threshold value of 2:1 as recommended by Julious (2005). The items correlations were also positive and meaningful at the 0.01 level (two-tailed). These statistics proved that each grouping objects represented approximately the same proportion of information about the construct being evaluated.

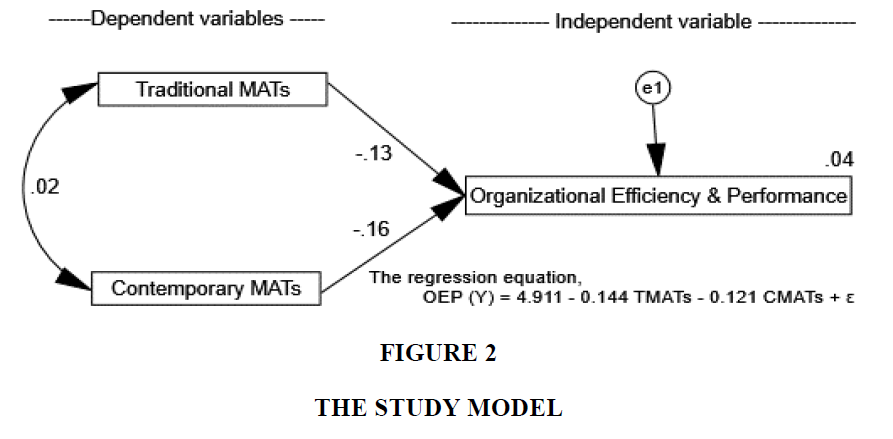

A standard multiple regression was carried out between OEP as the reliant variable with TMATs and CMATs as autonomous variables. The model summary was shown in Table 6, and the ANOVA (Analysis of Variance) was demonstrated in Table 7. The adjusted R Square was significantly different from zero (F=8.368, p=0.000) and accounted for approximately 4.0 % of the reliant variable variation in the set of autonomous variables. The overall model of the study was stated in Table 8 and Figure 2.

| Table 6 Model Summary – TMATs vs CMATs in Nepal | |||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||

| R Square Change | F Change | DF1 | DF2 | Sig. F Change | |||||

| 0.205a | 0.042 | 0.037 | 0.66587 | 0.042 | 8.368 | 2 | 382 | 0.000 | |

| Table 7 Anova Result - TMATs vs CMATs in Nepal | |||||

| Model | Sum of Squares | DF | Mean Square | F | Sig. |

| Regression | 7.420 | 2 | 3.710 | 8.368 | 0.000 |

| Residual | 169.373 | 382 | 0.443 | ||

| Total | 176.794 | 384 | |||

| Table 8 Regression Coefficients – TMATS vs CMATS in NEPAL | |||||||

| Model | Unstandardized Coefficients | Standardized coefficients | t-value | Sig. | Variance Inflation Factor (VIF) |

Remarks on hypothesis |

|

| B | SE | Beta | |||||

| (Constant) | 4.911 | 0.247 | 19.889 | 0.000 | - | ||

| Conventional MAPs | -0.144 | 0.056 | -0.130 | -2.586 | 0.010 | 1.503 | Not accepted |

| Contemporary MAPs | -0.121 | 0.039 | -0.156 | -3.106 | 0.002 | 1.503 | Not accepted |

| Reliant variable: OEP Regression equation:  |

|||||||

There was no multi-collinearity issue since the noticed values of the VIF (Variance Inflation Factor) were not surpassing 4.0 (Hair et al., 2011). The relationship of each dormant measure was established in the model. The outcome of the study, TMATs with OEP (β = - 0.130, p = 0.010) and CMATs with OEP (β = - 0.156, p = 0.002) exhibited a negative and significant degree of relationship between the variables. The speculated model assumed the positive and significant relationship between the variables; hence the study hypotheses were not recognized.

Discussion and Conclusion

The study summarized nine TMATs, ten CMATs, and five OEP test-variables that were relevant and applicable in the NMCs. Two test-variables (i.e., AC/VC, and CBA) from the TMATs and four test-variables (i.e., LCC, BM, CP, and BSC) from the CMATs were not taken into consideration since they had lower factor loading than 0.50. Such test-variables AC/VC (Jones et al., 2012; Lucas, 2000), CBA (Dompere, 1995), LCC (Bhimani et al., 2012), BM (Kelessidis, 2000), CP (Sridhar & Corbey, 2015), and BSC (Kaplan & Norton, 2004) were beneficial and had a high level of adoption in earlier studies. The study revealed that out of 19 MATs presented, 13 were retained in the study (seven from TMATs and six from CMATs). Based on the statistical means, the TMATs were ranked as: CFA (mean = 4.27, s.d. = 0.699) was the most advantageous having with the lowest variability followed by SC/VA (mean = 4.17, s.d. = 0.740); RA (mean = 4.02, s.d. = 0.748); BA (mean = 3.93, s.d. = 0.874); BC (mean = 3.72 & s.d. = 0.723); PC (mean = 3.64, s.d. = 0.799); and CB (mean = 3.37, s.d. = 1.043) respectively. Similarly, the CMATs were ranked as: TQM (mean = 3.24, s.d. = 1.282) was the most advantageous with greatest variability followed by JITS (mean = 3.21, s.d. = 1.130); ABC (mean = 3.17, s.d. = 1.253); SCM (mean = 3.03 & s.d. = 1.197); EC (mean = 2.99, s.d. = 1.275); and ERP (mean = 2.98, s.d. = 1.228) respectively. The statistics showed that TMATs items mean ranges from 3.37 to 4.27 and standard deviation ranges from 0.699 to 1.043 (i.e. 1.49:1). Similarly, CMATs items mean ranges from 2.98 to 3.24 and standard deviation ranges from 1.130 to 1.282 (i.e. 1.13:1).

As conflicting with earlier studies (like Angelakis et al., 2010; Ashfaq et al., 2014; Jones et al., 2012; Malmi & Brown 2008; Palermo 2018; Pirttila & Sandstrom; 1995; Taipaleenmaki & Ikaheimo, 2013, and so forth), the consequence of the study disclosed that TMATs had negative yet a meaningful relationship with OEP (β = - 0.130, p = 0.010) in the NMCs at a 5 % level of importance. Similarly, the outcome of the study was likewise contrary to the previous examinations (for example, Chenhall & Euske, 2007; Hyvonen, 2005; Nor et al., 2016; Polnaya et al., 2018; Seal, 2006; Selto et al., 1995; Sheikh, 2003; and so on) and exhibited that CMATs also had negative yet a meaningful relationship with OEP (β = - 0.156, p = 0.002) in the NMCs at a 5 % level of importance. Such a result was steady with Sharkar et al.'s (2006) study that had outlined the MATs in the listed MCs in Bangladesh. The examination uncovered that all sectors neglected to exercise recently developed MATs. Furthermore, this analysis was steady with Bidhan's (2007) study, which assessed the status of the practice of MATs in Bangladesh's MCs and revealed that most of the CMATs were not exercised in the public and private sector MCs.

MATs are relative, which generally rely on many contingent factors like business, organizational culture, management style, etc. The business world is constantly changing, and management strategies are developing to keep up with the new competition. Sustainable acts of MATs are a lot of fundamental to accomplish and keep up predominant OEP. Consequently, it is important to take the required steps to ensure successful management by implementing profoundly persuasive techniques. The study's central objective was to account for the widespread acknowledgement and benefits got from both TMATs and CMATs in Nepal. MATs are supposed to produce helpful information for OEP. The consequences indicated that the NMCs need to concentrate on fitting MATs into a relevant organizational framework for strategic functions associated with nursing better OEP. The NMCs appeared to be manner at the back of the expected adoption and relevance of the MAPs because of the absence of knowledge on applying the appropriate MATs to value OEP. If MATs are incorporated as a part of a general organizational strategy, the eventual outcome can upgrade OEP. It desires an advanced comprehension of factors influencing variations in recognizing recently evolved MATs amongst industries.

Globalization has helped advance and latest technologies that increased the business world's competitiveness (Alsharari, 2018), yet studies have criticized TMATs position in satisfying current business expectations. As a result, the analysis centered on the relevance of TMATs versus CMATs in the Nepalese context. No evidence was found that the CMATs had made significant organizational changes in the performance evaluation system. The findings were consistent with Sharma's (2000) study that observed TMATs and CMATs had similar levels of perceived benefits for manufacturing companies, so managers could use both strategies to make better managerial decisions. It was also discovered that the genuine usage of MATs in the NMCs is still extremely low. At most, TMATs such as CFA, RA, SC/VA, BC, CB were utilized. It was seen that MATs very much subservient to financial accounting, which was statutorily governed. Companies were generally utilizing using financial accounting information for organizational planning, control, and decision-making. The survey analysis showed that MATs were not effective, while overall CMATs were more popular than TMATs though the NMCs are lingered behind to use the CMATs deliberately.

Limitations and Scope of Future Research

The utilization of a quantitative survey with an organized poll overview to gather the fundamental data was the significant constraint of the study. The organized poll overview denies the likelihood to tour various proper reactions; however, the entirety of the appraisals had been comprised to pick the authenticity and steadfastness of the data aggregated. The results' reliability might depend upon the respondents' number that may have been improved further by a more extensive example. A more prominent example size might have extended the authenticity and agreement of the results. More areas/sectors and ventures can be tried to improve the generalizability. This study's outcome should be interpreted, bearing in mind that the survey included the listed NMCs and not the Nepalese manufacturing industry's general population.

Research Implications

The examination may have explicit importance in the Nepalese context since it could help determine the impact of MATs on OEP. Prospective researchers and analysts may pull in the relevant personnel's consideration towards the MATs to make operative managerial decisions, progress the association's inventive capacity, and flexibility to adapt to the environment reliably and progress the OEP. Policymakers can separate which of the MATs needs uphold in regards strategies, guidelines, and practices. Both practitioners and researchers have long debated about the utility of MATs in practice. The professionals have supposed that the researchers usually generate new MATs that are profoundly theoretical and not easily or economically applicable to all organizations. The researchers, on the other perspective, have assumed that because of aversion to change, professionals are reluctant to pursue new techniques. The findings of the study showed some compromise between the two clashing believes. Hence, researchers, experts, and professionals may use this examination to upswing their knowledge and experiences, consequently urging them to help the NMCs enhance organizational viability. MA research on the least developed countries is generally exploratory however contributes to understanding the local context. It provides the fundamental background to further advanced studies by investigating the elements/variables associated with the use or change in the MA framework and reporting their reality and use. The study offers a unique assessment of the MAPs in the Nepalese scenario with a sign of future patterns.

References

- Alsharari, N. M. (2018). Internationalization of the higher education system: An interpretive analysis. International Journal of Educational Management, 32(3), 359-381.

- Angelakis, G., Theriou, N., & Floropoulos, I. (2010). Adoption and benefits of management accounting practices: Evidence from Greece and Finland. Advances in Accounting Incorporating Advances in International Accounting, 26, 78-96.

- Ashfaq, K., Younas, S., Usman, M., & Hanif, Z. (2014). Traditional Vs. contemporary management accounting practices and its role and usage across business life cycle stages: Evidence from Pakistani financial sector. International Journal of Academic Research in Accounting, Finance and Management Sciences, 4(4), 104-125.

- Atkinson, A. A., Kaplan, R. S., Matsumura, E. M., Young, S. M., & Kumar, G. A. (2014). Management accounting information for decision making and strategy execution (6th ed.). New Delhi: Pearson Education, Inc.

- Bagozzi, R. P., & Baumgartner, H. (1994). The evaluation of structural equation models and hypothesis testing. In R. P. Bagozzi (ed.). Principles of Marketing Research, pp. 386-422.

- Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74-94.

- Bentler, P. M., & Bonnet, D. G. (1980). Significance tests and goodness of fit in the analysis of covariance structures. Psychological Bulletin, 88, 588-606.

- Bhimani, A., Horngren, C., Datar, S., & Rajan, M. (2012). Management and cost accounting (5th ed.). Harlow: Pearson.

- Bidhan, C. M. (2007). Application of management accounting techniques in decision making in the manufacturing business firms in Bangladesh. The Cost and Management, 35(1), 5-18.

- Bitner, L. N. (1991). A framework for teaching management accounting. Issues in Accounting Education, 6, 112-l 19.

- Cho, Y. J., & Lee, J. W. (2012). Performance management and trust in supervisors. Review of Public Personnel Administration, 32(3), 236-259.

- Conti, T. (1993). Building quality: A guide to management. London: Chapman & Hall.

- Dahal, R. K. (2019). Changing role of management accounting in the 21st century. Review Public Administration and Management, 7(2), 264, 1-8.

- Dahal, R. K., Bhattarai, G., & Karki, D. (2020). Management accounting techniques on rationalize decisions in the Nepalese listed manufacturing companies. Researcher: A Research Journal of Culture and Society, 4(1), 112-128.

- Dompere, K. K. (1995). The theory of social costs and costing for cost-benefit analysis in a fuzzy-decision space. Fuzzy Sets and Systems, 76, l-24.

- Emmanuel, C., Otley, D., & Merchant, K. (1990). Accounting for management control (2nd ed.). London: Chapman & Hall.

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Garrison, R. H., Noreen, E. W., & Brewer, P. C. (2015). Managerial accounting (15th ed.). New York: McGraw-Hill Education.

- Garson, G. D. (2009). Structural equation modeling. Retrieved June 2018, from http://faculty.chass.ncsu.edu/garson/PA765/structur.htm.

- Hair, J. F., Black, W. C., Babin, B. J., Anderson R. E., & Tatham R. L. (2006). Multivariate data analysis. New Jersey: Prentice-Hall, Pearson Education, Inc.

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139-151.

- Haldma, T., & Laats, K. (2002). Contingencies influencing the management accounting practices of Estonian manufacturing companies. Management Accounting Research, 13(4), 379-400.

- Horngren, C. T., Sundem, G. L., Burgstahler, D., & Schatzberg, J. (2005). Introduction to management accounting (6th ed.). Edinburgh: Pearson Education Limited.

- Hu, L., & Bentler, P. (1999). Cut-off criteria for fit indices in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling-A Multidisciplinary Journal, 6(1), 1-55.

- Hussain, M., & Gunasekaran, A. (2002). Management accounting and performance measures in Japanese banks. Managing Service Quality: An International Journal, 12(4), 232-245.

- Hyvonen, J. (2005). Adoption and benefits of management accounting systems: Evidence from Finland and Australia. Advances in International Accounting, 18, 97-120.

- Johnson, H. T., & Kaplan, R. S. (1987). Relevance lost - The rise and fall of management accounting. Boston, MA: Harvard Business School Press.

- Jones, T., Atkinson, H., Lorenz, A., & Harris, P. (2012). Strategic managerial accounting: Hospitality, tourism and events applications. Oxford: Goodfellow Publishers.

- Joshi, P. L. (2001). The international diffusion of new management accounting practices: The case of India. Journal of International Accounting, Auditing, and Taxation, 10(1), 85-109.

- Julious, S.A. (2005). Why do we use pooled variance analysis of variance? Pharmaceutical Statistics, 4(1), 3-5.

- Kaplan, R. S., & Norton, D. P. (2004). Strategy maps-Converting intangible assets into tangible outcomes. Boston, Massachusetts: Harvard Business School Publishing Corporation.

- Kattan, F., Pike, R., & Tayles M. (2007). Reliance on management accounting under environmental uncertainty: The case of Palestine. Journal of Accounting and Organizational Change, 3, 227-249.

- Kelessidis, V. (2000). Benchmarking in InnoRegio consortium, 21 Innovation management technologies. Recite programme: Directorate general regional policy-European Commission.

- Kharbanda, O. P. (1992), Japan's Lesson for West. CMA Magazine, 66(1), 26-28.

- Kline, R. B. (1998). Principles and practice of structural equation modeling. New York: The Guilford Press.

- Laitinen, E. K. (2014). Influence of cost accounting change on the performance of manufacturing firms. Advances in Accounting, 30(1), 230-240.

- Ledford, G. E. (1993). Employee involvement: Lessons and predictions. In J., Galbraith, E. E. Lawler, III & Associates (Eds.), Organizing for the future-the new logic for managing complex organizations. San Francisco: Jossey-Bass.

- Lucas, M. (2000). The reality of product costing. Management Accounting, 78(2), 28-31.

- Malmi, T., & Brown, D. A. (2008). Management control systems as a package - Opportunities, challenges, and research directions. Management Accounting Research, 19(4), 287-300.

- Nor, N. M., Bahari, N. A. S., Adnan, N. A., Kamal, S. M. Q. A. S., & Ali, I. M. (2016). The effects of environmental disclosure on financial performance in Malaysia. Procedia Economics and Finance, 35(1), 117-126.

- Nunnally, J. C. (1993). Psychometric theory (3rd ed.). New York: McGraw-Hill.

- Otley, D. T. (1978). Budget use and managerial performance. Journal of Accounting Research, 16(1), 122-149.

- Palermo, T. (2018). Accounts of the future: A multiple-case study of scenarios in planning and management control processes. Qualitative Research in Accounting & Management, 15(1), 2-23.

- Pavlatos, O., & Paggios, I. (2008). Management accounting practices in the Greek hospitality industry. Managerial Auditing Journal, 24(1), 81-98.

- Pirttila, T., & Sandstrom, J. (1995). Manufacturing strategy and capital budgeting process. International Journal of Production Economics, 41(1-3), 335-341.

- Polnaya, I., Nirwanto, N., & Triatmanto, B. (2018). The evaluation of lecturer performance through soft skills, organizational culture, and compensation on Private University of Ambon. Academy of Strategic Management Journal, 17(2), 1-9.

- Rahman, I. K. A., Omar, N., & Abidin, Z. Z. (2003). The application of management accounting techniques in Malaysian companies: An industrial survey. National Accounting Research Journal, 1(1), 1-12.

- Rompho, N. (2018). Operational performance measures for startups. Measuring Business Excellence, 22(1), 31-41.

- Sakurai, M. (2008). Target costing and how to use it. Journal of Cost Management, 3(2), 39-51.

- Seal, W. (2006). Management accounting and corporate governance: An institutional interpretation of the agency problem. Management Accounting Research, 17(4), 389-408.

- Selto, F. H., Renner, C. J., & Young, S. M. (1995). Assessing the organizational fit of a just-in-time manufacturing system: Testing, selection, interaction and systems models of contingency theory. Accounting, Organizations and Society, 20(7-8), 665-684.

- Shank, J., & Govindarajan, V. (1993). Strategic cost management: The new tool for competitive advantage. New York: The Free Press.

- Sharkar, H. M. Z., Sobhan, Md. A., & Sultana, S. (2006). Management accounting development and practices in Bangladesh. BRAC University Journal, III(2), 113-124.

- Sharma, R., (2000), From relevance lost to relevance regained: Management practice in the new millennium, International Federation of Accountants, December, 1-14.

- Sheikh, K. (2003). Manufacturing resource planning (MRP II) - With introduction to ERP, SCM, and CRM. New York: McGraw-Hill Publishing Limited.

- Sleihat, N., Al-Nimer, M., & Almahamid, S. (2012). An exploratory study of the level of sophistication of management accounting practices in Jordan. International Business Research, 5(9), 217-234.

- Sotiris, Z. (2000). The supply chain management. INNOREGIO: Dissemination of innovation and knowledge management techniques. http://www.adi.pt/docs/innoregio_sup_management.pdf.

- Sridhar, A., & Corbey, M. (2015). Customer profitability analysis and customer lifetime value. Maandblad Voor Accountancy en Bedrijfseconomie, 89(7/8): 265-273. http://dx.doi.org/10.5117/mab.89.31335

- Taipaleenmaki, J., & Ikaheimo, S. (2013). On the convergence of management accounting and financial accounting - The role of information technology in accounting change. International Journal of Accounting Systems, 14(4), 321-348.

- Triatmanto, B., Wahyuni, N., & Respati, H. (2019). Continual human resources empowerment through human capital and commitment for the organizational performance in hospitality industry. Quality Access to Success, 20(173), 84-91.

- Umble, M. M., & Srikanth, M. L. (1990). Synchronous manufacturing. Cincinnati: South-Western Publishing Co.

- Waal, AAD. (2010). Performance-driven behavior as the key to improved organizational performance. Measuring Business Excellence, 14(1), 79-95.

- Wahyuni, N., & Triatmanto, B. (2020). The effect of the organizational change on company performance mediated by changes in management accounting practices. Accounting, 6, 581-588.

- Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2008). Managerial accounting: Tools for business decision making. Hoboken, NJ: Wiley.