Research Article: 2018 Vol: 22 Issue: 3

Transition of Insurance Market to Oligopoly: Benefits and Drawbacks

Tatyana D. Odinokova, The Ural State University of Economics, Ekaterinburg, Russia

Natalia A. Istomina, The Ural State University of Economics, Ekaterinburg, Russia

Abstract

The insurance market as an integral part of national economy raises the level of social peace and security. This article is devoted to the analysis of pros and cons of the insurance market transition to oligopoly. The Herfindahl-Hirschman Index was used to determine the oligopolization effect in the market. It was established that insurance supply pattern does not allow satisfying the consumer demand completely. This leads to a reduction in the insurance coverage. Since the large insurance companies have a wide branch network and act as a social institution, they can often go beyond the legislation. Moreover, transnational companies may absorb local insurance companies. On the other hand, greater financial stability of insurance companies can be gained through the international mergers and acquisitions. Oligopolization also refers to relatively low tariffs that contribute to availability of insurance products for the majority of consumers. The authors suggest systematized measures for minimizing the negative oligopolization consequences by improving the specific methods for regulating the insurance entity performance.

Keywords

Oligopolization Effect, Herfindahl-Hirschman Index, Insurance Market, Increasing Of Financial Capabilities, Customer-Oriented Market, Insurance Supply Patterns, Reduction In Social Tensions.

JEL Classification: D43, D47, D49

Introduction

The insufficiently developed and substantiated issue of insurance market oligopolization impact on the system of insurance relations, functioning in the context of country's accession to the World Trade Organization (WTO), is a pressing problem of the current stage of financial science and practice development (Bruno, Grande & Oliva, 2015; Anagol, Cole & Sarkar, 2017; Bobojonov & Goetz & Glauben, 2014).

The scale effect from oligopoly, contributing to a reduction in the long-term average production costs, is the most solid argument in its favor. Lower prices are known to be established by the oligopolists (at the level of marginal costs, if possible). The greater is the output volume, the higher is the market structure efficiency from the public point of view. As far as the company is concerned, performance efficiency depends on how much the existing demand was met and what share of the market segment is occupied (Panasyuk, Pudovik & Sabirova, 2014; Vasileva et al., 2015; Ramazanov & Grigoryan, 2014; Hallam et al., 2017; Banerji, 2017).

In case when the obvious market transition from competition to oligopoly is realized, efforts should be made to improve the relationships between its participants in order to minimize the negative consequences of such a transition.

This circumstance is closely connected with an important scientific task, which is centered around the need to substantiate the comprehensive recommendations for increasing the Russian financial market competitiveness, forming an international financial center and improving the investment climate in the Russian Federation. The study of various oligopolization aspects, in fact, is associated with an important practical task centered around the need to improve the insurance services in terms of quality and completeness and the need to meet the customers demand for insurance protection. We should also emphasize that insurance is an important strategic sector of Russian economy that promotes both an increase in the economic strength and social welfare, and a reduction in social tensions.

The issues of corporate behavior in the context of an oligopoly market structure and antimonopoly policy are considered in an extensive list of papers. This list include papers devoted to the following issues: interdependence of oligopoly enterprises (Lamantia & Radi, 2018; Knyazeva & Lukashenko, 2014), transaction costs peculiarities (Divshali & Choi, 2016; Leontieva, 2014), the role of the State in the oligopoly regulation system, as well as the process of developing mechanisms for eliminating the collusion in the oligopoly markets (Singh & Kaur, 2015; Feng, Li & Li, 2014; Molotskaya, 2015; Kutsegreeva, 2015; Kazantseva & Kharchenko, 2014).

Despite the abundance of scientific developments made for various aspects of oligopolistic relations and the role of the State, there are specific features of the oligopoly market structure and its government regulation that remain little studied in regard to the insurance market.

Research objectives are the following: drawing up and substantiating recommendations for minimizing the negative consequences of the insurance market transition to oligopoly by improving the specific methods for regulating the insurance entity performance.

Methods

The theoretical and methodological research basis involves the specific provisions of the theory of insurance market development regulation in the context of various business patterns and integration processes, as well as domestic and foreign research papers devoted to our research problem.

This article is based on methods of abstract-logical, analytical, economic-statistical and comparative analysis. All assessments were made through the prism of current legislation and the regulatory and legal framework of the Russian Federation.

Data, Analysis and Results

The Russian economic situation and development analysis has showed its inefficiency and weak differentiation along the lines of business in each industry. A tendency towards oligopolization is understandable in the context of this situation. Xu Chengang, the Professor of Economics at the University of Hong Kong, states that “problems existing in Russian economy are not isolated or accidental, but regular: in modern Russia, there is an oligopolistic economic system that stifles competition and not only rejects innovations and entrepreneurship, but is directed against them” (Shamkhalov, 2008).

Oligopolization process has also affected the Russian insurance market. This is evidenced by the following:

1. Insurance companies have decreased in number by 523 (from 857 in 2007 to 334 at the beginning of 2016) due to the collapse of small companies and through the M&A (mergers and acquisitions);

2. High barriers were established for market entry (this refers to licensing, which imposes certain requirements to business reputation of top management, to the minimum charter capital size, etc.);

3. There were almost no new insurance products/services or groundbreaking ideas for the new types of voluntary insurance during the last few years. This indicates the dominance of similar products over the differentiated ones.

The Russian insurance market transition to oligopoly is recognized as the leading institution in the field of finance. In particular, such significant qualitative signs of oligopolization as restrictive trade practices in the insurance market and its information closeness were noted in the report of the Accounting Chamber of the Russian Federation made in 2007, The Federal Service for Insurance Supervision Performance Analysis for Insurance Market Safety Improvement (Bulletin of the Accounts Chamber of the Russian Federation, 2007).

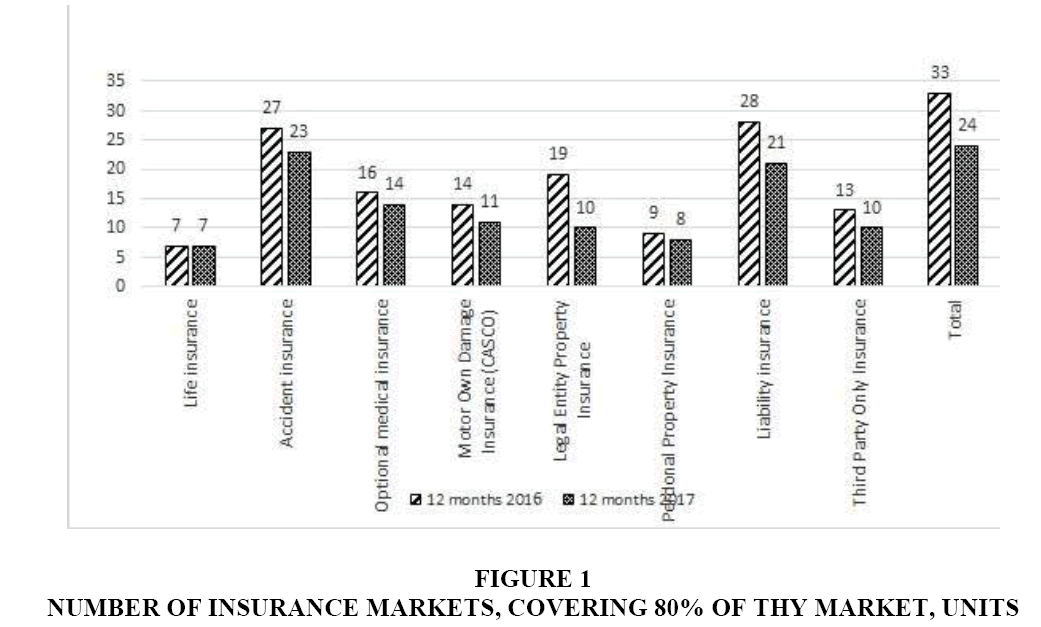

The oligopolization trend has been strengthening during the period from 2016 to 2017. The current Russian insurance market is characterized by a consistently high market concentration (Figure 1).

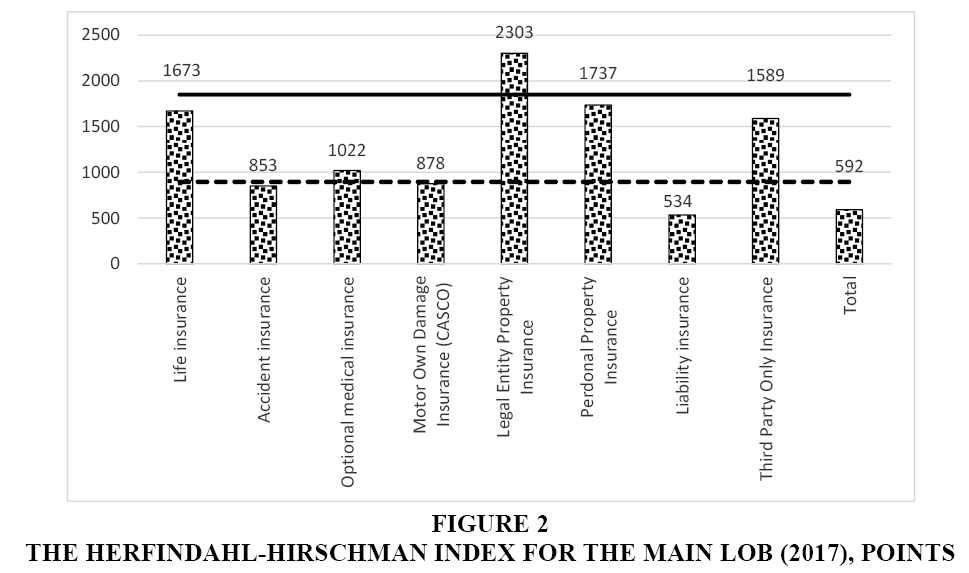

The Herfindahl-Hirschman Index is used to determine the oligopolization effect in the market. Its calculation made for the Russian insurance market for 2017 shows a low market concentration (592 points). However, the largest four lines of insurance business (life insurance, optional health insurance, personal property insurance, third party only insurance) are moderately concentrated (over than 1000 points; concentration border is dashed). Legal entity property insurance is highly concentrated (over 1800 points; concentration border is marked by a solid line) (Yurgens, 2016). The third party only insurance services are the most concentrated segment of the insurance market. More than a half of insurance premiums have been collected by 2 insurance groups and 2 insurance companies since 2009 (Figure 2).

Let’s consider the insurance market oligopolization advantages and disadvantages. There were identified the following disadvantages:

1. Limited number of the active insurance market participants. This is fraught with insurance abuse, which eventually affects the consumers (Yang, Ng & Ni, 2017).

2. Pressure on the State and the oligopolists striving to dictate the game rules. Since the large insurance companies have a wide branch network and act as a social institution, they can often go beyond the legislation, thereby creating a situation, in which the State will be forced to make advances for these market participants.

3. Small insurance companies exit from the market. They were more responsive to the specific consumer demands in a particular region. Thus, this situation will lead to the lack of regional and local insurance markets and will immediately affect the state of regional economy, since such a regional, local insurer participates in the process of regional socio-economic development and provides jobs for the population by performing various socially desired functions (Yuldashev, 2011). This will also affect the state of regional (local) budgets.

4. Increased risk of losing the control over the national market. The Russian insurance market, which has a huge potential, is very attractive for transnational insurance companies that have much more financial capabilities than even the largest Russian insurance company. Thus, transnational companies may absorb the Russian insurance companies.

5. Insurance companies that manage the regional business at a distance are concentrated at the federal level. This leads to the company costs minimization, but to an increase in money spent by the clients.

6. Unification of the insurance product creation and promotion without due account for the interests of the clients, whereas the customer-oriented market formation involves the creation of conditions and mechanisms for accounting and meeting the consumer interests.

7. Insurance supply pattern does not allow satisfying the consumer demand completely. This leads to a reduction in the insurance coverage.

8. Gradual insurance shift by types and their distribution by companies with regard to their financial or financial industrial group. Practice shows that insurance companies, included in this group (the so-called captive insurance companies), receive their fundamental insurance premiums by working with the bank’s client base in such low-market segments as credit and unit-linked life insurance. On the other hand, they are much less active in those types when it comes to those types of insurance, which margin is lower: car insurance, property insurance, travels insurance, optional health insurance (Yuldashev & Odinokova, 2016). Thus, insurance market is gradually shifting to oligopoly through the captive insurance companies, which are becoming more profitable than the market insurance companies.

9. There is an increase in the number of organizational risks associated with the process of building a new insurance market structure.

10. Box insurance is a dominant product in the insurance market, as such products are developed with a regard to consumer’s/company’s/bank’s time and costs minimization. This leads to an increase in the level of dissatisfaction with a service during the process of settling losses.

The insurance market oligopolization has also a number of advantages:

1. Increased number of offered insurance products oriented on citizens with different income levels.

2. Relatively low tariffs that contribute to availability of insurance products for the majority of consumers.

3. Business cost reduction for the purpose of strengthening the market and competitive positions.

4. Greater financial stability of insurance companies gained through the M&A (both by increasing the insurance portfolio and by expanding the opportunities for investing their assets).

5. Insurance entity supervision costs minimization by the state.

The Russian insurance market analysis has shown that current market is characterized by a moderate concentration and is centered on the several players determining its further development in many ways. Major insurers can come into agreement to lower the insurance rates at own expense for quite some time, thereby pushing out the smaller competitors from the market. If their goal is achieved, they raise the price to the required level, thereby making the potential insurers dependent on their offer (Khitrova, 2014).

Discussion

According to Kotlobovsky, “oligopoly is much worse than the monopoly is, as it only imitates the market relations, where all good intentions regarding the protection of consumer’s interests/rights cannot be realized in practice. In the context of oligopoly, business is most likely to come down to the imitation of consumer rights protection. This means that consumer confidence in the insurance will decline” (Zhu & Xu, 2016).

At present, scientific literature introduces the following options for minimizing the insurance market oligopolization impact on the insurance relations development in Russia:

1. Supervision measures undertaken with due account for the capital concentration and centralization (Yuldashev, 2011);

2. Separating the reserve funds from the unions of insurers (Insurance market oligopolization: modern insurance reality, 2016);

3. Developing regional insurance, which will take into account the interests of regional consumers, since regional companies are better adapted to the regional market (Yuldashev, 2011).

4. Making amendments to the current legislation prescribing the federal insurance companies to do international business at certain financial parameters, for example collecting premiums in the amount of not less than 5-10% of the capital base (Yuldashev, 2011).

According to this research, oligopolization process will be the dominant trend of the Russian insurance market development in the future. Therefore, we should consider its objective characteristics, as well as the role of the State and insurance companies, as necessary components of the insurance market relations development with regard to the need in increasing the business activity and competition in the domestic market (2020 Strategy, 2016).

Conclusion

In our opinion, the above mentioned recommendations for minimizing the negative oligopolization consequences are not sufficient due to the national insurance market deterioration. They should be supplemented with the following provisions:

1. Insurance market regulation policy should be smoothly changed. Standardization process should be developed for the mandatory types of insurance in order to improve the supervision efficiency and eliminate the discriminatory requirements imposed for the capital of the small insurance entities;

2. Insurance supervision should be carried out based on the analysis of indicators used to assess the oligopolized insurance markets;

3. Amendments should be made to the current legislation, prescribing the federal insurance companies to:

a) Increase the charter capital size (min size should not be RUB 1 billion);

b) Limit the number of branches (for example, 20 branches or less). At this point, their direct sales are also limited;

c) Reinsure the regional insurance companies at certain financial parameters, for example: Reinsurance premium collection in the amount of not less than 5-10% of the capital base;

d) Transfer a 10% reinsurance premium to the National Reinsurance Company (NPC), which main is to provide protection for losses;

e) Be a member of a Self-Regulatory Organization (SRO), which main purpose is to protect the interests of consumers in case of the insurance company collapse.

4. Amendments should be made to the current legislation, prescribing the regional insurance companies to:

a. make the reinsurance contracts with the federal insurance companies at certain financial parameters, for example – reinsurance cover involves the entire portfolio and 60% of the retention;

b. participate in the regional risk pools;

c. not transfer the reinsurance premium (downside protection payment) to the NIC, since this protection is provided by the federal insurers;

d. be a member of an association or a union, which is a part of the SRO;

5. Amendments should be made to the current legislation, prohibiting the insurance contracts made with the insurance companies interdependent in relation to the insured party.

These recommendations will allow:

1. Increasing the financial stability of insurance companies by expanding the opportunities for providing reinsurance;

2. Preserving and stimulating the regional insurance market development, since federal companies will be limited to act in the regional markets;

3. Increasing the insurance coverage by improving the quality of insurance products through the increased competition of companies;

4. Increasing the variety of offered insurance products that take into account the specific features of consumers;

5. Increasing the responsibility of insurance companies to their clients;

6. Improving the investment potential in the country, as there are more opportunities for the insurance companies to attract new clients;

7. Raising the country’s image by means of foreign economic activity;

8. Developing the insurance market infrastructure, since the federal companies will be forced to sell their products through an insurance broker;

9. Minimizing the risks associated with the insurance market structure reforming, as the financial strength and responsibility of its participants have increased.

Thus, negative consequences of the Russian insurance market oligopolization will be minimized by improving the specific methods for regulating the insurance entity performance. This will positively affect the insurance relations development in the country.

References

- 2020 Strategy: A new growth model: A new social policy. [Electronic resource]. Assess mode: www.hse.ru/pubs/share/direct/document/99110182 (Assess date: 20.12.2016)

- Anagol, S., Cole, S. & Sarkar, S. (2017). Understanding the advice of commissions-motivated agents: Evidence from the Indian life insurance market. Review of Economics and Statistics, 99(1), 1-15.

- Banerji, A. (2017). Corporate governance, ownership and firm performance: A review of impact of financial globalization. Academy of Accounting and Financial Studies Journal, 21(3), 1-11.

- Bobojonov, I., Goetz, L. & Glauben, T. (2014). How well does the crop insurance market function in Russia?. In 2014 International Congress, August 26-29, 2014, Ljubljana, Slovenia (No. 182856). European Association of Agricultural Economists.

- Bruno, M.G., Grande, A. & Oliva, C.F. (2015). Anomalous demand and supply in cat risks insurance market. Annali MEMOTEF, 51-62.

- Bulletin of the Accounts Chamber of the Russian Federation. No. 8 (116), (2007), 201. [Electronic resource]. Assess mode: www.audit.gov.ru/activities/bulleten/637/15883/. (Assess date: 10.12.2016)

- Divshali, P.H. & Choi, B.J. (2016). Indirect demand side management program under realtime pricing in smart grids using oligopoly market model. In Proceedings of the First International Conference on Green Communications, Computing and Technologies (GREEN 2016), Nice, France (24-28).

- Feng, Y., Li, B. & Li, B. (2014). Price competition in an oligopoly market with multiple iaas cloud providers. IEEE Transactions on Computers, 63(1), 59-73.

- Hallam, C., Novick, D., Gilbert, D.J., Frankwick, G.L. & Zanella, G. (2017). Academic entrepreneurship and the entrepreneurial ecosystem: the UT transform project. Academy of Entrepreneurship Journal, 23(1), 77-90.

- Insurance market oligopolization: modern insurance reality. [Electronic resource]. Assess mode: www.nisse.ru/articles/details.php?ELEMENT_ID=108732 (Assess date: 16.12.2016)

- Kazantseva, E.G. & Kharchenko L.L. (2014). The role of oligopoly companies in the global value chains. New technologies, Issue. 33, 33-39 (in Russian).

- Khitrova, E.M. (2014). Development Problems and Prospects of Insurance Relations in Conditions of Increasing Market Concentration. JournaloftheUralStateUniversityofEconomics, 2 (52).

- Knyazeva, I.V. & Lukashenko O.A. (2014). ?ligopoly markets: Competition forms and content transformation. Bulletin of the Tomsk Polytechnic University. Geo Assets Engineering, 325(6).

- Kutsegreeva, L.V. (2015). Antimonopoly policy and antimonopoly regulation of pricing in the Russian Federation. ThePotentialofModernScience, 4, 17-32.

- Lamantia, F.G. & Radi, D. (2018). Evolutionary Technology Adoption in an Oligopoly Market with Forward-Looking Firms.

- Leontieva, A.V. (2014). Transaction costs in the oligopolies. The Molodoy Uchyony (The Young Scientist), 17, 293-295.

- Molotskaya, A.A. (2015). Collusion risk assessment model: oligopoly markets. Collection of materials of the IV International Youth Scientific and Practical Conference in Mathematical Modeling in Economics, Insurance and Risk Management, 2.

- Panasyuk, M.V., Pudovik, E.M. & Sabirova, M.E. (2014). Problems of labor market of modern Russia in conditions of stable economic growth. Life Science Journal, 11(6s), 487-489.

- Ramazanov, A.V. & Grigoryan, K.A. (2014). Government regulation of the financial market in Russia. Mediterranean Journal of Social Sciences, 5(24), 321.

- Shamkhalov, F.I. (2008). Corporatocracy and the power of society. Economics and property management journal,1 (34).

- Singh, A. & Kaur, B. (2015). A mathematical version of cournot oligopoly for n firms. Indian Journal of Research, 4(2), 197-204.

- Vasileva, E., Viljainen, S., Sulamaa, P. & Kuleshov, D. (2015). RES support in Russia: Impact on capacity and electricity market prices. Renewable Energy, 76, 82-90.

- Yang, L., Ng, C.T. & Ni, Y. (2017). Flexible capacity strategy in an asymmetric oligopoly market with competition and demand uncertainty. Naval Research Logistics (NRL).

- Yuldashev, R.T. (2011). Much to our regret, the great opportunities for insurance are a mystery for the President, the Prime Minister and the Duma. InsuranceBusiness, 1.

- Yuldashev, R.T. & Odinokova T.D. (2016). The role of captive insurance companies in the Russian life insurance market development. InsuranceBusiness, 11(284), 20-30.

- Yurgens, I.Yu. (2016). Insurance market: 2015 results, forecasts, main trends. [Electronic resource]. Assess mode: www.insur-info.ru/analysis/1083/ (Assess date: 18.12.2016)

- Zhu, W.Q. & Xu, D.Y. (2016). Analysis on the influence factors and fluctuation of iron ore price based on oligopoly market. DEStech Transactions on Economics, Business and Management, (ICEM).