Research Article: 2021 Vol: 24 Issue: 1S

Trends and Configuration of Politics and Law on Sharia Economics Development in Indonesia

Miftahul Huda, Institut Agama Islam Negeri Ponorogo

Lukman Santoso, Institut Agama Islam Negeri Ponorogo

Agus Purnomo, Institut Agama Islam Negeri Ponorogo

Luthfi Hadi Aminuddin, Institut Agama Islam Negeri Ponorogo

Abstract

In a legal state entity, politics and law are always intertwined. The presence of the law cannot be separated from the intervention of political policyholders. Meanwhile, on the other hand, the political actors' movements must comply with the laws that have been made. However, legal products as political products are ideally a representation of the aspirations of the people and at the same time can have an impact on the benefit of the people at large. This study aims to explore the trends and configurations of Islamic politics and economic law after reform in Indonesia. This study employed a conceptual- juridical approach and is a type of qualitative research. Data collection techniques were carried out by digging library sources that are relevant to the topic of study. This study found that the trend and configuration of politics and law in the field of Islamic economics in post-reform Indonesia is largely determined by the internal socio-cultural dynamics of Muslims on the one hand, Islamic-leaning political parties in parliament, as well as fluctuations in the relationship between Muslims and the state. A conducive political climate allows the development of the Islamic economic industry joints at the regional and national levels. This dynamic contributes to the process of strengthening Sharia economic values in the legislative process and bureaucratization of Sharia economic law in the national legal arena.

Keywords:

Configuration, Legal Policy (LP), Sharia Economics (SE), Indonesia

Citation Information:

Huda, M., Santoso, L., Purnomo, A., Aminuddin, L.H. (2021). Trends and configuration of politics and law on sharia economics development in Indonesia. Journal of Management Information and Decision Sciences, 24(S1), 1-9.

Introduction

In the context of legal development nowadays, the Indonesian nation is faced with the massive development of information technology and economic globalization. This condition then has an impact on the thin barrier between legal systems in the world, such as common law and civil law, including their practice in Indonesian law. This shows that the dynamics of law involving streams, between systems, and between countries have brought about changes in the legal structure that adopts universal principles (Hernoko, 2016; Panjaitan, 2016). For example, the development of sharia economic law in various institutions and countries. The presence of the reform era is at least a sign of the shift as well as the configuration of legal politics in Indonesia. This includes the field of Islamic law. This can at least be seen from several studies such as the "state school of law fiqh" or "national school of thought fiqh" conducted by Marzuki Wahid, dan M.B Hooker (Hefni, 2020; Wahid & Rumadi, 2001). Regarding the politics of Islamic law written by Kamsi, Masnun Tahir, Ahmad Gunaryo, Masruhan, Muhammad Ainun Najib (Gunaryo, 2005; Kamsi, 2020; Masruhan, 2011; Najib, 2017). Alternatively related to the politics of sharia economic law more specifically, such as the writings of Ibn Elmi AS Pelu, Cholil Nafis, Nevi Hasnita, Fauzan Ali Rasyid, Mu’adil Faizin, Fitrianur Syarif, dan Ana Indriana & Abdillah Halim (Faizin, 2017; Hasnita, 2017; Indriana & Halim, 2020; Nafis, 2011; Pelu, 2008; Rasyid, 2016; Syarif, 2019). This dynamic in its development has also shifted as the current of decentralization and regional autonomy is getting stronger, from the politics of Islamic law legislation at the central level shifting to the local level, resulting in massive Sharia regulations in various regions. This can be observed from Robin Bush's research which mentions that Sharia regulations (shari'ah-by laws) began to popular from mid-1999 to 2007 (Bush, 2008). Likewise, in Muntoha's research (2010) and confirmed by Dani Muhtada's research, they mention the massive positivization of Islamic law through sharia regulations, which was widespread until 2013 (Muhtada, 2014).

Based on the various explanations of the studies above, the direction of the political configuration of Islamic law seems to be experiencing a trend and a shift from the field of private law to the field of Islamic economics (muamalah). Asep Saepudin Jahar, called this period the bureaucratization of Sharia (Jahar, 2019). Meanwhile, Jan Michel Otto, mentions Sharia Incorporation (Otto, 2010). Several legal products that were successfully promulgated during this period include the Law on Sharia Banking, the Zakat Law, the Waqf Law, the Religious Courts Law, the Government Islamic Securities Law, KHES, and several other similar legal products. Meanwhile, the Sharia industry, if developed in Indonesia with a Muslim majority population, is even more potential than in other countries. Therefore, it is necessary to sharpen the concept and development strategy, one of which is through synergy and connectivity between policymakers and Sharia industry actors (BI, 2017). This great potential was also conveyed by the Ministry of Finance through the May 2019 edition of Financial Media magazine, that the Islamic economy contributed US$3.8 billion to Gross Domestic Product (GDP) per year.

From this background, this study is certainly different from several studies that have been conducted regarding the politics of Islamic law and the politics of sharia economic law. The point of distinction offered and strengthened by the authors in this study is more on the aspects of the trend and configuration of legal politics related to the synergy and integration of law in the sharia economy through the omnibus law in the sharia economy on the one hand, and the halal industry on the other. To sharpen the focus of this study, the authors formulate a research question: what are the trends and political configurations of Islamic economic law after reform in Indonesia? As well as how the synergy and integration of legal development within the national legal framework.

Literature Review

In looking at the politics of Islamic law in Indonesia, it can be seen from two points of view. First, instrumentally, as evidenced by the many provisions of legal products that have adopted Islamic law. Second, further proof of the contribution and role of Islamic law in the institutional aspect, namely the acceptance of Islamic law institutions for a long time along with its dynamics and changes (Pelu, 2008). The formation of statutory legal products as part of the concept of legal politics is always in a configuration space that cannot be value-free. Values rooted in social aspirations, culture, economy, politics, law, and the like, interact and influence each other. Thus, the formation of sharia economic law products in the realm of the concept of Indonesian legal politics does not only experience one configuration but also varies. Therefore, political configurations, socio-cultural configurations, socio- economic configurations, globalization configurations, and others emerge.

In a modern legal state, the existence of legal politics has at least several objectives: First, a strategic step in ensuring justice in society. Second, creating a peaceful life by realizing and maintaining legal certainty. Third, dealing with real interests in common life with more concrete strategies (Rusydi, 2007). The presence of various configurations at the level of legal politics for the formation of these statutory products theoretically, as Nonet & Selznick's thesis, can at least be grouped into 3 (three) legal categories that apply in society, as follows (Nonet & Selznick, 1980), the presence of laws and regulations that act as servants of repressive powers; the presence of laws and regulations that act as an autonomous institution capable of taming the repressive regime and protecting its integrity; and The presence of laws and regulations that act as facilitators of various responses to social needs and aspirations.

The existence of Sharia economic law is directly related to the political dynamics of a country. The face and economic performance of a country are largely determined by the mechanisms and processes of political decision-making that apply and are agreed upon by the community. A good understanding of political processes and mechanisms greatly determines the success of an idea or economic ideology in creating an economic system that makes the value it brings, in this case, the Islamic economy (Iswanto, 2013). Therefore, legal products resulting from the political process must reflect the legal values that develop in society, which function to uphold religious values, justice, and welfare for the community and nation. This is in line with Abdullahi Ahmed An-Naim's view, which states that the development of Islamic law in the context of national law must reflect universal human values. In the socio- political and constitutional fields, the resulting regulations must be able to accommodate human values and the rights of citizens proportionally. Likewise in the economic field, the resulting regulations must be able to absorb and reflect legal values that have a vision for the benefit of the community (Dahlan, 2016). The enactment of Sharia economic law in Indonesia throughout history has undergone a dynamic configuration along with the legal politics implemented by state policies. However, post-reform, Sharia economic law has experienced encouraging developments both in the form of regulations and institutions, both through political infrastructure and political superstructures with various dimensions of socio-cultural support that accompany it (Muttaqien, 2020). Within that framework, legal politics as both a theory and a concept will be used as an analytical knife in unraveling the configurations that are present along with the regulation and institutionalization of the Islamic economy in post-reformation Indonesia.

Research Methodology

This research is qualitative research with a conceptual approach. The data collection technique used was library research. Books, scientific journals, and literature related to the theme of the study were subjects that are collected using a snowball sampling pattern. The data used in this study were qualitative data consisting of primary data sources and secondary data (Nawawi & Martini, 1996). Primary data are the main material in research while secondary sources function as a complement to primary sources that can enrich research (Yasid, 2010). Legal data analysis was carried out by organizing it, sorting it out, systematizing it, and interpreting it to find patterns, categories, units of description, and meaning (Alkostar, 2018). In order for the research data to better guarantee the accountability aspect, then re-checking was carried out, both in the form of triangulation and peer debriefing/analytic triangulation.

Results and Discussion

Today's Islamic economy has reached the global economy, across national borders, and even across religious beliefs. The institutionalization of Islamic economic law is increasingly important and prospective in Indonesia, according to Fauzan Ali Rasyid, (Rasyid, 2016) this is at least motivated by several factors. First, with Indonesia's increasingly open political system, political issues and statements in favor of Islam have become an attractive brand for politicians to carry in gaining support. Second, other methods of reducing pressure and the development of radical and fundamental groups. With the development of Islamic economics into a national political discourse, radical groups lost sympathy and shifted to Sharia economic discourse that carried the public interest. Third, changes in the global economy. This was motivated by the financial crisis in European and American countries so that the EEC was in danger of disbanding. This condition makes the Western world look at economic power in Muslim countries, including in terms of Islamic economics by establishing Islamic banks, such as Switzerland, England, et cetera.

In line with that, it can be said that the political configuration of sharia economic law in Indonesia today is increasingly important for the people. This is at least within the framework of fulfilling instrumental needs as well as human rights. Especially when it is associated with national economic development that has a populist vision and has an impact on all people regardless of their religion. To support this, the urgency of the position and role of Sharia economic law can be seen from a multi-dimensional perspective, for example from a historical point of view, the Indonesian community, community needs, and even from the philosophy and constitution of the country. This is in line with the contents of the 1945 Constitution Chapter XI concerning Religion Article 29 paragraphs (1) and (2), as well as Chapter XIV Articles 33 and 34 which regulates the national economy and social welfare. As a starting point for its current and future development efforts. Based on the explanations of experts, culturally, Sharia economic law has been in effect among the community since the entry of Islam in the archipelago. This can be proven by the establishment of many economic institutions by the Muslim community (Buzama, 2012). This dynamic was later formulated by Lodewijk Willem Christian van den Berg (1845-1927) as a theory of receptio in complexu, namely that the Indonesian Muslim community has embraced Islamic law as a whole (Rana, 2018).

As an effort to anticipate these dynamics, the Dutch government then made legal political efforts to eliminate Islamic law to strengthen the legal policies brought by the Dutch. The idea driven by C. Snouck Hurgronje (1857-1936) was later known as the receptie theory. This theory emphasizes that the law that applies to the people of the archipelago is customary law. Therefore, Islamic law can be accepted and applies when it does not conflict with customary law (Irmawati, 2017; Triyanta, 1997). The influence of the legal politics of the colonial era in its journey gave influence and became one of the ups and downs of the development of Islamic law in the national legal system until the reform era.

In the reform era, sharia economic law developed massively, especially in the era of the Habibi, Susilo Bambang Yudhoyono, and Joko Widodo administrations. During the third term of the President, the sharia economy, both legally and institutionally, thrived and strengthened each other. Consequently, with the development of the Islamic economy in the national economic system, it is expected to create a balance between the real sector and the monetary sector (Syarif, 2019). Based on this understanding, the trends and configurations of post-reform Sharia economic law can be categorized into two conditions. First, ius constitutum, namely the product of sharia economic law that has been ratified and is running. Second, legal politics is ius constituendum, namely legal products that are currently and will be enforced. To make it easier to analyze trends and configurations of Islamic economic law in the post-reform era, sorting will be presented in several periods of development trends

In this first period (1991-1999), the trend and configuration of the development of sharia economic law were marked by the establishment of Bank Muamalah Indonesia (BMI) in 1991. The legal basis used was Law No. 7 of 1992 concerning Banking. Entering the beginning of 1999, on February 10, 1999, the National Sharia Council of the Indonesian Ulema Council (DSN-MUI) was established as an institution that has authority in the field of Sharia finance related to Muslims in Indonesia through Indonesian Ulema Council Decree No. Kep754/MUI/II/1999. Furthermore, as the representative of DSN in Islamic financial institutions, a Sharia Supervisory Board (SSB) was formed. In general, the SSB plays a role in conducting periodic supervision of Islamic financial institutions. Meanwhile, to mediate disputes between financial institutions and their customers following Sharia principles as an alternative settlement route outside the court, BASYARNAS was formed (Wahid, 2016). With the presence of the DSN-MUI, according to Cholil Nafis, the application of fiqh muamalah in Islamic economic practice can be grouped into 3 periods: The first is the pioneering period. The second is the application period. The third is the period of absorption into legislation. The pioneering period began in 1992 when efforts were made to study and establish a muamalah bank. The implementation period began in 2000 when DSN produced many fatwas as guidelines for Islamic financial institutions. The absorption of fatwas under laws and regulations began when the Sharia Banking Law was passed in 2008 (Nafis, 2011). The next regulation that was issued was Law no. 38 of 1999 concerning Zakat which was ratified on September 23, 1999. This law recognizes that there are two types of zakat management organizations, namely the Amil Zakat Agency which was formed by the government, and the Amil Zakat Institution which was formed by the community and confirmed by the government. Subsequently, Law No. 17 of 1999 concerning the Organization of the Hajj was enacted, which was later amended by Law No. 13 of 2008 concerning the Organization of the Hajj. This regulation comes as a response to the modernization of the global Hajj organization. Regarding the implementation of the Hajj, it is fully managed by the Ministry of Religion.

In the second period (2000-2004), the development of the Islamic economy in Indonesia has not been seen significantly. This is none other than influenced by the dynamics of legal politics in the parliament which is still focused on the amendments to the 1945 Constitution from the first to the fourth stages. The legal product that was successfully enacted only appeared at the end of this period, namely Law Number 41 of 2004 concerning Waqf (Huda & Santoso, 2020). To complement the regulation, two years later the government issued Government Regulation No. 42 of 2006 regarding the implementation of Law No. 41 of 2004, plus Ministerial Decree No. 4 of 2009 concerning the Administration of Cash Waqf. The institution that was also formed during this period was the Sharia pawnshop which was under the pawnshop.

In this third period (2005-2009), the legal product that was successfully promulgated was Law No. 3 of 2006 concerning religious courts. This legal product is an amendment to Law No. 7 of 1989 concerning religious courts, by providing additional authority to handle, decide, and resolve cases at the first level between people who are Muslims in the field of Islamic economics (Rusydi, 2007). The next legal product that was issued in this phase is Law No. 19 of 2008 concerning Government Islamic Securities (Surat Berharga Syariah Negara, abbreviated as SBSN), which was ratified on May 7, 2008. The enactment of this law aims to support the financing of the APBN which is always in deficit, including also for project financing. This policy shows the government's support for funding the APBN with Islamic financial instruments, and it is proven that the development of global and retail Sukuk is very rapid after the presence of the regulation. The policy that emerged later was the establishment of the Directorate of Sharia financing at the Ministry of Finance of the Republic of Indonesia in response to Law No. 19 of 2008 concerning Government Islamic Securities, resulting in the birth of various types of state Sukuk, for example, retail and corporate Sukuk. On May 19, 2008, the government then issued Government Regulation No. 39 of 2008 concerning Sharia Insurance as the second amendment regulation to Government Regulation No. 73 of 1992 concerning the implementation of the insurance business. Not long ago, Law No. 21 of 2008 concerning Islamic banking was enacted, which was passed on June 17, 2008. With the presence of this legal product, the government represented by BUMN then established a Sharia Commercial Bank. In an effort to strengthen the implementation of Sharia economics, as well as the effectiveness of the performance of the religious courts, on September 10, 2008, the Supreme Court through Supreme Court Regulation (PERMA) No. 2 of 2008, issued the Compilation of Islamic Economic Law (Compilation of Sharia Economic Law, abbreviated as KHES) which contains 4 books, 43 chapters, and 796 Articles. This KHES is a response to new developments in the study and practice of Islamic economics in Indonesia (Habibullah, 2017).

During this fourth period (2020-2014), the government passed Law No. 23 of 2011 on zakat management on November 25, 2011. This law replaced Law No. 38 of 1999 on zakat. This regulation was established to strengthen zakat institutions and governance, thus require zakat management institutions to be integrated with BAZNAS (Amil Zakat National Agency) as the coordinator of all zakat managers, both Provincial Baznas, Regency/Municipal Baznas, and Amil Zakat Institutions. In the 2014 Syariah People's market, the 2015-2019 Syariah Banking Roadmap was launched. Then accompanied by the birth of Law No. 22 of 2014 concerning guarantees of halal products. The law, which consists of 68 articles, was ratified on October 17, 2014. In legal products, it is emphasized that products that enter, circulate, and are traded in the territory of Indonesia must be certified halal. To implement the JPH (Jaminan Produk Halal or Halal Certification), a Halal Products Certification Agency (Badan Penyelenggara Haminan Produk Halal, abbreviated as BPJPH) was formed which is located under and responsible to the Minister of Religion. In addition to BPJPH, the JPH Law also regulates the role and function of the MUI in halal certification, as well as the role of the Halal Inspection Agency (LPH). However, this law only had its implementation rules five years later through PP No. 31 of 2019 concerning the Implementation of Law No. 33 of 2014. Not long ago, Law No. 34 of 2014 was issued on Hajj Financial Management. This law is a change from the previous regulations. The presence of this regulation brings a new paradigm in the context of Islamic public finance. One of the important mandates of this law is to establish the Hajj Financial Management Agency (BPKH) no later than September 2015. In addition, the use of hajj quotas is carried out in a transparent and accountable manner, both in terms of management and services.

This phase of fifth period (2015-2019) is marked by the development of Islamic financial institutions that are getting better. The government launched the Indonesian Islamic Financial Architecture Master Plan (MAKSI) which contains plans to create a large-scale Islamic bank. In this phase, the Master Plan for Islamic Economics and Finance was also launched as well as the inauguration of the National Sharia Finance Committee (KNKS). In addition, to describe the rules in the articles contained in the JPH Law, the government then issued Government Regulation No. 31 of 2019 concerning the implementation of Law No. 33 of 2014. This Government Regulation clearly explains the duties and authorities of the institutions that must be established and related to the halal certification process, namely: BPJPH, MUI, and LPH. This Government Regulation describes in detail the duties, authorities, and functions of the institutions involved in halal certification, namely: BPJPH, MUI, and LPH. BPJPH acts as a regulator of halal certification in Indonesia. Meanwhile, MUI plays a role in halal auditor certification, product halal determination, and LPH accreditation. In addition, Minister of Religion Decree No. 982 of 2019 was issued to technically support existing regulations.

This sixth period (2020-2024) was marked by the inclusion of several bills related to the Sharia economic industry in the 2020-2024 National Legislation Program. Some of the bills are, the bill on amendments to Law No. 33 of 2014 concerning JPH, the bill of amendments to Law NO. 41 of 2004 on Waqf, the bill of amendments to Law No. 23 of 2011 on Zakat Management, the bill of amendments to Law No. 34 of 2014 on Financial Management Hajj, the Bill on Halal Tourism Destinations, and the Bill on the Sharia Economy. What is quite interesting about the bill is that it is entirely a parliamentary initiative. In the draft of the national legislation program, in contrast to other Sharia economic bills which are sectoral regulations, the Sharia Economy Bill is present as an umbrella regulation or umbrella act that covers all sectoral laws in the Sharia economy. This Sharia Economy Bill aims to provide a legal basis for all aspects of the Sharia economic ecosystem in Indonesia. The number of bills related to the Sharia economy in this national legislation program shows that the government's commitment to developing the Sharia economy is very high. In addition, in this phase, as an effort to expand the work focus of the KNKS, an institutional change was made to the National Committee for Sharia Economics and Finance (KNEKS). As a form of optimism for the growth of the Islamic financial sector, the government finally decided to merge 3 Islamic banks under BUMN, namely BRI Syariah, Bank Syariah Mandiri, BNI Syariah into a new institution named Bank Syariah Indonesia (BSI). The merger of the 3 Islamic banks was inaugurated on February 1, 2021. The government's commitment to boost the economy through BSI is expected to be a new energy in national economic development.

The description of the trends and configurations of the various periods above at least confirms that the birth of various products of legislation related to the sharia economy in the dynamics of legal politics in the post-reform era shows that the role of regulation is the most important critical point in the development of the sharia economy in the contemporary era. The presence of regulation in the sharia industry ecosystem is a challenge for stakeholders to understand and balance between effective supervision, consumer protection, and facilitation of the industry for future growth and development in the national and global spheres. This is where the role of legal politics is carried out by the government through the establishment of regulations as checks and balances, such as making policies that can support economic activities and sharia economic growth, both institutionally and in a system that remains focused and comprehensive. Accordingly, it is not only concentrated in the financial sector but also massively in the real sector. In this regard, according to Edy Suandi Hamid, the real sector needs to be encouraged for it goes hand in hand with the monetary sector. The implementation of the Islamic economy is not only at the level of large corporations, but also at the people's economy to the bottom tier. This includes a digital-based sharia economy.

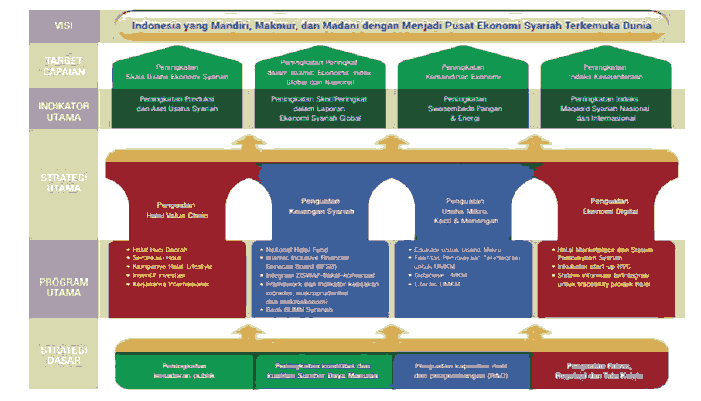

The big map of the dynamics of the sharia economic ecosystem can at least be observed in the framework of the following Indonesian Sharia economic master plan: as shows in Figure 1.

Figure 1: Indonesian Sharia Economic Masterplan Framework

Source: Indonesian Islamic Economic Masterplan 2019-2024, 2018

Based on the actual developments described in the Indonesian Islamic Economics Master Plan 2019-2024, there are several challenges to the development of the sharia economy, one of which is the integration aspect of various regulatory fields and the halal industry. Therefore, in the future, there need to be systematic efforts and strengthening policies in realizing an integrated sharia economic law political design. This design must cover three main areas, namely the realm of regulations and related regulations, the realm of institutional strengthening and expansion, and the realm of internalizing sharia economic values in the industrial and business ecosystems (Iswanto, 2013).

First, in the realm of regulation. Thus, the existence of statutory products and their derivative rules is very urgent. There needs to be a regulatory design formulation that can increase the acceleration of Islamic economic development which is currently still lagging and not yet synergistic. The choice of a regulatory model through an omnibus law against the Sharia Economy Bill is an ideal and prospective design for efforts to accelerate the development of the Sharia economy. Consequently, the comprehensive regulations can reach the entire ecosystem of the Islamic economic industry which is spread in various legal products.

Second, in the realm of institutional expansion. This is done by focusing on efforts to increase the size of the Islamic economic industry so that it can develop and grow, for example, the sharia cooperative sector and halal tourism which currently do not have clear institutions.

Accordingly, this must also build synergies and be integrated with the private sector and higher education which gives birth to undergraduate competence in the field of Islamic economics.

Third, in the realm of internalizing sharia economic values in business and industrial practices. With this effort, it is hoped that it can consciously and fundamentally change the economic legal system which has so far been of liberal quality and only relies on the rule of law to a law that is oriented towards the rule of morals, the rule of ethics as well as the rule of justice. This is in line with the legal objectives in the siyasah syar'iyyah paradigm which states that the leader's policy over his people is a manifestation of the embodiment of benefit to the public (tasarruf al-imam ‘alaa raiyyah manuttun bi al-maslahah). This rule can simply be interpreted that legal politics in the field of sharia economics must be firmly spearheaded by the leader while still prioritizing the goal of realizing the welfare of the wider community.

Conclusion

Based on the description in the discussion of this paper, it can be concluded that the trend and configuration of the government through regulatory support and political will is currently showing a better graph. These must continue to be encouraged and improved in order to accelerate the realization of the sharia economic ecosystem in the national economic system. In such developments, efforts to realize Indonesia as the center of the world Sharia economy and the world's halal industry can be realized immediately under the foundation of the Pancasila economic system which is the root of Indonesia's economic legal system.

References

- Alkostar, A. (2018). Prophetic law research methods. Yogyakarta: UII Press.

- Antonio, S. (2001). Islamic banking from theory to practice. Jakarta: Gema Insani Press.

- Basuki, (2011). Easy ways to prepare a research proposal. Yogyakarta: Pustaka Felicha.

- Bush, R. (2008). Regional sharia regulations in Indonesia: Anomaly or symptom? expressing Islam: Religious life and politics in Indonesia, 174.

- Buzama, K. (2012). Application of Islamic legal theories in Indonesia. AL-’ADALAH, 10(2), 467–472.

- Dahlan, M. (2016). Human values in islamic law legislation in Indonesia. Al-Manahij: Journal of Islamic Legal Studies, 10(2), 217–234.

- Faizin, M. (2017). The sharia law politics law in Indonesia Year 2008-2017. Adzkiya : Journal of Sharia Law and Economics, 5(2), 378–392.

- Gunaryo, A. (2005). The struggle of politics and islamic law: Repositioning the religious courts and the garlic fertilizer court towards real justice. Yogyakarta: Pustaka Pelajar.

- Habibullah, E.S. (2017). Sharia economic law in the national legal order. Al- Mashlahah, Journal of Islamic Law and Islamic Social Institutions, 5(09).

- Hasan, H. (2010). Competence of religious justice in the resolution of shariah economic matters. Jakarta, Gramata Publishing.

- Hefni, W. (2020). The new fiqh in a national school of legal thought: A paradigm shift in national school of islamic law on m. barry hooker’s perspective, Justicia Islamica, 17(1), 17–34.

- Hernoko, A.Y. (2016). Contract law: The principle of proportionality in commercial contracts. Jakarta, Kencana.

- Hooker, M.B. (2008). Indonesian syariah: Defining a national school of Islamic law. Singapore, Institute of Southeast Asian Studies.

- Huda, M., & Santoso, L. (2020). The construction of corporate waqf models for indonesia. International Journal of Innovation, Creativity and Change, 13, 720– 734.

- Indriana, A., & Halim, A. (2020). Politics of sharia economic law in Indonesia. El-Wasathiya: Journal of Religious Studies, 8(1), 79–98.

- Irawan, M. (2018). Politics of sharia economic law in the development of islamic financial institutions in Indonesia. Legal Media Journal, 25(1), 10–21.

- Irmawati, (2017). Syahrizal abbas' bamboo split theory: between reception in complex theory, receptie theory and receptio a contrario theory. PETITA, Journal of the Study of Islamic Law, 2(2), 119–130.

- Iswanto, B. (2013). Islamic economics and legal politics in Indonesia. Mazahib, 12(2).

- Jahar, A.S. (2019). Bureaucratizing sharia in modern Indonesia: The case of zakat, waqf and family law. Studia Islamika, 26(2), 207–245.

- Jihad, N. (2016). Implementation of Law No. 38/1999 on Zakat Management. Journal of Law IUS QUIA IUSTUM, 8(17), 63–72.

- Kamsi. (2020). The politics of law and the positivation of islamic sharia in Indonesia. Yogyakarta: Graha Ilmu.

- Masruhan, M. (2011). Positivization of islamic law in indonesia in the reformation era. ISLAMICA, Journal of Islamic Studies, 6(1),119–133.

- MD, M. Mahfud. (2019). Legal politics in Indonesia. Jakarta: Rajawali Press.

- Muntoha. (2010). Regional autonomy and development of sharia-based regional regulations in Indonesia. Yogyakarta, Safiria Insani Press.

- Najib, M.A. (2017). Legal politics of the formalization of islamic sharia in Indonesia. IN RIGHT, Journal of Religion and Human Rights, 6(2).

- Nawawi, H., & Martini, M. (1996). Applied research. Yogyakarta, Gajah Mada University Press.

- Nonet, P., & Selznick, P. (1980). Law and society in transition: Toward responsive law. New York: Harper & Row.

- Otto, J.M. (2010). Sharia incorporated. A comparative overview of the legal systems of twelve muslim countries in past and present. Leiden: Leiden University Press.

- Panjaitan, S.P. (2016). The Politics of legal development in the investment sector is a necessity of the economic constitution. Constitutional Journal, 7(2), 047–066.

- Pelu, I.E.A.S. (2008). The politics of shari'ah economic law (from the idea to the formation of national legal legislation). Himmah, IX (25), 80–96.

- Pryor, F.L. (1985). The islamic economic system. Journal of Comparative Economics, 9(2), 197–223.

- Rana, M. (2018). The influence of receptie theory in the development of islamic law in Indonesia. Court. Journal of Islamic Legal Studies, 3(1), 17–34.

- Rasyid, F.A. (2016). Political configuration of sharia economic law in Indonesia. Ijtihad, Journal of Islamic Law and Humanitarian Discourse, 16(2), 297–315.

- Rusydi, M. (2007). Formalization of islamic economic law: Opportunities and challenges (responding to law no. 3 of 2006). Al-Mawarid Journal of Islamic Law, 17(3), 425–436.

- Santoso, L. (2012). Politics of sharia economic law in Indonesia. socio-religious,10(2), 101–122.

- Santoso, L. (2016). State of law and democracy. Ponorogo: IAINPo Press.

- Seff, S. M. (2008). Sharia banking regulations after the birth of law number 21 of 2008 concerning sharia banking (legal political studies). Legal treatise, 86–92.

- Soekanto, S., & Abdullah, M. (1990). Sociology of law in society. Jakarta: Rajawali Pers.

- Syarif, F. (2019). Development of sharia economic law in Indonesia. Plenary jure, 8(2), 1–16.

- Triyanta, A. (1997). Prospects of Islamic Law in Indonesia. Journal of Law ius quia iustum, 5(8), 1–13.

- Wahid, M., & Rumadi. (2001). State Fiqh Madzhab: Criticism of the Politics of Islamic Law in Indonesia. Yogyakarta: LKiS.

- Wahid, S.H. (2016). Pattern of transformation of DSN-MUI sharia economic fatwa in indonesian legislation. ahkam: Journal of Islamic Law, 4(2), 171–198.

- Yasid, A. (2010). Legal Research Aspects. Yogyakarta: Student Library.

- Yulianti, R.T. (2003). Islamic banking in Indonesia (Study of Legislation). Phenomenon Journal, 1(2).