Research Article: 2022 Vol: 26 Issue: 3S

Usage of Debt and the Probability of Increased Profits

S. Martono, Universitas Negeri Semarang

Yulianto, Arief, Universitas Negeri Semarang

Wijaya, A.P, Universitas Negeri Semarang

Citation Information: Martono, S., Arief, Y., & Wijaya, A.P. (2022). Usage of debt and the probability of increased profits.Academy of Accounting and Financial Studies Journal, 26(S3), 1-09.

Abstract

The purpose of this paper is to investigate how relationship usage of debt and probability of Increased Profit in the context a manufacturing industry in Indonesia as Emerging Market. The Study utilized a cross sectional design and investigated the relationship performance on a sample of 611 unit of observation from the Manufacturing sector in Indonesia period 2009 – 2018. Data analysis uses logistic regression. The findings are asymmetric information between debtholders and shareholders resulted in the use debt in some manufacturing companies with heterogeneous sub-sectors for a significant investment. Consequently, companies in intra-industry (manufactures) need to consider the relationship between the level of debt and asymmetric information produced by their characteristics. The predictions has been criticized inability to adjusted with market timing of debt or equity. The study to extend of relationship usage short term debt and profitability through logistic regression and marginal profitability. The study implies to manager to create to handle debt is optimal for investment, therefore agency problem will decrease.

Keywords

Debt, Profitability, Asymmetric Information, Intra Industry.

Introduction

Currently, asymmetric information is still an interesting research topic in developing countries Mishkin (2000), carried out research in East Asian developing countries explaining the effects of weak financial regulation and supervision. More explained, study in Indonesia in the pre-and post crisis of 1997-2000, reported that in the pre-crisis period it was caused by governance and the post-crisis was caused by the uncertainty of economic policies and the instability of political conditions that damaged market confidence Kasri, (2014) resulting asymmetric information from firm’s perspective that produced agency conflict (Cheryta & Mustaruddin, 2017). In corporate finance, asymmetric information refers to the idea of managers which have better information than market participants, therefore, they better know the value of their company’s assets and investment opportunities. Resulting have effects whether or not the market will correctly claim the company’s value, therefore debt in the capital structure replaced (SA Ross, 1977). The agency theorizes that the nexus contract was denied due to the managers’ actions because they (a) acted in their own interests (b) acted in the interests of shareholders, therefore harming the interests of debt holders. A lot of previous research has been carried out to address the first actions, therefore, this research is more focused on manager actions towards the interests of shareholders, while ignoring the interests of the debt holders (La Rocca, 2007).

Presence between an increase in funding needs with debt and asymmetric information are used for investment according to shareholders' recommendations, there is the possibility of both over-investment and under-investment. In over-investment decisions, shareholders will be concentrating on increasing the value of equity, thereby encouraging managers to make high-risk investment decisions. However, Bondholder rejected over investment decisions due to the increased chances of default risk from the company. Hence, the use of the debt is only beneficial to the shareholders. Conversely, under-investment decisions occur when managers act on the interests of shareholders to invest in positive NPV projects. The rejection occurs when the use of debt for investments purposes with a positive NPV does not significantly exceed the debt interest that must be paid. Even though the NPV is positive, there are no benefits for the shareholders.

Sub-optimal investment are over-investment (Jensen, 1976) and under investment problem (Myers, 1984) which results in the optimal use of debt will affect the profitability. Previous research by Fama, (2012) demonstrated that increasing debt does not always provide tax profits, conversely, it causes agency problems between shareholders and managers or debt holders, thus reflecting the negative relationship between debt and profitability.

Research inconsistency has findings the impact of debt on the capital structure of SMEs in Australia (Cassar & Holmes, 2003). They found an inverse relationship between profitability and debt ratios; Abor & Biekpe, (2005) found an inverse relationship between the profits of listed companies in Ghana and long-term debt; (Amidu, 2007) in Ghana & Prempeh, (2019) found significant negative relationship between STD and profitability; different result, Kirmi, (2017) demonstrated STD had a insignificant negative effect on profitability. Therefore, further research is needed to gain better understanding impact debt to profitability.

Background of the research is appear when asymmetric information caused the company to use debt as a signal to the marketplace (Prempeh & Peprah-Amankona, 2019) reported that profitable companies will use debt as a qualified signal to the marketplace. Niu (2008) carried out a study in China and explained that there is a positive relationship between leverage and profitability. Companies with a good expected value will use debt as an indicator of a good signal quality. Therefore, the expected value opportunity can be filled by the use of debt. Other research such as Dwilaksono (2016) found STD has a significant positive effect on profitability.

The research was carried out in the manufacturing sector because the period 2017 to 2019 showed a significant increase in the GDP rate and a tendency for the decrease of year on year (see attachment 2). This manufacturing sector growth can quite appropriately be used as research data due to the growth being identical to funding needs in order to get a positive cash flow. If the investment funding requirements are satisfied using debt, furthermore it can potentially bring on asymmetric information.

Based on differences in results from the perspective of agency and signalling theory, it is used as an opportunity in this manufacturing sector research. The present paper focuses on the relationship between debt and business profitability and the conclusion reached is that the theory of signaling theory based on agency theory of choice works only in emerging country. Therefore, the purpose of this research is to determine how the influence of debt effects profitability.

Literature Review

Agency Theory and Debt

Agency theory is based on the interaction between agents and principals. An agent is the party that manages the company, and the principals are shareholders who are the owners of the company. To ensure a balanced relationship between agents and stakeholders (shareholders, suppliers or other parties), explicit and implicit nexus contracts are prepared. The manager has direct control over developing and planning resources according to the nexus contract. However, in fact managers are opportunistic because they use resources and suboptimal investment decisions, which reduces the value of the company (La Rocca, 2007).

Agency conflicts happen between agents, bondholders and shareholders especially in capital structure decisions. Managers working as direct controllers can act on (a) their own interests, resulting in the selection of suboptimal projects with low risk and inadequate results. This is contrary to the preferences of shareholders regarding risky projects which increase the value of equity (b) the interests of shareholders by making suboptimal investment decisions based on risky projects. The investment decision will maximize the value of equity, conversely on the value of the company due to contradicting the preferences of debtholders.

Decisions about the value of equity and the worth of the company are not rationally based on the total assets or the company’s value sourcing from its debt and equity. Then the reduction in debt will have an impact on the decline in company value. If the company's value needed to remain constant, then a debt reduction strategy will require an increase in equity.

Managers can allocate debt in suboptimal investment in the form of over and under-investment. The problem of over investment relates to the possibility of managers misusing power and decision making by adopting unprofitable and risky projects that damage the interests of shareholders and debtholders (M. Jensen, 1976).

After the manager enters into a contract in the use of debt and acts on behalf of the shareholders’ interests, any decision making for a risky project is carried out. It is impacted based on increasing leverage and the risk of bankruptcy.

In the under-investment decision, the manager will reject the debt for the project with a positive NPV (net present value) as long as it cannot significantly increase the value of the company, which will further reduce the value of the company (Myers, 1977). Company value will depend on growth opportunities that can affect profitable investments in the future.

Presence growth opportunities and agency problems still exist resulting that have not been realized, they will have a very strong impact on agency costs (Brito, 2002). Companies can carry out financial manipulation in order to reduce the debt problem on under and over investment, thereby aligning the interests of shareholders and debt holders. Debt innovation can transfer some risks from companies and/or shareholders to debtholders. Therefore, debt and agency costs that come from management, shareholders and debt holders can be reduced.

In conclusion, the first hypothesis is that the higher the debt, the higher the agency problem and the more probability that profitability will decrease.

Asymmetric Information: Short-Term Debt and Profitability

Myers & Majluf (1984) in Pecking Order Theory (hereafter POT) explained that the first investment made is debt issuance and the last is issuing equity which is financed by internal funds. This theory is based on asymmetric information, which is generated when the managers’ information is of a better quality than outsiders, therefore, the debt can be used as a signal. The asymmetry causes a funding hierarchy, and therefore, equity is only issued if the company no longer has any debt. The pecking order theory is dependent on asymmetric information existing, therefore it is necessary to send signals to the market.

The company or manager can determine the debt level based on the expected value. Companies which are expected to have low cash flow use debt less as a signal due to it being too costly. Conversely, companies which are expected to be worth more use debt more often as a signal due to it costing less as compared to companies that are expected to be worth less (Ross, 1977).

Investment and asymmetrics information are fixed, therefore, the quality of debt information is good if it is based on high profitability. Furthermore, companies with greater profits try to maintain higher debt levels Klein, (2002) resulting lenders will raise debt on companies with high profitability and a good income history.

Therefore, the second hypothesis is the greater the level of debt, the more qualified the signal. Furthermore, companies can capture investment opportunities and increase profitability. Firms that rely more heavily on short-term liabilities are likely to be more profitable. Based on the perspective of the pecking order theory as the implication of asymmetric information, the hierarchy of corporate funding prioritizes debt over equity (Baum, 2014). Debt or liability can be categorized into two areas, namely short-term debt (current liability, hereafter STD) and long-term debt (long-term liability).

Various literatures stated STD is more sensitive than long-term. The first reason is that companies with spontaneous growth need greater changes in STD than companies that do not experience spontaneous growth. Spontaneous growth will have an impact on increasing current assets such as inventories and will increase STD spontaneously as well. Fulfillment of STD will spontaneously have an impact on decreasing or increasing profitability (Fosberg, 2012). When the STD capital cost is greater (smaller) than income, there is a decrease (increase) in profitability.

The second reason is that STD is more profitable than long-term debt. STD is not affected by fluctuations in interest rates and it has an impact on the cost of capital. Increased cost of capital will have an impact on profitability Abor, (2007) explained that STD has a positive effect on profitability and LTDR has a negative impact on profitability. The use of STD can reduce the occurred agency problems between debt holders and shareholders in a long term.

In this study, profitability uses the proxy of propensity to profitability due to the inconsistency of the influence of debt on profitability, as it has both a positive effect (signalling theory) and a negative (agency theory). If the dependent variable is a binominal dichotomy Gujarati, (2014) suggest using the probability approach in the dependent variable.

Research Method

The data source of this study is IDX Statistics in 2010 - 2019 which contains STD and profitability in 2009 - 2018. 1185 observation units were collected, while 611 units met the observational requirements (appendix 1).

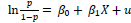

Data analysis uses logistic regression to determine the effect of STD as proxy debt on the probability of changes in profitability (Baum, 2014). The equation in logistic regression is:

Where:

= is the probability of an increase in profitability 1 is an increase in profitability and 0 is a decrease in profitability)

= is the probability of an increase in profitability 1 is an increase in profitability and 0 is a decrease in profitability)

β0= constants or intercepts

= slope and STD

= slope and STD

TD variables are measured using the STD proxy as a ratio between SDT/Total Assets and profitability by using change proxies (Rupiah interval scale) with current profitability reduced/prior proficiency. Therefore, an increase in profitability is part of the ratio data. When there is an increase, the value is greater than 0, and vice versa.

Results and Discussion

Descriptive Data

The average STD during the observation period 2009 - 2018 tends not to change or remain constant (Appendix 2). The average use of STD is relatively low at 0.33, so the LTDR is greater than the STD. based on the perspective of agency theory. This shows a future that cannot be predicted so that the use of low STD aims to reduce agency conflict caused by asymmetric information.

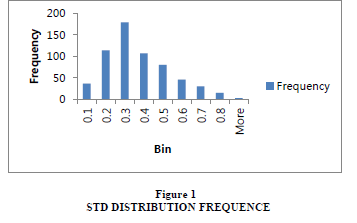

Based on the signalling theory perspective, the low STD implies poor expected cash flow, therefore, there is no need to send a qualified signal to the marketplace. Based on appendix 3, it can be seen that STD interquartile sample companies have relatively homogeneous data. There is no difference in STD in any of the companies by period. This shows the absence of spontaneous STD growth, which rarely happens in the manufacturing sector during the observation period. The use of company STD is mostly in the range of 0.2 to 0.3 and totals179 of 611 observation units (29.29%), as in the following histogram in Figure 1:

When STD increased to 347 units of observation (56.8%) profitability increased. When it increased by only 264 units of observation (43.2%) there was a decrease in profits. Based on sample data, companies in which STD increased have a greater probability of an increase rather than a decrease in profits in Table 1.

| Table 1 Profitability Changes In The Std Interval Range |

||||||||

|---|---|---|---|---|---|---|---|---|

| Increase Profitability | Decrease Profitability | |||||||

| STD | N Obs | N obs | Profitablity | STD | N Obs | Prof | STD | |

| 0.0-0.1 | 37 | 21 | 0.44 | 0.07 | 16 | -0.57 | 0.07 | |

| 0.1-0.2 | 114 | 67 | 0.27 | 0.15 | 47 | -0.39 | 0.14 | |

| 0.2-0.3 | 179 | 101 | 0.40 | 0.25 | 78 | -0.41 | 0.25 | |

| 0.3-0.4 | 107 | 65 | 0.32 | 0.34 | 42 | -0.44 | 0.34 | |

| 0.4-0.5 | 80 | 43 | 0.48 | 0.44 | 37 | -0.56 | 0.45 | |

| 0.5-0.6 | 46 | 23 | 0.42 | 0.55 | 23 | -0.53 | 0.55 | |

| 0.6-0.7 | 30 | 18 | 0.31 | 0.63 | 12 | -0.49 | 0.64 | |

| 0.7-0.8 | 15 | 9 | 0.30 | 0.75 | 6 | -0.61 | 0.74 | |

| >0.8 | 3 | 0 | 3 | -0.75 | 0.87 | |||

| 611 | 347 | 264 | ||||||

STD Marginal to the Probability of Profitability

STD class range affects the probability of profits increasing. An STD range of 0.01 to 0.1 has a probability of an increase in profitability that is 1.31 times greater than the probability of decreasing profitability. In a range of 0.2 to 0.3 the probability of an increase in profits of 1.21 is better than the probability of a decrease in profits Table 2. A higher STD indicates the likelihood of profits going up is going down.

| Table 2 Odds Ratio |

||||

| STD | P (Increase profit) | Odds (Increase profit) | Ln Odss (Increase profit) | |

|---|---|---|---|---|

| 0.0-0.1 | 0.567568 | 1.3125 | 0.27 | |

| 0.1-0.2 | 0.587719 | 1.425532 | 0.35 | |

| 0.2-0.3 | 0.564246 | 1.294872 | 0.26 | |

| 0.3-0.4 | 0.607477 | 1.547619 | 0.44 | |

| 0.4-0.5 | 0.5375 | 1.162162 | 0.15 | |

| 0.5-0.6 | 0.5 | 1 | 0.00 | |

| 0.6-0.7 | 0.6 | 1.5 | 0.41 | |

| 0.7-0.8 | 0.6 | 1.5 | 0.41 | |

| >0.8 | 0 | 0 | 0 | |

At 65 units of observation there was an increase in profitability (0.61) with a range of STD of 0.3 to 0.4. In this STD interval, the probability of a company experiencing profitability increases by 1.54 times greater than the probability of a decrease in profitability. This shows that higher STD increases agency problems, therefore agency costs are needed and impact the possibility of profits going up.

Model Testing

Logistic regression predictions are obtained as follows in Figure 3:

| Table 3 Logistic Regression Testing |

|||||||

|---|---|---|---|---|---|---|---|

| coeff b | s.e. | Wald | p-value | exp(b) | lower | upper | |

| Intercept | 0.412 | 0.196 | 4.409 | 0.036 | 1.510 | ||

| STD | -0.374 | 0.480 | 0.606 | 0.436 | 0.688 | 0.269 | 1.763 |

Then the probability prediction equation (p) using logit is

Therefore, when the STD is from 0.0 to 0.1, the probability prediction of increased profitability is

For the description of each STD interval, the prediction of probability to increase profitability is as represented in Table 4.

| Table 4 Std Interval |

|||||||

|---|---|---|---|---|---|---|---|

| STD | Increase profit | Profit Decrease | Total | p-Obs | p-Pred | Suc-Pred | Fail-Pred |

| 0.0-0.1 | 21 | 16 | 37 | 0.57 | 0.593 | 21.93 | 15.07 |

| 0.1-0.2 | 67 | 47 | 114 | 0.59 | 0.584 | 66.52 | 47.48 |

| 0.2-0.3 | 101 | 78 | 179 | 0.56 | 0.574 | 102.82 | 76.18 |

| 0.3-0.4 | 65 | 42 | 107 | 0.61 | 0.565 | 60.48 | 46.52 |

| 0.4-0.5 | 43 | 37 | 80 | 0.54 | 0.556 | 44.48 | 35.52 |

| 0.5-0.6 | 23 | 23 | 46 | 0.50 | 0.547 | 25.15 | 20.85 |

| 0.6-0.7 | 18 | 12 | 30 | 0.60 | 0.538 | 16.13 | 13.87 |

| 0.7-0.8 | 9 | 6 | 15 | 0.60 | 0.528 | 7.92 | 7.08 |

| >0.8 | 0 | 3 | 3 | 0.00 | 0.519 | 1.56 | 1.44 |

| 347 | 264 | 611 | 347 | 264 | |||

Every time STD increases to 0.4 it increases the chance of profits increasing to 0.61. However, if STD is higher than 0.4, there is more of a chance of profits going down. Prediction of the probability (p-Pred) of the company’s population at all intervals shows a coefficient greater than 0.5, which means it predicts that it’s more likely that a company which has all STD intervals has a higher likelihood of increasing their profits.

Agency theory perspective explain, when there is a change in the function of control and cash flow rights, then the manager can do his interests, resulting in conflicts between managers and shareholders. When the control and right functions become one (agent as well as principal), there is a change in conflict between shareholders and debtholders. Managers as shareholders will make suboptimal investment decisions (over or under investment). On the issue of over-investment, managers choose investment projects that are at risk with a negative NPV, so they can transfer the value of debtholders to shareholders. In the case of under investment, the manager rejects a project with a positive NPV that does not significantly exceed the level of debt. This will transfer the debtholders value to shareholders.

In predicting probability, it is known that an increase in STD causes a decrease in profitability probability. However, inferential testing found that Ho is accepted where the probability (p-value) is greater than 0.05, therefore STD has a insignificant negative effect on probability profitability. The results of this test are aligned with agency theory predictions based on asymmetric information. Indonesia as a developing country is still confronted with the problem of information asymmetry, therefore a manager’s decision to use debt for investment has the potential to cause agency problems among shareholders and debt holders. Explained that the problem of asymmetric information asymmetry in the post-crisis period is caused by economic policy uncertainties and political condition instability in line with the research carried out by (Kasri, 2014).

Indonesia Manufacturing sector consists of the Basic Industry and Chemicals sector; Miscellaneous Industry and Consumer Goods Industry which both have relatively homogeneous STD. The low use of STD shows there is still an agency problem due to the instability of economic conditions in the future. STD is considered safer to reduce conflicts that occur between bondholders and shareholders.

The evidence also shows that a higher STD will reduce the probability of an increase in profitability. However, it showed insignificant results. The result is an indication that research on manufacturing companies cannot be generalized to all sub-sectors due to the differences in the characteristics of each business and industry.

Conclusion

Consistent with the conditions in developing countries, the problem of asymmetric information is still happening in Indo nesia. Therefore, companies are trying to maintain low levels of STD. When managers use STD to make investments in under and over investment has the potential to cause agency problems between debt holders and shareholders. However, this study does not exam ine debt’s impact in relation to over and under investment on profitability.

The study considers that both over or under investment decisions affect asymmetric information. Therefore, managers as agents are expected to make decisions on how to use debt for optimal investment opportunities in order to reduce agency problems between debt holders and shareholders. Furthermore, the characteristics of the manufacturing sub sector have varying effects on over or under investment decisions. Therefore, these result s are only applied in the sample area (this is insignificant).

References

Abor, J., & Biekpe, N. (2005). Does corporate governance affect the capital structure decisions of Ghanaian SMEs. In Biennial Conference of the Economic Society of South Africa, Durban, South Africa, September.

Abor, J. (2007). Industry classification and the capital structure of Ghanaian SMEs. Studies in Economics and Finance.

Indexed at, Google Scholar, Cross Ref

Brito, J.A., & John, K. (2001). Leverage and Growth Opportunities: Risk-Avoidance Induced by Risky Debt.

Indexed at, Google Scholar, Cross Ref

Amidu, M. (2007). Determinants of capital structure of banks in Ghana: an empirical approach. Baltic Journal of Management.

Indexed at, Google Scholar, Cross Ref

Baum, C.F., Schäfer, D., & Talavera, O. (2006). The effects of short-term liabilities on profitability: the case of Germany (No. 635). DIW Discussion Papers.

Cariola, A., La Rocca, M., & La Rocca, T. (2005). Overinvestment and underinvestment problems: determining factors, consequences and solutions. Consequences and Solutions (October 2005).

Indexed at, Google Scholar, Cross Ref

Cassar, G., & Holmes, S. (2003). Capital structure and financing of SMEs: Australian evidence. Accounting & Finance, 43(2), 123-147.

Indexed at, Google Scholar, Cross Ref

Cassar & Holmes, A.M., Moeljadi, D.N.K.A., & Indrawati, K. (2017). The effect of leverage, profitability, information asymmetry, firm size on cash holding and firm value of manufacturing firms listed at Indonesian Stock Exchange. International Journal of Research in Business Studies and Management, 4(4), 21-31.

Dwilaksono, H. (2016). Effect of short and long term debt to profitability in the mining industry listed in jsx. Business and Entrepreneurial Review, 10(1), 77-88.

Indexed at, Google Scholar, Cross Ref

Fama, E.F., & French, K.R. (2012). Capital structure choices, Crit. Financ.

Fosberg, R.H. (2012). Capital structure and the financial crisis. Journal of Finance and Accountancy, 11, 1.

Gujarati, D.N., Porter, D.C., & Gunasekar, S. (2012). Basic Econometrics. Tata mcgraw-hill education.

Hall, G.C., Hutchinson, P.J., & Michaelas, N. (2004). Determinants of the capital structures of European SMEs. Journal of Business Finance & Accounting, 31(5?6), 711-728.

Indexed at, Google Scholar, Cross Ref

Kirmi, P.N. (2017). Relationship between capital structure and profitability, evidence from listed energy and petroleum companies listed in Nairobi Securities Exchange. Journal of Investment and Management, 6(5), 97-102.

Indexed at, Google Scholar, Cross Ref

Klein, L.S., O’Brien, T.J., & Peters, S.R. (2002). Debt vs. equity and asymmetric information: A review. Financial Review, 37(3), 317-349.

Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

Indexed at, Google Scholar, Cross Ref

Mishkin, F.S. (1999). Lessons from the Asian crisis. Journal of International Money and Finance, 18(4), 709-723.

Mustaruddin, M., Dinata, A., Wendy, W., & Azazi, A. (2017). Asymmetric information and capital structure: Empirical evidence from Indonesia Stock Exchange. International Journal of Economics and Financial Issues, 7(6), 8.

Myers, S.C. (1977). Determinants of corporate borrowing. Journal of Financial Economics, 5(2), 147-175.

Indexed at, Google Scholar, Cross Ref

Myers, S.C. (1984). Capital structure puzzle.

Indexed at, Google Scholar, Cross Ref

Myers, S.C., & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221.

Indexed at, Google Scholar, Cross Ref

Niu, X. (2008). Theoretical and practical review of capital structure and its determinants. International Journal of Business and Management, 3(3), 133-139.

Indexed at, Google Scholar, Cross Ref

Prempeh, K.B., & Peprah-Amankona, G. (2019). Does working capital management affect Profitability of Ghanaian manufacturing firms? Journal of Advanced Studies in Finance, 10(1 (19)), 22-33.

Indexed at, Google Scholar, Cross Ref

Ross, S.A. (1977). The determination of financial structure: the incentive-signalling approach. The Bell Journal of Economics, 23-40.

Indexed at, Google Scholar, Cross Ref

Received: 17-Jan-2022, Manuscript No. AAFSJ-22-10887; Editor assigned: 18-Jan-2022, PreQC No. AAFSJ-22-10887(PQ); Reviewed: 25-Jan-2022, QC No. AAFSJ-22-10887; Published: 31-Jan-2022