Research Article: 2020 Vol: 24 Issue: 6

Using the Technology Acceptance Model to Clarify the Trends of The Electronic Financial Reports Users

Nasr Taha Hassan, Prince Sattam Bin Abdul Aziz University

Alaa Mohamad Malo-Alain, Al-Balqa Applied University

Magdy Melegy Abdel Hakim Melegy, Benha University

Abstract

Purpose: The study aims to provide a theoretical background about understanding the users attitudes towards financial disclosure via the Internet based on the technology acceptance model. Design-Methodology-Approach: In this study, we adopted the descriptive analysis approach to identify the attitude of financial annual reports users of Egyptian companies. The study sample consisted of bank managers, brokers, and academics. Findings: The results of the study showed limited or medium interest of the users in the Egyptian business environment with different dimensions of the Electronic financial report, and this can be explained through the technology acceptance model. As the results indicated that concerns about information security is receiving great attention from users, which negatively affects their vision of expected ease of use and may ultimately be reflected in usage trends. Limitations-Implications: It is expected for this study to provide useful information to Legislators related to the Electronic financial report, drawing their attention to pay more attention to information security controls. Originality-Value: The current study is distinguished from previous studies by examining the Technology Acceptance Model TAM to clarify the trends of the electronic financial reports by users in the Egyptian business environment. The current study can provide useful information to understand the trends of users in regard to E- financial reporting, which may help Egyptian companies in developing the electronic financial reports and thus contribute to attracting more investors.

Keywords

Financial Report, Internet, Technology Acceptance Model.

Introduction

The phenomenon of using the internet to spread company information has witnessed significant growth in recent years (Moradi et al., 2011). Electronic information dissemination is a common practice across the world (Bonson et al., 2006)) and has become an important part of business information services (Lemay et al., 2019). It is a common thing for companies to communicate information to relevant parties using an optional method of disclosure such as the Internet where all companies create their own websites that contain a large amount of information, including information on financial matters, where the Internet has enormous potential that can be used to improve the process Disclosure is particularly important in the financial reporting process (Izuagbe et al., 2019). The Internet provides more flexible means of displaying information, as it allows for instantaneous, wider, and less costly communication with investors (Kelton & Yang, 2008; Schmidthuber et al., 2018) and assists companies in providing optional disclosure that provides information beyond the local level to the global level. (Abdelsalam et al., 2007; Wright & Wiersma, 2019).

With great interest by accounting literature in the financial report via the Internet, studies that concerned with this topic can be classified into two main sections: descriptive studies to describe the practices of E-financial reporting in a specific country or more than one country, and studies interested in determining the characteristics of companies that attention directed towards financial reporting practices via the Internet. However, Khan & Ismail (2012) indicated that there is still a shortage of studies that dealt with the benefits, factors, advantages, and disadvantages of reporting via Internet in emerging economies. Indeed, accounting literature facing certain limits in the field of financial reporting via the Internet that is the theoretical rooting in previous studies (Xiao et al., 2002; Xiao et al., 2004). In this context, (Pinsker (2007)) has proposed a technology acceptance model which is an extension of justified acts theory as a theoretical context to study financial reporting via internet. The model has been used extensively in the framework of information systems and provides a viewpoint for users about the benefits and possibility of using the financial report via the Internet (Sohn & Kwon, 2020) In this framework, the current study provides a theoretical framework that helps to understand the attitudes of users in the Egyptian business environment about reporting practices via the Internet from both viewpoints i.e. perceived benefits and attitude toward using.

The importance of E-financial reporting in the Egyptian business environment is increasing day by day due to the importance of attracting foreign investments, but it faces many problems and challenges, and therefore Egyptian companies must provide more confidence and transparency and thus encourage foreign investors to invest by providing more information that correspond to user needs, which are transparent, objective and timely. In this context, the current study can provide useful information to understand the trends of users about the financial report via the Internet, which may help Egyptian companies in developing electronic publishing of financial reports and thus contribute to attracting more investors.

Literature Review

In the Egyptian business environment, some previous studies focused on the impact of financial disclosure via the Internet on users. Abdul-Malik, 2005 aimed at identifying the extent to which investors ’decisions can be improved through electronic disclosure. On the other hand, (Al-Sabbagh, 2009) examined the impact of the International Information Network (Internet) on the benefit of financial accounting information system outputs to stakeholders (current investors, prospects, creditors, and government agencies). Al-Rashidi, 2009 aimed at identifying the impact of accounting disclosure via the Internet on corporate governance from the user’s point of view, while the study of (Abdel-Sadiq, 2010) examined the impact of the XBRL language in assisting users of electronic disclosure in conducting analyzes on the information of financial reports published far away from the company website .

On the other hand, (Ahmed, 2013) analyzed the impact of International financial reporting standards (IFRS) and the language of extended business reports (XBRL) on disclosure, transparency and investor decisions, while (Awad, 2013) attempted to analyze the impact of electronic disclosure of financial reports using smart devices on investor decisions in the Egyptian Stock Exchange, whereas, Wali, 2013) attempted to define the role of electronic disclosure in reducing risks under the conditions of uncertainty among investors.

As far as the current study, it deals with E-financial reporting by providing an integrated knowledge framework based on the views of the demand side, which is represented by the users of the report concerning to the benefits, factors, advantages and disadvantages associated with the financial report via the Internet. The current study also relies on the use of the technology acceptance model in analyzing the behavioral intentions of users and their attitudes towards the benefits and expected ease of use of the financial report via the Internet, which was not covered in previous studies.

Theoretical Framework of the Study

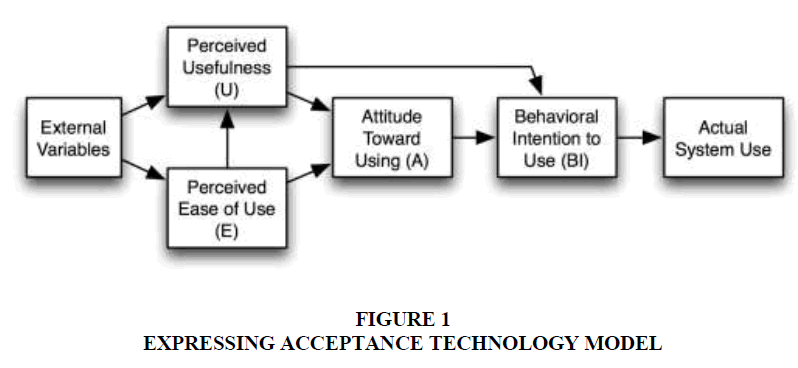

McVay Technological development has greatly affected the rapid change in the perspective of business studies and practices. One of the topics that is subject to this development is the use of the internet in the reporting process and the use of associated languages such as XBRL (Pinsker, 2007). However, many questions need an answer regarding the benefits of use, usability and effectiveness of this technology. Several models have emerged to explore the variables that affect individuals' acceptance of technology (Lemay & Bazelais, 2019; Morris & Dillon, 1997; Thompson, et al., 2006) where Granic & Marangunic, 2019) define acceptance of technology as the adaptation process and a system that is designed to perform certain tasks by group of users. In this context, Davis (1989) expanded the theory of reasoned action by proposing a model called the technology acceptance model. The theory presumed that individuals having the ability to rationally use information where information is processed and used to achieve rational behaviors (Estriegana et al., 2019; Scherer et al., 2020) as the technology acceptance model broadens that vision. The idea of the technology acceptance model can be illustrated by the following Figure 1.

In light of the previous figure, it becomes clear that the idea of the technology acceptance model is based on that each of the expected benefits of use and ease of use of new applications of information technology affect the trends towards the adoption of those applications, and the model considers that external variables affect the expected ease of use, which is in turn affects the expected benefits of use and each of them constitute the users ’attitudes towards technological development, which drive the desired behaviors in use to the actual use of those developments (Scherer et al., 2020). Hu et al. (1999) there are many factors that affect the initial acceptance of technology, but there are basic factors that affect the continuity of acceptance and are the expected ease of use and the expected benefits of use. In the context of the online financial report, external variables reflect the potential entry, for example the level of knowledge and learning is necessary to determine the user (Althuizen, 2017; Kamal, 2020) assuming the ability to evaluate the financial report via the Internet objectively, potential users will assess the possibilities and the benefits of using the report, which will determine their directions towards using it.

The technology acceptance model was used in the context of Internet user behavior, and some applied studies have provided evidence to support its use (Walker & Hong, 2017, Trespalacios et al., 2020). This model addresses three main variables in regard to the use and acceptance of technology, which are the perceived usefulness (PBOU), perceived ease-of-use (PEOU) and attitude towards using (Ajzen & Fishbein, 2000; Zhonggen & Xiaozhi, 2019). Perceived usefulness (PBOU) can be defined as the degree to which the user believes that the use of a particular system leads to improved performance, while Perceived ease-of-use (PEOU) - indicates the degree to which the individual believes that the use of a particular system does not require more effort. Whereas, attitude towards using indicate the degree to which an individual links a particular system with his work. Both the perceived usefulness (PBOU) and perceived easeof- use (PEOU) are potential factors. As for the attitude towards using, they can be considered as the factor that guides future behavior and determines the intentions that ultimately lead to actual behavior.

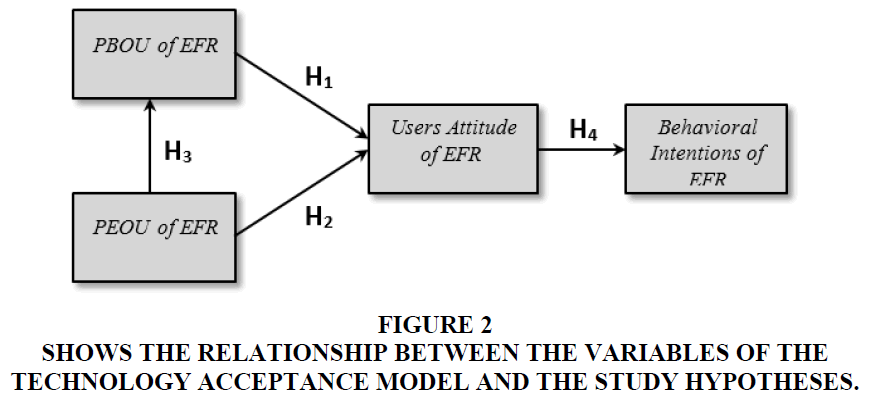

In the context of the financial report via the Internet, where the relationship between the four main variables in the model can be tested, the perceived usefulness (PBOU) can be defined as the degree to which the user believes that using the report will improve his performance toward the work, and the perceived ease-of-use (PEOU) is the degree of the individual’s belief that using the report does not result any additional effort. According to the technology acceptance model, the actual use of the financial report is determined based on the behavioral intentions of its use, which in turn are determined based on the users ’attitudes toward the system, perceived usefulness (PBOU) and the perceived ease-of-use (PEOU). Indeed, Both (PBOU) and (PEOU) fundamentally affect the attitude toward using. Figure 2 illustrates the relationship between the variables of the technology acceptance model and the study hypotheses:

Figure 2 Shows the Relationship between the Variables of the Technology Acceptance Model and the Study Hypotheses.

H1: The perceived usefulness (PBOU) of using electronic financial reports substantially affect its attitude towards using.

H2: The perceived ease-of-use (PEOU) of electronic financial reports substantially influences its attitude towards using.

H3: The perceived ease-of-use (PEOU) of electronic financial reports substantially impacts the perceived usefulness (PBOU) of using.

H4: Users' attitudes toward E-financial reporting fundamentally affect the behavioral intentions of users.

Study Design and Research Methodology

The study aims to test the suitability of the technology acceptance model as a theoretical basis for explaining user trends towards financial reporting via the Internet .

Research Tool

To achieve the research objectives, the questionnaire has been designed to include two main sections:

The first section: includes several questions aimed at determining the characteristics of users such as Gender, age, qualifications, work experience and the intensity of using Internet at work. This section is of great importance when designing the questionnaire as it provides information indicating the suitability of users to achieve the research goals (Al-Razeen & Karbhari, 2007). It is also useful in conducting some analyzes about the correlation of the study sample's views with some characteristics, in addition to that the section is consistent with the theoretical framework of the study, according to the technology acceptance model, external variables (such as the characteristics of the study sample) will affect their views on the possibility and benefits of using the electronic financial report.

The second section: includes a set of statements related to the dimensions of the financial report via the Internet in order to obtain a viewpoint of the respondents about those dimensions. The importance of each statement is determined by the Likert five-dimensional scale, where respondents are required to rate their agreements with (1=strongly disagree to 5=strongly agree).

Society and Study Sample

The study population consists of the users of the financial report via the Internet. The study sample was chosen from three categories of users of the financial report: the bank managers, stockbrokers and academics as they are more able to provide valuable views on the financial report via the Internet. The following Table 1 shows the study population and sample.

| Table 1 Study Population and Sample | |||

| Sample | Distributed Questionnaire | Returned & Eligible for Analysis | Percentage |

| Bank Mangers | 100 | 81 | 81 |

| Brokers | 90 | 68 | 75 |

| Academics | 70 | 56 | 80 |

| Total | 260 | 205 | 78 |

Statistical Analysis Methods Used

The researchers used a set of statistical methods i.e. frequencies, weighted averages, standard deviations and alpha-crobnach coefficient to measure the consistency of the statements, the calculated value of alpha-crobnach 0.534.

Table 2 shows descriptive statistics of the study sample, where (205) representing three categories, bank managers (81) manager representing (39.5%), brokerage firms (68) representing (33.2%), and academics (56) representing (27.3%). Table 2 indicate that (167) were male, representing (81.5%), while females counting (38) representing only (18.5%). With regard to the educational qualifications of the respondents, the majority have only bachelor degree (136) representing (66.3%), while PhD holders registered 62 representing (30.2%). Indeed, the highest percentage of the PhD holder was due to the fact that the majority of the respondents were academics. Concerning to the age variable, it is clear from the table that the highest percentage (52.2%) was concentrated between (41 and 50) years old, followed by (51 and 60) years old representing (31.2%), this is undoubtedly connected with average experience to the respondents, as it is laying between 20 to 15 years. With regard to the use of the Internet, most of the respondents (173) indicated that they use Internet in a large scale and continuous manner representing (84.4%).

| Table 2 Descriptive Analysis for Study Sample | |||

| Variable | Criterion | Frequencies | % |

| Gender | Male | 167 | 81.5 |

| Female | 38 | 18.5 | |

| Work Nature | Bank Managers | 81 | 39.5 |

| Brokers | 68 | 33.2 | |

| Academics | 56 | 27.3 | |

| Qualification | Bachelor | 136 | 66.3 |

| Master | 7 | 3.4 | |

| PH.D | 62 | 30.2 | |

| Using Internet | Not Used | 8 | 3.9 |

| Less Used | 16 | 7.8 | |

| Moderate Use | 8 | 3.9 | |

| High Use | 147 | 71.7 | |

| Continuously Used | 26 | 12.7 | |

| Age | Less than 30 | 1 | 0.5 |

| 30-40 | 27 | 13.2 | |

| 41-50 | 107 | 52.2 | |

| 51-60 | 64 | 31.2 | |

| More than 60 | 6 | 2.9 | |

| Experience | Less than 5 | 5 | 2.4 |

| 5-10 | 10 | 4.9 | |

| 10-15 | 91 | 44,4 | |

| 15-20 | 81 | 39,5 | |

| More than 20 | 12 | 8.2 | |

Testing the Technology Acceptance Model

To test the suitability of the technology acceptance model as a theoretical basis for understanding the users ’attitudes towards the dimensions of E-financial reporting in the Egyptian business environment, the structural equation modelling and Path coefficient analysis was used. Based on the model shown in Figure 2, the following equations can be formulated:

1. IBU = a + B1 ATIT + B2 PEOU + B3 PBOU + ?

2. ATIT = a + B1 PEOU + B2 PBOU + ?

3. PEOU = a + B1 PEOU + ?

Where IBU indicates the intentional behavior of using the electronic financial reports. ATIT= user attitudes towards the electronic financial reports.

PEOU= perceived ease of use of the electronic financial reports.

PBOU= perceived benefits of use the electronic financial reports.

The following Table 3 shows the regression test for the previous equations as follows:

| Table 3 Regression Results for Model Equations | |||||||||

| Model 1 | Model 2 | Model 3 | |||||||

| Sig | T | Beta | Sig | T | Beta | Sig | T | Beta | |

| 0.017 | 2.397 | 0.169 | ATIT | ||||||

| 0.104 | 1.631 | 0.117 | PEOU | 0.017 | 2.411 | 0.170 | 0.000 | 4.108 | 0.276 |

| 0.620 | 0.497 | 0.036 | PBOU | 0.033 | 2.145 | 0.151 | |||

| 4.067 | F | 7.179 | 16.875 | ||||||

| 0.008a | Sig | 0.001a | 0.000a | ||||||

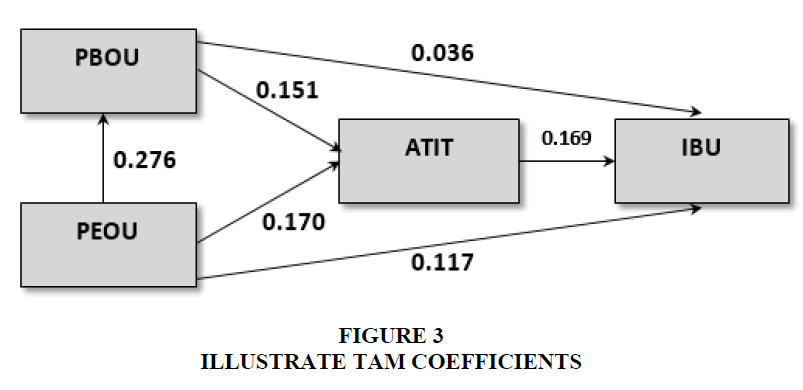

The following Figure 3 shows the coefficients for TAM.

The results show that the behavioral intentions are directly affected by the users ’attitudes towards E- financial reports, which supports the fourth hypothesis while not directly affected by both (PBOU) and (PBOU) although PEOU and PBOU do not directly affect IBU. However, it can be said that PEOU and PBOU have indirect affect through their influence on ATIT. With regard to the trends of (ATIT) toward E- financial reports, they are affected by both PEOU, which supports the second hypothesis and PBOU, which supports the first hypothesis. The results also show that PEOU affects PBOU the E- financial reports, which supports the third hypothesis. Consequently, the results of the hypothesis test demonstrate the validity of the model and its suitability for use in the context of user perceptions of E- financial reports.

In the context of electronic financial reports EFR, users' perspectives can be divided into different dimensions (based on the results of the first study dimension) in the light of technology acceptance model TAM, where concerns about the EFR related to security problems largely determine the users' view of perceived ease-of-use (PEOU), as safety issues have been considered as the most important disadvantage of EFR and the most important factor for the company not adopting it. Thus it can be said that there is a somewhat negative view towards the perceived easeof- use (PEOU) of the EFR in the Egyptian business environment and this affects the view of users about the perceived usefulness (PBOU) of EFR. The view of the users about the benefits of the EFR focused on the expected impact on information properties such as the timing and transparency while the users did not pay much attention to the role of the EFR in attracting external or local investors to the company or contributing in enhancing promoting trend of the company. Furthermore, users didn’t care much about providing company information at a lower cost or assisting in decision-making. The conservative view of users about the perceived usefulness (PBOU) of EFR can thus be understood in the light of the negative view of the perceived ease-ofuse (PEOU). In the light of this, it can be expected that trends in the use and behavioral intentions of using EFR in the Egyptian business environment are still between low and medium, which may require addressing it from other studies to provide practical evidence that supports or opposes this expectation.

Additional Analysis

The basic technology acceptance model contains external variables that affect both perceived ease-of-use (PEOU) and perceived usefulness (PBOU). External variables can be expressed in the current study by the characteristics of the study sample (gender, job, educational qualifications, and extent of online interaction, age and experience). In this context, The Digital Future Report, 2004, Fox, 2004, Lenhart et al., 2003 and NTIA, 2002) concluded that the use of the Internet is affected by some demographic characteristics, as the rates of using internet are less among the older, less educated and less-income individuals. To test the relationship between these external variables and the variables of the technology acceptance model, a correlation test was conducted between these variables.

Table 4 shows the correlation between the external variables and the technology acceptance model variables.

| Table 4 Correlation Between the External Variables and Tam Variables | ||||||||||||

| GE | OS | UA | I | AGE | EXP | ATIT | BU | PEOU | PBOU | |||

| GEN | Pearson Correlation | 1 | 165* | 230** | 0.028 | 0.040 | -0.030 | -0.035 | 0.026 | -0.031 | -0.021 | |

| POS | Pearson Correlation | 0.165* | 11 | 733** | 036 | -0.077 | -0.267** | -0.048 | 0.125 | -0.117 | -0.196** | |

| QUA | Pearson Correlation | 0.230** | 733** | 11 | .118 | -0.015 | 0.078 | -0.103 | 0.131 | -0.022 | -0.143* | |

| UI | Pearson Correlation | 0.028 | 0.036 | -0.118 | 11 | 0.118 | -0.121 | -0.159* | -0.023 | -0.113 | 0.014 | |

| AGE | Pearson Correlation | 0.040 | 0.077 | -0.015 | 0.118 | 1 | 0.138* | -0.171* | 0081 | -0.048 | -0.114 | |

| EXP | Pearson Correlation | -0.030 | 0.267** | .078 | -0.121 | 0.138* | 1 | -0.186** | -0.123 | -0.061 | -0.022 | |

| ATIT | Pearson Correlation | -0.035 | 0.048 | -0.103 | -0.159* | -0.171* | -0.186** | 1 | .202** | 0.211** | 0.198** | |

| IBU | Pearson Correlation | -0.026 | 0.125 | -0.131 | -0.023 | 0.081 | -0.123 | 0.202** | 11 | 0.163* | 0.101 | |

| PEOU | Pearson Correlation | -0.031 | 0.117 | -0.022 | -0.113 | -0.048 | -0.061 | 0.211** | .163* | 1 | 0.276** | |

| PBOU | Pearson Correlation | -0.021 | 0.196** | -0.143* | .014 | -0.114 | -0.022 | 0.198** | .101 | 0.276** | 1 | |

**. Correlation is significant at the 0.01 level (2-tailed).

Table 4 shows that there is no significant correlation between the external variables (sample characteristics) and TAM variables. In addition, the extent of correlation between the external variables and the variables that resulted from the study has been tested which represent both perceived ease-of-use (PEOU) (concern about information security) and perceived usefulness (PBOU) of EFR (improving the timing feature, improving transparency, improving the corporate image). The results of the correlation analysis also showed that, in general, the external variables and study variables that represent perceived ease-of-use (PEOU) and perceived usefulness (PBOU) are not correlated except for a very weak negative correlation between the (PBOU) of providing more transparency and a gender variable (Chi2-0.170 & Sig. 0.015). The result denotes to that this benefit is receiving more attention from males rather than female.

Conclusion

The results showed that the behavioral intentions of using EFR are directly affected by the users ’attitudes towards the financial report, which supports the validity of the fourth hypothesis, while not directly affected by both perceived ease-of-use (PEOU) and perceived usefulness (PBOU) although the (PBOU) does not directly affect behavioral intentions, but it can be said that they influence them indirectly through their influence on user attitudes. With regard to the trends of using EFR, it is affected by both perceived ease-of-use (PEOU), which is ultimately supports the validity of the second hypothesis, and perceived usefulness (PBOU), which supports the validity of the first hypothesis. The results also show that the perceived ease-of-use (PEOU) affects the perceived usefulness (PBOU) of using EFR, which supports the validity of the third hypothesis. The following Table 5 shows the results of hypothesis testing, validity of the model, and its suitability for use in the context of users' views towards EFR.

| Table 5 Results of Tam Hypothesis | ||

| Hypothesis | Relation | Result |

| H1 | PBOU) of using electronic financial reports substantially affect its attitude towards using | Accepted |

| H2 | Perceived ease-of-use (PEOU) of electronic financial reports substantially influences its attitude towards using. | Accepted |

| H3 | Perceived ease-of-use (PEOU) of electronic financial reports substantially impacts the perceived usefulness (PBOU) of using. | Accepted |

| H4 | Users' attitudes toward financial reporting via the Internet fundamentally affect the behavioral intentions of users. | Accepted |

References

- Abdel-Sadiq, O.S. (2010). International implications of using the language of extended business reports XBRL on building the Egyptian classification of accounting information published electronically. Journal of the Faculty of Commerce for Scientific Research, 47(2), 1-7.

- Abdelsalam, O.H., & Street, D.L. (2007). Corporate governance and the timeliness of corporate internet reporting by U.K. listed companies. Journal of International Accounting, Auditing and Taxation, 16, 111-113.

- Abdul-Malik, A.R. (2005). The role of financial and non-financial disclosure via the Internet in improving investor decisions in the stock market - a theoretical and practical study. Scientific Journal of Economics and Trade, Faculty of Commerce, 4, 55-101.

- Ahmed, A.H.T. (2013). International Financial Reporting Standards and the language of extended business reports and its impact on disclosure, transparency and investor decisions. Journal of Accounting Thought, Faculty of Commerce, 1, 169-198.

- Ajzen, I., & Fishbein, M. (2000). Attitudes and the attitude-behavior relation: Reasoned and automatic processes. In W. Stroebe & M. Hewstone (Eds.). European review of social psychology, 1-33.

- Al-Rashidi, M.S. (2009). Accounting disclosure via internet and corporate governance-A theoretical and field study. Journal of Contemporary Business Research, 23(1), 1-63.

- Al-Razeen, A., & Karbhari, Y. (2007). An empirical investigation into the importance, use, and technicality of Saudi annual corporate information. Advances in International Accounting, 20, 55-74.

- Al-Sabbagh, A., & El-Sayed, A., (2009). Timeliness of disclosure via the internet, and its impact on the benefit of accounting Information. Applied Study, Master Thesis in Accounting, Unpublished, Faculty of Commerce, Alexandria University.

- Althuizen, N. (2017). Using structural technology acceptance models to segment intended users of a new technology: Propositions and an empirical illustration. Information Systems Journal, 10(1), 879-904.

- Awad, A.M. (2013). Analysis of the impact of electronic disclosure of financial reports using smart devices on investor decisions in the Egyptian stock exchange. Journal of Accounting Thought, 1, 11-55.

- Bonson, E., Escobar, T. & Flores, F. (2006). Online transparency of banking sector. Online Information Review, 30(6), 714-730.

- Davis, F.D., Bagozzi, R.P., &Warshaw, P.R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8), 982-1003.

- Estriegana, R., Merodio, J., & Barchino, R. (2019). Student acceptance of virtual laboratory and practical work: An extension of the technology acceptance model. Computers & Education. 135(1), 1-14.

- Fox, S. (2004). Older Americans and the internet: The pew internet and American life. Retrieved from http://www.pewInternet.org

- Granic, A., & Marangunic, N. (2019). Technology acceptance model in educational context: A systematic literature review. British Journal of Educational Technology, 50(5), 2572-2593.

- Hu, P.J., Chau, P.Y.K., Sheng, O.R.L., & Tam, K.Y. (1999). Examining the technology acceptance model using physician acceptance of telemedicine technology. Journal of Management Information Systems, 16(2), 91-112.

- Izuagbea, R., Ibrahimb, N., Ogiamienc, L., Olawoyina, O., Nwokeomaa, L., Iloa, P., & Osayanda, O. (2019). Effect of perceived ease of use on librarians' e-skills: Basis for library technology acceptance intention. Library and Information Science Research, 41(1), 1-15.

- Kamal, S., Shafiq, M., & Kakria, P. (2020). Investigating acceptance of telemedicine services through an extended technology acceptance model (TAM). Technology in Society, 60(1), 1-10.

- Kelton, A.S., & Yang, Y. (2008). The impact of corporate governance on internet financial reporting. Journal of Accounting and Public Policy, 27(1), 62-87.

- Khan, M.N.A.B., & Ismail, N.A.B. (2012). Various aspects of internet financial reporting: Evidence from Malaysian Academician. Journal of Global Business and Economics, 4(1), 1-15.

- Lemay, D., Doleck, T., & Bazelais, P. (2019). Context and technology use: Opportunities and challenges of the situated perspective in technology acceptance research. British Journal of Educational Technology, 50(5), 2450-2465.

- Lenhart, J., Horrigan, L., Rainie, K., Allen, A., & Boyce, M. (2003). The ever-shifting internet population: A new look at internet access and the digital divide. The pew internet and American life project. Retrieved from http://www.pewinternet.org

- Moradi, M., Salehi, M., & Arianpoor, A. (2011). A study of the reasons for shortcomings in establishment of internet financial reporting in Iran. African Journal of Business Management, 5(8), 3312-3321.

- Morris, M., & Dillon, A. (1997). How user perceptions influence software use. IEEE Software, 14(4), 58-65.

- National Telecommunications and Information Administration, (2002). A nation online: How Americans are expanding their use of the internet. US Department of Commerce, Washington D.C.

- Pinsker, R. (2007). A theoretical framework for examining the corporate adoption decision involving XBRL as a continuous disclosure reporting technology. New dimensions of business reporting and XBRL, Wiesbaden: DUV.

- Scherer, R., Siddiiq, F., & Tondeur, J. (2020). All the same or different? Revisiting measures of teachers' technology acceptance. Computers & Education, 143(1), 1-17.

- Schmidthubera, L., Mareschb, D., & Ginnerd, M. (2018). Disruptive technologies and abundance in the service sector- toward a refined technology acceptance model. Technological Forecasting & Social Change, 1-11.

- Sohn, K., & Kwon, O. (2020). Technology acceptance theories and factors influencing artificial intelligence based intelligent products. Telematics and Informatics, 47(1), 1-15.

- The Digital Future Report. (2004). Surveying the digital future. Retrieved from http://www. digitalcenter.org/downloads/DigitalFutureReport-Year4 2004.pdf

- Thompson, R., Compeau, D., & Higgins, C. (2006). Intentions to use information technologies: Anintegrative model. Journal of Organizational and End User Computing, 18(3), 25-43.

- Trespalacios, O., Briant., O., Kaye, S., & King, M. (2020). Assessing driver acceptance of technology that reduces mobile phone use while driving: The case of mobile phone applications. Accident Analysis and Prevention, 135(1), 1-9.

- Wali, M.Z.A., & Mohamed M.S. (2013). The role of electronic accounting disclosure in reducing risks under uncertainty conditions for the purposes of investment decision making. Journal of Accounting Thought, 1, 11-55.

- Walker, S., & Hong, S. (2017). Workplace predictors of parenting educators’ technology acceptance attitudes. Family and Consumer Sciences Research Journal. 45(4), 377-393.

- Wright, P., & Wiersma, B. (2019). Understanding community acceptance of a potential offshore wind energy project in different locations: An island-based analysis of ‘place-technology fit’. Energy Policy, 1, 1-14.

- Xiao, J.Z., Jones, M.J., & Lymer, A. (2002). Immediate trends in Internet reporting. European Accounting Review, 11 (2), 245-275.

- Xiao, J.Z., Yang, H., & Chow, C.W. (2004). The determinants and characteristics of voluntary Internet-based disclosures by listed Chinese companies. Journal of Accounting and Public Policy, 23, 191-225.

- Zhonggen, Y., & Xiaozhi. (2019). An extended technology acceptance model of a mobile learning technology. Computer Applications in Education. 27(4), 721-732.