Research Article: 2020 Vol: 24 Issue: 2

Utilizing Accounting Information For Enhancing Performance of Indonesian SMEs

Heri Yanto, Universitas Negeri Semarang

Kiswanto, Universitas Negeri Semarang

Suwito Eko Pramono, Universitas Negeri Semarang

Kuat Waluyo Jati, Universitas Negeri Semarang

Abstract

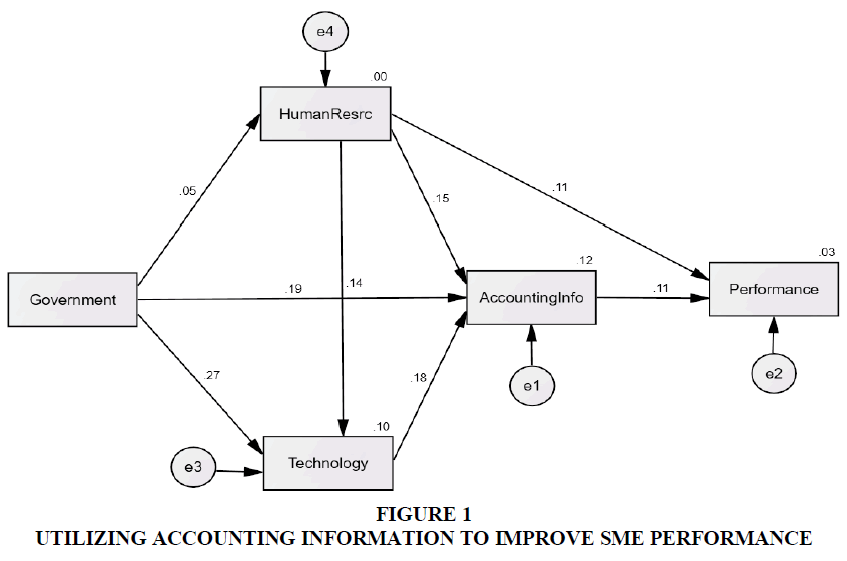

The government has declared that SMEs should have implemented Finacial Accounting Standards for SMEs (SAK EMKM) by the beginning of 2018. One of the objectives of this implementation is to provide accounting information for SME’s managers or business owners in developing their businesses. This study attempts to find the impacts of using accounting information (UAI) on SMEs’ performance and to identify the antecedent variables that determine UAI by SME managers or owners. This study employs random sampling and collected 367 data, but only 348 data were appropriate for further analyses. Despite its relatively small magnitude, SMEs’ performance was significantly influenced by the use of accounting information by managers or owners. In turn, the UAI significantly depends on the quality of SMEs’ human resources, technology utilization, and government supports. Human resource quality and government support also impact on technology utilization by managers or owners. The study found that SME human resources play a key strategic factor in developing the business. The government should facilitate many more SMEs to develop their human resources, SAK EMKM implementation, and UAI. To enhance SMEs’ performance, the government should collaborate with higher education institutions, large scale enterprises, and related parties to provide substantial facilitation.

Keywords

Accounting Information, SMEs, Business Performance, Government Support

Introduction

Data on economic indicators show that the role of SMEs still dominates the Indonesian economy. There is an indication that their current contribution to GDP and employment absorption is still considered high (Machmud & Sidharta, 2016). However, Indonesian SMEs face substantial problems in running their businesses, one of which is management skills (Irjayanti & Azis, 2012). More specifically, SMEs have difficulties using accounting information for making business decisions (Wirjono & Raharjono, 2012). The Indonesia Institute of Accountants (IAI) has issued accounting standards called SAK EMKM intending to make SMEs able to prepare financial reports that provide information for their decision making. Accounting information is also useful for accessing capital from financial and banking institutions as well as accessing capital assistance from the government (Nurwani & Safitri, 2019; Wibowo & Kurniawati, 2015). Although the Indonesian financial authority has simplified the requirements for credit applications, the availability of SMEs' financial information is still an important consideration (Manurung & Manurung, 2019).

Previous research conducted in Spain found that SMEs using accounting information systems showed better performance (Grande et al., 2011). This suggests that the use of accounting information (UAI) positively contributes to SMEs’ performance. However, this research was conducted in a developed country, using an established accounting information system infrastructure. Furthermore, Juita (2016) contended that Indonesian SMEs have limited infrastructure and resources for utilizing accounting information. Moreover, a study in a developing country conducted by Nalukenge (2012) found that Ugandan authorities to require its SMEs to improve the quality of their information to promote economic growth.

Serving as a backbone of the Indonesian economy, SMEs are facing several major problems (Irjayanti & Azis, 2012; Wirjono & Raharjono, 2012). One of them is the problem of UAI for business decision making. To date, most of these studies employ a case study (Nurwani & Safitri, 2019; Wibowo & Kurniawati, 2015), hence it is necessary to examine the role of accounting information utilization by SMEs from various types of businesses. Several studies found that the use of accounting information is considerably useful in developing a business. The main objective of this study is to identify the impacts of UAI on the performance of Indonesian SMEs. Moreover, this research also aims at finding the determinants of UAI by SME managers or owners. This study would provide useful information to policymakers for developing SMEs.

Literature Review

In 2009 Indonesia Chartered Accountant (IAI) issued financial accounting standards called SAK ETAP to facilitate SMEs preparing their financial statements. Nevertheless, a lot of SMEs experienced difficulties in implementing the standards due to its complexity. Eventually, IAI simplified SAK ETAP to SAK EMKM. The latter financial accounting standard took effect on January 1, 2018 (Esterlin et al., 2018). The goal is to serve as a standard for preparing simple financial statements and a source of information for decision-makers e.g. managers or company owners (Putra, 2018). The number of research focusing on the effectiveness of SAK EMKM in providing information for decision making seems to be limited. Nevertheless, not all SMEs have already fully implemented SAK EMKM (Juita, 2016) due to inadequate human resources (Kurniawati & Yuliando, 2015).

Accounting Information, Human Resource, and Performance

To make effective decisions, decision-makers shall use information both from internal and external (Palm, 2016). This is critical as accurate and relevant decisions could help improve the company’s performance. Grušovnik et al. (2017) suggest that decision making by managers should be based on complete and accurate information. Studies on SMEs in Spain show that the accounting information system positively impacted on firm’s financial performance (Grande et al., 2011). Likewise, research conducted in Malaysia also found that SMEs that adopted accounting information systems have better performance (Kharuddin et al., 2010).

Two case studies have been conducted by Wibowo and Kurniawati (2015) in convection SMEs and Nurwani and Safitri (2019) in SMEs of the snack industry. The two studies come to a similar conclusion that the accounting information system has important roles in enhancing SMEs’ performance. This study attempts to test the causal relationship between the UAI and the performance of general SMEs as previous studies only employed SMEs with specific industry and area.

As previously stated that decision making would be effective when SME’ managers or owners use complete and up-to-date data. In turn, accurate decision making would impact on SMEs’ performance. Therefore, the study posits the following hypothesis:

H1: The financial performance of SMEs tends to improve significantly when their managers or owners use accounting information as the basis for decision making.

SMEs’ performance is not only determined by the UAI for decision making, but also by the quality of the company’s resources. Mendes & Lourenço (2014) found that the quality of human resources is an important factor in improving the quality of program implementation in SMEs. Karami et al. (2008) state that human resources are the main factor to achieve the success of SME in the technology sector. Moreover, human resources and technological mastery play a significant role in influencing the performance of SME in the services sector in the UK (Georgiadis & Pitelis, 2012). Research in Vietnam also found that human resources influence SMEs’ performance (Kauanui et al., 2006).

The role of human resources in modernizing business is undisputed. Previous research conducted in developed countries shows that human resources significantly influence the ability of SMEs in adopting technology (Carroll & Wagar, 2010). In such a case, technology refers to the production process (March-Chordà et al., 2002) and information technology (Bruque & Moyano, 2007). Other research finds that the role of human resources is very important in adopting business technology by SMEs (Romero & Martínez-Román, 2015). Based on the literature above, the role of human resources not only increases SMEs’ performance, but also influences the UAI, and the adoption of technology. Thus, this study proposes the following three hypotheses:

H2: Competent human resources improve SMEs’ performance

H3: Quality of human resources has important roles in improving SMEs’ ability to utilize accounting information for making business decisions.

H4: Competent human resources influence the ability of SMEs in adopting business technology.

The Role of the Government

Studies show that to improve SMEs’ performance, the role of government is considered pivotal. Research on biotechnology companies in Korea found that the government has direct and indirect roles in the development of SMEs (Kang & Park, 2012). Becoming a customer of SMEs is a direct role of the government to boost SME performance. Other research shows that SMEs having the government as their customers develop better (Hansen et al., 2009; Loader, 2005). The indirect role of the government may be in the form of regulations, training, and capital assistance. Research in Zimbabwe also found that the role of government indirectly is truly needed by SMEs (Maseko et al., 2011). Furthermore, to develop SMEs more effectively, Handoko et al. (2014) and Marri et al. (2002) propose the participation of government, educational institutions, and big companies. Nevertheless, research conducted by Nugroho (2015) found that government support was not an important factor of SMEs in adopting the technology. This is likely due to the limited financial resources owned by SMEs to adopt technology quickly (Sarosa & Zowghi, 2003), and to improve their human resources (Kurniawati & Yuliando, 2015).

The development of human resources is one of the important keys to improving SMEs’ performance. Previous studies show that SMEs in Indonesia face the problem of human resources (Aribawa, 2016; Hamdani & Wirawan, 2012; Kurniawati & Yuliando, 2015; Tyas & Safitri, 2014). Besides, the role of government in developing human resources of SMEs is critical (Pandya, 2012). Modernization of technology for SMEs also plays a pivotal role in the digital and global era. Government and higher education institutions should provide facilitation to update SMEs’ business technology to empower them in dealing with local and global competition. There have been many successful cases on the development of SME technology supported by the government. Doh & Kim (2014) report that the South Korean government supports its SMEs to develop technology for innovation purposes. The government support in technology will be even more important under the era of industrial revolution 4.0 (Moeuf et al., 2018; Toanca, 2016).

In addition to the direct contribution, the role of government is also critical in improving SMEs’ management. One example is facilitating the implementation of accounting standards in SMEs (Yanto et al., 2016). The government plays important roles in socializing, providing training, and other facilities for implementing accounting standards for SMEs as well as appealing SMEs to use of financial information (Wuryandani & Meilani, 2013). As discussed earlier, technology application is not only for the production process but also for decision making. In this regard, Grande et al. (2011) contended that the accounting technology positively influences the performance of SMEs. Thus, information technology could provide up-to-date and timely data for decision making. Based on the above literature, the government has a pivotal role in developing SMEs in the fields of human resources, technology, and information systems. Thus, this study proposes the following four hypotheses:

H5: The role of government as a facilitator has a significant influence on the quality of SMEs’ human resources

H6: There is a significant influence of government in modernizing SMEs’ technology

H7: The government’s facilitation motivates managers or owners of SMEs to utilize more accounting information for making business decisions.

H8: Information technology can encourage owners or managers to use accounting information for making business decisions.

Methodology

Population and Sample

The study’s population is all SMEs in Central Java assisted by the Office of Cooperatives and SMEs that reaches the number of 147,233 in 2019 (Dinkop, 2019). This study collected 367 samples from all cities and regencies in Central Java, but only 348 data were eligible for further analysis.

Research Variables

This study uses five variables consisting of four endogenous variables and one exogenous variable. SME performance is measured by the achievement of financial performance based on the perception of SME managers or owners. This technique is suggested by Asah (2015) and Tarut? & Gatautis (2014). The use of accounting information (UAI) is the behavior of SME managers or owners in utilizing accounting information for making decisions. Next, the human resource variable measures SMEs’ human resources competencies. Finally, the technology variable is the ability of SMEs to adopt new technologies for the production process and information system. As an exogenous variable, government support is the government facilitation and assistance received by SMEs.

Validity and Reliability of Instrument

This study employs a questionnaire for measuring respondents' perceptions with a five-point-Likert scale. Corrected Item Total Correlation (CITC) analysis was used to test item validity, while Cronbach’s Alpha was employed to analyzed instrument reliability. According to De Vaus (2013), the threshold for CITC and Cronbach's Alpha respectively are 0.3 and 0.7.

The results of validity and reliability analyses showed that all question items to measure government support has a very good performance. All CITCs from the Government Support, Performance, Technology, The Use of Accounting Information (UAI), and Human Resource met the minimum threshold value of 0.3. Items having CITC less 0.3 were dropped. The results of reliability analysis with Cronbach's Alpha for each variable have a satisfactory coefficient. All Cronbach's Alpha coefficients have more than 0.7.

Data Analysis

Three techniques of analyses i.e. descriptive, correlation, and path were employed to analyze data. Descriptive analysis is intended to understand the extent of all variables studied, while correlation analysis is used to determine the associations among variables in this study model. Correlation analysis also becomes a benchmark of path analysis to ensure all causal relationships are fit. This study uses path analysis to test the proposed hypotheses. Standardized estimation calculations were carried out simultaneously so that patterns of causal relationships among variables can be identified as decisions to accept or reject the proposed hypotheses.

To find out the fitness level of the model built by path analysis, this study uses nine goodness-of-fit indices. Chi-squared is used as a measure that the model built does not have a different matrix with the predicted model (Hoe, 2008). Therefore, the Chi-squared coefficient must be insignificant or has a probability above 0.05 (Ghozali, 2008). Furthermore, the ratio between CMIN and d.f. or CMIN/d.f. should be between 2.00 and 5.00 (Hafiz & Shaari, 2013), while the RMSEA coefficient an indication that the model can be used with larger samples should have values below 0.08 (Ghozali, 2008; Hafiz & Shaari, 2013). Furthermore, other indexes of NFI, IFI, FGFI, AGFI, TLI, and CFI should have values of min 0.9 (Hoe, 2008; Mulaik et al., 1989). The results of normality analysis show that Human Resource, Technology, and Performance variables have c.r. which does not meet the allowed threshold (-2 to +2). This study performed a bootstrapping technique with 2,000 samples. The analysis shows that Bollen-Stine bootstrap p=0.325 meaning that the path analysis can be carried out further because the p value is above 0.05 (Widhiarso, 2012).

Results and Discussion

Descriptive Analysis

Descriptive analysis (Table 1) shows that the average perception of SMEs’ performance is 15.95 with a maximum value of 25 and a standard deviation of 3.58 meaning that this performance is somewhat unsatisfactory. Managers or owners were considered good enough in utilizing accounting information for making business decisions. The average utilization of accounting information is 15.34 with a maximum value of 20.00 or 77%. The average perception of SMEs towards government support is 13.31 with a maximum value of 30.00 and a standard deviation of 6.37. In other words, the percentage of government support is perceived at 44%. The human resources competency in SMEs was categorized as ‘somewhat good’ with an average value of 14.78, a maximum value of 20, and a fairly small standard deviation of 2.83. When calculated as a percentage, the competence of SMEs' human resources is 74%. The use of technology by SMEs is around 15.72 with a maximum value of 25 and a fairly high standard deviation of 5.36. SMEs managers or owners perceived that the use of new technology only reached 63%.

| Table 1 Descriptive Analysis | ||||

| Variable | Minimum | Maximum | Mean | Std. Deviation |

| Technology | 5.00 | 25.00 | 15.72 | 5.36 |

| Human Resource | 4.00 | 20.00 | 14.78 | 2.83 |

| Government | 6.00 | 30.00 | 13.31 | 6.37 |

| The Use of Accounting Information (UAI) | 4.00 | 20.00 | 15.34 | 4.34 |

| Performance | 8.00 | 25.00 | 15.95 | 3.58 |

Correlation Analysis

The association between UAI and SMEs’ performance is 0.133 (p<0.05). This correlation value is categorized as small in magnitude, even though it is statistically significant. Likewise, human resources have a small correlation with SMEs’ performance with a coefficient of 0.153 (p<0.05). However, the human resource variable shows a significant relationship with UAI by SME managers or owners. The coefficient value of the relationship between the two variables is 0.188 significant at the 1% level, although this relationship is still considered a non-strong relationship. Human resources also have a relationship with the use of technology with a correlation value of 0.157 (p<0.01). Thus, human resources have a significant relationship with performance, utilization of accounting information, and utilization of technology for SME businesses.

Our analysis shows that the government as facilitator and regulator plays a very strategic role in developing SMEs in Indonesia. The intensity of government support correlates with the use of technology by SMEs with a coefficient value of 0.274 (p<0.01). This study found that the use of technology is significantly related to UAI with a correlation coefficient of 0.250 (p<0.01). The correlation between government support and UAI is also significant with a coefficient value of 0.241 (p<0.01). The government support and the quality of SMEs’ human resources are insignificantly correlated (0.046, p>0.05). Table 2 shows a complete picture regarding the relationship of all the variables studied.

| Table 2 Correlation Analysis | |||||

| Techno-logy | Human Resource | Accounting Info |

Perfor-mance | Government | |

| Technology | 1.000 | ||||

| Human Resource | 0.157** | 1.000 | |||

| UAI | 0.250** | 0.188** | 1.000 | ||

| Performance | -0.031 | 0.135* | 0.133* | 1.000 | |

| Government | 0.274** | 0.046 | 0.241** | 0.014 | 1.000 |

Path Analysis

The calculation of path analysis shows that SMEs’ performance is influenced by the UAI by managers or owners (0.112, p<0.05). In this model, SMEs’ performance is also influenced by human resources (0.114, p<0.05). The magnitude of human resource (HR) impacts on SMEs’ performance is also still relatively small. Thus, the HR variable and the use of accounting information significantly influence SMEs’ performance, although the influence of these two variables only has squared multiple correlations of 0.030 or 3%.

The use of technology has a significant influence on the use of accounting information for making business decisions by SMEs (0.176, p <0.001). The human resource variable also influences UAI with an estimated value of 0.152 (p< 0.05). The variable influence of government support for the utilization of accounting information is 0.186 (p <0.001). In other words, this study finds that the use of accounting information is determined by three variables, namely human resources, technology, and government support. Squared multiple correlation value of 0.117 means that the contribution of three variables to the UAI is approximately 11.7%.

Human resources have a significant influence on the use of technology by SMEs with an estimated value of 0.145 (p<0.05). Also, the government support for the use of technology by SME managers or owners is highly significant (0.268,p<0.001). Squared multiple correlation value of technology is 0.096, meaning that the influence of human resource and government variables on the use of technology is 9.60%. The analysis also shows that the influence of government on the development of human resources is not significant (0.046,p> 0.05). The results of correlation and path analyses provide the same results, hence it can be concluded that the value of estimates in the model are fit, because these estimates are not influenced by the estimates of other variables. To conclude, seven hypotheses proposed by this study are accepted, while one hypothesis is rejected (Table 3).

| Table 3 Path Analysis and Hypothesis Testing | ||||||

| Hypothesis | Variable | Estimate | p | Remark | ||

| H1 | Technology | <--- | HumanResrc | 0.145 | 0.005 | Accepted |

| H2 | Technology | <--- | Government | 0.268 | *** | Accepted |

| H3 | UAI | <--- | Technology | 0.176 | *** | Accepted |

| H4 | UAI | <--- | Government | 0.186 | *** | Accepted |

| H5 | UAI | <--- | HumanResrc | 0.152 | 0.003 | Accepted |

| H6 | Performance | <--- | UAI | 0.112 | 0.038 | Accepted |

| H7 | Performance | <--- | HumanResrc | 0.114 | 0.035 | Accepted |

| H8 | HumanResrc | <--- | Government | 0.046 | 0.394 | Rejected |

The results showed that SMEs’ performance was influenced by UAI and the competency of SMEs’ human resources. UAI as a mediator variable is influenced by human resources, technology, and government support. In turn, the use of technology is influenced by human resources competency and government supports. The competency of SMEs’ human resources is not influenced by government support. In other words, the government has yet been able to maximize its roles in building the competency of SMEs’ human resources.

Goodness of Fit

As explained in the previous section, this study measures the fitness of empirical models using nine indices. The Chi-squared value is 2.32 with a p-value of 0.313 and a maximum threshold of 0.05. This means that the Chi-squared value meets the specified standard. Likewise, based on the rule that CMIN/df value must be below 2.00, our CMIN/df value is 1.162 meaning that this index also meets the requirements.

The index values of GFI and AGFI are 0.997 and 0.980, respectively, with a minimum threshold of 0.90. The NFI and IFI index values are 0.975 and 0.996, with a the same standard value of 0.90. Likewise, the TLI and CFI values are 0.980 and 0.996 respectively with a minimum value equal to the above threshold. RMSEA value 0.022 means that it is below 0.08 (i.e. the maximum benchmark). Thus, the nine goodness of fit tests provide satisfying results.

Discussion

The role of SMEs in developing Indonesian economy is undisputed (Machmud & Sidharta, 2016), however, SMEs still face several typical problems such as unsatisfying management skills (Irjayanti & Azis, 2012), which include the issue of using accounting information for decision making (Wirjono & Raharjono, 2012). The results showed that owners or managers perceived that they have used accounting information for decision making, although the use frequency and the information quality still needs improving. Good quality information comes from a good accounting information system. However, there are still numerous SMEs had difficulty to implement accounting standards (Juita, 2016; Kurniawati & Yuliando, 2015).

The analysis shows in Figure 1 that UAI for decision making has a significant contribution to improve SMEs’ performance. This finding is very much consistent with previous studies conducted in Spain (Grande et al., 2011), Malaysia (Kharuddin et al., 2010) and Indonesia (Nurwani & Safitri, 2019). The problem is the influence of the use of accounting information on SMEs’ performance is nevertheless considered insignificant. The value of r squared is 0.013 meaning that the influence of UAI on performance of SMEs is only 1.3%. This is most likely due to the condition that not all SMEs have fully implemented accounting standards as stated by Juita (2016). Next, there is likely an issue of inadequate competency of SMEs human resources (Kurniawati & Yuliando, 2015), hence the difficulty in implementing accounting standards while utilizing the information produced. Finally, SMEs currently undergo a transition phase from using SAK ETAP to SAK EMKM which was effectively applied in early 2018 (Esterlin et al., 2018). As such, socialization, education and accounting training on the new standards may not have reached all SMEs due to personnel and budget constraints.

The next finding is regarding the influence of human resources competency on SMEs’ performance. The result is following the findings from Karami et al. (2008), Georgiadis and Pitelis (2012), Kauanui et al. (2006), and Kurniawati and Yuliando (2015). The problem is that the roles of human resources in enhancing SMEs’ performance are still very small with an r squared 0.0182 (1.82%). This finding does not seem to be following the previous studies in that human resources is a major factor in developing SMEs (Karami et al., 2008; Mendes & Lourenço, 2014). We suggest that this is due to the condition of SMEs' resources that are yet well established in their management expertise as stated by Irjayanti and Azis (2012).

The analysis finds that SMEs' human resources competency had a positive influence on UAI. Research that specifically identifies the effect of human resources on the use of accounting information is still limited in number. As stated before, human resource is an important factor in SMEs’ achievements (Karami et al., 2008; Mendes & Lourenço, 2014). A company will be able to implement an accounting system with competent resources. Further, competent human resources know how to utilize internal and external information for making a decision (Palm, 2016).

As the main determinant in business development, human resources also influences SMEs’ ability to adapt the technology (Carroll & Wagar, 2010) for the production process (March-Chordà et al., 2002) as well as an information system (Bruque & Moyano, 2007; Romero & Martínez-Román, 2015). This study supports the finding of Rahayu and Day (2015) that human resources influence the ability of SMEs in adopting technology. SMEs' human resources have a positive effect on performance, information utilization, and technology adoption. However, the effect is considered small in magnitude. As such, supports from the government and related parties is needed to improve the competency of SMEs’ human resources so they can enhance their skills for managing and developing SMEs.

The Indonesian authority puts a lot of interest in SME development mainly because SME accounts for a great part of Indonesian GDP (Machmud & Sidharta, 2016) and total employment absorption (Yanto et al., 2016). However, SME perceives that the roles of government in terms of improving its human resource competency are still inadequate (44%), whereas currently SMEs still face the lack of competency (Aribawa, 2016; Tyas & Safitri, 2014). On the other hand, the government plays a very important role in developing human resources (Pandya, 2012). The result of the analysis shows that the government support for improving human resources competency is insignificant. This insignificant influence is probably caused by the great number of SMEs i.e. 147,233 (Dinkop, 2019). Therefore, it is important to find the right strategy to improve SMEs’ human resources.

The government support influences the use of accounting information and technology adoption by SMEs. As a regulator, the government has succeeded to collaborate with IAI to apply SAK EMKM as the standards for accounting in SMEs as of January 1, 2018 (Esterlin et al., 2018). The application of accounting and accounting systems standards would enable SMEs to have the right information for their decision making. The government support in developing SME management skills also continues to improve, bearing in mind that the competency of SME managers in this field, however, is still discouraging (Irjayanti & Azis, 2012). At present, the government continues to facilitate the SAK EMKM implementation as the use of financial information for SMEs is urgent (Wuryandani & Meilani, 2013). Unfortunately, such support has not reached all SMEs due to the government’s limited budget and personnel.

The government's role in modernizing technology is relatively encouraging, as the analysis shows that government support shows a positive effect on the adoption of technology by SMEs with an r squared of 0.075 or an effect of 7.5%. This is similar to the findings of Doh and Kim (2014) that government support has a significant effect on the ability of SMEs to adopt the technology. In the era of globalization and disruption, mastery of technology for administering SMEs business processes is seen as crucial (Moeuf et al., 2018; Toanca, 2016). Economic globalization requires companies to continue to innovate business processes to improve their competitiveness in national and international levels. However, Nugroho (2015) and Sarosa and Zowghi (2003) find different facts that the government is not a strong driver for SMEs to adopt the technology. This study found that mastery of technology has a significant influence on the use of accounting information by SMEs. As previously discussed, technology adoption is not only for the production process but also for the development of information systems (Bruque & Moyano, 2007; Romero & Martínez-Román, 2015). Thus, it can be concluded that technology has been used by SMEs in producing data for decision-making purposes.

Based on the above discussion, this study suggests that the main problem of SMEs in Indonesia is the lack of competent human resources. Competent human resources would be able to enhance SMEs’ performance, increase the effectiveness of the use of accounting information, and to adopt technology properly. Given the limited ability of SMEs financial access (Irjayanti & Azis, 2012) and the lack of competent human resources (Aribawa, 2016; Hamdani & Wirawan, 2012; Kurniawati & Yuliando, 2015; Tyas & Safitri, 2014), the responsibility for developing human resources lies on the government as suggested by Doh and Kim (2014) and Pandya (2012). However, there are limitations of personnel and budget from the government. Several previous studies find that the responsibility to develop SMEs lies not only in the government but also in higher education institutions and big companies (Handoko et al., 2014; Marri et al., 2002).

In the context of business in Indonesia, the development of SMEs' human resources must be supported by the local and central government, higher education institutions, big companies, and NGOs. Indonesian universities and colleges have sufficient and competent resources to participate in the development of SMEs' human resources. The mobilization of lecturers and students to facilitate SMEs in improving the competency of their human resources is a promising strategy. Also, banking institutions need to continue to increase the number of soft loans to SMEs to support SMEs' business development. This study shall conclude that competent human resources will help solve the problem of developing SMEs in Indonesia. Thus, as the backbone of the economy (Machmud & Sidharta, 2016) SMEs will be stronger and economic growth will continuously prosper in the future.

Conclusion

SME managers and owners perceive that the competency of their human resources, the ability to utilize technology, and the use of accounting information are considered ‘somewhat good’. They also consider their performance ‘good’ and the government support ‘relatively low’. Albeit its magnitude, human resources and the use of financial information influence SMEs’ performance. The utilization of financial information as an intervening variable is affected by the quality of human resources, government support, and the use of technology. At the same time, human resources competency influences the use of technology by SMEs. Government support has an important role in building SMEs’ ability to use technology and accounting information. Finally, government support does not influence SMEs' human resources.

The insignificant impact of government support on the improvement of SMEs’ human resources might be caused by limited personnel and budget of government to handle all SMEs. Considering that the role of human resources is critical in developing SMEs, the government as a facilitator and regulator needs to implement a substantial facilitation strategy by engaging higher education institutions, NGOs, and LSEs. Such facilitation is a strategic policy for the government in this globalized economy and Industrial Revolution 4.0 so the SMEs would have the power to compete globally and to adapt to the fast and unexpected technological changes. Future research should identify the effectiveness of integrated facilitation that includes government, higher education institutions, NGOs, and LSEs to develop SMEs in Indonesia.

The respondents of the study are limited in the cities and regencies in Central Java, which is likely considered insufficient to represent all SMEs in Indonesia. Future research needs to include SMEs from outside Java, which would provide more complete data to enable the government and other related parties to make more accurate policies, facilitation, and assistance for developing SMEs.

References

- Aribawa, D. (2016). The effect of financial literacy on the performance and sustainability of MSMEs in Central Java. Journal of the Faculty of Law UII, 20(1), 1-13.

- Asah, F. (2015). The impact of motivations, personal values and management skills on the performance of SMEs in South Africa. African Journal of Economic and Management Studies, 6(3), 308-322.

- Bruque, S., & Moyano, J. (2007). Organisational determinants of information technology adoption and implementation in SMEs: The case of family and cooperative firms. Technovation, 27(5), 241-253.

- Carroll, W.R., & Wagar, T.H. (2010). Is there a relationship between information technology adoption and human resource management? Journal of Small Business and Enterprise Development, 17(2), 218-229.

- De Vaus, D. (2013). Surveys in social research. Routledge.

- Dinkop. (2019). Data Koperasi dan UMKM. Retrieved from http://dinkop-umkm.jatengprov.go.id/content/index/2/ 73/6/data-koperasi-umkm

- Doh, S., & Kim, B. (2014). Government support for SME innovations in the regional industries: The case of government financial support program in South Korea. Research Policy, 43(9), 1557-1569.

- Esterlin, I.N., Indrawaty, A., & Solihin, D. (2018). Implementasi SAK EMKM (Entitas Mikro, Kecil dan Menengah) Pada UMKM Borneo Food Truck Samarinda Community. Research Journal of Accounting and Business Management, 2(2), 176-183.

- Georgiadis, A., & Pitelis, C. N. (2012). Human resources and SME performance in services: Empirical evidence from the UK. The International Journal of Human Resource Management, 23(4), 808-825.

- Ghozali, I. (2008). Model persamaan struktural: Konsep dan aplikasi dengan program AMOS 16.0: Badan Penerbit Universitas Diponegoro.

- Grande, E., Pérez Estébanez, R., & Colomina, C. (2011). The impact of accounting information systems (AIS) on performance measures: Empirical evidence in Spanish SMEs. The international journal of digital accounting research, 11.

- Grušovnik, D., Kavkler, A., & Urši?, D. (2017). Dimensions of decision-making process quality and company performance: A study of top managers in Slovenia. Naše gospodarstvo/Our economy, 63(4), 66-75.

- Hafiz, B., & Shaari, J.A.N. (2013). Confirmatory factor analysis (CFA) of first order factor measurement model-ICT empowerment in Nigeria. International Journal of Business Management and Administration, 2(5), 081-088.

- Hamdani, J., & Wirawan, C. (2012). Open innovation implementation to sustain Indonesian SMEs. Procedia Economics and Finance, 4, 223-233.

- Handoko, F., Smith, A., & Burvill, C. (2014). The role of government, universities, and businesses in advancing technology for SMEs’ innovativeness. Journal of Chinese Economic and Business Studies, 12(2), 171-180.

- Hansen, H., Rand, J., & Tarp, F. (2009). Enterprise growth and survival in Vietnam: Does government support matter? The Journal of Development Studies, 45(7), 1048-1069.

- Hoe, S. L. (2008). Issues and procedures in adopting structural equation modeling technique. Journal of applied quantitative methods, 3(1), 76-83.

- Irjayanti, M., & Azis, A.M. (2012). Barrier Factors and Potential Solutions for Indonesian SMEs. Procedia Economics and Finance, 4, 3-12.

- Juita, V. (2016). Pemanfaatan Sistem Akuntansi pada Usaha Mikro, Kecil, dan Menengah (UMKM) Sektor Jasa Perdagangan di Padang, Sumatra Barat. Jurnal Riset Akuntansi Terpadu, 9(1), 1-20.

- Kang, K.N., & Park, H. (2012). Influence of government R&D support and inter-firm collaborations on innovation in Korean biotechnology SMEs. Technovation, 32(1), 68-78.

- Karami, A., Jones, B.M., & Kakabadse, N. (2008). Does strategic human resource management matter in high?tech sector? Some learning points for SME managers. Corporate Governance: The international journal of business in society, 8(1), 7-17.

- Kauanui, S., Ngoc, S.U., & Ashley-Cotleur, C. (2006). Impact of human resource management: SME performance in Vietnam. Journal of Developmental Entrepreneurship (JDE), 11, 79-95.

- Kharuddin, S., Ashhari, Z.M., & Nassir, A.M. (2010). Information system and firms' performance: The case of Malaysian small medium enterprises. International business research, 3(4), 28-35.

- Kurniawati, D., & Yuliando, H. (2015). Productivity improvement of small scale medium enterprises (SMEs) on food products: case at Yogyakarta province, Indonesia. Agriculture and Agricultural Science Procedia, 3, 189-194.

- Loader, K. (2005). Supporting SMEs through government purchasing activity. The International Journal of Entrepreneurship and Innovation, 6(1), 17-26.

- Machmud, S., & Sidharta, I. (2016). Entrepreneurial Motivation and Business Performance of SMEs in the SUCI Clothing Center, Bandung, Indonesia. DLSU Business & Economics Review, 25(2), 63-78.

- Manurung, E.T., & Manurung, E.M. (2019). A new approach of bank credit assessment for SMEs. Academy of Accounting and Financial Studies Journal, 23(3), 1-13.

- March-Chordà, I., Gunasekaran, A., & Lloria-Aramburo, B. (2002). Product development process in Spanish SMEs: an empirical research. Technovation, 22(5), 301-312.

- Marri, H.B., Grieve, R., Gunasekaran, A., & Kobu, B. (2002). Government?industry?university collaboration on the successful implementation of CIM in SMEs: an empirical analysis. Logistics Information Management, 15(2), 105-114.

- Maseko, N., Manyani, O., Chiriseri, L., Tsekea, S., Mugogo, P.C., Chazuza, T., & Mutengezanwa, M. (2011). An analysis of the impact of targeted government support on SMEs growth and development in Zimbabwe: A survey of Mashonaland Central Province. Journal of Research in International Business Management, 2(2), 051-059.

- Mendes, L., & Lourenço, L. (2014). Factors that hinder quality improvement programs’ implementation in SME. Journal of Small Business and Enterprise Development, 21(4), 690-715.

- Moeuf, A., Pellerin, R., Lamouri, S., Tamayo-Giraldo, S., & Barbaray, R. (2018). The industrial management of SMEs in the era of Industry 4.0. International Journal of Production Research, 56(3), 1118-1136.

- Mulaik, S. A., James, L. R., Van Alstine, J., Bennett, N., Lind, S., & Stilwell, C. D. (1989). Evaluation of goodness-of-fit indices for structural equation models. Psychological bulletin, 105(3), 430-445.

- Nalukenge, I. (2012). Literacy, External User-Pressure and Quality of Accounting Information of Ugandan SMEs. In K. Nkundabanyanga Stephen, T. Venancio & M. Musa (Eds.), Accounting in Africa (12 Part A, 51-73): Emerald Group Publishing Limited.

- Nugroho, M.A. (2015). Impact of government support and competitor pressure on the readiness of SMEs in Indonesia in adopting the information technology. Procedia Computer Science, 72, 102-111.

- Nurwani, & Safitri, A. (2019). The influence of the use of accounting information on the success of small and medium businesses (Studies in dodol centers in Tanjung Pura District). Liability Journal of Accounting Education, 2(1), 37-52.

- Palm, P. (2016). Information for decision-making in in-house and outsourced real estate management organisations. Facilities, 34(13/14), 891-905.

- Pandya, V.M. (2012). Comparative analysis of development of SMEs in developed and developing countries. Paper presented at the The 2012 International Conference on Business and Management, Phuket, Thailand.

- Putra, Y.M. (2018). Mapping the Application of EMKM Financial Accounting Standards at MSMEs in South Tangerang City. Profita: Accounting and Taxation Scientific Communication, 11(2), 201-217.

- Rahayu, R., & Day, J. (2015). Determinant Factors of E-commerce Adoption by SMEs in Developing Country: Evidence from Indonesia. Procedia - Social and Behavioral Sciences, 195, 142-150.

- Romero, I., & Martínez-Román, J. (2015). Determinants of technology adoption in the retail trade industry: The case of SMEs in Spain. Amfiteatru Economic, 17, 646-660.

- Sarosa, S., & Zowghi, D. (2003). Strategy for adopting information technology for SMEs: Experience in adopting email within an Indonesian furniture company. Electronic Journal of Information Systems Evaluation (EJISE), 6(2), 165-176.

- Tarut?, A., & Gatautis, R. (2014). ICT impact on SMEs performance. Procedia-social and behavioral sciences, 110(1), 1218-1225.

- Toanca, L. (2016). Empirical research regarding the importance of digital transformation for romanian SMEs. Management and Economics Review, 1(2), 92-108.

- Tyas, A.A.W.P., & Safitri, V.I. (2014). Strengthening the MSME sector as a strategy to face the AEC 2015. Economic Journal of Esa Unggul University, 5(1), 42-48.

- Wibowo, A., & Kurniawati, E.P. (2015). The influence of the use of accounting information on the success of small and medium businesses (Studies in convection centers in the District Tingkir Salatiga City). Journal of Economics and Business, 18(2), 107-126.

- Widhiarso, W. (2012). Structural Equation Modeling (SEM) in Abnormal Data. Retrieved from http://widhiarso.staff. ugm.ac.id/wp/

- Wirjono, E.R., & Raharjono, D.A.B. (2012). Survey of understanding and utilization of accounting information in small and medium businesses in the Special Region of Yogyakarta. Scientific Journal of Accounting and Business, 7(2), 205-2016.

- Wuryandani, D., & Meilani, H. (2013). The Role of Local Government Policy in the Development of Micro, Small and Medium Enterprises in the Special Province of Yogyakarta. Journal of Economics and Public Policy, 4(1), 103-115.

- Yanto, H., Handayani, B.D., Solikhah, B., & Mula, J.M. (2016). The behavior of Indonesian SMEs in accepting financial accounting standards without public accountability. International Journal of Business & Management Science, 6(1), 43-62.