Research Article: 2022 Vol: 26 Issue: 6

Value Relevance of Capital Structure: Evidence from the Property Sector Companies Listed in the Philippine Stock Exchange

Erdilyn L. Carino, Central Luzon State University

Judith A. Teano, Central Luzon State University

Citation Information: Carino, E.L., & Teano, J.A. (2022). Value relevance of capital structure: evidence from the property sector companies listed in the philippine stock exchange. Academy of Accounting and Financial Studies Journal, 26(6), 1-20.

Abstract

Researchers have attempted to measure the relationship between capital structure and firm performance. However, only a few empirical studies have explored whether the capital structure is a relevant factor that creates value for the firm. Hence, this study investigated whether capital structure decisions are relevant to attain the desired outcome on the firm’s market value. The study considered the 20-property sector firms listed on the Philippine Stock Exchange. To analyze the relationship of the capital structure to the firm value, the panel data regression was used with a span of five years from 2013 to 2017 using interest-bearing debt-to-equity ratio and the market price per share (MPPS) as proxy variables. The statistical estimation involving simple ordinary least squares, fixed effects model, and random effects model showed that capital structure is significant and negatively associated with the firm’s value. The result implies that capital structure decisions are relevant to management’s decision-making since it affects the firm’s value. The management needs to be more cautious in using high gearing capital structure because it can potentially decrease the firm’s MPPS. The study brings significant knowledge in the accounting and finance industry in which capital structure is considerably important for evaluation in the decision-making process of the management.

Keywords

Capital Structure, Firm Value, Property Sector, Panel Data Regression, Fixed Effects Model, Random Effects Model.

Introduction

Among the imperative roles of accountants and financial managers is to assess whether the management’s past and current decisions are relevant to the firm’s value. These accountants and financial managers primarily evaluate the internal and external impact of the firm’s financial data if it could signal a favorable outlook for the investors and stockholders for them to commit their funds or to increase their investments. The firm’s value is a significant indicator of the management’s effectiveness in its decision-making as well as the potential success of the business. In this case, accountants and financial managers must give advice to the management in terms of the value relevance of its decisions.

Value relevance is a crucial concept in the contemporary business world. Businesses would primarily consider if the management’s decisions could create value for the owners (stockholders) and stakeholders (government, employees, community, etc.). Value relevance is a combined concept wherein the primary goal of business is to create value for the firm and the management’s past and current decisions geared towards value creation. In fact, accountants and financial managers consider that relevance is a fundamental qualitative characteristic of financial information. Financial information is relevant to decision-makers if it has confirmatory value, predictive value, or even both (Conceptual Framework for Financial Reporting, 2018). In the context of the study, past decisions are relevant if they resulted in an expected increase or decrease in value. Hence, management can conform to or correct past decisions in order to maintain or redirect the future performance of the firm.

The management should ensure that its past and current decisions are leading towards improving the firm’s value that is observable in terms of improvement in the market price per share (MPPS). In this case, accountants and financial managers would have to assist the management in interpreting its current decisions whether it can bring future impact on the MPPS or not. Most likely, accountants and financial managers could provide management advisory based on past decisions if they brought an impact on the firm’s current MPPS. Certainly, external stakeholders such as financial analysts, investors, and creditors are also concerned about the firm’s value, and the management’s decisions could affect their approval ratings and client recommendations that immediately translates into the firm’s market value. Therefore, it is important that the management formulate decisions that are relevant to improving the market value of the firm.

Modern capital markets brought easier access for corporations to acquire debt and equity capital. This gives an opportunity for corporations to pool bigger capital and to identify the best mix of capital structure. However, the corporation’s capital structure can affect the overall risk exposure of the firm that could affect its value. This means that the management would have to face some trade-offs because the level of debt and equity of the firm could probably bring growth for the firm or it can increase the level of the firm’s risk. The firm may increase its debt structure that may not only affect claims of the stockholders but also increases the risk of insolvency of the firm. On the other hand, when the firm increases its equity, it may avoid the risk of insolvency but it could dilute the percentage of ownership of the shareholders and the earnings per share. Despite these trade-offs, the management may need to pursue its capital structure decisions to attain the firm’s goals.

The management’s decisions on its capital structure could have relevance to the firm’s market value. Several stakeholders such as financial analysts, accountants, and investors believe that capital structure would generally affect the value and the performance of the firm as this area has been subjected to many empirical studies. However, there have been contradictions in most studies. For instance, the irrelevance theory of Modigliani & Miller (1958) presented that capital structure is irrelevant to the firm’s value in a perfect market condition. Other theories have also emerged including but not limited to the agency trade-off theory, cost theory, signaling theory, and pecking order theory that also posit different and contradicting philosophies of the ideal capital structure. Hence, this paper attempted to revisit the value relevance of capital structure among the selected property sector corporations in the Philippines.

The study on the value relevance of capital structure is still a daunting task in academic research papers. There were several studies on the impact of capital structure among foreign firm, but there were limited scholarly works that explored whether the capital structure has value relevance in the Philippines. Additionally, there is a challenge among accountants to generate worthwhile research to provide appropriate financial advisory for managers. Value relevance has recently evolved as important accounting research that aims to assess the relevance of financial decisions in the market price and return.

Despite the efforts to identify the impact of capital structure on the financial aspect of the firm, a crucial gap in the literature remains and there is a few empirical researches to determine the value relevance of capital structure specifically in the Philippines which belongs to emerging economies. Countries which are categorized as an emerging market have different characteristics as compared to developed countries that may affect the capital structure decisions of firms’ executives due to different environment and situations (Booth et al., 2001). These developing countries’ distinct circumstances include higher investment risk - a factor that affects interest rates, undeveloped bond and stock market, and weaker policies that protect investors.

The studies on the value relevance of capital structure produced opposing results making it one of the most controversial topics. Some studies favor the use of high gearing while others are in favor of issuing equity securities. This is on top of the substantial seminal papers which have demonstrated diverse theories of capital structure. Thus, the capital structure must be subjected to continued attention in the field of accounting and finance. It is observed as one of the most perplexing issues in the corporate finance literature and it is a significant topic since it is linked to the capability of the firm to fulfill investors’ expectations. The capital structure still needs to be given attention to with the main purpose of determining whether or not it affects the firm’s value.

The use of property sector companies in the Philippines in this paper is motivated by considerable reasons. First, all real estate firms are capital –intensive, contrary to other sectors in the Philippine Stock Exchange which include a mix of capital-intensive and labor-intensive firms. The service industry, for instance, includes airline and telecommunication organizations that invest in numerous and expensive capital assets but this sector also includes website- developing firms and logistics companies which have a lower capital intensity. Real estate companies also involve a very low inventory turnover causing a longer period that the capital investment is tied up to the inventories. Hence, these unique features of property sector firms are significant relative to the amount and period of financing.

Review of Related Literature

Value relevance theory: Value relevance is a challenge for corporations in contemporary times. It relates to the ability of the financial statement items to affect the stock market value of the firm (Kar??n, 2013). The financial statements contain the results of the management’s financial decisions which give implications to the firm’s value as the stakeholders would use it to predict future performance and risk level of the firm.

Value relevance needs to be studied as it shows the usefulness and reliance of the investors to the financial statements. Various studies revealed that some accounting data have different levels of association with the price of shares in the market. Some empirical works resulted in a strong relationship to the stock price; other accounting data depicted weak relationships and some are irrelevant to the market price (Uwuigbe et al., 2016).

Capital structure: Capital structure refers to the combination of debt and equity as a source of a firm’s financing. It is one of the most crucial areas in finance which should be carefully studied by the managers of an entity because it involves both risks and costs. Choosing debt involves incurrence of interest along with the exposure to financial risk. Unlike equity, debt involves regular payment of a fixed amount of money in regular intervals, so one must consider many factors such as its ability to pay its future cash flows and its credit ratings in lending institutions. However, although debt financing involves higher risk than equity financing, there are circumstances that this is more advantageous as debt is temporary; the contract with the lender ends after paying the debt. Meaning, lenders have no control over the company and there is no long term obligation involved. It also has a tax advantage because interest expense, unlike dividends, is deductible from the income in computing tax payable to the government. Conversely, issuing equity securities encompasses an obligation to pay dividends to the shareholders but unlike debt, it does not entail a company to carry the burden of paying regular loan repayments. The company is not required to repay the money acquired; and therefore, the firm carries less pressure in its cash outflow. However, since equity represents ownership interest, additional shares issued may affect the voting rights of the existing shareholders as control over the major decisions in the company depends on the percentage of equity ownership. Indeed, debt and equity have their advantages and disadvantages and a proper level of debt and equity financing should be carefully maintained by firms.

The main goal of the company is to maximize the value of the shareholder’s wealth. This is being done by maximizing revenues and minimizing its costs. In capital structure, computation of costs involves the computation of the weighted average cost of capital (WACC). It consists of computation of cost of debt and cost of equity which is proportionately weighted. Prior to the prospective project or business opportunity, decision-makers have to deal with deciding for the ideal source of financing that will maximize shareholders’ wealth. In the case of debt, the cost is being identified through the computation of principal repayment and the interest associated with it considering the term of the borrowed fund offered by their prospective lenders. However, the cost of equity is implicit and the amount that will be paid to shareholders in the future cannot be concretely identified. The cost of capital is the amount being required by the shareholders which will keep them contented for them to retain their investment. Since there are alternative uses of resources, investors who provide assets to the firm will only be committed to stay if they are satisfied with the value that they are receiving (Carton & Hofer, 2006). If the shareholders are not satisfied with the return that they are getting from the firm, they are going to sell off their shares which will then result to decline in the share price. Carton & Hofer (2006) also added that as a consequence of this concept, there is a need for value creation and that is the essence of performance. According to Horvathova & Mokrisova (2017), equity is generally more expensive than debt. Business owners require higher returns than creditors as they bear more risk.

The effect of the level of debt and equity to the shareholders’ wealth cannot be identified in a straightforward manner. On top of the direct costs associated with debt and equity securities, another issue that complicates the computation of costs and its impact on the shareholders’ value is the existence of indirect costs including the bankruptcy cost and agency cost. Agency cost exists when managers who are the agent of the shareholders make decisions for their own interest rather than for the best interest of the shareholders. Thus this is contrary to the businesses’ ultimate goal of maximizing the value of the shareholders’ wealth. Needless to say, this happens because of the separation of ownership and management in a corporate setting. An implication of agency cost to the capital structure was explained in the theory of Jensen and Meckling (1976) where it was explained that the conflict of interest between shareholders & managers in capital decision making plays a significant role. Jensen (1986) further suggests that one way of minimizing this cost is by increasing the portion of the debt in the capital structure resulting in a decrease in free cash available which is controllable by the managers. If the firm has an obligation to pay regular loan principal and interest payments, free cash flow will be reduced; therefore, the possibility of misusing free cash by the managers will be minimized (Stretcher & Johnson, 2011). Thus, this theory suggests that there is a positive correlation between debt and firm value.

On the other hand, many scholars also consider debt as a costly source of financing due to the associated bankruptcy cost. Baxter (1967) investigated the companies which filed for bankruptcy and believed that excessive leverage or using a high level of debt increases the probability of bankruptcy. This situation will lead to various administrative costs; therefore, he claimed that too much debt may increase the cost of capital and reduce the value of the firm.

The above concepts, however, were contrary to the pioneering study of (Modigliani & Miller, 1958). Capital structure has captured the attention of researchers in the financial management arena after the introduction of Modigliani and Miller’s “irrelevance theory”. They stated that in a capital market with no taxes, bankruptcy cost, asymmetric information, transaction cost, and other constraints, the value of the firm is not affected by the choice of capital structure. This paper has brought criticisms and has led to debates, for there is no such perfect capital market in the real world where taxes are not required to be paid and other frictions do not exist.

Ross (1977) proposed signaling theory which states that the choice between using debt and equity serves as a hint that communicates to investors about the managers’ perspective of future cash flow and earnings. This theory has emerged because of the belief that there are information asymmetries in an organization where insiders or managers are more knowledgeable than the outsiders concerning the firm’s future earnings. For instance, if the executives believe that the company is doing well and expect high future earnings and better cash flow, they tend to raise funds using debt. It depicts that the managers are confident that the cost of capital associated with the debt can be paid by the firm. This is a rational notion considering that using debt will add financial distress to a company that is expecting poor future earnings. Conversely, this theory proposes that issuing equity securities signifies that managers perceive that the firm’s shares are overpriced. Thus, under the signaling theory, using equity as a source of financing is a negative sign that the managers are not confident with the firm’s future earnings.

Myers (1984) introduced the pecking order theory and argued that optimal capital structure does not exist but rather, firms follow a pecking order in financing wherein internal funds are preferred than issuing securities. In situations where an outside source of funds is needed, debt is preferred than issuing equity securities.

The Trade-off theory proposed that optimal capital structure is achieved by having a balance between the tax benefit of debt and the financial distress caused by the debt (Kraus & Litzenberger, 1973). This theory also explained that firms with a high level of fixed assets are considered safe business entities and therefore they should choose to be financed with more debt while firms with less fixed assets are considered high-risk firms and should choose to be financed by equity (Okuyan & Tacsi, 2010).

The above scholarly works have significantly built relevant theories and have emphasized the importance of capital structure in different perspectives. However, the impact of the leverage on firms’ value has remained to be a question as the above theories have presented contradicting conclusions.

Value relevance of capital structure: empirical and theoretical perspective: There are empirical studies that have been published on capital structure relative to the value of the firm, but it remains controversial as its results provide mixed and opposing pieces of evidence.

Chowdhury & Chowdhury (2010) found a positive relationship between debt ratio and stock price in their examination of the impact of capital structure to firm value using secondary data gathered from firms listed in the Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) of Bangladesh. As independent variables, EPS, dividend payout ratio, percentage of public shareholding, fixed asset turnover, long term debt to total assets, current ratio, operating leverage, sales growth, and total share capital were utilized. The cross-sectional time-series regression was conducted using the data gathered from 1997 to 2003.

Ogbulu & Emeni (2012) provided empirical evidence in their study of 124 companies listed in the Nigerian Stock Exchange that long term debt has a strong and positive relationship to firm value. The paper suggests that managers of the firms should employ more long-term debt to finance the company’s operations. On the other hand, equity was found to be insignificant with the value of the firm. This study used the Ordinary Least Squares method of regression. This is inconsistent with the proposition of Baxter (1967) which argued that a high leverage is associated with bankruptcy cost that increases the cost of capital. Hence, excessive debt decreases the value of the firm. This study, however, supports agency theory as the debt was found to have a positive effect on the value of the firm.

Although Lawal (2014) used data from different industries in Nigeria, he found a consistent result with Ogbulu & Emeni (2012) which showed that debt instruments significantly boost the value of firms in the banking industry in Nigeria. However, the role of equity in market value was found to be partially significant. He used the OLS technique and tested the heteroskedasticity using the White-HAC heteroskedasticity test and employed Nigerian’s six- year data of commercial banks from 2007 to 2012.

Javeed et al. (2014) support the above studies as they found evidence that leverage positively relates to the value of the firm using five-year data from 2008 to 2012. The empirical study used the fixed-effects regression method employing 155 non-financial firms listed in Karachi Stock Exchange in Pakistan. The capital structure was represented by debt to total assets ratio and the firm’s value was represented by Tobin’s Q.

Hadi et al. (2017) on the other hand found an interesting outcome as it found that capital structure is irrelevant to the value of the firm. Twenty-seven consumer product companies listed in Bursa Malaysia were tested. They used the Generalized Method of Moments as a method to analyze the relationship of capital structure (the debt-equity ratio was used as a proxy) to firm value (represented by Earnings Per Share). Interestingly, the results are consistent with the irrelevance theory of Modigliani & Miller (1958) where it assumed that there is a perfect market where no frictions exist. Furthermore, the variables and model used were tested for its robustness and fitness of the study. This implies that some industries like Consumer Product in Bursa, Malaysia, Efficient Market Hypothesis (EMH) may prevail causing the capital structure to be insignificant of the firm value. However, it should be noted that this study used Earnings Per Share as a proxy of share value which involves an Accounting performance only rather than incorporating the market-based indicator such as the market price.

Another significant study was conducted by Aggarwal & Padhan (2017) where they used several variables and identified whether or not these variables affect the value of the firm. It includes leverage, profitability, liquidity, growth, tangibility, and quality of the firm measured by the Altman Z-Score, a bankruptcy prediction model. The study was conducted using panel data techniques employing a 15-year data from hospitality companies listed in the Bombay Stock Exchange (BSE). Contrary to the study of Lawal (2014), Chowdhury & Chowdhury (2010), Ogbulu & Emeni (2012), Javeed et al. (2014), the result of this study shows that leverage leads to adverse effect to market capitalization. However, the test of the relationship of leverage on Enterprise Value gave a contradicting result as leverage was depicted to have a positive effect on EV. As compared to the studies stated above, Aggarwal & Padhan (2017) studied companies in a different industry with very different characteristics in terms of products, capitalization, and gestation period which might be some of the reasons why these papers have given contradicting results. Bowen et al. (1982) suggest that the industry’s average debt ratio is a strong determinant of capital structure. There is a significant difference in the level of debt among companies in different industries (Solomon, 1963). Dimitrov & Jain (2008) also postulated that the market’s perception of capital structure standard is the industry median.

Statement of the Problem

A vast amount of published works on the impact of capital structure on the value of the firm has been published in several countries based on the literature. However, most of these research papers have provided mixed and contradicting results. The differences in many factors such as the diverse circumstances present in different industries, different countries; considering the dissimilarities in emerging and developed countries, and various methods used, provide varying and opposing findings in different research papers conducted in the area of value relevance of capital structure.

Moreover, most of them focused on the accounting-based performance indicators and indeed, the value relevance on a market-based performance should also be further explored. Specifically, most of the scholarly works used financial ratios like Return on Assets (ROA), Return on Equity (ROE), and other single ratios that relate to profitability and neglect the market-based indicators like the market price of stocks. The proxies that represent capital structure should also be specific to interest-bearing debts only as such is the essence of the capital structure. Almost all of the research papers published utilized the total amount of liabilities including accounts payable and accrued liabilities which were not part of the firm’s financing. Therefore, this topic has remained to be a gray area and is still subject to further research.

Indeed, this paper raised a research question: Is the capital structure of property sector companies listed in the Philippine stock exchange value relevant?

Objectives of the Study

The main objective of the study was to identify whether or not the mix of interest-bearing liabilities and equity components of property sector firms in the Philippines value relevant to the market price. It aimed to add knowledge in the literature in the field of Finance and Accounting.

Significance of the Study

The outcome of the study may give more emphasis on the importance of capital structure decisions. Indeed, it will contribute mainly to the Academic Sector as additional knowledge to the capital structure, specific in the Philippine setting and specific in the property sector. The author believes that this will add a significant part of the literature. This work will also contribute to the corporate sector as the findings of this paper might give a significant result that will encourage the decision-makers of the firms and the accountants who advise them to give more time and attention in scrutinizing sources of financing for both daily operations and new business opportunities. It will also give a better understanding and new insight concerning the relationship between capital structure and firm value in the Philippines which is very relevant in making sound capital structure policies.

Research Design

The main objective of this research was to identify whether or not the capital structure is relevant to the firm value. This objective was empirically investigated using quantitative data. Panel Data Regression was employed to achieve the objective of the study using the secondary data which were extracted from the published financial statements of each firm. Some figures in the financial statements of property sector firms were carefully gathered and used as a variable or were utilized as a component needed in the computation of the ratios that are included in the variables of the regression model. After each variable had been computed, the panel data regression was conducted using a statistical software called Stata. The financial statements were collected from the annual report being required by the Securities and Exchange Commission from the firms, specifically called SEC form 17-A. These reports are being published by the Securities and Exchange Commission. The data gathering focused on the Statement of Financial Position, Statement of Comprehensive Income, and Notes to Financial Statements to verify which of the liabilities are interest-bearing. The significance of the independent variables to the dependent variable to identify the relevance of the capital structure to the firm value was then estimated using Stata 16.0

Panel Data

Panel data which are also called longitudinal data are datasets containing both cross- sectional and time-series data. Many researchers use this kind of data as they have advantages in statistical analysis over purely cross-section or time-series data. Baltagi (2001) stated, “Panel data give more informative data, more variability, less collinearity among the variables, more degrees of freedom and more efficiency” (p.6). They manage to control for differences among the cross-sections as panel data have the ability to control for variables that cannot be easily observed. Indeed, the use of panel data allows the researcher to compare cross-sections with different firm- specific characteristics.

Since both cross-sectional (firms) and time-series (2013-2017) data were utilized in this paper, it is considered as panel data. This paper focused on five years data only because of the limited data available before 2013.

At the time that this paper was started to be written, there were 28 companies listed in the property sector of the Philippine Stock Exchange, and if all of the conditions were met, the entire population of property sector firms was included and the total population utilized in this study would have to be 140 (28 X 5) firm-years.

The following conditions were set in choosing the firms that were included in the data:

1. All data should be available from 2013-2017 to be able to use a balanced panel data.

2. Firms should be listed consistently from 2013-2017.

3. There was no shifting of financial statement dates (some companies shifted from fiscal year to calendar year).

4. The firm uses both debt and equity as its capital structure.

Variables

Dependent variable: The market price per share which is the sole dependent variable was used to represent the value of the firm.

Market price per share: Market price per share is the value that the market presently assigns to each share of the company’s stock. This can be computed by dividing the total business’ market value to the number of outstanding shares of stock. It is being used by researchers as an external benchmark of value relevance since in the efficient markets, the market price is considered as the best estimate of equity value (Dichev, 1997). Uwuigbe et al. (2016) used share price to test the research hypothesis related to the value-relevance of some components of the financial statements. They further added that firms aim to maximize their stock price as it is the most significant measure of firm value and it depends on how the market perceives its performance (Uwuigbe et al., 2016).

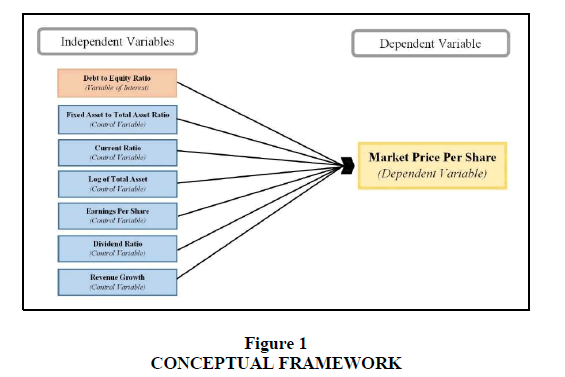

Independent variables: The independent variables in this study consist of a variable of interest and the control variables.

Variable of interest: The only variable of interest in this study is the debt to equity ratio. Debt to equity ratio (debt_to_equity). This variable represents the capital structure of the firms. It was computed by dividing the total interest-bearing debt by the total equity of the companies. The debt to equity ratio was proven by Rizki et al. (2018) as a significant factor that affects the firm value. This variable was the sole proxy of capital structure to avoid problems involving multicollinearity of variables that gives a spurious result in the regression analysis.

H0: There is no statistically significant relationship between the Debt to Equity Ratio and Market Price Per Share.

H1: There is a statistically significant relationship between the Debt to Equity Ratio and Market Price Per Share.

H0: The Debt to Equity Ratio is positively related to Market Price Per Share. H2: The Debt to Equity Ratio is negatively related to Market Price Per Share.

Control variables: Firm value is not exclusively influenced by the capital structure only, thus, the use of control variables was needed to specify individual characteristics that may influence the dependent variable. Using control variables that historically affect the dependent variables based on the literature will avoid the existence of omitted variable bias in the regression model that may result in spurious regression analysis.

Fixed asset to total asset ratio (fa_ta_ratio): This variable represents the firms’ asset tangibility. Having a high amount of fixed assets is of a great deal especially on the property sector as it is being perceived as an indicator of the company’s ability to finance more investment opportunities. The reason behind this lies in its ability to procure more funds using fixed assets as collateral. Hence, a higher fixed to total asset ratio is expected to affect the firm value positively. This variable has been used by (Aggarwal & Padhan, 2017; Booth et al., 2001).

Current ratio (cur_ratio): This variable which is the proxy for liquidity was computed by dividing the firms’ current assets by its current liabilities. Since it depicts the ability of the company to pay its current obligations using its current assets, a higher amount usually indicates a favorable signal to investors. However, a very high current ratio compared to its peer group might indicate that the firm is not using its current assets efficiently and that the firm is incurring opportunity costs for keeping its assets idle. The current ratio as a control variable was also used by Chowdhury & Chowdhury (2010) and found out that it has a positive relationship to the firm value.

Log of total assets (ln_asset): The log of total assets indicates the size of the firm. Company size is being used by many researchers as a determinant of profitability and firm value (like the study of Zeitun & Tian, 2007; Abeywardhana, 2015) as assets are being utilized by the business firms to generate profits. Consequently, because companies with higher amounts of assets have more opportunities to generate more profits, investors tend to be more interested to invest and thus it creates a demand for the shares of stocks that eventually increases its value.

Thus, it is expected that firms with larger assets will result in better firm value. This is consistent with the study of Degryse et al. (2012) who proposed that the size of the firm does matter due to the volatility of earnings where larger firms have the ability to diversify their investments.

Earnings per share (eps): Earnings per share is an indicator of profitability which is being computed by dividing the firm’s net income by its outstanding shares. Milad et al. (2013) explained that EPS is one of the most significant indicators of profitability that investors oversee in assessing investment decisions. Akhtar et al. (2016) added that the earnings per share provides a basis for the investor to assess the value of the shares based on the amount of future earnings on a per-share basis.

Dividend ratio (div_ratio): This control variable represents the dividend policy of the firm. A significant number of empirical research papers have been conducted to investigate the relationship of dividend policy to the firm value but to date, this issue has remained to be unresolved. There are theories and empirical studies that support the positive relationship between dividend policy and firm value. Pandey (2015) found out in his empirical study that dividend policy affects the market price of the shares. On the other hand, there are seminal papers that state that dividend policy negatively influences the firm value.

Revenue growth (rev_growth): Revenue growth is a proxy for the firm’s growth which is an important driver of the firm value. An investor would typically look for an investment with an upward trend in terms of sales as it will predict the profitability and sustainability of a business entity. Myers (1977) has proposed that one of the significant factors that affect the value of the firm is revenue growth. Several empirical studies have identified the relationship between the capital structure and firm value including the studies of (Varaiya et al., 1987; Hermuningsih, 2014; Kodongo et al., 2015). Chowdhury & Chowdhury (2010) and Aggarwal & Padhan (2017) used revenue growth as a control variable to identify the relationship between capital structure and firm value.

Although the variables included control variables to improve the accuracy of the result, not all of the factors affecting the market price per share were incorporated in the model including the investors’ behavior, interest rates, and political issues. These factors will be captured by the error term of the econometric model. The adequacy of the control variables included will be tested using the R-Squared in the panel data regression Figure 1.

The Empirical Model and Statistical Procedures

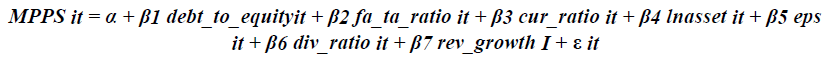

Based on the related studies on factors affecting the market price per share, the regression model used to test the hypothesis is as follows:

Where MPPS or Market Price Per Share (the dependent variable) represents the firm value, debt_to_equity (the variable of interest) is the debt to equity ratio, fa_ta_ratio (a control variable) is the fixed asset to total assets, cur_ratio (a control variable) is the current ratio, lnasset (a control variable)is the log of asset, eps (a control variable) is the Earnings Per Share, div_ratio (a control variable) is the dividend ratio, rev_growth (a control variable)is the revenue growth, εit is the error term, i is the firm subscript and the t is the time subscript.

Panel data regression was conducted using a statistical software package specifically, Stata. Initially, the panel data qualities were evaluated based on the conditions stated above. The data were arranged in a manner that the Stata can correctly identify the cross-section and time- series data of the panel. Park (2011) specified that the Stata and most of the statistical software packages assume that panel data are arranged in a long-form which means that the figures are arranged based on cross-section (based on firms in the case of this paper). The applicability of the data was then verified using pairwise correlation and variable inflation analysis for the test of the existence of multicollinearity.

After confirming the validity and applicability of the data, the panel data were examined using Pooled Ordinary Least Squares. It was followed by the estimation of data using the fixed effects model and subsequently, using the random effects model.

Out of the results of the three models, only one regression result is appropriate. To identify the applicable model, the following tests were conducted; (a) to choose between the fixed effects model and pooled OLS, F-Test; (b) to choose between random effects model and pooled OLS, Breusch Pagan LM Test; (c) to choose between fixed effects model and random effects model, Hausman test (Hausman, 1978). This is consistent with the process proposed by (Baltagi, 2005; Park, 2011).

To identify the final model to be used in analyzing the results, the chosen regression model was further tested for the presence of heteroscedasticity using the Modified Wald test. It was also tested for the presence of serial correlation using the Wooldridge Test or Lagram- Multiplier test.

The chosen model was identified to be both heteroscedastic and/or serially correlated. Indeed, the chosen model across simple OLS, fixed effects model or random effects model was not yet considered as the final model. A Stata command and option that produced a robust standard error estimates were utilized to cure the problem involving heteroscedasticity and serial correlation. The result of this Stata option and command was considered as the final model. Using this final model, the variables were analyzed to identify any significant relationship between any of the independent variables to the dependent variable.

Results and Discussion

This chapter presents the results from the econometric analysis of the Philippine property sector firms’ specific data aligned in the background of the model discussed in chapter 2. The first section of this chapter reports the basic features of the panel data of 20 companies taken from their financial statements for five years from 2013 to 2017. The second section explains the diagnostic tests done to guarantee the applicability of the data in the panel data regression in terms of the absence of multicollinearity. The third section provides an interpretation of the results from the estimation of the regression model using Stata 16.0 as the statistical software. Next is the presentation of the diagnostic tests conducted to ensure the reliability of the results of the analysis. Lastly, the latter section of the chapter presents the final model applicable to the analysis considering the diagnostic tests and further process conducted to deal with problems in the model like heteroscedasticity and serial correlation.

Descriptive Statistics

Table 1 shows the standard deviation, mean, minimum, maximum of each variable, and the number of observations of the data. The data involves 100 firm years (20 firms x 5 years) which also give 100 observations per variable. Out of 28 property companies presently listed in the Philippine Stock Exchange, only 20 firms passed the qualifications listed in the methodology section of this paper. Two of the variables had only 99 observations instead of 100 including the market price per share and revenue growth due to unavailability of the data but the statistical software used which is the Stata 16.0 has still analyzed the panel variable as strictly balanced, thus, it did not affect the analysis of the data. Stata can handle missing values by automatically dropping the observations with missing values (UCLA: Statistical Consulting Group). In the case of this paper, the Stata’s system of excluding the cases with missing values is enough as the amount of the missing data is not significant to affect the regression estimates. Indeed, the dropping of variables and imputation procedures are not necessary (Williams, 2015). Additionally, the log of asset was used to represent the size of the firms. Logarithm was used so that the analysis of data may be done in a more refined manner as the asset of different companies varies widely from a comparatively small amount to a very large amount of assets in bigger companies.

| Table 1 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| Std. Dev. | Mean | Min | Max | Observations | |

| Market Price Per Share | 7.76 | 4.13 | 0.07 | 39.70 | 99 |

| Debt to Equity Ratio | 0.47 | 0.33 | 0.00 | 3.55 | 100 |

| Fixed Asset to Total Asset Ratio | 0.23 | 0.51 | 0.01 | 1.28 | 100 |

| Current Ratio | 1.33 | 2.87 | 0.46 | 9.20 | 100 |

| Log of Asset | 1.91 | 23.48 | 19.81 | 27.01 | 100 |

| Earnings Per Share | 0.25 | 0.22 | -0.17 | 0.98 | 100 |

| Dividend Ratio | 0.15 | 0.11 | 0.00 | 0.76 | 100 |

| Revenue Growth | 2.57 | 0.43 | -1.00 | 25.01 | 99 |

Table 1 presents that the average market price per share (MPPS) of the firms in the property sector listed in the Philippine Stock Exchange (PSE) is ?4.13. However, it presents high variability in the prices having a standard deviation of ±7.76 which indicates that some firms have higher MPPS and vice versa. The observed highest MPPS is ?39.70 while the lowest is ?0.071. The descriptive statistics shows a high degree of variances in the MPPS that gives an interesting quest to discover whether the debt-to-equity ratio (as a proxy variable for capital structure) is relevant to the differences in the MPPS of the property sector. Results show further that the debt-to-equity of the firms in the property sector is 0.33 indicating that creditors are claiming 33% of the firms’ equity. Similar to the MPPS, the standard deviation of ±0.47 shows a high degree of variability on the firms’ capital structure indicating that some firms carry a high degree of leverage (Max=3.55) and some have a low degree of leverage (Min=0.0003). This manifests that some firms show an aggressive stance in terms of the capital structure while some almost do not employ interest-bearing debt as part of the firm’s source of financing.

Panel Data Regression Estimation

Panel data regression involves a series of processes including the pre-estimation tests. Pre-estimation tests include the verification of the existence of multicollinearity using pairwise correlation and Variance Inflation Factor (VIF).

Table 3 (See Appendix B) indicates the pairwise correlation coefficients that aim to check for the degree of multicollinearity between the dependent variables. The three highest correlation matrices among variables are as follows: log of asset to earnings per share with 0.71; market per share to earnings per share with 0.54; earnings per share to dividend ratio with 0. 52. As a rule, if the correlation coefficient between two regressors exceeds .80, the problem of multicollinearity exists. None of the variables contained a correlation coefficient higher than .80; therefore, the risk of mul ticollinearity is unlikely to occur (Dang et al., 2019).

The absence of multicollinearity tested using pairwise correlation was supported by the result of the Variance Inflation Factor (VIF) analysis presented in Table 4 (See Appendix C). It resulted in a low mean VIF of 1.64 which signifies that there is no multicollinearity problem. Moreover, the highest VIF among all the variables is 2.66. Most of the research studies state that the threshold where the VIF should be based is 10. However, Gujarati (2003) proposed that the acceptable limit is 5. Using either of the stated thresholds, no variable needed to be eliminated due to the multicollinearity problem in the panel data of this paper.

After proving that the data are suitable for the panel data regression, the relationship of the predictor variables to the value of the firm was analyzed using pooled ordinary least squares regression (OLS), fixed effect regression, and random-effect regression. OLS was used initially, followed by the fixed effects model and then the random-effects model. For comparison purposes, Table 5 (See Appendix D) shows the result of these analyses which indicates different outcomes of analysis among the three models.

To choose between the OLS and the fixed-effect, the F- test was used. The null hypothesis for F –Test analysis is that all the coefficients in the model are all zero. Table 6 (See Appendix E) shows the results of tests under the fixed effect model which is F (19, 71) = 15.33 with Prob >F = 0.0000 which suggests that the null hypothesis is rejected and there is a significant fixed effect or a significant increase in goodness-of-fit. This means that the fixed effects model is preferable over the OLS.

To choose between the random effect and OLS, the Breusch Pagan LM Test was conducted which examined if the individual or time-specific variance components are zero. The result of the LM test is presented in Table 6 (Appendix E) which shows that Prob >chibar2 = 0. 0000. This suggests that the null hypothesis is rejected and that there is a significant random effect in the data. It means that the random effect model is preferred as it is able to deal with heterogeneity better than the OLS.

The pooled OLS model has been rejected using both F-Test and Breusch Pagan LM Test. To identify the applicable model between fixed effect and random effect, the Hausman Test was employed. The null hypothesis of the Hausman Test is that the individual effects are not correlated with any independent variable in the regression equation (Hausman, 1978). Based on Table 6 (Appendix E), the Hausman test resulted in Prob>chi2=0.0001 which depicts that individual effects ui are significantly correlated with at least one independent variable in the regression model. Indeed, the Hausman test suggests that the random effect model is problematic and fixed effect should be chosen.

The result of the fixed effects model, however, should be further tested for the presence of heteroscedasticity and serial correlation. To test for the presence of heteroscedasticity, the Modified Wald Test for group-wise heteroscedasticity was used. Based on the result of this test in Table 7 (Appendix F), the Prob>chi2 of 0.0000 implies that the null hypothesis that the model has homoscedastic disturbances should be rejected. On the other hand, to test for the presence of serial correlation, the Wooldridge Test or Lagram-Multiplier test was conducted. The result stated in table 6 shows a prob >chi2 of 0.0000 which rejects the null hypothesis that serial correlation does not exist. Thus, based on the results of these post estimation tests, the fixed effects model which was previously chosen involves both heteroscedasticity and serial correlation.

To cure the problems diagnosed in the regression model, a Stata command that produces a robust standard error estimate was employed. Since the results of the model used were found to be both heteroscedastic and auto-correlated, the fixed effect command with cluster option was used. Using this option, the result of the final model was then produced.

Table 2 shows the result of the final model. Interestingly, it shows that only the variable of interest, the debt to equity ratio remained to be significant at 5 per cent level of significance and the log of total assets which was previously found to be significant at 5 percent level of significance in the usual fixed effects model turned out to be significant only at 10% level using the corrected or “cured” model. It further suggests that the debt to equity ratio which represents capital structure is negatively related to the firm value represented by the market price. For each unit of increase in the debt to equity ratio, there was 5.07 pesos decrease in the market price.

| Table 2 Final mode: fixed effect (std. Error adjusted for 20 clusters in firm) |

|||

|---|---|---|---|

| Independent Variable | Coefficient | t | p value |

| Total Debt To Equity | -5.07 | -4.14 | 0.001* |

| Fixed Asset to Total Asset Ratio | 2.09 | 0.54 | 0.598 |

| Current Ratio | -0.22 | -0.48 | 0.637 |

| Log of Total Assets | 6.91 | 2.08 | 0.052 |

| Earnings Per Share | 4.44 | 0.53 | 0.601 |

| Dividend Ratio | 5.50 | 0.77 | 0.453 |

| Revenue Growth | -0.02 | -0.53 | 0.606 |

| _cons | -158.62 | -1.98 | 0.062 |

| No. of Obs | 98 | ||

| R Squared | 0.90 | ||

| Adjusted R-Squared | 0.86 | ||

| F-Static | 68.33(0.0000) | ||

The result leads to the rejection of the null hypothesis that the capital structure is not significantly related to the market price per share. As to the relationship of the variables, the regression suggests rejection of the null hypothesis as well and acceptance of the alternative hypothesis 2 that the capital structure is negatively related to the market price per share.

The econometric results have also provided proof that the model has also fit the panel data as it gives an R-squared of 0.90 and an adjusted R-squared of 0.86 which is presented in Table 7. This means that the model explains 86% of the variability of the market price per share around its mean. This is high enough to explain the variability of the market price per share and not too high to be considered as an “over-fitted” model (Please refer to Appendix G: Rating Scale on Analyzing R-Squared). It is worth emphasizing that the R-squared presented is the result of the analysis of a fixed effect model with a cluster option using the “areg” command in Stata instead of using “xtreg”. Park (2011) confirmed that the Stata command “xtreg” gives an erroneous R-squared and adjusted R-Squared. “xtreg” and “areg” are Stata commands which are being used to run a fixed effect model that gives similar values except for the r squared and adjusted r squared. Both of them were conducted in the panel data regression analysis (Refer to Appendix 1: Statistics/Data Analysis Using Stata 16.0).

The statistical results and processes undertaken have finally shown the value relevance of capital structure to the firms’ value. The relationship was determined by identifying the relationship between debt-to-equity as a proxy variable to capital structure and the MPPS as a proxy variable to the firm’s value. The statistical result shows that debt-to-equity ratio significantly affects the firm’s MPPS (p value 0.001). This means that when firms change the level of debt in the capital structure, then it results in a significant amount of change in the market price per share. Moreover, the result shows a negative association (Coeff. = -5.07) which indicates that when firms increase (decrease) the debt in the capital structure (computed using debt-to-equity ratio) then it brings an inverse relationship in which MPPS tends to decrease (increase). This means that when firms tend to increase their interest-bearing debt then firms would expect a significant decline in their MPPS and vice versa. The result seems to corroborate the findings of Baxter (1967) wherein he found that high amount of debt can result in high transaction costs and a higher risk of bankruptcy; thus, financial analysts, investors, and creditors may have an unfavorable outlook leading to devaluation of the firm’s stock.

However, the result of this paper is not consistent with the scholarly work of Modigliani & Miller (1958) where they claimed that the capital structure is not relevant with the firm value in a perfect market condition. It is also against the signaling theory of Ross (1977) which favors the use of debt rather than the equity on the assumption that there are information asymmetries between the managers and the outsiders. This theory proposes that the use of debt signals that the managers of the firm are expecting a high future income and the use of equity as their capital signifies that the managers believe that firm will not generate high future earnings. It is also inconsistent with the agency theory proposed by Jensen and Meckling (1976) which suggests that using debt is better than using the equity on the ground that using gearing will motivate the managers to work harder for the best interest of the shareholders rather than for their own benefits. Moreover, the result of this paper has also given an opposite premise compared to the conclusion of Myers (1984) who introduced the Pecking Order Theory preferring the use of debt over issuing equity securities.

The outcome of this study is also inconsistent with most of the empirical works which were recently published. Chowdhury & Chowdhury (2010), Ogbulu & Emeni (2012), Lawal (2014), Javeed et al. (2014), which were previously discussed in the introduction chapter of this paper favor the use of debt over equity in the capital structure as far as the effect of the capital structure to the firm value is concerned. The result is also against the paper of Hadi et al. (2017) who postulated that capital structure is irrelevant to the firm value like the theory of (Modigliani & Miller, 1958). Interestingly, this paper supports the findings of Aggarwal & Padhan (2017) who found a negative association of leverage from the value of the firm.

The fact that the result of this is consistent only with the work of Aggarwal & Padhan (2017) posts a significant finding. Focusing on the comparison of the data used in the previous works, only the work of Aggarwal & Padhan (2017) has utilized a specific industry- the hospitality sector. Other studies mentioned used data of companies from different industries and analyzed them together. This paper uses property sector firms’ data which is capital-intensive like the hospitality industry that requires acquiring and maintaining hotels. This finding may suggest that the negative relationship of capital structure to the firm value could be associated with the fact that both of these industries are capital intensive and most of the assets of these firms are real properties.

Although the result is not aligned with the several theories and empirical studies cited in this paper, the outcome of this study is reasonable as far as the property sector is concerned. The leverage in a real estate business could be highly significant in the perspective of the investors because of the risks that these firms are exposed to. The property sector companies’ products belong to non-essential commodities, unlike those which are among the food, healthcare, hygiene, utilities, etc. During a crisis, people and even business entities have a relatively low cash inflow making them prioritize more on essential goods and services. They tend to hold money, and to buy properties or a new house which is a source of a property sector firm earnings might be the least of their concerns. Property owners tend to even sell their properties to generate cash flow for everyday expenses. Following the demand and supply theory, the prices of the inventories of real estate firms are volatile depending on the prevailing economic condition. Thus, the earnings of this industry are considered cyclical. Meaning, in the times of good economic condition, these prices of assets tend to be higher but during the economic downturn, real property prices burst as the supply increases and the demand decreases. These properties are being used by the companies as collateral to secure their loans if they are relying on leverage on their projects. This situation, however, may cause significant risk if the values of the property used as a collateral shrink in times of crisis. This condition which is called the “bubble burst” was one of the alleged causes of the 2008 global economic crisis. Thus, the property sector industry is vulnerable to a higher level of risk than the entities from other sectors during the times of economic downturn and a high gearing for this industry might add a greater risk exposure. The world’s experience on that recession might have taught the investors of the property sector firms a great lesson that too much leverage signifies an unstable financial condition.

Conclusion

This study has confirmed a significant effect of the management’s past capital structure decisions on the firms’ MPPS. The empirical evidence provided by this paper has also presented that the capital structure can be used to predict the future trend of the MPPS of the property sector firms listed in PSE. Having been substantiated that the capital structure encompasses both confirmatory and predictive roles, this study concludes that the capital structure is relevant to the firm value of the property sector listed in the Philippine Stock Exchange (PSE). Specifically, the debt-to-equity ratio significantly affects the firm’s market price per share (MPPS). When firms decide to increase or decrease their debt in relation to the stockholders’ equity then the firms’ MPPS tends to decline or increase at a significant level. The study also found out a negative association of capital structure to the firms’ value that indicates an inverse relationship. When firms increase their debt, their MPPS declines and vice versa.

The study shows practical implication to contemporary corporate managers that capital structure needs sufficient attention. The study concludes that capital structure is a relevant financial information that must be carefully considered in the management’s decision making because it can either increase or decrease the firm’s value (MPPS). Therefore, accountants and financial managers must weigh the management’s capital structure decision and assist the management in its effect on the firm’s value. Specifically, this paper guides accountants and financial managers in the property sector in giving a more accurate and reliable management advisory that property sector firms listed in the PSE can improve their firm value by decreasing the use of interest-bearing debt.

The study provides further theoretical implications to the literature and to the academe. This paper has derived that capital structure has value relevance. Although several researchers have found that capital structure has no relationship to firm value, this paper provides empirical evidence that capital structure in the property sector is relevant to MPPS. This paper exemplifies that high leverage is being perceived by external financial analysts, investors, and creditors as risky and detrimental to those companies with non-essential products.

Recommendation

A more detailed analysis of the capital structure is being recommended for future studies including analyzing the capital structure employing an analysis of the short- term debt, long – term debt, preferred stock, common stock, and retained earnings employing property sector firms’ data in a broader population. The capital structure of other industries in the Philippine Stock Exchange or other stock exchanges may also be looked into. A keen analysis of the varying results of these kinds of studies also needs to be done considering the diverse attributes of the different classes of industries that will enable the researchers to claim a more generalized conclusion.

It is also recommended to the financial managers of the property sector firms to be more vigilant in making their decisions relative to the components of their capital structure as it was empirically proven in this paper that the level of the debt to equity ratio affects the price of the shares negatively.

Limitation of this Paper

This paper is not without limitations. First, although it includes some control variables to avoid the variable omitted bias, this study was not able to incorporate all of the factors that may have had an effect on the firm’s market price per share in the econometric model. The author believes that this limitation has been properly managed and does not significantly affect the result of this work. As a matter of fact, the variability of the market price per share around its mean which is supported by the r-squared of the model’s regression estimation was high enough. However, the capital structure was not analyzed in a more detailed manner, specifically, a separate model for the current and non- current interest-bearing debt was not analyzed due to the nature of the data where other companies do not use short term interest-bearing liabilities or other companies do not utilize long-term interest-bearing debt. It did not also tackle the components of the equity including preferred stock, common stock, and retained earnings. The researcher found it impossible to analyze them separately as most of the firms do not have a preferred stock and there is an inherent limitation on the number of the property sector firms listed in the PSE. This paper could have been more significant if those aspects were available for further analysis.

References

Abeywardhana, D.K.Y. (2015). Capital structure and profitability: An empirical analysis of SMEs in the UK, Journal of Emerging Issues in Economics, Finance and Banking, 4(2), 1661-1675.

Abor, J. (2005). The effect of capital structure on profitability: An empirical analysis of listed firms in Ghana, Journal of Risk Finance, 6(5), 438-447.

Indexed at, Google Scholar, Cross Ref

Aggarwal, D., & Padhan, P.C. (2017). Impact of capital structure on firm value: Evidence from Indian hospitality industry. Theoretical Economics Letters, 7, 982-1000.

Indexed at, Google Scholar, Cross Ref

Akhtar, W. et al. (2016). Effects of debt on value of a firm. Journal of Accounting & Marketing, 5(4).

Indexed at, Google Scholar, Cross Ref

Baltagi, B. (2005). Econometric analysis of panel data, 3rd ed. England: John Wiley and Sons, Ltd

Baxter, N. (1967). Leverage, risk of ruin and the cost of capital. The Journal of Finance, 22, 395-403.

Indexed at, Google Scholar, Cross Ref

Booth, L., Aivazian, V., Demirguc-kunt, A., & Maksomovic, V. (2001). Capital structures in developing countries. The Journal of Finance, 56, 87-130.

Indexed at, Google Scholar, Cross Ref

Bowen, R., Daley, L., & Huber, C., Jr. (1982). Evidence on the existence and determinants of inter-industry differences of leverage, Management, 11, 10-20.

Indexed at, Google Scholar, Cross Ref

Carton, R.B. & Hofer, C.W. (2006). Measuring organizational performance. Massachusetts, USA: Edward Elgar.

Chalmers, Clinch & Godfrey (2011). Changes in value relevance of accounting information upon IFRS adoption: Evidence from Australia, Australian Journal of Management, 36(2), 151-173.

Indexed at, Google Scholar, Cross Ref

Chowdhury, A., & Chowdhury, S.P. (2010). Impact of capital structure on firm’s value: Evidence from Bangladesh. Business and Economic Horizons, 3(3), 111-122.

Indexed at, Google Scholar, Cross Ref

Conceptual Framework for Financial Reporting (2018). IFRS Foundation.

Indexed at, Google Scholar, Cross Ref

Dang, H., Vu, V., Ngo, X., & Hoang, H. (2019). Study the impact of growth, firm size, capital structure, profitability on enterprise value: Evidence of enterprises in Vietnam. The Journal of Corporate Accounting & Finance, 146-162.

Indexed at, Google Scholar, Cross Ref

Degryse, D., de Goeij, P., & Kappert, P. (2012). The impact of firm and industry characteristics on small firm’s capital structure, Small Business Economics, 38, 431-447.

Indexed at, Google Scholar, Cross Ref

Dimitrov & Jain (2008). The value-relevance of changes in financial leverage beyond growth in assets and GAAP earnings. Journal of Accounting, Auditing & Finance, 23(2),191- 222.

Indexed at, Google Scholar, Cross Ref

Ebaid, I.E.S. (2009). The impact of capital-structure choice on firm performance: empirical evidence from Egypt. The Journal of Risk Finance, 10(5), 477-487.

Indexed at, Google Scholar, Cross Ref

Fatoki & Olweny (2017). Effect of earnings per shares on capital structure choice of listed non-financial firms in Nigeria. European Scientific Journal, 13(34), 1857-7881.

Indexed at, Google Scholar, Cross Ref

Gharaibeh, A.O. (2015). The effect of capital structure on the financial performance of listed companies in Bahrain Bourse. Journal of Finance and Accounting, 3(3), 50-60.

Indexed at, Google Scholar, Cross Ref

Greene, W. (2008). Econometric analysis, 6th edition. Upper Saddle River, N.J.: Pearson/Prentice Hall.

Gujarati, D.N. (2004). Basic Econometrics, 4th edition. New York: McGraw-Hill Companies.

Hadi, Pyeman & Ismail (2017). The relevance of capital structure theories to consumer product firms at Bursa Malaysia. Asia-Pacific Management Accounting Journal, 12 (1),143-158.

Hermuningsih, S. (2014). Profitability, growth opportunity, capital structure and the firm value. Bulletin of Monetary Economics and Banking, 16(2), 115–136.

Indexed at, Google Scholar, Cross Ref

Horvathova, J. & Mokrisova, M. (2017). Risk as factor of performance and competitiveness of Slovak businesses. International Multidisciplinary Scientific Conference on Social Sciences and Arts, 1(3), 23-30.

Indexed at, Google Scholar, Cross Ref

Hung, M. (2001). Accounting standards and value relevance of financial statements: An international analysis. Journal of Accounting & Economics, 30 (3), 401-420.

Indexed at, Google Scholar, Cross Ref

IASB. (2008). Exposure draft on an improved Conceptual Framework of Financial Reporting. The Objective of Financial Reporting and Qualitative Characteristics of Decision-useful Financial Reporting Information. London.

Javeed, A., & Azeem, M. (2014). Interrelationship among capital structure, corporate governance measures and firm value: Panel study from Pakistan. Pakistan Journal of Commerce and Social Sciences, 8(3), 572-589.

Jayiddin, N.F., Jamil, A., & Roni, S.M. (2017). Capital structure influence on construction firm performance. In SHS Web of Conferences, 36, p. 00025. EDP Sciences.

Indexed at, Google Scholar, Cross Ref

Jensen, M. & Meckling, W. (1976). Theory of the firm, managerial behavior, agency costs and ownership structure, Journal of Financial Economics, 3(4), 305-360.

Jensen, M. (1986). Agency costs of free cash flow, corporate finance and takeovers, American Economic Review, 76(2), 323-339.

Indexed at, Google Scholar, Cross Ref

Jones & Smith (2011). Comparing the value relevance, predictive value, and persistence of other comprehensive income and special items. The Accounting Review, 86(6), 2047-2073.

Indexed at, Google Scholar, Cross Ref

Kargin, S. (2013). The impact of IFRS on the value relevance of accounting information: Evidence from Turkish firms. International Journal of Economics and Finance, 5(4), 71-80.

Indexed at, Google Scholar, Cross Ref

Kodongo, O., Mokoaleli- Mokoteli, T., & Maina, L.N. (2015). Capital structure, profitability and firm value: Panel evidence of listed firms in Kenya. African Finance Journal, 17(1), 1-20.

Indexed at, Google Scholar, Cross Ref

Kraus, A., & Litzenberger, R. (1973). A state-preference model of optimal financial leverage. The Journal of Finance, 28(4), 911-922.

Indexed at, Google Scholar, Cross Ref

Lawal (2014). Capital structure and the value of the firm: Evidence from the Nigeria banking industry. Journal of Accounting and Management, 4(1), 31-41.

Le , T., & Ooi, J. (2012). Financial structure of property companies and capital market development. Journal of Property Investment & Finance, 30(6), 596-611.

Indexed at, Google Scholar, Cross Ref

Lev, V., & Sougiannis (1996). The capitalization, amortization, and value relevance of R&D. Journal of Accounting and Economics, 107-138.

Indexed at, Google Scholar, Cross Ref

Margaritis, D., & Psillaki, M. (2010). Capital structure, equity ownership and firm performance. Journal of Banking & Finance, 34(3), 621-632.

Indexed at, Google Scholar, Cross Ref

Marzieh, K., Zukarnain Z., & Annuar N. (2017). Capital structure and firm performance during global financial crisis. International Journal of Economics and Financial Issues, 7(4), 498-506.

Milad, E., Abbasali, P., Naser, A.Y.T., Milad, H., & Ali, A.A.S. (2013). The effects of performance evaluation market ratios on the stock return: Evidence from the Tehran Stock Exchange. International Research Journal of Applied and Basic Sciences, 4 (3), 696-703.

Modigliani, F., & Miller, M.H., (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48, 261-297.

Modigliani, F., & Miller, M.H., (1963). Corporate income taxes and the cost of capital: A correction. The American Economic Review, 53(3), 433-443.

Myers, S.C. (1977). The determinants of corporate borrowing. Journal of Financial Economics, 5, 147-175.

Indexed at, Google Scholar, Cross Ref

Myers, S.C. (1984). The capital structure puzzle. Journal of Finance, 39(3), 575-592.

Myers, S.C. (2001). Capital structure. The Journal of Economic Perspectives, 15(2), 81-102.

Ogbulu, O.M., & Emeni, F.K. (2012). Capital structure and firm value: Empirical evidence from Nigeria. International Journal of Business and Social Science, 3(19), 252-261.

Okuyan, H.A., & Tasci, H.M. (2010). Determinants of capital structure: Evidence from real sector firms listed in ISE. Ekonomik Yakla??m, 21(76), 55-72.

Indexed at, Google Scholar, Cross Ref

Oliveira, Rodrigues, & Craig (2010). Intangible assets and value relevance: Evidence from the Portuguese stock exchange. The British Accounting Review, 42, 241–252.

Indexed at, Google Scholar, Cross Ref

Pandey, I. (2001). Corporate dividend policy and behaviour: The Malaysian experience. IIMA Working Paper, 11(1).

Indexed at, Google Scholar, Cross Ref

Park, H.M. (2011). Practical guides to panel data modeling: A step by step analysis using Stata.Tutorial Working Paper. Graduate School of International Relations, International University of Japan.

Rehma, Z., Siddiqui, M.A., & Khan A. (2016). Influence of capital structure choice on firm performance: A case of listed non-financial firms of Pakistan. The Journal of Humanities and Social Sciences, 24(1), 83-97.

Rizki, A., Lubis, A.F., & Sadalia, I. (2018). The influence of capital structure to the firm value with profitability as intervening variables. KnE Social Sciences, 220-230.

Indexed at, Google Scholar, Cross Ref

Ross, S.A. (1977). The determination of financial structure: The incentive-signaling approach. The Bell Journal of Economics, 8, 23-40.

Indexed at, Google Scholar, Cross Ref

Shah & Akbar (2012). Value relevance of advertising expenditure: A review of the literature. International Journal of Management Reviews, 10(4), 301-325.

Indexed at, Google Scholar, Cross Ref

Solomon, E. (1963). The theory of financial management. New York: Columbia University Press.

Stankevi?ien?, J., & Mencait?, E. (2012). The evaluation of bank performance using a multicriteria decision making model: a case study on Lithuanian commercial banks. Technological and Economic Development of Economy, 18(1), 189-205.

Indexed at, Google Scholar, Cross Ref

Stretcher, R., & Johnson S. (2011). Capital structure: Professional management guidance. Managerial Finance, 37(8), 788-804.

Indexed at, Google Scholar, Cross Ref

Tian & Zeitun (2007). Capital structure and corporate performance: Evidence from Jordan. The Australasian Accounting Business and Finance Journal, 1(4), 6-37.

Indexed at, Google Scholar, Cross Ref

Uwuigbe, O.R., Uwuigbe, U., Jafaru, J., Igbinoba, E.E., & Oladipo, O.A. (2016). Value relevance of financial statements and share price: a study of listed banks in Nigeria. Banks & bank systems, 11(4), 135-143.

Indexed at, Google Scholar, Cross Ref

Varaiya, Kerin & Weeks (1987). The relationship between growth, profitability, and firm value. Strategic Management Journal, 8(5), 487-497.

Indexed at, Google Scholar, Cross Ref

Venkachalam (1996). Value relevance of banks’ derivatives disclosures. Journal of Accounting and Economics, 22, 327-355.

Indexed at, Google Scholar, Cross Ref

Received: 25-Jul-2022, Manuscript No. AAFSJ-22-12382; Editor assigned: 27-Jul-2022, PreQC No. AAFSJ-22-12382(PQ); Reviewed: 10-Aug-2022, QC No. AAFSJ-22-12382; Revised: 16-Aug-2022, Manuscript No. AAFSJ-22-12382(R); Published: 23-Aug-2022