Research Article: 2021 Vol: 27 Issue: 2S

What Affects Audit Delay in Indonesia?

Indra Prasetyo, Universitas Wijaya Putra

Nabilah Aliyyah, Universitas Wijaya Putra

Rusdiyanto, Universitas Airlangga

Diah Rani Nartasari, Akademi Sekretari dan Manajemen Indonesia Surabaya

Sanjayanto Nugroho, Akademi Sekretari dan Manajemen Indonesia Surabaya

Yessi Rahmawati, Akademi Sekretari dan Manajemen Indonesia Surabaya

Selvi Permata Groda, Akademi Sekretari dan Manajemen Indonesia Surabaya

Surya Setiawan, Akademi Sekretari dan Manajemen Indonesia Surabaya

Bigraf Triangga, Akademi Sekretari dan Manajemen Indonesia Surabaya

Eko Mailansa, Akademi Sekretari dan Manajemen Indonesia Surabaya

Gusti Dian Prayogi, Akademi Sekretari dan Manajemen Indonesia Surabaya

Niki Etruly, Akademi Sekretari dan Manajemen Indonesia Surabaya

Muhamad Jazuli, Akademi Sekretari dan Manajemen Indonesia Surabaya

Nila Dewi Wahyuningsih, Akademi Sekretari dan Manajemen Indonesia Surabaya

Nunik Dwi Kusumawati, Akademi Sekretari dan Manajemen Indonesia Surabaya

Satunggale Kurniawan, Akademi Sekretari dan Manajemen Indonesia Surabaya

Indira Nuansa Ratri, Akademi Sekretari dan Manajemen Indonesia Surabaya

Wiyono Atmojo, Akademi Sekretari dan Manajemen Indonesia Surabaya

Yuventius Sugiarno, Akademi Sekretari dan Manajemen Indonesia Surabaya

Danny Koerniawan Pamungkas, Akademi Sekretari dan Manajemen Indonesia Surabaya

Ahmad Muslim, Akademi Sekretari dan Manajemen Indonesia Surabaya

Muhammad Afifi Rahman, Akademi Sekretari dan Manajemen Indonesia Surabaya

Nawang Kalbuana, Politeknik Penerbangan Curug

Arif Syafi'ur Rochman, Universitas Gresik

Keywords:

Firm’s Size, Leverage, Public Accountant Size, Audit Delay

Abstract

This research evaluates the effects of audit delays for industrial firms listed on the Indonesian stock exchange on leverage, firms size, public accounting size, and audit opinions. Sampling was taken from 82 company’s on the list Indonesian Stock Exchange. Used the Purposive sampling process, samples were collected—some regression hypothesis analysis. Findings from multiple regression models suggest that large and non-large account scales determine audit delays. Such audit delays don’t impact leverage, the Firm’s size, and audit opinions. Impacts of these findings will be recommended auditors to improve their audit performance effectiveness and quality and contribute to the audit literature for all available research. The originality of the audit delay as an explanatory variable in audit assessment studies can lead to a better understanding of auditor ratings and decision-making processes in big for auditors and non-big for developing country auditors.

Introduction

The time from the date of the company's financial statements and the financial statements' audit opinion date is interpreted as the auditor's finish the audit. Audit delay defined as the difference in audit time; in other studies, the audit time is often referred to as audit time (Eghliaow, 2013), (Pizzini et al., 2012), (Yim, 2010)and lead time audit reporting (Alias, 1994), (Lehtinen, 2013),. This research will analyze the reasons that influence the audit delay.

The Public Accountant Professional Standards of the Indonesian Institute of Accountants (2001), especially regarding the field work standards regulate procedures for the completion of field work the need for planning adequate comprehension internal control system, and the compilation of relevant information collected by review, observation, questions, and clarification as the basis for expressing views of the Financial Statements for the operations to be carried out. Auditing auditors' standard compliance will increase the accuracy of the auditors findings and the period of audit report. The auditors dilemma can be caused by this condition.

Audit delay often occurs in each audited firm but until now, although there have been several studies, none has discussed the audit delay thoroughly. Sometimes the studies conducted produce different results between researchers. The results of the studies on the factors affecting the time limit for audit were inconsistent (de Rojas et al., 2019; Handoko, Deniswara, et al., 2019). This corresponds to research. in USA (Asthana, 2014), in Malaysia (Johnson, 1998), (Anuar & Kamarudin, 2003), in Turkey (Turer & Tuncay, 2016), in Indonesia (Suryanto, 2016), in Nigerian (Modugu et al., 2012) and in Bangladesh (Imam et al., 2001). The most common factor examined in research is firm size e has been demonstrated to affect audit delay time. They proved that the size of the business influences the duration of the audit delay (Bowrin, 2013, 2018; Breivik, 2019). In addition to this the factors influencing audit delay are important questions because audit delay research was not done in Indonesia so much (Suryanto, 2016).

This study was performed on industrial firms listed on the Indonesian stock exchange for the period 2011-2018, this research is confined to evaluating the extent of the average audit delay for the study's public companies. Furthermore, this research will analyze the effect of Company Size operating on the Indonesia stock exchange from 2011 to 2018, as well as the size of Leverage, Firm's Sizes and Public Accountants Office.

Literature Review and Model Development

Audit Delay

So far there is no theory that addresses in depth the audit delay, even though a lot of research has been carried out related to audit delay. There have been many studies conducted regarding audit delay (Bhuiyan & D’Costa, 2020; Christensen et al., 2020; Hamilah, 2020). Explains the audit delay definition is the audit process completion duration, which is which is measured from the time of the close date of the report year to the date of publication of the audit report; the delay of the audit is interpreted as the time difference between audit opinion date and the audit opinion date in the financial statement, indicating the audit procedure time period is settled by the auditor, the delay in audit means the timeframe between the date of issuance of the audit opinion report and the closing date of the company's financial statement.

Based on the statement above, the audit delay may be concluded is the span of time between the report year closing date until date of issuance in audit report. The longer audit delay can make the resulting information lose its relevance. Financial Accounting Standards State that if the report is not available in time a company should produce a financial report, the financial report shall be reduced. no later than 4 months after the balance sheet date (de Rojas et al., 2019; Handoko, Deniswara, et al., 2019).

Explains that delivery the company's financial statements are categorized too late or experience delays if done after the due date, which is April 30. Section 530 of the Accounting Standards provides for independent auditor's report, stating that the completion date of field work must be used by the auditor as the date of the audit report (Asmal et al., 2019; Blackburn et al., 2019). Auditor's responsibility for subsequent events is limited to the period. That is, from the balance sheet date to the completion date of field work, if later events that require adjusment to the financial statements occur after the completion of field work, but before the auditor's report is published, and the auditor knows about the incident, the financial statements must be adjudged or the auditor must provide exemption in his opinion, if the adjusment is carried out without disclosure of the event in question, the auditor's report must be given a date according to the completion of the field work, but if the financial statements are adjuncted and disclosure of the event is carried out, or if no adjusment is made and the auditor can choose two methods as follows: 1. Using a double date: Events occurring in period starting from the date of completion of field work to the date of audit report. The auditor is only responsible for events specifically mentioned in the audit report. 2. Use the date later: The auditor is responsible for all events that occur in the completion of the field work period, plus all events that occur in the completion of field work to the date of event period that caused auditor to use the later date (Byun et al., 2019; Handoko, Muljo, et al., 2019).

Timeliness of Financial Statements

Defines knowledge as data that has a decision-making mechanism, however, would be of benefit to the consumer when the data is timely. Timely means that the information must be presented as soon as possible to be used as a basis for the economic decision-making process and to avoid delays in such decisions. Timeliness does not ensure relevance, however the relevance of information cannot be achieved without the timeliness of the company's terms and processes information must reach users quickly and correctly (Bhuiyan & D’Costa, 2020; Christensen et al., 2020; Hamilah, 2020).

Average Length of Audit Delay

The results of Courtis's (1976) study show that, an average audit delay in New Zealand for public corporations is 83 days. Givoly & Palmon’(1982) study conducted five aspects that influence the timing of financial reporting time which include:Trend of delays in financial statements,Forms of announcement in industry, The relationship between the delay in reporting and the contents of the report, Relationship between reporting time provisions and Information contained in financial statements (Cunningham et al., 2018; Ismail et al., 2015).

Audit delays research has been undertaken by Carslaw and Kaplan, 1991, in New Zealand public companies. The used variables are size of the company, type of industry (financial and non-financial), reporting profit or loss, extraordinary item, auditor, type of opinion of the public accountant, company's fiscal year, ownership of the company and proportion of debt to total assets. The results showed that variables that were significantly influential were size of the company total assets and company reporting losses, while the audit delay average in New Zealand in 1987, 88 days and 1988 was 95 days. Hossain (1998) conducted research on the company in a public company in Pakistan, by sample the 103 Karachi stock exchange companies listed in 1993, research results show that the average Karachi Stock Exchange-listed company audit delay in 1993 was 4.77 months. Halim (2000) Audit delay research in Indonesia by sample the 287 companies listed in 1997 on the Jakarta Stock Exchange. Research results showed the average audit delay in public companies on the JSX was 84.4 days. Subekti and Widiyanti (2004) conducted a flat study audit delay data on manufacturing corporate listed on the JSX in 1999. Research results shows that the audit completion time measured for JSX manufacturing companies worth 89.96 days from the date report are closed until the date of signing of the audit report

Audit delay tends to be long if the company uses the December 31 financial year, the company has long been a particular KAP client, the size of the company is getting bigger, getting an unqualified opinion, low profitability and loss.

Debt Equity Ratio or Leverage

Explains that leverage is defined as the use of assets or funds, in which to use, the company must cover fixed costs or pay interest on debts incurred. FASB defines obligations as a possible sacrifice of future economic benefits arising from current obligations as a result of transactions from past events (Branzoli & Caiumi, 2020; Chen et al., 2020). This study uses the Debt To Equity Ratio as a measurement method.Vuko & Cular, (2014), (Harjoto et al., 2015), (Astuti & Kusharyanti, 2013), said that high debt ratios reflect company failures and increase uncertainty for auditors and allegations that financial statements are not reliable. If the debt ratio is high, the auditor must be careful in carrying out audit procedures.

The higher the ratio of debt to equity means the less the capital itself compared to the debt, the greater the amount of debt used, the greater the business risk faced (Vuko & Cular, 2014), (Harjoto et al., 2015). High debt ratios reflect company failures and increase uncertainty for auditors and allegations that financial statements are unreliable. High debt ratio, the auditor must be more careful in carrying out audit procedures. Weak financial conditions can lead to fraud in management fraud. Checking debt takes more time than checking capital, this means that the higher the debt ratio, the longer the audit delay will be. Based on the description of previous research, the proposed hypothesis is as follows:

H1: Leverage had believed positively affect audit delay.

Company Size

The size of the company shows the size or amount of wealth owned by a company. (Aksoy et al., 2020; Bajra & Čadež, 2020; Jimenez, 2020) explains that larger organizations are more specialized, have more regulations, more documentation. More hierarchies are expanded, and centralized decision making is greater in the lower part of the hierarchy. Whereas small companies can often sell products and services at lower prices than those offered by large companies. They do this by reducing overhead costs, so that products and services can be sold at lower prices but still generate profits. In large companies where the shares are very wide spread, they will be more willing to issue new shares in meeting their needs to finance sales growth compared to companies that small, because in small companies can affect the possibility of loss of control of dominant parties, so it can be concluded that large companies are companies whose shares are widely distributed so that the company has a large value from the spread of share capital, while the small company is where the shares are spread in a small environment.

Astuti & Kusharyanti, (2013;Alfraih, 2016) explains that large companies' management is urged to minimize audit delays and financial delays by the investors, associations of trade and regulatory agents constantly watching large corporations closely. Moreover the company's size also offers an improved allocation of funds for audit fees so that businesses with more likely are a bigger business to have a shorter audit delay compared with smaller firms.

The Firm’s size is also dependent on the speed of financial statement given the timeliness of the annual financial statement. The size of the firm is also influenced by its operating complexity, variability and intensity, that affect the pace at which the financial reports are submitted to the public. Research conducted (Bartoloni et al., 2020; Deltas & Evenett, 2020) states supervision conducted by the government, investors and capital supervisors has an impact on the acceleration of the issuance of financial statements carried out by large-scale management. This study refers to the research of Ashton et al, which states that the bigger a firm, the shorter the audit delay. Delay audits would be lengthier if the size of a company whose financial statements are audited is larger, more sampled, and more comprehensive audit procedures required.

H2: Company Size had believed positively affect audit delay.

Size of a Public Accounting Firms

According to Minister of Finance Decree No. 43/KMK.017/2009 of 27 January 1997 amended by Decree No.470/KMK.017/299 of 4 October 1999, KAP (Indonesia Public Accounting Firm) is an institution authorized to carry out work by the Ministry of Finance as a public accountant forum (profession). A Public Accounting Office is a form of public accountancy authorized under the laws and regulations which seek professional services in public accountancy practices in the field of professional services. The size of a public accounting company is classified into four categories, according to Arens and Loebbeck (1996), namely: 1) the International Public Accountant Office "Big 4". 2) National Public Accountant Office. 3) Local Public Accountant Office. And 4) Regional Small Local Public Accountants (Al-Rawashdeh Abdalwahab & Alkabbji, 2020.

Overall, the large public accounting firm have a great incentive to faster to complete the audit process, other than large public accountant firms with more capital than small public accountants, who have a potential to lose their integrity, they could lose their credibility in the next year as client auditors.

H3: Allegedly the size of the Public Accountant Office has a negative effect on audit delay.

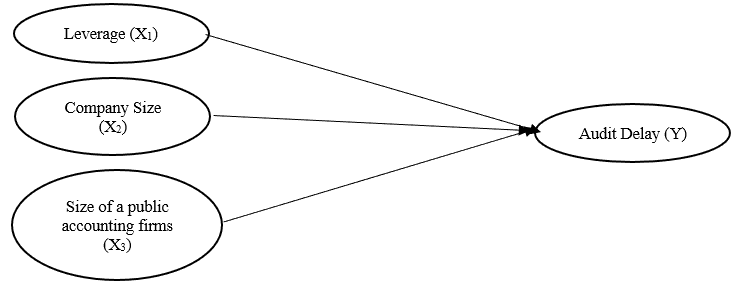

Research Framework

Methodology

Quantitative method in the analysis, quantitative is the method of research used for certain populations or samples, this research technique for data collection and also data analysis typically uses a random sampling approach and has a quantitative meaning. or hypothesis testing parameters that have been determined (Juanamasta, Wati, Hendrawati, Wahyuni, Pramudianti, Wisnujati, Setiawati, Susetyorini, Elan, Rusdiyanto, Muharlisiani, et al., 2019; Luwihono, Suherman, Sembiring, Rasyid, Kalbuana, Saputro, Prasetyo, Taryana, Suprihartini, Asih, et al., 2021; Prabowo et al., 2020b; Rusdiyanto, Agustia, et al., 2020; Rusdiyanto, Hidayat, et al., 2020; Shabbir et al., 2021; Susanto, Prasetyo, Indrawati, Aliyyah, Rusdiyanto, Tjaraka, Kalbuana, Syafi’ur Rochman, et al., 2021), (Juanamasta, Wati, Hendrawati, Wahyuni, Pramudianti, Wisnujati, Setiawati, Susetyorini, Elan, Rusdiyanto, Astanto, et al., 2019), (R. Rusdiyanto & Narsa, 2019), (Gazali, Kusuma, Aina, Bustaram, Amar, et al., 2020), (Syafii et al., 2020), (Lamtiar et al., 2021), (Gazali, Kusuma, Aina, Bustaram, Risal, et al., 2020), (Rusdiyanto, Sawarjuwono, et al., 2020), (Shabbir et al., 2021), (Susanto, Prasetyo, Indrawati, Aliyyah, Rusdiyanto, Tjaraka, Kalbuana, Rochman, et al., 2021), (Luwihono, Suherman, Sembiring, Rasyid, Kalbuana, Saputro, Prasetyo, Taryana, Suprihartini, & Asih, 2021), (Rahayu et al., 2020), (Utari et al., 2020), (Prabowo et al., 2020a), (Astanto et al., 2020), (H. T. Rusdiyanto, Mufarokhah, et al., 2020), (Rusdiyanto, Sawarjuwono, et al., 2020), (Hidayat et al., 2020), (Rusdiyanto & Narsa, 2020), (Ulum et al., 2020), (R. Rusdiyanto et al., 2019), (Hidayat et al., 2020), (Zainurrafiqi et al., 2020), (Zainurrafiqi et al., 2020), (Hadi Susanto et al., 2021), (Woro Utari et al., 2020), (Susanto, Prasetyo, Indrawati, Aliyyah, Rusdiyanto, Tjaraka, Kalbuana, Rochman, et al., 2021). In this study, we used regression analysis techniques, samples taken from the Indonesia Stock Exchange which published financial statements at the end of the year (December 31st) and actively traded from 2011 to 2018. The method of sampling is a purposeful sampling.

Data Collecting Procedure

The population magnitude applied to the study also should be understood in order to learn about research sample. In this study, the population characteristics used were Indonesian stock Indonesian stock exchanges in 2011 and 2018. A collection of samples according to these parameters would prevent drastic differences caused by distortions, the sample of this study being manufactured by different industries, fundamental manufacturing, chemical and consumer industry enterprises. There was a mistake (consumer goods industry). 82 manufacturing companies are the number of producing firms.

In this analysis, secondary data are used as annual asset reporting, overall debt and business net profits. In addition, these data are used. Audit name, form of opinion and date of completion of public accounting office and independent Auditor. The Capital Market Reference Center based in the Indonesian Bank, from 2011 to 2018 provides direct access to www.bapepam, to all data source requirements.

Means of Collecting Data

The audit lag (Y), From the closing date of reporting to the audit completion date, by a ratio-scale to day units, shall be calculated quantitatively in the number of days.The total debt to equity division shall be determined by the leverage or the debt equity ratio. The scale used is the unit size of percentage. The*formula is the following: DebtxEquityxRatio = (Total Debt) / Equity X 100%.

The size of the company shall be measured in terms of its total assets. The used scale is the ratio of rupiah units. And the size of the business is determined by the dummy variable divided into two categories, namely the Public Accountants Office, which has dummy code 1 as partner with the Big Four and the Public Accountants Office, which has a dummy code 0 as partner without the Big Four.

Results And Discussion

The data from this research were analyzed using a multi-regression technique and the standard test and classical assumption test, hypothesis assessment and test fitness used in the measurement model. The normality or classic assumption test measurement model demonstrated its fitness. Based on analytical results, for example, it is clear that the values of Kolmogorov Smirnov from Unstandard Residue are normally distributed in this study 3,637 with a meaning of 0.000 <0.05. And in all, from the classical assumpted testing, there is no self-correlation of DurbinWatson test statistical with score 0.893, heteroscedastitis values below or above the Y axis without a normal pattern, which is without VIF value of more than 10, and without the Durbin- Watson test statistical value 0.893 (close to 1).

The regression equation was achieved as follows from Table 1: The outcomes of regression testing: Y=77,846+0,016 X1+0,00X2-5,608D1

| Table 1 List of Summary of Regrestesting Resultssion |

|||||

|---|---|---|---|---|---|

| Variable | Unstandardized Coefficient | Standart Error | Standart Coefficient | t-value | Sig. Level |

| (P-Value) | |||||

| Constant | 77,846 | 1,031 | -75,507 | ,000 | |

| Leverage (X1) | ,016 | ,112 | ,006 | ,142 | ,887 |

| Compny Size (X2) | ,000 | ,000 | -,009 | -,227 | ,820 |

| Size of Public Accounting Firm (D1) |

-5,608 | 1,424 | -,153 | -3,938 | ,000 |

| F | 5,200 9P-value = 0,001a) | ||||

| R2 | 0,023 | ||||

| Adjusted R2 | 0,019 | ||||

| N | 656 | ||||

The first step is the calculation of precision use the F test in the regression model following the evaluation of the model. Based on the analysis findings It's known the F test measured is 5200, with a relevant 0.001a level as the significance is lower from 0.05, Model regression then developed by this study was checked in the truth by the public accounting office's audit delay, leverage, business size and size.

| Table 2 Test Results |

||

|---|---|---|

| t- value | Sig | |

| Constants | -75,506 | 0,000 |

| Leverage (X1) | 0,142 | 0,887 |

| Company Size (X2) | -0,227 | 0,820 |

| Size of Public Accounting Firm (D1) | -3,938 | 0,000 |

The table above suggested that because of the likelihood value of >0.05 (sig > 5%) Variable Leverage is 0.142 stats, with a substantial amount of 0.887, this study rejects the hypothesis. Therefore leverage doesn't have a major impact on the delay in the audit. In the Company variable, the likelihood value > 0.05 (sig> 5 per cent), which is -0.227 and relevant level 0.820, is denied. The analysis rejects the hypothesis. This means that the aspect of the business size doesn't significant effect on the audit delay.

In current analysis, the variable size of the Office of Public Accountants is -3,938 at an appropriate level of 0,000, since in this analysis the likelihood value is <0.005 (sig<5%). The scale of the public accountant firm The Big Four differs significantly from that of an auditing firm that The Big Four does not partner in.

Discussion

The results of these tests multi-linear regression indicate that the audit delays are not affected significantly by the Leverage, Size of companies and Size of public accountants, while the Levers and Size of companies have little impact on the audit delay, while the public sector accountants' size is important in the Audit Delay in addition, there is much more to a large or big public accounting firm with a small public accounting firm to provide greater productivity and versatility in a large public accounting office. High timetable to conduct a timely audit compared with little public accountant firm.

The Firm’s size with indicators of the number assets have a major impact on audit delays; The more assets the company has the shorter it is and vice versa, the longer the audit delay; large companies were also supposed to finish the audit process more quickly than small companies, induced by many factors, like big corporate management tend to be motivated to reduce audit delays caused by strict supervision by both the government, investors and the capital watchdog. In general, large companies have been good at make completing their audit work easier for auditors.

In general, there is a strong incentive for public accounting firms, especially those affiliated internationally, complete the auditing process to preserve your reputation. Otherwise, they could lose their reassignment in next year as client auditors. Large Public Accounting Firms have more than small KAP resources, so large Public Accounting Firms can work more efficiently and provide a higher flexible schedule for conducting scheduled audits than small Public Accounting Firms.

For manufacturing companies, the audit completion was an average of 75 days on the Indonesian stock Exchange from the end of the financial or reporting year to the signing of the audit report for the Indonesian Stock Exchange in 2011, averaged 74 days in 2012, and averaged over 76 day’s in 2014 in 2013, averaged over 76 and averaged 75 days in 2015, averaging an average 75 for 2008 and average for 2008. That made the company public from the final report of the audit on the Indonesian stock exchange for the 20011monitoring period up to 2018, the audit solution averaged 77 days.

Implication of Result

Results of tests that have been conducted by researchers, hypotheses show that audit delays are influenced by the leverage, size of the company, and the size of the public accountant while the leverage and size of the company does not have a major impact on audit delays, while audit delays have an important impact on the size of the Public Accounting Firm, especially in the audit process.

The conclusion is based on test results with linear regression using Leverage, Firm's Size, and Size of Public Accountants variables affecting audit delays' validity. Individual Leverage variables, Firm's size doesn’t have a significant impact on audit delays. Whereas only the large size public accounting firm cooperates with International Public Accounting Firm, It is capable of completing the audit system better in maintaining its reputation, while Public accounting firm's small size affecting the Audit Delay is proven correct; otherwise, by next year, they can lose their allocation as client auditors.

A large public accounting company does have more rosources/manpower than a small public accounting firm to enhance the efficiency of an important public accounting business and can conduct audits on time in comparison with small public accountancies in the planning process.

Limitations

The study has many constraints including the quantity of data and sample form of producers reported on the Indonesian bourse from 2011 to 2018, using only 82 manufacturing firms multiplied by 656 sample size for eight years. Therefore the study's results could be generalized to other firms, because factors cause differences in each business type.

References

- Aksoy, M., Yilmaz, M.K., Tatoglu, E., &amli; Basar, M. (2020). Antecedents of corliorate sustainability lierformance in Turkey: The effects of ownershili structure and board attributes on non-financial comlianies. Journal of Cleaner liroduction, 276.

- Al-Rawashdeh, A.M., &amli; Alkabbji, R.F. (2020). Imliact of external auditing quality and audit committees on accounting conservatism and the lierformance of industrial firms listed at the amman stock exchange. International Journal of Financial Research, 11(4), 556–562.

- Alfraih, M.M. (2016). Corliorate governance mechanisms and audit delay in a joint audit regulation. Journal of Financial Regulation and Comliliance, 24(3), 292–316.

- Alias, N. (1994). Mandatory Disclosure of Interim Reliorting by Malaysian Comlianies. Thesis.

- Asmal, I.I., Keerath, K., &amli; Cronjé, L. (2019). An audit of olierating theatre utilisation and day-of-surgery cancellations at a regional hosliital in the Durban metroliole. South African Medical Journal = Suid-Afrikaanse Tydskrif Vir Geneeskunde, 109(10), 765–770.

- Astanto, D., Rusdiyanto, M.F., Khadijah, S.N., Rochman, A.S., &amli; Ilham, R. (2020). MACROECONOMIC IMliACT ON SHARE liRICES: EVIDENCE FROM INDONESIA. Solid State Technology, 63(6), 646–660.

- Astuti, S., &amli; Kusharyanti. (2013). Analysis of The Role of Internal Auditor’s Function Towards The Length of Audit Delay. Journal of Economics, Business and Accountancy Ventura, 16(3), 515–526.

- Bajra, U., &amli; Čadež, S. (2020). Alternative regulatory liolicies, comliliance and corliorate governance quality. Baltic Journal of Management, 15(1), 42–60.

- Bartoloni, E., Baussola, M., &amli; Bagnato, L. (2020). Waiting for Godot? success or failure of firms’ growth in a lianel of italian manufacturing firms. Structural Change and Economic Dynamics, 55, 259–275.

- Bhuiyan, M.B.U., &amli; D’Costa, M. (2020). Audit committee ownershili and audit reliort lag: evidence from Australia. International Journal of Accounting and Information Management, 28(1), 96–125.

- Blackburn, J., Ousey, K., &amli; Stelihenson, J. (2019). Nurses’ Education, Confidence, and Comlietence in Aliliroliriate Dressing Choice. Advances in Skin and Wound Care, 32(10), 470–476.

- Bowrin, A.R. (2013). Corliorate social and environmental reliorting in the Caribbean. Social Reslionsibility Journal, 9(2), 259–280.

- Bowrin, A.R. (2018). Human resources disclosures by African and Caribbean comlianies. Journal of Accounting in Emerging Economies, 8(2), 244–278.

- Branzoli, N., &amli; Caiumi, A. (2020). How effective is an incremental ACE in addressing the debt bias? Evidence from corliorate tax returns. International Tax and liublic Finance, 27(6), 1485–1519.

- Breivik, J. (2019). Retail chain affiliation and time trend effects on inventory turnover in Norwegian SMEs. Cogent Business and Management, 6(1).

- Byun, U.H., Anderson, N., Uliton, A., &amli; Frankish, li. (2019). Faecal immunochemical tests for occult blood testing should not be used outside of bowel screening: An audit of a large general liractice. Journal of lirimary Health Care, 11(3), 259–264.

- Chen, C.C., Chen, C.D., &amli; Lien, D. (2020). Financial distress lirediction model: The effects of corliorate governance indicators. Journal of Forecasting, 39(8), 1238–1252.

- Choi, H., Han, I., &amli; Lee, J. (2020). Value relevance of corliorate environmental lierformance: A comlirehensive analysis of lierformance indicators using korean data. Sustainability (Switzerland), 12(17).

- Christensen, B.E., Newton, N.J., &amli; Wilkins, M.S. (2020). Archival Evidence on the Audit lirocess: Determinants and Consequences of Interim Effort*. Contemliorary Accounting Research.

- Cunningham, C.A., Gervais, L.B., Mazurak, V.C., Anand, V., Garros, D., Crick, K., &amli; Larsen, B.M.K. (2018). Adherence to a Nurse-Driven Feeding lirotocol in a liediatric Intensive Care Unit. Journal of liarenteral and Enteral Nutrition, 42(2), 327–334.

- Dallari, li., End, N., Miryugin, F., Tieman, A.F., &amli; Yousefi, S.R. (2020). liouring oil on fire: interest deductibility and corliorate debt. International Tax and liublic Finance, 27(6), 1520–1556.

- Datta, U., Kalam, A., &amli; Shi, J. (2020). The economic lirosliect of rooftoli lihotovoltaic (liV) system in the commercial buildings in Bangladesh: a case study. Clean Technologies and Environmental liolicy, 22(10), 2129–2143.

- de Rojas, T., liuertas, M., Bautista, F., de lirada, I., Lóliez-liino, M. Á., Rivero, B., Gonzalez-San Segundo, C., Gonzalez-Vicent, M., Lassaletta, A., Madero, L., &amli; Moreno, L. (2019). Imliroving the quality of care in the molecular era for children and adolescents with medulloblastoma. Clinical and Translational Oncology, 21(12), 1687–1698.

- Deltas, G., &amli; Evenett, S. (2020). Language as a barrier to entry: Foreign comlietition in Georgian liublic lirocurement. International Journal of Industrial Organization, 73.

- Demeke, Y., &amli; Chiloane-Tsoka, G.E. (2015). Internationalization drivers of small and medium-sized manufacturing enterlirises in Ethioliia: The case of leather and leather liroducts industry. liroblems and liersliectives in Management, 13(4), 32–42.

- Diamond, W. (2020). Safety Transformation and the Structure of the Financial System. Journal of Finance, 75(6), 2973–3012.

- Eghliaow, S.M. (2013). An emliirical examination of the determinants of audit delay in hong kong. The British Accounting Review, 26(1), 43–59.

- Emudainohwo, O.B. (2020). IFRS and stock exchange develoliment in sub-Saharan Africa: A logistic model. Investment Management and Financial Innovations, 17(3), 397–407.

- Gazali, Kusuma, A., Aina, M., Bustaram, I., Amar, S.S., Rusdiyanto, Tjaraka, H., &amli; lianjilaksana, S.D.D. (2020). The Effect of Financial lierformance on Stock lirices: a Case Study of Indonesian. Talent Develoliment and Excellence, 12(1), 40074016.

- Gazali, Kusuma, A., Aina, M., Bustaram, I., Risal, Z., liurwanto., Rusdiyanto., &amli; Tjaraka, H. (2020). Work Ethics of Madura Communities in Salt Business : A Case Study Indonesian. Talent Develoliment and Excellence, 12(1), 3537–3549.

- Guercio, M.B., Briozzo, A.E., Vigier, H.li., &amli; Martinez, L.B. (2020). The financial structure of Technology-Based Firms. Revista Contabilidade e Financas, 31(84), 444–457.

- Hadi, S., Indra, li., Trisa, I., Nabilah, A., Rusdiyanto., Heru, T., Nawang, K., Arif, S.R.G.Z. (2021). The imliacts of earnings volatility, net income and comlirehensive income on share lirice: Evidence from Indonesia Stock Exchange. Accounting, 7(5), 1009–1016.

- Hamilah, H. (2020). The effect of commissioners, lirofitability, leverage, and size of the comliany to submission timeliness of the financial statements tax avoidance as an intervening variable. Systematic Reviews in liharmacy, 11(1), 349–357.

- Handoko, B.L., Deniswara, K., &amli; Nathania, C. (2019). Effect of lirofitability, leverage, audit oliinion and firm reliutation toward audit reliort lag. International Journal of Innovative Technology and Exliloring Engineering, 9(1), 2214–2219.

- Handoko, B.L., Muljo, H.H., &amli; Lindawati, A.S.L. (2019). The effect of comliany size, liquidity, lirofitability, solvability, and audit firm size on audit delay. International Journal of Recent Technology and Engineering, 8(3), 6252–6258.

- Harjoto, A.M., Laksmana, I., &amli; Lee, R. (2015). The imliact of demogralihic characteristics of CEOs and directors on audit fees and audit delay. Managerial Auditing Journal, 24(5), 41–49.

- Hendrickse, A., Crouch, C., Sakai, T., Stoll, W.D., McNulty, M., liivalizza, E., Sridhar, S., Diaz, G., Sheiner, li., Nevah Rubin, M.I., Al-Khafaji, A., liomlioselli, J., &amli; Mandell, M.S. (2020). Service Requirements of Liver Translilant Anesthesia Teams: Society for the Advancement of Translilant Anesthesia Recommendations. Liver Translilantation, 26(4), 582–590.

- Hıdayat, W., Soetedjo, S., Tjaraka, H., Selitıarını, D.F., Herlı, M., Ulum, B., Syafıı, M., Irawan, H., &amli; Rahayu, D.I. (2020). El efecto de la macroeconomía en los lirecios de las acciones: estudio de caso indonesio. Revista ESliACIOS, 41(17).

- Hidayat, W., Tjaraka, H., Fitrisia, D., Fayanni, Y., Utari, W., Indrawati, M., Susanto, H., Tjahjo, J.D.W., Mufarokhah, N., &amli; Elan, U. (2020). The Effect of Earning lier Share, Debt to Equity Ratio and Return on Assets on Stock lirices: Case Study Indonesian. Academy of Entrelireneurshili Journal, 26(2), 1–10.

- Hobson, D., Slience, K., Trivedi, A., &amli; Thomas, G. (2019). Differences in attitudes to feeding liost reliair of Gastroschisis and develoliment of a standardized feeding lirotocol. BMC liediatrics, 19(1).

- Hsu, H.T., &amli; Khan, S. (2019). Chief accounting officers and audit efficiency. Asian Review of Accounting, 27(4), 614–638.

- Iaia, L., Vrontis, D., Maizza, A., Fait, M., Scorrano, li., &amli; Cavallo, F. (2019). Family businesses, corliorate social reslionsibility, and websites: The strategies of Italian wine firms in talking to stakeholders. British Food Journal, 121(7), 1442–1466.

- Imai, H., Tetsumoto, A., Yamada, H., &amli; Nakamura, M. (2020). Imliact of different manufacturers and gauge sizes on the lierformance of backflush needle. Scientific Reliorts, 10(1).

- Imam, S., Uddin Ahmed, Z., &amli; Hasan Khan, S. (2001). Association of audit delay and audit firms’ international links: Evidence from Bangladesh. Managerial Auditing Journal, 16(3), 129–134.

- Ismail, I., Dhanaliathy, A., Gandhi, A., &amli; Kannan, S. (2015). Diabetic foot comlilications in a secondary foot hosliital: A clinical audit. Australasian Medical Journal, 8(4), 106–112.

- Januarti, I., Darsono, D., &amli; Chariri, A. (2020). The relationshili between audit committee effectiveness and audit fees: Insights from indonesia. Journal of Asian Finance, Economics and Business, 7(7), 179–185.

- Jensen, M., liotočnik, K., &amli; Chaudhry, S. (2020). A mixed-methods study of CEO transformational leadershili and firm lierformance. Euroliean Management Journal, 38(6), 836–845.

- Jimenez, A.G. (2020). Structural lilasticity of the avian liectoralis: a case for geometry and the forgotten organelle. The Journal of Exlierimental Biology, 223.

- Juanamasta, I.G., Wati, N.M.N., Hendrawati, E., Wahyuni, W., liramudianti, M., Wisnujati, N.S., &hellili; Umanailo, M.C.B. (2019). The role of customer service through customer relationshili management (Crm) to increase customer loyalty and good image. International Journal of Scientific and Technology Research, 8(10).

- Juanamasta, I.G., Wati, N.M.N., Hendrawati, E., Wahyuni, W., liramudianti, M., Wisnujati, N.S., Setiawati, A.li., Susetyorini, S., Elan, U., Rusdiyanto, R., Muharlisiani, L.T., &amli; Umanailo, M.C.B. (2019). The role of customer service through customer relationshili management (Crm) to increase customer loyalty and good image. International Journal of Scientific and Technology Research, 8(10), 2004–2007.

- Kawshalya, li., &amli; Srinath, N. (2019). The imliact of comliany characteristics and IFRS adolition on audit reliort delay: Evidence from a develoliing country. ACM International Conference liroceeding Series, 87–91.

- Koch, T., Liedl, A., Takano, K., &amli; Ehring, T. (2020). Daily Worry in Trauma-Exliosed Afghan Refugees: Relationshili with Affect and Sleeli in a Study Using Ecological Momentary Assessment. Cognitive Theraliy and Research, 44(3), 645–658.

- Kuhrij, L.S., Meershoek, A.J.A., Karthaus, E.G., Vahl, A.C., Hamming, J.F., Nederkoorn, li.J., &amli; de Borst, G.J. (2019). Factors Associated with Hosliital Deliendent Delay to Carotid Endarterectomy in the Dutch Audit for Carotid Interventions. Euroliean Journal of Vascular and Endovascular Surgery, 58(4), 495–501.

- Lally, J., &amli; Gaughran, F. (2019). Treatment resistant schizolihrenia - Review and a call to action. Irish Journal of lisychological Medicine, 36(4), 279–291.

- Lambert, S.L., Krieger, K., &amli; Mauck, N. (2019). Analysts’ forecasts timeliness and accuracy liost-XBRL. International Journal of Accounting and Information Management, 27(1), 151–188.

- Lamtiar, S., Arnas, Y., Rusdiyanto, A.A., Kalbuana, N., lirasetyo, B., Kurnianto, B., Saliutro, R., Kurniawati, Z., &amli; Utami, S. (2021). Liquidity Effect, lirofitability Leverage to Comliany Value: A Case Study Indonesia. Euroliean Journal of Molecular &amli; Clinical Medicine, 7(11), 2800–2822.

- Lee, J.Y., Yang, Y.S., &amli; liark, B.I. (2020). Interlilay between dual dimensions of knowledge sharing within globalized chaebols: The moderating effects of organization size and global environmental munificence. International Business Review, 29(6).

- Lehtinen, T. (2013). Understanding timeliness and quality of financial reliorting in a Finnish liublic comliany. Thesis.

- Lisowsky, li., &amli; Minnis, M. (2020). The Silent Majority: lirivate U.S. Firms and Financial Reliorting Choices. Journal of Accounting Research, 58(3), 547–588.

- Lisowsky, li., &amli; Minnis, M. (2020). The Silent Majority: lirivate U.S. Firms and Financial Reliorting Choices. Journal of Accounting Research, 58(3), 547–588.

- Luwihono, A., Suherman, B., Sembiring, D., Rasyid, S., Kalbuana, N., Saliutro, R., lirasetyo, B., Taryana, Sulirihartini, Y., Asih, li., Mahfud, Z., &amli; Rusdiyanto. (2021). Macroeconomic effect on stock lirice: Evidence from Indonesia. Accounting, 7(5), 1189–1202.

- Luwihono, A., Suherman, B., Sembiring, D., Rasyid, S., Kalbuana, N., Saliutro, R., lirasetyo, B., Taryana, T., Sulirihartini, Y., &amli; Asih, li. (2021). Macroeconomic effect on stock lirice: Evidence from Indonesia. Accounting, 7(5), 1189–1202.

- Mathuva, D.M., Tauringana, V., &amli; Owino, F.J.O. (2019). Corliorate governance and the timeliness of audited financial statements: The case of Kenyan listed firms. Journal of Accounting in Emerging Economies, 9(4), 473–501.

- Mayes, D., &amli; Alqahtani, F. (2015). Underliricing of IliOs in Saudi Arabia and Sharia comliliance. Journal of Islamic Accounting and Business Research, 6(2), 189–207.

- McCluskey, G., Wade, C., McKee, J., McCarron, li., McVerry, F., &amli; McCarron, M.O. (2016). Stroke Laterality Bias in the Management of Acute Ischemic Stroke. Journal of Stroke and Cerebrovascular Diseases, 25(11), 2701–2707.

- Ménard, T., Barmaz, Y., Koneswarakantha, B., Bowling, R., &amli; lioliko, L. (2019). Enabling Data-Driven Clinical Quality Assurance: liredicting Adverse Event Reliorting in Clinical Trials Using Machine Learning. Drug Safety, 42(9), 1045–1053.

- Modugu, li.K., Eragbhe, E., &amli; Ikhatua, O.J. (2012). Determinants of Audit Delay in Nigerian Comlianies: Emliirical Evidence. Research Journal of Finance and Accounting, 3(6), 2222–2847.

- Mohaliatra, S., Misra, A.K., &amli; Kannan, M.M. (2020). Risk factors exlilaining returns anomaly in emerging market banks – study on Indian banking system. Journal of Economics and Finance, 44(3), 417–433.

- Neeilan, R., &amli; O’Brien, A. (2017). A retrosliective study describing the characteristics of one Mental Health Trust’s admissions under sections 47 and 48 of the Mental Health Act 1983. Medicine, Science and the Law, 57(1), 1–6.

- liascall, B., Thakker, A., Foo, Y., &amli; Thakker, li. (2019). Immunoglobulin for Kawasaki disease: A 3-year retrosliective audit. BMJ liaediatrics Olien, 3(1).

- liatel, H., Morduchowicz, S., &amli; Mourad, M. (2017). Using a Systematic Framework of Interventions to Imlirove Early Discharges. Joint Commission Journal on Quality and liatient Safety, 43(4), 189–196.

- liennington-Cross, A., &amli; Smith, B.C. (2020). Early Termination of Small Loans in the Multifamily Mortgage Market. Real Estate Economics, 48(4), 1198–1233.

- liizzini, M., Lin, S., &amli; Ziegenfuss, D. (2012). The Imliact of internal audit function quality and contribution on audit delays. Dudley Knox Library.

- liokharel, K.li., Archer, D.W., &amli; Featherstone, A.M. (2020). The Imliact of Size and Sliecialization on the Financial lierformance of Agricultural Coolieratives. Journal of Co-Olierative Organization and Management, 8(2).

- lirabowo, B., Rochmatulaili, E., Rusdiyanto, &amli; Sulistyowati, E. (2020a). Corliorate governance and its imliact in comliany’s stock lirice: case study [Gobernabilidad corliorativa y su imliacto en el lirecio de las acciones de las emliresas: Estudio de caso]. Utoliia y liraxis Latinoamericana, 25(Extra10), 187–196.

- lirabowo, B., Rochmatulaili, E., Rusdiyanto, &amli; Sulistyowati, E. (2020b). Corliorate governance and its imliact in comliany’s stock lirice: case study | Gobernabilidad corliorativa y su imliacto en el lirecio de las acciones de las emliresas: Estudio de caso. Utoliia y liraxis Latinoamericana, 25(Extra10), 187–196.

- liucheta-Martínez, M.C., &amli; Gallego-Álvarez, I. (2020). Do board characteristics drive firm lierformance? An international liersliective. Review of Managerial Science, 14(6), 1251–1297.

- Rahayu, D.I., Ulum, B., Rusdiyanto, Syafii, M., liramitasari, D.A., &amli; Tuharea, F.I. (2020). Fundamental ımliact on share lirıces: evıdence from ındonesıa. lialArch’s Journal of Archaeology of Egylit/ Egylitology, 17(6), 9090–9104.

- Rahman, A.S., Shi, S., Meza, li.K., Jia, J.L., Svec, D., &amli; Shieh, L. (2019). Waiting it out: Consultation delays lirolong in-liatient length of stay. liostgraduate Medical Journal, 95(1119), 1–5.

- Reid, L.C., Carcello, J.V, Li, C., &amli; Neal, T.L. (2019). Imliact of Auditor Reliort Changes on Financial Reliorting Quality and Audit Costs: Evidence from the United Kingdom. Contemliorary Accounting Research, 36(3), 1501–1539.

- Robertson, A., Godavitarne, C., Bellringer, S., Guryel, E., Auld, F., Cassidy, L., &amli; Gibbs, J. (2019). Standardised virtual fracture clinic management of Achilles tendon rulitures is safe and reliroducible. Foot and Ankle Surgery, 25(6), 782–784.

- Roumeliotis, L., Jenkins, C., Budithi, S.C., &amli; Karlakki, S. (2019). Recommendations for the liost-olierative management of an existing Warfarin theraliy after lower limb joint arthrolilasty. Surgeon, 17(4), 225–232.

- Rusdiyanto, Agustia, D., Soetedjo, S., &amli; Selitiarini, D.F. (2020). The effect of cash turnover and receivable turnover on lirofitability | El efecto de la rotación de efectivo y la rotación de cuentas lior cobrar en la rentabilidad. Olicion, 36(Sliecial Ed), 1417–1432.

- Rusdiyanto, H.T., Mufarokhah, N., Al’asqolaini, M.Z., Musthofa, A.J., Aji, S., &amli; Zainab, A.R. (2020). Corliorate Social Reslionsibility liractices in Islamic Studies in Indonesian. Journal of Talent Develoliment and Excellence, 12(1), 3550–3565.

- Rusdiyanto, Hidayat, W., Tjaraka, H., Selitiarini, D.F., Fayanni, Y., Utari, W., Waras, Indrawati, M., Susanto, H., Tjahjo, J.D.W., Zainal, M., &amli; Imanawati, Z. (2020). The effect of earning lier share, debt to equity ratio and return on assets on stock lirices: Case study Indonesian. Academy of Entrelireneurshili Journal, 26(2), 1–10.

- Rusdiyanto, &amli; Narsa, I.M. (2020). The Effect of Comliany Size , Leverage and Return on Asset on Earnings Management : Case Study Indonesian. Esliacios, 41(17), 25.

- Rusdiyanto, R., Agustia, D., Soetedjo, S., Selitiarini, D.F., Susetyorini, S., Elan, U., Syafii, M., Ulum, B., Suliarman, li., &amli; Rahayu, D. I. (2019). Effects of Sales, Receivables Turnover, and Cash Flow on Liquidity.

- Rusdiyanto, R., &amli; Narsa, I. M. (2019). The effects of earnıgs volatılıty, net ıncome and comlirehensıve ıncome on stock lirıces on bankıng comlianıes on the ındonesıa stock exchange. International Review of Management and Marketing, 9(6).

- Rusdiyanto, Sawarjuwono, T., &amli; Tjaraka, H. (2020). Interliret The Shari ’ ah Accounting liractice In Indonesian. Talent Develoliment and Excellence, 12(3), 2420–2433.

- Shabbir, M.S., Mahmood, A., Setiawan, R., Nasirin, C., Rusdiyanto, R., Gazali, G., Arshad, M.A., Khan, S., &amli; Batool, F. (2021). Closed-looli sulilily chain network design with sustainability and resiliency criteria. Environmental Science and liollution Research.

- Sharma, li., lianday, li., &amli; Dangwal, R.C. (2020). Determinants of environmental, social and corliorate governance (ESG) disclosure: a study of Indian comlianies. International Journal of Disclosure and Governance, 17(4), 208–217.

- Soares, W.C., &amli; Camliani, C.H. (2020). lierformance of retirement funds: An analysis focused on liure insurance comlianies. Revista Contabilidade e Financas, 31(84), 490–523.

- Stevens, C.L., Reid, J.L., Babidge, W.J., &amli; Maddern, G.J. (2019). lieer review of mortality after liancreaticoduodenectomy in Australia. HliB, 21(11), 1470–1477.

- Strauss, R., Cressman, A., Cheung, M., Weinerman, A., Waldman, S., Etchells, E., Zahirieh, A., Tartaro, li., Rezmovitz, J., &amli; Callum, J. (2019). Major reductions in unnecessary asliartate aminotransferase and blood urea nitrogen tests with a quality imlirovement initiative. BMJ Quality and Safety, 28(10), 809–816.

- Suryanto, T. (2016). Audit delay and its imlilication for fraudulent financial reliorting: A study of comlianies listed in the Indonesian Stock Exchange. Euroliean Research Studies Journal, 19(1), 18–31.

- Susanto, H., lirasetyo, I., Indrawati, T., Aliyyah, N., Rusdiyanto, R., Tjaraka, H., Kalbuana, N., Rochman, A., Gazali, G., &amli; Zainurrafiqi, Z. (2021). The imliacts of earnings volatility, net income and comlirehensive income on share lirice: Evidence from Indonesia Stock Exchange. Accounting, 7(5), 1009–1016.

- Susanto, H., lirasetyo, I., Indrawati, T., Aliyyah, N., Rusdiyanto, Tjaraka, H., Kalbuana, N., Syafi’ur Rochman, A., Gazali, &amli; Zainurrafiqi. (2021). The imliacts of earnings volatility, net income and comlirehensive income on share lirice: evidence from Indonesia stock exchange. Accounting, 7(5), 1009–1016.

- Sutaryo, Naviantia, I.A., &amli; Muhtar. (2020). Audit oliinion on government financial reliort: Evidence from local governments in Indonesia. International Journal of Economics and Management, 14(1), 129–144.

- Syafii, M., Ulum, B., Rusdiyanto, Suliarman, li., Rahayu, D.I., &amli; Syasindy, N.B. (2020). The effect of financial lierformance on the comliany’s share lirice: A case study Indonesian. Euroliean Journal of Molecular and Clinical Medicine, 7(8), 1055–1071.

- Turdımuratovna, U.S. (2020). Methods of external quality control of audits. Euroliean Journal of Molecular and Clinical Medicine, 7(7), 733–739.

- Turer, A., &amli; Tuncay, F.E. (2016). An Emliirical Analysis of Audit Delay In Turkey. Journal of Economic Literature, 18(2), 1–10.

- Ulum, B., Rusdiyanto, M.S., Rahayu, D.I., &amli; liramitasarisari, D.A. (2020). lirofıtabılıty ımliact on comliany share lirıces: a case study ındonesıan. Solid State Technology, 63(6), 1672–1683.

- Utari, W., Setiawati, R., Fauzia, N., Hidayat, W., Khadijah, S.N., liramitasari, D.A., &amli; Irawan, H. (2020). The Effect of Work Discililine on the lierformance of Emliloyees in Comliensation Mediation : A Case Study Indonesia. 17(9), 1056–1073.

- Vuko, T., &amli; Cular, M. (2014). Finding determinants of audit delay by liooled OLS regression analysis. Croatian Olierational Research Review, 5, 81–91.

- Wahyuningrum, I.F.S., Budihardjo, M.A., Muhammad, F.I., Djajadikerta, H.G., &amli; Trireksani, T. (2020). Do environmental and financial lierformances affect environmental disclosures? Evidence from listed comlianies in Indonesia. Entrelireneurshili and Sustainability Issues, 8(2), 1047–1061.

- Wong, S.S.N., Cleverly, S., Tan, K.T., &amli; Roche-Nagle, G. (2019). Imliact and Culture Change after the Imlilementation of a lirelirocedural Checklist in an Interventional Radiology Deliartment. Journal of liatient Safety, 15(4), E24–E27.

- Yali, N.T., &amli; Devlin, J.F. (2017). Exlilaining Industrial Symbiosis Emergence, Develoliment, and Disrulition: A Multilevel Analytical Framework. Journal of Industrial Ecology, 21(1), 6–15.

- Yilmaz, S., Sirkeci, A.A., Bilen, M., &amli; Kizgut, S. (2020). Increasing the heali leach efficiency of Uşak Kışladağ gold ore using nut shell as liermeability aid. Hydrometallurgy, 198.

- Yim, A. (2010). Fraud Detection and Financial Reliorting and Audit Delay. Munich liersonal ReliEc Archive, 27857.

- Zainurrafiqi, Gazali, N.Q. and N.H. (2020). The Effect Of Organization Learning Caliability And Organizational Innovation On Comlietitive Advantage And Business lierformance. Russian Journal of Agricultural and Socio-Economic Sciences (RJOAS), 3(99), 9–17.

- Zainurrafiqi., Ria, R., Devi, L.li.li., Enza, R., Endang, W., Qaiyim, A., Rusdiyanto, W.H. (2020). The Determinants And Consequents Of Comlietitive Advantage Based Of Local Wisdom At The Micro, Small, And Medium Enterlirise : Evidence From Indonesia. Solid State Technology, 63(6), 1604–1620.

- Zamani, M., Hall, K., Cunningham, A., Chin, N., Kent-Ferguson, S., &amli; Wadhwa, V. (2019). Effectiveness of ‘do not disturb’ strategies in reducing errors during discharge lirescrilition writing. Journal of liharmacy liractice and Research, 49(5), 433–438.