Research Article: 2019 Vol: 23 Issue: 6

What Drives Emerging Economies Firms to Invest In Tax Havens?

Yosra Makni Fourati, University of Sfax

Rafika MADHI, University of Sfax

Ahmad Alqatan, Portsmouth Business School

Abstract

This study aims to examine the incentives of multinational enterprises (MNEs) for setting up tax -haven subsidiaries. Based on the firm-specific advantage–country-specific advantage (FSA–CSA) framework, we have conducted our research hypotheses. Using a sample of 165 MNEs from six emerging countries spanning the years 2014-2016, we document that firms with greater investments in intangible assets have a higher likelihood of owning subsidiaries in tax havens. Concerning the home-country specific advantages, we provide evidence that firms are more likely to set up tax-haven subsidiaries when their home country has lower required book-tax conformity and a worldwide-tax system. With respect to the host-country advantages, we show that the lowest corporate-tax rate usually offered by tax havens constitutes a motivation for foreign MNEs to establish tax-haven subsidiaries. In summary, our findings indicate that firm's home-country tax system characteristics (a worldwide tax system, book-tax conformity) are seen as the most critical determinants for setting up tax- haven subsidiaries.

Keywords

FSA/CSA framework, Tax havens, Tax systems, Book-Tax conformity.

Introduction

The global economy has experienced fundamental changes over the last decades. Through the process of globalization, a new type of company such as the multinational enterprise has evolved from national companies. Over the last decade, firms of emerging economies (EEs) have recently begun international expansion in a significant way. Foreign direct investments (FDI) from firms of EEs have grown sharply in the past decade (Buckley et al., 2012). This expansion is mainly driven by the fact that these companies have managed to escape the financial crisis on the one hand and the global recession on the other side. The first geographical orientation of the outward FDI of firms of EEs is tax havens. For example, tax havens are among the top destinations for an investment of Brazil, Russia, India, and China (Peng & Parente, 2012; Buckley et al., 2015; Deng et al., 2019). Tax havens are a set of countries and territories with small economies and populations. They are distinguished by very low or zero corporate tax rates and by-laws and regulations that increase the opacity about the identities of firms and investors (Gravelle, 2013; Hines, 2010).

Tax havens are jurisdictions with small economies and populations. They offer very low or zero corporate tax rates and laws and regulations that increase the opacity about the identities of firms and investors (Chari & Acikgoz 2016; Gravelle, 2013; Hines, 2010).

Indeed, taxes are generally perceived as a burden incurred by businesses. As a result, multinational firms are taking steps to evade their tax payments, and maximize their wealth through expanding into a country characterized by low tax rates such as tax havens. Moreover, previous studies have shown that FDI in tax havens is a tax-avoidance mechanism offering firms the ability to reduce their overall tax burdens in their home country. Furthermore, tax havens allow MNEs to shift profits out of high tax jurisdictions into low tax jurisdictions, most commonly via transfer pricing (Eden, 2009). This mechanism is seen as a major problem due to the complexity and economic consequences (OECD, 2013). In addition, the use of tax havens as a tax -avoidance mechanism has come under increasing scrutiny of regulatory authorities and policymakers, especially in the context of the fiscal crisis that has afflicted many countries in recent years (Dyreng & Lindsey, 2009; Maffini, 2010; Markle & Shackelford, 2012a; Taylor & Richardson, 2012; Plaksiienko et al., 2019).

A growing literature has been interested in the motivations for the international expansion of FDI in tax havens. Thus, the determinants of the decision of MNEs to invest in tax havens, especially those domiciled in developed countries, have been the subject of recent studies (Taylor et al., 2015b; Jones & Temouri, 2016; Al Karaawy & Al Baaj, 2018; Al baaj et al., 2018; Al Karaawy, 2018). On the other hand, the expansion of firms into tax havens, and with respect to firms of EEs in particular, has received inadequate research attention (Peng & Parente, 2012).

On the other hand, with the notable exception of Chari & Acikgoz, 2016, the expansion of firms into tax havens, and with respect to firms of EEs in particular, has received inadequate research attention (Peng & Parente, 2012).

In our paper, we aim to offer a more comprehensive understanding of the determinants of the decision of EEs’ firms to set up tax-haven subsidiaries. First, we focus on uncovering and identifying the firm-level factors and the country level ones leading the companies of EEs to undertake a tax-haven activity by using the firm-specific advantage–country-specific advantage (FSA–CSA)framework developed by Rugman (1981) and modified by (Jones & Temouri,2016). Second, we examine the impact of a firm's home-country tax system characteristics on the decision of multinational enterprises of EEs to set up tax-haven subsidiaries.

Based on a sample of 165 multinational firms from six emerging countries over the 2014–2016 period (495 firm-year observations), our results demonstrate that firms with greater investments in intangible assets have a higher likelihood of owning subsidiaries in tax havens. Regarding the home country-specific advantages, we provide evidence that firms are more likely to set up tax- haven subsidiaries when the home country has both lower required book-tax conformity and a worldwide approach. With respect to the host-country advantages, we show that the lower corporate-tax rate offered by tax havens constitutes a motivation for foreign MNEs to establish tax-haven subsidiaries.

This study contributes to the literature in several ways. First, we highlight the importance of studying the determinants of the decision of MNEs of EEs to set up tax-haven subsidiaries. Second, our research adds to the limited empirical literature on the firms of EEs behaviour. Along with Chari & Acikgoz, 2016, our study is among the first studies to provide detailed empirical evidence of the main determinants of the decision of multinationals of EEs to set up tax-haven subsidiaries, particularly, firm-level determinants and country-level ones. Finally, our research contributes to the extent literature interested in the impact of the characteristics of the home-country tax system on the likelihood of the MNEs to own subsidiaries in tax havens providing empirical evidence from firms domiciled in emerging countries, which has not been analyzed in the literature before.

The rest of this paper is organized as follows. In the next section, we provide an overview of the relevant theoretical framework and develop hypotheses on the determinants of setting up tax-haven subsidiaries. The subsequent section describes the research design. The next section presents the main empirical results. We conclude with avenues for future research in this area.

Given the impact of the disclosure of classified files from the law firms Apple by in 2017 (known as the ‘Paradise Papers’) and Mossack Fonseca in 2016 (known as the 'Panama Papers') on public finance of developed countries and also the emerging countries, the role of 'tax havens' in the world economy has gained increasing attention. However, tax havens offer multinational enterprises (MNEs) the ability to evade their tax payments and increase their after-tax income. On the other hand, the use of tax havens adversely affects the ability of many countries to raise tax revenues. The United Nations Conference on Trade and Development (UNCTAD 2015) focuses on developing countries and finds that these countries lose $70-120 billion in tax revenue annually. Moreover, the corporate tax revenue loss in India related to all tax havens used by MNCs could have been as high $40 billion or 2.3 per cent of the GDP in 2013 (Cobham & Jansky, 2017). According to Angel Gurría, the Secretary-General of the Organisation for Economic Co-operation and Development (OECD) the loss of tax revenues among developing economies is estimated to be three times higher than the international financial aid they receive (Bearak 2016). Additionally, the loss of tax revenues has a detrimental impact on the development of society, emerging governments which are affected by tax havens do not have enough money to spend on the public service, and thus, it widens the gap between the rich and the poor, worsening the state of inequality simultaneously. One of the essential factors of loss tax revenues is the institutional weakness in developing countries, which motivate large numbers of firms from these economies may continue to invest in tax havens to escape the grabbing hands of their governments (chari 2016).

In response to limit the loss of tax revenues and the comprehensive migration of profits to tax havens, especially after the Panama Paper leaks, many countries have extended their international tax policy rules with measures designed to curb profit shifting. The most important examples are base erosion, and profit shifting (BEPS) report and legislation are known as Controlled Foreign Corporation (CFC) rules. However, CFC rules are considered the vital tool for many countries for preventing the allocation of passive income to low-taxed jurisdictions as tax havens in order to protect the domestic corporate tax base, and BEPS' report is considered as a measure aiming to rebuild international tax transparency and restore fair competition ground (OECD 2018; United Nations 2016a, b).

Due a detrimental impact of a loss of tax revenues on the public finance of emerging markets and the burgeoning investments of emerging market firms into tax havens, the factors that motivate emerging markets firms to invest into tax havens must be exploring. Therefore, our study aims to offer a more comprehensive understanding of the determinants of the decision of firms of emerging economies (EEs) to set up tax-haven subsidiaries. In particular, we focus firstly on uncovering and identifying a set of associated firm-country-level factors leading the companies of EEs to undertake a tax-haven activity, which is based on the theoretical framework "firm-specific advantage–country-specific advantage" (FSA–CSA) developed by Rugman (1981) and modified by (Jones & Temouri, 2016). Secondly, we investigated how and what are the firm's home-country tax system characteristics which increased the propensity of EEs firms to invest in overseas tax havens.

We conduct our empirical analyses using a panel dataset that includes 165 multinational firms from six emerging countries over the 2014–2016 periods (495 firm-year observations). The panel data we have allows us to investigate the determinants of the propensity of firms from EEs to invest in tax havens using a probit model. Our results demonstrate that firms with greater investments in intangible assets have a higher likelihood of owning subsidiaries in tax havens. Regarding the home country-specific advantages, we provide evidence that firms are more likely to set up tax- haven subsidiaries when the home country has both lower required book-tax conformity and a worldwide approach. With respect to the host-country advantages, we show that the lower corporate-tax rate offered by tax havens constitutes a motivation for foreign MNEs to establish tax-haven subsidiaries.

Overall, our results contribute to the literature in several ways. First, we highlight the importance of studying the determinants of the decision of MNEs of EEs to set up tax-haven subsidiaries, by situating it in the emerging market. Along with Chari & Acikgoz, (2016), our study is among the first studies to provide detailed empirical evidence of the main determinants of the decision of multinationals of EEs to set up tax-haven subsidiaries, particularly, firm-level determinants and country-level ones. Second, our research contributes to the extent literature interested in the impact of the characteristics of the home-country tax system on the likelihood of the MNEs to own subsidiaries in tax havens providing empirical evidence from firms domiciled in emerging countries.

Our study should be of interest to tax policymakers and researchers curb tax avoidance by tax havens. In particular, our results suggest that increasing tax -rules enforcement by emerging governments, that creates accordingly, an equal competition between multinationals.

The rest of this paper is organized as follows. In the next section, we provide an overview of the relevant theoretical framework and develop hypotheses on the determinants of setting up tax-haven subsidiaries. The subsequent section describes the research design. The next section presents the main empirical results. We conclude with avenues for future research in this area.

Theoretical Framework and Hypotheses

Theoretical framework FSA/CSA

Abundant literature of international business (IB) has been widely developed in recent decades to provide explanations to the phenomenon of foreign direct investment (FDI) of a multinational. In fact, researchers in the field of FDI (Dunning, 1980; Rugman, 1981) have developed theories explaining FDI, in which multinational firms are internationalized. FDI theories have started with the study of the behaviour of MNEs and location problems have been added due to economic dynamics and practical observations in activities between MNEs and host countries. Moreover, (Popovici & C?lin, 2014) found that the expansion of FDI theories is due to the incorporation of the new variables on the location, i.e., the advantages of localization.

In the 1980s, the FSA-CSA framework was crystallized in the FDI theory. Alan Rugman developed the conceptual basis of the FSA/CSA matrix at the level MNE (Rugman, 1981). He created his version of internalization theory focusing on the firm-specific advantages held by a firm and thus defining the firm as the relevant unit of analysis. In addition to FSA, Rugman considered location, under the form of country-specific advantages, as an essential determinant for MNE decision-making, ultimately leading to his well-known FSA/CSA matrix (Narula & Verbeke, 2015). Internalisation theory (Buckley & Casson, 1976; Hennart, 1982; Rugman, 1981) is the dominant framework in the international business literature explaining the reasons behind which MNEs expand abroad. According to prior researchers (Liu & Wang, 2003; Xu, 2000), firms are more likely to expand abroad to add value not only for themselves but also for their host- country locations via technology transfer. Internalization theory is set at the firm level and focuses upon the strategic decision-making of the MNE. For this reason, internalisation theory is useful in this context because it demonstrates the heterogeneity of firm-level behaviour. Rugman (1981) suggested a differentiation between FSA as internal-business factors or management-decision factors and CSA as external business factors or environmental factors. More specifically, FSA highlight a firm's competitive strength, e.g., resulting from advantages in upstream (R&D) and/or downstream (marketing/customization) capabilities. In contrast, CSA was considered to refer to exogenous country-level factors (e.g., economy and culture) that ultimately influence international business (Collinson & Rugman, 2011).

In order to model a firm’s strategy in terms of setting up subsidiaries in tax havens, we adopt FSA– CSA framework initially established by Rugman’s (1981). In other words, we will analyze the determinants of the decision of multinational firms to establish subsidiaries in tax havens at the firm and country levels. Indeed, this framework is modified by Jones & Temouri, (2016) providing a new way of distinguishing between home-country specific advantages and host-country particular advantages.

Applying the FSA–CSA Framework to Tax-Haven Use

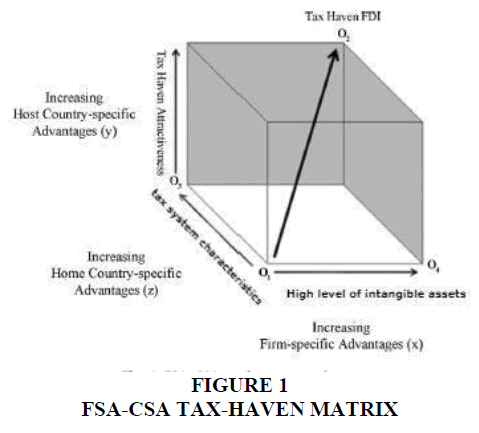

Figure 1 illustrates a three-dimensional cube of the FSA-CSA Rugman’s matrix (1981). It is modified by Jones & Temouri, (2016). It identifies the three following axes: (1) the (x) axis shows FSA manifested in terms of large levels of intangible assets; (2) the (z) axis shows home country-specific advantages in terms of tax-system characteristics; and (3) the y-axis shows host country-specific advantages in terms of tax-haven attractiveness.

Firms that are positioned or are moving towards the origin (O2) are more likely to develop dynamic organizational capabilities (Teece et al., 1997), and maintaining an effective strategy. They are likely to be international in nature, and taking advantage of complex financial structures, such as tax haven FDI, in order to maintain a competitive advantage. We are going now to discuss each set of the advantages in turn, within the context of a tax haven- FDI, and develop several testable hypotheses.

Development of Hypotheses

Firm-Specific Advantages (FSAs)

FSAs are the main factors frequently used to explain the decision of the MNEs to set up tax-haven subsidiaries. In their seminal article, Jones & Temouri (2016) emphasise the importance of higher-order FSA in terms of intangible assets on the likelihood of owning subsidiaries in tax havens. Several authors have focused on the definition of firm-specific advantages; Rugman (2005) defines them as a “unique capability proprietary to the organization…built upon product or process technology, marketing, or distribution skills”. In fact, a MNE has a set of FSAs which are proprietary knowledge, arisen from technology, marketing, technological know-how, corporate culture, innovative capabilities, brand name, capital, access to financing, process efficiencies, size (economies of scale and scope) and managerial expertise (Rugman, 1981; Verbeke, 2013).

In a similar vein, Siripaisalpipat & Hoshino (2000) consider that FSAs refer to the advantages derived from specific assets, particularly intangible assets and capabilities, bringing a superior competitive position to the firm. Thus, Contractor et al., (2016) define parent firm or company-wide intangible assets as technology or proprietary knowledge, intellectual property (IP) such as patents or brands, internal organizational routines (Nelson & Winter, 2002), production processes (Markusen, 1995), and the firm’s relationships and reputation. These assets (i) are distinctive or unique to the firm, (ii) intangible, (iii) proprietary: can be confined or internalized within the firm’s boundary, and (iv)transferable to foreign affiliates so as to extend the multinational company’s competitiveness to the foreign nation.

Also, the FSAs coming mainly from the assets held by multinationals are generally non-financial (Barney,1991) such as patents, trademarks, advanced production techniques and entrepreneurial skills. In contrast, Jones & Temouri (2016) have highlighted the importance of FSAs giving rise to financial ownership advantages.

In order to illustrate a financial-ownership advantage giving a MNE the ability to reap the rewards of investing in a tax haven, the firms will use financial mechanisms- such as tax havens-to extract as much value as possible to create further competitive advantage (Jones & Temouri, 2017). Clearly, MNEs prefer to transfer rights, patents, trademarks, licences and sub-licences to low-tax jurisdictions, and receive payments for these ‘intangible assets’ from related companies in non-tax-haven countries (OECD, 2013). However, firms have taken advantage of the transfer-pricing aggressiveness through the transfer of high-value intangible assets (e.g. R&D and intellectual property) to low-tax jurisdictions such as tax havens. Because many intangible assets are difficult to estimate, the payments (e.g. royalties) attributed to intangible assets are difficult to value (Gravelle, 2009).

There are two main strands in the academic literature focusing on the role of intangibles assets - such as R & D and trademarks-in terms of the likelihood of firms to use tax havens.

The first strand includes several survey papers presenting various case studies and bivariate statistics. Sikka & Willmott (2010) discuss a number of interesting cases of different types of industries where MNEs have taken advantage of transfer pricing via the use of tax havens. They describe in detail the Enron Affair of 2001 and the collapse of WorldCom in 2002 and also identify cases involving the pharmaceutical industry and the motor industry as GlaxoSmithKline and Honda, respectively. Dyreng et al. (2008) find, using univariate analysis, that the more R & D-intensive firms are, the more likely tax-avoidance schemes are used.

The second strand of literature deals with econometric evidence. Desai et al., (2006) find that US-parent companies tending to use intra-firm trade heavily, and having high R & D to sales ratios are more likely to invest in tax havens. They conclude that the rising intensity of MNEs and the growing volume of world trade between related parties imply that the demand for tax-haven operations may grow over time.

Using European data, Dischinger & Riedel (2011) investigate whether multinational companies have an incentive to transfer intangible assets to subsidiaries located in countries with relatively low tax rates. Their findings indicate that the lower the corporate -tax rates in a subsidiary location are the higher the level of intangible assets is.

Moreover, Richardson & Taylor (2015) examine the income-shifting incentives to use tax haven, using U.S. Multinational firms. The document that there is a positive association between intangible assets and tax -haven utilization. These findings suggest that firms with greater investments in intangible assets are more likely to utilize a tax-haven incorporated firm. Similarly, Taylor et al., (2015a) who are also interested in the US context, they find that the use of intangible assets is important factors that assist firms in obtaining tax benefits via transfer-pricing aggressiveness. Furthermore, Taylor et al., (2015b) examines the major determinants of tax-haven utilization, using a sample of 200 Australian publicly-listed firms over the 2006–2010 periods. They document that the level of intangible assets is an essential determinant of tax- haven utilization. Additionally, the authors find that firms taking part in transfer pricing aggressiveness and investment in intangible assets concurrently are more likely to utilize a tax-haven incorporated firm.

More recently, Jones & Temouri (2016) analyze the determinants of the decision of MNEs to locate subsidiaries in tax havens, using a large sample of firms from 12 OECD countries for a period covering 2002-2010. They acknowledge that the technological intensity of multinational manufacturing and service companies with significant levels of intangibles is more likely to have subsidiaries in tax havens. In particular, these authors have suggested that there are strong incentives for high-tech companies to transfer their valuable intellectual property to tax havens in order to minimize taxation both in the home country and in the country of origin in subsidiaries located in countries that are not classified as tax havens.

In summary, these studies find consistent evidence that R & D and/or the size of a firm’s intangible assets to total assets are key drivers of tax avoidance, through of the transfer pricing aggressiveness or the incidence of the use of tax haven subsidiaries. This is the case when analyzing both single -country firms, and MNEs from developed countries, but not firms from developing ones.

We rely the studies on these single -country and developed countries via exploiting a sample of MNEs constituted by a set of developing countries. This allows us to generate our first hypothesis to determine whether the FSAs in terms of intangible assets affect the likelihood of locating subsidiaries in tax havens. Our primary hypothesis is formally stated in the alternative form as follows:

H1. Firms with greater investments in intangible assets are more likely to set up tax-haven subsidiaries.

Home Country-Specific Advantages

It is worth emphasizing that a company is committed to establish subsidiaries in tax havens not only by using its FSAs but also by taking advantage of CSAs from countries of origin or host countries. Country-level factors are crucial determinants, particularly at the home-country institutional level from both the perspective of the home country where the FDI originates and the host country where FDI is received.

The IB literature is interested in country-of-origin-specific benefits; specifically, the institutional quality of the country of origin as an important determinant of a multinational's decision to locate subsidiaries in tax havens. For example, Chari & Acikgoz (2016) document that the low institutional quality motivates the investment of the enterprises of EEs in tax havens in the country of origin (including corruption, the inefficiency of government).

On the other hand, the tax literature focuses on the specific advantages of the country of origin, specifically the tax-system characteristics. Moreover, the study by Atwood et al., (2012) examines whether the three tax-system characteristics -namely the required book conformity, the worldwide versus territorial approach and perceived strength of tax enforcement-influence tax avoidance. The document that companies avoid more taxes, on average, when the country of origin has a territorial approach and a lower level book-tax conformity.

In a similar way, another study conducted by Jaafar & Thornton (2015) provides an analysis of tax avoidance through affiliates in tax havens via the examination of the impact of investment in tax havens on the relative tax burden, using private and public-listed companies domiciled in Europe. This study provides evidence that tax havens are used as a tax-avoidance strategy by of publicly-listed and privately-held firms domiciled in Europe. Also, the results indicate that tax-system characteristics (i.e., worldwide approach and book-tax conformity) are prominent determinants of the corporate tax burden.

On the basis of these studies, we try in our research work to enrich the IB and accounting literature through analyzing home-country tax-system characteristics, the territorial or worldwide approach and book-tax conformity, as determinants of the decision of MNEs to locate subsidiaries in tax havens as a tax-avoidance strategy.

Worldwide Versus Territorial Tax System

The first tax -system characteristic that we tend to examine is the nature of the tax system in the home country. According to prior studies (Hines, 2006; Maffini, 2010; Markle and Shackelford, 2011; Markle and Shackelford, 2012a; Atwood et al., 2012; Jaafar & Thornton, 2015), the nature of the tax system is seen as the significant tax-system determinant. In an increasingly globalized economy, firms often grow beyond the borders of their home country. Therefore, countries must define rules determining the taxation of foreign income. In fact, foreign income is taxed differently from national income (Markle, 2015).

Generally, a country can adopt either a worldwide or a territorial system so that it can determine corporate taxes. For parent firms located in countries with a worldwide tax system, income earned by foreign subsidiaries is potentially subject to an additional tax in the home country when it is repatriated via dividend payments. This extra tax is not imposed on parent firms located in countries with the territorial-tax system.

Under the territorial approach, income received from foreign subsidiaries in the form of dividend payments is partially or totally excluded from the parent firm’s taxable income. This means that territorial tax regimes do not tax the income that corporations earn in foreign countries. In other words, only income earned within the country's borders (national income) is taxed (Atwood et al., 2012; Jaafar & Thornton, 2015).

On the other hand, countries with a worldwide tax system impose the same tax rates on foreign income and domestic income (Blouin & Krull, 2009). Furthermore, dividends received from foreign subsidiaries are included in the parent firm’s taxable income, but foreign income taxes paid can be claimed as either a deduction or a credit (subject to limitations) so that they can mitigate the double taxation of foreign-source income (Atwood et al.,2012).

Proponents of adopting a territorial approach in the U.S setting consider that U.S. multinationals are at a competitive disadvantage, compared to multinationals headquartered in the territorial -ax jurisdictions, because of the additional taxes imposed in a worldwide-tax system (Hines, 2006; Hubbard, 2006; Ousterhuis, 2006). Therefore, firms can reduce their tax burden through locating their operations or shifting their profits to jurisdictions with low or no corporate taxation (Blouin & Krull, 2009). Besides, the territorial system avoids double taxation via exempting foreign income from the income tax of the home country (Markle,2015). Furthermore, the territorial design thus equalizes the tax costs between international competitors operating in the same jurisdiction. (Philip, 2012).

In terms of the econometric evidence, Hicks et al. (2009) argue that parent firms in countries with a territorial tax system can achieve greater tax benefits from shifting income to low-tax jurisdictions because the dividends received from foreign subsidiaries are permanently exempt from tax in the home country. However, in countries with a worldwide tax system, shifting income merely defers home-country tax. Consistent with this, Markle (2010) finds no difference in income shifting among foreign affiliates of firms in worldwide tax systems that consistently reinvest earnings abroad, but firms in territorial-tax systems do not. Based on a sample of firms from 22 countries, Atwood et al. (2012) examine whether the three tax-system characteristics prevent firms from avoiding taxes. They find that multinationals are more susceptible to avoid more taxes, on average, when the home country adopts the worldwide approach.

However, opponents of adopting a territorial approach in the U.S. corporations argue that U.S. multinational firms have several options available to minimize or eliminate the perceived disadvantage related to the worldwide-tax system. For example, firms can defer paying U.S. tax by delaying payments of dividends to the U.S. parent. This deferral can be indefinite if the earnings are reinvested in the foreign country in which they are generated, or invested in other foreign countries (Atwood et al., 2012). When earnings are designated as permanently reinvested abroad, the potential future-tax liability is not recorded in the financial statements either (Accounting Standard Codification Section 740). Indeed, the worldwide tax system avoids double taxation by providing credits for taxes paid to foreign governments, which reduces the tax debt of the country of origin (Markle, 2015). In addition, the overarching purpose of the worldwide design is to “create equality among resident taxpayers” so as not to distort the investment decisions of domestically headquartered companies toward low-tax countries (Philip, 2012).

In terms of the econometric evidence, Lokken (2006) and Mandolfo (2007) argue that US multinationals may have the opportunity to use international tax-planning strategies (using carry-forward provisions, tax havens, transfer pricing, tax credit, etc.) so that they actually pay less tax than they would do under a territorial approach. In addition, empirical results derived from Jaafar & Thornton (2015) document that private and public firms located in countries adopting the global approach with subsidiaries in tax havens have a lower tax burden. Concerning the above, we expect multinationals located in countries are more susceptible to establish subsidiaries in tax havens compared to multinationals domiciled in countries using the territorial approach. Consequently, we predict multinationals located in countries using the worldwide approach have a higher probability to establish subsidiaries in tax havens compared to multinationals domiciled in countries using the territorial approach. Therefore, we make the following assumption:

H2: Firms in home countries with a worldwide approach are more likely to set up tax-haven subsidiaries compared to those located in countries with a territorial approach.

Required Book-Tax Conformity

The second tax system characteristic that we examine is the level of needed book-tax conformity in the firm's home country. Book-tax conformity pertains to the degree to which book and tax accountings are aligned (Goncharov & Zimmermann,2006). Thus, these authors argue that higher required book-tax conformity is consistent with a common accounting and tax system, in which financial accounting is directly used to calculate taxable income. Moreover, they argue that with lower required book-tax conformity, both accounting and tax systems are separated.

In fact, firms domiciled in jurisdictions with a higher degree of financial-tax reporting conformity may have fewer opportunities to avoid taxes without decreasing reported earnings because financial-accounting policy choices are directly linked to taxable income. In other words, financial-tax reporting conformity reduces firms ‘incentives to engage in upward earnings manipulations since it also increases tax burdens (Coppens & Peek, 2005; Desai & Dharmapala, 2009; Lee & Swenson, 2012). Furthermore, Atwood et al. (2012) argue tax authorities act as an additional-enforcement mechanism of financial reporting when higher conformity between reported earnings and taxable income is required. Moreover, Desai (2005) argues that these constraints (decreased opportunity and increased monitoring) on managers would result in less "creative accounting" activities if required book-tax conformity increased in the U.S. In this context, the Joint Committee on Taxation (2006) supports that managers may implement other tax-reducing strategies such as locating more operations in tax havens, or shifting more income into lower tax jurisdictions. These strategies create differences between reported income and taxable income. However, these alternative tax-avoidance strategies are more costly to implement than strategies creating differences between reported earnings and taxable income (Atwood et al., 2012).

Prior studies have examined the effect of book-tax conformity on various variables (e.g. tax avoidance, tax burden, tax shelte). Others have explored the relationship between tax avoidance and book-tax conformity. According to Desai (2005), book-tax conformity is negatively associated with tax avoidance.

Using a cross-country dataset, Atwood et al. (2012) examine the effect of tax-system characteristics on tax avoidance. They report that firms engage in less tax avoidance when their home countries have higher book-tax conformity. While Lee & Swenson (2012) find that book-tax conformity rules increase tax burdens of publicly traded firms domiciled across the European Union. Jaafar’s & Thornton’s recent study (2015) used 148 private and public firms in 22 European countries during the period 2001-2008. The authors found that private companies with subsidiaries in domiciled tax havens and originated from low book-tax conformity countries benefit from low effective tax rates.

Consistent with results derived from previous empirical findings, we expect a negative relationship between the decision to set up subsidiaries in tax havens seen as a tax avoidance mechanism, and the required book-tax conformity. We hypothesize the following:

H3: Firms in home countries with low required book-tax conformity are more likely to set up tax-haven subsidiaries.

Host-Country Specific Advantages

It not sufficient for firms to have only FSAs if they tend to use tax-haven subsidiaries, but also they should take advantage of the CSAs of the countries of origin as well as those of the host countries. Indeed, the host country-specific advantages are essential determinants to help MNEs invest in tax havens (Jones & Temouri, 2016). In fact, tax havens do not share the same characteristics of countries as those owned by the country of origin. They have other specific characteristics that are of value to multinational companies wishing to locate a subsidiary in tax havens.

The OECD defines four-criterion tax havens:

1. The tax system in the respective country provides zero or low nominal tax rates.

2. There is no effective information exchange with other countries.

3. There is a lack of or inadequate transparency with regard to disclosure requirements

4. Strict laws regarding the protection of bank secrecy

Tax havens are countries or territories with small economies and low populations. They typically attract a lot of amounts of investment relative to the size of their own economy and population (Konrad & Stolper, 2016). As a result, they have benefited from extensive foreign investment, and for the most part, they have experienced very rapid economic growth over the last 25 years (Hines, 2005).

Thus, tax havens are seen jurisdictions having very low or insignificant corporate-tax rates, and having laws and regulations increasing the opacity of identity of firms and investors (Gravelle, 2013; Hines, 2010). They also have good governance in order to protect investors (Dharmapala & Hines, 2009). They offer firms the possibility to minimize their taxable base, to escape regulatory constraints, and to conceal a high level of indebtedness, using multiple kinds of stratagems (Chavagneux & Palan, 2012). As a result, companies with subsidiaries in tax havens could have lower tax burdens than those without tax havens because of the benefits of tax havens.

Previous studies have focused on the impact of the tax rate on FDI in tax havens. Likewise, Jones & Temouri (2016) examine the firm and country-level factors leading MNEs to establish subsidiaries in tax havens over the period 2002 to 2010. The empirical results of this study have shown that the corporate tax rate imposed by OECD countries has an impact on the decision to locate subsidiaries in tax havens. Also, Chari & Acikgoz (2016) examine the motives of emerging economy companies to invest in tax havens. They have shown that the international expansion of multinational enterprises of the emerging economy in tax havens is motivated by a lower tax rate in the host country.

Based on these studies, we argue that lowering taxes is an important reason for businesses to invest in tax havens. Our hypothesis is conducted as follows:

H4: Multinational companies are encouraged to establish subsidiaries in tax havens in order to benefit from a low corporate tax rate.

Research Design

Sample Selection

Our initial sample consists of 309 companies listed on the stock exchange of six emerging markets which are as following; Brazil (Bovespa), Russia (RTSI), India (Nifty 100), Malaysia (KLCI), Turkey (BIST 30) and South Africa (FTSE/JSE All Share) for which the data of firms listed on the stock exchange index is available on Datastream over the period of 2014 - 2016. We have eliminated firms with no foreign subsidiaries. Moreover, we have extracted firms whose annual reports are not available. This reduces our final sample to 165 companies or 495 observations for the period (2014-2016) (Table 1).

| Table 1 Summary of the Sample Selection Process | ||

| Number of companies | Number of observations | |

| Initial sample | 309 | 927 |

| Firms with no foreign subsidiaries | 72 | 216 |

| Firms with no available annual reports | 72 | 216 |

| Final sample | 165 | 495 |

Measures of the Variables

Dependent Variable

Our dependent variable is represented by the determinants of MNEs decision to set up tax-haven subsidiaries (Tax-Haven FDIi). Tax-Haven FDIi is a dichotomous variable taking value 1 if the firm has at least one-subsidiary company incorporated in an OECD-listed tax haven (2011), and 0 otherwise. The data for this variable are collected from the annual reports of multinational companies in emerging countries.

Explanatory Variables

The independent variables are denoted by intangible assets (INTANG), worldwide tax system (WWTS), book-tax conformity (BTaxC) and statutory corporate-tax rate (Tax).

INTANG is used as a proxy measuring the level of FSAs in each MNE, and is measured by the natural logarithm of intangible assets. This measure is used by Jones & Temouri, (2016).

We use an indicator variable (WWTS) to distinguish between firms in home countries with a worldwide approach or a territorial one so that they can tax foreign income. We code home countries with a worldwide approach as 1 if the firm is headquartered in a jurisdiction with a worldwide tax system, and 0 otherwise. This measure consistent with prior research done by Jaafar & Thornton, (2015). Brazil, Russia, India and South Africa are characterized by a worldwide-tax system, but Malaysia and Turkey have a territorial tax system.

We use the measure of required book-tax conformity developed by Atwood et al. (2010). This measure is based on the conditional variance of current tax expense (CTE) for a given level of pre-tax book income (PTBI) in a given country-year (i.e., Var(CTEjPTBI)). This measure captures the required level of book-tax conformity in the firm’s home country. Countries with a lower conditional variance are presumed to allow less flexibility in the reporting of taxable income for a given level of reported pre-tax earnings, and thus having higher required book-tax conformity. To compute BTaxC, we use the conditional variance of current-tax expense in accordance with the following model estimated by country-year:

CTE i = β0 + β1 PTBIt + β2 ForPTBIt + β3 DIVt +εit,

Where CTE is current-tax expense, including both domestic and foreign current-tax expenses; PTBI is pre-tax book income; ForPTBI is the estimated foreign pre-tax book income (foreign tax expense/total tax expense * PTBI); DIV is total dividends, and e is the error term. We scale CTE, PTBI, ForPTBI and DIV by total assets.

Our measure of the book-tax conformity is calculated as the scaled ranking of the root mean- squared errors (RMSEs) obtained from country-year estimates of Eq. (1). The RMSE from Eq. (1) Represents the standard error of CTE for a given level of PTBI which not explained by the model. The RMSEs provide an indication of the overall amount of discretion that managers have to report different book income and taxable income. They are ranked so that countries with higher rankings in a given year have higher required book-tax conformity using descending ranks, the highest RMSE in each year is ranked 0, and the lowest is ranked n - 1 where n is the number of countries included in that year.

Finally, we obtain data on the statutory corporate tax rate (Tax Rate) from a KPMG LLP online summary, following Atwood et al. (2012), and Jones & Temouri(2016).

Control Variables

Our control variables are represented by firm size (SIZE), leverage (LEV) and cash flow operating (CFO).

SIZE is included in our regression model as a control variable. Graham & Tucker (2006) and Taylor et al., (2015b) find evidence that larger firms are more likely to have a propensity to use tax-haven subsidiaries. SIZE is measured as the natural logarithm of total assets, following Atwood et al. (2012); Richardson & Taylor,(2015); Taylor & Richardson,(2012); Taylor et al.,2015b, and Jaafar & Thornton (2015). We expect SIZE to have a positive sign.

We incorporate LEV in our regression model as a control variable as it is expected that firms with higher debt-to-equity ratios tend to be more likely to have a propensity to use tax- haven subsidiaries (Taylor et al., 2015b). LEV is measured as long-term debt divided by total assets. Following previous studies, we expect LEV to have a positive sign.

Finally, CFO is incorporated in our regression model to control the flow of funds from operations and firm performance (Dechow et al., 1998). Jones & Temouri (2016) find that firms with larger cash flow are also more likely to set up tax-haven subsidiaries. CFO is measured as the natural logarithm-cash flow from operations. We expect CFO to have a positive sign in line with prior studies.

Eventually, country fixed effects are introduced in our model to control for the home country. Table 2 summarizes the definitions of the variables used in our analyses.

| Table 2 Variables Definitions | ||

| Variable | Description | Data source |

| TAXHAV FDI | A dummy variable that is coded as 1 if the firm has at least one subsidiary company incorporated in an OECD-listed tax haven, and 0 otherwise; | Annual reports |

| INTANG | Is measured by the natural logarithm of intangible assets; | Datastream |

| WWTS | Set to 1 if a firm is headquartered in a jurisdiction with a worldwide tax system and 0 otherwise; | Atwood et al. (2012) and Markle(2015) |

| BTaxC | Scaled ranking of the RMSEs obtained from country-year estimates of Eq. (1), where the scaled ranking value ranges between 0 and 1, and a higher value corresponds to higher book-tax conformity; | Datastream |

| TaxRate | The statutory corporate tax rate | KMPG |

| LEV | Is measured as long-term debt divided by total assets. | Datastream |

| SIZE | Is measured as the natural logarithm of total assets. | Datastream |

| CFO | The natural logarithm-cash flow from operations | Datastream |

Base-Regression Model

Our base-regression model used to examine the major determinants of MNEs’ decision to set up tax- haven subsidiaries are represented as follows:

TAXHAV FDI i = β0 + β1 INTANGit + β2 WWTSit + β3 BTaxCit + β4 TaxRate it +β5 LEVit + β6 SIZEit + β7 CFOit +Country fixed effects+εit

where: i = firms 1–165; t = financial years of 2014–2016;

TaxHavenFDIi = 1 if a MNE has at least one subsidiary company incorporated in an OECD-listed tax haven (2011), and equals zero otherwise;

INTANG it = the natural logarithm of intangible assets;

WWTS=1 for firms in countries with the worldwide-tax system, and 0 for firms in countries with territorial tax systems;

BTaxC it = proxy of the level of required book-tax conformity, following Atwood et al. (2010);

TaxRate it =the statutory-corporate tax rate in the home country;

SIZE = the natural logarithm of total assets;

LEV = the long-term debt divided by total assets;

CFO =the natural logarithm cash flow from operations;

and e = the error term.

Empirical Results

Summary Statistics

Table 3 reports the descriptive statistics for our dependent variable (TAXHAV FDI), independent variables (INTANG, WWTS, BTaxC, TaxRate) and control variables (CFO, SIZE, LEV). Specifically, the dependent variable (THAVFDI) has a mean of 0.585 showing that approximately 58.8% of the sample firms have at least one-subsidiary firm incorporated in countries listed on an OECD (2011) tax haven. For the independent variables, we note that 75.7 per cent of our sample observations are from countries with a worldwide tax approach. The mean, median and range of the control variables are also reported in Table 2.

| Table 3 Descriptive Statistics | ||||||||

| Variable | Obs | Mean | Std. dev. | Q1 | Median | Q3 | MIN | MAX |

| TAXHAV FDI | 495 | 0.585 | 0.493 | 0 | 1 | 1 | 0 | 1 |

| INTANG | 495 | 15.407 | 1.907 | 14.072 | 15.621 | 16.934 | 12.082 | 18.186 |

| WWTS | 495 | 0.757 | 0.428 | 1 | 1 | 1 | 0 | 1 |

| BTaxC | 495 | 1.872 | 1.834 | 0 | 1 | 4 | 0 | 5 |

| TaxRate | 495 | 0.280 | 0.056 | 0.200 | 0.280 | 0.340 | 0.200 | 0.340 |

| CFO | 495 | 14.827 | 4.465 | 14.194 | 15.939 | 17.606 | 0.368 | 22.170 |

| Size | 495 | 18.758 | 2.131 | 17.381 | 18.711 | 20.286 | 3.439 | 24.030 |

| LEV | 495 | 26.079 | 17.472 | 11.730 | 26.630 | 39.530 | 0.060 | 59.130 |

Correlation Matrix

Table 4 reports the Pearson pairwise correlations of the independent variables used in our empirical regressions. The results show that only moderate levels of collinearity exist between our explanatory variables1. Specifically, the highest correlation coefficient is between WWTS and TAXRate of 0.5849 (p < 0.01). Additionally, we compute variance inflation factors (VIFs) when estimating our base regression model to test the signs of multicollinearity between the explanatory variables. We document that VIF values related to our independent variables do not exceed the value of 5. We conclude, therefore, that our model does not suffer from a multicollinearity problem.

| Table 4 Correlation Matrix | |||||||

| Variable | INTANG | WWTS | BTaxC | TaxRate | LEV | CFO | Size |

| INTANG | 1 | ||||||

| WWTS | 0.474*** | 1 | |||||

| BTaxC | -0.097** | -0.502*** | 1 | ||||

| TaxRate | -0.170*** | -0.653*** | 0.630*** | 1 | |||

| LEV | 0.200*** | 0.041 | 0.203*** | -0.077* | 1 | ||

| CFO | 0.256*** | 0.055 | -0.217*** | -0.021 | -0.272*** | 1 | |

| Size | 0.587*** | 0.362*** | -0.093** | -0.160*** | -0.005 | 0.494*** | 1 |

Regression Results

Table 5 presents our probit-regression results related to the major determinants of tax- haven FDI.

| Table 5 Regression Results | ||||

| Dependent variable : TAX HAV FDI | ||||

| Variable | Hypo. | Sig | Coef. | Z |

| INTANG | H1 | + | 0.162*** | 2.72 |

| WWTS | H2 | + | 3.674* | 1.76 |

| BTaxC | H3 | - | -0.743** | -2.11 |

| TaxRate | H4 | + | 0.695** | 2.05 |

| Size | 0.197*** | 3.27 | ||

| LEV | 0.007* | 1.40 | ||

| CFO | -1.124*** | -3.29 | ||

| Country fixed effects | Yes | |||

| Constant | ? | -0.231 | -0.04 | |

| Wald chi2 | 194.20 | |||

| Prob > chi2 | 0.0000 | |||

| Observations | 495 | |||

| Log likelihood | -110.455 | |||

Regarding firm-specific advantages, the regression coefficient of INTANG is positive and significantly associated with tax-haven FDI (p < 0.05), providing support for H1. Intangible assets are used as a means of transferring profits internationally (Dyreng et al., 2008) via the use of tax havens, and they are seen as crucial factors of tax avoidance by using subsidiaries located in tax havens (Jones & Temouri, 2016; Taylor et al., 2015b).

With reference to the results regarding the home country-specific advantages measured through the nature of the tax system (worldwide versus territorial approaches) and required book-tax conformity, the regression coefficient of WWTS is positive, and significantly associated with tax-haven FDI (p < 0.01). This suggests that firms in home countries with a worldwide approach are more likely to set up tax-haven subsidiaries than firms domiciled in countries with a territorial approach, so H2 is supported. These findings are not consistent with those of Atwood et al. (2012) providing that firms in home countries with a worldwide approach engage in less tax avoidance than do firms in home countries with a territorial approach because of the additional taxes imposed in a worldwide tax system. Our results are consistent with those of Lokken (2006) and Mandolfo (2007). These authors find that firms resident in countries with worldwide tax systems does not use sophisticated international tax-planning techniques(using tax havens)to produce better results (i.e., that avoid more taxes) on average than those produced by firms resident in countries with territorial tax systems. However, our findings are supported by a recent study (Jaafar & Thornton, 2015) suggesting that multinationals with tax-haven subsidiaries resident in countries with worldwide-tax systems have lower effective tax rates than multinationals with tax-haven subsidiaries resident in countries with territorial-tax systems.

Consistent with H3, the decision to set up tax-haven subsidiaries is negatively associated with BTaxC, so H3 is supported by the results. Our results suggest that firms in home countries with lower required book-tax conformity are more likely to set up tax-haven subsidiaries. This can be explained by the fact that companies can use subsidiaries in tax havens as a tax-reduction strategy because the accounting-policy choices are not directly related to taxable income, and the tax authorities do not have the legal power to verify the taxable income. This overall result is consistent with Atwood et al., (2012), who find firms in home countries with lower required book-tax conformity engage in higher tax avoidance. Furthermore, our result is consistent with empirical results of Jaafar & Thornton (2015) showing that private firms with tax havens domiciled in jurisdictions with a low degree of financial and tax conformity enjoy lower tax burdens.

Regarding the host-country specific advantages, the coefficient estimate for the top rate of corporate tax is positive and significant, providing support for Hypothesis 4. The result gives the impression that higher tax rates in home countries drive MNEs abroad. Regardless of the corporate tax rate, MNEs will adopt such a strategy when the host country has a low or zero tax rates and a high degree of secrecy. That’s why tax havens are proved to be incredibly attractive.

It’s also important to discuss the control variables. The estimates of cash flow are not as expected. These findings are not supported by Jones & Temouri (2016), suggesting that MNEs with larger cash flow are more likely to have a propensity to use tax-haven subsidiaries. Nevertheless, we find that the firm size positively influences the decision of MNEs to set up tax-haven subsidiaries. Large firms are less likely to set up tax-haven subsidiaries than small firms do. This finding is similar to Taylor et al., (2015b). Additional insights also suggest that MNEs with higher debt-to-equity ratios tend to have more propensities to use tax-haven subsidiaries. These findings are supported by Taylor et al., (2015b).

Conclusion

Globalization has vastly expanded the opportunities for MNEs to build complex- international value chains, and locate subsidiaries across the world to add value. These opportunities include operating subsidiaries for tax purposes. We examine, in this study, the determinants of publicly-listed firms located in emerging markets to set up subsidiaries in tax havens. To the best of our knowledge, this is the first study to offer a comprehensive analysis of tax avoidance by means of tax-haven affiliates of firms, regardless of their listing status. Our principal-regression results indicate that MNEs with high levels of intangible assets are more likely to have a tax-haven presence. With regard to the home-country specific advantages, we provide evidence that firms are more likely to set up tax-haven subsidiaries when they are located in countries characterized by lower required book-tax conformity and a worldwide tax system. With respect to the host-country advantages, we show that the lower corporate-tax rate offered by tax havens constitutes a motivation for foreign MNEs to establish tax haven- subsidiaries. Furthermore, our findings indicate that the firm's home-country characteristics (i.e., a worldwide-tax reporting system, and financial and tax conformity) are important determinants of MNEs’ decision to set up tax haven-subsidiaries.

Our study extends the current literature on the international tax-avoidance practices of firms, with specific reference to set up tax-haven subsidiaries by publicly-listed emerging firms. We add to the current literature by examining the impact of firm's home-country tax system characteristics on the decision to set up subsidiaries in tax havens, which has not been explored in the literature before.

This study is subject to several limitations. First, the sample is drawn from publicly-listed emerging firms because data are not available. Second, it is not possible to determine the importance of a particular tax-haven incorporated subsidiary to the corporate group as a whole. Third, it is conceivable that firms do not disclose all of their subsidiaries (including tax-haven incorporated subsidiaries) in the annual report owing to brevity, economic importance, transparency and reputation.

Future researches on tax havens could investigate several issues. Firstly, future studies could explore the impact of tax-haven use on firm performance in terms of profitability and/or efficiency gains. Secondly, they could examine the effect of transfer pricing, an interaction term between transfer pricing and intangible assets, withholding taxes, performance-based management remuneration and multinationality on the decision of MNEs of EEs to set up tax- haven subsidiaries. Finally, they could investigate the association between the firm’s home-country tax system characteristics (i.e., a worldwide tax -reporting system and financial and tax conformity) and MNEs decision to set up tax-haven subsidiaries in other countries around the world, especially in developed countries.

End Notes

1According to Hair et al. (2006), if a value of the correlation coefficient of a pair of explanatory variables lies between _ 0.25 and _ 0.75, there is a moderate level of collinearity between the two variables.

References

- Al Baaj, Q.M.A., Al Marshedi, A.A.S., & Al-Laban, D.A.A. (2018). The impact of electronic taxation on reducing tax evasion methods of iraqi companies listed in the Iraqi Stock Exchange. Academy of Accounting and Financial Studies Journal, 22(4), 1-13.

- Al Karaawy, N.A.A. (2018). The impact of making tax digital application on the accounting costs. Academy of Accounting and Financial Studies Journal, 22(3).

- Al Karaawy, N.A.A., & Al Baaj, Q.M.A. (2018). Taxation of international business organizations. Academy of Accounting and Financial Studies Journal, 22(1), 1-16

- Atwood, T., Drake, M.S., Myers, J.N., & Myers, L.A. (2012). Home country tax system characteristics and corporate tax avoidance: International evidence. The Accounting Review, 87(6), 1831-1860.

- Atwood, T.J., Drake, M.S., & Myers, L.A. (2010). Book-tax conformity, earnings persistence and the association between earnings and cash flows. Journal of Accounting and Economics, 50(1), 111-125.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Blouin, J., & Krull, L. (2009). Bringing it home: A study of the incentives surrounding the repatriation of foreign earnings under the American Jobs Creation Act of 2004. Journal of Accounting Research, 47.

- Buckley, P.J., & Casson, M. (1976). The future of the multinational enterprise. London: Macmillan.

- Buckley, P.J., Forsans, N., & Munjal, S. (2012). Host–home country linkages and host–home country specific advantages as determinants of foreign acquisitions by Indian firms. International Business Review, 21(5), 878-890.

- Buckley, P.J., Sutherland, D., Voss, H., & El-Gohari, A. (2015). The economic geography of offshore incorporation in tax havens and offshore financial centres: The case of Chinese MNEs. Journal of Economic Geography, 15(1), 103–128.

- Chari, M., & Acikgoz, S. (2016). What drives emerging economy firm acquisitions in tax havens? Journal of Business Research, 69(2), 664-671.

- Chavagneux, C., & Palan, R. (2012). Les paradis fiscaux. Paris: Editions La découverte.

- Collinson, S.C., & Rugman, A.M. (2011). Relevance and rigor in international business teaching: Using the CSA-FSA matrix. Journal of Teaching in International Business, 22(1), 29-37.

- Contractor, F., Yang, Y., & Gaur, A.S. (2016). Firm-specific intangible assets and subsidiary profitability: The moderating role of distance, ownership strategy and subsidiary experience. Journal of World Business 51(6), 950-964.

- Coppens, L., & Peek, E. (2005). An analysis of earnings management by European private firms. Journal of International Accounting, Auditing and Taxation, 14(1), 1-17.

- Dechow, P.M., Kothari, S.P., & Watts, R.L. (1998). The relation between earnings and cash flows. Journal of Accounting and Economics, 25, 133-168.

- Deng, Z., Yan, J., & Sun, P. (2019). Political status and tax haven investment of emerging market firms: Evidence from China. Journal of Business Ethics, 1-20.

- Department of the Treasury. (2007). Report to the Congress on Earnings Stripping, Transfer Pricing and US Income Tax Treaties. Department of the Treasury, Washington, DC.

- Desai, M. (2005). The degradation of reported corporate profits. The Journal of Economic Perspectives, 19, 171-193.

- Desai, M.A., & Dharmapala, D. (2006). Corporate tax avoidance and high powered incentives. Journal of Financial Economics, 79, 145-179.

- Desai, M.A., Dyck, A., & Zingales, L. (2007). Theft and taxation. Journal of Financial Economics, 84(3), 591-623.

- Dharmapala, D., & Hines, J.R., Jr. (2009). Which countries become tax havens? Journal of Public Economics, 93(9-10), 1058-1068.

- Dischinger, M., & Riedel, N. (2011). Corporate taxes and the location of intangible assets within multinational firms. Journal of Public Economics, 95(7-8), 691-707.

- Dunning, J.H. (1980). Toward an eclectic theory of international production: Some empirical tests. Journal of International Business Studies, 11(1), 9-31.

- Dunning, J.H. (1988). Explaning international production. Unwin Hyman

- Dyreng, S.D., & Lindsey, B.P. (2009). Using financial accounting data to examine the effect of foreign operations located in tax havens and other countries on U.S. tax rates. Journal of Accounting Research, 46(5), 1283-1316.

- Dyreng, S.D., Hanlon, M., & Maydew, E.L. (2008). Long-run corporate tax avoidance. The Accounting Review, 83(1), 61-82.

- Eden, L. (2009). Taxes, transfer pricing, and the multinational enterprise. The Oxford Handbook in International Business. Oxford University Press: Oxford, 591-619.

- Goncharov, I., & Zimmermann, J. (2006). Earnings management when incentives compete: The role of tax accounting in Russia. Journal of International Accounting Research, 5, 41-65.

- Graham, J.R., & Tucker, A.L. (2006). Tax shelters and corporate debt policy. Journal of Financial Economics, 81(3), 563-594.

- Gravelle, J.G. (2009). Tax havens: International tax avoidance and evasion. National Tax Journal, 727-753.

- Gravelle, J.G. (2013). Tax havens: International tax avoidance and evasion CRS Report for Congress. congressional research service.

- Grubert, H., & Mutti, J. (2006). New developments in the effect of taxes on royalties and the migration of intangible assets abroad, Working paper (National Bureau of Economic Research).

- Hennart, J. (1982). A theory of multinational enterprise. Ann Arbor. University of Michigan.

- Hicks, H., Sotos, D., & Jenn, B. (2009). Hey you kids: Get off my lawn: Living with your (Grumpy) granddad's foreign tax credit: The foreign tax credit in a non-income tax world and the prospects of seeing a territorial tax system (if Not Russia) from your front porch. Tax Mag, 87.

- Hines, J. (2006). Testimony before the House Ways and Means Committee. Retrieved from: http://waysandmeans.house.gov/UploadedFiles/Hines.pdf

- Hines, J.R. (2010). Treasure islands. The Journal of Economic Perspectives, 24(4), 103–125.

- Hines, J.R. (2005). Do tax havens flourish? in J.M. Poterba (ed.) Tax Policy and the Economy, 19, Cambridge, MA: MIT Press, 65-99.

- Hubbard, R.G. (2006). Testimony before the House Ways and Means Committee.

- Jaafar, A., & Thornton, J. (2015). Tax havens and effective tax rates: An analysis of private versus public European firms. The International Journal of Accounting, 50(4), 435-457.

- Joint Committee on Taxation (JCT). (2006). Present law and background relating to corporate tax reform: Issues of conforming book and tax income and capital cost recovery.

- Jones, C., & Temouri, Y. (2016). The determinants of tax haven FDI. Journal of World Business, 51(2), 237-250.

- Konrad, K.A., & Stolper, T.B. (2016). Coordination and the fight against tax havens. Journal of International Economics 103, 96-107.

- Lee, N., & Swenson, C. (2012). Are multinational corporate tax rules as important as tax rates? The International Journal of Accounting, 47, 155-167.

- Lokken, L. (2006). Territorial taxation: Why some U.S. multinationals may be less than enthusiastic about the idea (and some ideas they really dislike). SMU Law Review, 59, 751 761.

- Maffini, G. (2010). Territoriality, worldwide principle, and competitiveness of multinationals: A firm-level analysis of tax burdens. Working paper 12/10. Oxford University Centre for Business Taxation.

- Mandolfo, J. (2007). The IRS’s cost-sharing proposals in the worldwide-tax system: Why Congress should avoid anti-competitive transfer pricing regulation and embrace a territorial tax. Fordham Journal of Corporate and Financial Law, 52, 371–392.

- Markle, K. (2015). A Comparison of the Tax?Motivated Income Shifting of Multinationals in Territorial and Worldwide Countries. Contemporary Accounting Research.

- Markle, K., & Shackelford, D.A. (2012a). Cross-country comparisons of corporate income taxes. National Tax Journal, 65, 493-528.

- Markle, K.A. (2010). A Comparison of the Tax-Motivated Income Shifting of Multinationals in Territorial and Worldwide Countries. Working paper, Dartmouth College.

- Markle, K.S., & Shackelford, D.A. (2011). Cross-country comparisons of corporate income taxes. National Bureau of Economic Research.

- Markusen, J.R. (1995). The boundaries of multinational enterprises and the theory of international trade. Journal of Economic Perspectives, 9(2), 169-189.

- Narula, R., & Verbeke, A. (2015). Making internalization theory good for practice: The essence of Alan Rugman's contributions to international business. Journal of World Business 50(4), 612-622.

- Nelson, R., & Winter, S. (2002). Evolutionary theorizing in economics. Journal of Economic Perspectives, 16(2), 23-46.

- OCDE. (2013). Addressing base erosion and profit shifting. Retrieved from http://www.oecd-ilibrary.org.

- Ousterhuis, P. (2006). Testimony before the House Ways and Means Committee.

- Peng, M.W., & Parente, R.C. (2012). Institution-based weaknesses behind emerging multinationals. Revista de Administração de Empresas, 52(3), 360-364

- Philip Dittmer (2012). A Global Perspective on Territorial Taxation. Retrieved from https://taxfoundation.org/global-perspective-territorial-taxation/

- Plaksiienko, V.Y., Melikhova, T.O., Yermolaieva, M.V., Chernenko, K.V., & Lipskyi, R.V. (2019). Formation of Accounting and Tax Policy of the Company. Academy of Accounting and Financial Studies Journal.

- Popovici, O.C., & C?lin, A.C. (2014). FDI theories. A location-based approach. Romanian Economic Journal 17(53), 3-24.

- Richardson, G., & Taylor, G. (2015). Income shifting incentives and tax haven utilization: Evidence from Multinational US Firms. The International Journal of Accounting 50(4), 458-485.

- Rugman, A.M. (1981). Inside the Multinationals, London. Croom Helm.

- Rugman, A.M. (2005). The Regional Multinationals. Cambridge: Cambridge University Press.

- Sikka, P., & Willmott, H. (2010). The dark side of transfer pricing: Its role in tax avoidance and wealth retentiveness. Critical Perspectives on Accounting, 21(4), 342–356.

- Siripaisalpipat, P., & Hoshino, Y. (2000). Firm-specific advantages, entry modes, and performance of Japanese FDI in Thailand. Japan and the World Economy, 12(1), 33-48.

- Taylor, G., & Richardson, G. (2012). International corporate tax avoidance practices: Evidence from Australian firms. The International Journal of Accounting, 47(4), 469-496.

- Taylor, G., Richardson, G., & Lanis, R. (2015a). Multinationality, tax havens, intangible assets, and transfer pricing aggressiveness: An empirical analysis. Journal of International Accounting Research 14(1), 25-57.

- Taylor, G., Richardson, G., & Taplin, R. (2015b). Determinants of tax haven utilization: Evidence from Australian firms. Accounting & Finance 55(2), 545-574.

- Teece, D.J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic management journal, 509-533.

- Verbeke, A. (2013). Rethinking the foundations of global corporate success. International Business Strategy.