Research Article: 2021 Vol: 25 Issue: 3S

What Explains Penny Stocks Seasoned Equity Offerings?

Anutchanat Jaroenjitrkam, University of Adelaide, Thammasat University

Thi Mai Lan Nguyen, University of Adelaide, VinUniversity

Abstract

We examine the motivation why small firms conduct seasoned equity offerings (SEOs) by considering the SEOs of penny stocks in the U.S. market from 1990 to 2016. Our results do not strongly support the market-timing or the life-cycle hypotheses. However, they suggest that manipulation exists around SEOs as firms experiencing positive abnormal accruals are more likely to issue SEOs. A regulation scrutiny shock also negatively affects the probability of penny stock SEOs. We also detect evidence of the “dump and dilute” scheme surrounding the SEOs of penny stocks. Our findings, therefore, represent an alert to both investors and regulators to be more cautious when dealing with penny stocks surrounding their SEOs.

Keywords:

Penny Stocks, SEOs, Capital Structure, Market Timing, Corporate Life Cycle, Earnings Management

JEL Classification:

G30, G32

Introduction

Research on seasoned equity offerings (SEOs) focuses primarily on “ordinary” stocks, which often exclude stocks with prices lower than $5, or penny stocks. These low-priced stocks, however, are receiving increasing attention from both investors and regulators. From the investor’s perspective, penny stocks attract them in terms of the lottery-like payoffs that offer extremely high returns for a few stocks (Eraker & Ready, 2015). At the same time, penny stocks are also under scrutiny by regulators given the possibility of manipulation (Bradley et al., 2006). According to the Security Exchange Committee of the U.S. (Walker, 2000), during the 1980s, there existed several penny stock manipulations. The most prominent case was the crime of Marshall Zolp and Lorenzo Formato, who manipulated Laser Arms Corp’s stock by making up the firm’s financial statements and reporting non-existing products. The wrongdoing activities in relation to penny stocks’ issues eventually led to the issuance of the Penny Stock Reform Act in 1990 (PSRA) by the U.S. government. We thus believe that penny stock SEOs can bring about both investment opportunities and threats to investors. Therefore, we conducted this research in order to examine the underlying motivations for penny stock SEOs and to detect whether there is any threat of manipulation surrounding those SEOs.

The most common reasons for firms issuing capital include: to take advantage of prevailing market conditions (Baker & Wurgler, 2002; DeAngelo et al., 2010); to satisfy needs during a certain stage in the firm’s life cycle (Huang & Ritter, 2009; DeAngelo et al., 2010); and to finance deficit (Frank & Goyal, 2003; Huang & Ritter, 2009). Apart from these “good” motivations, previous studies also document evidence of earnings manipulation surrounding SEOs, which is even more severe among firms with opaquer earnings management (Rangan, 1998; Teoh et al., 1998; Kothari et al., 2015).

Given the fact that penny stocks are subject to less strict regulatory disclosure requirements, these stocks tend to have higher opacity than “ordinary” stocks. Thus, we conjecture that penny stock SEOs are issued to serve inappropriate purposes. We therefore test whether penny stocks issue additional equity capital for any “good” purposes. Otherwise, we can suspect that there are threats surrounding penny stock SEOs that need to be carefully taken into consideration by all stakeholders. Our study has critical implications for investors that need to be more cautious with their trading around the date of penny stock SEOs. We also raise an alert for regulators to develop more efficient regulations in order to govern penny stock SEOs.

In this study, we examine penny stocks in the U.S. market from 1990 to 2016, and we utilize stock price data from the CRSP database and fundamental data from the COMPUSTAT database. The data on firms’ SEOs are from the SDC New Issues database. Our final sample includes 17,192 firm-year observations with 175 penny stock SEO issues.

First, we perform preliminary univariate analyses in order to test the life-cycle hypothesis, which states that growth-stage firms, which have low market-to-book (M/B) ratios and rarely pay dividends, are more likely to issue shares (DeAngelo et al., 2010). Our results, however, show that the probability of penny stock SEOs’ issuances for dividend payers is higher than for non-dividend payers (1.44% compared to 0.79%). Firms within the top 20% of M/B ratio or firms within 15 to 20 years of being listed have the highest probability of conducting SEOs (2.38% and 8.44% respectively, compared to the average probability of 1.03% for all firms). This evidence contradicts the life-cycle hypothesis.

Next, we examine the market-timing hypothesis, which states that firms tend to issue new shares when their stocks are over-priced. This can be indicated by high stock returns prior to the SEOs and low stock returns afterward. We subsample penny firms based on their prior and future net-of-market returns and find that firms with prior 36-month returns in the range of 0% to 75% have the highest probability of SEOs (1.32% to 1.59%); on the other hand, firms whose futures 36-month stock returns below -75% or in the range of 25% to 75% are those having the highest probability of SEOs (1.38% to 1.98%). However, the difference in the probability of SEOs among the subsamples is minimal. The conclusion remains unchanged when we examine 12-month returns around the year of SEOs. Overall, the evidence is not strong enough to support the market-timing hypothesis.

We also utilize logit regressions to confirm our univariate test results. The results also show that the M/B ratio and prior stock returns have an insignificant impact on the probability of SEOs, except that prior stock returns have a significantly positive impact when we include earnings management in the model. Future stock returns have a significantly negative relationship with the probability of SEOs among penny stocks. Specifically, when other variables are set at a mean value, a reduction of 10% in future stock returns results in an increase of 6.7% in the probability of SEOs. We also find no material differences in the results for the subsamples of stocks that pay dividends and non-dividend payers. These results, again, fail to support both the market-timing and life-cycle hypotheses.

Our test for the market-timing hypothesis, however, faces a reverse causality problem since the negative future returns may not be an indicator of market timing but can possibly result from the penny stocks’ SEO itself. In order to address this, we utilize the global financial crisis (GFC) from 2007 to 2009 as an exogenous shock to this relationship. During the GFC period, stock returns are typically low, which demotivates firms to issue shares under the market-timing hypothesis. Thus, we should expect a reduction in the probability of penny stock SEOs during the GFC. By including a dummy variable for any observations during this crisis-affected period, we however find that the probability of penny stock SEOs during a crisis period presents a significant increase compared to other periods (when all variables are set at the mean, the probability of an SEO during the GFC increases by 1.71%). This is inconsistent with the expectation from the market-timing hypothesis, which provides evidence for us to rule out this hypothesis. This finding also raises the question as to why penny stock SEOs are conducted during such a difficult period.

In order to test our concern that there exists manipulation surrounding penny stocks’ SEOs, we employ earnings management via accruals following Kothari et al. (2016) and find that penny stocks experiencing positive abnormal accruals, implying overstated earnings, are more likely to issue SEOs. The probability increases by 0.53% at the mean. This implies that firms tend to manage their earnings to “look good” for investors before issuing SEOs. In addition, we utilize the Sarbanes-Oxley Act (SOX) of 2002, which indicates a shock to market scrutiny, as an indirect test of manipulation. Essentially, the SOX imposes strict reforms in order to improve the quality of financial disclosures of listed firms. This can effectively increase the cost of listed firms when raising new capital and thus can discourage firms from issuing new shares. Whilst the penny stocks in our sample are traded on the over-the-counter (OTC) market, they are not considered as listed firms and are not directly influenced by the SOX (Walker, 2000). However, penny stocks can be indirectly affected by the increased market’s scrutiny caused by the SOX. Specifically, if small firms manipulate activities surrounding their penny stock SEOs, the probability of SEOs would be reduced during the period after the SOX. By including a dummy variable for any observations within three years from 2002, we find as we expect that the SOX has a significantly negative impact on the probability of an SEO (a reduction of 1.25% at the mean). This supports our belief that there exists manipulation around penny stock SEOs.

Our further analyses show that both dividend payers and non-dividend payers tend to use only a tiny portion of the SEO proceeds to stockpile cash or to spend on capital expenditure. Furthermore, we find that both dividend payers and non-dividend payers are less likely to use the SEO proceeds to pay off debts (only around 30% of firms see a reduction in debt). These findings suggest that penny stocks only use a small portion of SEO proceeds for “good” purposes. This further strengthens our conjecture that there exists manipulation surrounding penny stock SEOs.

We also attempt to find evidence of manipulation surrounding penny stock SEOs by tracking whether the stocks are involved in the “dump and dilute” scheme (i.e., firms keep issuing shares without a proper reason and conduct a reverse split to raise share prices before issuing SEOs). Our findings support the scheme of “dump and dilute” by reporting that 56.57% of the SEOs in our sample tend to reissue shares and 29.71% of the SEOs reverse their stock splits surrounding the SEOs. Furthermore, firms with negative abnormal accruals are more likely to do the reverse split than those with positive abnormal accruals. This implies that firms will use the reverse split around SEOs to boost stock prices if they do not have an advantage from earnings management via accruals.

Our contribution to the literature is twofold. First, we add to the limited literature on penny stocks by studying the underlying reasons why penny stock SEOs are conducted. We find no evidence that the market-timing or life-cycle theories can explain the probability of SEOs among penny stocks. At the same time, we find evidence that penny stocks are manipulated surrounding their SEOs. We employ earnings management via accrual in order to test the existence of manipulation. The results are consistent with the work of Kothari, et al., (2016), which focuses on “ordinary” stocks—that firms are more likely to overstate earnings before issuing SEOs. In addition, we find greater evidence of manipulation by applying the “dump and dilute” scheme, and find that penny stocks do the reverse split around SEOs when they do not have an advantage from earnings management. Our study, therefore, supplements prior literature (Baker & Wurgle, 2002; Carlson et al., 2006; Huang & Ritter, 2009; DeAngelo et al., 2010), which mostly focuses on examining the motivation of the share issues of ordinary stocks with the exception of penny stocks.

Our study also provides important implications for both investors and regulators. We find that penny firms raise additional capital for no “good’” purposes, including stockpiling cash, making capital investment, and paying debt. Specifically, we find evidence of the “dump and dilute” scheme surrounding the SEOs of penny stocks. This alerts both investors and regulators to be more cautious with penny stocks in particular, and any stocks with high opacity in general. Specifically, investors should gather sufficient information in order to avoid trading manipulated penny stocks, whilst regulators should invent efficient regulations in order to mitigate penny stock manipulation.

Our study proceeds as follows. Section 2 is the literature review. Section 3 explains the data used. Section 4 provides the preliminary univariate analyses. Section 5 contains the regression results. Section 6 discusses the use of penny stock SEO proceeds and evidence of manipulation. Section 7 concludes.

Literature Review

The extant literature suggests that the most prominent theoretical explanations for corporate SEOs are marketing timing opportunities and the firms’ life-cycle stages (Baker & Wurgle, 2002; Carlson et al., 2006; Huang & Ritter, 2009; DeAngelo et al., 2010). First, the market-timing theory argues that firms issue shares when the market condition is favorable (hereinafter referred to as the market-timing hypothesis). This theory is supported by several studies. For example, Loughran & Ritter, (1997) document a sharp increase in stock prices before firms’ SEOs, followed by abnormal low stock returns during the five years after the SEOs. This indicates a market-timing opportunity in which firms conduct SEOs when their stocks are over-priced to earn higher proceeds. Similarly, Baker & Wurgler, (2002) show that an optimal capital structure does not exist, and firms issue shares when their market value is high. Huang & Ritter, (2009) also provide evidence supporting the market-timing theory by showing that U.S. firms issue shares to sponsor their financial deficit when the cost of capital is low.

The life cycle of firms can also explain why firms raise capital. Specifically, the life-cycle theory argues that firms in the early business stage tend to issue shares to fund their investment projects, whilst mature firms prioritize internal financing (hereinafter referred to as the life-cycle hypothesis). Evidence of this theory is documented by DeAngelo, et al., (2010), which shows that young firms with high M/B ratios, no dividend payments, and low operating cash flows are more likely to conduct SEOs. Carlson, et al., (2006) find that since growth firms tend to dominate the market for SEOs, there is an increase in the stock prices of those firms before the SEOs, which reflects the value of the growth prospect of the issuers.

Apart from these two prominent theories, prior literature also suggests that overvalued SEOs are driven by earnings management. Rangan (1998); Teoh, et al., (1998); Kothari, et al., (2016) find the existence of the overvalued SEOs and earnings management surrounding SEO periods. Kothari, et al., (2016) also find stronger evidence of earnings management in firms with more information opacity, which implies that the market cannot detect this misleading information.

In the market for penny stocks, manipulation surrounding SEOs is also documented. Penny stocks (sometimes referred to as microcap stocks), according to the definition of the U.S. Securities and Exchange Commission (SEC), are stocks where the trading price is not greater than $5.1 During the 1980s, several fraud events and manipulation activities related to penny stock issues were recorded, leading to the SEC’s issuance of the Penny Stock Reform Act of 1990 (PSRA) on October 15, 1990. This act increases the sanction authority of the SEC, where the SEC can sanction not only persons that are directly associated with broker-dealers but also all affiliates of penny stock issuers. Furthermore, the act requires brokers to obtain a written sales agreement from any buyer that is not a regular client. After the act took effect, however, Beatty & Kadiyala, (2003) showed that there was no significant change in penny issuer quality or the market fundamentals for speculative IPOs. Bradley, et al., (2006) find that penny stock IPOs have higher initial returns than ordinary stock IPOs, but they underperform in the long run. Furthermore, the IPOs of penny stocks led by underwriters that have been punished by the SEC are more underpriced than IPOs led by other underwriters. This evidence suggests that the severity of the stock price manipulation and information asymmetry in the market for penny stock SEOs still exists after the PSRA.

The literature related to penny stocks also suggests that investors in penny stocks are non-sophisticated and uninformed. For example, Kumar (2009) defines the lottery stock (i.e., another term for penny stocks) as a stock with a low price, high idiosyncratic volatility, and highly positive idiosyncratic skewness. He finds that investors in lottery stocks have characteristics similar to those of state lottery buyers. Further, Nofsinger & Varma, (2014) investigate the investor behavior of OTC stocks and the results show that investors in OTC stocks are older, wealthier, more experienced in investing, and more frequently trade. The evidence supports that investors trade OTC stock for their enjoyment. However, the investor characteristics of those that deal with penny stocks, whose price is less than $1, are different—they tend to be poorer males and consistent with the demographics of lottery buyers. Therefore, the direct gambling hypothesis can explain investor behavior regarding penny stocks. Apart from investor behavior, Fama & French, (2015) purpose a five-factor asset pricing model whose factors are excess return on market, size, value, profitability, and investment pattern. According to their study, small-cap stocks perform well from their study. However, small stocks with high investment and low profitability perform poorly, and the model cannot explain this. Behavioral finance may potentially explain this issue, as some investors in small stocks have lottery buyers’ characteristics (Kumar, 2009). Based on prior evidence of manipulation in the market regarding penny stocks and the analyses of penny stock investors, we hypothesize that there could be manipulation associated with penny stock SEOs (hereinafter referred to as the manipulation hypothesis).

Data

We examine penny stocks in the U.S. market from 1990 to 2016. Our sample begins in 1990, the year of the Penny Stock Reform Act, which enhances the regulation over penny stocks in general. We choose to examine the period after this regulation in order to ensure that our results are not affected by a regulatory shock. Our study period is up to 2016, but we only examine penny stock SEOs up to 2013 so that we have sufficient data to measure the net-of-market return of the stocks 36 months after the SEO date. Following Bradley, et al., (2006) and DeAngelo et al. (2010), we collect data on penny stocks from CRSP using the following criteria: (1) have an average price throughout the year less than $5; (2) have four-digit SIC codes outside the intervals 4900-4949 (utilities) and 6000-6999 (financial companies); (3) have securities with CRSP share codes 10 or 11 (ordinaries common shares); (4) are not listed on national markets (i.e. NYSE, AMEX, or Nasdaq), which is equivalent to the CRSP National Market Indicator 3; and (5) have non-missing values on Compustat for dividends and earnings before extraordinary items. These filters result in 17,192 firm-year observations.

We then collect data on penny stock SEOs from the SDC New Issues database. In a few cases if issuers have multiple SEOs each year, we aggregate the issue proceeds for that year and treat the total as a single observation. If a firm issues an IPO or SEO within the same year, we still count these transactions as one observation of an SEO and the total proceeds for that year is the sum of the proceeds from both the IPO and SEO. This step results in 175 firm-year observations with SEO issues.

Table 1 shows the summary statistics of our SEO sample. We first rank penny stock SEOs into quartiles in which quartile 4 includes SEOs with the largest amount of proceeds. Although the firm size of the penny stocks is not largely varied, we document material variation across the quartiles in terms of SEO proceeds. Column (2) reports that the SEOs that belong to the first quartile only have an average proceed of $3.0 million, compared to the fourth quartile with average proceeds of $81.8 million (more than 27 times as much). Columns (4) and (5) present that the top 25% issuers (quartile 4) account for 66.3% of the total proceeds, and the top 50% issuers (quartiles 3 and 4) already cover 89.7% of the total SEO proceeds of penny stocks during the entire period. This suggests that the market for penny stock SEOs is dominated by a modest number of firms that raise a large amount of cash.

According to Column (6), we also document that dividend payers (i.e., both current and former payers) account for about 59% in the fourth and third quartiles, and about 39% in the bottom two quartiles. This is opposed to the view that SEOs are mainly for young growth firms and also suggests that dividend payers tend to conduct SEOs with higher proceeds.

| Table 1 Summary Of The Statistics Of Penny Stocks’ Seos By Size Of Proceeds |

|||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) |

| Quartile | Mean offer proceeds ($m) | Total proceeds for quartile ($m) | Percent of total proceeds for all SEOs | Cumulative percent of total proceeds for all SEOs | Percent of SEOs by firms that previously paid dividends |

| 4 | 81.8 | 3597.6 | 66.3% | 66.3% | 59.1% |

| 3 | 28.9 | 1272.0 | 23.4% | 89.7% | 59.1% |

| 2 | 9.7 | 427.6 | 7.9% | 97.6% | 38.6% |

| 1 | 3.0 | 127.5 | 2.4% | 100.0% | 39.5% |

| All SEOs | 31.0 | 5424.7 | 100.0% | 100.0% | 49.1% |

Preliminary Univariate Analyses

In this section, we perform univariate analyses on SEO characteristics and issuer characteristics. In Table 2, we summarize the number of SEOs, issue proceeds, and the probability of SEOs for our full sample and for the subsamples based on various criteria. Panels A, B, and C examine the life-cycle hypothesis, which states that young-growth firms are more likely to conduct SEOs. Following DeAngelo, et al., (2010), we identify young-growth firms as those that do not pay dividends, have a high M/B ratio, and have fewer years listed. If the life-cycle hypothesis is correct for penny stocks, we would expect a higher SEO probability among those firms.

First, Panel A presents penny stock SEO observations based on the issuers’ dividend payment history. The subsamples we examine include: (1) firms having paid dividends; (2) firms that have never paid dividends; (3) the top 10% of cumulative dividend payers for all years; (4) current dividends payers; (5) current nonpayers; and (6) former dividend payers. Contrary to our expectation, firms that pay dividends tend to issue more SEOs than non-dividend payers. The probabilities of an SEO are 1.44% and 0.79%, respectively (Lines 2 and 3). We also find that most of the SEO deals (82.9%) occur for current non-dividend payers (Line 6). This means that in the year of an SEO, firms tend to pay no dividend.

Panel B sorts the sample into quintile by M/B ratio, where observations with a higher M/B ratio belong to quintile 5. We find that firms with a high M/B ratio tend to conduct more SEOs. The probability of an SEO in quintile 5 is 2.38% compared to 0.17% in quintile 1 (Line 1 and 5). This evidence partially supports the life-cycle hypothesis.

Finally, Panel C exhibits the probability of an SEO based on the number of years listed. We find that the probability increases when the firms become older, as the highest probability of an SEO belonging to the subsample of firms aged 15 to 20 years (8.44% - Line 4). This finding opposes the life-cycle hypothesis.

Overall, the evidence in Panels A to C is mixed; therefore, we cannot confirm the life-cycle hypothesis. Panels D to G examine the market-timing hypothesis, which states that firms tend to conduct SEOs if their stocks are over-valued. Therefore, we examine whether there is any evidence that penny stocks have high returns before the SEO year and low returns afterward. From Panel D, we subsample firms by their 36-month pre-SEO net-of-market returns (i.e., abnormal return) and examine the probability of firms’ conducting SEOs in each subsample. The purpose is to test whether pre-SEO stock returns are associated with penny stocks’ SEO probability. We find that firms in all ranges of pre-SEO abnormal returns exert quite similar probabilities of SEOs (from 0.85% to 1.59%). In Panel E, we subsample firms by their post-SEO 36-month abnormal returns in order to examine whether future stock returns can explain penny stock SEO issuances. We document that firms having post-SEO abnormal returns below -75% have the highest probability of SEOs (2.85%) (Row 1), whilst those having post-SEO abnormal returns above 75% have the lowest SEO probability (0.69%) (Row 8). However, the differences between the SEO probability of all subsamples are not material.

The results in Panel D and E suggest that the relationship between the stocks’ pre- and post-SEO abnormal returns and penny stocks’ SEO probabilities is unclear. In addition, we find a similar conclusion when examining 12-month abnormal returns around the year of SEOs (Panels F and G) instead of 36-month returns. Overall, the evidence is not strong enough to support the market-timing hypothesis. as shows in Table 2.

| Table 2 Univariate Analysis Of Issuer Characteristics And Seo Probability |

||||||||

|---|---|---|---|---|---|---|---|---|

| No. of SEOs | % of SEOs | Issue proceeds ($m) | % of Total issue proceeds | Median Std. M/B ratio | Median no. of years listed | Prob. of an SEO in a given year | ||

| PANEL A: Dividend payment history | ||||||||

| (1) | All firms | 175 | 100 | 5,424.7 | 100 | 1.07 | 6.0 | 1.03% |

| (2) | Have paid dividends | 86 | 49.1 | 3,094.7 | 75.3 | 1.85 | 7 | 1.44% |

| (3) | Never paid dividends | 89 | 50.9 | 2,330.0 | 24.7 | 2.18 | 5 | 0.79% |

| (4) | Top 10% cum. dividend payers | 10 | 5.7 | 534.7 | 9.9 | 0.68 | 7 | 1.35% |

| (5) | Current dividends payers | 30 | 17.1 | 1,272.0 | 23.4 | 1.28 | 12 | 1.26% |

| (6) | Current nonpayers | 145 | 82.9 | 4,152.7 | 76.6 | 2.14 | 11 | 0.98% |

| (7) | Former dividend payers | 77 | 44.0 | 2,613.4 | 48.2 | 0.96 | 7 | 0.66% |

| PANEL B: M/B ratio quintile | ||||||||

| (1) | Quintile 1 (lowest) | 4 | 2.3 | 35.42 | 0.65 | 0.28 | 6 | 0.17% |

| (2) | Quintile 2 | 16 | 9.1 | 336.06 | 6.19 | 0.60 | 6 | 0.69% |

| (3) | Quintile 3 | 39 | 22.3 | 1,042.18 | 19.2 | 1.07 | 5 | 1.69% |

| (4) | Quintile 4 | 53 | 30.3 | 2,086.18 | 38.5 | 2.06 | 6 | 2.30% |

| (5) | Quintile 5 (highest) | 55 | 31.4 | 1,783.45 | 32.9 | 6.51 | 6 | 2.38% |

| PANEL C: Years listed | ||||||||

| (1) | Less than 5 | 28 | 16.0 | 348.80 | 6.4 | 1.20 | 2 | 1.47% |

| (2) | 5 to 10 | 37 | 21.1 | 1,572.80 | 28.9 | 1.15 | 7 | 2.52% |

| (3) | 10 to 15 | 32 | 18.3 | 672.16 | 12.4 | 1.09 | 12 | 4.27% |

| (4) | 15 to 20 | 34 | 19.4 | 1,038.11 | 19.1 | 1.06 | 16 | 8.44% |

| (5) | More than 20 | 44 | 25.1 | 1,792.88 | 33.1 | 1.03 | 22 | 0.34% |

| PANEL D: Prior 36-month abnormal stock returns | ||||||||

| (1) | R < -75.0% | 33 | 18.9 | 1,134.91 | 20.1 | 0.81 | 6 | 1.18% |

| (2) | -75.0 % < R < -50.0% | 10 | 5.7 | 169.641 | 3.1 | 0.78 | 6 | 1.14% |

| (3) | -50.0 % < R < -25.0% | 10 | 5.7 | 274.72 | 5.1 | 0.83 | 7 | 1.07% |

| (4) | -25.0 % < R < 0.0% | 8 | 4.6 | 271.64 | 5.0 | 0.98 | 8.5 | 0.87% |

| (5) | 0.0 % < R < 25.0% | 13 | 7.4 | 332.46 | 6.1 | 0.97 | 8 | 1.59% |

| (6) | 25.0 % < R < 50.0% | 12 | 6.9 | 281.61 | 5.2 | 1.03 | 9 | 1.57% |

| (7) | 50.0 % < R < 75.0% | 9 | 5.1 | 94.33 | 1.7 | 1.19 | 8 | 1.32% |

| (8) | 75.0 % < R | 80 | 4.6 | 2,865.42 | 5.3 | 1.26 | 4 | 0.85% |

| PANEL E: Future 36-month abnormal stock returns | ||||||||

| (1) | R < -75.0% | 43 | 24.6 | 1,773.16 | 32.7 | 1.78 | 6 | 2.85% |

| (2) | -75.0 % < R < -50.0% | 5 | 2.9 | 96.21 | 1.8 | 1.21 | 8 | 1.02% |

| (3) | -50.0 % < R < -25.0% | 8 | 4.6 | 239.30 | 4.4 | 1.20 | 7 | 1.37% |

| (4) | -25.0 % < R < 0.0% | 9 | 5.1 | 403.48 | 7.4 | 1.26 | 6 | 1.29% |

| (5) | 0.0 % < R < 25.0% | 10 | 5.7 | 463.96 | 8.6 | 1.07 | 7 | 1.45% |

| (6) | 25.0 % < R < 50.0% | 12 | 6.9 | 565.87 | 10.4 | 0.96 | 8 | 1.72% |

| (7) | 50.0 % < R < 75.0% | 6 | 3.4 | 96.96 | 1.7 | 0.96 | 6 | 0.87% |

| (8) | 75.0 % < R | 82 | 4.7 | 1,785.81 | 32.9 | 0.97 | 5 | 0.69% |

| PANEL F: Prior 12-month abnormal stock return | ||||||||

| (1) | R < -75.0% | 25 | 15.4 | 711.03 | 13.1 | 0.87 | 5 | 1.65% |

| (2) | -75.0 % < R < -50.0% | 10 | 5.7 | 364.93 | 6.7 | 0.89 | 5 | 0.72% |

| (3) | -50.0 % < R < -25.0% | 20 | 11.4 | 282.32 | 5.2 | 0.91 | 5 | 1.03% |

| (4) | -25.0 % < R < 0.0% | 17 | 9.7 | 718.67 | 13.2 | 1.01 | 7 | 0.78% |

| (5) | 0.0 % < R < 25.0% | 20 | 11.4 | 974.83 | 17.9 | 1.04 | 7 | 1.17% |

| (6) | 25.0 % < R < 50.0% | 16 | 9.1 | 706.26 | 13.0 | 1.06 | 7 | 1.38% |

| (7) | 50.0 % < R < 75.0% | 15 | 8.6 | 444.11 | 8.2 | 1.21 | 7 | 1.98% |

| (8) | 75.0 % < R | 52 | 29.7 | 1,222.57 | 22.5 | 1.30 | 5 | 0.85% |

| PANEL G: Future 12-month abnormal stock return | ||||||||

| (1) | R < -75.0% | 33 | 18.9 | 995.29 | 18.34% | 1.72 | 5 | 2.04% |

| (2) | -75.0 % < R < -50.0% | 9 | 5.1 | 325.26 | 5.6 | 1.37 | 6 | 0.89% |

| (3) | -50.0 % < R < -25.0% | 19 | 10.9 | 471.69 | 8.7 | 1.20 | 6 | 1.31% |

| (4) | -25.0 % < R < 0.0% | 28 | 16.0 | 1,650.62 | 30.4 | 1.04 | 7 | 1.46% |

| (5) | 0.0 % < R < 25.0% | 17 | 9.7 | 575.58 | 10.6 | 0.90 | 7 | 0.93% |

| (6) | 25.0 % < R < 50.0% | 13 | 7.4 | 211.08 | 3.9 | 0.87 | 7 | 0.92% |

| (7) | 50.0 % < R < 75.0% | 13 | 7.4 | 444.78 | 8.2 | 0.93 | 6 | 1.23% |

| (8) | 75.0 % < R | 43 | 24.6 | 750.42 | 13.8 | 1.05 | 5 | 0.63% |

Logit Regression Results

In this section, we test the market-timing and life-cycle hypotheses by using a regression method. Table 3 presents the results of our logit regressions to assess how penny stocks’ SEO probabilities are affected by market-timing opportunities and stage of corporate life cycle. It also reports the results of a variety of sensitivity checks on the basic model specification.

In order to measure market-timing opportunities, we utilize the recent and future 36-month net-of-market returns surrounding the examined years. This measure is employed by Loughran & Ritter, (1997); DeAngelo, et al., (2010) in their timing analyses. We also follow Baker & Wurgler, (2002) to include the standardized M/B ratio (i.e., M/B ratio of the firms at the end of a fiscal year divided by the median M/B ratio of the industry in the same year) to proxy for market-timing opportunity as it reflects the misvaluation of stocks.

First, to test the market-timing hypothesis, we run logit regressions for the full sample of penny stocks to see whether the probability that a firm conducts an SEO is positively related to its standardized M/B ratio and recent abnormal returns, and negatively related to its future abnormal returns. The regression results are reported in Panel A of Table 3, depicting that the SEO probability in a given year is negatively related to future abnormal returns (Coefficient -0.3764, significant at the one percent level and marginal effect = -0.0067). The marginal effect shows that a 10% reduction in future stock returns decreases the probability of an SEO by 0.67% for all firms. We however find that the standardized M/B ratio and prior period of abnormal returns have no statistically significant effect on the probability of SEOs by penny stock issuers. Again, these results clearly diffuse the market-timing hypothesis.

We also present robustness checks in order to confirm our findings in Panel A. For example, in Panel B, we replace the standardized M/B ratio in the main model with a raw M/B ratio. In Panel C, we replace net-of-market returns with raw returns. In Panel D, we follow DeAngelo, et al., (2010) in using 12-month recent and future abnormal returns instead of 36-month returns. In all cases, the coefficients for the M/B ratio and prior stock returns remain insignificant, whereas the coefficients for future stock returns are always negative and significant at the one percent level.

Next, we utilize a logit regression model on our full sample, which is analogous to the model in Panel A, but we add Years listed (i.e., the number of years a firm is listed) as an explanatory variable in order to test the life-cycle hypothesis. The results are reported in Panel E of Table 3. We find a positive and significant relationship between Years listed and the probability of an SEO (coefficient=0.0938, marginal effect=0.0034). The marginal effect implies that for every 10-year increase in the number of years listed, the probability that a firm will issue an SEO increases by 0.34%. This finding does not support the life-cycle hypothesis, which states that young growth firms are more likely to issue shares to fund investments. Our findings regarding the M/B ratio and stock returns in Panel A are qualitatively unchanged when we include Years listed in the regression model.

In Panels F and G in Table 3, we utilize the same regression model as in Panel A but on two subsamples; namely, firms that have never paid dividends and dividend payers to provide an additional test for the life-cycle hypothesis. DeAngelo, et al., (2010) suggest that young growth firms are those that have a high M/B ratio and almost no dividend payments. We thus anticipate that firms with a high M/B ratio and that pay dividends are more likely to pass the growth stage of their life cycle. Therefore, if the life-cycle hypothesis is true, we should expect a positive relationship between the M/B ratio and the probability of penny stocks’ SEOs for the “never paid dividend” subsample (Panel F), whereas the relationship would be insignificant for the “dividend payers” subsample (Panel G).

Against our expectations, the results, as shown in Panel F and Panel G, indicate that the M/B ratio is not significantly related to the decision to conduct an SEO for both firms that pay dividends and those that have never paid dividends. The impact of future stock return on the probability of penny stock SEO remains significantly negative for both dividend payers and non-payers, while the impact of prior market returns is insignificant for both dividend and non-dividend payers. These results fail to support both the market-timing and life-cycle hypotheses.

Our regression results, however, potentially face a reverse causality problem since one may argue that the SEO itself depresses future returns. In order to address this, we utilize the global financial crisis (GFC) from 2007 to 2009 as the shock to market timing. During this GFC period, stock returns were typically low, which demotivated firms from issuing shares under the market-timing hypothesis. By including a dummy variable that equals one for any observations during this crisis period and zero otherwise in the regression, and reporting the results in Panel H, we find that the probability of penny stocks conducting SEOs during this crisis period saw a significant increase compared to non-crisis periods. At the mean, the probability of SEOs increased by 1.71% during the GFC period. This is inconsistent with the expectation from market-timing hypothesis, which provides more solid evidence for us to rule out this hypothesis. At the same time, this finding raises a question as to why penny firms still decided to conduct SEOs during this crisis period when the market condition was not favorable. We question whether this is a sign of manipulation.

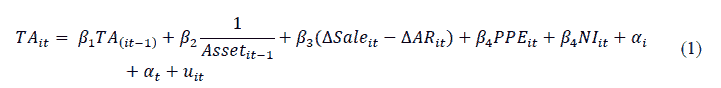

In order to address this issue, we add a lagged dummy variable of positive abnormal accruals, which implies that firms try to inflate their earnings before issuing SEOs, in our regression model for all firms in our sample. We follow Kothari, et al., (2016) in calculating positive abnormal accruals.2 First, we run the regression of total accruals as in Equation (1). Secondly, we get abnormal accruals by subtracting each firm-year residual from the mean of the residuals across all years for the corresponding firm. Then we assign a dummy variable equal to one if abnormal accruals are positive and zero otherwise.

Where TAit is the total accruals3 divided by lagged total assets, Asset it-1 is lagged total asset,  is the change in the sales of account receivables divided by lagged total assets, PPEitis net property, plant, and equipment divided by lagged total assets, NIit is net income divided by lagged total assets, ai and at are firm and year fixed effects, respectively.

is the change in the sales of account receivables divided by lagged total assets, PPEitis net property, plant, and equipment divided by lagged total assets, NIit is net income divided by lagged total assets, ai and at are firm and year fixed effects, respectively.

The results in Panel I of Table 3 show that firms having positive abnormal accruals are more likely to issue SEOs in the next period. At the mean, the probability of penny SEOs increases by 0.53% if firms have positive abnormal accruals. Incorporating negative stock returns after SEOs, we can infer that a sign of manipulation exists.

Moreover, in order to check if the results are robust, we utilize the SOX of 2002 as a shock to the market’s scrutiny as an indirect test for manipulation. Essentially, the SOX imposes strict reforms to improve the quality of financial disclosure of listed firms. This can effectively increase the cost of listed firms when they raise new capital and thus can discourage firms from issuing new shares. Whilst the penny stocks in our sample are traded on the OTC market, they are not considered as listed firms and are not influenced by the SOX (Walker, 2000). Therefore, the SOX should not affect the intention of penny firms in terms of conducting SEOs.

However, whilst the SOX does not target penny stocks, it still increases market scrutiny in general. Thus, if penny stocks intend to manipulate their SEOs, they would be less willing to conduct SEOs after the SOX took effect. In other words, the probability of penny stock SEOs would reduce during the period after the SOX. In Panel J of Table 3, by including a dummy variable that equals one for any observations within three years from 2002 and zero otherwise, we find that the SOX has a significantly negative impact on the probability of SEO (a reduction of 1.25% at the mean). This supports our belief that penny stocks can conduct manipulation in conjunction with SEOs.

In summary, the evidence in Table 3 does not support either the market-timing or the life-cycle hypotheses in explaining the probability of penny stock SEOs. Instead, we find indirect evidence that penny stocks potentially exhibit manipulation when they conduct SEOs.

| Table 3 Logit Regression For The Probability Of Seos Among Penny Stocks |

||||||

|---|---|---|---|---|---|---|

| Intercept | M/B ratio | Prior stock return | Future stock return | Years listed | Shock / positive abnormal accruals |

|

| PANEL A: All firms | ||||||

| Coefficient | -3.7836*** | -0.0003 | -0.0130 | -0.3764*** | - | - |

| (Marginal Probability) | - | (-4.6e-06) | (-0.0002) | (-0.0067) | - | - |

| [z-statistics] | [-39.58] | [-0.43] | [-0.18] | [-4.55 ] | - | - |

| PANEL B: All firms with raw M/B ratio in lieu of standardized M/B ratio | ||||||

| Coefficient | -3.8050*** | 0.0001 | -0.0084 | -0.3619*** | - | - |

| (Marginal Probability) | - | (-2.4e-06) | (-0.0001) | (-0.0063) | - | - |

| [z-statistics] | [-40.01] | [-0.29] | [-0.12] | [-4.29 ] | - | - |

| PANEL C: All firms with raw returns in lieu of net-of-market returns | ||||||

| Coefficient | -3.7249*** | 0.0002 | -0.0349 | -0.3290*** | - | - |

| (Marginal Probability) | - | (-2.9e-06) | (-0.0002) | (-0.0067) | - | - |

| [z-statistics] | [-35.83] | [-0.33] | [-0.48] | [-3.84 ] | - | - |

| PANEL D: All firms with 12 months prior market adjusted returns in lieu of 36 month prior returns | ||||||

| Coefficient | -3.9523*** | -0.0006 | 0.1224 | -0.3483*** | - | - |

| (Marginal Probability) | - | (-9.02e-06) | (0.0019) | (-0.0054) | - | - |

| [z-statistics] | [-42.80] | [-0.68] | [0.22] | [-4.43] | - | - |

| PANEL E: All firms with years listed | ||||||

| Coefficient | -3.8880*** | 0.0010 | 0.0312 | -0.3622*** | 0.0938*** | - |

| (Marginal Probability) | - | (3.5e-05) | (0.0011) | (-0.0131) | (0.0034) | - |

| [z-statistics] | [-16.39] | [0.64] | [0.68] | [-3.85 ] | [5.41] | - |

| PANEL F: Never paid dividend | ||||||

| Coefficient | -3.9201*** | 0.0022 | 0.0291 | -0.2248* | - | - |

| (Marginal Probability) | - | (3.7e-5) | (0.0005) | (-0.0038) | - | - |

| [z-statistics] | [-27.54] | [1.35] | [0.32] | [-1.71] | - | - |

| PANEL G: Dividend payers | ||||||

| Coefficient | -3.7374*** | -0.0013 | -0.0343 | -0.4936*** | - | - |

| (Marginal Probability) | - | (-2.4e-05) | (0.0006) | (-0.0087) | - | - |

| [z-statistics] | [-28.10] | [-0.60] | [-0.31] | [-4.74] | - | - |

| PANEL H: All firms with GFC shock | ||||||

| Coefficient | -3.8940*** | -0.0001 | 0.0002 | -0.3708*** | - | 0.7323*** |

| (Marginal Probability) | - | (2.5e-6) | (0.0002) | (-0.0063) | - | (0.0171) |

| [z-statistics] | [-36.98] | [-0.28] | [0.12] | [-4.28] | - | [2.75] |

| PANEL I: All firms with earnings management | ||||||

| Coefficient | -4.3200*** | -0.0002 | 0.2000** | -0.2701*** | 0.3588* | |

| (Marginal Probability) | - | (-2.92e-06) | (0.0031) | (-0.0042) | (0.0053) | |

| [z-statistics] | [-26.92] | [-0.10] | [2.37] | [-2.75] | [1.93] | |

| PANEL J: All firms with SOX shock | ||||||

| Coefficient | -3.7244*** | -0.0001 | -0.0224 | -0.3555*** | - | -1.0340** |

| (Marginal Probability) | - | (-2.5e-06) | (0.0004) | (-0.0060) | - | (-0.0125) |

| [z-statistics] | [-38.47] | [-0.29] | [-0.30] | [-4.21] | - | [-2.40] |

The use of Penny Stock SEO Proceeds and Evidence of Manipulation

Cash Balances, SEO Proceeds and the Need for External Capital

In the market-timing hypothesis, firms tend to issue shares whenever market conditions are favorable, even if they are in no need for cash, in which case, we would expect SEO issuers to stockpile their SEO proceeds as cash until they have a profitable investment opportunity. Thus, in this section, we follow the method by DeAngelo, et al., (2010) to examine whether penny firms use their SEO proceeds to stockpile cash. We examine the full sample and three subsamples; namely, top dividend payers, other dividend payers, and firms that have never paid dividends.

Rows 1 through 3 in Table 4 show that the median cash to total assets ratio (Cash/TA) for all issuers increases marginally from 23.4% in the year before the SEO to 23.8% in the year of the SEO, then falls to 19.7% in the year after the SEO. These results imply that penny stock issuers do not keep much of their SEO proceeds in cash as the cash ratio. This pattern is also recorded for other payers and for the never paid subsamples. Whilst for the top payer subsample, we document a decline of Cash/TA from 21.1% in the year before the SEO to 19.7% in the year of the SEO. This number further reduces to 11.9% in the year after the SEO. These findings differ from the conclusion of DeAngelo et al. (2010), as they found that issuers kept SEO proceeds as cash with the Cash/TA ratio increasing from 7.2% in the year before the SEO to 13.3% in the year of the SEO. With the Cash/TA ratio increasing marginally in our study, we surmise that firms do not stockpile their SEO proceeds as cash but use the proceeds for other purposes.

In Row 4 through Row 6, we perform similar analyses but focusing on the Excess cash/TA (i.e., the firm’s actual cash/TA minus the estimated normal level required to operate the firms). Accordingly, the median Excess cash/TA increases from 9.5% in the year before the SEO to 11.3% in the year of the SEO and further drops to 7.8% in the year after the SEO for all issuers. In Rows 7 through 9, we find that the cash level (in million dollars) sees no material changes from one year before to one year after the SEOs. This evidence further strengthens our conclusion that penny firms do not retain their SEO proceeds as cash.

In addition, from Rows 10 to 11, the median SEO issuers in the full sample raise $16 million in cash in the year of the SEO, which is equivalent to 68% of pre-SEO total assets, but retain only $6 million in the year after the SEO (Row 9), and similar differentials hold for all subsamples. This raises further questions regarding what the SEO proceeds are used for since the earlier analyses report that most issuers do not use the SEO proceeds to stockpile cash.

We next examine the pro forma Cash/TA ratio for the SEO issuer, which is based on the pro forma cash level should there be no SEO and all other decisions of the firms remain unchanged. The results are reported in Rows 12 through 15, showing that the majority of SEO issuers would almost immediately run out of cash if they had not received the issue proceeds. Specifically, the median pro forma Cash/TA ratio in the year after the SEO is -42.7% for the full sample, and -17.6%, -43.9%, and -50.7%, respectively for the top payers, other payers, and the never paid dividend group (Row 12). The median pro forma Excess cash/TA ratio is -51.7% for the full sample, and -34.6%, -51.9%, and -58.4%, respectively for the three groups (Row 13). From Row 14, without SEO proceeds, 80.1% of penny stock issuers would have negative Cash/TA in the year after the SEO. This is much higher compared to 62.6% of issuers in DeAngelo, et al., (2010) paper, which studied the SEOs of all firms except penny firms. We thus conclude that the majority of penny stock issuers need SEO proceeds to survive.

From Row 16 through 23, we estimate the change and abnormal change in the Cash/SEO proceeds ratio from the year before to the year of the SEO, then one, two, and three years after the SEO. The change we document is minimal; for example, the median change in Cash/SEO proceeds during the studied period ranges from 2.1% to 4.3%, whilst the median abnormal change in Cash/SEO proceeds ranges from 2.1% to 3.8%. This is much lower compared to the ranges of 21.6% to 39.0% and -1.9% to 10.4%, respectively, documented in DeAngelo et al. (2010), who studied the SEOs of all firms except penny firms. Since the change in cash is minimal and insignificant, we conclude that there is no clear relationship between change in cash held and SEO proceeds. as shows in Table 4.

| Table 4 Cash Level Of Firms Surrounding Seos |

|||||

|---|---|---|---|---|---|

| All Issuers | Top Payers | Other Payers | Never Paid | ||

| 1 | Median Cash/TA in year before SEO | 23.4% | 22.1% | 19.7% | 25.8% |

| 2 | Median Cash/TA in year of SEO | 23.8% | 19.67% | 23.7% | 24.9% |

| 3 | Median Cash/TA in year after SEO | 19.7% | 11.9% | 22.1% | 21.3% |

| 4 | Median Excess cash/TA in year before SEO | 9.5% | 0.8% | 0.9% | 10.1% |

| 5 | Median Excess cash/TA in year of SEO | 11.3% | 2.7% | 11.5% | 12.1% |

| 6 | Median Excess cash/TA in year after SEO | 7.8% | 0.1% | 11.6% | 7.3% |

| 7 | Median Cash ($m) in year before SEO | 5.5 | 11.9 | 4.1 | 5.1 |

| 8 | Median Cash ($m) in year of SEO | 5.2 | 15.1 | 4.7 | 4.5 |

| 9 | Median Cash ($m) in year after SEO | 6.0 | 22.7 | 7.5 | 5.4 |

| 10 | Median SEO proceeds ($m) | 16.0 | 52.9 | 21.0 | 10.2 |

| 11 | Median SEO proceeds/TA in year before SEO | 68.0% | 41.7% | 68.0% | 69.5% |

| 12 | Median pro forma Cash/TA in year after the SEO | -42.7% | -17.6% | -43.9% | -50.7% |

| 13 | Median pro forma Excess cash/TA in year after SEO | -51.7% | -34.6% | -51.9% | -58.4% |

| 14 | Percent with pro forma Cash/TA < 0 in year after SEO | 80.1% | 80.0% | 81.1% | 80.7% |

| 15 | Percent with pro forma Excess cash/TA < 0 in year after SEO | 92.2% | 90.0% | 91.9% | 93.7% |

| Median raw change in Cash/SEO proceeds | |||||

| 16 | From year before to year of SEO | 3.5% | 10.4% | 1.2% | 4.6% |

| 17 | From year before to year after SEO | 2.1% | -0.9% | 6.5% | 0.2% |

| 18 | From year before to two years after SEO | 4.3% | -7.9% | 5.4% | 0.5% |

| 19 | From year before to three years after SEO | 3.1% | -1.8% | 5.5% | 2.5% |

| Median abnormal change in Cash/SEO proceeds | |||||

| 20 | From year before to year of SEO | 2.6% | 4.7% | 1.8% | 2.5% |

| 21 | From year before to year after SEO | 2.1% | -0.1% | 6.5% | 0.2% |

| 22 | From year before to two years after SEO | 3.8% | 0.7% | 0.5% | 0.6% |

| 23 | From year before to three years after SEO | 2.8% | -0.9% | 4.3% | 2.3% |

Capital Expenditures, Debt, Dividends, and Other Needs for External Capital

From the previous analyses, we find no evidence that penny firms stockpile their SEO proceeds as cash to spend on future investments. However, it is possible that SEO issuers issue shares to time the market then quickly spend the proceeds on investments which they would not undertake should there be no SEO. To address this concern, we examine the firms’ capital expenditure surrounding the SEOs. We also report the data for all issuers and three subsamples, namely top dividend payers, other dividend payers, and firms that have never paid dividends.

In Panel A of Table 5, we report the median capital expenditure/SEO proceeds ratio (CapEx/SEO proceeds) and find that for the median penny issuers in the full sample, capital expenditures in the year before the SEO accounts for 1.91% of the SEO proceeds (Row 1). This ratio is 5.98% for the median top payer, 2.31% for other payers, and 1.09% for the never paid dividends group. We only document marginal changes in this ratio in the year of SEO (Row 2) and the year after SEO (Row 3). Similarly, in Row 4 and 5, we further document minimal changes in the CapEx/SEO proceeds and CapEx/Total assets ratios over the two-year period from one year before to one year after SEO. In Row 7, we document that around 63% of penny stock issues see an increase in their capital expenditure after their SEO. This is much lower compared to the figure documented by DeAngelo, et al., (2020) for all firms except penny firms, which is 81%. Overall, the results in Panel A suggest no evidence that the penny issuers use their SEO proceeds to fund capital investment.

In Panel B of Table 5, we examine the pro forma Cash/Total assets (Cash/TA) and Excess cash/TA ratios under the assumptions that there would be no increase in capital expenditure in the year after the SEO and there would be no SEO. We find that if the capital expenditures of penny firms remained flat at the level of the year before the SEO, only 32.23% of issuers would run out of cash and 40.79% would have negative excess cash balances the year after the SEO (Rows 10 and 11). This suggests that the need for capital investment is not necessarily the motivation for penny issuers to conduct SEOs.

We also perform a further test to ascertain whether most penny issuers do not face an immediate cash shortfall due to the repayment of debt. In Panel C of Table 5, we document that 33.04% of penny issuers increase the absolute level of their debt obligations from the year before to the year after the SEO (Row 12). On the other hand, 26.9% of the issuers see no change in their debt (Row 13), leaving only about 40% of the issuers with a decline in their debt. This means that most of the issuers do not use the SEO proceeds for debt repayment.

| Table 5 Capital Expenditure And Debt Level Of Firms Surrounding Seos |

|||||

|---|---|---|---|---|---|

| All Issuers | Top Payers | Other Payers | Never Paid | ||

| PANEL A: Capital Expenditures in years surrounding SEO | |||||

| 1 | Median [CapEx in year before SEO]/SEO proceeds | 1.91% | 5.98% | 2.31% | 1.09% |

| 2 | Median [CapEx in year of SEO]/SEO proceeds | 1.50% | 7.63% | 1.69% | 1.21% |

| 3 | Median [CapEx in year after SEO]/SEO proceeds | 1.98% | 9.51% | 3.02% | 1.22% |

| 4 | Median [two-year change in CapEx]/SEO proceeds | 2.22% | 2.56% | 0.57% | 0.12% |

| 5 | Median [two-year change in CapEx]/TA in year after SEO | 0.19% | 1.68% | 0.12% | 0.59% |

| 7 | Percent with CapEx increase (year before to year after SEO) | 63.82% | 70.00% | 57.35% | 64.86% |

| PANEL B: Cash holdings given no SEO proceeds received and no CapEx increases made in year of and after SEO | |||||

| 8 | Median pro forma Cash/TA in year after SEO | 34.25% | 37.45% | 33.12% | 34.61% |

| 9 | Median pro forma Excess cash/TA in year after SEO | 19.14% | 28.11% | 11.99% | 21.40% |

| 10 | Percent with pro forma cash/TA<0 in year after SEO | 32.23% | 40.00% | 32.35% | 31.08% |

| 11 | Percent with pro forma Excess cash/TA<0 in year after SEO | 40.79% | 40.00% | 42.65% | 39.19% |

| PANEL C: Absolute Change in debt(year before to year after SEO) | |||||

| 12 | Percent of issuers with debt increase | 33.04% | 33.33% | 28.57% | 31.67% |

| 13 | Percent with no change in debt | 26.96% | 33.33% | 26.79% | 21.68% |

| 14 | Percent with debt decrease less than 25% of SEO proceeds | 24.34% | 11.11% | 25.00% | 46.43% |

| 15 | Percent with debt decrease between 25% and 50% of SEO proceeds | 1.74% | 11.11% | 1.79% | 0.00% |

| 16 | Percent with debt decrease equal to 50% or more of SEO proceeds | 13.92% | 11.11% | 17.86% | 8.33% |

Evidence of “Dump and Dilute” Activities Surrounding Penny Stocks’ SEOs

According to the previous analyses, our findings fail to support both the market-timing and life-cycle hypotheses. We also find that penny issuers do not use their SEO proceeds for any “good” purposes, including cash stockpiling, capital investment, and debt repayment. This evidence gives rise to the suspicion that manipulation exists surrounding penny stocks’ SEOs. In the subsequent part of this study, we attempt to test this manipulation hypothesis.

Essentially, one of the well-known penny stock wrongdoings is the “pump and dump” scheme. The seller will hype the stock price with false information and then dump the shares after the price increases and gain a huge profit (Bartels, 2000; Barnes, 2017). Penny stock issuers may fool uninformed investors via private placement in which they issue shares to speculators that do not have any intention to develop the companies but want to resell these shares to uninformed investors (Chen, 2004). Unregistered brokers may use “boiler room” tactics to induce unsophisticated investors to invest in penny stocks (Bradley et al., 2006). The “dump and dilute” scheme is when the firms keep issuing stocks for no reason but take investors’ money and periodically reverse stock splits.

We try to test whether there is any evidence of “dump and dilute” in penny stocks’ SEOs by examining the re-issued SEOs and reverse stock splits. Reverse stock split data are provided by the CRSP. Panel A of Table 6 shows that 56.57% of penny stock SEO events are followed by SEO re-issuing. Thirty SEO events out of 175 re-issue shares once after conducting an SEO, whereas 69 SEO events re-issue shares at least two times. These results suggest that penny issuers tend to issue shares many times, which is evidence that they may keep issuing shares for no reason. We also find that non-dividend payers are more likely to reissue SEOs than dividend payers (57.39% vs. 55.00%). Moreover, the results of this part are consistent with the results in Panel I of Table 3, which indicates that firms with positive abnormal accruals are more likely to issue SEOs but are less likely to reissue shares than firms with negative abnormal accruals (54.03% vs 62.75%).

In Panel B of Table 6, we document that 29.71% of SEO events perform a reverse split during the window from two years before to one year after the SEOs. This figure reduces to 18.86% when we examine the window from two years before to the year of the SEOs, and we find that 9.14% of SEO firms do reverse splits in the same year of the SEO. Moreover, the results show that dividend payers and firms with negative abnormal accruals are more likely to do a reverse split than non-dividend payers and firms with positive abnormal accruals, respectively. We therefore infer that penny issuers tend to reverse their stock splits to artificially hype their stock prices so that they can receive higher proceeds for their current and future SEOs. Further, firms with negative accruals, which cannot gain an advantage from earnings manipulation, seem to employ reverse splits to boost the stock prices.

Overall, our findings are consistent with the “dump and dilute” scheme, which suggests that penny firms tend to reissue shares without any proper reason and reverse stock splits when the stock prices decline. Moreover, firms experiencing negative abnormal accruals, which cannot gain an advantage from earnings management, employ reverse splits to boost stock prices and reissue shares to substitute overstated earnings. In other words, if firms can utilize earnings management to make their performance look good, they do not have to engage in activities such as the “dump and dilute” scheme. This provides evidence to support our manipulation hypothesis.

| Table 6 Reissuance And Reverse Split Among Seo Sample |

|||||

|---|---|---|---|---|---|

| PANEL A: Reissuance of shares | |||||

| Number of SEO events | |||||

| Frequency of issues | Dividend payer | Non dividend payer | Abnormal accruals < 0 | Abnormal accruals > 0 | Total |

| 1 | 27 | 49 | 19 | 57 | 76 |

| 2 | 14 | 16 | 10 | 20 | 30 |

| 3 | 6 | 24 | 9 | 21 | 30 |

| 4 | 8 | 16 | 8 | 16 | 24 |

| 5 | 5 | 10 | 5 | 10 | 15 |

| Total SEO events | 60 | 115 | 51 | 124 | 175 |

| Reissued SEO events | 33 | 66 | 32 | 67 | 99 |

| Percent of reissued SEO events | 55.00% | 57.39% | 62.75% | 54.03% | 56.57% |

| PANEL B: Reverse split | |||||

| Dividend payer | Non dividend payer | Abnormal accruals < 0 | Abnormal accruals > 0 | Total | |

| reverse split [t-2, t+1] | 28 | 24 | 26 | 26 | 52 |

| reverse split [t-2, t] | 17 | 16 | 15 | 18 | 33 |

| reverse split on the same year of SEO | 9 | 7 | 7 | 9 | 16 |

| reverse split [t-2, t+1] | 46.67% | 20.87% | 50.98% | 20.97% | 29.71% |

| reverse split [t-2, t] | 28.33% | 13.91% | 29.41% | 14.52% | 18.86% |

| reverse split on the same year of SEO | 15.00% | 6.09% | 13.73% | 7.26% | 9.14% |

Conclusion

In the present study, we examine the SEOs of penny stocks in the U.S. market from 1990 to 2013. Our analyses show that neither the market-timing nor the life-cycle hypotheses can explain the decision of conducting SEOs among penny stocks. We also find that penny issuers tend to use a small portion of the SEO proceeds to stockpile cash or spend it on capital expenditure. Moreover, they are less likely to use the SEO proceeds to pay off debts. These findings suggest that penny stocks only use a small portion of their SEO proceeds for “good” purposes. More importantly, we also find evidence of the “dump and dilute” scheme among penny stocks, where there is a tendency to reissue shares many times and to reverse stock splits. Overall, our evidence suggests that there exists manipulation surrounding penny stocks’ SEOs.

We add to the limited literature that examines penny stocks by showing that penny stocks conduct SEOs for none of the “good” purposes. Moreover, we find evidence of manipulation surrounding the SEOs of penny stocks. This will alert both investors and regulators to be more cautious regarding penny stocks and any stocks with low opacity in general. We also suggest that future research should look at the scheme of manipulation used by penny issuers and how they withdraw money from the companies for their own purposes.

Conflict of Interest

The authors declare that they have no conflict of interest.

Endnotes

1. Seguin, & Smoller. (1997). Define penny stocks as having a price below $3. Beatty, & Kadiyala. (2003). Bradley, et al., (2006); Floros & Shastri, (2009). Apply the definition of penny stocks when the stock price is below $5. Nofsinger & Varma, (2014). Classify penny stocks as having a price below $1

2. Kothari, et al., (2016). also use abnormal R&D as a proxy of real activity earnings management. However, penny stocks have a lot of missing data in terms of R&D, so we focus only on abnormal accruals.

3. Total accruals = (change in non-cash current assets - change in current labilities net of the current portion of long-term debt—depreciation and amortization)/lagged assets.

References

- Baker, M., & Wurgler, J. (2002). Market timing and capital structure. The Journal of Finance, 57(1), 1-32.

- Barnes, P. (2017). Stock market scams, shell companies, penny shares, boiler rooms and cold calling: The UK experience. International Journal of Law, Crime and Justice, 48, 50-64.

- Bartels, K.C. (2000). Click here to buy the next Microsoft: The penny stock rules, online microcap fraud, and the unwary investor. Indiana Law Journal, 75, 353.

- Beatty, R., & Kadiyala, P. (2003). Impact of the penny stock reform Act of 1990 on the initial public offering market. The Journal of Law and Economics, 46(2), 517-541.

- Bradley, D.J., Cooney Jr, J.W., Dolvin, S.D., & Jordan, B.D. (2006). Penny stock IPOs. Financial Management, 35(1), 5-29.

- Carlson, M., Fisher, A., & Giammarino, R. (2006). Corporate investment and asset price dynamics: Implications for SEO event studies and long?run performance. The Journal of Finance, 61(3), 1009-1034.

- Chen, R. (2004). Precarious investments in microcap stocks. The Journal of Investing, 13(4), 25-36.

- DeAngelo, H., DeAngelo, L., & Stulz, R.M. (2010). Seasoned equity offerings, market timing, and the corporate lifecycle. Journal of Financial Economics, 95(3), 275-295.

- Eraker, B., & Ready, M. (2015). Do investors overpay for stocks with lottery-like payoffs? An examination of the returns of OTC stocks. Journal of Financial Economics, 115(3), 486-504.

- Fama, E.F., & French, K.R. (2015). A five-factor asset pricing model. Journal of financial economics, 116(1), 1-22.

- Floros, I.V., & Shastri, K. (2009). A comparison of penny stock initial public offerings and reverse mergers as alternative mechanisms to going public.

- Frank, M.Z., & Goyal, V.K. (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67(2), 217-248.

- Huang, R., & Ritter, J.R. (2009). Testing theories of capital structure and estimating the speed of adjustment. Journal of Financial and Quantitative analysis, 44(02), 237-271.

- Kothari, S.P., Mizik, N., & Roychowdhury, S. (2016). Managing for the moment: The role of earnings management via real activities versus accruals in SEO valuation. The Accounting Review, 91(2), 559-586.

- Kumar, A. (2009). Who gambles in the stock market? The Journal of Finance, 64(4), 1889-1933.

- Loughran, T., & Ritter, J. (1995). The new issues puzzle. Journal of Finance, 50, 23–51.

- Loughran, T., & Ritter, J. (1997). The operating performance of firms conducting seasoned equity offerings. Journal of Finance, 52, 1823–1850.

- Nofsinger, J.R., & Varma, A. (2014). Pound wise and penny foolish? OTC stock investor behavior. Review of Behavioral Finance, 6(1), 2-25.

- Rangan, S. (1998). Earnings management and the performance of seasoned equity offerings. Journal of Financial Economics, 50(1), 101-122.

- Seguin, P.J., & Smoller, M.M. (1997). Share price and mortality: An empirical evaluation of newly listed Nasdaq stocks. Journal of Financial Economics, 45(3), 333-363.

- Teoh, S.H., Welch, I., & Wong, T.J. (1998). Earnings management and the underperformance of seasoned equity offerings. Journal of Financial economics, 50(1), 63-99.

- Walker, R.H. (2000). Testimony concerning the involvement of organized crime on Wall Street.