Research Article: 2023 Vol: 26 Issue: 3S

What Makes People Actually Adopt the Mobile Payment Services in Pakistan?

Anjum Ilyas Siddiqui, Virtual University of Pakistan

Amna Mumtaz, Virtual University of Pakistan

Muhammad Ashfaq, Virtual University of Pakistan

Citation Information: Ilyas Siddiqui, A., Mumtaz, A., & Ashfaq, M. (2023). What makes people actually adopt the mobile payment services in pakistan?. Journal of Management Information and Decision Sciences, 26 (S3), 1-14.

Abstract

Mobile phones are not only used as a communication gadget in these days but they are also used to make payments. It is necessary for telecommunication companies and banks to understand the factors which consumer consider while adopting mobile payment services. Hypotheses were developed to understand and analyze the factors effecting the adaptation of Mobile payments in Pakistan. The questionnaires were distributed using convenience sampling where the response rate from the participants was 93%. The study results using Smart-PLS concluded that perceived ease of use, mobile payment relative advantage, trust and security, cost and perceived usefulness have significant effect on the customers’ behavior of mobile payments. The study could not find mediating role of perceived usefulness in the behavioral intention of mobile payments adaptation. Furthermore; security was partially mediating the relationship between cost and behavioral intention of adopting the mobile payment service. Relationship between compatibility and mobile payment service adoption was found as highly insignificant. This study is valuable for cellular companies and financial institutions to design and improve their services and products. This study also contributes to the diffusion of innovation theory and technology acceptance model.

Keywords

Structural Equation Modeling, TAM, Behavioral Intention, Mobile Payment.

Introduction

The speedy progress in information technology (IT) has assumed an extraordinary importance in our life, that’s why IT is being used by the banks these days for formulating their marketing and business strategies (Adebiyi et al., 2013). While during the last couple of decades, banking industry is using IT at large scale, so e-banking has become one of the important mechanism for delivering financial services to the customers (Salehi & Alipour, 2010).

Mobile phones have changed the telephony over the last few decades. Today, mobile phones are not only fulfilling the need of telephony but also providing significant services like mobile payments (m-payments) to mobile users. Today, millions of Pakistani have access to internet which is not only playing significant role in time saving while making transactions through m-payment but also playing indispensable role to increase volume of business. Stakeholders of mobile payments are cellular mobile operators and their clients and financial institutions including banks. Information technology is playing important role in development of banking sector. After the revolution in the information and communication technologies in Pakistan, E- banking facilities have already been provided by the consumer banking from the last two decades (Salehi & Alipour, 2010). Now a days, Mobile payments has been widely used as an alternate for the micro-payments in shopping mall, restaurants or even payment of utility bills by the mobile users. Mobile payment system is working in collaboration of mobile cellular companies and banks. M-payment system is paper less because SMS is sent to both sender and receiver upon sending/receiving money. M-payment service has many potential benefits than what is currently offering to customer but the adoption of m-payment system is very slow in Pakistan (Bachfischer et al., 2004; Noreen et al., 2021). So it is necessary to identify the behavioral factors which are considered by customers while adopting m-payment service. Many factors contribute to the success or failure of M- payment service systems like use of information technology in business (Bachfischer et al., 2004). Mobile Payment system is a relatively new technology in Pakistan, therefore; the mobile users in Pakistan have different perceptions about adoption. The main objective of the study is to determine the reasons for accepting mobile payments from the consumer's point of view and to identify factors that may affect their intention to use the service. M-payment service system is getting popularity worldwide; its transactions are increasing but financial institutions and mobile companies are still facing problem to attract customers for mobile payment services in Pakistan. So it is a dire need to identify “What Makes People Actually Adopt the Mobile Payment Services in Pakistan?”.

Literature Review

Detailed review of previous studies in this area has been discussed in this part. Countless transactions at personal and business are being conducted through mobile phones. Instant access and mobility are important features for such a massive use of mobile phones (Leung & Wei, 2000). Demand for money transfer services is also increased due to urbanization from villages to cities (Tobbin & Kuwornu, 2011).

The mobile money is not well-defined in the literature (Tobbin & Kuwornu, 2011). However, monetary transactions like funds transfer or receipt either directly or through agent or without agent using mobile phones is referred as payments (M-Payment) (Mallat, 2007)”.

The comprehensive review of the literature is done by Dahlberget et al., (2008) where they have concluded that technology is one of the most important elements in mobile payments. The author also tried to predict the consumer intention to use mobile payments. For this purpose, the author had used TAM-model to explore the factors which are critical for Pakistani customers’ behavioral intention to use the mobile phones as payment devices, through mobile payment services.

Technology Acceptance Model

The studies where acceptance of technologies by the users had been investigated, the Technology Acceptance Model (TAM) (Davis, 1989) was widely used (Mailizar et al., 2021). In this theory, it is stated that intention of users to use a system is explained by perceived ease of use and perceived usefulness of users to use a service (Adebiyi et al., 2013).

From time to time, there is a need to adjust or extend the TAM so that it will fulfill the needs of a certain study or requirements of the particular service or product (Zmijewska et al., 2004). So, this is the beauty of TAM that it can be adjusted for different variables, while using it in various types of modern technologies. However, the basic TAM model remains the same and in most of the studies, additional variables are added in TAM (Mailizar et al., 2021).

Sleiman et al., (2021) used TAM to explore the mobile payments’ adoption in China. Another study by Mallat (2007) explored the important factors that affect the mobile payments adoption in Finland. The findings of the study revealed that mobile payments provide the advantages to the consumers especially when the payments are at the micro level (like 10-100 euros).

Liu et al., (2009) have used the TAM model to examine the critical factors that affect the usage of learning online. The author added additional variables in the TAM model like user interface design, previous online learning experience and perceived interaction to study the related phenomenon. SEM was used to analyse the data and results revealed that online course design positively affects the PU, PEU and behavioral intention.

Adebiyi et al., (2013) conducted a study in in the context of Nigeria for exploring the mobile payments adoption, using DIT (Diffusion of Innovation Theory) and TAM. The study used behavioral intention as dependent variable and compatibility, perceived usefulness (PU), complexity, perceived ease of use (PEU), cost, trust and security and relative advantages as independent variables. The findings revealed that PEU is significantly affected by PU of mobile payments and PEU and PU are significantly affected by the compatibility, while trust and security, cost and complexity are also significant for mobile payments adoption in Nigeria.

The study conducted by Pagani (2004) explores the factors regarding the adoption of third generation mobile multimedia services in Itlay. The study is exploratory and covers the twenty-four focus groups and six markets of Italy. The author concluded that PEU and PU are the most crucial factors for adoption of mobile multimedia services.

Dahlberg et al., (2003) have examined the efficiency of the TAM model in explaining the acceptance of mobile payments by the users. The results revealed that the TAM model is useful at explaining the customers’ adoption of mobile payments.

Diffusion of Innovation Theory (DIT)

Another popular theory for explaining the consumer intentions to use new technology is Diffusion of Innovation Theory (Rogers, 1995). Rogers (2003) explained that any innovation has 5 characteristics including Compatibility, Relative Advantage, Observability, Complexity, and Trialability.

DIT by Rogers (1995) has been used in various studies related to technological adoption (Szmigin & Bourne, 1999; Lee et al., 2003; Tornatzky & Klein, 1982; Ntemana &Olatokun, 2012; Teo & Pok, 2003). It is a widely accepted theory for analyzing the adoption of different mobile and financial and technologies like electronic payments (Szmigin & Bourne, 1999), mobile commerce (Teo & Pok, 2003) and mobile banking (Lee et al., 2003). So in this study, variables compatibility and relative advantage have been taken as independent variables as suggested by DIT.

Independent variables

Perceived Usefulness (PU)

Any factor which is important for particular person and it can satisfy his needs in comparatively better way is referred as Perceived usefulness (Fishbein& Ajzen, 1977).

“The degree to which a person believes that using a particular system would enhance his or her job performance is Perceived Usefulness” (Davis, 1989). Sleiman et al., (2021) suggested that behavioral intention toward actual usage is influenced by PU. To & Trinth proved that PU has a significant positive impact on behavioral intention to use M-wallets.

Many studies related to information systems prove that perceived usefulness significantly impact the usage intention (Agarwal & Prasad, 1999; Davis et al., 1989; Jackson et al., 1997; Basuki et al., 2022).

Perceived Ease of Use (PEU)

“The degree to which a person believes that using a particular system would be free of effort is PEU” (Davis, 1989). PEU is a key factor because it demonstrates that whether a customer perceives a system easier to use or not (Tobbin & Kuwornu, 2011). To and Trinh (2021) conducted a study related to use mobile wallets in vietnam and concluded that PEU affects BI (Behavioral Intention).

Trouble-free registration process, convenient customer services, simple payment method, minimum steps needed for a payment, etc. comprise the perceived ease of use of mobile payment system. In addition, perceived ease of use increases with the increase in sale points and approachable money transfer brokers. Moreover, mobile payments can be made through mobile phones with simple features and software. (Tobbin & Kuwornu, 2011)

Extensive research have been conducted to know the relationship between perceived ease of use and usage intention and it is proved that there is significant relationship between these factors (Basuki et al., 2022; Davis, 1989; Agarwal & Prasad, 1999; Humida et al., 2022; Guriting & Ndubisi, 2006). Similarly a study conducted by Humida et al., (2022) found that PEU had an impact on behavioral intention to use e-learning system in Bangladesh.

Compatibility (Co)

From prospective users’ point of view, it is necessary to confirm that M-payment service system should be consistent with his basic needs. So compatibility refers to the degree to which an invention is believed to be consistent with the needs, belief and prior experience of potential users. Hardgrave et al., (2003) concluded that compatibility affects the PEU, PU and BI.

Relative Advantage (RA)

An innovation is believed to be relatively advantageous to use if it is considered by the users comparatively a better option based on some features including financial benefits, satisfaction, etc. Moore & Benbasat (1991); Plouffe et al., (2001), Tan & Teo (2000) and Taylor & Todd (1995)s asserted that the relative advantage of mobile payments have significant impact on the customer intention to use of mobile payment system.

Some variables extracted from literature, other than TAM and DIT, are taken in this study as independent variables including Trust and Security (TS) and Cost of Service (Cost).

Trust and Security (TS)

According to Tobbin & Kuwornu (2011), trust actually measures the customer’s confidence level that the service will be delivered with minimum obstructions. Moreover, perceived risk is the faith of customer about possibility of negative outcomes by using mobile money transactions (Tobbin & Kuwornu, 2011). Studies by Kim (2010) and Adebiyi et al. (2013) concluded that trust and security plays an important role in the mobile payment usage intentions.

Cost of Service (Cost)

Adebiyi et al. (2013); Heijden (2002) and Mallat (2007) suggested that Cost is one of the important factors to adopt mobile payments. Mallat (2007) suggested that if the cost of doing a transaction is to be charged by the customers, then it affects the customers’ adoption.

Dependent variable- Behavioral intention (BI)

A number of researchers have used Behavioral intention (BI) as a dependent variable including Pourghanbari et al. (2022); Nuangjamnong & Maj (2022); Humida et al. (2022), Chen (2007); Mailizar et al. (2021); Adebiyi et al. (2013); Basuki et al. (2022) and Cheng et al. (2011). These studies were focused to study the Behavioral intention (BI) so using different variables. So in this study Behavioral intention (BI) is taken as dependent variable.

The Study Problem and Its Hypotheses

The demand of Mobile payments is increasing day by day and the volume of transaction through theses services is also growing. But still the financial institutions and comapnies offering these services are facing difficulty to know about the factors which are responsilbe for adoption of these services. So, there is a need to know what makes people adopt the mobile payment services in pakistan? For this, based on literature, following hypotheses have been developed:

H01: BI to use Mobile payments is significantly affected by Perceived Usefulness (PU).

H02: BI to use Mobile payments is significantly affected by Perceived Ease of Use (PEU).

H03: PU of mobile payments is significantly affected by PEU.

H04: BI is significantly affected by the Compatibility (Co)

H05: BI is significantly affected by the Relative advantage (RA)

H06: Trust and Security (TS) has significant impact on mobile payment’s Perceived usefulness (PU).

H07: There is a significant impact of cost on Behavioral intention (BI) of mobile payments.

H08: Cost has significant impact on Behavioral intention (BI) with mediating effect of Trust and Security (TS).

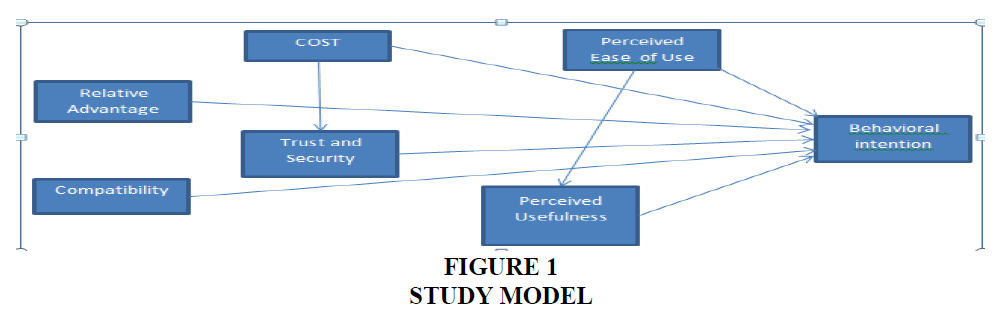

Study Model

Following theoretical framework has been formulated to predict behavioral intention through modified TAM model on the basis of available literature Figure 1.

Objectives of the Study

Investigating the factors responsible for adoption of mobile payment services

Studying the mediating role of Trust and Security between Cost and Behavioral intention

Study Methodology

The study sample and procedure

Purpose of the study is to identify the factors which play important role in adoption of mobile payment service. Population of the study is users and non-users of mobile payment services. According to Hoyle (1995), it was concluded that sample of 100-200 is sufficient for path analysis modeling. Sample size was 250 because previous studies on this topic used sample of two hundred and fifty or less than two hundred (Pourghanbari et al., 2022; Adebiyi et al., 2013; Amin, 2008; Davis, 1989; Yan et al., 2009; Nuangjamnong & Maj, 2022). Furthermore; this study is limited to main cities of Pakistan i.e Islamabad, Lahore and Karachi. Reason to select these cities is that money transfer service is usually used from big cities to countrywide (Tobbin & Kuwornu, 2011). Data was collected through an adaptive questionnaire (Adebiyi et al., 2013) for the purpose of analysis.

Study Tool

Instrument used in this study is based on literature review. The instrument consists of two sections. Section A provides demographic attributes of respondents like age, gender etc. Section B is based on factors indicating consumer intention to use mobile payment service. This section is further divided into different constructs having 23 items. Further, for hypothesis testing of the structural model SMART PLS 3.0 (Pourghanbari et al., 2022; Basuki et al., 2022; Humida et al., 2022) is used which is considered a complete Structural Equation Modeling tool. Christian Ringle and his team developed this tool at the University of Hamburg in Germany. The five-point Likert scale is used in questionnaire. Items of Behavioral Intention (BI), perceived usefulness (PU), Compatibility (Co), perceived usefulness (PU), Trust and security (TS), and Cost were adapted from Adebiyi et al., 2013.

Reliability of the Study Tool

Reliability and Validity Analysis respectively is given in Table 1 and Table 2. Reliability of the scales is checked through Cronbach’s Alpha. Range of reliability coefficient of Cronbach’s alpha is ‘zero to one’. Higher the value of Coronbach’s alpha represents internal consistency of the items on the scale but it does not mean uni-dimensionality of the scale (Gliem & Gliem, 2003). It was suggested by Nunnally (1967) that cronbach’s alpha betwenn 0.50 and 0.60 is acceptable. The reported results in table 1 show that the reliability of the all construct is above 0.50 except trust and security.

| Table 1 Construct Reliability | |

| Cronbach's Alpha | |

| Behavioral Intention | 0.787 |

| Compatibility | 0.863 |

| Cost | 0.545 |

| PEU | 0.826 |

| PU | 0.823 |

| Relative advantage | 0.838 |

| Trust and Security | 0.475 |

| Table 2 Composite Reliability | |

| Variable | Composite Reliability |

| Behavioral Intention | 0.874 |

| Compatibility | 0.888 |

| Cost | 0.760 |

| PEU | 0.887 |

| PU | 0.884 |

| Relative advantage | 0.903 |

| Trust and Security | 0.725 |

Composite Reliability

Internal consistency of the construct is estimated through composite reliability. Value of composite reliability should be higher than 0.60. Values of composite reliability are greater than 0.60 in this study.

Discriminant Validity

Reflective measurement model is used in this study and its validity assessment focuses on discriminant validity and convergent validity. Hetrotrait-Monotrait (HTMT) ratio is used to check the Discriminant validity. HTMT ratio should be less than 0.90 which indicates that constructs are discriminated from each other. According to the results given in the table 3; all the values are below the 0.90.

| Table 3 Determinant Validy | |||||||

| Behavioral Intention | Compatibility | Cost | Perceived Ease of Use | Perceived Usefulness | Relative advantage | Trust and security | |

| BI | |||||||

| Compatibility | 0.165 | ||||||

| Cost | 0.624 | 0.176 | |||||

| PEU | 0.199 | 0.08 | 0.132 | ||||

| PU | 0.695 | 0.198 | 0.387 | 0.066 | |||

| Relative advantage |

0.665 | 0.146 | 0.243 | 0.164 | 0.6 | ||

| Trust and security |

0.389 | 0.116 | 0.478 | 0.165 | 0.272 | 0.286 | |

Average Variance Extracted (AVE)

Convergent validity is equally important as discriminant validity is important. The value of AVE must be greater greeter than 0.5 Fornell C., & Larcker, D. F. (1981). According the Table 4; values of all construct is greater than 0.5 except Trust and security.

| Table 4 Convergent Validity | |

| Average Variance Extracted (AVE) | |

| Behavioral Intention | 0.699 |

| Compatibility | 0.675 |

| Cost | 0.516 |

| PEU | 0.724 |

| PU | 0.657 |

| Relative advantage | 0.755 |

| Trust and Security | 0.486 |

Study Results

Model Evaluation: Structural Model Results

In this part statistical evidence are provided for theorized model and it is estimated through the structural portion of the model.

Multi-Collinearity

First and foremost thing is examining the structural model for collinearity.

In the context of PLS-SEM, It is suggested that value of VIF 5 or above indicates the problem of potential collinearity. However, the result given in the Table 5 shows all the values are below 5 thus we can say that the data is free from collinearity problem.

| Table 5 Inner VIF Values | |||||||

| Behavioral Intention | Compatibility | Cost | PEU | PU | Relative advantage | Trust and security | |

| Behavioral Intention |

- | - | - | - | - | - | |

| Compatibility | 1.113 | - | - | - | - | - | - |

| Cost | 1.028 | - | - | - | - | 1 | |

| PEU | 1.411 | - | - | - | 1 | - | - |

| PU | 1.38 | -- | - | - | - | - | - |

| Relative Advantage |

1.057 | - | - | - | -- | - | |

| Trust and Security |

1.052 | - | - | - | - | - | |

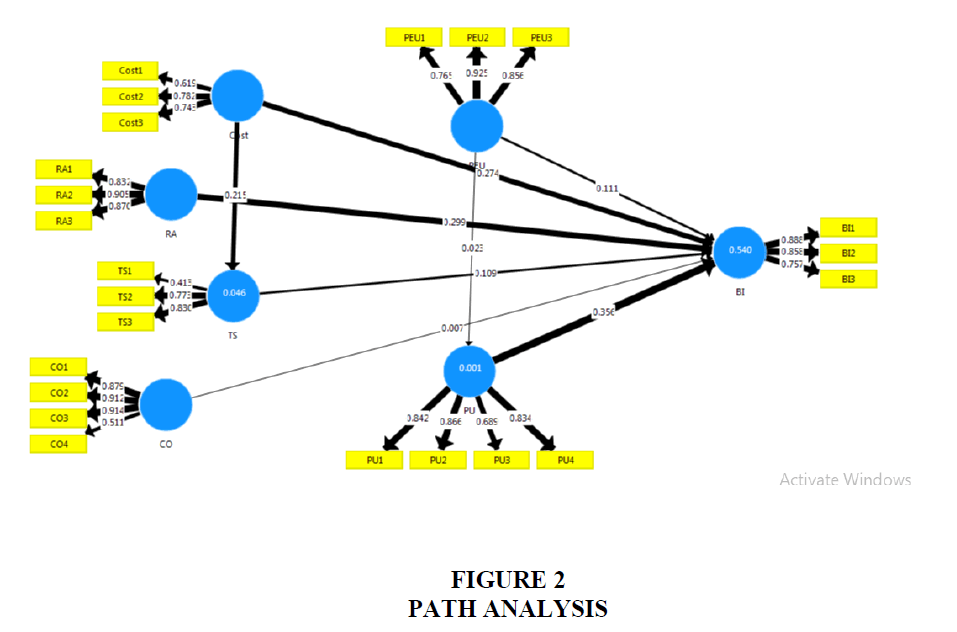

PLS Path Model Analysis

Structural model of this study is provided in Figure 2 and figure 3. Arrows shows hypothesized relationships. PLS R2 represents the amount of variance explained through variables used in the model. In the model; Cost, Compatibility, relative advantage, trust and security, Perceived ease of usefulness and Perceived usefulness and behavioral intention are used. The value of R2 ranges between 0 and 1, where higher the value better the path model estimation. According to Chin (1998), values of 0.19, 0.33 or 0.67 for endogenous latent variables in the inner path model are considered as weak, moderate, or substantial respectively but Wong (2013) claimed that the R2 value should be at least 0.25. As shown in figure 2 and table 6, the model explains 54% of the variance in Behavioral Intention which is due to perceived ease of use and perceived usefulness and it is moderate variation (Chin, 1998).

| Table 6 Direct Relationship for Hypothesis Testing | |||||||

| Original Sample (O) |

Mean- value | STDEV | T- Statistics |

P- Values |

Decision | ||

| H01 | CO -> BI |

0.007 | 0.016 | 0.049 | 0.138 | 0.89 | Rejected |

| H02 | Cost -> BI |

0.274 | 0.277 | 0.045 | 6.06 | 0 | Accepted |

| H03 | Cost -> TS |

0.215 | 0.23 | 0.089 | 2.427 | 0.016 | Accepted |

| H04 | PEU -> BI |

0.111 | 0.106 | 0.054 | 2.068 | 0.039 | Accepted |

| H05 | PEU -> PU |

0.023 | 0.024 | 0.083 | 0.273 | 0.785 | Rejected |

| H06 | PU -> BI | 0.356 | 0.35 | 0.056 | 6.379 | 0 | Accepted |

| H07 | RA -> BI |

0.299 | 0.298 | 0.051 | 5.92 | 0 | Accepted |

| H08 | TS -> BI | 0.109 | 0.11 | 0.057 | 1.919 | 0.056 | Accepted |

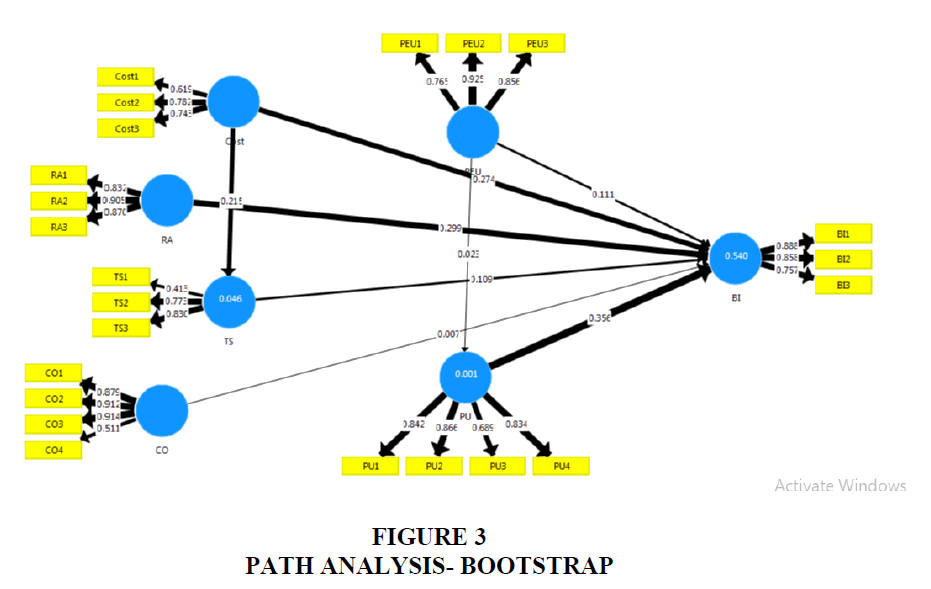

PLS Path Model Analysis using Bootstrapping

Purpose of Bootstrapping option is to achieve precision in the estimations of the path coefficients (Wong, 2013). T-statistics and P-Vales are generated for testing the significance of both inner and outer model. The measurement model and proposed hypothesized relationships in model are tested for goodness of fit After bootstrapping. Figure 3 shows the structural model drawn through bootstrapping procedure Yan et al. (2021).

Table 6 represents the p-values of the model which indicates that the path PEU to BI is significant with a p-value of 0.039, which is less than 0.05. Similarly, the path PU to BI is highly significant as p-vale is less than 1%. Hypothesized path of Relative Advantage (RA) to BI is highly significant as p-value is less than 1%; Cost to BI and relative advantage (RA) to BI are also highly significant and Trust and security (TS) to BI is significant at 10%.

Specific indirect effects of the model can be obtained through bootstrapping approach. PLS-SEM generates a bias-corrected confidence interval for indirect paths. The relationships between Cost → BI, Cost → TS and TS → BI are significant which means partial mediation. No mediation exist where PEU → PU is insignificant, PU → BI and PEU → BI are significant Table 7.

| Table 7 Model Fitness | ||

| Saturated Model |

Estimated Model |

|

| SRMR | 0.083 | 0.122 |

| d_ULS | 1.919 | 4.111 |

| d_G1 | 0.858 | 0.953 |

| d_G2 | 0.652 | 0.742 |

| Chi-Square | 868.537 | 901.770 |

| NFI | 0.654 | 0.641 |

Model Fit

In Smart PLS, standardized root mean square (SRMR) is used to assess the model fit. The model used in the study, the value of SRMR is 0.083 indicating that model is good fit (Ringle, 2022).

Conclusion

The aim of the study is to predict the behavioral intention of consumer to use mobile payment service. It is tested through TAM model by re-specifying the integrated model topredict behavioral intention to use mobile payment services by adding some variables from DIT including compatibility and relative advantage and some additional variables like cost and trust and security.

Relationship between Perceived ease of use to behavioral intention perceived usefulness to behavioral intention are found in support of technology acceptance model. Cost, compatibility trust and security have directly and indirectly significant relationship with behavioral intention to use mobile payment services but relative advantage is highly insignificant relationship with behavioral intention.

This study is considered as an important empirical research related to m-payment technologies. Moreover, it is contributing for identifying the factors which are important to predict the adoption in developing markets. This study also provides an insight of the attitude of Pakistani mobile service user clients.

Partial Least Square Structural Equation Modeling (PLS-SEM) is used in this study which is an emerging path modeling approach capable of handling data inadequacies.

Recommendations

As this study provides an insight into the factors which are important for adoption of mobile payments but still, there are some recommendations for future research. Firstly, mobile payments is not a very old service in Pakistan, so still there is a need to make people aware of this service so that better results can be obtained which will enable to more precisely predict the factors affecting its adoption. Moreover, much generalized results can be obtained if sample size is increased. It is also possible to use proportionate sampling technique; sample can be divided among equal number of literate and illiterate people and a comparison among the responses of both groups can be carried put. Another recommendation for future research is to divide the sample into equal number of users and non-users of these services. In addition, some other variables can also be included like demographics, social norms, etc

References

Adebiyi, A., Alabi, E., Ayo, C., & Adebiyi, M. O. (2013). An empirical investigation of the level of adoption of mobile payment in nigeria. African Journal of Computing & ICT, 6(1), 197-207.

Agarwal, R., & Prasad, J. (1999). Are individual differences germane to the acceptance of new information technologies?. Decision sciences, 30(2), 361-391.

Indexed at, Google Scholar, Cross Ref

Amin, H. (2008). Factors affecting the intentions of customers in Malaysia to use mobile phone credit cards. Management Research News.

Indexed at, Google Scholar, Cross Ref

Bachfischer, A., Lawrence, E., & Steele, R. (2004). Towards understanding of factors influencing user acceptance of mobile payment systems. Paper presented at the IADIS International Conference WWW/Internet.

Basuki, R., Tarigan, Z., Siagian, H., Limanta, L., Setiawan, D., & Mochtar, J. (2022). The effects of perceived ease of use, usefulness, enjoyment and intention to use online platforms on behavioral intention in online movie watching during the pandemic era. International Journal of Data and Network Science, 6(1), 253-262.

Indexed at, Google Scholar, Cross Ref

Chen, H. (2008).Individual mobile communication services and tariffs (No. EPS-2008-123-LIS).

Chen, I. J. (2007). Using the Theory of Planned Behavior to understand in-service kindergarten teachers behavior to enroll in a graduate level academic program. Journal of College Teaching & Learning (TLC), 4(11).

Indexed at, Google Scholar, Cross Ref

Cheng, Y.S., Yu, T.F., Huang, C.F., Yu, C., & Yu, C.C. (2011). The comparison of three major occupations for user acceptance of information technology: Applying the UTAUT model. IBusiness, 3(02), 147.

Chin, W.W. (1998). The partial least squares approach to structural equation modeling. Modern methods for business research, 295(2), 295-336.

Dahlberg, T., Mallat, N., Ondrus, J., & Zmijewska, A. (2008). Past, present and future of mobile payments research: A literature review. Electronic Commerce Research and Applications, 7(2), 165-181.

Indexed at, Google Scholar, Cross Ref

Dahlberg, T., Mallat, N., & Öörni, A. (2003). Trust enhanced technology acceptance modelconsumer acceptance of mobile payment solutions: Tentative evidence. Stockholm Mobility Roundtable, 22, 23.

Davis, F.D., Bagozzi, R.P., & Warshaw, P.R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management science, 35(8), 982-1003.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 13(3), 319-340.

Indexed at, Google Scholar, Cross Ref

Fishbein, M., & Ajzen, I. (1977). Belief, attitude, intention, and behavior: An introduction to theory and research. Philosophy and Rhetoric, 10(2).

Indexed at, Google Scholar, Cross Ref

Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 39-50.

Gliem, J.A., & Gliem, R.R. (2003). Calculating, interpreting, and reporting Cronbach’s alpha reliability coefficient for Likert-type scales.

Guriting, P., & Ndubisi, N. O. (2006). Borneo online banking: evaluating customer perceptions and behavioural intention. Management research news, 29(1/2), 6-15.

Hardgrave, B. C., Davis, F. D., & Riemenschneider, C. K. (2003). Investigating determinants of software developers' intentions to follow methodologies. Journal of Management Information Systems, 20(1), 123-151.

Indexed at, Google Scholar, Cross Ref

Heijden, H.V.D. (2002). Factors affecting the successful introduction of mobile payment systems. Paper presented at the 15th Bled Electronic Commerce Conference eReality: Constructing the eEconomy, Bled, Slovenia.

Hoyle, R.H. (1995). Structural equation modeling: Concepts, issues, and applications: Sage.

Humida, T., Al Mamun, M.H., & Keikhosrokiani, P. (2022). Predicting behavioral intention to use e-learning system: A case-study in Begum Rokeya University, Rangpur, Bangladesh. Education and information technologies, 27(2), 2241-2265.

Indexed at, Google Scholar, Cross Ref

Jackson, C.M., Chow, S., & Leitch, R.A. (1997). Toward an understanding of the behavioral intention to use an information system. Decision sciences, 28(2), 357-389.

Indexed at, Google Scholar, Cross Ref

Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior, 26(3), 310-322.

Indexed at, Google Scholar, Cross Ref

Lee, M. S., McGoldrick, P. J., Keeling, K. A., & Doherty, J. (2003). Using ZMET to explore barriers to the adoption of 3G mobile banking services. International Journal of Retail & Distribution Management, 31 (6/7)

Indexed at, Google Scholar, Cross Ref

Leung, L., & Wei, R. (2000). More than just talk on the move: Uses and gratifications of the cellular phone. Journalism & Mass Communication Quarterly, 77(2), 308-320.

Indexed at, Google Scholar, Cross Ref

Liu, Z., Min, Q., & Ji, S. (2009). An empirical study on mobile banking adoption: The role of trust. In 2009 Second International Symposium on Electronic Commerce and Security 2, 7-13.

Luarn, P., & Lin, H.H. (2005). Toward an understanding of the behavioral intention to use mobile banking. Computers in human behavior, 21(6), 873-891.

Mailizar, M., Almanthari, A., & Maulina, S. (2021). Examining teachers’ behavioral intention to use E-learning in teaching of mathematics: an extended TAM model. Contemporary Educational Technology, 13(2), ep298.

Indexed at, Google Scholar, Cross Ref

Mallat, N. (2007). Exploring consumer adoption of mobile payments–A qualitative study. The Journal of Strategic Information Systems, 16(4), 413-432.

Moore, G.C., & Benbasat, I. (1991). Development of an instrument to measure the perceptions of adopting an information technology innovation. Information systems research, 2(3), 192-222.

Noreen, M., Ghazali, Z., & Mia, M.S. (2021). The Impact of Perceived Risk and Trust on Adoption of Mobile Money Services: An Empirical Study in Pakistan. The Journal of Asian Finance, Economics and Business, 8(6), 347-355.

Ntemana, T.J., & Olatokun, W. (2012). Analyzing the influence of diffusion of innovation attributes on lecturers’ attitude towards information and communication technologies. Human Technology: An Interdisciplinary Journal on Humans in ICT Environments, 8(2), 179-197.

Indexed at, Google Scholar, Cross Ref

Nuangjamnong, C., & Maj, S.P. (2022). Students’behavioral intention to adopt cognitive load optimization to teach stem in graduate studies. Journal of Education Naresuan University, 24(3), 24-43.

Nunnally, J.C. (1967). Psychometric theory.

Pagani, M. (2004). Determinants of adoption of third generation mobile multimedia services. Journal of interactive marketing, 18(3), 46-59.

Indexed at, Google Scholar, Cross Ref

Plouffe, C.R., Hulland, J.S., & Vandenbosch, M. (2001). Research report: richness versus parsimony in modeling technology adoption decisions—understanding merchant adoption of a smart card-based payment system. Information systems research, 12(2), 208-222.

Pourghanbari, F., Yazdifar, H., & Faghani, M. (2022). Investigating the Factors Affecting Accountants' Behavioral Intentions in Accounting Information System Adoption: Empirical Evidence of Unified Theory of Acceptance and Use of technology, and Task-Fit Model. Iranian Journal of Accounting, Auditing and Finance 6(3)

Ringle, Christian M., Wende, Sven, & Becker, Jan-Michael. (2022). SmartPLS 4. Boenningstedt: SmartPLS. Retrieved from https://www.smartpls.com

Rogers, E.M. (1995). Diffusion of innovations (4th ed.).

Indexed at, Google Scholar, Cross Ref

Rogers, E.M. (2003). Diffusion of Innovations (5th ed.): Free Press.

Salehi, M., & Alipour, M. (2010). E-banking in emerging economy: Empirical evidence of Iran. International Journal of Economics and Finance, 2(1), 201.

Indexed at, Google Scholar, Cross Ref

Sleiman, K.A.A., Juanli, L., Lei, H., Liu, R., Ouyang, Y., & Rong, W. (2021). User trust levels and adoption of mobile payment systems in China: an empirical analysis. Sage Open, 11(4), 21582440211056599.

Indexed at, Google Scholar, Cross Ref

Szmigin, I.T., & Bourne, H. (1999). Electronic cash: a qualitative assessment of its adoption. International Journal of Bank Marketing, 17(4), 192-203.

Indexed at, Google Scholar, Cross Ref

Tan, M., & Teo, T.S.H. (2000). Factors influencing the adoption of Internet banking. Journal of the AIS, 1(1es), 5.

Taylor, S., & Todd, P. A. (1995). Understanding information technology usage: A test of competing models. Information systems research, 6(2), 144-176.

Teo, T.S., & Pok, S.H. (2003). Adoption of WAP-enabled mobile phones among Internet users. Omega, 31(6), 483-498.

Tobbin, P., & Kuwornu, J.K. (2011). Adoption of mobile money transfer technology: structural equation modeling approach. European journal of business and management, 3(7), 59-77.

Tornatzky, L.G., & Klein, K.J. (1982). Innovation characteristics and innovation adoption-implementation: A meta-analysis of findings. IEEE Transactions on engineering management, (1), 28-45.

Indexed at, Google Scholar, Cross Ref

Wong, K.K.K. (2013). Partial least squares structural equation modeling (PLS-SEM) techniques using SmartPLS. Marketing Bulletin, 24(1), 1-32.

Yan, A.W., Md-Nor, K., Abu-Shanab, E., & Sutanonpaiboon, J. (2009). Factors that affect mobile telephone users to use mobile payment solution. International Journal of Economics and Management, 3(1), 37-49.

Yan, L.Y., Tan, G.W. H., Loh, X.M., Hew, J.J., & Ooi, K.B. (2021). QR code and mobile payment: The disruptive forces in retail. Journal of Retailing and Consumer Services, 58, 102300.

Indexed at, Google Scholar, Cross Ref

Zmijewska, A., Lawrence, E., & Steele, R. (2004). Towards Understanding of Factors Influencing User Acceptance of Mobile Payment Systems. Icwi, 2004, 270-277.

Received: 16-Dec-2023, Manuscript No. JMIDS-23-13000; Editor assigned: 20-Dec-2023, Pre QC No. JMIDS-23-13000(PQ); Reviewed: 03- Jan-2023, QC No. JMIDS-23-13000; Revised: 21-Feb-2023, Manuscript No. JMIDS-23-13000(R); Published: 28-Feb-2023