Research Article: 2020 Vol: 24 Issue: 2

Who will Take Costs Incurred by Revaluation? The Choice between Two Kinds of Measurements

Na Ra Kang, Hankyong National University

Tae-Young Paik, Sungkyunkwan University

Abstract

The issues of when fair value accounting should be applied and under what circumstances it is valuable are still unresolved problems. This study investigates differences in expected costs and benefits using a natural experiment in Korea. Assets revaluation had been prohibited since 2000 but was re-allowed owing to a change in the Korean GAAP in 2008. At the time, some unlisted firms used appraised prices to revalue their lands, paying costs. Others used the prices announced by the government for taxation, avoiding out-of-pocket costs. Through this unique setting, we investigate how the out-of-pocket revaluation costs play roles in assets revaluation.

Keywords

Assets Revaluations, Out-of-Pocket Cost, Costs and Benefits, Small Firms.

Introduction

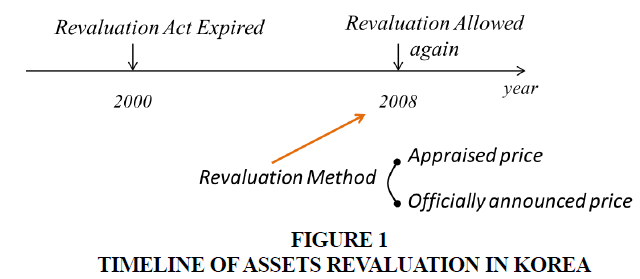

In Korea, there have been considerable changes in accounting standards related to assets revaluation. Until 2000, it was possible to revalue assets by the Assets Revaluation Act. From 2001, revaluation of property, plant, and equipment was not allowed as Assets Revaluation Act expired. After a considerable period, the KASB (Korean Accounting Standards Board) changed its accounting standards to allow the tangible assets revaluation at management's discretion in 2008. One feature of the revaluation in 2008 is that it has no effect on corporate taxes and net incomes unlike the revaluation before. The reason why KASB has allowed the asset revaluation again is to improve the comparability with the financial statements of the countries that had already adopted IFRS and to smooth the mandatory adoption of IFRS by narrowing the gap between Korean GAAP with IFRS as to the revaluation of tangible assets. Financial Supervisory Service of Korea had scheduled to mandate IFRS for listed firms in 2011.

This study investigates the benefits and costs expected from the revaluation of property, plant, and equipment by investigating firm choices when the revaluation was allowed again in Korea in 2008. In this unique setting, we identify two revaluation measurements for land that differ in benefits and costs and find the factors that lead managers to choose one of the two measurements. In 2008, some unlisted firms revalued their lands using the officially announced prices set by the government to levy the property tax.

We expect significant findings related to management's accounting behavior because the two measurements are different in the benefits and costs of accounting choices. In general, the officially announced price by the government is assessed at a lower value than the market price, but the officially announced price is free to use. When managers use appraised prices, the expected benefit must be higher than that of using the officially announced prices. It implies that the expected benefits and costs are different depending on whether the managers revalue assets with the appraised price or the officially announced price.

We use the data of 1,735 unlisted firms that revalued their lands for the accounting periods ending in December 2008. We focus on lands since managers consider lands first for revaluation.1 337 firms (about 20% of observations) among them revalued their lands using officially announced prices to avoid out-of-pocket costs.

The results of this study can be summarized as follows. First, the firms with higher debts from financial institutions revalued their lands with appraised prices. This result indicates that as the need to raise money from financial institutions are bigger, the manager tries to lower the debt ratio by land revaluation with the higher appraised price paying out-of-pocket cost rather than with the free but lower officially announced price. Second, larger firms more tend to revalue their lands with the appraised prices. It is because the economy of scale in appraisal charges makes the charges less burdensome to larger firms.

The main contribution of this study is to examine how out-of-pocket costs affect assets revaluation. It is meaningful because the out-of-pocket costs could be an obstacle in fair value accounting. In particular, our results may be useful for accounting standards setters and accounting policymakers for small firms. It is hard for small firms to enjoy the economy of scale in adopting fair value accounting. It might be necessary to consider policy alternatives for small firms in the direction of lowering the costs associated with reporting fairly presented financial statements.

Our paper is organized as follows. Section II discusses the prior research related to this study. In section III, the hypotheses and research models to test them are set up. In section IV, sample selection criteria and descriptive statistics are presented. In section V, empirical results are discussed. Finally, the conclusions are provided in section VI.

Related Literature and Background

Prior Studies on Assets Revaluation

Recently, the demand for fair value accounting has increased steadily including revaluation of property, plant, and equipment. However, when, how, and by whom fair value accounting should be applied is an unsolved problem (Penman 2007). In a sense, the benefits and costs related to fair value accounting have not yet been fully understood.

The discussion on assets revaluation could be grouped into two streams. One is how the revaluation of property, plant, and equipment enhances the usefulness of financial information. The other is what the managerial motivations to revalue assets are. The studies testing whether the revaluation increases the value relevance to the stock price or the accuracy of the financial analysts' forecasts deal with the enhanced use of the accounting information from the viewpoint of users.

The empirical results are not consistent in the effect of the tangible assets revaluation on the usefulness of accounting information. Although some studies report that assets revaluation enhances the value of accounting information to investors (Barth & Clinch 1998; Kim et al., 2012), other studies do not find the effect (Paek & Song 2000). One reason for this lack of consistency is that there are differences in the impact on corporate taxes, the level of inflation, and the criteria for revaluation in different countries and periods of samples investigated. Another reason is that only a few countries such as Australia, Belgium, Netherlands, Switzerland, and Korea allowed the asset revaluation before IFRS adoption. Hence, there were not enough data to investigate whether asset revaluation enhances information usefulness.

Prior studies show managers have incentives to revalue property, plant, and equipment. One of the most important motivations for asset revaluation is the need for financing and borrowing more. Many papers show that most important motivation is increase in the ability to borrow money or the need to raise capital. Generally, the debt ratio can be a significant constraint in borrowing contracts (Smith & Warner, 1979). Cotter & Zimmer (1995) reports that managers revalue their property, plant, and equipment to enhance their ability to borrow in Australia. Christensen & Nikolaev (2013) argues that the main reason for revaluating tangible assets is to satisfy the debt covenants rather than to meet shareholders' needs for information.

The studies in Korea also show that the primary motivation of assets revaluation is the necessity for capital financing. In particular, Yoo et al. (2017) reports that the demand for assets revaluation is not significantly different between listed and unlisted firms. These studies suggest that the managerial motivation to revalue assets is to facilitate raising debt capital rather than to provide shareholders with useful information.

The assets revaluation is costly in several ways. There are opportunity costs of managerial efforts to manage revaluation items and coordinate with auditors as well as out-of-pocket costs such as appraisal fee (Brown et al., 1992; Choi et al., 2013). However, the role of costs in assets revaluation has not been investigated enough in prior studies. Choi et al. (2013) is one of the few studies that investigate the role of costs in asset revaluation. They report that opportunity cost for revaluation depends on what assets are revalued. The manager will first pick lands, the asset revalued at the lowest opportunity cost. Since lands do not need to be depreciated, the opportunity costs such as managerial efforts for revaluation are not so much. Choi et al. (2013) shows that there is a pecking order for revaluation due to the opportunity costs.

The cost of revaluating assets requires not only indirect costs but also direct costs. The direct costs may vary depending on what the measurement is used. The reason why managers can consider the measurements, not one, is that the exact price of the land does not exist, and the real estate market is incomplete (Gottlieb et al., 2010, Kim & Jang 2019). This study is interested in two measurement methods: the official land price and appraisal value. The appraisal value is assessed based on the reasonably probable and legal use of vacant land or an improved property that is physically possible, reasonably permissible, appropriately supported, financially feasible, and that results in the highest value. This approach appears to match the fair value assuming the highest and best use of the asset by market participants in FASB (Johnson et al., 2010). The officially announced price is lower than the market price by the government because the primary purpose is to impose a property tax on land (Wayne 2008). However, it could be said as reflecting the market price, even though it could be insufficient (Min, 2010).

This paper in contrast studies the impact of cash costs for revaluation on managerial choice and shows that small firms are concerned of out-of-pocket costs for revaluation. Within our knowledge, this study is the first one investigating the role of out-of-pocket costs in revaluation accounting.

PP&E Revaluation and its Costs and Benefits

PP&E Revaluation in Korea

In 2008, before the adoption of K-IFRS, the Korean Accounting Standards Board (KASB), the standard-setting entity amended K-GAAP to allow assets revaluation. In Korea, the revaluation of tangible assets had not been allowed for eight years since 2000 as shown in Figure 1.

There are essential differences between the revaluation before the year 2000 and the new revaluation in 2008 in motivation and tax effect. The revaluation before 2000 was intended to bridge the gap between book value and market value when Korean inflation rate was significant. In 2008, the Korean Accounting Standards Board newly granted the asset revaluation from a policy motive to smooth out the anticipated confusion during mandatory K-IFRS adoption scheduled to 2011. In the revaluation before 2000, the amortization of revaluation gain could be recognized as a tax exclusion even though the government did not impose the corporate tax on revaluation gain. It was important to relieve the taxpayer's burden incurred by timing mismatch between the acquisition and the tax amortization(?). On the other hand, the revaluation of property, plant, and equipment in 2008 did not affect corporate tax, because the purpose of allowing revaluation was different. We can investigate the incentives of managers to revalue assets excluding motivation for tax saving with data in 2008.

In the course of this transition, we identify the significant clue that enables us to infer the role of costs by comparing two kinds of the estimation method. At that time, the Korean Accounting Standards Board allowed the manager to choose the appraised price or the officially announced price as revaluation measurements. There are differences in expected benefits and costs between the two estimation methods. It is the unique setting that we pay attention to.

Costs and Benefits of Two Revaluation Measurements

There is a difference in the expected benefits from revaluating lands between using the appraised prices and the officially announced prices. The benefits expected with the appraised prices are bigger. Partially reflecting the fair value, the officially announced prices are generally assessed at lower values than the market/appraised prices. The Table 1 shows the realization ratio, the ratio of the officially announced prices over market prices of samples by the Korean government.

| Table 1 Realization Ratio of the Officially Announced Price | |||||||||

| Year* | 2008 | 2009 | 2012 | 2013 | 2014 | 2015 | 2016 | 2018 | 2019 |

| Realization ratio (%) | 68.5 | 66.9 | 58.7 | 61.2 | 61.9 | 63.6 | 64.7 | 62.6 | 64.8 |

The officially announced price is inherently lower than the market price because taxpayers resist high imposed taxes based on it. If the land prices are officially announced high, the property tax on the owner will be high accordingly. Therefore, taxpayers can press the government to assess their land prices low. To avoid taxpayers' resistance, the government does not assess the officially announced price as high as the market price. As result, the expected benefits from assets revaluation are not maximized, using officially announced prices.

There is also a difference in anticipated costs between using the officially announced price and the appraised price. Managers have to pay appraisal fees to their appraisers. However, there are no out-of-pocket costs in using the officially announced prices assessed by the government. Managers revalue the property, plant, and equipment when the expected benefits from revaluation exceed their costs (Whittred & Chan, 1992). The manager therefore revalues land with the appraised price, not with the officially announced price when its net benefit (benefit minus cost) is significant for the revaluation. Table 2 summarizes this comparison.

| Table 2 Comparison of Costs & Benefits and Other Effects | ||

| Appraised Price | Officially Announced Price | |

| Costs | Out-of-Pocket Costs (o) | Out-of-Pocket Costs(X) |

| Benefits | Close to the Market Price | Lower than the Market Price |

| Larger | Smaller | |

| Reported Earnings | No Effect | No Effect |

| Tax | No Effect | No Effect |

The new revaluation in 2008 does not affect reported profits and taxes. The revaluation reserve is added to equity and only disclosed in the footnote. Therefore, such a unique setting enables us to investigate how the costs and benefits play roles in assets revaluation depending on the nature of the firm, excluding the effects on taxes and earnings.

The burden of out-of-pocket appraisal fees could be different depending on the size of firms. In general, as the scale of service by experts such as appraisal and auditing are larger, the marginal costs are diminishing (DeAngelo, 1981; Simunic, 1980). So, the fees for appraisers have the economy of scale. Table 3 shows the standard appraisal rate disclosed by the Ministry of Land, Transport, and Maritime Affairs of Korea. This table shows that the standard appraisal fee reflects the economy of scale. It means that as the firm's size grows, the advantage of the scale economy increases. So, the burden of costs for assets revaluation reduces as the size of firms grows.

| Table 3 Standard Fees for Appraisal Service by Ministry of Land, Transport, and Maritime Affairs | |

| (Unit: Korean Won) | |

| Amount of Assets Revalued | Marginal Rate of Fee |

| ~ 50 millions | 150,000 ± 10% |

| 50 millions ~ 500 millions | 11/10,000 ± 10% |

| 500 millions ~ 1 billion | 9/10,000 ± 10% |

| 1 billion ~ 5 billions | 8/10,000 ± 10% |

| 5 billions ~ 10 billions | 7/10,000 ± 10% |

| 10 billions ~ 50 billions | 6/10,000 ± 10% |

| 50 billions ~ 100 billions | 5/10,000 ± 10% |

| 100 billions ~ | 4/10,000 ± 10% |

Hypothesis Development and Research Design

Hypothesis Development

One of the most critical factors affecting the demand for assets revaluation is to make it easier to borrow money from financial institutions by lowering the debt ratio. In the prior studies, it is reported that the higher the debt ratio, the higher the incentive for revaluation of tangible assets (Brown et al., 1992; Choi et al., 2013; Whittred & Chan, 1992). In Korea, the study comparing listed firms that revalued tangible assets and those that do not also shows that the debt ratios of firms that revalue assets are higher than those of firms that do not. These studies consistently show that the benefit expected from the revaluation grows as the need to raise funds from financial institutions increases.

Although the revaluation of assets has an expected benefit, there are also costs to be incurred (Barlev et al., 2007; Choi et al. 2013; Cotter & Zimmer 1995). These costs include formal appraisal fees to assess the assets at fair value and informal costs of managers' related works. These works include, for example, the selection of revaluation items, coordination with the auditor concerning assets revaluation, and increased complexity of tax calculations. The manager decides to revalue tangible assets when the expected benefits exceed costs with revaluation (Whittred & Chan, 1992). For these reasons, the manager will sequentially select the assets items with the lowest related costs for revaluation (Choi et al., 2013). Land without depreciation does not require much managerial effort compared to other tangible assets such as buildings and machinery. Therefore, the manager will consider land the first choice (Choi et al., 2013).

The out-of-pocket costs of appraisal fees matter. The larger the need for revaluation is, the higher out-of-pocket costs managers are willing to pay. When the expected benefits from revaluation are relatively small, the land might be revalued without out-of-pocket costs. In Korea, some unlisted firms revalue their lands with officially announced prices for free.

The appraised price seems to be very close to the market price generally. In comparison, the officially announced prices that the government evaluates to impose property tax is lower than the market price. Therefore, managers' expected benefits from revaluation of land can be considered to be larger when using appraised prices than using officially announced prices.

As discussed above, one of the critical reasons why managers revalue lands is to make funding from financial institutions easy. Therefore, the higher the need for borrowing from financial institutions is, the higher the need for land revaluation. Firms with high debt ratios will revalue land to fully reflect market prices even though they have to pay the out-of-pocket costs. When funds to be borrowed from financial institutions are not large enough, the managers are less willing to revalue their lands, paying cash. Based on this conjecture, we set the following first hypothesis.

H1: The higher the need for borrowing from financial institutions is, the more likely it is to revalue land with appraised prices.

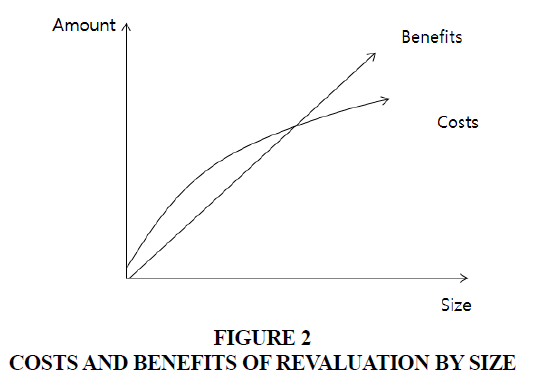

Our second hypothesis is based on the facts that the larger firms have the smaller burden of cash revaluation costs. As the revaluation scale increases, the available borrowing capacity increases. It means that the benefit from revaluation is proportional with size. But the associated costs do not increase proportionally as shown in Figure 2. The out-of-cost of appraisals diminishingly increase according to size because it reflects on economies of scale. The appraisal fee rate gets smaller as the amount of asset revalued gets bigger in Table 3. Hence, the bigger the firm is, the lower the burden of revaluation costs compared to the revaluation benefits is. So, for small firms, the out-of-pocket costs related to revaluation is felt more significant than for large firms.

On the other hand, the effect of the improved debt ratio by assets revaluation on borrowing capacity of small firms could be unclear. In some small firms, information asymmetry between financial institutions and firms could be too significant to reduce credit risk by assets revaluation (Schiffer & Weder 2001, Beck et al., 2005, Beck & Demirguc-Kunt 2006). Even if small firms could improve the financial leverage through assets revaluation, it might not be a meaningful signal to financial institutions.

Small firms are also often financed through policy loans (Riding and Haines 2001). The other factors than the firm's credit could determine their credit risk. Therefore, managers of small firms are less likely to revalue their lands with appraised price due to the uncertainty of expected benefit. Hence, we set the following second hypothesis.

H2: The smaller the size of firms, the more likely their lands are revalued by the officially announced price.

Research Design

To test our first hypothesis, we run a logistic regression with the following model equation (1). The dependent variable, OfficialPrice, is a dummy variable that equals one if the firm revalues its land with officially announced prices, or zero otherwise. In our study, we calculate FinDebt by dividing the sum of short-term borrowing, financial lease liability, and long-term debts excluding borrowing from related parties by total assets at the end of the year. Some unlisted firms in Korea raise debts from associated parties such as large shareholders and affiliated firms. We exclude borrowings from related parties in calculating FinDebt because the borrowings from related parties have little to do with credit risk. In the first hypothesis, the larger the need to raise funds from financial institutions, the more likely it is that the manager revalues with the appraisal price. If the coefficient of β1 in regression analysis of equation (1) shows a significant negative value, our first hypothesis is supported.

OfficialPrice = β0 + β1*FinDebt + β2*Land + β3*ROA + β4*Big4 + β5*Depletd + β6*OtherItems + β7*Groups+ β8*Loss + e Eq (1)

Variable definitions

OfficialPrice = an indicator variable that equals one if land is revalued by officially announced price, zero otherwise;

FinDebt = the ratio of debts from financial institution to total assets;

Land =the ratio of revalued land to total assets;

ROA = the return on assets defined by net incomes over total assets;

Big4 = an indicator variable that equals one if the firm is audited by a Big 4 firm, zero otherwise;

Depletd = an indicator variable that equals one if the owners’ equity is less than zero;

OtherItems = an indicator variable that equals one if the firm revalues other tangible asset items as well as land;

Groups = an indicator variable that equals one if the firm belongs to a corporate group that is limited on mutual investment by the Fair-Trade Commission;

Loss = an indicator variable that equals one if net incomes are less than zero, and zero otherwise;

The second hypothesis in our study is tested by the equation (2). SIZE is the natural log of the total assets of a firm at the end of the fiscal year. The dependent variable and other control variables in the equation (2) are the same as in equation (1). In the second hypothesis, the smaller the firm's size, the more likely it is that the land is revalued using the officially announced price. So, if the empirical results support our second hypothesis, the coefficient of β1 in the logistic analysis by equation (2) will show a significant negative value.

OfficialPrice = β0 + β1*SIZE + β2*Land + β3*ROA + β4*Big4 + β5*Depletd +β6*OtherItems + β7*Groups + β8*Loss + e Eq (2)

SIZE = the natural log of total asset value at the end of the year 2008;

The other variable s are defined in t he same way as in the equation (1).

The control variables in equations (1) and (2) are known as the motives of the managers for asset revaluation in prior studies. The return on assets (ROA) might affect managerial decision. When the manager decides to revalue asset, the return on assets (ROA) is expected to reduce by the increase in total assets. The ratio of land to total assets could also affect the revaluation method because management decisions differ depending on how vital lands are for the company. The dummy variable Big4 is added as a control variable because the coordination with the auditor is a substantial opportunity cost of asset revaluation (Choi et al. 2013). The big4 accounting firms may require managers to provide stronger audit evidence than non-big4 firms in assessing the adequacy of the asset revaluation amount (Francis and You 2009). The appraiser’s report should be stronger evidence around fair value than the officially announced price. Depletd is the dummy variable that is one if the capital is depleted, zero otherwise. The capital depletion is the one of the factors that deteriorate credit level in capital market. So, the manager can use the revaluation of land to solve the capital depletion problem (Yoo et al., 2017).

OtherItem included in the control variables indicates whether the manager chooses to revalue other items than lands. Choi et al. (2013) reports that there is a pecking order in the selection of revaluation items. When revaluating other asset items in addition to lands, the managers have to make higher level of efforts with the opportunity cost. The variable Groups is a dummy variable that equals one if a firm belongs to large business groups whose member firms are restricted from investing in each other by Monopoly Regulation and Fair-Trade Act in Korea, or zero otherwise. For firms belonging to large business groups, accounting policies are determined at the group level rather than at firm units. Finally, Loss, which represents loss firms, is included in the control variables. It is more difficult for loss firms to access the capital market, which can lead to a greater incentive to revalue lands at the highest prices possible.

Sample Selection and Descriptive Statistics

Sample Selection

Our study investigates the unlisted firms that revalued lands with fiscal years ended on December 31, 2008. The reason why our research focuses on land revaluation is that lands are the assets that managers consider first for revaluation. So, most unlisted firms that revalue assets include lands in revaluation items, and only very few firms, such as shipping companies with vessels, revalue non-land assets. The other reason is that there are two kinds of measurements with which the firms could revalue lands, the appraised prices and the officially announced prices for tax purpose.

In our study, we use financial data on KIS-VALUE database for unlisted firms that revalued lands in the year 2008. We identify 2,503 samples with revaluation reserve accounts among them. In this sample, we confirm whether Financial Supervisory Service discloses the audit reports in the Data Analysis, Retrieval, and Transfer System in Korea. We manually search for 2,503 firms and find that audit reports are available for 1,786 samples. Among these, we select 1,735 samples with the revaluation items in their audit reports. We search the footnote disclosures of the audit reports by hand-collection and find that 337 audit reports, about 20% of the total samples show that their lands were revalued with the officially announced prices.

Descriptive Statistics and Correlation

Table 4 shows the descriptive statistics of the variables used in our study. First, the mean of OfficialPrice, the dependent variable, is 0.194, which indicates that 19.4% of the total sample revalued the land with the officially announced prices. The mean of FinDebt is 0.439, implying that the proportion of capital raised from financial institutions in total assets is 43.9% in our samples. The median value of SIZE is smaller than the mean value, which is due to the skewed distribution of firm size in Korea.

| Table 4 Descriptive Statistics | |||||

| Mean | Std. dev | 25% | Median | 75% | |

| OfficialPrice | 0.194 | 0.396 | 0.000 | 0.000 | 0.000 |

| FinDebt | 0.439 | 0.174 | 0.328 | 0.450 | 0.555 |

| SIZE | 24.007 | 0.876 | 23.383 | 23.783 | 24.399 |

| Land | 0.287 | 0.169 | 0.161 | 0.257 | 0.382 |

| ROA | -0.016 | 0.080 | -0.036 | 0.007 | 0.025 |

| Big4 | 0.115 | 0.319 | 0.000 | 0.000 | 0.000 |

| Depletd | 0.131 | 0.338 | 0.000 | 0.000 | 0.000 |

| OtherItems | 0.110 | 0.313 | 0.000 | 0.000 | 0.000 |

| Group | 0.022 | 0.148 | 0.000 | 0.000 | 0.000 |

| Loss | 0.364 | 0.481 | 0.000 | 0.000 | 1.000 |

OfficialPrice = an indicator variable that equals one if lands are revalued by officially announced price, zero otherwise;

FinDebt = the ratio of debts from financial institution to total assets;

SIZE = the natural log of total asset value at the end of the fiscal year 2008;

Land = the ratio of revalued land to total assets.;

ROA = the return on assets defined by net income divided by total assets;

Big4 = an indicator variable that equals one if the firm is audited by a Big 4 audit firm, zero otherwise;

Depletd = an indicator variable that equals one if equity capital is less than zero;

OtherItems = an indicator variable that equals one if a firm revalues other property, plant, and equipment items than lands, zero otherwise;

Group = an indicator variable that equals one if a firm belongs to business groups that are limited on mutual investment by the Fair-Trade Commission;

Loss = an indicator variable that equals one if earnings are less than zero, and zero otherwise.

An average ratio of lands to total assets is 0.287, indicating that lands are essential assets for observations, accounting for a substantial proportion of total assets. The average value of ROA, the earnings divided by total assets, is negative. It suggests that when the performance is not good, it may be difficult for firms to get capital from financial institutions and the managers revalue the tangible assets. The mean value of the control variable Big4 was 0.115. Generally, Big 4 accounting firms are considered to provide a high level of audit services, but require the corresponding expensive audit fees (Caramanis & Lennox, 2008). The reason why the Big 4 firms audit the only small group of observations may be that unlisted firms do not usually want audit services with higher audit fees (Burgstahler et al. 2006, Hope et al. 2012).

The average value of OtherItems representing the firms revaluating property, plant, and equipment other than lands is 0.110. In most firms, only lands were revalued, because revaluation of depreciable assets requires the more managerial effort for revalued assets (Choi et al. 2013). The average value of the dummy variable Loss is 0.364. It means that many firms that choose to revalue land have negative earnings.

Table 5 shows Pearson correlation coefficients among the variables used in our study. The correlation between OfficialPrice and FinDebt is significantly negative at less than 1% level. It implies that the higher the need to raise borrowings from financial institutions, the more the manager revalues lands with the appraised price. The relationship between OfficialPrice and SIZE is also negative at 1% significance level and it indicates that as the size of the firm increases, the manager tends to revalue lands with the appraised prices. All results of Pearson correlation analysis above indirectly support our first and second hypotheses.

| Table 5 Pearson Correlation | |||||||||

| ? | OfficialPrice | FinDebt | SIZE | Land | ROA | Big4 | Depletd | OtherItems | Group |

| FinDebt | -0.071 (0.003) |

||||||||

| SIZE | -0.128 (0.000) |

-0.222 (0.000) |

|||||||

| Land | 0.066 (0.006) |

-0.053 (0.026) |

-0.014 (0.564) |

||||||

| ROA | 0.019 (0.436) |

-0.415 (0.000) |

0.053 (0.026) |

-0.133 (0.000) |

|||||

| Depletd | 0.042 (0.082) |

0.234 (0.000) |

-0.038 (0.117) |

0.300 (0.000) |

-0.478 (0.000) |

||||

| Big4 | -0.148 (0.000) |

-0.075 (0.002) |

0.388 (0.000) |

-0.069 (0.004) |

-0.001 (0.978) |

-0.034 (0.162) |

|||

| OtherItems | -0.168 (0.000) |

-0.013 (0.586) |

0.101 (0.000) |

-0.162 (0.000) |

-0.027 (0.263) |

-0.006 (0.807) |

0.059 (0.013) |

||

| Group | -0.045 (0.061) |

-0.106 (0.000) |

0.274 (0.000) |

0.010 (0.664) |

0.023 (0.333) |

-0.006 (0.802) |

0.298 (0.000) |

0.021 (0.378) |

|

| Loss | 0.010 (0.683) |

0.296 (0.000) |

0.018 (0.445) |

0.190 (0.000) |

-0.714 (0.000) |

0.368 (0.000) |

0.032 (0.187) |

0.005 (0.820) |

-0.002 (0.945) |

The negative correlation between OfficialPrice and Big4 is significant at less than 1%. Big 4 auditors require higher levels of audit evidence (Hope et al., 2012). The negative correlation might show that Big 4 accounting firms ask for revaluation amounts close to the fair values. Alternatively, having significantly positive correlation between Big4 and SIZE, that is, bigger unlisted firms hiring Big 4 auditors, Big4 variable might represents just audited firm size.

The correlation between OfficialPrice and OtherItems is significantly negative at less than 1%. The firms that revalue lands with an officially announced prices may not be so much motivated to revalue assets and they do not try to broaden the scope of the revaluation to other items taking high opportunity costs. (Choi et al., 2013).

The correlation between OfficialPrice and Groups is also significantly negative at less than 1%. It is more likely for the unlisted firms belonging to large business groups to take the accounting policy set at the level of the business groups. It is unlikely that listed firms revalue their land using officially announced prices to avoid appraisal fee. Unlisted firms may take the revaluation measurement of the listed firms in the same group.

Empirical Results

Univariate Analysis

Table 6 shows the results of the univariate test for the interest variables of debt ratio and size between the firms revaluating lands using appraised prices and those using officially announced prices. In other words, it is to examine whether there are statistically significant differences in the debt ratio and size between the two groups.

| Table 6 Univariate Analysis Between Official Price and Appraisal Measurement Groups | |||||

| Variables | Appraised Price | Official Price | Difference (t-value) | ||

| FinDebt | 0.445 | 0.414 | 0.313 | (2.98) | *** |

| SIZE | 24.062 | 23.778 | 0.284 | (5.39) | *** |

| Obs. | 1,398 | 337 | |||

2) *** indicates statistical significance at 1% levels.

The average value of FinDebt, the ratio of borrowings from financial institutions is 0.414 for the group using the officially announced price and 0.445 for the group using appraised price. The financial leverage of the group using the appraisal price is larger than that of the group using officially announced price at the significance level of less than 1%. The results show that the higher the need to raise funds from financial institutions, the more they are willing to pay out-of-pocket costs of the revaluation. That is consistent with the first hypothesis.

It is notable that the mean value of SIZE is higher statistically significantly for the group using the appraisal price (24.062) than for the group using the officially announced price (23.778). This result is consistent with the second hypothesis.

Logistic Regression Analysis

Table 7 presents the results of logistic regression analysis to test the choice of measurement depending on financial leverage. In Table 7, the FinDebt coefficient is negative at 1% significance level. It suggests that as the need to raise fund from financial institutions increases, the managers revalue their land with the appraised prices that can fully reflect the market prices supporting the first hypothesis. In sum, high financial leverage leads to the powerful incentive to revalue land regardless of the out-of-pocket costs.

| Table 7 Effect of Debts from Financial Institution on Revaluation Method | ||

| Variables | Logit Model Coeff. (X2-stat.) |

|

| Intercept | -0.683 | (9.10) |

| FinDebt | -1.406 | (12.29) *** |

| Land | 0.078 | (0.04) |

| ROA | 1.117 | (0.77) |

| Big4 | -1.809 | (26.80) *** |

| Depletd | 0.418 | (3.53) |

| OtherItems | -3.917 | (15.17) *** |

| Groups | 0.011 | (0.00) |

| Loss | 0.236 | (1.61) |

| Obs. | 1,735 | |

| Pseudo R2 | 8.37% | |

For control variables, the coefficient of Big4 shows a significant positive value as expected. The coefficient of OtherItems, which indicates whether revaluation items include tangible assets other than lands, is significantly negative. It might be due to the fact that the managers have to take not only more opportunity costs but also more cash costs in revaluating the non-land assets. The other control variables do not show significant values. It could be attributed to the fact that most of the prior studies investigate for listed firms while our research does for unlisted firms. It is also possible that the economic environments and accounting systems related to tangible assets revaluation are different in each country and period.

Table 8 shows the results of the second hypothesis by logistic analysis. Our study predicts that as the size of the firm is larger, the manager more tends to revalue their lands using the appraised prices. So, we anticipate that the coefficient of SIZE will show a significant negative value.

| Table 8 The Effect of Firm Size on Revaluation Method | ||

| Variables | Logit Model Coeff. (X2-stat.) |

|

| Intercept | 5.929 | (7.05) |

| SIZE | -0.306 | (10.58) *** |

| Land | 0.334 | (0.72) |

| ROA | 2.886 | (5.26) ** |

| Big4 | -1.522 | (18.64) *** |

| EqDepletd | 0.381 | (2.94) |

| OtherItems | -3.847 | (14.64) *** |

| Groups | 0.304 | (0.21) |

| Loss | 0.284 | (2.32) |

| Obs. | 1,735 | |

| Pseudo R2 | 8.31% | |

The coefficient of SIZE is significantly negative at 1% level as reported in Table 8. Small firms may be able to borrow money by policy financing rather than by their credits, which may prevent small businesses from choosing a revaluation measurement incurring out-of-pocket costs. The results for control variables are the same as in Table 7.

The results in Table 9 are the test of the first and second hypotheses in one logit model. This analysis is to verify whether each prediction is independent of each other. Table 9 shows that the coefficients of FinDebt and SIZE are significant at less than 1% level. It seems that our predictions are supported independently.

| Table 9 Result to Test two Hypotheses in one Model | |||

| Variables | Logit Model Coeff. (χ2-stat.) |

||

| Intercept | 8.346 | (12.99) | |

| FinDebt | -1.710 | (17.40) *** | |

| SIZE | -0.375 | (15.26) *** | |

| Land | 0.103 | (0.07) | |

| ROA | 1.397 | (1.19) | |

| Big4 | -1.521 | (18.19) *** | |

| Depletd | 0.451 | (4.06) ** | |

| OtherItems | -3.863 | (14.75) *** | |

| Groups | 0.303 | (0.21) | |

| Loss | 0.283 | (2.28) | |

| Obs. Pseudo R2 |

1,735 9.33% |

||

OfficialPrice = β0 + β1*FinDebt + β2*SIZE + β3*Land + β4*ROA + β5*Big4 + β6*Depletd + β7*OtherItems + β8*Groups + β9*Loss + e Eq(3)

Additional Tests

In the second hypothesis, we expect that as the firm's size increases, the cost burden for the revaluation of tangible assets will be less. The economies of scale can also affect opportunity costs of management efforts. So, we expect that the significance of not only out-of-pocket costs but also the opportunity costs would reduce as the firm size gets larger.

When managers include more asset items other than lands in revaluation they have to spend their time and effort in selecting revaluation items and changing depreciations after revaluation. However, as the size of a firm gets larger, the managerial efforts would increase less compared to the benefits expected from the assets revaluation. Thus, the managers of the larger firms will be more able to control easily the complexity caused by the revaluation of non-land asset items. Equation (4) is a logistic model to test such expectation. If the result of logistic analysis supports our prediction, the coefficient value of SIZE(=β1) will show a significant positive value.

OtherItems = β0 + β1*SIZE + β2*Land + β3*ROA + β4*Big4 + β5*Depletd + β6*Groups + β7*Loss + e Eq(4)

Table 10 shows the result of model equation (4). In this table, the coefficient of SIZE is positive at less than 1% significance level. Interestingly, the coefficient of Land variable, the ratio of lands amount to total assets, shows a negative value at less than 1% significance level. It implies that when a firm does not have enough lands to revalue, other tangible asset items are included in the revaluation.

| Table 10 Factors of Non-Land Asset Revaluation | ||

| Variables | Logit Model | |

| Coeff. (χ2-stat.) | ||

| Intercept | -8.276 | (14.76) *** |

| SIZE | 0.295 | (10.88) *** |

| Land | -3.928 | (42.48) *** |

| ROA | -1.358 | (0.90) |

| Big4 | 0.084 | (0.13) |

| Depletd | 0.311 | (1.03) |

| Groups | -0.134 | (0.07) |

| Loss | -0.016 | (0.00) |

| Obs. | 1,735 | |

| Pseudo R2 | 5.92% | |

Conclusions

Our paper investigates the role of out-of-pocket costs in assets revaluation in a unique setting in Korea. The unique setting that we pay attention to is following. The Korean Accounting Standards Board (KASB), an entity that establishes accounting standards in Korea, amended the accounting standard for tangible assets and re-introduced the tangible assets revaluation in 2008. At that time, many unlisted firms revalued tangible assets using one of the two alternative measurements with different out-of-pocket costs involved.

The results of this study can be summarized as follows. First, the more massive borrowing from financial institutions is needed, the more likely it is to revalue lands with the appraised prices. This result indicates that as the need to raise capital from financial institutions is bigger, managers are willing to revalue at a higher price even if they have to pay for it. Second, the larger the size of firms, the more they revalue their lands with the appraised prices accompanied by cash costs. It is because the marginal cost is diminishing as the size of the firm grows. Besides, it may also be uncertain whether small firms will benefit from revaluation and hence they hesitate to pay extra costs for revaluation.

The main contribution of this study is to examine the role of the constraint of out-of-pocket costs for assets revaluation. Our research shows that managers of unlisted firms tend to revalue lands using officially announced prices to save cash costs when the necessity of raising capital from financial institutions is not so much. The second empirical result of this study implies that small firms are more sensitive to out-of-pocket costs. These results mean that direct costs associated with fair value are constraints that can affect the managerial decision making. In particular, managers of small firms are reluctant to take the burden for fair value accounting. The results of this paper will be meaningful to regulators determining accounting policies for small firms. Specificall y, it could contribut e to establis h th e

accounting standards applicable to small firms.

End Note

1. In 200 8, most unlisted firms revalued assets including lands. Shipping companies with vessels excluded land for revaluation.

Acknowledgement

1. This work was supported by a research grant from Hankyong Na tional University in the year of 2017.

2. Corresponding Author: Tae Young Paik , Sungkyunkwan University , South Kore a

References

- Appraisal Institute (2008). The appraisal of real estate 13th. Illinois: The Appraisal Institute.

- Barth, M.E., & Clinch, G. (1998). Revalued financial, tangible, and intangible assets: Associations with share prices and non-market-based estimates. Journal of Accounting Research, 36(3), 199-233.

- Beck, T., & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: access to finance as a growth constraint. Journal of Banking and Finance, 30(11), 2931-2943.

- Beck, T., Demirgüç?Kunt, A., & Maksimovic, V. (2005). Financial and legal constraints to growth: Does firm's size matter? The Journal of Finance, 60(1), 137-177.

- Brown, P., Izan, H., & Loh, A. (1992). Fixed asset revaluations and managerial incentives. ABACUS, 28(1), 36-57.

- Burgstahler, D., Hail, L., & Leuz, C. (2006). The importance of reporting incentives: earnings management in european private and public firms. The Accounting Review, 81(5), 983-1016.

- Caramanis, C., & Lennox, C. (2008). Audit effort and earnings management. Journal of Accounting and Economics, 45(1), 116-138.

- Choi, T., Pae, J., Park, S., & Song, Y. (2013). Assets revaluations: Motive and choice of items to revalue. Asia-Pacific Journal of Accounting and Economics, 20(2), 144-171.

- Christensen, H., & Nikolaev, V. (2009). Who uses fair value accounting for non-financial assets after ifrs adoption? Working paper. University of Chicago.

- Christensen, H., & Nikolaev, V. (2013). Does fair value accounting for non-financial assets pass the market test? Review of Accounting Studies, 18(3), 734-775.

- Chung, J., Kim, Y., & Choi, J. (2013). Usefulness of accounting information from the viewpoint of financial analysts before and after assets revaluation. Korean Accounting Review, 38(2), 248-279.

- Cotter, J., & Zimmer, I. (1995). Asset revaluations and assessment of borrowing capacity. Abacus 31(2): 136-151.

- DeAngelo, L. (1981). Auditor size and audit quality. Journal of Accounting and Economics, 3(3),183-199.

- Francis, J., & Yu, M. (2009). Big 4 office size and audit quality. The Accounting Review, 84(5), 1521-1552.

- Gottlieb. S., Robert, M., & Matthew, B. (2010). Will FASB 157 achieve a higher and better use? Journal of Accountancy, 207(1), 50-53.

- Hope, O., Langli, J., & Thomas, W. (2012). Agency conflicts and auditing in private firms. Accounting, Organizations and Society, 37, 500-517.

- Johnson, I.R., Atwood, E., & Larry, W. (2010). Incorporating highest and best use into accounting standards expands opportunities for appraisers. The Appraisal Journal, 207(1), 50-158.

- Kim, H., Yang, D., & Cho, K. (2012). Relevance of fair value accounting: property, plant and equipment-revaluation model. Korean Accounting Review, 37(3), 87-119.

- Kim, Y., & Jang, H. (2019). Conceptualizing the market value on real estate appraisal. Journal of The Residential Environment Institute of Korea, 17(4), 127-140.

- Lin, Y., & Peasnell, K. (2000). Fixed asset revaluation and equity depletion in the UK. Journal of Business Finance & Accounting, 27(3/4), 359-394.

- Min, T.Y. (2010). Reconsideration of the land appraisal system based on the officially announced land price. Korea Public Land Law Association Public Land Law Review, 51, 67-88.

- Paek, W., & Song, I. (2000). Valuation of dirty surplus: Revaluation reserve, deferred charges, and adjustments to stockholder' equity. Korean Accounting Review, 25(2), 1-20.

- Penman, S (2007). Financial reporting quality: Is fair value a plus or a minus? Accounting and business research, 37(Special), 33-44.

- Riding, A., & Haines, G. (2001). Loan guarantees: Costs of default and benefits to SMEs. Journal of Business Venturing,16(6), 595-612.

- Schiffer, M., & Weder, B. (2001). Firm size and the business environment: Worldwide Survey Results 43. World Bank Publications.

- Simunic, D. (1980). The pricing of audit services: Theory and evidence. Journal of Accounting Research, 18(1), 161-190.

- Smith, C., & Warner, J.B. (1979). On financial contracting: An analysis of bond covenants. Journal of Financial Economics, 7(2), 117-161.

- Wayne, M.J. (2008). Property tax equity implications of assessment capping and homestead exemptions for owner-occupied single-family housing. Journal of Property Tax Assessment & Administration, 5(3), 37-70.

- Whittred, G., & Chan, Y. (1992). Asset revaluations and the mitigation of underinvestment. ABACUS, 28(1), 58-74.

- Yoo, C., Choi, T., & Pae, H. (2017). Demand for fair value accounting: The case of the asset revaluation boom in korea during the global financial crisis. Journal of Business Finance & Accounting, 45(1-2), 92-114.