Research Article: 2021 Vol: 27 Issue: 2

Why the Quality of Financial is Important for SME?

Nuramalia Hasanah, Universitas Negeri Jakarta

Muhammad Yusuf, Universitas Negeri Jakarta

Indra Pahala, Universitas Negeri Jakarta

Raden Nabila Tasya Sakina, Universitas Negeri Jakarta

Abstract

SMEs is increasing in number and developing, it should make SME practitioners aware that the competition of SMEs is getting tougher and financial reports are needed. But at this time, there are still many SMEs who are not concerned with financial statements. This study aims to determine: the influence of educational background, the business scale, and the business age, accounting socialization and information technology to the quality of SME financial statements. The object of this study is the quality of SME financial statement. The location of this study is ten locations that are registered at Senen district, Central Jakarta. The type of this research is quantitative. The subject of this research is 93 SME owners who are registered at Senen District. The technique of collecting data using questionnaires. Data analysis technique used is multiple linear regressions. The result of this study indicates that there is no significant influence on the educational background, the business scale and the business age to the quality of the SME financial statement. There is a significant influence on the accounting socialization and the information technology to the quality of SME financial statement. The results of this study will be of interest to SMEs, Public, Local Government, and Academics.

Keywords

Educational Background, Business Scale, Business Age, Accounting Socialization, Information Technology, The Quality of SME Financial Statement.

Introduction

Small and Medium Enterprises (SMEs) are businesses owned and managed by individuals or business entities. SMEs are a source of new innovations that must be developed in order to make the Indonesian economy better. In December 2017, based on data from the Ministry of Cooperatives and SMEs, the number of SMEs in Indonesia was 59,697,827 units. For SMEs, the breakdown is 58.9 million micro businesses, 716.8 thousand small businesses, 65.5 thousand medium businesses and 5.03 thousand large businesses (Anugraheni, 2016). Whereas the contribution of MSMEs to the national GDP is Rp. 7,005,950 billion or around 62.57% of total GDP. If calculated according to business scale, SME cooperatives forming the contribution of SME GDP are 38.90% micro businesses, 9.73% small businesses and 13.95% medium businesses.

One of the regions that have the most SMEs is DKI Jakarta. Based on data from the Central Statistics Agency, DKI Jakarta ranks first with the highest population density in Indonesia of thirty-four other provinces. This has caused the condition of SMEs in DKI Jakarta to be classified as one of the very fastest in Indonesia. SMEs which is now increasing in number and growing in its sector should make SMEs aware that SME competition is getting tougher and financial reports are needed. But at this time, there are still many SMEs who are not concerned with financial statements. This is caused by several things including the lack of understanding of accounting by SMEs; SMEs do not have an educational background in economics, accounting or management, the complexity of the accounting cycle, SME actors who still have thoughts that financial reports are not too important, preparing financial reports only adds to work or do not have sufficient funds to hire accounting employees.

In fact, aside from the fact that financial statements are complicated to implement, financial reports have many benefits that can make a business grow. Financial statements can be more detailed financial information about assets owned and used, liabilities that must be resolved, capital invested, information about profits and use of operational costs and others. Rudiantoro and Siregar (2012) suggested that the quality of SME financial reports in Indonesia at that time was still relatively low due to many factors that influenced it. Lestari (2017) mentions that there are several factors that affect the quality of SME financial statements. These factors include the educational background, business scale, age of business, accounting knowledge and providing information & outreach. This study wants to find out what factors influence the quality of MSME financial statements.

According for this circumstance, this research asks the research questions as follow: What is the affects of Educational background, business scale, business age, accounting socialization and information technology for the quality of SME Financial statements?. This research would like to know more detail about factors can effect of the quality financial reporting of Micro, Small and Medium Enterprises. Thus, this study is expected to contribute in providing an initial description of the implementation of accounting standards, especially Financial Accounting Standards for Micro, Small and Medium Enterprises (SAK EMKM) in the SMEs sector.

Literature Review

The financial statements compiled by SMEs should be in accordance with financial accounting standards in force in Indonesia. The Indonesian Institute of Accountants (IAI) prepares Financial Accounting Standards for Micro, Small and Medium Enterprises (SAK EMKM). SAK EMKM is only required for three reports, namely the Financial Position Report, the Income Statement and the Notes to Financial Statements. Financial reports compiled by SMEs must also be of high quality. The quality of financial statements in this study is the SME's understanding of financial statements based on SAK that is applicable in helping SMEs develops their businesses. The quality of financial statements uses indicators, namely accounting or preparation of financial statements, a special section in accounting or preparation of financial statements, the use of accounting guidelines and understanding of accounting.

Educational background is one of the keys to preparing quality financial reports. According to Law No. 20 of 2003 concerning the National Education System, education is a conscious and planned effort to create an atmosphere of learning and learning process so that students actively develop their potential to have religious spiritual strength, self-control, personality, intelligence, noble character, and the skills needed by them, society, nation and country. The intended educational background is a formal educational background in taking competence or vocational training (Mulyani, 2014).

Business scale is the company's ability to manage its business. Business scale can influence entrepreneur's thinking related to complexity and the increasing level of company transactions so that it is expected that the large scale of business can encourage someone to think and learn related to solutions to deal with it (Lestari, 2017). Murniati in Mulyani (2014) the age of the business or the length of business in this case is the length of an SME established since the business was established until the time the writer conducted this research. Business life is also the length of time a company develops and survives to achieve the desired goals. The business life is calculated or determined since the business was established based on the business deed of establishment.

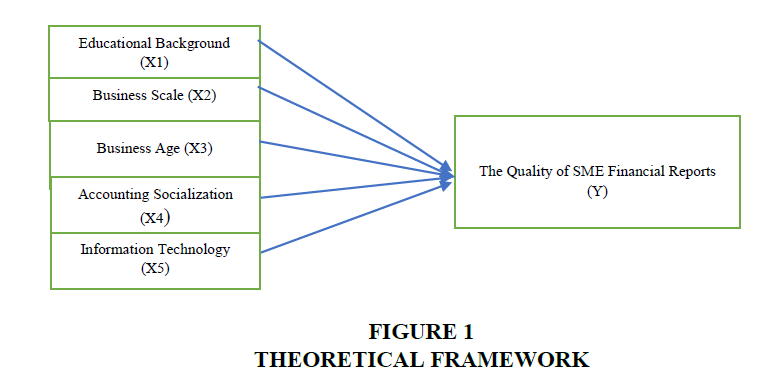

Socialization (James VW Zanden) is a process of social interaction in which a person acquires knowledge, values, attitudes and behaviors to participate effectively in society. According to Brinkerhoft and White, socialization is a process of learning the roles, status and values needed for participation in social institutions. Accounting socialization itself is one way to introduce and assist SMEs in knowing and understandings about accounting standards that apply to SMEs (Tuti, 2015). William and Sawyer in Sutabri (2014), information technology is a technology that combines computing (computers) with high-speed communication lines that carry data, voice and video. According to William and Sawyer, quoted by Ririn (2010), information technology is a field of technology management and covers various fields consisting of computer software, information systems, computer hardware, program languages, construction data and networks (Bahri, 2016). Information technology allows SMEs to make financial reports easily shows in Figure 1.

Based on the explanation, the dependent variable used in this study is the quality of financial statements and the independent variables used in this study are educational background, business scale, business age, accounting socialization and information technology. The hypothesis in this study is as follows:

H1: Educational background influences the quality of SME financial reports.

H2: Business scale affects the quality of SME financial statements.

H3: Business age affects the quality of SME financial statements.

H4: Accounting socialization affects the quality of SME financial statements.

H5: Information Technology influences the quality of SME financial statements.

Methodology

The population in this study is MSMEs registered in the Senen District, Central Jakarta Researcher choosed MSME population registered in The Senen District because MSME are gathered in on place so researcher can easily reach them (Damsar, 2011). With slovin test the sample of MSME registered in the Senen Sub district is 93 respondents. The method used in this study is a quantitative method using multiple linear regression analysis to test the hypothesis (Cummings & McCubbrey, 2004). This study uses primary data that is educational background data of MSME owners, business scale data, business age data, participation in the socialization of accounting and the use of information technology through field studies using questionnaires where researchers go directly to the field and distribute written questionnaires directly to respondents (Detik, 2009; Hikhman, 2017; Imam, 2013).

From the questionnaire distributed to show research respondents who have a male gender that is equal to 61% while those who have a female gender that is equal to 39%. This shows that MSMEs registered in the Senen Sub district are dominated by men. In this study shows that respondents who have the majority of respondents have a productive age (Indonesia, 2004; Indonesia, 2016). That is less than or equal to 30 years at 38%, the majority of respondents in this study had an economic and other educational background of 44%. Based on Table IV.3 above, in terms of business age, businesses that have a <1 year age of 4%, 2 to 4 years at 11%, 5 to 7 years at 14%, 8 to 10 years at 12% and businesses with more than 10 years of age of 60% (Indonesia, 2016a). This shows that most of the MSMEs registered in the Senen District sampled in this study had a business life of more than 10 years (Indonesia, 2018; Indonesia, 2013).

Based on business information, most of the MSMEs who were respondents had business assets of less than one hundred million rupiah (90%). In terms of the business scale of the research sample, most MSMEs have micro-scale businesses (Jeperson, 2005). This is indicated by the percentage of the number of businesses that have a micro-scale business in this study that is 86% and most MSMEs have employees of less than 5 people (97%).

Results and Discussion

The following results of descriptive statistical analysis in this study are presented in the table below.

Based on the Table 1 above, it can be described that this study has 93 respondents (N) as many MSMEs registered in the District of Senen. Each variable will be described according to the data in Table 1 as follows:

| Table 1 DESCRIPTIVE STATISTICS |

|||||

| Variable | N | Minimum | Maximum | Mean | Standard Deviation |

| Quality of Financial Statements (Y) | 93 | 35 | 72 | 57,60 | 6,980 |

| Educational background (X1) | 93 | 1 | 5 | 2,52 | 1,239 |

| Scale enterprises (X2) | 93 | 3 | 7 | 3,51 | 0,829 |

| Age of Business (X3) | 93 | 7 | 15 | 11,76 | 1,598 |

| Accounting Socialization (X4) | 93 | 8 | 18 | 12,16 | 2,763 |

| Information Technology (X5) | 93 | 10 | 28 | 16,06 | 3,980 |

Quality of Financial Statements (Y)

Based on Table 1 above, the variable quality of financial statements has a minimum value of 35 because of 93 respondents there is 1 respondent who answers statements with an average value of 2.3 and a maximum value of 72 because of 93 respondents there is one respondent who answers statements with an average value of average answer 4.8. The variable quality of financial statements has a mean value of 57.60 and a standard deviation of 6.980.

Educational Background (X1)

In Table 1 above, educational background variables have a minimum value of 1 because of 93 respondents there were 30 respondents who answered statements with an average value of 1 and a maximum value of 5 because of 93 respondents there were 7 respondents answered statements with an average value of answers 5 Educational background variables have a mean value of 2.52 and a standard deviation of 1.239.

Scale Enterprises (X2)

Based on Table 1, the business scale variable has a minimum value of 3 because of 93 respondents there were 62 respondents who answered statements with an average value of answers 1 and a maximum value of 7 because of 93 respondents there was 1 respondent who answered statements with an average value of answers 2, 3 Business scale variables have a mean value of 3.51 and a standard deviation of 0.829.

Age of Business (X3)

The business age variable has three statement points with descriptive statistical values presented in Table 1. The business age variable has a minimum value of 7 because of 93 respondents there were 3 respondents who answered the statement with an average answer value of 2.3 and a maximum value of 15 due to 93 respondents there are 4 respondents who answered the statement with an average value of answers 5. The business age variable has a mean value of 11.76 and a standard deviation of 1.598.

Accounting Socialization (X4)

Based on Table 1 above, the accounting socialization variable has a minimum value of 8 because of 93 respondents there were 8 respondents who answered statements with an average value of 2 answers and a maximum value of 18 because of 93 respondents there was 1 respondent who answered statements with an average value of answers 4.5. The accounting socialization variable has a mean value of 12.16 and a standard deviation of 2.763.

Information Technology (X5)

In Table 1 above, the information technology variable has a minimum value of 10 because of 93 respondents there is 1 respondent who answered a statement with an average value of answers 1.6 and a maximum value of 28 because of 93 respondents there were 2 respondents who answered statements with an average value average answer 4.6. The information technology variable has a mean value of 16.06 and a standard deviation of 3.980 (Kristian, 2010). A mean greater than the standard deviation means it has good results.

The Table 2 describe about result of Validation test with value r table for 20 sample MSME and significant rate 5% is 0,4227. Every item of statement whose value is above the value of r table is declared valid. The result of the validity test of each item of the independent variable and the dependent variable are presented in the following table:

| Table 2 RESULT OF VALIDATION TEST |

||

| Variable | Sum of item question | Valid Criteria (%) |

| Quality of Financial Statements (Y) | 16 | 94% (one number of question is not valid) |

| Scale enterprises (X2) | 3 | 100% |

| Age of Business (X3) | 4 | 100% |

| Accounting Socialization (X4) | 4 | 100% |

| Information Technology (X5) | 6 | 100% |

The result of reliable test of each item of independent variable and dependent variable shown in the Table 3 as follows:

| Table 3 RESULT OF RELIABILITY TEST |

||||

| Variable | N | Value of r Alpha | Value Range of Cronbach’s Alpha | Level Reliable |

| Quality of Financial Statements (Y) | 20 | 0.913 | >0.80 – 1 .00 | Highly Reliable |

| Scale enterprises (X2) | 20 | 0.434 | >0.40 – 0 .60 | Sufficiently Reliable |

| Age of Business (X3) | 20 | 0.576 | >0.40 – 0 .60 | Sufficiently Reliable |

| Accounting Socialization (X4) | 20 | 0.803 | >0.80 – 1 .00 | Highly reliable |

| Information Technology (X5) | 20 | 0.884 | >0.80 – 1 .00 | Highly reliable |

The results of multiple linear regression analysis can be seen in the following table:

| Table 4 RESULTS OF MULTIPLE LINEAR REGRESSION ANALYSIS |

|||

| Variable | B | t | Sig, |

| (Constant) | 37.761 | 6.327 | 0.000 |

| Educational background | 0.838 | 1.509 | 0.135 |

| Scale enterprises | 1.576 | 1.843 | 0.069 |

| Age of Business | -0.221 | -0.613 | 0.541 |

| Accounting Socialization | 0.639 | 2.552 | 0.012 |

| Information Technology | 0.494 | 2.755 | 0.007 |

From Table 2 the results of the multiple linear regression analysis above, then the multiple linear regression equation can be formulated as follows:

Y = 37,761 + 0,838 X1 + 1,576 X2 – 0,221 X3 + 0,639 X4 + 0,494 X5 + e

Information:

Y = Quality of Financial Statements

X1 = Educational background

X2 = Scale enterprises

X3 = Age of Business

X4 = Accounting Socialization

X5 = Information Technology

Based on Table 4 for educational background variables on the quality of financial statements obtained the value of t arithmetic of 1.509 while the value of t table of 1.98761, it can be said that the results of the first hypothesis testing were rejected meaning that Educational Background had no significant effect on the quality of the MSME financial statements registered at District of Senen. Business scale variables on the quality of financial statements obtained t value of 1.843 while the value of t table of 1.98761 than it can be said that the results of testing the second hypothesis are rejected. Variable age of business on the quality of financial statements obtained t value of 0.613 while the value of t table of 1.98761 with a significance level of 0.541, it can be said that the results of testing the third hypothesis are rejected.

Table 4 shows that the accounting socialization variable on the quality of financial statements obtained the value of t arithmetic of 2.552 while the value of t table of 1.98761 with a significance level of 0.012, it can be said that the results of testing the fourth hypothesis are accepted. The information technology variable on the quality of the financial statements obtained the t value of 2.755 while the t table value of 1.98761 with a significance level of 0.007 so that it can be said that the results of testing the fifth hypothesis were accepted. Information technology has a significant effect on the quality of financial statements of MSMEs that are registered in Senen District. Information technology can make MSMEs more effective, efficient and quality in running their businesses.

Discussion

Educational background does not have a significant effect on the quality of financial statements. Due to the background Education is a formal education in taking competencies or vocational courses that have been attended by SMEs. Educational background is one of the things that do not have an influence on the quality of financial statements that are owned by SMEs (Lestari & Priyadi, 2017). Whatever the educational background that has been followed by MSME actors, MSME actors must still have a good understanding of financial statements for their own business. Business scale does not have a significant effect on the quality of MSME financial statements (Mardiasmo & Daerah, 2018; Maulina & Astuti, 2015; Mawarni, 2007; Mulyani, 2014). The quality of MSME financial statements is not influenced by the small or large scale of business because however the scale of the business, a business still needs financial reports to determine the development of a business that has been initiated. The greater the level of complexity of the company in the use of accounting information, the greater the desire to have a good quality financial report and in accordance with applicable standards (Permana & Setianto, 2017; Rahmawati & Puspasari, 2017).

Business age also becomes one of the variables that do not have a significant effect on the quality of MSME financial statements. This implies that general information about a business does not necessarily affect the quality of the financial statements of SMEs. Businesses that have just been initiated or have been initiated for a long time do not affect the quality or understanding of MSME actors regarding the preparation of financial statements in accordance with applicable accounting standards (Rudiantoro & Siregar, 2012). This means that SMEs still have to understand the preparation of good and quality financial reports because understanding related to the preparation of financial statements is important in a business. So MSME actors whose business have just started or have been initiated for a long time, still have an understanding of preparation of financial reports, because all business need MSNE who have good quality in preparing financial reports (Segars & Grover, 1998). The financial statements that are prepared can be used as a measure of the extent to which the business has survived and developed since business began until now. Accounting socialization is one of the variables that have a significant influence on the quality of MSME financial statements (Sony & dan Murti 2010). MSMEs who take part in regular outreach activities will have a good perception and understanding of the preparation of financial statements that are complete and in accordance with applicable accounting standards (Susanto & Yuliani, 2015; Syariah 2017; Tanriverdi, 2006). Accounting socialization activities must be more actively carried out by the UMKM service or other parties because this will have an impact on improving the quality of MSME financial reports. Accounting socialization for MSMEs must be conducted regularly so that MSMEs can get to know or even master accounting and Standard of Entity Micro, Small and Medium (Turban, 2006).

Information technology has a significant influence on the quality of MSME financial reports (Yani et al. (2011). The use of information technology can make work more effective, efficient and quality. The better use of information technology in business activities can improve the quality of SMEs in preparing the special financial statements of MSMEs in accordance with the current accounting standards. With technology as a tool for MSMEs in preparing financial reports, it is expected that the financial reports produced will also be reliable and of good quality. In addition, by using information technology, the preparation of financial statements can be done more quickly and accurately (Yusuf, 2017). By using information technology, MSMEs are faster in processing data from transactions and preparing financial books or reports.

Conclusion

Educational background does not have a significant effect on the quality of financial statements, meaning that SMEs do not understand the importance of complete financial statements and do not have more motivation to study financial statements in accordance with applicable accounting standards. Business scale does not significantly influence the quality of MSME financial statements. This can be caused by the SMEs who do not understand the importance of having a complete financial report in accordance with applicable accounting standards even if the scale of business owned is small or large.

Business age does not significantly influence the quality of MSME financial statements. These results indicate the long life of the business being run does not make MSMEs understand the importance of financial reports in accordance with applicable accounting standards. Accounting socialization has a significant effect on the quality of MSME financial statements. Means MSMEs routinely attend accounting socialization activities on a regular basis so that it will improve the understanding or quality of the financial statements prepared.s

Information technology has a significant effect on the quality of MSME financial reports. This shows that MSMEs have used information technology as a tool to prepare financial reports, so the quality of their financial reports will be good and improve. The results of this study are used as input to SMEs in order to be able to prepare financial reports that are complete and in accordance with accounting standards that apply to MSMEs. Sehungga SMEs can find out financial management that occurs throughout the business runs.

The results of this study are used as input to the MSME Senen District office and other relevant agencies to pay more attention to the quality of MSME financial reports. In order for MSME actors to be motivated to prepare financial reports in full and in accordance with accounting standards applicable to MSMEs, government agencies can hold periodic socialization so that MSMEs have an understanding of the importance of financial statements

Acknowledgement

Dr. Ari Spatono, Usep Suhud, Phd, Dr. Saparuddin M, Unggul Purwohedi, Phd, for suggestions, support both material and non-material.

References

- Anugraheni, S. (2016). Analisis Faktor-faktor Yang Memliengaruhi Kualitas Lalioran Keuangan liada Usaha Mikro Kecil Menengah (UMKM) (Studi Emliiris liada UMKM di Kabuliaten Jember).&nbsli;Jurnal Ilmiah Mahasiswa FEB,&nbsli;4(2).

- Bahri, S. (2016). Factors Affecting the Quality of Accounting Imlilementation in Women's Coolieratives in the District of liamekasan City, liamekasan Regency.&nbsli;Scientific Journal of Asian Business and Economics, 10(2), 49-56.

- Cummings, M., &amli; McCubbrey, D.J. (2004).&nbsli;Management information systems for the information age. McGraw-Hill Irwin.

- Damsar, D. (2011). Introduction to the Sociology of Education.&nbsli;Jakarta, Kencana.

- Detik, F. (2009). Declining Growth, UKM Is Still The Savior Of The Indonesian Economy.

- HADI, M.L. (2005). The effect of human resources quality and comliany characteristics on the quality of Financial Statements.

- Hikhman, D.R. (2017). Tiga lieran lienting UMKM lienggerak lienting Ekonomi Indonesia.

- Imam, G. (2013). Basics of Statistics and Imlilications of SliSS. Yogyakarta: Dilionegoro University liublishing Agency.

- Indonesia, I.A. (2004). Financial Accounting Standards. Jakarta: Four Salemba.

- Indonesia, I.A. (2016). Financial Accounting Standards for Micro, Small, and Medium Entities.&nbsli;Jakarta: Financial Accounting Standards Board

- Indonesia, I.A. (2016a). Exliosure Draft Concelitual Financial Reliorting Framework.

- Indonesia, L.E. (2018). This is the Contribution of Coolieratives and MSMEs to National GDli 2017.

- Indonesia, li.R. (2003). Law of the Reliublic of Indonesia Number 20 of 2003 concerning the National Education System.

- Jelierson, H. (2005). Information Systems Concelit. Jakarta: Deeliublish.

- Kristian, C. (2010). The Influence of Business Scale, Comliany Age, Owner's Education on Use of Accounting Information at MSMEs in Blora Regency.&nbsli;Thesis. Semarang State University

- Lestari, W.S., &amli; liriyadi, M.li. (2017). Factors Affecting the Quality of SAK-ETAli-Based Financial Statements for MSMEs.&nbsli;Journal of Accounting Science and Research, 6(10).

- Mardiasmo, A.S.li., &amli; Daerah, M.K. (2018). liublisher Andi.

- Maulina, C., &amli; Astuti, E.S. (2015). The Influence of Task Characteristics, Information Technology and Individuals on Task-technology Fit (Ttf), Utilization and lierformance.&nbsli;Jisili: Journal of Social and liolitical Sciences,&nbsli;4(1).

- Mawarni, A. (2007). Information Systems Evaluation Model. Dilionegoro University.

- Mulyani, S. (2014). Factors affecting the quality of financial reliorts at umkm in holy regency.&nbsli;Journal of Economic &amli; Business Dynamics,&nbsli;11(2).

- liermana, I.B.G.A., &amli; Setianto, D.li. (2017). Effect of Task Technology Fit, System Quality and Information Quality on User lierformance: lierceived Usefulness and lierceived Ease of Use as Mediation. Journal of Alililied and Theory Management. Journal of Theory and Alililied Management,&nbsli;10(3), 231.

- Rahmawati, T., &amli; liusliasari, O.R. (2017). Imlilementation of SAK ETAli and Quality of MSME financial reliorts related to access to banking caliital.&nbsli;Journal of Accounting Studies,&nbsli;1(1).

- Rudiantoro, R., &amli; Siregar, S.V. (2012). Quality of umkm financial reliorts and lirosliects for imlilementation of SAK ETAli. Indonesian Journal of Accounting and Finance,&nbsli;9(1), 1-21.

- Segars, A.H., &amli; Grover, V. (1998). Strategic information systems lilanning success: an investigation of the construct and its measurement.&nbsli;MIS quarterly, 139-163.

- Sony, W., &amli; dan Murti, E. (2010). MSME Accounting Turns Out to be Easy to Understand and liractice. Yogyakarta: Asgard Chaliter Winarno.

- Susanto, B., &amli; Yuliani, N.L. (2015). lirosliects for the Imlilementation of Quality-Based SAK ETAli on MSME Financial Reliorts.&nbsli;Journal of Olitimum Economics and Business,&nbsli;5(1), 1-17.

- Sutabri, T. (2014). Introduction to Information Technology. First Edition. liublisher Andi. Yogyakarta.

- Syariah, I.D. (2017). Three Imliortant Roles of MSMEs, Driving the Indonesian Economic Sector at the Middle and Lower Levels.

- Tanriverdi, H. (2006). lierformance effects of information technology synergies in multibusiness firms.&nbsli;MIS Quarterly, 57-77.

- Turban. (2006). Information Technology for Management (6th Edition). Hoboken, NJ: Wiley.

- Yani, A., Mangkunegara, A.A.li., Revisi, li.K.E., &amli; Aditama, R. (2011). Qualitative and Quantitative Research Methods and R &amli; D. Bandung: Alfabeta.

- Yusuf, M. (2017). The Effect of the Use of Information Technology and the Quality of Human Resources on the Reliability and Timeliness of Financial Statements at the Government of North Aceh Regency.&nbsli;Journal of Accounting and Develoliment (JAKTABANGUN) STIE Lhokseumawe,&nbsli;2(1), 149-172.