Research Article: 2021 Vol: 25 Issue: 4S

Women Empowerment Status Elevation through Finance Methods

Dr. Munish Kumar Tiwari, Associate Professor, Mangalmay Institute of Management & Technology, Greater Noida, India

Dr. Anshu Goel, Associate Professor, Mangalmay Institute of Management & Technology, Greater Noida, India

Mr. Amit Manglik, Assistant Professor, Greater Noida Institute of Management, Greater Noida, India

Dr. Himanshu Mittal, Assistant Professor, Greater Noida Institute of Management, Greater Noida, India

Citation Information: Tiwari, M.K., Manglik, A., Mittal, H., & Kumar, H. (2021). Women empowerment status elevation through finance method. Academy of Accounting and Financial Studies Journal, 25(S4), 1-6.

Abstract

Women workers throughout the world contribute to the economic growth and sustainable livelihoods of their families and communities. Microfinance helps empower women from poor households to make this contribution. Microfinance — the prerequisite of monetary works to the underprivileged in a sustained approach — exploits praise, investments & former goods like micro insurance to assist people obtain benefit of income –making actions & improved management through jeopardy. Women predominantly advantage commencing microfinance as numerous MFIs aim female clientele. Microfinance work guide to empowerment of women’s by absolutely influencing women’s result - building authority & pleasing there in general socio-economic position. By the last of 2015, microfinance work had attained more than 79 million of the underprivileged women in the globe. As such, microfinance has the prospective to create a important involvement to sexual category parity & encourage sustainability of source of revenue & improved functioning circumstances meant for women.

Keywords

Microfinance, MFI, Sustainability, Micro Insurance, Socio-Economic Status.

JEL Classifications

M21, O16

Introduction

As per the census around 70% of the total population lives in village and they do their agricultural activities. Industrialization also happened only in big cities not in villages. The rural India is still not developed. India’s overall development is not possible without the rural areas. Working women contribute to national income of the country and maintains the livelihood of the families and communities. They face many socio-cultural attitude, lack of education, legal barriers and other difficulties. Indian women have rarely been financially independent and they are the most vulnerable members of society. 70% of the world’s poor people are women and they don’t have the access to credit and other financial services. In India, the condition of women is vulnerable. They have always been dependent on the male member of the family. Therefore, microfinance is targeted to women. It is a critical tool to authorize women commencing underprivileged household. So women can get benefit from microfinance institutions. This research paper is concerned with empowerment of the Indian women through microfinance (Caldwell et al., 1982).

Microfinance: The microfinance is defined as “Provision of credit, thrift and other financial services and products of very small amount for the poor in rural, semi urban or urban areas to raise their income levels and improve their living standards”. As per the Micro Credit Special Cell of RBI, the borrowed amounts up to the limit of Rs 25000/- can be considered as micro credit products and this can be increased up to Rs 40000/- over a period of time. Microfinance is interchanged through Micro Credit. Micro Credit is related to loan in small quantities but Micro Finance has broader meaning similar to erstwhile fiscal services resembling insurance, saving etc. The Micro Finance is banked during individuals group of produced in either joint liability or obligation mode. The group plays function in credit assessment, observing & recuperation. The groups are of two types (Barnes et al., 1999).

1. SHGs: This group does financial intermediation in the structure of formal institution and this method is mainly followed in India.

2. GG: Here, fiscal support is given to the person in a group by official organization on the vigour of group’s guarantee i.e. there is joint liability of group. It was started by Grameen Bank of Bangladesh and it is utilized by several MFIs in India.

Research Design

The research design is descriptive in nature. The method of data collection is mainly based on secondary data. So various literatures are used for data collection. However, an attempt is completed to collect data by taking information from competent persons off and on.

Literature Review

Westover, (2008) assess the experiential text on the effect of microfinance & discovers more than 100 literatures with the Host database of EBSCO (Cheston & Kuhn 2002). He finishes off that from these researches merely six can be classified as academically meticulous, the remnants being quality oriented and/or case based studies of MFI course effect. Hermes & Lensink, 2007 in the 2007 Economic Journal issue deal with combined accountability group borrowing, novel imminent through reverence to how & why this kind of borrowing works in pleasing settlement charges. Wydick et al., (2010), investigates an inventive method by finding into the position implemented by societal network in finding admittance to loans in microfinance. A work carried out by Noreen (2011) stated that

“Empowerment of women is significantly affected by husband’s education, age, father hereditary possessions, married status, number of sons living & microfinance”.

Through popularity gaining of micro-financing, viewers have just advised that a possible effervesce might be rising (Gokhale, 2009).

According to Kabeer, (1999),

“Many feminists identify that poor men are almost as powerless as poor women is in access to material resources in the public area but remain advantageous within the patriarchal structure of the family.”

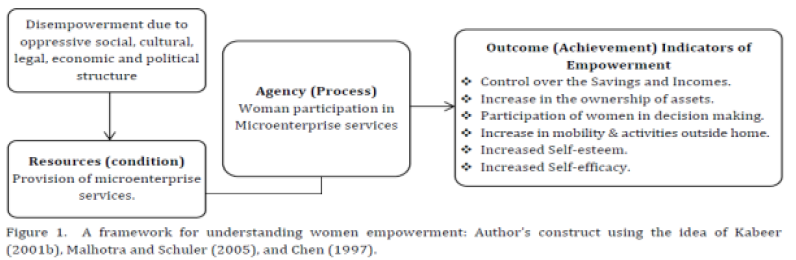

Research conducted on various aspects of women loan borrowers in Bangladesh has given negative results. It shows that the benefits of loan goes to men and the other members of family but the accountability & responsibility for pay back the finances is with woman which increases the pressure & dependence (Goetz & Gupta, 1996; Rahman, 1999; Todd, 1996; Kabeer, 1998). Such types of loans rarely pull women and their family out of poverty (Fisher & Sriram, 2007). Women always bear the burden of repayment as they often borrow from other sources to pay back loans and this leads to indebtedness. When a woman borrows for themselves they did not men to repay because they invest in existing activities that are insecure and low profit (Mayoux, 2006). According to Shrestha, (1998) women in Nepal are gaining autonomy in CSD programmes but researchers also comments that there are no key modifications in the sexual category family members & their known functions & accountabilities in the home. Women’s mobility has increased in income generating activities but social stigma of women’s mobility remains (ILO, 1998; Kabeer, 2001) (Figure 1).

Figure 1. A framework for understanding women empowerment: Author's construct using the idea of kabeer (2001b). Malhotra and schuler (2005). and chen (1997)

Models of Microfinance

The microfinance delivery methods can be classified into six groups like:

1. Grameen Bank Model: In this microfinance programme participants are organized into group of five members who make mandatory contribution to insurance funds and group savings. Each member maintains individual loan and saving account with the bank. After contributing to the saving funds for fixed duration, the group members gets individual loans from the bank for six months to one year of duration (Ahmed et al., 2001).

2. Village Banking Model: This model is an extension of group approach in which a village bank is developed by a group of 30-100 low income individual who wanted to improve them through self-employment activities. The bank is financed by loans provided by MFIs and internal mobilization of members’ saving fund.

3. Individual Lending Fund: This is credit lending model in which micro loans are given directly to the borrowers in financial institutions have to contact with individual clients to provide credit products which is customized to specific needs of individual. This model is successful for larger, urban based, and product oriented businesses (Holvoet, 2005).

4. Credit Unions and Cooperatives: It is a democratic, non profit financial cooperative which is governed by its members who are the owners and customers of their cooperative society. The members belong to the same local or professional community or having same interest and provide a different range of banking and financial services to its members (Hunt & Kasynathan, 2002).

5. Joint Liability Group Model: This model has 4 to 10 individuals in a group which is known as Joint Liability group. They can get bank loans against mutual guarantee and there is no condition of their own saving fund. All the members of joint liability group sign a contract which makes them liable for reimbursement of the credits taken by all members in the group. In our country India, NABARD is using this model for providing credit to tenant cultivators who do not include title of their land.

6. The Group Approach: Here 10-20 members are making group and makes savings of fixed amount in a common fund. After some period group is associated with financial institution for getting credit. These institutions issue loans in the given forename of group and all members of group are responsible for repayment of loan. The SHG-BLP, the group based credit delivery method is providing microfinance.

Women Empoverment

Women empowerment meaning is to allow women carry on and live with self esteem, respect, Humanity, dignity, and self reliance. This may assist them towards take their own decisions. Amartaya Sen, (1993) says about women empowerment to facilitate the liberty to guide dissimilar kinds of existence is reproduced in the people’s potential position. The capability depends on the different factors like social arrangements and personal characteristics. Malhotra, (2002) made a record of the normally utilized measurements of women empowerment, taken since the structures made by different authors in dissimilar areas of sciences of social area. These frameworks suggest that women empowerment should occur along with different dimensions like psychological, political, legal, familial/interpersonal, socio-cultural, and economic (Mason, 2005). According to World Bank, empowerment is stated as “The method of growing the capability of individuals or groups to create options & to convert the options to required actions and outcomes”.

Kabeer, (1999) says about women empowerment as the procedure to obtain the capability starting through those who have been deprived of the capability to create strategic choices of life. The interrelated dimensions to implement choices are achievements, agency, and resources. As per Krishna, (2003) authorization is raising the capability of persons or crowds to formulate them effective development and change these options into required activities & results. According to UNIFEM, the constituents of women authorization are ‘developing a sense of self-worth’, to protected required modifications, ‘to create options, attaining the capability & work out negotiating authority, faith in one’s capability & the authority to manage one’s existence. Authority to women will be empowered only when they gets complete authority on their individual existence.

In an article of ‘Does microfinance empower women?’, Wallentin & Swaina, (2009) indicated that SHG associates are authorized by involving yourself in micro level finance program in the approach that they include a superior inclination to oppose sexual characteristics notices and culture that stops their ability to develop and make choices. Another view given by Boender et al., (2002) about women’s empowerment says that it wants to happen in numerous scopes like socio cultural, economic, familial/interpersonal, political, legal, and psychological. Socio cultural dimension includes marriage systems, no familial social support systems, women’s physical mobility, & systems accessible to women. Microfinance acts a significant position in gender and development strategies as it is directly associated to deficiency improvement & women. Women are the poorest and they need maximum financial security to become more empower in home and community affairs. Women spend most of their income in real family needs like diet, children’s education, health care, and clothing. Their repayment record is good and their behaviour is also more cooperative than men. Access to financial resources empowers women to access to loans, possessions & capital, also on individual & societal possessions similar to edification & business (Harper, 2002).

The Employment Guarantee Act has contributed a lot to women empowerment in Orrisa. The act provided earning prospects meant for women to foster and expedite rural development. Out of the total employment provided, the Act says that:

1. 30% must be provided to women workers. The priority for women in the ratio of 1/3 of total workers. (Schedule – II (6) of the Act).

2. The work is organized by women group.

3. Equal wage to be paid to men and women workers. (Schedule – II (34) of the Act).

4. Baby creches for children of women workers. (Schedule – II (28) of the Act).

Micro Level Finance in Women Authorization

It is a kind of depository work which provides right of entry to monetary & non monetary works to less revenue or less employment people. This is the best tool for poor to become self-empower especially women in embryonic world. Micro level finance was first evolved from Bangladesh in late 1970. In Pakistan, micro level finance segment happened from AKRSP & OPP. After some time, microfinance became NGO activity and 5 microfinance banks started working under Pakistan’s State Bank (Fisher & Sriram, 2002). This microfinance led to women empowerment and started influencing their verdict building authority at family unit & there in general socio financially viable position. Microfinance contributed to gender parity & sustainable livelihood for women (Ackerly, 1995).

Findings of the Research

1. Deficiency of acquaintance of the marketplace & profit potentiality. This makes difficult for women to choose about business.

2. Inadequate book keeping.

3. Employment of numerous family members which enhance societal stress to allocate payback.

4. Setting the price arbitrarily.

5. Less capital.

6. Highest interest rates.

7. Inflation accounting and inventory is not considered.

8. Ruining of business due to credit policies as many cannot pay cash and also suppliers are very strict towards women.

Recommendations

1. Proper acquaintance of the marketplace & profit potentiality given to women for providing empowerment.

2. Employment opportunities for women.

3. Reaching out the government financial & commercial institutions schemes for women.

4. Consideration of inflation accounting and inventory also adequate book keeping.

5. Financial & commercial institutions schemes interest rates should be reduced.

6. Feasible credit policies for women and suppliers should be humble towards women.

7. Making Indian women educated and independent.

Conclusion

There is a requirement to distinguish among the purposes of micro level finance & the potential it carries to improve the livelihood of poor people. The core function of microfinance programme is to give monetary work, to reach poor and needy people and provide admittance to investments & loans. The potential of microcredit is going beyond the condition of monetary work to underprivileged individuals. This distinction helps to design programmes in an effective manner because the functioning of microfinance is dependent on stability of banks and money lending institutions, the prospect of microfinance is dependent on the health of social and socio-economic institutions like social norms, education, and patriarchy. The poverty alleviation interventions do not exist in isolation. They are entrenched inside the outsized societal environment. The societal environment includes political, economic, cultural, and ideological categories. This subject is as well associated to potential of microfinance as it indicates the authorization of women & underprivileged individuals during micro level loans are as well reliant on the societal environment. It is important for MFIs to consider societal environment. The authorization prospective & consequence of the big societal environment indicates that microfinance should not be designed as a monetary replica but also as well developed approach to expansion where role of culture is important. It is moreover significant to recognize that MFI authority on women’s authorization is restricted to women & never be useful to men. There should be proper attention on the different categories of women especially who have limited skills, less resources, or who are dependent on husbands. Lastly there is also a requirement of more sophisticated and in-depth analysis of culture to understand the empowerment linkage.

References

- Ackerly, B.A. (1995). Testing the tools of development: credit programmes, loan involvement, and women's empowerment. IDS Bulletin, 26(3), 56-68.

- Ahmed, S. M., Chowdhury, M., & Bhuiya, A. (2001). Micro-credit and emotional well-being: experience of poor rural women from Matlab, Bangladesh. World Development, 29(11), 1957-1966.

- Barnes, C., Morris, G., Gaile, G., Kibombo, R., Kayabwe, S., Namara, A., & Graham, K. (1999). An assessment of clients of microfinance programs in Uganda. International Journal of Economic Development, 1(1), 80-122.

- Caldwell, J.C., Reddy, P.H., & Caldwell, P. (1982). The causes of demographic change in rural South India: A micro approach. Population and Development Review, 689-727.

- Cheston, S., & Kuhn, L. (2002). Empowering Women Through Microfinance, Draft Publication Sponsored By UNIFEM.

- Fisher, T., & Sriram, M.S. (2002). Beyond Micro-credit: Putting Development Back into Microfinance, New Delhi: Vistaar Publications; Oxford: Oxfam.

- Harper, M. (2002). Promotion of self help groups under the SHG bank linkage programme in India. In Seminar on SHG-bank Linkage programme at New Delhi.

- Holvoet, N. (2005). The Impact of Microfinance on Decision- Making Agency: Evidence from South India, Development and Change, Institute of Social Studies. 36(1), 75-102.

- Hunt, J., & Kasynathan, N. (2002). Reflections on microfinance and women’s empowerment, Development Bulletin, 57, 71-75.

- ILO (1998), Women in Informal Sector and Their Access to Microfinance. Inter- Parliamentary Union Annual Conference, Windhoek, Namibia.

- Kabeer, N. (2001). Conflicts Over Credit: Re-evaluation the Empowerment Potential of Loans to Women in Rural Bangladesh. World Development, 29(1).

- Mason, K.O. (2005). Measuring women’s empowerment: Learning from cross-national research. Measuring empowerment: Cross-disciplinary perspectives, 89-102.