Research Article: 2023 Vol: 29 Issue: 1S

Youth Entrepreneurship in Morocco: Evaluation of the Moukawalati Program

Rania Sama, Université Ibn Tofail

Noureddine Abdelbaki, Université Ibn Tofail

Said Bribich, Université Ibn Zohr

Citation Information: Sama, R., Abdelbaki, N., & Bribich, S. (2023). Youth entrepreneurship in morocco: Evaluation of the moukawalati program. Academy of Entrepreneurship Journal, 29(S1), 1-14.

Abstract

The problem of unemployment, especially among higher education graduates, appeared in Morocco in the early 1980s. In this regard, initiatives to promote self-employment were launched, including the "Young Promoters Credits" program, launched in 1987, and the "Moukawalati" program in 2006, as part of the State's efforts to promote employment, but without achieving satisfactory results. The explanation lies in the intrinsic flaws of these programs (conditions, procedures, stakeholders, etc.) as well as in extrinsic issues (economic situation, training system, availability of resources, etc.).

The informal sector has therefore developed widely as an alternative activity that can generate income and improve living conditions.

The idea in itself, to rely on youth entrepreneurship to boost employment in particular and the economy in general, is commendable. However, it is necessary to shed light on previous deficiencies in order to overcome them and not make the same mistakes in future programs.

It is precisely in this context that we will look at the experience of the program Moukawalati to try to answer the crucial question: Why so much will and investment have not succeeded in promoting this ambitious, youth entrepreneurship?

Introduction

The Very small enterprises which are becoming increasingly important in the economic framework, constitute a real lever for development. But in Morocco, their situation remains poorly understood, as the majority of their framework escapes the formal sector. In addition, very small enterprises face several constraints, which mean that only a small number of them manage to survive the first few years of existence.

Drawing lessons from past experiences, the Moroccan government launched the “moukawalati” program on July 1, 2006. This is a national program to support the creation of 30,000 micro and small enterprises. This program targets vocational training graduates as well as unemployed people with a bachelor's degree or higher education. Despite the important financial and non-financial support that was provided to young people under this program, it has been a total failure. Indeed, it is clear that the results obtained are very low and largely below the objectives set at the outset. The failure of the program was completely consummated in the first years of its implementation.

Thus, for example, the program's achievement rate was only 6.8% in terms of the number of businesses created and 6.7% in terms of jobs generated... The program's failure to achieve its initial objectives can be explained by the multiple constraints encountered by young people, which were highlighted by our empirical study. On the one hand, there are the general constraints of the business climate in an unfavorable, even hostile, environment such as that of Morocco, which is marked by financial problems, the land issue, the heaviness and complexity of administrative procedures, etc. On the other hand, there are the specific constraints of youth entrepreneurship, such as the nature and quality of non-financial support, the absence of a true entrepreneurial spirit and a real entrepreneurial will, and the lack of supervision of the businesses created.

In this sense, the Ministry of Employment and the National Agency for the Promotion of Employment and Skills have given themselves the hard task of rebounding on the failure of the program. Thus, was launched in 2013, the project "Evaluation of the “Moukawalati” program and development of a support system for the creation of the very small enterprise according to a regional approach" which served as a basis for the design of a recovery plan consisting of the replacement of the “Moukawalati” program by the program " support to self-employment ", whose implementation is supervised by the National Agency for the Promotion of Employment and Skills. Our research devoted to this ambitious program aims to highlight the main reasons that led to the failure of this very ambitious program. To do this, we will analyze the results of diagnostic studies conducted as part of the project "Evaluation of the Moukawalati program and development of a support system for the creation of very small enterprises according to a regional approach" in order to demonstrate that the approach adopted, which consists of arousing, or even "wanting to artificially create", an entrepreneurial spirit among young people who are often unemployed, and the willingness of the public authorities to rely on a highly concentrated oligopolistic and mercantile banking system, is completely outdated and completely ineffective.

Entrepreneurial Activity in Morocco

Main characteristics of entrepreneurial activity in Morocco

The regulatory and institutional framework is characterized by a very important effort accomplished (promulgation of many laws in favor of business creation) in recent years aligning Morocco on most international standards; a numerous and diversified actors and support mechanisms and a well-developed and integrated business creation support programs and mechanisms, but with a very mixed profile at the level of very small businesses;

The economic and business environment is characterized by the existence of creation niches in the country's economic dynamics (national development programs and plans); however, they are not very well exploited and a doing Business environment that tends to be flexible and has definite potential for improvement;

Culture and entrepreneurial activity in Morocco is characterized by a population with favorable attitudes towards entrepreneurship; nevertheless, there are still important factors of fragility: high proportion of entrepreneurs between 25-44 years old in the least educated groups of the Moroccan adult population, a relatively high rate of entrepreneurial activity compared to the benchmark countries (15.8% in 2009), a rate of business creation that has been steadily increasing since 1997; but is still low compared to the benchmark group and a landscape of very small enterprises unevenly distributed both sectorally and geographically and with varied characteristics.

Creation and start-up constraints

Environmental constraints:

In fact, all new entrepreneurs have difficulties in finding their way through all the official procedures and in finding reliable information. Thus, the problems of the creation phase remain during the start-up, or even increase. These problems are of a financial, technical, administrative, commercial, human and legal nature:

Constraints related to the management

The supervision rate in Morocco is 25%, with little disparity between sectors of activity. With a rate of 18%, industrial SMEs are relatively the least supervised. On the other hand, the highest supervision rate is recorded in commercial SMEs (33%).

Financing constraints:

Overall, one company in five uses external financing, the majority of which (93%) comes from bank credit. This proportion rises to 46% for the big enterprises compared with 18% for SMEs. Small and medium-sized enterprises are the most confronted with difficulties in accessing financing, which constitute a serious obstacle for 40% of them.

Constraints related to the entrepreneur's profile:

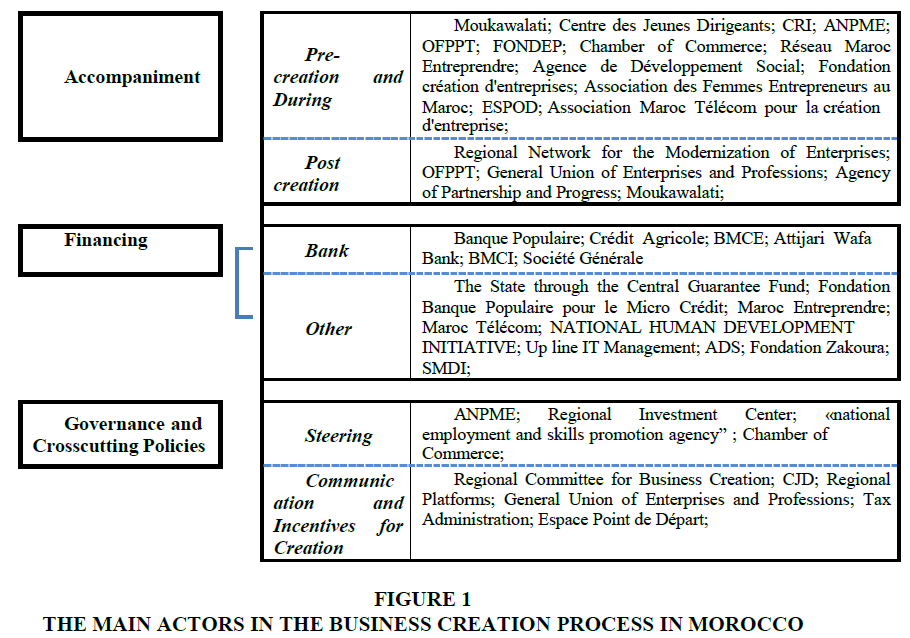

It lies in the lack of experience of project leaders and young entrepreneurs, which often proves to be a handicap. This inexperience and the absence, or at least the weakness of a certain business culture and innovative ideas, represent the major handicaps to the success of the program. It must be said that the profile of the project leaders is of fundamental importance in this field. Certainly, a pre- and post-creation support has been provided in terms of development of the business plan, training ... but it remains inadequate and inappropriate(Figure 1).

Specificities Of Very Small Enterprises In Morocco

Definition of Very Small Enterprises

Very small enterprises suffers from a lack of consensus on its definition (there is no "unitary and universal definition" in the sense of [HERTZ, 1982]

When talking about very small enterprises, it is necessary sooner or later to determine exactly what is meant by this term. Most specialists consider that one of the greatest difficulties in studying very small enterprises is the extreme heterogeneity that exists among them. Consequently, attempts at definition have been proposed by introducing a set of approaches, a quantitative, qualitative, international, composite and finally technological approach. Thus, there are other authors who add a microeconomic approach according to the aspirations of the manager. In fact, very small enterprises are marked by the omnipresence of the manager, and both internal and external relations are highly personalized and informal. Strategic decision- making is intuitive and rarely formalized. Julien and Marchesnay developed three types of objectives that allowed them to characterize the entrepreneur who is generally the leader. Thus, they talk about sustainability, independence and autonomy of decision, growth and power.

The various definitions of MSEs in the literature and in practice are based mainly on quantitative criteria. They refer essentially to the number of employees, capital investment, turnover and total assets. Defines the very small enterprise quantitatively as an enterprise with fewer than 10 employees, the number of employees of the micro enterprise is between 1 and 4. The number of employees of very small enterprises is between 5 and 9. However, there are still some difficulties. Concerning the definition of the workforce, do we only count permanent employees; do we incorporate part-time employees, fixed-term contracts, temporary workers, etc.? We can certainly get around this obstacle by defining the scope of the study. Another, more serious problem is that this criterion cannot be applied identically to all sectors. The "total assets" criterion is based on the assets of the firm. Nevertheless, their evaluation remains sometimes delicate. Another more concrete difficulty concerns the quality of statistical data on very small enterprises; they are difficult to obtain and often differ from one organization to another.

Characteristics of very small enterprises in Morocco

In Morocco, the very small enterprise. is defined as a company employing less than 10 employees. The second quantitative criterion used in Morocco is turnover. Any enterprise with a turnover of less than 3,000,000dh excluding value added tax per year is a very small enterprise (Ministry of Economy and Finance, 2011). Another criterion adopted in Morocco is the distinction between informal and formal units. Indeed, the structure of the small business sector in Morocco includes formal small businesses, which number 733,000 according to the last economic census of 2001/2002 (HCP, 2001), and informal production units, which increased from 1.233 million in 1999/2000 to 1.550 million in 2007 (HCP, 2009).

The structure of companies in Morocco is 64% made up of very small enterprises, The breakdown by sector of activity shows that almost 42% of the companies operate in the service sector, 27% in trade, 21% in construction and 10% in industry (National Business Survey 2019).

Methodology

To conduct our study, we used a methodological framework based on tools and resources drawn from different sources.

• The existing literature, both theoretical and Moroccan studies and monographs on the issue;

• The results of past experiences in promoting youth entrepreneurship in Morocco;

• The statistics produced by the various organizations involved in this program: the National Agency for the Promotion of Employment and Skills, the Professional Grouping of Banks in Morocco (GPBM), the Regional Investment Centers (CRI), etc.

• The Diagnostic studies conducted as part of the project "Evaluation of the Moukawalati program and development of a support system for the creation of very small enterprises according to a regional approach", supervised by the National Agency for the Promotion of Employment and Skills and the ministry of Employment in June 2013.

The Failure Of The Moukawalati Experiment

Background

Over the past fifteen years, several programs and measures have been launched to support small business creation and self-employment in Morocco:

“Moukawalati” programs with the participation of several sectors and institutions (2007-2013);

“Self-employment support" program managed by «NATIONAL EMPLOYMENT AND SKILLS PROMOTION AGENCY” since 2014;

“MIN AJLIKI" program in the framework of Moroccan-Belgian cooperation;

Program "Support to young initiatives" in the framework of the Moroccan-Belgian cooperation;

Support program for people with disabilities to create a business or an IGA with the participation of MINISTRY OF LABOUR, «National employment and skills promotion agency” , National mutual aid , ADS and the Ministry of Family, Solidarity, Equality and Social Development ;

Measures to support business creation in partnership with regional councils ;

Program "Supporting the Economic Integration of Youth" in the region of Marrakech Safi.

As part of the effort to promote youth employment, the Ministry has developed an active employment policy that supports and complements the macroeconomic policy to stimulate productive investment for employment opportunities. Given the limited employment opportunities relative to the growing demand for jobs, and the fact that wage employment alone cannot absorb all job seekers, encouraging self-employment and entrepreneurship remains a strategic alternative to solve the problem of youth unemployment and economic integration.

In this context, the government has taken a series of measures, starting with the "young entrepreneurs" scheme in the late 80s, through the "MOUKAWALATI" scheme from 2006, and the "support to self-employment" scheme currently in force, leading to the proposal of an integrated system for self-employment under the executive program of the national plan Promotion of Employment 2017-2021

Presentation of the "MOUKAWALATI" program and its achievements:

The “Moukawalati” program aims to support the entrepreneurial activities of young people through;

Technical support to prepare the feasibility study, facilitate the start-up of the company and ensure post- creation follow-up during the first year of the company's life;

Financial support in the form of a guarantee of the bank loan by the State within a range of 85% of the project cost and to provide an interest-free advance to the project leader within the range of 15 000 dirhams, provided that it does not exceed 10% of the project cost, repayable in 6 years, including 3 years of deferred payment.

In order to activate the financing component of the "Moukawalati" program, a self- employment support fund has been created, which has been entrusted with running the Central Guarantee Fund in accordance with the agreement signed in September 2005. The purpose of this fund is to grant the beneficiaries interest - free advances up to 10% of the amount of the project financing, the remaining 90% being financed by means of a bank loan guaranteed by the Fund for Enterprise Creation(Table 1).

| Table 1 Key Data And Main Achievements Of The Moukawalati Program |

|

|---|---|

| Key data | Main achievements |

| Approximately 4119 creations since the launch of the program, of which nearly 50% were financed by banks. | Establishment of a national technical committee bringing together the banks, the GPBM, CCG, |

| 310 support counters, including 60 OFPPT counters | «NATIONAL EMPLOYMENT AND SKILLS PROMOTION AGENCY” , CRI, CCSI, OFPPT and |

| Until 2009, the program recorded : | the branches. |

| 46% wastage in the screening/selection process | Elaboration of the MKW practical guide to homogenize the procedures. |

| 19% wastage in selection/training | Organization of tours and awareness actions for all stakeholders. |

| On the solvency of companies created until 2009 under the program : | Revitalization of regional and local steering |

| The rate of unpaid files in relation to released files is 20%, including files with a single unpaid payment | Expansion of the network of support offices |

| The rate of cases in dispute compared to unpaid bills is 35%. | Training and certification of 350 coaches |

| Mass media communication on the program | |

| TV broadcast : 200 | |

| Radio broadcast : 868 | |

| Mobilization of a call center over 3 months | |

| 700 awareness-raising actions at the local level with the participation of 30,000 potential project leaders. | |

Balance sheet and results of the "MOUKAWALATI" program

Overall, the “Moukawalati” program has enabled the creation of some 2,050 businesses, i.e 410 businesses per year. This represents an achievement rate of 6.8% compared to the initial target of 30,000 enterprises. It can therefore be said that this program has largely failed in this respect. It should also be noted that the number of businesses created has continued to decline from one year to the next, from 612 in 2007 to 430 in 2009 and only 232 in 2011. At the same time, the number of businesses created with bank financing was only 918 between 2007 and 2011, or 44.8% of all entities created under this program. The “Moukawalati” program was supposed to facilitate bank financing for micro and small enterprises created by young unemployed graduates. On this level also, it should be noted that the banked projects have experienced a continuous and significant decline from one year to another by being limited to 122 in 2011 against 241 in 2007. This only confirms the criticisms and grievances expressed by young promoters towards banks whose mutual distrust only increases as the program progresses.

Results Of The “Moukawalati” Evaluation

In 2013, when the deadline came to an end, diagnostic analyses were carried out as part of the project "Evaluation of the “Moukawalati” program and development of a support system for the creation of very small enterprises according to a regional approach". This study was carried out by the competent institutions, namely «National employment and skills promotion agency” , the ministry in charge of employment and the “Moukawalati” national committee, in order to zoom in on the results of the “Moukawalati” program and to situate them in relation to the initial objectives. This assessment was carried out in two phases:

• An internal evaluation which had the objective of evaluating the axes of the program in terms of objectives, achievement and feasibility (strengths and weaknesses of the program)

• An external survey of project leaders who have benefited from the program in order to collect their feedback

Results of the Evaluation of the program axes

Initially, several meetings were held at the regional and local levels, in order to gather feedback from the institutions in charge of implementing the program as well as from the people who were in direct contact with the project leaders.

The results of the program are weak and it was found that the project was much too ambitious, thus creating several handicaps at several levels, namely(Table 2).

| Table 2 Strengths And Weaknesses Of The Moukawalati Program |

||

|---|---|---|

| Strengths | Strong political will with regionalized implementation | |

| Homogeneity and complementarity between the governance bodies of the system | ||

| A local operational committee ensuring proximity between stakeholders | ||

| Delegation of the Regional Investment Center by WALI as a contact person | ||

| Governance Axis | Program maturity | |

| Weaknesses | Lack of coordination between the institutional actors involved | |

| Lack of steering by objectives broken down into figures to which all the actors commit themselves | ||

| Level of involvement of actors varies according to the situation | ||

| National objectives that are not adapted to all regions in view of their specificities | ||

| Failure to hold regional committees | ||

| Lack of a program manager at the regional level | ||

| Lack of designated bank contacts at the regional level | ||

| Strengths | Global and integrated support process: before - during and after the creation; | |

| A network of 269 operational support offices throughout the country; | ||

| Cumulation of experience and Know-How in the accompaniment to the creation of a company; | ||

| Existence of an information system and dedicated program monitoring ; | ||

| Homogeneity and complementarity of the members of the selection committee; | ||

| Relevance of the new approach: Requirement of the business plan in the application file; | ||

| Implementation of tax incentives and creation incentives (DGI 2011) | ||

| Accompaniment axis | Weaknesses | Identification and choice of the target/profile of the project leader |

| Standard support offer vs. heterogeneous demand | ||

| Multiplicity of stakeholders on identical segments without overall coherence, which undermines the effectiveness of collective actions; | ||

| Post-creation support services are still very weak and limited; | ||

| Accompaniment path considered long | ||

| Selection system generates frustration or inconsistencies because it does not guarantee funding | ||

| Lack of accompanying expertise in certain areas | ||

| No access to market segments: public and private markets | ||

| Poor perception (publicity) of the program by youth/poor communications about the program | ||

| Unattractive costs and payment terms for the branches. | ||

| Weak entrepreneurial culture: Entrepreneurial training | ||

| Strengths | State guarantee (CCG) of 85% of bank credit delegated to banks; | |

| Financing Axis | State advance (CCG) without interests representing at most 10% of the investment and within the limit of 15.000 DHS or 30.000 DHS in case of binomial, refundable over 6 years including 3 years of Grace; | |

| Advance on the state advance of 10.000 DHS | ||

| Efforts to mobilize and involve banks in the program | ||

| Weaknesses | Financing of MKW projects, which is exclusively based on bank financing and state guarantee | |

| Low participation in the financing of Moukawalati projects by banks due to : | ||

| The high mortality rates of Moukawalati creations (the quality of the project, the viability and the profile of the entrepreneur); | ||

| High delinquency and litigation rates at the bank level; and experiences with previous schemes | ||

| Slow release of credits granted | ||

| Undercapitalization of the company at start-up | ||

| Non-exploitation of funds dedicated to very small enterprises, created within the framework of large national and sectoral development projects or other (bank, | ||

| oundation, national human development initiative). | ||

Results of the Survey of project leaders who have benefited from the MOUKAWALATI program

In a second step, a survey was conducted among 500 project leaders, including those who had succeeded in their entrepreneurial journey and those who had to abandon for various reasons. The objective of this study was to have their feedback on the program, being the beneficiaries of the program, it was important to collect their opinions on the following points.

1. Motivations and creative skills

2. Creation Itinerary: Program Registration and Selection

3. Creation itinerary: Pre-creation support process

4. Reasons for dropping out of the business creation process (for those who dropped out of the program

Motivations and Creative skills

• A desire to take on challenges: Overall, the desire to be one's own boss/self is the fundamental motivation for starting a business. With a weight of 41.5%, this motivation stands out strongly from the other objectives.

• More than a quarter of the project holders created a company in order to generate jobs

• 22% of the project leaders mention the personal challenge (self-realization) as the main motivation to create.

• In close order, the exit from unemployment and the existence of market opportunities are the motivations mentioned by 17.1% of the creators. The remainder being weakly expressed (less than 12% of project holders for each theme) as motivations for creation by young people.

Creation Itinerary: Program Registration and Selection

• The majority (43.9%) of the project leaders claim to have learned about the MKW program through television.

• 26.5% learned about the program through posters/brochures, and 14.6% learned about it through newspapers and magazines.

• 22% found out through friends

• In order of importance, (7.3%) of the project leaders indicate the awareness action, family members and the internet/web as the first source of information on the existence of the program. Only 2.4% of creators mention banks/financial institutions.

Moreover, the choice of opting for the MKW program to create a business is mainly motivated by obtaining financing for 72.2% of the creators. 53.7% indicate the assistance and the accompaniment as a reason for using the program, and 48.8% underline the procedural/administrative facilities while only 7.3% mention having opted for the program following the recommendations of a beneficiary.

Creation itinerary: Pre-creation support process

It is recorded that 80.5% of the creators claim to have benefited from support in the preparation of the business plan.

• 78,3% of the creators were accompanied by the “national employment and skills promotion agency” counters

• 2.4% of the creators were accompanied by firms mandated by the “national employment and skills promotion agency”.

• For the creators who did not benefit from the support, they mention the following reasons

• Already prepared business plan

• No need to be accompanied

Reasons for dropping out of the business creation process (for those who dropped out of the program)

Among the most important reasons for abandoning the business start-up project, financing needs are most frequently emphasized. In addition, there are:

• Obtaining a position as an employee

• Administrative complications and gaps in support

The majority of project holders (64.7%) place the responsibility for the non-realization of their projects at the level of the bank (not obtaining the financing of the project). Then is indexed of the finger 26,1%), the accompanying counter then the forces of intrinsic motivations of the carrier of project itself.

Moukawalati Program Improvement Recommendation

Following the evaluation of the program and the analysis of the results obtained, several scenarios were proposed to face the problems encountered, following exchanges between the institutions concerned it was agreed to opt for the scenario of improvement of the existing, to this effect, the recommendations of improvement are as follows(Table 3).

| Table 3 Recommendations For Improvement |

|

|---|---|

| Axis | Recommendations |

| Governance axis | • Energize the CR and CTL committees • Prepare and disseminate a shared annual report and action plan • Standardize / Standardize / Standardize the procedures of the 2 approaches • «NATIONAL EMPLOYMENT AND SKILLS PROMOTION AGENCY” and OFPPT • Encourage autonomous management at the regional level • Share and learn from best practices between regions |

| Accompaniment axis | • Specialize and professionalize support structures; • Develop a regional project bank; • Involve the banks in the support process; • Create incubators adapted to the activities of creation of VERY SMALL ENTERPRISE according to the region; • Work on the land of the TPE; • Facilitate access to public and private markets for VERY SMALL ENTERPRISEs created; • To develop the entrepreneurial culture and the qualification of the holders by the organization of workshops and training courses, and the integration of modules on entrepreneurship in the teaching and education of young people; • Put in place legal measures on a case-by-case basis for the repayment of loans granted ; • Change the name of the program; |

| Financing axis | • Establish contractualized targets with banks for MKW project financing • Put in place measures to reduce the financial burden (zero interest rates, subsidized rates, etc.) • Develop co-financing mechanisms: ? NATIONAL HUMAN DEVELOPMENT INITIATIVE ? National and/or sectoral programs ? Regional funds dedicated to the creation of the VERY SMALL ENTERPRISE ? Revolving funds |

Following this study and its recommendations, the MOUKAWALATI program was replaced by the "support for self-employment" program, whose implementation is supervised by the National Agency for the Promotion of Employment and Skills. Its role is mainly to accompany project holders who wish to create a small business through independent consultants, through three main stages:

• Assistance in preparing the project (feasibility study and market study);

• Accompaniment of the administrative steps of creation of the company;

• Accompaniment during the first year of the project.

Conclusion

It should be noted that the program evaluation study focused on three main points: (a) the development of a culture of entrepreneurial thinking, (b) the process of accompanying project holders before and after, (c) the mechanisms for financing projects, and (d) the governance of support measures for self-employment at the national, regional and local levels. It concluded by identifying a set of strengths and weaknesses related to the major thrusts of the program, namely governance, certificate holder support, and financing.

The strong points, they are summarized in:

• Integrated offers to keep pace with project leaders;

• National coverage of the support offices;

• Generalization of the program at all levels (national, regional and local). As for the weaknesses or difficulties, they were as follows:

• Weakness in entrepreneurial thinking;

• Lack of additional technical training for project leaders;

• Lack of pre- and post-creation mechanisms;

• Difficulty in accessing bank financing ;

• Lack of other funding sources;

• Difficulty in obtaining space

The main trends in favor of self-employment aim to separate support from financing, to develop a sense of entrepreneurship and entrepreneurship within the educational system and to diversify the sources of financing. Also, the new approach to support self-employment is a territorial approach based on the encouragement of local initiatives by creating a local dynamic, whether in the field of the endowment of regional and local funds adapted (National Initiative of Local Development, regional and local funds of financing, regional platforms, international associations, common funds of capital). Or by finding solutions to the problem of real estate and businesses (provision of professional businesses at appropriate prices, incubators for contracting, incubators for contracting), thus creating a bank of ideas with a sectoral approach.

The goal is to no longer reduce entrepreneurship to a simple palliative for unemployment, but to adopt a clear and homogeneous vision on the long term, to create a strong entrepreneurial chain where the different stakeholders are really and durably involved.

References

National employment and skills promotion agency, E.d. (2013). Evaluation of the Moukawalati program and development of a support system for the creation of Very Small Enterprises according to a regional approach. casablanca: ALCO.

National employment and skills promotion agency, G. (2007). Practical guide to moukawalati program. casablanca.

Boussetta, M. (2013). Auto emploi: l expérience du programme Moukawalati. Le Matin, 1-3.

HCP. (2019). National business survey. Rabat.

Laila Elouarat, M.A. (2021). Review of the main public programs supporting the creation of businesses by young people in Morocco. cidegef, 1.

Ministry of labour. (2006). Employment initiatives" procedures manual/Moukawalati. Rabat: MINISTRY OF LABOUR.

Ministry of labour. (2006). Program Launch Terms of Reference moukawalati. Rabat: MINISTRY OF LABOUR.

Ministry of Economic Inclusion, d.l. (2021). Note on facilitating the professional integration of young people in Morocco through self-employment. Rabat: MINISTRY OF LABOUR.

Professionnelles, L.C. (2016). Self-employment, a lever for the development and integration of the informal sector. Flap: CanaPrint.

Sophie Clusel, C.M. (2014). Risk management in Very Small Enterprises (TPE): Proposal of a vulnerability diagnostic tool based on the life cycle concept. HAL open science, 2.

Received: 07-Oct-2022, Manuscript No. AEJ-22-12649; Editor assigned: 09-Oct-2022, PreQC No. AEJ-22-12649(PQ); Reviewed: 19-Oct-2022, QC No. AEJ-22-12649; Revised: 22-Oct-2022, Manuscript No. AEJ-22-12649(R); Published: 26-Oct-2022