Research Article: 2020 Vol: 24 Issue: 1

Zombie Companies in Vietnam: The Empirical Insights and Experiences from Asian and European Companies

Ta Quang Binh, Thuong Mai University

Abstract

This study conducts a comprehensive review of the literature on Zombies companies and the empirical insights from Asian companies and European companies during 2006-2018. At the same time, the authors also identify differences in the characteristics, impact or treatment and influence of zombie companies in countries around the world to the financial performance of businesses, thereby bringing out the valuable experience for developing countries like Vietnam.

Keywords

Zombies Companies, Experiences, Viet Nam.

Introduction

The definition of “zombie company” began during the middle 1970s; clearly formed in the end 1980s and became popularly over the financial market from 2008 (Jiang et al., 2017; Thomas, 2012). It was the main reason causing the stagnant economy in Japan in 1990s (Caballero et al, 2008). These less productive companies should be eliminated by the market. However, they were still supported by many ways in order to survive. Based on the report of BIS (2018), from the middle 1980s, nominal interest rate declined 10% causing 17% of the increase of six times numbers of these zombie firms.

In developing countries, this phenomenon also has rise up. According to Jiang et al (2017), the too fast developed economy for a long time in develooping countries such as China has been the main reasons causing the great state groups many which operate profitless and unable to cover their loans include the continuous existance by the support from the economic policies. For example, Vietnam is recognizing the growth of zombie firms. According to Ministry of Planning and Investment, during 8 months of 2018, there were 41.660 businesses which were waiting to suspend or dissolve. This number has raised 45.9% comparing with the same period of 2017 (Loi, 2017). Additionally, the efficient of these Government companies has declined from 2012 to 2016. ROE has fallen into 39% and ROA has reduced into 30%.

Therefore, reforming state owned companies where exist the presence of zombies, is a part of the effort to restructure the economy. It has also become the difficult duty for most of countries and global economy not only Russia, China, Japan, Korea, EU, but the developing countries like Vietnam. That’s the reason why identifying differences in characteristics, impacts or ways of handling zombie firms in Asian and European plays an important role. It may create the controversy and potential research in order to evaluate how the feature native elements solve this problem. It also indicates the comprehensive view of the phenomenon of zombie companies in the world as well as the ambition of this research. Regardless this issue, Japan and the United States can be considered two examples of success, showing many valuable experiences that other countries can refer to learning.

Literature Review

Caballero et al (2008) gave the simple criterion to detemine zombie companies that they are devived lower interest rate from the banks than other ones in the industry (the average of market interest rate). However, Nakamura (2017) shown that a normal firm may be received lower interest rate or a zombie sometimes accepted the market interest rate in a detail period of time. Therefore, they developed the norm about the profitability criteria of firm.

Studies of Hoshi (2006); Imai (2016); Urionabarrenetxea et al. (2018) relied on analysing a number of indicators from the financial statements to identify zombies. These companies had the negative value of pledge assets (equity) but they still continued the economic transactions. However, Urionabarrenetxea et al (2018) judged the criteria about the ability of interest rate payment as a good norm but data may not be available. Thus, he proposed replacing this criteria into the ability to pay short term loans which is reflected in the financial statement or in the balance sheet.

Shen & Chen (2017) argued that, when studying the case studies in China, it was nesscessary to count the subsidizations and tax reductions of the Government for state zombies because China has many state owned enterprises. They used the actual profit method to identify zombie firms. Their analysis is that profit in the financial statments was not necessarily reflected in real profit, because these firms could obtain positive normal profits by financial assistance, tax reduction or other subsidizations. The actual profit was caculated by subtracting the subsidizations and other non-operation income from normal profit. Thus, the determination of zombies will be underestimated if we ignore the government supports (Kane, 1987).

In conclusion, there are many perspectives, concepts about zombie companies and criteria for identifying zombie companies that are analyzed in either direction or measure based on the not run well of mature companies. (McGowan et al., 2017) or prediction of a decline of profits in the future from the market value on the stock market (Banerjee & Hofmann, 2018).

General situation of Zombie around the world and in Vietnam

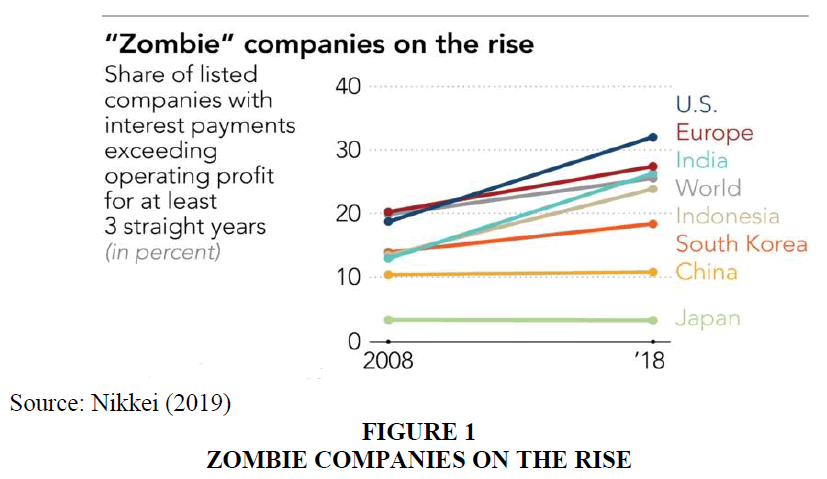

The ranks of zombies have grown especially fast in the U.S., Europe and some countries in Asia. Nikkei examined the financial health of about 26,000 listed companies in Japan, the U.S., Europe, China and Asia, excluding financial institutions, using data from Nikkei (2019) and the findings are ominous. The number unable to cover debt-servicing costs from operating profits for at least three consecutive years hit about 5,300 in fiscal 2018, accounting for 20% of the total, compared to 14% of the total of 18,000 listed companies in 2008.

In Asia, where debt has risen markedly over the past several years, India is the leader with 617 zombie companies in 2018, followed by China with 431, South Korea with 371 and Taiwan with 327. In Japan, the number of zombie companies is relatively low at 109 because Japanese companies tend to have low debt levels. The ratio of zombie companies has risen especially fast in India, Indonesia and South Korea. They accounted for 26% of the total in India, up 13 points from a decade earlier; 24% in Indonesia, up 11 points; and 18% in South Korea, up 4 points. Similarly, in South Korea, a number of companies belonging to such leading conglomerates as Samsung and Hyundai have become zombies. The figure for China, however, rose only 1 point to 11%, while the figure for Japan dipped to 3.3% due to the fact that many Japanese companies are debt-shy and inclined to build up cash reserves. Nevertheless, in China the ratio of zombie companies is particularly high in the retail sector at 20% (Figure 1).

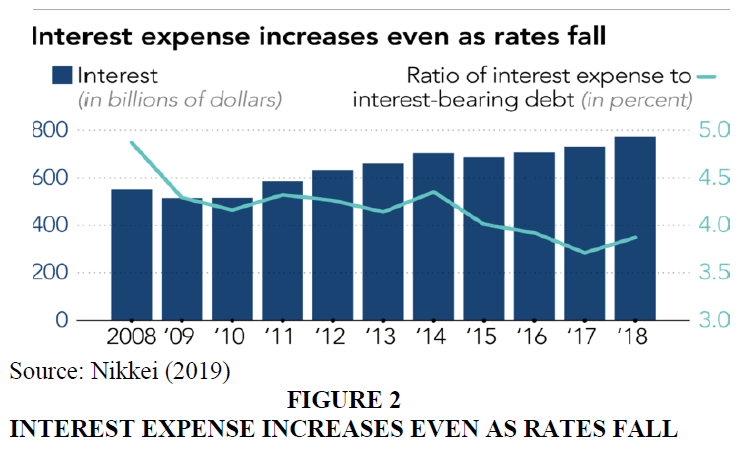

Europe has the largest number of zombie companies with 1,439. The U.S. is second with 923 companies. This apparently reflects the financial environment, in which it is easier to issue corporate bonds even with low ratings. The ratio of excessively indebted companies is especially high in the medical, pharmaceutical, nonferrous metals, energy and information technology industries (Figure 2).

While the ratio of interest payments to debt stood at 3.9% in fiscal 2018, down about 1 point from a decade earlier, the actual amount of interest payments grew 40% to $800 billion due to sharply increased indebtedness. This borrowing dynamic explains the rise of zombie companies.

Vietnam is a developing country and is becoming a phenomenon due to the support of a number of economic policies and recognizing the rapid increase of zombie-operated businesses. Since the beginning of the 21st century, up to now, there have been nearly 18,000 enterprises reporting losses, bankruptcy or dissolution. Specifically, in the first 6 months of 2019, the number of enterprises temporarily suspended operation pending completion of dissolution procedures was 21,849 enterprises, increased 19.5% in comparison with the same period in 2018; of which 10,992 enterprises were withdrawn business registration certificate; 6,464 firms posted notices of dissolution and 4,393 businesses waiting for procedures for dissolution with the tax authorities. This is a large number that seriously affects the financial efficiency of the economic sector and is the basic formation of zombie companies in Vietnam.

Private enterprises in Vietnam are trapped in a "credit trap" when they are shunned by banks because the domestic banking system is still struggling to deal with bad debts stemming from easy lending formerly. Meanwhile, state-owned enterprises (SOE) account for half of the credit debt and have many bad debts but still receive incentives. One feature that is most worrying for SOEs' business activities is "Flying by the Seat of Their Pants". In the structure of SOE assets, equity is low or very low, and the ratio of liabilities to equity in SOEs is 3-10 times. In some large provinces, such as Thanh Hoa, there are times when there are about 9,200 enterprises with less than 7,500 operating, less than 70% of which generate revenue and less than 60% of which are profitable; many other businesses are in the state of waiting for dissolution and bankruptcy. According to a survey of the Vietnam Chamber of Commerce and Industry VCCI (2014), more than 75% of firms stated that they were facing difficulties in business capital, business results decreased compared to previous years. The increasing of Zombies companies in Vietnam has emerged as a remarkable phenomenon. Therefore, it is necessary to have the empirical insights of how to identify zombies, their impact on productivity, the allocation of resources as well as on labor and unemployment.

Empirical insights of Zombie Companies in Europe, Asian Countries and Vietnam

About identification

Hoshi (2006) uses a sample of 63 companies listed in Japan, period 1997-2001 concluded: (1) Zombie companies tend to have low profit, high debt to total assets ratio and high dependence on banks; (2) When the size of the business (capital size, labor size) is small, the business is more likely to become Zombie, but when the size of the business is large enough, it is less likely to become a Zombie. Inheriting the research of Hoshi (2006), Caballero et al. (2008), the criteria for determining Zombie companies are more widely known. Subsequent studies often use this criterion to identify this Zombie companies with the name CHK.

On the impact of Zombie companies on productivity growth

McGowan et al. (2017) used enterprise-level data in the industries of 13 OECD countries between 2003-2013. From the empirical results, the authors came to the conclusion: the increase of zombie companies led to a decline in OECD's potential output growth through two main channels: business investment and productivity growth. Banerjee and Hofmann (2018) with data of 32,000 listed non-financial companies from 14 developed countries from the Worldscop database. Empirical research results show that when the proportion of fixed capital of zombie companies compared with the whole industry in a country increases, productivity growth decreases significantly.

On the impact of zombie companies on the allocation of resources

Caballero et al. (2008) have showed that in order to keep non-profit borrowers (zombies) alive, banks allow them to distort competition. Increasing government responsibility comes from securing banks' deposits to support zombie companies as a very inefficient program to maintain employment. Using data from listed companies in Shanghai, China in the period 2009-2016, Jiang et al. (2017) showed that the long-term survival of zombies not only occupies valuable resources, but also causes financial problems for other businesses, reducing the production efficiency of the entire industry.

On the impact of zombie companies on labor and employment

Impact on employment destruction: Research by Caballero et al. (2016) suggested that the presence of zombie enterprises in the Japanese economy slows down the process of job destruction in some industry groups. For example, manufacturing, construction, services, wholesale and retail by analyzing the correlation of changes in the rate of job destruction with changes in the Zombie index as a percentage.

In fact, in the industries that exist, many zombie companies have job destruction. Specifically, the wholesale, retail, service or construction industries have the lowest job destruction rates. However, the destruction of jobs in zombie enterprises is not necessarily a bad thing. The dismissal of employees in zombie enterprises can be controversial at first because they will lose the jobs of workers but in the long run will be beneficial to the economy. The nature of zombie businesses is inefficient, low productivity, keeping too many workers only costs these businesses more. Moreover, the redundancy of workers cannot improve the status quo of enterprises. Laying off workers from the corpse business then made the social labor resources used more effectively.

Fukuda & Nakamura (2011) have pointed out a solution to dealing with a zombie bank, helping this zombie to regenerate with two things to do: restructuring and reducing staff. However, this article is limited to a very narrow range of Japanese banking and finance but has not provided an overview of other areas. In the study of Jiang et al. (2017), although the majority of zombie companies adversely affect the economy, a zombie company can be guaranteed by the government only because it uses some large number of employees. If the company goes bankrupt, many workers losing their jobs can have a significant social impact.

Ability to create new jobs: The existence of zombie businesses not only affects the rate of job destruction but also the ability to create new jobs. Research by Caballero et al. (2016) suggests that the existence of zombie enterprises in the economy also stagnates the process of creating new jobs. When an industry has a low rate of job destruction, the likelihood of job creation will be low. The change in job creation rate significantly reduced in the industries with only the increase of corpses such as construction, wholesale and retail or services. Thus, the existence of zombie enterprises negatively affects labor in particular and the economy in general. This also hampers the distortions of normal healthy businesses, preventing potential businesses from entering the market. On the other hand, they make the performance indicators of normal healthy businesses worse, making the economy become stagnant, encroachment into crisis or difficult to escape from crisis. Therefore, it is necessary to take appropriate measures to solve the problem of zombie corporates.

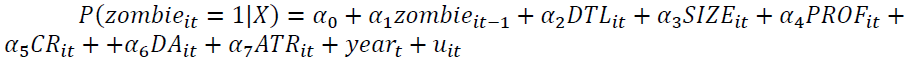

In Vietnam, the following Table 1 empirical model in Binh et al. (2019) shows the factors that identify zombie companies:

| Table 1 Empirical Model | ||

| Variable | Variable meaning | Variable definitions |

| zombie | Zombie company | Dummy variable takes the value 1 if the company is a zombie company and takes the value 0 in otherwise. |

| PROF | Profit | EBIT/ total asset |

| SIZE | Company size | Logarithm of total assets |

| DTL | Financial leverage | Total liabilities / total assets |

| DA | Change in total assets | Logarithm of total assets in year t subtract logarithm of total assets in year t-1 |

| CR | Current Ratio | Current assets / short-term liabilities |

| ATR | Asset Turnover Ratio | Net revenue / average total assets |

The results of empirical research show that, the variables of SIZE, DA, PROF, ATR and CR have negative coefficients and are statistically significant at 1% and 5% with the ability of becoming Zombie companies.

The influence of zombie companies on the financial efficiency of enterprises in Vietnam

Positive effect

Perhaps the only benefit the government has in maintaining the survival of zombie companies is that the increase in unemployment is limited. According to statistics of the Vietnam Productivity Center, for the period of 2007-2013, compared to Spain (more than 26%) and France (more than 10%), the unemployment rate in Vietnam (more than 2%) is near the lowest. Thus, although zombie enterprises have an adverse effect on the economy, some businesses play an important role in employment. Some zombie corporates may be guaranteed by the government because they employ a large number of workers. If the company goes bankrupt, the job loss can have a significant impact on society and the economy (impacts on economic growth, inflation, workers' income and living standards). Vietnamese zombie businesses are often state-owned, many of which play an important role in an industry. Therefore, it is assigned to undertake the role of creating jobs for workers. On the other hand, the Government of Vietnam allows equitization and socialization of state-owned enterprises and the explosion of business licenses, the rapid rise of zombie companies in a short period of time has no immediate negative impact on the labor market. On the contrary, it contributes to reducing unemployment by creating jobs for workers (Table 2).

| Table 2 Some Key Indicators of Labor and Employment in the First Quarter of VIET Nam 2015-2019 | |||||

| Quarter I / 2015 | Quarter I / 2016 | Quarter I / 2017 | Quarter I / 2018 | Quarter I / 2019 | |

| Labor force aged 15 and over (Thous. People) | 53,643.9 | 54,404.9 | 54,505.1 | 55,099.3 | 55,431.2 |

| Working employees aged 15 and above (Thousand people) | 52,427 | 53,288.8 | 53,363.5 | 53,992.8 | 54,322 |

| Unemployment rate of labor force in working age (%) | 2.43 | 2.25 | 2.30 | 2.20 | 2.17 |

| Underemployment rate of labor force in working age (%) | 2.43 | 1.76 | 1.82 | 1.52 | 1.21 |

Negative Influence

Although zombie businesses have the advantage of providing jobs for laborers, in the long term this impact is no longer positive. Caballero et al. (2008) pointed out that zombie companies distort the market by influencing on the rate of newly created jobs and the rate of job losses. In addition, the authors' research shows that zombie companies reduce the rate of investment and increase the unemployment rate of normal businesses in the same industry. In addition, zombie companies increase the number of employees more than ordinary businesses, but the rate of job losses is the same (Hoshi, 2006).

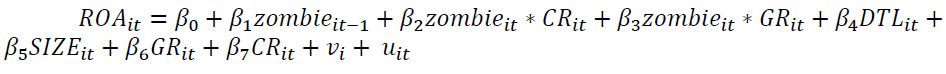

In Binh et al. (2020), the regression model Table 3 to assess the impact of zombies companies in the building materials industry on the performance of enterprises in the industry according to array data is given as follows:

| Table 3 Regression Model | ||

| Variable | Variable meaning | Variable definitions |

| ROA | Financial performance | Profit divided by total assets |

| zombie | Zombie company | Dummy variable takes the value 1 if the company is a zombie company and takes the value 0 in otherwise. |

| SIZE | Company size | Logarithm of total assets |

| DTL | Financial leverage | Total liabilities / total assets |

| GR | Growth of revenue | Revenue in year t minus revenue in year t -1, then divided by revenue in year t-1 |

| CR | Current Ratio | Current assets / short-term liabilities |

The results of empirical research Table 4 show that, out of the Growth of revenue, all the other variables are statistically significant at 1% and 5% with the firm perfomance (ROA) of Zombie companies. The results also state that: zombie companies have a negative impact on the average value of ROA among listed building materials companies in Vietnam in the period 2008-2016.

| Table 4 Estimated Results of the Model | |||

| Model | |||

| REM | FEM | POLS | |

| L1.zombie | -0,0253*** | -0,0217** | -0,0253** |

| (0,0096) | (0,0297) | (0,0104) | |

| zombie*CR | -0,0820*** | -0,0792*** | -0,0820*** |

| (0,0000) | (0,0000) | (0,0000) | |

| zombie*GR | -0,1147*** | -0,1138*** | -0,1147*** |

| (0,0000) | (0,0000) | (0,0000) | |

| DTL | -0,2253*** | -0,2262*** | -0,2253*** |

| (0,0000) | (0,0000) | (0,0000) | |

| SIZE | 0,0100*** | 0,0100*** | 0,0100*** |

| (0,0001) | (0,0001) | (0,0001) | |

| GR | 0,0249*** | 0,0233*** | 0,0249** |

| (0,0039) | (0,0083) | (0,0281) | |

| CR | 0,0055 | 0,0045 | 0,0055 |

| (0,3257) | (0,4303) | (0,5470) | |

| Constant | 0,0478 | 0,0498 | 0,0478 |

| (0,2153) | (0,1994) | (0,2891) | |

| N | 440 | 440 | 440 |

| R2 | 67,08% | 67,05% | 67,08% |

Discussion

Corporate restructure: In Lam et al. (2017), survey results show that addressing these weak businesses can generate significant increases from 0.7% to 1.2% in long-term growth each year. These results also shed light on the government's strategy to address these issues by assessing the impact of different restructuring options.

Government grants: Jiang et al. (2017) point out those zombie businesses can 'linger breathlessly' due to government support in the form of subsidies and bank loans. Governments tend to provide more subsidies to zombie companies assuming greater policy burdens, in particular those providing more jobs.

Restructuring loans: Caballero et al. (2008) stated that large Japanese banks are often involved in restructuring fake loans to keep credit flowing to other debtors (zombies). The congestion created by zombies reduces profits for healthy companies, which hinders their investment.

Facing the fairly formation and development of Zombie companies, initially recognizing quite serious impacts on the economy, the Government of Vietnam has implemented many guidelines and policies to both encourage the development of the enterprises those doing business effectively, while at the same time restricting and having solutions to deal with enterprises that do not do business effectively, gradually proceeding to clean and healthy the economy. However, assessing the operation of SOEs those are not effective, the operations of credit institutions do not ensure financial safety criteria, to small and medium-sized enterprises operating in the form of a zombie company become a topical requirement for Vietnam. Moreover, the international reference on Zombie handling experience is a profound lesson for Vietnam in dealing with this alarming situation.

Conclusion and Future Research

The existence of zombie companies can have positive or negative effects on the growth of an economy in general and Vietnam's economy in particular. Therefore, dealing with zombie companies in the economy is an urgent and topical task. Therefore, the experience in dealing with zombie companies of Asian and European countries will be valuable lessons for Vietnam in managing the negative impacts of these businesses on growth of the economy.

References

- Banerjee, R., & Hofmann, B. (2018). The rise of zombie firms: Causes and consequences. Retrieved from SSRN: https://ssrn.com/abstract=3288098

- Binh, T.Q., Huong, V.T.T., & Minh, N.T. (2019). Zombie companies and identification factors: Evidence from listed companies in Vietnam. The 2nd International Conference on Contemporary Issues in Economics, Management and Business (2nd CIEMB 2019), Hanoi, Vietnam.

- Binh, T.Q., Huong, V.T.T., Suong, H.T.M., & Ngan, L.T.H. (2020). The impact of zombie companies on financial peformance: Results of Experimental Research at Listed Construction Materials Companies in Vietnam. Journal of Trade Science 1+2/2020.

- Caballero, R.J., Hoshi, T. & Kashyap, A.K. (2008). Zombie lending and depressed restructuring in Japan. American Economic Review, 98, 1943-77.

- Fukuda, S.I., & Nakamura, J.I. (2011). Why Did ‘Zombie’ Firms Recover in Japan? The World Economy, 34, 1124-1137.

- Hoshi, T. (2006). Economics of the living dead. The Japanese Economic Review, 57, 30-49.

- Imai, K. (2016). A panel study of zombie SMEs in Japan: Identification, borrowing and investment behavior. Journal of the Japanese and International Economies, 39, 91-107.

- Jiang, X., Li, S. & Song, X. (2017). The mystery of zombie enterprises “stiff but deathless”. China Journal of Accounting Research, 10, 341-357.

- Kane, E.J. (1987). Dangers of capital forbearance: The case of the FSLIC and “Zombie” S&Ls. Contemporary Economic Policy, 5(1), 77-83.

- McGowan, M.A, Andrews, D., & Millot, V. (2017). Confronting the zombies: Policies for productivity revival. OECD Publishing.

- Nakamura, J.I. (2017). Japanese Firms during the lost two decades. The Recovery of Zombie Firms and Entrenchment of Reputable Firms. Springer.

- Loi, N.V. (2017). Stepping up the restructuring of State enterprises. Retrieved from https://www.nhandan.com.vn/ kinhte/item/33002902-%C3%B0ay-manh-co-cau-lai-doanh-nghiep-nha-nuoc.html

- Nikkei, T.N (2019). Asia’s zombies concentrated in India, Indonesia and South Korea. Retrieved from https://asia.nikkei.com/Spotlight/Datawatch/Asia-s-zombies-concentrated-in-India-Indonesia-and-South-Korea.

- Lam, R., Schipke, A., Tan, Y., & Tan, Z. (2017). Resolving China’s Zombies: Tackling Debt and Raising Productivity. IMF Working Paper, WP/17/266.

- Shen, G., & Chen, B. (2017). Zombie firms and over-capacity in Chinese manufacturing. China Economic Review, 44, 327-342.

- Urionabarrenetxea, S., Garcia-Merino, J.D., San-Jose, L., & Retolaza, J.L. (2018). Living with zombie companies: Do we know where the threat lies? European Management Journal, 36, 408-420.