Research Article: 2021 Vol: 20 Issue: 6S

A Cointegration Analysis of the Impact of Selected Macroeconomic Fundamentals on Stock Market Performance in Nigeria

Benjamin Ighodalo EHIKIOYA, Covenant University

Alexander Ehimare OMANKHANLEN, Covenant University

Cordelia Onyinyechi OMODERO, Covenant University

Areghan Akhanolu ISIBOR, Covenant University

Victoria Abosede AKINJARE, Covenant University

Lawrence Uchenna OKOYE, Chukwuemek Odimegwu Ojukwu University

Abstract

The stock market and macroeconomic fundamental variables are important elements with a significant impact on economic growth and development. Thus, using the Johansen cointegration technique and the Vector Error Correction Model, this paper examines the connection between stock market performance and macroeconomic fundamentals in Nigeria. The study employs data from the Nigerian Stock Exchange and the Central Bank of Nigeria from 2010 to 2019. The findings from the empirical analysis reveal evidence that a long-run equilibrium connection exists between stock market prices and several macroeconomic factors in Nigeria. The result of the study indicates that the exchange rate and inflation exerts a negative influence on stock prices. A positive connection exists between money supply, crude oil prices, financial openness and stock prices in Nigeria. However, the result from the post-2016 economic recession reveals a negative and significant influence of crude oil prices on stock prices while all other variables maintain their direction of relationship with stock prices. This result implies that there is a need for the government to embark on aggressive economic diversification to other sectors of the economy. Also, the government must reduce the interest rate to encourage investment in the stock market, in addition to creating an enabling environment through policies and programs that would stimulate the economy and boost investors’ confidence.

Keywords

Macroeconomic Variables, Cointegration, Inflation, VECM, Stock Market.

JEL Classifications

E31, E43, F32, G12

Introduction

The interactions between the stock market and macroeconomic variables have been documented (Al-sharkas, 2004; Alam, 2017; Gatsimbazi, Jaya, Mulyungi & Ochieng, 2018; Mechri, Hamad, Peretti & Charfi, 2019). However, despite the substantial development of the literature, these two concepts continued to gain relevance in the face of the present global economic challenges and the need for policymakers and other agents of the economy to drive economic performance. Developing countries like Nigeria desire economic growth that would translate into real socio-economic gains in terms of employment opportunity, poverty alleviation and improvement in the general living condition of the citizens (Tayo, Uchenna, Uchenna & Nwanneka, 2017). The stock market, as well as macroeconomic factors such as the exchange rate, inflation and interest rates among other indices, are considered critical key factors that influence economic growth and development. Fundamentally, the stock markets, among other functions, accelerate economic growth and create wealth for the citizens through resource mobilisation from surplus areas to the productive sectors of the economy. However, recent reports have shown that the stock markets could be heavily influenced by various elements like the interest rates, exchange rates and inflation that could preclude it from optimally performing its functions (Alam, 2017; Omodero & Mlanga, 2019, Ucheaga, Omankhanlen, Olokoyo, Isibor & Ehikioya, 2020).

Before the 2016 economic recession, the Nigerian economy performed reasonably well. In 2012, the economy was ranked the largest in Africa, followed by South Africa and Egypt in that order. In the West Africa region, the economy contributed over 40% to the subregion's Gross Domestic Product (GDP) (Babajide, Adegboye & Omankhanle, 2015). In 2014, the economy witnessed a GDP growth rate of 6.3%. The economic growth before the 2016 economic recession was primarily due to foreign equity portfolio investment (FEPI), sales from crude oil and foreign direct investment inflows. However, in recent times, the Nigerian stock market has continued to underperform and the economy has struggled to regain its growth potentials from the current growth rate. The drastic drop in GDP from 6.3% in 2014 to 2.27% in 2019 can be attributed to several factors from poor market performance to the fall in oil revenue accruing to the government. Nigeria runs a mono-cultural economic structure, where over 70% of the government revenue is generated from the trade of crude oil at the international markets (Ehikioya, 2019). The dynamic changes in macroeconomic variables and the significant drop in foreign direct investment inflows have equally been identified in the current economic growth rate with implications. These issues with other factors such as frequent policy reversal have raised some serious concerns amongst the stakeholders of the economy.

The behavior of macroeconomic variables is perceived to influence the level and direction of the stock market development. These factors similarly affect the overall economic growth of a country. According to Fama (1970), the stock prices are a reflection of the changes in macroeconomic factors. Similarly, Hosseini, Ahmad and Lai (2011) as well as Jareño and Negrut (2015) opined that fluctuations in macroeconomic dynamics might affect the advancement of the stock market. This suggests that factors such as inflation and exchange rate influence the behaviour of the markets, especially in developing countries like Nigeria. However, despite the significance of macroeconomic fundamentals on stock market development, and since (Chen, Roll & Ross, 1986) demonstrated the existence of a long-term association between stock prices and related macroeconomic factors, studies on this issue remain limited with conflicting results. There is no conclusion in the literature about the magnitude and direction of the relationship between macroeconomic determining factors and the stock market index (Gay, 2008; Dasgupta, 2012; Kolapo, Oke & Olaniyan, 2018; Mechri et al., 2019). Moreover, a number of these studies focused on economically advanced countries with few works in the context of developing countries (Olowe, 2007; Alam, 2017). Besides, the different strands of the literature have used different levels of the stock market development and models with no consensus on whether macroeconomic factors have any influencing power on the stock market of developing economies. In addition, studies such as Omodero and Mlanga (2019) has attributed several factors as responsible for the disappointing stock market performance, particularly in developing countries without adequate consideration to the effect of oil price movement.

Consequently, the main objective of this study is to employ the Johansen cointegration and data from 2010 - 2019 to evaluate whether there is an equilibrium relationship between the stock market performance and macroeconomic factors from the perspective of developing countries like Nigeria. Also, the study seeks to evaluate the power of macroeconomic fundamental variables to influence stock prices in Nigeria in the short run. This study is important for the agents of the economy to gain more understanding of the influence of macroeconomic factors on stock market development especially in emerging nations desirous to attain economic self-sufficiency. Besides, apart from being an empirical evaluation of this issue, the study period from a developing economy viewpoint is significant in the face of the present dynamics in the environment. This study assumes a long-run association between the variables. Similarly, the study postulates an adverse impact of inflation, exchange rate, interest rate and crude oil prices on the stock market prices in Nigeria. Previous studies have used Vector Autoregressive (VAR), Generalized Least Square (GLS) and other models for similar studies. However, the VAR model lacks the ability to select the appropriate lag length to measure the long-run connection between variables. Besides, the VAR cannot incorporate possible long-term correlation among the variables of interest. Similarly, the use of GLS to estimate macroeconomic variables may neglect certain vital information for policymakers about the long- term relationship to focus on the short term changes of non-stationary variables. Thus, this study employs the Vector Error Correction Model (VECM), which combines data for both the short run and long run in analysis. The VECM is important for this study to avoid possible misspecification bias and other pitfalls associated with modelling techniques such as the Ordinary Least Square (OLS) and VAR.

As important as the issue about the connection between stock market prices and macroeconomic indicators is to the economy and its stakeholders, only little works have been done in Nigeria, especially since the 2016 economic recession and the recent fluctuation in crude oil prices at the international market place. This study is apt considering the current slow pace of global economic performance and the yearnings of developing nations to advance their economy and reduce the levels of poverty and unemployment in their system. This study made salient contributions to the literature in some ways. For instance, the study empirically examines the equilibrium connection between macroeconomic fundamental indicators and stock prices, taking into consideration the 2016 economic recession and crude oil price fluctuations at the transnational markets. During the economic recession, the country witnessed a significant increase in the exchange rate, inflation and cost of capital, which significantly affected the capital market and the performance of the economy. Also, this study provides ground to investigate a similar issue in other economies, especially in developing countries. Moreover, unlike studies that used other models, this study employs the VECM to evaluate the long term equilibrium connection between macroeconomic factors and stock prices. Finally, the study offers a further understanding of this issue from a developing country’s perspectives.

Furthermore, the understanding of the interactions between macroeconomic fundamental factors and the stock market development is indispensable to guide policymakers with suitable macroeconomic policies that would stimulate the market and enhance economic growth and development. Moreover, this study would enrich investors, analyst and other stakeholders of the economy with knowledge about the market for decision making. This study demonstrates evidence of a long-run equilibrium connection between macroeconomic factors and stock prices. Moreover, the study argues that crude oil and stock prices move in the same direction both in the short term and long term, which could be due to the long term dependence of the Nigerian economy on a single product, whose prices are primarily influenced at the international markets. The remaining part of the paper is organised as follows; Section 2 of the study presents the literature review. While Section 3 discussed the data and methodology applied in the study, Section 4 documents the empirical findings. The final section concludes the paper.

Literature Review

The influencing power of macroeconomic indicators and the stock market performance on the economy vary considerably across national boundaries due to several factors such as country-specific characteristics. Furthermore, different theories explain macroeconomic fundamentals and stock returns. In the Efficient Market Hypothesis, (Fama, 1970) maintained that when a market is well-organised, the current stock prices will reflect all the existing and significant information about the market. In other words, the stock prices mirror fully all the related information that is freely accessible about changes in macroeconomic factors. This means that no investor may stand a chance to earn any abnormal profits since details about the market is equally open and at the same time to all. On the other hand, the Arbitrage Pricing Theory (APT) established by Ross (1976), Roll (1978) and Roll and Ross (1980) opined that the return on an asset is a reflection of several macroeconomic, market and security-specific factors. Ross (1976) argued that the number of unknown factors that measure the sensitivity of the assets could range from inflation, foreign exchange rates amongst other factors. According to APT, in an efficient market condition, an arbitrage exists where two same items sell at different prices.

Also, several empirical studies abound on the connection between the stock market and macroeconomic fundamentals but with mixed findings. For instance, using data from advanced countries, (Chen, Roll & Ross, 1986) as well as French, Schwert, and Stanbaugh, (1987) examined the connection between stock prices and inflation, and they concluded that inflation is negatively related to stock returns. In a similar study using Japanese data, (Brown & Otsuki, 1990) established a long run symmetry connection between the Japanese stock market and macroeconomic determining factors. Also, Gjerde and Saettem (1999) used data from Norway to evaluate the relation between stock output and macroeconomic indicators. The study reported an insignificant connection between stock performance and inflation on the one hand and conversely, a positive connection between oil prices and stock output. Similarly, Marie, Tomáš and Daniel. (2016) employed data from the Swiss real estate companies to appraise the long run connection between stock prices and macroeconomic indicators. The study reported that asset prices respond sensitively to changes in the public announcement about macroeconomic indices. These studies used records from advanced nations without due attention to measuring how macroeconomic factors affect markets in transitional and emerging nations.

Al-sharkas (2004) applied Johansen's (1991) vector error correction model to analyse the long-run equilibrium associations between macroeconomic indicators and the Amman Stock Exchange index. They documented the presence of a cointegrating connection among the variables. Limpanithiwat and Rungsombudpornkul (2010) employed the VAR model to evaluate the long-run connection between stock prices and inflation in Thailand and established that there is no linkage between stock price volatility and inflation. Similarly, Geetha, Mohidin, Chandran and Chong (2011) assess the linkage between macroeconomic factors and the stock returns in Malaysia, the US and China using the Johansen Cointegration test and the VECM. They documented a long-run cointegrating connection between the stock prices and macroeconomic factors in the US, Malaysia and China. Additionally, their result suggested that the stock market has no connection with the macroeconomic variables like interest rate, exchange rate, inflation and GDP for the US and Malaysia in the short run. On the other hand, the results from China revealed that there is a short-run connection between the Chinese stock market and inflation rates.

In a related study, Dasgupta (2012) assessed the influence of four macroeconomic fundamental variables on the Bombay Stock Exchange using ADF, Johansen and Juselius’s cointegration and Granger causality tests in the short run. Dasgupta reported that there are no causal relationships between the stock market and the macroeconomic factors. In the same way, Barakat, Elgazzar and Hanafy (2016) explored the influence of consumer price index, exchange rate, money supply and the interest rate on stock markets. They used data from Egypt and Tunisia from 1998 to 2014. They found that apart from the consumer price index in Tunisia, the stock market index has a connection with other variables both in Egypt and Tunisia. Epaphra and Salema (2018) used the regression technique and monthly data from ten firms listed in the Dar es Salaam Stock Exchange during the period 2012 to 2016 to assess the connection between stock prices and macroeconomic factors. They reported that while the Treasury bill rate exercised an adverse power on stock prices, money supply and exchange rate showed a positive power on stock prices. The study established that the inflation rate has no influencing power on stock prices.

Similarly, the few studies on this subject in Nigeria have produced mixed results. For example, Amadi, Oneyema and Odubo (2002) evaluated the connection between the Nigerian Stock Market prices and macroeconomic indicators using a multiple regression approach and confirmed the presence of a link between stock price and macroeconomic indicators. In another study, Olowe (2007) explored the dynamic equilibrium connection between macroeconomic fundamentals and the stock market index in Nigeria, using Johansen's (1991) vector error correction model. The study showed that a cointegration exists among macroeconomic variables. The results of Olowe revealed that while the exchange rate exerts negative influences on stock prices, inflation, money supply, interest rates and oil prices are reported to have a positive impact on stock prices in Nigeria. Similarly, Kolapo et al. (2018) employed the Autoregressive Distributed Lag (ARDL) bounds technique to estimate the impact of macroeconomic indicators on stock market output in Nigeria between 1986 and 2015. The study documented evidence of a long run connection between macroeconomic determinants and stock market output. Also, they reported evidence that GDP and money supply have a significant influence on stock market output in Nigeria. Omodero and Mlanga (2019) observed the influence of macroeconomic determining factors on stock prices and established that macroeconomic factors have a significant influence on Nigerian stock prices. One key issue with most of the studies from Nigeria is that they failed to account for the influence of oil price movements on stock market development. As a major source of revenue to the country, fluctuation in the price of crude oil may impact the stock market and the overall economic development.

Methodology

Data Source

To evaluate the connection between stock prices and macroeconomic fundamentals, this study employs monthly data on stock prices and crude oil prices gathered from the Nigerian Stock Exchange (NSE) official daily publications and the West Texas Intermediate (WTI) crude oil prices published by the US Energy Information Administration. Data on other variables were obtained from the Central Bank of Nigeria (CBN) and the International Financial Statistics (IFS) issued by the International Monetary Fund (IMF). The sample period is from 2010 to 2019 and consists of 120 monthly observations. This period of study is particularly important because it represents the pre and post-economic recession of 2016 in Nigeria. The period also witnessed the devaluation of the naira. In January 2010, the NSE had 220 firms listed on its platform. However, this study considered only firms that traded at least once a month throughout the sample period and the final sample consists of 87 firms with available data.

The study uses the Nigerian Stock Exchange Index (NSEI) as a proxy variable for stock prices, and Inflation (INFL), Exchange Rates (EXR), Interest Rates (INTR), broad money supply (M2) and financial openness (FOP) to represent the macroeconomic variables. The control variable is Crude Oil Prices (COP). The choice for these variables was not only influenced by the objective of the study but notably by the theoretical and empirical literature reviewed (Fama, 1970; Brown and Otsuki, 1990; Al-sharkas, 2004; Olowe, 2007; Issahaku, 2013; Barakat, 2016; Alam 2017; Kolapo et al., 2018). We transformed the variables in the study into natural logarithms to assume linearity and reduce the possible effect of multicollinearity. The definition of the variables in the study is reported in Table 1.

| Table 1 Measurement of Variables |

||

|---|---|---|

| Variable | Abbreviation | Measurement |

| Stock Prices | SP | Index of the market value-weighted average of closing share prices quoted on the Nigeria Stock Exchange |

| Inflation | INFL | Inflation rates are computed using consumer price indexes. |

| Exchange Rate | EXR | the mean monthly exchange rate stated in terms of the US dollars per naira |

| Interest Rate | INTR | Short-term interest rates measured as the treasury-bill rate |

| Broad Money Supply | M2 | It equals a narrow money supply (M1) plus quasi money. On the asset side, quasi money equals net national assets plus net foreign assets of the banking system. |

| Financial Openness | FOP | Measured as the ratio of the sum of foreign assets and liabilities to GDP in Nigeria |

| Crude Oil Prices | COP | Crude oil prices denoted by the West Texas Intermediate (WTI) |

Table 2 presents the summary of the descriptive statistics of the variables employed in this study. The result of the analysis shows that the stock market index with a mean value of 0.3729 range from -04112 to 0.5503. Expectedly, the stock market index skewed positively while all the macroeconomic variables except financial openness negatively skewed. The inflation, exchange rate and interest rate reveal a mean of 0.0361, 0.0167 and 0.0333 with a standard deviation of 0.0430, 0.1039 and 0.0625, respectively. The analysis shows that the interest rates moved away from their mean more than the inflation, perhaps due to changes and adjustment to the economic environment. Table 2 shows that the broad money supply which ranges from -0.3011 to 0.3005, grew at a mean value of 0.0306 with a standard deviation of 0.0640 per month. The financial openness and crude oil prices increased at a mean value per month of 0.0115 and 0.03005 with a standard deviation of 0.0891 and 0.0133, in that order. The Jarque-Bera statistics show a corresponding probability value that is more than 5% for each of the variables, which indicates that the residuals are normally distributed.

| Table 2 Descriptive Statistics of Variables |

|||||||

|---|---|---|---|---|---|---|---|

| SP | INFL | EXR | INTR | M2 | FOP | COP | |

| Mean | 0.3729 | 0.0361 | 0.0167 | 0.0333 | 0.0306 | 0.0115 | 0.03005 |

| Std Dev | 0.2101 | 0.0430 | 0.1039 | 0.0625 | 0.0640 | 0.0891 | 0.0133 |

| Min | -0.4112 | -0.0827 | -0.5209 | -0.0910 | -0.3011 | -0.3221 | -0.5606 |

| Max | 0.5503 | 0.8139 | 0.3636 | 0.5242 | 0.3005 | 0.2072 | 0.3972 |

| Skewness | 0.4697 | -0.3642 | -0.3383 | -0.1534 | -0.2115 | 0.4122 | -2.0532 |

Model Specification

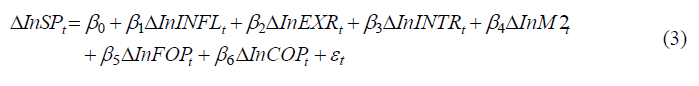

The model for stock market index and macroeconomic indicators is expressed in a functional form as follows:

Where SP denotes stock market prices, INFL is the inflation and EXR is the exchange rate. The interest rate, broad money supply, financial openness and crude oil prices are represented as INTR, M2, FOP and COP respectively. The model in a functional form is expressed in the econometrics model as:

Where β0 is the constant, β1 to β6 are the coefficients of the explanatory variables and ε is the error term. By introducing the natural logarithms and lag values, then we can transform the time series data as:

Where In the logarithms and Δ is the lag of the logged variable. A priori expectation is express as β1 to β

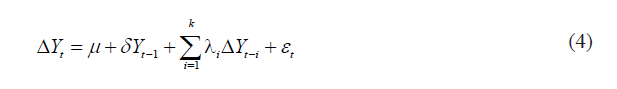

To appraise the precise connection between the stock market index and macroeconomic indicators in Nigeria, we started by analysing the unit root of the data. We employed the Augmented Dickey-Fuller (ADF) to test whether the data have a unit root or not. This is important since time-series data are known to be nonstationary and to make certain the reliability of the results. We used the Phillips Perron (PP) test as a confirmation of the results obtained with ADF. The ADF model specification for unit root analysis is as follows:

Where α is equal toα -1, α is the coefficient of Yt -1 and ΔYt is the first difference of Yt - Yt -1 . Where K indicates the number of lags and εt is a I(0) with zero mean. The PP test, which is the alternative model for the ADF test is stated as ΔYt = φYt - 1 + βi Dt - i + εt . Where Dt -1 denotes a deterministic trend component. The null hypothesis for the ADF test is that the time series data have a unit root and this is represented as Ho : p = 0 . The ADF test will provide evidence about the integration order of the data series that is if the data are integrated of 1(0) or 1(1).

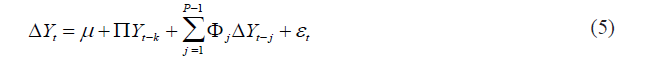

Furthermore, once the unit root analysis confirms the variables are integrated in the same order, we proceed to test for cointegration between the unified variables. Several methods such as Vector Autoregression (VAR) for analysing cointegration have been proposed in the literature to define the relationship amongst variables of the time series characteristics. Cointegration can be tested either in a single equation using the Engle and Granger (1987) methods or in a system of equations using Johansen's (1991) technique of testing. This study uses Johansen's (1991) Cointegration test to indicate if there is a long-run association between the stock prices and macroeconomic factors. Furthermore, the optimal lag length for the cointegration test is selected using the Akaike Information Criterion (AIC). The use of Johansen is particularly essential since it allows for a more efficient estimation of cointegrating vectors from a system of equations. According to Granger (1986), the existence of a direct combination would mean that there is a long-run equilibrium association among the cointegrating variables. The establishment of a cointegration from the time series data provides the basis to employ the VECM, which is a VAR in first differences to evaluate the causal relations between the stock prices and macroeconomic fundamentals. The VECM which uses the full information maximum likelihood as developed by Johansen (1991) is as follows:

Where Δ denotes the first difference notation and Yt represents the order of integration.

While µ is the linear trend in a system, the short-term speed of adjustment between the variables

across the P equation is denoted by Φj . The lag structure is represented by K and εt is the

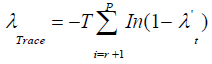

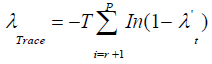

stochastic disturbance. The Johansen cointegration tests specify the trace statistics defined as  and the maximum eigenvalue statistics defined as

and the maximum eigenvalue statistics defined as

Where r is the number of cointegrating vectors, λi is the estimated eigenvalues and T is the total observations used in the model after the lag adjustment.

Results and Discussion

Unit Root Analysis

This study employs time-stamped data to examine the connection between the stock market performance and certain macroeconomic indicators in Nigeria. Thus, to enhance the reliability of the study, we used the ADF and PP to test for the unit root analysis. This is significant to decide the appropriate procedure to establish cointegration among the variables. The findings from the unit root analysis in levels and first differences are reported in Table 3. In levels, the result demonstrates that the variables except for inflation and financial openness exhibit a trend in mean and variance, and this suggests that the variables are non-stationary. However, at first differences, the series is found to be stationary at 5 and 10 per cent levels of significance. Furthermore, this finding indicates that the variables are integrated of order one. This outcome is in term with studies by Al-Sharkas (2004) and Olowel (2007).

| Table 3 Results of Unit Root Analysis |

||||

|---|---|---|---|---|

| Variables | ADF | PP | ||

| First Differences | First Differences | |||

| Test Statistic | Remark | Test Statistic | Remark | |

| SP | –4.71810** | 1(1) | –4.35119** | 1(1) |

| INF | –3.38311 | 1(1) | –5.44447 | 1(1) |

| EXR | –3.15347 | 1(1) | –5.37264** | 1(1) |

| INTR | –5.90236** | 1(1) | –4.65520*** | 1(1) |

| M2 | –4.01230 | 1(1) | –4.02635 | 1(1) |

| FOP | –7.37409 | 1(1) | –5.31111 | 1(1) |

| COP | –3.12022 | 1(1) | –3.9352** | 1(1) |

Source: Authors’ computation, 2021

Cointegration Test

Following the findings from the unit root analysis, we proceed to perform the Johansen cointegration tests to ascertain if there is a continued association between the stock market index and certain macroeconomic fundamentals in Nigeria. The Johansen cointegration tests specify the trace statistics plus the maximum eigenvalue statistics. Furthermore, the null hypothesis is that there no long term connection and this is denoted as r = 0 and the number of cointegration vector is represented as r ≤ 1, r ≤ 2, …. r ≤ n. The results in Table 4 indicate that there are two cointegrating vectors for trace test and maximum eigenvalue test. The results show that the trace test accepts the alternative hypothesis of r > 0 and fail to accept the null hypothesis of r = 0 at a 5% level of significance. Also, the maximum eigenvalue test agrees with the alternative hypothesis of r = 1 and fail to accept the null hypothesis of r = 0 at a 5% level of significance. The result implies that in the long run, the macroeconomic variables in consideration are essential determinates of the Nigerian stock market index. This result supports studies by Amadi et al. (2000) and Alam (2017).

| Table 4 Johansen Cointegration Test |

||||

|---|---|---|---|---|

| Null Hypotheses | lTrace | lMax | ||

| lTrace value | Critical value @ 5% | lMaxvalue | Critical value @ 5% | |

| r = 0 | 135.3003 | 125.6154 | 47.5719 | 46.2314 |

| r ≤ 1 | 93.1194 | 95.7536 | 37.3620 | 40.0775 |

| r ≤ 2 | 67.0239 | 69.8188 | 27.0024 | 33.8768 |

| r ≤ 3 | 39.9584 | 47.8561 | 25.1846 | 27.5843 |

| r ≤ 4 | 25.1577 | 29.7970 | 17.7392 | 21.1316 |

| r ≤ 5 | 11.5837 | 15.4947 | 11.4004 | 14.2646 |

| r ≤ 6 | 3.1802 | 3.8414 | 3.0122 | 3.8414 |

Estimation using VECM

The study employs the VECM to assess the influence power of selected macroeconomic factors on the stock market output in Nigeria. Unlike the VAR, the VECM allows for a short run dynamism while correcting the partial deviation of the variables in the system to come together to their long-run equilibrium. The result as reported in Table 5, indicates that the variables are statistically significant with stock prices in Nigeria at 1% and 5% levels. The coefficient of - 0.479250 for the error correction model specifies the speed of adjustment as well as confirms the presence of a long-run equilibrium connection between stock prices and other variables in the study. The result of the ECM, which explains the speed of adjustments in the long run is found to be negative at the 5% level of significance. This result indicates that there is a long-run equilibrium connection between the variables in consideration. The result suggests that in the short run, 29% of any imbalance, in the long run, will be corrected. Moreover, the result implies that any increase in macroeconomic fundamentals will have an adverse effect on stock prices in Nigeria. The result shows R2 of 0.5926, and this suggests that the model is fit, and the macroeconomic indicators in this study explain 59% of the factors influencing stock market prices. The overall suitability of the variables employed is reported in the F-value of 6.8435 and p-value of 0.0015. The Durbin-Watson statistic of 1.9057 reveals the absence of autocorrelation among the residuals in the model.

| Table 5 Results of The Vecm Analysis |

|||

|---|---|---|---|

| Jan. 2010 – Dec. 2019 | |||

| Coefficient | Std. Error | Prob. | |

| INF | -0.5887 | 0.2025 | 0.0000 |

| EXR | -0.0146 | 0.0101 | 0.0300 |

| INTR | -0.0034 | 0.0291 | 0.0001 |

| M2 | 0.3521 | 0.3405 | 0.0502 |

| FOP | 0.1644 | 0.0948 | 0.0000 |

| COP | 0.1114 | 0.0178 | 0.0311 |

| Intercept | -0.0531 | 0.0186 | 0.4832 |

| Observations | 120 | ||

| R2 | 0.5926 | ||

| Adjusted R2 | 0.3803 | ||

| Log-Likelihood | 34.1206 | ||

| F-stat | 6.8435 | ||

| Prob (F-stat) | 0.0015 | ||

| Durbin-Watson statistic | 1.9057 | ||

The result, as reported in Table 5, demonstrates that inflation has an adverse connection with stock market prices in Nigeria at the 1% level. This result is in tandem with the reports by Chen et al. (1986) for US data and Pal and Mittal (2011) for Indian data. However, the finding of this study conflicts with studies by Olowel (2007) for Nigerian data and Alam (2017) for Indian data, who found positive relationships between inflation and stock prices. The adverse connection between inflation and stock prices is likely due to the effect of the high cost of capital on firm performance. Moreover, the relationship between the two variables may be due to the impact of the drop in oil prices at the international market. The sale of crude oil remains an important source of revenue for the Nigerian government and any fluctuations of the oil price can influence government revenue. Investors' perceptions about inflation and the ensuing decision can lead too to such a negative influence of inflation on stock prices. Our result suggests the need for policymakers to ensure that inflation is kept under control to prevent the adverse effect on the capital markets.

Another impressive result is the influence of exchange rates, which has an adverse and significant connection with stock prices at the 5% level. This result support earlier studies by Olowel (2007), Pal and Mittal (2011) and Alam (2017). But Mukherjee and Naka (1995) reported a different relationship for Japanese data. A critical consideration of the present result for policymakers is that any increase in the exchange rate or appreciation of the UD dollar will depreciate the naira and in turn, decline the stock market performance. This is partly due to the dwindling foreign reserve, the recent devaluation of the naira, the drop in oil prices and the over- reliance on crude oil for foreign earnings. In this case, deliberate effort is required to achieve economic diversification. As hypothesised, the link between stock prices and interest rate measured as Treasury bill is found to be negative, supporting the studies by French et al. (1987); Al-Sharkas (2004) and Alam, (2017), but contrary to the works of Mukherjee and Naka (1995) and Olowel (2007). The importance of our result is that it will help policymakers to understand the implication of increased interest rate on debt and the borrowing power of firms on their performance. Practically, many Nigerian firms rely heavily on short-term finance for their working capital requirement and an increase in interest rate may adversely impact performance.

The result of the investigation as reported in Table 5, contradicts our hypothesis that the broad money supply has an adverse connection with the stock prices. The result demonstrates that the broad money supply has a positive connection with stock prices in Nigeria. This outcome is per the findings of Mukherjee and Naka (1995), Olowel (2007) and Alam (2017) who had earlier found a positive connection between money supply and stock prices. Furthermore, this outcome suggests the need for policymakers to keep watch on optimal money supply as monetary policy to stimulate the economy. The results show that financial openness and crude oil prices have a positive influence power on stock prices. The finding is in tandem with Hamilton (2000) who found a positive connection between the international price of crude oil and the stock prices.

Robust Check

To check the strength of our findings, first, we apply the VECM to check for the long-run equilibrium relationship. The results confirmed the long run connection and the speed of adjustments for the variables to converge. Second, we look at the link between stock prices and macroeconomic indicators over two sub-periods. The first period is January 2010 – March 2016, which is before the economic recession and the second period is April 2017 – December 2019, which is after the recovery from the economic recession. The period from January 2010 to March 2016 confirms the earlier findings for the whole study period. However, the results in Table 6 for the post-2016 economic recession period (2017 to 2019) indicate that oil prices have a negative and substantial relationship with stock prices. This result suggests the influence of the recent drop in crude oil prices at the global markets on the stock market, and which may have been creating concerns in the minds of investors about the Nigerian economy.

| Table 6 Results of The Robust Check |

||||||

|---|---|---|---|---|---|---|

| Jan. 2010 – March 2016 | April. 2017 – Dec. 2019 | |||||

| Coefficient | Std. Error | Prob. | Coefficient | Std. Error | Prob. | |

| INF | -2.0045 | 0. 17832 | 0.0300 | -0.0191 | 0.0634 | 0.0000 |

| EXR | -0.1904 | 0.0112 | 0.0010 | -0.3313 | 0.4211 | 0.0000 |

| INTR | -0.0028 | 0.0103 | 0.0031 | -0.5975 | 0.0157 | 0.0031 |

| M2 | 0.0700 | 0.0016 | 0.0002 | 0.1361 | 0.1312 | 0.0000 |

| FOP | 0.1020 | 0.0734 | 0.0000 | 0.1450 | 0.2101 | 0.0083 |

| COP | 0.0337 | 0.0830 | 0.0011 | -0.0863 | 0.1738 | 0.0194 |

| ECM(t-1) | -0.2854 | 0.1517 | 0.0326 | -0.1627 | 0.0911 | 0.0382 |

| Intercept | -1.5265 | 3.0945 | 0.0253 | 0.3340 | 0.0683 | 0.5326 |

| Observations | 75 | 33 | ||||

| R2 | 0.4684 | 0.5312 | ||||

| Adjusted R2 | 0.3710 | 0.4273 | ||||

| Log-Likelihood | 31.4004 | 30.3017 | ||||

| F-stat | 7.0327 | 6.5463 | ||||

| Prob (F-stat) | 0.0000 | 0.0006 | ||||

| Durbin-Watson statistic |

1.6055 | 2.01511 | ||||

Source: Authors’ computation, 2021

Diagnostic tests

We carried out some analytic assessments to ascertain the strength, suitability and validity of the model used in this study. These tests are necessary considering the properties of the dataset used and the need to reinforce the robustness of the results for investors, policymakers and other agents of the economy. Table 7 reports the finding for the serial correlation applying the Breusch-Godfrey LM test, which shows a p-value of 0.3015 and it is at a 1% level of significance. This result suggests the absence of serial correlation and confirms the Durbin-Watson statistics, which indicates that there is no autocorrelation of the residuals. The White tests result reveals a p-value of 0.4913, which shows the acceptance of the null hypothesis that there is no issue about heteroscedasticity in the study. The result of the normality using the Jarque–Bera test reveals a p-value of 0.3722, which demonstrates that the residuals remain normally dispersed. Furthermore, the study used the Ramsey RESET check for misplaced variables to test the functional form of the model and the result shows a p-value of 0.3115, which is significant at the 5% level. This suggests that there are no omitted variables in the model.

| Table 7 Results of The Diagnostic Tests |

|||||

|---|---|---|---|---|---|

| Serial correlation | Breusch-Godfrey LM test | F-statistic | 2.6027 | Pro. F (2.353) | 0.4017 |

| Obs*R2 | 0.1000 | Prob. Chi-Square (2) | 0.3015 | ||

| Heteroskedasticity | White test | F-statistic | 1.0161 | Pro. F (6.327) | 0.2716 |

| Obs*R2 | 0.4623 | Prob. Chi-Square (5) | 0.4913 | ||

| Normality | Jarque-Bera normality test | t-statistic (df 2) | 0.5768 | Prob. value | 0.3722 |

| t-statistics (df 26) 0.4273 | Pro. | 0.2444 | |||

| Functional form | Ramsey RESET test for | F-statistic (df 1, 26) 0.3079 | Prob. | 0.3115 | |

| omitted variables | Likelihood ratio (df 1) 0.1030 | Prob. | 0.7483 | ||

Conclusion and Policy Implication

This paper employs the Johansen Cointegration and VECM to evaluate the dynamic equilibrium connection between the stock market performance and several macroeconomic fundamentals that is inflation, financial openness, exchange rates, interest rates and broad money supply. The study controls for the influence of crude oil prices on stock market prices in Nigeria. Moreover, the study employs data from 2010 to 2019. This period was characterised by the 2016 economic recession and the devaluation of the Naira, which have implications on macroeconomic determining factors and the stock prices.

The findings from the analysis indicate the existence of cointegration between stock market output and macroeconomic fundamental variables. The study demonstrates that despite the reliance on foreign revenue from a single product that frequently fluctuates at the international markets to drive the economy, the Nigerian stock market still reacts to the fluctuations in the macroeconomic indicators in the long run. The study demonstrates that inflation, exchange rate and interest rate exerts a negative influence on stock prices. Conversely, money supply, financial openness and crude oil prices positively impact stock prices in Nigeria. However, the outcome of the post-economic recession analysis shows that crude oil prices have an adverse connection with the stock market prices. The outcomes of this study further confirm the significant power of the macroeconomic fundamentals and oil prices to determine the stock prices in Nigeria.

The results of this study have salient policy implications for the stakeholders of the economy. For example, investors require an excellent decision to ensure proper diversification of investment to maximise returns as well as reduce any potential risks from macroeconomic variables. The government should formulate monetary policies that would help to moderate the adverse effects of interest rates and inflation. Reduced interest rates would reduce inflation and encourage investment in the stock market. The government’s effort is required to stabilise the environment to promote investment. Deliberate policies and programs are needed to moderate exchange rates fluctuation for investors' confidence in the market. The Government should also diversify the economy away from crude oil to increase industrial production from other sectors of the economy. Also, the government and other agents of the economy must develop the stock and make it attractive to investors. This study is limited in terms of scope. Future research is required to examine this issue in other developing countries. Moreover, other studies could look at a more extended period with the addition of other macroeconomic variables capable of influencing the stock market.

Acknowledgements

Covenant University Centre for Research Innovation and Discovery (CUCRID) is deeply appreciated for its funding support for this research work. The authors are grateful for comments and suggestions from the editor, referees and colleagues.

References

Alam, N. (2017). Analysis of the impact of select macroeconomic variables on the Indian stock market: A heteroscedastic cointegration approach. Business and Economic Horizons, 13(1), 119-127. http://dx.doi.org/10.15208/beh.2017.09.

Al-sharkas A., (2004). The dynamic relationship between macroeconomic factors and the Jordanian stock market. International Journal of Applied Econometrics and Quantitative Studies, 1(1), 97-114. Available at: https://ideas.repec.org/a/eaa/ijaeqs/v1y2004i1_5.html

Amadi, S.N., Onyema, J. I. & Odubo, T. D. (2002). Macroeconomic variables and stock prices. A multivariate analysis. Africa Journal of Development Studies, 2(1), 159-164. Retrieved from https://www.arcjournals.org/pdfs/ijmsr/v5-i5/2.pdf.

Asaolu, T.O. & Ogunmakinwa, M. S. (2011). An econometric analysis of the impact of macroeconomic variables on stock market movement in Nigeria’ Asian Journal of Business Management, 3(1), 72 – 78. Retrieved from https://nairametrics.com/wp-content/uploads/2013/03/macro-economic-variables-on-stocck-prices.pdf

Babajide, A. A., Adegboye, F. B. & Omankhanlen, A. E. (2015). Financial inclusion and economic growth in Nigeria. International Journal of Economics and Financial Issues, 5(3), 629-637. Retrieved from https://www.econjournals.com/index.php/ijefi/article/view/1154/pdf

Barakat, M. R., Elgazzar, S. H., & Hanafy, K. M. (2016). Impact of macroeconomic variables on stock markets: Evidence from emerging markets. International Journal of Economics and Finance, 8(1), 195-207. https://doi.org/10.5539/ijef.v8n1p195

Brown, S. J & T. Otsuki, (1990). Macroeconomic factors and the Japanese equity markets: The CAPMD project, in E. J. Elton and M. Gruber (eds.), Japanese Capital Markets, New York: Harper & Row.

Chen, N. F., Roll, R., & Ross, S. A. (1986). Economic forces and the stock market. Journal of Business, 59, 383- 403. https://doi.org/10.1086/296344

Dasgupta, R., (2012). Long-run and short-run relationships between BSE SENSEX and macroeconomic variables. International Research Journal of Finance and Economics, 95, 135 -150.

Ehikioya, B. I. (2019). The impact of exchange rate volatility on the Nigerian economic growth: An empirical investigation. Journal of Economics & Management, 37(3), 45-68. http://doi.org/10.22367/jem.2019.37.03

Engle, R. F. & Granger, C. W. J. (1987). Cointegration and error correction: Representation, estimation and testing, Econometrica, 55, 251-76. DOI: 10.2307/1913236

Epaphra, M., & Salema, E. (2018). The impact of macroeconomic variables on stock prices in Tanzania. Journal of Economic Library, 5(1), 12-41. Retrieved from https://ideas.repec.org/a/ksp/journ5/v5y2018i1p12-41.html

Fama, E. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383-417. https://doi.org/10.2307/2325486

French, K. R. Schwert, GW, & Stanbaugh, R. F. (1987). Expected stock returns and volatility. Journal of Financial Economics, 19(1), 3-29. DOI 10.1016/0304-405X(87)90026-2

Gatsimbazi, I., Jaya, S., Mulyungi, P., & Ochieng, A. (2018). Effects of macroeconomic variables on stock market performance in Rwanda. Case study of Rwanda Stock Exchange. European Journal of Economic and Financial Research, 3(1), 104-125. DOI: 10.5281/zenodo.1250559

Gay, Jr., R. D., (2008). Effect of macroeconomic variables on stock market returns for four emerging economies: Brazil, Russia, India, and China. International Business and Economics Research Journal, 7(3), 1 -8.

Geetha, C., Mohidin, R., Chandran, V. V., & Chong, V. (2011). The relationship between inflation and stock market: Evidence from Malaysia, United States and China. International Journal of Economics and Management Sciences, 1(2), 1-16.

Giri, A. K., & Joshi, P. (2017). The impact of macroeconomic indicators on India stock prices: An empirical analysis. Studies in Business and Economics, 12(1), 61-78. https://doi.org/10.1515/sbe-2017-0005

Gjerde, Ø. & F. Sættem, (1999). Causal relations among stock returns and macroeconomic variables in a small, open economy. Journal of International Financial Markets, Institutions & Money, 9(1), 61-74.

Granger, C. W. J., (1986). Developments in the study of cointegrated economic variables, Oxford Bulletin of Economics and Statistics, 48, 213-27.

Gurioveleen, K., & Bhatai, B. S. (2015). An impact of macroeconomic variables on the functioning of Indian stock market: A study of manufacturing firms of BSE 500. Journal of Stock & Forex Trading, 5(1), 1-7.

Hosseini S. M, Ahmad Z, & Lai Y. W. (2011). The role of macroeconomic variables on stock market index in China and India. International Journal of Economics and Finance, 3, 233-243.

Issahaku, H., Ustarz, Y., & Domanban, P. B. (2013). Macroeconomic variables and stock market returns in Ghana: Any causal link? Asian Economic and Financial Review, 3(8), 1044-1062.

Jareño, F., & Negrut, L. (2015). US stock market and macroeconomic factors. The Journal of Applied Business Research, 32, 325-340.

Johansen, S., (1991). Estimation and hypothesis testing of cointegrating vectors in Gaussian vector autoregressive models, Econometrica, 59, 1551-80.

Kolapo, F. T., Oke, M. O., & Olaniyan, T. O. (2018). Unravelling the impact of macroeconomic fundamentals on stock market performance in Nigeria: An ARDL-bound testing approach. Journal of Economics, Management and Trade, 21(3), 1-15. https://doi.org/10.9734/JEMT/2018/40177

Limpanithiwat, K., & Rungsombudpornkul, L. (2010). Relationship between inflation and stock prices in Thailand. Master Thesis in Finance, Umea School of Business, UMEA University, Sweden, pp. 1-60.

Marie, L., Tomáš, P., & Daniel, S. (2016). The effect of macroeconomic factors on stock prices of Swiss real estate companies. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 64(6): 2015–2024.

Mechri, N., Hamad, S. B., Peretti, C., & Charfi, S. (2019). The impact of the exchange rate volatilities on stock markets dynamics: Evidence from Tunisia and Turkey. Hal archives. Hal id: hal-01766742v2.

Mukherjee, K. T. & Naka, A. (1995), Dynamic relations between macroeconomic variables and the Japanese stock market: An application of a vector error correction model, Journal of Financial Research, 18, 223-237.

Olowe, R. A. (2007). The relationship between stock prices and macroeconomic factors in the Nigerian stock market. African Review of Money Finance Banking, 79-98.

Omodero, C. O. & Mlanga, S. (2019). Evaluation of the impact of macroeconomic variables on stock market. Business and Management Studies, 5(2), 34-44. doi:10.11114/bms.v5i2.4208

Pal, K., & Mittal, R. (2011). Impact of macroeconomic indicators on Indian capital markets. Journal of Risk Finance, 12(2), 84-97.

Roll R., (1978). Ambiguity when performance is measured by the securities market line. Journal of Finance, 33(4), 1051-1069.

Roll, R. & Ross, S. A. (1980). An empirical investigation of the arbitrage pricing theory. Journal of Finance, 35(5), 1073-1103.

Ross, S. A. (1976). The arbitrage theory of capital asset pricing. Journal of Economic Theory, 13, 341-360. https://doi.org/10.1016/0022-0531(76)90046-6

Tayo, G.O., Uchenna, O.L., Uchenna, E., & Nwanneka, M.J. (2017). Financial decision and poverty: Examining the financial behavior of the extreme poor in Nigeria. Proceedings of the 29th International Business Information Management Association Conference - Education Excellence and Innovation Management through Vision 2020: From Regional Development Sustainability to Global Economic Growth, (May), 3106–3116